nsp-20210331

INSPERITY, INC.

0001000753

--12-31

2021

Q1

FALSE

38,674,991

55,489

555

95,528

626,984

575,033

44,132

—

—

29,686

—

29,686

—

10,851

971

—

11,822

—

329

569

—

240

—

364

318

—

682

—

—

—

15,461

15,461

—

—

—

7

7

—

—

—

61,922

61,922

55,489

555

81,329

628,391

620,151

73,644

55,489

555

48,141

544,102

499,485

4,079

—

—

61,203

—

61,203

—

4,893

1,659

—

6,552

—

381

261

—

642

—

—

—

15,557

15,557

—

—

—

85

85

—

—

—

62,092

62,092

55,489

555

46,327

595,487

545,295

3,310

Greater than 1 year

Greater than 1 year

0.010

0001000753

2021-01-01

2021-03-31

0001000753

us-gaap:CommonStockMember

2021-01-01

2021-03-31

0001000753

us-gaap:RightsMember

2021-01-01

2021-03-31

xbrli:shares

0001000753

2021-04-26

iso4217:USD

0001000753

2021-03-31

0001000753

2020-12-31

0001000753

2020-01-01

2020-03-31

iso4217:USD

xbrli:shares

0001000753

2019-12-31

0001000753

2020-03-31

0001000753

us-gaap:CommonStockMember

2020-12-31

0001000753

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001000753

us-gaap:TreasuryStockMember

2020-12-31

0001000753

us-gaap:RetainedEarningsMember

2020-12-31

0001000753

us-gaap:CommonStockMember

2021-01-01

2021-03-31

0001000753

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-03-31

0001000753

us-gaap:TreasuryStockMember

2021-01-01

2021-03-31

0001000753

us-gaap:RetainedEarningsMember

2021-01-01

2021-03-31

0001000753

us-gaap:CommonStockMember

2021-03-31

0001000753

us-gaap:AdditionalPaidInCapitalMember

2021-03-31

0001000753

us-gaap:TreasuryStockMember

2021-03-31

0001000753

us-gaap:RetainedEarningsMember

2021-03-31

0001000753

us-gaap:CommonStockMember

2019-12-31

0001000753

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0001000753

us-gaap:TreasuryStockMember

2019-12-31

0001000753

us-gaap:RetainedEarningsMember

2019-12-31

0001000753

us-gaap:CommonStockMember

2020-01-01

2020-03-31

0001000753

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

2020-03-31

0001000753

us-gaap:TreasuryStockMember

2020-01-01

2020-03-31

0001000753

us-gaap:RetainedEarningsMember

2020-01-01

2020-03-31

0001000753

us-gaap:CommonStockMember

2020-03-31

0001000753

us-gaap:AdditionalPaidInCapitalMember

2020-03-31

0001000753

us-gaap:TreasuryStockMember

2020-03-31

0001000753

us-gaap:RetainedEarningsMember

2020-03-31

xbrli:pure

0001000753

2019-10-01

0001000753

nsp:NortheastMember

2021-01-01

2021-03-31

0001000753

nsp:NortheastMember

2020-01-01

2020-03-31

0001000753

nsp:SoutheastMember

2021-01-01

2021-03-31

0001000753

nsp:SoutheastMember

2020-01-01

2020-03-31

0001000753

nsp:CentralMember

2021-01-01

2021-03-31

0001000753

nsp:CentralMember

2020-01-01

2020-03-31

0001000753

nsp:SouthwestMember

2021-01-01

2021-03-31

0001000753

nsp:SouthwestMember

2020-01-01

2020-03-31

0001000753

nsp:WestMember

2021-01-01

2021-03-31

0001000753

nsp:WestMember

2020-01-01

2020-03-31

0001000753

nsp:OtherRevenuesMember

2021-01-01

2021-03-31

0001000753

nsp:OtherRevenuesMember

2020-01-01

2020-03-31

0001000753

us-gaap:CashAndCashEquivalentsMember

2021-03-31

0001000753

us-gaap:MoneyMarketFundsMember

2021-03-31

0001000753

us-gaap:CashAndCashEquivalentsMember

2020-12-31

0001000753

us-gaap:MoneyMarketFundsMember

2020-12-31

0001000753

us-gaap:FairValueInputsLevel1Member

2021-03-31

0001000753

us-gaap:FairValueInputsLevel2Member

2021-03-31

0001000753

us-gaap:FairValueInputsLevel1Member

2020-12-31

0001000753

us-gaap:FairValueInputsLevel2Member

2020-12-31

0001000753

us-gaap:USTreasurySecuritiesMember

2021-03-31

0001000753

us-gaap:USTreasurySecuritiesMember

2021-01-01

2021-03-31

0001000753

nsp:MunicipalBondMember

2021-03-31

0001000753

nsp:MunicipalBondMember

2021-01-01

2021-03-31

0001000753

us-gaap:USTreasurySecuritiesMember

2020-12-31

0001000753

us-gaap:USTreasurySecuritiesMember

2020-01-01

2020-12-31

0001000753

nsp:MunicipalBondMember

2020-12-31

0001000753

nsp:MunicipalBondMember

2020-01-01

2020-12-31

0001000753

2020-01-01

2020-12-31

0001000753

us-gaap:LondonInterbankOfferedRateLIBORMember

srt:MinimumMember

2021-01-01

2021-03-31

0001000753

us-gaap:LondonInterbankOfferedRateLIBORMember

srt:MaximumMember

2021-01-01

2021-03-31

0001000753

srt:MinimumMember

us-gaap:BaseRateMember

2021-01-01

2021-03-31

0001000753

us-gaap:BaseRateMember

srt:MaximumMember

2021-01-01

2021-03-31

nsp:conversionRatio

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

10-Q

(Mark One)

|

|

|

|

|

|

|

|

☒

|

Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the quarterly period ended

|

March 31, 2021

|

|

|

or

|

|

☐

|

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

For the transition period from _______________ to _______________

|

Commission File No.

