|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES

|

||

|

SECURITIES AND EXCHANGE COMMISSION

|

||

|

Washington, D.C. 20549

|

||

|

FORM 10-K

|

||

|

(Mark One)

|

||

|

☒ ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

||

|

For the fiscal year ended December 31, 2016

|

||

|

or

|

||

|

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

||

|

For the transition period from __________ to __________.

|

||

|

Commission file Number 34603-9

|

||

|

MVB Financial Corp.

|

||

|

(Exact name of registrant as specified in its charter)

|

||

|

West Virginia

|

20-0034461

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

301 Virginia Avenue, Fairmont, WV

|

26554

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

Registrant's telephone number, including area code

(304) 363-4800

|

||

|

(Former name, former address and former fiscal year, if changed since last report)

[None]

|

||

|

Securities registered pursuant to Section 12(b) of the Act:

|

||

|

Title of each class

|

Name of each exchange on

which registered

|

|

|

Common Stock, $1.00 Par

|

None

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

||

|

Common Stock, $1.00 Par

|

||

|

(Title of Class)

|

||

|

Preferred Stock, $1,000.00 Par

|

||

|

(Title of Class)

|

||

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒.

|

|||

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) Act. Yes ☐ No ☒

|

|||

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

|

|||

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

|

|||

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

|

|||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|||

|

Large accelerated filer ☐

|

Accelerated filer ☒

|

Non-accelerated filer ☐

|

Smaller reporting company ☐

|

|

Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒.

|

|||

|

TABLE OF CONTENTS

|

||

|

Page

|

||

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

||||||||||||||||||||||||

|

(Dollars in thousands)

|

Commercial & Retail Banking

|

Mortgage Banking

|

Financial Holding Company

|

Insurance

|

Intercompany Eliminations

|

Consolidated

|

||||||||||||||||||

|

Revenues:

|

||||||||||||||||||||||||

|

Interest income

|

$

|

50,413

|

|

$

|

4,285

|

|

$

|

3

|

|

$

|

—

|

|

$

|

(578

|

)

|

$

|

54,123

|

|

||||||

|

Mortgage fee income

|

(252

|

)

|

36,960

|

|

—

|

|

—

|

|

(1,035

|

)

|

35,673

|

|

||||||||||||

|

Insurance and investment services income

|

420

|

|

—

|

|

—

|

|

—

|

|

—

|

|

420

|

|

||||||||||||

|

Other income

|

5,485

|

|

1,674

|

|

5,247

|

|

—

|

|

(5,294

|

)

|

7,112

|

|

||||||||||||

|

Total operating income

|

56,066

|

|

42,919

|

|

5,250

|

|

—

|

|

(6,907

|

)

|

97,328

|

|

||||||||||||

|

Expenses:

|

|

|

|

|

|

|

||||||||||||||||||

|

Interest expense

|

8,437

|

|

2,082

|

|

2,226

|

|

—

|

|

(1,613

|

)

|

11,132

|

|

||||||||||||

|

Salaries and employee benefits

|

11,592

|

|

27,696

|

|

5,937

|

|

—

|

|

—

|

|

45,225

|

|

||||||||||||

|

Provision for loan losses

|

3,632

|

|

—

|

|

—

|

|

—

|

|

—

|

|

3,632

|

|

||||||||||||

|

Other expense

|

18,009

|

|

8,125

|

|

3,144

|

|

—

|

|

(5,294

|

)

|

23,984

|

|

||||||||||||

|

Total operating expenses

|

41,670

|

|

37,903

|

|

11,307

|

|

—

|

|

(6,907

|

)

|

83,973

|

|

||||||||||||

|

Income (loss) from continuing operations, before income taxes

|

14,396

|

|

5,016

|

|

(6,057

|

)

|

—

|

|

—

|

|

13,355

|

|

||||||||||||

|

Income tax expense (benefit) - continuing operations

|

4,496

|

|

1,954

|

|

(2,072

|

)

|

—

|

|

—

|

|

4,378

|

|

||||||||||||

|

Net income (loss) from continuing operations

|

9,900

|

|

3,062

|

|

(3,985

|

)

|

—

|

|

—

|

|

8,977

|

|

||||||||||||

|

Income (loss) from discontinued operations

|

—

|

|

—

|

|

6,926

|

|

(580

|

)

|

—

|

|

6,346

|

|

||||||||||||

|

Income tax expense (benefit) - discontinued operations

|

$

|

—

|

|

$

|

—

|

|

$

|

2,629

|

|

$

|

(218

|

)

|

$

|

—

|

|

$

|

2,411

|

|

||||||

|

Net income (loss) from discontinued operations

|

$

|

—

|

|

$

|

—

|

|

$

|

4,297

|

|

$

|

(362

|

)

|

$

|

—

|

|

$

|

3,935

|

|

||||||

|

Net income (loss)

|

$

|

9,900

|

|

$

|

3,062

|

|

$

|

312

|

|

$

|

(362

|

)

|

$

|

—

|

|

$

|

12,912

|

|

||||||

|

Preferred stock dividends

|

—

|

|

—

|

|

1,128

|

|

—

|

|

—

|

|

1,128

|

|

||||||||||||

|

Net income (loss) available to common shareholders

|

9,900

|

|

3,062

|

|

(816

|

)

|

(362

|

)

|

—

|

|

11,784

|

|

||||||||||||

|

Capital Expenditures for the year ended December 31, 2016

|

$

|

1,145

|

|

$

|

220

|

|

$

|

303

|

|

$

|

—

|

|

$

|

—

|

|

$

|

1,668

|

|

||||||

|

Total Assets as of December 31, 2016

|

1,415,735

|

|

122,242

|

|

180,340

|

|

—

|

|

(299,513

|

)

|

1,418,804

|

|

||||||||||||

|

Goodwill as of December 31, 2016

|

1,598

|

|

16,882

|

|

—

|

|

—

|

|

—

|

|

18,480

|

|

||||||||||||

|

2015

|

||||||||||||||||||||||||

|

(Dollars in thousands)

|

Commercial & Retail Banking

|

Mortgage Banking

|

Financial Holding Company

|

Insurance

|

Intercompany Eliminations

|

Consolidated

|

||||||||||||||||||

|

Revenues:

|

||||||||||||||||||||||||

|

Interest income

|

$

|

40,524

|

|

$

|

3,882

|

|

$

|

2

|

|

$

|

—

|

|

$

|

(308

|

)

