|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

36-2048898

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS. Employer Identification No.)

|

|

410 North Michigan Avenue, Suite 400, Chicago, Illinois

|

60611-4213

|

|

(Address of principal executive offices)

|

(Zip code)

|

|

Title of Each Class

|

Trading Symbol(s)

|

Name of Each Exchange on Which Registered

|

|

Common Stock, par value $0.10 per share

|

ODC

|

New York Stock Exchange

|

|

Large accelerated filer

|

o

|

|

Smaller reporting company

|

ý

|

|

Accelerated filer

|

ý

|

|

Emerging growth company

|

o

|

|

Non-accelerated filer

|

o

|

|||

|

Item

|

|

Page

|

||

|

|

||||

|

1

|

||||

|

|

|

|

|

|

|

1A.

|

|

|

||

|

|

|

|

|

|

|

1B.

|

|

|

||

|

|

|

|

|

|

|

2

|

|

|

||

|

|

|

|

|

|

|

3

|

|

|

||

|

|

|

|

|

|

|

4

|

|

Mine Safety Disclosure

|

|

|

|

|

|

|

|

|

|

|

||||

|

5

|

|

|

||

|

|

|

|

|

|

|

7

|

|

|

||

|

|

|

|

|

|

|

8

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

9

|

|

|

||

|

|

|

|

|

|

|

9A.

|

|

|

||

|

|

|

|

|

|

|

9B.

|

|

|

||

|

|

|

|

|

|

|

|

||||

|

10

|

|

|

||

|

|

|

|

|

|

|

11

|

|

|

||

|

|

|

|

|

|

|

12

|

|

|

||

|

|

|

|

|

|

|

13

|

|

|

||

|

|

|

|

|

|

|

14

|

|

|

||

|

Land & Mineral Rights

|

Plant and

Equipment

|

|||||||

|

Ochlocknee, Georgia

|

$

|

8,873

|

|

$

|

31,241

|

|

||

|

Ripley, Mississippi

|

$

|

2,006

|

|

$

|

14,013

|

|

||

|

Mounds, Illinois

|

$

|

1,637

|

|

$

|

2,903

|

|

||

|

Blue Mountain, Mississippi

|

$

|

908

|

|

$

|

10,323

|

|

||

|

Taft, California

|

$

|

1,747

|

|

$

|

5,263

|

|

||

|

•

|

fluctuating demand for our products and services;

|

|

•

|

size and timing of sales of our products and services;

|

|

•

|

the mix of products with varying profitability sold in a given quarter;

|

|

•

|

changes in our operating costs including raw materials, energy, transportation, packaging, overburden removal, trade spending and marketing, wages and other employee-related expenses such as health care costs, and other costs;

|

|

•

|

our ability to anticipate and adapt to rapidly changing conditions;

|

|

•

|

introduction of new products and services by us or our competitors;

|

|

•

|

our ability to successfully implement price increases and surcharges, as well as other changes in our pricing policies or those of our competitors;

|

|

•

|

variations in purchasing patterns by our customers, including due to weather conditions;

|

|

•

|

the ability of major customers and other debtors to meet their obligations to us as they come due;

|

|

•

|

our ability to successfully manage regulatory, intellectual property, tax and legal matters;

|

|

•

|

litigation and regulatory judgments and charges, settlements, or other litigation and regulatory-related costs;

|

|

•

|

the overall tax rate of our business, which may be affected by a number of factors, including the use of tax attributes, the financial results of our international subsidiaries and the timing, size and integration of acquisitions we may make from time to time;

|

|

•

|

the incurrence of restructuring, impairment or other charges; and

|

|

•

|

general economic conditions and specific economic conditions in our industry and the industries of our customers.

|

|

•

|

uncertainties in assessing the value, strengths, and potential profitability of acquisition candidates, and in identifying the extent of all weaknesses, risks, contingent and other liabilities (including environmental, legacy product or mining safety liabilities) of those candidates;

|

|

•

|

the potential loss of key customers, management and employees of an acquired business;

|

|

•

|

the ability to achieve identified operating and financial synergies anticipated to result from an acquisition;

|

|

•

|

problems that could arise from the integration of the acquired business; and

|

|

•

|

unanticipated changes in business, industry or general economic conditions that affect the assumptions underlying our rationale for pursuing the acquisition.

