|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the fiscal year ended December 31, 2015

|

FORM 10-K

|

Commission File No. 1-15579

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 |

||

MSA SAFETY INCORPORATED

(Exact name of registrant as specified in its charter

)

|

||

|

Pennsylvania

(State or other jurisdiction of

incorporation or organization)

1000 Cranberry Woods Drive

Cranberry Township, Pennsylvania

(Address of principal executive offices)

|

Registrant’s telephone number, including area code: (724) 776-8600

|

46-4914539

(IRS Employer Identification No.)

16066-5207

(Zip code)

|

|

(Title of each class)

Common Stock, no par value

|

Securities registered pursuant to Section 12(b) of the Act:

|

(Name of each exchange on which registered)

New York Stock Exchange

|

|

Large accelerated filer

x

|

Accelerated filer

¨

|

|

Non-accelerated filer

¨

|

Smaller reporting company

¨

|

|

Item No.

|

Page

|

|

|

Part I

|

||

|

1.

|

||

|

1A.

|

||

|

1B.

|

||

|

2.

|

||

|

3.

|

||

|

4.

|

||

|

Part II

|

||

|

5.

|

||

|

6.

|

||

|

7.

|

||

|

7A.

|

||

|

8.

|

||

|

9.

|

||

|

9A.

|

||

|

9B.

|

||

|

Part III

|

||

|

10.

|

||

|

11.

|

||

|

12.

|

||

|

13.

|

||

|

14.

|

||

|

Part IV

|

||

|

15.

|

||

|

•

|

Multi-point permanently installed gas detection systems.

This product line is used to monitor for combustible and toxic gases and oxygen deficiency in virtually any application where continuous monitoring is required. Our systems are used for gas detection in petrochemical, pulp and paper, wastewater, refrigerant monitoring, and general industrial applications. These systems utilize a wide array of sensing technologies including electrochemical, catalytic, infrared and ultrasonic.

|

|

•

|

Flame detectors and open-path infrared gas detectors.

These instruments are used for plant-wide monitoring of toxic gases and for detecting the presence of flames. These systems use infrared optics to detect potentially hazardous conditions across long distances, making them suitable for use in such applications as offshore oil rigs, storage vessels, refineries, pipelines and ventilation ducts. First used in the oil and gas industry, our systems now have broad applications in petrochemical facilities, the transportation industry and in pharmaceutical production.

|

|

•

|

unexpected changes in regulatory requirements;

|

|

•

|

changes in trade policy or tariff regulations;

|

|

•

|

changes in tax laws and regulations;

|

|

•

|

changes to the company's legal structure could have unintended tax consequences;

|

|

•

|

inability to generate sufficient profit in certain foreign jurisdictions could lead to additional valuation allowances on deferred tax assets;

|

|

•

|

intellectual property protection difficulties;

|

|

•

|

difficulty in collecting accounts receivable;

|

|

•

|

complications in complying with a variety of foreign laws and regulations, some of which may conflict with U.S. laws;

|

|

•

|

trade protection measures and price controls;

|

|

•

|

trade sanctions and embargoes;

|

|

•

|

nationalization and expropriation;

|

|

•

|

increased international instability or potential instability of foreign governments;

|

|

•

|

effectiveness of worldwide compliance with MSA's anti-bribery policy, local laws and the Foreign Corrupt Practices Act

|

|

•

|

the ability to effectively negotiate with labor unions in foreign countries;

|

|

•

|

the need to take extra security precautions for our international operations; and

|

|

•

|

costs and difficulties in managing culturally and geographically diverse international operations.

|

|

•

|

failure of the acquired businesses to achieve the results we expect;

|

|

•

|

diversion of our management’s attention from operational matters;

|

|

•

|

our inability to retain key personnel of the acquired businesses;

|

|

•

|

risks associated with unanticipated events or liabilities;

|

|

•

|

potential disruption of our existing business; and

|

|

•

|

customer dissatisfaction or performance problems at the acquired businesses.

|

|

Location

|

Function

|

Square Feet

|

Owned

or Leased

|

||

|

North America

|

|||||

|

Murrysville, PA

|

Manufacturing

|

295,000

|

|

Owned

|

|

|

Cranberry Twp., PA

|

Office, Research and Development and Manufacturing

|

212,000

|

|

Owned

|

|

|

New Galilee, PA

|

Distribution

|

120,000

|

|

Leased

|

|

|

Jacksonville, NC

|

Manufacturing

|

107,000

|

|

Owned

|

|

|

Queretaro, Mexico

|

Office, Manufacturing and Distribution

|

77,000

|

|

Leased

|

|

|

Cranberry Twp., PA

|

Research and Development

|

68,000

|

|

Owned

|

|

|

Lake Forest, CA

|

Office, Research and Development and Manufacturing

|

62,000

|

|

Leased

|

|

|

Corona, CA

|

Manufacturing

|

19,000

|

|

Leased

|

|

|

Torreon, Mexico

|

Office

|

15,000

|

|

Leased

|

|

|

Lake Forest, CA

|

Office

|

6,000

|

|

Owned

|

|

|

Houston, TX

|

Office and Distribution

|

9,000

|

|

Leased

|

|

|

Europe

|

|||||

|

Berlin, Germany

|

Office, Research and Development, Manufacturing and Distribution

|

340,000

|

|

Leased

|

|

|

Chatillon sur Chalaronne, France

|

Office, Research and Development, Manufacturing and Distribution

|

94,000

|

|

Owned

|

|

|

Milan, Italy

|

Office

|

43,000

|

|

Owned

|

|

|

Rapperswil, Switzerland

|

Office

|

8,000

|

|

Leased

|

|

|

Glasgow, Scotland

|

Office

|

7,000

|

|

Leased

|

|

|

Mohammedia, Morocco

|

Manufacturing

|

24,000

|

|

Owned

|

|

|

Barcelona, Spain

|

Office

|

23,000

|

|

Leased

|

|

|

Galway, Ireland

|

Office and Manufacturing

|

20,000

|

|

Owned

|

|

|

Varnamo, Sweden

|

Office, Manufacturing and Distribution

|

18,000

|

|

Leased

|

|

|

Hoorn, Netherlands

|

Office and Distribution

|

10,000

|

|

Leased

|

|

|

Rajarhat, India

|

Office and Distribution

|

10,000

|

|

Leased

|

|

|

Warsaw, Poland

|

Office and Distribution

|

18,000

|

|

Leased

|

|

|

Devizes, UK

|

Office, Manufacturing and Distribution

|

115,000

|

|

Owned

|

|

|

Kozina, Slovenia

|

Office and Manufacturing

|

17,000

|

|

Leased

|

|

|

International

|

|||||

|

Suzhou, China

|

Office and Manufacturing

|

193,000

|

|

Owned

|

|

|

Sydney, Australia

|

Office, Manufacturing

|

18,000

|

|

Leased

|

|

|

Sao Paulo, Brazil

|

Office, Manufacturing and Distribution

|

74,000

|

|

Owned

|

|

|

Johannesburg, South Africa

|

Office, Manufacturing and Distribution

|

35,000

|

|

Leased

|

|

|

Lima, Peru

|

Office and Distribution

|

34,000

|

|

Owned

|

|

|

Santiago, Chile

|

Office and Distribution

|

32,000

|

|

Leased

|

|

|

Buenos Aires, Argentina

|

Office and Distribution

|

9,000

|

|

Owned

|

|

|

Name

|

Age

|

|

Title

|

||

|

William M. Lambert

(a)

|

57

|

|

Chairman, President and Chief Executive Officer since May 2015.

