|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM 10-Q

|

|

ý

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

TIMKENSTEEL CORPORATION

(Exact name of registrant as specified in its charter)

|

|

Ohio

|

46-4024951

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

1835 Dueber Avenue SW, Canton, OH

|

|

44706

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Large accelerated filer

|

o

|

|

Accelerated filer

|

ý

|

||

|

Non-accelerated filer

|

|

o

|

(Do not check if smaller reporting company)

|

Smaller reporting company

|

o

|

|

|

Emerging growth company

|

o

|

|||||

|

Class

|

Outstanding at April 15, 2019

|

|||

|

Common Shares, without par value

|

44,765,909

|

|||

|

|

|

PAGE

|

|

Item 1A

.

|

||

|

Three Months Ended March 31,

|

|||||||

|

2019

|

2018

|

||||||

|

(Dollars in millions, except per share data)

|

|||||||

|

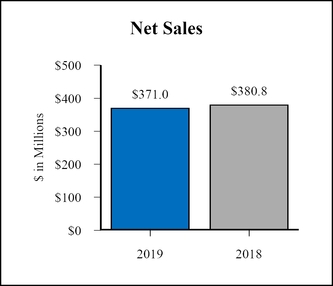

Net sales

|

|

$371.0

|

|

|

$380.8

|

|

|

|

Cost of products sold

|

341.9

|

|

359.7

|

|

|||

|

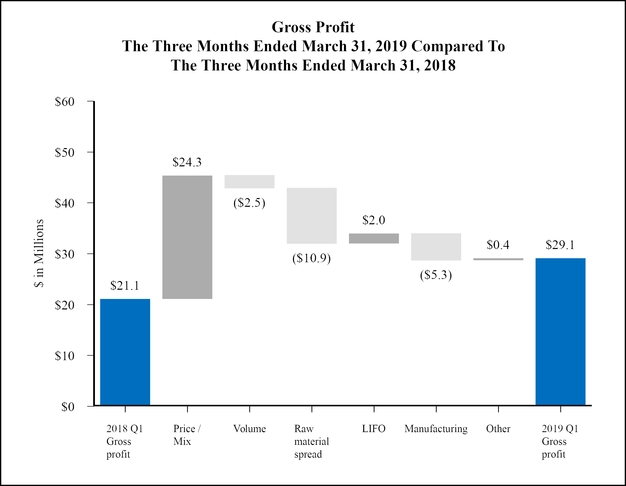

Gross Profit

|

29.1

|

|

21.1

|

|

|||

|

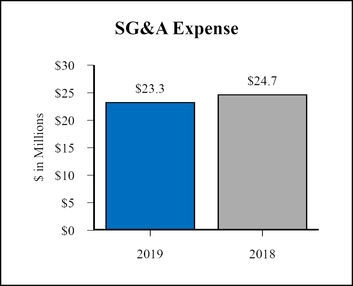

Selling, general and administrative expenses

|

23.3

|

|

24.7

|

|

|||

|

Operating Income (Loss)

|

5.8

|

|

(3.6

|

)

|

|||

|

Interest expense

|

4.2

|

|

4.6

|

|

|||

|

Other income, net

|

2.7

|

|

6.4

|

|

|||

|

Income (Loss) Before Income Taxes

|

4.3

|

|

(1.8

|

)

|

|||

|

Provision for income taxes

|

0.1

|

|

0.1

|

|

|||

|

Net Income (Loss)

|

|

$4.2

|

|

|

|

($1.9

|

)

|

|

Per Share Data:

|

|||||||

|

Basic earnings (loss) per share

|

|

$0.09

|

|

|

($0.04

|

)

|

|

|

Diluted earnings (loss) per share

|

|

$0.09

|

|

|

($0.04

|

)

|

|

|

Three Months Ended March 31,

|

|||||||

|

2019

|

2018

|

||||||

|

(Dollars in millions)

|

|||||||

|

Net income (loss)

|

|

$4.2

|

|

|

($1.9

|

)

|

|

|

Other comprehensive income, net of tax:

|

|||||||

|

Foreign currency translation adjustments

|

0.4

|

|

0.8

|

|

|||

|

Pension and postretirement liability adjustments

|

0.1

|

|

0.1

|

|

|||

|

Other comprehensive income, net of tax

|

0.5

|

|

0.9

|

|

|||

|

Comprehensive Income (Loss), net of tax

|

|

$4.7

|

|

|

($1.0

|

)

|

|

|

March 31,

2019 |

December 31,

2018 |

||||||

|

(Dollars in millions)

