|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[x]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended January 31, 2016

|

|

|

[_]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

94-3177549

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

Incorporation or Organization)

|

Identification No.)

|

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value per share

|

The NASDAQ Global Select Market

|

|

Large accelerated filer

x

|

Accelerated filer

o

|

|

Non-accelerated filer

o

(Do not check if a smaller reporting company)

|

Smaller reporting company

o

|

|

|

|

Page

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Businesses

|

NVIDIA Visual Computing Platforms and Brands

|

||

|

GPU

|

∙

|

GeForce

for PC gaming

|

|

|

∙

|

Quadro

for design professionals working in computer-aided design, video editing, special effects and other creative applications

|

||

|

∙

|

Tesla

for deep learning and accelerated computing, leveraging the parallel computing capabilities of GPUs for general purpose computing

|

||

|

∙

|

GRID

to provide the power of NVIDIA graphics through the cloud and datacenters

|

||

|

Tegra Processor

|

∙

|

Tegra

processors are primarily designed to enable our branded platforms - DRIVE and SHIELD. Tegra is also sold to OEMs for devices where graphics and overall performance is of great importance

|

|

|

∙

|

DRIVE

automotive computers that provide supercomputing capabilities to make driving safer and more enjoyable

|

||

|

∙

|

SHIELD

includes a family of devices designed to harness the power of mobile-cloud to revolutionize gaming

|

||

|

•

|

Design and Manufacturing

- including computer-aided design, architectural design, consumer-products manufacturing, medical instrumentation and aerospace

|

|

•

|

Digital Content Creation

- including professional video editing and post production, special effects for films and broadcast-television graphics

|

|

•

|

Enterprise Graphics Virtualization

- including enterprises that virtualize their IT infrastructure using software from companies such as VMware, Inc. and Citrix Systems, Inc., which are significantly improved by NVIDIA GRID hardware and software

|

|

•

|

suppliers of discrete and integrated GPUs, including supercomputers and chipsets that incorporate 3D graphics functionality as part of their existing solutions, such as Advanced Micro Devices, or AMD, and Intel Corporation, or Intel;

|

|

•

|

suppliers of SOC products that are embedded into automobiles and smart devices such as televisions, monitors, set-top boxes, gaming devices and automobiles, such as Ambarella, Inc., AMD, Apple, Inc., Avago Technologies Ltd., Intel, Marvell Technology Group Ltd., Mediatek, Mobileye N.V., Qualcomm Incorporated, Renesas Electronics Corporation, Samsung, ST Microelectronics, and Texas Instruments Incorporated; and

|

|

•

|

licensors of graphics technologies, such as ARM Holdings plc, or ARM, and Imagination Technologies Group plc.

|

|

Name

|

Age

|

Position

|

||

|

Jen-Hsun Huang

|

53

|

President, Chief Executive Officer and Director

|

||

|

Colette M. Kress

|

48

|

Executive Vice President and Chief Financial Officer

|

||

|

Ajay K. Puri

|

61

|

Executive Vice President, Worldwide Field Operations

|

||

|

David M. Shannon

|

60

|

Executive Vice President, Chief Administrative Officer and Secretary

|

||

|

Debora Shoquist

|

61

|

Executive Vice President, Operations

|

||

|

•

|

a lack of guaranteed supply of wafers and other components and potential higher wafer and component prices due to supply constraints;

|

|

•

|

a failure by our foundries to procure raw materials or to provide or allocate adequate manufacturing or test capacity for our products;

|

|

•

|

a failure to develop, obtain or successfully implement high quality, leading-edge process technologies, including transitions to smaller geometry process technologies, needed to manufacture our products profitably or on a timely basis;

|

|

•

|

loss of a supplier and additional expense and/or production delays as a result of qualifying a new foundry or subcontractor and commencing volume production or testing in the event of a loss of or a decision to add or change a supplier;

|

|

•

|

a lack of direct control over delivery schedules or product quantity and quality; and

|

|

•

|

delays in product shipments, shortages, a decrease in product quality and/or higher expenses in the event our subcontractors or foundries prioritize our competitors’ orders over our orders or otherwise.

|

|

•

|

incorporate those features and functionalities into products that meet the exacting design requirements of our customers; and

|

|

•

|

most of our sales are made on a purchase order basis, which permits our customers to cancel, change or delay product purchase commitments with little or no notice to us and without penalty;

|

|

•

|

our customers may develop their own solutions;

|

|

•

|

our customers may purchase products from our competitors; or

|

|

•

|

our customers may discontinue sales or lose market share in the markets for which they purchase our products.

|

|

•

|

international economic and political conditions, such as political tensions between countries in which we do business;

|

|

•

|

unexpected changes in, or impositions of, legislative or regulatory requirements;

|

|

•

|

differing legal standards with respect to protection of intellectual property and employment practices;

|

|

•

|

local business and cultural factors that differ from our normal standards and practices, including business practices that we are prohibited from engaging in by the Foreign Corrupt Practices Act and other anticorruption laws and regulations;

|

|

•

|

exporting or importing issues related to export or import restrictions, tariffs, quotas and other trade barriers and restrictions;

|

|

•

|

financial risks such as longer payment cycles, difficulty in collecting accounts receivable and foreign exchange rate fluctuations; and

|

|

•

|

increased costs due to imposition of climate change regulations, such as carbon taxes, fuel or energy taxes, and pollution limits.

|

|

•

|

difficulty in combining the technology, products, operations or workforce of the acquired business with our business;

|

|

•

|

diversion of capital and other resources, including management's attention;

|

|

•

|

assumption of liabilities;

|

|

•

|

incurring amortization expenses, impairment charges to goodwill or write-downs of acquired assets;

|

|

•

|

potential failure of our due diligence processes to identify significant issues with product quality, architecture and development, or legal and financial contingencies, among other things; and

|

|

•

|

impairment of relationships with, or loss of our or our target’s, employees, vendors and customers, as a result of our acquisition or investment.