|

||

|

Joakim Birgersson

(b)

|

51

|

|

Vice President and General Manager, Europe since August 2015

|

||

|

Steven C. Blanco

(c)

|

49

|

|

Vice President, General Manager Northern North America since May 2015.

|

||

|

Kerry M. Bove

(d)

|

57

|

|

Senior Vice President and Chief Strategy Officer since May 2015.

|

||

|

Ronald N. Herring, Jr.

(e)

|

55

|

|

Senior Vice President and President, MSA Europe and International Segments since May 2015.

|

||

|

Kenneth D. Krause

(f)

|

40

|

|

Vice President, Chief Financial Officer and Treasurer since December 2015.

|

||

|

Douglas K. McClaine

|

58

|

|

Vice President, Secretary and General Counsel since May 2005.

|

||

|

Thomas Muschter

(g)

|

55

|

|

Vice President, Global Product Leadership since November 2011.

|

||

|

Paul R. Uhler

|

57

|

|

Vice President, Global Human Resources since May 2006.

|

||

|

Nishan Vartanian

(h)

|

56

|

|

Senior Vice President and President, MSA Americas Segment since May 2015.

|

||

|

Markus H. Weber

(i)

|

51

|

|

Vice President and Chief Information Officer since April 2010.

|

||

|

(a)

|

Prior to his present position, Mr. Lambert was President and Chief Executive Officer.

|

|

(b)

|

Prior to his present position, Mr. Birgersson served as Project Director of Europe 2.0x.

|

|

(c)

|

Prior to his present position, Mr. Blanco served as Vice President of Global Operational Excellence.

|

|

(d)

|

Prior to his present position, Mr. Bove was Vice President and President MSA International Segment. Mr. Bove also served as Acting Chief Financial Officer from September to December 2015.

|

|

(e)

|

Prior to his present position, Mr. Herring was Vice President and President MSA Europe Segment.

|

|

(f)

|

Prior to his present position, Mr. Krause was Vice President, Strategic Finance and Treasurer.

|

|

(g)

|

Prior to his present position, Dr. Muschter held the positions of Director, Research & Development, International; and Director, Research & Development, Europe.

|

|

(h)

|

Prior to his present position, Mr. Vartanian was Vice President and President, MSA North America.

|

|

(i)

|

Prior to joining MSA, Mr. Weber served as Chief Information Officer of Berlin-Chemie AG, an international research-based pharmaceutical company.

|

|

Price Range of Our

Common Stock

|

Dividends

|

|||||||||

|

High

|

Low

|

|||||||||

|

Year ended December 31, 2014

|

||||||||||

|

First Quarter

|

$

|

57.94

|

|

$

|

46.50

|

|

$

|

0.30

|

|

|

|

Second Quarter

|

58.90

|

|

49.85

|

|

0.31

|

|

||||

|

Third Quarter

|

61.08

|

|

49.37

|

|

0.31

|

|

||||

|

Fourth Quarter

|

58.99

|

|

46.25

|

|

0.31

|

|

||||

|

Year ended December 31, 2015

|

||||||||||

|

First Quarter

|

$

|

53.64

|

|

$

|

43.12

|

|

$

|

0.31

|

|

|

|

Second Quarter

|

52.59

|

|

43.43

|

|

0.32

|

|

||||

|

Third Quarter

|

54.54

|

|

38.32

|

|

0.32

|

|

||||

|

Fourth Quarter

|

47.46

|

|

39.17

|

|

0.32

|

|

||||

|

Period

|

Total Number of Shares Purchased

|

Average Price Paid Per Share

|

Total Number of Shares Purchased as Part of Publicly Announced

Plans or Programs

|

Maximum Number of Shares that May Yet Be Purchased

Under the Plans or Programs

|

||||||||

|

October 1 — October 31, 2015

|

180

|

|

$

|

43.48

|

|

—

|

|

2,136,533

|

|

|||

|

November 1 — November 30, 2015

|

4,778

|

|

44.96

|

|

—

|

|

1,980,734

|

|

||||

|

December 1 — December 31, 2015

|

—

|

|

—

|

|

—

|

|

2,137,024

|

|

||||

|

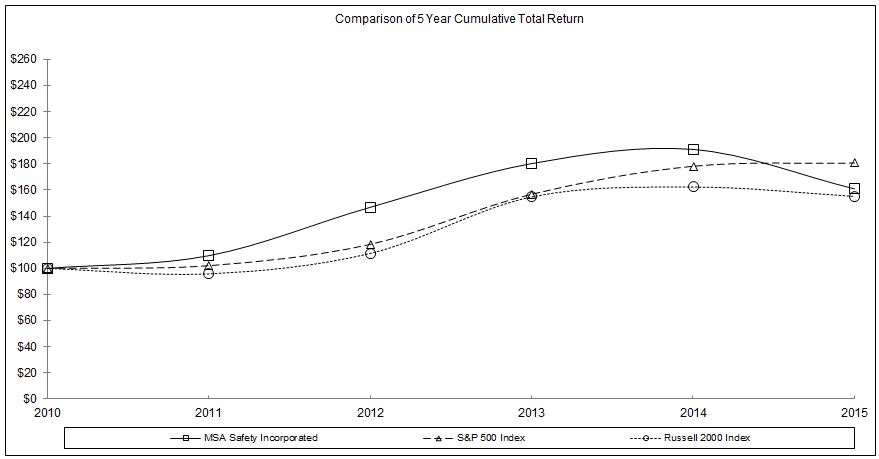

Value at December 31,

|

|||||||||||||||||||||||

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

||||||||||||||||||

|

MSA Safety Incorporated

|

$

|

100.00

|

|

$

|

109.73

|

|

$

|

146.79

|

|

$

|

180.28

|

|

$

|

191.17

|

|

$

|

160.88

|

|

|||||

|

S&P 500 Index

|

100.00

|

|

102.11

|

|

118.45

|

|

156.82

|

|

178.28

|

|

180.75

|

|

|||||||||||

|

Russell 2000 Index

|

100.00

|

|

95.82

|

|

111.49

|

|

154.78

|

|

162.35

|

|

155.18

|

|

|||||||||||

|

(In thousands, except as noted)

