|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Maryland

|

|

86-0611231

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(IRS Employer

Identification No.)

|

|

17851 North 85th Street, Suite 300,

Scottsdale, Arizona

|

|

85255

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

Title of Each Class

|

|

Name of Each Exchange on which Registered

|

|

Common Stock, $.01 par value

|

|

New York Stock Exchange

|

|

Large accelerated filer

|

|

ý

|

|

Accelerated Filer

|

|

¨

|

|

Non-accelerated filer

|

|

¨

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

¨

|

|

•

|

Maintain sufficient capital and liquidity to take advantage of market opportunities while holding leverage at moderate levels to optimize shareholder returns;

|

|

•

|

Ensure that we have the best team available by hiring and nurturing top talent, expecting top level performance and allocating proper resources to drive execution of our business plan;

|

|

•

|

Utilize our state-of-the-art market research tools to make informed decisions about land purchases;

|

|

•

|

Employ our knowledge of customer preferences generated through regular surveys and research to align our product offerings with our buyers’ demands;

|

|

•

|

Customize our sales techniques for today’s buyers and educate our sales team about the benefits of our Meritage Green offerings and other features of our homes and on the availability of mortgage products;

|

|

•

|

Re-engineer and constantly evaluate our pricing, product and community amenity offerings to better appeal to potential buyers, while incorporating our Meritage Green concepts and technologies into routine construction practices;

|

|

•

|

Continuously improve our construction process by working with our vendors to find mutual efficiencies in order to construct high-quality homes at the lowest possible cost;

|

|

•

|

Provide the highest level of customer service and care by working closely with our buyers throughout the sales and construction process and monitoring their satisfaction routinely after delivery of their homes; and

|

|

•

|

Provide a shortened and efficient sales-to-close cycle time by refining our processes and streamlining scheduling and production.

|

|

•

|

2012 Project of the Year - Single Family Production, NAHB's National Green Building Awards

|

|

•

|

2012 MAME Green Builder of the Year, BIA Bay Area

|

|

•

|

2011

Energy Value Housing Award

from the National Association of Homebuilders for our Lyon’s Gate community located in Gilbert, Arizona

|

|

•

|

2011

ENERGY STAR

®

Builder Partner of the Year Award

|

|

•

|

2011

Best Green Building Program Award

|

|

•

|

2011

People’s Choice Award

, recognizing Meritage for voluntarily incorporating energy efficiency in the design, construction and marketing of our homes.

|

|

Markets

|

Year Entered

|

|

Phoenix, AZ

|

1985

|

|

Dallas/Ft. Worth, TX

|

1987

|

|

Austin, TX

|

1994

|

|

Tucson, AZ

|

1995

|

|

Houston, TX

|

1997

|

|

East Bay/Central Valley, CA

|

1998

|

|

Sacramento, CA

|

1998

|

|

Las Vegas, NV

|

2002

|

|

San Antonio, TX

|

2003

|

|

Inland Empire, CA

|

2004

|

|

Denver, CO

|

2004

|

|

Orlando, FL

|

2004

|

|

Raleigh, NC

|

2011

|

|

Tampa, FL

|

2011

|

|

Charlotte, NC

|

2012

|

|

|

Year Ended December 31, 2012

|

At December 31, 2012

|

||||||||||||||||||

|

|

# of

Homes

Closed

|

Average

Closing

Price

|

# Homes

in

Backlog

|

$ Value of

Backlog

|

# Home Sites

Controlled (1)

|

# of

Actively

Selling

Communities

|

||||||||||||||

|

West Region

|

||||||||||||||||||||

|

Arizona

|

825

|

|

$

|

268.0

|

|

249

|

|

$

|

80,816

|

|

7,360

|

|

38

|

|

||||||

|

California

|

732

|

|

$

|

361.2

|

|

315

|

|

124,588

|

|

2,062

|

|

17

|

|

|||||||

|

Colorado

|

292

|

|

$

|

331.5

|

|

142

|

|

50,089

|

|

1,446

|

|

12

|

|

|||||||

|

Nevada

|

61

|

|

$

|

187.6

|

|

14

|

|

3,105

|

|

293

|

|

1

|

|

|||||||

|

West Region Total

|

1,910

|

|

$

|

310.9

|

|

720

|

|

$

|

258,598

|

|

11,161

|

|

68

|

|

||||||

|

Central Region

|

||||||||||||||||||||

|

Texas

|

1,655

|

|

$

|

236.0

|

|

500

|

|

$

|

132,317

|

|

6,468

|

|

65

|

|

||||||

|

Central Region Total

|

1,655

|

|

$

|

236.0

|

|

500

|

|

$

|

132,317

|

|

6,468

|

|

65

|

|

||||||

|

East Region

|

||||||||||||||||||||

|

Carolinas

|

117

|

|

358.0

|

|

49

|

|

$

|

17,341

|

|

774

|

|

7

|

|

|||||||

|

Florida

|

556

|

|

$

|

284.3

|

|

203

|

|

71,010

|

|

2,414

|

|

18

|

|

|||||||

|

East Region Total

|

673

|

|

$

|

297.1

|

|

252

|

|

88,351

|

|

3,188

|

|

25

|

|

|||||||

|

Total Company

|

4,238

|

|

$

|

279.5

|

|

1,472

|

|

$

|

479,266

|

|

20,817

|

|

158

|

|

||||||

|

|

Year Ended December 31, 2011

|

At December 31, 2011

|

||||||||||||||||||

|

|

# of

Homes

Closed

|

Average

Closing

Price

|

# Homes

in

Backlog

|

$ Value of

Backlog

|

# Home Sites

Controlled (1)

|

# of

Actively

Selling

Communities

|

||||||||||||||

|

West Region

|

||||||||||||||||||||

|

Arizona

|

594

|

|

$

|

253.0

|

|

158

|

|

$

|

45,232

|

|

6,790

|

|

37

|

|

||||||

|

California

|

355

|

|

$

|

338.9

|

|

82

|

|

27,648

|

|

1,527

|

|

20

|

|

|||||||

|

Colorado

|

258

|

|

$

|

322.1

|

|

70

|

|

23,493

|

|

607

|

|

10

|

|

|||||||

|

Nevada

|

59

|

|

$

|

213.4

|

|

5

|

|

1,076

|

|

425

|

|

2

|

|

|||||||

|

West Region Total

|

1,266

|

|

$

|

289.3

|

|

315

|

|

97,449

|

|

9,349

|

|

69

|

|

|||||||

|

Central Region

|

||||||||||||||||||||

|

Texas

|

1,660

|

|

$

|

238.1

|

|

396

|

|

93,494

|

|

5,825

|

|

67

|

|

|||||||

|

Central Region Total

|

1,660

|

|

$

|

238.1

|

|

396

|

|

93,494

|

|

5,825

|

|

67

|

|

|||||||

|

East Region

|

||||||||||||||||||||

|

Carolinas

|

—

|

|

N/A

|

|

24

|

|

8,616

|

|

241

|

|

3

|

|

||||||||

|

Florida

|

342

|

|

$

|

290.5

|

|

180

|

|

49,295

|

|

1,307

|

|

18

|

|

|||||||

|

East Region Total

|

342

|

|

$

|

290.5

|

|

204

|

|

$

|

57,911

|

|

1,548

|

|

21

|

|

||||||

|

Total Company

|

3,268

|

|

$

|

263.4

|

|

915

|

|

$

|

248,854

|

|

16,722

|

|

157

|

|

||||||

|

(1)

