|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

|

Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

For the Quarterly Period Ended: September 30, 2013

|

||

|

o

|

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

Delaware

(State or other jurisdiction

of incorporation or organization)

|

41-1724239

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

211 Carnegie Center, Princeton, New Jersey

(Address of principal executive offices)

|

08540

(Zip Code)

|

|

|

Large accelerated filer

x

|

Accelerated filer

o

|

Non-accelerated filer

o

|

Smaller reporting company

o

|

|||

|

(Do not check if a smaller reporting company)

|

||||||

|

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING INFORMATION

|

|

|

GLOSSARY OF TERMS

|

|

|

PART I — FINANCIAL INFORMATION

|

|

|

ITEM 1 — CONDENSED CONSOLIDATED FINANCIAL STATEMENTS AND NOTES

|

|

|

ITEM 2 — MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

|

ITEM 3 — QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

|

|

ITEM 4 — CONTROLS AND PROCEDURES

|

|

|

PART II — OTHER INFORMATION

|

|

|

ITEM 1 — LEGAL PROCEEDINGS

|

|

|

ITEM 1A — RISK FACTORS

|

|

|

ITEM 2 — UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

|

|

|

ITEM 3 — DEFAULTS UPON SENIOR SECURITIES

|

|

|

ITEM 4 — MINE SAFETY DISCLOSURES

|

|

|

ITEM 5 — OTHER INFORMATION

|

|

|

ITEM 6 — EXHIBITS

|

|

|

SIGNATURES

|

|

|

•

|

General economic conditions, changes in the wholesale power markets and fluctuations in the cost of fuel;

|

|

•

|

Volatile power supply costs and demand for power;

|

|

•

|

Hazards customary to the power production industry and power generation operations such as fuel and electricity price volatility, unusual weather conditions, catastrophic weather-related or other damage to facilities, unscheduled generation outages, maintenance or repairs, unanticipated changes to fuel supply costs or availability due to higher demand, shortages, transportation problems or other developments, environmental incidents, or electric transmission or gas pipeline system constraints and the possibility that NRG may not have adequate insurance to cover losses as a result of such hazards;

|

|

•

|

The effectiveness of NRG's risk management policies and procedures, and the ability of NRG's counterparties to satisfy their financial commitments;

|

|

•

|

Counterparties' collateral demands and other factors affecting NRG's liquidity position and financial condition;

|

|

•

|

NRG's ability to operate its businesses efficiently, manage capital expenditures and costs tightly, and generate earnings and cash flows from its asset-based businesses, including NRG Yield, in relation to its debt and other obligations;

|

|

•

|

NRG's ability to enter into contracts to sell power and procure fuel on acceptable terms and prices;

|

|

•

|

The liquidity and competitiveness of wholesale markets for energy commodities;

|

|

•

|

Government regulation, including compliance with regulatory requirements and changes in market rules, rates, tariffs and environmental laws;

|

|

•

|

Price mitigation strategies and other market structures employed by ISOs or RTOs;

|

|

•

|

NRG's ability to borrow additional funds and access capital markets, as well as NRG's substantial indebtedness and the possibility that NRG may incur additional indebtedness going forward;

|

|

•

|

NRG's ability to receive federal loan guarantees or cash grants to support development projects;

|

|

•

|

Operating and financial restrictions placed on NRG and its subsidiaries that are contained in the indentures governing NRG's outstanding notes, in NRG's Senior Credit Facility, and in debt and other agreements of certain of NRG subsidiaries and project affiliates generally;

|

|

•

|

NRG's ability to implement its strategy of developing and building new power generation facilities, including new solar projects;

|

|

•

|

NRG's ability to implement its econrg strategy of finding ways to address environmental challenges while taking advantage of business opportunities;

|

|

•

|

NRG's ability to implement its

FOR

NRG strategy to increase cash from operations through operational and commercial initiatives, corporate efficiencies, asset strategies, and a range of other programs throughout the Company to reduce costs or generate revenues;

|

|

•

|

NRG's ability to achieve its strategy of regularly returning capital to stockholders;

|

|

•

|

NRG's ability to maintain and grow retail market share;

|

|

•

|

NRG's ability to successfully evaluate investments in new businesses and growth initiatives;

|

|

•

|

NRG's ability to successfully integrate and manage any acquired businesses; and

|

|

•

|

NRG's ability to develop and maintain successful partnering relationships.

|

|

2012 Form 10-K

|

NRG’s Annual Report on Form 10-K for the year ended December 31, 2012

|

|

|

ASC

|

The FASB Accounting Standards Codification, which the FASB established as the source of authoritative U.S. GAAP

|

|

|

ASU

|

Accounting Standards Updates - updates to the ASC

|

|

|

BACT

|

Best Available Control Technology

|

|

|

Baseload

|

Units expected to satisfy minimum baseload requirements for the system and produce electricity at an essentially constant rate and run continuously

|

|

|

BTU

|

British Thermal Unit

|

|

|

CAA

|

Clean Air Act

|

|

|

CAIR

|

Clean Air Interstate Rule

|

|

|

CAISO

|

California Independent System Operator

|

|

|

Capital Allocation Program

|

NRG's plan of allocating capital

between debt reduction, reinvestment

in the business, share

repurchases and shareholder dividends

|

|

|

CCUS

|

Carbon capture, utilization and storage project

|

|

|

CO

2

|

Carbon dioxide

|

|

|

CPUC

|

California Public Utilities Commission

|

|

|

CSAPR

|

Cross-State Air Pollution Rule

|

|

|

CWA

|

Clean Water Act

|

|

|

Distributed Solar

|

Solar power projects, typically less than 20 MW in size, that primarily sell power produced to customers for usage on site, or are interconnected to sell power into the local distribution grid

|

|

|

DNREC

|

Delaware Department of Natural Resources and Environmental Control

|

|

|

EME

|

Edison Mission Energy

|

|

|

Energy Plus Holdings

|

Energy Plus Holdings LLC

|

|

|

EPA

|

U.S. Environmental Protection Agency

|

|

|

ERCOT

|

Electric Reliability Council of Texas, the Independent System Operator and the regional reliability coordinator of the various electricity systems within Texas

|

|

|

ESEC

|

El Segundo Energy Center LLC

|

|

|

ESPP

|

Employee Stock Purchase Plan

|

|

|

Exchange Act

|

The Securities Exchange Act of 1934, as amended

|

|

|

FASB

|

Financial Accounting Standards Board

|

|

|

FERC

|

Federal Energy Regulatory Commission

|

|

|

GenOn

|

GenOn Energy, Inc.

