|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2018

|

|

|

OR

|

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

|

|

For the transition period from ________ to ________

|

|

|

Delaware

(State or Other Jurisdiction of Incorporation or Organization)

|

52-1165937

(I.R.S. Employer Identification No.)

|

|

|

|

|

One Liberty Plaza, New York, New York

(Address of Principal Executive Offices)

|

10006

(Zip Code)

|

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Stock, $.01 par value per share

|

The Nasdaq Stock Market

|

|

Large accelerated filer

|

☒

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

☐

|

|

Emerging growth company

|

☐

|

||

|

Class

|

Outstanding at February 14, 2019

|

|

|

Common Stock, $.01 par value per share

|

165,420,039 shares

|

|

|

DOCUMENTS INCORPORATED BY REFERENCE

|

|

|

Document

|

Parts Into Which Incorporated

|

|

Certain portions of the Definitive Proxy Statement for the 2019 Annual Meeting

of Stockholders

|

Part III

|

|

|

|

Page

|

|

Part I.

|

|

|

|

|

|

|

|

Item 1.

|

||

|

|

|

|

|

Item 1A.

|

||

|

|

|

|

|

Item 1B.

|

||

|

|

|

|

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

Part II.

|

||

|

|

|

|

|

Item 5.

|

||

|

|

|

|

|

Item 6.

|

||

|

|

|

|

|

Item 7.

|

||

|

|

|

|

|

Item 7A.

|

||

|

|

|

|

|

Item 8.

|

||

|

|

|

|

|

Item 9.

|

||

|

|

|

|

|

Item 9A.

|

||

|

|

|

|

|

Item 9B.

|

||

|

|

|

|

|

Part III.

|

||

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

Part IV.

|

||

|

Item 15.

|

||

|

Item 16.

|

||

|

•

|

“Nasdaq,” “we,” “us” and “our” refer to Nasdaq, Inc.

|

|

•

|

“Nasdaq Baltic” refers to collectively, Nasdaq Tallinn AS, Nasdaq Riga, AS, and AB Nasdaq Vilnius.

|

|

•

|

“Nasdaq BX” refers to the cash equity exchange operated by Nasdaq BX, Inc.

|

|

•

|

“Nasdaq BX Options” refers to the options exchange operated by Nasdaq BX, Inc.

|

|

•

|

“Nasdaq Clearing” refers to the clearing operations conducted by Nasdaq Clearing AB.

|

|

•

|

“Nasdaq GEMX” refers to the options exchange operated by Nasdaq GEMX, LLC.

|

|

•

|

“Nasdaq ISE” refers to the options exchange operated by Nasdaq ISE, LLC.

|

|

•

|

“Nasdaq MRX” refers to the options exchange operated by Nasdaq MRX, LLC.

|

|

•

|

“Nasdaq Nordic” refers to collectively, Nasdaq Clearing AB, Nasdaq Stockholm AB, Nasdaq Copenhagen A/S, Nasdaq Helsinki Ltd, and Nasdaq Iceland hf.

|

|

•

|

“Nasdaq PHLX” refers to the options exchange operated by Nasdaq PHLX LLC.

|

|

•

|

“Nasdaq PSX” refers to the cash equity exchange operated by Nasdaq PHLX LLC.

|

|

•

|

“The Nasdaq Stock Market” refers to the cash equity exchange operated by The Nasdaq Stock Market LLC.

|

|

•

|

our strategy, growth forecasts and 2019 outlook;

|

|

•

|

the integration of acquired businesses, including accounting decisions relating thereto;

|

|

•

|

the scope, nature or impact of acquisitions, divestitures, investments, joint ventures or other transactional activities;

|

|

•

|

the effective dates for, and expected benefits of, ongoing initiatives, including transactional activities and other strategic, restructuring, technology, de-leveraging and capital return initiatives;

|

|

•

|

our products, order backlog and services;

|

|

•

|

the impact of pricing changes;

|

|

•

|

tax matters;

|

|

•

|

the cost and availability of liquidity and capital; and

|

|

•

|

any litigation, or any regulatory or government investigation or action, to which we are or could become a party or which may affect us.

|

|

•

|

our operating results may be lower than expected;

|

|

•

|

our ability to successfully integrate acquired businesses or divest sold businesses or assets, including the fact that any integration or transition may be more difficult, time consuming or costly than expected, and we may be unable to realize synergies from business combinations, acquisitions, divestitures or other transactional activities;

|

|

•

|

loss of significant trading and clearing volumes or values, fees, market share, listed companies, market data products customers or other customers;

|

|

•

|

our ability to keep up with rapid technological advances and adequately address cybersecurity risks;

|

|

•

|

economic, political and market conditions and fluctuations, including interest rate and foreign currency risk, inherent in U.S. and international operations;

|

|

•

|

the performance and reliability of our technology and technology of third parties on which we rely;

|

|

•

|

any significant error in our operational processes;

|

|

•

|

our ability to continue to generate cash and manage our indebtedness; and

|

|

•

|

adverse changes that may occur in the litigation or regulatory areas, or in the securities markets generally.

|

|

•

|

Increasing Investment in Businesses Where We See the Highest Growth Opportunity

. We have increased investment in areas that we believe help solve our clients’ biggest challenges and are likely to generate growth for our stockholders. In 2018, these businesses included: the data analytics business within our Information Services segment, NPM, within our Corporate Services segment, and our Market Technology segment (including our regulatory technology business).

|

|

•

|

Sustaining Our Foundation.

As we strive to grow our business, we also have focused on enhancing our leadership position in the marketplaces in which we operate as we continue to innovate with new functionality and strong market share in our core markets.

|

|

•

|

Optimizing Slower Growth Businesses

. We continually review areas that are not critical to our core. In these areas, we expect to target resiliency and efficiency versus growth, and free up resources when possible to redirect toward greater opportunities. In furtherance of this strategy, in April 2018 we sold the public relations (Public Relations Solutions) and webcasting and webhosting (Digital Media Services) businesses within our Corporate Solutions business to West Corporation.

In addition, in December 2018, we sold our 5.0% ownership interest in LCH.

|

|

•

|

Investor Relations Intelligence

. We offer a global team of consultative experts that deliver advisory services including Strategic Capital Intelligence, Shareholder Identification and Perception Studies as well as an industry-leading software, Nasdaq IR Insight®, to investor relations professionals. These solutions allow investor relations officers to better manage their investor relations programs, understand their investor base, target new investors, manage meetings and consume key data elements such as equity research, consensus estimates and news.

|

|

•

|

Board & Leadership.

We provide a global technology offering that streamlines the meeting process for board of directors and executive leadership teams and helps them accelerate decision marking and strengthen governance. Our solutions protect sensitive data and facilitate productive collaboration, so board members and teams can work faster and more effectively.

|

|

•

|

Governance, Risk & Compliance.