|

“Home Sites Controlled” is the estimated number of homes that could be built on unstarted lots we control, including lots available for sale and on undeveloped land.

|

|

•

|

surrounding demographics based on extensive marketing studies, including surveys of both new and resale homebuyers;

|

|

•

|

existing concentration of contracted lots in surrounding markets, including nearby Meritage communities;

|

|

•

|

suitability for development, generally within a three to five-year time period from the beginning of the development process to the delivery of the last home;

|

|

•

|

financial feasibility of the proposed project, including projected profit margins, returns on capital invested, and the capital payback period;

|

|

•

|

the ability to secure governmental approvals and entitlements, if required;

|

|

•

|

results of environmental and legal due diligence;

|

|

•

|

proximity to local traffic and employment corridors and amenities;

|

|

•

|

availability of seller-provided purchase options or agreements that allow us to defer lot purchases until needed for production; and

|

|

•

|

management’s judgment as to the local real estate market and economic trends, and our experience in particular markets.

|

|

|

Number of

Lots Owned (1)

|

Number of

Lots Under Contract

or Option (1)(2)

|

Total Number

of Lots

Controlled

|

|||||||||||||

|

|

Finished

|

Under Development

and Held for Sale

|

||||||||||||||

|

West Region

|

||||||||||||||||

|

Arizona

|

1,946

|

|

4,968

|

|

446

|

|

7,360

|

|

||||||||

|

California

|

867

|

|

1,157

|

|

38

|

|

2,062

|

|

||||||||

|

Colorado

|

264

|

|

513

|

|

669

|

|

1,446

|

|

||||||||

|

Nevada

|

293

|

|

—

|

|

—

|

|

293

|

|

||||||||

|

West Region Total

|

3,370

|

|

6,638

|

|

1,153

|

|

11,161

|

|

||||||||

|

Central Region

|

||||||||||||||||

|

Texas

|

1,521

|

|

3,776

|

|

1,171

|

|

6,468

|

|

||||||||

|

Central Region Total

|

1,521

|

|

3,776

|

|

1,171

|

|

6,468

|

|

||||||||

|

East Region

|

||||||||||||||||

|

Carolinas

|

423

|

|

108

|

|

243

|

|

774

|

|

||||||||

|

Florida

|

698

|

|

962

|

|

754

|

|

2,414

|

|

||||||||

|

East Region Total

|

1,121

|

|

1,070

|

|

997

|

|

3,188

|

|

||||||||

|

Total Company

|

6,012

|

|

11,484

|

|

3,321

|

|

20,817

|

|

||||||||

|

Total book cost (3)

|

$

|

348,234

|

|

$

|

402,128

|

|

$

|

12,376

|

|

$

|

762,738

|

|

||||

|

(1)

|

Excludes lots with finished homes or homes under construction. The number of lots is an estimate and is subject to change.

|

|

(2)

|

There can be no assurance that we will actually acquire any lots under option or purchase contract. These amounts do not include 1,514 lots under contract with $2.0 million of refundable earnest money deposits, for which we have not completed due diligence and, accordingly, have no money at risk and are under no obligation to perform under the contract.

|

|

(3)

|

For lots owned, book cost primarily represents land, development and capitalized interest. For lots under contract or option, book cost primarily represents earnest and option deposits.

|

|

•

|

oversee home construction;

|

|

•

|

monitor subcontractor and supplier performance;

|

|

•

|

manage scheduling and construction completion deadlines;

|

|

•

|

conduct formal inspections as specific stages of construction are completed;

|

|

•

|

regularly update buyers on the progress of the construction of their homes and coordinate the closing process; and

|

|

•

|

manage warranty and customer care efforts.

|

|

•

|

experience within our geographic markets which allows us to develop and offer products that are in line with the needs and desires of the targeted demographic;

|

|

•

|

streamlined construction processes that allow us to save on material, labor and time and pass those savings to our customers in the form of lower prices;

|

|

•

|

ENERGY STAR

®

standards in all of our communities and incremental green features that create a variety of benefits to our customers and differentiate our product from competing new and existing homes inventory;

|

|

•

|

ability to recognize and adapt to changing market conditions, from both a capital and human resource perspective;

|

|

•

|

ability to capitalize on opportunities to acquire land on favorable terms; and

|

|

•

|

reputation for outstanding service and quality products.

|

|

•

|

timing of home deliveries and land sales;

|

|

•

|

the changing composition and mix of our asset portfolio;

|

|

•

|

delays in construction schedules due to adverse weather, acts of God, reduced subcontractor availability and governmental restrictions;

|

|

•

|

timing of write-offs and impairments;

|

|

•

|

conditions of the real estate market in areas where we operate and of the general economy;

|

|

•

|

the cyclical nature of the homebuilding industry;

|

|

•

|

changes in prevailing interest rates and the availability of mortgage financing;

|

|

•

|

our ability to acquire additional land or options for additional land on acceptable terms; and

|

|

•

|

costs and availability of materials and labor.

|

|

•

|

our ability to obtain additional financing for working capital, capital expenditures, acquisitions or general corporate purposes could be impaired;

|

|

•

|

we could have to use a substantial portion of our cash flow from operations to pay interest and principal on our indebtedness, which would reduce the funds available to us for other purposes such as capital expenditures;

|

|

•

|

we have a moderate level of indebtedness and a lower volume of cash and cash equivalents than some of our competitors, which may put us at a competitive disadvantage and reduce our flexibility in planning for, or responding to, changing conditions in our industry, including increased competition; and

|

|

•

|

we may be more vulnerable to economic downturns and adverse developments in our business than some of our competitors.

