|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Maryland

|

|

31-0387920

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Stock, par value $0.01 per share

|

New York Stock Exchange

|

|

|

Large accelerated filer

|

x

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

£

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

o

|

|

Part III:

|

Portions of the Registrant’s Definitive Proxy Statement for its Annual Meeting of Stockholders to be filed pursuant to Regulation 14A within 120 days after the Registrant’s fiscal year end of December 31, 2011 are incorporated by reference into Part III of this Report.

|

|

Item

|

Description

|

Page

|

|

PART I

|

||

|

1.

|

||

|

1A.

|

||

|

1B.

|

||

|

2.

|

||

|

3.

|

||

|

4.

|

||

|

PART II

|

||

|

5.

|

||

|

6.

|

||

|

7.

|

||

|

7A.

|

||

|

8.

|

||

|

9.

|

||

|

9A.

|

||

|

9B.

|

||

|

PART III

|

||

|

10.

|

||

|

11.

|

||

|

12.

|

||

|

13.

|

||

|

14.

|

||

|

PART IV

|

||

|

15.

|

||

|

Name

|

Age

|

Position and Offices Held

|

|||

|

William R. Nuti

|

48

|

|

Chairman of the Board, Chief Executive Officer and President

|

||

|

John G. Bruno

|

47

|

|

Chief Technology Officer and Executive Vice President, Corporate Development

|

||

|

Jennifer M. Daniels

|

48

|

|

Senior Vice President, General Counsel and Secretary

|

||

|

Peter A. Dorsman

|

56

|

|

Executive Vice President, Industry Solutions Group and Global Operations

|

||

|

Robert P. Fishman

|

48

|

|

Senior Vice President and Chief Financial Officer

|

||

|

Peter A. Leav

|

41

|

|

Executive Vice President, Global Sales, Professional Services and Consumables

|

||

|

Andrea L. Ledford

|

46

|

|

Senior Vice President, Human Resources

|

||

|

•

|

incur additional indebtedness;

|

|

•

|

create liens on, sell or otherwise dispose of our assets;

|

|

•

|

engage in certain fundamental corporate changes or changes to our business activities;

|

|

•

|

make investments in others;

|

|

•

|

engage in sale-leaseback or hedging transactions;

|

|

•

|

repurchase our common stock, pay dividends or make similar distributions on our capital stock;

|

|

•

|

repay other indebtedness;

|

|

•

|

engage in certain affiliate transactions; and

|

|

•

|

enter into agreements that restrict our ability to create liens, pay dividends or make loan repayments.

|

|

•

|

require us to dedicate a substantial portion of our cash flow to the payment of principal and interest, thereby reducing the funds available for operations and future business opportunities;

|

|

•

|

limit our ability to borrow additional money if needed for other purposes, including working capital, capital expenditures, debt service requirements, acquisitions and general corporate or other purposes, on satisfactory terms or at all;

|

|

•

|

limit our ability to adjust to changing economic, business and competitive conditions;

|

|

•

|

place us at a competitive disadvantage with competitors who may have less indebtedness or greater access to financing;

|

|

•

|

make us more vulnerable to an increase in interest rates, a downturn in our operating performance or a decline in general economic conditions; and

|

|

•

|

make us more susceptible to changes in credit ratings, which could impact our ability to obtain financing in the future and increase the cost of such financing.

|

|

•

|

react to competitive product and pricing pressures (particularly in the ATM marketplace);

|

|

•

|

penetrate and meet the changing competitive requirements and deliverables in developing and emerging markets, such as India and China;

|

|

•

|

exploit opportunities in new vertical markets, such as travel and telecom and technology;

|

|

•

|

rapidly and continually design, develop and market, or otherwise maintain and introduce innovative solutions and related products and services for our customers that are competitive in the marketplace;

|

|

•

|

react on a timely basis to shifts in market demands;

|

|

•

|

compete in reverse auctions for new and continuing business;

|

|

•

|

reduce costs without creating operating inefficiencies;

|

|

•

|

maintain competitive operating margins;

|

|

•

|

improve product and service delivery quality; and

|

|

•

|

effectively market and sell all of our diverse solutions.

|

|

•

|

the impact of ongoing global economic and credit crises on the stability of national and regional economies;

|

|

•

|

political conditions that could adversely affect demand for our solutions, or our ability to access funds and resources, in these markets;

|

|

•

|

the impact of a downturn in the global economy on demand for our products;

|

|

•

|

currency exchange rate fluctuations that could result in lower demand for our products as well as generate currency translation losses;

|

|

•

|

changes to and compliance with a variety of laws and regulations that may increase our cost of doing business or otherwise prevent us from effectively competing internationally;

|

|

•

|

the institution of, or changes to, trade protection measures and import or export licensing requirements;

|

|

•

|

the successful implementation and use of systems, procedures and controls to monitor our operations in foreign markets;

|

|

•

|

changing competitive requirements and deliverables in developing and emerging markets;

|

|

•

|

work stoppages and other labor conditions or issues;

|

|

•

|

disruptions in transportation and shipping infrastructure; and

|

|

•

|

the impact of civil unrest relating to war and terrorist activity on the economy or markets in general, or on our ability, or that of our suppliers, to meet commitments.

|

|

•

|

assimilating and integrating different business operations, corporate cultures, personnel, infrastructures and technologies or products acquired or licensed;

|

|

•

|

the potential for unknown liabilities within the acquired or combined business; and

|

|

•

|

the possibility of conflict with joint venture or alliance partners regarding strategic direction, prioritization of objectives and goals, governance matters or operations.

