|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[x]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended January 30, 2011

|

|

[_]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

94-3177549

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

Incorporation or Organization)

|

Identification No.)

|

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value per share

|

The NASDAQ Global Select Market

|

|

Large accelerated filer

x

|

Accelerated filer

o

|

|

Non-accelerated filer

o

(Do not check if a smaller reporting company)

|

Smaller reporting company

o

|

|

Page

|

||

|

|

||

|

|

|

3

|

|

|

|

11

|

|

|

|

25

|

|

|

|

25

|

|

|

|

26

|

|

|

Removed

and Reserved

|

29

|

|

|

||

|

|

|

30

|

|

|

|

33

|

|

|

|

34

|

|

|

|

52

|

|

|

|

53

|

|

|

|

53

|

|

|

|

53

|

|

|

|

53

|

|

|

||

|

|

|

54

|

|

|

|

54

|

|

|

|

54

|

|

|

|

55

|

|

|

|

55

|

|

|

||

|

|

|

56

|

|

|

95

|

|

·

|

suppliers of GPUs, including chipsets that incorporate 3D graphics functionality as part of their existing solutions, such as Advanced Micro Devices, or AMD, Intel, Matrox Electronics Systems Ltd., Silicon Integrated Systems, and VIA Technologies, Inc.;

|

|

·

|

suppliers of system-on-a-chip products that support tablets, smartphones, PMPs, internet television, automotive navigation and other similar devices, such as AMD, ARM Holdings plc, Broadcom Corporation, Freescale Semiconductor Inc., Fujitsu Limited, Imagination Technologies Ltd., Intel, Marvell Technology Group Ltd., NEC Corporation, Qualcomm Incorporated, Renesas Technology Corp., Samsung Electronics Co. Ltd., Seiko Epson Corporation, STMicroelectronics, Texas Instruments Incorporated, and Toshiba America Electronic Components, Inc.; and

|

|

·

|

licensors of graphics technologies such as ARM Holdings plc, and Imagination Technologies Group plc.

|

|

·

|

the location in which our products are manufactured;

|

|

·

|

our strategic technology or product directions in different countries;

|

|

·

|

the degree to which intellectual property laws exist and are meaningfully enforced in different jurisdictions; and

|

|

·

|

the commercial significance of our operations and our competitors’ operations in particular countries and regions.

|

|

Name

|

Age

|

Position

|

||

|

Jen-Hsun Huang

|

48

|

President, Chief Executive Officer and Director

|

||

|

David L. White

|

55

|

Executive Vice President and Chief Financial Officer

|

||

|

Ajay K. Puri

|

56

|

Executive Vice President, Worldwide Sales

|

||

|

David M. Shannon

|

55

|

Executive Vice President, General Counsel and Secretary

|

||

|

Debora Shoquist

|

56

|

Executive Vice President, Operations

|

|

·

|

Effectively identify and capitalize upon opportunities in new markets;

|

|

·

|

Timely complete and introduce new products and technologies;

|

|

·

|

Transition our semiconductor products to increasingly smaller line width geometries; and

|

|

·

|

Obtain sufficient foundry capacity and packaging materials.

|

|

·

|

anticipate the features and functionality that customers and consumers will demand;

|

|

·

|

incorporate those features and functionalities into products that meet the exacting design requirements of our customers;

|

|

·

|

price our products competitively; and

|

|

·

|

introduce products to the market within our customers’ limited design cycles

|

|

·

|

suppliers of GPUs, including chipsets, that incorporate 3D graphics functionality as part of their existing solutions, such as Advanced Micro Devices Inc., or AMD, Intel Corporation, or Intel, Matrox Electronics Systems Ltd., Silicon Integrated Systems, or SIS, and

VIA

Technologies, Inc.;

|

|

·

|

suppliers of system-on-a-chip products that support tablets, netbooks, PNDs, PMPs, PDAs, cellular phones, handheld devices or embedded devices such as AMD, Broadcom Corporation, Freescale Semiconductor, Inc., Fujitsu Limited, Imagination Technologies Ltd., Intel,

Marvell

Technology Group Ltd., NEC Corporation, Qualcomm Incorporated, Renesas Technology Corp., Samsung Electronics Co., Ltd., Seiko Epson Corporation, STMicroelectronics, Texas Instruments Incorporated, and Toshiba America Electronic Components, Inc.; and

|

|

·

|

licensors of graphics technologies such as ARM Holdings plc, and Imagination Technologies Group plc. |

|

·

|

continue to keep pace with technological developments;

|

|

·

|

develop and introduce new products, services, technologies and enhancements on a timely basis;

|

|

·

|

become a preferred partner for operating system platforms, such as Android and Windows Mobile;

|

|

·

|

transition our semiconductor products to increasingly smaller line width geometries;

|

|

·

|

obtain sufficient foundry capacity and packaging materials; and

|

|

·

|

succeed in significant foreign markets, such as China and India.

|

|

·

|

substantially all of our sales are made on a purchase order basis, which permits our customers to cancel, change or delay product purchase commitments with little or no notice to us and without penalty;

|

|

·

|

our customers may develop their own solutions;

|

|

·

|

our customers may purchase products from our competitors; or

|

|

·

|

our customers may discontinue sales or lose market share in the markets for which they purchase our products.

|

|

·

|

changes in business and economic conditions, including downturns in the semiconductor industry and/or overall economy;

|

|

·

|

changes in consumer confidence caused by changes in market conditions, including changes in the credit market, expectations for inflation, and energy prices;

|

|

·

|

if there were a sudden and significant decrease in demand for our products;

|

|

·

|

if there were a higher incidence of inventory obsolescence because of rapidly changing technology and customer requirements;

|

|

·

|

if we fail to estimate customer demand properly for our older products as our newer products are introduced; or

|

|

·

|

if our competition were to take unexpected competitive pricing actions.

|

|

·

|

the mix of our products sold;

|

|

·

|

average selling prices;

|

|

·

|

introduction of new products;

|

|

·

|

product transitions;

|

|

·

|

sales discounts;

|

|

·

|

unexpected pricing actions by our competitors;

|

|

·

|

the cost of product components; and

|

|

·

|

the yield of wafers produced by the foundries that manufacture our products.

|

|

·

|

international economic and political conditions, such as political tensions between countries in which we do business;

|

|

·

|

unexpected changes in, or impositions of, legislative or regulatory requirements;

|

|

·

|

complying with a variety of foreign laws;

|

|

·

|

differing legal standards with respect to protection of intellectual property and employment practices;

|

|

·

|

cultural differences in the conduct of business;

|

|

·

|

inadequate local infrastructure that could result in business disruptions;

|

|

·

|

exporting or importing issues related to export or import restrictions, tariffs, quotas and other trade barriers and restrictions;

|

|

·

|

financial risks such as longer payment cycles, difficulty in collecting accounts receivable and fluctuations in currency exchange rates;

|

|

·

|

imposition of additional taxes and penalties; and

|

|

·

|

other factors beyond our control such as terrorism, civil unrest, war and diseases such as severe acute respiratory syndrome and the Avian flu.