We offer a global suite of managed services and solutions for risk management, internal audit and regulatory compliance.

|

|

Switches from the New York Stock Exchange LLC, or NYSE, and NYSE American LLC, or NYSE American

|

18

|

|

|

IPOs

|

186

|

|

|

Upgrades from OTC

|

43

|

|

|

ETPs and Other Listings

|

56

|

|

|

Total

|

303

|

|

|

•

|

Market Data;

|

|

•

|

Index; and

|

|

•

|

Investment Data & Analytics.

|

|

•

|

Develop efficient and reliable technologies to facilitate capital markets activity;

|

|

•

|

Manage the complexities and costs of business on a global scale; and

|

|

•

|

Provide data, tools and insights that drive sound decision making.

|

|

•

|

Brokers and Traders

- Helping brokers and traders to confidently plan, optimize and execute their business vision.

|

|

•

|

Market Participants

- Enabling market participants to monitor and capitalize on real-time market changes.

|

|

•

|

Investors and Asset Managers

- Offering products and services to assist investors and asset managers in optimizing their portfolios and offerings.

|

|

•

|

Listed Companies

- Promoting the capital health of our listed companies.

|

|

•

|

Private Companies

- Working with private companies to meet liquidity needs, manage relationships with long-term institutional investors and oversee their entire equity program.

|

|

•

|

Market Infrastructure Players

- Assisting market infrastructure players (exchanges, regulators, clearinghouses, and Central Securities Depositories) in increasing efficiency, meeting customer needs and growing revenue.

|

|

•

|

Capital-Markets

- Delivering efficiencies through economies of scale (cost, speed, connectivity) to all members of the capital-markets ecosystem.

|

|

•

|

regulation of our registered national securities exchanges; and

|

|

•

|

regulation of our U.S. broker-dealer and investment advisor subsidiaries.

|

|

•

|

agreements with FINRA covering the enforcement of common rules, the majority of which relate to the regulation of common members of our SROs and FINRA;

|

|

•

|

joint industry agreements with FINRA covering responsibility for enforcement of insider trading rules;

|

|

•

|

joint industry agreement with FINRA covering enforcement of rules related to cash equity sales practices and certain other non-market related rules; and

|

|

•

|

joint industry agreement covering enforcement of rules related to options sales practices.

|

|

•

|

difficulties, costs or complications in combining the companies’ operations, including technology platforms, which could lead to us not achieving the synergies we anticipate or customers not renewing their contracts with us as we migrate platforms;

|

|

•

|

incompatibility of systems and operating methods;

|

|

•

|

reliance on, or provision of, transition services;

|

|

•

|

inability to use capital assets efficiently to develop the business of the combined company;

|

|

•

|

difficulties of complying with government-imposed regulations in the U.S. and abroad, which may be conflicting;

|

|

•

|

resolving possible inconsistencies in standards, controls, procedures and policies, business cultures and compensation structures;

|

|

•

|

the diversion of management’s attention from ongoing business concerns and other strategic opportunities;

|

|

•

|

difficulties in operating businesses we have not operated before;

|

|

•

|

difficulties of integrating multiple acquired businesses simultaneously;

|

|

•

|

the retention of key employees and management;

|

|

•

|

the implementation of disclosure controls, internal controls and financial reporting systems at non-U.S. subsidiaries to enable us to comply with U.S. GAAP and U.S. securities laws and regulations, including the Sarbanes Oxley Act of 2002, required as a result of our status as a reporting company under the Exchange Act;

|

|

•

|

the coordination of geographically separate organizations;

|

|

•

|

the coordination and consolidation of ongoing and future research and development efforts;

|

|

•

|

possible tax costs or inefficiencies associated with integrating the operations of a combined company;

|

|

•

|

pre-tax restructuring and revenue investment costs;

|

|

•

|

the retention of strategic partners and attracting new strategic partners; and

|

|

•

|

negative impacts on employee morale and performance as a result of job changes and reassignments.

|

|

•

|

our ability to maintain the security of our data and systems;

|

|

•

|

the quality and reliability of our technology platforms and systems;

|

|

•

|

the ability to fulfill our regulatory obligations;

|

|

•

|

the ability to execute our business plan, key initiatives or new business ventures and the ability to keep up with changing customer demand;

|

|

•

|

the representation of our business in the media;

|

|

•

|

the accuracy of our financial statements and other financial and statistical information;

|

|

•

|

the accuracy of our financial guidance or other information provided to our investors;

|

|

•

|

the quality of our corporate governance structure;

|

|

•

|

the quality of our products, including the reliability of our transaction-based, Corporate Solutions and Market

|

|

•

|

the quality of our disclosure controls or internal controls over financial reporting, including any failures in supervision;

|

|

•

|

extreme price volatility on our markets;

|

|

•

|

any negative publicity surrounding our listed companies;

|

|

•

|

any negative publicity surrounding the use of our products or\and services by our customers, including in connection with emerging asset classes such as crypto assets; and

|

|

•

|

any misconduct, fraudulent activity or theft by our employees or other persons formerly or currently associated with us.

|

|

•

|

economic, political and geopolitical market conditions;

|

|

•

|

natural disasters, terrorism, war or other catastrophes;

|

|

•

|

broad trends in finance and technology;

|

|

•

|

changes in price levels and volatility in the stock markets;

|

|

•

|

the level and volatility of interest rates;

|

|

•

|

changes in government monetary or tax policy;

|

|

•

|

the perceived attractiveness of the U.S. or European capital markets; and

|

|

•

|

inflation.

|

|

•

|

reduce funds available to us for operations and general corporate purposes or for capital expenditures as a result of the dedication of a substantial portion of our consolidated cash flow from operations to the payment of principal and interest on our indebtedness;

|

|

•

|

increase our exposure to a continued downturn in general economic conditions;

|

|

•

|

place us at a competitive disadvantage compared with our competitors with less debt;

|

|

•

|

affect our ability to obtain additional financing in the future for refinancing indebtedness, acquisitions, working capital, capital expenditures or other purposes; and

|

|

•

|

increase our cost of debt and reduce or eliminate our ability to issue commercial paper.

|

|

•

|

problems with effective integration of operations;

|

|

•

|

the inability to maintain key pre-transaction business relationships;

|

|

•

|

reliance on, or provision of, transition services;

|

|

•

|

increased operating costs;

|

|

•

|

the diversion of our management team from other operations;

|

|

•

|

problems with regulatory bodies;

|

|

•

|

risks associated with divesting employees, customers or vendors when divesting businesses or assets;

|

|

•

|

declines in the value of investments;

|

|

•

|

exposure to unanticipated liabilities;

|

|

•

|

difficulties in realizing projected efficiencies, synergies and cost savings; and

|

|

•

|

changes in our credit rating and financing costs.