|

$

|

44,100

|

|

||||||

|

Mortgage fee income

|

7

|

|

30,560

|

|

—

|

|

—

|

|

(1,095

|

)

|

29,472

|

|

||||||||||||

|

Insurance and investment services income

|

338

|

|

—

|

|

—

|

|

—

|

|

—

|

|

338

|

|

||||||||||||

|

Other income

|

3,721

|

|

1,673

|

|

4,331

|

|

—

|

|

(4,580

|

)

|

5,145

|

|

||||||||||||

|

Total operating income

|

44,590

|

|

36,115

|

|

4,333

|

|

—

|

|

(5,983

|

)

|

79,055

|

|

||||||||||||

|

Expenses:

|

|

|

|

|

|

|

||||||||||||||||||

|

Interest expense

|

6,776

|

|

1,647

|

|

2,204

|

|

—

|

|

(1,402

|

)

|

9,225

|

|

||||||||||||

|

Salaries and employee benefits

|

11,049

|

|

20,774

|

|

4,250

|

|

—

|

|

—

|

|

36,073

|

|

||||||||||||

|

Provision for loan losses

|

2,493

|

|

—

|

|

—

|

|

—

|

|

—

|

|

2,493

|

|

||||||||||||

|

Other expense

|

16,132

|

|

7,471

|

|

2,534

|

|

—

|

|

(4,362

|

)

|

21,775

|

|

||||||||||||

|

Total operating expenses

|

36,450

|

|

29,892

|

|

8,988

|

|

—

|

|

(5,764

|

)

|

69,566

|

|

||||||||||||

|

Income (loss) from continuing operations, before income taxes

|

8,140

|

|

6,223

|

|

(4,655

|

)

|

—

|

|

(219

|

)

|

9,489

|

|

||||||||||||

|

Income tax expense (benefit) - continuing operations

|

2,176

|

|

2,394

|

|

(1,597

|

)

|

—

|

|

(87

|

)

|

2,886

|

|

||||||||||||

|

Net income (loss) from continuing operations

|

5,964

|

|

3,829

|

|

(3,058

|

)

|

—

|

|

(132

|

)

|

6,603

|

|

||||||||||||

|

Income (loss) from discontinued operations

|

—

|

|

—

|

|

—

|

|

134

|

|

219

|

|

353

|

|

||||||||||||

|

Income tax expense (benefit) - discontinued operations

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

53

|

|

$

|

87

|

|

$

|

140

|

|

||||||

|

Net income (loss) from discontinued operations

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

81

|

|

$

|

132

|

|

$

|

213

|

|

||||||

|

Net income (loss)

|

$

|

5,964

|

|

$

|

3,829

|

|

$

|

(3,058

|

)

|

$

|

81

|

|

$

|

—

|

|

$

|

6,816

|

|

||||||

|

Preferred stock dividends

|

—

|

|

—

|

|

575

|

|

—

|

|

—

|

|

575

|

|

||||||||||||

|

Net income (loss) available to common shareholders

|

5,964

|

|

3,829

|

|

(3,633

|

)

|

81

|

|

—

|

|

6,241

|

|

||||||||||||

|

Capital Expenditures for the year ended December 31, 2015

|

$

|

1,174

|

|

$

|

354

|

|

$

|

616

|

|

$

|

9

|

|

$

|

—

|

|

$

|

2,153

|

|

||||||

|

Total Assets as of December 31, 2015

|

1,378,988

|

|

125,227

|

|

148,509

|

|

5,017

|

|

(273,265

|

)

|

1,384,476

|

|

||||||||||||

|

Goodwill as of December 31, 2015

|

1,598

|

|

16,882

|

|

—

|

|

—

|

|

—

|

|

18,480

|

|

||||||||||||

|

|

2014

|

|||||||||||||||||||||||

|

(Dollars in thousands)

|

Commercial & Retail Banking

|

Mortgage Banking

|

Financial Holding Company

|

Insurance

|

Intercompany Eliminations

|

Consolidated

|

||||||||||||||||||

|

Revenues:

|

||||||||||||||||||||||||

|

Interest income

|

$

|

33,175

|

|

$

|

2,645

|

|

$

|

2

|

|

$

|

—

|

|

$

|

346

|

|

$

|

36,168

|

|

||||||

|

Mortgage fee income

|

64

|

|

18,691

|

|

—

|

|

—

|

|

(1,198

|

)

|

17,557

|

|

||||||||||||

|

Insurance and investment services income

|

328

|

|

—

|

|

—

|

|

—

|

|

—

|

|

328

|

|

||||||||||||

|

Other income

|

4,458

|

|

(2

|

)

|

4,357

|

|

—

|

|

(4,676

|

)

|

4,137

|

|

||||||||||||

|

Total operating income

|

38,025

|

|

21,334

|

|

4,359

|

|

—

|

|

(5,528

|

)

|

58,190

|

|

||||||||||||

|

Expenses:

|

|

|

|

|

|

|

||||||||||||||||||

|

Interest expense

|

5,663

|

|

1,063

|

|

1,703

|

|

—

|

|

(918

|

)

|

7,511

|

|

||||||||||||

|

Salaries and employee benefits

|

9,629

|

|

14,487

|

|

3,658

|

|

—

|

|

—

|

|

27,774

|

|

||||||||||||

|

Provision for loan losses

|

2,582

|

|

—

|

|

—

|

|

—

|

|

—

|

|

2,582

|

|

||||||||||||

|

Other expense

|

13,994

|

|

5,990

|

|

1,970

|

|

—

|

|

(4,534

|

)

|

17,420

|

|

||||||||||||

|

Total operating expenses

|

31,868

|

|

21,540

|

|

7,331

|

|

—

|

|

(5,452

|

)

|

55,287

|

|

||||||||||||

|

Income (loss) from continuing operations, before income taxes

|

6,157

|

|

(206

|

)

|

(2,972

|

)

|

—

|

|

(76

|

)

|

2,903

|

|

||||||||||||

|

Income tax expense (benefit) - continuing operations

|

1,326

|

|

(57

|

)

|

(993

|

)

|

—

|

|

(28

|

)

|

248

|

|

||||||||||||

|

Net income (loss) from continuing operations

|

4,831

|

|

(149

|

)

|

(1,979

|

)

|

—

|

|

(48

|

)