|

|

•

|

demand and market acceptance for our products and services and/or our customers’ products;

|

|

•

|

the successful development and volume production of our next-generation products;

|

|

•

|

our inability to adjust spending to offset revenue shortfalls due to the multi-year development cycle for some of our products and services;

|

|

•

|

new product and service announcements or product and service introductions by our competitors;

|

|

•

|

our introduction of new products in accordance with OEMs’ design requirements and design cycles;

|

|

•

|

changes in the timing of product orders due to unexpected delays in the introduction of our customers’ products;

|

|

•

|

the level of growth or decline of the PC industry in general;

|

|

•

|

seasonal fluctuations associated with the PC and consumer products market;

|

|

•

|

contraction in automotive and consumer end-market demand due to adverse regional or worldwide economic conditions;

|

|

•

|

slower than expected growth of demand for new technologies;

|

|

•

|

fluctuations in the availability of manufacturing capacity or manufacturing yields;

|

|

•

|

our ability to reduce the manufacturing costs of our products;

|

|

•

|

competitive pressures resulting in lower than expected average selling prices;

|

|

•

|

product rates of return in excess of that forecasted or expected due to quality issues;

|

|

•

|

rescheduling or cancellation of customer orders;

|

|

•

|

the loss of a significant customer;

|

|

•

|

substantial disruption in the operations of our foundries or other third-party subcontractors, as a result of a natural disaster, equipment failure, terrorism or other causes;

|

|

•

|

supply constraints for and changes in the cost of the other components incorporated into our customers’ products, including memory devices;

|

|

•

|

costs associated with the repair and replacement of defective products;

|

|

•

|

unexpected inventory write-downs or write-offs;

|

|

•

|

legal and other costs related to defending intellectual property and other types of lawsuits;

|

|

•

|

availability of software and technology licenses at commercially reasonable terms for the continued sale or development of new products;

|

|

•

|

customer bad debt write-offs;

|

|

•

|

changes in our effective tax rate as a result of changes in the mix of earnings in countries with differing statutory tax rates, applicable tax laws or interpretations of tax laws;

|

|

•

|

any unanticipated costs associated with environmental liabilities;

|

|

•

|

unexpected costs related to our ownership of real property;

|

|

•

|

costs to comply with new government regulations and regulatory enforcement actions;

|

|

•

|

costs to maintain effective internal control over financial reporting;

|

|

•

|

changes in financial accounting standards or interpretations of existing standards; and

|

|

•

|

general macroeconomic events and factors affecting the overall semiconductor industry and our target markets.

|

|

•

|

limit our ability to use our cash flow or borrow additional funds for working capital, capital expenditures, acquisitions and general corporate and other purposes;

|

|

•

|

make it difficult for us to satisfy our financial obligations;

|

|

•

|

place us at a competitive disadvantage compared to our less leveraged competitors; and

|

|

•

|

increase our vulnerability to the impact of adverse economic and industry conditions.

|

|

High

|

Low

|

||||||

|

Fiscal year ending January 29, 2017

|

|

|

|||||

|

First Quarter (through March 11, 2016)

|

$

|

33.06

|

|

$

|

24.75

|

|

|

|

Fiscal year ended January 31, 2016

|

|||||||

|

Fourth Quarter

|

$

|

33.94

|

|

$

|

26.45

|

|

|

|

Third Quarter

|

$

|

28.78

|

|

$

|

19.09

|

|

|

|

Second Quarter

|

$

|

22.88

|

|

$

|

19.16

|

|

|

|

First Quarter

|

$

|

23.61

|

|

$

|

18.94

|

|

|

|

Fiscal year ended January 26, 2015

|

|||||||

|

Fourth Quarter

|

$

|

21.25

|

|

$

|

18.27

|

|

|

|

Third Quarter

|

$

|

20.15

|

|

$

|

16.77

|

|

|

|

Second Quarter

|

$

|

19.73

|

|

$

|

17.71

|

|

|

|

First Quarter

|

$

|

19.46

|

|

$

|

15.32

|

|

|

|

Period

|

Total Number of Shares Purchased

|

Average Price Paid per Share (1)

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

|

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs

|

||||||||

|

October 26, 2015 - November 22, 2015

|

3,047,106

|

$

|

44.30

|

|

3,047,106

|

$

|

1,465

|

|

||||

|

November 23, 2015 - December 27, 2015

|

—

|

$

|

—

|

|

—

|

$

|

1,465

|

|

||||

|

December 28, 2015 - January 31, 2016

|

1,205,682

|

$

|

—

|

|

1,205,682

|

$

|

1,465

|

|

||||

|

Total

|

4,252,788

|

$

|

31.74

|

|

4,252,788

|

|||||||

|

(1)

|

In November 2015, we entered into an accelerated share repurchase agreement, or ASR, with an investment bank, under which we made an upfront payment of $135 million to purchase shares of our common stock. We received an initial delivery of 3,047,106 shares in November 2015 at an average price per share of $44.30, which is based solely on the result of dividing the $135 million we had paid towards the ASR by such 3,047,106 shares. In January 2016, at the time of settlement of the ASR, we received an additional 1,205,682 shares without any further cash payment. The total number of shares repurchased under this ASR was 4,252,788 shares, and thus the average price we ultimately paid per share under the ASR was $31.74. Please refer to

Note 14

of the Notes to the Consolidated Financial Statements in Part IV, Item 15 of this Annual Report on Form 10-K for further discussion regarding the accelerated share repurchase program.

