|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[x]

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

For the Fiscal Year Ended December 31, 2012

|

|

[ ]

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

Virginia

(State of incorporation)

|

54-1375874

(I.R.S. Employer Identification No.)

|

|

Securities registered pursuant to Section 12(b) of the Act:

None

|

Securities registered Pursuant to Section 12(g) of the Act:

Common Stock, Par Value $1.25 per share

|

|

Document

|

Part of Form 10-K into which incorporated

|

|

National Bankshares, Inc. 2012 Annual Report to Stockholders

|

Part II

|

|

National Bankshares, Inc. Proxy Statement for the 2013 Annual Meeting of Stockholders

|

Part III

|

|

Page

|

||

|

Item 1.

|

3

|

|

|

Item 1A.

|

8

|

|

|

Item 1B.

|

9

|

|

|

Item 2.

|

9

|

|

|

Item 3.

|

10

|

|

|

Item 4.

|

10

|

|

|

Item 5.

|

10

|

|

|

Item 6.

|

12

|

|

|

Item 7.

|

13

|

|

|

Item 7A.

|

35

|

|

|

Item 8.

|

36

|

|

|

Item 9.

|

86

|

|

|

Item 9A.

|

86

|

|

|

Item 9B.

|

87

|

|

|

Item 10.

|

87

|

|

|

Item 11.

|

88

|

|

|

Item 12.

|

88

|

|

|

Item 13.

|

88

|

|

|

Item 14.

|

88

|

|

|

Item 15.

|

89

|

|

|

91

|

||

|

96

|

|

Period

|

Class of Service

|

Percentage of

Total Revenues

|

|||

|

December 31, 2012

|

Interest and Fees on Loans

|

61.58

|

%

|

||

|

Interest on Investments

|

22.78

|

%

|

|||

|

December 31, 2011

|

Interest and Fees on Loans

|

62.57

|

%

|

||

|

Interest on Investments

|

22.75

|

%

|

|||

|

December 31, 2010

|

Interest and Fees on Loans

|

64.22

|

%

|

||

|

Interest on Investments

|

21.03

|

%

|

National Bankshares, Inc.

| 2012 |

2011

|

Dividends per share

|

|||||||||||||||||||||||

| High |

Low

|

High

|

Low |

2012

|

2011

|

||||||||||||||||||||

|

First Quarter

|

$ | 31.16 | $ | 25.95 | $ | 31.80 | $ | 27.46 | $ | --- | $ | --- | |||||||||||||

|

Second Quarter

|

30.65 | 28.60 | 29.71 | 24.08 | 0.53 | 0.48 | |||||||||||||||||||

|

Third Quarter

|

35.82 | 29.18 | 27.23 | 22.93 | --- | --- | |||||||||||||||||||

|

Fourth Quarter

|

33.82 | 29.03 | 29.00 | 23.21 | 0.57 | 0.52 | |||||||||||||||||||

|

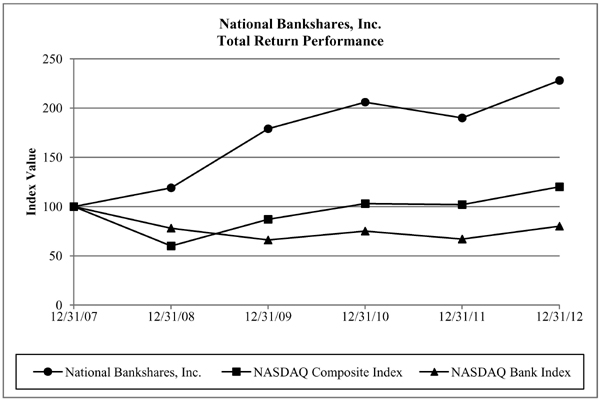

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

||||||||

|

NATIONAL BANKSHARES, INC.

|

100

|

119

|

179

|

206

|

190

|

228

|

|||||||

|

NASDAQ COMPOSITE INDEX

|

100

|

60

|

87

|

103

|

102

|

120

|

|||||||

|

NASDAQ BANK INDEX

|

100

|

78

|

66

|

75

|

67

|

80

|

|

$ in thousands, except per share data

|

Year ended December 31,

|

|||||||||||||||||||

|

2012

|

2011

|

2010

|

2009

|

2008

|

||||||||||||||||

|

Selected Income Statement Data:

|

||||||||||||||||||||

|

Interest income

|

$ | 48,670 | $ | 49,946 | $ | 49,139 | $ | 50,487 | $ | 50,111 | ||||||||||

|

Interest expense

|

7,887 | 9,184 | 11,158 | 15,825 | 18,818 | |||||||||||||||

|

Net interest income

|

40,783 | 40,762 | 37,981 | 34,662 | 31,293 | |||||||||||||||

|

Provision for loan losses

|

3,134 | 2,949 | 3,409 | 1,634 | 1,119 | |||||||||||||||

|

Noninterest income

|

8,739 | 8,410 | 8,347 | 8,804 | 9,087 | |||||||||||||||

|

Noninterest expense

|

23,396 | 23,338 | 23,127 | 23,853 | 22,023 | |||||||||||||||

|

Income taxes

|

5,245 | 5,247 | 4,223 | 3,660 | 3,645 | |||||||||||||||

|

Net income

|

17,747 | 17,638 | 15,569 | 14,319 | 13,593 | |||||||||||||||

|

Per Share Data:

|

||||||||||||||||||||

|

Basic net income

|

2.56 | 2.54 | 2.25 | 2.07 | 1.96 | |||||||||||||||

|

Diluted net income

|

2.55 | 2.54 | 2.24 | 2.06 | 1.96 | |||||||||||||||

|

Cash dividends declared

|

1.10 | 1.00 | 0.91 | 0.84 | 0.80 | |||||||||||||||

|

Book value

|

21.60 | 20.36 | 18.63 | 17.61 | 15.89 | |||||||||||||||

|

Selected Balance Sheet Data at End of Year:

|

||||||||||||||||||||

|

Loans, net

|

583,813 | 580,402 | 568,779 | 583,021 | 569,699 | |||||||||||||||

|

Total securities

|

352,043 | 318,913 | 315,907 | 297,417 | 264,999 | |||||||||||||||

|

Total assets

|

1,104,361 | 1,067,102 | 1,022,238 | 982,367 | 935,374 | |||||||||||||||

|

Total deposits

|

946,766 | 919,333 | 884,583 | 852,112 | 817,848 | |||||||||||||||

|

Stockholders’ equity

|

150,109 | 141,299 | 129,187 | 122,076 | 110,108 | |||||||||||||||

|

Selected Balance Sheet Daily Averages:

|

||||||||||||||||||||

|

Loans, net

|

579,817 | 580,037 | 577,210 | 572,438 | 533,190 | |||||||||||||||

|

Total securities

|

339,416 | 320,908 | 289,532 | 298,237 | 281,367 | |||||||||||||||

|

Total assets

|

1,080,351 | 1,031,899 | 989,952 | 971,538 | 899,462 | |||||||||||||||

|

Total deposits

|

925,986 | 888,044 | 852,953 | 846,637 | 783,774 | |||||||||||||||

|

Stockholders’ equity

|

147,812 | 136,794 | 129,003 | 117,086 | 108,585 | |||||||||||||||

|

Selected Ratios:

|

||||||||||||||||||||

|

Return on average assets

|

1.64 | % | 1.71 | % | 1.57 | % | 1.47 | % | 1.51 | % | ||||||||||

|

Return on average equity

|

12.01 | % | 12.89 | % | 12.07 | % | 12.23 | % | 12.52 | % | ||||||||||

|

Dividend payout ratio

|

43.04 | % | 39.34 | % | 40.52 | % | 40.67 | % | 40.78 | % | ||||||||||

|

Average equity to average assets

|

13.68 | % | 13.26 | % | 13.03 | % | 12.05 | % | 12.07 | % | ||||||||||

|

·

|

interest rates,

|

|

·

|

general economic conditions,

|

|

·

|

the legislative/regulatory climate,

|

|

·

|

monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury, the Office of the Comptroller of the Currency, the Federal Reserve Board and the Federal Deposit Insurance Corporation, and the impact of any policies or programs implemented pursuant to the Emergency Economic Stabilization Act of 2008 (“EESA”) the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) and other financial reform legislation,

|

|

·

|

unanticipated increases in the level of unemployment in the Company’s trade area,

|

|

·

|

the quality or composition of the loan and/or investment portfolios,

|

|

·

|

demand for loan products,

|

|

·

|

deposit flows,

|

|

·

|

competition,

|

|

·

|

demand for financial services in the Company’s trade area,

|

|

·

|

the real estate market in the Company’s trade area,

|

|

·

|

the Company’s technology initiatives, and

|

|

·

|

applicable accounting principles, policies and guidelines.

|

|

12/31/12

|

12/31/11

|

|||||||

|

Return on average assets

|

1.64 | % | 1.71 | % | ||||

|

Return on average equity

|

12.01 | % | 12.89 | % | ||||

|

Basic net earnings per common share

|

$ | 2.56 | $ | 2.54 | ||||

|

Fully diluted net earnings per common share

|

$ | 2.55 | $ | 2.54 | ||||

|

Net interest margin

(1)

|

4.38 | % | 4.59 | % | ||||

|

Noninterest margin

(2)

|

1.36 | % | 1.45 | % | ||||

|

|

(1)

|

Net Interest Margin – Year-to-date tax equivalent net interest income divided by year-to-date average earning assets.