|

2,655

|

|

||||||||||||

|

Income (loss) from discontinued operations

|

—

|

|

—

|

|

—

|

|

(996

|

)

|

76

|

|

(920

|

)

|

||||||||||||

|

Income tax expense (benefit) - discontinued operations

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

(372

|

)

|

$

|

28

|

|

$

|

(344

|

)

|

||||||

|

Net income (loss) from discontinued operations

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

(624

|

)

|

$

|

48

|

|

$

|

(576

|

)

|

||||||

|

Net income (loss)

|

$

|

4,831

|

|

$

|

(149

|

)

|

$

|

(1,979

|

)

|

$

|

(624

|

)

|

$

|

—

|

|

$

|

2,079

|

|

||||||

|

Preferred stock dividends

|

—

|

|

—

|

|

332

|

|

—

|

|

—

|

|

332

|

|

||||||||||||

|

Net income (loss) available to common shareholders

|

4,831

|

|

(149

|

)

|

(2,311

|

)

|

(624

|

)

|

—

|

|

1,747

|

|

||||||||||||

|

Capital Expenditures for the year ended December 31, 2014

|

$

|

9,072

|

|

$

|

333

|

|

$

|

40

|

|

$

|

353

|

|

$

|

—

|

|

$

|

9,798

|

|

||||||

|

Total Assets as of December 31, 2014

|

1,048,101

|

|

101,791

|

|

146,137

|

|

4,031

|

|

(189,601

|

)

|

1,110,459

|

|

||||||||||||

|

Goodwill as of December 31, 2014

|

897

|

|

16,882

|

|

—

|

|

—

|

|

—

|

|

17,779

|

|

||||||||||||

|

December 2016

|

December 2015

|

December 2014

|

|||||||

|

Berkeley County, WV

|

3.1

|

%

|

3.8

|

%

|

4.3

|

%

|

|||

|

Harrison County, WV

|

4.9

|

%

|

5.8

|

%

|

4.5

|

%

|

|||

|

Jefferson County, WV

|

2.6

|

%

|

3.1

|

%

|

3.5

|

%

|

|||

|

Marion County, WV

|

5.1

|

%

|

5.9

|

%

|

4.9

|

%

|

|||

|

Monongalia County, WV

|

3.2

|

%

|

3.8

|

%

|

3.5

|

%

|

|||

|

Kanawha County, WV

|

4.6

|

%

|

5.2

|

%

|

5.1

|

%

|

|||

|

Fairfax County, VA

|

3.0

|

%

|

3.1

|

%

|

3.5

|

%

|

|||

|

•

|

Risks to consumers and compliance with the federal consumer financial laws, when it evaluates the policies and practices of a financial institution.

|

|

•

|

The markets in which firms operate and risks to consumers posed by activities in those markets.

|

|

•

|

Depository institutions that offer a wide variety of consumer financial products and services.

|

|

•

|

Depository institutions with a more specialized focus.

|

|

•

|

Non-depository companies that offer one or more consumer financial products or services.

|

|

•

|

In general, for a given change in interest rates, the amount of change in value (positive or negative) is larger for assets and liabilities with longer remaining maturities. The shape of the yield curve may affect new loan yields, funding costs and investment income differently.

|

|

•

|

The remaining maturity of various assets or liabilities may shorten or lengthen as payment behavior changes in response to changes in interest rates. For example, if interest rates decline sharply, loans may pre-pay, or pay down, faster than anticipated, thus reducing future cash flows and interest income. Conversely, if interest rates increase, depositors may cash in their certificates of deposit prior to maturity (notwithstanding any applicable early withdrawal penalties) or otherwise reduce their deposits to pursue higher yielding investment alternatives.

|

|

•

|

Re-pricing frequencies and maturity profiles for assets and liabilities may occur at different times. For example, in a falling rate environment, if assets re-price faster than liabilities, there will be an initial decline in earnings. Moreover, if

|

|

•

|

The ability to develop, maintain and build long-term customer relationships based on top quality service, high ethical standards and safe, sound assets.

|

|

•

|

The ability to expand our market position.

|

|

•

|

The scope, relevance and pricing of products and services offered to meet customer needs and demands.

|

|

•

|

The rate at which we introduce new products and services relative to our competitors.

|

|

•

|

Customer satisfaction with our level of service.

|

|

•

|

Industry and general economic trends.

|

|

•

|

Potential exposure to unknown or contingent liabilities of the target company.

|

|

•

|

Exposure to potential asset quality issues of the target company.

|

|

•

|

Potential disruption to our business.

|

|

•

|

Potential diversion of our management’s time and attention.

|

|

•

|

The possible loss of key employees and customers of the target company.

|

|

•

|

Difficulty in estimating the value of the target company.

|

|

•

|

Potential changes in banking or tax laws or regulations that may affect the target company.

|

|

•

|

Actual or anticipated variations in quarterly results of operations.

|

|

•

|

Recommendations by securities analysts.

|

|

•

|

Operating and stock price performance of other companies that investors deem comparable to us.

|

|

•

|

News reports relating to trends, concerns and other issues in the financial services industry.

|

|

•

|

Perceptions in the marketplace regarding us and/or our competitors.

|

|

•

|

New technology used, or services offered, by competitors.

|

|

•

|

Significant acquisitions or business combinations, strategic partnerships, joint ventures or capital commitments by or involving us or our competitors.

|

|

•

|

Failure to integrate acquisitions or realize anticipated benefits from acquisitions.

|

|

•

|

Changes in government regulations.

|

|

•

|

Geopolitical conditions such as acts or threats of terrorism or military conflicts.

|

|

Quarterly Market and Dividend Information:

|

||||||||||||||||

|

High

|

Low

|

Last

|

Dividend

|

|||||||||||||

|

2016

|

||||||||||||||||

|

Fourth Quarter

|

$

|

13.05

|

|

$

|

11.50

|

|

$

|

12.80

|

|

$

|

0.02

|

|

||||

|

Third Quarter

|

13.50

|

|

11.95

|

|

12.31

|

|

0.02

|

|

||||||||

|

Second Quarter

|

14.00

|

|

12.06

|

|

12.95

|

|

0.02

|

|

||||||||

|

First Quarter

|

13.99

|

|

9.50

|

|

13.40

|

|

0.02

|

|

||||||||

|

2015

|

||||||||||||||||

|

Fourth Quarter

|

$

|

15.25

|

|

$

|

13.05

|

|

$

|

13.10

|

|

$

|

0.02

|

|

||||

|

Third Quarter

|

15.64

|

|

14.35

|

|

15.10

|

|

0.02

|

|

||||||||

|

Second Quarter

|

14.99

|

|

12.75

|

|

14.85

|

|

0.04

|

|

||||||||

|

First Quarter

|

15.80

|

|

12.77

|

|

13.00

|

|

—

|

|

||||||||

|

Plan Category

|

Number of securities to be issued upon exercise of outstanding options (a)

|

Weighted-average exercise price of outstanding options (b)

