|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

£

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

|

94-2896096

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

Title of each class

Common stock, $0.001 par value

|

|

Name of each exchange on which registered

The NASDAQ Global Select Market

|

|

Large Accelerated Filer

T

|

Accelerated Filer

£

|

Non-accelerated Filer

£

(Do not check if a smaller reporting company)

|

Smaller Reporting Company

£

|

|||

|

(1)

|

Items 10, 11, 12, 13 and 14 of Part III incorporate information by reference from the Proxy Statement for Maxim's 2012 Annual Meeting of Stockholders, to be filed subsequently.

|

|

Forward-Looking Statements

|

|||

|

Part I

|

|||

|

Business

|

|||

|

Risk Factors

|

|||

|

Unresolved Staff Comments

|

|||

|

Properties

|

|||

|

Legal Proceedings

|

|||

|

Mine Safety Disclosures

|

|||

|

Part II

|

|||

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|||

|

Selected Financial Data

|

|||

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

|||

|

Quantitative and Qualitative Disclosures about Market Risk

|

|||

|

Financial Statements and Supplementary Data

|

|||

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

|||

|

Controls and Procedures

|

|||

|

Other Information

|

|||

|

Part III

|

|||

|

Directors, Executive Officers, and Corporate Governance

|

|||

|

Executive Compensation

|

|||

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|||

|

Certain Relationships and Related Transactions, and Director Independence

|

|||

|

Principal Accountant Fees and Services

|

|||

|

Part IV

|

|||

|

Exhibits and Financial Statement Schedules

|

|||

|

•

|

digital devices, such as memories and microprocessors that operate primarily in the digital domain;

|

|

•

|

linear devices, such as amplifiers, references, analog multiplexers and switches that operate primarily in the analog domain; and

|

|

•

|

mixed-signal devices such as data converter devices that combine linear and digital functions on the same integrated circuit and interface between the analog and digital domains.

|

|

MAJOR END-MARKET

|

MARKET SEGMENT

|

|

|

|

|

INDUSTRIAL

|

Automatic Test Equipment

|

|

|

Automotive

|

|

|

Control & Automation

|

|

|

Electronic Instrumentation

|

|

|

Medical

|

|

|

Military & Aerospace

|

|

|

Security

|

|

|

Utility & Other Meters

|

|

|

Other Industrial

|

|

|

|

|

COMMUNICATIONS

|

Basestations

|

|

|

Network & Datacom

|

|

|

Telecom

|

|

|

Other Communications

|

|

|

|

|

CONSUMER

|

Cell Phones

|

|

|

Digital Cameras

|

|

Handheld Computers

|

|

|

|

Home Entertainment & Appliances

|

|

|

Other Consumer

|

|

|

|

|

COMPUTING

|

Data Storage

|

|

|

Financial Terminals

|

|

|

Notebook Computers

|

|

|

Server & Desktop Computers

|

|

|

Peripherals & Other Computer

|

|

Facility Location

|

Fiscal Year Acquired

|

|

Beaverton, Oregon

|

1994

|

|

San Jose, California

|

1998

|

|

San Antonio, Texas

|

2004

|

|

•

|

new product definition and development of proprietary products;

|

|

•

|

design of parts for performance differentiation and the ability to achieve manufacturing high yield and reliability;

|

|

•

|

development of, and access to, manufacturing processes and advanced packaging;

|

|

•

|

development of hardware and software to support the acceptance and design-in of our products in the end customer's system; and

|

|

•

|

development and design wins of high-integration products across multiple end markets.

|

|

•

|

technical innovation, service and support;

|

|

•

|

time to market;

|

|

•

|

differentiated product performance and features;

|

|

•

|

quality and reliability;

|

|

•

|

product pricing and delivery capabilities;

|

|

•

|

customized design and applications;

|

|

•

|

business relationship with customers;

|

|

•

|

experience, skill and productivity of employees and management; and

|

|

•

|

manufacturing competence and inventory management.

|

|

•

|

Fluctuations in demand for our products and services;

|

|

•

|

Loss of a significant customer or significant customers electing to purchase from another supplier;

|

|

•

|

Reduced visibility into our customers' spending plans and associated revenue;

|

|

•

|

The level of price and competition in our product markets;

|

|

•

|

Our pricing practices, including our use of available information to maximize pricing potential;

|

|

•

|

The impact of the uncertain economic and credit environment on our customers, channel partners, and suppliers, including their ability to obtain financing or to fund capital expenditures;

|

|

•

|

The overall movement toward industry consolidations among our customers and competitors;

|

|

•

|

Below industry-average growth of the non-consumer segments of our business;

|

|

•

|

Announcements and introductions of new products by us or our competitors;

|

|

•

|

Deferrals of customer orders in anticipation of new products or product enhancements (introduced by us or our competitors);

|

|

•

|

Our ability to meet increases in customer orders in a timely manner;

|

|

•

|

Striking an appropriate balance between short-term execution and long-term innovation;

|

|

•

|

Our ability to develop, introduce, and market new products and enhancements and market acceptance of such new products and enhancements; and

|

|

•

|

Our levels of operating expenses.

|

|

•

|

our anticipated or actual results of operations;

|

|

•

|

announcements or introductions of new products by us or our competitors;

|

|

•

|

anticipated or actual operating results of our customers, peers or competitors;

|

|

•

|

technological innovations or setbacks by us or our competitors;

|

|

•

|

conditions in our four major markets;

|

|

•

|

the commencement or outcome of litigation or governmental investigations;

|

|

•

|

change in ratings and estimates of our performance by securities analysts;

|

|

•

|

announcements of merger, acquisition or divestiture transactions;

|

|

•

|

dividend changes;

|

|

•

|

changes in our capital structure, including any decision we make in regard to the repurchase of our common stock;

|

|

•

|

management changes;

|

|

•

|

supply constraints;

|

|

•

|

semiconductor industry cyclicality;

|

|

•

|

our inclusion in certain stock indices;

|

|

•

|

our ability to maintain compliance with the SEC reporting requirements; and

|

|

•

|

other events or factors beyond our control.

|

|

•

|

the jurisdictions in which profits are determined to be earned and taxed;

|

|

•

|

recent changes in our global structure that involve an increased investment in technology outside of the United States to better align asset ownership and business functions with revenues and profits;

|

|

•

|

the resolution of issues arising from tax audits with various tax authorities;

|

|

•

|

changes in the valuation of our deferred tax assets and liabilities;

|

|

•

|

adjustments to estimated taxes upon finalization of various tax returns;

|

|

•

|

increases in expenses not deductible for tax purposes, including impairments of goodwill in connection with acquisitions;

|

|

•

|

changes in available tax credits;

|

|

•

|

changes in share-based compensation;

|

|

•

|

changes in tax laws or the interpretation of such tax laws, and changes in generally accepted accounting principles; and

|

|

•

|

the repatriation of non-U.S. earnings for which we have not previously provided for U.S. taxes.