|

|

|

(2)

|

Noninterest Margin – Noninterest expense (excluding the provision for bad debts and income taxes) less noninterest income (excluding securities gains and losses) divided by average year-to-date assets.

|

|

12/31/12

|

12/31/11

|

|||||||

|

Securities

|

$ | 352,043 | $ | 318,913 | ||||

|

Loans, net

|

583,813 | 580,402 | ||||||

|

Deposits

|

946,766 | 919,333 | ||||||

|

Total assets

|

1,104,361 | 1,067,102 | ||||||

|

12/31/12

|

12/31/11

|

|||||||

|

Nonperforming loans

(1)

|

$ | 5,617 | $ | 5,204 | ||||

|

Loans past due 90 days or more and accruing

|

170 | 481 | ||||||

|

Other real estate owned

|

1,435 | 1,489 | ||||||

|

Allowance for loan losses to loans

(2)

|

1.41 | % | 1.37 | % | ||||

|

Net charge-off ratio

|

0.49 | % | 0.43 | % | ||||

|

(1)

|

Nonperforming loans include nonaccrual loans plus restructured loans in nonaccrual status. Accruing restructured loans are not included.

|

|

(2)

|

Loans are net of unearned income and deferred fees.

|

|

December 31, 2012

|

December 31, 2011

|

December 31, 2010

|

||||||||||||||||||||||||||||||||||

|

Average

Balance

|

Interest

|

Average

Yield/

Rate

|

Average

Balance

|

Interest

|

Average

Yield/

Rate

|

Average

Balance

|

Interest

|

Average

Yield/

Rate

|

||||||||||||||||||||||||||||

|

Interest-earning assets:

|

||||||||||||||||||||||||||||||||||||

|

Loans, net

(1)(2)(3)

|

$ | 589,935 | $ | 35,744 | 6.06 | % | $ | 589,257 | $ | 36,813 | 6.25 | % | $ | 585,933 | $ | 37,282 | 6.36 | % | ||||||||||||||||||

|

Taxable securities

(4)

|

167,874 | 6,613 | 3.94 | % | 155,765 | 6,745 | 4.33 | % | 123,920 | 5,588 | 4.51 | % | ||||||||||||||||||||||||

|

Nontaxable securities

(1)(4)

|

167,355 | 10,002 | 5.98 | % | 163,174 | 10,102 | 6.19 | % | 161,571 | 10,074 | 6.24 | % | ||||||||||||||||||||||||

|

Interest-bearing deposits

|

94,724 | 240 | 0.25 | % | 64,977 | 155 | 0.24 | % | 55,477 | 128 | 0.23 | % | ||||||||||||||||||||||||

|

Total interest-earning assets

|

$ | 1,019,888 | $ | 52,599 | 5.16 | % | $ | 973,173 | $ | 53,815 | 5.53 | % | $ | 926,901 | $ | 53,072 | 5.73 | % | ||||||||||||||||||

|

Interest-bearing liabilities:

|

||||||||||||||||||||||||||||||||||||

|

Interest-bearing demand deposits

|

$ | 420,947 | $ | 4,167 | 0.99 | % | $ | 378,971 | $ | 4,088 | 1.08 | % | $ | 322,705 | $ | 3,332 | 1.03 | % | ||||||||||||||||||

|

Savings deposits

|

64,973 | 36 | 0.06 | % | 58,273 | 45 | 0.08 | % | 54,543 | 51 | 0.09 | % | ||||||||||||||||||||||||

|

Time deposits

|

298,797 | 3,684 | 1.23 | % | 314,920 | 5,051 | 1.60 | % | 352,887 | 7,775 | 2.20 | % | ||||||||||||||||||||||||

|

Total interest-bearing liabilities

|

$ | 784,717 | $ | 7,887 | 1.01 | % | $ | 752,164 | $ | 9,184 | 1.22 | % | $ | 730,135 | $ | 11,158 | 1.53 | % | ||||||||||||||||||

|

Net interest income and interest rate spread

|

$ | 44,712 | 4.15 | % | $ | 44,631 | 4.31 | % | $ | 41,914 | 4.20 | % | ||||||||||||||||||||||||

|

Net yield on average interest-earning assets

|

4.38 | % | 4.59 | % | 4.52 | % | ||||||||||||||||||||||||||||||

|

|

(1)

|

Interest on nontaxable loans and securities is computed on a fully taxable equivalent basis using a Federal income tax rate of 35% in the three years presented.

|

|

|

(2)

|

Loan fees of $802 in 2012, $729 in 2011 and $863 in 2010 are included in total interest income.

|

|

|

(3)

|

Nonaccrual loans are included in average balances for yield computations.

|

|

|

(4)

|

Daily averages are shown at amortized cost.

|

|

2012 Over 2011

|

2011 Over 2010

|

|||||||||||||||||||||||

|

Changes Due To

|

Changes Due To

|

|||||||||||||||||||||||

|

Rates

(2)

|

Volume

(2)

|

Net Dollar

Change

|

Rates

(2)

|

Volume

(2)

|

Net Dollar Change

|

|||||||||||||||||||

|

Interest income:

(1)

|

|

|

|

|

|

|

||||||||||||||||||

|

Loans

|

$ | (1,111 | ) | $ | 42 | $ | (1,069 | ) | $ | (680 | ) | $ | 211 | $ | (469 | ) | ||||||||

|

Taxable securities

|

(634 | ) | 502 | (132 | ) | (229 | ) | 1,386 | 1,157 | |||||||||||||||

|

Nontaxable securities

|

(355 | ) | 255 | (100 | ) | (71 | ) | 99 | 28 | |||||||||||||||

|

Interest-bearing deposits

|

10 | 75 | 85 | 4 | 23 | 27 | ||||||||||||||||||

|

Increase (decrease) in income on interest-earning assets

|

$ | (2,090 | ) | $ | 874 | $ | (1,216 | ) | $ | (976 | ) | $ | 1,719 | $ | 743 | |||||||||

|

Interest expense:

|

||||||||||||||||||||||||

|

Interest-bearing demand deposits

|

$ | (352 | ) | $ | 431 | $ | 79 | $ | 154 | $ | 602 | $ | 756 | |||||||||||

|

Savings deposits

|

(14 | ) | 5 | (9 | ) | (9 | ) | 3 | (6 | ) | ||||||||||||||

|

Time deposits

|

(1,119 | ) | (248 | ) | (1,367 | ) | (1,952 | ) | (772 | ) | (2,724 | ) | ||||||||||||

|

Increase (decrease) in expense of interest-bearing liabilities

|

$ | (1,485 | ) | $ | 188 | $ | (1,297 | ) | $ | (1,807 | ) | $ | (167 | ) | $ | (1,974 | ) | |||||||

|

Increase (decrease) in net interest income

|

$ | (605 | ) | $ | 686 | $ | 81 | $ | 831 | $ | 1,886 | $ | 2,717 | |||||||||||

|

|

(1)

|

Taxable equivalent basis using a Federal income tax rate of 35% in 2012, 2011 and 2010.

|

|

|

(2)

|

Variances caused by the change in rate times the change in volume have been allocated to rate and volume changes proportional to the relationship of the absolute dollar amounts of the change in each.

|

|

Rate Shift (bp)

|

Return on Average Assets

|

Return on Average Equity

|

|||||||

|

2012

|

2011

|

2012

|

2011

|

||||||

|

300

|

1.13

|

%

|

0.96

|

%

|

8.02

|

%

|

6.96

|

%

|

|

|

200

|

1.35

|

%

|

1.13

|

%

|

9.53

|

%

|

8.19

|

%

|

|

|

100

|

1.56

|

%

|

1.30

|

%

|

10.92

|

%

|

9.32

|

%

|

|

|

(-)100

|

1.95

|

%

|

1.62

|

%

|

13.51

|

%

|

11.51

|

%

|

|

|

(-)200

|

1.82

|

%

|

1.58

|

%

|

12.61

|

%

|

11.23

|

%

|

|

|

(-)300

|

1.55

|

%

|

1.46

|

%

|

10.85

|

%

|

10.39

|

%

|

|

|

Year Ended

|

||||||||||||

|

December 31, 2012

|

December 31, 2011

|

December 31, 2010

|

||||||||||

|

Service charges on deposits

|

$ | 2,594 | $ | 2,617 | $ | 2,858 | ||||||

|

Other service charges and fees

|

243 | 287 | 317 | |||||||||

|

Credit card fees

|

3,278 | 3,197 | 2,954 | |||||||||

|

Trust fees

|

1,313 | 1,087 | 1,118 | |||||||||

|

Bank-owned life insurance income

|

814 | 762 | 760 | |||||||||

|

Other income

|

472 | 449 | 354 | |||||||||

|

Realized securities gains (losses)