|

|

|

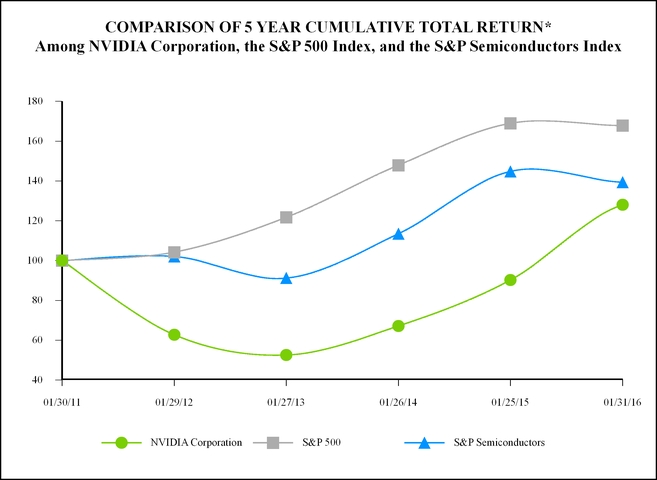

1/30/2011

|

1/29/2012

|

1/27/2013

|

1/26/2014

|

1/25/2015

|

1/31/2016

|

||||||||||||||||||

|

NVIDIA Corporation

|

$

|

100.00

|

|

$

|

62.75

|

|

$

|

52.55

|

|

$

|

67.11

|

|

$

|

90.21

|

|

$

|

127.99

|

|

||||||

|

S&P 500

|

$

|

100.00

|

|

$

|

104.22

|

|

$

|

121.71

|

|

$

|

147.89

|

|

$

|

168.93

|

|

$

|

167.81

|

|

||||||

|

S&P Semiconductors

|

$

|

100.00

|

|

$

|

102.04

|

|

$

|

91.20

|

|

$

|

113.44

|

|

$

|

144.77

|

|

$

|

139.35

|

|

||||||

|

|

1/29/2006

|

|

1/28/2007

|

|

1/27/2008

|

|

1/25/2009

|

|

1/31/2010

|

|

1/30/2011

|

|

1/29/2012

|

|

1/27/2013

|

|

1/26/2014

|

|

1/25/2015

|

|

1/31/2016

|

|

|||||||||||||||||||||

|

NVIDIA Corporation

|

$

|

100.00

|

|

$

|

136.09

|

|

$

|

161.84

|

|

$

|

50.01

|

|

$

|

99.83

|

|

$

|

154.12

|

|

$

|

96.71

|

|

$

|

80.98

|

|

$

|

103.43

|

|

$

|

139.04

|

|

$

|

197.25

|

|

||||||||||

|

S&P 500

|

$

|

100.00

|

|

$

|

114.51

|

|

$

|

111.87

|

|

$

|

68.65

|

|

$

|

91.41

|

|

$

|

111.68

|

|

$

|

116.39

|

|

$

|

135.92

|

|

$

|

165.17

|

|

$

|

188.66

|

|

$

|

187.41

|

|

||||||||||

|

S&P Semiconductors

|

$

|

100.00

|

|

$

|

93.20

|

|

$

|

87.12

|

|

$

|

48.31

|

|

$

|

72.37

|

|

$

|

92.93

|

|

$

|

94.82

|

|

$

|

84.75

|

|

$

|

105.42

|

|

$

|

134.53

|

|

$

|

129.50

|

|

||||||||||

|

|

Year Ended

|

||||||||||||||||||

|

January 31,

2016 (A)

|

January 25,

2015

|

January 26,

2014

|

January 27,

2013

|

January 29,

2012

|

|||||||||||||||

|

|

(In millions, except per share data)

|

||||||||||||||||||

|

Consolidated Statement of Operations Data:

|

|

|

|

|

|

||||||||||||||

|

Revenue

|

$

|

5,010

|

|

$

|

4,682

|

|

$

|

4,130

|

|

$

|

4,280

|

|

$

|

3,998

|

|

||||

|

Income from operations

|

$

|

747

|

|

$

|

759

|

|

$

|

496

|

|

$

|

648

|

|

$

|

648

|

|

||||

|

Net income

|

$

|

614

|

|

$

|

631

|

|

$

|

440

|

|

$

|

563

|

|

$

|

581

|

|

||||

|

Net income per share:

|

|||||||||||||||||||

|

Basic

|

$

|

1.13

|

|

$

|

1.14

|

|

$

|

0.75

|

|

$

|

0.91

|

|

$

|

0.96

|

|

||||

|

Diluted

|

$

|

1.08

|

|

$

|

1.12

|

|

$

|

0.74

|

|

$

|

0.90

|

|

$

|

0.94

|

|

||||

|

Weighted average shares used in per share computation:

|

|||||||||||||||||||

|

Basic

|

543

|

|

552

|

|

588

|

|

619

|

|

604

|

|

|||||||||

|

Diluted

|

569

|

|

563

|

|

595

|

|

625

|

|

616

|

|

|||||||||

|

Year Ended

|

|||||||||||||||||||

|

January 31,

2016 (B, C)

|

January 25,

2015 (B)

|

January 26,

2014 (B,C)

|

January 27,

2013 (B)

|

January 29,

2012 (D)

|

|||||||||||||||

|

(In millions, except per share data)

|

|||||||||||||||||||

|

Consolidated Balance Sheet Data:

|

|

|

|

|

|

||||||||||||||

|

Cash, cash equivalents and marketable securities

|

$

|

5,037

|

|

$

|

4,623

|

|

$

|

4,672

|

|

$

|

3,728

|

|

$

|

3,130

|

|

||||

|

Total assets

|

$

|

7,370

|

|

$

|

7,201

|

|

$

|

7,251

|

|

$

|

6,412

|

|

$

|

5,553

|

|

||||

|

Convertible short-term debt

|

$

|

1,413

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

Convertible long-term debt

|

$

|

—

|

|

$

|

1,384

|

|

$

|

1,356

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

Capital lease obligations, less current portion

|

$

|

10

|

|

$

|

14

|

|

$

|

18

|

|

$

|

19

|

|

$

|

21

|

|

||||

|

Convertible debt conversion obligation

|

$

|

87

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

Total shareholders’ equity

|

$

|

4,469

|

|

$

|

4,418

|

|

$

|

4,456

|

|

$

|

4,828

|

|

$

|

4,146

|

|

||||

|

Cash dividends declared and paid per common share

|

$

|

0.3950

|

|

$

|

0.3400

|

|

$

|

0.3100

|

|

$

|

0.0750

|

|

$

|

—

|

|

||||

|

(A)

|

In May 2015, we announced our intention to wind down or sell our Icera modem operations. We were unable to identify a viable buyer with genuine interest and, as a result, we began the wind-down of Icera modem operations in the second quarter of fiscal year 2016. Our income from operations for fiscal year 2016 included $131 million of restructuring and other charges, and our net income for fiscal year 2016 included $86 million of restructuring and other charges, net of tax.

|

|

(B)

|

On November 8, 2012, we initiated a quarterly dividend payment of $0.075 per share, or $0.30 per share on an annual basis. On November 7, 2013, we increased the quarterly cash dividend to $0.085 per share, or $0.34 per share on an annual basis. On May 7, 2015, we increased the quarterly cash dividend to $0.0975 per share, or $0.39 per share on an annual basis. On November 5, 2015, we increased the quarterly cash dividend to $0.115 per share, or $0.46 per share on an annual basis.

|

|

(C)

|

On December 2, 2013, we issued

1.00%

Convertible Senior Notes due 2018 in the aggregate principal amount of

$1.50 billion

. As of January 31, 2016, the Notes became convertible at the holders’ option beginning February 1, 2016 and ending May 1, 2016. As such, $1.41 billion of the carrying value of the Notes was reclassified from long-term debt to short-term debt and $87 million was reclassified from shareholders’ equity to convertible debt conversion obligation in our Consolidated Balance Sheet as of January 31, 2016.

