|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

(State or other jurisdiction of

incorporation or organization)

|

|

|

|

(I.R.S. Employer Identification No.)

|

(Registrant’s telephone number, including area code)

|

||||||||||||||||||

|

(Address of principal executive offices, including zip code)

|

|||||||||||||||||||||||

|

Securities registered pursuant to Section 12(b) of the Act:

|

||||||||

|

Title of each class

|

Trading

Symbol(s)

|

Name of exchange on

which registered

|

||||||

|

|

|

|

||||||

|

Depositary Shares, each representing 1/1,000th interest in a share of Floating Rate

|

|

|

||||||

|

|

||||||||

|

Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate

|

|

|

||||||

|

|

||||||||

|

Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate

|

|

|

||||||

|

|

||||||||

|

Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate

|

|

|

||||||

|

|

||||||||

|

Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate

|

|

|

||||||

|

|

||||||||

|

Depository Shares, each representing 1/1000th interest in a share of 4.875%

|

|

|

||||||

|

|

||||||||

|

|

|

|

||||||

|

of Morgan Stanley Finance LLC (and Registrant’s guarantee with respect thereto)

|

||||||||

|

|

|

|

||||||

|

|

☒ |

Accelerated filer

|

☐ |

Non-accelerated filer

|

☐ |

Smaller reporting company

|

|

Emerging growth company

|

|

||||||||||||||||||||

|

Table of Contents

|

Part

|

Item

|

Page

|

|||||||||||

|

I

|

|

|||||||||||||

|

I

|

2 | |||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

I

|

3 | |||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

I

|

1 | |||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

|

|

|||||||||||||

|

II

|

|

|||||||||||||

|

II

|

1 | |||||||||||||

|

II

|

1A | |||||||||||||

|

II

|

2 | |||||||||||||

|

I

|

4 | |||||||||||||

|

II

|

6 | |||||||||||||

|

|

|

|||||||||||||

|

i

|

||||||||

|

ii

|

||||||||

| March 2021 Form 10-Q |

1

|

|||||||

| Management’s Discussion and Analysis |

|

||||

|

2

|

March 2021 Form 10-Q | |||||||

| Management’s Discussion and Analysis |

|

||||

| March 2021 Form 10-Q |

3

|

|||||||

| Management’s Discussion and Analysis |

|

||||

|

|

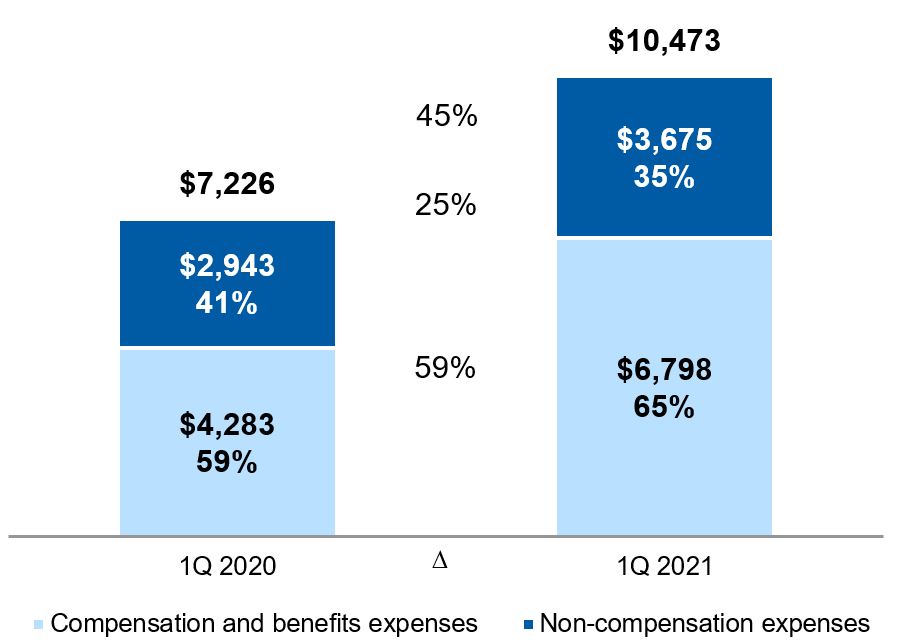

Three Months Ended March 31, | |||||||

|

$ in millions

|

2021 | 2020 | ||||||

| Consolidated results | ||||||||

|

Net revenues

1

|

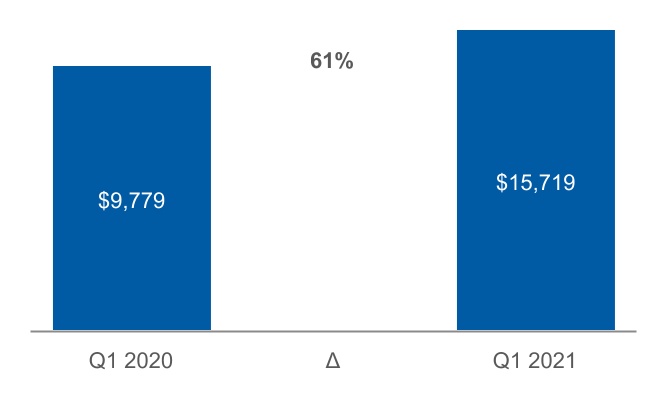

$ | 15,719 | $ | 9,779 | ||||

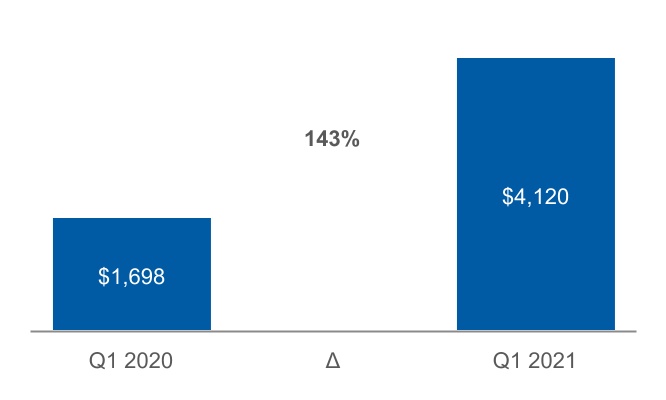

| Earnings applicable to Morgan Stanley common shareholders | $ | 3,982 | $ | 1,590 | ||||

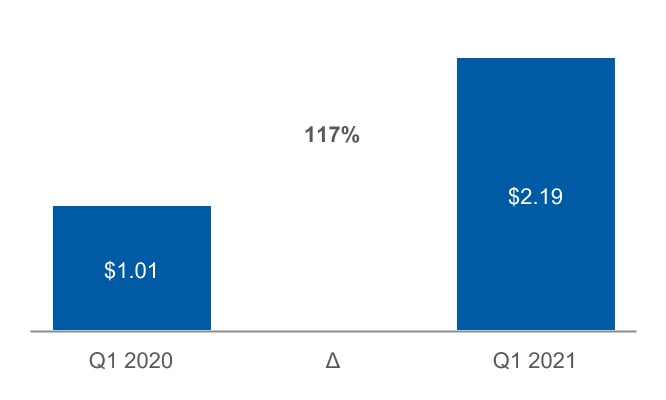

| Earnings per diluted common share | $ | 2.19 | $ | 1.01 | ||||

| Consolidated financial measures | ||||||||

|

Expense efficiency ratio

1, 2

|

66.6 | % | 73.9 | % | ||||

|

Adjusted expense efficiency ratio

1, 2, 4

|

66.1 | % | 73.9 | % | ||||

|

ROE

3

|

16.9 | % | 8.5 | % | ||||

|

Adjusted ROE

3, 4

|

17.1 | % | 8.5 | % | ||||

|

ROTCE

3, 4

|

21.1 | % | 9.7 | % | ||||

|

Adjusted ROTCE

3, 4

|

21.4 | % | 9.7 | % | ||||

|

Pre-tax margin

1, 5

|

34.0 | % | 21.9 | % | ||||

| Effective tax rate | 22.0 | % | 17.1 | % | ||||

|

Pre-tax margin by segment

5

|

||||||||

|

Institutional Securities

1

|

39.3 | % | 18.3 | % | ||||

|

Wealth Management

1

|

26.9 | % | 26.0 | % | ||||

|

Wealth Management, adjusted

1, 4

|

27.9 | % | 26.0 | % | ||||

| Investment Management | 28.2 | % | 20.7 | % | ||||

|

Investment Management, adjusted

4

|

29.0 | % | 20.7 | % | ||||

|

in millions, except per share and employee data

|

At

March 31, 2021 |

At

December 31, 2020 |

||||||

|

Liquidity resources

6

|

$ | 353,304 | $ | 338,623 | ||||

|

Loans

7

|

$ | 159,123 | $ | 150,597 | ||||

| Total assets | $ | 1,158,772 | $ | 1,115,862 | ||||

| Deposits | $ | 323,138 | $ | 310,782 | ||||

| Borrowings | $ | 215,826 | $ | 217,079 | ||||

| Common shares outstanding | 1,869 | 1,810 | ||||||

| Common shareholders' equity | $ | 98,509 | $ | 92,531 | ||||

|

Tangible common shareholders’ equity

4

|

$ | 72,828 | $ | 75,916 | ||||

|

Book value per common share

8

|

$ | 52.71 | $ | 51.13 | ||||

|

Tangible book value per common share

4, 8

|

$ | 38.97 | $ | 41.95 | ||||

|

Worldwide employees

9

(in thousands)

|

71 | 68 | ||||||

|

Capital Ratios

10

|

||||||||

| Common Equity Tier 1 capital—Standardized | 16.7 | % | 17.4 | % | ||||

| Common Equity Tier 1 capital—Advanced | 17.4 | % | 17.7 | % | ||||

| Tier 1 capital—Standardized | 18.5 | % | 19.4 | % | ||||

| Tier 1 capital—Advanced | 19.2 | % | 19.8 | % | ||||

|

SLR

11

|

6.7 | % | 7.4 | % | ||||

| Tier 1 leverage | 7.5 | % | 8.4 | % | ||||

|

4

|

March 2021 Form 10-Q | |||||||

| Management’s Discussion and Analysis |

|

||||

|

Three Months Ended

March 31, |

||||||||

| $ in millions, except per share data | 2021 | 2020 | ||||||

| Earnings applicable to Morgan Stanley common shareholders | $ | 3,982 | $ | 1,590 | ||||