|

|||||||

|

ASSETS

|

|||||||

|

Current Assets

|

|||||||

|

Cash and cash equivalents

|

|

$7.8

|

|

|

$21.6

|

|

|

|

Accounts receivable, net of allowances (2019 - $1.5 million; 2018 - $1.7 million)

|

151.3

|

|

163.4

|

|

|||

|

Inventories, net

|

324.3

|

|

296.8

|

|

|||

|

Deferred charges and prepaid expenses

|

3.4

|

|

3.5

|

|

|||

|

Other current assets

|

7.4

|

|

6.1

|

|

|||

|

Total Current Assets

|

494.2

|

|

491.4

|

|

|||

|

Property, plant and equipment, net

|

661.1

|

|

674.4

|

|

|||

|

Operating lease right-of-use assets

|

15.9

|

|

—

|

|

|||

|

Pension assets

|

12.7

|

|

10.5

|

|

|||

|

Intangible assets, net

|

17.7

|

|

17.8

|

|

|||

|

Other non-current assets

|

3.1

|

|

3.5

|

|

|||

|

Total Assets

|

|

$1,204.7

|

|

|

$1,197.6

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|||||||

|

Current Liabilities

|

|||||||

|

Accounts payable

|

|

$129.9

|

|

|

$160.6

|

|

|

|

Salaries, wages and benefits

|

26.6

|

|

36.8

|

|

|||

|

Accrued pension and postretirement costs

|

3.0

|

|

3.0

|

|

|||

|

Current operating lease liabilities

|

5.9

|

|

—

|

|

|||

|

Other current liabilities

|

20.3

|

|

20.4

|

|

|||

|

Total Current Liabilities

|

185.7

|

|

220.8

|

|

|||

|

Convertible notes, net

|

75.2

|

|

74.1

|

|

|||

|

Credit Agreement

|

140.0

|

|

115.0

|

|

|||

|

Non-current operating lease liabilities

|

10.0

|

|

—

|

|

|||

|

Accrued pension and postretirement costs

|

241.3

|

|

240.0

|

|

|||

|

Deferred income taxes

|

0.6

|

|

0.8

|

|

|||

|

Other non-current liabilities

|

10.6

|

|

11.7

|

|

|||

|

Total Liabilities

|

663.4

|

|

662.4

|

|

|||

|

Shareholders’ Equity

|

|||||||

|

Preferred shares, without par value; authorized 10.0 million shares, none issued

|

—

|

|

—

|

|

|||

|

Common shares, without par value; authorized 200.0 million shares;

issued 2019 and 2018 - 45.7 million shares

|

—

|

|

—

|

|

|||

|

Additional paid-in capital

|

841.2

|

|

846.3

|

|

|||

|

Retained deficit

|

(265.0

|

)

|

(269.2

|

)

|

|||

|

Treasury shares - 2019 - 1.0 million; 2018 - 1.1 million

|

(26.5

|

)

|

(33.0

|

)

|

|||

|

Accumulated other comprehensive loss

|

(8.4

|

)

|

(8.9

|

)

|

|||

|

Total Shareholders’ Equity

|

541.3

|

|

535.2

|

|

|||

|

Total Liabilities and Shareholders’ Equity

|

|

$1,204.7

|

|

|

$1,197.6

|

|

|

|

(Dollars in millions)

|

Common Shares Outstanding

|

Additional Paid-in Capital

|

Retained Deficit

|

Treasury Shares

|

Accumulated Other Comprehensive Loss

|

Total

|

||||||||||||||||

|

Balance as of December 31, 2018

|

44,584,668

|

|

|

$846.3

|

|

|

($269.2

|

)

|

|

($33.0

|

)

|

|

($8.9

|

)

|

|

$535.2

|

|

|||||

|

Net income

|

—

|

|

—

|

|

4.2

|

|

—

|

|

—

|

|

4.2

|

|

||||||||||

|

Other comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

0.5

|

|

0.5

|

|

||||||||||

|

Stock-based compensation expense

|

—

|

|

2.2

|

|

—

|

|

—

|

|

—

|

|

2.2

|

|

||||||||||

|

Stock option activity

|

—

|

|

0.2

|

|

—

|

|

—

|

|

—

|

|

0.2

|

|

||||||||||

|

Issuance of treasury shares

|

261,130

|

|

(7.5

|

)

|

—

|

|

7.5

|

|

—

|

|

—

|

|

||||||||||

|

Shares surrendered for taxes

|

(79,889

|

)