|

|

•

|

that a majority of the board of directors consists of independent directors;

|

|

•

|

that we have a nominating and governance committee comprised entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and

|

|

•

|

that we have a compensation committee comprised entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities.

|

|

•

|

fluctuations in our quarterly operating results or the operating results of our competitors;

|

|

•

|

changes in general conditions in the economy, the financial markets, or the industries in which we operate;

|

|

•

|

announcements of significant acquisitions, strategic alliances or joint ventures by us, our customers, suppliers or competitors;

|

|

•

|

introduction of new products or services;

|

|

•

|

increases in the price of energy sources and other raw materials; and

|

|

•

|

other developments affecting us, our industries, customers or competitors.

|

|

Land

Owned

|

Land

Leased

|

Land

Unpatented

Claims

|

Total

|

Estimated

Proven

Reserves

|

Estimated

Probable

Reserves

|

Total

|

|||||||||||||||

|

(acres)

|

(thousands of tons)

|

||||||||||||||||||||

|

California

|

795

|

|

—

|

|

1,030

|

|

1,825

|

|

3,806

|

|

11,226

|

|

15,032

|

|

|||||||

|

Georgia

|

3,851

|

|

1,447

|

|

—

|

|

5,298

|

|

33,062

|

|

22,640

|

|

55,702

|

|

|||||||

|

Illinois

|

105

|

|

508

|

|

—

|

|

613

|

|

2,651

|

|

1,596

|

|

4,247

|

|

|||||||

|

Mississippi

|

2,219

|

|

999

|

|

—

|

|

3,218

|

|

36,385

|

|