|

2015

|

2014

|

2013

|

2012

|

2011

|

||||||||||||||

|

Statement of Income Data:

|

|||||||||||||||||||

|

Net sales

|

$

|

1,130,783

|

|

$

|

1,133,885

|

|

$

|

1,112,058

|

|

$

|

1,110,443

|

|

$

|

1,112,814

|

|

||||

|

Income from continuing operations

|

69,590

|

|

87,447

|

|

85,858

|

|

87,557

|

|

67,518

|

|

|||||||||

|

Income from discontinued operations

|

1,217

|

|

1,059

|

|

2,389

|

|

3,080

|

|

2,334

|

|

|||||||||

|

Net income

|

70,807

|

|

88,506

|

|

88,247

|

|

90,637

|

|

69,852

|

|

|||||||||

|

Earnings per share attributable to MSA common shareholders:

|

|||||||||||||||||||

|

Basic per common share (in dollars):

|

|||||||||||||||||||

|

Income from continuing operations

|

$

|

1.86

|

|

$

|

2.34

|

|

$

|

2.31

|

|

$

|

2.37

|

|

$

|

1.85

|

|

||||

|

Income from discontinued operations

|

0.03

|

|

0.03

|

|

0.06

|

|

0.08

|

|

0.06

|

|

|||||||||

|

Net income

|

1.89

|

|

2.37

|

|

2.37

|

|

2.45

|

|

1.91

|

|

|||||||||

|

Diluted per common share (in dollars):

|

|||||||||||||||||||

|

Income from continuing operations

|

$

|

1.84

|

|

$

|

2.30

|

|

$

|

2.28

|

|

$

|

2.34

|

|

$

|

1.81

|

|

||||

|

Income from discontinued operations

|

0.03

|

|

0.03

|

|

0.06

|

|

0.08

|

|

0.06

|

|

|||||||||

|

Net income

|

1.87

|

|

2.33

|

|

2.34

|

|

2.42

|

|

1.87

|

|

|||||||||

|

Dividends paid per common share (in dollars)

|

1.27

|

|

1.23

|

|

1.18

|

|

1.38

|

|

1.03

|

|

|||||||||

|

Weighted average common shares outstanding—basic

|

37,293

|

|

37,138

|

|

36,868

|

|

36,564

|

|

36,221

|

|

|||||||||

|

Weighted average common shares outstanding—diluted

|

37,710

|

|

37,728

|

|

37,450

|

|

37,042

|

|

36,831

|

|

|||||||||

|

Balance Sheet Data:

|

|||||||||||||||||||

|

Total assets

|

$

|

1,424,818

|

|

$

|

1,264,792

|

|

$

|

1,234,270

|

|

$

|

1,111,746

|

|

$

|

1,115,052

|

|

||||

|

Long-term debt

|

459,959

|

|

245,000

|

|

260,667

|

|

272,333

|

|

334,046

|

|

|||||||||

|

Shareholders’ equity

|

516,496

|

|

533,809

|

|

566,452

|

|

462,955

|

|

433,666

|

|

|||||||||

|

Net Sales from Continuing Operations

|

2015 vs. 2014

|

2014 vs. 2013

|

||

|

Organic growth

|

7

|

%

|

4

|

%

|

|

Acquisitions, divestitures, & other, net

|

1

|

%

|

—

|

%

|

|

Foreign exchange impact

|

(8

|

)%

|

(2

|

)%

|

|

Total % Year-Over-Year Change

|

—

|

%

|

2

|

%

|

|

Percent

Increase

(Decrease)

|

Percent

Increase

(Decrease)

|

|||

|

Core Sales

|

2015

|

2014

|

||

|

Breathing Apparatus

|

52

|

%

|

(7

|

)%

|

|

Fall Protection

|

22

|

%

|

5

|

%

|

|

Fire & Rescue Helmets

|

9

|

%

|

4

|

%

|

|

Fixed Gas & Flame Detection

|

(2

|

)%

|

10

|

%

|

|

Portable Gas Detection

|

(7

|

)%

|

9

|

%

|

|

Head Protection

|

(9

|

)%

|

5

|

%

|

|

Total

|

11

|

%

|

4

|

%

|

|

Net Sales

(Dollars in millions)

|

2015

|

2014

|

Dollar

Increase

(Decrease)

|

Percent

Increase

(Decrease)

|

||||||||||

|

North America

|

$

|

609.0

|

|

$

|

547.7

|

|

$

|

61.3

|

|

11

|

%

|

|||

|

Europe

|

293.2

|

|

321.6

|

|

(28.4

|

)

|

(9

|

)%

|

||||||

|

International

|

228.6

|

|

264.5

|

|

(35.9

|

)

|

(14

|

)%

|

||||||

|

Total

|

1,130.8

|

|

1,133.9

|

|

(3.1

|

)

|

—

|

%

|

||||||

|

Net Sales from Continuing Operations

|

2014 vs. 2013

|

2013 vs. 2012

|

||

|

Organic growth

|

4

|

%

|

2

|

%

|

|

Acquisitions, divestitures, & other, net

|

—

|

%

|

(1

|

)%

|

|

Foreign exchange impact

|

(2

|

)%

|

(1

|

)%

|

|

Total % Year-Over-Year Change

|

2

|

%

|

—

|

%

|

|

Percent

Increase

(Decrease)

|

Percent

Increase

(Decrease)

|

|||

|

Core Sales

|

2014

|

2013

|

||

|

Fixed Gas & Flame Detection

|

10

|

%

|

6

|

%

|

|

Portable Gas Detection

|

9

|

%

|

11

|

%

|

|

Fall Protection

|

5

|

%

|

6

|

%

|

|

Head Protection

|

5

|

%

|

3

|

%

|

|

Fire & Rescue Helmets

|

4

|

%

|

9

|

%

|

|

Breathing Apparatus

|

(7

|

)%

|

4

|

%

|

|

Total

|

4

|

%

|

6

|

%

|

|

Net Sales

(Dollars in millions)

|

2014

|

2013

|

Dollar

Increase (Decrease)

|

Percent

Increase (Decrease)

|

||||||||||

|

North America

|

$

|

547.7

|

|

$

|

533.2

|

|

$

|

14.5

|

|

3

|

%

|

|||

|

Europe

|

321.6

|

|

293.1

|

|

28.5

|

|

10

|

%

|

||||||

|

International

|

264.5

|

|

285.8

|

|

(21.3

|

)

|

(7

|

)%

|

||||||

|

Total

|

1,133.9

|

|

1,112.1

|

|

21.8

|

|

2

|

%

|

||||||

|

(In millions)

