|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2016

|

|

|

Or

|

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from ________ to ________

|

|

|

Minnesota

|

95-3848122

|

|

(

State or Other Jurisdiction of Incorporation or Organization

)

|

(I.R.S. Employer Identification No.)

|

|

Title of Each Class

|

|

Name of Each Exchange On Which Registered

|

|

Common Stock, $0.001 par value

|

|

NYSE MKT

|

|

Large Accelerated Filer ☐

|

Accelerated Filer

ý

|

Non-Accelerated Filer ☐

(Do not check if a smaller reporting company)

|

Smaller Reporting Company ☐

|

|

|

|

Page

|

|

Part I

|

||

|

Business

|

||

|

Risk Factors

|

||

|

Unresolved Staff Comments

|

||

|

Properties

|

||

|

Legal Proceedings

|

||

|

Mine Safety Disclosures

|

||

|

|

|

|

|

Part II

|

||

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

||

|

Selected Financial Data

|

||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

||

|

Quantitative and Qualitative Disclosures About Market Risk

|

||

|

Financial Statements and Supplementary Data

|

||

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

||

|

Controls and Procedures

|

||

|

Other Information

|

||

|

|

|

|

|

Part III

|

||

|

Directors, Executive Officers and Corporate Governance

|

||

|

Executive Compensation

|

||

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

||

|

Certain Relationships and Related Transactions, and Director Independence

|

||

|

Principal Accountant Fees and Services

|

||

|

|

|

|

|

Part IV

|

||

|

Exhibits and Financial Statement Schedules

|

||

|

|

|

|

|

As of December 31, 2016

|

||||||||||||||||||

|

|

Net

Acres |

Productive Wells

|

Average Daily Production

(1)

(Boe per day) |

Proved Reserves

(MBoe) |

% Oil

|

% Proved Developed

|

||||||||||||

|

Gross

|

Net

|

|||||||||||||||||

|

North Dakota

|

135,110

|

|

2,820

|

|

202.2

|

|

13,404

|

|

53,505

|

|

86

|

69

|

||||||

|

Montana

|

19,906

|

|

94

|

|

10.9

|

|

249

|

|

576

|

|

83

|

100

|

||||||

|

Total

|

155,016

|

|

2,914

|

|

213.1

|

|

13,653

|

|

54,081

|

|

86

|

70

|

||||||

|

(1)

|

Represents the average daily production over the twelve months ended

December 31, 2016

.

|

|

•

|

Deploy our Capital in a Conservative and Strategic Manner and Review Opportunities to Bolster our Liquidity.

In the current industry environment, maintaining liquidity is critical. Therefore, we will be highly selective in the projects that we fund and will review opportunities to bolster our liquidity and financial position through various means.

|

|

•

|

Continue Participation in the Development of Our Existing Properties in the Williston Basin as a Non-Operator.

In the current price environment, we believe the best way to develop our acreage is to take a long-term approach and develop our locations with potential for the highest rates of return. We plan to continue to concentrate our capital expenditures in the Williston Basin, where we believe our current acreage position can provide an attractive return on the capital employed on our multi-year drilling inventory of oil-focused properties.

|

|

•

|

Diversify Our Risk Through Non-Operated Participation in a Large Number of Bakken and Three Forks Wells

. As a non-operator, we seek to diversify our investment and operational risk through participation in a large number of oil wells and with multiple operators. As of

December 31, 2016

, we have participated in

2,914

gross (

213.1

net) producing wells in the Williston Basin with an average working interest of 7.3% in each gross well, with more than 35 experienced operating partners. We expect to continue partnering with numerous experienced operators across our leasehold positions.

|

|

•

|

Evaluate and Pursue Value-Enhancing Acquisitions, Joint Ventures and Divestitures.

We will continue to monitor the market for strategic acquisitions that we believe could be accretive and enhance shareholder value.

We generally seek to acquire small lease positions at a significant discount to the contiguous acreage positions typically sought by larger producers. As part of this strategy, we consider areas that are actively being drilled and permitted and where we have an understanding of the operators and their drilling plans, capital requirements and well economics. In addition, we have increasingly taken interest in and will continue to evaluate the acquisition of non-operated producing properties as a means to grow and/or bolster our credit metrics.

|

|

•

|

Maintain a Strong Balance Sheet and Proactively Manage to Limit Downside.

We strive to remain financially strong, yet flexible, through the prudent management of our balance sheet and active management of commodity price volatility. Given the low commodity price environment existing at

December 31, 2016

and continuing into

2017

, Northern intends to preserve liquidity by remaining selective on capital deployment. We employ an active commodity price risk management program to better enable us to execute our business plan over the entire commodity price cycle. The following table summarizes the open oil derivative contracts that we have entered into as of

December 31, 2016

:

|

|

Open Contracts

|

||||||||||||

|

Year

|

Swap Volumes

(Bbl)

|

Weighted

Average Swap Price ($) |

Costless Collar Volumes

(Bbl)

|

Weighted

Average Floor/Ceiling Prices ($) |

||||||||

|

2017

(1)

|

2,525,000

|

|

52.55

|

|

300,000

|

|

50.00 / 60.06

|

|

||||

|

2018

|

813,000

|

|

54.40

|

|

—

|

|

—

|

|

||||

|

2019 and beyond

|

—

|

|

—

|

|

—

|

|

—

|

|

||||

|

(1)

|

The Company has entered into crude oil derivative contracts that give counterparties the option to extend certain current derivative contracts for an additional six-month period. Options covering a notional volume of 10,000 barrels per month are exercisable on or about June 30, 2017. If the counterparties exercise all such options, the notional volume of the Company’s existing crude oil derivative contracts would increase by 10,000 barrels per month at an average price of $55.20 per barrel for each month during the period July 1, 2017 through December 31, 2017.

|

|

•

|

require the acquisition of a permit or other authorization before construction or drilling commences and for certain other activities;

|

|

•

|

limit or prohibit construction, drilling and other activities on certain lands lying within wilderness and other protected areas; and

|

|

•

|

impose substantial liabilities for pollution resulting from its operations.

|

|

•

|

changes in global supply and demand for oil and natural gas;

|

|

•

|

the actions of OPEC and other major oil producing countries;

|

|

•

|

the price and quantity of imports of foreign oil and natural gas;

|

|

•

|

political and economic conditions, including embargoes, in oil-producing countries or affecting other oil-producing activity;

|

|

•

|

the level of global oil and natural gas exploration and production activity;

|

|

•

|

the level of global oil and natural gas inventories;

|

|

•

|

changes in U.S. energy policy under the current administration;

|

|

•

|

weather conditions;

|

|

•

|

technological advances affecting energy consumption;

|

|

•

|

domestic and foreign governmental regulations;

|

|

•

|

proximity and capacity of oil and natural gas pipelines and other transportation facilities;

|

|

•

|

the price and availability of competitors’ supplies of oil and natural gas in captive market areas; and

|

|

•

|

the price and availability of alternative fuels.