|

|

(D)

|

On June 10, 2011, we completed the acquisition of Icera, Inc. for total cash consideration of $352 million, and recorded goodwill of $271 million. On May 5, 2015, we announced our intent to wind down our Icera modem operations. Please refer to Note 17 of the Notes to the Consolidated Financial Statements in Part IV, Item 15 of this Annual Report on Form 10-K for further discussion.

|

|

|

Year Ended

|

||||||||

|

|

January 31,

2016 |

January 25,

2015

|

Change

|

||||||

|

(In millions, except per share data)

|

|||||||||

|

Revenue

|

$

|

5,010

|

|

$

|

4,682

|

|

up 7%

|

||

|

Gross margin

|

56.1

|

%

|

55.5

|

%

|

up 60 bps

|

||||

|

Operating expenses

|

$

|

2,064

|

|

$

|

1,840

|

|

up 12%

|

||

|

Income from operations

|

$

|

747

|

|

$

|

759

|

|

down 2%

|

||

|

Net income

|

$

|

614

|

|

$

|

631

|

|

down 3%

|

||

|

Net income per diluted share

|

$

|

1.08

|

|

$

|

1.12

|

|

down 4%

|

||

|

|

Year Ended

|

|||||||

|

|

January 31, 2016

|

January 25, 2015

|

January 26, 2014

|

|||||

|

Revenue

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||

|

Cost of revenue

|

43.9

|

|

44.5

|

|

45.1

|

|

||

|

Gross profit

|

56.1

|

|

55.5

|

|

54.9

|

|

||

|

Operating expenses:

|

|

|

|

|||||

|

Research and development

|

26.6

|

|

29.0

|

|

32.3

|

|

||

|

Sales, general and administrative

|

12.0

|

|

10.3

|

|

10.5

|

|

||

|

Restructuring and other charges

|

2.6

|

|

—

|

|

—

|

|

||

|

Total operating expenses

|

41.2

|

|

39.3

|

|

42.8

|

|

||

|

Income from operations

|

14.9

|

|

16.2

|

|

12.1

|

|

||

|

Interest income

|

0.8

|

|

0.6

|

|

0.4

|

|

||

|

Interest expense

|

(0.9

|

)

|

(1.0

|

)

|

(0.3

|

)

|

||

|

Other income, net

|

0.1

|

|

0.3

|

|

0.2

|

|

||

|

Income before income taxes

|

14.9

|

|

16.1

|

|

12.4

|

|

||

|

Income tax expense

|

2.6

|

|

2.6

|

|

1.7

|

|

||

|

Net income

|

12.3

|

%

|

13.5

|

%

|

10.7

|

%

|

||

|

Year Ended

|

Year Ended

|

||||||||||||||||||||||||||||

|

January 31,

2016 |

|

January 25,

2015 |

$

Change

|

%

Change

|

January 25,

2015 |

January 26,

2014 |

$

Change

|

%

Change

|

|||||||||||||||||||||

|

(In millions)

|

(In millions)

|

||||||||||||||||||||||||||||

|

GPU

|

$

|

4,187

|

|

$

|

3,839

|

|

$

|

348

|

|

9

|

%

|

$

|

3,839

|

|

$

|

3,468

|

|

$

|

371

|

|

11

|

%

|

|||||||

|

Tegra Processor

|

559

|

|

579

|

|

(20

|

)

|

(3

|

)%

|

579

|

|

398

|

|

181

|

|

45

|

%

|

|||||||||||||

|

All Other

|

264

|

|

264

|

|

—

|

|

—

|

%

|

264

|

|

264

|

|

—

|

|

—

|

%

|

|||||||||||||

|

Total

|

$

|

5,010

|

|

$

|

4,682

|

|

$

|

328

|

|

7

|

%

|

$

|

4,682

|

|

$

|

4,130

|

|

$

|

552

|

|

13

|

%

|

|||||||

|

|

Year Ended

|

|||||||

|

|

January 31,

2016 |

January 25,

2015

|

January 26,

2014

|

|||||

|

Revenue:

|

|

|

|

|||||

|

Customer A

|

11

|

%

|

11

|

%

|

11

|

%

|

||

|

Customer B

|

9

|

%

|

9

|

%

|

10

|

%

|

||

|

|

Year Ended

|

Year Ended

|

|||||||||||||||||||||||||||

|

|

January 31,

2016 |

|

January 25,

2015 |

$

Change

|

%

Change

|

January 25,

2015

|

January 26,

2014 |

$

Change

|

%

Change

|

||||||||||||||||||||

|

|

(In millions)

|

(In millions)

|

|||||||||||||||||||||||||||

|

Research and development expenses

|

$

|

1,331

|

|

$

|

1,360

|

|

$

|

(29

|

)

|

(2

|

)%

|

$

|

1,360

|

|

$

|

1,336

|

|

$

|

24

|

|

2

|

%

|

|||||||

|

Sales, general and administrative expenses

|

602

|

|

480

|

|

122

|

|

25

|

%

|

480

|

|

436

|

|

44

|

|

10

|

%

|

|||||||||||||

|

Restructuring and other charges

|

131

|

|

—

|

|

131

|

|

100

|

%

|

—

|

|

—

|

|

—

|

|

—

|

%

|

|||||||||||||

|

Total operating expenses

|

$

|

2,064

|

|

$

|

1,840

|

|

$

|

224

|

|

12

|

%

|

$

|

1,840

|

|

$

|

1,772

|

|

$

|

68

|

|

4

|

%

|

|||||||

|

Research and development as a percentage of net revenue

|

26.6

|

%

|

29.0

|

%

|

|

|

29.0

|

%

|

32.3

|

%

|

|

|

|||||||||||||||||

|

Sales, general and administrative as a percentage of net revenue

|

12.0

|

%

|

10.3

|

%

|

|

|

10.3

|

%

|

10.5

|

%

|

|

|

|||||||||||||||||

|

Restructuring and other charges as a percentage of net revenue

|

2.6

|

%

|

—

|

%

|

|

|

—

|

%

|

—

|

%

|

|

|

|||||||||||||||||

|

Year Ended

|

||||

|

January 31,

|

||||

|

2016

|

||||

|

(In millions)

