Table of Contents

As filed with the Securities and Exchange Commission on July 10, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF

THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2019

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

Commission file number 000-54189

KABUSHIKI KAISHA MITSUBISHI UFJ FINANCIAL GROUP

(Exact name of Registrant as specified in its charter)

MITSUBISHI UFJ FINANCIAL GROUP, INC.

(Translation of Registrant’s name into English)

Japan

(Jurisdiction of incorporation or organization)

7-1, Marunouchi 2-chome

Chiyoda-ku, Tokyo 100-8330

Japan

(Address of principal executive offices)

Masahisa Takahashi, +81-3-3240-8111, +81-3-3240-7073, same address as above

(Name, Telephone, Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading

symbol(s) |

Name of each exchange on which registered | ||||

|

Common stock, without par value |

New York Stock Exchange (1) | |||||

|

American depositary shares, each of which represents one share of common stock |

MUFG | New York Stock Exchange | ||||

| (1) |

The listing of the registrant’s common stock on the New York Stock Exchange is for technical purposes only and without trading privileges. |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

As of March 31, 2019,13,667,770,520 shares of common stock (including 745,921,774 shares of common stock held by the registrant and its consolidated subsidiaries as treasury stock)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☒ No ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Note—Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☒ |

Accelerated filer ☐ |

Non-accelerated filer ☐ | Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

U.S. GAAP ☒ |

International Financial Reporting Standards as issued

by the International Accounting Standards Board ☐ |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

Table of Contents

For purposes of this Annual Report, we have presented our consolidated financial statements in accordance with accounting principles generally accepted in the United States, or U.S. GAAP, except for risk-adjusted capital ratios, capital components, risk-weighted assets, business segment financial information and some other specifically identified information. Unless otherwise stated or the context otherwise requires, all amounts in our financial statements are expressed in Japanese yen.

In this Annual Report, unless otherwise indicated or the context otherwise requires, all figures are rounded to the figures shown except for the capital ratios, capital components, risk-weighted assets, leverage ratios and liquidity coverage ratios of MUFG and its domestic subsidiaries, which are rounded down and truncated to the figures shown. In some cases, figures presented in tables are adjusted to match the sum of the figures with the total amount, and such figures are also referred to in the related text.

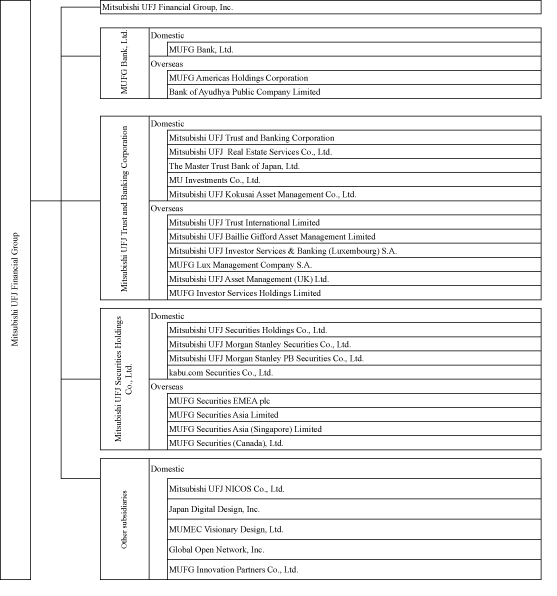

When we refer in this Annual Report to “MUFG,” “we,” “us,” “our” and the “Group,” we generally mean Mitsubishi UFJ Financial Group, Inc. and its consolidated subsidiaries, but from time to time as the context requires, we mean Mitsubishi UFJ Financial Group, Inc. as an individual legal entity. In addition, our “commercial banking subsidiaries” refers to MUFG Bank, Ltd. (formerly, The Bank of Tokyo-Mitsubishi UFJ, Ltd.), or “BK,” and, as the context requires, its consolidated subsidiaries engaged in the commercial banking business. Our “trust banking subsidiaries” refers to Mitsubishi UFJ Trust and Banking Corporation, or “TB,” and, as the context requires, its consolidated subsidiaries engaged in the trust banking business. Our “banking subsidiaries” refers to MUFG Bank and Mitsubishi UFJ Trust and Banking and, as the context requires, their respective consolidated subsidiaries engaged in the banking business. Our “securities subsidiaries” refers to Mitsubishi UFJ Securities Holdings Co., Ltd., or “SCHD,” and as the context requires, its consolidated subsidiaries engaged in the securities business.

1

Table of Contents

References to “MUAH” and “BK(US)” are to MUFG Americas Holdings Corporation and MUFG Union Bank, N.A., as single entities, respectively, as well as to MUFG Americas Holdings and MUFG Union Bank and their respective consolidated subsidiaries, as the context requires.

References to “Krungsri” are to Bank of Ayudhya Public Company Limited, as a single entity, as well as to Bank of Ayudhya Public Company Limited and its respective consolidated subsidiaries, as the context requires. References to “Bank Danamon” are to PT Bank Danamon Indonesia, Tbk., as a single entity, as well as to PT Bank Danamon Indonesia, Tbk. and its respective consolidated subsidiaries, as the context requires.

References to the “FSA” are to the Financial Services Agency, an agency of the Cabinet Office of Japan.

References in this Annual Report to “yen” or “¥” are to Japanese yen, references to “U.S. dollars,” “U.S. dollar,” “dollars,” “U.S.$” or “$” are to United States dollars, references to “euro” or “€” are to the currency of the member states of the European Monetary Union, references to “THB” are to Thai baht, references to “AU$” are to Australian dollars, references to “HK$” are to Hong Kong dollars, and references to “IDR” are to Indonesian Rupiah.

Our fiscal year ends on March 31 of each year. References to years not specified as being fiscal years are to calendar years.

We usually hold the annual ordinary general meeting of shareholders of Mitsubishi UFJ Financial Group, Inc. in June of each year in Tokyo.

2

Table of Contents

We may from time to time make written or oral forward-looking statements. Written forward-looking statements may appear in documents filed with, or submitted to, the U.S. Securities and Exchange Commission, or SEC, including this Annual Report, and other reports to shareholders and other communications.

The U.S. Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking information to encourage companies to provide prospective information about themselves. We rely on this safe harbor in making these forward-looking statements.

Forward-looking statements appear in a number of places in this Annual Report and include statements regarding our current intent, business plan, targets, belief or expectations or the current belief or current expectations of our management with respect to our results of operations and financial condition, including, among other matters, our problem loans and loan losses. In many, but not all cases, we use words such as “anticipate,” “aim,” “believe,” “estimate,” “expect,” “intend,” “plan,” “probability,” “risk,” “will,” “may” and similar expressions, as they relate to us or our management, to identify forward-looking statements. These statements reflect our current views with respect to future events and are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize or should underlying assumptions prove incorrect, actual results may vary materially from those which are aimed, anticipated, believed, estimated, expected, intended or planned, or otherwise stated.

Our forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results may differ from those in the forward-looking statements as a result of various factors. We identify in this Annual Report in “Item 3.D. Key Information—Risk Factors,” “Item 4.B. Information on the Company—Business Overview,” “Item 5. Operating and Financial Review and Prospects” and elsewhere, some, but not necessarily all, of the important factors that could cause these differences.

We are under no obligation, and disclaim any obligation, to update or alter our forward-looking statements, whether as a result of new information, future events or otherwise unless required by law.

3

Table of Contents

| Item 1. |

Identity of Directors, Senior Management and Advisers. |

Not applicable.

| Item 2. |

Offer Statistics and Expected Timetable. |

Not applicable.

| Item 3. |

Key Information. |

| A. |

Selected Financial Data |

The selected statement of income data and selected balance sheet data set forth below has been derived from our audited consolidated financial statements.