|

|

•

|

incur additional indebtedness or liens;

|

|

•

|

pay dividends or make other distributions;

|

|

•

|

repurchase our stock;

|

|

•

|

make acquisitions and investments (including investments in joint ventures); or

|

|

•

|

consolidate, merge or sell all or substantially all of our assets.

|

|

|

2012

|

2011

|

||||||||||||||

|

Quarter Ended

|

High

|

Low

|

High

|

Low

|

||||||||||||

|

March 31

|

$

|

29.32

|

|

$

|

23.19

|

|

$

|

27.42

|

|

$

|

22.21

|

|

||||

|

June 30

|

$

|

34.20

|

|

$

|

24.31

|

|

$

|

26.65

|

|

$

|

20.90

|

|

||||

|

September 30

|

$

|

42.59

|

|

$

|

32.96

|

|

$

|

23.91

|

|

$

|

14.50

|

|

||||

|

December 31

|

$

|

42.28

|

|

$

|

32.33

|

|

$

|

23.50

|

|

$

|

13.68

|

|

||||

|

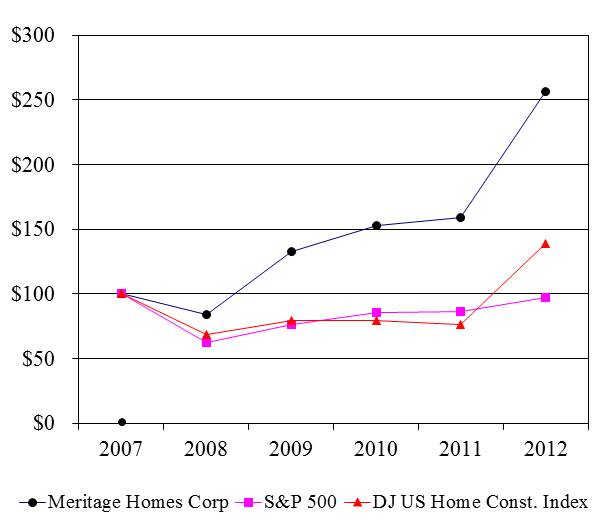

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

|||||||||||||

|

Meritage Homes Corp

|

100.00

|

|

83.53

|

|

132.67

|

|

152.37

|

|

159.16

|

|

256.35

|

|

||||||

|

S&P 500 Index

|

100.00

|

|

62.27

|

|

76.03

|

|

85.58

|

|

85.83

|

|

97.42

|

|

||||||

|

Dow Jones US Home Construction Index

|

100.00

|

|

68.05

|

|

78.94

|

|

79.29

|

|

76.22

|

|

138.45

|

|

||||||

|

Name

|

Age

|

Position

|

||

|

Steven J. Hilton

|

51

|

Chairman of the Board and Chief Executive Officer

|

||

|

Larry W. Seay

|

57

|

Chief Financial Officer, Executive Vice President

|

||

|

C. Timothy White

|

52

|

General Counsel, Executive Vice President and Secretary

|

||

|

Steven M. Davis

|

54

|

Chief Operating Officer, Executive Vice President

|

||

|

|

Historical Consolidated Financial Data

Years Ended December 31,

|

|||||||||||||||||||

|

|

($ in thousands, except per share amounts)

|

|||||||||||||||||||

|

|

2012

|

2011

|

2010

|

2009

|

2008

|

|||||||||||||||

|

Statement of Operations Data:

|

||||||||||||||||||||

|

Total closing revenue

|

$

|

1,193,674

|

|

$

|

861,244

|

|

$

|

941,656

|

|

$

|

970,313

|

|

$

|

1,523,068

|

|

|||||

|

Total cost of closings

|

(973,466

|

)

|

(704,812

|

)

|

(767,509

|

)

|

(840,046

|

)

|

(1,322,544

|

)

|

||||||||||

|

Impairments

|

(2,009

|

)

|

(15,324

|

)

|

(6,451

|

)

|

(126,216

|

)

|

(237,439

|

)

|

||||||||||

|

Gross profit/(loss)

|

218,199

|

|

141,108

|

|

167,696

|

|

4,051

|

|

(36,915

|

)

|

||||||||||

|

Commissions and other sales costs

|

(94,833

|

)

|

(74,912

|

)

|

(76,798

|

)

|

(78,683

|

)

|

(136,860

|

)

|

||||||||||

|

General and administrative expenses

|

(68,185

|

)

|

(64,184

|

)

|

(59,784

|

)

|

(59,461

|

)

|

(64,793

|

)

|

||||||||||

|

Goodwill and intangible asset impairments

|

—

|

|

—

|

|

—

|

|

—

|

|

(1,133

|

)

|

||||||||||

|

Earnings/(loss) from unconsolidated entities, net (1)

|

10,233

|

|

5,849

|

|

5,243

|

|

4,013

|

|

(17,038

|

)

|

||||||||||

|

Interest expense

|

(24,244

|

)

|

(30,399

|

)

|

(33,722

|

)

|

(36,531

|

)

|

(23,653

|

)

|

||||||||||

|

(Loss)/gain on extinguishment of debt

|

(5,772

|

)

|

—

|

|

(3,454

|

)

|

9,390

|

|

—

|

|

||||||||||

|

Other (loss)/income, net

|

(6,544

|

)

|

2,162

|

|

3,303

|

|

2,422

|

|

4,426

|

|

||||||||||

|

Earnings/(loss) before income taxes

|

28,854

|

|

(20,376

|

)

|

2,484

|

|

(154,799

|

)

|

(275,966

|

)

|

||||||||||

|

Benefit from/(provision for) income taxes

|

76,309

|

|

(730

|

)

|

4,666

|

|

88,343

|

|

(15,969

|

)

|

||||||||||

|

Net income/(loss)

|

$

|

105,163

|

|

$

|

(21,106

|

)

|

$

|

7,150

|

|

$

|

(66,456

|

)

|

$

|

(291,935

|

)

|

|||||

|

Earnings/(loss) per common share:

|

||||||||||||||||||||

|

Basic

|

$

|

3.09

|

|

$

|

(0.65

|

)

|

$

|

0.22

|

|

$

|

(2.12

|

)

|

$

|

(9.95

|

)

|

|||||

|

Diluted (2)

|

$

|

3.00

|

|

$

|

(0.65

|

)

|

$

|

0.22

|

|

$

|

(2.12

|

)

|

$

|

(9.95

|

)

|

|||||

|

Balance Sheet Data (December 31):