| Impact of adjustments: | ||||||||

| Integration-related expenses | 75 | — | ||||||

| Related tax benefit | (17) | — | ||||||

|

Adjusted earnings applicable to

Morgan Stanley common shareholders—non-GAAP

1

|

$ | 4,040 | $ | 1,590 | ||||

| Earnings per diluted common share | $ | 2.19 | $ | 1.01 | ||||

| Impact of adjustments | 0.03 | — | ||||||

|

Adjusted earnings per diluted common

share—non-GAAP

1

|

$ | 2.22 | $ | 1.01 | ||||

|

Expense efficiency ratio

2

|

66.6 | % | 73.9 | % | ||||

| Impact of adjustments | (0.5) | % | — | % | ||||

|

Adjusted expense efficiency ratio—non-GAAP

1, 2

|

66.1 | % | 73.9 | % | ||||

|

Wealth Management Pre-tax margin

2

|

26.9 | % | 26.0 | % | ||||

| Impact of adjustments | 1.0 | % | — | % | ||||

|

Adjusted Wealth Management pre-tax margin—non-GAAP

1, 2

|

27.9 | % | 26.0 | % | ||||

| Investment Management Pre-tax margin | 28.2 | % | 20.7 | % | ||||

| Impact of adjustments | 0.8 | % | — | % | ||||

|

Adjusted Investment Management pre-tax margin—non-GAAP

1

|

29.0 | % | 20.7 | % | ||||

| $ in millions |

At

March 31, 2021 |

At

December 31, 2020 |

||||||

| Tangible equity | ||||||||

| Common shareholders' equity | $ | 98,509 | $ | 92,531 | ||||

| Less: Goodwill and net intangible assets | (25,681) | (16,615) | ||||||

| Tangible common shareholders' equity—non-GAAP | $ | 72,828 | $ | 75,916 | ||||

|

Average Monthly Balance

|

||||||||

|

|

Three Months Ended March 31, | |||||||

|

$ in millions

|

2021 | 2020 | ||||||

| Tangible equity | ||||||||

| Common shareholders' equity | $ | 94,343 | $ | 74,724 | ||||

| Less: Goodwill and net intangible assets | (18,849) | (9,200) | ||||||

| Tangible common shareholders' equity—non-GAAP | $ | 75,494 | $ | 65,524 | ||||

|

|

Three Months Ended

March 31, |

|||||||

|

$ in billions

|

2021 | 2020 | ||||||

| Average common equity | ||||||||

| Unadjusted—GAAP | $ | 94.3 | $ | 74.7 | ||||

|

Adjusted

1

—Non-GAAP

|

94.4 | 74.7 | ||||||

|

ROE

3

|

||||||||

| Unadjusted—GAAP | 16.9 | % | 8.5 | % | ||||

|

Adjusted

1

—Non-GAAP

|

17.1 | % | 8.5 | % | ||||

| Average tangible common equity—Non-GAAP | ||||||||

| Unadjusted | $ | 75.5 | $ | 65.5 | ||||

|

Adjusted

1

|

75.5 | 65.5 | ||||||

|

ROTCE

3

—Non-GAAP

|

||||||||

| Unadjusted | 21.1 | % | 9.7 | % | ||||

|

Adjusted

1

|

21.4 | % | 9.7 | % | ||||

| March 2021 Form 10-Q |

5

|

|||||||

| Management’s Discussion and Analysis |

|

||||

|

Three Months Ended

March 31, |

||||||||

| $ in billions | 2021 | 2020 | ||||||

|

Average common equity

4

|

||||||||

| Institutional Securities | $ | 43.5 | $ | 42.8 | ||||

| Wealth Management | 28.5 | 18.2 | ||||||

| Investment Management | 4.4 | 2.6 | ||||||

|

ROE

5

|

||||||||

| Institutional Securities | 23.0 | % | 6.3 | % | ||||

| Wealth Management | 16.9 | % | 18.5 | % | ||||

| Investment Management | 24.8 | % | 11.7 | % | ||||

|

Average tangible common equity

4

|

||||||||

| Institutional Securities | $ | 42.9 | $ | 42.3 | ||||

| Wealth Management | 13.4 | 10.4 | ||||||

| Investment Management | 1.2 | 1.7 | ||||||

|

ROTCE

5

|

||||||||

| Institutional Securities | 23.3 | % | 6.4 | % | ||||

| Wealth Management | 36.0 | % | 32.3 | % | ||||

| Investment Management | 88.2 | % | 18.1 | % | ||||

|

6

|

March 2021 Form 10-Q | |||||||

| Management’s Discussion and Analysis |

|

||||

|

Three Months Ended

March 31, |

|||||||||||

|

$ in millions

|

2021 | 2020 |

% Change

|

||||||||

|

Revenues

|

|||||||||||

| Advisory | $ | 480 | $ | 362 | 33 | % | |||||

| Equity | 1,502 | 336 | N/M | ||||||||

| Fixed income | 631 | 446 | 41 | % | |||||||

| Total Underwriting | 2,133 | 782 | 173 | % | |||||||

| Total Investment Banking | 2,613 | 1,144 | 128 | % | |||||||

|

Equity

1

|

2,875 | 2,449 | 17 | % | |||||||

|

Fixed Income

1

|

2,966 | 2,062 | 44 | % | |||||||

|

Other

1

|

123 | (477) | 126 | % | |||||||

|

Net revenues

1

|

$ | 8,577 | $ | 5,178 | 66 | % | |||||

|

Provision for credit losses

1

|

(93) | 388 | (124) | % | |||||||

|

Compensation and benefits

|

3,114 | 1,814 | 72 | % | |||||||

|

Non-compensation expenses

1

|

2,185 | 2,026 | 8 | % | |||||||

|

Total non-interest expenses

1

|

5,299 | 3,840 | 38 | % | |||||||

| Income before provision for income taxes | 3,371 | 950 | N/M | ||||||||

| Provision for income taxes | 736 | 151 | N/M | ||||||||

| Net income | 2,635 | 799 | N/M | ||||||||

| Net income applicable to noncontrolling interests | 34 | 42 | (19) | % | |||||||

| Net income applicable to Morgan Stanley | $ | 2,601 | $ | 757 | N/M | ||||||

|

Three Months Ended

March 31, |

||||||||

|

$ in billions

|

2021 | 2020 | ||||||

|

Completed mergers and acquisitions

1

|

$ | 225 | $ | 119 | ||||

|

Equity and equity-related offerings

2, 3

|

36 | 14 | ||||||

|

Fixed income offerings

2, 4

|

102 | 94 | ||||||

|

Three Months Ended

March 31, 2021 |

|||||||||||||||||

|

Net Interest

2

|

All Other

3

|

||||||||||||||||

| $ in millions | Trading |

Fees

1

|

Total | ||||||||||||||

| Financing | $ | 645 | $ | 130 | $ | 182 | $ | 3 | $ | 960 | |||||||

| Execution services | 1,114 | 800 | (62) | 63 | 1,915 | ||||||||||||

| Total Equity | $ | 1,759 | $ | 930 | $ | 120 | $ | 66 | $ | 2,875 | |||||||

| Total Fixed Income | $ | 2,313 | $ | 81 | $ | 439 | $ | 133 | $ | 2,966 | |||||||

|

Three Months Ended

March 31, 2020

4

|

|||||||||||||||||

|

Net Interest

2

|

All Other

3

|

||||||||||||||||

| $ in millions | Trading |

Fees

1

|

Total | ||||||||||||||

| Financing | $ | 1,034 | $ | 101 | $ | (37) | $ | 5 | $ | 1,103 | |||||||

| Execution services | 579 | 783 | (38) | 22 | 1,346 | ||||||||||||

| Total Equity | $ | 1,613 | $ | 884 | $ | (75) | $ | 27 | $ | 2,449 | |||||||

| Total Fixed Income | $ | 1,773 | $ | 102 | $ | 328 | $ | (141) | $ | 2,062 | |||||||

| March 2021 Form 10-Q |

7

|

|||||||

| Management’s Discussion and Analysis |

|

||||

|

8

|

March 2021 Form 10-Q | |||||||

| Management’s Discussion and Analysis |

|

||||

|

Three Months Ended

March 31, |

|||||||||||

| $ in millions | 2021 | 2020 | % Change | ||||||||

| Revenues | |||||||||||

| Asset management | $ | 3,191 | $ | 2,680 | 19 | % | |||||

|

Transactional

1

|

1,228 | 399 | N/M | ||||||||

| Net interest | 1,385 | 896 | 55 | % | |||||||

|

Other

1,2

|

155 | 81 | 91 | % | |||||||

| Net revenues | 5,959 | 4,056 | 47 | % | |||||||

|

Provision for credit losses

2

|

(5) | 19 | (126) | % | |||||||

| Compensation and benefits | 3,170 | 2,212 | 43 | % | |||||||

| Non-compensation expenses | 1,194 | 770 | 55 | % | |||||||

| Total non-interest expenses | 4,364 | 2,982 | 46 | % | |||||||

|

Income before provision for

income taxes

|

$ | 1,600 | $ | 1,055 | 52 | % | |||||

| Provision for income taxes | 358 | 191 | 87 | % | |||||||

|

Net income applicable to

Morgan Stanley

|

$ | 1,242 | $ | 864 | 44 | % | |||||

| $ in billions |

At March 31,

2021 |

At December 31,

2020 |

||||||

| Total client assets | $ | 4,231 | $ | 3,999 | ||||

| U.S. Bank Subsidiary loans | $ | 104.9 | $ | 98.1 | ||||

|

Margin and other lending

1

|

$ | 26.6 | $ | 23.1 | ||||

|

Deposits

2

|

$ | 322 | $ | 306 | ||||

|

Weighted average cost of deposits

3

|

0.18% | 0.24% | ||||||

|

Three Months Ended

March 31, |

||||||||

| 2021 | 2020 | |||||||

|

Net new assets

4

|

$ | 104.9 | $ | 37.1 | ||||

| $ in billions |

At March 31,

2021 |

At December 31,

2020 |

||||||

|

Advisor-led client assets

1

|

$ | 3,349 | $ | 3,167 | ||||

|

Fee-based client assets

2

|

$ | 1,574 | $ | 1,472 | ||||

|

Fee-based client assets as a

percentage of advisor-led client

assets

|

47% | 46% | ||||||

|

Three Months Ended

March 31, |

||||||||

| 2021 | 2020 | |||||||

|

Fee-based asset flows

3

|

$ | 37.2 | $ | 18.4 | ||||

| $ in billions |

At March 31,

2021 |

At December 31,

2020 |

||||||

|

Self-directed assets

1

|

$ | 882 | $ | 832 | ||||

|

Self-directed households (in millions)