|

|

|

GenOn Americas Generation

|

GenOn Americas Generation, LLC

|

|

|

GenOn Americas Generation Senior Notes

|

GenOn Americas Generation's $850 million outstanding unsecured senior notes consisting of $450 million of 8.55% senior notes due 2021 and $400 million of 9.125% senior notes due 2031

|

|

|

GenOn Mid-Atlantic

|

GenOn Mid- Atlantic, LLC and, except where the context indicates otherwise, its subsidiaries, which include the coal generation units at two generating facilities under operating leases

|

|

|

GenOn Senior Notes

|

GenOn's $1.9 billion outstanding unsecured senior notes consisting of $725 million of 7.875% senior notes due 2017, $675 million of 9.5% senior notes due 2018, and $550 million of 9.875% senior notes due 2020

|

|

|

GHG

|

Greenhouse gases

|

|

|

Green Mountain Energy

|

Green Mountain Energy Company

|

|

|

GWh

|

Gigawatt hour

|

|

|

Heat Rate

|

A measure of thermal efficiency computed by dividing the total BTU content of the fuel burned by the resulting kWhs generated. Heat rates can be expressed as either gross or net heat rates, depending whether the electricity output measured is gross or net generation and is generally expressed as BTU per net kWh

|

|

|

High Desert

|

TA - High Desert, LLC

|

|

|

High Desert Facility

|

High Desert's $82 million non-recourse project level financing facility under the Note Purchase and Private Shelf Agreement

|

|

|

Intermediate

|

Units expected to satisfy system requirements that are greater than baseload and less than peaking

|

|

|

ISO

|

Independent System Operator, also referred to as Regional Transmission Organization, or RTO

|

|

|

ITC

|

Investment Tax Credit

|

|

|

Kansas South

|

NRG Solar Kansas South LLC

|

|

|

kWh

|

Kilowatt-hours

|

|

|

LIBOR

|

London Inter-Bank Offered Rate

|

|

|

LTIPs

|

Collectively, the NRG Long-Term Incentive Plan and the NRG GenOn Long-Term Incentive Plan

|

|

|

Marsh Landing

|

NRG Marsh Landing, LLC (formerly known as GenOn Marsh Landing, LLC)

|

|

|

Mass

|

Residential and small business

|

|

|

MATS

|

Mercury and Air Toxics Standards promulgated by the EPA

|

|

|

MDE

|

Maryland Department of the Environment

|

|

|

Merger

|

The merger completed on December 14, 2012 by NRG and GenOn pursuant to the Merger Agreement

|

|

|

Merger Agreement

|

Agreement and Plan of Merger by and among NRG Energy, Inc., Plus Merger Corporation and GenOn Energy, Inc. dated as of July 20, 2012

|

|

|

MISO

|

Midcontinent Independent System Operator, Inc.

|

|

|

MMBtu

|

Million British Thermal Units

|

|

|

MOPR

|

Minimum Offer Price Rule

|

|

|

MW

|

Megawatt

|

|

|

MWh

|

Saleable megawatt hours, net of internal/parasitic load megawatt-hours

|

|

|

MWt

|

Megawatts Thermal Equivalent

|

|

|

NAAQS

|

National Ambient Air Quality Standards

|

|

|

Net Exposure

|

Counterparty credit exposure to NRG, net of collateral

|

|

|

Net Generation

|

The net amount of electricity produced, expressed in kWh or MWhs, that is the total amount of electricity generated (gross) minus the amount of electricity used during generation

|

|

|

NJDEP

|

New Jersey Department of Environmental Protection

|

|

|

NOL

|

Net Operating Loss

|

|

|

NOV

|

Notice of Violation

|

|

|

NO

x

|

Nitrogen oxide

|

|

|

NPNS

|

Normal Purchase Normal Sale

|

|

|

NRC

|

U.S. Nuclear Regulatory Commission

|

|

|

NRG Yield

|

Reporting segment including the following projects: Alpine, Avenal, Avra Valley, AZ DG Solar, Blythe, Borrego, CVSR, GenConn, Marsh Landing, PFMG DG Solar, Roadrunner, South Trent and Thermal.

|

|

|

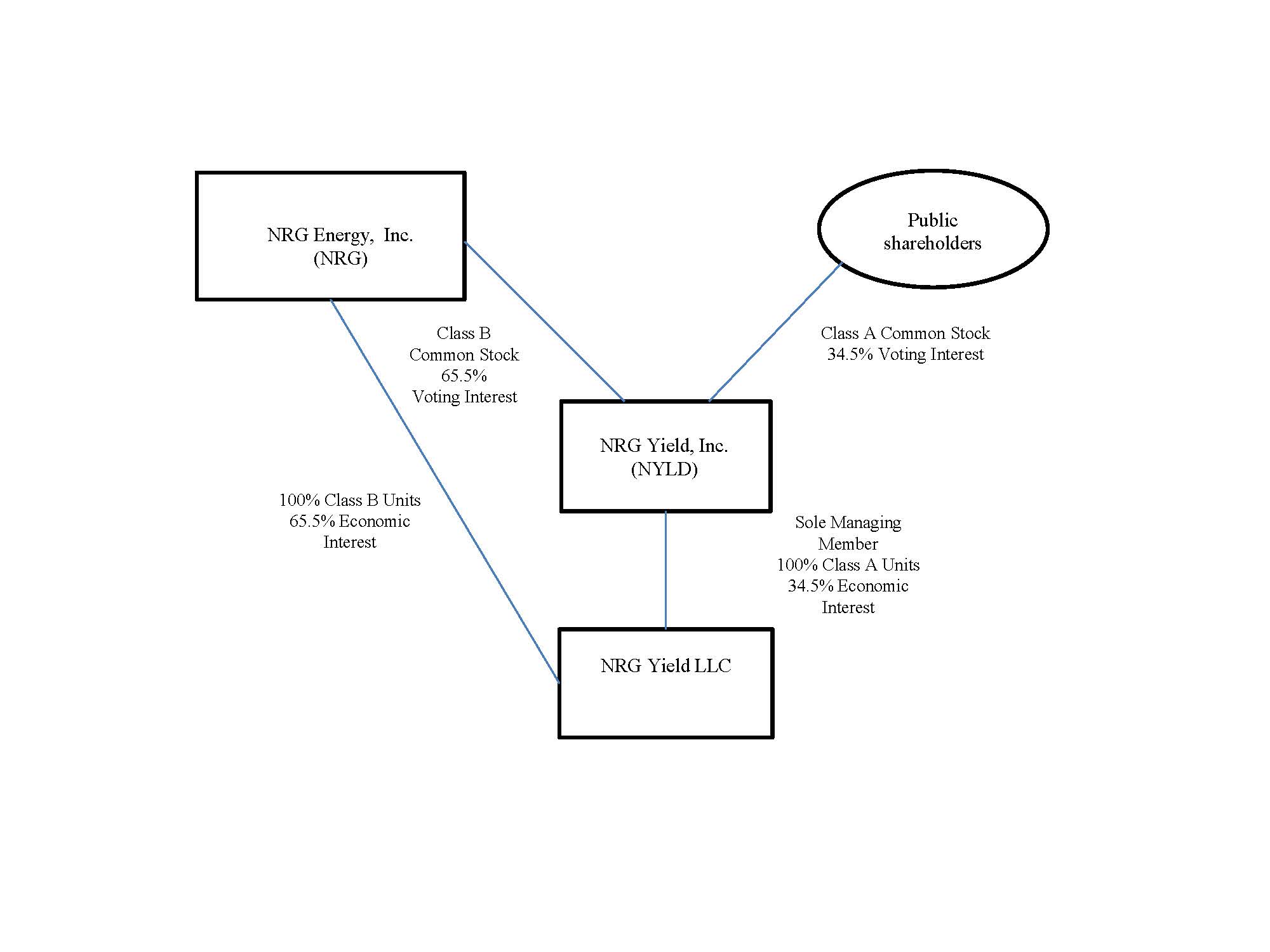

NRG Yield, Inc.