|

Total

|

2016

|

2017

|

2018

|

2019

|

2020

|

Thereafter

|

|||||||||||||||||||||

|

Long-term debt

|

$

|

466.6

|

|

$

|

6.7

|

|

$

|

26.7

|

|

$

|

26.7

|

|

$

|

26.7

|

|

$

|

273.1

|

|

$

|

106.7

|

|

|||||||

|

Operating leases

|

51.4

|

|

11.2

|

|

9.5

|

|

7.4

|

|

6.1

|

|

4.6

|

|

12.6

|

|

||||||||||||||

|

Totals

|

518.0

|

|

17.9

|

|

36.2

|

|

34.1

|

|

32.8

|

|

277.7

|

|

119.3

|

|

||||||||||||||

|

Impact of Changes in Actuarial Assumptions

|

|||||||||||||||||||||||

|

Change in Discount

Rate

|

Change in Expected

Return

|

Change in Market Value of Assets

|

|||||||||||||||||||||

|

(In thousands)

|

1%

|

(1)%

|

1%

|

(1)%

|

5%

|

(5)%

|

|||||||||||||||||

|

(Decrease) increase in net benefit cost

|

$

|

(6,771

|

)

|

$

|

8,209

|

|

$

|

(4,230

|

)

|

$

|

4,230

|

|

$

|

(975

|

)

|

$

|

938

|

|

|||||

|

(Decrease) increase in projected benefit obligation

|

(63,738

|

)

|

78,520

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Increase (decrease) in funded status

|

63,738

|

|

(78,520

|

)

|

—

|

|

—

|

|

20,954

|

|

(20,954

|

)

|

|||||||||||

|

/s/ WILLIAM M. LAMBERT

|

|

William M. Lambert

Chief Executive Officer

|

|

/s/ KENNETH D. KRAUSE

|

|

Kenneth D. Krause

Vice President of Finance and Chief Financial Officer

|

|

Year ended December 31,

|

|||||||||||

|

(In thousands, except per share amounts)

|

2015

|

2014

|

2013

|

||||||||

|

Net sales

|

$

|

1,130,783

|

|

$

|

1,133,885

|

|

$

|

1,112,058

|

|

||

|

Other (loss) income, net (Note 15)

|

(861

|

)

|

2,765

|

|

(175

|

)

|

|||||

|

1,129,922

|

|

1,136,650

|

|

1,111,883

|

|

||||||

|

Costs and expenses

|

|

|

|

||||||||

|

Cost of products sold

|

629,680

|

|

618,536

|

|

615,213

|

|

|||||

|

Selling, general and administrative

|

315,270

|

|

322,797

|

|

309,206

|

|

|||||

|

Research and development

|

48,630

|

|

48,247

|

|

45,858

|

|

|||||

|

Restructuring and other charges (Note 2)

|

12,258

|

|

8,515

|

|

5,344

|

|

|||||

|

Interest expense

|

10,854

|

|

9,851

|

|

10,677

|

|

|||||

|

Currency exchange losses, net

|

2,204

|

|

1,509

|

|

5,452

|

|

|||||

|

1,018,896

|

|

1,009,455

|

|

991,750

|

|

||||||

|

Income from continuing operations before income taxes

|

111,026

|

|

127,195

|

|

120,133

|

|

|||||

|

Provision for income taxes (Note 9)

|

44,407

|

|

41,044

|

|

35,145

|

|

|||||

|

Income from continuing operations

|

66,619

|

|

86,151

|

|

84,988

|

|

|||||

|

Income from discontinued operations (Note 20)

|

1,325

|

|

1,776

|

|

3,061

|

|

|||||

|

Net income

|

67,944

|

|

87,927

|

|

88,049

|

|

|||||

|

Net loss attributable to noncontrolling interests

|

2,863

|

|

579

|

|

198

|

|

|||||

|

Net income attributable to MSA Safety Incorporated

|

$

|

70,807

|

|

$

|

88,506

|

|

$

|

88,247

|

|

||

|

Amounts attributable to MSA Safety Incorporated common shareholders:

|

|||||||||||

|

Income from continuing operations

|

$

|

69,590

|

|

$

|

87,447

|

|

$

|

85,858

|

|

||

|

Income from discontinued operations (Note 20)

|

1,217

|

|

1,059

|

|

2,389

|

|

|||||

|

Net income

|

$

|

70,807

|

|

$

|

88,506

|

|

$

|

88,247

|

|

||

|

Earnings per share attributable to MSA Safety Incorporated common shareholders (Note 8)

|

|||||||||||

|

Basic

|

|||||||||||

|

Income from continuing operations

|

$

|

1.86

|

|

$

|

2.34

|

|

$

|

2.31

|

|

||

|

Income from discontinued operations (Note 20)

|

$

|

0.03

|

|

$

|

0.03

|

|

$

|

0.06

|

|

||

|

Net income

|

$

|

1.89

|

|

$

|

2.37

|

|

$

|

2.37

|

|

||

|

Diluted

|

|||||||||||

|

Income from continuing operations

|

$

|

1.84

|

|

$

|

2.30

|

|

$

|

2.28

|

|

||

|

Income from discontinued operations (Note 20)

|

$

|

0.03

|

|

$

|

0.03

|

|

$

|

0.06

|

|

||

|

Net income

|

$

|

1.87

|

|

$

|

2.33

|

|

$

|

2.34

|

|

||

|

Year ended December 31,

|

|||||||||||

|

(In thousands)

|

2015

|

2014

|

2013

|

||||||||

|

Net income

|

$

|

67,944

|

|

$

|

87,927

|

|

$

|

88,049

|

|

||

|

Foreign currency translation adjustments (Note 5)

|

(49,067

|

)

|

(40,568

|

)

|

(7,281

|

)

|

|||||

|

Pension and post-retirement plan actuarial gains (losses), net of tax (Note 14)

|

6,181

|

|

(48,490

|

)

|

54,951

|

|

|||||

|

Comprehensive net income (loss)

|

25,058

|

|

(1,131

|

)

|

135,719

|

|

|||||

|

Comprehensive net loss attributable to noncontrolling interests

|

4,280

|

|

1,176

|

|

1,331

|

|

|||||

|

Comprehensive net income attributable to MSA Safety Incorporated

|

$

|

29,338

|

|

$

|

45

|

|

$

|

137,050

|

|

||

|

December 31,

|

|||||||

|

(In thousands, except share amounts)

|

2015

|

2014

|

|||||

|

Assets

|

|||||||

|

Cash and cash equivalents

|

$

|

105,925

|

|

$

|

105,998

|

|

|

|

Trade receivables, less allowance for doubtful accounts of $8,189 and $7,821

|

232,862

|

|

211,440

|

|

|||

|

Inventories (Note 3)

|

125,849

|

|

122,954

|

|

|||

|

Income taxes receivable

|

8,745

|

|

2,876

|

|

|||

|

Prepaid expenses and other current assets (Note 17)