|

|

•

|

declines in oil or natural gas prices;

|

|

•

|

the high cost, shortages or delivery delays of equipment and services;

|

|

•

|

shortages of or delays in obtaining water for hydraulic fracturing operations;

|

|

•

|

unexpected operational events;

|

|

•

|

adverse weather conditions;

|

|

•

|

facility or equipment malfunctions;

|

|

•

|

title problems;

|

|

•

|

pipeline ruptures or spills;

|

|

•

|

compliance with environmental and other governmental requirements;

|

|

•

|

regulations, restrictions, moratoria and bans on hydraulic fracturing;

|

|

•

|

unusual or unexpected geological formations;

|

|

•

|

loss of drilling fluid circulation;

|

|

•

|

formations with abnormal pressures;

|

|

•

|

environmental hazards, such as oil, natural gas or well fluids spills or releases, pipeline or tank ruptures and discharges of toxic gas;

|

|

•

|

fires;

|

|

•

|

blowouts, craterings and explosions;

|

|

•

|

uncontrollable flows of oil, natural gas or well fluids; and

|

|

•

|

pipeline capacity curtailments.

|

|

SEC Defined Prices for 12 Months Ended

|

NYMEX Oil

Price (per Bbl) |

Henry Hub Gas Price

(per MMBtu) |

||||||

|

December 31, 2016

|

$

|

42.75

|

|

$

|

2.49

|

|

||

|

September 30, 2016

|

41.68

|

|

2.28

|

|

||||

|

June 30, 2016

|

43.12

|

|

2.24

|

|

||||

|

March 31, 2016

|

46.26

|

|

2.39

|

|

||||

|

•

|

lower commodity prices or production;

|

|

•

|

increased leverage ratios;

|

|

•

|

inability to drill or unfavorable drilling results;

|

|

•

|

changes in crude oil, NGL and natural gas reserve engineering;

|

|

•

|

increased operating and/or capital costs;

|

|

•

|

the lenders’ inability to agree to an adequate borrowing base; or

|

|

•

|

adverse changes in the lenders’ practices (including required regulatory changes) that affect reserves-based lending.

|

|

•

|

oil and natural gas prices and other factors generally affecting industry operating environment;

|

|

•

|

the timing and amount of capital expenditures;

|

|

•

|

their expertise and financial resources;

|

|

•

|

approval of other participants in drilling wells;

|

|

•

|

selection of technology; and

|

|

•

|

the rate of production of reserves, if any.

|

|

•

|

a counterparty to our derivative contracts is unable to satisfy its obligations under the contracts;

|

|

•

|

our production is less than expected; or

|

|

•

|

there is a widening of price differentials between delivery points for our production and the delivery point assumed in the derivative arrangement.

|

|

•

|

the volume, pricing and duration of our oil and natural gas hedging contracts;

|

|

•

|

actual prices we receive for oil, natural gas and NGLs;

|

|

•

|

our actual operating costs in producing oil, natural gas and NGLs;

|

|

•

|

the amount and timing of our capital expenditures;

|

|

•

|

the amount and timing of actual production; and

|

|

•

|

changes in governmental regulations or taxation.

|

|

•

|

the validity of our assumptions about reserves, future production, revenues and costs;

|

|

•

|

a decrease in our liquidity by using a significant portion of our cash from operations or borrowing capacity to finance acquisitions;

|

|

•

|

a significant increase in our interest expense or financial leverage if we incur additional debt to finance acquisitions;

|

|

•

|

dilution to shareholders if we use equity as consideration for, or to finance, acquisitions;

|

|

•

|

the assumption of unknown liabilities, losses or costs for which we are not indemnified or for which our indemnity is inadequate;

|

|

•

|

an inability to hire, train or retain qualified personnel to manage and operate our growing business and assets; and

|

|

•

|

an increase in our costs or a decrease in our revenues associated with any potential royalty owner or landowner claims or disputes.

|

|

•

|

declare or pay any dividend or make any other distributions on, purchase or redeem our equity interests or purchase or redeem subordinated debt;

|

|

•

|

make certain investments;

|

|

•

|

incur or guarantee additional indebtedness or issue certain types of equity securities;

|

|

•

|

create certain liens;

|

|

•

|

sell assets;

|

|

•

|

consolidate, merge or transfer all or substantially all of our assets; and

|

|

•

|

engage in transactions with our affiliates.

|

|

•

|

would not be required to lend any additional amounts to us;

|

|

•

|

could elect to declare all borrowings outstanding, together with accrued and unpaid interest and fees, to be due and payable;

|

|

•

|

may have the ability to require us to apply all of our available cash to repay these borrowings; and

|

|

•

|

may prevent us from making debt service payments under our other agreements.

|

|

•

|

require us to dedicate a substantial portion of our cash flow from operations to service our existing debt, thereby reducing the cash available to finance our operations and other business activities and could limit our flexibility in planning for or reacting to changes in our business and the industry in which we operate;

|

|

•

|

increase our vulnerability to economic downturns and adverse developments in our business, such as the current low commodity price environment;

|

|

•

|

limit our ability to access the capital markets to raise capital on favorable terms or to obtain additional financing for working capital, capital expenditures or acquisitions or to refinance existing indebtedness;

|

|

•

|

place restrictions on our ability to obtain additional financing, make investments, lease equipment, sell assets and engage in business combinations;

|

|

•

|

place us at a competitive disadvantage relative to competitors with lower levels of indebtedness in relation to their overall size or less restrictive terms governing their indebtedness; and

|

|

•

|

make it more difficult for us to satisfy our obligations under our debt agreements and increase the risk that we may default on our debt obligations.

|

|

•

|

refinancing or restructuring our debt;

|

|

•

|

selling assets;

|

|

•

|

reducing or delaying capital investments; or

|

|

•

|

seeking to raise additional capital.

|

|

•

|

the repeal of the percentage depletion allowance for oil and gas properties;

|

|

•

|

the elimination of current deductions for intangible drilling and development costs;

|

|

•

|

the elimination of the deduction for U.S. oil and gas production activities;

|

|

•

|

an extension of the amortization period for certain geological and geophysical expenditures; and

|

|

•

|

the repeal of the enhanced oil recovery credit.

|

|

|

December 31, 2016

|

December 31, 2015

|

December 31, 2014

|

|||||||||||

|

|

Proved Reserves

(MBoe) (1) |

% of

Total |

Proved Reserves

(MBoe) (2) |

% of

Total |

Proved Reserves (MBoe)