|

||||||||||||||||||||

|

Cash, cash equivalents, investments and securities and restricted cash

|

$

|

295,469

|

|

$

|

333,187

|

|

$

|

412,642

|

|

$

|

391,378

|

|

$

|

205,923

|

|

|||||

|

Real estate

|

$

|

1,113,187

|

|

$

|

815,425

|

|

$

|

738,928

|

|

$

|

675,037

|

|

$

|

859,305

|

|

|||||

|

Total assets

|

$

|

1,575,562

|

|

$

|

1,221,378

|

|

$

|

1,224,938

|

|

$

|

1,242,667

|

|

$

|

1,326,249

|

|

|||||

|

Senior, senior subordinated and convertible notes, loans payable and other borrowings

|

$

|

722,797

|

|

$

|

606,409

|

|

$

|

605,780

|

|

$

|

605,009

|

|

$

|

628,968

|

|

|||||

|

Total liabilities

|

$

|

881,352

|

|

$

|

732,466

|

|

$

|

724,943

|

|

$

|

757,242

|

|

$

|

799,043

|

|

|||||

|

Stockholders’ equity

|

$

|

694,210

|

|

$

|

488,912

|

|

$

|

499,995

|

|

$

|

485,425

|

|

$

|

527,206

|

|

|||||

|

Cash Flow Data:

|

||||||||||||||||||||

|

Cash (used in)/provided by:

|

||||||||||||||||||||

|

Operating activities

|

$

|

(220,487

|

)

|

$

|

(74,136

|

)

|

$

|

32,551

|

|

$

|

184,074

|

|

$

|

199,829

|

|

|||||

|

Investing activities

|

$

|

23,844

|

|

$

|

141,182

|

|

$

|

(174,515

|

)

|

$

|

(145,419

|

)

|

$

|

(23,263

|

)

|

|||||

|

Financing activities

|

$

|

193,488

|

|

$

|

2,613

|

|

$

|

(3,414

|

)

|

$

|

4,753

|

|

$

|

1,680

|

|

|||||

|

(1)

|

Earnings/(loss) from unconsolidated entities in 2012, 2011, 2010, 2009 and 2008 includes $0, $0, $0.3 million, $2.8 million, and $26.0 million, respectively, of joint venture investment impairments. See Note 2 of our consolidated financial statements for additional information.

|

|

(2)

|

Diluted earnings per common share for the year ended December 31, 2012 includes adjustments to net income to account for the interest attributable to our convertible debt, net of income taxes. See Note 7 of our consolidated financial statements for additional information.

|

|

•

|

Strengthening our balance sheet - completed a new senior note issuance and debt tender, extending our earliest debt maturities until 2017 and completed a convertible debt transaction at an attractive 1.875% interest rate;

|

|

•

|

Generating additional working capital and improving liquidity - completed an equity offering and established a revolving credit facility;

|

|

•

|

Continue to actively acquire and develop lots in markets we deem key to our success in order to maintain and grow our lot supply and active community count; grew controlled lots by 24.5%;

|

|

•

|

Utilizing our enhanced market research to capitalize on the knowledge of our buyers' demands in each community, tailoring our pricing, product and amenities offered;

|

|

•

|

Continuing to innovate and promote the Meritage Green energy efficiency program, where every new home we construct, at a minimum, meets ENERGY STAR® standards, including the recent construction of the only triple-certified homes in the country, certified by the U.S. Environmental Protection Agency, for indoor air quality, water conservation and overall energy efficiency;

|

|

•

|

Adapting sales and marketing efforts to generate additional traffic and compete with resale homes;

|

|

•

|

Focusing our purchasing efforts to manage cost increases as homebuilding recovers and demand rises;

|

|

•

|

Growing our inventory balance while ensuring sufficient liquidity through exercising tight control over cash flows;

|

|

•

|

Striving for excellence in construction; and monitoring our customers' satisfaction as measured by survey scores and working toward improving them based on the results of the surveys.

|

|

•

|

The presence and significance of local competitors, including their offered product type and competitive actions;

|

|

•

|

Economic and related demographic conditions for the population of the surrounding community;

|

|

•

|

Desirability of the particular community, including unique amenities or other favorable or unfavorable attributes; and

|

|

•

|

Existing home inventory supplies, including foreclosures and short sales.

|

|

|

Years Ended December 31,

|

Year Over Year

|

|||||||||||||

|

|

2012

|

2011

|

Chg $

|

Chg %

|

|||||||||||

|

Home Closing Revenue

|

|||||||||||||||

|

Total

|

|||||||||||||||

|

Dollars

|

$

|

1,184,360

|

|

$

|

860,884

|

|

$

|

323,476

|

|

37.6

|

%

|

||||

|

Homes closed

|

4,238

|

|

3,268

|

|

970

|

|

29.7

|

%

|

|||||||

|

Average sales price

|

$

|

279.5

|

|

$

|

263.4

|

|

$

|

16.1

|

|

6.1

|

%

|

||||

|

West Region

|

|||||||||||||||

|

Arizona

|

|||||||||||||||

|

Dollars

|

$

|

221,100

|

|

$

|

150,258

|

|

$

|

70,842

|

|

47.1

|

%

|

||||

|

Homes closed

|

825

|

|

594

|

|

231

|

|

38.9

|

%

|

|||||||

|

Average sales price

|

$

|

268.0

|

|

$

|

253.0

|

|

$

|

15.0

|

|

5.9

|

%

|

||||

|

California

|

|||||||||||||||

|

Dollars

|

$

|

264,388

|

|

$

|

120,319

|

|

$

|

144,069

|

|

119.7

|

%

|

||||

|

Homes closed

|

732

|

|

355

|

|

377

|

|

106.2

|

%

|

|||||||

|

Average sales price

|

$

|

361.2

|

|

$

|

338.9

|

|

$

|

22.3

|

|

6.6

|

%

|

||||

|

Colorado

|

|||||||||||||||

|

Dollars

|

$

|

96,807

|

|

$

|

83,095

|

|

$

|

13,712

|

|

16.5

|

%

|

||||

|

Homes closed

|

292

|

|

258

|

|

34

|

|

13.2

|

%

|

|||||||

|

Average sales price

|

$

|

331.5

|

|

$

|

322.1

|

|

$

|

9.4

|

|

2.9

|

%

|

||||

|

Nevada

|

|||||||||||||||

|

Dollars

|

$

|

11,444

|

|

$

|

12,593

|

|

$

|

(1,149

|

)

|

(9.1

|

)%

|

||||

|

Homes closed

|

61

|

|

59

|

|

2

|

|

3.4

|

%

|

|||||||

|

Average sales price

|

$

|

187.6

|

|

$

|

213.4

|

|

$

|

(25.8

|

)