Except for risk-adjusted capital ratios, which are calculated in accordance with Japanese banking regulations based on information derived from our consolidated financial statements prepared in accordance with accounting principles generally accepted in Japan, or Japanese GAAP, the selected financial data set forth below are derived from our consolidated financial statements prepared in accordance with U.S. GAAP.

You should read the selected financial data set forth below in conjunction with “Item 5. Operating and Financial Review and Prospects,” “Selected Statistical Data” and our consolidated financial statements and other financial data included elsewhere in this Annual Report. These data are qualified in their entirety by reference to all of that information.

4

Table of Contents

| Fiscal years ended March 31, | ||||||||||||||||||||

| 2015 | 2016 | 2017 | 2018 | 2019 | ||||||||||||||||

| (in millions, except per share data and number of shares) | ||||||||||||||||||||

|

Statement of income data: |

||||||||||||||||||||

|

Interest income |

¥ | 2,894,645 | ¥ | 3,005,738 | ¥ | 2,990,767 | ¥ | 3,259,016 | ¥ | 3,813,379 | ||||||||||

|

Interest expense |

663,184 | 744,364 | 769,639 | 1,028,755 | 1,517,981 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Net interest income |

2,231,461 | 2,261,374 | 2,221,128 | 2,230,261 | 2,295,398 | |||||||||||||||

|

Provision for (reversal of) credit losses |

86,998 | 231,862 | 253,688 | (240,847 | ) | 34,330 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Net interest income after provision for (reversal of) credit losses |

2,144,463 | 2,029,512 | 1,967,440 | 2,471,108 | 2,261,068 | |||||||||||||||

|

Non-interest income |

2,845,078 | 2,407,690 | 1,196,706 | 1,935,091 | 1,595,244 | |||||||||||||||

|

Non-interest expense |

2,726,885 | 3,274,532 | 2,891,603 | 2,744,380 | 2,985,470 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Income before income tax expense |

2,262,656 | 1,162,670 | 272,543 | 1,661,819 | 870,842 | |||||||||||||||

|

Income tax expense |

666,020 | 369,432 | 94,453 | 407,823 | 133,237 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Net income before attribution of noncontrolling interests |

1,596,636 | 793,238 | 178,090 | 1,253,996 | 737,605 | |||||||||||||||

|

Net income (loss) attributable to noncontrolling interests |

65,509 | (9,094 | ) | (24,590 | ) | 25,836 | 18,960 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Net income attributable to Mitsubishi UFJ Financial Group |

¥ | 1,531,127 | ¥ | 802,332 | ¥ | 202,680 | ¥ | 1,228,160 | ¥ | 718,645 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Earnings applicable to common shareholders of Mitsubishi UFJ Financial Group |

¥ | 1,522,157 | ¥ | 802,332 | ¥ | 202,680 | ¥ | 1,228,160 | ¥ | 718,645 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Amounts per share: |

||||||||||||||||||||

|

Basic earnings per common share—Earnings applicable to common shareholders of Mitsubishi UFJ Financial Group |

¥ | 107.81 | ¥ | 57.78 | ¥ | 14.93 | ¥ | 92.40 | ¥ | 55.03 | ||||||||||

|

Diluted earnings per common share—Earnings applicable to common shareholders of Mitsubishi UFJ Financial Group |

107.50 | 57.51 | 14.68 | 92.10 | 54.74 | |||||||||||||||

|

Number of shares used to calculate basic earnings per common share (in thousands) |

14,118,469 | 13,885,842 | 13,574,314 | 13,291,842 | 13,058,698 | |||||||||||||||

|

Number of shares used to calculate diluted earnings per common share (in thousands) (1) |

14,137,645 | 13,903,316 | 13,584,885 | 13,293,492 | 13,059,182 | |||||||||||||||

|

Cash dividends per share paid during the fiscal year: |

||||||||||||||||||||

|

—Common stock |

¥ | 18.00 | ¥ | 18.00 | ¥ | 18.00 | ¥ | 18.00 | ¥ | 21.00 | ||||||||||

| $ | 0.16 | $ | 0.15 | $ | 0.17 | $ | 0.16 | $ | 0.19 | |||||||||||

|

—Preferred stock (Class 5) (2) |

¥ | 57.50 | — | — | — | — | ||||||||||||||

| $ | 0.57 | — | — | — | — | |||||||||||||||

|

—Preferred stock (Class 11) (3) |

¥ | 2.65 | — | — | — | — | ||||||||||||||

| $ | 0.03 | — | — | — | — | |||||||||||||||

| As of March 31, | ||||||||||||||||||||

| 2015 | 2016 | 2017 | 2018 | 2019 | ||||||||||||||||

| (in millions) | ||||||||||||||||||||

|

Balance sheet data: |

||||||||||||||||||||

|

Total assets |

¥ | 280,875,706 | ¥ | 292,557,355 | ¥ | 297,185,019 | ¥ | 300,570,312 | ¥ | 305,228,899 | ||||||||||

|

Loans, net of allowance for credit losses |

117,209,723 | 121,679,828 | 117,032,784 | 116,271,771 | 116,225,757 | |||||||||||||||

|

Total liabilities |

265,594,365 | 277,709,088 | 282,420,311 | 284,924,497 | 289,244,151 | |||||||||||||||

|

Deposits |

171,991,267 | 181,438,087 | 190,401,623 | 195,674,593 | 199,280,789 | |||||||||||||||

|

Long-term debt (4) |

18,782,257 | 20,524,615 | 26,131,527 | 27,069,556 | 27,990,543 | |||||||||||||||

|

Total equity |

15,281,341 | 14,848,267 | 14,764,708 | 15,645,815 | 15,984,748 | |||||||||||||||

|

Capital stock |

2,090,270 | 2,090,270 | 2,090,270 | 2,090,270 | 2,090,270 | |||||||||||||||

5

Table of Contents

| Fiscal years ended March 31, | ||||||||||||||||||||

| 2015 | 2016 | 2017 | 2018 | 2019 | ||||||||||||||||

| (in millions, except percentages) | ||||||||||||||||||||

|

Other financial data: |

||||||||||||||||||||

|

Average balances: |

||||||||||||||||||||

|

Interest-earning assets |

¥ | 237,247,664 | ¥ | 252,715,743 | ¥ | 239,192,449 | ¥ | 239,048,981 | ¥ | 241,407,356 | ||||||||||

|

Interest-bearing liabilities |

210,091,493 | 221,135,208 | 223,522,296 | 233,857,052 | 234,643,197 | |||||||||||||||

|

Total assets |

277,547,638 | 299,270,873 | 307,938,699 | 320,589,932 | 321,292,847 | |||||||||||||||

|

Total equity |

13,002,955 | 15,285,766 | 15,010,829 | 15,423,078 | 16,076,679 | |||||||||||||||

|

Return on equity and assets: |

||||||||||||||||||||

|

Earnings applicable to common shareholders as a percentage of average total assets |

0.55 | % | 0.27 | % | 0.07 | % | 0.38 | % | 0.22 | % | ||||||||||

|

Earnings applicable to common shareholders as a percentage of average total equity |