|

—

|

|

—

|

|

(1.0

|

)

|

—

|

|

(1.0

|

)

|

||||||||||

|

Balance of March 31, 2019

|

44,765,909

|

|

|

|

$841.2

|

|

|

|

($265.0

|

)

|

|

|

($26.5

|

)

|

|

|

($8.4

|

)

|

|

$541.3

|

|

|

|

Common Shares Outstanding

|

Additional Paid-in Capital

|

Retained Deficit

|

Treasury Shares

|

Accumulated Other Comprehensive Loss

|

Total

|

|||||||||||||||||

|

Balance at December 31, 2017

|

44,445,747

|

|

|

$843.7

|

|

|

($238.0

|

)

|

|

($37.4

|

)

|

|

($7.6

|

)

|

|

$560.7

|

|

|||||

|

Net loss

|

—

|

|

—

|

|

(1.9

|

)

|

—

|

|

—

|

|

(1.9

|

)

|

||||||||||

|

Other comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

0.9

|

|

0.9

|

|

||||||||||

|

Revenue recognition accounting standard adoption

|

—

|

|

—

|

|

0.7

|

|

—

|

|

—

|

|

0.7

|

|

||||||||||

|

Stock-based compensation expense

|

—

|

|

2.2

|

|

—

|

|

—

|

|

—

|

|

2.2

|

|

||||||||||

|

Stock option activity

|

—

|

|

0.1

|

|

—

|

|

—

|

|

—

|

|

0.1

|

|

||||||||||

|

Issuance of treasury shares

|

121,012

|

|

(3.4

|

)

|

(0.1

|

)

|

3.5

|

|

—

|

|

—

|

|

||||||||||

|

Shares surrendered for taxes

|

(37,533

|

)

|

—

|

|

—

|

|

(0.7

|

)

|

—

|

|

(0.7

|

)

|

||||||||||

|

Balance at March 31, 2018

|

44,529,226

|

|

|

$842.6

|

|

|

($239.3

|

)

|

|

($34.6

|

)

|

|

($6.7

|

)

|

|

$562.0

|

|

|||||

|

Three Months Ended March 31,

|

|||||||

|

2019

|

2018

|

||||||

|

(Dollars in millions)

|

|||||||

|

CASH PROVIDED (USED)

|

|||||||

|

Operating Activities

|

|||||||

|

Net income (loss)

|

|

$4.2

|

|

|

($1.9

|

)

|

|

|

Adjustments to reconcile net income (loss) to net cash provided by operating activities:

|

|||||||

|

Depreciation and amortization

|

17.8

|

|

18.5

|

|

|||

|

Amortization of deferred financing fees and debt discount

|

1.3

|

|

1.8

|

|

|||

|

Deferred income taxes

|

(0.2

|

)

|

(0.3

|

)

|

|||

|

Stock-based compensation expense

|

2.2

|

|

2.2

|

|

|||

|

Pension and postretirement expense (benefit), net

|

1.8

|

|

(1.4

|

)

|

|||

|

Pension and postretirement contributions and payments

|

(2.4

|

)

|

(2.5

|

)

|

|||

|

Changes in operating assets and liabilities:

|

|||||||

|

Accounts receivable, net

|

12.1

|

|

(31.3

|

)

|

|||

|

Inventories, net

|

(27.5

|

)

|

(28.8

|

)

|

|||

|

Accounts payable

|

(30.7

|

)

|

35.7

|

|

|||

|

Other accrued expenses

|

(11.4

|

)

|

(13.2

|

)

|

|||

|

Deferred charges and prepaid expenses

|

0.1

|

|

0.4

|

|

|||

|

Other, net

|

(0.9

|

)

|

1.4

|

|

|||

|

Net Cash Used by Operating Activities

|

(33.6

|

)

|

(19.4

|

)

|

|||

|

Investing Activities

|

|||||||

|

Capital expenditures

|

(4.4

|

)

|

(2.2

|

)

|

|||

|

Net Cash Used by Investing Activities

|

(4.4

|

)

|

(2.2

|

)

|

|||

|

Financing Activities

|

|||||||

|

Proceeds from exercise of stock options

|

0.2

|

|

0.1

|

|

|||

|

Shares surrendered for employee taxes on stock compensation

|

(1.0

|

)

|

(0.7

|

)

|

|||

|

Refunding Bonds repayments

|

—

|

|

(30.2

|

)

|

|||

|

Repayments on credit agreements

|

(5.0

|

)