|

(12.1

|

)%

|

||||

|

West Region Totals

|

|||||||||||||||

|

Dollars

|

$

|

593,739

|

|

$

|

366,265

|

|

$

|

227,474

|

|

62.1

|

%

|

||||

|

Homes closed

|

1,910

|

|

1,266

|

|

644

|

|

50.9

|

%

|

|||||||

|

Average sales price

|

$

|

310.9

|

|

$

|

289.3

|

|

$

|

21.6

|

|

7.5

|

%

|

||||

|

Central Region - Texas

|

|||||||||||||||

|

Central Region Totals

|

|||||||||||||||

|

Dollars

|

$

|

390,642

|

|

$

|

395,278

|

|

$

|

(4,636

|

)

|

(1.2

|

)%

|

||||

|

Homes closed

|

1,655

|

|

1,660

|

|

(5

|

)

|

(0.3

|

)%

|

|||||||

|

Average sales price

|

$

|

236.0

|

|

$

|

238.1

|

|

$

|

(2.1

|

)

|

(0.9

|

)%

|

||||

|

East Region

|

|||||||||||||||

|

Carolinas

|

|||||||||||||||

|

Dollars

|

$

|

41,888

|

|

N/A

|

|

$

|

41,888

|

|

N/M

|

|

|||||

|

Homes closed

|

117

|

|

N/A

|

|

117

|

|

N/M

|

|

|||||||

|

Average sales price

|

$

|

358.0

|

|

N/A

|

|

$

|

358.0

|

|

N/M

|

|

|||||

|

Florida

|

|||||||||||||||

|

Dollars

|

$

|

158,091

|

|

$

|

99,341

|

|

$

|

58,750

|

|

59.1

|

%

|

||||

|

Homes closed

|

556

|

|

342

|

|

214

|

|

62.6

|

%

|

|||||||

|

Average sales price

|

$

|

284.3

|

|

$

|

290.5

|

|

$

|

(6.2

|

)

|

(2.1

|

)%

|

||||

|

East Region Totals

|

|||||||||||||||

|

Dollars

|

$

|

199,979

|

|

$

|

99,341

|

|

$

|

100,638

|

|

101.3

|

%

|

||||

|

Homes closed

|

673

|

|

342

|

|

331

|

|

96.8

|

%

|

|||||||

|

Average sales price

|

$

|

297.1

|

|

$

|

290.5

|

|

$

|

6.6

|

|

2.3

|

%

|

||||

|

|

Years Ended December 31,

|

Year Over Year

|

|||||||||||||

|

|

2011

|

2010

|

Chg $

|

Chg %

|

|||||||||||

|

Home Closing Revenue

|

|||||||||||||||

|

Total

|

|||||||||||||||

|

Dollars

|

$

|

860,884

|

|

$

|

940,406

|

|

$

|

(79,522

|

)

|

(8.5

|

)%

|

||||

|

Homes closed

|

3,268

|

|

3,700

|

|

(432

|

)

|

(11.7

|

)%

|

|||||||

|

Average sales price

|

$

|

263.4

|

|

$

|

254.2

|

|

$

|

9.2

|

|

3.6

|

%

|

||||

|

West Region

|

|||||||||||||||

|

Arizona

|

|||||||||||||||

|

Dollars

|

$

|

150,258

|

|

$

|

156,117

|

|

$

|

(5,859

|

)

|

(3.8

|

)%

|

||||

|

Homes closed

|

594

|

|

700

|

|

(106

|

)

|

(15.1

|

)%

|

|||||||

|

Average sales price

|

$

|

253.0

|

|

$

|

223.0

|

|

$

|

30.0

|

|

13.5

|

%

|

||||

|

California

|

|||||||||||||||

|

Dollars

|

$

|

120,319

|

|

$

|

147,194

|

|

$

|

(26,875

|

)

|

(18.3

|

)%

|

||||

|

Homes closed

|

355

|

|

417

|

|

(62

|

)

|

(14.9

|

)%

|

|||||||

|

Average sales price

|

$

|

338.9

|

|

$

|

353.0

|

|

$

|

(14.1

|

)

|

(4.0

|

)%

|

||||

|

Colorado

|

|||||||||||||||

|

Dollars

|

$

|

83,095

|

|

$

|

48,820

|

|

$

|

34,275

|

|

70.2

|

%

|

||||

|

Homes closed

|

258

|

|

162

|

|

96

|

|

59.3

|

%

|

|||||||

|

Average sales price

|

$

|

322.1

|

|

$

|

301.4

|

|

$

|

20.7

|

|

6.9

|

%

|

||||

|

Nevada

|

|||||||||||||||

|

Dollars

|

$

|

12,593

|

|

$

|

16,006

|

|

$

|

(3,413

|

)

|

(21.3

|

)%

|

||||

|

Homes closed

|

59

|

|

81

|

|

(22

|

)

|

(27.2

|

)%

|

|||||||

|

Average sales price

|

$

|

213.4

|

|

$

|

197.6

|

|

$

|

15.8

|

|

8.0

|

%

|

||||

|

West Region Totals

|

|||||||||||||||

|

Dollars

|

$

|

366,265

|

|

$

|

368,137

|

|

$

|

(1,872

|

)

|

(0.5

|

)%

|

||||

|

Homes closed

|

1,266

|

|

1,360

|

|

(94

|

)

|

(6.9

|

)%

|

|||||||

|

Average sales price

|

$

|

289.3

|

|

$

|

270.7

|

|

$

|

18.6

|

|

6.9

|

%

|

||||

|

Central Region - Texas

|

|||||||||||||||

|

Central Region Totals

|

|||||||||||||||

|

Dollars

|

$

|

395,278

|

|

$

|

487,797

|

|

$

|

(92,519

|

)

|

(19.0

|

)%

|

||||

|

Homes closed

|

1,660

|

|

2,028

|

|

(368

|

)

|

(18.1

|

)%

|

|||||||

|

Average sales price

|

$

|

238.1

|

|

$

|

240.5

|

|

$

|

(2.4

|

)