|

31,646

|

|

30,771

|

|

|||

|

Total current assets

|

505,027

|

|

474,039

|

|

|||

|

Property, plant, and equipment, net (Note 4)

|

155,839

|

|

151,352

|

|

|||

|

Prepaid pension cost (Note 14)

|

62,072

|

|

75,017

|

|

|||

|

Deferred tax assets (Note 9)

|

26,455

|

|

44,057

|

|

|||

|

Goodwill (Note 12)

|

340,338

|

|

252,520

|

|

|||

|

Intangible assets, net (Note 12)

|

90,068

|

|

31,323

|

|

|||

|

Other noncurrent assets

|

245,019

|

|

236,484

|

|

|||

|

Total assets

|

$

|

1,424,818

|

|

$

|

1,264,792

|

|

|

|

Liabilities

|

|||||||

|

Notes payable and current portion of long-term debt (Note 11)

|

$

|

6,668

|

|

$

|

6,700

|

|

|

|

Accounts payable

|

68,206

|

|

70,210

|

|

|||

|

Employees’ compensation

|

37,642

|

|

40,249

|

|

|||

|

Insurance and product liability (Note 19)

|

57,718

|

|

47,456

|

|

|||

|

Taxes on income (Note 9)

|

11,658

|

|

5,545

|

|

|||

|

Other current liabilities

|

70,013

|

|

63,890

|

|

|||

|

Total current liabilities

|

251,905

|

|

234,050

|

|

|||

|

Long-term debt (Note 11)

|

459,959

|

|

245,000

|

|

|||

|

Pensions and other employee benefits (Note 14)

|

156,160

|

|

174,598

|

|

|||

|

Deferred tax liabilities (Note 9)

|

24,872

|

|

26,313

|

|

|||

|

Other noncurrent liabilities (Note 19)

|

14,794

|

|

46,198

|

|

|||

|

Total liabilities

|

$

|

907,690

|

|

$

|

726,159

|

|

|

|

Commitments and contingencies (Note 19)

|

|

|

|||||

|

Shareholders' Equity

|

|||||||

|

Preferred stock, 4

1

/

2

% cumulative, $50 par value (Note 6)

|

3,569

|

|

3,569

|

|

|||

|

Common stock, no par value (180,000,000 shares authorized; 62,081,391 shares issued; 2015 shares outstanding 37,372,474 and 37,448,310 shares outstanding 2014)

|

157,643

|

|

148,401

|

|

|||

|

Treasury shares, at cost (Note 6)

|

(295,070

|

)

|

(286,557

|

)

|

|||

|

Accumulated other comprehensive loss

|

(208,199

|

)

|

(166,730

|

)

|

|||

|

Retained earnings

|

858,553

|

|

835,126

|

|

|||

|

Total shareholders’ equity

|

516,496

|

|

533,809

|

|

|||

|

Noncontrolling interests

|

632

|

|

4,824

|

|

|||

|

Total shareholders’ equity

|

517,128

|

|

538,633

|

|

|||

|

Total liabilities and shareholders’ equity

|

$

|

1,424,818

|

|

$

|

1,264,792

|

|

|

|

Year ended December 31,

|

|||||||||||

|

(In thousands)

|

2015

|

2014

|

2013

|

||||||||

|

Operating Activities

|

|||||||||||

|

Net income

|

$

|

67,944

|

|

$

|

87,927

|

|

$

|

88,049

|

|

||

|

Depreciation and amortization

|

31,684

|

|

29,921

|

|

30,764

|

|

|||||

|

Pension expense (Note 14)

|

11,955

|

|

4,836

|

|

12,268

|

|

|||||

|

Net gain from investing activities—asset disposals (Note 15)

|

(1,745

|

)

|

(2,094

|

)

|

(436

|

)

|

|||||

|

Stock-based compensation (Note 10)

|

7,599

|

|

9,053

|

|

10,337

|

|

|||||

|

Asset Impairment Charges (Note 15)

|

4,946

|

|

—

|

|

—

|

|

|||||

|

Deferred income tax provision (Note 9)

|

(1,699

|

)

|

(5,388

|

)

|

(3,234

|

)

|

|||||

|

Other noncurrent assets and liabilities

|

(45,859

|

)

|

(53,482

|

)

|

(18,162

|

)

|

|||||

|

Currency exchange losses, net

|

2,471

|

|

1,393

|

|

5,127

|

|

|||||

|

Excess tax benefit related to stock plans (Note 6)

|

(596

|

)

|

(2,573

|

)

|

(2,246

|

)

|

|||||

|

Other, net

|

(2,786

|

)

|

(5,168

|

)

|

4,386

|

|

|||||

|

Operating cash flow before changes in certain working capital items

|

73,914

|

|

64,425

|

|

126,853

|

|

|||||

|

(Increase) in trade receivables

|

(21,959

|

)

|

(23,480

|

)

|

(13,171

|

)

|

|||||

|

(Increase) in inventories (Note 3)

|

(9,403

|

)

|

(600

|

)

|

(6,296

|

)

|

|||||

|

Increase in accounts payable and accrued liabilities

|

20,286

|

|

56,988

|

|

10,732

|

|

|||||

|

(Increase) decrease in income taxes receivable, prepaid expenses and other current assets

|

(7,584

|

)

|

9,698

|

|

(7,337

|

)

|

|||||

|

Changes in certain working capital items

|

(18,660

|

)

|

42,606

|

|

(16,072

|

)

|

|||||

|

Cash Flow From Operating Activities

|

55,254

|

|

107,031

|

|

110,781

|

|

|||||

|

Investing Activities

|

|||||||||||

|

Capital expenditures

|

(36,241

|

)

|

(33,583

|

)

|

(36,517

|

)

|

|||||

|

Property disposals

|

8,022

|

|

3,385

|

|

1,360

|

|

|||||

|

Acquistion of business, net of cash acquired (Note 13)

|

(180,271

|

)

|

—

|

|

—

|

|

|||||

|

Other investing

|

—

|

|

(500

|

)

|

—

|

|

|||||

|

Cash Flow From Investing Activities

|

(208,490

|

)

|

(30,698

|

)

|

(35,157

|

)

|

|||||

|

Financing Activities

|

|||||||||||

|

Proceeds from (payments on) short-term debt, net (Note 11)

|

5

|

|

(796

|

)

|

662

|

|

|||||

|

Payments on long-term debt (Note 11)

|

(291,525

|

)

|

(421,667

|

)

|

(306,766

|

)

|

|||||

|

Proceeds from long-term debt (Note 11)

|

510,456

|

|

406,000

|

|

295,100

|

|

|||||

|

Restricted cash

|

264

|

|

86

|

|

(2,790

|

)

|

|||||

|

Cash dividends paid

|

(47,380

|

)