|

(65.0

|

)

|

|||

|

Borrowings on credit agreements

|

30.0

|

|

130.0

|

|

|||

|

Debt issuance costs

|

—

|

|

(1.7

|

)

|

|||

|

Net Cash Provided by Financing Activities

|

24.2

|

|

32.5

|

|

|||

|

Effect of exchange rate changes on cash

|

—

|

|

—

|

|

|||

|

Decrease (Increase) In Cash and Cash Equivalents

|

(13.8

|

)

|

10.9

|

|

|||

|

Cash and cash equivalents at beginning of period

|

21.6

|

|

24.5

|

|

|||

|

Cash and Cash Equivalents at End of Period

|

|

$7.8

|

|

|

$35.4

|

|

|

|

Standards Adopted

|

Description

|

|

ASU 2018-07, Compensation - Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting

|

The standard provides an expanded scope of Topic 718, to include share-based payment transactions for acquiring goods and services from nonemployees.

|

|

ASU 2018-02, Reporting Comprehensive Income: Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income

|

The standard permits entities to reclassify tax effects stranded in accumulated other comprehensive income as a result of tax reform to retained earnings.

|

|

ASU 2017-11, Distinguishing Liabilities from Equity; Derivatives and Hedging

|

The standard eliminates the requirement to consider “down round” features when determining whether certain equity-linked financial instruments or embedded features are indexed to an entity’s own stock.

|

|

•

|

A package of practical expedients to not reassess:

|

|

◦

|

Whether a contract is or contains a lease

|

|

◦

|

Lease classification

|

|

◦

|

Initial direct costs

|

|

•

|

A practical expedient to not reassess certain land easements

|

|

Standard Pending Adoption

|

Description

|

Effective Date

|

Anticipated Impact

|

|

ASU 2018-15, Intangibles - Goodwill and Other - Internal-Use Software (Subtopic 350-40)

|

The standard aligns the requirements for capitalizing implementation costs in cloud computing software arrangements with the requirements for capitalizing implementation costs incurred to develop or obtain internal-use software.

|

January 1, 2020

|

The Company is currently evaluating the impact of the adoption of this ASU on its results of operations and financial condition.

|

|

ASU 2018-14, Compensation - Retirement Benefits - Defined Benefit Plans - General (Subtopic 715-20)

|

The standard eliminates, modifies and adds disclosure requirements for employers that sponsor defined benefit pension or other postretirement plans.

|

January 1, 2021

|

The Company is currently evaluating the impact of the adoption of this ASU on its results of operations and financial condition.

|

|

ASU 2018-13, Fair Value Measurement (Topic 820)

|

The standard eliminates, modifies and adds disclosure requirements for fair value measurements.

|

January 1, 2020

|

The Company is currently evaluating the impact of the adoption of this ASU on its results of operations and financial condition.

|

|

ASU 2016-13, Measurement of Credit Losses on Financial Instruments

|

The standard changes how entities will measure credit losses for most financial assets, including trade and other receivables and replaces the current incurred loss approach with an expected loss model.

|

January 1, 2020

|

The Company is currently evaluating the impact of the adoption of this ASU on its results of operations and financial condition.

|

|

March 31,

2019 |

December 31,

2018 |

||||||

|

Manufacturing supplies

|

|

$52.5

|

|

|

$46.9

|

|

|

|

Raw materials

|

51.8

|

|

35.2

|

|

|||

|

Work in process

|

170.6

|

|

155.7

|

|

|||

|

Finished products

|

132.5

|

|

142.8

|

|

|||

|

Gross inventory

|

407.4

|

|

380.6

|

|

|||

|

Allowance for surplus and obsolete inventory

|

(5.1

|

)

|

(5.1

|

)

|

|||

|

LIFO reserve

|

(78.0

|

)

|

(78.7

|

)

|

|||

|

Total Inventories, net

|

|

$324.3

|

|

|

$296.8

|

|

|

|

March 31,

2019 |

December 31,

2018 |

||||||

|

Land

|

|

$14.1

|

|

|

$14.1

|

|

|

|

Buildings and improvements

|

426.0

|

|

424.4

|

|

|||

|

Machinery and equipment

|

1,414.1

|

|

1,404.2

|

|

|||

|

Construction in progress

|

18.8

|

|

28.5

|

|

|||

|

Subtotal

|

1,873.0

|

|

1,871.2

|

|

|||

|

Less allowances for depreciation

|

(1,211.9

|

)

|

(1,196.8

|

)