2

|

7.2 | 6.7 | ||||||

|

Three Months Ended

March 31, |

||||||||

| 2021 | 2020 | |||||||

|

Daily average revenue

trades (“DARTs”) (in thousands)

3

|

1,619 | 5 | ||||||

| $ in billions |

At March 31,

2021 |

At December 31,

2020 |

||||||

|

Workplace unvested assets

2

|

$ | 461 | $ | 435 | ||||

|

Number of participants (in millions)

3

|

5.1 | 4.9 | ||||||

| March 2021 Form 10-Q |

9

|

|||||||

| Management’s Discussion and Analysis |

|

||||

|

$ in billions

|

At

December 31, 2020 |

Inflows

|

Outflows

|

Market

Impact

|

At

March 31, 2021 |

||||||||||||

|

Separately managed

1

|

$ | 359 | $ | 13 | $ | (7) | $ | 20 | $ | 385 | |||||||

|

Unified managed

|

379 | 27 | (14) | 13 | 405 | ||||||||||||

|

Advisor

|

177 | 12 | (9) | 8 | 188 | ||||||||||||

|

Portfolio manager

|

509 | 33 | (18) | 25 | 549 | ||||||||||||

|

Subtotal

|

$ | 1,424 | $ | 85 | $ | (48) | $ | 66 | $ | 1,527 | |||||||

| Cash management | 48 | 8 | (9) | — | 47 | ||||||||||||

|

Total fee-based

client assets

|

$ | 1,472 | $ | 93 | $ | (57) | $ | 66 | $ | 1,574 | |||||||

|

$ in billions

|

At

December 31, 2019 |

Inflows

|

Outflows

|

Market

Impact

|

At

March 31, 2020 |

||||||||||||

|

Separately managed

1

|

$ | 322 | $ | 12 | $ | (7) | $ | 2 | $ | 329 | |||||||

|

Unified managed

|

313 | 16 | (13) | (53) | 263 | ||||||||||||

|

Advisor

|

155 | 10 | (9) | (25) | 131 | ||||||||||||

|

Portfolio manager

|

435 | 27 | (18) | (65) | 379 | ||||||||||||

|

Subtotal

|

$ | 1,225 | $ | 65 | $ | (47) | $ | (141) | $ | 1,102 | |||||||

| Cash management | 42 | 4 | (14) | — | 32 | ||||||||||||

|

Total fee-based

client assets

|

$ | 1,267 | $ | 69 | $ | (61) | $ | (141) | $ | 1,134 | |||||||

|

|

Three Months Ended

March 31, |

|||||||

|

Fee rate in bps

|

2021 | 2020 | ||||||

|

Separately managed

|

14 | 14 | ||||||

|

Unified managed

|

97 | 99 | ||||||

| Advisor | 81 | 85 | ||||||

| Portfolio manager | 93 | 94 | ||||||

| Subtotal | 73 | 72 | ||||||

| Cash management | 5 | 5 | ||||||

| Total fee-based client assets | 71 | 71 | ||||||

|

10

|

March 2021 Form 10-Q | |||||||

| Management’s Discussion and Analysis |

|

||||

|

|

Three Months Ended

March 31, |

|

|||||||||

| $ in millions | 2021 | 2020 |

% Change

|

||||||||

| Revenues |

|

||||||||||

| Asset management and related fees | $ | 1,103 | $ | 665 | 66 | % | |||||

|

Performance-based income and other

1

|

211 | 27 | N/M | ||||||||

|

Net revenues

|

1,314 | 692 | 90 | % | |||||||

|

Compensation and benefits

|

514 | 257 | 100 | % | |||||||

|

Non-compensation expenses

|

430 | 292 | 47 | % | |||||||

|

Total non-interest expenses

|

944 | 549 | 72 | % | |||||||

| Income before provision for income taxes | 370 | 143 | 159 | % | |||||||

|

Provision for income taxes

|

81 | 25 | N/M | ||||||||

|

Net income

|

289 | 118 | 145 | % | |||||||

| Net income applicable to noncontrolling interests | 14 | 40 | (65) | % | |||||||

| Net income applicable to Morgan Stanley | $ | 275 | $ | 78 | N/M | ||||||

| $ in billions | Equity | Fixed income | Alternatives and Solutions | Long-term AUM Subtotal | Liquidity and Overlay Services | Total | ||||||||||||||

| December 31, 2020 | $ | 242 | $ | 98 | $ | 153 | $ | 493 | $ | 288 | $ | 781 | ||||||||

| Inflows | 31 | 13 | 15 | 59 | 459 | 518 | ||||||||||||||

| Outflows | (23) | (9) | (10) | (42) | (433) | (475) | ||||||||||||||

| Market Impact | 4 | (2) | 10 | 12 | — | 12 | ||||||||||||||

|

Acquisition

1

|

119 | 103 | 251 | 473 | 116 | 589 | ||||||||||||||

| Other | (2) | (2) | (1) | (5) | (1) | (6) | ||||||||||||||

| March 31, 2021 | $ | 371 | $ | 201 | $ | 418 | $ | 990 | $ | 429 | $ | 1,419 | ||||||||

| $ in billions | Equity | Fixed income | Alternatives and Solutions | Long-term AUM Subtotal | Liquidity and Overlay Services | Total | ||||||||||||||

| December 31, 2019 | $ | 138 | $ | 79 | $ | 139 | $ | 356 | $ | 196 | $ | 552 | ||||||||

| Inflows | 14 | 10 | 8 | 32 | 446 | 478 | ||||||||||||||

| Outflows | (12) | (9) | (4) | (25) | (395) | (420) | ||||||||||||||

| Market Impact | (18) | (4) | (7) | (29) | 1 | (28) | ||||||||||||||

| Other | (1) | (1) | 5 | 3 | (1) | 2 | ||||||||||||||

| March 31, 2020 | $ | 121 | $ | 75 | $ | 141 | $ | 337 | $ | 247 | $ | 584 | ||||||||

| March 2021 Form 10-Q |

11

|

|||||||

| Management’s Discussion and Analysis |

|

||||

|

|

Three Months Ended

March 31, |

|||||||

|

$ in billions

|

2021 | 2020 | ||||||

| Equity | $ | 288 | $ | 133 | ||||

| Fixed income | 131 | 79 | ||||||

| Alternatives and Solutions | 242 | 139 | ||||||

| Long-term AUM subtotal | 661 | 351 | ||||||

| Liquidity and Overlay Services | 339 | 206 | ||||||

| Total AUM | $ | 1,000 | $ | 557 | ||||

|

|

Three Months Ended

March 31, |

|||||||

|

Fee rate in bps

|

2021 | 2020 | ||||||

| Equity | 77 | 77 | ||||||

| Fixed income | 33 | 31 | ||||||

| Alternatives and Solutions | 45 | 60 | ||||||

| Long-term AUM | 57 | 60 | ||||||

| Liquidity and Overlay Services | 8 | 17 | ||||||

| Total AUM | 40 | 44 | ||||||

|

12

|

March 2021 Form 10-Q | |||||||

| Management’s Discussion and Analysis |

|

||||

|

$ in billions

|

At

March 31, 2021 |

At

December 31, 2020 |

||||||

| Investment securities portfolio: | ||||||||

| Investment securities—AFS | 84.8 | 90.3 | ||||||

| Investment securities—HTM | 64.6 | 52.6 | ||||||

| Total investment securities | $ | 149.4 | $ | 142.9 | ||||

|

Wealth Management Loans

2

|

||||||||

| Residential real estate | $ | 36.8 | $ | 35.2 | ||||

|

Securities-based lending and Other

3

|

68.1 | 62.9 | ||||||

| Total | $ | 104.9 | $ | 98.1 | ||||

|

Institutional Securities Loans

2

|

||||||||

| Corporate | $ | 9.5 | $ | 7.9 | ||||

| Secured lending facilities | 27.8 | 27.4 | ||||||

| Commercial and Residential real estate | 8.9 | 10.1 | ||||||

| Securities-based lending and Other | 6.3 | 5.4 | ||||||

| Total | $ | 52.5 | $ | 50.8 | ||||

| Total Assets | $ | 357.2 | $ | 346.5 | ||||

|

Deposits

4

|

$ | 321.6 | $ | 309.7 | ||||

| March 2021 Form 10-Q |

13

|

|||||||

| Management’s Discussion and Analysis |

|

||||

| At March 31, 2021 | ||||||||||||||

| $ in millions | IS | WM | IM | Total | ||||||||||

| Assets | ||||||||||||||

|

Cash and cash equivalents

|

$ | 93,021 | $ | 24,396 | $ | 701 | $ | 118,118 | ||||||

|

Trading assets at fair value

|

307,854 | 310 | 4,994 | 313,158 | ||||||||||

|

Investment securities

|

40,888 | 148,318 | — | 189,206 | ||||||||||

| Securities purchased under agreements to resell | 87,279 | 27,442 | — | 114,721 | ||||||||||

|

Securities borrowed

|

100,957 | 1,192 | — | 102,149 | ||||||||||

| Customer and other receivables | 80,475 | 33,381 | 1,187 | 115,043 | ||||||||||

|

Loans

1

|

54,163 | 104,933 | 27 | 159,123 | ||||||||||

|

Other assets

2

|

13,918 | 21,702 | 11,634 | 47,254 | ||||||||||

| Total assets | $ | 778,555 | $ | 361,674 | $ | 18,543 | $ | 1,158,772 | ||||||

| At December 31, 2020 | ||||||||||||||

|

$ in millions

|

IS

|

WM

|

IM

|

Total

|

||||||||||

|

Assets

|

||||||||||||||

|

Cash and cash equivalents

|

$ | 74,281 | $ | 31,275 | $ | 98 | $ | 105,654 | ||||||

|

Trading assets at fair value

|

308,413 | 280 | 4,045 | 312,738 | ||||||||||

|

Investment securities

|

41,630 | 140,524 | — | 182,154 | ||||||||||

| Securities purchased under agreements to resell | 84,998 | 31,236 | — | 116,234 | ||||||||||