|

NRG Yield, Inc., the owner of 34.5% of NRG Yield LLC with a controlling interest, and issuer of publicly held shares of Class A common stock

|

|

|

NRG Yield LLC

|

NRG Yield LLC, which owns, through its wholly owned subsidiary, NRG Yield Operating LLC, all of the assets contributed to NRG Yield LLC in connection with the initial public offering of Class A common stock of NRG Yield, Inc.

|

|

|

NSPS

|

New Source Performance Standards

|

|

|

NSR

|

New Source Review

|

|

|

Nuclear Decommissioning Trust Fund

|

NRG's nuclear decommissioning trust fund assets, which are for the Company's portion of the decommissioning of the STP, units 1 & 2

|

|

|

NYISO

|

New York Independent System Operator

|

|

|

NYSPSC

|

New York State Public Service Commission

|

|

|

OCI

|

Other comprehensive income

|

|

|

PADEP

|

Pennsylvania Department of Environmental Protection

|

|

|

Peaking

|

Units expected to satisfy demand requirements during the periods of greatest or peak load on the system

|

|

|

PG&E

|

Pacific Gas & Electric Company

|

|

|

PJM

|

PJM Interconnection, LLC

|

|

|

PPA

|

Power Purchase Agreement

|

|

|

PUCT

|

Public Utility Commission of Texas

|

|

|

Reliant Energy

|

Reliant Energy Retail Services, LLC

|

|

|

Repowering

|

Technologies utilized to replace, rebuild, or redevelop major portions of an existing electrical generating facility, generally to achieve a substantial emissions reduction, increase facility capacity, and improve system efficiency

|

|

|

Retail Business

|

NRG's retail energy brands, including Reliant, Green Mountain, Energy Plus and NRG Residential Solutions

|

|

|

Revolving Credit Facility

|

The Company's $2.5 billion revolving credit facility due 2018, a component of the Senior Credit Facility

|

|

|

RGGI

|

Regional Greenhouse Gas Initiative

|

|

|

RMR

|

Reliability Must Run

|

|

|

RSS

|

Reliability Support Service

|

|

|

Schkopau

|

Kraftwerk Schkopau Betriebsgesellschaft mbH

|

|

|

Senior Credit Facility

|

NRG's senior secured facility, comprised of the Term Loan Facility and the Revolving Credit Facility

|

|

|

Senior Notes

|

The Company’s $5.7 billion outstanding unsecured senior notes, consisting of $1.1 billion of 7.625% senior notes due 2018, $607 million of 8.5% senior notes due 2019, $800 million of 7.625% senior notes due 2019, $1.1 billion of 8.25% senior notes due 2020, $1.1 billion of 7.875% senior notes due 2021, and $990 million of 6.625% senior notes due 2023

|

|

|

SO

2

|

Sulfur dioxide

|

|

|

STP

|

South Texas Project — nuclear generating facility located near Bay City, Texas in which NRG owns a 44% interest

|

|

|

Term Loan Facility

|

The Company's $2.0 billion term loan facility due 2018, a component of the Senior Credit Facility

|

|

|

Texas Genco

|

Texas Genco LLC, now referred to as the Company's Texas Region

|

|

|

U.S.

|

United States of America

|

|

|

U.S. DOE

|

U.S. Department of Energy

|

|

|

U.S. DOJ

|

U.S. Department of Justice

|

|

|

U.S. GAAP

|

Accounting principles generally accepted in the United States

|

|

|

Utility Scale Solar

|

Solar power projects, typically 20 MW or greater in size (on an alternating current basis), that are interconnected into the transmission or distribution grid to sell power at a wholesale level

|

|

|

VaR

|

Value at Risk

|

|

|

VIE

|

Variable Interest Entity

|

|

|

Three months ended September 30,

|

Nine months ended September 30,

|

||||||||||||||

|

(In millions, except for per share amounts)

|

2013

|

2012

|

2013

|

2012

|

|||||||||||

|

Operating Revenues

|

|||||||||||||||

|

Total operating revenues

|

$

|

3,490

|

|

$

|

2,331

|

|

$

|

8,500

|

|

$

|

6,359

|

|

|||

|

Operating Costs and Expenses

|

|||||||||||||||

|

Cost of operations

|

2,355

|

|

1,740

|

|

6,179

|

|

4,660

|

|

|||||||

|

Depreciation and amortization

|

318

|

|

239

|

|

921

|

|

703

|

|

|||||||

|

Selling, general and administrative

|

229

|

|

224

|

|

671

|

|

613

|

|

|||||||

|

Acquisition-related transaction and integration costs

|

26

|

|

18

|

|

95

|

|

18

|

|

|||||||

|

Development activity expenses

|

27

|

|

24

|

|

63

|

|

52

|

|

|||||||

|

Total operating costs and expenses

|

2,955

|

|

2,245

|

|

7,929

|

|

6,046

|

|

|||||||

|

Operating Income

|

535

|

|

86

|

|

571

|

|

313

|

|

|||||||

|

Other Income/(Expense)

|

|||||||||||||||

|

Equity in (losses)/earnings of unconsolidated affiliates

|

(5

|

)

|

4

|

|

6

|

|

|

26

|

|

||||||

|

Other income, net

|

5

|

|

|

9

|

|

9

|

|

|

12

|

|

|||||

|

Loss on debt extinguishment

|

(1

|

)

|

|

(41

|

)

|

(50

|

)

|

|

(41

|

)

|

|||||

|

Interest expense

|

(228

|

)

|

|

(163

|

)

|

(630

|

)

|

|

(495

|

)

|

|||||

|

Total other expense

|

(229

|

)

|

(191

|

)

|

(665

|

)

|

(498

|

)

|

|||||||

|

Income/(Loss) Before Income Taxes

|

306

|

|

(105

|

)

|

(94

|

)

|

(185

|

)

|

|||||||

|

Income tax expense/(benefit)

|

163

|

|

(113

|

)

|

(47

|

)

|

(246

|

)

|

|||||||

|

Net Income/(Loss)

|

143

|

|

8

|

|

(47

|

)

|

61

|

|

|||||||

|

Less: Net income attributable to noncontrolling interest

|

19

|

|

9

|

|

27

|

|

18

|

|

|||||||

|

Net Income/(Loss) Attributable to NRG Energy, Inc.