1-13998

Insperity, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

76-0479645

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

19001 Crescent Springs Drive

|

|

Kingwood,

|

Texas

|

77339

|

|

(Address of principal executive offices)

|

(Registrant’s Telephone Number, Including Area Code): (

281

)

358-8986

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Ticker symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $.01 par value per share

|

NSP

|

New York Stock Exchange

|

|

Rights to Purchase Series A Junior Participating Preferred Stock

|

NSP

|

New York Stock Exchange

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes

☒

No

☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes

☒

No

☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer”, “non-accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

☒

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

Emerging growth company

|

☐

|

|

Smaller reporting company

|

☐

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

☐

No

☒

As of April 26, 2021,

38,674,991

shares of the registrant’s common stock, par value $0.01 per share, were outstanding.

|

|

|

|

|

|

|

|

|

|

|

|

|

Page

|

|

|

|

|

|

Part I, Item 1.

|

Financial Statements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part I, Item 2.

|

|

|

|

Part I, Item 3.

|

|

|

|

Part I, Item 4.

|

|

|

|

Part II, Item 1.

|

|

|

|

Part II, Item 1A.

|

|

|

|

Part II, Item 2.

|

|

|

|

Part II, Item 6.

|

|

|

|

|

|

|

FINANCIAL STATEMENTS

(Unaudited)

|

PART I

Item 1. Financial Statements

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands)

|

March 31, 2021

|

|

December 31, 2020

|

|

Assets

|

|

|

|

|

Cash and cash equivalents

|

$

|

494,777

|

|

|

$

|

554,846

|

|

|

Restricted cash

|

46,353

|

|

|

45,522

|

|

|

Marketable securities

|

34,292

|

|

|

34,529

|

|

|

Accounts receivable, net

|

561,244

|

|

|

392,746

|

|

|

Prepaid insurance

|

57,670

|

|

|

10,164

|

|

|

Other current assets

|

53,718

|

|

|

39,461

|

|

|

Income taxes receivable

|

3,451

|

|

|

—

|

|

|

Total current assets

|

1,251,505

|

|

|

1,077,268

|

|

|

Property and equipment, net of accumulated depreciation

|

220,262

|

|

|

216,256

|

|

|

Right-of-use (“ROU”) leased assets

|

67,688

|

|

|

60,663

|

|

|

Prepaid health insurance

|

9,000

|

|

|

9,000

|

|

|

Deposits – health insurance

|

7,900

|

|

|

7,900

|

|

|

Deposits – workers’ compensation

|

193,067

|

|

|

186,331

|

|

|

Goodwill and other intangible assets, net

|

12,707

|

|

|

12,707

|

|

|

Deferred income taxes, net

|

—

|

|

|

9,603

|

|

|

Other assets

|

6,955

|

|

|

4,548

|

|

|

Total assets

|

$

|

1,769,084

|

|

|

$

|

1,584,276

|

|

|

Liabilities and stockholders' equity

|

|

|

|

|

Accounts payable

|

$

|

5,841

|

|

|

$

|

6,203

|

|

|

Payroll taxes and other payroll deductions payable

|

310,519

|

|

|

377,960

|

|

|

Accrued worksite employee payroll cost

|

503,334

|

|

|

334,836

|

|

|

Accrued health insurance costs

|

72,136

|

|

|

32,685

|

|

|

Accrued workers’ compensation costs

|

49,696

|

|

|

48,186

|

|

|

Accrued corporate payroll and commissions

|

41,720

|

|

|

44,277

|

|

|

Other accrued liabilities

|

61,105

|

|

|

60,777

|

|

|

|

|

|

|

|

Total current liabilities

|

1,044,351

|

|

|

904,924

|

|

|

Accrued workers’ compensation cost, net of current

|

190,336

|

|

|

195,239

|

|

|

Long-term debt

|

369,400

|

|

|

369,400

|

|

|

Operating lease liabilities, net of current

|

71,716

|

|

|

64,289

|

|

|

Deferred income taxes, net

|

13,343

|

|

|

—

|

|

|

Other accrued liabilities, net of current

|

6,294

|

|

|

6,292

|

|

|

Total noncurrent liabilities

|

651,089

|

|

|

635,220

|

|

|

Commitments and contingencies

|

|

|

|

|

Common stock

|

555

|

|

|

555

|

|

|

Additional paid-in capital

|

81,329

|

|

|

95,528

|

|

|

Treasury stock, at cost

|

(

628,391

)

|

|

|

(

626,984

)

|

|

|

Retained earnings

|

620,151

|

|

|

575,033

|

|

|

Total stockholders’ equity

|

73,644

|

|

|

44,132

|

|

|

Total liabilities and stockholders’ equity

|

$

|

1,769,084

|

|

|

$

|

1,584,276

|

|

See accompanying notes.

|

|

|

|

|

|

|

|

Insperity | 2021 First Quarter Form 10-Q

|

4

|

|

|

|

|

FINANCIAL STATEMENTS

(Unaudited)

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

(in thousands, except per share amounts)

|

|

|

|

2021

|

2020

|

|

|

|

|

|

|

|

|

Revenues

(1)

|

|

|

|

$

|

1,286,835

|

|

$

|

1,229,483

|

|

|

Payroll taxes, benefits and workers’ compensation costs

|

|

|

|

1,035,390

|

|

995,461

|

|

|

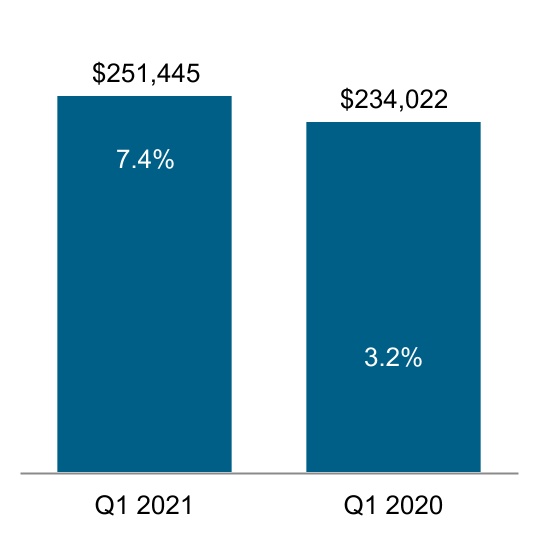

Gross profit

|

|

|

|

251,445

|

|

234,022

|

|

|

Salaries, wages and payroll taxes

|

|

|

|

103,075

|

|

86,501

|

|

|

Stock-based compensation

|

|

|

|

11,822

|

|

6,552

|

|

|

Commissions

|

|

|

|

7,719

|

|

8,460

|

|

|

Advertising

|

|

|

|

5,322

|

|

4,833

|

|

|

General and administrative expenses

|

|

|

|

31,636

|

|

34,853

|

|

|

Depreciation and amortization

|

|

|

|

8,047

|

|

7,602

|

|

|

Total operating expenses

|

|

|

|

167,621

|

|

148,801

|

|

|

Operating income

|

|

|

|

83,824

|

|

85,221

|

|

|

Other income (expense):