|

|

Owned Property Location

|

Use(s)

|

Approximate

Floor Space

(sq. ft.)

|

|

|

San Jose, California

|

Corporate headquarters, office space, engineering, manufacturing, administration, customer services, shipping, and other

|

435,000

|

|

|

San Jose, California

|

Wafer fabrication, office space and administration

|

80,000

|

|

|

Sunnyvale, California

|

Office space and engineering space (not being utilized currently)

|

23,000

|

|

|

N. Chelmsford, Massachusetts

|

Engineering, office space and administration

|

30,000

|

|

|

Beaverton, Oregon

|

Wafer fabrication, engineering, office space and administration

|

226,000

|

|

|

Hillsboro, Oregon

|

Engineering, manufacturing, office space and administration

|

325,000

|

|

|

Farmers Branch, Texas

|

Office space, engineering, manufacturing, administration, bump facility, customer service, warehousing, shipping, and other (240,000 sq.ft. are not being utilized currently)

|

704,000

|

|

|

Irving, Texas

|

Wafer fabrication space, office space and administration (not being utilized currently)

|

622,000

|

|

|

San Antonio, Texas

|

Wafer fabrication, office space and administration

|

381,000

|

|

|

Cavite, the Philippines

|

Manufacturing, engineering, administration, office space, customer service, shipping, and other

|

479,000

|

|

|

Batangas, the Philippines

|

Manufacturing, engineering, office space and other

|

78,000

|

|

|

Chonburi Province, Thailand

|

Manufacturing, engineering, administration, office space, customer service, shipping, and other

|

144,000

|

|

|

Bangalore, India

|

Land

|

4.6 acres

|

|

|

Chandler, Arizona

|

Office space, engineering, and test

|

65,000

|

|

|

|

High

|

Low

|

|

|

Fiscal Year ended June 30, 2012

|

|

|

|

|

First Quarter

|

$25.95

|

$21.08

|

|

|

Second Quarter

|

$27.08

|

$22.92

|

|

|

Third Quarter

|

$29.19

|

$25.95

|

|

|

Fourth Quarter

|

$29.86

|

$24.41

|

|

|

|

|

|

|

|

|

High

|

Low

|

|

|

Fiscal Year ended June 25, 2011

|

|

|

|

|

First Quarter

|

$18.54

|

$15.87

|

|

|

Second Quarter

|

$24.82

|

$17.81

|

|

|

Third Quarter

|

$28.10

|

$23.58

|

|

|

Fourth Quarter

|

$28.34

|

$23.79

|

|

|

|

Fiscal Years

|

||

|

|

2012

|

2011

|

|

|

|

|

|

|

|

First Quarter

|

$0.22

|

$0.21

|

|

|

Second Quarter

|

$0.22

|

$0.21

|

|

|

Third Quarter

|

$0.22

|

$0.21

|

|

|

Fourth Quarter

|

$0.22

|

$0.21

|

|

|

Issuer Repurchases of Equity Securities

|

|||||||||||||

|

(in thousands, except per share amounts)

|

|||||||||||||

|

Total Number

of Shares

Purchased

|

Weighted Average Price Paid per Share

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

|

Maximum Amount That May Yet Be Purchased Under the Plans or Programs

|

||||||||||

|

Apr. 1, 2012 - Apr. 28, 2012

|

535

|

|

$

|

27.74

|

|

535

|

|

$

|

592,645

|

|

|||

|

Apr. 29, 2012 - May 26, 2012

|

630

|

|

$

|

27.19

|

|

630

|

|

$

|

575,515

|

|

|||

|

May 27, 2012 - Jun. 30, 2012

|

955

|

|

$

|

25.46

|

|

955

|

|

$

|

551,204

|

|

|||

|

Total

|

2,120

|

|

$

|

26.55

|

|

2,120

|

|

$

|

551,204

|

|

|||

|

|

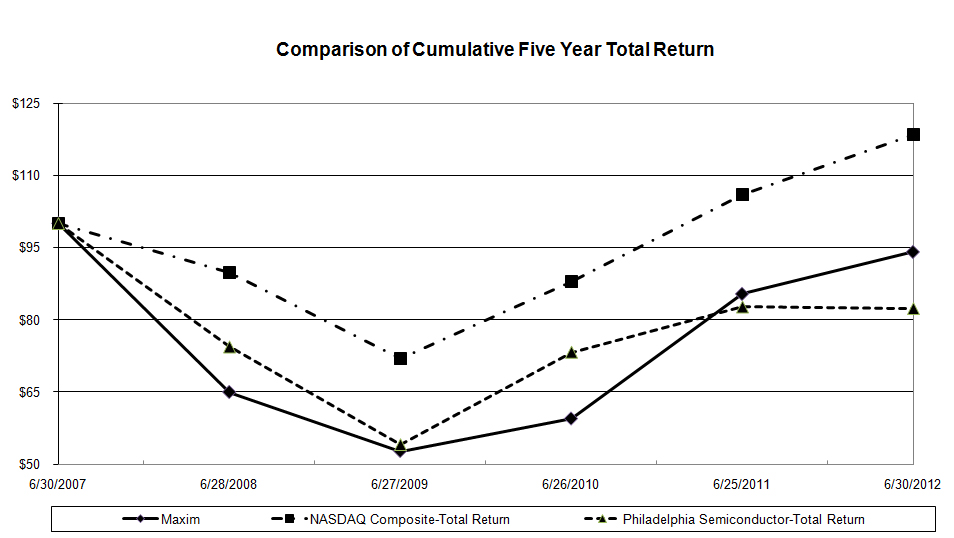

Base Year

|

Fiscal Year Ended

|

|||||||||||||||

|

|

June 30, 2007

|

June 28, 2008

|

June 27, 2009

|

June 26, 2010

|

June 25, 2011

|

June 30, 2012

|

|||||||||||

|

Maxim Integrated Products, Inc.