|

Securities borrowed

|

110,480 | 1,911 | — | 112,391 | ||||||||||

| Customer and other receivables | 67,085 | 29,781 | 871 | 97,737 | ||||||||||

|

Loans

1

|

52,449 | 98,130 | 18 | 150,597 | ||||||||||

|

Other assets

2

|

13,986 | 22,458 | 1,913 | 38,357 | ||||||||||

|

Total assets

|

$ | 753,322 | $ | 355,595 | $ | 6,945 | $ | 1,115,862 | ||||||

|

$ in millions

|

At

March 31, 2021 |

At

December 31, 2020 |

||||||

|

Cash deposits with central banks

|

$ | 59,154 | $ | 49,669 | ||||

|

Unencumbered HQLA Securities

1

:

|

||||||||

|

U.S. government obligations

|

135,008 | 136,555 | ||||||

|

U.S. agency and agency mortgage-backed securities

|

110,659 | 99,659 | ||||||

|

Non-U.S. sovereign obligations

2

|

37,434 | 39,745 | ||||||

|

Other investment grade securities

|

2,015 | 2,053 | ||||||

|

Total HQLA

1

|

$ | 344,270 | $ | 327,681 | ||||

| Cash deposits with banks (non-HQLA) | 9,034 | 10,942 | ||||||

| Total Liquidity Resources | $ | 353,304 | $ | 338,623 | ||||

|

At

March 31, 2021 |

At

December 31, 2020 |

Average Daily Balance

Three Months Ended |

|||||||||

| $ in millions | March 31, 2021 | ||||||||||

|

Bank legal entities

|

|||||||||||

| U.S. | $ | 184,993 | $ | 178,033 | $ | 189,008 | |||||

| Non-U.S. | 8,889 | 7,670 | 7,882 | ||||||||

| Total Bank legal entities | 193,882 | 185,703 | 196,890 | ||||||||

|

Non-Bank legal entities

|

|||||||||||

| U.S.: | |||||||||||

|

Parent Company

|

54,854 | 59,468 | 57,194 | ||||||||

|

Non-Parent Company

|

42,299 | 33,368 | 40,982 | ||||||||

| Total U.S. | 97,153 | 92,836 | 98,176 | ||||||||

| Non-U.S. | 62,269 | 60,084 | 58,735 | ||||||||

| Total Non-Bank legal entities | 159,422 | 152,920 | 156,911 | ||||||||

| Total Liquidity Resources | $ | 353,304 | $ | 338,623 | $ | 353,801 | |||||

|

14

|

March 2021 Form 10-Q | |||||||

| Management’s Discussion and Analysis |

|

||||

|

Average Daily Balance

Three Months Ended |

||||||||

| $ in millions | March 31, 2021 | December 31, 2020 | ||||||

|

Eligible HQLA

1

|

||||||||

| Cash deposits with central banks | $ | 50,815 | $ | 43,596 | ||||

|

Securities

2

|

166,060 | 162,509 | ||||||

|

Total Eligible HQLA

1

|

$ | 216,875 | $ | 206,105 | ||||

| LCR | 125 | % | 129 | % | ||||

| $ in millions |

At

March 31, 2021 |

At

December 31, 2020 |

||||||

| Securities purchased under agreements to resell and Securities borrowed | $ | 216,870 | $ | 228,625 | ||||

| Securities sold under agreements to repurchase and Securities loaned | $ | 63,050 | $ | 58,318 | ||||

|

Securities received as collateral

1

|

$ | 4,758 | $ | 4,277 | ||||

|

|

Average Daily Balance

Three Months Ended |

|||||||

| $ in millions | March 31, 2021 | December 31, 2020 | ||||||

| Securities purchased under agreements to resell and Securities borrowed | $ | 214,610 | $ | 195,376 | ||||

| Securities sold under agreements to repurchase and Securities loaned | $ | 61,152 | $ | 54,528 | ||||

| March 2021 Form 10-Q |

15

|

|||||||

| Management’s Discussion and Analysis |

|

||||

|

$ in millions

|

At

March 31, 2021 |

At

December 31, 2020 |

||||||

|

Savings and demand deposits:

|

||||||||

|

Brokerage sweep deposits

1

|

$ | 253,411 | $ | 232,071 | ||||

|

Savings and other

|

45,576 | 47,150 | ||||||

|

Total Savings and demand deposits

|

298,987 | 279,221 | ||||||

|

Time deposits

|

24,151 | 31,561 | ||||||

|

Total

2

|

$ | 323,138 | $ | 310,782 | ||||

| $ in millions | Parent Company | Subsidiaries |

Total

|

||||||||

| Original maturities of one year or less | $ | 1,501 | $ | 6,058 | $ | 7,559 | |||||

| Original maturities greater than one year | |||||||||||

| 2021 | $ | 12,517 | $ | 4,487 | $ | 17,004 | |||||

| 2022 | 11,930 | 6,440 | 18,370 | ||||||||

| 2023 | 17,056 | 5,880 | 22,936 | ||||||||

| 2024 | 18,824 | 7,472 | 26,296 | ||||||||

| 2025 | 11,859 | 6,940 | 18,799 | ||||||||

| Thereafter | 81,975 | 22,887 | 104,862 | ||||||||

| Total | $ | 154,161 | $ | 54,106 | $ | 208,267 | |||||

| Total Borrowings | $ | 155,662 | $ | 60,164 | $ | 215,826 | |||||

|

Maturities over next 12 months

2

|

|

$ | 18,976 | ||||||||

| Parent Company | |||||||||||

|

Short-Term

Debt |

Long-Term

Debt |

Rating

Outlook |

|||||||||

| DBRS, Inc. | R-1 (middle) | A (high) | Stable | ||||||||

| Fitch Ratings, Inc. | F1 | A | Stable | ||||||||

| Moody’s Investors Service, Inc. | P-1 | A1 | Stable | ||||||||

| Rating and Investment Information, Inc. | a-1 | A | Stable | ||||||||

| S&P Global Ratings | A-2 | BBB+ | Stable | ||||||||

| MSBNA | |||||||||||

|

Short-Term

Debt |

Long-Term

Debt |

Rating

Outlook |

|||||||||

| Fitch Ratings, Inc. | F1 | A+ | Stable | ||||||||

| Moody’s Investors Service, Inc. | P-1 | Aa3 | Stable | ||||||||

| S&P Global Ratings | A-1 | A+ | Stable | ||||||||

| MSPBNA | |||||||||||

|

Short-Term

Debt |

Long-Term

Debt |

Rating

Outlook |

|||||||||

| Moody’s Investors Service, Inc. | P-1 | Aa3 | Stable | ||||||||

| S&P Global Ratings | A-1 | A+ | Stable | ||||||||

|

16

|

March 2021 Form 10-Q | |||||||

| Management’s Discussion and Analysis |

|

||||

|

|

Three Months Ended

March 31, |

|||||||

|

in millions, except for per share data

|

2021 | 2020 | ||||||

| Number of shares | 28 | 29 | ||||||

| Average price per share | $ | 77.47 | $ | 46.01 | ||||

| Total | $ | 2,135 | $ | 1,347 | ||||

| Announcement date | April 16, 2021 | ||||

| Amount per share | $0.35 | ||||

| Date to be paid | May 14, 2021 | ||||

| Shareholders of record as of | April 30, 2021 | ||||

| Series M and N | All Other Series | |||||||

| Announcement date | February 16, 2021 | February 16, 2021 | ||||||

| Date paid | March 15, 2021 | April 15, 2021 | ||||||

| Shareholders of record as of | March 1, 2021 | March 31, 2021 | ||||||

| March 2021 Form 10-Q |

17

|

|||||||

| Management’s Discussion and Analysis |

|

||||

|

At March 31, 2021

and

December 31, 2020

|

|||||||||||

| Standardized | Advanced | ||||||||||

| Capital buffers | |||||||||||

| Capital conservation buffer | — | 2.5% | |||||||||

|

SCB

1

|

5.7% | N/A | |||||||||

|

G-SIB capital surcharge

2

|

3.0% | 3.0% | |||||||||

|

CCyB

3

|

0% | 0% | |||||||||

|

Capital buffer requirement

4

|

8.7% | 5.5% | |||||||||

|

At March 31, 2021

and

December 31, 2020

|

|||||||||||

|

Regulatory Minimum

|

Standardized | Advanced | |||||||||

|

Required ratios

5

|

|||||||||||

| Common Equity Tier 1 capital ratio | 4.5 | % | 13.2% | 10.0% | |||||||

| Tier 1 capital ratio | 6.0 | % | 14.7% | 11.5% | |||||||

| Total capital ratio | 8.0 | % | 16.7% | 13.5% | |||||||

|

|

Standardized | Advanced | ||||||||||||

| $ in millions |

Required

Ratio 1 |

At March 31, 2021 |

Required

Ratio 1 |

At March 31, 2021 | ||||||||||

| Risk-based capital | ||||||||||||||

| Common Equity Tier 1 capital | $ | 76,176 | $ | 76,176 | ||||||||||

| Tier 1 capital |

|

84,059 | 84,059 | |||||||||||

| Total capital |

|

92,823 | 92,605 | |||||||||||

| Total RWA |

|

455,071 | 438,839 | |||||||||||

| Common Equity Tier 1 capital ratio | 13.2 | % | 16.7 | % | 10.0 | % | 17.4 | % | ||||||