|

(1.0

|

)%

|

||||

|

East Region

|

|||||||||||||||

|

Carolinas

|

|||||||||||||||

|

Dollars

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

|||||||

|

Homes closed

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

|||||||

|

Average sales price

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

|||||||

|

Florida

|

|||||||||||||||

|

Dollars

|

$

|

99,341

|

|

$

|

84,472

|

|

$

|

14,869

|

|

17.6

|

%

|

||||

|

Homes closed

|

342

|

|

312

|

|

30

|

|

9.6

|

%

|

|||||||

|

Average sales price

|

$

|

290.5

|

|

$

|

270.7

|

|

$

|

19.8

|

|

7.3

|

%

|

||||

|

East Region Totals

|

|||||||||||||||

|

Dollars

|

$

|

99,341

|

|

$

|

84,472

|

|

$

|

14,869

|

|

17.6

|

%

|

||||

|

Homes closed

|

342

|

|

312

|

|

30

|

|

9.6

|

%

|

|||||||

|

Average sales price

|

$

|

290.5

|

|

$

|

270.7

|

|

$

|

19.8

|

|

7.3

|

%

|

||||

|

|

Years Ended December 31,

|

Year Over Year

|

|||||||||||||

|

|

2012

|

2011

|

Chg $

|

Chg %

|

|||||||||||

|

Home Orders (1)

|

|||||||||||||||

|

Total

|

|||||||||||||||

|

Dollars

|

$

|

1,414,772

|

|

$

|

907,922

|

|

$

|

506,850

|

|

55.8

|

%

|

||||

|

Homes ordered

|

4,795

|

|

3,405

|

|

1,390

|

|

40.8

|

%

|

|||||||

|

Average sales price

|

$

|

295.1

|

|

$

|

266.6

|

|

$

|

28.5

|

|

10.7

|

%

|

||||

|

West Region

|

|||||||||||||||

|

Arizona

|

|||||||||||||||

|

Dollars

|

$

|

256,684

|

|

$

|

163,510

|

|

$

|

93,174

|

|

57.0

|

%

|

||||

|

Homes ordered

|

916

|

|

627

|

|

289

|

|

46.1

|

%

|

|||||||

|

Average sales price

|

$

|

280.2

|

|

$

|

260.8

|

|

$

|

19.4

|

|

7.4

|

%

|

||||

|

California

|

|||||||||||||||

|

Dollars

|

$

|

361,328

|

|

$

|

132,672

|

|

$

|

228,656

|

|

172.3

|

%

|

||||

|

Homes ordered

|

965

|

|

392

|

|

573

|

|

146.2

|

%

|

|||||||

|

Average sales price

|

$

|

374.4

|

|

$

|

338.4

|

|

$

|

36.0

|

|

10.6

|

%

|

||||

|

Colorado

|

|||||||||||||||

|

Dollars

|

$

|

123,403

|

|

$

|

89,624

|

|

$

|

33,779

|

|

37.7

|

%

|

||||

|

Homes ordered

|

364

|

|

276

|

|

88

|

|

31.9

|

%

|

|||||||

|

Average sales price

|

$

|

339.0

|

|

$

|

324.7

|

|

$

|

14.3

|

|

4.4

|

%

|

||||

|

Nevada

|

|||||||||||||||

|

Dollars

|

$

|

13,473

|

|

$

|

11,300

|

|

$

|

2,173

|

|

19.2

|

%

|

||||

|

Homes ordered

|

70

|

|

52

|

|

18

|

|

34.6

|

%

|

|||||||

|

Average sales price

|

$

|

192.5

|

|

$

|

217.3

|

|

$

|

(24.8

|

)

|

(11.4

|

)%

|

||||

|

West Region Totals

|

|||||||||||||||

|

Dollars

|

$

|

754,888

|

|

$

|

397,106

|

|

$

|

357,782

|

|

90.1

|

%

|

||||

|

Homes ordered

|

2,315

|

|

1,347

|

|

968

|

|

71.9

|

%

|

|||||||

|

Average sales price

|

$

|

326.1

|

|

$

|

294.8

|

|

$

|

31.3

|

|

10.6

|

%

|

||||

|

Central Region - Texas

|

|||||||||||||||

|

Central Region Totals

|

|||||||||||||||

|

Dollars

|

$

|

429,465

|

|

$

|

377,165

|

|

$

|

52,300

|

|

13.9

|

%

|

||||

|

Homes ordered

|

1,759

|

|

1,593

|

|

166

|

|

10.4

|

%

|

|||||||

|

Average sales price

|

$

|

244.2

|

|

$

|

236.8

|

|

$

|

7.4

|

|

3.1

|

%

|

||||

|

East Region

|

|||||||||||||||

|

Carolinas

|

|||||||||||||||

|

Dollars

|

$

|

50,613

|

|

$

|

8,616

|

|

$

|

41,997

|

|

487.4

|

%

|

||||

|

Homes ordered

|

142

|

|

24

|

|

118

|

|

491.7

|

%

|

|||||||

|

Average sales price

|

$

|

356.4

|

|

$

|

359.0

|

|

$

|

(2.6

|

)

|

(0.7

|

)%

|

||||

|

Florida

|

|||||||||||||||

|

Dollars

|

$

|

179,806

|

|

$

|

125,035

|

|

$

|

54,771

|

|

43.8

|

%

|

||||

|

Homes ordered

|

579

|

|

441

|

|

138

|

|

31.3

|

%

|

|||||||

|

Average sales price

|

$

|

310.5

|

|

$

|

283.5

|

|

$

|

27.0

|

|

9.5

|

%

|

||||

|

East Region Totals

|

|||||||||||||||

|

Dollars

|

$

|

230,419

|

|

$

|

133,651

|

|

$

|

96,768

|

|

72.4

|

%

|

||||

|

Homes ordered

|

721

|

|

465

|

|

256

|

|

55.1

|

%

|

|||||||

|

Average sales price

|

$

|

319.6

|

|

$

|

287.4

|

|

$

|

32.2

|

|

11.2

|

%

|

||||

|

|

Years Ended December 31,

|

Year Over Year

|

|||||||||||||

|

|

2011

|

2010

|

Chg $

|

Chg %

|

|||||||||||

|

Home Orders (1)

|

|||||||||||||||

|

Total

|

|||||||||||||||

|

Dollars

|

$

|

907,922

|

|

$

|

854,687

|

|

$

|

53,235

|

|

6.2

|

%

|

||||

|

Homes ordered

|

3,405

|

|

3,383

|

|

22

|

|

0.7

|

%

|

|||||||

|

Average sales price

|

$

|

266.6

|

|

$

|

252.6

|

|

$

|

14.0

|

|

5.5

|

%

|

||||

|

West Region

|

|||||||||||||||

|

Arizona

|

|||||||||||||||

|

Dollars

|

$

|

163,510

|

|

$

|

155,987

|

|

$

|

7,523

|

|

4.8

|

%

|

||||

|

Homes ordered

|

627

|

|

678

|

|

(51

|

)