(3)

|

% of

Total |

||||||||

|

SEC Proved Reserves:

|

|

|

|

|

|

|

||||||||

|

Developed

|

37,713

|

|

70

|

42,177

|

|

65

|

51,046

|

|

51

|

|||||

|

Undeveloped

|

16,368

|

|

30

|

23,121

|

|

35

|

49,690

|

|

49

|

|||||

|

Total Proved Properties

|

54,081

|

|

100

|

65,298

|

|

100

|

100,736

|

|

100

|

|||||

|

(1)

|

The table above values oil and natural gas reserve quantities as of

December 31, 2016

assuming constant realized prices of $35.24 per barrel of oil and $1.67 per Mcf of natural gas. Under SEC guidelines, these prices represent the average prices per barrel of oil and per Mcf of natural gas at the beginning of each month in the 12-month period prior to the end of the reporting period, after adjustment to reflect applicable transportation and quality differentials.

|

|

(2)

|

The table above values oil and natural gas reserve quantities as of

December 31, 2015

assuming constant realized prices of $42.03 per barrel of oil and $1.63 per Mcf of natural gas. Under SEC guidelines, these prices represent the average prices per barrel of oil and per Mcf of natural gas at the beginning of each month in the 12-month period prior to the end of the reporting period, after adjustment to reflect applicable transportation and quality differentials.

|

|

(3)

|

The table above values oil and natural gas reserve quantities as of

December 31, 2014

assuming constant realized prices of $83.11 per barrel of oil and $7.37 per Mcf of natural gas. Under SEC guidelines, these prices represent the average prices per barrel of oil and per Mcf of natural gas at the beginning of each month in the 12-month period prior to the end of the reporting period, after adjustment to reflect applicable transportation and quality differentials.

|

|

|

SEC Pricing Proved Reserves

(1)

|

||||||||||||||||

|

|

Reserve Volumes

|

PV-10

(3)

|

|||||||||||||||

|

Reserve Category

|

Oil

(MBbls) |

Natural Gas

(MMcf) |

Total

(MBoe) (2) |

%

|

Amount

(In thousands) |

%

|

|||||||||||

|

PDP Properties

|

30,514

|

|

30,974

|

|

35,676

|

|

66

|

$

|

322,735

|

|

85

|

||||||

|

PDNP Properties

|

1,731

|

|

1,834

|

|

2,037

|

|

4

|

16,903

|

|

5

|

|||||||

|

PUD Properties

|

14,030

|

|

14,024

|

|

16,368

|

|

30

|

39,784

|

|

10

|

|||||||

|

Total

|

46,275

|

|

46,832

|

|

54,081

|

|

100

|

$

|

379,422

|

|

100

|

||||||

|

(1)

|

The SEC Pricing Proved Reserves table above values oil and natural gas reserve quantities and related discounted future net cash flows as of

December 31, 2016

based on average prices of $42.75 per barrel of oil and $2.49 per Mcf of natural gas. Under SEC guidelines, these prices represent the average prices per barrel of oil and per Mcf of natural gas at the beginning of each month in the 12-month period prior to the end of the reporting period. The average resulting price used as of

December 31, 2016

, after adjustment to reflect applicable transportation and quality differentials, was $35.24 per barrel of oil and $1.67 per Mcf of natural gas.

|

|

(2)

|

Boe are computed based on a conversion ratio of one Boe for each barrel of oil and one Boe for every 6,000 cubic feet (i.e., 6 Mcf) of natural gas.

|

|

(3)

|

Pre-tax PV10%, or “PV-10,” may be considered a non-GAAP financial measure as defined by the SEC and is derived from the standardized measure of discounted future net cash flows, which is the most directly comparable GAAP measure. See “Reconciliation of PV-10 to Standardized Measure” below.

|

|

SEC Pricing Proved Reserves

(in thousands) |

|||

|

Standardized Measure Reconciliation

|

|||

|

Pre-Tax Present Value of Estimated Future Net Revenues (Pre-Tax PV10%)

|

$

|

379,422

|

|

|

Future Income Taxes, Discounted at 10%

(1)

|

(396

|

)

|

|

|

Standardized Measure of Discounted Future Net Cash Flows

|

$

|

379,026

|

|

|

(1)

|

The expected tax benefits to be realized from utilization of the net operating loss and tax credit carryforwards are used in the computation of future income tax cash flows. As a result of available net operating loss carryforwards and the remaining tax basis of our assets at

December 31, 2016

, our future income taxes were significantly reduced.

|

|

|

MMBoe

|

|

|

Estimated Proved Undeveloped Reserves at 12/31/2015

|

23.1

|

|

|

Converted to Proved Developed Through Drilling

|

(1.1

|

)

|

|

Added from Extensions and Discoveries

|

7.1

|

|

|

Removed for 5-Year Rule

|

(3.4

|

)

|

|

Removed Due to Low Commodity Prices

|

(8.7

|

)

|

|

Revisions

|

(0.6

|

)

|

|

Estimated Proved Undeveloped Reserves at 12/31/2016

|

16.4

|

|

|

|

Price Cases

|

|||||||

|

|

SEC Case

(1)

|

Scenario 1

(2)

|

Scenario 2

(3)

|

|||||

|

Net Proved Reserves (December 31, 2016)

|

|

|

||||||

|

Oil (MBbl)

|

|

|

||||||

|

Developed

|

32,245

|

|

35,248

|

|

36,030

|

|

||

|

Undeveloped

|

14,030

|

|

14,326

|

|

14,404

|

|

||

|

Total

|

46,275

|

|

49,574

|

|

50,434

|

|

||

|

Natural Gas (MMcf)

|

|

|

|

|

||||

|

Developed

|

32,808

|

|

36,076

|

|

36,932

|

|

||

|

Undeveloped

|

14,024

|

|

14,302

|

|

14,376

|

|

||

|

Total

|

46,832

|

|

50,378

|

|

51,308

|

|

||

|

Total Proved Reserves (MBOE)

|

54,081

|

|

57,970

|

|

58,985

|

|

||

|

(1)

|

Represents reserves based on pricing prescribed by the SEC. The unescalated twelve month arithmetic average of the first day of the month posted prices were adjusted for transportation and quality differentials to arrive at prices of $35.24 per Bbl for oil and $1.67 per Mcf for natural gas. Production costs were held constant for the life of the wells.

|

|

(2)

|

Prices based on $55.00 per Bbl for oil and $3.00 per MMbtu for natural gas, which were then adjusted for transportation and quality differentials to arrive at prices of $47.49 per Bbl for oil and $2.01 per Mcf for natural gas. Production costs and the future development drilling program were both held constant with the SEC case.

|

|

(3)

|

Prices based on $60.00 per Bbl for oil and $3.25 per MMbtu for natural gas, which were then adjusted for transportation and quality differentials to arrive at prices of $52.49 per Bbl for oil and $2.18 per Mcf for natural gas. Production costs and the future development drilling program were both held constant with the SEC case.