|

|

2011

|

2010

|

||||||||||||||||||

|

High

|

Low

|

High

|

Low

|

||||||||||||||||

|

1st quarter

|

$

|

20.62

|

|

$

|

15.32

|

|

11.11

|

|

1st quarter

|

$

|

14.31

|

|

$

|

11.11

|

|

||||

|

2nd quarter

|

$

|

20.04

|

|

$

|

17.67

|

|

11.30

|

|

2nd quarter

|

$

|

16.00

|

|

$

|

11.30

|

|

||||

|

3rd quarter

|

$

|

20.97

|

|

$

|

15.28

|

|

11.87

|

|

3rd quarter

|

$

|

14.43

|

|

$

|

11.87

|

|

||||

|

4th quarter

|

$

|

20.48

|

|

$

|

15.56

|

|

13.41

|

|

4th quarter

|

$

|

15.50

|

|

$

|

13.41

|

|

||||

|

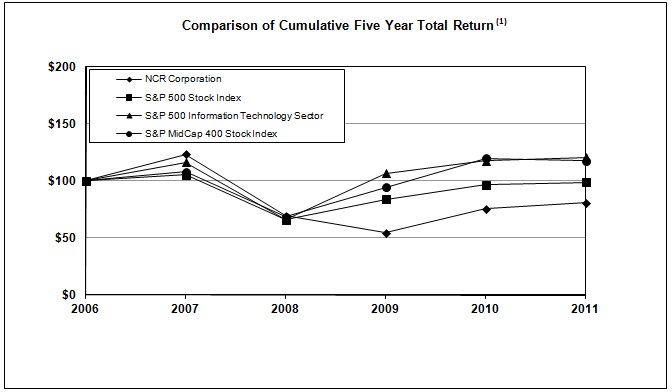

Company / Index

|

2007

|

2008

|

2009

|

2010

|

2011

|

|||||||||||||||

|

NCR Corporation

(2)

|

$

|

124

|

|

$

|

70

|

|

$

|

55

|

|

$

|

76

|

|

$

|

81

|

|

|||||

|

S&P 500 Stock Index

|

$

|

105

|

|

$

|

66

|

|

$

|

84

|

|

$

|

97

|

|

$

|

99

|

|

|||||

|

S&P 500 Information Technology Sector

|

$

|

116

|

|

$

|

66

|

|

$

|

107

|

|

$

|

118

|

|

$

|

121

|

|

|||||

|

S&P MidCap 400 Stock Index

|

$

|

108

|

|

$

|

69

|

|

$

|

95

|

|

$

|

120

|

|

$

|

118

|

|

|||||

|

(1)

|

In each case, assumes a $100 investment on December 31, 2006, and reinvestment of all dividends, if any.

|

|

(2)

|

For the year ended December 31, 2007, includes a dividend of $26.45 per share based on the opening stock price of Teradata

|

|

In millions, except per share and employee and contractor amounts

|

|||||||||||||||||||||

|

For the years ended December 31

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||||||

|

Continuing Operations

(a)

|

|||||||||||||||||||||

|

Revenue

|

$

|

5,443

|

|

$

|

4,810

|

|

$

|

4,599

|

|

$

|

5,300

|

|

$

|

4,957

|

|

||||||

|

Income from operations

|

$

|

65

|

|

$

|

106

|

|

$

|

103

|

|

$

|

328

|

|

$

|

224

|

|

||||||

|

Other (expense) income, net

|

$

|

(3

|

)

|

$

|

(11

|

)

|

$

|

(31

|

)

|

$

|

16

|

|

$

|

51

|

|

||||||

|

Income tax (benefit) expense

|

$

|

—

|

|

$

|

(26

|

)

|

$

|

(3

|

)

|

$

|

70

|

|

$

|

68

|

|

||||||

|

Income from continuing operations attributable to NCR Common Stockholders

(c)

|

$

|

50

|

|

$

|

116

|

|

$

|

62

|

|

$

|

253

|

|

$

|

183

|

|

||||||

|

Income (loss) from discontinued operations, net of tax

|

$

|

3

|

|

$

|

18

|

|

$

|

(95

|

)

|

$

|

(25

|

)

|

$

|

91

|

|

||||||

|

Basic earnings (loss) per common share attributable to NCR common shareholders:

|

|||||||||||||||||||||

|

From continuing operations

(a,c)

|

$

|

0.32

|

|

$

|

0.73

|

|

$

|

0.39

|

|

$

|

1.53

|

|

$

|

1.02

|

|

||||||

|

From discontinued operations

|

$

|

0.02

|

|

$

|

0.11

|

|

$

|

(0.60

|

)

|

$

|

(0.15

|

)

|

$

|

0.51

|

|

||||||

|

Total basic earnings (loss) per common share

|

$

|

0.34

|

|

$

|

0.84

|

|

$

|

(0.21

|

)

|

$

|

1.38

|

|

$

|

1.52

|

|

||||||

|

Diluted earnings (loss) per common share attributable to NCR common shareholders:

|

|||||||||||||||||||||

|

From continuing operations

(a,c)

|

$

|

0.31

|

|

$

|

0.72

|

|

$

|

0.39

|

|

$

|

1.51

|

|

$

|

1.00

|

|

||||||

|

From discontinued operations

|

$

|

0.02

|

|

$

|

0.11

|

|

$

|

(0.60

|

)

|

$

|

(0.15

|

)

|

$

|

0.50

|

|

||||||

|

Total diluted earnings (loss) per common share

|

$

|

0.33

|

|

$

|

0.83

|

|

$

|

(0.21

|

)

|

$

|

1.36

|

|

$

|

1.50

|

|

||||||

|

Cash dividends per share

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||||

|

As of December 31

|

|||||||||||||||||||||

|

Total assets

|

$

|

5,591

|

|

$

|

4,361

|

|

$

|

4,094

|

|

$

|

4,255

|

|

$

|

4,780

|

|

(b)

|

|||||

|

Total debt

|

$

|

853

|

|

$

|

11

|

|

$

|

15

|

|

$

|

308

|

|

$

|

308

|

|

(b)

|

|||||

|

Total NCR stockholders' equity

|

$

|

799

|

|

$

|

883

|

|

$

|

564

|

|

$

|

440

|

|

$

|

1,757

|

|

(b)

|

|||||

|

Number of employees and contractors

|

23,500

|

|

21,000

|

|

21,500

|

|

22,400

|

|

23,200

|

|

(b)

|

||||||||||

|

(a)

|

Continuing operations exclude the results of the Teradata Data Warehousing business which was spun-off through a tax free distribution to the Company's stockholders on September 30, 2007, costs and insurance recoveries relating to certain environmental obligations associated with discontinued operations, including the Fox River, Japan and Kalamazoo matters, the closure of NCR's EFT payment processing business in Canada, as well as the results from our healthcare solutions business which was sold on December 23, 2011.

|

|

(b)

|

Reflects NCR's assets, debt, stockholders' equity and number of employees and contractors from continuing operations following the spin-off of Teradata on September 30, 2007.