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c)

|

|||||||

|

Equity compensation plans approved by security holders

|

768,598

|

|

$

|

12.75

|

|

400,825

|

|

|||

|

Equity compensation plans not approved by security holders

|

n/a

|

|

n/a

|

|

n/a

|

|

||||

|

Total

|

768,598

|

|

$

|

12.75

|

|

400,825

|

|

|||

|

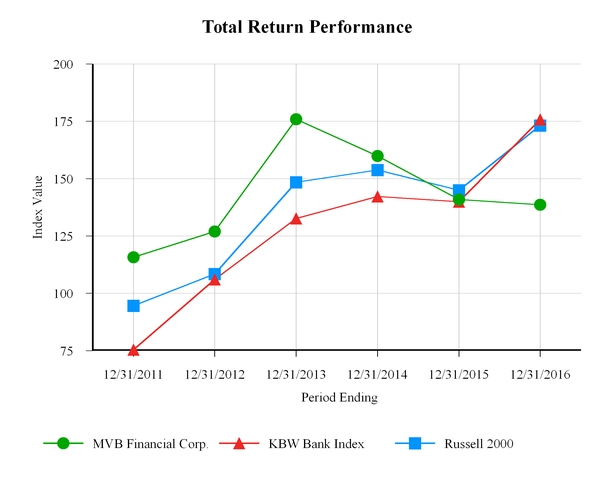

Index

|

12/31/2011

|

12/31/2012

|

12/31/2013

|

12/31/2014

|

12/31/2015

|

12/31/2016

|

||||||||||||||||||

|

MVB Financial Corp.

|

$

|

115.76

|

|

$

|

126.97

|

|

$

|

175.95

|

|

$

|

159.92

|

|

$

|

140.96

|

|

$

|

138.65

|

|

||||||

|

KBW Bank Index

|

75.43

|

|

106.07

|

|

132.66

|

|

142.23

|

|

139.97

|

|

175.81

|

|

||||||||||||

|

Russell 2000

|

94.55

|

|

108.38

|

|

148.49

|

|

153.73

|

|

144.95

|

|

173.18

|

|

||||||||||||

|

The following consolidated summary sets forth the Company’s selected financial data that has been derived from the Company’s audited consolidated financial statements for each of the periods and at the dates indicated

|

||||||||||||||||||||

|

Years Ended December 31,

|

||||||||||||||||||||

|

(Dollars in thousands except per share data)

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||||

|

Balance Sheet Data:

|

||||||||||||||||||||

|

Assets

|

$

|

1,418,804

|

|

$

|

1,384,476

|

|

$

|

1,110,459

|

|

$

|

987,060

|

|

$

|

726,769

|

|

|||||

|

Investment securities

|

162,368

|

|

123,115

|

|

122,751

|

|

163,081

|

|

114,748

|

|

||||||||||

|

Loans, net

|

1,043,764

|

|

1,024,164

|

|

792,074

|

|

617,370

|

|

442,367

|

|

||||||||||

|

Loans held for sale

|

90,174

|

|

102,623

|

|

69,527

|

|

89,186

|

|

85,529

|

|

||||||||||

|

Deposits

|

1,107,017

|

|

1,012,314

|

|

823,227

|

|

695,811

|

|

486,519

|

|

||||||||||

|

Stockholders' equity

|

145,625

|

|

114,712

|

|

109,438

|

|

94,022

|

|

67,549

|

|

||||||||||

|

Weighted average shares outstanding - basic

|

8,212,021

|

|

8,014,316

|

|

7,905,468

|

|

6,657,093

|

|

4,388,650

|

|

||||||||||

|

Weighted average shares outstanding - diluted

|

10,068,733

|

|

8,140,116

|

|

8,102,117

|

|

6,939,028

|

|

4,509,234

|

|

||||||||||

|

Income Statement Data:

|

||||||||||||||||||||

|

Interest income

|

$

|

54,123

|

|

$

|

44,100

|

|

$

|

36,168

|

|

$

|

27,515

|

|

$

|

22,254

|

|

|||||

|

Interest expense

|

11,132

|

|

9,225

|

|

7,511

|

|

5,187

|

|

4,930

|

|

||||||||||

|

Net interest income

|

42,991

|

|

34,875

|

|

28,657

|

|

22,328

|

|

17,324

|

|

||||||||||

|

Provision for loan loss

|

3,632

|

|

2,493

|

|

2,582

|

|

2,260

|

|

2,800

|

|

||||||||||

|

Net interest income after provision for loan loss

|

39,359

|

|

32,382

|

|

26,075

|

|

20,068

|

|

14,524

|

|

||||||||||

|

Noninterest income

|

43,205

|

|

34,955

|

|

22,022

|

|

25,844

|

|

7,749

|

|

||||||||||

|

Gain on sale of securities

|

1,082

|

|

130

|

|

413

|

|

145

|

|

638

|

|

||||||||||

|

Noninterest expense

|

69,209

|

|

57,848

|

|

45,194

|

|

40,388

|

|

16,439

|

|

||||||||||

|

Income from continuing operations, before income taxes

|

13,355

|

|

9,489

|

|

2,903

|

|

5,524

|

|

5,834

|

|

||||||||||

|

Income tax expense - continuing operations

|

4,378

|

|

2,886

|

|

248

|

|

1,245

|

|

1,666

|

|

||||||||||

|

Net Income from continuing operations

|

8,977

|

|

6,603

|

|

2,655

|

|

4,279

|

|

4,168

|

|

||||||||||

|

Income from discontinued operations, before income taxes

|

6,346

|

|

353

|

|

(920

|

)

|

(522

|

)

|

—

|

|

||||||||||

|

Income tax expense (benefit) - discontinued operations

|

2,411

|

|

140

|

|

(344

|

)

|

(262

|

)