|

|

SEC Case

(1)

|

Scenario 1

(2)

|

Scenario 2

(3)

|

|||||||||

|

Standardized Measure Reconciliation

(in thousands)

|

|||||||||||

|

Pre-Tax Present Value of Estimated Future Net Revenues

(Pre-Tax PV10%) |

$

|

379,422

|

|

$

|

664,600

|

|

$

|

783,004

|

|

||

|

Future Income Taxes, Discounted at 10%

(4)

|

(396

|

)

|

(2,525

|

)

|

(13,980

|

)

|

|||||

|

Standardized Measure of Discounted Future Net Cash Flows

|

$

|

379,026

|

|

$

|

662,075

|

|

$

|

769,024

|

|

||

|

(1)

|

Represents reserves based on pricing prescribed by the SEC. The unescalated twelve month arithmetic average of the first day of the month posted prices were adjusted for transportation and quality differentials to arrive at prices of $35.24 per Bbl for oil and $1.67 per Mcf for natural gas. Production costs were held constant for the life of the wells.

|

|

(2)

|

Prices based on $55.00 per Bbl for oil and $3.00 per MMbtu for natural gas, which were then adjusted for transportation and quality differentials to arrive at prices of $47.49 per Bbl for oil and $2.01 per Mcf for natural gas. Production costs and the future development drilling program were both held constant with the SEC case.

|

|

(3)

|

Prices based on $60.00 per Bbl for oil and $3.25 per MMbtu for natural gas, which were then adjusted for transportation and quality differentials to arrive at prices of $52.49 per Bbl for oil and $2.18 per Mcf for natural gas. Production costs and the future development drilling program were both held constant with the SEC case.

|

|

(4)

|

The expected tax benefits to be realized from utilization of the net operating loss and tax credit carryforwards are used in the computation of future income tax cash flows. As a result of available net operating loss carryforwards and the remaining tax basis of our assets at December 31, 2016, our future income taxes were significantly reduced.

|

|

•

|

Comparison of historical expenses from the lease operating statements and workover authorizations for expenditure to the operating costs input in our reserves database;

|

|

•

|

Review of working interests and net revenue interests in our reserves database against our well ownership system;

|

|

•

|

Review of historical realized prices and differentials from index prices as compared to the differentials used in our reserves database;

|

|

•

|

Review of updated capital costs prepared by our operations team;

|

|

•

|

Review of internal reserve estimates by well and by area by our internal reservoir engineer;

|

|

•

|

Discussion of material reserve variances among our internal reservoir engineer and our executive management; and

|

|

•

|

Review of a preliminary copy of the reserve report by executive management.

|

|

|

Years Ended December 31,

|

||||||||||

|

|

2016

|

2015

|

2014

|

||||||||

|

Net Production:

|

|||||||||||

|

Oil (Bbl)

|

4,325,919

|

|

5,168,687

|

|

5,150,913

|

|

|||||

|

Natural Gas and NGLs (Mcf)

|

4,026,899

|

|

4,651,583

|

|

3,682,781

|

|

|||||

|

Total (Boe)

|

4,997,069

|

|

5,943,950

|

|

5,764,710

|

|

|||||

|

Average Sales Prices:

|

|

|

|

|

|||||||

|

Oil (per Bbl)

|

$

|

35.22

|

|

$

|

37.77

|

|

$

|

79.23

|

|

||

|

Effect of Gain (Loss) on Settled Derivatives on Average Price (per Bbl)

|

14.22

|

|

31.17

|

|

(1.53

|

)

|

|||||

|

Oil Net of Settled Derivatives (per Bbl)

|

49.44

|

|

68.94

|

|

77.70

|

|

|||||

|

Natural Gas and NGLs (per Mcf)

|

1.82

|

|

1.60

|

|

6.38

|

|

|||||

|

Realized Price on a Boe Basis Including all Realized Derivative Settlements

|

44.27

|

|

61.19

|

|

73.51

|

|

|||||

|

Average Costs:

|

|||||||||||

|

Production Expenses (per Boe)

|

$

|

9.14

|

|

$

|

8.77

|

|

$

|

9.66

|

|

||

|

|

Years Ended December 31,

|

||||||||||||||||

|

|

2016

|

2015

|

2014

|

||||||||||||||

|

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

|||||||||||

|

Exploratory Wells:

|

|

|

|

|

|

|

|||||||||||

|

Oil

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Natural Gas

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Non-Productive

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Development Wells:

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Oil

|

294

|

|

10.7

|

|

292

|

|

18.6

|

|

589

|

|

41.6

|

|

|||||

|

Natural Gas

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Non-Productive

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Total Productive Exploratory and Development Wells

|

294

|

|

10.7

|

|

292

|

|

18.6

|

|

589

|

|

41.6

|

|

|||||

|

|

At December 31,

|

||||||||||||||||

|

|

2016

|

2015

|

2014

|

||||||||||||||

|

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

|||||||||||

|

North Dakota

|

2,820

|

|

202.2

|

|

2,533

|

|

192.6

|

|

2,243

|

|

174.1

|

|

|||||

|

Montana

|

94

|

|

10.9

|

|

97

|

|

11.7

|

|

95

|

|

11.6

|

|

|||||

|

Total

|

2,914

|

|

213.1

|

|

2,630

|

|

204.3

|

|

2,338

|

|

185.7

|

|

|||||

|

|

Developed Acreage

|

Undeveloped Acreage

|

Total Acreage

|

||||||||||||||

|

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

|||||||||||

|

North Dakota:

|

|

|

|

|

|

|

|||||||||||

|

Mountrail County

|

117,107

|

|

26,546

|

|

11,760

|

|

1,629

|

|

128,867

|

|

28,175

|

|

|||||

|

McKenzie County

|

99,952

|

|

24,250

|

|

15,726

|

|

6,196

|

|

115,678

|

|

30,446

|

|

|||||

|

Williams County

|

67,909

|

|

16,606

|

|

7,419

|

|

3,342

|

|

75,328

|

|

19,948

|

|

|||||

|

Dunn County

|

68,424

|

|

14,492

|

|

14,043

|

|

5,456

|

|

82,467

|

|

19,948

|

|

|||||

|

Divide County

|

55,936

|

|

15,073

|

|

5,866

|

|

2,973

|

|

61,802

|

|

18,046

|

|

|||||

|

Other

|

90,151

|

|

13,977

|

|

13,474

|

|

4,570

|

|

103,625

|

|

18,547

|

|

|||||

|

North Dakota

|

499,479

|

|

110,944

|

|

68,288

|

|

24,166

|

|

567,767

|

|

135,110

|

|

|||||

|

Montana

|

41,789

|

|

10,994

|

|

17,436

|

|

8,912

|

|

59,225

|

|

19,906

|

|

|||||

|

Total:

|

541,268

|

|

121,938

|

|

85,724

|

|

33,078

|

|

626,992

|

|

155,016

|

|

|||||

|

|

Acreage Subject to Expiration

|

|||||

|

Year Ended

|

Gross

|

Net

|

||||

|

December 31, 2017

|

47,068

|

|

14,873

|

|

||

|

December 31, 2018

|

24,205

|

|

10,736

|

|

||

|

December 31, 2019

|

9,854

|

|

4,483

|

|

||

|

December 31, 2020

|

1,877

|

|

898

|

|

||

|

December 31, 2021 and thereafter

|

2,720

|

|

2,088

|

|

||

|

Total

|

85,724

|

|

33,078

|

|

||

|

|

Years Ended December 31,

|

||||||||||

|

|

2016

|

2015

|

2014

|

||||||||

|

Depletion of Oil and Natural Gas Properties

|

$

|

60,637,746

|

|

$

|

137,105,397

|

|

$

|

172,106,389

|

|

||

|

Depletion Expense (per Boe)

|

12.13

|

|

23.07

|

|

29.86

|

|

|||||

|

|

Sales Price

|

||||||

|

|

High

|

Low

|

|||||

|

Fiscal Year Ended December 31, 2015

|

|||||||

|

First Quarter

|

$

|

9.48

|

|

$

|

5.16

|

|

|

|

Second Quarter

|

9.51

|

|

6.15

|

|

|||

|

Third Quarter

|

6.74

|

|

4.05

|

|

|||

|

Fourth Quarter

|

5.95

|

|

3.36

|

|

|||

|

Fiscal Year Ended December 31, 2016

|

|

|

|

|

|||

|

First Quarter

|

5.07

|

|

1.99

|

|

|||

|

Second Quarter

|

5.85

|

|

3.70

|

|

|||

|

Third Quarter

|

4.94

|

|

2.52

|

|

|||

|

Fourth Quarter

|

3.50

|

|

1.55

|

|

|||

|

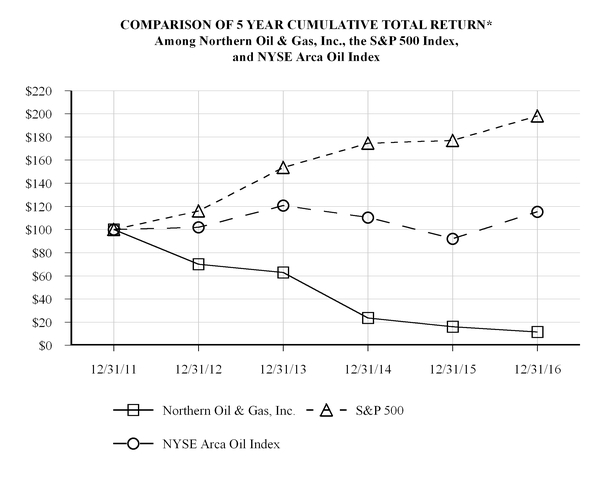

12/31/2011

|

|

12/31/2012

|

|

12/31/2013

|

|

12/31/2014

|

|

12/31/2015

|

|

12/31/2016

|

|

||||||

|

Northern Oil & Gas, Inc.

|

100.00

|

|

70.14

|

|

62.84

|

|

23.56

|

|

16.10

|

|

11.47

|

|

|||||

|

S&P 500

|

100.00

|

|

116.00

|

|

153.58

|

|

174.60

|

|

177.01

|

|

198.18

|

|

|||||

|

NYSE Arca Oil Index

|

100.00

|

|

101.96

|

|

120.73

|

|

110.50

|

|

92.08

|

|

115.46

|

|

|||||

|

•

|

our financial condition and performance;

|

|

•

|

earnings;

|

|

•

|

need for funds;

|

|

•

|

capital requirements;

|

|

•

|

prior claims of preferred stock to the extent issued and outstanding; and

|

|

•

|

other factors, including income tax consequences, contractual restrictions and any applicable laws.

|

|

Period

|

Total Number of Shares Purchased

(1)

|

Average Price Paid Per Share

|

Total Number of Shares Purchased as Part of Publically Announced Plans or Programs

|

Approximate Dollar Value of Shares that May Yet be Purchased Under the Plans or Programs

(2)

|

||||||||

|

Month #1

|

|

|||||||||||

|

October 1, 2016 to October 31, 2016

|

—

|

|

$

|

—

|

|

—

|

|

$ 108.3 million

|

||||

|

Month #2

|

|

|

|

|

|

|

|

|||||

|

November 1, 2016 to November 30, 2016

|

969

|

|

2.00

|

|

—

|

|

108.3 million

|

|||||

|

Month #3

|

|

|

|

|

|

|

|

|||||

|

December 1, 2016 to December 31, 2016

|

32,258

|

|

2.29

|

|

—

|

|

108.3 million

|

|||||

|

Total

|

33,227

|

|

$

|

2.29

|

|

—

|

|

$ 108.3 million

|

||||

|

(1)

|

All shares purchased reflect shares surrendered in satisfaction of tax obligations in connection with the vesting of restricted stock awards.

|

|

(2)

|

In May 2011, our board of directors approved a stock repurchase program to acquire up to $150 million worth of shares of our Company’s outstanding common stock. In total, we have repurchased 3,190,268 shares under this program through

December 31, 2016

at a weighted average price of $13.06 per share. The last time we repurchased shares under this program was in 2014.

|

|

|

Fiscal Years

|

||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

|

(in thousands, except share and per common share data)

|

||||||||||||||||||

|

|

|||||||||||||||||||

|

Revenues

|

|||||||||||||||||||

|

Oil and Gas Sales

|

$

|

159,691

|

|

$

|

202,639

|

|

$

|

431,605

|

|

$

|

369,187

|

|

$

|

296,638

|

|

||||

|

Gain (Loss) on Derivative Instruments, Net

|

(14,819

|

)

|

72,383

|

|

163,413

|

|

(33,458

|

)

|

14,756

|

|

|||||||||

|

Other Revenue

|

31

|

|

36

|

|

9

|

|

44

|

|

179

|

|

|||||||||

|

Total Revenues

|

144,903

|

|

275,057

|

|

595,027

|

|

335,773

|

|

311,573

|

|

|||||||||

|

|

|

|

|

|

|

||||||||||||||

|

Operating Expenses

|

|||||||||||||||||||

|

Production Expenses

|

45,680

|

|

52,108

|

|

55,696

|

|

41,859

|

|

32,382

|

|

|||||||||

|

Production Taxes

|

15,514

|

|

21,567

|

|

43,674

|

|

34,959

|

|

28,486

|

|

|||||||||

|

General and Administrative Expense

|

14,758

|

|

19,042

|

|

17,602

|

|

16,575

|

|

22,645

|

|

|||||||||

|

Depletion, Depreciation, Amortization and Accretion

|

61,244

|

|

137,770

|

|

172,884

|

|

124,383

|

|

98,923

|

|

|||||||||

|

Impairment of Oil and Natural Gas Properties

|

237,013

|

|

1,163,959

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Total Expenses

|

374,208

|

|

1,394,446

|

|

289,855

|

|

217,776

|

|

182,436

|

|

|||||||||

|

Income (Loss) from Operations

|

(229,305

|

)