11.71 | % | 5.25 | % | 1.35 | % | 7.96 | % | 4.47 | % | ||||||||||

|

Dividends per common share as a percentage of basic earnings per common share |

16.70 | % | 31.15 | % | 120.56 | % | 19.48 | % | 38.16 | % | ||||||||||

|

Average total equity as a percentage of average

|

4.68 | % | 5.11 | % | 4.87 | % | 4.81 | % | 5.00 | % | ||||||||||

|

Net interest income as a percentage of average total interest-earning assets |

0.94 | % | 0.89 | % | 0.93 | % | 0.93 | % | 0.95 | % | ||||||||||

|

Credit quality data: |

||||||||||||||||||||

|

Allowance for credit losses |

¥ | 1,055,479 | ¥ | 1,111,130 | ¥ | 1,182,188 | ¥ | 764,124 | ¥ | 658,184 | ||||||||||

|

Allowance for credit losses as a percentage of loans |

0.89 | % | 0.90 | % | 1.00 | % | 0.65 | % | 0.56 | % | ||||||||||

|

Impaired loans |

¥ | 1,686,806 | ¥ | 1,725,150 | ¥ | 1,715,850 | ¥ | 1,331,123 | ¥ | 1,209,791 | ||||||||||

|

Impaired loans as a percentage of loans |

1.43 | % | 1.40 | % | 1.45 | % | 1.14 | % | 1.04 | % | ||||||||||

|

Allowance for credit losses related to impaired loans as a percentage of impaired loans |

36.00 | % | 42.60 | % | 51.42 | % | 37.14 | % | 32.33 | % | ||||||||||

|

Net loan charge-offs |

¥ | 150,666 | ¥ | 156,959 | ¥ | 169,809 | ¥ | 180,999 | ¥ | 129,924 | ||||||||||

|

Net loan charge-offs as a percentage of average loans |

0.13 | % | 0.13 | % | 0.14 | % | 0.15 | % | 0.11 | % | ||||||||||

|

Average interest rate spread |

0.90 | % | 0.85 | % | 0.91 | % | 0.92 | % | 0.93 | % | ||||||||||

|

Risk-adjusted capital ratio calculated under Japanese GAAP (5) |

15.62 | % | 16.01 | % | 15.85 | % | 16.56 | % | 16.03 | % | ||||||||||

| Notes: |

| (1) | Includes the common shares that were potentially issuable upon conversion of the Class 11 Preferred Stock and stock acquisition rights. |

| (2) | Preferred dividends were ¥57.5 per share and paid semi-annually. In April 2014, we acquired and cancelled all of the issued shares of First Series of Class 5 Preferred Stock. As a result, there is currently no issued Class 5 Preferred Stock. See Note 17 to our audited consolidated financial statements included elsewhere in this Annual Report. |

| (3) | Preferred dividends were ¥2.65 per share and paid semi-annually. In August 2014, we acquired all of the issued shares of Class 11 Preferred Stock in exchange for 1,245 shares of our common stock held in treasury, and cancelled the acquired shares. As a result, there is currently no issued Class 11 Preferred Stock. See Note 17 to our audited consolidated financial statements included elsewhere in this Annual Report. |

| (4) | Reflects the changes in presentation adopted in the fiscal year ended March 31, 2018, where long-term payables under repurchase agreements are no longer included in long-term debt but are aggregated with short-term payables under repurchase agreements in payables under repurchase agreements, and applied to the fiscal years ended March 31, 2015, 2016 and 2017. |

| (5) | Risk-adjusted capital ratios have been calculated in accordance with Japanese banking regulations as applicable on the relevant calculation date, based on information derived from our consolidated financial statements prepared in accordance with Japanese GAAP. For a description of the applicable capital ratio calculation and other requirements applicable, see “Item 4.B. Information on the Company—Business Overview—Supervision and Regulation—Japan—Capital adequacy” and “Item 5.B. Operating and Financial Review and Prospects—Liquidity and Capital Resources—Capital Adequacy.” |

| B. |

Capitalization and Indebtedness |

Not applicable.

| C. |

Reasons for the Offer and Use of Proceeds |

Not applicable.

6

Table of Contents

| D. |

Risk Factors |

Investing in our securities involves a high degree of risk. You should carefully consider the risks described in this section, which is intended to disclose all of the risks that we consider material based on the information currently available to us, as well as all the other information in this Annual Report, including our consolidated financial statements and related notes, “Item 5. Operating and Financial Review and Prospects,” “Item 11. Quantitative and Qualitative Disclosures about Credit, Market and Other Risk” and “Selected Statistical Data.”

Our business, operating results and financial condition could be materially and adversely affected by any of the factors discussed below. The trading price of our securities could decline due to any of these factors. This Annual Report also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those described in this section and elsewhere in this Annual Report. See “Forward-Looking Statements.”

Risks Related to Our Business

Because a large portion of our assets as well as our business operations are in Japan, we may incur losses if economic conditions in Japan worsen.

Our performance is particularly affected by the general economic conditions of Japan where we are headquartered and conduct a significant amount of our business. As of March 31, 2019, 63.6% of our total assets were related to Japanese domestic assets, including Japanese national government and Japanese government agency bonds, which accounted for 56.0% of our total investment securities portfolio and 8.2% of our total assets, respectively. Interest and non-interest income in Japan represented 34.9% of our total interest and non-interest income for the fiscal year ended March 31, 2019. Furthermore, as of March 31, 2019, our loans in Japan accounted for 55.7% of our total loans outstanding.

There is significant uncertainty surrounding Japan’s economy. For example, Japan’s fiscal health and sovereign creditworthiness may deteriorate if the Japanese government’s economic measures and the Bank of Japan’s monetary policies prove ineffective or result in negative consequences. If the prices of Japanese government bonds decline rapidly, resulting in an unexpectedly sudden increase in interest rates, our investment securities portfolio as well as our lending, borrowing, trading and other operations may be negatively impacted. In addition, interest rates may suddenly increase as a result of a decision made by the Bank of Japan to end or modify its current interest rate policy, including the negative interest rate of minus 0.1% applied to certain current account amounts that financial institutions hold at the Bank of Japan and the Japanese government bond purchase program with an aim to keep the yield of 10-year Japanese government bonds around zero percent, or market expectations relating to any such decision. See “—Risks Related to Our Business—Fluctuations in interest rates could adversely affect the value or the yield of our bond portfolio.”

Instability in the Japanese stock market and foreign currency exchange rates may also have a significant adverse impact on our asset and liability management as well as our results of operations. Various other factors, including the decreasing and aging demographics in Japan, stagnation or deterioration of economic and market conditions in other countries, growing global competition and trade conflicts, may also have a material negative impact on the Japanese economy. For a detailed discussion on the business environment in Japan and abroad, see “Item 5. Operating and Financial Review and Prospects—Business Environment.”

Since our domestic loans in Japan accounted for a significant portion of our loan portfolio, deteriorating or stagnant economic conditions in Japan may cause adverse effects on our financial results, such as increases in credit costs, as the credit quality of some borrowers could deteriorate. For example, due to the intensifying global competition and weakening consumer spending in recent periods, some Japanese companies, including electronics manufacturers, have experienced significant financial difficulties. For a further discussion,

7

Table of Contents

see “—Risks Related to Our Business—We may suffer additional credit-related losses in the future if our borrowers are unable to repay their loans as expected or if the measures we take in reaction to, or in anticipation of, our borrowers’ deteriorating repayment abilities prove inappropriate or insufficient.”

Our domestic loan portfolio may also be adversely affected by interest rate fluctuations in Japan. For example, as a result of the Bank of Japan’s interest rate policy and measures to purchase Japanese government bonds in the market, the yield on many financial instruments and other market interest rates in Japan have declined to low or negative levels. If the Bank of Japan’s policy and measures are maintained for an extended period, or if the Bank of Japan’s negative interest rate is lowered from the current level, market interest rates may decline further, and our interest rate spread on our domestic loan portfolio may narrow further, reducing our net interest income.