| Tier 1 capital ratio | 14.7 | % | 18.5 | % | 11.5 | % | 19.2 | % | ||||||

| Total capital ratio | 16.7 | % | 20.4 | % | 13.5 | % | 21.1 | % | ||||||

|

$ in millions

|

Required

Ratio

1

|

At

March 31, 2021 |

||||||||||||

| Leverage-based capital | ||||||||||||||

|

Adjusted average assets

2

|

$ | 1,121,413 | ||||||||||||

| Tier 1 leverage ratio | 4.0 | % | 7.5 | % | ||||||||||

|

Supplementary leverage exposure

3,4

|

$ | 1,263,959 | ||||||||||||

|

SLR

4

|

5.0 | % | 6.7 | % | ||||||||||

|

18

|

March 2021 Form 10-Q | |||||||

| Management’s Discussion and Analysis |

|

||||

|

|

Standardized | Advanced | ||||||||||||

|

$ in millions

|

Required

Ratio

1

|

At December 31, 2020 |

Required

Ratio

1

|

At December 31, 2020 | ||||||||||

| Risk-based capital | ||||||||||||||

| Common Equity Tier 1 capital | $ | 78,650 | $ | 78,650 | ||||||||||

| Tier 1 capital | 88,079 | 88,079 | ||||||||||||

| Total capital | 97,213 | 96,994 | ||||||||||||

| Total RWA | 453,106 | 445,151 | ||||||||||||

| Common Equity Tier 1 capital ratio | 13.2 | % | 17.4 | % | 10.0 | % | 17.7 | % | ||||||

| Tier 1 capital ratio | 14.7 | % | 19.4 | % | 11.5 | % | 19.8 | % | ||||||

| Total capital ratio | 16.7 | % | 21.5 | % | 13.5 | % | 21.8 | % | ||||||

|

$ in millions

|

Required

Ratio

1

|

At

December 31, 2020 |

||||||||||||

| Leverage-based capital | ||||||||||||||

|

Adjusted average assets

2

|

$ | 1,053,510 | ||||||||||||

| Tier 1 leverage ratio | 4.0 | % | 8.4 | % | ||||||||||

|

Supplementary leverage exposure

3,4,

|

$ | 1,192,506 | ||||||||||||

|

SLR

4

|

5.0 | % | 7.4 | % | ||||||||||

|

$ in millions

|

At

March 31, 2021 |

At

December 31, 2020 |

Change

|

||||||||

| Common Equity Tier 1 capital | |||||||||||

| Common stock and surplus | $ | 19,229 | $ | 15,799 | $ | 3,430 | |||||

| Retained earnings | 82,287 | 78,978 | 3,309 | ||||||||

| AOCI | (2,754) | (1,962) | (792) | ||||||||

| Regulatory adjustments and deductions: | |||||||||||

| Net goodwill | (16,701) | (11,527) | (5,174) | ||||||||

| Net intangible assets | (7,171) | (4,165) | (3,006) | ||||||||

|

Other adjustments and deductions

1

|

1,286 | 1,527 | (241) | ||||||||

|

Total Common Equity Tier 1

capital |

$ | 76,176 | $ | 78,650 | $ | (2,474) | |||||

| Additional Tier 1 capital | |||||||||||

| Preferred stock | $ | 7,750 | $ | 9,250 | $ | (1,500) | |||||

| Noncontrolling interests | 589 | 619 | (30) | ||||||||

| Additional Tier 1 capital | $ | 8,339 | $ | 9,869 | $ | (1,530) | |||||

| Deduction for investments in covered funds | (456) | (440) | (16) | ||||||||

| Total Tier 1 capital | $ | 84,059 | $ | 88,079 | $ | (4,020) | |||||

| Standardized Tier 2 capital | |||||||||||

| Subordinated debt | $ | 7,476 | $ | 7,737 | $ | (261) | |||||

| Eligible ACL | 1,173 | 1,265 | (92) | ||||||||

| Other adjustments and deductions | 115 | 132 | (17) | ||||||||

|

Total Standardized Tier 2

capital |

$ | 8,764 | $ | 9,134 | $ | (370) | |||||

| Total Standardized capital | $ | 92,823 | $ | 97,213 | $ | (4,390) | |||||

| Advanced Tier 2 capital | |||||||||||

| Subordinated debt | $ | 7,476 | $ | 7,737 | $ | (261) | |||||

| Eligible credit reserves | 955 | 1,046 | (91) | ||||||||

|

Other adjustments and

deductions |

115 | 132 | (17) | ||||||||

| Total Advanced Tier 2 capital | $ | 8,546 | $ | 8,915 | $ | (369) | |||||

| Total Advanced capital | $ | 92,605 | $ | 96,994 | $ | (4,389) | |||||

| March 2021 Form 10-Q |

19

|

|||||||

| Management’s Discussion and Analysis |

|

||||

|

|

Three Months Ended

March 31, 2021 |

|||||||

|

$ in millions

|

Standardized

|

Advanced

|

||||||

|

Credit risk RWA

|

||||||||

| Balance at December 31, 2020 | $ | 387,066 | $ | 284,930 | ||||

|

Change related to the following items:

|

||||||||

|

Derivatives

|

(156) | (12,520) | ||||||

|

Securities financing transactions

|

(1,641) | (1,634) | ||||||

|

Investment securities

|

486 | 594 | ||||||

|

Commitments, guarantees and loans

|

(4,409) | 233 | ||||||

|

Equity investments

|

1,091 | 1,104 | ||||||

|

Other credit risk

1

|

1,889 | 1,662 | ||||||

|

Total change in credit risk RWA

|

$ | (2,740) | $ | (10,561) | ||||

| Balance at March 31, 2021 | $ | 384,326 | $ | 274,369 | ||||

|

Market risk RWA

|

||||||||

| Balance at December 31, 2020 | $ | 66,040 | $ | 66,040 | ||||

|

Change related to the following items:

|

||||||||

|

Regulatory VaR

|

3,095 | 3,095 | ||||||

|

Regulatory stressed VaR

|

2,732 | 2,732 | ||||||

|

Incremental risk charge

|

1,481 | 1,481 | ||||||

|

Comprehensive risk measure

|

(225) | (261) | ||||||

| Specific risk | (2,378) | (2,378) | ||||||

|

Total change in market risk RWA

|

$ | 4,705 | $ | 4,669 | ||||

| Balance at March 31, 2021 | $ | 70,745 | $ | 70,709 | ||||

|

Operational risk RWA

|

||||||||

| Balance at December 31, 2020 | N/A | $ | 94,181 | |||||

|

Change in operational risk RWA

|

N/A | (420) | ||||||

| Balance at March 31, 2021 | N/A | $ | 93,761 | |||||

|

Total RWA

|

$ | 455,071 | $ | 438,839 | ||||

|

|

Actual

Amount/Ratio

|

|||||||||||||

|

$ in millions

|

Regulatory Minimum

|

Required Ratio

1

|

At

March 31, 2021 |

At

December 31, 2020 |

||||||||||

|

External TLAC

2

|

$ | 216,426 | $ | 216,129 | ||||||||||

| External TLAC as a % of RWA | 18.0 | % | 21.5 | % | 47.6 | % | 47.7 | % | ||||||

| External TLAC as a % of leverage exposure | 7.5 | % | 9.5 | % | 17.1 | % | 18.1 | % | ||||||

|

Eligible LTD

3

|

$ | 122,234 | $ | 120,561 | ||||||||||

| Eligible LTD as a % of RWA | 9.0 | % | 9.0 | % | 26.9 | % | 26.6 | % | ||||||

| Eligible LTD as a % of leverage exposure | 4.5 | % | 4.5 | % | 9.7 | % | 10.1 | % | ||||||

|

20

|

March 2021 Form 10-Q | |||||||

| Management’s Discussion and Analysis |

|

||||

|

Three Months Ended

March 31, |

||||||||

|

$ in billions

|

2021 | 2020 | ||||||

|

Institutional Securities

|

$ | 43.5 | $ | 42.8 | ||||

|

Wealth Management

2

|

28.5 | 18.2 | ||||||

|

Investment Management

3

|

4.4 | 2.6 | ||||||

|

Parent

|

17.9 | 11.1 | ||||||

|

Total

|

$ | 94.3 | $ | 74.7 | ||||

| March 2021 Form 10-Q |

21

|

|||||||

| Management’s Discussion and Analysis |

|

||||

|

22

|

March 2021 Form 10-Q | |||||||

|

|

Three Months Ended | |||||||||||||

| March 31, 2021 | ||||||||||||||

|

$ in millions

|

Period

End

|

Average

|

High

2

|

Low

2

|

||||||||||

|

Interest rate and credit spread

|

$ | 31 | $ | 33 | $ | 41 | $ | 29 | ||||||

|

Equity price

|

30 | 31 | 170 | 19 | ||||||||||

|

Foreign exchange rate

|

11 | 14 | 24 | 8 | ||||||||||

|

Commodity price

|

14 | 18 | 27 | 13 | ||||||||||

|

Less: Diversification benefit

1

|

(36) | (38) | N/A | N/A | ||||||||||

|

Primary Risk Categories

|

$ | 50 | $ | 58 | $ | 171 | $ | 44 | ||||||

|

Credit Portfolio

|

17 | 24 | 31 | 17 | ||||||||||

|

Less: Diversification benefit

1

|

(15) | (13) | N/A | N/A | ||||||||||

|

Total Management VaR

|

$ | 52 | $ | 69 | $ | 175 | $ | 50 | ||||||

|

|

Three Months Ended | |||||||||||||

| December 31, 2020 | ||||||||||||||

|

$ in millions

|

Period

End

|

Average

|

High

2

|

Low

2

|

||||||||||

|

Interest rate and credit spread

|

$ | 35 | $ | 32 | $ | 42 | $ | 28 | ||||||

|

Equity price

|

23 | 24 | 29 | 18 | ||||||||||

|

Foreign exchange rate

|

14 | 12 | 19 | 8 | ||||||||||

|

Commodity price

|

15 | 16 | 20 | 13 | ||||||||||

|

Less: Diversification benefit

1

|

(32) | (36) | N/A | N/A | ||||||||||

|

Primary Risk Categories

|

$ | 55 | $ | 48 | $ | 56 | $ | 39 | ||||||

|

Credit Portfolio

|

31 | 23 | 31 | 19 | ||||||||||

|

Less: Diversification benefit

1

|

(10) | (16) | N/A | N/A | ||||||||||

|

Total Management VaR

|

$ | 76 | $ | 55 | $ | 76 | $ | 43 | ||||||

| March 2021 Form 10-Q |

23

|

|||||||

| Risk Disclosures |

|

||||

|

$ in millions

|

At

March 31, 2021 |

At

December 31, 2020 |

||||||

|

Derivatives

|

$ | 7 | $ | 7 | ||||

|

Funding liabilities

2

|

47 | 50 | ||||||

|

$ in millions

|

At

March 31, 2021 |

At

December 31, 2020 |

||||||

|

Basis point change

|

||||||||

| +100 | $ | 1,671 | $ | 1,540 | ||||

| -100 | (560) | (654) | ||||||

|

|

Loss from 10% Decline

|

|||||||

|

$ in millions

|

At

March 31, 2021 |

At

December 31, 2020 |

||||||

| Investments related to Investment Management activities | $ | 472 | $ | 386 | ||||