|

25 | 11 | (14 | ) | ||||||||

|

Total noninterest income

|

$ | 8,739 | $ | 8,410 | $ | 8,347 | ||||||

|

Year Ended

|

||||||||||||

|

December 31, 2012

|

December 31, 2011

|

December 31, 2010

|

||||||||||

|

Salaries and employee benefits

|

$ | 12,005 | $ | 11,357 | $ | 10,963 | ||||||

|

Occupancy, furniture and fixtures

|

1,589 | 1,599 | 1,875 | |||||||||

|

Data processing and ATM

|

1,593 | 1,701 | 1,499 | |||||||||

|

FDIC assessment

|

475 | 677 | 1,080 | |||||||||

|

Credit card processing

|

2,442 | 2,485 | 2,300 | |||||||||

|

Intangibles amortization

|

1,083 | 1,083 | 1,083 | |||||||||

|

Net costs of other real estate owned

|

208 | 518 | 214 | |||||||||

|

Franchise taxes

|

901 | 780 | 963 | |||||||||

|

Other operating expenses

|

3,100 | 3,138 | 3,150 | |||||||||

|

Total noninterest expense

|

$ | 23,396 | $ | 23,338 | $ | 23,127 | ||||||

|

2012

|

||||||||||||||||

|

First

Quarter

|

Second

Quarter

|

Third

Quarter

|

Fourth

Quarter

|

|||||||||||||

|

Income Statement Data:

|

|

|||||||||||||||

|

Interest income

|

$ | 12,114 | $ | 12,182 | $ | 12,237 | $ | 12,137 | ||||||||

|

Interest expense

|

2,117 | 2,018 | 1,936 | 1,816 | ||||||||||||

|

Net interest income

|

9,997 | 10,164 | 10,301 | 10,321 | ||||||||||||

|

Provision for loan losses

|

672 | 1,104 | 778 | 580 | ||||||||||||

|

Noninterest income

|

2,152 | 2,283 | 2,108 | 2,196 | ||||||||||||

|

Noninterest expense

|

5,711 | 5,731 | 6,088 | 5,866 | ||||||||||||

|

Income taxes

|

1,337 | 1,272 | 1,250 | 1,386 | ||||||||||||

|

Net income

|

$ | 4,429 | $ | 4,340 | $ | 4,293 | $ | 4,685 | ||||||||

|

Per Share Data:

|

||||||||||||||||

|

Basic net income per common share

|

$ | 0.64 | $ | 0.63 | $ | 0.62 | $ | 0.67 | ||||||||

|

Fully diluted net income per common share

|

0.64 | 0.62 | 0.62 | 0.67 | ||||||||||||

|

Cash dividends per common share

|

--- | 0.53 | --- | 0.57 | ||||||||||||

|

Book value per common share

|

20.86 | 21.14 | 21.66 | 21.60 | ||||||||||||

|

2011

|

||||||||||||||||

|

First

Quarter

|

Second

Quarter

|

Third

Quarter

|

Fourth

Quarter

|

|||||||||||||

|

Income Statement Data:

|

|

|||||||||||||||

|

Interest income

|

$ | 12,465 | $ | 12,475 | $ | 12,577 | $ | 12,429 | ||||||||

|

Interest expense

|

2,379 | 2,346 | 2,282 | 2,177 | ||||||||||||

|

Net interest income

|

10,086 | 10,129 | 10,295 | 10,252 | ||||||||||||

|

Provision for loan losses

|

800 | 753 | 643 | 753 | ||||||||||||

|

Noninterest income

|

1,934 | 2,090 | 2,129 | 2,257 | ||||||||||||

|

Noninterest expense

|

6,084 | 6,025 | 5,887 | 5,342 | ||||||||||||

|

Income taxes

|

1,112 | 1,225 | 1,385 | 1,525 | ||||||||||||

|

Net income

|

$ | 4,024 | $ | 4,216 | $ | 4,509 | $ | 4,889 | ||||||||

|

Per Share Data:

|

||||||||||||||||

|

Basic net income per common share

|

$ | 0.58 | $ | 0.61 | $ | 0.65 | $ | 0.70 | ||||||||

|

Fully diluted net income per common share

|

0.58 | 0.61 | 0.65 | 0.70 | ||||||||||||

|

Cash dividends per common share

|

--- | 0.48 | --- | 0.52 | ||||||||||||

|

Book value per common share

|

19.27 | 19.65 | 20.44 | 20.36 | ||||||||||||

|

2010

|

||||||||||||||||

|

First

Quarter

|

Second

Quarter

|

Third

Quarter

|

Fourth

Quarter

|

|||||||||||||

|

Income Statement Data:

|

|

|||||||||||||||

|

Interest income

|

$ | 12,240 | $ | 12,347 | $ | 12,287 | $ | 12,265 | ||||||||

|

Interest expense

|

2,979 | 2,850 | 2,726 | 2,603 | ||||||||||||

|

Net interest income

|

9,261 | 9,497 | 9,561 | 9,662 | ||||||||||||

|

Provision for loan losses

|

647 | 852 | 710 | 1,200 | ||||||||||||

|

Noninterest income

|

1,971 | 2,123 | 2,101 | 2,152 | ||||||||||||

|

Noninterest expense

|

5,784 | 5,697 | 5,826 | 5,820 | ||||||||||||

|

Income taxes

|

1,032 | 1,075 | 1,129 | 987 | ||||||||||||

|

Net income

|

$ | 3,769 | $ | 3,996 | $ | 3,997 | $ | 3,807 | ||||||||

|

Per Share Data:

|

||||||||||||||||

|

Basic net income per share

|

$ | 0.54 | $ | 0.58 | $ | 0.58 | $ | 0.55 | ||||||||

|

Fully diluted net income per share

|

0.54 | 0.58 | 0.58 | 0.55 | ||||||||||||

|

Cash dividends per share

|

--- | 0.44 | --- | 0.47 | ||||||||||||

|

Book value per share

|

18.25 | 18.44 | 19.13 | 18.63 | ||||||||||||

|

December 31,

|

||||||||||||||||||||

|

2012

|

2011

|

2010

|

2009

|

2008

|

||||||||||||||||

|

Real estate construction

|

$ | 50,313 | $ | 48,531 | $ | 46,169 | $ | 44,744 | $ | 60,798 | ||||||||||

|

Consumer real estate

|

143,262 | 150,224 | 153,405 | 154,380 | 152,482 | |||||||||||||||

|

Commercial real estate

|

304,308 | 303,192 | 293,171 | 293,229 | 277,511 | |||||||||||||||

|

Commercial non real estate

|

37,349 | 38,832 | 37,547 | 41,402 | 36,978 | |||||||||||||||

|

Public sector and IDA

|

26,169 | 15,571 | 12,553 | 19,207 | 11,518 | |||||||||||||||

|

Consumer non real estate

|

31,714 | 33,072 | 34,543 | 38,047 | 37,393 | |||||||||||||||

|

Total loans

|

$ | 593,115 | $ | 589,422 | $ | 577,388 | $ | 591,009 | $ | 576,680 | ||||||||||

|

Less unearned income and deferred fees

|

(953 | ) | (952 | ) | (945 | ) | (1,062 | ) | (1,123 | ) | ||||||||||

|

Total loans, net of unearned income

|

$ | 592,162 | $ | 588,470 | $ | 576,443 | $ | 589,947 | $ | 575,557 | ||||||||||

|

Less allowance for loans losses

|

(8,349 | ) | (8,068 | ) | (7,664 | ) | (6,926 | ) | (5,858 | ) | ||||||||||

|

Total loans, net

|

$ | 583,813 | $ | 580,402 | $ | 568,779 | $ | 583,021 | $ | 569,699 | ||||||||||

|

December 31, 2012

|

||||||||||||||||

|

< 1 Year

|

1 – 5 Years

|

After 5 Years

|

Total

|

|||||||||||||

|

Commercial non real estate

|

$ | 19,872 | $ | 14,296 | $ | 3,181 | $ | 37,349 | ||||||||

|

Commercial real estate

|

41,481 | 250,765 | 12,062 | 304,308 | ||||||||||||

|

Real estate construction

|

48,106 | 2,207 | --- | 50,313 | ||||||||||||

|

Total

|

109,459 | 267,268 | 15,243 | 391,970 | ||||||||||||

|

Less loans with predetermined interest rates

|

(24,915 | ) | (23,734 | ) | (6,694 | ) | (55,343 | ) | ||||||||

|

Loans with adjustable rates

|

$ | 84,544 | $ | 243,534 | $ | 8,549 | $ | 336,627 | ||||||||

|

December

31,

|

||||||||||||||||||||

|

2012

|

2011

|

2010

|

2009

|

2008

|

||||||||||||||||

|

Nonaccrual loans:

|

||||||||||||||||||||

|

Real estate construction

|

$ | 89 | $ | --- | $ | --- | $ | 2,643 | $ | --- | ||||||||||

|

Consumer real estate

|

612 | 296 | 964 | --- | --- | |||||||||||||||

|

Commercial real estate

|

2,736 | 702 | 526 | 1,455 | 1,333 | |||||||||||||||

|

Commercial non real estate

|

26 | 400 | 448 | --- | --- | |||||||||||||||

|

Public sector and IDA

|

--- | --- | --- | --- | --- | |||||||||||||||

|

Consumer non real estate

|

3 | --- | --- | --- | --- | |||||||||||||||

|

Total nonaccrual loans

|

$ | 3,466 | $ | 1,398 | $ | 1,938 | $ | 4,098 | $ | 1,333 | ||||||||||

|

Restructured loans (TDR Loans) in nonaccrual

|

||||||||||||||||||||

|

Real estate construction

|

$ | 123 | $ | 1,681 | $ | 2,185 | $ | --- | $ | --- | ||||||||||

|

Consumer real estate

|

407 | 315 | --- | --- | --- | |||||||||||||||

|

Commercial real estate

|

1,142 | 1,544 | 3,698 | --- | --- | |||||||||||||||

|

Commercial non real estate

|

479 | 198 | 250 | --- | --- | |||||||||||||||

|

Public sector and IDA

|

--- | --- | --- | --- | --- | |||||||||||||||

|

Consumer non real estate

|

--- | 68 | --- | --- | --- | |||||||||||||||

|

Total restructured loans in nonaccrual

|

2,151 | 3,806 | 6,133 | --- | --- | |||||||||||||||

|

Total nonperforming loans

|

$ | 5,617 | $ | 5,204 | $ | 8,071 | $ | 4,098 | $ | 1,333 | ||||||||||

|

Other real estate owned, net

|

1,435 | 1,489 | 1,723 | 2,126 | 1,984 | |||||||||||||||

|

Total nonperforming assets

|

$ | 7,052 | $ | 6,693 | $ | 9,794 | $ | 6,224 | $ | 3,317 | ||||||||||

|

Accruing loans past due 90 days or more:

|

||||||||||||||||||||

|

Real estate construction

|

$ | --- | $ | --- | $ | --- | $ | 20 | $ | --- | ||||||||||

|

Consumer real estate

|

156 | 346 | 612 | 873 | 394 | |||||||||||||||

|

Commercial real estate

|

--- | 63 | 577 | 643 | 589 | |||||||||||||||

|

Commercial non real estate

|

--- | 26 | 81 | 99 | 74 | |||||||||||||||

|

Public sector and IDA

|

--- | --- | --- | --- | --- | |||||||||||||||

|

Consumer non real estate

|

14 | 46 | 66 | 62 | 70 | |||||||||||||||

| $ | 170 | $ | 481 | $ | 1,336 | $ | 1,697 | $ | 1,127 | |||||||||||

|

Accruing restructured loans:

|

||||||||||||||||||||

|

Real estate construction

|

$ | --- | $ | 1,611 | $ | --- | $ | --- | $ | --- | ||||||||||

|

Consumer real estate

|

80 | 156 | --- | --- | --- | |||||||||||||||

|

Commercial real estate

|

1,886 | 1,922 | 350 | 2,652 | --- | |||||||||||||||

|

Commercial non real estate

|

39 | 67 | --- | --- | --- | |||||||||||||||

|

Public sector and IDA

|

--- | --- | --- | --- | --- | |||||||||||||||

|

Consumer non real estate

|

--- | --- | --- | --- | --- | |||||||||||||||

| $ | 2,005 | $ | 3,756 | $ | 350 | $ | 2,652 | $ | --- | |||||||||||

|

2012

|

2011

|

2010

|

||||||||||

|

Provision for loan losses

|

$ | 3,134 | $ | 2,949 | $ | 3,409 | ||||||

|

Net charge-offs to average net loans

|

0.49 | % | 0.43 | % | 0.46 | % | ||||||

|

Allowance for loan losses to loans, net of unearned

income and deferred fees

|

1.41 | % | 1.37 | % | 1.33 | % | ||||||

|

Allowance for loan losses to nonperforming loans

|

148.64 | % | 155.03 | % | 94.96 | % | ||||||

|

Allowance for loan losses to nonperforming assets

|

118.39 | % | 120.54 | % | 78.25 | % | ||||||

|

Nonperforming assets to loans, net of unearned income

and deferred fees, plus other real estate owned

|

1.19 | % | 1.13 | % | 1.69 | % | ||||||

|

Nonaccrual loans

|

$ | 3,466 | $ | 1,398 | $ | 1,938 | ||||||

|

Restructured loans in nonaccrual status

|

2,151 | 3,806 | 6,133 | |||||||||

|

Other real estate owned, net

|

1,435 | 1,489 | 1,723 | |||||||||

|

Total nonperforming assets

|

$ | 7,052 | $ | 6,693 | $ | 9,794 | ||||||

|

Accruing loans past due 90 days or more

|

$ | 170 | $ | 481 | $ | 1,336 | ||||||

|

TDR Delinquency Status as of December 31, 2012

|

||||||||||||||||||||

|

Accruing

|

||||||||||||||||||||

|

Total TDR Loans

|

Current

|

30-89 Days Past Due

|

90+ Days

Past Due

|

Nonaccrual

|

||||||||||||||||

|

Real estate construction

|

$ | 123 | $ | --- | $ | --- | $ | --- | $ | 123 | ||||||||||

|

Consumer real estate

|

487 | 80 | --- | --- | 407 | |||||||||||||||

|

Commercial real estate

|

3,028 | 1,886 | --- | --- | 1,142 | |||||||||||||||

|

Commercial non real estate

|

518 | 39 | --- | --- | 479 | |||||||||||||||

|

Public sector and IDA

|

--- | --- | --- | --- | --- | |||||||||||||||

|

Consumer non real estate

|

--- | --- | --- | --- | --- | |||||||||||||||

|

Total TDR Loans

|

$ | 4,156 | $ | 2,005 | $ | --- | $ | --- | $ | 2,151 | ||||||||||

|

TDR Delinquency Status as of December 31, 2011

|

||||||||||||||||||||

|

Accruing

|

||||||||||||||||||||

|

Total TDR Loans

|

Current

|

30-89 Days Past Due

|

90+ Days

Past Due

|

Nonaccrual

|

||||||||||||||||

|

Real estate construction

|

$ | 3,292 | $ | 1,611 | $ | --- | $ | --- | $ | 1,681 | ||||||||||

|

Consumer real estate

|

471 | 156 | --- | --- | 315 | |||||||||||||||

|

Commercial real estate

|

3,466 | 1,922 | --- | --- | 1,544 | |||||||||||||||

|

Commercial non real estate

|

265 | 67 | --- | --- | 198 | |||||||||||||||

|

Public sector and IDA

|

--- | --- | --- | --- | --- | |||||||||||||||

|

Consumer non real estate

|

68 | --- | --- | 68 | ||||||||||||||||

|

Total TDR Loans

|

$ | 7,562 | $ | 3,756 | $ | --- | $ | --- | $ | 3,806 | ||||||||||

|

TDR Delinquency Status as of December 31, 2010

|

||||||||||||||||||||

|

Accruing

|

||||||||||||||||||||

|

Total TDR Loans

|

Current

|

30-89 Days Past Due

|

90+ Days

Past Due

|

Nonaccrual

|

||||||||||||||||

|

Real estate construction

|

$ | 2,185 | $ | --- | $ | --- | $ | --- | $ | 2,185 | ||||||||||

|

Consumer real estate

|

--- | --- | --- | --- | --- | |||||||||||||||

|

Commercial real estate

|

4,048 | 350 | --- | --- | 3,698 | |||||||||||||||

|

Commercial non real estate

|

250 | --- | --- | --- | 250 | |||||||||||||||

|

Public sector and IDA

|

--- | --- | --- | --- | --- | |||||||||||||||

|

Consumer non real estate

|

--- | --- | --- | --- | ||||||||||||||||

|

Total TDR Loans

|

$ | 6,483 | $ | 350 | $ | --- | $ | --- | $ | 6,133 | ||||||||||

|

December 31,

|

||||||||||||||||||||

|

2012

|

2011

|

2010

|

2009

|

2008

|

||||||||||||||||

|

Average net loans outstanding

|

$ | 588,170 | $ | 588,439 | $ | 586,133 | $ | 579,581 | $ | 538,868 | ||||||||||

|

Balance at beginning of year

|

8,068 | 7,664 | 6,926 | 5,858 | 5,219 | |||||||||||||||

|

Charge-offs:

|

||||||||||||||||||||

|

Real estate construction

|

640 | 444 | --- | --- | --- | |||||||||||||||

|

Consumer real estate

|

370 | 584 | 475 | 181 | 35 | |||||||||||||||

|

Commercial real estate

|

1,589 | 320 | 1,050 | --- | 82 | |||||||||||||||

|

Commercial non real estate

|

109 | 990 | 919 | 83 | 64 | |||||||||||||||

|

Public Sector and IDA

|

--- | --- | --- | --- | --- | |||||||||||||||

|

Consumer non real estate

|

245 | 290 | 366 | 383 | 430 | |||||||||||||||

|

Total loans charged off

|

2,953 | 2,628 | 2,810 | 647 | 611 | |||||||||||||||

|

Recoveries:

|

||||||||||||||||||||

|

Real estate construction

|

13 | --- | --- | --- | --- | |||||||||||||||

|

Consumer real estate

|

8 | 16 | 10 | 16 | 2 | |||||||||||||||

|

Commercial real estate

|

--- | --- | 61 | --- | 28 | |||||||||||||||

|

Commercial non real estate

|

2 | --- | 1 | 3 | 9 | |||||||||||||||

|

Public Sector and IDA

|

--- | --- | --- | --- | --- | |||||||||||||||

|

Consumer non real estate

|

77 | 67 | 67 | 62 | 92 | |||||||||||||||

|

Total recoveries

|

100 | 83 | 139 | 81 | 131 | |||||||||||||||

|

Net loans charged off

|

2,853 | 2,545 | 2,671 | 566 | 480 | |||||||||||||||

|

Additions charged to operations

|

3,134 | 2,949 | 3,409 | 1,634 | 1,119 | |||||||||||||||

|

Balance at end of year

|

$ | 8,349 | $ | 8,068 | $ | 7,664 | $ | 6,926 | $ | 5,858 | ||||||||||

|

Net charge-offs to average net loans outstanding

|

0.49 | % | 0.43 | % | 0.46 | % | 0.10 | % | 0.09 | % | ||||||||||

|

December 31,

|

||||||||||||||||||||||

|

2012

|

2011

|

2010

|

2009

|

2008

|

||||||||||||||||||

|

Allowance

Amount

|

Percent of

Loans in Each

Category to

Total

Loans

|

Allowance

Amount

|

Percent of

Loans in

Each

Category to

Total

Loans

|

Allowance

Amount

|

Percent of

Loans in

Each

Category to

Total Loans

|

Allowance

Amount

|

Percent of

Loans in

Each

Category to

Total

Loans

|

Allowance

Amount

|

Percent of

Loans in

Each

Category to

Total Loans

|

|||||||||||||

|

Real estate construction

|

$

|

1,175

|

8.48

|

%

|

$

|

1,079

|

8.23

|

%

|

$

|

1,087

|

8.00

|

%

|

$

|

1,917

|

7.57

|

%

|

$

|

468

|

10.54

|

%

|

||

|

Consumer real estate

|

2,263

|

24.15

|

%

|

1,245

|

25.49

|

%

|

1,052

|

26.57

|

%

|

330

|

26.12

|

%

|

874

|

26.44

|

%

|

|||||||

|

Commercial real estate

|

3,315

|

51.31

|

%

|

3,515

|

51.44

|

%

|

3,461

|

50.78

|

%

|

2,654

|

49.61

|

%

|

2,566

|

48.12

|

%

|

|||||||

|

Commercial non real estate

|

956

|

6.30

|

%

|

1,473

|

6.59

|

%

|

1,089

|

6.50

|

%

|

1,148

|

7.01

|

%

|

1,035

|

6.41

|

%

|

|||||||

|

Public sector and IDA

|

142

|

4.41

|

%

|

232

|

2.64

|

%

|

259

|

2.17

|

%

|

84

|

3.25

|

%

|

93

|

2.00

|

%

|

|||||||

|

Consumer non real estate

|

417

|

5.35

|

%

|

403

|

5.61

|

%

|

587

|

5.98

|

%

|

507

|

6.44

|

%

|

700

|

6.49

|

%

|

|||||||

|

Unallocated

|

81

|

121

|

129

|

286

|

122

|

|||||||||||||||||

|

$

|

8,349

|

100.00

|

%

|

$

|

8,068

|

100.00

|

%

|

$

|

7,664

|

100.00

|

%

|

$

|

6,926

|

100.00

|

%

|

$

|

5,858

|

100.00

|

%

|

|||

|

December 31,

|

||||||||||||

|

2012

|

2011

|

2010

|

||||||||||

|

Impaired loans

|

$ | 11,053 | $ | 12,596 | $ | 8,791 | ||||||

|

Allowance related to impaired loans

|

269 | 1,123 | 1,200 | |||||||||

|

Allowance to impaired loans

|

2.43 | % | 8.92 | % | 13.65 | % | ||||||

|

Non-impaired loans

|

582,062 | 575,874 | 567,652 | |||||||||

|

Allowance related to non-impaired loans

|

8,080 | 6,945 | 6,464 | |||||||||

|

Allowance to non-impaired loans

|

1.39 | % | 1.21 | % | 1.14 | % | ||||||

|

Total loans, net of unearned income and deferred fees

|

592,162 | 588,470 | 576,443 | |||||||||

|

Total allowance for loan losses

|

8,349 | 8,068 | 7,664 | |||||||||

|

Total allowance for total loans

|

1.41 | % | 1.37 | % | 1.33 | % | ||||||

|

Maturities and Yields

|

||||||||||||||||||||||||

|

$ in thousands, except percent data

|

December 31, 2012

|

|||||||||||||||||||||||

|

< 1 Year

|

1-5 Years

|

5-10 Years

|

> 10 Years

|

None

|

Total

|

|||||||||||||||||||

|

Available for Sale:

|

|

|||||||||||||||||||||||

|

U.S. Treasury

|

$ | 2,073 | $ | --- | $ | --- | $ | --- | $ | --- | $ | 2,073 | ||||||||||||

| 3.97 | % | --- | --- | --- | --- | 3.97 | % | |||||||||||||||||

|

U.S. Government agencies

|

1,007 | 1,051 | 2,180 | 125,326 | --- | 129,564 | ||||||||||||||||||

| 4.75 | % | 4.44 | % | 3.18 | % | 3.38 | % | --- | 3.40 | % | ||||||||||||||

|

Mortgage-backed securities

|

139 | 958 | 1,244 | 2,228 | --- | 4,569 | ||||||||||||||||||

| 4.45 | % | 5.17 | % | 4.96 | % | 5.36 | % | --- | 5.18 | % | ||||||||||||||

|

States and political subdivision – nontaxable

(1)

|

6,515 | 8,603 | 9,451 | 12,210 | --- | 36,779 | ||||||||||||||||||

| 5.29 | % | 5.74 | % | 5.66 | % | 5.77 | % | --- | 5.65 | % | ||||||||||||||

|

Corporate

|

6,471 | 1,937 | --- | 6,167 | --- | 14,575 | ||||||||||||||||||

| 4.40 | % | 4.90 | % | --- | 4.13 | % | --- | 4.35 | % | |||||||||||||||

|

Federal Home Loan Bank stock

|

--- | --- | --- | --- | 1,597 | 1,597 | ||||||||||||||||||

| --- | --- | --- | --- | 0.01 | % | 0.01 | % | |||||||||||||||||

|

Federal Reserve Bank stock

|

--- | --- | --- | --- | 92 | 92 | ||||||||||||||||||

| --- | --- | --- | --- | 6.00 | % | 6.00 | % | |||||||||||||||||

|

Other securities

|

688 | --- | --- | --- | 1,567 | 2,255 | ||||||||||||||||||

| 0.16 | % | --- | --- | --- | 0.70 | % | 0.53 | % | ||||||||||||||||

|

Total

|

$ | 16,893 | $ | 12,549 | $ | 12,875 | $ | 145,931 | $ | 3,256 | $ | 191,504 | ||||||||||||

| 4.54 | % | 5.46 | % | 5.17 | % | 3.64 | % | 0.51 | % | 3.89 | % | |||||||||||||

|

Held to Maturity:

|

||||||||||||||||||||||||

|

U.S. Government agencies

|

$ | --- | $ | --- | $ | 3,056 | $ | 4,932 | $ | --- | $ | 7,988 | ||||||||||||

| --- | --- | 4.17 | % | 3.66 | % | --- | 3.86 | % | ||||||||||||||||

|

Mortgage-backed securities

|

--- | --- | --- | 691 | --- | 691 | ||||||||||||||||||

| --- | --- | --- | 5.55 | % | --- | 5.55 | % | |||||||||||||||||

|

States and political subdivision – nontaxable

(1)

|

3,256 | 8,537 | 10,689 | 128,727 | --- | 151,209 | ||||||||||||||||||

| 6.77 | % | 6.05 | % | 5.43 | % | 5.48 | % | --- | 5.54 | % | ||||||||||||||

|

Corporate

|

651 | --- | --- | --- | --- | 651 | ||||||||||||||||||

| 3.95 | % | --- | --- | --- | --- | 3.95 | % | |||||||||||||||||

|

Total

|

$ | 3,907 | $ | 8,537 | $ | 13,745 | $ | 134,350 | $ | --- | $ | 160,539 | ||||||||||||

| 6.30 | % | 6.05 | % | 5.15 | % | 5.41 | % | --- | 5.45 | % | ||||||||||||||

|

|

(1) Rates shown represent weighted average yield on a fully taxable basis.