If the global economy deteriorates, our credit-related losses may increase, and the value of the financial instruments we hold may decrease, resulting in losses.

Global economic conditions remain volatile, and it is uncertain how the global economy will evolve over time. Factors that could negatively impact the global market, both developed and emerging, include concerns over the possible negative impact on global economic activity resulting from changes in the trade policies of various countries, the potentially serious ramifications of the negotiations on the United Kingdom’s withdrawal from the European Union, the potential negative effect from the monetary policy changes in the United States, slowing economic growth in China in the midst of a shift in the government’s economic policy, possible adverse effects on economic conditions in commodity-exporting countries of a decline in oil and other commodity prices, and the political turmoil in various regions around world. As of March 31, 2019, based principally on the domicile of the obligors, assets related to the United States accounted for approximately 16.4% of our total assets, assets related to Asia and Oceania excluding Japan accounted for approximately 9.2% of our total assets, and assets related to Europe accounted for approximately 7.1% of our total assets. If the global economy deteriorates or the global economic recovery significantly slows down again, the availability of credit may become limited, and some of our borrowers may default on their loan obligations to us, increasing our credit losses. Some of our credit derivative transactions may also be negatively affected, including the protection we sold through single name credit default swaps, and index and basket credit default swaps. The notional amounts of these protections sold as of March 31, 2019 were ¥2.49 trillion and ¥0.66 trillion, respectively. In addition, if credit market conditions worsen, our capital funding structure may need to be adjusted or our funding costs may increase, which could have a material adverse impact on our financial condition and results of operations.

Furthermore, we have incurred losses, and may incur further losses, as a result of changes in the fair value of our financial instruments resulting from weakening market conditions. For example, we recorded ¥355.8 billion of net losses from marketable equity securities, which reflected unrealized losses, or holding losses, on marketable equity securities, and ¥0.6 billion of impairment losses on available-for-sale debt securities and other securities for the fiscal year ended March 31, 2019. As of March 31, 2019, approximately 26.6% of our total assets were financial instruments for which we measure fair value on a recurring basis, and less than 0.5% of our total assets were financial instruments for which we measure fair value on a non-recurring basis. Generally, in order to establish the fair value of these instruments, we rely on quoted prices. If the value of these financial instruments declines, a corresponding loss or write-down may be recognized in our consolidated statements of income. In addition, because we hold a large amount of investment securities, short-term fluctuations in the value of our securities may trigger losses or exit costs for us to manage our risk. For more information on our valuation method for financial instruments, see “Item 5. Operating and Financial Review and Prospects—Critical Accounting Estimates.”

8

Table of Contents

We may suffer additional credit-related losses in the future if our borrowers are unable to repay their loans as expected or if the measures we take in reaction to, or in anticipation of, our borrowers’ deteriorating repayment abilities prove inappropriate or insufficient.

When we lend money or commit to lend money, we incur credit risk, which is the risk of losses if our borrowers do not repay their loans. We may incur significant credit losses or have to provide for a significant amount of additional allowance for credit losses if:

| • |

large borrowers become insolvent or must be restructured; |

| • |

domestic or global economic conditions, either generally or in particular industries in which large borrowers operate, deteriorate; |

| • |

the value of the collateral we hold, such as real estate or securities, declines; or |

| • |

we are adversely affected by corporate credibility issues among our borrowers, to an extent that is worse than anticipated. |

As a percentage of total loans, impaired loans, which primarily include nonaccrual loans and troubled debt restructurings, or TDRs, ranged from 1.04% to 1.45% as of the five most recent fiscal year-ends. As of March 31, 2019, impaired loans were ¥1.21 trillion, representing 1.04% of our total outstanding loans. If the economic conditions in Japan or other parts of the world, or in particular industries, including the energy and real estate industries, to which we have significant credit risk exposure, worsen, our problem loans and credit-related expenses may increase. An increase in problem loans and credit-related expenses would adversely affect our results of operations, weaken our financial condition and erode our capital base.

We may provide additional loans, equity capital or other forms of support to troubled borrowers in order to facilitate their restructuring and revitalization efforts. We may also forbear from exercising some or all of our rights as a creditor against them, and we may forgive loans to them in conjunction with their debt restructurings. We may take these steps even when such steps might not be warranted from the perspective of our short-term or narrow economic interests or a technical analysis of our legal rights against those borrowers, in light of other factors such as our longer-term economic interests, and our commitment to supporting the Japanese economy. These practices may substantially increase our exposure to troubled borrowers and increase our losses. Credit losses may also increase if we elect, or are forced by economic or other considerations, to sell or write off our problem loans at a larger discount, in a larger amount or in a different time or manner, than we may otherwise want.

Although we, from time to time, enter into credit derivative transactions, including credit default swap contracts, to manage our credit risk exposure, such transactions may not provide the protection against credit defaults that we intended due to counterparty defaults or similar issues. The credit default swap contracts could also result in significant losses. As of March 31, 2019, the total notional amount of the protection we sold through single name credit default swaps and index and basket credit default swaps was ¥3.15 trillion. In addition, negative changes in financial market conditions may restrict the availability and liquidity of credit default swaps. For more information on our credit derivative transactions, see Note 24 to our consolidated financial statements included elsewhere in this Annual Report.

Our loan losses could prove to be materially different from our estimates and could materially exceed our current allowance for credit losses, in which case we may need to provide for additional allowance for credit losses and may also record credit losses beyond our allowance. Our allowance for credit losses in our loan portfolio is based on evaluations of customers’ creditworthiness and the value of collateral we hold. We recorded ¥34.3 billion of provision for credit losses for the fiscal year ended March 31, 2019. While we closely observe conditions of our individual borrowers and industry trends, our borrowers may incur financial and non-financial losses that exceed our estimations depending on, for example, domestic and international economic conditions or commodity price fluctuations. In such case, we may need to provide for additional allowance for credit losses.

9

Table of Contents

Also, the regulatory standards or guidance on establishing allowances may also change, causing us to change some of the evaluations used in determining the allowances. As a result, we may need to provide for additional allowance for credit losses.

Our efforts to diversify our portfolio to avoid any concentration of credit risk exposures to particular industries or counterparties may prove insufficient. For example, our credit exposures to the energy and real estate industries are relatively high in comparison to other industries. The credit quality of borrowers in this sector do not necessarily correspond to general economic conditions in Japan or other parts of the world, and adverse fluctuations in oil and other commodity prices or adverse developments in the real estate market may disproportionately increase our credit costs.

When we believe there is an improvement in asset quality, we may reverse the allowance for credit losses to a level management deems appropriate and record the amount of reversal in our consolidated statements of income. For example, for the fiscal year ended March 31, 2019, we recorded ¥43.9 billion and ¥4.5 billion of reversal of credit losses for the Commercial and Residential segments, respectively, of our loan portfolio. However, we have historically recorded provision for credit losses rather than recording reversal of credit losses in most periods, and in future periods we may need to recognize provision for credit losses for these and other segments of our loan portfolio.

For more information on our loan portfolio, see “Item 5.B. Operating and Financial Review and Prospects—Liquidity and Capital Resources—Financial Condition—Loan Portfolio.”

Fluctuations in interest rates could adversely affect the value or the yield of our bond portfolio.

The aggregate carrying amount of the Japanese government and corporate bonds and foreign bonds, including U.S. Treasury bonds, that we held as of March 31, 2019 was 9.5% of our total assets. In particular, the Japanese national government and Japanese government agency bonds accounted for 8.2% of our total assets as of March 31, 2019. For a detailed discussion of our bond portfolio, see “Selected Statistical Data—Investment Portfolio.”