|

|

(c)

|

The following income (expense) amounts, net of tax are included in income from continuing operations for

the years ended December 31

:

|

|

In millions

|

2011

|

2010

|

2009

|

2008

|

2007

|

|||||||||||||||

|

Impairment charges

|

$

|

(70

|

)

|

$

|

(9

|

)

|

$

|

(30

|

)

|

$

|

—

|

|

$

|

—

|

|

|||||

|

Acquisition related costs

|

(36

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||

|

Legal settlements and charges

|

2

|

|

(5

|

)

|

(4

|

)

|

(8

|

)

|

—

|

|

||||||||||

|

Japan valuation reserve release

|

|

39

|

|

|

|

|

||||||||||||||

|

Incremental costs directly related to the relocation of the worldwide headquarters

|

—

|

|

(11

|

)

|

(4

|

)

|

—

|

|

—

|

|

||||||||||

|

Organizational realignment initiative

|

—

|

|

—

|

|

—

|

|

(45

|

)

|

—

|

|

||||||||||

|

Net gains from sales of real estate

|

—

|

|

—

|

|

—

|

|

13

|

|

—

|

|

||||||||||

|

Manufacturing realignment initiative

|

—

|

|

—

|

|

—

|

|

—

|

|

(38

|

)

|

||||||||||

|

Japan realignment initiative

|

—

|

|

—

|

|

—

|

|

—

|

|

(18

|

)

|

||||||||||

|

Costs related to Teradata spin-off

|

—

|

|

—

|

|

—

|

|

—

|

|

(12

|

)

|

||||||||||

|

Tax adjustments

|

—

|

|

—

|

|

—

|

|

—

|

|

(10

|

)

|

||||||||||

|

Total

|

$

|

(104

|

)

|

$

|

14

|

|

$

|

(38

|

)

|

$

|

(40

|

)

|

$

|

(78

|

)

|

|||||

|

Item 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (MD&A)

|

|

•

|

Revenue growth of approximately 13% compared to full year

2010

|

|

•

|

Gross margin improvement of approximately 90 basis points compared to full year

2010

|

|

•

|

Continued realization of the benefits of our cost reduction initiatives

|

|

•

|

Continued growth of higher margin software and services offerings and improvements in revenue mix

|

|

•

|

Delivered differentiating solutions, such as our Scalable Deposit Module and our APTRA suite of software solutions

|

|

•

|

Acquired Radiant Systems, Inc. during the third quarter of 2011 for a purchase price of approximately $1.2 billion

|

|

•

|

Created a strategic alliance with Scopus Tecnologia Ltda. for ATM manufacturing in Brazil

|

|

In millions

|

2011

|

2010

|

2009

|

||

|

Revenue

|

$5,443

|

$4,810

|

$4,599

|

||

|

Gross margin

|

1,135

|

964

|

880

|

||

|

Gross margin as a percentage of revenue

|

20.9%

|

20.0%

|

19.1%

|

||

|

Operating expenses

|

|||||

|

Selling, general and administrative expenses

|

$805

|

$696

|

$636

|

||

|

Research and development expenses

|

177

|

162

|

141

|

||

|

Impairment of long-lived and other assets

|

88

|

—

|

—

|

||

|

Income from operations

|

$65

|

$106

|

$103

|

||

|

In millions

|

2011

|

2010

|

2009

|

||

|

Product revenue

|

$2,744

|

$2,400

|

$2,228

|

||

|

Cost of products

|

2,209

|

1,923

|

1,808

|

||

|

Product gross margin

|

$535

|

$477

|

$420

|

||

|

Product gross margin as a percentage of revenue

|

19.5%

|

19.9%

|

18.9%

|

||

|

Services revenue

|

$2,699

|

$2,410

|

$2,371

|

||

|

Cost of services

|

2,099

|

1,923

|

1,911

|

||

|

Services gross margin

|

$600

|

$487

|

$460

|

||

|

Services gross margin as a percentage of revenue

|

22.2%

|

20.2%

|

19.4%

|

||

|

In millions

|

2011

|

% of Total

|

2010

|

% of Total

|

% Increase (Decrease)

|

% Increase (Decrease) Constant Currency

|

||

|

Brazil, India, China and Middle East Africa (BICMEA)

|

$849

|

16%

|

$753

|

16%

|

13%

|

12%

|

||

|

North America

|

2,272

|

42%

|

1,866

|

39%

|

22%

|

20%

|

||

|

Europe

|

1,421

|

26%

|

1,378

|

28%

|

3%

|

(2)%

|

||

|

Japan Korea

|

332

|

6%

|

348

|

7%

|

(5)%

|

(14)%

|

||

|

South Asia Pacific

|

345

|

6%

|

286

|

6%

|

21%

|

11%

|

||

|

Caribbean Latin America (CLA)

|

224

|

4%

|

179

|

4%

|

25%

|

23%

|

||

|

Consolidated revenue

|

$5,443

|

100%

|

$4,810

|

100%

|

13%

|

10%

|

||

|

In millions

|

2011

|

2010

|

2009

|

||

|

Pension expense

|

$222

|

$208

|

$159

|

||

|

Postemployment expense

|

46

|

43

|

49

|

||

|

Postretirement benefit

|

(13)

|

(4)

|

(3)

|

||

|

Total expense

|

$255

|

$247

|

$205

|

||

|

•

|

Financial Services -

We offer solutions to enable customers in the financial services industry to reduce costs, generate new revenue streams and enhance customer loyalty. These solutions include a comprehensive line of ATM and payment processing hardware and software, and related installation, maintenance, and managed and professional services. We also offer a complete line of printer consumables.

|

|

•

|

Retail Solutions

- We offer solutions to customers in the retail industry designed to improve selling productivity and checkout processes as well as increase service levels. These solutions primarily include retail-oriented technologies, such as point of sale terminals and bar-code scanners, as well as innovative self-service kiosks, such as self-checkout. We also offer installation, maintenance, and managed and professional services and a complete line of printer consumables.

|

|

•

|

Hospitality and Specialty Retail

- The former business of Radiant is managed and reported as a separate segment, Hospitality and Specialty Retail. Through this line of business, we offer technology solutions to customers in the hospitality, convenience, and specialty retail industries, serving businesses that range from a single store or restaurant to global chains and the world's largest sports stadiums. Our solutions include point of sale hardware and software solutions, installation, maintenance, and managed and professional services and a complete line of printer consumables.