|

|

|

Deposits

|

|

|

Average amounts and average rates paid on deposit categories are presented below:

|

|

Year Ended December

31,

|

||||||||||||||||

|

2012

|

2011

|

2010

|

||||||||||||||

|

Average

Amounts

|

Average

Rates

Paid

|

Average

Amounts

|

Average

Rates

Paid

|

Average

Amounts

|

Average

Rates

Paid

|

|||||||||||

|

Noninterest-bearing demand deposits

|

$

|

141,269

|

---

|

$

|

135,880

|

---

|

$

|

122,817

|

---

|

|||||||

|

Interest-bearing demand deposits

|

420,947

|

0.99

|

%

|

378,971

|

1.08

|

%

|

322,705

|

1.03

|

%

|

|||||||

|

Savings deposits

|

64,973

|

0.06

|

%

|

58,273

|

0.08

|

%

|

54,543

|

0.09

|

%

|

|||||||

|

Time deposits

|

298,797

|

1.23

|

%

|

314,920

|

1.60

|

%

|

352,888

|

2.20

|

%

|

|||||||

|

Average total deposits

|

$

|

925,986

|

1.01

|

%

|

$

|

888,044

|

1.22

|

%

|

$

|

852,953

|

1.53

|

%

|

||||

|

December

31,

2012

|

||||||||||||||||||||

|

3 Months or Less

|

Over 3 Months Through 6 Months

|

Over 6 Months

Through 12 Months

|

Over 12 Months

|

Total

|

||||||||||||||||

|

Total time deposits of $100,000 or more

|

$ | 29,259 | $ | 24,097 | $ | 41,312 | $ | 17,577 | $ | 112,245 | ||||||||||

|

Payments Due by Period

|

||||||||||||||||||||

|

Total

|

Less Than 1 Year

|

1-3 Years

|

3-5 Years

|

More Than 5 Years

|

||||||||||||||||

|

Commitments to extend credit

|

$ | 128,162 | $ | 128,162 | $ | --- | $ | --- | $ | --- | ||||||||||

|

Standby letters of credit

|

12,533 | 12,533 | --- | --- | --- | |||||||||||||||

|

Mortgage loans with potential recourse

|

22,574 | 22,574 | --- | --- | --- | |||||||||||||||

|

Operating leases

|

478 | 219 | 237 | 22 | --- | |||||||||||||||

|

Total

|

$ | 163,747 | $ | 163,488 | $ | 237 | $ | 22 | $ | --- | ||||||||||

|

|

December

31,

|

|||||||

|

$ in thousands, except per share data

|

2012

|

2011

|

||||||

|

Assets

|

||||||||

|

Cash and due from banks

|

$ | 14,783 | $ | 11,897 | ||||

|

Interest-bearing deposits

|

96,597 | 98,355 | ||||||

|

Securities available for sale, at fair value

|

191,504 | 174,918 | ||||||

|

Securities held to maturity (fair value approximates $170,846 at December 31, 2012 and $151,429 at December 31, 2011)

|

160,539 | 143,995 | ||||||

|

Mortgage loans held for sale

|

2,796 | 2,623 | ||||||

|

Loans:

|

||||||||

|

Real estate construction loans

|

50,313 | 48,531 | ||||||

|

Consumer real estate loans

|

143,262 | 150,224 | ||||||

|

Commercial real estate loans

|

304,308 | 303,192 | ||||||

|

Commercial non real estate loans

|

37,349 | 38,832 | ||||||

|

Public sector and IDA loans

|

26,169 | 15,571 | ||||||

|

Consumer non real estate loans

|

31,714 | 33,072 | ||||||

|

Total loans

|

593,115 | 589,422 | ||||||

|

Less unearned income and deferred fees

|

(953 | ) | (952 | ) | ||||

|

Loans, net of unearned income and deferred fees

|

592,162 | 588,470 | ||||||

|

Less allowance for loan losses

|

(8,349 | ) | (8,068 | ) | ||||

|

Loans, net

|

583,813 | 580,402 | ||||||

|

Premises and equipment, net

|

10,401 | 10,393 | ||||||

|

Accrued interest receivable

|

6,247 | 6,304 | ||||||

|

Other real estate owned, net

|

1,435 | 1,489 | ||||||

|

Intangible assets and goodwill

|

9,377 | 10,460 | ||||||

|

Bank-owned life insurance

|

20,523 | 19,812 | ||||||

|

Other assets

|

6,346 | 6,454 | ||||||

|

Total assets

|

$ | 1,104,361 | $ | 1,067,102 | ||||

|

Liabilities and Stockholders’ Equity

|

||||||||

|

Noninterest-bearing demand deposits

|

$ | 144,252 | $ | 142,163 | ||||

|

Interest-bearing demand deposits

|

455,713 | 404,801 | ||||||

|

Savings deposits

|

69,063 | 61,298 | ||||||

|

Time deposits

|

277,738 | 311,071 | ||||||

|

Total deposits

|

946,766 | 919,333 | ||||||

|

Accrued interest payable

|

139 | 206 | ||||||

|

Other liabilities

|

7,347 | 6,264 | ||||||

|

Total liabilities

|

954,252 | 925,803 | ||||||

|

Commitments and contingencies

|

--- | --- | ||||||

|

Stockholders’ equity:

|

||||||||

|

Preferred stock, no par value, 5,000,000 shares authorized; none issued and outstanding

|

--- | --- | ||||||

|

Common stock of $1.25 par value. Authorized 10,000,000 shares; issued and outstanding, 6,947,974 shares in 2012 and 6,939,974 shares in 2011

|

8,685 | 8,675 | ||||||

|

Retained earnings

|

144,162 | 133,945 | ||||||

|

Accumulated other comprehensive (loss), net

|

(2,738 | ) | (1,321 | ) | ||||

|

Total stockholders’ equity

|

150,109 | 141,299 | ||||||

|

Total liabilities and stockholders’ equity

|

$ | 1,104,361 | $ | 1,067,102 | ||||

|

Years

ended

December

31,

|

||||||||||||

|

$ in thousands, except per share data

|

2012

|

2011

|

2010

|

|||||||||

|

Interest Income

|

||||||||||||

|

Interest and fees on loans

|

$ | 35,354 | $ | 36,514 | $ | 36,919 | ||||||

|

Interest on interest-bearing deposits

|

240 | 155 | 128 | |||||||||

|

Interest on securities – taxable

|

6,613 | 6,745 | 5,588 | |||||||||

|

Interest on securities – nontaxable

|

6,463 | 6,532 | 6,504 | |||||||||

|

Total interest income

|

48,670 | 49,946 | 49,139 | |||||||||

|

Interest Expense

|

||||||||||||

|

Interest on time deposits of $100,000 or more

|

1,491 | 2,019 | 3,439 | |||||||||

|

Interest on other deposits

|

6,396 | 7,165 | 7,719 | |||||||||

|

Total interest expense

|

7,887 | 9,184 | 11,158 | |||||||||

|

Net interest income

|

40,783 | 40,762 | 37,981 | |||||||||

|

Provision for loan losses

|

3,134 | 2,949 | 3,409 | |||||||||

|

Net interest income after provision for loan losses

|

37,649 | 37,813 | 34,572 | |||||||||

|

Noninterest Income

|

||||||||||||

|

Service charges on deposit accounts

|

2,594 | 2,617 | 2,858 | |||||||||

|

Other service charges and fees

|

243 | 287 | 317 | |||||||||

|

Credit card fees

|

3,278 | 3,197 | 2,954 | |||||||||

|

Trust income

|

1,313 | 1,087 | 1,118 | |||||||||

|

BOLI income

|

814 | 762 | 760 | |||||||||

|

Other income

|

472 | 449 | 354 | |||||||||

|

Realized securities gains (losses), net

|

25 | 11 | (14 | ) | ||||||||

|

Total noninterest income

|

8,739 | 8,410 | 8,347 | |||||||||

|

Noninterest Expense

|

||||||||||||

|

Salaries and employee benefits

|

12,005 | 11,357 | 10,963 | |||||||||

|

Occupancy, furniture and fixtures

|

1,589 | 1,599 | 1,875 | |||||||||

|

Data processing and ATM

|

1,593 | 1,701 | 1,499 | |||||||||

|

FDIC assessment

|

475 | 677 | 1,080 | |||||||||

|

Credit card processing

|

2,442 | 2,485 | 2,300 | |||||||||

|

Intangible assets amortization

|

1,083 | 1,083 | 1,083 | |||||||||

|

Net costs of other real estate owned

|

208 | 518 | 214 | |||||||||

|

Franchise taxes

|

901 | 780 | 963 | |||||||||

|

Other operating expenses

|

3,100 | 3,138 | 3,150 | |||||||||

|

Total noninterest expense

|

23,396 | 23,338 | 23,127 | |||||||||

|

Income before income taxes

|

22,992 | 22,885 | 19,792 | |||||||||

|

Income tax expense

|

5,245 | 5,247 | 4,223 | |||||||||

|

Net income

|

$ | 17,747 | $ | 17,638 | $ | 15,569 | ||||||

|

Basic net income per common share

|

$ | 2.56 | $ | 2.54 | $ | 2.25 | ||||||

|

Fully diluted net income per common share

|

$ | 2.55 | $ | 2.54 | $ | 2.24 | ||||||

|

Years

ended

December

31,

|

||||||||||||

|

$ in thousands, except per share data

|

2012

|

2011

|

2010

|

|||||||||

|

Net Income

|

$ | 17,747 | $ | 17,638 | $ | 15,569 | ||||||

|

Other Comprehensive Income, Net of Tax

|

||||||||||||

|

Unrealized holding gains (losses) on available for sale securities net of taxes of ($320) in 2012, $1,468 in 2011 and ($923) in 2010