|

Other investments:

|

||||||||

|

MUMSS

|

174 | 184 | ||||||

|

Other Firm investments

|

223 | 210 | ||||||

|

24

|

March 2021 Form 10-Q | |||||||

| Risk Disclosures |

|

||||

|

|

At March 31, 2021 | |||||||||||||

| $ in millions |

HFI

|

HFS

|

FVO

|

Total

|

||||||||||

| Institutional Securities: | ||||||||||||||

|

Corporate

|

$ | 5,185 | $ | 11,824 | $ | 14 | $ | 17,023 | ||||||

|

Secured lending facilities

|

25,886 | 3,025 | 914 | 29,825 | ||||||||||

|

Commercial and Residential real estate

|

7,277 | 541 | 2,898 | 10,716 | ||||||||||

|

Securities-based lending and Other

|

1,034 | 62 | 7,758 | 8,854 | ||||||||||

| Total Institutional Securities | 39,382 | 15,452 | 11,584 | 66,418 | ||||||||||

| Wealth Management: | ||||||||||||||

|

Residential real estate

|

36,843 | 14 | — | 36,857 | ||||||||||

|

Securities-based lending and Other

|

68,167 | — | — | 68,167 | ||||||||||

| Total Wealth Management | 105,010 | 14 | — | 105,024 | ||||||||||

|

Total Investment Management

1

|

5 | 22 | 1,105 | 1,132 | ||||||||||

|

Total loans

2

|

144,397 | 15,488 | 12,689 | 172,574 | ||||||||||

| ACL | (762) | (762) | ||||||||||||

| Total loans, net of ACL | $ | 143,635 | $ | 15,488 | $ | 12,689 | $ | 171,812 | ||||||

|

Lending commitments

3

|

$ | 132,717 | ||||||||||||

| Total exposure |

|

|

|

$ | 304,529 | |||||||||

|

|

At December 31, 2020 | |||||||||||||

| $ in millions |

HFI

|

HFS

|

FVO

|

Total

|

||||||||||

| Institutional Securities: | ||||||||||||||

|

Corporate

|

$ | 6,046 | $ | 8,580 | $ | 13 | $ | 14,639 | ||||||

|

Secured lending facilities

|

25,727 | 3,296 | 648 | 29,671 | ||||||||||

|

Commercial and Residential real estate

|

7,346 | 859 | 3,061 | 11,266 | ||||||||||

|

Securities-based lending and Other

|

1,279 | 55 | 7,001 | 8,335 | ||||||||||

| Total Institutional Securities | 40,398 | 12,790 | 10,723 | 63,911 | ||||||||||

| Wealth Management: | ||||||||||||||

|

Residential real estate

|

35,268 | 11 | — | 35,279 | ||||||||||

|

Securities-based lending and Other

|

62,947 | — | — | 62,947 | ||||||||||

| Total Wealth Management | 98,215 | 11 | — | 98,226 | ||||||||||

|

Total Investment Management

1

|

6 | 12 | 425 | 443 | ||||||||||

|

Total loans

2

|

138,619 | 12,813 | 11,148 | 162,580 | ||||||||||

| ACL | (835) | (835) | ||||||||||||

| Total loans, net of ACL | $ | 137,784 | $ | 12,813 | $ | 11,148 | $ | 161,745 | ||||||

|

Lending commitments

3

|

$ | 127,855 | ||||||||||||

| Total exposure |

|

|

|

$ | 289,600 | |||||||||

| March 2021 Form 10-Q |

25

|

|||||||

| Risk Disclosures |

|

||||

|

$ in millions

|

|||||

|

December 31, 2020

1

|

$ | 1,231 | |||

| Gross charge-offs | (10) | ||||

|

Provision for credit losses

2

|

(98) | ||||

| Other | (7) | ||||

| March 31, 2021 | $ | 1,116 | |||

| ACL—Loans | $ | 762 | |||

| ACL—Lending commitments | 354 | ||||

| At March 31, 2021 | At December 31, 2020 | |||||||||||||

|

IS

|

WM

|

IS

|

WM

|

|||||||||||

|

Accrual

|

99.4 | % | 99.7 | % | 99.2 | % | 99.7 | % | ||||||

|

Nonaccrual

1

|

0.6 | % | 0.3 | % | 0.8 | % | 0.3 | % | ||||||

|

26

|

March 2021 Form 10-Q | |||||||

| Risk Disclosures |

|

||||

|

|

At March 31, 2021 | ||||||||||||||||

|

|

Contractual Years to Maturity

|

|

|||||||||||||||

|

$ in millions

|

Less than 1

|

1-3

|

3-5

|

Over 5

|

Total

|

||||||||||||

|

Loans

|

|||||||||||||||||

|

AA

|

$ | 43 | $ | 9 | $ | 85 | $ | 35 | $ | 172 | |||||||

|

A

|

680 | 787 | 340 | 241 | 2,048 | ||||||||||||

|

BBB

|

5,673 | 5,119 | 2,279 | 314 | 13,385 | ||||||||||||

|

BB

|

11,381 | 7,783 | 4,325 | 673 | 24,162 | ||||||||||||

|

Other NIG

|

5,557 | 6,323 | 3,472 | 6,931 | 22,283 | ||||||||||||

|

Unrated

2

|

223 | 122 | 370 | 2,982 | 3,697 | ||||||||||||

| Total loans, net of ACL | 23,557 | 20,143 | 10,871 | 11,176 | 65,747 | ||||||||||||

|

Lending commitments

|

|||||||||||||||||

|

AAA

|

— | 50 | — | — | 50 | ||||||||||||

|

AA

|

3,852 | 1,169 | 1,979 | — | 7,000 | ||||||||||||

|

A

|

5,597 | 6,877 | 9,909 | 432 | 22,815 | ||||||||||||

|

BBB

|

8,493 | 19,580 | 16,675 | 594 | 45,342 | ||||||||||||

|

BB

|

3,282 | 11,102 | 7,252 | 2,543 | 24,179 | ||||||||||||

|

Other NIG

|

1,965 | 7,250 | 6,849 | 3,291 | 19,355 | ||||||||||||

|

Unrated

2

|

— | 2 | 10 | 1 | 13 | ||||||||||||

| Total lending commitments | 23,189 | 46,030 | 42,674 | 6,861 | 118,754 | ||||||||||||

|

Total exposure

|

$ | 46,746 | $ | 66,173 | $ | 53,545 | $ | 18,037 | $ | 184,501 | |||||||

|

|

At December 31, 2020 | ||||||||||||||||

|

|

Contractual Years to Maturity

|

|

|||||||||||||||

|

$ in millions

|

Less than 1

|

1-3

|

3-5

|

Over 5

|

Total

|

||||||||||||

|

Loans

|

|||||||||||||||||

|

AA

|

$ | 279 | $ | 10 | $ | — | $ | — | $ | 289 | |||||||

|

A

|

759 | 798 | 36 | 391 | 1,984 | ||||||||||||

|

BBB

|

5,043 | 5,726 | 2,746 | 469 | 13,984 | ||||||||||||

|

BB

|

10,963 | 7,749 | 5,324 | 503 | 24,539 | ||||||||||||

|

Other NIG

|

5,214 | 6,956 | 4,002 | 3,269 | 19,441 | ||||||||||||

|

Unrated

2

|

141 | 142 | 330 | 2,322 | 2,935 | ||||||||||||

| Total loans, net of ACL | 22,399 | 21,381 | 12,438 | 6,954 | 63,172 | ||||||||||||

|

Lending commitments

|

|||||||||||||||||

|

AAA

|

— | 50 | — | — | 50 | ||||||||||||

|

AA

|

4,047 | 1,038 | 2,135 | — | 7,220 | ||||||||||||

|

A

|

6,025 | 8,359 | 9,808 | 425 | 24,617 | ||||||||||||

|

BBB

|

6,783 | 17,782 | 15,500 | 460 | 40,525 | ||||||||||||

|

BB

|

4,357 | 8,958 | 7,958 | 3,103 | 24,376 | ||||||||||||

|

Other NIG

|

664 | 7,275 | 6,077 | 2,652 | 16,668 | ||||||||||||

|

Unrated

2

|

4 | — | — | — | 4 | ||||||||||||

| Total lending commitments | 21,880 | 43,462 | 41,478 | 6,640 | 113,460 | ||||||||||||

|

Total exposure

|

$ | 44,279 | $ | 64,843 | $ | 53,916 | $ | 13,594 | $ | 176,632 | |||||||

|

$ in millions

|

At

March 31, 2021 |

At

December 31, 2020 |

||||||

|

Industry

|

||||||||

| Financials | $ | 52,174 | $ | 44,358 | ||||

| Real estate | 25,515 | 25,484 | ||||||

| Industrials | 17,310 | 15,861 | ||||||

| Healthcare | 13,656 | 12,650 | ||||||

| Communications services | 13,411 | 12,600 | ||||||

| Information technology | 11,502 | 11,358 | ||||||

| Utilities | 10,111 | 9,504 | ||||||

| Consumer discretionary | 9,982 | 11,177 | ||||||

| Energy | 9,380 | 10,064 | ||||||

| Consumer staples | 7,963 | 9,088 | ||||||

| Materials | 5,759 | 6,084 | ||||||

| Insurance | 4,410 | 3,889 | ||||||

| Other | 3,328 | 4,515 | ||||||

| Total exposure | $ | 184,501 | $ | 176,632 | ||||

| March 2021 Form 10-Q |

27

|

|||||||

| Risk Disclosures |

|

||||

| At March 31, 2021 | |||||||||||||||||

|

Contractual Years to Maturity

|

|||||||||||||||||

|

$ in millions

|

Less than 1

|

1-3

|

3-5

|

Over 5

|

Total

|

||||||||||||

|

Loans, net of ACL

|

$ | 1,985 | $ | 602 | $ | 428 | $ | 5,991 | $ | 9,006 | |||||||

|

Lending commitments

|

4,238 | 5,502 | 2,380 | 4,596 | 16,716 | ||||||||||||

| Total exposure | $ | 6,223 | $ | 6,104 | $ | 2,808 | $ | 10,587 | $ | 25,722 | |||||||