|

|

|

|

|

|

|

Interest income

|

|

|

|

543

|

|

1,879

|

|

|

Interest expense

|

|

|

|

(

1,599

)

|

|

(

2,362

)

|

|

|

Income before income tax expense

|

|

|

|

82,768

|

|

84,738

|

|

|

Income tax expense

|

|

|

|

20,846

|

|

22,646

|

|

|

Net income

|

|

|

|

$

|

61,922

|

|

$

|

62,092

|

|

|

Less distributed and undistributed earnings allocated to participating securities

|

|

|

|

(

197

)

|

|

(

462

)

|

|

|

Net income allocated to common shares

|

|

|

|

$

|

61,725

|

|

$

|

61,630

|

|

|

|

|

|

|

|

|

|

Net income per share of common stock

|

|

|

|

|

|

|

Basic

|

|

|

|

$

|

1.62

|

|

$

|

1.59

|

|

|

Diluted

|

|

|

|

$

|

1.59

|

|

$

|

1.58

|

|

____________________________________

(1)

Revenues are comprised of gross billings less worksite employee (“WSEE”) payroll costs as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

|

|

(in thousands)

|

2021

|

2020

|

|

|

|

|

|

|

|

|

|

|

|

Gross billings

|

$

|

8,050,422

|

|

$

|

7,436,754

|

|

|

|

|

|

Less: WSEE payroll cost

|

$

|

6,763,587

|

|

$

|

6,207,271

|

|

|

|

|

|

Revenues

|

$

|

1,286,835

|

|

$

|

1,229,483

|

|

|

|

|

See accompanying notes.

|

|

|

|

|

|

|

|

Insperity | 2021 First Quarter Form 10-Q

|

5

|

|

|

|

|

FINANCIAL STATEMENTS

(Unaudited)

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

(in thousands)

|

2021

|

|

2020

|

|

|

|

|

|

|

Cash flows from operating activities

|

|

|

|

|

Net income

|

$

|

61,922

|

|

|

$

|

62,092

|

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

Depreciation and amortization

|

8,047

|

|

|

7,602

|

|

|

Stock-based compensation

|

11,822

|

|

|

6,552

|

|

|

Deferred income taxes

|

22,946

|

|

|

12,560

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

Accounts receivable

|

(

168,498

)

|

|

|

(

54,966

)

|

|

|

Prepaid insurance

|

(

47,506

)

|

|

|

(

35,107

)

|

|

|

Other current assets

|

(

14,257

)

|

|

|

3,068

|

|

|

Other assets and ROU assets

|

1,508

|

|

|

3,403

|

|

|

Accounts payable

|

(

362

)

|

|

|

1,675

|

|

|

Payroll taxes and other payroll deductions payable

|

(

67,441

)

|

|

|

(

9,003

)

|

|

|

Accrued worksite employee payroll expense

|

168,498

|

|

|

34,905

|

|

|

Accrued health insurance costs

|

39,451

|

|

|

25,661

|

|

|

Accrued workers’ compensation costs

|

(

3,393

)

|

|

|

3,467

|

|

|

Accrued corporate payroll, commissions and other accrued liabilities

|

(

5,421

)

|

|

|

(

46,531

)

|

|

|

Income taxes payable/receivable

|

(

5,345

)

|

|

|

8,409

|

|

|

Total adjustments

|

(

59,951

)

|

|

|

(

38,305

)

|

|

|

Net cash provided by operating activities

|

1,971

|

|

|

23,787

|

|

|

|

|

|

|

|

Cash flows from investing activities

|

|

|

|

|

Marketable securities:

|

|

|

|

|

Purchases

|

(

10,585

)

|

|

|

(

8,689

)

|

|

|

|

|

|

|

|

Proceeds from maturities

|

10,580

|

|

|

24,000

|

|

|

Property and equipment:

|

|

|

|

|

Purchases

|

(

12,072

)

|

|

|

(

15,625

)

|

|

|

Net cash used in investing activities

|

(

12,077

)

|

|

|

(

314

)

|

|

|

|

|

|

|

|

Cash flows from financing activities

|

|

|

|

|

Purchase of treasury stock

|

(

29,686

)

|

|

|

(

61,203

)

|

|

|

Dividends paid

|

(

15,461

)

|

|

|

(

15,557

)

|

|

|

Borrowings under revolving line of credit

|

—

|

|

|

100,000

|

|

|

Other

|

2,751

|

|

|

2,363

|

|

|

Net cash provided by (used in) financing activities

|

(

42,396

)

|

|

|

25,603

|

|

|

Net increase (decrease) in cash, cash equivalents and restricted cash

|

(

52,502

)

|

|

|

49,076

|

|

|

Cash, cash equivalents and restricted cash beginning of period

|

786,699

|

|

|

592,550

|

|

|

Cash, cash equivalents and restricted cash end of period

|

$

|

734,197

|

|

|

$

|

641,626

|

|

|

|

|

|

|

|

|

|

Insperity | 2021 First Quarter Form 10-Q

|

6

|

|

|

|

|

FINANCIAL STATEMENTS

(Unaudited)

|

CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

(in thousands)

|

2021

|

|

2020

|

|

|

|

|

|

|

Supplemental schedule of cash and cash equivalents and restricted cash

|

|

|

|

Cash and cash equivalents

|

$

|

554,846

|

|

|

$

|

367,342

|

|

|

Restricted cash

|

45,522

|

|

|

49,295

|

|

|

Deposits – workers’ compensation

|

186,331

|

|

|

175,913

|

|

|

Cash, cash equivalents and restricted cash beginning of period

|

$

|

786,699

|

|

|

$

|

592,550

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

$

|

494,777

|

|

|

$

|

404,728

|

|

|

Restricted cash

|

46,353

|

|

|

48,349

|

|

|

Deposits – workers’ compensation

|

193,067

|

|

|

188,549

|

|

|

Cash, cash equivalents and restricted cash end of period

|

$

|

734,197

|

|

|

$

|

641,626

|

|

|

|

|

|

|

|

Supplemental operating lease cash flow information:

|

|

|

|

|

ROU assets obtained in exchange for lease obligations

|

$

|

12,104

|

|

|

$

|

6,787

|

|

See accompanying notes.