|

|

•

|

Entertainment -

We offer solutions that provide the consumer the ability to rent or buy movies at their convenience through self-service kiosks which we own and operate.

|

|

•

|

Emerging Industries -

We offer maintenance and managed and professional services for third-party computer hardware provided to select manufacturers, primarily in the telecommunications industry, who value and leverage our global service capability. Also included in the Emerging Industries segment are solutions designed to enhance the customer experience for the travel and gaming industries, including self-service kiosks, as well as related installation, maintenance, and managed and professional services.

|

|

In millions

|

2011

|

2010

|

2009

|

||

|

Revenue

|

$2,999

|

$2,645

|

$2,614

|

||

|

Operating income

|

$313

|

$250

|

$252

|

||

|

Operating income as a percentage of revenue

|

10.4%

|

9.5%

|

9.6%

|

||

|

In millions

|

2011

|

2010

|

2009

|

||

|

Revenue

|

$1,755

|

$1,705

|

$1,610

|

||

|

Operating income

|

$83

|

$79

|

$14

|

||

|

Operating income as a percentage of revenue

|

4.7%

|

4.6%

|

0.9%

|

||

|

In millions

|

2011

|

2010

|

2009

|

||

|

Revenue

|

$141

|

—

|

—

|

||

|

Operating income

|

$22

|

—

|

—

|

||

|

Operating income as a percentage of revenue

|

15.6%

|

—%

|

—%

|

||

|

In millions

|

2011

|

2010

|

2009

|

||

|

Revenue

|

$163

|

$102

|

$27

|

||

|

Operating loss

|

$(60)

|

$(50)

|

$(33)

|

||

|

Operating loss as a percentage of revenue

|

(36.8)%

|

(49.0)%

|

(122.2)%

|

||

|

In millions

|

2011

|

2010

|

2009

|

||

|

Revenue

|

$385

|

$358

|

$348

|

||

|

Operating income

|

$76

|

$61

|

$57

|

||

|

Operating income as a percentage of revenue

|

19.7%

|

17.0%

|

16.4%

|

||

|

In millions

|

2011

|

2010

|

2009

|

||

|

Net cash provided by operating activities

|

$375

|

$247

|

$260

|

||

|

Less: Expenditures for property, plant and equipment, net of grant reimbursements

|

(101)

|

(169)

|

(112)

|

||

|

Less: Additions to capitalized software

|

(62)

|

(57)

|

(61)

|

||

|

Net cash (used in) provided by discontinued operations

|

(24)

|

16

|

(37)

|

||

|

Free cash flow (non-GAAP)

|

$188

|

$37

|

$50

|

||

|

In millions

|

Total Amounts

|

2012

|

2013 - 2014

|

2015 - 2016

|

2017 & Thereafter

|

All Other

|

||||||||||||

|

Debt obligations

|

$

|

853

|

|

$

|

1

|

|

$

|

141

|

|

$

|

702

|

|

$

|

9

|

|

$

|

—

|

|

|

Interest on debt obligations

|

117

|

|

27

|

|

50

|

|

38

|

|

2

|

|

—

|

|

||||||

|

Estimated environmental liability payments

|

240

|

|

40

|

|

74

|

|

51

|

|

75

|

|

—

|

|

||||||

|

Lease obligations

|

205

|

|

62

|

|

83

|

|

47

|

|

13

|

|

—

|

|

||||||

|

Purchase obligations

|

880

|

|

772

|

|

71

|

|

37

|

|

—

|

|

—

|

|

||||||

|

Uncertain tax positions

|

148

|

|

—

|

|

—

|

|

—

|

|

—

|

|

148

|

|

||||||

|

Total obligations

|

$

|

2,443

|

|

$

|

902

|

|

$

|

419

|

|

$

|

875

|

|

$

|

99

|

|

$

|

148

|

|

|

•

|

a consolidated leverage ratio on the last day of any fiscal quarter, commencing with the fiscal quarter ending December 31, 2011, not to exceed (i)

3.50 to 1.00

for each fiscal quarter ending prior to December 31, 2013, (ii)

3.25 to 1.00

for each fiscal quarter ending on or after December 31, 2013 and prior to December 31, 2014, and (iii)

3.00 to 1.00

for each fiscal quarter ending on or after December 31, 2014; and

|

|

•

|

|

|

•

|

an interest coverage ratio of at least (i) 3.50 to 1.00, in the case of any four consecutive fiscal quarters ending prior to December 31, 2013, and (ii) 4.00 to 1.00, in the case of any four consecutive fiscal quarters ending on or after December 31, 2013.

|

|

•

|

The total clean-up costs for the site (we use the best estimate within a range of reasonably possible outcomes—

$852 million

—which consists of the current estimate of the lower river clean-up and long-term monitoring costs developed in consultation with the engineering firms working on the design, the projected costs of the upper river clean-up, plus a

15%

contingency for probable cost overruns and a contingency for future Government oversight costs, and the NCR-API share of the estimated natural resource damages);

|

|

•

|

The total natural resource damages for the site (we use a best estimate of

$76 million

, which is based on prior negotiations);

|

|

•

|

The share NCR and API will jointly bear of the total clean-up costs (as a result of the December 2009 and February 2011 judicial orders discussed in Note 9, we now assume NCR and API will be responsible for the full extent of the clean-up activities they are undertaking, which is a best estimate, and for a substantial portion of the counterclaims filed against them, as to which we use the low end of a range) and of natural resource damages (we use a best estimate);

|

|

•

|

The share NCR will bear of the joint NCR/API payments for clean-up costs and natural resource damages (based upon an agreement between NCR and API, and an arbitration award, we utilized a

45%

share for NCR of the first

$75 million

—a threshold that was reached in the second quarter of 2008—and a

40%

share for amounts in excess of

$75 million

); and

|

|

•

|

Our transaction costs to defend NCR in this matter, including participation in litigation to establish proper allocation shares and the lawsuit filed by the Governments on October 14, 2010 as described in Note 9 (we have estimated the costs we are likely to incur through 2017, the end of the time period the Governments have projected it will take to design and implement the remedy for the Fox River).