|

|

At December 31, 2020 | ||||||||||||||||

|

|

Contractual Years to Maturity

|

|

|||||||||||||||

|

$ in millions

|

Less than 1

|

1-3

|

3-5

|

Over 5

|

Total

|

||||||||||||

|

Loans, net of ACL

|

$ | 1,241 | $ | 907 | $ | 873 | $ | 2,090 | $ | 5,111 | |||||||

|

Lending commitments

|

2,810 | 4,649 | 2,678 | 4,650 | 14,787 | ||||||||||||

| Total exposure | $ | 4,051 | $ | 5,556 | $ | 3,551 | $ | 6,740 | $ | 19,898 | |||||||

| At March 31, 2021 | |||||||||||

| $ in millions | Loans | Lending Commitments | Total | ||||||||

| Corporate | $ | 5,185 | $ | 71,893 | $ | 77,078 | |||||

| Secured lending facilities | 25,886 | 9,085 | 34,971 | ||||||||

| Commercial real estate | 7,277 | 276 | 7,553 | ||||||||

| Other | 1,034 | 866 | 1,900 | ||||||||

| Total, before ACL | $ | 39,382 | $ | 82,120 | $ | 121,502 | |||||

| ACL | $ | (671) | $ | (350) | $ | (1,021) | |||||

| At December 31, 2020 | |||||||||||

| $ in millions | Loans | Lending Commitments | Total | ||||||||

| Corporate | $ | 6,046 | $ | 69,488 | $ | 75,534 | |||||

| Secured lending facilities | 25,727 | 8,312 | 34,039 | ||||||||

| Commercial real estate | 7,346 | 334 | 7,680 | ||||||||

| Other | 1,279 | 1,135 | 2,414 | ||||||||

| Total, before ACL | $ | 40,398 | $ | 79,269 | $ | 119,667 | |||||

| ACL | $ | (739) | $ | (391) | $ | (1,130) | |||||

| $ in millions | Corporate | Secured lending facilities | Commercial real estate | Other | Total | ||||||||||||

| At December 31, 2020 | |||||||||||||||||

| ACL—Loans | $ | 309 | $ | 198 | $ | 211 | $ | 21 | $ | 739 | |||||||

| ACL—Lending commitments | 323 | 38 | 11 | 19 | 391 | ||||||||||||

| Total | $ | 632 | $ | 236 | $ | 222 | $ | 40 | $ | 1,130 | |||||||

| Gross charge-offs | (1) | — | (9) | — | (10) | ||||||||||||

|

Provision for credit losses

1

|

(89) | (7) | 3 | — | (93) | ||||||||||||

| Other | (3) | (1) | (2) | — | (6) | ||||||||||||

| Total at March 31, 2021 | $ | 539 | $ | 228 | $ | 214 | $ | 40 | $ | 1,021 | |||||||

| ACL—Loans | $ | 250 | $ | 193 | $ | 206 | $ | 22 | $ | 671 | |||||||

| ACL—Lending commitments | 289 | 35 | 8 | 18 | 350 | ||||||||||||

|

At

March 31, 2021 |

At

December 31, 2020 |

|||||||

| Corporate | 4.8 | % | 5.1 | % | ||||

| Secured lending facilities | 0.7 | % | 0.8 | % | ||||

|

Commercial real estate

|

2.8 | % | 2.9 | % | ||||

| Other | 2.1 | % | 1.7 | % | ||||

| Total Institutional Securities loans | 1.7 | % | 1.8 | % | ||||

|

|

At March 31, 2021 | ||||||||||||||||

|

|

Contractual Years to Maturity

|

|

|||||||||||||||

|

$ in millions

|

Less than 1

|

1-3

|

3-5

|

Over 5

|

Total

|

||||||||||||

| Securities-based lending and Other | $ | 59,264 | $ | 5,371 | $ | 1,876 | $ | 1,620 | $ | 68,131 | |||||||

| Residential real estate | 7 | 1 | 3 | 36,791 | 36,802 | ||||||||||||

| Total loans, net of ACL | $ | 59,271 | $ | 5,372 | $ | 1,879 | $ | 38,411 | $ | 104,933 | |||||||

| Lending commitments | 11,294 | 2,281 | 131 | 257 | 13,963 | ||||||||||||

| Total exposure | $ | 70,565 | $ | 7,653 | $ | 2,010 | $ | 38,668 | $ | 118,896 | |||||||

|

|

At December 31, 2020 | ||||||||||||||||

|

|

Contractual Years to Maturity

|

|

|||||||||||||||

|

$ in millions

|

Less than 1

|

1-3

|

3-5

|

Over 5

|

Total

|

||||||||||||

| Securities-based lending and Other | $ | 54,483 | $ | 4,587 | $ | 2,167 | $ | 1,672 | $ | 62,909 | |||||||

| Residential real estate | 9 | 1 | 1 | 35,210 | 35,221 | ||||||||||||

| Total loans, net of ACL | $ | 54,492 | $ | 4,588 | $ | 2,168 | $ | 36,882 | $ | 98,130 | |||||||

| Lending commitments | 11,666 | 2,356 | 120 | 253 | 14,395 | ||||||||||||

| Total exposure | $ | 66,158 | $ | 6,944 | $ | 2,288 | $ | 37,135 | $ | 112,525 | |||||||

|

28

|

March 2021 Form 10-Q | |||||||

| Risk Disclosures |

|

||||

|

$ in millions

|

|||||

|

December 31, 2020

1

|

$ | 101 | |||

| Gross charge-offs | — | ||||

|

Provision for credit losses

2

|

(5) | ||||

| Other | (1) | ||||

| March 31, 2021 | $ | 95 | |||

| ACL—Loans | $ | 91 | |||

| ACL—Lending commitments | 4 | ||||

| $ in millions |

At

March 31, 2021 |

At

December 31, 2020 |

||||||

| Institutional Securities | $ | 55,935 | $ | 51,570 | ||||

| Wealth Management | 26,609 | 23,144 | ||||||

| Total | $ | 82,544 | $ | 74,714 | ||||

|

|

Counterparty Credit Rating

1

|

|

||||||||||||||||||

|

$ in millions

|

AAA

|

AA

|

A

|

BBB

|

NIG

|

Total

|

||||||||||||||

| At March 31, 2021 | ||||||||||||||||||||

|

Less than 1 year

|

$ | 1,346 | $ | 15,620 | $ | 45,783 | $ | 23,734 | $ | 12,533 | $ | 99,016 | ||||||||

|

1-3 years

|

591 | 4,755 | 15,600 | 12,197 | 7,535 | 40,678 | ||||||||||||||

|

3-5 years

|

703 | 4,907 | 10,115 | 8,153 | 3,695 | 27,573 | ||||||||||||||

|

Over 5 years

|

4,151 | 26,657 | 68,658 | 49,759 | 11,487 | 160,712 | ||||||||||||||

|

Total, gross

|

$ | 6,791 | $ | 51,939 | $ | 140,156 | $ | 93,843 | $ | 35,250 | $ | 327,979 | ||||||||

|

Counterparty netting

|

(3,245) | (40,745) | (109,294) | (71,170) | (19,149) | (243,603) | ||||||||||||||

| Cash and securities collateral | (2,879) | (8,735) | (24,958) | (16,801) | (7,961) | (61,334) | ||||||||||||||

|

Total, net

|

$ | 667 | $ | 2,459 | $ | 5,904 | $ | 5,872 | $ | 8,140 | $ | 23,042 | ||||||||

|

|

Counterparty Credit Rating

1

|

|

||||||||||||||||||

|

$ in millions

|

AAA

|

AA

|

A

|

BBB

|

NIG

|

Total

|

||||||||||||||

| At December 31, 2020 | ||||||||||||||||||||

|

Less than 1 year

|

$ | 1,179 | $ | 16,166 | $ | 52,164 | $ | 26,088 | $ | 12,175 | $ | 107,772 | ||||||||

|

1-3 years

|

572 | 5,225 | 17,560 | 13,750 | 8,134 | 45,241 | ||||||||||||||

|

3-5 years

|

359 | 4,326 | 11,328 | 8,363 | 4,488 | 28,864 | ||||||||||||||

|

Over 5 years

|

4,545 | 32,049 | 84,845 | 63,084 | 13,680 | 198,203 | ||||||||||||||

|

Total, gross

|

$ | 6,655 | $ | 57,766 | $ | 165,897 | $ | 111,285 | $ | 38,477 | $ | 380,080 | ||||||||

|

Counterparty netting

|

(3,269) | (44,306) | (134,310) | (84,171) | (22,227) | (288,283) | ||||||||||||||

| Cash and securities collateral | (3,124) | (10,973) | (26,712) | (20,708) | (8,979) | (70,496) | ||||||||||||||

|

Total, net

|

$ | 262 | $ | 2,487 | $ | 4,875 | $ | 6,406 | $ | 7,271 | $ | 21,301 | ||||||||

|

$ in millions

|

At

March 31, 2021 |

At

December 31, 2020 |

||||||

|

Industry

|

||||||||

| Financials | $ | 8,404 | $ | 6,195 | ||||

| Utilities | 4,082 | 3,954 | ||||||

| Consumer discretionary | 2,350 | 1,866 | ||||||

| Energy | 1,007 | 965 | ||||||

| Healthcare | 961 | 1,494 | ||||||

| Industrials | 906 | 1,291 | ||||||

| Information technology | 894 | 1,104 | ||||||

| Regional governments | 845 | 806 | ||||||

| Sovereign governments | 708 | 650 | ||||||

| Insurance | 554 | 518 | ||||||

| Not-for-profit organizations | 538 | 701 | ||||||

| Real estate | 474 | 378 | ||||||

| Communications services | 473 | 529 | ||||||

| Materials | 363 | 430 | ||||||

| Consumer staples | 332 | 339 | ||||||

| Other | 151 | 81 | ||||||

|

Total

|

$ | 23,042 | $ | 21,301 | ||||

| March 2021 Form 10-Q |

29

|

|||||||

| Risk Disclosures |

|

||||

| $ in millions | United Kingdom | Japan | France | Germany | Spain | ||||||||||||