|

(7.5

|

)%

|

|||||||

|

Average sales price

|

$

|

260.8

|

|

$

|

230.1

|

|

$

|

30.7

|

|

13.3

|

%

|

||||

|

California

|

|||||||||||||||

|

Dollars

|

$

|

132,672

|

|

$

|

128,167

|

|

$

|

4,505

|

|

3.5

|

%

|

||||

|

Homes ordered

|

392

|

|

373

|

|

19

|

|

5.1

|

%

|

|||||||

|

Average sales price

|

$

|

338.4

|

|

$

|

343.6

|

|

$

|

(5.2

|

)

|

(1.5

|

)%

|

||||

|

Colorado

|

|||||||||||||||

|

Dollars

|

$

|

89,624

|

|

$

|

54,328

|

|

$

|

35,296

|

|

65.0

|

%

|

||||

|

Homes ordered

|

276

|

|

175

|

|

101

|

|

57.7

|

%

|

|||||||

|

Average sales price

|

$

|

324.7

|

|

$

|

310.4

|

|

$

|

14.3

|

|

4.6

|

%

|

||||

|

Nevada

|

|||||||||||||||

|

Dollars

|

$

|

11,300

|

|

$

|

15,704

|

|

$

|

(4,404

|

)

|

(28.0

|

)%

|

||||

|

Homes ordered

|

52

|

|

79

|

|

(27

|

)

|

(34.2

|

)%

|

|||||||

|

Average sales price

|

$

|

217.3

|

|

$

|

198.8

|

|

$

|

18.5

|

|

9.3

|

%

|

||||

|

West Region Totals

|

|||||||||||||||

|

Dollars

|

$

|

397,106

|

|

$

|

354,186

|

|

$

|

42,920

|

|

12.1

|

%

|

||||

|

Homes ordered

|

1,347

|

|

1,305

|

|

42

|

|

3.2

|

%

|

|||||||

|

Average sales price

|

$

|

294.8

|

|

$

|

271.4

|

|

$

|

23.4

|

|

8.6

|

%

|

||||

|

Central Region - Texas

|

|||||||||||||||

|

Central Region Totals

|

|||||||||||||||

|

Dollars

|

$

|

377,165

|

|

$

|

417,840

|

|

$

|

(40,675

|

)

|

(9.7

|

)%

|

||||

|

Homes ordered

|

1,593

|

|

1,776

|

|

(183

|

)

|

(10.3

|

)%

|

|||||||

|

Average sales price

|

$

|

236.8

|

|

$

|

235.3

|

|

$

|

1.5

|

|

0.6

|

%

|

||||

|

East Region

|

|||||||||||||||

|

Carolinas

|

|||||||||||||||

|

Dollars

|

$

|

8,616

|

|

N/A

|

|

$

|

8,616

|

|

N/M

|

|

|||||

|

Homes ordered

|

24

|

|

N/A

|

|

24

|

|

N/M

|

|

|||||||

|

Average sales price

|

$

|

359.0

|

|

N/A

|

|

$

|

359.0

|

|

N/M

|

|

|||||

|

Florida

|

|||||||||||||||

|

Dollars

|

$

|

125,035

|

|

$

|

82,661

|

|

$

|

42,374

|

|

51.3

|

%

|

||||

|

Homes ordered

|

441

|

|

302

|

|

139

|

|

46.0

|

%

|

|||||||

|

Average sales price

|

$

|

283.5

|

|

$

|

273.7

|

|

$

|

9.8

|

|

3.6

|

%

|

||||

|

East Region Totals

|

|||||||||||||||

|

Dollars

|

$

|

133,651

|

|

$

|

82,661

|

|

$

|

50,990

|

|

61.7

|

%

|

||||

|

Homes ordered

|

465

|

|

302

|

|

163

|

|

54.0

|

%

|

|||||||

|

Average sales price

|

$

|

287.4

|

|

$

|

273.7

|

|

$

|

13.7

|

|

5.0

|

%

|

||||

|

(1)

|

Home orders for any period represent the aggregate sales price of all homes ordered, net of cancellations. We do not include orders contingent upon the sale of a customer’s existing home as a sales contract until the contingency is removed.

|

|

|

December 31,

|

||||||||

|

|

2012

|

2011

|

2010

|

||||||

|

Active Communities

|

|||||||||

|

Total

|

158

|

|

157

|

|

151

|

|

|||

|

West Region

|

|||||||||

|

Arizona

|

38

|

|

37

|

|

32

|

|

|||

|

California

|

17

|

|

20

|

|

14

|

|

|||

|

Colorado

|

12

|

|

10

|

|

9

|

|

|||

|

Nevada

|

1

|

|

2

|

|

4

|

|

|||

|

West Region Totals

|

68

|

|

69

|

|

59

|

|

|||

|

Central Region - Texas

|

|||||||||

|

Central Region Totals

|

65

|

|

67

|

|

82

|

|

|||

|

East Region

|

|||||||||

|

Carolinas

|

7

|

|

3

|

|

—

|

|

|||

|

Florida

|

18

|

|

18

|

|

10

|

|

|||

|

East Region Totals

|

25

|

|

21

|

|

10

|

|

|||

|

|

Years Ended December 31,

|

||||||||

|

|

2012

|

2011

|

2010

|

||||||

|

Cancellation Rates (1)

|

|||||||||

|

Total

|

13.2

|

%

|

17.0

|

%

|

20.9

|

%

|

|||

|

West Region

|

|||||||||

|

Arizona

|

10.3

|

%

|

9.9

|

%

|

12.9

|

%

|

|||

|

California

|

14.1

|

%

|

22.8

|

%

|

18.7

|

%

|

|||

|

Colorado

|

7.1

|

%

|

12.9

|

%

|

15.0

|

%

|

|||

|

Nevada

|

19.5

|

%

|

22.4

|

%

|

17.7

|

%

|

|||

|

West Region Totals

|

11.7

|

%

|

15.2

|

%

|

15.2

|

%

|

|||

|

Central Region - Texas

|

|||||||||

|

Central Region Totals

|

15.0

|

%

|

18.2

|

%

|

25.1

|

%

|

|||

|

East Region

|

|||||||||

|

Carolinas

|

9.0

|

%

|

N/A

|

|

N/A

|

|

|||

|

Florida

|

14.3

|

%

|

19.1

|

%

|

17.7

|

%

|

|||

|

East Region Totals

|

13.3

|

%

|

18.3

|

%

|

17.7

|

%

|

|||

|

(1)

|

Cancellation rates are computed as the number of canceled units for the period divided by the gross sales units for the same period.