|

(45,586

|

)

|

(43,994

|

)

|

|||||

|

Distributions to noncontrolling interests

|

—

|

|

—

|

|

(556

|

)

|

|||||

|

Company stock purchases (Note 6)

|

(9,885

|

)

|

(5,654

|

)

|

(11,785

|

)

|

|||||

|

Exercise of stock options (Note 6)

|

1,930

|

|

6,926

|

|

9,643

|

|

|||||

|

Employee stock purchase plan

|

488

|

|

—

|

|

—

|

|

|||||

|

Excess tax benefit related to stock plans (Note 6)

|

596

|

|

2,573

|

|

2,246

|

|

|||||

|

Cash Flow From Financing Activities

|

164,949

|

|

(58,118

|

)

|

(58,240

|

)

|

|||||

|

Effect of exchange rate changes on cash and equivalents

|

(11,786

|

)

|

(8,482

|

)

|

(3,837

|

)

|

|||||

|

(Decrease) increase in cash and cash equivalents

|

(73

|

)

|

9,733

|

|

13,547

|

|

|||||

|

Beginning cash and cash equivalents

|

105,998

|

|

96,265

|

|

82,718

|

|

|||||

|

Ending cash and cash equivalents

|

$

|

105,925

|

|

$

|

105,998

|

|

$

|

96,265

|

|

||

|

Supplemental cash flow information:

|

|||||||||||

|

Interest payments

|

$

|

10,818

|

|

$

|

9,663

|

|

$

|

10,884

|

|

||

|

Income tax payments

|

50,001

|

|

31,679

|

|

36,242

|

|

|||||

|

(In thousands)

|

Retained

Earnings

|

Accumulated

Other

Comprehensive

(Loss)

|

|||||

|

Balances January 1, 2013

|

$

|

747,953

|

|

$

|

(127,072

|

)

|

|

|

Net income

|

88,049

|

|

—

|

|

|||

|

Foreign currency translation adjustments

|

—

|

|

(7,281

|

)

|

|||

|

Pension and post-retirement plan adjustments, net of tax of $30,849

|

—

|

|

54,951

|

|

|||

|

Loss attributable to noncontrolling interests

|

198

|

|

1,133

|

|

|||

|

Common dividends

|

(43,952

|

)

|

—

|

|

|||

|

Preferred dividends

|

(42

|

)

|

—

|

|

|||

|

Balances December 31, 2013

|

792,206

|

|

(78,269

|

)

|

|||

|

Net income

|

87,927

|

|

—

|

|

|||

|

Foreign currency translation adjustments

|

—

|

|

(40,568

|

)

|

|||

|

Pension and post-retirement plan adjustments, net of tax of $26,840

|

—

|

|

(48,490

|

)

|

|||

|

Loss attributable to noncontrolling interests

|

579

|

|

597

|

|

|||

|

Common dividends

|

(45,544

|

)

|

—

|

|

|||

|

Preferred dividends

|

(42

|

)

|

—

|

|

|||

|

Balances December 31, 2014

|

835,126

|

|

(166,730

|

)

|

|||

|

Net income

|

67,944

|

|

—

|

|

|||

|

Foreign currency translation adjustments

|

—

|

|

(49,067

|

)

|

|||

|

Pension and post-retirement plan adjustments, net of tax of $1,160

|

—

|

|

6,181

|

|

|||

|

Loss attributable to noncontrolling interests

|

2,863

|

|

1,417

|

|

|||

|

Common dividends

|

(47,338

|

)

|

—

|

|

|||

|

Preferred dividends

|

(42

|

)

|

—

|

|

|||

|

Balances December 31, 2015

|

$

|

858,553

|

|

$

|

(208,199

|

)

|

|

|

(in millions)

|

North America

|

Europe

|

International

|

Corporate

|

Total

|

||||||||||||||

|

Reserve balances at January 1, 2013

|

$

|

0.3

|

|

$

|

2.5

|

|

$

|

0.2

|

|

$

|

—

|

|

$

|

3.0

|

|

||||

|

Restructuring charges

|

—

|

|

3.0

|

|

2.3

|

|

—

|

|

5.3

|

|

|||||||||

|

Cash payments

|

(0.3

|

)

|

(3.8

|

)

|

(2.5

|

)

|

—

|

|

(6.6

|

)

|

|||||||||

|

Reserve balances at December 31, 2013

|

$

|

—

|

|

$

|

1.7

|

|

$

|

—

|

|

$

|

—

|

|

$

|

1.7

|

|

||||

|

Restructuring charges

|

—

|

|

4.8

|

|

3.7

|

|

—

|

|

8.5

|

|

|||||||||

|

Asset disposals

|

—

|

|

(0.4

|

)

|

(1.7

|

)

|

—

|

|

(2.1

|

)

|

|||||||||

|

Cash payments

|

—

|

|

(3.5

|

)

|

(1.8

|

)

|

—

|

|

(5.3

|

)

|

|||||||||

|

Reserve balances at December 31, 2014

|

$

|

—

|

|

$

|

2.6

|

|

$

|

0.2

|

|

$

|

—

|

|

$

|

2.8

|

|

||||

|

Restructuring charges

|

2.0

|

|

3.3

|

|

5.4

|

|

1.6

|

|

12.3

|

|

|||||||||

|

Cash payments

|

(0.9

|

)

|

(1.7

|

)

|

(3.9

|

)

|

(0.5

|

)

|

(7.0

|

)

|

|||||||||

|

Reserve balances at December 31, 2015

|

$

|

1.1

|

|

$

|

4.2

|

|

$

|

1.7

|

|

$

|

1.1

|

|

$

|

8.1

|

|

||||

|

December 31,

|

|||||||

|

(In thousands)

|

2015

|

2014

|

|||||

|

Finished products

|

$

|

74,929

|

|

$

|

89,595

|

|

|

|

Work in process

|

8,979

|

|

$

|

8,942

|

|

||

|

Raw materials and supplies

|

85,643

|

|

68,885

|

|

|||

|

Inventories at current cost

|

169,551

|

|

167,422

|

|

|||

|

Less: LIFO valuation

|

(43,702

|

)

|

(44,468

|

)

|

|||

|

Total inventories

|

125,849

|

|

122,954

|

|

|||

|

December 31,

|

|||||||

|

(In thousands)

|

2015

|

2014

|

|||||

|

Land

|

$

|

2,929

|

|

$

|

3,573

|

|

|

|

Buildings

|

114,324

|

|

110,144

|

|

|||

|

Machinery and equipment

|

345,064

|

|

335,318

|

|

|||

|

Construction in progress

|

12,451

|

|

17,327

|

|

|||

|

Total

|

474,768

|

|

466,362

|

|

|||

|

Less accumulated depreciation

|

(318,929

|

)

|

(315,010

|

)

|

|||

|

Net property

|

155,839

|

|

151,352

|

|

|||

|

MSA Safety Incorporated

|

Noncontrolling Interests

|

|||||||||||||||||||||||

|

(In thousands)

|

2015

|

2014

|

2013

|

2015

|

2014

|

2013

|

||||||||||||||||||

|

Pension and other post-retirement benefits

|

||||||||||||||||||||||||

|

Balance at beginning of period

|

$

|

(125,570

|

)

|

$

|

(77,080

|

)

|

$

|

(132,031

|

)