The Bank of Japan has maintained a “quantitative and qualitative monetary easing with yield curve control” policy and applied a negative interest rate of minus 0.1% to the “Policy-Rate Balances,” which are a part of current account amounts held by financial institutions at the Bank of Japan, while purchasing Japanese government bonds to increase its aggregate holding of such bonds by approximately ¥80 trillion each year with an aim to keep the yield of 10-year Japanese government bonds around zero percent. If the policy is maintained in Japan for an extended period, or if the Bank of Japan’s negative interest rate or target long-term interest rate is lowered from the current level, market interest rates may decline further, and the yield on the Japanese government bonds and other financial instruments that we hold may also decline. On the other hand, the value of our investment portfolio may decrease if interest rates increase rapidly or significantly because of heightened market expectations for tapering or cessation of the current policy in Japan. Separate from the Bank of Japan’s monetary policies, interest rates could also significantly increase in the event that Japanese government bonds decline in value due to such factors as a decline in confidence in the Japanese government’s fiscal administration or further issuances of Japanese government bonds in connection with emergency economic measures or in the event that interest rates on U.S. Treasury securities rise due to such factors as instability in the U.S. government bond market, additional issuances of U.S. government bonds, or changes in the monetary policy of the Federal Reserve Board, or FRB, including an increase in the U.S. policy interest rate. If relevant interest rates increase for these or other reasons, particularly if such increase is unexpected or sudden, we may incur significant losses on sales of, and valuation losses on, our bond portfolio. Furthermore, if short-term interest rates rise to a larger extent than long-term interest rates or long-term interest rates decline to a larger extent than short-term interest rates in the United States due to the monetary policy of the FRB, concerns over the U.S. economic outlook or other reason, our interest income may be adversely affected. See “Item 5. Operating and Financial Review and Prospects—Business Environment.”

10

Table of Contents

Fluctuations in foreign currency exchange rates may result in transaction losses on translation of monetary assets and liabilities denominated in foreign currencies as well as foreign currency translation losses with respect to our foreign subsidiaries and equity method investees.

Fluctuations in foreign currency exchange rates against the Japanese yen create transaction gains or losses on the translation into Japanese yen of monetary assets and liabilities denominated in foreign currencies. To the extent that our foreign currency-denominated assets and liabilities are not matched in the same currency or appropriately hedged, we could incur losses due to future foreign exchange rate fluctuations. During the fiscal year ended March 31, 2019, the average balance of our foreign interest-earning assets was ¥96,128.3 billion and the average balance of our foreign interest-bearing liabilities was ¥61,443.6 billion, representing 39.8% of our average total interest-earning assets and 26.2% of our average total interest-bearing liabilities during the same period. Due to foreign currency exchange rate fluctuations, we may incur losses attributable to net transaction losses on the translation into Japanese yen of monetary assets and liabilities denominated in foreign currencies, net losses on currency derivative instruments entered into for trading purposes, and net losses on translation into Japanese yen of securities accounted for under the fair value option. In addition, we may incur foreign currency translation losses with respect to our foreign subsidiaries and equity method investees due to fluctuations in foreign currency exchange rates. The average exchange rate for the fiscal year ended March 31, 2019 was ¥110.91 per U.S.$1.00, compared to ¥110.85 per U.S.$1.00 for the previous fiscal year. The change in the average exchange rate of the Japanese yen against the U.S. dollar and other foreign currencies had the effect of decreasing total revenue by ¥21.6 billion, net interest income by ¥9.3 billion and income before income tax expense by ¥5.4 billion, respectively, while increasing the fair value of trading account securities accounted for under the fair value option by ¥186.6 billion, for the fiscal year ended March 31, 2019. The Japanese yen was ¥107.79 to the U.S. dollar on June 28, 2019. For more information on foreign exchange gains and losses and foreign currency translation gains and losses, see “Item 5. Operating and Financial Review and Prospects—Business Environment” and “Item 5.A. Operating and Financial Review and Prospects—Operating Results.”

If the Japanese stock market or other global markets decline in the future, we may incur losses on our securities portfolio and our capital ratios will be adversely affected.

A decline in Japanese stock prices could reduce the value of the Japanese domestic marketable equity securities that we hold, which accounted for 14.1% of our total investment securities portfolio, and 2.1% of our total assets, as of March 31, 2019. The Nikkei Stock Average, which is the average of 225 blue chip stocks listed on the Tokyo Stock Exchange, fluctuated throughout the fiscal year ended March 31, 2019, rising to an intra-day high of ¥24,448.07 on October 2, 2018, declining to an intra-day low of ¥18,948.58 on December 26, 2018, and rising again to ¥21,205.81 at the end of trading on March 29, 2019. As of June 28, 2019, the closing price of the Nikkei Stock Average was ¥21,275.92. The Nikkei Stock Average has increased in recent periods, and may fluctuate significantly and negatively in future periods, as the global economy remains volatile and investors continue to observe the changes in economic, monetary and trade policies mainly in Japan, the United States, China, the Eurozone and Asian countries. In addition, weakening or stagnant economic conditions in these and other regions may have a significant negative impact on Japanese companies, which in turn will cause their stock prices to decline. Concerns over the impact of geopolitical tensions and conflicts in various parts of the world on Japanese companies may also adversely affect stock prices in Japan. In addition, the global trend towards further reduction in risk assets could result in lower stock prices, and the recent trend in Japan towards strengthening corporate governance may subject public companies to stricter scrutiny. See “Item 5. Operating and Financial Review and Prospects—Business Environment” and “Item 5.B. Operating and Financial Review and Prospects—Liquidity and Capital Resources—Investment Portfolio.”

We may become subject to regulatory actions or other legal proceedings relating to our transactions or other aspects of our operations, which could result in significant financial losses, restrictions on our operations and damage to our reputation.

We conduct our business subject to ongoing regulation and associated regulatory and legal risks. Global financial institutions, including us, currently face heightened regulatory scrutiny as a result of the concerns

11

Table of Contents

developing in the global financial sector, and growing public pressure to demand even greater regulatory surveillance following several high-profile scandals and risk management failures in the financial industry. In the current regulatory environment, we are subject to various regulatory inquiries or investigations from time to time in connection with various aspects of our business and operations. In addition, multiple government authorities with overlapping jurisdiction more frequently conduct investigations and take other regulatory actions in coordination with one another or separately on the same or related matters.

In November 2014, MUFG Bank entered into a consent agreement with the New York State Department of Financial Services, or DFS, to resolve issues relating to instructions given to PricewaterhouseCoopers LLP, or PwC, and the disclosures made to DFS in connection with MUFG Bank’s 2007 and 2008 voluntary investigation of MUFG Bank’s U.S. dollar clearing activity toward countries under U.S. economic sanctions. MUFG Bank had hired PwC to conduct a historical transaction review report in connection with that investigation, and voluntarily submitted the report to DFS’s predecessor entity in 2008. Under the terms of the agreement with DFS, MUFG Bank made a payment of $315 million to DFS, and agreed to take actions on persons involved in the matter at that time, relocate its U.S. Bank Secrecy Act/Anti-Money Laundering, or BSA/AML, and Office of Foreign Assets Control, or OFAC, sanctions compliance programs to New York, and extend, if regarded as necessary by DFS, the period during which an independent consultant is responsible for assessing MUFG Bank’s internal controls regarding compliance with applicable laws and regulations related to U.S. economic sanctions. In June 2013, MUFG Bank reached an agreement with DFS regarding inappropriate operational processing of U.S. dollar clearing transactions with countries subject to OFAC sanctions during the period of 2002 to 2007. Under the terms of the June 2013 agreement, MUFG Bank made a payment of $250 million to DFS and retained an independent consultant to conduct a compliance review of the relevant controls and related matters in MUFG Bank’s current operations. In December 2012, MUFG Bank agreed to make a payment of approximately $8.6 million to OFAC to settle potential civil liability for apparent violations of certain U.S. sanctions regulations from 2006 to 2007.