|

100.00

|

|

64.93

|

|

52.68

|

|

59.42

|

|

85.30

|

|

94.01

|

|

|||||

|

NASDAQ Composite-Total Return

|

100.00

|

|

89.69

|

|

71.94

|

|

87.84

|

|

105.90

|

|

118.54

|

|

|||||

|

Philadelphia Semiconductor-Total Return

|

100.00

|

|

74.33

|

|

53.98

|

|

73.22

|

|

82.65

|

|

82.31

|

|

|||||

|

|

Fiscal Year Ended

|

||||||||||||||||||

|

|

June 30, 2012

|

June 25, 2011

|

June 26, 2010

|

June 27, 2009

|

June 28, 2008

|

||||||||||||||

|

(Amounts in thousands, except percentages and per share data)

|

|||||||||||||||||||

|

Consolidated Statements of Income Data:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Net revenues

|

$

|

2,403,529

|

|

$

|

2,472,341

|

|

$

|

1,997,603

|

|

$

|

1,646,015

|

|

$

|

2,052,783

|

|

||||

|

Cost of goods sold

|

952,677

|

|

942,377

|

|

804,537

|

|

797,138

|

|

804,083

|

|

|||||||||

|

Gross margin

|

$

|

1,450,852

|

|

$

|

1,529,964

|

|

$

|

1,193,066

|

|

$

|

848,877

|

|

$

|

1,248,700

|

|

||||

|

Gross margin %

|

60.4

|

%

|

61.9

|

%

|

59.7

|

%

|

51.6

|

%

|

60.8

|

%

|

|||||||||

|

Operating income

|

$

|

534,797

|

|

$

|

673,039

|

|

$

|

292,050

|

|

$

|

17,378

|

|

$

|

426,053

|

|

||||

|

% of net revenues

|

22.3

|

%

|

27.2

|

%

|

14.6

|

%

|

1.1

|

%

|

20.8

|

%

|

|||||||||

|

Income from continuing operations

|

$

|

354,918

|

|

$

|

489,009

|

|

$

|

125,139

|

|

$

|

10,455

|

|

$

|

317,725

|

|

||||

|

Income from discontinued operations, net of tax

|

31,809

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Net income

|

$

|

386,727

|

|

$

|

489,009

|

|

$

|

125,139

|

|

$

|

10,455

|

|

$

|

317,725

|

|

||||

|

Earnings per share: basic

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

From continuing operations

|

$

|

1.21

|

|

$

|

1.65

|

|

$

|

0.41

|

|

$

|

0.03

|

|

$

|

0.99

|

|

||||

|

From discontinued operations

|

0.11

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Basic net income per share

|

$

|

1.32

|

|

$

|

1.65

|

|

$

|

0.41

|

|

$

|

0.03

|

|

$

|

0.99

|

|

||||

|

Earnings per share: diluted

|

|||||||||||||||||||

|

From continuing operations

|

$

|

1.18

|

|

$

|

1.61

|

|

$

|

0.40

|

|

$

|

0.03

|

|

$

|

0.98

|

|

||||

|

From discontinued operations

|

0.11

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Diluted net income per share

|

$

|

1.29

|

|

$

|

1.61

|

|

$

|

0.40

|

|

$

|

0.03

|

|

$

|

0.98

|

|

||||

|

Shares used in the calculation of

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

earnings per share:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Basic

|

292,810

|

|

296,755

|

|

304,579

|

|

310,805

|

|

320,553

|

|

|||||||||

|

Diluted

|

300,002

|

|

303,377

|

|

310,016

|

|

311,479

|

|

325,846

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Dividends paid per share

|

$

|

0.88

|

|

$

|

0.84

|

|

$

|

0.80

|

|

$

|

0.80

|

|

$

|

0.75

|

|

||||

|

|

As of

|

||||||||||||||||||

|

|

June 30, 2012

|

June 25, 2011

|

June 26, 2010

|

June 27, 2009

|

June 28, 2008

|

||||||||||||||

|

|

(Amounts in thousands)

|

||||||||||||||||||

|

Consolidated Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Cash, cash equivalents and short-term investments

|

$

|

956,386

|

|

$

|

1,012,887

|

|

$

|

826,512

|

|

$

|

913,403

|

|

$

|

1,218,198

|

|

||||

|

Working capital

|

$

|

943,977

|

|

$

|

1,313,512

|

|

$

|

1,174,096

|

|

$

|

1,316,175

|

|

$

|

1,627,406

|

|

||||

|

Total assets

|

$

|

3,737,946

|

|

$

|

3,527,743

|

|

$

|

3,482,325

|

|

$

|

3,081,775

|

|

$

|

3,708,390

|

|

||||

|

Long-term debt

|

$

|

5,592

|

|

$

|

300,000

|

|

$

|

300,000

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

Stockholders' equity

|

$

|

2,538,277

|

|

$

|

2,510,818

|

|

$

|

2,352,958

|

|

$

|

2,594,465

|

|

$

|

3,147,811

|

|

||||

|

|

June 30,

2012 |

June 25,

2011 |

June 26,

2010 |

|||||

|

|

|

|

|

|

|

|

||

|

Net revenues

|

100

|

%

|

100

|

%

|

100

|

%

|

||

|

Cost of goods sold

|

39.6

|

%

|

38.1

|

%

|

40.3

|

%

|

||

|

Gross margin

|

60.4

|

%

|

61.9

|

%

|

59.7

|

%

|

||

|

Operating expenses:

|

|

|

|

|

|

|

||

|

Research and development

|

23.0

|

%

|

21.2

|

%

|

23.8

|

%

|

||

|

Selling, general and administrative

|

13.4

|

%

|

11.8

|

%

|

12.1

|

%

|

||

|

Intangible asset amortization

|

0.7

|

%

|

0.8

|

%

|

0.5

|

%

|

||

|

Impairment of long-lived assets

|

1.3

|

%

|

—

|

%

|

0.4

|

%

|

||

|

Severance and restructuring expenses

|

0.3

|

%

|

0.1

|

%

|

—

|

%

|

||

|

Other operating (income) expenses, net

|

(0.5

|

)%

|

0.8

|

%

|

8.3

|

%

|

||

|

Total operating expenses

|

38.2

|

%

|

34.7

|

%

|

45.1

|

%

|

||

|

Operating income

|

22.2

|

%

|

27.2

|

%

|

14.6

|

%

|

||

|

Interest (expense) income and other, net

|

(0.1

|

)%

|

(0.5

|

)%

|

0.4

|

%

|

||

|

Income before provision for income taxes

|

22.1

|

%

|

26.7

|

%

|

15.0

|

%

|

||

|

Provision for income taxes

|

7.4

|

%

|

7.0

|

%

|

8.8

|

%

|

||

|

Income from continuing operations

|

14.7

|

%

|

19.7

|

%

|

6.2

|

%

|

||

|

Income from discontinued operations, net of tax

|

1.3

|

%

|

—

|

%

|

—

|

%

|

||

|

Net income

|

16.0

|

%

|

19.7

|

%

|

6.2

|

%

|

||

|

|

For the Year Ended

|

|||||||

|

|

June 30,

2012 |

June 25,

2011 |

June 26,

2010 |

|||||

|

|

|

|

|

|

|

|

||

|

Cost of goods sold

|

0.5

|

%

|

0.6

|

%

|

0.8

|

%

|

||

|

Research and development

|

2.0

|

%

|

2.2

|

%

|

2.7

|

%

|

||

|

Selling, general and administrative

|

1.1

|

%

|

1.0

|

%

|

1.2

|

%

|

||

|

|

3.6

|

%

|

3.8

|

%

|

4.7

|

%

|

||

|

June 30,

2012 |

June 25,

2011 |

June 26,

2010 |

|||||||||

|

(in thousands)