|

||||

|

Employee severance and related costs

|

$

|

82

|

|

|

|

Tax subsidy impairment

|

17

|

|

||

|

Fixed assets impairment

|

18

|

|

||

|

Facilities and related costs

|

9

|

|

||

|

Other exit costs

|

5

|

|

||

|

Restructuring and other charges

|

$

|

131

|

|

|

|

|

January 31, 2016

|

January 25, 2015

|

|||||

|

|

(In millions)

|

||||||

|

Cash and cash equivalents

|

$

|

596

|

|

$

|

497

|

|

|

|

Marketable securities

|

4,441

|

|

4,126

|

|

|||

|

Cash, cash equivalents, and marketable securities

|

$

|

5,037

|

|

$

|

4,623

|

|

|

|

|

Year Ended

|

||||||||||

|

January 31,

2016 |

January 25,

2015 |

January 26,

2014 |

|||||||||

|

|

(In millions)

|

||||||||||

|

Net cash provided by operating activities

|

$

|

1,175

|

|

$

|

906

|

|

$

|

835

|

|

||

|

Net cash (used in) investing activities

|

$

|

(400

|

)

|

$

|

(727

|

)

|

$

|

(806

|

)

|

||

|

Net cash (used in) provided by financing activities

|

$

|

(676

|

)

|

$

|

(834

|

)

|

$

|

390

|

|

||

|

•

|

decreased demand and market acceptance for our products and/or our customers’ products;

|

|

•

|

inability to successfully develop and produce in volume production our next-generation products;

|

|

•

|

competitive pressures resulting in lower than expected average selling prices; and

|

|

•

|

new product announcements or product introductions by our competitors.

|

|

Payment Due By Period

|

|||||||||||||||||||||||

|

Contractual Obligations

|

Total

|

Less than

1 Year

|

1-3 Years

|

4-5 Years

|

More than

5 Years

|

All Other

|

|||||||||||||||||

|

|

(In millions)

|

||||||||||||||||||||||

|

1.00% Convertible Senior Notes due 2018 (1)

|

$

|

1,545

|

|

$

|

1,515

|

|

$

|

30

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

|||||

|

Inventory purchase obligations

|

391

|

|

391

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Operating leases (2) (3)

|

265

|

|

75

|

|

123

|

|

46

|

|

21

|

|

—

|

|

|||||||||||

|

Uncertain tax positions, interest and penalties (4)

|

78

|

|

—

|

|

—

|

|

—

|

|

—

|

|

78

|

|

|||||||||||

|

Capital purchase obligations

|

36

|

|

36

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Capital lease

|

17

|

|

5

|

|

12

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Restructuring related obligation (5)

|

23

|

|

23

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Total contractual obligations

|

$

|

2,355

|

|

$

|

2,045

|

|

$

|

165

|

|

$

|

46

|

|

$

|

21

|

|

$

|

78

|

|

|||||

|

(1)

|

Represents the aggregate principal amount of

$1.50 billion

and anticipated interest payments of

$45 million

of the Notes. See

Note 11

of the Notes to the Consolidated Financial Statements in Part IV, Item 15 of this Annual Report on Form 10-K.

|

|

(2)

|

Includes facilities leases as well as non-cancelable obligations under certain software licensing arrangements in the operating lease category.

|

|

(3)

|

Excludes operating lease payments that we expect to make under an operating lease financing arrangement following construction of a new headquarters building in Santa Clara, California, which is currently targeted for completion in the fourth quarter of fiscal year 2018. The amount of the operating lease payments will be determined after the completion of construction. See the section below titled “Off-Balance Sheet Arrangements” for additional information.

|

|

(4)

|

Represents unrecognized tax benefits of

$78 million

which consists of

$67 million

plus the related interest and penalties of

$11 million

recorded in non-current income tax payable as of January 31, 2016. We are unable to reasonably estimate the timing of any potential tax liability or interest/penalty payments in individual years due to uncertainties in the underlying income tax positions and the timing of the effective settlement of such tax positions.

|

|

(5)

|

Our operating expenses for the fiscal year 2016 included $131 million of restructuring and other charges related to the wind-down of our Icera modem operations. The $23 million represents the remaining balance of the restructuring liability as of January 31, 2016.

|

|

|

|

Page

|

||

|

(a)

|

1.

|

Consolidated Financial Statements

|

|

|

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

2.

|

Financial Statement Schedule

|

|

||

|

|

||||

|

3.

|

Exhibits

|

|

||

|

|

||||

|

Year Ended

|

|||||||||||

|

January 31,

2016 |

January 25,

2015 |

January 26,

2014 |

|||||||||

|

Revenue

|

$

|

5,010

|

|

$

|

4,682

|

|

$

|

4,130

|

|

||

|

Cost of revenue

|

2,199

|

|

2,083

|

|

1,862

|

|

|||||

|

Gross profit

|

2,811

|

|

2,599

|

|

2,268

|

|

|||||

|

Operating expenses:

|

|

|

|

||||||||

|

Research and development

|

1,331

|

|

1,360

|

|

1,336

|

|

|||||

|

Sales, general and administrative

|

602

|

|

480

|

|

436

|

|

|||||

|

Restructuring and other charges

|

131

|

|

—

|

|

—

|

|

|||||

|

Total operating expenses

|

2,064

|

|

1,840

|

|

1,772

|

|

|||||

|

Income from operations

|

747

|

|

759

|

|

496

|

|

|||||

|

Interest income

|

39

|

|

28

|

|

17

|

|

|||||

|

Interest expense

|

(47

|

)

|

(46

|

)

|

(10

|

)

|

|||||

|

Other income, net

|

4

|

|

14

|

|

7

|

|

|||||

|

Income before income tax expense

|

743

|

|

755

|

|

510

|

|

|||||

|

Income tax expense

|

129

|

|

124

|

|

70

|

|

|||||

|

Net income

|

$

|

614

|

|

$

|

631

|

|

$

|

440

|

|

||

|

Net income per share:

|

|||||||||||

|

Basic

|

$

|

1.13

|

|

$

|

1.14

|

|

$

|

0.75

|

|

||

|

Diluted

|

$

|

1.08

|

|

$

|

1.12

|

|

$

|

0.74

|

|

||

|

Weighted average shares used in per share computation:

|

|||||||||||

|

Basic

|

543

|

|

552

|

|

588

|

|

|||||

|

Diluted

|

569

|

|

563

|

|

595

|

|

|||||

|

Cash dividends declared and paid per common share

|

$

|

0.3950

|

|

$

|

0.3400

|

|

$

|

0.3100

|

|

||

|

Year Ended

|

||||||||||||

|

January 31, 2016

|

January 25, 2015

|

January 26, 2014

|

||||||||||

|

Net income

|

$

|

614

|

|

$

|

631

|

|

$

|

440

|

|

|||

|

Other comprehensive income (loss), net of tax:

|

||||||||||||

|

Net change in unrealized gains (losses) on available-for-sale securities

|

(6

|

)

|

3

|

|

(4

|

)

|

||||||

|

Net change in fair value of interest rate swap

|

(4

|

)

|

—

|

|

—

|

|

||||||

|

Reclassification adjustments for net realized gains on available-for-sale securities included in net income

|

(2

|

)

|

—

|

|

(1

|

)

|

||||||

|

Other comprehensive income (loss)

|

(12

|

)

|

3

|

|

(5

|

)

|

||||||

|

Total comprehensive income

|

$

|

602

|

|

$

|

634

|

|

$

|

435

|

|

|||

|

|

January 31, 2016

|

January 25, 2015

|

|||||

|

ASSETS

|

|

|

|||||

|

Current assets:

|

|

|

|||||

|

Cash and cash equivalents

|

$

|

596

|

|

$

|

497

|

|

|

|

Marketable securities

|

4,441

|

|

4,126

|

|

|||

|

Accounts receivable, less allowances of $11 as of January 31, 2016 and $17 as of January 25, 2015

|

505

|

|

474

|

|

|||

|

Inventories

|

418

|

|

483

|

|

|||

|

Prepaid expenses and other current assets

|

93

|

|

70

|

|

|||

|

Deferred income taxes

|

—

|

|

63

|

|

|||

|

Total current assets

|

6,053

|

|

5,713

|

|

|||

|

Property and equipment, net

|

466

|

|

557

|

|

|||

|

Goodwill

|

618

|

|

618

|

|

|||

|

Intangible assets, net

|

166

|

|

222

|

|

|||

|

Other assets

|

67

|

|

91

|

|

|||

|

Total assets

|

$

|

7,370

|

|

$

|

7,201

|

|

|

|

LIABILITIES, CONVERTIBLE DEBT CONVERSION OBLIGATION AND SHAREHOLDERS' EQUITY

|

|||||||

|

Current liabilities:

|

|

|

|||||

|

Accounts payable

|

$

|

296

|

|

$

|

293

|

|

|

|

Accrued and other current liabilities

|

642

|

|

603

|

|

|||

|

Convertible short-term debt

|

1,413

|

|

—

|

|

|||

|

Total current liabilities

|

2,351

|

|

896

|

|

|||

|

Convertible long-term debt

|

—

|

|

1,384

|

|

|||

|

Other long-term liabilities

|

453

|

|

489

|

|

|||

|

Capital lease obligations, long-term

|

10

|

|

14

|

|

|||

|

Total liabilities

|

2,814

|

|

2,783

|

|

|||

|

Commitments and contingencies - see Note 12

|

|

|

|

|

|||

|

Convertible debt conversion obligation

|

87

|

|

—

|

|

|||

|

Shareholders’ equity:

|

|

|

|||||

|

Preferred stock, $.001 par value; 2 shares authorized; none issued

|

—

|

|

—

|

|

|||

|

Common stock, $.001 par value; 2,000 shares authorized; 780 shares issued and 539 outstanding as of January 31, 2016; 759 shares issued and 545 outstanding as of January 25, 2015

|

1

|

|

1

|

|

|||

|

Additional paid-in capital

|

4,170

|

|

3,855

|

|

|||

|

Treasury stock, at cost (242 shares in 2016 and 214 shares in 2015)

|

(4,048

|

)

|

(3,395

|

)

|

|||

|

Accumulated other comprehensive income (loss)

|

(4

|

)

|

8

|

|

|||

|

Retained earnings

|

4,350

|

|

3,949

|

|

|||

|

Total shareholders' equity

|

4,469

|

|

4,418

|

|

|||

|

Total liabilities, convertible debt conversion obligation and shareholders' equity

|

$

|

7,370

|

|

$

|

7,201

|

|

|

|

Common Stock

Outstanding

|

Additional

|

Treasury

|

Accumulated Other Comprehensive

|

Retained

|

Total Shareholders'

|

|||||||||||||||||||||

|

|

Shares

|

Amount

|

Paid-in Capital

|

Stock

|

Income (Loss)

|

Earnings

|

Equity

|

|||||||||||||||||||

|

Balances, January 27, 2013

|

617

|

|

$

|

1

|

|

$

|

3,194

|

|

$

|

(1,623

|

)

|

$

|

10

|

|

$

|

3,245

|

|

$

|

4,827

|

|

||||||

|

Other comprehensive loss

|

—

|

|

—

|

|

—

|

|

—

|

|

(5

|

)

|

—

|

|

(5

|

)

|

||||||||||||

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

440

|

|

440

|

|

||||||||||||

|

Issuance of common stock from stock plans

|

15

|

|

—

|

|

97

|

|

—

|

|

—

|

|

—

|

|

97

|

|

||||||||||||

|

Tax withholding related to vesting of restricted stock units

|

(2

|

)

|

—

|

|

—

|

|

(28

|

)

|

—

|

|

—

|

|

(28

|

)

|

||||||||||||

|

Share repurchase

|

(62

|

)

|

—

|

|

—

|

|

(887

|

)

|

—

|

|

(887

|

)

|

||||||||||||||

|

Discount on convertible notes

|

—

|

|

—

|

|

126

|

|

—

|

|

—

|

|

—

|

|

126

|

|

||||||||||||

|

Purchase of convertible note hedges

|

—

|

|

—

|

|

(167

|

)

|

—

|

|

—

|

|

—

|

|

(167

|

)

|

||||||||||||

|

Proceeds from the sale of common stock warrants

|

—

|

|

—

|

|

59

|

|

—

|

|

—

|

|

—

|

|

59

|

|

||||||||||||

|

Deferred tax asset associated with convertible notes

|

—

|

|

—

|

|

14

|

|

—

|

|

—

|

|

—

|

|

14

|

|

||||||||||||

|

Cash dividends declared and paid ($0.310 per common share)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(181

|

)