|

|

Item 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

|

For the years ended December 31 (in millions except per share amounts)

|

2011

|

2010

|

2009

|

||||||||

|

Product revenue

|

$

|

2,744

|

|

$

|

2,400

|

|

$

|

2,228

|

|

||

|

Service revenue

|

2,699

|

|

2,410

|

|

2,371

|

|

|||||

|

Total revenue

|

5,443

|

|

4,810

|

|

4,599

|

|

|||||

|

Cost of products

|

2,209

|

|

1,923

|

|

1,808

|

|

|||||

|

Cost of services

|

2,099

|

|

1,923

|

|

1,911

|

|

|||||

|

Selling, general and administrative expenses

|

805

|

|

696

|

|

636

|

|

|||||

|

Research and development expenses

|

177

|

|

162

|

|

141

|

|

|||||

|

Impairment of long-lived and other assets

|

88

|

|

—

|

|

—

|

|

|||||

|

Total operating expenses

|

5,378

|

|

4,704

|

|

4,496

|

|

|||||

|

Income from operations

|

65

|

|

106

|

|

103

|

|

|||||

|

Interest expense

|

(13

|

)

|

(2

|

)

|

(10

|

)

|

|||||

|

Other (expense) income, net

|

(3

|

)

|

(11

|

)

|

(31

|

)

|

|||||

|

Income from continuing operations before income taxes

|

49

|

|

93

|

|

62

|

|

|||||

|

Income tax (benefit) expense

|

—

|

|

(26

|

)

|

(3

|

)

|

|||||

|

Income from continuing operations

|

49

|

|

119

|

|

65

|

|

|||||

|

Income (loss) from discontinued operations, net of tax

|

3

|

|

18

|

|

(95

|

)

|

|||||

|

Net income (loss)

|

52

|

|

137

|

|

(30

|

)

|

|||||

|

Net (loss) income attributable to noncontrolling interests

|

(1

|

)

|

3

|

|

3

|

|

|||||

|

Net income (loss) attributable to NCR

|

$

|

53

|

|

$

|

134

|

|

$

|

(33

|

)

|

||

|

Amounts attributable to NCR common stockholders:

|

|

|

|

||||||||

|

Income from continuing operations

|

$

|

50

|

|

$

|

116

|

|

$

|

62

|

|

||

|

Income (loss) from discontinued operations, net of tax

|

3

|

|

18

|

|

(95

|

)

|

|||||

|

Net income (loss)

|

$

|

53

|

|

$

|

134

|

|

$

|

(33

|

)

|

||

|

Net income per share attributable to NCR common stockholders:

|

|

|

|

||||||||

|

Net income per common share from continuing operations

|

|

|

|

||||||||

|

Basic

|

$

|

0.32

|

|

$

|

0.73

|

|

$

|

0.39

|

|

||

|

Diluted

|

$

|

0.31

|

|

$

|

0.72

|

|

$

|

0.39

|

|

||

|

Net income (loss) per common share

|

|

|

|

||||||||

|

Basic

|

$

|

0.34

|

|

$

|

0.84

|

|

$

|

(0.21

|

)

|

||

|

Diluted

|

$

|

0.33

|

|

$

|

0.83

|

|

$

|

(0.21

|

)

|

||

|

Weighted average common shares outstanding

|

|

|

|

||||||||

|

Basic

|

158.0

|

|

159.8

|

|

158.9

|

|

|||||

|

Diluted

|

161.0

|

|

161.2

|

|

160.1

|

|

|||||

|

As of December 31 (in millions except per share amounts)

|

2011

|

2010

|

|||||

|

Assets

|

|||||||

|

Current assets

|

|||||||

|

Cash and cash equivalents

|

$

|

398

|

|

$

|

496

|

|

|

|

Accounts receivable, net

|

1,038

|

|

928

|

|

|||

|

Inventories, net

|

774

|

|

741

|

|

|||

|

Other current assets

|

305

|

|

313

|

|

|||

|

Total current assets

|

2,515

|

|

2,478

|

|

|||

|

Property, plant and equipment, net

|

365

|

|

429

|

|

|||

|

Goodwill

|

913

|

|

115

|

|

|||

|

Intangibles

|

312

|

|

15

|

|

|||

|

Prepaid pension cost

|

339

|

|

286

|

|

|||

|

Deferred income taxes

|

714

|

|

630

|

|

|||

|

Other assets

|

433

|

|

408

|

|

|||

|

Total assets

|

$

|

5,591

|

|

$

|

4,361

|

|

|

|

Liabilities and stockholders’ equity

|

|||||||

|

Current liabilities

|

|||||||

|

Short-term borrowings

|

$

|

1

|

|

$

|

1

|

|

|

|

Accounts payable

|

525

|

|

499

|

|

|||

|

Payroll and benefits liabilities

|

221

|

|

175

|

|

|||

|

Deferred service revenue and customer deposits

|

418

|

|

362

|

|

|||

|

Other current liabilities

|

400

|

|

379

|

|

|||

|

Total current liabilities

|

1,565

|

|

1,416

|

|

|||

|

Long-term debt

|

852

|

|

10

|

|

|||

|

Pension and indemnity plan liabilities

|

1,662

|

|

1,259

|

|

|||

|

Postretirement and postemployment benefits liabilities

|

256

|

|

309

|

|

|||

|

Income tax accruals

|

148

|

|

165

|

|

|||

|

Environmental liabilities

|

220

|

|

244

|

|

|||

|

Other liabilities

|

53

|

|

42

|

|

|||

|

Total liabilities

|

4,756

|

|

3,445

|

|

|||

|

Commitments and contingencies (Note 9)

|

|

|

|||||

|

Redeemable noncontrolling interest

|

1

|

|

—

|

|

|||

|

Stockholders’ equity

|

|||||||

|

NCR stockholders’ equity

|

|||||||

|

Preferred stock: par value $0.01 per share, 100.0 shares authorized, no shares issued and outstanding as of December 31, 2011 and December 31, 2010

|

—

|

|

—

|

|

|||

|

Common stock: par value $0.01 per share, 500.0 shares authorized, 157.6 and 159.7 shares issued and outstanding as of December 31, 2011 and December 31, 2010, respectively