On November 9, 2017, MUFG Bank entered into a Stipulation and Consent to the Issuance of a Consent Order with the U.S. Office of the Comptroller of the Currency, or OCC, under which MUFG Bank agreed to the entry by the OCC of a Consent Order that includes remedial terms and conditions that are substantively the same as those included in the consent agreements that MUFG Bank had reached with DFS in June 2013 and November 2014. This Consent Order, which the OCC executed, enables the OCC to supervise MUFG Bank’s plans to enhance its internal controls and compliance program relating to OFAC sanctions requirements. The Stipulation and Consent with the OCC followed MUFG’s conversion of the U.S. Branches and Agencies of MUFG Bank and Mitsubishi UFJ Trust and Banking, including MUFG Bank’s New York Branch, from state-licensed branches and agencies under the supervision of state regulatory agencies, including DFS, to federally licensed branches and agencies under the supervision of the OCC. Although, MUFG Bank was engaged in litigation with DFS with regard to the conversion of its New York Branch license as well as purported violations of law alleged to have occurred prior to the federal license conversion, in June 2019, MUFG Bank entered into a settlement with NYDFS to resolve this litigation and made a settlement payment. In February 2019, MUFG Bank entered into a Consent Order with the OCC relating to deficiencies identified by the OCC in the Bank Secrecy Act/Anti-Money Laundering compliance program of MUFG Bank’s U.S. branches in New York, Los Angeles, and Chicago. MUFG Bank is undertaking necessary actions relating to these matters. See “Item 8.A. Financial Information—Consolidated Statements and Other Financial Information—Legal Proceedings.”

We have received requests and subpoenas for information from government agencies in some jurisdictions that are conducting investigations into past submissions made by panel members, including us, to the bodies that set various interbank benchmark rates as well as investigations into foreign exchange related practices of global financial institutions. Some of the investigations into foreign exchange related practices resulted in our payment of monetary penalties to the relevant government agencies. We are cooperating with the ongoing investigations and have been conducting an internal investigation, among other things. In connection with these matters, we and other financial institutions are involved as defendants in a number of civil lawsuits, including putative class actions, in the United States.

12

Table of Contents

These developments or other similar matters may result in additional regulatory actions against us or agreements to make significant additional settlement payments. These developments or other matters to which we are subject from time to time may also expose us to substantial monetary damages, legal defense costs, criminal and civil liability, and restrictions on our business operations as well as damage to our reputation. The outcome of such matters, including the extent of the potential impact of any unfavorable outcome on our financial results, however, is inherently uncertain and difficult to predict. The extent of financial, human and other resources required to conduct any investigations or to implement any corrective or preventive measures is similarly uncertain and could be significant. Such resources may also be difficult for us to secure in a timely manner.

Legal and regulatory changes could have a negative impact on our business, financial condition and results of operations.

As a global financial services provider, our business is subject to ongoing changes in laws, regulations, rules, policies, voluntary codes of practice and interpretations in Japan and other markets where we operate. Major global financial institutions currently face an increasingly stricter set of laws, regulations and standards as a result of the concerns enveloping the global financial sector. There is also growing political pressure to demand even greater internal compliance and risk management systems following several high-profile scandals and risk management failures in the financial industry. We may not be able to enhance our compliance risk management systems and programs, which, in some cases, are supported by third-party service providers, in a timely manner or as planned. Our risk management systems and programs may not be fully effective in preventing all violations of laws, regulations and rules applicable locally or on a global basis to our subsidiaries, offices and branches.

Our failure or inability to comply fully with applicable laws and regulations could lead to fines, public reprimands, damage to reputation, civil liability, enforced suspension of operations or, in extreme cases, withdrawal of authorization to operate, adversely affecting our business and results of operations. Legal or regulatory compliance failure may also adversely affect our ability to obtain regulatory approvals for future strategic initiatives. Furthermore, failure to take necessary corrective action, or the discovery of violations of laws in the process of further review of any of the matters mentioned above or in the process of implementing any corrective measures, could result in further regulatory action.

We could also be required to incur significant expenses to comply with new or revised regulations. For example, benchmark rate reforms may result in significant costs for making necessary adjustments to our financial instruments and related operations and also in significant financial losses relating to instruments using such rates. If we adopt a new information technology system infrastructure in the future, for instance, we may be required to incur significant additional costs for establishing and implementing effective internal controls, which may materially and adversely affect our financial condition and results of operations.

Future developments or changes in laws, regulations, rules, policies, voluntary codes of practice and their effects are expected to require greater capital, human and technological resources as well as significant management attention, and may require us to modify our business strategies and plans. For example, we are subject to new bank regulatory standards that were finalized as part of the reforms to “Basel III: A global regulatory framework for more resilient banks and banking systems,” or Basel III, in December 2017. These new standards include a minimum leverage ratio requirement, which became applicable to us in March 2019 and which is expected to be raised in 2022, as well as revisions to risk measurement approaches, which are expected to be phased in from 2022. We also became subject to minimum total loss-absorbing capacity, or TLAC, requirements in March 2019, and the minimum requirements are expected to be raised in 2022. For more information, see “—Risks Related to Our Business—We may not be able to maintain our capital ratios above minimum required levels, which could result in the suspension of some or all of our operations.” and “Item 4.B. Information on the Company—Business Overview—Supervision and Regulation—Japan.”

Furthermore, regulatory reforms recently implemented, proposed and currently being debated in the United States may also significantly affect our business operations. For example, in July 2016, we established

13

Table of Contents

MUFG Americas Holdings as a U.S. intermediate holding company, or IHC, and reorganized our U.S. bank and non-bank subsidiaries under MUFG Americas Holdings pursuant to rules adopted by the FRB in February 2014. Under the FRB rules, MUFG Americas Holdings is also subject to U.S. capital requirements, capital stress testing, liquidity buffer requirements, and other enhanced prudential standards comparable to those applicable to top-tier U.S. bank holding companies of the same size. In April 2019, the FRB proposed modifications to such requirements and standards as applied to foreign banking organizations, which could result in stricter requirements and standards for MUFG Americas Holdings. We are continuing to devote resources and management attention on establishing an appropriate governance structure with effective internal control systems for MUFG Americas Holdings designed to ensure compliance with the rules on an on-going basis. See “Item 4.B. Information on the Company—Business Overview—Supervision and Regulation—United States.”

Any adverse changes in the business of MUFG Americas Holdings Corporation, a wholly owned subsidiary in the United States, could significantly affect our results of operations.

MUFG Americas Holdings, which is a wholly owned subsidiary in the United States formerly called UnionBanCal Corporation, or UNBC, and which is our IHC in the United States, has historically contributed to a significant portion of net income attributable to the Mitsubishi UFJ Financial Group. MUFG Americas Holdings reported net income of $990 million, $1,077 million and $1,073 million for the fiscal years ended December 31, 2016, 2017 and 2018 respectively. Any adverse developments which could arise at MUFG Americas Holdings may have a significant negative impact on our results of operations and financial condition. For more information, see “Item 4.B. Information on the Company—Business Overview—Global Commercial Banking Business Group—MUFG Union Bank, N.A.”