|

|

•

|

we may incur additional amortization expense over the estimated useful lives of certain of the intangible assets acquired in connection with acquisitions during such estimated useful lives;

|

|

•

|

we may have additional depreciation expense as a result of recording acquired tangible assets at fair value, in accordance with U.S. GAAP, as compared to book value as recorded;

|

|

•

|

to the extent the value of goodwill or intangible assets becomes impaired, we may be required to incur material charges relating to the impairment of those assets;

|

|

•

|

we may incur additional costs from integrating our acquisitions. The success of our acquisitions depends, in part, on our ability to integrate these businesses into our existing operations and realize anticipated cost savings, revenue synergies and growth opportunities; and

|

|

•

|

we may incur restructuring costs in connection with the reorganization of any of our businesses.

|

|

•

|

do not permit stockholders to act by written consent;

|

|

•

|

require certain advance notice for director nominations and actions to be taken at annual meetings; and

|

|

•

|

authorize the issuance of undesignated preferred stock, or “blank check” preferred stock, which could be issued by our board of directors without stockholder approval.

|

|

Location

|

|

Use

|

|

Size (approximate, in square feet)

|

|

|

Stockholm, Sweden

|

|

European headquarters

|

|

264,000

|

|

|

New York, New York

|

|

U.S. headquarters

|

|

113,000

|

|

|

Philadelphia, Pennsylvania

|

|

General office space

|

|

74,000

|

|

|

Atlanta, Georgia

|

|

General office space

|

|

68,000

|

|

|

New York, New York

|

Location of MarketSite

|

66,000

|

|

||

|

Bengaluru, India

|

|

General office space

|

|

63,000

|

|

|

New York, New York

|

|

General office space

|

|

53,000

|

|

|

Vilnius, Lithuania

|

|

General office space

|

|

51,000

|

|

|

Rockville, Maryland

|

|

General office space

|

|

48,000

|

|

|

Manila, Philippines

|

|

General office space

|

|

36,000

|

|

|

London, England

|

|

General office space

|

|

31,000

|

|

|

Sydney, Australia

|

|

General office space

|

|

29,000

|

|

|

Toronto, Canada

|

|

General office space

|

|

26,000

|

|

|

Period

|

(a) Total Number of Shares Purchased

|

(b) Average Price Paid Per Share

|

(c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

|

(d) Maximum Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs

(in millions)

|

||||||||||

|

October 2018

|

|

|

|

|

|

|

||||||||

|

Share repurchase program

|

—

|

|

$

|

—

|

|

—

|

|

$

|

332

|

|

||||

|

Employee transactions

(1)

|

2,060

|

|

84.57

|

|

N/A

|

|

N/A

|

|

||||||

|

November 2018

|

||||||||||||||

|

Share repurchase program

|

—

|

|

$

|

—

|

|

—

|

|

$

|

332

|

|

||||

|

Employee transactions

(1)

|

1,370

|

|

87.33

|

|

N/A

|

|

N/A

|

|

||||||

|

December 2018

|

||||||||||||||

|

Share repurchase program

|

—

|

|

$

|

—

|

|

—

|

|

$

|

332

|

|

||||

|

Employee transactions

(1)

|

66,133

|

|

82.11

|

|

N/A

|

|

N/A

|

|

||||||

|

Total Quarter Ended December 31, 2018

|

||||||||||||||

|

Share repurchase program

|

—

|

|

$

|

—

|

|

—

|

|

$

|

332

|

|

||||

|

Employee transactions

|

69,563

|

|

$

|

82.29

|

|

N/A

|

|

N/A

|

|

|||||

|

(1)

|

Represents shares we purchased from employees in connection with the settlement of employee tax withholding obligations arising from the vesting of restricted stock and PSUs.

|

|

Fiscal Year Ended December 31,

|

|||||||||||||||||||||

|

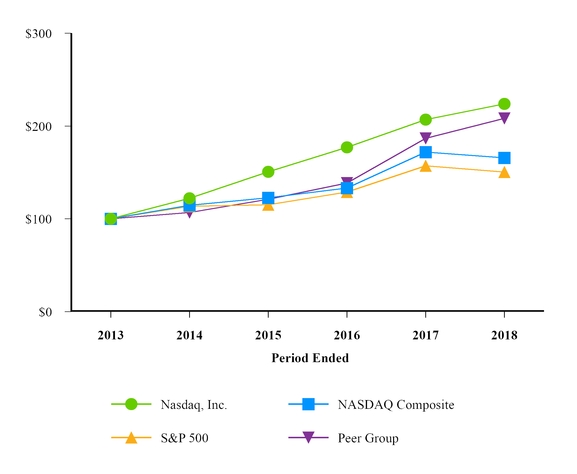

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

||||||||||||||||

|

Nasdaq, Inc.

|

$ 100

|

$

|

122

|

|

$

|

151

|

|

$

|

177

|

|

$

|

207

|

|

$

|

224

|

|

|||||

|

Nasdaq Composite

|

100

|

115

|

|

123

|

|

133

|

|

172

|

|

166

|

|

||||||||||

|

S&P 500

|

100

|

114

|

|

115

|

|

129

|

|

157

|

|

150

|

|

||||||||||

|

Peer Group

|

100

|

107

|

|

121

|

|

139

|

|

187

|

|

208

|

|

||||||||||

|

Year Ended December 31,

|

||||||||||||||||||||

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||||||||

|

(in millions, except share and per share amounts)

|

||||||||||||||||||||

|

Statements of Income Data:

|

||||||||||||||||||||

|

Total revenues

|

$

|

4,277

|

|

$

|

3,948

|

|

$

|

3,704

|

|

$

|

3,403

|

|

$

|

3,500

|

|

|||||

|

Transaction-based expenses

|

(1,751

|

)

|

(1,537

|

)

|

(1,428

|

)

|

(1,313

|

)

|

(1,433

|

)

|

||||||||||

|

Revenues less transaction-based expenses

|

2,526

|

|

2,411

|

|

2,276

|

|

2,090

|

|

2,067

|

|

||||||||||

|

Total operating expenses

|

1,498

|

|

1,420

|

|

1,440

|

|

1,370

|

|

1,313

|

|

||||||||||

|

Operating income

|

1,028

|

|

991

|

|

836

|

|

720

|

|

754

|

|

||||||||||

|

Net income attributable to Nasdaq

|

458

|

|

729

|

|

106

|

|

428

|

|

414

|

|

||||||||||

|

Per share information:

|

||||||||||||||||||||

|

Basic earnings per share

|

$

|

2.77

|

|

$

|

4.38

|

|

$

|

0.64

|

|

$

|

2.56

|

|

$

|

2.45

|

|

|||||

|

Diluted earnings per share

|

$

|

2.73

|

|

$

|

4.30

|

|

$

|

0.63

|

|

$

|

2.50

|

|

$

|

2.39

|

|

|||||

|

Cash dividends declared per common share

|

$

|

1.70

|

|

$

|

1.46

|

|

$

|

1.21

|

|

$

|

0.90

|

|

$

|

0.58

|

|

|||||

|

Weighted-average common shares outstanding for earnings per share:

|

||||||||||||||||||||

|

Basic

|

165,349,471

|

|

166,364,299

|

|

165,182,290

|

|

167,285,450

|

|

168,926,733

|

|

||||||||||

|

Diluted

|

167,691,299

|

|

169,585,031

|

|

168,800,997

|

|

171,283,271

|

|

173,018,849

|

|

||||||||||

|

December 31,

|

||||||||||||||||||||

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||||||||

|

(in millions)

|

||||||||||||||||||||

|

Balance Sheets Data:

|

||||||||||||||||||||

|

Cash and cash equivalents and financial investments

|

$

|

813

|

|

$

|

612

|

|

$

|

648

|

|

$

|

502

|

|

$

|

601

|

|

|||||

|

Default funds and margin deposits

|

4,742

|

|

3,988

|

|

3,301

|

|

2,228

|

|

2,194

|

|

||||||||||

|

Goodwill

|

6,363

|

|

6,586

|

|

6,027

|

|

5,395

|

|

5,538

|

|

||||||||||

|

Total assets

|

15,700

|

|

15,354

|

|

13,411

|

|

11,257

|

|

11,542

|

|

||||||||||

|

Long-term debt

|

2,956

|

|

3,727

|

|

3,603

|

|

2,364

|

|

2,297

|

|

||||||||||

|

Total Nasdaq stockholders' equity

|

5,449

|

|

5,880

|

|

5,428

|

|

5,609

|

|

5,794

|

|

||||||||||

|

•

|

the challenges created by the automation of market data consumption, including competition and the quickly evolving nature of the market data business;

|

|

•

|

regulatory changes relating to market structure, including market data, or affecting certain types of instruments, transactions, pricing structures or capital market participants;

|

|

•

|

the demand for information about, or access to, our markets, which is dependent on the products we trade, our importance as a liquidity center, and the quality and pricing of our market data and trade management services;

|

|

•

|

the demand for ETPs licensed to Nasdaq's indexes, enhanced analytics and other financial products based on our indexes as well as changes to the underlying assets associated with existing licensed financial products;

|

|

•

|

the outlook of our technology customers for capital market activity;

|

|

•

|

technological advances and members’ and customers’ demand for speed, efficiency, and reliability;

|

|

•

|

the acceptance of cloud-based services and advanced analytics by our customers and global regulators;

|

|

•

|

trading volumes and values in equity derivatives, cash equities and FICC, which are driven primarily by overall macroeconomic conditions;

|

|

•

|

the number of companies seeking equity financing, which is affected by factors such as investor demand, the global economy, and availability of diverse sources of financing, as well as tax and regulatory policies;

|

|

•

|

the demand by companies and other organizations for the products sold by our Corporate Solutions business, which

is largely driven by the overall state of the economy and the attractiveness of our offerings;

|

|

•

|

continuing pressure in transaction fee pricing due to intense competition in the U.S. and Europe; and

|

|

•

|

competition related to pricing, product features and service offerings.

|

|

•

|

rapidly evolving technology for our businesses and their clients;

|

|

•

|

increased demand for applications using emerging technologies and sophisticated analytics by both new entrants and industry incumbents;

|

|

•

|

the expansion of the number of industries, and emergence of new industries, seeking to use advanced market technology;

|

|

•

|

intense competition among U.S. exchanges and dealer-owned systems for cash equity trading and strong competition between MTFs and exchanges in Europe for cash equity trading; and

|

|

•

|

globalization of exchanges, customers and competitors extending the competitive horizon beyond national markets.

|

|

Year Ended December 31,

|

||||||||||||

|

|

2018

|

2017

|

2016

|

|||||||||

|

Market Services

|

|

|||||||||||

|

Equity Derivative Trading and Clearing

|

|

|||||||||||

|

U.S. equity options

|

|

|||||||||||

|

Total industry average daily volume (in millions)

|

18.2

|

|

14.7

|

|

14.4

|

|

||||||

|

Nasdaq PHLX matched market share

|

15.7

|

%

|

17.3

|

%

|

16.0

|

%

|

||||||

|

The Nasdaq Options Market matched market share

|

9.4

|

%

|

9.2

|

%

|

7.8

|

%

|

||||||

|

Nasdaq BX Options matched market share

|

0.4

|

%

|

0.7

|

%

|

0.8

|

%

|

||||||

|

Nasdaq ISE Options matched market share

|

8.8

|

%

|

9.1

|

%

|

5.8

|

%

|

||||||

|

Nasdaq GEMX Options matched market share

|

4.5

|

%

|

5.2

|

%

|

1.1

|

%

|

||||||

|

Nasdaq MRX Options matched market share

|

0.1

|

%

|

0.1

|

%

|

0.1

|

%

|

||||||

|

Total matched market share executed on Nasdaq’s exchanges

|

38.9

|

%

|

41.6

|

%

|

31.6

|

%

|

||||||

|

Nasdaq Nordic and Nasdaq Baltic options and futures

|

|

|

||||||||||

|

Total average daily volume of options and futures contracts

(1)

|

339,139

|

|

330,218

|

|

376,730

|

|

||||||

|

Cash Equity Trading

|

|

|||||||||||

|

Total U.S.-listed securities

|

|

|||||||||||

|

Total industry average daily share volume (in billions)

|

7.32

|

|

6.53

|

|

7.35

|

|

||||||

|

Matched share volume (in billions)

|

358.5

|

|

295.9

|

|

321.6

|

|

||||||

|

The Nasdaq Stock Market matched market share

|

15.9

|

%

|

14.2

|

%

|

14.0

|

%

|

||||||

|

Nasdaq BX matched market share

|

2.8

|

%

|

3.1

|

%

|

2.4

|

%

|

||||||

|

Nasdaq PSX matched market share

|

0.8

|

%

|

0.8

|

%

|

1.0

|

%

|

||||||

|

Total matched market share executed on Nasdaq’s exchanges

|

19.5

|

%

|

18.1

|

%

|

17.4

|

%

|

||||||

|

Market share reported to the FINRA/Nasdaq Trade Reporting Facility

|

31.3

|

%

|

34.5

|

%

|

33.1

|

%

|

||||||

|

Total market share

(2)