|

|||||||||||

|

Net cash provided by operating activities

|

$

|

756,722

|

|

$

|

861,454

|

|

$

|

490,953

|

|

||

|

Net cash used in investing activities

|

(384,765

|

)

|

(278,334

|

)

|

(241,648

|

)

|

|||||

|

Net cash used in financing activities

|

(453,438

|

)

|

(447,091

|

)

|

(132,141

|

)

|

|||||

|

Net (decrease) increase in cash and cash equivalents

|

$

|

(81,481

|

)

|

$

|

136,029

|

|

$

|

117,164

|

|

||

|

|

Total

|

Less than

1 year

|

2-3 years

|

4-5 years

|

More than

5 years

|

||||||||||||||

|

|

(Amounts in thousands)

|

||||||||||||||||||

|

Operating lease obligations (1)

|

$

|

40,390

|

|

$

|

10,993

|

|

$

|

14,625

|

|

$

|

9,951

|

|

$

|

4,821

|

|

||||

|

Royalty obligations (2)

|

10,000

|

|

10,000

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Long-term debt obligations (3)

|

309,088

|

|

303,496

|

|

2,028

|

|

2,599

|

|

965

|

|

|||||||||

|

Interest payments associated with long-term debt obligations (4)

|

10,806

|

|

10,554

|

|

168

|

|

79

|

|

5

|

|

|||||||||

|

Capital equipment and inventory related purchase obligations (5)

|

19,258

|

|

2,162

|

|

4,564

|

|

4,564

|

|

7,968

|

|

|||||||||

|

Total

|

$

|

389,542

|

|

$

|

337,205

|

|

$

|

21,385

|

|

$

|

17,193

|

|

$

|

13,759

|

|

||||

|

Name

|

Age

|

Position

|

||

|

Tunc Doluca

|

54

|

President and Chief Executive Officer

|

||

|

Bruce E. Kiddoo

|

51

|

Senior Vice President and Chief Financial Officer

|

||

|

David A. Caron

|

52

|

Vice President and Principal Accounting Officer

|

||

|

Vivek Jain

|

52

|

Senior Vice President of Manufacturing Operations

|

||

|

Chae Lee

|

47

|

Senior Vice President, Mobility Group

|

||

|

Edwin Medlin

|

55

|

Vice President, General Counsel

|

||

|

Matthew J. Murphy

|

39

|

Senior Vice President, Communications and Automotive Solutions Group

|

||

|

Christopher J. Neil

|

46

|

Senior Vice President, Industrial and Medical Solutions Group

|

||

|

Pirooz Parvarandeh

|

52

|

Chief Technology Officer

|

||

|

Walter Sangalli

|

55

|

Vice President, Worldwide Sales and Marketing

|

||

|

Steven Yamasaki

|

57

|

Vice President of Human Resources

|

||

|

Page

|

||||

|

(1)

|

Financial Statements.

|

|||

|

|

Consolidated Balance Sheets at June 30, 2012 and June 25, 2011

|

|||

|

|

Consolidated Statements of Income for each of the three years in the period ended June 30, 2012

|

|||

|

|

Consolidated Statements of Stockholders' Equity for each of the three years in the period ended June 30, 2012

|

|||

|

|

Consolidated Statements of Cash Flows for each of the three years in the period ended June 30, 2012

|

|||

|

|

Notes to Consolidated Financial Statements

|

|||

|

Report of Independent Registered Public Accounting Firm

|

||||

|

(2)

|

Financial Statement Schedule.

|

|||

|

The following financial statement schedule is filed as part of this Annual Report on Form 10-K and should be read in conjunction with the financial statements.

|

||||

|

Schedule II - Valuation and Qualifying Accounts

|

||||

|

All other schedules are omitted because they are not applicable, or because the required information is included in the consolidated financial statements or notes thereto.

|

||||

|

(3)

|

The Exhibits filed as a part of this Report are listed in the attached Index to Exhibits.

|

|||

|

|

June 30,

2012 |

June 25,

2011 |

|||||

|

|

|

|

|

|

|||

|

ASSETS

|

|||||||

|

Current assets:

|

|

|

|

|

|||

|

Cash and cash equivalents

|

$

|

881,060

|

|

$

|

962,541

|

|

|

|

Short-term investments

|

75,326

|

|

50,346

|

|

|||

|

Total cash, cash equivalents and short-term investments

|

956,386

|

|

1,012,887

|

|

|||

|

Accounts receivable, net of allowances of $12,529 in 2012 and $17,697 in 2011

|

317,461

|

|

297,632

|

|

|||

|

Inventories

|

242,162

|

|

237,928

|

|

|||

|

Deferred tax assets

|

98,180

|

|

113,427

|

|

|||

|

Other current assets

|

85,177

|

|

65,978

|

|

|||

|

Total current assets

|

1,699,366

|

|

1,727,852

|

|

|||

|

Property, plant and equipment, net

|

1,353,606

|

|

1,308,850

|

|

|||

|

Intangible assets, net

|

208,913

|

|

204,263

|

|

|||

|

Goodwill

|

423,073

|

|

265,125

|

|

|||

|

Other assets

|

52,988

|

|

21,653

|

|

|||

|

TOTAL ASSETS

|

$

|

3,737,946

|

|

$

|

3,527,743

|

|

|

|

|

|

|

|||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|||||||

|

Current liabilities:

|

|

|

|||||

|

Accounts payable

|

$

|

147,086

|

|

$

|

110,153

|

|

|

|

Income taxes payable

|

22,589

|

|

3,912

|

|

|||

|

Accrued salary and related expenses

|

191,846

|

|

215,627

|

|

|||

|

Accrued expenses

|

64,092

|

|

47,767

|

|

|||

|

Current portion of long-term debt

|

303,496

|

|

—

|

|

|||

|

Deferred income on shipments to distributors

|

26,280

|

|

36,881

|

|

|||

|

Total current liabilities

|

755,389

|

|

414,340

|

|

|||

|

Long term debt

|

5,592

|

|

300,000

|

|

|||

|

Income taxes payable

|

212,389

|

|

96,099

|

|

|||

|

Deferred tax liabilities

|

198,502

|

|

183,715

|

|

|||

|

Other liabilities

|

27,797

|

|

22,771

|

|

|||

|

Total liabilities

|

1,199,669

|

|

1,016,925

|

|

|||

|

Commitments and contingencies (Note 13)