|

—

|

|

||||||||||

|

Net Income from discontinued operations

|

3,935

|

|

213

|

|

(576

|

)

|

(260

|

)

|

—

|

|

||||||||||

|

Net Income

|

12,912

|

|

6,816

|

|

2,079

|

|

4,020

|

|

4,168

|

|

||||||||||

|

Preferred dividends

|

1,128

|

|

575

|

|

332

|

|

85

|

|

136

|

|

||||||||||

|

Net Income available to common shareholders

|

11,784

|

|

6,241

|

|

1,747

|

|

3,935

|

|

4,032

|

|

||||||||||

|

Per Share Data:

|

||||||||||||||||||||

|

Earnings per share from continuing operations - basic

|

$

|

0.96

|

|

$

|

0.75

|

|

$

|

0.29

|

|

$

|

0.63

|

|

$

|

0.92

|

|

|||||

|

Earnings per share from discontinued operations - basic

|

0.48

|

|

0.03

|

|

(0.07

|

)

|

(0.04

|

)

|

—

|

|

||||||||||

|

Earnings per share per common shareholder - basic

|

1.44

|

|

0.78

|

|

0.22

|

|

0.59

|

|

0.92

|

|

||||||||||

|

Earnings per share from continuing operations - diluted

|

0.92

|

|

0.74

|

|

0.29

|

|

0.60

|

|

0.90

|

|

||||||||||

|

Earnings per share from discontinued operations - diluted

|

0.39

|

|

0.03

|

|

(0.07

|

)

|

(0.03

|

)

|

—

|

|

||||||||||

|

Earnings per share per common shareholder - diluted

|

1.31

|

|

0.77

|

|

0.22

|

|

0.57

|

|

0.90

|

|

||||||||||

|

Cash dividends

|

0.08

|

|

0.08

|

|

0.08

|

|

0.08

|

|

0.07

|

|

||||||||||

|

Book value

|

12.93

|

|

12.20

|

|

11.59

|

|

11.10

|

|

10.07

|

|

||||||||||

|

Tangible book value

|

11.01

|

|

9.81

|

|

9.44

|

|

8.85

|

|

7.19

|

|

||||||||||

|

Asset Quality Ratios:

|

||||||||||||||||||||

|

Nonperforming loans to gross loans

|

0.59

|

%

|

0.99

|

%

|

1.16

|

%

|

0.14

|

%

|

0.77

|

%

|

||||||||||

|

Nonperforming assets to total assets

|

0.47

|

|

0.76

|

|

0.89

|

|

0.12

|

|

0.50

|

|

||||||||||

|

Net charge-offs to gross loans

|

0.24

|

|

0.07

|

|

0.16

|

|

0.23

|

|

0.40

|

|

||||||||||

|

Allowance for loan losses to gross loans

|

0.86

|

|

0.78

|

|

0.78

|

|

0.79

|

|

0.91

|

|

||||||||||

|

Selected Ratios:

|

||||||||||||||||||||

|

Return on average assets - continuing operations

|

0.63

|

%

|

0.54

|

%

|

0.26

|

%

|

0.54

|

%

|

0.71

|

%

|

||||||||||

|

Return on average assets - discontinued operations

|

0.28

|

|

0.02

|

|

(0.06

|

)

|

(0.03

|

)

|

—

|

|

||||||||||

|

Return on average equity - continuing operations

|

7.30

|

|

5.89

|

|

2.57

|

|

5.44

|

|

8.33

|

|

||||||||||

|

Return on average equity - discontinued operations

|

3.20

|

|

0.19

|

|

(0.56

|

)

|

(0.33

|

)

|

—

|

|

||||||||||

|

Dividend payout

|

5.00

|

|

9.40

|

|

30.59

|

|

13.36

|

|

7.37

|

|

||||||||||

|

Efficiency ratio

|

80.29

|

|

82.84

|

|

89.18

|

|

85.44

|

|

65.56

|

|

||||||||||

|

Equity to assets

|

10.26

|

|

8.29

|

|

9.86

|

|

9.53

|

|

9.29

|

|

||||||||||

|

Common equity tier 1 capital ratio

|

10.11

|

|

7.59

|

|

n/a

|

|

n/a

|

|

n/a

|

|

||||||||||

|

Tier 1 risk-based capital ratio

|

11.92

|

|

9.47

|

|

12.03

|

|

13.03

|

|

11.40

|

|

||||||||||

|

Total risk-based capital ratio

|

15.36

|

|

12.91

|

|

16.40

|

|

13.80

|

|

12.30

|

|

||||||||||

|

Leverage ratio

|

9.54

|

|

7.77

|

|

8.98

|

|

9.28

|

|

8.40

|

|

||||||||||

|

•

|

statements with respect to the beliefs, plans, objectives, goals, guidelines, expectations, anticipations, and future financial condition, results of operations and performance of the Company and its subsidiary (collectively “we,” “our,” or “us), including the Bank;

|

|

•

|

statements preceded by, followed by or that include the words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “projects,” or similar expressions.

|

|

•

|

the ability of the Company, the Bank, and MVB Mortgage to successfully execute business plans, manage risks, and achieve objectives;

|

|

•

|

changes in local, national and international political and economic conditions, including without limitation the political and economic effects of the recent economic crisis, delay of recovery from that crisis, economic conditions and fiscal imbalances in the United States and other countries, potential or actual downgrades in rating of sovereign debt issued by the United States and other countries, and other major developments, including wars, military actions, and terrorist attacks;

|

|

•

|

changes in financial market conditions, either internationally, nationally or locally in areas in which the Company, the Bank, and MVB Mortgage conduct operations, including without limitation, reduced rates of business formation and growth, commercial and residential real estate development and real estate prices;

|

|

•

|

fluctuations in markets for equity, fixed-income, commercial paper and other securities, including availability, market liquidity levels, and pricing; changes in interest rates, the quality and composition of the loan and securities portfolios, demand for loan products, deposit flows and competition;

|

|

•

|

the ability of the Company, the Bank, and MVB Mortgage to successfully conduct acquisitions and integrate acquired businesses;

|

|

•

|

potential difficulties in expanding the businesses of the Company, the Bank, and MVB Mortgage in existing and new markets;

|

|

•

|

increases in the levels of losses, customer bankruptcies, bank failures, claims, and assessments;