|

(181

|

)

|

||||||||||||

|

Tax benefit from stock-based compensation

|

—

|

|

—

|

|

24

|

|

—

|

|

—

|

|

—

|

|

24

|

|

||||||||||||

|

Stock-based compensation

|

—

|

|

—

|

|

136

|

|

—

|

|

—

|

|

—

|

|

136

|

|

||||||||||||

|

Balances, January 26, 2014

|

568

|

|

1

|

|

3,483

|

|

(2,538

|

)

|

5

|

|

3,504

|

|

4,455

|

|

||||||||||||

|

Other comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

3

|

|

—

|

|

3

|

|

||||||||||||

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

631

|

|

631

|

|

||||||||||||

|

Issuance of common stock from stock plans

|

24

|

|

—

|

|

197

|

|

—

|

|

—

|

|

—

|

|

197

|

|

||||||||||||

|

Tax withholding related to vesting of restricted stock units

|

(3

|

)

|

—

|

|

—

|

|

(43

|

)

|

—

|

|

—

|

|

(43

|

)

|

||||||||||||

|

Share repurchase

|

(44

|

)

|

—

|

|

—

|

|

(814

|

)

|

—

|

|

—

|

|

(814

|

)

|

||||||||||||

|

Cash dividends declared and paid ($0.340 per common share)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(186

|

)

|

(186

|

)

|

||||||||||||

|

Tax benefit from stock-based compensation

|

—

|

|

—

|

|

17

|

|

—

|

|

—

|

|

—

|

|

17

|

|

||||||||||||

|

Stock-based compensation

|

—

|

|

—

|

|

158

|

|

—

|

|

—

|

|

—

|

|

158

|

|

||||||||||||

|

Balances, January 25, 2015

|

545

|

|

1

|

|

3,855

|

|

(3,395

|

)

|

8

|

|

3,949

|

|

4,418

|

|

||||||||||||

|

Other comprehensive loss

|

—

|

|

—

|

|

—

|

|

—

|

|

(12

|

)

|

—

|

|

(12

|

)

|

||||||||||||

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

614

|

|

614

|

|

||||||||||||

|

Issuance of common stock from stock plans

|

22

|

|

—

|

|

186

|

|

—

|

|

—

|

|

—

|

|

186

|

|

||||||||||||

|

Tax withholding related to vesting of restricted stock units

|

(3

|

)

|

—

|

|

—

|

|

(66

|

)

|

—

|

|

—

|

|

(66

|

)

|

||||||||||||

|

Share repurchase

|

(25

|

)

|

—

|

|

—

|

|

(587

|

)

|

—

|

|

—

|

|

(587

|

)

|

||||||||||||

|

Cash dividends declared and paid ($0.395 per common share)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(213

|

)

|

(213

|

)

|

||||||||||||

|

Tax benefit from stock-based compensation

|

—

|

|

—

|

|

10

|

|

—

|

|

—

|

|

—

|

|

10

|

|

||||||||||||

|

Stock-based compensation

|

—

|

|

—

|

|

206

|

|

—

|

|

—

|

|

—

|

|

206

|

|

||||||||||||

|

Reclassification of convertible debt conversion obligation

|

—

|

|

—

|

|

(87

|

)

|

—

|

|

—

|

|

—

|

|

(87

|

)

|

||||||||||||

|

Balances, January 31, 2016

|

539

|

|

$

|

1

|

|

$

|

4,170

|

|

$

|

(4,048

|

)

|

$

|

(4

|

)

|

$

|

4,350

|

|

$

|

4,469

|

|

||||||

|

Year Ended

|

|||||||||||

|

|

January 31, 2016

|

January 25, 2015

|

January 26, 2014

|

||||||||

|

Cash flows from operating activities:

|

|

|

|||||||||

|

Net income

|

$

|

614

|

|

$

|

631

|

|

$

|

440

|

|

||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|||||||||

|

Depreciation and amortization

|

197

|

|

220

|

|

239

|

|

|||||

|

Stock-based compensation expense

|

204

|

|

158

|

|

136

|

|

|||||

|

Restructuring and other charges

|

45

|

|

—

|

|

—

|

|

|||||

|

Amortization of debt discount

|

29

|

|

28

|

|

5

|

|

|||||

|

Net gain on sale and disposal of long-lived assets and investments

|

(6

|

)

|

(17

|

)

|

(8

|

)

|

|||||

|

Deferred income taxes

|

134

|

|

83

|

|

15

|

|

|||||

|

Tax benefit from stock-based compensation

|

(10

|

)

|

(18

|

)

|

(26

|

)

|

|||||

|

Other

|

19

|

|

24

|

|

21

|

|

|||||

|

Changes in operating assets and liabilities, net of effects of acquisitions:

|

|

|

|||||||||

|

Accounts receivable

|

(32

|

)

|

(49

|

)

|

29

|

|

|||||

|

Inventories

|

66

|

|

(95

|

)

|

25

|

|

|||||

|

Prepaid expenses and other assets

|

(16

|

)

|

4

|

|

12

|

|

|||||

|

Accounts payable

|

(11

|

)

|

(27

|

)

|

(20

|

)

|

|||||

|

Accrued and other current liabilities

|

39

|

|

5

|

|

5

|

|

|||||

|

Other long-term liabilities

|

(97

|

)

|

(41

|

)

|

(38

|

)

|

|||||

|

Net cash provided by operating activities

|

1,175

|

|

906

|

|

835

|

|

|||||

|

Cash flows from investing activities:

|

|

|

|||||||||

|

Purchases of marketable securities

|

(3,477

|

)

|

(2,862

|

)

|

(3,066

|

)

|

|||||

|

Proceeds from sales of marketable securities

|

2,102

|

|

1,372

|

|

1,927

|

|

|||||

|

Proceeds from maturities of marketable securities

|

1,036

|

|

865

|

|

585

|

|

|||||

|

Purchases of property and equipment and intangible assets

|

(86

|

)

|

(122

|

)

|

(255

|

)

|

|||||

|

Proceeds from sale of long-lived assets and investments

|

7

|

|

21

|

|

25

|

|

|||||

|

Acquisition of businesses, net of cash and cash equivalents

|

—

|

|

—

|

|

(17

|

)

|

|||||

|

Reimbursement of headquarters building development costs from banks

|

24

|

|

—

|

|

—

|

|

|||||

|

Other

|

(6

|

)

|

(1

|

)