|

|

·

|

difficulty in combining the technology, products, operations or workforce of the acquired business with our business;

|

|

·

|

difficulty in operating in a new or multiple new locations;

|

|

·

|

disruption of our ongoing businesses or the ongoing business of the company we invest in or acquire;

|

|

·

|

difficulty in realizing the potential financial or strategic benefits of the transaction;

|

|

·

|

difficulty in maintaining uniform standards, controls, procedures and policies;

|

|

·

|

disruption of or delays in ongoing research and development efforts;

|

|

·

|

diversion of capital and other resources;

|

|

·

|

assumption of liabilities;

|

|

·

|

diversion of resources and unanticipated expenses resulting from litigation arising from potential or actual business acquisitions or investments;

|

|

·

|

difficulties in entering into new markets in which we have limited or no experience and where competitors in such markets have stronger positions; and

|

|

·

|

impairment of relationships with employees and customers, or the loss of any of our key employees or customers our target’s key employees or customers, as a result of our acquisition or investment.

|

|

●

|

the jurisdictions in which profits are determined to be earned and taxed;

|

|

●

|

adjustments to estimated taxes upon finalization of various tax returns;

|

|

●

|

changes in available tax credits;

|

|

●

|

changes in share-based compensation expense;

|

|

●

|

changes in tax laws, the interpretation of tax laws either in the United States or abroad or the issuance of new interpretative accounting guidance related to uncertain transactions and calculations where the tax treatment was previously uncertain; and

|

|

●

|

the resolution of issues arising from tax audits with various tax authorities.

|

|

●

|

assert claims of infringement of our intellectual property;

|

|

●

|

enforce our patents;

|

|

●

|

protect our trade secrets or know-how; or

|

|

●

|

determine the enforceability, scope and validity of the propriety rights of others.

|

|

·

|

the commercial significance of our operations and our competitors’ operations in particular countries and regions;

|

|

·

|

the location in which our products are manufactured;

|

|

·

|

our strategic technology or product directions in different countries; and

|

|

·

|

the degree to which intellectual property laws exist and are meaningfully enforced in different jurisdictions.

|

|

·

|

the possibility of environmental contamination and the costs associated with mitigating any environmental problems;

|

|

·

|

adverse changes in the value of these properties, due to interest rate changes, changes in the market in which the property is located, or other factors;

|

|

·

|

the risk of loss if we decide to sell and are not able to recover all capitalized costs;

|

|

·

|

increased cash commitments for the possible construction of a campus;

|

|

·

|

the possible need for structural improvements in order to comply with zoning, seismic and other legal or regulatory requirements;

|

|

·

|

increased operating expenses for the buildings or the property or both;

|

|

·

|

possible disputes with third parties, such as neighboring owners or others, related to the buildings or the property or both; and

|

|

·

|

the risk of financial loss in excess of amounts covered by insurance, or uninsured risks, such as the loss caused by damage to the buildings as a result of earthquakes, floods and or other natural disasters.

|

|

·

|

the ability of our Board to create and issue preferred stock without prior stockholder approval;

|

|

·

|

the prohibition of stockholder action by written consent;

|

|

·

|

a classified Board; and

|

|

·

|

advance notice requirements for director nominations and stockholder proposals.

|

|

High

|

Low

|

|||||||

|

Fiscal year ending January 29, 2012

|

||||||||

|

First Quarter (through March 10, 2011)

|

$

|

26.17 |

$

|

17.90 | ||||

|

Fiscal year ended January 30, 2011

|

||||||||

|

Fourth Quarter

|

$

|

25.05

|

$

|

11.94

|

||||

|

Third Quarter

|

$

|

12.36

|

$

|

8.65

|

||||

|

Second Quarter

|

$

|

15.88

|

$

|

8.92

|

||||

|

First Quarter

|

$

|

18.34

|

$

|

15.32

|

||||

|

Fiscal year ended January 31, 2010

|

||||||||

|

Fourth Quarter

|

$

|

18.96

|

$

|

11.56

|

||||

|

Third Quarter

|

$

|

16.58

|

$

|

12.58

|

||||

|

Second Quarter

|

$

|

13.04

|

$

|

8.33

|

||||

|

First Quarter

|

$

|

12.08

|

$

|

7.21

|

||||

|

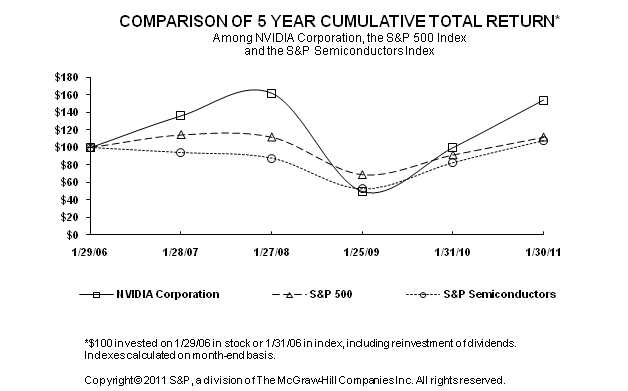

1/29/2006

|

1/28/2007

|

1/27/2008

|

1/25/2009

|

1/31/2010

|

1/30/2011

|

|||||||||||||||||||

|

NVIDIA Corporation

|

$

|

100.00

|

$

|

136.09

|

$

|

161.84

|

$

|

50.01

|

$

|

99.83

|

$

|

154.12

|

||||||||||||

|

S & P 500

|

$

|

100.00

|

$

|

114.51

|

$

|

111.87

|

$

|

68.66

|

$

|

91.41

|

$

|

111.69

|

||||||||||||

|

S & P Semiconductors

|

$

|

100.00

|

$

|

94.16

|

$

|

87.75

|

$

|

52.60

|

$

|

82.57

|

$

|

107.76

|

||||||||||||

|

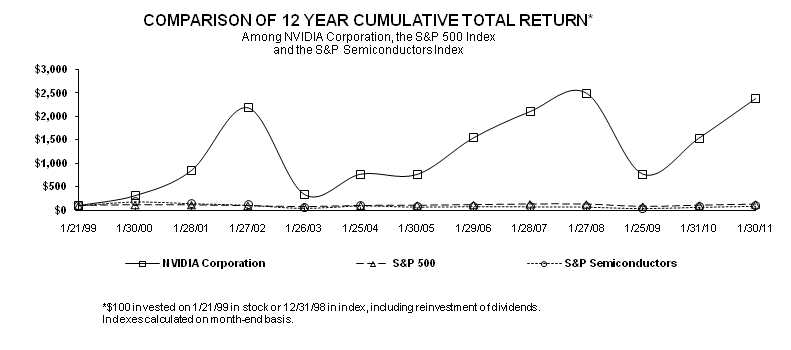

1/21/99

|

1/30/00

|

1/28/01

|

1/27/02

|

1/26/03

|

1/25/04

|

1/30/05

|

1/29/06

|

1/28/07

|

1/27/08

|

1/25/09

|

1/31/10

|

1/30/11

|

||||||||||||||||||||||||||||||||||||||||

|

NVIDIA Corporation

|

$ | 100.00 | $ | 311.46 | $ | 846.88 | $ | 2,182.33 | $ | 339.00 | $ | 769.67 | $ | 762.67 | $ | 1,541.67 | $ | 2,098.00 | $ | 2,495.00 | $ | 771.00 | $ | 1,539.00 | $ | 2,376.00 | ||||||||||||||||||||||||||