|

|

•

|

changes in fiscal, monetary, regulatory, trade and tax policies and laws, and regulatory assessments and fees, including policies of the U.S. Department of Treasury, the (Federal Reserve, and the FDIC);

|

|

•

|

the impact of executive compensation rules under the Dodd-Frank Act and banking regulations which may impact the ability of the Company and its subsidiaries, and other American financial institutions to retain and recruit executives and other personnel necessary for their businesses and competitiveness;

|

|

•

|

the impact of the Dodd-Frank Act and of new international standards known as Basel III, and rules and regulations thereunder, many of which have not yet been promulgated, on our required regulatory capital and liquidity levels, governmental assessments on us, the scope of business activities in which we may engage, the manner in which the

|

|

•

|

continuing consolidation in the financial services industry; new legal claims against the Company, the Bank, and MVB Mortgage, including litigation, arbitration and proceedings brought by governmental or self-regulatory agencies, or changes in existing legal matters;

|

|

•

|

success in gaining regulatory approvals, when required, including for proposed mergers or acquisitions;

|

|

•

|

changes in consumer spending and savings habits;

|

|

•

|

increased competitive challenges and expanding product and pricing pressures among financial institutions;

|

|

•

|

inflation and deflation;

|

|

•

|

technological changes and the implementation of new technologies by the Company and its subsidiaries;

|

|

•

|

the ability of the Company, the Bank, and MVB Mortgage to develop and maintain secure and reliable information technology systems;

|

|

•

|

legislation or regulatory changes which adversely affect the operations or business of the Company, the Bank, and MVB Mortgage;

|

|

•

|

the ability of the Company, the Bank, and MVB Mortgage to comply with applicable laws and regulations; changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or regulatory agencies; and,

|

|

•

|

costs of deposit insurance and changes with respect to FDIC insurance coverage levels.

|

|

2016

|

2015

|

2014

|

|||||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

Average Balance

|

Interest Income/Expense

|

Yield/Cost

|

Average Balance

|

Interest Income/Expense

|

Yield/Cost

|

Average Balance

|

Interest Income/Expense

|

Yield/Cost

|

||||||||||||||||||||||||

|

Assets

|

|||||||||||||||||||||||||||||||||

|

Interest-bearing deposits in banks

|

$

|

16,347

|

|

$

|

94

|

|

0.58

|

%

|

$

|

16,040

|

|

$

|

43

|

|

0.27

|

%

|

$

|

20,123

|

|

$

|

45

|

|

0.22

|

%

|

|||||||||

|

CDs with other banks

|

11,694

|

|

228

|

|

1.95

|

|

12,267

|

|

231

|

|

1.88

|

|

9,826

|

|

178

|

|

1.81

|

|

|||||||||||||||

|

Investment securities:

|

|||||||||||||||||||||||||||||||||

|

Taxable

|

76,525

|

|

1,366

|

|

1.79

|

|

66,110

|

|

958

|

|

1.45

|

|

86,868

|

|

1,272

|

|

1.46

|

|

|||||||||||||||

|

Tax-exempt

|

64,108

|

|

1,853

|

|

2.89

|

|

53,376

|

|

1,537

|

|

2.88

|

|

55,972

|

|

1,646

|

|

2.94

|

|

|||||||||||||||

|

Loans and loans held for sale: (1)

|

|||||||||||||||||||||||||||||||||

|

Commercial

|

734,829

|

|

32,620

|

|

4.44

|

|

616,057

|

|

26,264

|

|

4.26

|

|

489,382

|

|

21,344

|

|

4.36

|

|

|||||||||||||||

|

Tax exempt

|

16,326

|

|

564

|

|

3.45

|

|

19,678

|

|

689

|

|

3.50

|

|

29,682

|

|

1,078

|

|

3.63

|

|

|||||||||||||||

|

Real estate

|

398,766

|

|

16,594

|

|

4.16

|

|

334,538

|

|

13,586

|

|

4.06

|

|

242,526

|

|

9,832

|

|

4.05

|

|

|||||||||||||||

|

Consumer

|

16,762

|

|

804

|

|

4.80

|

|

17,383

|

|

792

|

|

4.56

|

|

18,228

|

|

773

|

|

4.24

|

|

|||||||||||||||

|

Total loans

|

1,166,683

|

|

50,582

|

|

4.34

|

|

987,656

|

|

41,331

|

|

4.18

|

|

779,818

|

|

33,027

|

|

4.24

|

|

|||||||||||||||

|

Total earning assets

|

1,335,357

|

|

54,123

|

|

4.05

|

|

1,135,449

|

|

44,100

|

|

3.88

|

|

952,607

|

|

36,168

|

|

3.80

|

|

|||||||||||||||

|

Less: Allowance for loan losses

|

(8,939

|

)

|

(7,016

|

)

|

(6,135

|

)

|

|||||||||||||||||||||||||||

|

Cash and due from banks

|

13,765

|

|

14,465

|

|

15,173

|

|

|||||||||||||||||||||||||||

|

Other assets

|

87,815

|

|

83,520

|

|

75,309

|

|

|||||||||||||||||||||||||||

|

Total assets

|

$

|

1,427,998

|

|

$

|

1,226,418

|

|

$

|

1,036,954

|

|

||||||||||||||||||||||||

|

Liabilities

|

|||||||||||||||||||||||||||||||||

|

Deposits:

|

|||||||||||||||||||||||||||||||||

|

NOW

|

$

|

454,320

|

|

$

|

2,413

|

|

0.53

|

|

$

|

446,704

|

|

$

|

2,713

|

|

0.61

|

|

$

|

402,273

|

|

$

|

3,157

|

|

0.78

|

|

|||||||||

|

Money market checking

|

163,630

|

|

1,282

|

|

0.78

|

|

65,306

|

|

396

|

|

0.61

|

|

38,332

|

|

191

|

|

0.50

|

|

|||||||||||||||

|

Savings

|

43,870

|

|

88

|

|

0.20

|

|

39,766

|

|

111

|

|

0.28

|

|

37,576

|

|

126

|

|

0.34

|

|

|||||||||||||||

|

IRAs

|

16,319

|

|

208

|

|

1.27

|

|

12,038

|

|

146

|

|

1.21

|

|

9,627

|

|

113

|

|

1.17

|

|

|||||||||||||||

|

CDs

|

314,542

|

|

3,757

|

|

1.19

|

|

278,499

|

|

2,880

|

|

1.03

|

|

222,609

|

|

1,976

|

|

0.89

|

|

|||||||||||||||

|

Repurchase agreements and federal funds sold

|

27,066

|

|

72

|

|

0.27

|

|

26,884

|

|

83

|

|

0.31

|

|

55,731

|

|

291

|

|

0.52

|

|

|||||||||||||||

|

FHLB and other borrowings

|

139,736

|

|

1,086

|

|

0.78

|

|

124,475

|

|

692

|

|

0.56

|

|

80,855

|

|

515

|

|

0.64

|

|

|||||||||||||||

|

Subordinated debt

|

33,524

|

|

2,226

|

|

6.64

|

|

33,524

|

|

2,204

|

|

6.57

|

|

19,011

|

|

1,142

|

|

6.01

|

|

|||||||||||||||

|

Total interest-bearing liabilities

|

1,193,007

|

|

11,132

|

|

0.93

|

|

1,027,196

|

|

9,225

|

|

0.90

|

|

866,014

|

|

7,511

|

|

0.87

|

|

|||||||||||||||

|

Noninterest bearing demand deposits

|

99,826

|

|

79,611

|

|

60,587

|

|

|||||||||||||||||||||||||||

|

Other liabilities

|

12,220

|

|

7,486

|

|

6,699

|

|

|||||||||||||||||||||||||||

|

Total liabilities

|

1,305,053

|

|

1,114,293

|

|

933,300

|

|

|||||||||||||||||||||||||||

|

Stockholders’ equity

|

|||||||||||||||||||||||||||||||||

|

Preferred stock

|

16,334

|

|

16,334

|

|

12,471

|

|

|||||||||||||||||||||||||||

|

Common stock

|

8,263

|

|

8,065

|

|

7,958

|

|

|||||||||||||||||||||||||||

|

Paid-in capital

|

75,799

|

|

74,331

|

|

72,308

|

|

|||||||||||||||||||||||||||

|

Treasury stock

|

(1,084

|

)

|

(1,084

|

)

|

(1,084

|

)

|

|||||||||||||||||||||||||||

|

Retained earnings

|

25,943

|

|

16,941

|

|

14,554

|

|

|||||||||||||||||||||||||||

|

Accumulated other comprehensive income

|

(2,310

|

)

|

(2,462

|

)

|

(2,553

|

)

|

|||||||||||||||||||||||||||

|

Total stockholders’ equity

|

122,945

|

|

112,125

|

|

103,654

|

|

|||||||||||||||||||||||||||

|

Total liabilities and stockholders’ equity

|

$

|

1,427,998

|

|

$

|

1,226,418

|

|

$

|

1,036,954

|

|

||||||||||||||||||||||||

|

Net interest spread

|

3.12

|

|

2.98

|

|

2.93

|

|

|||||||||||||||||||||||||||

|

Net interest income-margin

|

$

|

42,991

|

|

3.22

|

%

|

|

|

$

|

34,875

|

|

3.07

|

%

|

$

|

28,657

|

|

3.01

|

%

|

||||||||||||||||

|

(1) Non-accrual loans are included in total loan balances, lowering the effective yield for the portfolio in the aggregate.

|

|||||||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

Change in Volume

|

Change in Rate

|

Change in both Rate & Volume

|

Total Change

|

||||||||

|

Earning Assets

|

||||||||||||

|

Loans

|

||||||||||||

|

Commercial

|

5,064

|

|

1,083

|

|

209

|

|

6,356

|

|

||||

|

Tax exempt

|

(117

|

)

|

(10

|

)

|

2

|

|

(125

|

)

|

||||

|

Real estate

|

2,608

|

|

336

|

|

64

|

|

3,008

|

|

||||

|

Consumer

|

(28

|

)

|

41

|

|

(1

|

)

|

12

|

|

||||

|

Investment securities:

|

||||||||||||

|

Taxable

|

151

|

|

222

|

|

35

|

|

408

|

|

||||

|

Tax-exempt

|

309

|

|

6

|

|

1

|

|

316

|

|

||||

|

Interest-bearing deposits in banks

|

1

|

|

49

|

|

1

|

|

51

|

|

||||

|

CDs with other banks

|

(11

|

)

|

8

|

|

—

|

|

(3

|

)

|

||||

|

Total earning assets

|

7,977

|

|

1,735

|

|

311

|

|

10,023

|

|

||||

|

Interest bearing liabilities

|

||||||||||||

|

NOW

|

46

|

|

(340

|

)

|

(6

|

)

|

(300

|

)

|

||||

|

Money market checking

|

596

|

|

116

|

|

174

|

|

886

|

|

||||

|

Savings

|

11

|

|

(31

|

)

|

(3

|

)

|

(23

|

)

|

||||

|

IRAs

|

52

|

|

7

|

|

3

|

|

62

|

|

||||

|

CDs

|

373

|

|

446

|

|

58

|

|

877

|

|

||||

|

Repurchase agreements and federal funds sold

|

1

|

|

(12

|

)

|

—

|

|

(11

|

)

|

||||

|

FHLB and other borrowings

|

85

|

|

275

|

|

34

|

|

394

|

|

||||

|

Subordinated debt

|

—

|

|

22

|

|

—

|

|

22

|

|

||||

|

Total interest bearing liabilities

|

1,164

|

|

483

|

|

260

|

|

1,907

|

|

||||

|

Total

|

6,813

|

|

1,252

|

|

51

|

|

8,116

|

|

||||

|

(Dollars in thousands)

|

Change in Volume

|

Change in Rate

|

Change in both Rate & Volume

|

Total Change

|

||||||||

|

Earning Assets

|

||||||||||||

|

Loans

|

||||||||||||

|

Commercial

|

5,524

|

|

(480

|

)

|

(124

|

)

|

4,920

|

|

||||

|

Tax exempt

|

(363

|

)

|

(39

|

)

|

13

|

|

(389

|

)

|

||||

|

Real estate

|

3,730

|

|

17

|

|

7

|

|

3,754

|

|

||||

|

Consumer

|

(36

|

)

|

58

|

|

(3

|

)

|

19

|

|

||||

|

Investment securities:

|

||||||||||||

|

Taxable

|

(304

|

)

|

(13

|

)

|

3

|

|

(314

|

)

|

||||

|

Tax-exempt

|

(77

|

)

|

(34

|

)

|

2

|

|

(109

|

)