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||||

|

Unrecognized net actuarial (losses) gains

|

(8,002

|

)

|

(84,495

|

)

|

72,008

|

|

—

|

|

—

|

|

—

|

|

||||||||||||

|

Unrecognized prior service (cost) credit

|

(604

|

)

|

302

|

|

239

|

|

—

|

|

—

|

|

—

|

|

||||||||||||

|

Tax benefit (expense)

|

4,173

|

|

29,832

|

|

(25,783

|

)

|

—

|

|

—

|

|

—

|

|

||||||||||||

|

Total other comprehensive (loss) income before reclassifications, net of tax

|

(4,433

|

)

|

(54,361

|

)

|

46,464

|

|

—

|

|

—

|

|

—

|

|

||||||||||||

|

Amounts reclassified from accumulated other comprehensive loss:

|

||||||||||||||||||||||||

|

Amortization of prior service cost

|

(268

|

)

|

(251

|

)

|

(322

|

)

|

—

|

|

—

|

|

—

|

|

||||||||||||

|

Recognized net actuarial losses

|

16,215

|

|

9,114

|

|

13,875

|

|

—

|

|

—

|

|

—

|

|

||||||||||||

|

Tax benefit

|

(5,333

|

)

|

(2,992

|

)

|

(5,066

|

)

|

—

|

|

—

|

|

—

|

|

||||||||||||

|

Total amount reclassified from accumulated other comprehensive loss, net of tax

|

10,614

|

|

5,871

|

|

8,487

|

|

—

|

|

—

|

|

—

|

|

||||||||||||

|

Total other comprehensive income (loss)

|

6,181

|

|

(48,490

|

)

|

54,951

|

|

||||||||||||||||||

|

Balance at end of period

|

$

|

(119,389

|

)

|

$

|

(125,570

|

)

|

$

|

(77,080

|

)

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||||

|

Foreign currency translation

|

||||||||||||||||||||||||

|

Balance at beginning of period

|

$

|

(41,160

|

)

|

$

|

(1,189

|

)

|

$

|

4,959

|

|

$

|

(2,199

|

)

|

$

|

(1,602

|

)

|

$

|

(469

|

)

|

||||||

|

Foreign currency translation adjustments

|

(47,650

|

)

|

(39,971

|

)

|

(6,148

|

)

|

(1,417

|

)

|

(597

|

)

|

(1,133

|

)

|

||||||||||||

|

Balance at end of period

|

$

|

(88,810

|

)

|

$

|

(41,160

|

)

|

$

|

(1,189

|

)

|

$

|

(3,616

|

)

|

$

|

(2,199

|

)

|

$

|

(1,602

|

)

|

||||||

|

Shares

|

Dollars

|

|||||||||||||||||||

|

(Dollars in thousands)

|

Issued

|

Stock

Compensation

Trust

|

Treasury

|

Common

Stock

|

Stock

Compensation

Trust

|

Treasury

Cost

|

||||||||||||||

|

Balances January 1, 2013

|

62,081,391

|

|

(745,430

|

)

|

(24,328,162

|

)

|

$

|

112,135

|

|

$

|

(3,891

|

)

|

$

|

(267,987

|

)

|

|||||

|

Restricted stock awards

|

—

|

|

96,686

|

|

—

|

|

(505

|

)

|

505

|

|

—

|

|

||||||||

|

Restricted stock expense

|

—

|

|

—

|

|

—

|

|

4,244

|

|

—

|

|

—

|

|

||||||||

|

Restricted stock forfeitures

|

—

|

|

—

|

|

(7,365

|

)

|

(115

|

)

|

—

|

|

—

|

|

||||||||

|

Stock options exercised

|

—

|

|

277,687

|

|

—

|

|

8,194

|

|

1,449

|

|

—

|

|

||||||||

|

Stock option expense

|

—

|

|

—

|

|

—

|

|

2,825

|

|

—

|

|

—

|

|

||||||||

|

Performance stock issued

|

—

|

|

67,389

|

|

—

|

|

(352

|

)

|

352

|

|

—

|

|

||||||||

|

Performance stock expense

|

—

|

|

—

|

|

—

|

|

3,383

|

|

—

|

|

—

|

|

||||||||

|

Tax benefit related to stock plans

|

—

|

|

—

|

|

—

|

|

2,246

|

|

—

|

|

—

|

|

||||||||

|

Treasury shares purchased for stock compensation programs

|

—

|

|

—

|

|

(240,097

|

)

|

—

|

|

—

|

|

(11,785

|

)

|

||||||||

|

Balances December 31, 2013

|

62,081,391

|

|

(303,668

|

)

|

(24,575,624

|

)

|

132,055

|

|

(1,585

|

)

|

(279,772

|

)

|

||||||||

|

Restricted stock awards

|

—

|

|

72,291

|

|

13,936

|

|

(538

|

)

|

377

|

|

161

|

|

||||||||

|

Restricted stock expense

|

—

|

|

—

|

|

—

|

|

4,372

|

|

—

|

|

—

|

|

||||||||

|

Restricted stock forfeitures

|

—

|

|

—

|

|

(4,078

|

)

|

(346

|

)

|

—

|

|

—

|

|

||||||||

|

Stock options exercised

|

—

|

|

150,962

|

|

39,781

|

|

5,678

|

|

788

|

|

460

|

|

||||||||

|

Stock option expense

|

—

|

|

—

|

|

—

|

|

2,355

|

|

—

|

|

—

|

|

||||||||

|

Performance stock issued

|

—

|

|

80,415

|

|

—

|

|

(420

|

)

|

420

|

|

—

|

|

||||||||

|

Performance stock expense

|

—

|

|

—

|

|

—

|

|

2,705

|

|

—

|

|

—

|

|

||||||||

|

Performance stock forfeitures

|

—

|

|

—

|

|

—

|

|

(33

|

)

|

—

|

|

—

|

|

||||||||

|

Tax benefit related to stock plans

|

—

|

|

—

|

|

—

|

|

2,573

|

|

—

|

|

—

|

|

||||||||

|

Treasury shares purchased for stock compensation programs

|

—

|

|

—

|

|

(107,096

|

)

|

—

|

|

—

|

|

(5,654

|

)

|

||||||||

|

Balances December 31, 2014

|

62,081,391

|

|

—

|

|

(24,633,081

|

)