129,978

|

|

166,363

|

|

|||||||

|

Nevada

|

535

|

|

—

|

|

—

|

|

535

|

|

23,316

|

|

2,976

|

|

26,292

|

|

|||||||

|

Oregon

|

340

|

|

—

|

|

—

|

|

340

|

|

—

|

|

25

|

|

25

|

|

|||||||

|

Tennessee

|

178

|

|

—

|

|

—

|

|

178

|

|

3,000

|

|

3,000

|

|

6,000

|

|

|||||||

|

|

8,023

|

|

2,954

|

|

1,030

|

|

12,007

|

|

102,220

|

|

171,441

|

|

273,661

|

|

|||||||

|

Location

|

Owned/Leased

|

Function

|

|

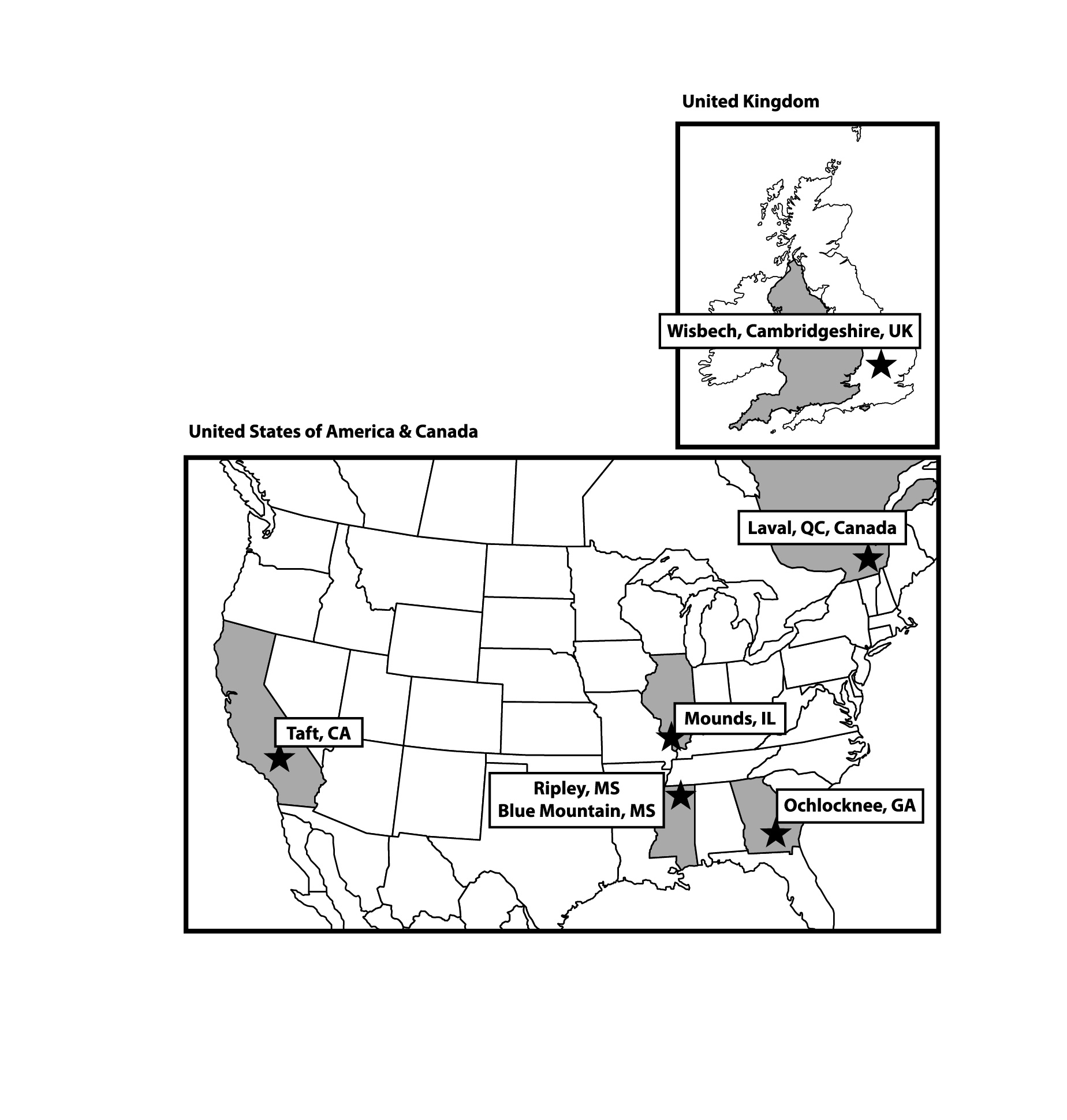

Alpharetta, Georgia

|

Leased

|

Non-clay manufacturing and packaging, sales, customer service

|

|

Blue Mountain, Mississippi

|

Owned

|

Manufacturing and packaging

|

|

Chicago, Illinois

|

Leased

|

Principal executive office

|

|

Coppet, Switzerland

|

Leased

|

Customer service office

|

|

Laval, Quebec, Canada

|

Owned

|

Non-clay manufacturing and clay and non-clay packaging, sales

|

|

Mounds, Illinois

|

Owned

|

Manufacturing and packaging

|

|

Ochlocknee, Georgia

|

Owned

|

Manufacturing and packaging

|

|

Ripley, Mississippi

|

Owned

|

Manufacturing and packaging

|

|

Shenzhen, China

|

Leased

|

Sales office, customer service

|

|

Taft, California

|

Owned

|

Manufacturing and packaging

|

|

Vernon Hills, Illinois

|

Owned & Leased

|

Research and development

|

|

Wisbech, United Kingdom

|

Leased

|

Non-clay manufacturing and clay and non-clay packaging, sales, customer service

|

|

ISSUER PURCHASES OF EQUITY SECURITIES

1

|

||||||||

|

(a)

|

(b)

|

(c)

|

(d)