|

|||

|

Property, Plant and Equipment, net

|

|

$661.1

|

|

|

$674.4

|

|

|

|

March 31, 2019

|

December 31, 2018

|

||||||||||||||||||||||

|

Gross Carrying Amount

|

Accumulated Amortization

|

Net Carrying Amount

|

Gross Carrying Amount

|

Accumulated Amortization

|

Net Carrying Amount

|

||||||||||||||||||

|

Customer relationships

|

|

$6.3

|

|

|

$4.7

|

|

|

$1.6

|

|

|

$6.3

|

|

|

$4.6

|

|

|

$1.7

|

|

|||||

|

Technology use

|

9.0

|

|

6.7

|

|

2.3

|

|

9.0

|

|

6.5

|

|

2.5

|

|

|||||||||||

|

Capitalized software

|

62.6

|

|

48.8

|

|

13.8

|

|

61.6

|

|

48.0

|

|

13.6

|

|

|||||||||||

|

Total Intangible Assets

|

|

$77.9

|

|

|

$60.2

|

|

|

$17.7

|

|

|

$76.9

|

|

|

$59.1

|

|

|

$17.8

|

|

|||||

|

March 31,

2019 |

December 31,

2018 |

||||||

|

Principal

|

|

$86.3

|

|

|

$86.3

|

|

|

|

Less: Debt issuance costs, net of amortization

|

(1.1

|

)

|

(1.2

|

)

|

|||

|

Less: Debt discount, net of amortization

|

(10.0

|

)

|

(11.0

|

)

|

|||

|

Convertible notes, net

|

|

$75.2

|

|

|

$74.1

|

|

|

|

Three Months Ended March 31,

|

|||||||

|

2019

|

2018

|

||||||

|

Contractual interest expense

|

|

$1.3

|

|

|

$1.3

|

|

|

|

Amortization of debt issuance costs

|

0.1

|

|

0.1

|

|

|||

|

Amortization of debt discount

|

1.0

|

|

0.9

|

|

|||

|

Total

|

|

$2.4

|

|

|

$2.3

|

|

|

|

Foreign Currency Translation Adjustments

|

Pension and Postretirement Liability Adjustments

|

Total

|

|||||||||

|

Balance as of December 31, 2018

|

|

($7.3

|

)

|

|

($1.6

|

)

|

|

($8.9

|

)

|

||

|

Other comprehensive income before reclassifications, before income tax

|

0.4

|

|

—

|

|

0.4

|

|

|||||

|

Amounts reclassified from accumulated other comprehensive loss, before income tax

|

—

|

|

0.1

|

|

0.1

|

|

|||||

|

Income tax

|

—

|

|

—

|

|

—

|

|

|||||

|

Net current period other comprehensive income, net of income taxes

|

0.4

|

|

0.1

|

|

0.5

|

|

|||||

|

Balance as of March 31, 2019

|

|

($6.9

|

)

|

|

($1.5

|

)

|

|

($8.4

|

)

|

||

|

Foreign Currency Translation Adjustments

|

Pension and Postretirement Liability Adjustments

|

Total

|

|||||||||

|

Balance at December 31, 2017

|

|

($5.9

|

)

|

|

($1.7

|

)

|

|

($7.6

|

)

|

||

|

Other comprehensive income before reclassifications, before income tax

|

0.8

|

|

—

|

|

0.8

|

|

|||||

|

Amounts reclassified from accumulated other comprehensive loss, before income tax

|

—

|

|

0.1

|

|

0.1

|

|

|||||

|

Income tax

|

—

|

|

—

|

|

—

|

|

|||||

|

Net current period other comprehensive income, net of income taxes

|

0.8

|

|

0.1

|

|

0.9

|

|

|||||

|

Balance as of March 31, 2018

|

|

($5.1

|

)

|

|

($1.6

|

)

|

|

($6.7

|

)

|

||

|

Three Months Ended

March 31, 2019 |

Three Months Ended

March 31, 2018 |

||||||||||||||

|

Pension

|

Postretirement

|

Pension

|

Postretirement

|

||||||||||||

|

Service cost

|

|

$4.3

|

|

|

$0.3

|

|

|

$4.3

|

|

|

$0.4

|

|

|||

|

Interest cost

|

12.2

|

|

2.0

|

|

11.4

|

|

1.9

|

|

|||||||

|

Expected return on plan assets

|

(16.2

|

)

|

(0.9

|

)

|

(18.4

|

)

|

(1.2

|

)