|

|

|

|

|

|||

|

|

|||||||

|

Stockholders' equity:

|

|||||||

|

Preferred stock, $0.001 par value

|

|||||||

|

Authorized: 2,000 shares, issued and outstanding: none

|

—

|

|

—

|

|

|||

|

Common stock, $0.001 par value

|

|||||||

|

Authorized: 960,000 shares

|

|||||||

|

Issued and outstanding: 292,732 in 2012 and 295,780 in 2011

|

293

|

|

296

|

|

|||

|

Additional paid-in capital

|

—

|

|

—

|

|

|||

|

Retained earnings

|

2,553,418

|

|

2,524,790

|

|

|||

|

Accumulated other comprehensive loss

|

(15,434

|

)

|

(14,268

|

)

|

|||

|

Total stockholders' equity

|

2,538,277

|

|

2,510,818

|

|

|||

|

TOTAL LIABILITIES & STOCKHOLDERS' EQUITY

|

$

|

3,737,946

|

|

$

|

3,527,743

|

|

|

|

|

For the Years Ended

|

||||||||||

|

|

June 30,

2012 |

June 25,

2011 |

June 26,

2010 |

||||||||

|

|

|||||||||||

|

Net revenues

|

$

|

2,403,529

|

|

$

|

2,472,341

|

|

$

|

1,997,603

|

|

||

|

Cost of goods sold

|

952,677

|

|

942,377

|

|

804,537

|

|

|||||

|

Gross margin

|

1,450,852

|

|

1,529,964

|

|

1,193,066

|

|

|||||

|

Operating expenses:

|

|

|

|

|

|

|

|||||

|

Research and development

|

552,379

|

|

525,308

|

|

474,652

|

|

|||||

|

Selling, general and administrative

|

321,273

|

|

292,494

|

|

242,144

|

|

|||||

|

Intangible asset amortization

|

16,737

|

|

18,752

|

|

10,477

|

|

|||||

|

Impairment of long-lived assets

|

30,095

|

|

—

|

|

8,291

|

|

|||||

|

Severance and restructuring expenses

|

6,785

|

|

1,247

|

|

(699

|

)

|

|||||

|

Other operating (income) expenses, net

|

(11,214

|

)

|

19,124

|

|

166,151

|

|

|||||

|

Total operating expenses

|

916,055

|

|

856,925

|

|

901,016

|

|

|||||

|

Operating income

|

534,797

|

|

673,039

|

|

292,050

|

|

|||||

|

Interest (expense) income and other, net

|

(2,064

|

)

|

(11,368

|

)

|

8,013

|

|

|||||

|

Income before provision for income taxes

|

532,733

|

|

661,671

|

|

300,063

|

|

|||||

|

Provision for income taxes

|

177,815

|

|

172,662

|

|

174,924

|

|

|||||

|

Income from continuing operations

|

354,918

|

|

489,009

|

|

125,139

|

|

|||||

|

Income from discontinued operations, net of tax

|

31,809

|

|

—

|

|

—

|

|

|||||

|

Net income

|

$

|

386,727

|

|

$

|

489,009

|

|

$

|

125,139

|

|

||

|

|

|

|

|

|

|

|

|||||

|

Earnings per share: basic

|

|

|

|

|

|

|

|||||

|

From continuing operations

|

$

|

1.21

|

|

$

|

1.65

|

|

$

|

0.41

|

|

||

|

From discontinued operations

|

0.11

|

|

—

|

|

—

|

|

|||||

|

Basic

|

$

|

1.32

|

|

$

|

1.65

|

|

$

|

0.41

|

|

||

|

Earnings per share: diluted

|

|||||||||||

|

From continuing operations

|

$

|

1.18

|

|

$

|

1.61

|

|

$

|

0.40

|

|

||

|

From discontinued operations

|

0.11

|

|

—

|

|

—

|

|

|||||

|

Diluted

|

$

|

1.29

|

|

$

|

1.61

|

|

$

|

0.40

|

|

||

|

Shares used in the calculation of earnings per share:

|

|

|

|

|

|

|

|||||

|

Basic

|

292,810

|

|

296,755

|

|

304,579

|

|

|||||

|

Diluted

|

300,002

|

|

303,377

|

|

310,016

|

|

|||||

|

|

|

|

|

|

|

|

|||||

|

Dividends paid per share

|

$0.88

|

$0.84

|

$0.80

|

||||||||

|

|

Common Stock

|

Additional

|

Accumulated Other

|

Total

|

||||||||||||||||||

|

(In thousands)

|

Shares

|

Par Value

|

Paid-In Capital

|

Retained Earnings

|

Comprehensive Loss

|

Stockholders' Equity

|

||||||||||||||||

|

Balance, June 27, 2009

|

306,019

|

|

$

|

306

|

|

$

|

21,205

|

|

$

|

2,580,610

|

|

$

|

(7,656

|

)

|

$

|

2,594,465

|

|

|||||

|

Components of comprehensive income:

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Net income

|

|

|

|

|

|

|

125,139

|

|

125,139

|

|

||||||||||||

|

Unrealized actuarial loss on post-retirement benefits, net of tax

|

|

|

|

|

|

|

(896

|

)

|

(896

|

)

|

||||||||||||

|

Tax effect of the unrealized exchange gain on long-term intercompany receivable

|

|

|

|

|

|

|

(1,893

|

)

|

(1,893

|

)

|

||||||||||||

|

Unrealized loss on available-for-sale investments, net of tax

|

|

|

|

|

|

|

(1,346

|

)

|

(1,346

|

)

|

||||||||||||

|

Unrealized loss on forward-exchange contracts, net of tax

|

(150

|

)

|

(150

|

)

|

||||||||||||||||||

|

Total comprehensive income

|

|

|

|

|

|

|

120,854

|

|

||||||||||||||

|

Repurchase of common stock

|

(10,303

|

)

|

(10

|

)

|

(93,499

|

)

|

(97,396

|

)

|

(190,905

|

)

|

||||||||||||

|

Common stock issued under stock plans, net of shares withheld for employee taxes

|

3,295

|

|

3

|

|

(29,475

|

)

|

(29,472

|

)

|

||||||||||||||

|

Stock based compensation

|

90,440

|

|

90,440

|

|

||||||||||||||||||

|

Tax shortfall on settlement of equity instruments

|

(15,748

|

)

|

(15,748

|

)

|

||||||||||||||||||

|

Derivative settlement, net of tax

|

3,512

|

|

3,512

|

|

||||||||||||||||||

|

Modification of equity instruments to liability

|

(1,205

|

)

|

(1,205

|

)

|

||||||||||||||||||

|

Common stock issued under Employee Stock Purchase Plan

|

1,837

|

|

2

|

|

24,770

|

|

24,772

|

|

||||||||||||||

|

Dividends paid

|

(243,755

|

)

|

(243,755

|

)

|

||||||||||||||||||

|

Balance, June 26, 2010

|

300,848

|

|

$

|

301

|

|

$

|

—

|

|

$

|

2,364,598

|

|

$

|

(11,941

|

)

|

$

|

2,352,958

|

|

|||||

|

Components of comprehensive income:

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Net income

|

489,009

|

|

489,009

|

|

||||||||||||||||||

|

Unrealized actuarial loss on post-retirement benefits, net of tax

|

(289

|

)

|

(289

|

)

|

||||||||||||||||||

|

Tax effect of the unrealized exchange gain on long-term intercompany receivable

|

(2,369

|

)

|

(2,369

|

)

|

||||||||||||||||||

|

Unrealized gain on available-for-sale investments, net of tax

|

331

|

|

331

|

|

||||||||||||||||||

|

Total comprehensive income

|

486,682

|

|

||||||||||||||||||||

|

Repurchase of common stock

|

(10,880

|

)

|

(11

|

)

|

(151,329

|

)

|

(79,672

|

)

|

(231,012

|

)

|

||||||||||||

|

Common stock issued under stock plans, net of shares withheld for employee taxes

|

2,660

|

|

3

|

|

(28,839

|

)

|

(28,836

|

)

|

||||||||||||||

|

Stock options exercised

|

1,461

|

|

1

|

|

24,829

|

|

24,830

|

|

||||||||||||||

|

Stock based compensation

|

93,623

|

|

93,623

|

|

||||||||||||||||||

|

Tax benefit on settlement of equity instruments

|

30,546

|

|

30,546

|

|

||||||||||||||||||

|

Modification of liability instruments to equity

|

2,350

|

|

2,350

|

|

||||||||||||||||||

|

Common stock issued under Employee Stock Purchase Plan

|

1,691

|

|

2

|

|

28,820

|

|

28,822

|

|

||||||||||||||

|

Dividends paid

|

(249,145

|

)

|

(249,145

|

)

|

||||||||||||||||||

|

Balance, June 25, 2011

|

295,780

|

|

$

|

296

|

|

$

|

—

|

|

$

|

2,524,790

|

|

$

|

(14,268

|

)

|

$

|

2,510,818

|

|

|||||

|

Components of comprehensive income:

|

||||||||||||||||||||||

|

Net income

|

386,727

|

|

386,727

|

|

||||||||||||||||||

|

Unrealized actuarial loss on post-retirement benefits, net of tax

|

(2,603

|

)

|

(2,603

|

)

|

||||||||||||||||||

|

Tax effect of the unrealized exchange loss on long-term intercompany receivable

|

1,612

|

|

1,612

|

|

||||||||||||||||||

|

Unrealized loss on available-for-sale investments, net of tax

|

(129

|

)

|

(129

|

)

|

||||||||||||||||||

|

Unrealized loss on foreign exchange forward contracts, net of tax

|

(46

|

)

|

(46

|

)

|

||||||||||||||||||

|

Total comprehensive income

|

385,561

|

|

||||||||||||||||||||

|

Repurchase of common stock

|

(9,920

|

)

|

(10

|

)

|

(146,034

|

)

|

(100,368

|

)

|

(246,412

|

)

|

||||||||||||

|

Net issuance of restricted stock units

|

2,357

|

|

2

|

|

(29,650

|

)

|

(29,648

|

)

|

||||||||||||||

|

Stock options exercised

|

2,843

|

|

3

|

|

49,903

|

|

49,906

|

|

||||||||||||||

|

Stock based compensation

|

88,958

|

|

88,958

|

|

||||||||||||||||||

|

Tax benefit on settlement of equity instruments

|

3,112

|

|

3,112

|

|

||||||||||||||||||

|

Common stock issued under Employee Stock Purchase Plan

|

1,672

|

|

2

|

|

33,711

|

|

33,713

|

|

||||||||||||||

|

Dividends paid

|

(257,731

|

)

|

(257,731

|

)

|

||||||||||||||||||

|

Balance, June 30, 2012

|

292,732

|

|

$

|

293

|

|

$

|

—

|

|

$

|

2,553,418

|

|

$

|

(15,434

|

)

|

$

|

2,538,277

|

|

|||||

|

|

For the Years Ended

|

||||||||||

|

|

June 30,

2012 |

June 25,

2011 |

June 26,

2010 |

||||||||

|

Cash flows from operating activities:

|

|

|

|

||||||||

|

Net income

|

$

|

386,727

|

|

$

|

489,009

|

|

$

|

125,139

|

|

||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|||||||

|

Stock-based compensation

|

89,867

|

|

94,297

|

|

93,525

|

|

|||||

|

Depreciation and amortization

|

211,096

|

|

205,062

|

|

167,523

|

|

|||||

|

Deferred taxes

|

30,759

|

|

140,084

|

|

29,090

|

|

|||||

|

In process research & development

|

1,600

|

|

—

|

|

—

|

|

|||||

|

(Gain) loss from sale of property, plant and equipment

|

(7,648

|

)

|

12,946

|

|

272

|

|

|||||

|

(Gain) loss from sale of investments in privately-held companies

|

(1,811

|

)

|

—

|

|

148

|

|

|||||

|

Tax benefit (shortfall) related to stock-based compensation

|

3,112

|

|

30,546

|

|

(15,748

|

)

|

|||||

|

Excess tax benefit related to stock-based compensation

|

(17,482

|

)

|

(12,869

|

)

|

(7,005

|

)

|

|||||

|

Impairment of long lived assets

|

30,645

|

|

—

|

|

8,291

|

|

|||||

|

Gain on sale of discontinued operations

|

(45,372

|

)

|

—

|

|

—

|

|

|||||

|

Changes in assets and liabilities:

|

|

|

|

|

|||||||

|

Accounts receivable

|

(19,262

|

)

|

43,256

|

|

(124,258

|

)

|

|||||

|

Inventories

|

(432

|

)

|

(29,435

|

)

|

22,681

|

|

|||||

|

Other current assets

|

(16,757

|

)

|

53,255

|

|

(79,319

|

)

|

|||||

|

Accounts payable

|

25,515

|

|

(4,746

|

)

|

41,191

|

|

|||||

|

Income taxes payable

|

134,967

|

|

(45,318

|

)