|

2

|

|

2

|

|

|||

|

Paid-in capital

|

301

|

|

281

|

|

|||

|

Retained earnings

|

1,988

|

|

1,935

|

|

|||

|

Accumulated other comprehensive loss

|

(1,492

|

)

|

(1,335

|

)

|

|||

|

Total NCR stockholders’ equity

|

799

|

|

883

|

|

|||

|

Noncontrolling interests in subsidiaries

|

35

|

|

33

|

|

|||

|

Total stockholders’ equity

|

834

|

|

916

|

|

|||

|

Total liabilities and stockholders’ equity

|

$

|

5,591

|

|

$

|

4,361

|

|

|

|

For the years ended December 31 (in millions)

|

2011

|

2010

|

2009

|

||||||||

|

Operating activities

|

|||||||||||

|

Net income (loss)

|

$

|

52

|

|

$

|

137

|

|

$

|

(30

|

)

|

||

|

Adjustments to reconcile net income (loss) to net cash provided by operating activities:

|

|||||||||||

|

(Income) loss from discontinued operations

|

(3

|

)

|

(18

|

)

|

95

|

|

|||||

|

Depreciation and amortization

|

168

|

|

138

|

|

128

|

|

|||||

|

Stock-based compensation expense

|

33

|

|

21

|

|

12

|

|

|||||

|

Excess tax benefit from stock-based compensation

|

(1

|

)

|

—

|

|

|

|

|||||

|

Deferred income taxes

|

(64

|

)

|

(63

|

)

|

(78

|

)

|

|||||

|

Gain on sale of property, plant and equipment

|

(5

|

)

|

(10

|

)

|

(12

|

)

|

|||||

|

Impairment of long-lived and other assets

|

98

|

14

|

|

39

|

|

||||||

|

Changes in operating assets and liabilities:

|

|

||||||||||

|

Receivables

|

(58

|

)

|

(26

|

)

|

27

|

|

|||||

|

Inventories

|

1

|

|

(54

|

)

|

5

|

|

|||||

|

Current payables and accrued expenses

|

55

|

|

(12

|

)

|

(28

|

)

|

|||||

|

Deferred service revenue and customer deposits

|

34

|

|

34

|

|

18

|

|

|||||

|

Employee severance and pension

|

92

|

|

80

|

|

49

|

|

|||||

|

Other assets and liabilities

|

(27

|

)

|

6

|

|

35

|

|

|||||

|

Net cash provided by operating activities

|

375

|

|

247

|

|

260

|

|

|||||

|

Investing activities

|

|||||||||||

|

Grant reimbursements from capital expenditures

|

—

|

|

5

|

|

9

|

|

|||||

|

Expenditures for property, plant and equipment

|

(101

|

)

|

(174

|

)

|

(121

|

)

|

|||||

|

Proceeds from sales of property, plant and equipment

|

2

|

|

39

|

|

11

|

|

|||||

|

Additions to capitalized software

|

(62

|

)

|

(57

|

)

|

(61

|

)

|

|||||

|

Business acquisitions, net of cash acquired

|

(1,087

|

)

|

—

|

|

—

|

|

|||||

|

Other investing activities, net

|

2

|

|

(24

|

)

|

(41

|

)

|

|||||

|

Net cash used in investing activities

|

(1,246

|

)

|

(211

|

)

|

(203

|

)

|

|||||

|

Financing activities

|

|||||||||||

|

Repurchases of Company common stock

|

(70

|

)

|

(20

|

)

|

(1

|

)

|

|||||

|

Repayment of short-term borrowings

|

—

|

|

(4

|

)

|

4

|

|

|||||

|

Repayment of long-term debt

|

—

|

|

(1

|

)

|

—

|

|

|||||

|

Repayment of senior unsecured notes

|

—

|

|

—

|

|

(300

|

)

|

|||||

|

Excess tax benefit from stock-based compensation

|

1

|

|

—

|

|

—

|

|

|||||

|

Proceeds from employee stock plans

|

18

|

|

11

|

|

9

|

|

|||||

|

Borrowings on term credit facility

|

700

|

|

—

|

|

—

|

|

|||||

|

Payments on revolving credit facility

|

(260

|

)

|

(75

|

)

|

(30

|

)

|

|||||

|

Borrowings on revolving credit facility

|

400

|

|

75

|

|

30

|

|

|||||

|

Debt issuance cost

|

(29

|

)

|

—

|

|

—

|

|

|||||

|

Proceeds from sale of noncontrolling interest

|

43

|

|

—

|

|

—

|

|

|||||

|

Dividend distribution to minority shareholder

|

(1

|

)

|

—

|

|

—

|

|

|||||

|

Net cash provided by (used in) financing activities

|

802

|

|

(14

|

)

|

(288

|

)

|

|||||

|

Cash flows from discontinued operations

|

|||||||||||

|

Net cash (used in) provided by operating activities

|

(24

|

)

|

16

|

|

(37

|

)

|

|||||

|

Effect of exchange rate changes on cash and cash equivalents

|

(5

|

)

|

7

|

|

8

|

|

|||||

|

(Decrease) increase in cash and cash equivalents

|

(98

|

)

|

45

|

|

(260

|

)

|

|||||

|

Cash and cash equivalents at beginning of period

|

496

|

|

451

|

|

711

|

|

|||||

|

Cash and cash equivalents at end of period

|

$

|

398

|

|

$

|

496

|

|

$

|

451

|

|

||

|

Supplemental data

|

|||||||||||

|

Cash paid during the year for:

|

|||||||||||

|

Income taxes

|

$

|

55

|

|

$

|

34

|

|

$

|

49

|

|

||

|

Interest

|

$

|

5

|

|

$

|

2

|

|

$

|

10

|

|

||

|

NCR Stockholders

|

|||||||||||||||||||||||||||||||

|

Common Stock

|

Accumulated Other Comprehensive (Loss) Income

|

Noncontrolling Interests in Subsidiaries

|

|||||||||||||||||||||||||||||

|

Redeemable Noncontrolling Interests

|

Shares

|

Amount

|

Paid-in Capital

|

Retained Earnings

|

Total

|

||||||||||||||||||||||||||

|

December 31, 2008

|

$

|

—

|

|

158

|

|

$

|

2

|

|

$

|

248

|

|

$

|

1,834

|

|

$

|

(1,644

|

)

|

$

|

25

|

|

$

|

465

|

|

||||||||

|

Comprehensive income (loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Net income (loss)

|

—

|

|

—

|

|

—

|

|

—

|

|

(33

|

)

|

—

|

|

3

|

|

(30

|

)

|

|||||||||||||||

|

Other comprehensive (loss) income:

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Currency translation adjustments

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

28

|

|

—

|

|

28

|

|

|||||||||||||||

|

Unrealized gain (loss) from securities, net of tax expense of $0

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1

|

|

—

|

|

1

|

|

|||||||||||||||

|

Cash flow hedging gains (losses), net of tax expense of $0

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

8

|

|

—

|

|

8

|

|

|||||||||||||||

|

Changes to unrecognized losses and prior service cost related to pension, postretirement and postemployment benefits, net of tax expense of $110

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

98

|

|

—

|

|

98

|

|

|||||||||||||||

|

Total other comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

135

|

|

—

|

|

135

|

|

|||||||||||||||

|

Total comprehensive (loss) income

|

—

|

|

—

|

|

—

|

|

—

|

|

(33

|

)

|

135

|

|

3

|

|

105

|

|

|||||||||||||||

|

Employee stock purchase and stock compensation plans

|

—

|

|

2

|

|

—

|

|

23

|

|

—

|

|

—

|

|

—

|

|

23

|

|

|||||||||||||||

|

Repurchase of Company common stock

|

—

|

|

—

|

|

—

|

|

(1

|

)

|

—

|

|

—

|

|

—

|

|

(1

|

)

|

|||||||||||||||

|

December 31, 2009

|

$

|

—

|

|

160

|

|

$

|

2

|

|

$

|

270

|

|

$

|

1,801

|

|

$

|

(1,509

|

)

|

$

|

28

|

|

$

|

592

|

|

||||||||

|

Comprehensive income (loss):

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Net income (loss)

|

—

|

|

—

|

|

—

|

|

—

|

|

134

|

|

—

|

|

3

|

|

137

|

|

|||||||||||||||

|

Other comprehensive (loss) income:

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Currency translation adjustments

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

30

|

|

2

|

|

32

|

|

|||||||||||||||

|

Unrealized gain (loss) from securities, net of tax expense of $0

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(1

|

)

|

—

|

|

(1

|

)

|

|||||||||||||||

|

Cash flow hedging gains (losses), net of tax expense of $1

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

5

|

|

—

|

|

5

|

|

|||||||||||||||

|

Changes to unrecognized losses and prior service cost related to pension, postretirement and postemployment benefits, net of tax expense of $27

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

140

|

|

—

|

|

140

|

|

|||||||||||||||

|

Total other comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

174

|

|

2

|

|

176

|

|

|||||||||||||||

|

Total comprehensive (loss) income

|

—

|

|

—

|

|

—

|

|

—

|

|

134

|

|

174

|

|

5

|

|

313

|

|

|||||||||||||||

|

Employee stock purchase and stock compensation plans

|

—

|

|

2

|

|

—

|

|

31

|

|

—

|

|

—

|

|

—

|

|

31

|

|

|||||||||||||||

|

Repurchase of Company common stock

|

—

|

|

(2

|

)

|

—

|

|

(20

|

)

|

—

|

|

—

|

|

—

|

|

(20

|

)

|

|||||||||||||||

|

December 31, 2010

|

$

|

—

|

|

160

|

|

$

|

2

|

|

$

|

281

|

|

$

|

1,935

|

|

$

|

(1,335

|

)

|

$

|

33

|

|

$

|

916

|

|

||||||||

|

Comprehensive income (loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Net income (loss)

|

(2

|

)

|

—

|

|

—

|

|

—

|

|

53

|

|

—

|

|

1

|

|

54

|

|

|||||||||||||||

|

Other comprehensive (loss) income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Currency translation adjustments

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(28

|

)

|

2

|

|

(26

|

)

|

|||||||||||||||

|

Unrealized gain (loss) from securities, net of tax expense of $0

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(1

|

)

|

—

|

|

(1

|

)

|

|||||||||||||||

|

Cash flow hedging gains (losses), net of tax benefit of $3

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(5

|

)

|

—

|

|

(5

|

)

|

|||||||||||||||

|

Changes to unrecognized losses and prior service cost related to pension, postretirement and postemployment benefits, net of tax benefit of $67

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(123

|

)

|

—

|

|

(123

|

)

|

|||||||||||||||

|

Total other comprehensive income (loss)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(157

|

)

|

2

|

|

(155

|

)

|

|||||||||||||||

|

Total comprehensive (loss) income

|

(2

|

)

|

—

|

|

—

|

|

—

|

|

53

|

|

(157

|

)

|

3

|

|

(101

|

)

|

|||||||||||||||

|

Employee stock purchase and stock compensation plans

|

—

|

|

1

|

|

—

|

|

53

|

|

—

|

|

—

|

|

—

|

|

53

|

|

|||||||||||||||

|

Repurchase of Company common stock

|

—

|

|

(3

|

)

|

—

|

|

(70

|

)

|

—

|

|

—

|

|

—

|

|

(70

|

)

|

|||||||||||||||

|

Dividends distribution to minority shareholder

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(1

|

)

|

(1

|

)

|

|||||||||||||||

|

Sale of redeemable noncontrolling interests

|

3

|

|

—

|

|

—

|

|

37

|

|

—

|

|

—

|

|

—

|

|

37

|

|

|||||||||||||||

|

December 31, 2011

|

$

|

1

|

|

158

|

|

$

|

2

|

|

$

|

301

|

|

$

|

1,988

|

|

$

|

(1,492

|

)

|

$

|

35

|

|

$

|

834

|

|

||||||||

|

In millions

|

2011

|

2010

|

2009

|

||||||||

|

Beginning balance as of January 1

|

$

|

107

|

|

$

|

102

|

|

$

|

92

|

|

||

|

Capitalization

|

62

|

|

57

|

|

61

|

|

|||||

|

Amortization

|

(51

|

)

|

(52

|

)

|

(51

|

)

|

|||||

|

Ending balance as of December 31

|

$

|

118

|

|

$

|

107

|

|

$

|

102

|

|

||

|

•

|

Level 1: Unadjusted quoted prices in active markets for identical assets or liabilities

|

|

•

|

Level 2: Unadjusted quoted prices in active markets for similar assets or liabilities, unadjusted quoted prices for identical or similar assets or liabilities in markets that are not active or inputs, other than quoted prices in active markets, that are observable either directly or indirectly

|

|

•

|

Level 3: Unobservable inputs for which there is little or no market data

|

|

•

|

Market approach: Prices and other relevant information generated by market transactions involving identical or comparable assets or liabilities.