|

|

|

|

|

|

|

|

Insperity | 2021 First Quarter Form 10-Q

|

7

|

|

|

|

|

FINANCIAL STATEMENTS

(Unaudited)

|

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

For the Three Months Ended March 31, 2021 and 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock Issued

|

Additional Paid-In Capital

|

Treasury Stock

|

Retained Earnings and AOCI

|

Total

|

|

(in thousands)

|

Shares

|

Amount

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2020

|

55,489

|

|

$

|

555

|

|

$

|

95,528

|

|

$

|

(

626,984

)

|

|

$

|

575,033

|

|

$

|

44,132

|

|

|

Purchase of treasury stock, at cost

|

—

|

|

—

|

|

—

|

|

(

29,686

)

|

|

—

|

|

(

29,686

)

|

|

|

Issuance of equity-based incentive awards and dividend equivalents

|

—

|

|

—

|

|

(

25,085

)

|

|

26,421

|

|

(

1,336

)

|

|

—

|

|

|

Stock-based compensation expense

|

—

|

|

—

|

|

10,851

|

|

971

|

|

—

|

|

11,822

|

|

|

Exercise of stock options

|

—

|

|

—

|

|

(

329

)

|

|

569

|

|

—

|

|

240

|

|

|

Other

|

—

|

|

—

|

|

364

|

|

318

|

|

—

|

|

682

|

|

|

Dividends paid

|

—

|

|

—

|

|

—

|

|

—

|

|

(

15,461

)

|

|

(

15,461

)

|

|

|

Unrealized loss on marketable securities, net of tax

|

—

|

|

—

|

|

—

|

|

—

|

|

(

7

)

|

|

(

7

)

|

|

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

61,922

|

|

61,922

|

|

|

Balance at March 31, 2021

|

55,489

|

|

$

|

555

|

|

$

|

81,329

|

|

$

|

(

628,391

)

|

|

$

|

620,151

|

|

$

|

73,644

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2019

|

55,489

|

|

$

|

555

|

|

$

|

48,141

|

|

$

|

(

544,102

)

|

|

$

|

499,485

|

|

$

|

4,079

|

|

|

Purchase of treasury stock, at cost

|

—

|

|

—

|

|

—

|

|

(

61,203

)

|

|

—

|

|

(

61,203

)

|

|

|

Issuance of equity-based incentive awards and dividend equivalents

|

—

|

|

—

|

|

(

7,088

)

|

|

7,898

|

|

(

810

)

|

|

—

|

|

|

Stock-based compensation expense

|

—

|

|

—

|

|

4,893

|

|

1,659

|

|

—

|

|

6,552

|

|

|

Other

|

—

|

|

—

|

|

381

|

|

261

|

|

—

|

|

642

|

|

|

Dividends paid

|

—

|

|

—

|

|

—

|

|

—

|

|

(

15,557

)

|

|

(

15,557

)

|

|

|

Unrealized gain on marketable securities, net of tax

|

—

|

|

—

|

|

—

|

|

—

|

|

85

|

|

85

|

|

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

62,092

|

|

62,092

|

|

|

Balance at March 31, 2020

|

55,489

|

|

$

|

555

|

|

$

|

46,327

|

|

$

|

(

595,487

)

|

|

$

|

545,295

|

|

$

|

(

3,310

)

|

|

|

|

|

|

|

|

|

|

Insperity | 2021 First Quarter Form 10-Q

|

8

|

|

|

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

|

Insperity, Inc., a Delaware corporation (“Insperity,” “we,” “our,” and “us”), provides an array of human resources (“HR”) and business solutions designed to help improve business performance. Our most comprehensive HR services offerings are provided through our professional employer organization (“PEO”) services, known as Workforce Optimization

®

and Workforce Synchronization

TM

solutions (together, our “PEO HR Outsourcing solutions”), which encompass a broad range of HR functions, including payroll and employment administration, employee benefits, workers’ compensation, government compliance, performance management, and training and development services, along with our cloud-based human capital management solution, the Insperity Premier

TM

platform.

In addition to our PEO HR Outsourcing solutions, we offer a comprehensive traditional payroll and human capital management solution, known as Workforce Acceleration. We also offer a number of other business performance solutions, including Comprehensive Traditional Payroll and Human Capital Management, Time and Attendance, Performance Management, Organizational Planning, Recruiting Services, Employment Screening, Retirement Services and Insurance Services, many of which are offered as a cloud-based software solution. These other products or services are offered separately or with our other solutions.

The Consolidated Financial Statements include the accounts of Insperity, Inc. and its wholly owned subsidiaries. Intercompany accounts and transactions have been eliminated in consolidation.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States (“GAAP”) requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

The accompanying Consolidated Financial Statements should be read in conjunction with our audited Consolidated Financial Statements at and for the year ended December 31, 2020. Our Condensed Consolidated Balance Sheet at December 31, 2020 has been derived from the audited financial statements at that date, but does not include all of the information or footnotes required by GAAP for complete financial statements. Our Condensed Consolidated Balance Sheet at March 31, 2021 and our Consolidated Statements of Operations for the three month periods ended March 31, 2021 and 2020, our Consolidated Statements of Cash Flows for the three month periods ended March 31, 2021 and 2020 and our Consolidated Statements of Stockholders’ Equity for the three month periods ended March 31, 2021 and 2020, have been prepared by us without audit. In the opinion of management, all adjustments, consisting only of normal recurring adjustments necessary to present fairly the consolidated financial position, results of operations and cash flows, have been made.

The results of operations for the interim periods are not necessarily indicative of the operating results for a full year or of future operations.

Health Insurance Costs

We provide group health insurance coverage to our WSEEs in our PEO HR Outsourcing solutions through a national network of carriers, including UnitedHealthcare (“United”), UnitedHealthcare of California, Kaiser Permanente, Blue Shield of California, HMSA BlueCross BlueShield of Hawaii, and Tufts, all of which provide fully insured policies or service contracts.