|

17,384

|

|

|||||

|

Deferred income on shipments to distributors

|

(10,601

|

)

|

11,102

|

|

9,020

|

|

|||||

|

Accrued liabilities - litigation settlement

|

—

|

|

(173,000

|

)

|

173,000

|

|

|||||

|

All other accrued liabilities

|

(38,201

|

)

|

47,265

|

|

30,019

|

|

|||||

|

Net cash provided by operating activities

|

756,722

|

|

861,454

|

|

490,953

|

|

|||||

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|||||

|

Purchases of property, plant and equipment

|

(264,348

|

)

|

(175,253

|

)

|

(123,901

|

)

|

|||||

|

Proceeds from sale of property, plant, and equipment

|

16,883

|

|

27,624

|

|

2,802

|

|

|||||

|

Acquisitions

|

(168,544

|

)

|

(80,918

|

)

|

(316,784

|

)

|

|||||

|

Proceeds from sale of discontinued operations

|

56,607

|

|

—

|

|

—

|

|

|||||

|

Other non-current assets

|

—

|

|

—

|

|

(3,998

|

)

|

|||||

|

Purchases of available-for-sale securities

|

(25,108

|

)

|

(49,787

|

)

|

—

|

|

|||||

|

Investments in privately-held companies

|

(3,480

|

)

|

—

|

|

—

|

|

|||||

|

Proceeds from sale/maturities of available-for-sale securities

|

—

|

|

—

|

|

200,233

|

|

|||||

|

Proceeds from sale of investments in privately-held companies

|

3,225

|

|

—

|

|

—

|

|

|||||

|

Net cash used in investing activities

|

(384,765

|

)

|

(278,334

|

)

|

(241,648

|

)

|

|||||

|

Cash flows from financing activities

|

|

|

|

|

|

|

|||||

|

Excess tax benefit from stock-based compensation plans

|

17,482

|

|

12,869

|

|

7,005

|

|

|||||

|

Mortgage liability

|

—

|

|

(3,237

|

)

|

(40

|

)

|

|||||

|

Proceeds from derivative litigation settlement

|

—

|

|

—

|

|

2,460

|

|

|||||

|

Repayment of notes payable

|

(20,806

|

)

|

(1,422

|

)

|

—

|

|

|||||

|

Issuance of notes payable, net of issuance costs

|

—

|

|

—

|

|

298,578

|

|

|||||

|

Net issuance of common stock

|

54,029

|

|

24,856

|

|

(5,484

|

)

|

|||||

|

Repurchase of common stock

|

(246,412

|

)

|

(231,012

|

)

|

(190,905

|

)

|

|||||

|

Dividends paid

|

(257,731

|

)

|

(249,145

|

)

|

(243,755

|

)

|

|||||

|

Net cash used in financing activities

|

(453,438

|

)

|

(447,091

|

)

|

(132,141

|

)

|

|||||

|

Net (decrease) increase in cash and cash equivalents

|

(81,481

|

)

|

136,029

|

|

117,164

|

|

|||||

|

Cash and cash equivalents:

|

|

|

|

|

|

|

|||||

|

Beginning of year

|

962,541

|

|

826,512

|

|

709,348

|

|

|||||

|

End of year

|

$

|

881,060

|

|

$

|

962,541

|

|

$

|

826,512

|

|

||

|

|

|

|

|

|

|

|

|||||

|

Supplemental disclosures of cash flow information:

|

|

|

|

|

|

|

|||||

|

Cash paid (refunded), net during the year for income taxes

|

$

|

39,827

|

|

$

|

(15,529

|

)

|

$

|

217,140

|

|

||

|

Cash paid for interest

|

10,890

|

|

10,264

|

|

—

|

|

|||||

|

|

|

|

|

|

|||||||

|

Noncash financing and investing activities:

|

|

|

|

|

|||||||

|

Accounts payable related to property, plant and equipment purchases

|

$

|

26,079

|

|

$

|

22,841

|

|

$

|

6,894

|

|

||

|

June 30, 2012

|

June 25, 2011

|

||||||

|

(in thousands)

|

|||||||

|

Accounts receivable

|

$

|

329,990

|

|

$

|

315,329

|

|

|

|

Returns and allowances

|

(12,529

|

)

|

(17,697

|

)

|

|||

|

$

|

317,461

|

|

$

|

297,632

|

|

||

|

|

June 30, 2012

|

|

June 25, 2011

|

||||

|

Inventory:

|

(In thousands)

|

||||||

|

Raw materials

|

$

|

11,922

|

|

$

|

18,419

|

|

|

|

Work-in-process

|

149,603

|

|

162,245

|

|

|||

|

Finished goods

|

80,637

|

|

57,264

|

|

|||

|

|

$

|

242,162

|

|

|

$

|

237,928

|

|

|

|

June 30, 2012

|

|

June 25, 2011

|

||||

|

Property and equipment:

|

(In thousands)

|

||||||

|

Land

|

$

|

65,007

|

|

$

|

86,257

|

|

|

|

Buildings and building improvements

|

348,727

|

|

313,642

|

|

|||

|

Machinery and equipment

|

2,105,905

|

|

1,978,827

|

|

|||

|

|

2,519,639

|

|

|

2,378,726

|

|

||

|

Less accumulated depreciation

|

(1,166,033

|

)

|

(1,069,876

|

)

|

|||

|

|

$

|

1,353,606

|

|

|

$

|

1,308,850

|

|

|

As of June 30, 2012

|

As of June 25, 2011

|

||||||||||||||||||||||||||||||

|

Fair Value

|

Fair Value

|

||||||||||||||||||||||||||||||

|

Measurements Using

|

Total

|

Measurements Using

|

Total

|

||||||||||||||||||||||||||||

|

Level 1

|

Level 2

|

Level 3

|

Balance

|

Level 1

|

Level 2

|

Level 3

|

Balance

|

||||||||||||||||||||||||

|

(in thousands)

|

|||||||||||||||||||||||||||||||

|

Assets

|

|||||||||||||||||||||||||||||||

|

Money market funds (1)

|

$

|

602,462

|

|

$

|

—

|

|

$

|

—

|

|

$

|

602,462

|

|

$

|

603,180

|

|

$

|

—

|

|

$

|

—

|

|

$

|

603,180

|

|

|||||||

|

Certificates of deposit (1)

|

—

|

|

6,182

|

|

—

|

|

6,182

|

|

—

|

|

3,457

|

|

—

|

|

3,457

|

|

|||||||||||||||

|

Government agency securities (2)

|

—

|

|

75,326

|

|

—

|

|

75,326

|

|

—

|

|

50,346

|

|

—

|

|

50,346

|

|

|||||||||||||||

|

Foreign currency forward contracts (3)