|

50.8

|

%

|

52.6

|

%

|

50.5

|

%

|

||||||

|

Nasdaq Nordic and Nasdaq Baltic securities

|

|

|

||||||||||

|

Average daily number of equity trades executed on Nasdaq’s exchanges

|

618,579

|

|

552,104

|

|

472,428

|

|

||||||

|

Total average daily value of shares traded (in billions)

|

$

|

5.6

|

|

$

|

5.3

|

|

$

|

5.1

|

|

|||

|

Total market share executed on Nasdaq’s exchanges

|

67.0

|

%

|

67.5

|

%

|

62.5

|

%

|

||||||

|

FICC

|

|

|

|

|||||||||

|

Fixed Income

|

|

|

|

|||||||||

|

U.S. fixed income notional trading volume (in billions)

|

$

|

15,983

|

|

$

|

17,800

|

|

$

|

21,504

|

|

|||

|

Total average daily volume of Nasdaq Nordic and Nasdaq Baltic fixed income contracts

|

132,475

|

|

116,357

|

|

89,252

|

|

||||||

|

Commodities

|

|

|

|

|||||||||

|

Power contracts cleared (TWh)

(3)

|

1,067

|

|

1,199

|

|

1,658

|

|

||||||

|

Corporate Services

|

|

|

|

|||||||||

|

Initial public offerings

|

|

|

|

|||||||||

|

The Nasdaq Stock Market

|

186

|

|

136

|

|

91

|

|

||||||

|

Exchanges that comprise Nasdaq Nordic and Nasdaq Baltic

|

53

|

|

88

|

|

62

|

|

||||||

|

Total new listings

|

|

|

|

|||||||||

|

The Nasdaq Stock Market

(4)

|

303

|

|

268

|

|

283

|

|

||||||

|

Exchanges that comprise Nasdaq Nordic and Nasdaq Baltic

(5)

|

73

|

|

108

|

|

88

|

|

||||||

|

Number of listed companies

|

|

|

|

|||||||||

|

The Nasdaq Stock Market

(6)

|

3,058

|

|

2,949

|

|

2,897

|

|

||||||

|

Exchanges that comprise Nasdaq Nordic and Nasdaq Baltic

(7)

|

1,019

|

|

984

|

|

900

|

|

||||||

|

Information Services

|

|

|

|

|||||||||

|

Number of licensed ETPs

|

365

|

|

324

|

|

298

|

|

||||||

|

ETP assets under management tracking Nasdaq indexes (in billions)

|

$

|

172

|

|

$

|

167

|

|

$

|

124

|

|

|||

|

Market Technology

|

|

|

|

|||||||||

|

Order intake (in millions)

(8)

|

$

|

223

|

|

$

|

249

|

|

$

|

235

|

|

|||

|

Total order value (in millions)

(9)

|

$

|

695

|

|

$

|

717

|

|

$

|

691

|

|

|||

|

(1)

|

Includes Finnish option contracts traded on Eurex.

|

|

(2)

|

Includes transactions executed on The Nasdaq Stock Market’s, Nasdaq BX’s and Nasdaq PSX’s systems plus trades reported through the FINRA/Nasdaq Trade Reporting Facility.

|

|

(3)

|

Transactions executed on Nasdaq Commodities or OTC and reported for clearing to Nasdaq Commodities measured by Terawatt hours (TWh).

|

|

(4)

|

New listings include IPOs, including those completed on a best efforts basis, issuers that switched from other listing venues, closed-end funds and separately listed ETPs.

|

|

(5)

|

New listings include IPOs and represent companies listed on the Nasdaq Nordic and Nasdaq Baltic exchanges and companies on the alternative markets of Nasdaq First North.

|

|

(6)

|

Number of total listings on The Nasdaq Stock Market at period end, including

392

ETPs as of

December 31, 2018

,

373

as of

December 31, 2017

and

328

as of December 31, 2016.

|

|

(7)

|

Represents companies listed on the Nasdaq Nordic and Nasdaq Baltic exchanges and companies on the alternative markets of Nasdaq First North at period end.

|

|

(8)

|

Total contract value of orders signed during the period.

|

|

(9)

|

Represents total contract value of signed orders that are yet to be recognized as revenue. Market technology deferred revenue, as discussed in Note 8, “Deferred Revenue,” to the consolidated financial statements, represents consideration received that is yet to be recognized as revenue for these signed orders. Total order value for the years ended

December 31, 2017

and 2016 was restated as a result of the adoption of Topic 606.

|

|

|

Year Ended December 31,

|

Percentage Change

|

||||||||||||||||

|

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

|||||||||||||

|

|

(in millions, except per share amounts)

|

|

|

|||||||||||||||

|

Revenues less transaction-based expenses

|

$

|

2,526

|

|

$

|

2,411

|

|

$

|

2,276

|

|

4.8

|

%

|

5.9

|

%

|

|||||

|

Operating expenses

|

1,498

|

|

1,420

|

|

1,440

|

|

5.5

|

%

|

(1.4

|

)%

|

||||||||

|

Operating income

|

1,028

|

|

991

|

|

836

|

|

3.7

|

%

|

18.5

|

%

|

||||||||

|

Interest expense

|

(150

|

)

|

(143

|

)

|

(135

|

)

|

4.9

|

%

|

5.9

|

%

|

||||||||

|

Gain on sale of investment security

|

118

|

|

—

|

|

—

|

|

N/M

|

|

—

|

%

|

||||||||

|

Net gain on divestiture of businesses

|

33

|

|

—

|

|

—

|

|

N/M

|

|

—

|

%

|

||||||||

|

Asset impairment charge

|

—

|

|

—

|

|

(578

|

)

|

—

|

%

|

(100.0

|

)%

|

||||||||

|

Income before income taxes

|

1,064

|

|

872

|

|

133

|

|

22.0

|

%

|

555.6

|

%

|

||||||||

|

Income tax provision

|

606

|

|

143

|

|

27

|

|

323.8

|

%

|

429.6

|

%

|

||||||||

|

Net income attributable to Nasdaq

|

$

|

458

|

|

$

|

729

|

|

$

|

106

|

|

(37.2

|

)%

|

587.7

|

%

|

|||||

|

Diluted earnings per share

|

$

|

2.73

|

|

$

|

4.30

|

|

$

|

0.63

|

|

(36.5

|

)%

|

582.5

|

%

|

|||||

|

Cash dividends declared per common share

|

$

|

1.70

|

|

$

|

1.46

|

|

$

|

1.21

|

|

16.4

|

%

|

20.7

|

%

|

|||||

|

|

Year Ended December 31,

|

Percentage Change

|

||||||||||||||||

|

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

|||||||||||||

|

|

(in millions)