The policy with United provides approximately

87

% of our health insurance coverage. While the policy with United is a fully-insured plan, as a result of certain contractual terms, we have accounted for this plan since its inception using a partially self-funded insurance accounting model. Effective January 1, 2020, under the amended agreement with United, we no longer have financial responsibilities for a participant’s annual claim costs that exceed $1 million. Accordingly, we record the costs of the United plan, including an estimate of the incurred claims, taxes and administrative fees (collectively the “Plan Costs”) as benefits expense, which is a component of direct costs, in our Consolidated Statements of Operations. The estimated incurred claims are based upon: (1) the level of claims processed during the quarter; (2) estimated completion rates based upon recent claim development patterns under the plan; and (3) the number of participants in the plan, including both active and COBRA enrollees. Each reporting period, changes in the estimated ultimate costs resulting from claim trends, plan design and migration, participant

|

|

|

|

|

|

|

|

Insperity | 2021 First Quarter Form 10-Q

|

9

|

|

|

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

|

demographics and other factors are incorporated into the benefits costs, which requires a significant level of judgment.

Additionally, since the plan’s inception, under the terms of the contract, United establishes cash funding rates

90

days in advance of the beginning of a reporting quarter. If the Plan Costs for a reporting quarter are greater than the premiums paid and owed to United, a deficit in the plan would be incurred and a liability for the excess costs would be accrued in our Condensed Consolidated Balance Sheets. On the other hand, if the Plan Costs for the reporting quarter are less than the premiums paid and owed to United, a surplus in the plan would be incurred and we would record an asset for the excess premiums in our Condensed Consolidated Balance Sheets. The terms of the arrangement require us to maintain an accumulated cash surplus in the plan of $

9.0

million, which is reported as long-term prepaid insurance. In addition, United requires a deposit equal to approximately one day of claims funding activity, which was $

6.5

million at March 31, 2021, and is included in deposits - health insurance as a long-term asset on our Condensed Consolidated Balance Sheets. As of March 31, 2021, Plan Costs were less than the net premiums paid and owed to United by $

51.4

million. As this amount is in excess of the agreed-upon $

9.0

million surplus maintenance level, the $

42.4

million difference is included in prepaid insurance, a current asset, in our Condensed Consolidated Balance Sheets. The premiums, including the additional quarterly premiums, owed to United at March 31, 2021 were $

66.0

million, which is included in accrued health insurance costs, a current liability in our Condensed Consolidated Balance Sheets. Our benefits costs incurred in the first three months of 2021 included an increase of $

5.5

million for changes in estimated run-off related to prior periods. Our benefits costs incurred in the first three months of 2020 included a reduction of $

1.5

million for changes in estimated run-off related to prior periods.

Workers’ Compensation Costs

Our workers’ compensation coverage for our WSEEs in our PEO HR Outsourcing solutions has been provided through an arrangement with the Chubb Group of Insurance Companies or its predecessors (the “Chubb Program”) since 2007. The Chubb Program is fully insured in that Chubb has the responsibility to pay all claims incurred under the policy regardless of whether we satisfy our responsibilities. Under the Chubb Program for claims incurred on or before September 30, 2019, we have financial responsibility to Chubb for the first $

1

million layer of claims per occurrence and, for claims over $

1

million, up to a maximum aggregate amount of $

6

million per policy year for claims that exceed $

1

million. Chubb bears the financial responsibility for all claims in excess of these levels. Effective for claims incurred on or after October 1, 2019, we have financial responsibility to Chubb for the first $

1.5

million layer of claims per occurrence and, for claims over $

1.5

million, up to a maximum aggregate amount of $

6

million per policy year for claims that exceed $

1.5

million.

Because we bear the financial responsibility for claims up to the levels noted above, such claims, which are the primary component of our workers’ compensation costs, are recorded in the period incurred. Workers’ compensation insurance includes ongoing health care and indemnity coverage whereby claims are paid over numerous years following the date of injury. Accordingly, the accrual of related incurred costs in each reporting period includes estimates, which take into account the ongoing development of claims and therefore requires a significant level of judgment.

We utilize a third-party actuary to estimate our loss development rate, which is primarily based upon the nature of WSEEs’ job responsibilities, the location of WSEEs, the historical frequency and severity of workers’ compensation claims, and an estimate of future cost trends. Each reporting period, changes in the actuarial assumptions resulting from changes in actual claims experience and other trends are incorporated into our workers’ compensation claims cost estimates. During the three months ended March 31, 2021 and 2020, we reduced accrued workers’ compensation costs by $

13.2

million and $

10.1

million, respectively, for changes in estimated losses related to prior reporting periods. Workers’ compensation cost estimates are discounted to present value at a rate based upon the U.S. Treasury rates that correspond with the weighted average estimated claim payout period (the average discount rate utilized in the 2021 period was

0.5

% and in the 2020 period was

1.0

%) and are accreted over the estimated claim payment period and included as a component of direct costs in our Consolidated Statements of Operations.

|

|

|

|

|

|

|

|

Insperity | 2021 First Quarter Form 10-Q

|

10

|

|

|

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

|

The following table provides the activity and balances related to incurred but not paid workers’ compensation claims:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

(in thousands)

|

2021

|

|

2020

|

|

|

|

|

|

|

Beginning balance, January 1,

|

$

|

240,761

|

|

|

$

|

242,904

|

|

|

Accrued claims

|

8,522

|

|

|

14,339

|

|

|

Present value discount, net of accretion

|

652

|

|

|

(

200

)

|

|

|

Paid claims

|

(

13,246

)

|

|

|

(

11,121

)

|

|

|

Ending balance

|

$

|

236,689

|

|

|

$

|

245,922

|

|

|

|

|

|

|

|

Current portion of accrued claims

|

$

|

46,353

|

|

|

$

|

48,289

|

|

|

Long-term portion of accrued claims

|

190,336

|

|

|

197,633

|

|

|

Total accrued claims

|

$

|

236,689

|

|

|

$

|

245,922

|

|

The current portion of accrued workers’ compensation costs on our Condensed Consolidated Balance Sheets at March 31, 2021 includes $

3.3

million of workers’ compensation administrative fees.

As of March 31, 2021 and 2020, the undiscounted accrued workers’ compensation costs were $

253.2

million and $

265.6

million, respectively.

At the beginning of each policy period, the workers’ compensation insurance carrier establishes monthly funding requirements comprised of premium costs and funds to be set aside for payment of future claims (“claim funds”). The level of claim funds is primarily based upon anticipated WSEE payroll levels and expected workers’ compensation loss rates, as determined by the insurance carrier. Monies funded into the program for incurred claims expected to be paid within

one year

are recorded as restricted cash, a short-term asset, while the remainder of claim funds are included in deposits – workers’ compensation, a long-term asset in our Condensed Consolidated Balance Sheets. At March 31, 2021, we had restricted cash of $

46.4

million and deposits – workers’ compensation of $

193.1

million.