|

(1,119,388

|

)

|

305,171

|

|

117,997

|

|

129,137

|

|

|||||||||

|

Interest Expense, Net of Capitalization

|

(64,486

|

)

|

(58,360

|

)

|

(42,106

|

)

|

(32,709

|

)

|

(13,875

|

)

|

|||||||||

|

Write-off of Debt Issuance Costs

|

(1,090

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Other Income (Expense)

|

(16

|

)

|

(30

|

)

|

47

|

|

(453

|

)

|

25

|

|

|||||||||

|

Total Other Income (Expense)

|

(65,591

|

)

|

(58,390

|

)

|

(42,058

|

)

|

(33,162

|

)

|

(13,850

|

)

|

|||||||||

|

Income (Loss) Before Income Taxes

|

(294,896

|

)

|

(1,177,779

|

)

|

263,113

|

|

84,835

|

|

115,287

|

|

|||||||||

|

|

|

|

|

|

|||||||||||||||

|

Income Tax Provision (Benefit)

|

(1,402

|

)

|

(202,424

|

)

|

99,367

|

|

31,768

|

|

43,002

|

|

|||||||||

|

Net Income (Loss)

|

$

|

(293,494

|

)

|

$

|

(975,355

|

)

|

$

|

163,746

|

|

$

|

53,067

|

|

$

|

72,285

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Net Income (Loss) Per Common Share – Basic

|

$

|

(4.80

|

)

|

$

|

(16.08

|

)

|

$

|

2.70

|

|

$

|

0.85

|

|

$

|

1.16

|

|

||||

|

Net Income (Loss) Per Common Share – Diluted

|

$

|

(4.80

|

)

|

$

|

(16.08

|

)

|

$

|

2.69

|

|

$

|

0.85

|

|

$

|

1.15

|

|

||||

|

Weighted Average Shares Outstanding – Basic

|

61,173,547

|

|

60,652,447

|

|

60,691,701

|

|

62,364,957

|

|

62,485,836

|

|

|||||||||

|

Weighted Average Shares Outstanding – Diluted

|

61,173,547

|

|

60,652,447

|

|

60,860,769

|

|

62,747,298

|

|

62,869,079

|

|

|||||||||

|

|

|||||||||||||||||||

|

Net Cash Provided By Operating Activities

|

$

|

101,892

|

|

$

|

247,016

|

|

$

|

274,258

|

|

$

|

222,774

|

|

$

|

198,527

|

|

||||

|

Net Cash Used For Investing Activities

|

$

|

(90,964

|

)

|

$

|

(288,936

|

)

|

$

|

(477,040

|

)

|

$

|

(358,536

|

)

|

$

|

(532,172

|

)

|

||||

|

Net Cash (Used For) Provided By Financing Activities

|

$

|

(7,832

|

)

|

$

|

35,973

|

|

$

|

206,433

|

|

$

|

128,061

|

|

$

|

340,754

|

|

||||

|

|

Fiscal Years

|

||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

|

(in thousands)

|

||||||||||||||||||

|

Balance Sheet Information:

|

|||||||||||||||||||

|

Assets:

|

|||||||||||||||||||

|

Cash and Cash Equivalents

|

$

|

6,486

|

|

$

|

3,390

|

|

$

|

9,338

|

|

$

|

5,687

|

|

$

|

13,388

|

|

||||

|

Total Current Assets

|

46,894

|

|

122,030

|

|

226,000

|

|

104,388

|

|

94,215

|

|

|||||||||

|

Total Property and Equipment, Net

|

376,208

|

|

589,320

|

|

1,761,927

|

|

1,397,307

|

|

1,083,245

|

|

|||||||||

|

Total Assets

|

431,533

|

|

721,431

|

|

2,026,746

|

|

1,519,600

|

|

1,190,935

|

|

|||||||||

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Total Current Liabilities

|

77,444

|

|

78,115

|

|

285,734

|

|

194,088

|

|

100,457

|

|

|||||||||

|

Revolving Line of Credit

|

144,000

|

|

150,000

|

|

298,000

|

|

75,000

|

|

124,000

|

|

|||||||||

|

8% Senior Notes

|

688,625

|

|

685,290

|

|

508,053

|

|

509,540

|

|

300,000

|

|

|||||||||

|

Total Liabilities

|

918,955

|

|

919,033

|

|

1,255,885

|

|

899,772

|

|

604,750

|

|

|||||||||

|

Total Stockholders' Equity (Deficit)

|

(487,422

|

)

|

(197,602

|

)

|

770,861

|

|

619,828

|

|

586,185

|

|

|||||||||

|

•

|

2016

new well additions averaged an estimated 27% rate of return based upon NYMEX strip prices at year-end;

|

|

•

|

Decreased total capital expenditures below discretionary cash flows allowing for a year-over-year reduction in bank borrowings;

|

|

•

|

Reduced cash general and administrative expenses by $1.2 million or 9% compared to

2015

;

|

|

•

|

Added 294 gross (10.7 net) wells to production;

|

|

•

|

Amended covenant requirements in bank agreements to relax the covenant requirements up to June 30, 2018; and

|

|

•

|

Ended

2016

in a strong liquidity position with borrowing availability under our revolving credit facility of

$206 million

.

|

|

•

|

Oil price differentials

. The price differential between our Williston Basin well head price and the NYMEX WTI benchmark price is driven by the additional cost to transport oil from the Williston Basin via train, barge, pipeline or truck to refineries.

|

|

•

|

Gain (loss) on derivative instruments, net.

We utilize commodity derivative financial instruments to reduce our exposure to fluctuations in the price of oil. Gain (loss) on derivative instruments, net is comprised of (i) cash gains and losses we recognize on settled derivatives during the period, and (ii) non-cash market-to-market gains and losses we incur on derivative instruments outstanding at period end.

|

|

•

|

Production expenses.

Production expenses are daily costs incurred to bring oil and natural gas out of the ground and to the market, together with the daily costs incurred to maintain our producing properties. Such costs also include field personnel compensation, salt water disposal, utilities, maintenance, repairs and servicing expenses related to our oil and natural gas properties.

|

|

•

|

Production taxes.

Production taxes are paid on produced oil and natural gas based on a percentage of revenues from products sold at market prices (not hedged prices) or at fixed rates established by federal, state or local taxing authorities. We seek to take full advantage of all credits and exemptions in our various taxing jurisdictions. In general, the production taxes we pay correlate to the changes in oil and natural gas revenues.

|

|

•

|

Depreciation, depletion, amortization and impairment.