|

124

|

|

(1

|

)

|

(74

|

)

|

43

|

|

|||||||

|

Dividends for preferred shares

|

2

|

|

2

|

|

7

|

|

7

|

|

|||||||

|

Income/(Loss) Available for Common Stockholders

|

$

|

122

|

|

$

|

(3

|

)

|

$

|

(81

|

)

|

$

|

36

|

|

|||

|

Earnings/(Loss) Per Share Attributable to NRG Energy, Inc. Common Stockholders

|

|||||||||||||||

|

Weighted average number of common shares outstanding — basic

|

323

|

|

228

|

|

323

|

|

228

|

|

|||||||

|

Earnings/(Loss) per Weighted Average Common Share — Basic

|

$

|

0.38

|

|

$

|

(0.01

|

)

|

$

|

(0.25

|

)

|

$

|

0.16

|

|

|||

|

Weighted average number of common shares outstanding — diluted

|

327

|

|

228

|

|

323

|

|

230

|

|

|||||||

|

Earnings/(Loss) per Weighted Average Common Share — Diluted

|

$

|

0.37

|

|

$

|

(0.01

|

)

|

$

|

(0.25

|

)

|

$

|

0.16

|

|

|||

|

Dividends Per Common Share

|

$

|

0.12

|

|

$

|

0.09

|

|

$

|

0.33

|

|

$

|

0.09

|

|

|||

|

Three months ended September 30,

|

Nine months ended September 30,

|

||||||||||||||

|

2013

|

2012

|

2013

|

2012

|

||||||||||||

|

(In millions)

|

|||||||||||||||

|

Net Income/(Loss)

|

$

|

143

|

|

$

|

8

|

|

$

|

(47

|

)

|

$

|

61

|

|

|||

|

Other Comprehensive (Loss)/Income, net of tax

|

|||||||||||||||

|

Unrealized (loss)/gain on derivatives, net of income tax benefit of $5, $24, $2 and $76

|

(16

|

)

|

(43

|

)

|

8

|

|

(132

|

)

|

|||||||

|

Foreign currency translation adjustments, net of income tax benefit of $1, $0, $13 and $1

|

5

|

|

1

|

|

(14

|

)

|

(1

|

)

|

|||||||

|

Reclassification adjustment for translation gain realized upon sale of Schkopau, net of income tax expense of $0, $6, $0 and $6

|

—

|

|

(11

|

)

|

—

|

|

(11

|

)

|

|||||||

|

Available-for-sale securities, net of income tax expense of $0, $1, $1 and $1

|

—

|

|

2

|

|

2

|

|

2

|

|

|||||||

|

Defined benefit plans, net of tax expense of $0, $0, $4 and $0

|

—

|

|

—

|

|

25

|

|

—

|

|

|||||||

|

Other comprehensive (loss)/income

|

(11

|

)

|

(51

|

)

|

21

|

|

(142

|

)

|

|||||||

|

Comprehensive Income/(Loss)

|

132

|

|

(43

|

)

|

(26

|

)

|

(81

|

)

|

|||||||

|

Less: Comprehensive income attributable to noncontrolling interest

|

18

|

|

9

|

|

26

|

|

18

|

|

|||||||

|

Comprehensive Income/(Loss) Attributable to NRG Energy, Inc.

|

114

|

|

(52

|

)

|

(52

|

)

|

(99

|

)

|

|||||||

|

Dividends for preferred shares

|

2

|

|

2

|

|

7

|

|

7

|

|

|||||||

|

Comprehensive Income/(Loss) Available for Common Stockholders

|

$

|

112

|

|

$

|

(54

|

)

|

$

|

(59

|

)

|

$

|

(106

|

)

|

|||

|

September 30, 2013

|

December 31, 2012

|

||||||

|

(In millions, except shares)

|

(unaudited)

|

|

|||||

|

ASSETS

|

|

|

|||||

|

Current Assets

|

|

|

|||||

|

Cash and cash equivalents

|

$

|

2,129

|

|

$

|

2,087

|

|

|

|

Funds deposited by counterparties

|

122

|

|

271

|

|

|||

|

Restricted cash

|

307

|

|

217

|

|

|||

|

Accounts receivable — trade, less allowance for doubtful accounts of $41 and $32

|

1,366

|

|

1,061

|

|

|||

|

Inventory

|

861

|

|

911

|

|

|||

|

Derivative instruments

|

1,389

|

|

2,644

|

|

|||

|

Cash collateral paid in support of energy risk management activities

|

288

|

|

229

|

|

|||

|

Deferred income taxes

|

—

|

|

56

|

|

|||

|

Renewable energy grant receivable

|

345

|

|

58

|

|

|||

|

Prepayments and other current assets

|

442

|

|

401

|

|

|||

|

Total current assets

|

7,249

|

|

7,935

|

|

|||

|

Property, plant and equipment, net of accumulated depreciation of $6,264 and $5,417

|

20,600

|

|

20,241

|

|

|||

|

Other Assets

|

|

|

|||||

|

Equity investments in affiliates

|

626

|

|

676

|

|

|||

|

Notes receivable, less current portion

|

76

|

|

79

|

|

|||

|

Goodwill

|

1,953

|

|

1,956

|

|

|||

|

Intangible assets, net of accumulated amortization of $1,915 and $1,706

|

1,141

|

|

1,200

|

|

|||

|

Nuclear decommissioning trust fund

|

524

|

|

473

|

|

|||

|

Derivative instruments

|

506

|

|

662

|

|

|||

|

Deferred income taxes

|

1,499

|

|

1,282

|

|

|||

|

Other non-current assets

|

689

|

|

600

|

|

|||

|

Total other assets

|

7,014

|

|

6,928

|

|

|||

|

Total Assets

|

$

|

34,863

|

|

$

|

35,104

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|||||

|

Current Liabilities

|

|

|

|||||

|

Current portion of long-term debt and capital leases

|

$

|

911

|

|

$

|

147

|

|

|

|

Accounts payable

|

1,140

|

|

1,171

|

|

|||

|

Derivative instruments

|

1,064

|

|

1,981

|

|

|||

|

Deferred income taxes

|

112

|

|

—

|

|

|||

|

Cash collateral received in support of energy risk management activities

|

122

|

|

271

|

|

|||

|

Accrued expenses and other current liabilities

|

1,033

|

|

1,085

|

|

|||

|

Total current liabilities

|

4,382

|

|

4,655

|

|

|||

|

Other Liabilities

|

|

|

|||||

|

Long-term debt and capital leases

|

15,802

|

|

15,736

|

|

|||

|

Nuclear decommissioning reserve

|

290

|

|

354

|

|

|||

|

Nuclear decommissioning trust liability

|

303

|

|

273

|

|

|||

|

Deferred income taxes

|

50

|

|

55

|

|

|||

|

Derivative instruments

|

372

|

|

500

|

|

|||

|

Out-of-market contracts

|

1,157

|

|

1,231

|

|

|||

|

Other non-current liabilities

|

1,377

|

|

1,553

|

|

|||

|

Total non-current liabilities

|

19,351

|

|

|

19,702

|

|

||

|

Total Liabilities

|

23,733

|

|

24,357

|

|

|||

|

3.625% convertible perpetual preferred stock (at liquidation value, net of issuance costs)

|

249

|

|

249

|

|

|||

|

Commitments and Contingencies

|

|

|

|

|

|||

|

Stockholders’ Equity

|

|

|

|||||

|

Common stock

|

4

|

|

4

|

|

|||

|

Additional paid-in capital

|

7,843

|

|

7,587

|

|

|||

|

Retained earnings

|

4,272

|

|

4,459

|

|

|||

|

Less treasury stock, at cost — 77,347,528 and 76,505,718 shares, respectively

|

(1,942

|

)

|

(1,920

|

)

|

|||

|

Accumulated other comprehensive loss

|

(129

|

)

|

(150

|

)