Our estimate of incurred claim costs expected to be paid within

one year

is included in short-term liabilities, while our estimate of incurred claim costs expected to be paid beyond one year is included in long-term liabilities on our Condensed Consolidated Balance Sheets.

Revenue and Direct Cost Recognition

We enter into contracts with our customers for human resources services based on a stated rate and price in the contract. Our contracts generally have a term of 12 months, but are cancellable at any time by either party with 30-days’ notice. Our performance obligations are satisfied as services are rendered each month. The term between invoicing and when our performance obligations are satisfied is not significant. Payment terms are typically due concurrently with the invoicing of our PEO services. We do not have significant financing components or significant payment terms.

Our revenue is generally recognized ratably over the payroll period as WSEEs perform their service at the client worksite. Customers are invoiced concurrently with each periodic payroll of its WSEEs. Revenues that have been recognized but unbilled of $

549.0

million and $

380.8

million at March 31, 2021 and December 31, 2020, respectively, are included in accounts receivable, net on our Condensed Consolidated Balance Sheets.

Pursuant to the “practical expedients” provided under Accounting Standards Update (“ASU”) No 2014-09, we expense sales commissions when incurred because the terms of our contracts generally are cancellable by either party with a 30-day notice. These costs are recorded in commissions in our Consolidated Statements of Operations.

|

|

|

|

|

|

|

|

Insperity | 2021 First Quarter Form 10-Q

|

11

|

|

|

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

|

Our revenue for our PEO HR Outsourcing solutions by geographic region and for our other products and services offerings are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

|

|

(in thousands)

|

2021

|

2020

|

% Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Northeast

|

$

|

373,629

|

|

$

|

344,086

|

|

8.6

|

%

|

|

|

|

|

|

Southeast

|

156,260

|

|

140,678

|

|

11.1

|

%

|

|

|

|

|

|

Central

|

225,700

|

|

211,302

|

|

6.8

|

%

|

|

|

|

|

|

Southwest

|

256,979

|

|

272,130

|

|

(5.6)

|

%

|

|

|

|

|

|

West

|

261,354

|

|

246,853

|

|

5.9

|

%

|

|

|

|

|

|

|

1,273,922

|

|

1,215,049

|

|

4.8

|

%

|

|

|

|

|

|

Other revenue

|

12,913

|

|

14,434

|

|

(10.5)

|

%

|

|

|

|

|

|

Total revenue

|

$

|

1,286,835

|

|

$

|

1,229,483

|

|

4.7

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

3.

|

Cash, Cash Equivalents and Marketable Securities

|

The following table summarizes our cash and investments in cash equivalents and marketable securities held by investment managers and overnight investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2021

|

|

December 31, 2020

|

|

(in thousands)

|

Cash & Cash Equivalents

|

Marketable Securities

|

Total

|

|

Cash & Cash Equivalents

|

Marketable Securities

|

Total

|

|

|

|

|

|

|

|

|

|

|

Overnight holdings

|

$

|

432,607

|

|

$

|

—

|

|

$

|

432,607

|

|

|

$

|

503,221

|

|

$

|

—

|

|

$

|

503,221

|

|

|

Investment holdings

|

48,278

|

|

34,292

|

|

82,570

|

|

|

47,992

|

|

34,529

|

|

82,521

|

|

|

Cash in demand accounts

|

23,105

|

|

—

|

|

23,105

|

|

|

33,692

|

|

—

|

|

33,692

|

|

|

Outstanding checks

|

(

9,213

)

|

|

—

|

|

(

9,213

)

|

|

|

(

30,059

)

|

|

—

|

|

(

30,059

)

|

|

|

Total

|

$

|

494,777

|

|

$

|

34,292

|

|

$

|

529,069

|

|

|

$

|

554,846

|

|

$

|

34,529

|

|

$

|

589,375

|

|

Our cash and overnight holdings fluctuate based on the timing of clients’ payroll processing cycles. Our cash, cash equivalents and marketable securities at March 31, 2021 and December 31, 2020 included $

273.5

million and $

342.0

million, respectively, of funds associated with federal and state income tax withholdings, employment taxes and other payroll deductions, as well as $

58.9

million and $

35.3

million, respectively, in client prepayments.

|

|

|

|

|

|

|

|

4.

|

Fair Value Measurements

|

We account for our financial assets in accordance with Accounting Standard Codification 820,

Fair Value Measurement

. This standard defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. The fair value measurement disclosures are grouped into three levels based on valuation factors:

•

Level 1 - quoted prices in active markets using identical assets

•

Level 2 - significant other observable inputs, such as quoted prices for similar assets or liabilities, quoted prices in markets that are not active, or other observable inputs

•

Level 3 - significant unobservable inputs

|

|

|

|

|

|

|

|

Insperity | 2021 First Quarter Form 10-Q

|

12

|

|

|

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

|

Fair Value of Instruments Measured and Recognized at Fair Value

The following table summarizes the levels of fair value measurements of our financial assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2021

|

|

December 31, 2020

|

|

(in thousands)

|

Total

|

Level 1

|

Level 2

|

|

Total

|

Level 1

|

Level 2

|

|

|

|

|

|

|

|

|

|

|

Money market funds

|

$

|

480,885

|

|

$

|

480,885

|

|

$

|

—

|

|

|

$

|

551,213

|

|

$

|

551,213

|

|

$

|

—

|

|

|

U.S. Treasury bills

|

13,269

|

|

13,269

|

|

—

|

|

|

10,531

|

|

10,531

|

|

—

|

|

|

Municipal bonds

|

21,023

|

|

—

|

|

21,023

|

|

|

23,998

|

|

—

|

|

23,998

|

|

|

Total

|

$

|

515,177

|

|

$

|

494,154

|

|

$

|

21,023

|

|

|

$

|

585,742

|

|

$

|

561,744

|

|

$

|

23,998

|

|

The municipal bond securities valued as Level 2 are primarily pre-refunded municipal bonds that are secured by escrow funds containing U.S. government securities. Our valuation techniques used to measure fair value for these securities during the period consisted primarily of third-party pricing services that utilized actual market data such as trades of comparable bond issues, broker/dealer quotations for the same or similar investments in active markets and other observable inputs.