|

(5

|

)

|

|||||

|

Net cash used in investing activities

|

(400

|

)

|

(727

|

)

|

(806

|

)

|

|||||

|

Cash flows from financing activities:

|

|

|

|||||||||

|

Proceeds from issuance of convertible notes, net

|

—

|

|

—

|

|

1,478

|

|

|||||

|

Purchase of convertible note hedges

|

—

|

|

—

|

|

(167

|

)

|

|||||

|

Proceeds from the sale of common stock warrants

|

—

|

|

—

|

|

59

|

|

|||||

|

Proceeds from issuance of common stock under employee stock plans

|

120

|

|

154

|

|

69

|

|

|||||

|

Payments related to repurchases of common stock

|

(587

|

)

|

(814

|

)

|

(887

|

)

|

|||||

|

Dividends paid

|

(213

|

)

|

(186

|

)

|

(181

|

)

|

|||||

|

Tax benefit from stock-based compensation

|

10

|

|

18

|

|

26

|

|

|||||

|

Payments under capital lease obligations

|

(3

|

)

|

(3

|

)

|

(2

|

)

|

|||||

|

Other

|

(3

|

)

|

(3

|

)

|

(5

|

)

|

|||||

|

Net cash (used in) provided by financing activities

|

(676

|

)

|

(834

|

)

|

390

|

|

|||||

|

Change in cash and cash equivalents

|

99

|

|

(655

|

)

|

419

|

|

|||||

|

Cash and cash equivalents at beginning of period

|

497

|

|

1,152

|

|

733

|

|

|||||

|

Cash and cash equivalents at end of period

|

$

|

596

|

|

$

|

497

|

|

$

|

1,152

|

|

||

|

|

Year Ended

|

||||||||||

|

|

January 31, 2016

|

January 25, 2015

|

January 26, 2014

|

||||||||

|

Supplemental disclosures of cash flow information:

|

|||||||||||

|

Cash paid for income taxes, net

|

$

|

14

|

|

$

|

14

|

|

$

|

15

|

|

||

|

Cash paid for interest

|

$

|

17

|

|

$

|

17

|

|

$

|

3

|

|

||

|

Non-cash investing and financing activities:

|

|

|

|||||||||

|

Assets acquired by assuming related liabilities

|

$

|

19

|

|

$

|

10

|

|

$

|

3

|

|

||

|

Goodwill adjustment related to previously acquired business

|

$

|

—

|

|

$

|

(25

|

)

|

$

|

—

|

|

||

|

|

Year Ended

|

||||||||||

|

January 31,

2016 |

January 25,

2015 |

January 26,

2014 |

|||||||||

|

|

(In millions)

|

||||||||||

|

Cost of revenue

|

$

|

15

|

|

$

|

12

|

|

$

|

11

|

|

||

|

Research and development

|

115

|

|

88

|

|

83

|

|

|||||

|

Sales, general and administrative

|

74

|

|

58

|

|

42

|

|

|||||

|

Total

|

$

|

204

|

|

$

|

158

|

|

$

|

136

|

|

||

|

Year Ended

|

|||||||||||

|

January 31,

|

|

January 25,

|

January 26,

|

||||||||

|

2016

|

|

2015

|

2014

|

||||||||

|

(In millions, except per share data)

|

|||||||||||

|

Stock Options

|

|||||||||||

|

Awards granted

|

—

|

|

|

—

|

|

|

6

|

|

|||

|

Estimated total grant-date fair value

|

$

|

—

|

|

$

|

—

|

|

$

|

21

|

|

||

|

Weighted average grant-date fair value (per share)

|

$

|

—

|

|

$

|

—

|

|

$

|

3.47

|

|

||

|

RSUs, PSUs and Market-based PSUs

|

|||||||||||

|

Awards granted

|

13

|

|

13

|

|

11

|

|

|||||

|

Estimated total grant-date fair value

|

$

|

296

|

|

$

|

228

|

|

$

|

145

|

|

||

|

Weighted average grant-date fair value (per share)

|

$

|

22.01

|

|

$

|

17.68

|

|

$

|

13.46

|

|

||

|

ESPP

|

|||||||||||

|

Shares purchased

|

6

|

|

7

|

|

6

|

|

|||||

|

Weighted average price (per share)

|

$

|

13.67

|

|

$

|

10.99

|

|

$

|

10.79

|

|

||

|

Weighted average grant-date fair value (per share)

|

$

|

4.53

|

|

$

|

4.99

|

|

$

|

5.60

|

|

||

|

January 31,

|

January 25,

|

||||||

|

2016

|

2015

|

||||||

|

(In millions)

|

|||||||

|

Unearned stock-based compensation expense

|

$

|

381

|

|

$

|

291

|

|

|

|

Estimated weighted average remaining amortization period

|

(In years)

|

||||||

|

Stock Options

|

1.1

|

|

1.8

|

|

|||

|

RSUs, PSUs and Market-based PSUs

|

2.7

|

|

2.8

|

|

|||

|

ESPP

|

0.7

|

|

0.5

|

|

|||

|

|

Year Ended

|

||||||

|

|

January 31,

2016 |

January 25,

2015 |

January 26,

2014 |

||||

|

(Using a binomial model)

|

|||||||

|

Stock Options

|

|||||||

|

Weighted average expected life (in years)

|

—

|

|

—

|

|

2.4-3.5

|

||

|

Risk-free interest rate

|

—

|

|

—

|

|

1.8%-3.0%

|

||

|

Volatility

|

—

|

|

—

|

|

28%-37%

|

||

|

Dividend yield

|

—

|

|

—

|

|

1.9%-2.4%

|

||

|

|

Year Ended

|

||||

|

|

January 31,

2016 |

January 25,

2015 |

January 26,

2014 |

||

|

(Using the Black-Scholes model)

|

|||||

|

ESPP

|

|||||

|

Weighted average expected life (in years)

|

0.5-2.0

|

0.5-2.0

|

0.5-2.0

|

||

|

Risk-free interest rate

|

0.1%-0.7%

|

0.1%-0.5%

|

0.1%-0.4%

|

||

|

Volatility

|

24%-34%

|

23%-31%

|

32%-37%

|

||

|

Dividend yield

|

1.5%-1.8%

|

1.7%-1.9%

|

2.0%-2.4%

|

||

|

RSUs, PSUs and Market-based PSUs Outstanding

|

Options Outstanding

|