|

S&P 500

|

$ | 100.00 | $ | 114.96 | $ | 113.93 | $ | 95.53 | $ | 73.54 | $ | 98.97 | $ | 105.13 | $ | 116.05 | $ | 132.89 | $ | 129.82 | $ | 79.67 | $ | 106.07 | $ | 129.61 | ||||||||||||||||||||||||||

|

S&P Semiconductors

|

$ | 100.00 | $ | 180.33 | $ | 145.17 | $ | 112.96 | $ | 50.00 | $ | 99.52 | $ | 74.79 | $ | 86.48 | $ | 81.43 | $ | 75.88 | $ | 45.49 | $ | 71.41 | $ | 93.19 | ||||||||||||||||||||||||||

|

Year Ended

|

||||||||||||||||

|

January 30,

|

January 31,

|

January 25,

|

January 27,

|

January 28,

|

||||||||||||

|

2011

(B,C)

|

2010

(B,D)

|

2009

(B,E)

|

2008

(F)

|

2007

(F,G)

|

||||||||||||

|

(In thousands, except per share data)

|

||||||||||||||||

|

Consolidated Statement of Operations Data:

|

||||||||||||||||

|

Revenue

|

$

|

3,543,309

|

$

|

3,326,445

|

$

|

3,424,859

|

$

|

4,097,860

|

$

|

3,068,771

|

||||||

|

Income (loss) from operations

|

$

|

255,747

|

$

|

(98,945

|

)

|

$

|

(70,700

|

)

|

$

|

836,346

|

$

|

453,452

|

||||

|

Net income (loss)

|

$

|

253,146

|

$

|

(67,987

|

)

|

$

|

(30,041

|

)

|

$

|

797,645

|

$

|

448,834

|

||||

|

Basic net income (loss) per share

|

$

|

0.44

|

$

|

(0.12

|

)

|

$

|

(0.05

|

)

|

$

|

1.45

|

$

|

0.85

|

||||

|

Diluted net income (loss) per share

|

$

|

0.43

|

$

|

(0.12

|

)

|

$

|

(0.05

|

)

|

$

|

1.31

|

$

|

0.76

|

||||

|

Shares used in basic per share computation (A)

|

575,177

|

549,574

|

548,126

|

550,108

|

528,606

|

|||||||||||

|

Shares used in diluted per share computation (A)

|

588,684

|

549,574

|

548,126

|

606,732

|

587,256

|

|||||||||||

|

January 30,

|

January 31,

|

January 25,

|

January 27,

|

January 28,

|

||||||||||||

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||

|

Consolidated Balance Sheet Data:

|

||||||||||||||||

|

Cash, cash equivalents and marketable securities

|

$

|

2,490,563

|

$

|

1,728,227

|

$

|

1,255,390

|

$

|

1,809,478

|

$

|

1,117,850

|

||||||

|

Total assets

|

$

|

4,495,246

|

$

|

3,585,918

|

$

|

3,350,727

|

$

|

3,747,671

|

$

|

2,675,263

|

||||||

|

Capital lease obligations, less current portion

|

$

|

23,389

|

$

|

24,450

|

$

|

25,634

|

$

|

-

|

$

|

-

|

||||||

|

Total stockholders’ equity

|

$

|

3,181,462

|

$

|

2,665,140

|

$

|

2,394,652

|

$

|

2,617,912

|

$

|

2,006,919

|

||||||

|

Cash dividends declared per common share

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

||||||

|

(A)

|

Reflects a three-for-two stock-split effective September 10, 2007 and a two-for-one stock-split effective April 6, 2006.

|

|

(B)

|

We recorded a net warranty charge of $193.9 million, $94.0 million and $188.0 million, during fiscal years 2011, 2010 and 2009, respectively, which reduced income from operations to cover anticipated customer warranty, repair, return, replacement and other costs arising from a weak die/packaging material set used in certain versions of our previous generation MCP and GPU products shipped after July 2008 and used in notebook configurations.

|

|

(C)

|

On January 10, 2011, we entered into a new six-year cross licensing agreement with Intel and also mutually agreed to settle all outstanding legal disputes. For accounting purposes, the fair valued benefit prescribed to the settlement portion was $57.0 million, which was recorded within income from operations in fiscal year 2011.

|

|

(D)

|

Fiscal year 2010 includes impact of charge for a tender offer to purchase an aggregate of 28.5 million outstanding stock options for a total cash payment of $78.1 million. As a result of the tender offer the Company incurred a charge of $140.2 million, consisting of the remaining unamortized stock-based compensation expenses associated with the unvested portion of the options tendered in the offer, stock-based compensation expense resulting from amounts paid in excess of the fair value of the underlying options, plus associated payroll taxes and professional fees.

|

|

(E)

|

Fiscal year 2009 includes a $18.9 million for a non-recurring charge resulting from the termination of a development contract related to a new campus construction project we have put on hold and $8.0 million for restructuring charges.

|

|

(F)

|

Fiscal years 2008 and 2007 include a charge of $4.0 million and $13.4 million towards in-process research and development expense related to our purchase of Mental Images Inc. and PortalPlayer Inc., respectively that had not yet reached technological feasibility and have no alternative future use.

|

|

(G)

|

Fiscal year 2007 included a charge of $17.5 million associated with a confidential patent licensing arrangement.

|

| 1 . |

Legal settlement

: In connection with the License Agreement, both parties agreed to settle all outstanding legal disputes. The fair value allocated to the settlement of $57.0 million was recorded in the fourth quarter of fiscal year 2011, as a benefit to operating expense.

|

| 2. . |

License to Intel:

We will recognize $1,583.0 million in total, or $66.0 million per quarter, as revenue over the term of the agreement of six years, the period over which Intel will have access to newly filed NVIDIA patents. We will commence recognition of the license revenue in April 2011 when our performance obligation under the agreement begins. Consideration received in advance of the performance period will be classified as deferred revenue.

|

| 3. |

License from Intel

: We recognized $140.0 million as an intangible asset upon execution of the agreement. Amortization of $5.0 million per quarter will be charged to cost of sales over the seven year estimated useful life of the technology beginning in April 2011.