|

|

||||||||||||||||

|

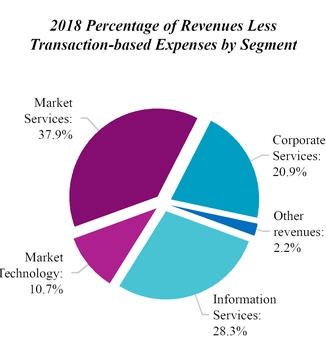

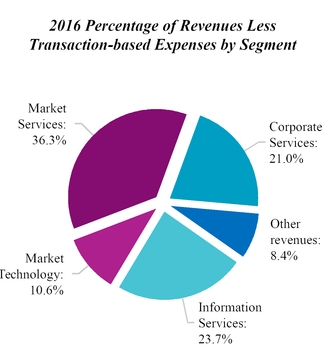

Market Services

|

$

|

2,709

|

|

$

|

2,418

|

|

$

|

2,255

|

|

12.0

|

%

|

7.2

|

%

|

|||||

|

Transaction-based expenses

|

(1,751

|

)

|

(1,537

|

)

|

(1,428

|

)

|

13.9

|

%

|

7.6

|

%

|

||||||||

|

Market Services revenues less transaction-based expenses

|

958

|

|

881

|

|

827

|

|

8.7

|

%

|

6.5

|

%

|

||||||||

|

Corporate Services

|

528

|

|

501

|

|

477

|

|

5.4

|

%

|

5.0

|

%

|

||||||||

|

Information Services

|

714

|

|

588

|

|

540

|

|

21.4

|

%

|

8.9

|

%

|

||||||||

|

Market Technology

|

270

|

|

247

|

|

241

|

|

9.3

|

%

|

2.5

|

%

|

||||||||

|

Other revenues

(1)

|

56

|

|

194

|

|

$

|

191

|

|

(71.1

|

)%

|

1.6

|

%

|

|||||||

|

Total revenues less transaction-based expenses

|

$

|

2,526

|

|

$

|

2,411

|

|

$

|

2,276

|

|

4.8

|

%

|

5.9

|

%

|

|||||

|

(1)

|

Includes the revenues from the Public Relations Solutions and Digital Media Services businesses which were sold in April 2018. Prior to the sale date, these revenues were included in our Corporate Solutions business. See “2018 Divestiture,” of Note 3, “Acquisitions and Divestiture,” to the consolidated financial statements for further discussion.

|

|

|

Year Ended December 31,

|

Percentage Change

|

||||||||||||||||

|

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

|||||||||||||

|

|

(in millions)

|

|

||||||||||||||||

|

Market Services Revenues:

|

|

|

|

|||||||||||||||

|

Equity Derivative Trading and Clearing Revenues

(1)

|

$

|

849

|

|

$

|

752

|

|

$

|

541

|

|

12.9

|

%

|

39.0

|

%

|

|||||

|

Transaction-based expenses:

|

|

|

|

|

||||||||||||||

|

Transaction rebates

|

(506

|

)

|

(450

|

)

|

(288

|

)

|

12.4

|

%

|

56.3

|

%

|

||||||||

|

Brokerage, clearance and exchange fees

(1)

|

(44

|

)

|

(43

|

)

|

(25

|

)

|

2.3

|

%

|

72.0

|

%

|

||||||||

|

Equity derivative trading and clearing revenues less transaction-based expenses

|

299

|

|

259

|

|

228

|

|

15.4

|

%

|

13.6

|

%

|

||||||||

|

Cash Equity Trading Revenues

(2)

|

1,476

|

|

1,279

|

|

1,349

|

|

15.4

|

%

|

(5.2

|

)%

|

||||||||

|

Transaction-based expenses:

|

|

|

|

|

|

|

||||||||||||

|

Transaction rebates

|

(830

|

)

|

(692

|

)

|

(785

|

)

|

19.9

|

%

|

(11.8

|

)%

|

||||||||

|

Brokerage, clearance and exchange fees

(2)

|

(361

|

)

|

(334

|

)

|

(309

|

)

|

8.1

|

%

|

8.1

|

%

|

||||||||

|

Cash equity trading revenues less transaction-based expenses

|

285

|

|

253

|

|

255

|

|

12.6

|

%

|

(0.8

|

)%

|

||||||||

|

FICC Revenues

|

92

|

|

96

|

|

99

|

|

(4.2

|

)%

|

(3.0

|

)%

|

||||||||

|

Transaction-based expenses:

|

|

|

|

|

|

|||||||||||||

|

Transaction rebates

|

(8

|

)

|

(16

|

)

|

(19

|

)

|

(50.0

|

)%

|

(15.8

|

)%

|

||||||||

|

Brokerage, clearance and exchange fees

|

(2

|

)

|

(2

|

)

|

(2

|

)

|

—

|

%

|

—

|

%

|

||||||||

|

FICC revenues less transaction-based expenses

|

82

|

|

78

|

|

78

|

|

5.1

|

%

|

—

|

%

|

||||||||

|

Trade Management Services Revenues

|

292

|

|

291

|

|

266

|

|

0.3

|

%

|

9.4

|

%

|

||||||||

|

Total Market Services revenues less transaction-based expenses

|

$

|

958

|

|

$

|

881

|

|

$

|

827

|

|

8.7

|

%

|

6.5

|

%

|

|||||

|

(1)

|

Includes Section 31 fees of $39 million in 2018, $40 million in 2017, and $24 million in 2016. Section 31 fees are recorded as equity derivative trading and clearing revenues with a corresponding amount recorded in transaction-based expenses.

|

|

(2)

|

Includes Section 31 fees of $343 million in 2018, $319 million in 2017, and $290 million in 2016. Section 31 fees are recorded as cash equity trading revenues with a corresponding amount recorded in transaction-based expenses.

|

|

•

|

lower U.S. industry trading volumes, partially offset by;

|

|

•

|

higher European industry trading volumes; and

|

|

•

|

an increase in our overall U.S. matched market share and European market share executed on Nasdaq's exchanges.