Factors that have negatively affected, and could continue to negatively affect, MUFG Americas Holdings’ results of operations include difficult economic conditions, such as a downturn in the real estate and housing industries in the United States, particularly in California, the fiscal challenges being experienced by the U.S. federal and California state governments, substantial competition in the banking markets in the United States and uncertainty over the U.S. economy, as well as negative trends in debt ratings and interest rate uncertainties. As was the case in recent periods, declining oil and gas prices could adversely affect the credit conditions of borrowers in the energy sector and related industries, resulting in an increase in credit costs. In addition, since the financial crisis in 2008 and 2009, the U.S. banking industry has operated in an extremely low interest rate environment as a result of the highly accommodative monetary policy of the FRB, which has placed downward pressure on the net interest margins of U.S. banks, including MUFG Americas Holdings. Although the FRB gradually raised its policy interest rate between December 2015 and December 2018, interest rates have remained at relatively low levels in the United States. Sudden fluctuations in interest rates may also negatively affect MUFG Americas Holdings’ results of operations.

Significant costs may arise from enterprise-wide compliance and risk management requirements under, or failure to comply with, applicable laws and regulations, such as the U.S. Bank Secrecy Act and related amendments under the USA PATRIOT Act, and any adverse impact of the implementation of the Dodd-Frank Act. In addition, the FRB and other U.S. bank regulators have adopted rules to implement the Basel III global regulatory framework for U.S. banks and bank holding companies which require higher quality of capital, as well as significantly revise the calculations for risk-weighted assets. The FRB has also adopted rules to implement various enhanced prudential standards required by the Dodd-Frank Act for larger U.S. bank holding companies, such as MUFG Americas Holdings. These standards require the larger bank holding companies to meet enhanced capital, liquidity and leverage standards. Further, the FRB has adopted regulations applicable to foreign banking organizations operating in the United States, which require MUFG’s and MUFG Bank’s U.S. operations to be restructured and, subject to certain exceptions, conducted under a single U.S. IHC, with its own capital and

liquidity requirements. Actions management may take in response to these regulatory changes may involve the issuance of additional capital or other measures. For more information, see “Item 4.B. Information on the Company—Business Overview—Supervision and Regulation—United States.”

14

Table of Contents

MUFG Union Bank, which is the principal subsidiary of MUFG Americas Holdings, and reportedly other financial institutions have been the targets of various denial-of-service or other cyber-attacks as part of what appears to be a coordinated effort to disrupt the operations of financial institutions and potentially test their cybersecurity in advance of future and more advanced cyber-attacks. These denial-of-service attacks may require substantial resources to defend against and affect customer satisfaction and behavior. Moreover, MUFG Union Bank’s information security measures may not be sufficient to defend against cyber-attacks and other information security breaches, in which case the consequences could be significant in terms of financial, reputational and other losses. In addition, there have been increasing efforts to breach data security at financial institutions as well as other types of companies, such as large retailers, or with respect to financial transactions, including through the use of social engineering schemes such as “phishing.” Even if cyber-attacks and similar tactics are not directed specifically at MUFG Union Bank, such attacks on other large institutions could disrupt the overall functioning of the U.S. or global financial system and undermine consumer confidence in banks generally to the detriment of other financial institutions, including MUFG Union Bank.

Any adverse changes in the business of Bank of Ayudhya, an indirect subsidiary in Thailand, or Bank Danamon, an indirect subsidiary in Indonesia, could significantly affect our results of operations.

Any adverse changes in the business or management of Bank of Ayudhya Public Company Limited, or Krungsri, a strategic subsidiary in Thailand in which we hold a 76.88% ownership interest as of March 31, 2019, or PT Bank Danamon Indonesia, Tbk, or Bank Danamon, a strategic subsidiary in Indonesia in which we hold a 94.1% ownership interest as of May 1, 2019, may negatively affect our financial condition and results of operations. Factors that may negatively affect the financial condition and results of operations of these subsidiaries include:

| • |

adverse economic conditions, substantial competition in the banking industry, volatile political and social conditions, natural disasters including floods, terrorism and armed conflicts, restrictions under applicable financial systems and regulations, or significant fluctuations in interest rates, foreign currency exchange rates, stock prices or commodity prices, in Southeast Asia, particularly in their respective home markets; |

| • |

the business performance of companies making investments in and entering into markets in the Southeast Asian region, as well as the condition of economies, financial systems, laws and financial markets in the countries where such companies primarily operate; |

| • |

losses from legal proceedings involving them; |

| • |

credit rating downgrades and declines in stock prices of their borrowers, and bankruptcies of their borrowers resulting from such factors; |

| • |

defaults on their loans to individuals; and |

| • |

costs incurred due to weaknesses in their internal controls and regulatory compliance systems or any of their subsidiaries. |

As of March 31, 2019, the balance of goodwill associated with the acquisition of Krungsri, including Krungsri’s acquisition of Hattha Kaksekar Limited, a microfinance institution in Cambodia, in September 2016, was ¥59.0 billion. In May 2019, we completed a series of transactions to increase our ownership interest in Bank Danamon to 94.1%, as a result of which Bank Danamon became our consolidated subsidiary. If the business of Krungsri or Bank Danamon deteriorates, we may be required to record impairment losses, which could have a material adverse effect on our results of operations and financial condition. See “—Risks Related to Our Business—If the goodwill recorded in connection with our acquisitions becomes impaired, we may be required to record impairment losses, which may adversely affect our financial results.”

15

Table of Contents

Our strategy to expand the range of our financial products and services and the geographic scope of our business globally may fail if we are unable to anticipate or manage new or expanded risks that entail such expansion.

We continue to seek opportunities to expand the range of our products and services beyond our traditional banking, trust, and securities businesses, through development and introduction of new products and services or through acquisitions of or investments in financial institutions with products and services that complement our business. For example, we continue to seek opportunities to expand our business outside of Japan. In addition, the sophistication of financial products and services and management systems has been growing significantly in recent years. As a result, we are exposed to new and increasingly complex risks, while market and regulatory expectations that we manage these risks properly continue to rise. Some of the activities that our subsidiaries are expected to engage in, such as credit extension to less conventional assets and operations as well as derivatives and foreign currency trading, present substantial risks. In some cases, we have only limited experience with the risks related to the expanded range of these products and services. In addition, we may not be able to successfully develop or operate the necessary information technology systems. As a result, we may not be able to foresee the risks relating to new products and services.

As we expand the geographic scope of our business, we will also be exposed to risks that are unique to particular jurisdictions or markets. For example, in an effort to further develop our operations in Asia, MUFG Bank purchased 72.01% of the outstanding shares of Krungsri in December 2013 and acquired additional shares in January 2015, increasing MUFG Bank’s ownership interest to 76.88%. MUFG Bank has also held an approximately 20% equity interest in Vietnam Joint Stock Commercial Bank of Industry and Trade since December 2012 and a 20.0% equity interest in Security Bank Corporation in the Philippines since April 2016. In addition, MUFG Bank acquired 19.9% of the shares of common stock of PT Bank Danamon Indonesia, Tbk in December 2017 and increased its shareholding in the bank to 94.1% in May 2019. As we seek to enter new markets or jurisdictions, we often seek to collaborate with a local business partner by becoming a shareholder as well as providing management expertise for the local market. In such circumstances, the local business partner may have business interests that are inconsistent with our interests and, as a result, we may be unable to achieve the goals initially set out in our strategy for that market. In addition, we may be unable to staff our newly expanded operations with qualified individuals familiar with local legal and regulatory requirements and business practices, exposing us to legal, regulatory, operational and other risks.