|

|||||||

|

Amortization of prior service cost

|

0.1

|

|

—

|

|

0.1

|

|

0.1

|

|

|||||||

|

Net Periodic Benefit Cost (Income)

|

|

$0.4

|

|

|

$1.4

|

|

|

($2.6

|

)

|

|

$1.2

|

|

|||

|

Three Months Ended March 31, 2019

|

|||

|

Operating lease cost

|

|

$1.8

|

|

|

Short-term lease cost

|

0.5

|

|

|

|

Total lease cost

|

|

$2.3

|

|

|

Three Months Ended March 31, 2019

|

|||

|

Cash paid for amounts included in the measurement of operating lease liabilities

|

|

$1.8

|

|

|

Right-of-use assets obtained in exchange for operating lease obligations

|

|

$1.6

|

|

|

2019 (excluding the three months ended March 31, 2019)

|

|

$5.0

|

|

|

2020

|

5.8

|

|

|

|

2021

|

3.8

|

|

|

|

2022

|

1.6

|

|

|

|

2023

|

0.8

|

|

|

|

After 2023

|

0.1

|

|

|

|

Total future minimum lease payments

|

17.1

|

|

|

|

Less amount of lease payment representing interest

|

(1.2

|

)

|

|

|

Total present value of lease payments

|

|

$15.9

|

|

|

2019

|

|

$6.3

|

|

|

2020

|

5.2

|

|

|

|

2021

|

3.3

|

|

|

|

2022

|

1.0

|

|

|

|

2023

|

0.6

|

|

|

|

After 2023

|

—

|

|

|

|

Total future minimum lease payments

|

|

$16.4

|

|

|

Three Months Ended March 31,

|

|||||||

|

2019

|

2018

|

||||||

|

Mobile

|

|

$144.2

|

|

|

$142.5

|

|

|

|

Industrial

|

147.0

|

|

147.7

|

|

|||

|

Energy

|

60.8

|

|

49.1

|

|

|||

|

Other

(1)

|

19.0

|

|

41.5

|

|

|||

|

Total Net Sales

|

|

$371.0

|

|

|

$380.8

|

|

|

|

Three Months Ended March 31,

|

|||||||

|

2019

|

2018

|

||||||

|

Bar

|

|

$239.9

|

|

|

$234.4

|

|

|

|

Tube

|

49.6

|

|

63.7

|

|

|||

|

Value-add

|

73.7

|

|

72.7

|

|

|||

|

Other

(2)

|

7.8

|

|

10.0

|

|

|||

|

Total Net Sales

|

|

$371.0

|

|

|

$380.8

|

|

|

|

Three Months Ended March 31,

|

|||||||

|

2019

|

2018

|

||||||

|

Numerator:

|

|||||||

|

Net income (loss)

|

|

$4.2

|

|

|

($1.9

|

)

|

|

|

Denominator:

|

|||||||

|

Weighted average shares outstanding, basic

|

44.7

|

|

44.5

|

|

|||

|

Dilutive effect of stock-based awards

|

0.5

|

|

—

|

|

|||

|

Weighted average shares outstanding, diluted

|

45.2

|

|

44.5

|

|

|||

|

Basic earnings (loss) per share

|

|

$0.09

|

|

|

($0.04

|

)

|

|

|

Diluted earnings (loss) per share

|

|

$0.09

|

|

|

($0.04

|

)

|

|

|

Three Months Ended March 31,

|

|||||||

|

2019

|

2018

|

||||||

|

Provision for incomes taxes

|

|

$0.1

|

|

|

|

$0.1

|

|

|

Effective tax rate

|

1.1

|

%

|

(5.6

|

)%

|

|||

|

Three Months Ended March 31,

|

|||||||

|

2019

|

2018

|

||||||

|

Pension and postretirement non-service benefit income

|

|

$2.8

|

|

|

$6.3

|

|

|

|

Foreign currency exchange (loss) gain

|

(0.1

|

)

|

0.1

|

|

|||

|

Total other income, net

|

|

$2.7

|

|

|

|

$6.4

|

|

|

Three Months Ended March 31,

|

|||||||||||

|

2019

|

2018

|

$ Change

|

|||||||||

|

Cash interest paid

|

|

$1.8

|

|

|

$0.9

|

|

|

$0.9

|

|

||

|

Accrued interest

|

1.1

|

|

1.9

|

|

(0.8

|

)

|

|||||

|

Amortization of deferred financing fees and debt discount

|

1.3

|

|

1.8

|

|

(0.5

|

)