|

|

|

Year Ended December 31,

|

Percentage Change

|

|||||||||||||||

|

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

||||||||||||

|

|

(in millions)

|

||||||||||||||||

|

Corporate Services:

|

|||||||||||||||||

|

Corporate Solutions

|

$

|

238

|

|

$

|

234

|

|

$

|

208

|

|

1.7

|

%

|

12.5

|

%

|

||||

|

Listing Services

|

290

|

|

267

|

|

269

|

|

8.6

|

%

|

(0.7

|

)%

|

|||||||

|

Total Corporate Services

|

$

|

528

|

|

$

|

501

|

|

$

|

477

|

|

5.4

|

%

|

5.0

|

%

|

||||

|

|

Year Ended December 31,

|

Percentage Change

|

|||||||||||||||

|

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

||||||||||||

|

|

(in millions)

|

|

|||||||||||||||

|

Information Services:

|

|||||||||||||||||

|

Market Data

|

$

|

390

|

|

$

|

369

|

|

$

|

354

|

|

5.7

|

%

|

4.2

|

%

|

||||

|

Index

|

206

|

|

171

|

|

149

|

|

20.5

|

%

|

14.8

|

%

|

|||||||

|

Investment Data & Analytics

|

118

|

|

48

|

|

37

|

|

145.8

|

%

|

29.7

|

%

|

|||||||

|

Total Information Services

|

$

|

714

|

|

$

|

588

|

|

$

|

540

|

|

21.4

|

%

|

8.9

|

%

|

||||

|

|

Year Ended December 31,

|

Percentage Change

|

|||||||||||||||

|

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

||||||||||||

|

|

(in millions)

|

||||||||||||||||

|

Market Technology

|

$

|

270

|

|

$

|

247

|

|

$

|

241

|

|

9.3

|

%

|

2.5

|

%

|

||||

|

|

Year Ended December 31,

|

Percentage Change

|

|||||||||||||||

|

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

||||||||||||

|

|

(in millions)

|

|

|||||||||||||||

|

Compensation and benefits

|

$

|

712

|

|

$

|

670

|

|

$

|

665

|

|

6.3

|

%

|

0.8

|

%

|

||||

|

Professional and contract services

|

144

|

|

153

|

|

153

|

|

(5.9

|

)%

|

—

|

%

|

|||||||

|

Computer operations and data communications

|

127

|

|

125

|

|

111

|

|

1.6

|

%

|

12.6

|

%

|

|||||||

|

Occupancy

|

95

|

|

94

|

|

86

|

|

1.1

|

%

|

9.3

|

%

|

|||||||

|

General, administrative and other

|

120

|

|

82

|

|

73

|

|

46.3

|

%

|

12.3

|

%

|

|||||||

|

Marketing and advertising

|

37

|

|

31

|

|

30

|

|

19.4

|

%

|

3.3

|

%

|

|||||||

|

Depreciation and amortization

|

210

|

|

188

|

|

170

|

|

11.7

|

%

|

10.6

|

%

|

|||||||

|

Regulatory

|

32

|

|

33

|

|

35

|

|

(3.0

|

)%

|

(5.7

|

)%

|

|||||||

|

Merger and strategic initiatives

|

21

|

|

44

|

|

76

|

|

(52.3

|

)%

|

(42.1

|

)%

|

|||||||

|

Restructuring charges

|

—

|

|

—

|

|

41

|

|

—

|

%

|

(100.0

|

)%

|

|||||||

|

Total operating expenses

|

$

|

1,498

|

|

$

|

1,420

|

|

$

|

1,440

|

|

5.5

|

%

|

(1.4

|

)%

|

||||

|

|

Year Ended December 31,

|

Percentage Change

|

|||||||||||||||

|

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

||||||||||||

|

|

(in millions)

|

||||||||||||||||

|

Interest income

|

$

|

10

|

|

$

|

7

|

|

$

|

5

|

|

42.9

|

%

|

40.0

|

%

|

||||

|

Interest expense

|

(150

|

)

|

(143

|

)

|

(135

|

)

|

4.9

|

%

|

5.9

|

%

|

|||||||

|

Net interest expense

|

(140

|

)

|

(136

|

)

|

(130

|

)

|

2.9

|

%

|

4.6

|

%

|

|||||||

|

Gain on sale of investment security

|

118

|

|

—

|

|

—

|

|

N/M

|

|

—

|

%

|

|||||||

|

Net gain on divestiture of businesses

|

33

|

|

—

|

|

—

|

|

N/M

|

|

—

|

%

|

|||||||

|

Asset impairment charge

|

—

|

|

—

|

|

(578

|

)

|

—

|

%

|

(100.0

|

)%

|

|||||||

|

Other investment income

|

7

|

|

2

|

|

3

|

|

250.0

|

%

|

(33.3

|

)%

|

|||||||

|

Net income from unconsolidated investees

|

18

|

|

15

|

|

2

|

|

20.0

|

%

|

650.0

|

%

|

|||||||

|

Total non-operating income (expenses)

|

$

|

36

|

|

$

|

(119

|

)

|

$

|

(703

|

)

|

(130.3

|

)%

|

(83.1

|

)%

|

||||

|

|

Year Ended December 31,

|

Percentage Change

|

|||||||||||||||

|

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

||||||||||||

|

|

(in millions)

|

|

|||||||||||||||

|

Interest expense on debt

|

$

|

140

|

|

$

|

135

|

|

$

|

129

|

|

3.7

|

%

|

4.7

|

%

|

||||

|

Accretion of debt issuance costs and debt discount

|

7

|

|

6

|

|

5

|

|

16.7

|

%

|

20.0

|

%

|

|||||||

|

Other bank and investment-related fees

|

3

|

|

2

|

|

1

|

|

50.0

|

%

|

100.0

|

%

|

|||||||

|

Interest expense

|

$

|

150

|

|

$

|

143

|

|

$

|

135

|

|

4.9

|

%

|

5.9

|

%

|

||||

|

Year Ended December 31,

|

Percentage Change

|

||||||||||||||||

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

|||||||||||||

|

($ in millions)

|

|||||||||||||||||

|

Income tax provision

|

$

|

606

|

|

$

|

143

|

|

$

|

27

|

|

323.8

|

%

|

429.6

|

%

|

||||

|

Effective tax rate

|

57.0

|

%

|

16.4

|

%

|

20.3

|

%

|

|||||||||||

|

•

|

gain on sale of investment security which represents our pre-tax gain of $118 million on the sale of our 5.0% ownership interest in LCH;

|

|

•

|

net gain on divestiture of businesses which represents our pre-tax net gain of

$33 million

on the sale of the Public Relations Solutions and Digital Media Services businesses;

|

|

•

|

other items:

|

|

◦

|

charges related to uncertain positions pertaining to sales and use tax and VAT which are recorded in general, administrative and other expense in our Consolidated Statements of Income; and

|

|

◦

|

certain litigation costs which are recorded in professional and contract services expense in our Consolidated Statements of Income.

|

|

•

|

loss on extinguishment of debt of $10 million which is recorded in general, administrative and other expense in our Consolidated Statements of Income; and

|

|

•

|

wind down costs associated with an equity method investment that was previously written off which are recorded in net income from unconsolidated investees in our Consolidated Statements of Income.