|

|||

|

Noncontrolling interest

|

833

|

|

518

|

|

|||

|

Total Stockholders’ Equity

|

10,881

|

|

10,498

|

|

|||

|

Total Liabilities and Stockholders’ Equity

|

$

|

34,863

|

|

$

|

35,104

|

|

|

|

Nine months ended September 30,

|

|||||||

|

2013

|

2012

|

||||||

|

(In millions)

|

|||||||

|

Cash Flows from Operating Activities

|

|||||||

|

Net (loss)/income

|

$

|

(47

|

)

|

$

|

61

|

|

|

|

Adjustments to reconcile net (loss)/income to net cash provided by operating activities:

|

|

|

|||||

|

Distributions and equity in earnings of unconsolidated affiliates

|

23

|

|

8

|

|

|||

|

Depreciation and amortization

|

921

|

|

703

|

|

|||

|

Provision for bad debts

|

49

|

|

40

|

|

|||

|

Amortization of nuclear fuel

|

27

|

|

29

|

|

|||

|

Amortization of financing costs and debt discount/premiums

|

(22

|

)

|

25

|

|

|||

|

Adjustment to loss on debt extinguishment

|

(15

|

)

|

8

|

|

|||

|

Amortization of intangibles and out-of-market contracts

|

75

|

|

108

|

|

|||

|

Amortization of unearned equity compensation

|

32

|

|

27

|

|

|||

|

Changes in deferred income taxes and liability for uncertain tax benefits

|

39

|

|

(261

|

)

|

|||

|

Changes in nuclear decommissioning trust liability

|

25

|

|

25

|

|

|||

|

Changes in derivative instruments

|

189

|

|

360

|

|

|||

|

Changes in collateral deposits supporting energy risk management activities

|

(59

|

)

|

213

|

|

|||

|

Gain on sale of emission allowances

|

(8

|

)

|

(3

|

)

|

|||

|

Cash used by changes in other working capital

|

(406

|

)

|

(285

|

)

|

|||

|

Net Cash Provided by Operating Activities

|

823

|

|

1,058

|

|

|||

|

Cash Flows from Investing Activities

|

|

|

|||||

|

Acquisitions of businesses, net of cash acquired

|

(374

|

)

|

(40

|

)

|

|||

|

Capital expenditures

|

(1,581

|

)

|

(2,474

|

)

|

|||

|

Increase in restricted cash, net

|

(67

|

)

|

(96

|

)

|

|||

|

(Increase)/decrease in restricted cash to support equity requirements for U.S. DOE funded projects

|

(20

|

)

|

151

|

|

|||

|

Increase in notes receivable

|

(22

|

)

|

(22

|

)

|

|||

|

Investments in nuclear decommissioning trust fund securities

|

(369

|

)

|

(341

|

)

|

|||

|

Proceeds from sales of nuclear decommissioning trust fund securities

|

344

|

|

316

|

|

|||

|

Proceeds from renewable energy grants

|

52

|

|

49

|

|

|||

|

Proceeds from sale of assets, net of cash disposed of

|

13

|

|

137

|

|

|||

|

Other

|

(7

|

)

|

(9

|

)

|

|||

|

Net Cash Used by Investing Activities

|

(2,031

|

)

|

(2,329

|

)

|

|||

|

Cash Flows from Financing Activities

|

|

|

|||||

|

Payment of dividends to common and preferred stockholders

|

(113

|

)

|

(28

|

)

|

|||

|

Payment for treasury stock

|

(25

|

)

|

—

|

|

|||

|

Net receipts from/(payments for) settlement of acquired derivatives that include financing elements

|

177

|

|

(65

|

)

|

|||

|

Proceeds from issuance of long-term debt

|

1,605

|

|

2,541

|

|

|||

|

Contributions and sale proceeds from noncontrolling interest in subsidiaries

|

504

|

|

316

|

|

|||

|

Proceeds from issuance of common stock

|

14

|

|

—

|

|

|||

|

Payment of debt issuance costs

|

(43

|

)

|

(30

|

)

|

|||

|

Payments for short and long-term debt

|

(868

|

)

|

(955

|

)

|

|||

|

Net Cash Provided by Financing Activities

|

1,251

|

|

1,779

|

|

|||

|

Effect of exchange rate changes on cash and cash equivalents

|

(1

|

)

|

(3

|

)

|

|||

|

Net Increase in Cash and Cash Equivalents

|

42

|

|

505

|

|

|||

|

Cash and Cash Equivalents at Beginning of Period

|

2,087

|

|

1,105

|

|

|||

|

Cash and Cash Equivalents at End of Period

|

$

|

2,129

|

|

$

|

1,610

|

|

|

|

(In millions)

|

|||

|

Balance as of December 31, 2012

|

$

|

518

|

|

|

Contributions from noncontrolling interest

|

289

|

|

|

|

Comprehensive income attributable to noncontrolling interest

|

26

|

|

|

|

Balance as of September 30, 2013

|

$

|

833

|

|

|

(In millions)

|

Amounts Recognized

as of Acquisition Date

(as previously reported)

|

Measurement Period Adjustments

|

Amounts Recognized

as of Acquisition Date

(as adjusted)

|

||||||||

|

Assets

|

|||||||||||

|

Cash

|

$

|

983

|

|

$

|

—

|

|

$

|

983

|

|

||

|

Current and non-current assets

|

1,385

|

|

(18

|

)

|

1,367

|

|

|||||

|

Property, plant and equipment

|

3,936

|

|

(27

|

)

|

3,909

|

|

|||||

|

Derivative assets

|

1,157

|

|

—

|

|

1,157

|

|

|||||

|

Deferred income taxes

|

2,265

|

|

21

|

|

2,286

|

|

|||||

|

Total assets acquired

|

$

|

9,726

|

|

$

|

(24

|

)

|

$

|

9,702

|

|

||

|

Liabilities

|

|||||||||||

|

Current and non-current liabilities

|

$

|

1,312

|

|

$

|

(7

|

)

|

$

|

1,305

|

|

||

|

Out-of-market contracts and leases

|

1,064

|

|

15

|

|

1,079

|

|

|||||

|

Derivative liabilities

|

399

|

|

—

|

|

399

|

|

|||||

|

Long-term debt and capital leases

|

4,203

|

|

3

|

|

4,206

|

|

|||||

|

Total liabilities assumed

|

6,978

|

|

11

|

|

6,989

|

|

|||||

|

Net assets acquired

|

2,748

|

|

(35

|

)

|

2,713

|

|

|||||

|

Consideration paid

|

2,188

|

|

—

|

|

2,188

|

|

|||||

|

Gain on bargain purchase

|

$

|

560

|

|

$

|

(35

|

)

|

$

|

525

|

|

||

|

As of September 30, 2013

|

As of December 31, 2012

|

||||||||||||||

|

Carrying Amount

|

Fair Value

|

Carrying Amount

|

Fair Value

|

||||||||||||

|

|

(In millions)

|

||||||||||||||

|

Assets:

|

|

|

|

|

|||||||||||

|

Notes receivable

(a)

|

$

|

107

|

|

$

|

107

|

|

$

|

88

|

|

$

|

88

|

|

|||

|

Liabilities:

|

|||||||||||||||

|

Long-term debt, including current portion

|

16,699

|

|

17,061

|

|

15,866

|

|

16,492

|

|

|||||||

|

As of September 30, 2013

|

|||||||||||||||

|

Fair Value

|

|||||||||||||||

|

(In millions)