The following is a summary of our available-for-sale marketable securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands)

|

Amortized Cost

|

Gross Unrealized Gains

|

Gross Unrealized Losses

|

Estimated Fair Value

|

|

|

|

|

|

|

|

March 31, 2021

|

|

|

|

|

|

U.S. Treasury bills

|

$

|

13,267

|

|

$

|

2

|

|

$

|

—

|

|

$

|

13,269

|

|

|

Municipal bonds

|

21,028

|

|

1

|

|

(

6

)

|

|

21,023

|

|

|

Total

|

$

|

34,295

|

|

$

|

3

|

|

$

|

(

6

)

|

|

$

|

34,292

|

|

|

|

|

|

|

|

|

December 31, 2020

|

|

|

|

|

|

U.S. Treasury bills

|

$

|

10,530

|

|

$

|

1

|

|

$

|

—

|

|

$

|

10,531

|

|

|

Municipal bonds

|

23,994

|

|

8

|

|

(

4

)

|

|

23,998

|

|

|

Total

|

$

|

34,524

|

|

$

|

9

|

|

$

|

(

4

)

|

|

$

|

34,529

|

|

As of March 31, 2021, the contractual maturities of our marketable securities were as follows:

|

|

|

|

|

|

|

|

|

|

|

(in thousands)

|

Amortized Cost

|

Estimated Fair Value

|

|

|

|

|

|

Less than one year

|

$

|

34,295

|

|

$

|

34,292

|

|

|

One to five years

|

—

|

|

—

|

|

|

Total

|

$

|

34,295

|

|

$

|

34,292

|

|

Fair Value of Other Financial Instruments

The carrying amounts of cash, cash equivalents, restricted cash, accounts receivable, deposits and accounts payable approximate their fair values due to the short-term maturities of these instruments.

As of March 31, 2021, the carrying value of borrowings under our revolving credit facility approximates fair value and was classified as Level 2 in the fair value hierarchy. Please read Note 5, “Long-Term Debt,” for additional information.

|

|

|

|

|

|

|

|

Insperity | 2021 First Quarter Form 10-Q

|

13

|

|

|

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

|

We have a revolving credit facility (the “Facility”) with borrowing capacity of up to $

500

million. The Facility may be further increased to $

550

million based on the terms and subject to the conditions set forth in the agreement relating to the Facility (the “Credit Agreement”). The Facility is available for working capital and general corporate purposes, including acquisitions, stock repurchases and issuances of letters of credit. Our obligations under the Facility are secured by

65

% of the stock of our captive insurance subsidiary and are guaranteed by all of our domestic subsidiaries. At March 31, 2021, our outstanding balance on the Facility was $

369.4

million, and we had an outstanding $

1.0

million letter of credit issued under the Facility, resulting in an available borrowing capacity of $

129.6

million.

The Facility matures on September 13, 2024. Borrowings under the Facility bear interest at an annual rate equal to an alternate base rate or LIBOR, at our option, plus an applicable margin. Depending on our leverage ratio, the applicable margin varies (1) in the case of LIBOR loans, from

1.50

% to

2.25

% and (2) in the case of alternate base rate loans, from

0.00

% to

0.50

%. The alternate base rate is the highest of (1) the prime rate most recently published in The Wall Street Journal, (2) the federal funds rate plus

0.50

% and (3) the 30-day LIBOR rate plus

2.00

%. We also pay an unused commitment fee on the average daily unused portion of the Facility at a rate of

0.25

% per year. The average interest rate for the three month period ended March 31, 2021 was

1.88

%. Interest expense and unused commitment fees are recorded in other income (expense). Upon the discontinuation of LIBOR, the Facility provides that we and the agent will negotiate in good faith to amend the agreement to address such discontinuation and to place the parties in substantially the same economic position.

The Facility contains both affirmative and negative covenants that we believe are customary for arrangements of this nature. Covenants include, but are not limited to, limitations on our ability to incur additional indebtedness, sell material assets, retire, redeem or otherwise reacquire our capital stock, acquire the capital stock or assets of another business, make investments and pay dividends. In addition, the Credit Agreement requires us to comply with financial covenants limiting our total funded debt, minimum interest coverage ratio and maximum leverage ratio. We were in compliance with all financial covenants under the Credit Agreement at March 31, 2021.

During the first three months of 2021, we repurchased or withheld an aggregate of

340,317

shares of our common stock, as described below.

Repurchase Program

Our Board of Directors (the “Board”) has authorized a program to repurchase shares of our outstanding common stock (“Repurchase Program”). The purchases may be made from time to time in the open market or directly from stockholders at prevailing market prices based on market conditions and other factors. During the three months ended March 31, 2021,

49,904

shares were repurchased under the Repurchase Program. As of March 31, 2021, we were authorized to repurchase an additional

1,078,233

shares under the Repurchase Program.

Withheld Shares

During the three months ended March 31, 2021, we withheld

290,413

shares to satisfy tax withholding obligations for the vesting of long-term incentive and restricted stock awards.

Dividends

The Board declared quarterly dividends as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(amounts per share)

|

2021

|

|

2020

|

|

|

|

|

|

|

First quarter

|

$

|

0.40

|

|

|

$

|

0.40

|

|

|

|

|

|

|

|

|

|

|

|

During the three months ended March 31, 2021 and 2020, we paid dividends totaling $

15.5

million and $

15.6

million, respectively.

|

|

|

|

|

|

|

|

Insperity | 2021 First Quarter Form 10-Q

|

14

|

|

|

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

|

Rights Plan

On May 21, 2020, the Board declared a dividend of one right (“Right”) for each outstanding share of common stock to common stockholders of record at the close of business on June 1, 2020 (the “Rights Plan”). Each Right, if and when it becomes exercisable, entitles the registered holder to purchase from us

one

unit consisting of one one-hundredth of a share of Series A Junior Participating Preferred Stock, par value $0.01 per share. Initially, the Rights are attached to all outstanding shares of our common stock. The Rights are not currently exercisable and the Rights Plan will expire at the close of business on

May 20, 2021

, unless the Rights are earlier redeemed or exchanged by us.

We utilize the two-class method to compute net income per share. The two-class method allocates a portion of net income to participating securities, which includes unvested awards of share-based payments with non-forfeitable rights to receive dividends. Net income allocated to unvested share-based payments is excluded from net income allocated to common shares. Any undistributed losses resulting from dividends exceeding net income are not allocated to participating securities. Basic net income per share is computed by dividing net income allocated to common shares by the weighted average number of common shares outstanding during the period. Diluted net income per share is computed by dividing net income allocated to common shares by the weighted average number of common shares outstanding during the period, plus the dilutive effect of outstanding stock options.