|

|

Weighted average expected life of stock options (in years)

|

3.1-6.7

|

|||

|

Risk free interest rate

|

1.5% - 3.3

|

%

|

||

|

Volatility

|

42% - 53

|

%

|

||

|

Dividend yield

|

-

|

|

Weighted average expected life of stock options (in years)

|

0.5-2.0

|

|||

|

Risk free interest rate

|

0.2-0.8

|

%

|

||

|

Volatility

|

45%-47

|

%

|

||

|

Dividend yield

|

-

|

|

|

Year Ended

|

|||||||

|

January 30, 2011

|

January 31, 2010

|

January 25, 2009

|

||||||

|

Revenue

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||

|

Cost of revenue

|

60.2

|

64.6

|

65.7

|

|||||

|

Gross profit

|

39.8

|

35.4

|

34.3

|

|||||

|

Operating expenses:

|

||||||||

|

Research and development

|

24.0

|

27.3

|

25.0

|

|||||

|

Sales, general and administrative

|

10.2

|

11.0

|

10.6

|

|||||

|

Restructuring charges and other

|

-

|

-

|

0.8

|

|||||

|

Legal settlement

|

(1.6

|

) |

-

|

-

|

||||

|

Total operating expenses

|

32.6

|

38.3

|

36.4

|

|||||

|

Income (loss) from operations

|

7.2

|

(2.9)

|

(2.1

|

)

|

||||

|

Interest and other income, net

|

0.4

|

0.5

|

0.8

|

|||||

|

Income (loss) before income taxes

|

7.6

|

(2.4)

|

(1.3

|

)

|

||||

|

Income tax expense (benefit)

|

0.5

|

(0.4)

|

(0.4

|

)

|

||||

|

Net income (loss)

|

7.1

|

% |

(2.0)

|

%

|

(0.9)

|

%

|

||

|

Year Ended

|

||||||||

|

January 30,

2011

|

January 31,

2010

|

January 25,

2009

|

||||||

|

Revenue:

|

||||||||

|

Customer A

|

12

|

%

|

12

|

%

|

7

|

%

|

||

|

Customer B

|

8

|

%

|

9

|

%

|

8

|

%

|

||

|

Customer C

|

6

|

%

|

7

|

%

|

11

|

%

|

||

|

Year Ended

|

Year Ended

|

||||||||||||||||||||||||||||

|

January

30,

2011

|

January 31,

2010

|

$

Change

|

%

Change

|

January 31,

2010

|

January 25,

2009

|

$

Change

|

%

Change

|

||||||||||||||||||||||

|

(In millions)

|

(In millions)

|

||||||||||||||||||||||||||||

|

Research and development expenses

|

$

|

848.8

|

$

|

908.9

|

$

|

(60.1)

|

(7

|

%

|

)

|

$

|

908.9

|

$

|

855.9

|

$

|

53.0

|

6

|

%

|

||||||||||||

|

Sales, general and administrative expenses

|

361.5

|

367.0

|

(5.5)

|

(1

|

%)

|

367.0

|

362.2

|

4.8

|

1

|

%

|

|||||||||||||||||||

|

Restructuring charges and other

|

-

|

-

|

-

|

-

|

%

|

-

|

26.9

|

(26.9)

|

(100

|

%)

|

|||||||||||||||||||

|

Legal settlement

|

(57.0)

|

-

|

(57.0)

|

(100

|

%

|

)

|

-

|

-

|

-

|

-

|

%

|

||||||||||||||||||

|

Total operating expenses

|

$

|

1,153.3

|

$

|

1,275.9

|

$

|

(122.6)

|

(10

|

%)

|

$

|

1,275.9

|

$

|

1,245.0

|

$

|

30.9

|

2.5

|

%

|

|||||||||||||

|

Research and development as a percentage of net revenue

|

24%

|

27

|

%

|

27

|

%

|

25

|

%

|

||||||||||||||||||||||

|

Sales, general and administrative as a percentage of net revenue

|

10%

|

11

|

%

|

11

|

%

|

11

|

%

|

||||||||||||||||||||||

|

January 30, 2011

|

January 31, 2010

|

|||||||

|

(In millions)

|

||||||||

|

Cash and cash equivalents

|

$

|

665.4

|

$

|

447.2

|

||||

|

Marketable securities

|

1,825.2

|

1,281.0

|

||||||

|

Cash, cash equivalents, and marketable securities

|

$

|

2,490.6

|

$

|

1,728.2

|

||||

|

Year Ended

|

||||||||||||

|

January 30,

|

January 31,

|

January 25,

|

||||||||||

|

2011

|

2010

|

2009

|

||||||||||

|

(In millions)

|

||||||||||||

|

Net cash provided by operating activities

|

$

|

675.8

|

$

|

487.8

|

$

|

249.4

|

||||||

|

Net cash used in investing activities

|

$ |

(649.7

|

)

|

$ |

(519.3

|

)

|

$ |

(209.4

|

)

|

|||

|

Net cash (used) provided by financing activities

|

$ |

192.0

|

$ |

61.1

|

$ |

(349.3

|

)

|

|||||

|

Contractual Obligations

|

Total

|

Within 1 Year

|

2-3 Years

|

4-5 Years

|

After 5 Years

|

All Other

|

||||||||||||||||||

|

(In thousands)

|

||||||||||||||||||||||||

|

Operating leases

|

$

|

177,166

|

$

|

46,329

|

$

|

50,969

|

$

|

34,115

|

$

|

45,753

|

$

|

-

|

||||||||||||

|

Capital lease

|

40,126

|

4,654

|

9,714

|

9,849

|

15,909

|

-

|

||||||||||||||||||

|

Purchase obligations (1)

|

546,360

|

546,360

|

-

|

|||||||||||||||||||||

|

Uncertain tax positions, interest and penalties (2)

|

132,211

|

132,211

|

||||||||||||||||||||||

|

Capital purchase obligations

|

31,736

|

31,736

|

||||||||||||||||||||||

|

Total contractual obligations

|

$

|

927,599

|

$

|

629,079

|

$

|

60,683

|

$

|

43,964

|

$

|

61,662

|

$

|

132,211

|

||||||||||||

|

(1)

|

Represents our inventory purchase commitments as of January 30, 2011.

|

|

(2)

|

Represents unrecognized tax benefits of $132.2 million which consists of $46.4 million recorded in non-current income taxes payable and $74.6 million reflected as a reduction to the related deferred tax assets, and the related interest and penalties on the non-current income tax payable of $11.2 million as of January 30, 2011. We are unable to reasonably estimate the timing of any potential tax liability or interest/penalty payments in individual years due to uncertainties in the underlying income tax positions and the timing of the effective settlement of such tax positions.

|

|

Page

|

|||

|

(a)

|

1.

|

Consolidated Financial Statements

|

|

|

57

|

|||

|

58

|

|||

|

59

|

|||

|

60

|

|||

|

61

|

|||

|

62

|

|||

|

(a)

|

2.

|

Financial Statement Schedule

|

|

|

93

|

|||

|

(a)

|

3.

|

Exhibits

|

|

|

94

|

|||

|

January 30,

2011

|

January 31,

2010

|

January 25,

2009

|

||||||||

|

Revenue

|

$

|

3,543,309

|

$

|

3,326,445

|

$

|

3,424,859

|

||||

|

Cost of revenue

|

2,134,219

|

2,149,522

|

2,250,590

|

|||||||

|

Gross profit

|

1,409,090

|

1,176,923

|

1,174,269

|

|||||||

|

Operating expenses:

|

||||||||||

|

Research and development

|

848,830

|

908,851

|

855,879

|

|||||||

|

Sales, general and administrative

|

361,513

|

367,017

|

362,222

|

|||||||

|

Restructuring charges and other

|

-

|

-

|

26,868

|

|||||||

|

Legal settlement

|

(57,000

|

)

|

-

|

-

|

||||||

|

Total operating expenses

|

1,153,343

|

1,275,868

|

1,244,969

|

|||||||

|

Income (loss) from operations

|

255,747

|

(98,945

|

)

|

(70,700

|

)