|

|||||

|

Total interest expense

|

|

$4.2

|

|

|

$4.6

|

|

|

($0.4

|

)

|

||

|

Three Months Ended March 31,

|

|||||||||||

|

|

2019

|

2018

|

$ Change

|

||||||||

|

Pension and postretirement non-service benefit income

|

|

$2.8

|

|

|

$6.3

|

|

|

($3.5

|

)

|

||

|

Foreign currency exchange gain (loss)

|

(0.1

|

)

|

0.1

|

|

(0.2

|

)

|

|||||

|

Total other income, net

|

|

$2.7

|

|

|

$6.4

|

|

|

($3.7

|

)

|

||

|

Three Months Ended March 31,

|

||||||||||||||

|

2019

|

2018

|

$ Change

|

% Change

|

|||||||||||

|

Provision for income taxes

|

|

$0.1

|

|

|

$0.1

|

|

|

$—

|

|

—

|

|

|||

|

Effective tax rate

|

1.1

|

%

|

(5.6

|

)%

|

NM

|

|

670

|

bps

|

||||||

|

Net Sales adjusted to exclude surcharges

|

||||||||||||||||

|

(dollars in millions, tons in thousands)

|

||||||||||||||||

|

Three Months Ended March 31, 2019

|

||||||||||||||||

|

Mobile

|

Industrial

|

Energy

|

Other

|

Total

|

||||||||||||

|

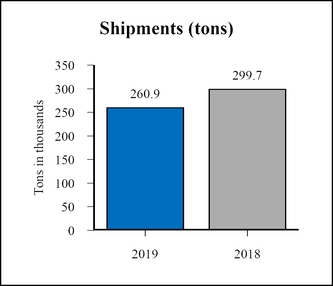

Tons

|

112.8

|

|

102.5

|

|

31.4

|

|

14.2

|

|

260.9

|

|

||||||

|

Net Sales

|

|

$144.2

|

|

|

$147.0

|

|

|

$60.8

|

|

|

$19.0

|

|

|

$371.0

|

|

|

|

Less: Surcharges

|

37.5

|

|

35.1

|

|

12.5

|

|

4.6

|

|

89.7

|

|

||||||

|

Base Sales

|

|

$106.7

|

|

|

$111.9

|

|

|

$48.3

|

|

|

$14.4

|

|

|

$281.3

|

|

|

|

Net Sales / Ton

|

|

$1,278

|

|

|

$1,434

|

|

|

$1,936

|

|

|

$1,338

|

|

|

$1,422

|

|

|

|

Base Sales / Ton

|

|

$946

|

|

|

$1,092

|

|

|

$1,538

|

|

|

$1,014

|

|

|

$1,078

|

|

|

|

Three Months Ended March 31, 2018

|

||||||||||||||||

|

Mobile

|

Industrial

|

Energy

|

Other

|

Total

|

||||||||||||

|

Tons

|

110.4

|

|

113.7

|

|

29.0

|

|

46.6

|

|

299.7

|

|

||||||

|

Net Sales

|

|

$142.5

|

|

|

$147.7

|

|

|

$49.1

|

|

|

$41.5

|

|

|

$380.8

|

|

|

|

Less: Surcharges

|

31.3

|

|

35.2

|

|

11.0

|

|

13.2

|

|

90.7

|

|

||||||

|

Base Sales

|

|

$111.2

|

|

|

$112.5

|

|

|

$38.1

|

|

|

$28.3

|

|

|

$290.1

|

|

|

|

Net Sales / Ton

|

|

$1,291

|

|

|

$1,299

|

|

|

$1,693

|

|

|

$891

|

|

|

$1,271

|

|

|

|

Base Sales / Ton

|

|

$1,007

|

|

|

$989

|

|

|

$1,314

|

|

|

$607

|

|

|

$968

|

|

|

|

March 31,

2019 |

December 31,

2018 |

|||||

|

Cash and cash equivalents

|

|

$7.8

|

|

|

$21.6

|

|

|

Credit Agreement:

|

||||||

|

Maximum availability

|

|

$300.0

|

|

|

$300.0

|

|

|

Amount borrowed

|

140.0

|

|

115.0

|

|

||

|

Letter of credit obligations

|

2.6

|

|

2.6

|

|

||

|

Availability not borrowed

|

157.4

|

|

182.4

|

|

||

|

Total liquidity

|

|

$165.2

|

|

|

$204.0

|

|

|

Three Months Ended March 31,

|

|||||||

|

2019

|

2018

|

||||||

|

Net cash used by operating activities

|

|

($33.6

|

)