Depreciation, depletion, amortization and impairment includes the systematic expensing of the capitalized costs incurred to acquire, explore and develop oil and natural gas properties. As a full cost company, we capitalize all costs associated with our development and acquisition efforts and allocate these costs to each unit of production using the units-of-production method.

|

|

•

|

General and administrative expenses.

General and administrative expenses include overhead, including payroll and benefits for our corporate staff, costs of maintaining our headquarters, costs of managing our acquisition and development operations, franchise taxes, audit and other professional fees and legal compliance.

|

|

•

|

Interest expense.

We finance a portion of our working capital requirements, capital expenditures and acquisitions with borrowings. As a result, we incur interest expense that is affected by both fluctuations in interest rates and our financing decisions. We capitalize a portion of the interest paid on applicable borrowings into our full cost pool. We include interest expense that is not capitalized into the full cost pool, the amortization of deferred financing costs and bond premiums (including origination and amendment fees), commitment fees and annual agency fees as interest expense.

|

|

•

|

Income tax expense.

Our provision for taxes includes both federal and state taxes. We record our federal income taxes in accordance with accounting for income taxes under GAAP which results in the recognition of deferred tax assets and liabilities for the expected future tax consequences of temporary differences between the book carrying amounts and the tax basis of assets and liabilities. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences and carryforwards are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. A valuation allowance is established to reduce deferred tax assets if it is more likely than not that the related tax benefits will not be realized.

|

|

•

|

the timing and success of drilling and production activities by our operating partners;

|

|

•

|

the prices and the supply and demand for oil, natural gas and NGLs;

|

|

•

|

the quantity of oil and natural gas production from the wells in which we participate;

|

|

•

|

changes in the fair value of the derivative instruments we use to reduce our exposure to fluctuations in the price of oil;

|

|

•

|

our ability to continue to identify and acquire high-quality acreage and drilling opportunities; and

|

|

•

|

the level of our operating expenses.

|

|

|

Years Ended December 31,

|

||||||||||

|

|

2016

|

2015

|

2014

|

||||||||

|

Average NYMEX Prices

(1)

|

|||||||||||

|

Oil (per Bbl)

|

$

|

43.47

|

|

$

|

48.76

|

|

$

|

92.91

|

|

||

|

Natural Gas (per MMBtu)

|

2.55

|

|

2.63

|

|

4.26

|

|

|||||

|

(1)

|

Based on average NYMEX closing prices.

|

|

|

Years Ended December 31,

|

||||||||||

|

|

2016

|

2015

|

2014

|

||||||||

|

Net Production:

|

|||||||||||

|

Oil (Bbl)

|

4,325,919

|

|

5,168,687

|

|

5,150,913

|

|

|||||

|

Natural Gas and NGLs (Mcf)

|

4,026,899

|

|

4,651,583

|

|

3,682,781

|

|

|||||

|

Total (Boe)

|

4,997,069

|

|

5,943,950

|

|

5,764,710

|

|

|||||

|

Net Sales (in thousands):

|

|

|

|

|

|||||||

|

Oil Sales

|

$

|

152,348

|

|

$

|

195,203

|

|

$

|

408,124

|

|

||

|

Natural Gas and NGL Sales

|

7,343

|

|

7,436

|

|

23,481

|

|

|||||

|

Gain (Loss) on Derivative Instruments, Net

|

(14,819

|

)

|

72,383

|

|

163,413

|

|

|||||

|

Other Revenue

|

31

|

|

36

|

|

9

|

|

|||||

|

Total Revenues

|

144,903

|

|

275,058

|

|

595,027

|

|

|||||

|

Average Sales Prices:

|

|

|

|

|

|||||||

|

Oil (per Bbl)

|

$

|

35.22

|

|

$

|

37.77

|

|

$

|

79.23

|

|

||

|

Effect of Gain (Loss) on Settled Derivatives on Average Price (per Bbl)

|

14.22

|

|

31.17

|

|

(1.53

|

)

|

|||||

|

Oil Net of Settled Derivatives (per Bbl)

|

49.44

|

|

68.94

|

|

77.70

|

|

|||||

|

Natural Gas and NGLs (per Mcf)

|

1.82

|

|

1.60

|

|

6.38

|

|

|||||

|

Realized Price on a Boe Basis Including all Realized Derivative Settlements

|

44.27

|

|

61.19

|

|

73.51

|

|

|||||

|

Operating Expenses (in thousands):

|

|

|

|

|

|||||||

|

Production Expenses

|

$

|

45,680

|

|

$

|

52,108

|

|

$

|

55,696

|

|

||

|

Production Taxes

|

15,514

|

|

21,567

|

|

43,674

|

|

|||||

|

General and Administrative Expense

|

14,758

|

|

19,042

|

|

17,602

|

|

|||||

|

Depletion, Depreciation, Amortization and Accretion

|

61,244

|

|

137,770

|

|

172,884

|

|

|||||

|

Costs and Expenses (per Boe):

|

|

|

|

|

|||||||

|

Production Expenses

|

$

|

9.14

|

|

$

|

8.77

|

|

$

|

9.66

|

|

||

|

Production Taxes

|

3.10

|

|

3.63

|

|

7.58

|

|

|||||

|

General and Administrative Expense

|

2.95

|

|

3.20

|

|

3.05

|

|

|||||

|

Depletion, Depreciation, Amortization and Accretion

|

12.26

|

|

23.18

|

|

29.99

|

|

|||||

|

Net Producing Wells at Period End

|

213.1

|

|

204.3

|

|

185.7

|

|

|||||

|

|

Years Ended December 31,

|

|||||||

|

|

2016

|

2015

|

2014

|

|||||

|

Production

|

|

|

|

|||||

|

Oil (Bbl)

|

4,325,919

|

|

5,168,687

|

|

5,150,913

|

|

||

|

Natural Gas and NGL (Mcf)

|

4,026,899

|

|

4,651,583

|

|

3,682,781

|

|

||

|

Total (Boe)

(1)

|

4,997,069

|

|

5,943,950

|

|

5,764,710

|

|

||

|

|

|

|

|

|

|

|

||

|

Average Daily Production

|

|

|

|

|

|

|

||

|

Oil (Bbl)

|

11,819

|

|

14,161

|

|

14,112

|

|

||

|

Natural Gas and NGL (Mcf)

|

11,002

|

|

12,744

|

|

10,090

|

|

||

|

Total (Boe)

(1)

|

13,653

|

|

16,285

|

|

15,794

|

|

||

|

(1)

|

Natural gas and NGLs are converted to Boe at the rate of one barrel equals six Mcf based upon the approximate relative energy content of oil and natural gas, which is not necessarily indicative of the relationship of oil and natural gas prices.