|

|||||

|

Interest income

|

19,057

|

23,115

|

42,859

|

|||||||

|

Interest expense

|

(3,127

|

)

|

(3,320

|

)

|

(406

|

)

|

||||

|

Other income (expense), net

|

(508

|

)

|

(3,144

|

)

|

(14,707

|

)

|

||||

|

Income (loss) before income tax

|

271,169

|

(82,294

|

)

|

(42,954

|

)

|

|||||

|

Income tax expense (benefit)

|

18,023

|

(14,307

|

)

|

(12,913

|

)

|

|||||

|

Net income (loss)

|

$ |

253,146

|

$

|

(67,987

|

)

|

$

|

(30,041

|

)

|

||

|

Basic net income (loss) per share

|

$

|

0.44

|

$

|

(0.12

|

)

|

$

|

(0.05

|

)

|

||

|

Weighted average shares used in basic per share computation

|

575,177

|

549,574

|

548,126

|

|||||||

|

Diluted net income (loss) per share

|

$

|

0.43

|

$

|

(0.12

|

)

|

$

|

(0.05

|

)

|

||

|

Weighted average shares used in diluted per share computation

|

588,684

|

549,574

|

548,126

|

|||||||

|

January 30, 2011

|

January 31, 2010

|

|||||||

|

ASSETS

|

||||||||

|

Current assets :

|

||||||||

|

Cash and cash equivalents

|

$

|

665,361

|

$

|

447,221

|

||||

|

Marketable securities

|

1,825,202

|

1,281,006

|

||||||

|

Accounts receivable, less allowances of $15,839 and $16,330 in 2011 and 2010, respectively

|

348,770

|

374,963

|

||||||

|

Inventories

|

345,525

|

330,674

|

||||||

|

Prepaid expenses and other

|

32,636

|

38,214

|

||||||

|

Deferred income taxes

|

9,456

|

8,752

|

||||||

|

Total current assets

|

3,226,950

|

2,480,830

|

||||||

|

Property and equipment, net

|

568,857

|

571,858

|

||||||

|

Goodwill

|

369,844

|

369,844

|

||||||

|

Intangible assets, net

|

288,745

|

120,458

|

||||||

|

Deposits and other assets

|

40,850

|

42,928

|

||||||

|

Total assets

|

$

|

4,495,246

|

$

|

3,585,918

|

||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable

|

$

|

286,138

|

$

|

344,527

|

||||

|

Accrued liabilities and other

|

656,544

|

439,851

|

||||||

|

Total current liabilities

|

942,682

|

784,378

|

||||||

|

Other long-term liabilities

|

347,713

|

111,950

|

||||||

|

Capital lease obligations, long term

|

23,389

|

24,450

|

||||||

|

Commitments and contingencies - see Note 13

|

-

|

-

|

||||||

|

Stockholders’ equity:

|

||||||||

|

Preferred stock, $.001 par value; 2,000,000 shares authorized; none issued

|

-

|

-

|

||||||

|

Common stock, $.001 par value; 2,000,000,000 shares authorized; 680,598,737 shares issued

and 588,555,701 outstanding in 2011; and 652,391,708 shares issued

and 561,465,851 outstanding in 2010

|

677

|

653

|

||||||

|

Additional paid-in capital

|

2,500,577

|

2,219,401

|

||||||

|

Treasury stock, at cost (92,043,036 shares in 2011 and 90,925,857 shares in 2010)

|

(1,479,392

|

)

|

(1,463,268

|

)

|

||||

|

Accumulated other comprehensive income

|

10,272

|

12,172

|

||||||

|

Retained earnings

|

2,149,328

|

1,896,182

|

||||||

|

Total stockholders' equity

|

3,181,462

|

2,665,140

|

||||||

|

Total liabilities and stockholders' equity

|

$

|

4,495,246

|

$

|

3,585,918

|

||||

|

Common Stock

Outstanding

Shares Amount

|

Additional Paid-in Capital

|

Treasury Stock

|

Accumulated Other Comprehensive Income(Loss)

|

Retained Earnings

|

Total Stockholders' Equity

|

|||||||||||||||||||||||

|

Balances, January 27, 2008

|

557,102,588

|

$ |

619

|

$ |

1,654,681

|

$ |

(1,039,632

|

)

|

$ |

8,034

|

$ |

1,994,210

|

$ |

2,617,912

|

||||||||||||||

|

Comprehensive Income (Loss):

|

||||||||||||||||||||||||||||

|

Unrealized loss, net of $2054 tax effect

|

-

|

-

|

-

|

-

|

(3,920

|

)

|

-

|

(3,920

|

)

|

|||||||||||||||||||

|

Reclassification adjustment for net realized gains included in net income, net of $135 tax effect

|

-

|

-

|

-

|

-

|

(249

|

)

|

-

|

(249

|

)

|

|||||||||||||||||||

|

Net Loss

|

-

|

-

|

-

|

-

|

(30,041

|

)

|

(30,041

|

)

|

||||||||||||||||||||

|

Total Comprehensive Loss

|

(34,210

|

)

|

||||||||||||||||||||||||||

|

Issuance of common stock from stock plans

|

10,685,101

|

10

|

73,537

|

-

|

-

|

-

|

73,547

|

|||||||||||||||||||||

|

Stock repurchase

|

(29,326,923

|

)

|

-

|

-

|

(423,636

|

)

|

-

|

-

|

(423,636

|

)

|

||||||||||||||||||

|

Tax benefit from stock-based compensation

|

-

|

-

|

(2,946

|

)

|

-

|

-

|

-

|

(2,946

|

)

|

|||||||||||||||||||

|

Stock-based compensation

|

-

|

-

|

163,985

|

-

|

-

|

-

|

163,985

|

|||||||||||||||||||||

|

Balances, January 25, 2009

|

538,460,766

|

629

|

1,889,257

|

(1,463,268

|

)

|

3,865

|

1,964,169

|

2,394,652

|

||||||||||||||||||||

|

Comprehensive Income (Loss):

|

||||||||||||||||||||||||||||

|

Unrealized gain, net of $484 tax effect

|

-

|

-

|

-

|

-

|

9,417

|

-

|

9,417

|

|||||||||||||||||||||

|

Reclassification adjustment for net realized gains included in net income, net of $598 tax effect

|

-

|

-

|

-

|

-

|

(1,110

|

)

|

-

|

(1,110

|

)

|

|||||||||||||||||||

|

Net Loss

|

-

|

-

|

-

|

-

|

-

|

(67,987

|

)

|

(67,987

|

)

|

|||||||||||||||||||

|

Total Comprehensive Loss

|

(59,680

|

)

|

||||||||||||||||||||||||||

|

Issuance of common stock from stock plans

|

23,005,124

|

24

|

138,005

|

-

|

-

|

-

|

138,029

|

|||||||||||||||||||||

|

Stock repurchase

|

(39

|

)

|

- | - | - | - | - | - | ||||||||||||||||||||

|

Tax benefit from stock-based compensation

|

-

|

-

|

29,891

|

-

|

-

|

-

|

29,891

|

|||||||||||||||||||||

|

Stock-based compensation

|

-

|

-

|

104,588

|

-

|

-

|

-

|

104,588

|

|||||||||||||||||||||

|

Tender offer

|

-

|

-

|

(78,075

|

)