| Sovereign | |||||||||||||||||

|

Net inventory

1

|

$ | 51 | $ | 6,101 | $ | 1,531 | $ | (3,354) | $ | (563) | |||||||

|

Net counterparty exposure

2

|

16 | 66 | 24 | 73 | 15 | ||||||||||||

| Exposure before hedges | 67 | 6,167 | 1,555 | (3,281) | (548) | ||||||||||||

|

Hedges

3

|

(310) | (91) | (6) | (287) | — | ||||||||||||

| Net exposure | $ | (243) | $ | 6,076 | $ | 1,549 | $ | (3,568) | $ | (548) | |||||||

| Non-sovereign | |||||||||||||||||

|

Net inventory

1

|

$ | 894 | $ | 508 | $ | (526) | $ | (215) | $ | (117) | |||||||

|

Net counterparty exposure

2

|

11,563 | 5,277 | 3,066 | 2,942 | 273 | ||||||||||||

| Loans | 3,620 | 382 | 681 | 1,890 | 3,577 | ||||||||||||

| Lending commitments | 5,452 | 181 | 4,368 | 4,355 | 922 | ||||||||||||

| Exposure before hedges | 21,529 | 6,348 | 7,589 | 8,972 | 4,655 | ||||||||||||

|

Hedges

3

|

(1,653) | (173) | (752) | (1,055) | (151) | ||||||||||||

| Net exposure | $ | 19,876 | $ | 6,175 | $ | 6,837 | $ | 7,917 | $ | 4,504 | |||||||

| Total net exposure | $ | 19,633 | $ | 12,251 | $ | 8,386 | $ | 4,349 | $ | 3,956 | |||||||

| $ in millions | Brazil | Canada | China | Australia | India | ||||||||||||

| Sovereign | |||||||||||||||||

|

Net inventory

1

|

$ | 2,962 | $ | (348) | $ | 87 | $ | 445 | $ | 1,734 | |||||||

|

Net counterparty exposure

2

|

— | 88 | 145 | 32 | — | ||||||||||||

| Exposure before hedges | 2,962 | (260) | 232 | 477 | 1,734 | ||||||||||||

|

Hedges

3

|

(12) | — | (82) | — | — | ||||||||||||

| Net exposure | $ | 2,950 | $ | (260) | $ | 150 | $ | 477 | $ | 1,734 | |||||||

| Non-sovereign | |||||||||||||||||

|

Net inventory

1

|

$ | 75 | $ | 493 | $ | 1,412 | $ | 302 | $ | 638 | |||||||

|

Net counterparty exposure

2

|

429 | 2,079 | 740 | 720 | 754 | ||||||||||||

| Loans | 208 | 164 | 636 | 405 | 214 | ||||||||||||

| Lending commitments | 166 | 1,366 | 821 | 1,617 | — | ||||||||||||

| Exposure before hedges | 878 | 4,102 | 3,609 | 3,044 | 1,606 | ||||||||||||

|

Hedges

3

|

(24) | (74) | (187) | (174) | — | ||||||||||||

| Net exposure | $ | 854 | $ | 4,028 | $ | 3,422 | $ | 2,870 | $ | 1,606 | |||||||

| Total net exposure | $ | 3,804 | $ | 3,768 | $ | 3,572 | $ | 3,347 | $ | 3,340 | |||||||

|

$ in millions

|

At

March 31, 2021 |

|||||||

|

Country of Risk

|

Collateral

2

|

|||||||

| Germany | Spain and Italy | $ | 11,670 | |||||

| United Kingdom | U.K., U.S. and Italy | 8,559 | ||||||

| Other | Japan, U.S. and France | 17,757 | ||||||

|

30

|

March 2021 Form 10-Q | |||||||

| Risk Disclosures |

|

||||

| March 2021 Form 10-Q |

31

|

|||||||

|

/s/ Deloitte & Touche LLP

|

||

|

New York, New York

|

||

| May 3, 2021 | ||

|

32

|

March 2021 Form 10-Q | |||||||

|

Consolidated Income Statements

(Unaudited) |

|

||||

|

|

Three Months Ended

March 31, |

|||||||

| in millions, except per share data | 2021 | 2020 | ||||||

| Revenues | ||||||||

| Investment banking | $ |

|

$ |

|

||||

| Trading |

|

|

||||||

| Investments |

|

|

||||||

| Commissions and fees |

|

|

||||||

| Asset management |

|

|

||||||

| Other |

|

(

|

||||||

| Total non-interest revenues |

|

|

||||||

| Interest income |

|

|

||||||

| Interest expense |

|

|

||||||

| Net interest |

|

|

||||||

| Net revenues |

|

|

||||||

| Provision for credit losses |

(

|

|

||||||

| Non-interest expenses | ||||||||

| Compensation and benefits |

|

|

||||||

| Brokerage, clearing and exchange fees |

|

|

||||||

| Information processing and communications |

|

|

||||||

| Professional services |

|

|

||||||

| Occupancy and equipment |

|

|

||||||

| Marketing and business development |

|

|

||||||

| Other |

|

|

||||||

| Total non-interest expenses |

|

|

||||||

| Income before provision for income taxes |

|

|

||||||

| Provision for income taxes |

|

|

||||||

| Net income | $ |

|

$ |

|

||||

| Net income applicable to noncontrolling interests |

|

|

||||||

| Net income applicable to Morgan Stanley | $ |

|

$ |

|

||||

| Preferred stock dividends |

|

|

||||||

| Earnings applicable to Morgan Stanley common shareholders | $ |

|

$ |

|

||||

| Earnings per common share | ||||||||

| Basic | $ |

|

$ |

|

||||

| Diluted | $ |

|

$ |

|

||||

| Average common shares outstanding | ||||||||

| Basic |

|

|

||||||

| Diluted |

|

|

||||||

|

|

Three Months Ended

March 31, |

|||||||

| $ in millions | 2021 | 2020 | ||||||

| Net income | $ |

|

$ |

|

||||

| Other comprehensive income (loss), net of tax: | ||||||||

| Foreign currency translation adjustments |

(

|

(

|

||||||

| Change in net unrealized gains (losses) on available-for-sale securities |

(

|

|

||||||

| Pension and other |

|

|

||||||

| Change in net debt valuation adjustment |

|

|

||||||

| Total other comprehensive income (loss) | $ |

(

|

$ |

|

||||

| Comprehensive income | $ |

|

$ |

|

||||

| Net income applicable to noncontrolling interests |

|

|

||||||

| Other comprehensive income (loss) applicable to noncontrolling interests |

(

|

|

||||||

| Comprehensive income applicable to Morgan Stanley | $ |

|

$ |

|

||||

| See Notes to Consolidated Financial Statements |

33

|

March 2021 Form 10-Q | ||||||

|

Consolidated Balance Sheets

|

|

||||

|

$ in millions, except share data

|

(Unaudited)

At

March 31, 2021 |

At

December 31, 2020 |

||||||

| Assets | ||||||||

|

Cash and cash equivalents

|

$ |

|

$ |

|

||||

|

Trading assets at fair value (

$

|

|

|

||||||

|

Investment securities (includes

$

|

|

|

||||||

|

Securities purchased under agreements to resell (includes

$

|

|

|

||||||

| Securities borrowed |

|

|

||||||

| Customer and other receivables |

|

|

||||||

| Loans: | ||||||||

|

Held for investment (net of allowance of

$

|

|

|

||||||

| Held for sale |

|

|

||||||

| Goodwill |

|

|

||||||

|

Intangible assets (net of accumulated amortization of

$

|

|

|

||||||

| Other assets |

|

|

||||||

| Total assets | $ |

|

$ |

|

||||

| Liabilities | ||||||||

|

Deposits (includes

$

|

$ |

|

$ |

|

||||

| Trading liabilities at fair value |

|

|

||||||

|

Securities sold under agreements to repurchase (includes

$

|

|

|

||||||

| Securities loaned |

|

|

||||||

|

Other secured financings (includes

$

|

|

|

||||||

| Customer and other payables |

|

|

||||||

| Other liabilities and accrued expenses |

|

|

||||||

|

Borrowings (includes

$

|

|

|

||||||

| Total liabilities |

|

|

||||||

| Commitments and contingent liabilities (see Note 14) |

|

|

||||||

|

|

||||||||

| Morgan Stanley shareholders’ equity: | ||||||||

| Preferred stock |

|

|

||||||

|

Common stock, $

|

||||||||

|

Shares authorized:

|

|

|

||||||

| Additional paid-in capital |

|

|

||||||

| Retained earnings |

|

|

||||||

| Employee stock trusts |

|

|

||||||

| Accumulated other comprehensive income (loss) |

(

|

(

|

||||||

|

Common stock held in treasury at cost, $

|

(

|

(

|

||||||

| Common stock issued to employee stock trusts |

(

|

(

|

||||||

| Total Morgan Stanley shareholders’ equity |

|

|

||||||

| Noncontrolling interests |

|

|

||||||

| Total equity |

|

|

||||||

| Total liabilities and equity | $ |

|

$ |

|

||||

| March 2021 Form 10-Q |

34

|

See Notes to Consolidated Financial Statements | ||||||

|

Consolidated Statements of Changes in Total Equity

(Unaudited) |

|

||||

|

Three Months Ended

March 31, |

||||||||

| $ in millions | 2021 | 2020 | ||||||

|

Preferred Stock

|

||||||||

| Beginning balance | $ |

|

$ |

|

||||

| Redemption of Series J preferred stock |

(

|

|

||||||

| Ending balance |

|

|

||||||

|

Common Stock

|

||||||||

|

Beginning and ending balance

|

|

|

||||||

|

Additional Paid-in Capital

|

||||||||

|

Beginning balance

|

|

|

||||||

|

Share-based award activity

|

(

|

(

|

||||||