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||

|

Investment in available-for-sale securities (classified within other

non-current assets):

|

|

||||||||||||||

|

Debt securities

|

$

|

—

|

|

$

|

—

|

|

$

|

15

|

|

$

|

15

|

|

|||

|

Other

(a)

|

37

|

|

—

|

|

—

|

|

37

|

|

|||||||

|

Trust fund investments:

|

|

||||||||||||||

|

Cash and cash equivalents

|

2

|

|

—

|

|

—

|

|

2

|

|

|||||||

|

U.S. government and federal agency obligations

|

51

|

|

4

|

|

—

|

|

55

|

|

|||||||

|

Federal agency mortgage-backed securities

|

—

|

|

58

|

|

—

|

|

58

|

|

|||||||

|

Commercial mortgage-backed securities

|

—

|

|

12

|

|

—

|

|

12

|

|

|||||||

|

Corporate debt securities

|

—

|

|

60

|

|

—

|

|

60

|

|

|||||||

|

Equity securities

|

281

|

|

—

|

|

55

|

|

336

|

|

|||||||

|

Foreign government fixed income securities

|

—

|

|

2

|

|

—

|

|

2

|

|

|||||||

|

Derivative assets:

|

|

||||||||||||||

|

Commodity contracts

|

436

|

|

1,337

|

|

111

|

|

1,884

|

|

|||||||

|

Interest rate contracts

|

—

|

|

11

|

|

—

|

|

11

|

|

|||||||

|

Total assets

|

$

|

807

|

|

$

|

1,484

|

|

$

|

181

|

|

$

|

2,472

|

|

|||

|

Derivative liabilities:

|

|

||||||||||||||

|

Commodity contracts

|

$

|

344

|

|

$

|

892

|

|

$

|

118

|

|

$

|

1,354

|

|

|||

|

Interest rate contracts

|

—

|

|

82

|

|

—

|

|

82

|

|

|||||||

|

Total liabilities

|

$

|

344

|

|

$

|

974

|

|

$

|

118

|

|

$

|

1,436

|

|

|||

|

As of December 31, 2012

|

|||||||||||||||

|

Fair Value

|

|||||||||||||||

|

(In millions)

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||

|

Investment in available-for-sale securities (classified within other

non-current assets):

|

|

||||||||||||||

|

Debt securities

|

$

|

—

|

|

$

|

—

|

|

$

|

12

|

|

$

|

12

|

|

|||

|

Other

(a)

|

44

|

|

—

|

|

—

|

|

44

|

|

|||||||

|

Trust fund investments:

|

|||||||||||||||

|

Cash and cash equivalents

|

10

|

|

—

|

|

—

|

|

10

|

|

|||||||

|

U.S. government and federal agency obligations

|

34

|

|

—

|

|

—

|

|

34

|

|

|||||||

|

Federal agency mortgage-backed securities

|

—

|

|

59

|

|

—

|

|

59

|

|

|||||||

|

Commercial mortgage-backed securities

|

—

|

|

9

|

|

—

|

|

9

|

|

|||||||

|

Corporate debt securities

|

—

|

|

80

|

|

—

|

|

80

|

|

|||||||

|

Equity securities

|

233

|

|

—

|

|

47

|

|

280

|

|

|||||||

|

Foreign government fixed income securities

|

—

|

|

2

|

|

—

|

|

2

|

|

|||||||

|

Derivative assets:

|

|

||||||||||||||

|

Commodity contracts

|

1,457

|

|

1,711

|

|

135

|

|

3,303

|

|

|||||||

|

Interest rate contracts

|

—

|

|

3

|

|

—

|

|

3

|

|

|||||||

|

Total assets

|

$

|

1,778

|

|

$

|

1,864

|

|

$

|

194

|

|

$

|

3,836

|

|

|||

|

Derivative liabilities:

|

|

||||||||||||||

|

Commodity contracts

|

$

|

1,144

|

|

$

|

1,047

|

|

$

|

147

|

|

$

|

2,338

|

|

|||

|

Interest rate contracts

|

—

|

|

143

|

|

—

|

|

143

|

|

|||||||

|

Total liabilities

|

$

|

1,144

|

|

$

|

1,190

|

|

$

|

147

|

|

$

|

2,481

|

|

|||

|

Fair Value Measurement Using Significant Unobservable Inputs (Level 3)

|

|||||||||||||||||||||||||||||||

|

Three months ended September 30, 2013

|

Nine months ended September 30, 2013

|

||||||||||||||||||||||||||||||

|

(In millions)

|

Debt Securities

|

Trust Fund Investments

|

Derivatives

(a)

|

Total

|

Debt Securities

|

Trust Fund Investments

|

Derivatives

(a)

|

Total

|

|||||||||||||||||||||||

|

Beginning balance

|

$

|

15

|

|

$

|

50

|

|

$

|

(12

|

)

|

$

|

53

|

|

$

|

12

|

|

$

|

47

|

|

$

|

(12

|

)

|

$

|

47

|

|

|||||||

|

Total gains/(losses) — realized/unrealized:

|

|

|

|||||||||||||||||||||||||||||

|

Included in earnings

|

—

|

|

—

|

|

14

|

|

14

|

|

—

|

|

—

|

|

(4

|

)

|

(4

|

)

|

|||||||||||||||

|

Included in OCI

|

—

|

|

—

|

|

—

|

|

—

|

|

3

|

|

—

|

|

—

|

|

3

|

|

|||||||||||||||

|

Included in nuclear decommissioning obligations

|

—

|

|

5

|

|

—

|

|

5

|

|

—

|

|

7

|

|

—

|

|

7

|

|

|||||||||||||||

|

Purchases

|

—

|

|

—

|

|

4

|

|

4

|

|

—

|

|

1

|

|

(3

|

)

|

(2

|

)

|

|||||||||||||||

|

Transfers into Level 3

(b)

|

—

|

|

—

|

|

(36

|

)

|

(36

|

)

|

—

|

|

—

|

|

(9

|

)

|

(9

|

)

|

|||||||||||||||

|

Transfers out of Level 3

(b)

|

—

|

|

—

|

|

23

|

|

23

|

|

—

|

|

—

|

|

21

|

|

21

|

|

|||||||||||||||

|

Ending balance as of

September 30, 2013

|

$

|

15

|

|

$

|

55

|

|

$

|

(7

|

)

|

$

|

63

|

|

$

|

15

|

|

$

|

55

|

|

$

|

(7

|

)

|

$

|

63

|

|

|||||||

|

Gains for the period included in earnings attributable to the change in unrealized gains or losses relating to assets or liabilities still held as of September 30, 2013

|

$

|

—

|

|

$

|

—

|

|

$

|

(7

|

)

|

$

|

(7

|

)

|

$

|

—

|

|

$

|

—

|

|

$

|

(4

|

)

|

$

|

(4

|

)

|

|||||||

|

(a)

|

Consists of derivative assets and liabilities, net.

|

|

(b)

|

Transfers in/out of Level 3 are related to the availability of external broker quotes and are valued as of the end of the reporting period. All transfers in/out are with Level 2.