|

|

•

|

Cost approach: Amount that would be required to replace the service capacity of an asset (replacement cost).

|

|

•

|

Income approach: Techniques to convert future amounts to a single present amount based upon market expectations (including present value techniques, option pricing and excess earnings models).

|

|

In millions, except per share amounts

|

2011

|

2010

|

2009

|

|||||||||

|

Income from continuing operations

|

$

|

50

|

|

$

|

116

|

|

$

|

62

|

|

|||

|

Income (loss) from discontinued operations, net of tax

|

3

|

|

18

|

|

(95

|

)

|

||||||

|

Net income (loss) attributable to NCR common stockholders

|

$

|

53

|

|

$

|

134

|

|

$

|

(33

|

)

|

|||

|

Weighted average outstanding shares of common stock

|

158.0

|

|

159.8

|

|

158.9

|

|

||||||

|

Dilutive effect of employee stock options and restricted stock

|

3.0

|

|

1.4

|

|

1.2

|

|

||||||

|

Common stock and common stock equivalents

|

161.0

|

|

161.2

|

|

160.1

|

|

||||||

|

Basic earnings (loss) per share:

|

||||||||||||

|

From continuing operations

|

$

|

0.32

|

|

$

|

0.73

|

|

$

|

0.39

|

|

|||

|

From discontinued operations

|

0.02

|

|

0.11

|

|

(0.60

|

)

|

||||||

|

Total basic earnings (loss) per share

|

$

|

0.34

|

|

$

|

0.84

|

|

$

|

(0.21

|

)

|

|||

|

Diluted earnings (loss) per share:

|

||||||||||||

|

From continuing operations

|

$

|

0.31

|

|

$

|

0.72

|

|

$

|

0.39

|

|

|||

|

From discontinued operations

|

0.02

|

|

0.11

|

|

(0.60

|

)

|

||||||

|

Total diluted earnings (loss) per share

|

$

|

0.33

|

|

$

|

0.83

|

|

$

|

(0.21

|

)

|

|||

|

For the years ended December 31

|

2011

|

2010

|

2009

|

|||||||||

|

Other (expense) income, net

|

||||||||||||

|

Interest income

|

$

|

5

|

|

$

|

5

|

|

$

|

6

|

|

|||

|

Impairment of an investment (Note 11)

|

—

|

|

(14

|

)

|

(24

|

)

|

||||||

|

Other, net

|

(8

|

)

|

(2

|

)

|

(13

|

)

|

||||||

|

Total other (expense) income, net

|

$

|

(3

|

)

|

$

|

(11

|

)

|

$

|

(31

|

)

|

|||

|

At December 31

|

2011

|

2010

|

||||||||||

|

Accounts Receivable

|

||||||||||||

|

Trade

|

$

|

1,002

|

|

$

|

878

|

|

||||||

|

Other

|

52

|

|

63

|

|

||||||||

|

Accounts Receivable, gross

|

1,054

|

|

941

|

|

||||||||

|

Less: allowance for doubtful accounts

|

(16

|

)

|

(13

|

)

|

||||||||

|

Total accounts receivable, net

|

$

|

1,038

|

|

$

|

928

|

|

||||||

|

Inventories

|

||||||||||||

|

Work in process and raw materials, net

|

$

|

167

|

|

$

|

143

|

|

||||||

|

Finished goods, net

|

177

|

|

180

|

|

||||||||

|

Service parts, net

|

430

|

|

418

|

|

||||||||

|

Total inventories, net

|

$

|

774

|

|

$

|

741

|

|

||||||

|

Other current assets

|

||||||||||||

|

Current deferred tax assets

|

$

|

147

|

|

$

|

125

|

|

||||||

|

Other

|

158

|

|

188

|

|

||||||||

|

Total other current assets

|

$

|

305

|

|

$

|

313

|

|

||||||

|

Property, plant and equipment

|

||||||||||||

|

Land and improvements

|

$

|

46

|

|

$

|

43

|

|

||||||

|

Buildings and improvements

|

234

|

|

234

|

|

||||||||

|

Machinery and other equipment

|

674

|

|

818

|

|

||||||||

|

Property, plant and equipment, gross

|

954

|

|

1,095

|

|

||||||||

|

Less: accumulated depreciation

|

(589

|

)

|

(666

|

)

|

||||||||

|

Total property, plant and equipment, net

|

$

|

365

|

|

$

|

429

|

|

||||||

|

Accumulated other comprehensive loss, net of tax

|

||||||||||||

|

Currency translation adjustments

|

$

|

(82

|

)

|

$

|

(54

|

)

|

||||||

|

Unrealized gain on securities

|

1

|

|

2

|

|

||||||||

|

Unrealized gain on derivatives

|

—

|

|

5

|

|

||||||||

|

Actuarial losses and prior service costs on employee benefit plans

|

(1,411

|

)

|

(1,288

|

)

|

||||||||

|

Total accumulated other comprehensive loss

|

$

|

(1,492

|

)

|

$

|

(1,335

|

)

|

||||||

|

•

|

Acquisition of Radiant on August 24, 2011, as described below.

|

|

•

|

1%

minority investment in ViVOtech Inc. on March 18, 2010, bringing the Company’s total investment in ViVOtech Inc. at that time to

6%

. This additional investment was recorded as a cost method investment.

|

|

•

|

17%

minority investment in Document Capture Technologies Inc. (DCT), a provider of imaging technology solutions on August 5, 2010. DCT’s product is designed to facilitate the way information is stored, shared and managed for business and personal use. The Company recorded this transaction as an equity method investment.

|

|

•

|

8%

minority investment in MOD Systems Inc. on August 20, 2010, bringing the Company’s total investment in MOD Systems Inc. to

16%

. Of this additional investment,

5%