|

|

|

Years Ended December 31,

|

Years Ended December 31,

|

|||||||||||||||||||||||||||

|

|

2016

|

2015

|

Change

|

Change

|

2015

|

2014

|

Change

|

Change

|

|||||||||||||||||||||

|

Depletion

|

$

|

12.13

|

|

$

|

23.07

|

|

$

|

(10.94

|

)

|

(47

|

)%

|

$

|

23.07

|

|

$

|

29.86

|

|

$

|

(6.79

|

)

|

(23

|

)%

|

|||||||

|

Depreciation, Amortization, and Accretion

|

0.13

|

|

0.11

|

|

0.02

|

|

18

|

%

|

0.11

|

|

0.13

|

|

(0.02

|

)

|

(15

|

)%

|

|||||||||||||

|

Total DD&A expense

|

$

|

12.26

|

|

$

|

23.18

|

|

$

|

(10.92

|

)

|

(47

|

)%

|

$

|

23.18

|

|

$

|

29.99

|

|

$

|

(6.81

|

)

|

(23

|

)%

|

|||||||

|

|

Years Ended December 31,

|

||||||||||

|

|

2016

|

2015

|

2014

|

||||||||

|

|

(in thousands, except share and per common share data)

|

||||||||||

|

Net Income (Loss)

|

$

|

(293,494

|

)

|

$

|

(975,355

|

)

|

$

|

163,746

|

|

||

|

Add:

|

|

|

|

|

|

|

|||||

|

Impact of Selected Items:

|

|

|

|

|

|

|

|||||

|

(Gain) Loss on the Mark-to-Market of Derivative Instruments

|

76,347

|

|

88,716

|

|

(171,276

|

)

|

|||||

|

Restructuring Costs

|

—

|

|

523

|

|

—

|

|

|||||

|

Impairment of Oil and Natural Gas Properties

|

237,013

|

|

1,163,959

|

|

—

|

|

|||||

|

Write-off of Debt Issuance Costs

|

1,090

|

|

—

|

|

—

|

|

|||||

|

Legal Settlements

|

—

|

|

—

|

|

577

|

|

|||||

|

Selected Items, Before Income Taxes (Benefit)

|

314,450

|

|

1,253,198

|

|

(170,699

|

)

|

|||||

|

Income Tax (Benefit) of Selected Items

(1)

|

(8,723

|

)

|

(230,259

|

)

|

64,473

|

|

|||||

|

Selected Items, Net of Income Taxes (Benefit)

|

305,727

|

|

1,022,939

|

|

(106,226

|

)

|

|||||

|

Adjusted Net Income

|

$

|

12,233

|

|

$

|

47,584

|

|

$

|

57,520

|

|

||

|

Weighted Average Shares Outstanding – Basic

|

61,173,547

|

|

60,652,447

|

|

60,691,701

|

|

|||||

|

Weighted Average Shares Outstanding – Diluted

|

61,824,749

|

|

60,887,698

|

|

60,860,769

|

|

|||||

|

Net Income (Loss) Per Common Share – Basic

|

$

|

(4.80

|

)

|

$

|

(16.08

|

)

|

$

|

2.70

|

|

||

|

Add:

|

|

|

|

|

|

|

|||||

|

Impact of Selected Items, Net of Income Taxes (Benefit)

|

5.00

|

|

16.86

|

|

(1.75

|

)

|

|||||

|

Adjusted Net Income Per Common Share – Basic

|

$

|

0.20

|

|

$

|

0.78

|

|

$

|

0.95

|

|

||

|

Net Income (Loss) Per Common Share – Diluted

|

$

|

(4.75

|

)

|

$

|

(16.02

|

)

|

$

|

2.69

|

|

||

|

Add:

|

|

|

|

|

|

|

|||||

|

Impact of Selected Items, Net of Income Taxes (Benefit)

|

4.95

|

|

16.80

|

|

(1.74

|

)

|

|||||

|

Adjusted Net Income Per Common Share – Diluted

|

$

|

0.20

|

|

$

|

0.78

|

|

$

|

0.95

|

|

||

|

(1)

|

For the

2016

and

2015

columns, this represents tax impact using an estimated tax rate of

37.4%

for

2016

and

36.9%

for

2015

, respectively, and includes adjustments for changes in our valuation allowance of

$109.0 million

for

2016

and

$232.3 million

for

2015

, respectively. For the

2014

column, this represents tax impact using an estimated tax rate of

37.8%

.

|

|

|

Years Ended December 31,

|

||||||||||

|

|

2016

|

2015

|

2014

|

||||||||

|

|

(in thousands)

|

||||||||||

|

Net (Loss) Income

|

$

|

(293,494

|

)

|

$

|

(975,355

|

)

|

$

|

163,746

|

|

||

|

Add:

|

|

|

|

|

|

|

|||||

|

Interest Expense

|

64,486

|

|

58,360

|

|

42,106

|

|

|||||

|

Income Tax Provision (Benefit)

|

(1,402

|

)

|

(202,424

|

)

|

99,367

|

|

|||||

|

Depreciation, Depletion, Amortization and Accretion

|

61,244

|

|

137,770

|

|

172,884

|

|

|||||

|

Impairment of Oil and Natural Gas Properties

|

237,013

|

|

1,163,959

|

|

—

|

|

|||||

|

Non-Cash Share Based Compensation

|

3,182

|

|

6,273

|

|

2,759

|

|

|||||

|

Write-off of Debt Issuance Costs

|

1,090

|

|

—

|

|

—

|

|

|||||

|

(Gain) Loss on the Mark-to-Market of Derivative Instruments

|

76,347

|

|

88,716

|

|

(171,276

|

)

|

|||||

|

Adjusted EBITDA

|

$

|

148,466

|

|

$

|

277,299

|

|

$

|

309,586

|

|

||

|

|

Reduction in Oil and Gas Sales

Assuming a % Decline in Average Sales Price (2) |

||||||||||

|

|

10%

|

20%

|

30%

|

||||||||

|

|

(in millions)

|

||||||||||

|

Base Production

(1)

|

$

|

(16.0

|

)

|

$

|

(31.9

|

)

|

$

|

(47.9

|

)

|

||

|

Base Production Down 10%

|

(30.3

|

)

|

(44.7

|

)

|

(59.1

|

)

|

|||||

|

(1)

|

Base production is actual net production in 2016.

|

|

(2)

|

Average 2016 sales prices (excluding the effect of settled derivatives) were $35.22 per Bbl of oil and $1.82 per Mcf of natural gas.

|

|

|

Years Ended December 31,

|

||||||||||

|

|

2016

|

2015

|

2014

|

||||||||

|

|

(in thousands)

|

||||||||||

|

Net Cash Provided by Operating Activities

|

$

|

101,892