|

|

|

Years Ended December 31,

|

Year Over Year

|

|||||||||||||

|

|

2012

|

2011

|

Chg $

|

Chg %

|

|||||||||||

|

Order Backlog (1)

|

|||||||||||||||

|

Total

|

|||||||||||||||

|

Dollars

|

$

|

479,266

|

|

$

|

248,854

|

|

$

|

230,412

|

|

92.6

|

%

|

||||

|

Homes in backlog

|

1,472

|

|

915

|

|

557

|

|

60.9

|

%

|

|||||||

|

Average sales price

|

$

|

325.6

|

|

$

|

272.0

|

|

$

|

53.6

|

|

19.7

|

%

|

||||

|

West Region

|

|||||||||||||||

|

Arizona

|

|||||||||||||||

|

Dollars

|

$

|

80,816

|

|

$

|

45,232

|

|

$

|

35,584

|

|

78.7

|

%

|

||||

|

Homes in backlog

|

249

|

|

158

|

|

91

|

|

57.6

|

%

|

|||||||

|

Average sales price

|

$

|

324.6

|

|

$

|

286.3

|

|

$

|

38.3

|

|

13.4

|

%

|

||||

|

California

|

|||||||||||||||

|

Dollars

|

$

|

124,588

|

|

$

|

27,648

|

|

$

|

96,940

|

|

350.6

|

%

|

||||

|

Homes in backlog

|

315

|

|

82

|

|

233

|

|

284.1

|

%

|

|||||||

|

Average sales price

|

$

|

395.5

|

|

$

|

337.2

|

|

$

|

58.3

|

|

17.3

|

%

|

||||

|

Colorado

|

|||||||||||||||

|

Dollars

|

$

|

50,089

|

|

$

|

23,493

|

|

$

|

26,596

|

|

113.2

|

%

|

||||

|

Homes in backlog

|

142

|

|

70

|

|

72

|

|

102.9

|

%

|

|||||||

|

Average sales price

|

$

|

352.7

|

|

$

|

335.6

|

|

$

|

17.1

|

|

5.1

|

%

|

||||

|

Nevada

|

|||||||||||||||

|

Dollars

|

$

|

3,105

|

|

$

|

1,076

|

|

$

|

2,029

|

|

188.6

|

%

|

||||

|

Homes in backlog

|

14

|

|

5

|

|

9

|

|

180.0

|

%

|

|||||||

|

Average sales price

|

$

|

221.8

|

|

$

|

215.2

|

|

$

|

6.6

|

|

3.1

|

%

|

||||

|

West Region Totals

|

|||||||||||||||

|

Dollars

|

$

|

258,598

|

|

$

|

97,449

|

|

$

|

161,149

|

|

165.4

|

%

|

||||

|

Homes in backlog

|

720

|

|

315

|

|

405

|

|

128.6

|

%

|

|||||||

|

Average sales price

|

$

|

359.2

|

|

$

|

309.4

|

|

$

|

49.8

|

|

16.1

|

%

|

||||

|

Central Region - Texas

|

|||||||||||||||

|

Central Region Totals

|

|||||||||||||||

|

Dollars

|

$

|

132,317

|

|

$

|

93,494

|

|

$

|

38,823

|

|

41.5

|

%

|

||||

|

Homes in backlog

|

500

|

|

396

|

|

104

|

|

26.3

|

%

|

|||||||

|

Average sales price

|

$

|

264.6

|

|

$

|

236.1

|

|

$

|

28.5

|

|

12.1

|

%

|

||||

|

East Region

|

|||||||||||||||

|

Carolinas

|

|||||||||||||||

|

Dollars

|

$

|

17,341

|

|

$

|

8,616

|

|

$

|

8,725

|

|

101.3

|

%

|

||||

|

Homes in backlog

|

49

|

|

24

|

|

25

|

|

104.2

|

%

|

|||||||

|

Average sales price

|

$

|

353.9

|

|

$

|

359.0

|

|

$

|

(5.1

|

)

|

(1.4

|

)%

|

||||

|

Florida

|

|||||||||||||||

|

Dollars

|

$

|

71,010

|

|

$

|

49,295

|

|

$

|

21,715

|

|

44.1

|

%

|

||||

|

Homes in backlog

|

203

|

|

180

|

|

23

|

|

12.8

|

%

|

|||||||

|

Average sales price

|

$

|

349.8

|

|

$

|

273.9

|

|

$

|

75.9

|

|

27.7

|

%

|

||||

|

East Region Totals

|

|||||||||||||||

|

Dollars

|

$

|

88,351

|

|

$

|

57,911

|

|

$

|

30,440

|

|

52.6

|

%

|

||||

|

Homes in backlog

|

252

|

|

204

|

|

48

|

|

23.5

|

%

|

|||||||

|

Average sales price

|

$

|

350.6

|

|

$

|

283.9

|

|

$

|

66.7

|

|

23.5

|

%

|

||||

|

(1)

|

Our backlog represents net sales that have not closed.

|

|

|

Years Ended December 31,

|

Year Over Year

|

|||||||||||||

|

|

2011

|

2010

|

Chg $

|

Chg %

|

|||||||||||

|

Order Backlog (1)

|

|||||||||||||||

|

Total

|

|||||||||||||||

|

Dollars

|

$

|

248,854

|

|

$

|

201,816

|

|

$

|

47,038

|

|

23.3

|

%

|

||||

|

Homes in backlog

|

915

|

|

778

|

|

137

|

|

17.6

|

%

|

|||||||

|

Average sales price

|

$

|

272.0

|

|

$

|

259.4

|

|

$

|

12.6

|

|

4.9

|

%

|

||||

|

West Region

|

|||||||||||||||

|

Arizona

|

|||||||||||||||

|

Dollars

|

$

|

45,232

|

|

$

|

31,980

|

|

$

|

13,252

|

|

41.4

|

%

|

||||

|

Homes in backlog

|

158

|

|

125

|

|

33

|

|

26.4

|

%

|

|||||||

|

Average sales price

|

$

|

286.3

|

|

$

|

255.8

|

|

$

|

30.5

|

|

11.9

|

%

|

||||

|

California

|

|||||||||||||||

|

Dollars

|

$

|

27,648

|

|

$

|

15,295

|

|

$

|

12,353

|

|

80.8

|

%

|

||||

|

Homes in backlog

|

82

|

|

45

|

|

37

|

|

82.2

|

%

|

|||||||

|

Average sales price

|

$

|

337.2

|

|

$

|

339.9

|

|

$

|

(2.7

|

)

|

(0.8

|

)%

|

||||

|

Colorado

|

|||||||||||||||

|

Dollars

|

$

|