|

|

•

|

restructuring charges of $41 million which were associated with our 2015 restructuring plan;

|

|

•

|

an asset impairment charge of $578 million related to the full write-off of a trade name from an acquired business;

|

|

•

|

executive compensation of $12 million which represents accelerated expense for equity awards previously granted due to the retirement of the company’s former CEO which is recorded in compensation and benefits expense in our Consolidated Statements of Income;

|

|

•

|

a regulatory matter that resulted in a regulatory fine of $6 million received by our Nordic exchanges and clearinghouse which is recorded in regulatory expense in our Consolidated Statements of Income;

|

|

•

|

other items:

|

|

◦

|

the release of a sublease loss reserve due to the early exit of a facility which is recorded in occupancy expense in our Consolidated Statements of Income; and

|

|

◦

|

the impact of the write-off of an equity method investment, partially offset by a gain resulting from the sale of a percentage of a separate equity method investment which is recorded in net income from unconsolidated investees in our Consolidated Statements of Income.

|

|

•

|

for the year ended

December 31, 2018

, a net $7 million increase to tax expense due to a remeasurement of unrecognized tax benefits (excluding the reversal of certain Swedish tax benefits discussed below) and the impact of state tax rate changes;

|

|

•

|

for the year ended

December 31, 2017

, a $12 million decrease to tax expense due to a remeasurement of unrecognized tax benefits; and

|

|

•

|

for the year ended December 31, 2016, a tax expense of $27 million due to an unfavorable tax ruling received during the second quarter of 2016, the impact of which is related to prior periods.

|

|

•

|

The impact of newly enacted U.S. tax legislation is related to the Tax Cuts and Jobs Act which was enacted on December 22, 2017.

|

|

◦

|

For the year ended

December 31, 2018

, we recorded an increase to tax expense of $290 million and a reduction to deferred tax assets related to foreign currency translation as a result of the finalization of the provisional estimate related to this act.

|

|

◦

|

For the year ended December 31, 2017, we recorded a decrease to tax expense of $89 million,

p

rimarily related to the remeasurement of our net U.S. deferred tax liability at the lower U.S. federal corporate income tax rate which reflected the provisional impact associated with the enactment of this act.

|

|

•

|

The reversal of certain Swedish tax benefits. See Note 17, “Income Taxes,” to the consolidated financial statements for further discussion.

|

|

•

|

Excess tax benefits related to employee share-based compensation of $9 million for the year ended December 31, 2018 and $40 million for the year ended December 31, 2017, were recorded as a result of the adoption of accounting guidance on January 1, 2017. This guidance requires all income tax effects of share-based awards to be recognized as income tax expense or benefit in the income statement when the awards vest or are settled on a prospective basis, as opposed to stockholders’ equity where it was previously recorded, and will be a recurring item going forward. This item is subject to volatility and will vary based on the timing of the vesting of employee share-based compensation arrangements and fluctuation in our stock price.

|

|

|

Year Ended December 31, 2018

|

Year Ended December 31, 2017

|

Year Ended December 31, 2016

|

||||||||||||||||||||

|

|

Net Income

|

Diluted Earnings Per Share

|

Net Income

|

Diluted Earnings Per Share

|

Net Income

|

Diluted Earnings Per Share

|

|||||||||||||||||

|

|

(in millions, except share and per share amounts)

|

||||||||||||||||||||||

|

U.S. GAAP net income attributable to Nasdaq and diluted earnings per share

|

$

|

458

|

|

$

|

2.73

|

|

$

|

729

|

|

$

|

4.30

|

|

$

|

106

|

|

$

|

0.63

|

|

|||||

|

Non-GAAP adjustments:

|

|

|

|

|

|

|

|||||||||||||||||

|

Amortization expense of acquired intangible assets

|

109

|

|

0.65

|

|

92

|

|

0.54

|

|

82

|

|

0.49

|

|

|||||||||||

|

Merger and strategic initiatives expense

|

21

|

|

0.13

|

|

44

|

|

0.26

|

|

76

|

|

0.45

|

|

|||||||||||

|

Clearing default

|

31

|

|

0.18

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Gain on sale of investment security

|

(118

|

)

|

(0.69

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Net gain on divestiture of businesses

|

(33

|

)

|

(0.20

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Extinguishment of debt

|

—

|

|

—

|

|

10

|

|

0.06

|

|

—

|

|

—

|

|

|||||||||||

|

Restructuring charges

|

—

|

|

—

|

|

—

|

|

—

|

|

41

|

|

0.24

|

|

|||||||||||

|

Asset impairment charge

|

—

|

|

—

|

|

—

|

|

—

|

|

578

|

|

3.42

|

|

|||||||||||

|

Executive compensation

|

—

|

|

—

|

|

—

|

|

—

|

|

12

|

|

0.07

|

|

|||||||||||

|

Regulatory matter

|

—

|

|

—

|

|

—

|

|

—

|

|

6

|

|

0.04

|

|

|||||||||||

|

Other

|

17

|

|

0.10

|

|

5

|

|

0.02

|

|

5

|

|

0.03

|

|

|||||||||||

|

Adjustment to the income tax provision to reflect non-GAAP adjustments and other tax items

|

4

|

|

0.02

|

|

(70

|

)

|

(0.40

|

)

|

(287

|

)

|

(1.70

|

)

|

|||||||||||

|

Impact of newly enacted U.S. tax legislation

|

290

|

|

1.73

|

|

(89

|

)

|

(0.52

|

)

|

—

|

|

—

|

|

|||||||||||

|

Reversal of certain Swedish tax benefits

|

41

|

|

0.24

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Excess tax benefits related to employee share-based compensation

|

(9

|

)

|

(0.05

|

)

|

(40

|

)

|

(0.24

|

)

|

—

|

|

—

|

|

|||||||||||

|

Total non-GAAP adjustments, net of tax

|

353

|

|

2.11

|

|

(48

|

)

|

(0.28

|

)

|

513

|

|

3.04

|

|

|||||||||||

|

Non-GAAP net income attributable to Nasdaq and diluted earnings per share

|

$

|

811

|

|

$

|

4.84

|

|

$

|

681

|

|

$

|

4.02

|

|

$

|

619

|

|

$

|

3.67

|

|

|||||

|

Weighted-average common shares outstanding for diluted earnings per share

|

|

167,691,299

|

|

|

169,585,031

|

|

|

168,800,997

|

|

||||||||||||||

|

•

|

deterioration of our revenues in any of our business segments;

|

|

•

|

changes in regulatory and working capital requirements; and

|

|

•

|

an increase in our expenses.

|

|

•

|

operating covenants contained in our credit facilities that limit our total borrowing capacity;

|

|

•

|

increases in interest rates under our credit facilities;

|

|

•

|

credit rating downgrades, which could limit our access to additional debt;

|

|

•

|

a decrease in the market price of our common stock; and