|

-

|

-

|

-

|

(78,075

|

)

|

|||||||||||||||||||

|

Charges related to stock option purchase-tender offer

|

-

|

-

|

135,735

|

-

|

-

|

-

|

135,735

|

|||||||||||||||||||||

|

Balances, January 31, 2010

|

561,465,851

|

|

653

|

|

2,219,401

|

|

(1,463,268

|

)

|

|

12,172

|

|

1,896,182

|

|

2,665,140

|

||||||||||||||

|

Comprehensive Income (Loss):

|

||||||||||||||||||||||||||||

|

Unrealized loss, net of $306 tax effect

|

- | - | - | - |

(918

|

)

|

- |

(918

|

)

|

|||||||||||||||||||

|

Reclassification adjustment for net realized gains included in net income, net of $528 tax effect

|

- | - | - | - |

(982

|

)

|

- |

(982

|

)

|

|||||||||||||||||||

|

Net Income

|

- | - | - | - | - |

253,146

|

253,146

|

|||||||||||||||||||||

|

Total Comprehensive Income

|

- | - | - | - | - | - |

251,246

|

|||||||||||||||||||||

|

Issuance of common stock from stock plans

|

28,207,029

|

24

|

193,381

|

- | - | - |

193,405

|

|||||||||||||||||||||

|

Stock repurchase

|

(1,117,179

|

)

|

- | - |

(16,124

|

)

|

- | - |

(16,124

|

)

|

||||||||||||||||||

|

Tax benefit from stock-based compensation

|

-

|

-

|

(14,201

|

)

|

-

|

-

|

-

|

(14,201

|

)

|

|||||||||||||||||||

|

Stock-based compensation

|

-

|

-

|

101,996

|

-

|

-

|

-

|

101,996

|

|||||||||||||||||||||

|

Balances, January 30, 2011

|

588,555,701

|

$

|

677

|

$

|

2,500,577

|

$

|

(1,479,392

|

)

|

$

|

10,272

|

$

|

2,149,328

|

$

|

3,181,462

|

||||||||||||||

|

Year ended

|

||||||||||||

|

January 30

,

2011

|

January 31,

2010

|

January 25,

2009

|

||||||||||

|

Cash flows from operating activities:

|

||||||||||||

|

Net income (loss)

|

$

|

253,146

|

$

|

(67,987

|

)

|

$

|

(30,041

|

)

|

||||

|

Adjustments to reconcile net income (loss) to net cash provided by operating activities:

|

||||||||||||

|

Stock-based compensation expense related to stock option purchase

|

-

|

135,735

|

-

|

|||||||||

|

Stock-based compensation expense

|

100,353

|

107,091

|

162,706

|

|||||||||

|

Depreciation and amortization

|

186,989

|

196,664

|

185,023

|

|||||||||

|

Impairment charge on investments

|

-

|

-

|

9,891

|

|||||||||

|

Deferred income taxes

|

(2,646

|

)

|

(21,147

|

)

|

(23,277

|

)

|

||||||

|

Payments under patent licensing arrangement

|

685

|

(857

|

)

|

(21,797

|

)

|

|||||||

|

Tax benefit from stock based compensation

|

(15,316)

|

(2,034)

|

(871)

|

|||||||||

|

Other

|

887

|

3,927

|

1,059

|

|||||||||

|

Changes in operating assets and liabilities, net of effects of acquisitions:

|

||||||||||||

|

Accounts receivable

|

26,341

|

(56,741

|

)

|

348,873

|

||||||||

|

Inventories

|

(14,128

|

)

|

204,656

|

(177,295

|

)

|

|||||||

|

Prepaid expenses and other current assets

|

8,528

|

1,580

|

21,528

|

|||||||||

|

Deposits and other assets

|

4,331

|

3,857

|

(2,108

|

)

|

||||||||

|

Accounts payable

|

(69,786

|

)

|

119,366

|

(283,207

|

)

|

|||||||

|

Accrued liabilities and other long-term liabilities

|

196,413

|

(136,303

|

)

|

58,876

|

||||||||

|

Net cash provided by operating activities

|

675,797

|

487,807

|

249,360

|

|||||||||

|

Cash flows from investing activities:

|

||||||||||||

|

Purchases of marketable securities

|

(1,719,700

|

)

|

(1,193,948

|

)

|

(999,953

|

)

|

||||||

|

Proceeds from sales and maturities of marketable securities

|

1,170,075

|

752,434

|

1,226,646

|

|||||||||

|

Purchases of property and equipment and intangible assets

|

(97,890

|

)

|

(77,601

|

)

|

(407,670

|

)

|

||||||

|

Acquisition of businesses, net of cash and cash equivalents

|

-

|

-

|

(27,948

|

)

|

||||||||

|

Other

|

(2,163

|

)

|

(218

|

)

|

(442

|

)

|

||||||

|

Net cash used in investing activities

|

(649,678

|

)

|

(519,333

|

)

|

(209,367

|

)

|

||||||

|

Cash flows from financing activities:

|

||||||||||||

|

Payments related to stock option purchase

|

-

|

(78,075

|

)

|

-

|

||||||||

|

Payments related to repurchases of common stock

|

-

|

-

|

(423,636

|

)

|

||||||||

|

Proceeds from issuance of common stock under employee stock plans

|

177,276

|

138,029

|

73,547

|

|||||||||

|

Tax benefit from stock based compensation

|

15,316

|

2,034

|

871

|

|||||||||

|

Other

|

(571)

|

(929)

|

(56)

|

|||||||||

|

Net cash provided by (used in) financing activities

|

192,021

|

61,059

|

(349,274

|

)

|

||||||||

|

Change in cash and cash equivalents

|

218,140

|

29,533

|

(309,281

|

)

|

||||||||

|

Cash and cash equivalents at beginning of period

|

447,221

|

417,688

|

726,969

|

|||||||||

|

Cash and cash equivalents at end of period

|

$

|

665,361

|

$

|

447,221

|

$

|

417,688

|

||||||

|

Supplemental disclosures of cash flow information:

|

||||||||||||

|

Cash paid for income taxes, net

|

$

|

(1,071

|

)

|

$

|

4,217

|

$

|

7,620

|

|||||

|

Cash paid for interest on capital lease obligations

|

$

|

3,127

|

$

|

3,256

|

$

|

-

|

||||||

|

Year Ended

|

||||||||||||

|

January 30,

2011

|

January 31,

2010

|

January 25,

2009

|

||||||||||

|

Non-cash activities:

|

||||||||||||

|

Change in unrealized gains (losses) from marketable securities

|

$

|

(1,899

|

)

|

$ |

8,305

|

$

|

(6,360

|

)

|

||||

|

Assets acquired by assuming related liabilities

|

$

|

252,796

|

$ |

37,830

|

$

|

47,236

|

||||||

|

Acquisition of business - goodwill adjustment

|

$

|

-

|

$ |

-

|

$

|

3,411

|

||||||

We have three financial reporting segments – GPU, Professional Solutions Business, or PSB and Consumer Products Business, or CPB. During fiscal years 2010 and 2009, we operated and reported four major product-line operating segments: the GPU business, the PSB business, the media and communications processor, or MCP, business, and the CPB business. However, during the first quarter of fiscal year 2011, we began reporting internally the results of our former MCP segment along with the results of our GPU segment to reflect the way we manage the GPU business. Comparative periods presented reflect this change.