|

|

($19.4

|

)

|

|

|

Net cash used by investing activities

|

(4.4

|

)

|

(2.2

|

)

|

|||

|

Net cash provided by financing activities

|

24.2

|

|

32.5

|

|

|||

|

(Decrease) Increase in Cash and Cash Equivalents

|

|

($13.8

|

)

|

|

$10.9

|

|

|

|

•

|

deterioration in world economic conditions, or in economic conditions in any of the geographic regions in which we conduct business, including additional adverse effects from global economic slowdown, terrorism or hostilities. This includes: political risks associated with the potential instability of governments and legal systems in countries in which we or our customers conduct business, and changes in currency valuations;

|

|

•

|

the effects of fluctuations in customer demand on sales, product mix and prices in the industries in which we operate. This includes: our ability to respond to rapid changes in customer demand; the effects of customer bankruptcies or liquidations; the impact of changes in industrial business cycles; and whether conditions of fair trade exist in the U.S. markets;

|

|

•

|

competitive factors, including changes in market penetration; increasing price competition by existing or new foreign and domestic competitors; the introduction of new products by existing and new competitors; and new technology that may impact the way our products are sold or distributed;

|

|

•

|

changes in operating costs, including the effect of changes in our manufacturing processes; changes in costs associated with varying levels of operations and manufacturing capacity; availability of raw materials and energy; our ability to mitigate the impact of fluctuations in raw materials and energy costs and the effectiveness of our surcharge mechanism; changes in the expected costs associated with product warranty claims; changes resulting from inventory management, cost reduction initiatives and different levels of customer demands; the effects of unplanned work stoppages; and changes in the cost of labor and benefits;

|

|

•

|

the success of our operating plans, announced programs, initiatives and capital investments; the ability to integrate acquired companies; the ability of acquired companies to achieve satisfactory operating results, including results being accretive to earnings; and our ability to maintain appropriate relations with unions that represent our associates in certain locations in order to avoid disruptions of business;

|

|

•

|

unanticipated litigation, claims or assessments, including claims or problems related to intellectual property, product liability or warranty, and environmental issues and taxes, among other matters;

|

|

•

|

the availability of financing and interest rates, which affect our cost of funds and/or ability to raise capital; our pension obligations and investment performance; and/or customer demand and the ability of customers to obtain financing to purchase our products or equipment that contain our products; and the amount of any dividend declared by our Board of Directors on our common shares;

|

|

•

|

The overall impact of the pension and postretirement mark-to-market accounting; and

|

|

•

|

Those items identified under the caption Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2018.

|

|

Exhibit Number

|

Exhibit Description

|

|

|

10.1*

|

||

|

10.2*

|

||

|

10.3*

|

||

|

10.4*

|

||

|

10.5*

|

||

|

31.1*

|

||

|

31.2*

|

||

|

32.1**

|

||

|

101.INS*

|

XBRL Instance Document.

|

|

|

101.SCH*

|

XBRL Taxonomy Extension Schema Document.

|

|

|

101.PRE*

|

XBRL Taxonomy Extension Presentation Linkbase Document.

|

|

|

101.CAL*

|

XBRL Taxonomy Extension Calculation Linkbase Document.

|

|

|

101.LAB*

|

XBRL Taxonomy Extension Label Linkbase Document.

|

|

|

101.DEF*

|

XBRL Taxonomy Extension Definition Linkbase Document.

|

|

|

TIMKENSTEEL CORPORATION

|

||

|

Date:

|

May 2, 2019

|

/s/ Kristopher R. Westbrooks

|

|

Kristopher R. Westbrooks

Executive Vice President and Chief Financial Officer (Principal Financial Officer) |

||

|

Exhibit Number

|

Exhibit Description

|

|

|

10.1

|

||

|

10.2

|

||

|

10.3

|

||

|

10.4

|

||

|

10.5

|

||

|

31.1

|

||

|

31.2

|

||

|

32.1

|

||

|

101.INS

|

XBRL Instance Document.

|

|

|

101.SCH

|

XBRL Taxonomy Extension Schema Document.

|

|

|

101.PRE

|

XBRL Taxonomy Extension Presentation Linkbase Document.

|

|

|

101.CAL

|

XBRL Taxonomy Extension Calculation Linkbase Document.

|

|

|

101.LAB

|

XBRL Taxonomy Extension Label Linkbase Document.

|

|

|

101.DEF

|

XBRL Taxonomy Extension Definition Linkbase Document.

|

|