|

|

Fair Value Measurement Using Significant Unobservable Inputs (Level 3)

|

|||||||||||||||||||||||||||||||

|

Three months ended September 30, 2012

|

Nine months ended September 30, 2012

|

||||||||||||||||||||||||||||||

|

(In millions)

|

Debt Securities

|

Trust Fund Investments

|

Derivatives

(a)

|

Total

|

Debt Securities

|

Trust Fund Investments

|

Derivatives

(a)

|

Total

|

|||||||||||||||||||||||

|

Beginning balance

|

$

|

9

|

|

$

|

43

|

|

$

|

171

|

|

$

|

223

|

|

$

|

7

|

|

$

|

42

|

|

$

|

8

|

|

$

|

57

|

|

|||||||

|

Total (losses)/gains — realized/unrealized:

|

|

|

|

|

|

||||||||||||||||||||||||||

|

Included in earnings

|

—

|

|

—

|

|

(9

|

)

|

(9

|

)

|

—

|

|

—

|

|

(3

|

)

|

(3

|

)

|

|||||||||||||||

|

Included in OCI

|

2

|

|

—

|

|

—

|

|

2

|

|

4

|

|

—

|

|

—

|

|

4

|

|

|||||||||||||||

|

Included in nuclear decommissioning obligations

|

—

|

|

3

|

|

—

|

|

3

|

|

—

|

|

3

|

|

—

|

|

3

|

|

|||||||||||||||

|

Purchases

|

—

|

|

—

|

|

(109

|

)

|

(109

|

)

|

—

|

|

1

|

|

(1

|

)

|

—

|

|

|||||||||||||||

|

Transfers into Level 3

(b)

|

—

|

|

—

|

|

(31

|

)

|

(31

|

)

|

—

|

|

—

|

|

4

|

|

4

|

|

|||||||||||||||

|

Transfers out of Level 3

(b)

|

—

|

|

—

|

|

(20

|

)

|

(20

|

)

|

—

|

|

—

|

|

(6

|

)

|

(6

|

)

|

|||||||||||||||

|

Ending balance as of

September 30, 2012

|

$

|

11

|

|

$

|

46

|

|

$

|

2

|

|

$

|

59

|

|

$

|

11

|

|

$

|

46

|

|

$

|

2

|

|

$

|

59

|

|

|||||||

|

(Losses)/gains for the period included in earnings attributable to the change in unrealized gains or losses relating to assets or liabilities still held as of September 30, 2012

|

$

|

—

|

|

$

|

—

|

|

$

|

(5

|

)

|

$

|

(5

|

)

|

$

|

—

|

|

$

|

—

|

|

$

|

1

|

|

|

$

|

1

|

|

||||||

|

(a)

|

Consists of derivative assets and liabilities, net.

|

|

(b)

|

Transfers in/out of Level 3 are related to the availability of external broker quotes and are valued as of the end of the reporting period. All transfers in/out are with Level 2.

|

|

|

Net Exposure

(a)

|

|

|

Category

|

(% of Total)

|

|

|

Financial institutions

|

58

|

%

|

|

Utilities, energy merchants, marketers and other

|

34

|

|

|

ISOs

|

6

|

|

|

Coal and emissions

|

2

|

|

|

Total as of September 30, 2013

|

100

|

%

|

|

|

Net Exposure

(a)

|

|

|

Category

|

(% of Total)

|

|

|

Investment grade

|

96

|

%

|

|

Non-rated

(b)

|

4

|

|

|

Total as of September 30, 2013

|

100

|

%

|

|

(a)

|

Counterparty credit exposure excludes uranium and coal transportation contracts because of the unavailability of market prices.

|

|

(b)

|

For non-rated counterparties, a significant portion are related to ISO and municipal public power entities, which are considered investment grade equivalent ratings based on NRG's internal credit ratings.

|

|

|

As of September 30, 2013

|

As of December 31, 2012

|

|||||||||||||||||||||||

|

(In millions, except otherwise noted)

|

Fair Value

|

Unrealized Gains

|

Unrealized Losses

|

Weighted-average Maturities (In years)

|

Fair Value

|

Unrealized Gains

(a)

|

Weighted-average Maturities (In years)

|

||||||||||||||||||

|

Cash and cash equivalents

|

$

|

2

|

|

$

|

—

|

|

$

|

—

|

|

—

|

|

$

|

10

|

|

$

|

—

|

|

—

|

|

||||||

|

U.S. government and federal agency obligations

|

54

|

|

2

|

|

1

|

|

9

|

|

33

|

|

2

|

|

10

|

|

|||||||||||

|

Federal agency mortgage-backed securities

|

58

|

|

1

|

|

1

|

|

24

|

|

59

|

|

2

|

|

23

|

|

|||||||||||

|

Commercial mortgage-backed securities

|

12

|

|

—

|

|

—

|

|

29

|

|

9

|

|

—

|

|

30

|

|

|||||||||||

|

Corporate debt securities

|

60

|

|

2

|

|

1

|

|

9

|

|

80

|

|

4

|

|

11

|

|

|||||||||||

|

Equity securities

|

336

|

|

187

|

|

—

|

|

—

|

|

280

|

|

143

|

|

—

|

|

|||||||||||

|

Foreign government fixed income securities

|

2

|

|

—

|

|

—

|

|

9

|

|

2

|

|

—

|

|

6

|

|

|||||||||||

|

Total

|

$

|

524

|

|

$

|

192

|

|

$

|

3

|

|

$

|

473

|

|

$

|

151

|

|

||||||||||

|

|

Nine months ended September 30,

|

||||||

|

2013

|

2012

|

||||||

|

(In millions)

|

|||||||

|

Realized gains

|

$

|

10

|

|

$

|

8

|

|

|

|

Realized losses

|

7

|

|

5

|

|

|||

|

Proceeds from sale of securities

|

344

|

|

316

|

|

|||

|

|

|

Total Volume

|

||||||

|

September 30, 2013

|

December 31, 2012

|

|||||||

|

Commodity

|

Units

|

(In millions)

|

||||||

|

Emissions

|

Short Ton

|

(1

|

)

|

(1

|

)

|

|||

|

Coal

|

Short Ton

|

42

|

|

37

|

|

|||

|

Natural Gas

|

MMBtu

|

(215

|

)

|

(413

|

)

|

|||

|

Oil

|

Barrel

|

—

|

|

1

|

|

|||

|

Power

|

MWh

|

(16

|

)

|

(14

|

)

|

|||

|

Interest

|

Dollars

|

$

|

1,520

|

|

$

|

2,612

|

|

|

|

|

Fair Value

|

||||||||||||||

|

|

Derivative Assets

|

Derivative Liabilities

|

|||||||||||||

|

September 30, 2013

|

December 31, 2012

|

September 30, 2013

|

December 31, 2012

|

||||||||||||

|

(In millions)

|

|||||||||||||||

|

Derivatives designated as cash flow hedges:

|

|

|

|

|

|||||||||||

|

Interest rate contracts current

|

$

|

—

|

|

$

|

—

|

|

$

|

27

|

|

$

|

29

|

|

|||

|

Interest rate contracts long-term

|

8

|

|

3

|

|

47

|

|

96

|

|

|||||||

|

Commodity contracts current

|

—

|

|

—

|

|

2

|

|

3

|

|

|||||||

|

Commodity contracts long-term

|

—

|

|

—

|

|

1

|

|

1

|

|

|||||||

|

Total derivatives designated as cash flow hedges

|

8

|

|

3

|

|

77

|

|

129

|

|

|||||||

|

Derivatives not designated as cash flow hedges

:

|

|

|

|

|

|||||||||||

|

Interest rate contracts current

|

—

|

|

—

|

|

5

|

|

7

|

|

|||||||

|

Interest rate contracts long-term

|

3

|

|

—

|

|

3

|

|

11

|

|

|||||||

|

Commodity contracts current

|

1,389

|

|

2,644

|

|

1,030

|

|

1,942

|

|

|||||||

|

Commodity contracts long-term

|

495

|

|

659

|

|

321

|

|

392

|

|

|||||||

|

Total derivatives not designated as cash flow hedges

|

1,887

|

|

3,303

|

|

1,359

|

|

2,352

|

|

|||||||

|

Total derivatives

|

$

|

1,895

|

|

$

|

3,306

|

|

$

|

1,436

|

|

$

|

2,481

|

|

|||

|

Gross Amounts Not Offset in the Statement of Financial Position

|

||||||||||||||||

|

Gross Amounts of Recognized Assets / Liabilities

|

Derivative Instruments

|

Cash Collateral (Held) / Posted

|

Net Amount

|

|||||||||||||

|

As of September 30, 2013

|

(In millions)

|

|||||||||||||||

|

Commodity contracts:

|

||||||||||||||||

|

Derivative assets

|

$

|

1,884

|

|

$

|

(1,151

|

)

|

$

|

(195

|

)

|

$

|

538

|

|

||||

|

Derivative liabilities

|

(1,354

|

)

|

1,151

|

|

65

|

|

(138

|

)

|

||||||||

|

Total commodity contracts

|

530

|

|

—

|

|

(130

|

)

|

400

|

|

||||||||

|

Interest rate contracts:

|

||||||||||||||||

|

Derivative assets

|

11

|

|

(6

|

)

|

—

|

|

5

|

|

||||||||

|

Derivative liabilities

|

(82

|

)

|

6

|

|

—

|

|

(76

|

)

|

||||||||

|

Total interest rate contracts

|

(71

|

)

|

—

|

|

—

|

|

(71

|

)

|

||||||||

|

Total derivative instruments

|

$

|

459

|

|

$

|

—

|

|

$

|

(130

|

)

|

$

|

329

|

|

||||

|

Gross Amounts Not Offset in the Statement of Financial Position

|

||||||||||||||||

|

Gross Amounts of Recognized Assets / Liabilities

|

Derivative Instruments

|

Cash Collateral (Held) / Posted

|

Net Amount

|

|||||||||||||

|

As of December 31, 2012

|

(In millions)

|

|||||||||||||||

|

Commodity contracts:

|

|

|||||||||||||||

|

Derivative assets

|

$

|

3,303

|

|

$

|

(2,024

|

)

|

$

|

(374

|

)

|

$

|

905

|

|

||||

|

Derivative liabilities

|

(2,338

|

)

|

2,024

|

|

28

|

|

(286

|

)

|

||||||||

|

Total commodity contracts

|

965

|

|

—

|

|

(346

|

)

|

619

|

|

||||||||

|

Interest rate contracts:

|

|

|||||||||||||||

|

Derivative assets

|

3

|

|

—

|

|

—

|

|

3

|

|

||||||||

|

Derivative liabilities

|

(143

|

)

|

—

|

|

—

|

|

(143

|

)

|

||||||||

|

Total interest rate contracts

|

(140

|

)

|

—

|

|

—

|

|

(140

|

)

|

||||||||

|

Total derivative instruments

|

$

|

825

|

|

$

|

—

|

|

$

|

(346

|

)

|

|

$

|

479

|

|

|||

|

Three months ended September 30, 2013

|

Nine months ended September 30, 2013

|

||||||||||||||||||||||

|

Energy Commodities

|

Interest Rate

|

Total

|

Energy Commodities

|

Interest Rate

|

Total

|

||||||||||||||||||

|

(In millions)

|

|||||||||||||||||||||||

|

Accumulated OCI beginning balance

|

$

|

24

|

|

$

|

(31

|

)

|

$

|

(7

|

)

|

$

|

41

|

|

$

|

(72

|

)

|

$

|

(31

|

)

|

|||||

|

Reclassified from accumulated OCI to income:

|

|||||||||||||||||||||||

|

Due to realization of previously deferred amounts

|

(15

|

)

|

2

|

|

(13

|

)

|

(38

|

)

|

6

|

|

(32

|

)

|

|||||||||||

|

Mark-to-market of cash flow hedge accounting contracts

|

1

|

|

(4

|

)

|

(3

|

)

|

7

|

|

33

|

|

40

|

|

|||||||||||

|

Accumulated OCI ending balance, net of $13 tax

|

$

|

10

|

|

$

|

(33

|

)

|

$

|

(23

|

)

|

$

|

10

|

|

$

|

(33

|

)

|

$

|

(23

|

)

|

|||||

|

Gains/(losses) expected to be realized from OCI during the next 12 months, net of $1 tax

|

$

|

11

|

|

$

|

(9

|

)

|

$

|

2

|

|

$

|

11

|

|

$

|

(9

|

)

|

$

|

2

|

|

|||||

|

Gains recognized in income from the ineffective portion of cash flow hedges

|

$

|

1

|

|

$

|

—

|

|

$

|

1

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

|||||

|

Three months ended September 30, 2012

|

Nine months ended September 30, 2012

|

||||||||||||||||||||||

|

Energy Commodities

|

Interest Rate

|

Total

|

Energy Commodities

|

Interest Rate

|

Total

|

||||||||||||||||||

|

(In millions)

|

|||||||||||||||||||||||

|

Accumulated OCI beginning balance

|

$

|

111

|

|

$

|

(68

|

)

|

$

|

43

|

|

$

|

188

|

|

$

|

(56

|

)

|

$

|

132

|

|

|||||

|

Reclassified from accumulated OCI to income:

|

|||||||||||||||||||||||

|

Due to realization of previously deferred amounts

|

(30

|

)

|

3

|

|

(27

|

)

|

(106

|

)

|

11

|

|

(95

|

)

|

|||||||||||

|

Mark-to-market of cash flow hedge accounting contracts

|

(1

|

)

|

(15

|

)

|

(16

|

)

|

(2

|

)

|

(35

|

)

|

(37

|

)

|

|||||||||||

|

Accumulated OCI ending balance, net of $12 tax

|

$

|

80

|

|

$

|

(80

|

)

|

$

|

—

|

|

$

|

80

|

|

$

|

(80

|

)

|

$

|

—

|

|

|||||

|

Gains/(losses) expected to be realized from OCI during the next 12 months, net of $38 tax

|

$

|

77

|

|

$

|

(11

|

)

|

$

|

66

|

|

$

|

77

|

|

$

|

(11

|

)

|

$

|

66

|

|

|||||

|