Our risk management systems may prove to be inadequate and may not work in all cases or to the degree required locally and globally for all of our subsidiaries, offices and branches. The increasing market, credit, compliance and regulatory risks in relation to the expanding scope of our products, services and trading activities or expanding our business beyond our traditional markets, could result in us incurring substantial losses. In addition, our efforts to offer new products and services or penetrate new markets may not succeed if product or market opportunities develop more slowly than expected, if our new products and services are not well accepted among customers, if the profitability of opportunities is undermined by competitive pressures or regulatory limitations, or if our planned acquisitions, investments or capital alliances are not approved by regulators. For more information on our recent acquisition and investment transactions, see “Item 5. Operating and Financial Review and Prospects—Recent Developments.”

Unanticipated economic changes in, and measures taken in response to such changes by, emerging market countries could result in additional losses.

We are increasingly active, through a network of branches and subsidiaries, in emerging market countries, particularly countries in Asia, Latin America, Central and Eastern Europe, and the Middle East. For example, based primarily on the domicile of the obligors, our assets in Europe, Asia and Oceania excluding Japan, and other areas excluding Japan and the United States, were ¥21,535.3 billion, ¥27,993.0 billion and ¥11,642.7 billion, representing 7.1%, 9.2% and 3.8% of our total assets as of March 31, 2019, respectively. The economies of emerging market countries can be volatile and susceptible to adverse changes and trends in the

16

Table of Contents

global financial markets. For example, a decline in the value of local currencies of these countries could negatively affect the creditworthiness of some of our borrowers in these countries. The loans we have made to borrowers and banks in these countries are often denominated in U.S. dollars, euro or other foreign currencies. These borrowers often do not hedge the loans to protect against fluctuations in the values of local currencies. A devaluation of the local currency would make it more difficult for a borrower earning income in that currency to pay its debts to us and other foreign lenders. In addition, some countries in which we operate may attempt to support the value of their currencies by raising domestic interest rates. If this happens, the borrowers in these countries would have to devote more of their resources to repaying their domestic obligations, which may adversely affect their ability to repay their debts to us and other foreign lenders. The limited credit availability resulting from these conditions may adversely affect economic conditions in some countries. This could cause a further deterioration of the credit quality of borrowers and banks in those countries and cause us to incur further losses. In addition, should there be excessively rapid economic growth and increasing inflationary pressure in some of the emerging market countries, such developments could adversely affect the wider regional and global economies. Some emerging market countries may also change their monetary or other economic policies in response to economic and political instabilities or pressures, which are difficult to predict. See “Item 5.B. Operating and Financial Review and Prospects—Liquidity and Capital Resources—Financial Condition.”

If our strategic alliance with Morgan Stanley fails, we could suffer financial or reputational loss.

We have a global strategic alliance with Morgan Stanley, under which we operate two joint venture securities companies in Japan, engage in joint corporate finance operations in the United States and pursue other cooperative opportunities. We hold approximately 24.0% of the voting rights in Morgan Stanley as of March 31, 2019 and continue to hold approximately $521.4 million of perpetual non-cumulative non-convertible preferred stock with a 10% dividend. In addition, we currently have two representatives on Morgan Stanley’s board of directors.

We initially entered into this strategic alliance in October 2008 with a view towards long-term cooperation with Morgan Stanley, and currently plan to deepen the strategic alliance. However, due to any unexpected changes in social, economic or financial conditions, changes in the regulatory environment, or any failure to integrate or share staff, products or services, or to operate, manage or implement the business strategy of the securities joint venture companies or other cooperative opportunities as planned, we may be unable to achieve the expected synergies from this alliance.

If our strategic alliance with Morgan Stanley is terminated, it could have a material negative impact on our business strategy, financial condition, and results of operations. For example, because we conduct our securities operations in Japan through the joint venture companies we have with Morgan Stanley, such termination may result in our inability to attain the planned growth in this line of business.

In addition, with our current investment in Morgan Stanley, we have neither a controlling interest in, nor control over the business operations of Morgan Stanley. If Morgan Stanley makes any business decisions that are inconsistent with our interests, we may be unable to achieve the goals initially set out for the strategic alliance. Furthermore, although we do not control Morgan Stanley, given the magnitude of our investment, if Morgan Stanley encounters financial or other business difficulties due to adverse changes in the economy, regulatory environment or other factors, we may suffer a financial loss on our investment or damage to our reputation. For example, we recorded an impairment loss of ¥579.5 billion on our investment in Morgan Stanley’s common stock for the fiscal year ended March 31, 2012.

We apply equity method accounting to our investment in Morgan Stanley in our consolidated financial statements. As a result, Morgan Stanley’s performance affects our results of operations, and Morgan Stanley has contributed to a significant portion of our net income in recent periods. Rule 3-09 of Regulation S-X requires Morgan Stanley’s financial statements to be included in this Annual Report. In addition fluctuations in Morgan

17

Table of Contents

Stanley’s stock price or in our equity ownership interest in Morgan Stanley may cause us to recognize additional losses on our investment in Morgan Stanley.

We may incur further losses as a result of financial difficulties relating to other financial institutions, both directly and through the effect they may have on the overall banking environment and on their borrowers.

Declining asset quality, capital adequacy and other financial problems of domestic and foreign financial institutions, including banks, non-bank lending and credit institutions, securities companies and insurance companies, may lead to severe liquidity and solvency problems, which have in the past resulted in the liquidation, government control or restructuring of affected institutions. In addition, allegations or governmental prosecution of improper trading activities or inappropriate business conduct of a specific financial institution could also negatively affect the public perception of other global financial institutions individually and the global financial industry as a whole. These developments may adversely affect our financial results.

Financial difficulties relating to financial institutions could adversely affect us because we have extended loans, some of which may need to be classified as impaired loans, to banks, securities companies, insurance companies and other financial institutions that are not our consolidated subsidiaries. Our loans to banks and other financial institutions have been more than 10% of our total loans as of each year-end in the three fiscal years ended March 31, 2019, with the percentage being 14.4% as of March 31, 2019. We may also be adversely affected because we are a shareholder of some other banks and financial institutions that are not our consolidated subsidiaries, including our shareholdings in Japanese regional banks and our 24.0% voting interest in Morgan Stanley as of March 31, 2019. If some of the financial institutions to which we have exposure experience financial difficulties, we may need to provide financial support to them even when such support might not be warranted from the perspective of our narrow economic interests because such institutions may be systemically important to the Japanese or global financial system.

We may also be adversely affected because we enter into transactions, such as derivative transactions, in the ordinary course of business, with other banks and financial institutions as counterparties. For example, we enter into credit derivatives with banks, broker-dealers, insurance companies and other financial institutions for managing credit risk exposures, for facilitating client transactions, and for proprietary trading purposes. The notional amount of the protection we sold through these instruments was ¥3.22 trillion as of March 31, 2019.

In addition, financial difficulties relating to financial institutions could indirectly have an adverse effect on us because:

| • |

we may be requested to participate in providing assistance to support distressed financial institutions that are not our consolidated subsidiaries; |

| • |

the government may elect to provide regulatory, tax, funding or other benefits to those financial institutions to strengthen their capital, facilitate their sale or otherwise, which in turn may increase their competitiveness against us; |

| • |

deposit insurance premiums could rise if deposit insurance funds prove to be inadequate; |

| • |

bankruptcies or government support or control of financial institutions could generally undermine confidence in financial institutions or adversely affect the overall banking environment; |

| • |

failures or financial difficulties experienced by other financial institutions could result in additional regulations or requirements that increase the cost of business for us; and |

| • |

negative media coverage of the financial industry, regardless of its accuracy and applicability to us, could affect customer or investor sentiment, harm our reputation and have a materially adverse effect on our business or the price of our securities. |

18

Table of Contents

Because of our loans to consumers and our shareholdings in companies engaged in consumer lending, changes in the business or regulatory environment for consumer finance companies in Japan may further adversely affect our financial results.