The following table summarizes the net income allocated to common shares and the basic and diluted shares used in the net income per share computations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

|

|

(in thousands)

|

2021

|

2020

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

$

|

61,922

|

|

$

|

62,092

|

|

|

|

|

|

Less distributed and undistributed earnings allocated to participating securities

|

(

197

)

|

|

(

462

)

|

|

|

|

|

|

Net income allocated to common shares

|

$

|

61,725

|

|

$

|

61,630

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding

|

38,216

|

|

38,802

|

|

|

|

|

|

Incremental shares from assumed time-vested and performance-based RSU awards and conversions of common stock options

|

623

|

|

266

|

|

|

|

|

|

Adjusted weighted average common shares outstanding

|

38,839

|

|

39,068

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Insperity | 2021 First Quarter Form 10-Q

|

15

|

|

|

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

|

|

|

|

|

|

|

|

|

8.

|

Commitments and Contingencies

|

Worksite Employee 401(k) Retirement Plan Class Action Litigation

In December 2015, a class action lawsuit was filed against us and a third-party who served as the discretionary trustee (the “Co-Defendant”) of the Insperity 401(k) retirement plan that is available to eligible worksite employees (the “Plan”) in the United States District Court for the Northern District of Georgia, Atlanta Division, on behalf of Plan participants. The suit generally alleged the third-party discretionary trustee of the Plan and Insperity breached their fiduciary duties to plan participants by selecting an Insperity subsidiary to serve as the recordkeeper for the Plan, by causing participants in the Plan to pay excessive recordkeeping fees to the Insperity subsidiary, by failing to monitor other fiduciaries, and by making imprudent investment choices. The court certified a class defined as “all participants and beneficiaries of the Insperity 401(k) Plan from December 22, 2009 through September 30, 2017.” The court dismissed the breach of fiduciary duty claims relating to the selection of an Insperity subsidiary to serve as the recordkeeper of the Plan. On March 28, 2019, the court partially granted Insperity’s motion for summary judgment, resulting in the dismissal of the claims concerning allegations of excessive recordkeeping fees. The court denied plaintiffs’ request for a jury trial and set a bench trial, which was held from March 2, 2020 to March 13, 2020. At trial, plaintiffs alleged damages up to approximately $

146

million against all defendants. All parties filed proposed findings of fact and conclusions of law on June 15, 2020. On September 18, 2020, the plaintiffs and Co-Defendant informed the court that they reached an agreement in principle to settle the entire case, including a full and final release of all claims against Insperity. Insperity did not participate in the settlement discussions and will make

no

financial contribution to the settlement. In connection with the settlement, the Plaintiffs and Co-Defendant filed a motion to extend the class period to March 31, 2019, which the court granted. The court granted final approval of the settlement on March 9, 2021.

Securities Class Action Lawsuit

In July 2020, a federal securities class action was filed against us and certain of our officers in the United States District Court for the Southern District of New York. The name of the case is

Building Trades Pension Fund of Western Pennsylvania v. Insperity, Inc. et al.

, Case No. 1:20-cv-05635-NRB. On October 23, 2020, the court issued an order appointing Oakland County Employees’ Retirement System and Oakland County Voluntary Employees’ Beneficiary Association Trust as lead plaintiff (“Lead Plaintiff”). On December 22, 2020, the lead plaintiff filed its consolidated complaint alleging that we made materially false and misleading statements regarding our business and operations in violation of the federal securities laws and seeking unspecified damages, attorneys’ fees, costs, equitable/injunctive relief, and such other relief that may be deemed proper. On April 26, 2021, the defendants moved to dismiss the consolidated complaint with prejudice. Plaintiff’s opposition is due June 10, 2021. We believe the allegations in the action are without merit, and we intend to vigorously defend this litigation. As a result of uncertainty regarding the outcome of this matter, no provision has been made in the accompanying Consolidated Financial Statements.

Other Litigation

We are a defendant in various other lawsuits and claims arising in the normal course of business. Management believes it has valid defenses in these cases and is defending them vigorously. While the results of litigation cannot be predicted with certainty, management believes the final outcome of such litigation will not have a material adverse effect on our financial position or results of operations.

|

|

|

|

|

|

|

|

Insperity | 2021 First Quarter Form 10-Q

|

16

|

|

|

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2020, as well as our Consolidated Financial Statements and notes thereto included in this Quarterly Report on Form 10-Q.

Executive Summary

Overview

Insperity, Inc. (“Insperity,” “we,” “our,” and “us”) provides an array of human resources (“HR”) and business solutions designed to help improve business performance. Our most comprehensive HR services offerings are provided through our professional employer organization (“PEO”) services, known as Workforce Optimization

®

and Workforce Synchronization

TM

solutions (together, our “PEO HR Outsourcing solutions”), which encompass a broad range of HR functions, including payroll and employment administration, employee benefits, workers’ compensation, government compliance, performance management, and training and development services, along with our cloud-based human capital management solution, the Insperity Premier

TM

platform.

COVID-19 Pandemic

The effects of the COVID-19 pandemic, including actions taken by businesses and governments, have resulted in a significant changes in U.S. economic activity. As the duration of the pandemic and such economic impacts remain uncertain, we have planned for a range of scenarios and have modified certain business and workforce practices. To conform to government restrictions and best practices, we have taken steps designed to keep our staff safe while continuing to serve clients, including implementing remote working for all non-essential employees and providing extra safety measures at corporate facilities. To serve our clients, we have instituted a number of service offerings and developed COVID-19 resources to assist clients with obtaining government provided tax credits, tax deferrals, loans and loan forgiveness and to provide guidance to assist clients with addressing the challenges faced by employers as a result of the pandemic. These service offerings and guidance to assist clients during the pandemic included additional benefits support, remote workforce transition, monitoring and educating on regulatory changes, return to the workplace and workplace safety.

In the first quarter of 2021, the average number of WSEEs paid per month declined 2.0% year-over-year and 2.5% sequentially as year-end client attrition exceeded new sales. We expect the average number of paid WSEEs per month to increase between 5% and 6% in the second quarter of 2021 as compared to the second quarter of 2020, which equates to the average number of paid worksite employees per month growing 2.6% to 3.6% sequentially from the first quarter of 2021.