|

||||

|

Interest-bearing deposits in banks

|

(9

|

)

|

9

|

|

(2

|

)

|

(2

|

)

|

||||

|

CDs with other banks

|

44

|

|

7

|

|

2

|

|

53

|

|

||||

|

Total earning assets

|

8,509

|

|

(475

|

)

|

(102

|

)

|

7,932

|

|

||||

|

Interest bearing liabilities

|

||||||||||||

|

NOW

|

349

|

|

(714

|

)

|

(79

|

)

|

(444

|

)

|

||||

|

Money market checking

|

135

|

|

41

|

|

29

|

|

205

|

|

||||

|

Savings

|

7

|

|

(21

|

)

|

(1

|

)

|

(15

|

)

|

||||

|

IRAs

|

28

|

|

4

|

|

1

|

|

33

|

|

||||

|

CDs

|

496

|

|

326

|

|

82

|

|

904

|

|

||||

|

Repurchase agreements and federal funds sold

|

(151

|

)

|

(119

|

)

|

62

|

|

(208

|

)

|

||||

|

FHLB and other borrowings

|

277

|

|

(65

|

)

|

(35

|

)

|

177

|

|

||||

|

Subordinated debt

|

872

|

|

108

|

|

82

|

|

1,062

|

|

||||

|

Total interest bearing liabilities

|

2,013

|

|

(440

|

)

|

141

|

|

1,714

|

|

||||

|

Total

|

6,496

|

|

(35

|

)

|

(243

|

)

|

6,218

|

|

||||

|

The following table sets forth a summary of the investment securities portfolio as of the dates indicated. Available for sale securities are reported at estimated fair value:

|

||||||||||||

|

December 31, (Dollars in thousands)

|

2016

|

2015

|

2014

|

|||||||||

|

Available-for-sale securities:

|

||||||||||||

|

U. S. Agency securities

|

$

|

28,816

|

|

$

|

29,351

|

|

$

|

37,534

|

|

|||

|

U.S. Sponsored Mortgage-backed securities

|

54,732

|

|

33,714

|

|

29,932

|

|

||||||

|

Municipal securities

|

70,796

|

|

1,798

|

|

—

|

|

||||||

|

Equity and other securities

|

8,024

|

|

5,393

|

|

747

|

|

||||||

|

Total investment securities available-for-sale

|

$

|

162,368

|

|

$

|

70,256

|

|

$

|

68,213

|

|

|||

|

Held-to-maturity securities:

|

||||||||||||

|

Municipal securities

|

$

|

—

|

|

$

|

52,859

|

|

$

|

54,538

|

|

|||

|

Within one year

|

After one year, but within five

|

After five years, but within ten

|

After ten years

|

Total investment securities

|

||||||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

Amortized Cost

|

Weighted Avg. Yield

|

Amortized Cost

|

Weighted Avg. Yield

|

Amortized Cost

|

Weighted Avg. Yield

|

Amortized Cost

|

Weighted Avg. Yield

|

Amortized Cost

|

Fair Value

|

||||||||||||||||||||||||||

|

U. S. Agency securities

|

$

|

—

|

|

—

|

%

|

$

|

8,253

|

|

1.52

|

%

|

$

|

6,530

|

|

1.73

|

%

|

$

|

14,451

|

|

1.70

|

%

|

$

|

29,234

|

|

$

|

28,816

|

|

||||||||||

|

U.S. Sponsored Mortgage-backed securities

|

—

|

|

—

|

|

—

|

|

—

|

|

2,186

|

|

2.12

|

|

53,894

|

|

1.68

|

|

56,080

|

|

54,732

|

|

||||||||||||||||

|

Equity and other securities

|

669

|

|

6.00

|

|

—

|

|

—

|

|

5,500

|

|

6.38

|

|

1,474

|

|

—

|

|

7,643

|

|

8,024

|

|

||||||||||||||||

|

Municipal securities

|

1,077

|

|

1.20

|

|

2,019

|

|

3.70

|

|

6,275

|

|

3.24

|

|

62,704

|

|

2.95

|

|

72,075

|

|

70,796

|

|

||||||||||||||||

|

$

|

1,746

|

|

3.04

|

%

|

$

|

10,272

|

|

1.95

|

%

|

$

|

20,491

|

|

3.48

|

%

|

$

|

132,523

|

|

2.26

|

%

|

$

|

165,032

|

|

$

|

162,368

|

|

|||||||||||

|

Major classification of loans held for investment at December 31, are as follows:

|

||||||||||||||||||||

|

(Dollars in thousands)

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||||

|

Commercial and non-residential real estate

|

$

|

757,516

|

|

$

|

729,319

|

|

$

|

560,752

|

|

$

|

457,388

|

|

$

|

299,639

|

|

|||||

|

Residential real estate and home equity

|

280,838

|

|

285,490

|

|

220,442

|

|

146,001

|

|

130,012

|

|

||||||||||

|

Consumer and other

|

14,511

|

|

17,361

|

|

17,103

|

|

18,916

|

|

16,792

|

|

||||||||||

|

Total

|

$

|

1,052,865

|

|

$

|

1,032,170

|

|

$

|

798,297

|

|

$

|

622,305

|

|

$

|

446,443

|

|

|||||

|

(Dollars in thousands)

|

One Year or Less

|

One Through Five Years

|

Due After Five Years

|

Total

|

||||||||||||

|

Commercial and non-residential real estate

|

$

|

232,796

|

|

$

|

301,027

|

|

$

|

223,693

|

|

$

|

757,516

|

|

||||

|

Residential real estate and home equity

|

119,644

|

|

5,088

|

|

156,106

|

|

280,838

|

|

||||||||

|

Consumer and other

|

2,684

|

|

6,244

|

|

5,583

|

|

14,511

|

|

||||||||

|

Total

|

$

|

355,124

|

|

$

|

312,359

|

|

$

|

385,382

|

|

$

|

1,052,865

|

|

||||

|

(Dollars in thousands)

|

Commercial and Non-Residential Real Estate

|

Residential Real Estate and Home Equity

|

Consumer and Other

|

Total

|

||||||||||||

|

Predetermined fixed interest rate

|

$

|

165,400

|

|

$

|

103,301

|

|

$

|

5,349

|

|

$

|

274,050

|

|

||||

|

Floating or adjustable interest rate

|

359,320

|

|

57,893

|

|

6,478

|

|

423,691

|

|