|

Cost of revenue

|

$

|

11,412

|

||

|

Research and development

|

90,456

|

|||

|

Sales, general and administrative

|

38,373

|

|||

|

Total

|

$

|

140,241

|

|

Year Ended

|

||||||||||||

|

January 30

|

January 31,

|

January 25,

|

||||||||||

|

2011

|

2010

|

2009

|

||||||||||

|

(In thousands)

|

||||||||||||

|

Cost of revenue

|

$

|

8,308

|

$

|

12,050

|

$

|

11,939

|

||||||

|

Research and development

|

57,974

|

61,337

|

98,007

|

|||||||||

|

Sales, general and administrative

|

34,071

|

33,704

|

52,760

|

|||||||||

|

Total

|

$

|

100,353

|

$

|

107,091

|

$

|

162,706

|

||||||

|

Year Ended

|

||||||||||||

|

January 30,

2011

|

January 31,

2010

|

January 25,

2009

|

||||||||||

|

Stock Options

|

(Using a binomial model)

|

|||||||||||

|

Weighted average expected life of stock options (in years)

|

3.1-6.7

|

3.7-5.8

|

3.6 - 5.8

|

|||||||||

|

Risk free interest rate

|

1.5%-3.3

|

%

|

1.8%-2.9

|

%

|

1.7% - 3.7

|

%

|

||||||

|

Volatility

|

42%-53

|

%

|

45%-72

|

%

|

52% - 105

|

%

|

||||||

|

Dividend yield

|

—

|

—

|

—

|

|||||||||

|

Year Ended

|

||||||||||||

|

January 30,

2011

|

January 31, 2010

|

January 25,

2009

|

||||||||||

|

Employee Stock Purchase Plan

|

(Using the Black-Scholes model)

|

|||||||||||

|

Weighted average expected life of stock options (in years)

|

0.5-2.0

|

0.5-2.0

|

0.5 - 2.0

|

|||||||||

|

Risk free interest rate

|

0.2%-0.8

|

%

|

0.2 %– 1.0

|

%

|

1.6% - 2.4

|

%

|

||||||

|

Volatility

|

45%-47

|

%

|

53%-73

|

%

|

62% - 68

|

%

|

||||||

|

Dividend yield

|

—

|

—

|

—

|

|||||||||

|

Options Available for Grant

|

Options

Outstanding

|

Weighted Average Exercise Price Per Share

|

Weighted Average Remaining Contractual Life

|

Aggregate Intrinsic Value (1)

|

|||||||||

|

Stock Options:

|

|||||||||||||

|

Balances, January 27, 2008

|

44,044,004

|

90,581,073

|

$

|

13.18

|

|||||||||

|

Authorized

|

-

|

-

|

-

|

||||||||||

|

Granted

|

(17,888,695

|

)

|

17,888,695

|

$

|

8.03

|

||||||||

|

Exercised

|

-

|

(7,670,038

|

)

|

$

|

3.14

|

||||||||

|

Cancelled

|

3,345,450

|

(3,345,450

|

)

|

$

|

7.66

|

||||||||

|

Balances, January 25, 2009

|

29,500,759

|

97,454,280

|

$

|

13.83

|

|||||||||

|

Authorized

|

-

|

-

|

-

|

||||||||||

|

Granted

|

(7,701,396

|

)

|

7,701,396

|

$

|

11.5

|

||||||||

|

Exercised

|

-

|

(17,099,663

|

)

|

$

|

5.74

|

||||||||

|

Cancelled

|

1,175,541

|

(1,175,541

|

)

|

$

|

12.90

|

||||||||

|

Cancellations related to stock options purchase (2)

|

28,532,050

|

(28,532,050

|

)

|

$

|

23.35

|

||||||||

|

Balances, January 31, 2010

|

51,506,954

|

58,348,422

|

$

|

11.30

|

|||||||||

|

Authorized

|

-

|

-

|

-

|

||||||||||

|

Granted

|

(5,818,966

|

)

|

5,818,966

|

$

|

13.79

|

||||||||

|

Exercised

|

-

|

(18,287,483

|

)

|

$

|

8.16

|

||||||||

|

Cancelled

|

1,878,447

|

(1,878,447

|

)

|

$

|

12.56

|

||||||||

|

Balances, January 30, 2011

|

47,566,435

|

44,001,458

|

$

|

12.88

|

2.91

|

$

|

490,941,491

|

||||||

|

Exercisable at January 30, 2011

|

29,016,290

|

$

|

12.85

|

1.71

|

$

|

326,752,839

|

|||||||

|

Vested and Expected to Vest after January 30, 2011

|

41,511,160

|

$

|

12.89

|

2.77

|

$

|

463,094,795

|

|||||||

|

|

RSUs

|

Weighted Average Grant-date fair value

|

Weighted Average Remaining Contractual Life

|

||||||

|

Restricted Stock Units:

|

|||||||||

| Balances, January 25, 2009 | - | $ | - | ||||||

| Awarded | 7,672,899 | $ | 12.26 | ||||||

| Vested | (2,400 | ) | $ | 12.40 | |||||

| Forfeited | (181,987 | ) | $ | 11.37 | |||||

|

Balances, January 31, 2010

|

7,488,512 | $ | 12.28 | ||||||

|

Awarded

|

7,104,693 | $ | 13.61 | ||||||

|

Vested

|

(3,215,633 | ) | $ | 11.74 | |||||

|

Forfeited

|

(765,658 | ) | $ | 13.76 | |||||

|

Balances, January 30, 2011

|

10,611,914 | $ | 13.23 | ||||||

|

Expected to Vest after January 30, 2011

|

8,593,484 | $ | 13.24 |

1.96

|

|||||

|

(in thousands)

|

||||

|

|

||||

|

Legal settlement

|

$

|

57,000

|

||

|

License to Intel

|

1,583,000

|

|||

|

License from Intel

|

(140,000

|

) | ||

|

Total cash consideration

|

$ |

1,500,000

|

||

| 1 . |

Legal settlement

: In connection with the License Agreement, both parties agreed to settle all outstanding legal disputes. The fair value allocated to the settlement of $57.0 million was recorded in the fourth quarter of fiscal year 2011, as a benefit to operating expense.

|

| 2. . |

License to Intel:

We will recognize $1,583.0 million in total, or $66.0 million per quarter, as revenue over the term of the agreement of six years, the period over which Intel will have access to newly filed NVIDIA patents. We will commence recognition of the license revenue in April 2011 when our performance obligation under the agreement begins. Consideration received in advance of the performance period will be classified as deferred revenue.

|

| 3. |

License from Intel

: We recognized $140.0 million as an intangible asset upon execution of the agreement. Amortization of $5.0 million per quarter will be charged to cost of sales over the seven year estimated useful life of the technology beginning in April 2011.