|

148,401

|

|

—

|

|

(284,805

|

)

|

||||||||

|

Restricted stock awards

|

—

|

|

—

|

|

34,624

|

|

(404

|

)

|

—

|

|

404

|

|

||||||||

|

Restricted stock expense

|

—

|

|

—

|

|

—

|

|

3,461

|

|

—

|

|

—

|

|

||||||||

|

Restricted stock forfeitures

|

—

|

|

—

|

|

(18,468

|

)

|

(426

|

)

|

—

|

|

—

|

|

||||||||

|

Stock options exercised

|

—

|

|

—

|

|

52,708

|

|

1,714

|

|

—

|

|

216

|

|

||||||||

|

Stock option expense

|

—

|

|

—

|

|

|

|

2,572

|

|

—

|

|

—

|

|

||||||||

|

Stock option forfeitures

|

—

|

|

—

|

|

—

|

|

(118

|

)

|

—

|

|

—

|

|

||||||||

|

Performance stock issued

|

—

|

|

—

|

|

52,839

|

|

(616

|

)

|

—

|

|

616

|

|

||||||||

|

Performance stock expense

|

—

|

|

—

|

|

—

|

|

2,265

|

|

—

|

|

—

|

|

||||||||

|

Performance stock forfeitures

|

—

|

|

—

|

|

—

|

|

(155

|

)

|

—

|

|

—

|

|

||||||||

|

Employee stock purchase plan

|

—

|

|

—

|

|

11,517

|

|

352

|

|

—

|

|

136

|

|

||||||||

|

Tax benefit related to stock plans

|

—

|

|

—

|

|

—

|

|

596

|

|

—

|

|

—

|

|

||||||||

|

Treasury shares purchased for stock compensation programs

|

—

|

|

—

|

|

(59,056

|

)

|

—

|

|

—

|

|

(2,781

|

)

|

||||||||

|

Share repurchase program

|

—

|

|

—

|

|

(150,000

|

)

|

—

|

|

—

|

|

(7,104

|

)

|

||||||||

|

Balances December 31, 2015

|

62,081,391

|

|

—

|

|

(24,708,917

|

)

|

$

|

157,642

|

|

$

|

—

|

|

$

|

(293,318

|

)

|

|||||

|

(In thousands)

|

North America

|

Europe

|

International

|

Corporate

|

Reconciling Items

|

Consolidated Totals

|

|||||||||||||||||

|

2015

|

|||||||||||||||||||||||

|

Sales to external customers

|

$

|

608,983

|

|

$

|

293,156

|

|

$

|

228,644

|

|

$

|

—

|

|

$

|

—

|

|

$

|

1,130,783

|

|

|||||

|

Intercompany sales

|

133,355

|

|

207,357

|

|

18,831

|

|

—

|

|

(359,543

|

)

|

—

|

|

|||||||||||

|

Net income:

|

|||||||||||||||||||||||

|

Continuing operations

|

87,092

|

|

6,843

|

|

10,137

|

|

(33,218

|

)

|

(1,264

|

)

|

69,590

|

|

|||||||||||

|

Discontinued operations

|

—

|

|

—

|

|

1,217

|

|

—

|

|

—

|

|

1,217

|

|

|||||||||||

|

Total assets

|

820,960

|

|

412,144

|

|

175,449

|

|

16,362

|

|

(97

|

)

|

1,424,818

|

|

|||||||||||

|

Interest income

|

619

|

|

60

|

|

840

|

|

6

|

|

—

|

|

1,525

|

|

|||||||||||

|

Interest expense

|

—

|

|

—

|

|

—

|

|

10,854

|

|

—

|

|

10,854

|

|

|||||||||||

|

Noncash items:

|

|||||||||||||||||||||||

|

Depreciation and amortization

|

20,048

|

|

7,737

|

|

3,899

|

|

—

|

|

—

|

|

31,684

|

|

|||||||||||

|

Pension expense

|

(3,759

|

)

|

(7,527

|

)

|

(669

|

)

|

—

|

|

—

|

|

(11,955

|

)

|

|||||||||||

|

Income tax provision

|

45,849

|

|

14,213

|

|

4,046

|

|

(19,804

|

)

|

103

|

|

44,407

|

|

|||||||||||

|

Capital expenditures

|

20,071

|

|

10,727

|

|

5,443

|

|

—

|

|

—

|

|

36,241

|

|

|||||||||||

|

Net property

|

89,418

|

|

41,922

|

|

24,498

|

|

1

|

|

—

|

|

155,839

|

|

|||||||||||

|

2014

|

|||||||||||||||||||||||

|

Sales to external customers

|

547,739

|

|

321,618

|

|

264,528

|

|

—

|

|

—

|

|

1,133,885

|

|

|||||||||||

|

Intercompany sales

|

116,795

|

|

113,914

|

|

18,449

|

|

—

|

|

(249,158

|

)

|

—

|

|

|||||||||||

|

Net income:

|

|||||||||||||||||||||||

|

Continuing operations

|

77,687

|

|

22,808

|

|

16,977

|

|

(30,324

|

)

|

299

|

|

87,447

|

|

|||||||||||

|

Discontinued operations

|

—

|

|

—

|

|

1,059

|

|

—

|

|

—

|

|

1,059

|

|

|||||||||||

|

Total assets

|

819,095

|

|

236,801

|

|

188,360

|

|

20,865

|

|

(329

|

)

|

1,264,792

|

|

|||||||||||

|

Interest income

|

995

|

|

111

|

|

711

|

|

5

|

|

—

|

|

1,822

|

|

|||||||||||

|

Interest expense

|

—

|

|

—

|

|

—

|

|

9,851

|

|

—

|

|

9,851

|

|

|||||||||||

|

Noncash items:

|

|||||||||||||||||||||||

|

Depreciation and amortization

|

18,635

|

|

6,357

|

|

4,929

|

|

—

|

|

—

|

|

29,921

|

|

|||||||||||

|

Pension income (expense)

|

1,977

|

|

(6,234

|

)

|

(579

|

)

|

—

|

|

—

|

|

(4,836

|

)

|

|||||||||||

|

Income tax provision

|

40,919

|

|

9,452

|

|

7,276

|

|

(15,972

|

)

|

(631

|

)

|

41,044

|

|

|||||||||||

|

Capital expenditures

|

18,377

|

|

10,859

|

|

4,347

|

|

—

|

|

—

|

|

33,583

|

|

|||||||||||

|

Net property

|

86,718

|

|

32,892

|

|

31,741

|

|

1

|

|

—

|

|

151,352

|

|

|||||||||||

|

2013

|

|||||||||||||||||||||||

|

Sales to external customers

|

533,161

|

|

293,092

|

|

285,805

|

|

—

|

|

—

|

|

1,112,058

|

|

|||||||||||