|

—

|

|

642

|

|

—

|

|

642

|

|

—

|

|

326

|

|

—

|

|

326

|

|

|||||||||||||||

|

Total Assets

|

$

|

602,462

|

|

$

|

82,150

|

|

$

|

—

|

|

$

|

684,612

|

|

$

|

603,180

|

|

$

|

54,129

|

|

$

|

—

|

|

$

|

657,309

|

|

|||||||

|

Liabilities

|

|||||||||||||||||||||||||||||||

|

Foreign currency forward contracts (4)

|

$

|

—

|

|

$

|

507

|

|

$

|

—

|

|

$

|

507

|

|

$

|

—

|

|

$

|

309

|

|

$

|

—

|

|

$

|

309

|

|

|||||||

|

Contingent Consideration (4)

|

—

|

|

—

|

|

17,737

|

|

17,737

|

|

—

|

|

—

|

|

8,800

|

|

8,800

|

|

|||||||||||||||

|

Total Liabilities

|

$

|

—

|

|

$

|

507

|

|

$

|

17,737

|

|

$

|

18,244

|

|

$

|

—

|

|

$

|

309

|

|

$

|

8,800

|

|

$

|

9,109

|

|

|||||||

|

Fair Value Measured and Recorded Using Significant Unobservable Inputs (Level 3)

|

||||||||

|

June 30,

2012 |

June 25,

2011 |

|||||||

|

Contingent Consideration

|

(in thousands)

|

|||||||

|

Beginning balance

|

$

|

8,800

|

|

$

|

—

|

|

||

|

Total gains or losses (realized and unrealized):

|

||||||||

|

Included in earnings

|

1,670

|

|

—

|

|

||||

|

Additions

|

11,354

|

|

8,800

|

|

||||

|

Payments

|

(4,087

|

)

|

—

|

|

||||

|

Ending balance

|

$

|

17,737

|

|

$

|

8,800

|

|

||

|

Changes in unrealized losses or (gains) included in earnings related to liabilities still held as of period end

|

$

|

1,670

|

|

$

|

—

|

|

||

|

June 30, 2012

|

June 25, 2011

|

||||||||||||||||||||||||||||||

|

Amortized Cost

|

Gross

Unrealized

Gain

|

Gross

Unrealized

Loss

|

Estimated

Fair Value

|

Amortized Cost

|

Gross

Unrealized

Gain

|

Gross

Unrealized

Loss

|

Estimated

Fair Value

|

||||||||||||||||||||||||

|

(in thousands)

|

|||||||||||||||||||||||||||||||

|

Available-for-sale investments

|

|||||||||||||||||||||||||||||||

|

Government agency securities

|

$

|

75,007

|

|

$

|

319

|

|

$

|

—

|

|

$

|

75,326

|

|

$

|

49,826

|

|

$

|

520

|

|

$

|

—

|

|

$

|

50,346

|

|

|||||||

|

Total available-for-sale investments

|

$

|

75,007

|

|

$

|

319

|

|

$

|

—

|

|

$

|

75,326

|

|

$

|

49,826

|

|

$

|

520

|

|

$

|

—

|

|

$

|

50,346

|

|

|||||||

|

As of June 30, 2012

|

As of June 25, 2011

|

||||||||||||||||||||||

|

Gross Notional(1)

|

Other Current Assets

|

Accrued Expenses

|

Gross Notional (1)

|

Other Current Assets

|

Accrued Expenses

|

||||||||||||||||||

|

(in thousands)

|

|||||||||||||||||||||||

|

Derivatives designated as hedging instruments

|

|||||||||||||||||||||||

|

Cash flow hedges:

|

|||||||||||||||||||||||

|

Foreign exchange contracts

|

$

|

37,955

|

|

$

|

150

|

|

$

|

459

|

|

$

|

35,629

|

|

$

|

53

|

|

$

|

287

|

|

|||||

|

Derivatives not designated as hedging instruments

|

|||||||||||||||||||||||

|

Foreign exchange contracts

|

35,105

|

|

492

|

|

48

|

|

26,342

|

|

273

|

|

22

|

|

|||||||||||

|

Total derivatives

|

$

|

73,060

|

|

$

|

642

|

|

$

|

507

|

|

$

|

61,971

|

|

$

|

326

|

|

$

|

309

|

|

|||||

|

June 30,

2012 |

June 25,

2011 |

|||||||

|

(in thousands)

|

||||||||

|

Beginning balance

|

$

|

(234

|

)

|

$

|

(235

|

)

|

||

|

Loss reclassified to income

|

653

|

|

514

|

|

||||

|

Loss recorded in other comprehensive loss

|

(110

|

)

|

(513

|

)

|

||||

|

Ending balance

|

$

|

309

|

|

$

|

(234

|

)

|

||

|

Gain (Loss) Reclassified from Accumulated OCI into Income (Effective portion)

|

||||||||||

|

Years Ended

|

||||||||||

|

Location

|

June 30,

2012 |

June 25,

2011 |

||||||||

|

(in thousands)

|

||||||||||

|

Cash Flow hedges:

|

||||||||||

|

Foreign exchange contracts

|

Net Revenues

|

$

|

(312

|

)

|

$

|

(1,152

|

)

|

|||

|

Foreign exchange contracts

|

Cost of goods sold

|

187

|

|

638

|

|

|||||

|

Foreign exchange contracts

|

Operating Expense

|

(528

|

)

|

—

|

|

|||||

|

Total cash flow hedges

|

$

|

(653

|

)

|

$

|

(514

|

)

|

||||

|

Gain (Loss) Recognized in Income on Derivative Instrument

|

|||||||||||||

|

Years Ended

|

|||||||||||||

|

Location

|

June 30,

2012 |

June 25,

2011 |

June 26,

2010 |

||||||||||

|

(in thousands)

|

|||||||||||||

|

Foreign exchange contracts

|

Interest income (expense) and other, net

|

$

|

1,653

|

|

$

|

(1,893

|

)

|

$

|

1,444

|

|

|||

|

Total

|

$

|

1,653

|

|

$

|

(1,893

|

)

|

$

|

1,444

|

|

||||

|

In United States Dollars

|

June 30, 2012

|

June 25, 2011

|

||||||

|

|

(in thousands)

|

|||||||

|

Euro

|

$

|

(10,686

|

)

|

$

|

1,542

|

|

||

|

Japanese Yen

|

(2,254

|

)

|

(5,156

|

)

|

||||

|

British Pound

|

(575

|

)

|

(10,928

|

)

|

||||

|

Philippine Peso

|

15,443

|

|

17,140

|

|

||||

|

Thai Baht

|

4,264

|

|

3,523

|

|

||||

|

Total

|