|

|

Year Ended

|

||||||||||||

|

January 30,

2011

|

January 31,

2010

|

January 25,

2009

|

||||||||||

|

(In thousands, except per share data)

|

||||||||||||

|

Numerator:

|

||||||||||||

|

Net income (loss)

|

$

|

253,146

|

$

|

(67,987

|

)

|

$

|

(30,041

|

)

|

||||

|

Denominator:

|

||||||||||||

|

Denominator for basic net income (loss) per share, weighted average shares

|

575,177

|

549,574

|

548,126

|

|||||||||

|

Effect of dilutive securities:

|

||||||||||||

|

Equity Awards outstanding

|

13,507

|

-

|

-

|

|||||||||

|

Denominator for diluted net income (loss) per share, weighted average shares

|

588,684

|

549,574

|

548,126

|

|||||||||

|

Net income (loss) per share:

|

||||||||||||

|

Basic net income (loss) per share

|

$

|

0.44

|

$

|

(0.12

|

)

|

$

|

(0.05

|

)

|

||||

|

Diluted net income (loss) per share

|

$

|

0.43

|

$

|

(0.12

|

)

|

$

|

(0.05

|

)

|

||||

|

|

Fair Market Value

|

Straight-Line Amortization Period

|

||||||

|

(In thousands)

|

(Years)

|

|||||||

|

Property and equipment

|

$

|

2,433

|

1-2

|

|||||

|

Trademarks

|

11,310

|

5

|

||||||

|

Goodwill

|

85,418

|

-

|

||||||

|

Total

|

$

|

99,161

|

||||||

|

January 30,

2011

|

January 31,

2010

|

|||||||

|

(In thousands)

|

||||||||

|

PortalPlayer

|

$

|

104,896

|

$

|

104,896

|

||||

|

3dfx

|

75,326

|

75,326

|

||||||

|

Mental Images

|

59,252

|

59,252

|

||||||

|

MediaQ

|

35,167

|

35,167

|

||||||

|

ULi

|

31,115

|

31,115

|

||||||

|

Hybrid Graphics

|

27,906

|

27,906

|

||||||

|

Ageia

|

19,198

|

19,198

|

||||||

|

Other

|

16,984

|

16,984

|

||||||

|

Total goodwill

|

$

|

369,844

|

$

|

369,844

|

||||

|

January 30, 2011

|

January 31, 2010

|

||||||||||||||||||||||||

|

Gross

Carrying

Amount

|

Accumulated

Amortization

|

Net Carrying

Amount

|

Weighted Average

Useful Life

|

Gross

Carrying

Amount

|

Accumulated

Amortization

|

Net Carrying

Amount

|

Weighted Average Useful Life

|

||||||||||||||||||

|

(In thousands)

|

(In years)

|

(In thousands)

|

(In years)

|

||||||||||||||||||||||

|

Technology licenses

|

$

|

320,477

|

$

|

(62,791

|

)

|

$

|

257,686

|

7.6

|

$

|

135,112

|

$

|

(48,337

|

)

|

$

|

$86,775

|

6.3

|

|||||||||

|

Acquired intellectual property

|

76,264

|

(61,175

|

)

|

15,089

|

3.8

|

75,339

|

(49,838

|

)

|

25,501

|

3.8

|

|||||||||||||||

|

Patents

|

31,278

|

(15,308

|

)

|

15,970

|

5.3

|

19,347

|

(11,165

|

)

|

8,182

|

5.3

|

|||||||||||||||

|

Total intangible assets

|

$

|

428,019

|

$

|

(139,274

|

)

|

$

|

288,745

|

$

|

229,798

|

$

|

(109,340

|

)

|

$

|

120,458

|

|||||||||||

Amortization expense associated with intangible assets for fiscal years 2011, 2010 and 2009 was $30.0 million, $31.9 million and $32.6 million, respectively. Future amortization expense for the net carrying amount of intangible assets at January 30, 2011 is estimated to be $53.8 million in fiscal year 2012, $46.6 million in fiscal year 2013, $42.1 million in fiscal year 2014, $42.0 million in fiscal year 2015, $39.9 million in fiscal year 2016 and $64.3 million in fiscal years subsequent to fiscal year 2016 until fully amortized.

|

January 30, 2011

|

||||||||||||||||

|

Amortized

Cost

|

Unrealized

Gain

|

Unrealized

Loss

|

Estimated

Fair Value

|

|||||||||||||

|

(In thousands)

|

||||||||||||||||

|

Debt securities of United States government agencies

|

$

|

531,789

|

$

|

1,034

|

$

|

(226

|

)

|

$

|

532,597

|

|||||||

|

Corporate debt securities

|

925,226

|

3,354

|

(208

|

)

|

928,372

|

|||||||||||

|

Mortgage backed securities issued by United States government-sponsored enterprises

|

140,844

|

4,599

|

(21

|

)

|

145,422

|

|||||||||||

|

Money market funds

|

132,586

|

-

|

-

|

132,586

|

||||||||||||

|

Debt securities issued by United States Treasury

|

435,091

|

1,939

|

(18

|

)

|

437,012

|

|||||||||||

|

Total

|

$

|

2,165,536

|

$

|

10,926

|

$

|

(473

|

)

|

$

|

2,175,989

|

|||||||

|

Classified as:

|

||||||||||||||||

|

Cash equivalents

|

$

|

350,787

|

||||||||||||||

|

Marketable securities

|

1,825,202

|

|||||||||||||||

|

Total

|

$

|

2,175,989

|

||||||||||||||

|

January 31, 2010

|

||||||||||||||||

|

Amortized

Cost

|

Unrealized

Gain

|

Unrealized

Loss

|

Estimated

Fair Value

|

|||||||||||||

|

(In thousands)

|

||||||||||||||||

|

Debt securities of United States government agencies

|

$

|

492,628

|

$

|

3,606

|

$

|

(29

|

)

|

$

|

496,205

|

|||||||

|

Corporate debt securities

|

514,200

|

4,064

|

(44

|

)

|

518,220

|

|||||||||||

|

Mortgage backed securities issued by United States government-sponsored enterprises

|

162,693

|

3,674

|

(13

|

)

|

166,353

|

|||||||||||

|

Money market funds

|

94,340

|

-

|

-

|

94,340

|

||||||||||||

|

Debt securities issued by United States Treasury

|

316,520

|

1,318

|

-

|

317,838

|

||||||||||||

|

Asset-backed securities

|

17

|

-

|

-

|

17

|

||||||||||||

|

Total

|

$

|

1,580,397

|

$

|

12,662

|

$

|

(86

|

)

|

$

|

1,592,973

|

|||||||

|

Classified as:

|

||||||||||||||||

|

Cash equivalents

|

$

|

311,967

|

||||||||||||||

|

Marketable securities

|

1,281,006

|

|||||||||||||||

|

Total

|

$

|

1,592,973

|

||||||||||||||

|

Less than 12 months

|

12 months or greater

|

Total

|

||||||||||||||||||||||

|

Fair Value

|

Gross

Unrealized

Losses

|

Fair Value

|

Gross

Unrealized

Losses

|

Fair Value

|

Gross

Unrealized

Losses

|

|||||||||||||||||||

|

(In thousands)

|

||||||||||||||||||||||||

|

Corporate debt securities

|

$

|

467,672

|

$

|

(11

|

)

|

$

|

460,700

|

$

|

(197