|

(592 | ) | 2,725 | (1,716 | ) | |||||||

|

Reclassification adjustment for gains included in net income, net of taxes of ($3) in 2012, $9 in 2011 and ($7) in 2010

|

(7 | ) | 17 | (12 | ) | |||||||

|

Net pension loss arising during the period, net of taxes of

($405) in 2012, ($731) in 2011, and ($188) in 2010

|

(752 | ) | (1,356 | ) | (348 | ) | ||||||

|

Less amortization of prior service cost included in net periodic

pension cost, net of taxes of ($35) in 2012, ($35) in 2011,

and

($39) in 2010

|

(66 | ) | (66 | ) | (73 | ) | ||||||

|

Other comprehensive income (loss), net of taxes of ($763) in 2012, $711 in 2011 and ($1,157) in 2010

|

(1,417 | ) | 1,320 | (2,149 | ) | |||||||

|

Total Comprehensive Income

|

$ | 16,330 | $ | 18,958 | $ | 13,420 | ||||||

|

$ in thousands, except per share data

|

Common Stock

|

Retained Earnings

|

Accumulated Other Comprehensive (Loss)

|

Total

|

||||||||

|

Balance at December 31, 2009

|

$

|

8,667

|

$

|

113,901

|

$

|

(492

|

)

|

$

|

122,076

|

|||

|

Net income

|

---

|

15,569

|

---

|

15,569

|

||||||||

|

Other comprehensive loss, net of tax of ($1,157)

|

---

|

---

|

(2,149

|

)

|

(2,149

|

)

|

||||||

|

Cash dividend ($0.91 per share)

|

---

|

(6,309

|

)

|

---

|

(6,309

|

)

|

||||||

|

Balance at December 31, 2010

|

$

|

8,667

|

$

|

123,161

|

$

|

(2,641

|

)

|

$

|

129,187

|

|||

|

Net income

|

---

|

17,638

|

---

|

17,638

|

||||||||

|

Other comprehensive income, net of tax of $711

|

---

|

---

|

1,320

|

1,320

|

||||||||

|

Cash dividend ($1.00 per share)

|

---

|

(6,938

|

)

|

---

|

(6,938

|

)

|

||||||

|

Exercise of stock options

|

8

|

84

|

---

|

92

|

||||||||

|

Balance at December 31, 2011

|

$

|

8,675

|

$

|

133,945

|

$

|

(1,321

|

)

|

$

|

141,299

|

|||

|

Net income

|

---

|

17,747

|

---

|

17,747

|

||||||||

|

Other comprehensive loss, net of tax of ($763)

|

---

|

---

|

(1,417

|

)

|

(1,417

|

)

|

||||||

|

Cash dividend ($1.10 per share)

|

---

|

(7,639

|

)

|

---

|

(7,639

|

)

|

||||||

|

Exercise of stock options

|

10

|

109

|

---

|

119

|

||||||||

|

Balance at December 31, 2012

|

$

|

8,685

|

$

|

144,162

|

$

|

(2,738

|

)

|

$

|

150,109

|

|||

|

Years

Ended

December

31,

|

||||||||||||

|

$ in thousands

|

2012

|

2011

|

2010

|

|||||||||

|

Cash Flows from Operating Activities

|

||||||||||||

|

Net income

|

$ | 17,747 | $ | 17,638 | $ | 15,569 | ||||||

|

Adjustment to reconcile net income to net cash provided by operating activities:

|

||||||||||||

|

Provision for loan losses

|

3,134 | 2,949 | 3,409 | |||||||||

|

Deferred income tax expense

|

204 | 582 | 563 | |||||||||

|

Depreciation of premises and equipment

|

764 | 799 | 886 | |||||||||

|

Amortization of intangibles

|

1,083 | 1,083 | 1,083 | |||||||||

|

Amortization of premiums and accretion of discounts, net

|

224 | 217 | 300 | |||||||||

|

(Gains) losses on disposal of fixed assets

|

(3 | ) | 1 | (5 | ) | |||||||

|

(Gains) losses on calls of securities available for sale, net

|

(10 | ) | 26 | (19 | ) | |||||||

|

(Gains) losses on calls of securities held to maturity, net

|

(15 | ) | (37 | ) | 33 | |||||||

|

(Gains) losses and writedowns on other real estate owned

|

(14 | ) | 334 | 63 | ||||||||

|

Originations of mortgage loans held for sale

|

(22,747 | ) | (13,582 | ) | (21,929 | ) | ||||||

|

Sales of mortgage loans held for sale

|

22,574 | 13,419 | 19,595 | |||||||||

|

Net change in:

|

||||||||||||

|

Accrued interest receivable

|

57 | (288 | ) | 234 | ||||||||

|

Other assets

|

(44 | ) | 501 | (858 | ) | |||||||

|

Accrued interest payable

|

(67 | ) | (51 | ) | (79 | ) | ||||||

|

Other liabilities

|

(175 | ) | (4,135 | ) | (280 | ) | ||||||

|

Net cash provided by operating activities

|

22,712 | 19,456 | 18,565 | |||||||||

|

Cash Flows from Investing Activities

|

||||||||||||

|

Net change in interest-bearing deposits

|

1,758 | (28,955 | ) | (36,670 | ) | |||||||

|

Proceeds from repayments of mortgage-backed securities

|

3,160 | 3,823 | 5,817 | |||||||||

|

Proceeds from calls and maturities of securities available for sale

|

151,051 | 74,961 | 68,565 | |||||||||

|

Proceeds from calls and maturities of securities held to maturity

|

30,942 | 22,123 | 39,234 | |||||||||

|

Purchases of securities available for sale

|

(171,601 | ) | (64,567 | ) | (93,862 | ) | ||||||

|

Purchases of securities held to maturity

|

(47,803 | ) | (35,411 | ) | (41,297 | ) | ||||||

|

Purchases of loan participations

|

1,988 | --- | (55 | ) | ||||||||

|

Collections of loan participations

|

(2,082 | ) | 934 | 876 | ||||||||

|

Loan originations and principal collections, net

|

(8,182 | ) | (17,081 | ) | 7,820 | |||||||

|

Purchase of bank-owned life insurance

|

--- | (1,900 | ) | --- | ||||||||

|

Proceeds from disposal of other real estate owned

|

1,699 | 1,391 | 2,393 | |||||||||

|

Recoveries on loans charged off

|

100 | 84 | 139 | |||||||||

|

Additions to premises and equipment

|

(769 | ) | (725 | ) | (728 | ) | ||||||

|

Proceeds from sale of premises and equipment

|

--- | 2 | 5 | |||||||||

|

Net cash used in investing activities

|

(39,739 | ) | (45,321 | ) | (47,763 | ) | ||||||

| (continued) | ||||||||||||

|

Cash Flows from Financing Activities

|

||||||||||||

|

Net change in time deposits

|

(33,333 | ) | (21,132 | ) | (35,109 | ) | ||||||

|

Net change in other deposits

|

60,766 | 55,882 | 67,580 | |||||||||

|

Cash dividends paid

|

(7,639 | ) | (6,938 | ) | (6,309 | ) | ||||||

|

Stock options exercised

|

119 | 92 | --- | |||||||||

|

Net cash provided by financing activities

|

19,913 | 27,904 | 26,162 | |||||||||

|

Net change in cash and due from banks

|

2,886 | 2,039 | (3,036 | ) | ||||||||

|

Cash and due from banks at beginning of year

|

11,897 | 9,858 | 12,894 | |||||||||

|

Cash and due from banks at end of year

|

$ | 14,783 | $ | 11,897 | $ | 9,858 | ||||||

|

Supplemental Disclosures of Cash Flow Information

|

||||||||||||

|

Interest paid on deposits and borrowed funds

|

$ | 7,954 | $ | 9,235 | $ | 11,237 | ||||||

|

Income taxes paid

|

4,930 | 4,779 | 5,478 | |||||||||

|

Supplemental Disclosures of Noncash Activities

|

||||||||||||

|

Loans charged against the allowance for loan losses

|

$ | 2,953 | $ | 2,628 | $ | 2,810 | ||||||

|

Loans transferred to other real estate owned

|

1,631 | 1,491 | 2,053 | |||||||||

|

Unrealized gains (losses) on securities available for sale

|

(922 | ) | 4,219 | (2,658 | ) | |||||||

|

Minimum pension liability adjustment

|

(1,258 | ) | (2,188 | ) | (648 | ) | ||||||

|

2012

|

2011

|

2010

|

|||||

|

Average number of common shares outstanding

|

6,942,411

|

6,936,869

|

6,933,474

|

||||

|

Effect of dilutive options

|

17,456

|

13,994

|

16,462

|

||||

|

Average number of common shares outstanding used to calculate diluted earnings per common share

|

6,959,867

|

6,950,863

|

6,949,936

|

|

December 31, 2012

|

||||||||||||||||

|

Available for sale:

|

Amortized

Cost

|

Gross

Unrealized

Gains

|

Gross

Unrealized

Losses

|

Fair Value

|

||||||||||||

|

U.S. Treasury

|

$ | 2,005 | $ | 68 | $ | --- | $ | 2,073 | ||||||||

|

U.S. Government agencies and corporations

|

128,805 | 1,381 | 622 | 129,564 | ||||||||||||

|

States and political subdivisions

|

35,029 | 1,753 | 3 | 36,779 | ||||||||||||

|

Mortgage-backed securities

|

4,202 | 367 | --- | 4,569 | ||||||||||||

|

Corporate debt securities

|

14,207 | 368 | --- | 14,575 | ||||||||||||

|

Federal Home Loan Bank stock – restricted

|

1,597 | --- | --- | 1,597 | ||||||||||||

|

Federal Reserve Bank stock – restricted

|

92 | --- | --- | 92 | ||||||||||||

|

Other securities

|

2,419 | 9 | 173 | 2,255 | ||||||||||||

|

Total securities available for sale

|

$ | 188,356 | $ | 3,946 | $ | 798 | $ | 191,504 | ||||||||

|

December 31, 2011

|

||||||||||||||||

|

Available for sale:

|

Amortized

Cost

|

Gross

Unrealized

Gains

|

Gross

Unrealized

Losses

|

Fair Value

|

||||||||||||

|

U.S. Treasury

|

$ | 2,010 | $ | 140 | $ | --- | $ | 2,150 | ||||||||

|

U.S. Government agencies and corporations

|

94,716 | 1,307 | 20 | 96,003 | ||||||||||||

|

States and political subdivisions

|

47,118 | 2,034 | 30 | 49,122 | ||||||||||||

|

Mortgage-backed securities

|

7,156 | 569 | --- | 7,725 | ||||||||||||

|

Corporate debt securities

|

15,852 | 322 | 97 | 16,077 | ||||||||||||

|

Federal Home Loan Bank stock – restricted

|

1,574 | --- | --- | 1,574 | ||||||||||||

|

Federal Reserve Bank stock – restricted

|

92 | --- | --- | 92 | ||||||||||||

|

Other securities

|

2,330 | 7 | 162 | 2,175 | ||||||||||||

|

Total securities available for sale

|

$ | 170,848 | $ | 4,379 | $ | 309 | $ | 174,918 | ||||||||

|

December 31, 2012

|

||||||||

|

Amortized Cost

|

Fair Value

|

|||||||

|

Due in one year or less

|

$ | 16,688 | $ | 16,893 | ||||

|

Due after one year through five years

|

12,096 | 12,549 | ||||||

|

Due after five years through ten years

|

11,987 | 12,875 | ||||||

|

Due after ten years

|

144,165 | 145,931 | ||||||

|

No maturity

|

3,420 | 3,256 | ||||||

| $ | 188,356 | $ | 191,504 | |||||

|

December 31, 2012

|

||||||||||||||||

|

Held to maturity:

|

Amortized

Cost

|

Gross

Unrealized

Gains

|

Gross

Unrealized

Losses

|

Fair Value

|

||||||||||||

|

U.S. Government agencies and corporations

|

$ | 7,988 | $ | 563 | $ | --- | $ | 8,551 | ||||||||

|

States and political subdivisions

|

151,209 | 9,880 | 216 | 160,873 | ||||||||||||

|

Mortgage-backed securities

|

691 | 73 | --- | 764 | ||||||||||||

|

Corporate debt securities

|

651 | 7 | --- | 658 | ||||||||||||

|

Total securities held to maturity

|

$ | 160,539 | $ | 10,523 | $ | 216 | $ | 170,846 | ||||||||

|

December 31, 2011

|

||||||||||||||||

|

Held to maturity:

|

Amortized

Cost

|

Gross

Unrealized

Gains

|

Gross

Unrealized

Losses

|

Fair Value

|

||||||||||||

|

U.S. Government agencies and corporations

|

$ | 22,057 | $ | 562 | $ | --- | $ | 22,619 | ||||||||

|

States and political subdivisions

|

119,381 | 6,775 | 15 | 126,141 | ||||||||||||

|

Mortgage-backed securities

|

902 | 94 | --- | 996 | ||||||||||||

|

Corporate debt securities

|

1,655 | 18 | --- | 1,673 | ||||||||||||

|

Total securities held to maturity

|

$ | 143,995 | $ | 7,449 | $ | 15 | $ | 151,429 | ||||||||

|

December 31, 2012

|

||||||||

|

Amortized

Cost

|

Fair

Value

|

|||||||

|

Due in one year or less

|

$ | 3,907 | $ | 3,958 | ||||

|

Due after one year through five years

|

8,537 | 8,814 | ||||||

|

Due after five years through ten years

|

13,745 | 15,050 | ||||||

|

Due after ten years

|

134,350 | 143,024 | ||||||

| $ | 160,539 | $ | 170,846 | |||||

|

December 31, 2012

|

||||||||||||||||

|

Less Than 12 Months

|

12 Months or More

|

|||||||||||||||

|

Fair

Value

|

Unrealized

Loss

|

Fair

Value

|

Unrealized

Loss

|

|||||||||||||

|

U. S. Government agencies and corporations

|

$ | 44,351 | $ | 622 | $ | --- | $ | --- | ||||||||

|

State and political subdivisions

|

9,358 | 216 | 482 | 3 | ||||||||||||

|

Other

|

--- | --- | 133 | 172 | ||||||||||||

|

Total temporarily impaired securities

|

$ | 53,709 | $ | 838 | $ | 615 | $ | 176 | ||||||||

|

December 31, 2011

|

||||||||||||||||

|

Less Than 12 Months

|

12 Months or More

|

|||||||||||||||

|

Fair

Value

|

Unrealized

Loss

|

Fair

Value

|

Unrealized

Loss

|

|||||||||||||

|

U. S. Government agencies and corporations

|

$ | 6,230 | $ | 20 | $ | --- | $ | --- | ||||||||

|

State and political subdivisions

|

3,527 | 19 | 981 | 26 | ||||||||||||

|

Corporate debt securities

|

4,916 | 97 | --- | --- | ||||||||||||

|

Other

|

--- | --- | 142 | 162 | ||||||||||||

|

Total temporarily impaired securities

|

$ | 14,673 | $ | 136 | $ | 1,123 | $ | 188 | ||||||||

|

Real Estate Construction

Construction, residential

Construction, other

Consumer Real Estate

Equity lines

Residential closed-end first liens

Residential closed-end junior liens

Commercial Real Estate

Multifamily real estate

Commercial real estate, owner occupied

Commercial real estate, other

|

Commercial Non Real Estate

Commercial and Industrial

Public Sector and IDA

Public sector and IDA

Consumer Non Real Estate

Credit cards

Automobile

Other consumer loans

|

|

Consumer Real Estate

Equity lines

Closed-end consumer real estate

Consumer construction

Consumer, Non Real Estate

Credit cards

Consumer, general

Consumer overdraft

Commercial & Industrial

Commercial & Industrial

Construction, Development and Land

Residential

Commercial

|

Commercial Real Estate

College housing

Office/Retail space

Nursing homes

Hotels

Municipalities

Medical professionals

Religious organizations

Convenience stores

Entertainment and sports

Nonprofits

Restaurants

General contractors

Other commercial real estate

|

|

Years ended December 31,

|

||||||||||||

|

2012

|

2011

|

2010

|

||||||||||

|

Balance at beginning of year

|

$ | 8,068 | $ | 7,664 | $ | 6,926 | ||||||

|

Loans charged off

|

(2,953 | ) | (2,628 | ) | (2,810 | ) | ||||||

|

Recoveries of loans previously charged off

|

100 | 83 | 139 | |||||||||

|

Provision for loan losses

|

3,134 | 2,949 | 3,409 | |||||||||

|

Balance at end of year

|

$ | 8,349 | $ | 8,068 | $ | 7,664 | ||||||

|

Activity in the Allowance for Loan Losses by Segment for the year ended December 31, 2012

|

||||||||||||||||||||||||

|

Real Estate Construction

|

Consumer Real Estate

|

Commercial Real Estate

|

Commercial Non Real Estate

|

Public Sector and IDA

|

Consumer Non Real Estate

|

Unallocated

|

Total

|

|||||||||||||||||

|

Balance, December 31, 2011

|

$

|

1,079

|

$

|

1,245

|

$

|

3,515

|

$

|

1,473

|

$

|

232

|

$

|

403

|

$

|

121

|

$

|

8,068

|

||||||||

|

Charge-offs

|

(640

|

)

|

(370

|

)

|

(1,589

|

)

|

(109

|

)

|

---

|

(245

|

)

|

---

|

(2,953

|

)

|

||||||||||

|

Recoveries

|

13

|

8

|

---

|

2

|

---

|

77

|

---

|

100

|

||||||||||||||||

|

Provision for loan losses

|

723

|

1,380

|

1,389

|

(410

|

)

|

(90

|

)

|

182

|

(40

|

)

|

3,134

|

|||||||||||||

|

Balance, December 31,

2012

|

$

|

1,175

|

$

|

2,263

|

$

|

3,315

|

$

|

956

|

$

|

142

|

$

|

417

|

$

|