|

|||||

|

For the Three Months Ended July 31, 2019

|

Total Number of Shares Purchased

|

Average Price Paid per Share

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

|

Maximum Number of Shares that may yet be Purchased Under Plans or Programs

2

|

||||

|

May, 1 2019 to May 31, 2019

|

—

|

$—

|

—

|

1,046,090

|

||||

|

June 1, 2019 to June 30, 2019

|

—

|

$—

|

—

|

1,046,090

|

||||

|

July 1, 2019 to July 31, 2019

|

173

|

$35.43

|

—

|

1,045,917

|

||||

|

2019

|

2018

|

|||||||

|

Net cash provided by operating activities

|

$

|

26,743

|

|

$

|

10,612

|

|

||

|

Net cash (used in) provided by investing activities

|

(7,888

|

)

|

2,572

|

|

||||

|

Net cash used in financing activities

|

(9,886

|

)

|

(9,339

|

)

|

||||

|

Effect of exchange rate changes on cash and cash equivalents

|

136

|

|

(183

|

)

|

||||

|

Net increase in cash and cash equivalents

|

$

|

9,105

|

|

$

|

3,662

|

|

||

|

|

July 31,

|

|||||||

|

2019

|

2018

|

|||||||

|

ASSETS

|

(in thousands)

|

|||||||

|

Current Assets

|

|

|

||||||

|

Cash and cash equivalents

|

$

|

21,862

|

|

$

|

12,757

|

|

||

|

Short-term investments

|

—

|

|

7,124

|

|

||||

|

Accounts receivable, less allowance of $644 and $817

in 2019 and 2018, respectively |

35,459

|

|

33,602

|

|

||||

|

Inventories, net

|

24,163

|

|

22,521

|

|

||||

|

Prepaid repairs expense

|

4,708

|

|

4,111

|

|

||||

|

Prepaid expenses and other assets

|

3,084

|

|

2,899

|

|

||||

|

Total Current Assets

|

89,276

|

|

83,014

|

|

||||

|

Property, Plant and Equipment

|

|

|

||||||

|

Buildings and leasehold improvements

|

38,852

|

|

38,534

|

|

||||

|

Machinery and equipment

|

145,402

|

|

141,530

|

|

||||

|

Office furniture and equipment

|

20,569

|

|

11,089

|

|

||||

|

Vehicles

|

15,375

|

|

14,151

|

|

||||

|

Gross depreciable assets

|

220,198

|

|

205,304

|

|

||||

|

Less accumulated depreciation and amortization

|

(159,036

|

)

|

(149,385

|

)

|

||||

|

Net depreciable assets

|

61,162

|

|

55,919

|

|

||||

|

Construction in progress

|

12,519

|

|

13,985

|

|

||||

|

Land and mineral rights

|

17,117

|

|

16,802

|

|

||||

|

Total Property, Plant and Equipment, Net

|

90,798

|

|

86,706

|

|

||||

|

Other Assets

|

|

|

||||||

|

Goodwill

|

9,262

|

|

9,262

|

|

||||

|

Trademarks and patents, net of accumulated amortization

of $299 and $267 in 2019 and 2018, respectively |

1,599

|

|

1,220

|

|

||||

|

Customer list, net of accumulated amortization

of $6,297 and $5,540 in 2019 and 2018, respectively |

1,488

|

|

2,245

|

|

||||

|

Deferred income taxes

|

7,755

|

|

7,349

|

|

||||

|

Other

|

5,049

|

|

4,886

|

|

||||

|

Total Other Assets

|

25,153

|

|

24,962

|

|

||||

|

Total Assets

|

$

|

205,227

|

|

$

|

194,682

|

|

||

|

|

July 31,

|

|||||||

|

|

2019

|

2018

|

||||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

(in thousands)

|

|||||||

|

Current Liabilities

|

|

|||||||

|

Current maturities of notes payable

|

$

|

3,083

|

|

$

|

3,083

|

|

||

|

Accounts payable

|

8,092

|

|

6,543

|

|

||||

|

Dividends payable

|

1,761

|

|

1,627

|

|

||||

|

Accrued expenses

|

|

|

||||||

|

Salaries, wages and commissions

|

6,740

|

|

8,974

|

|

||||

|

Trade promotions and advertising

|

1,588

|

|

1,280

|

|

||||

|

Freight

|

2,635

|

|

1,767

|

|

||||

|

Other

|

8,707

|

|

7,675

|

|

||||

|

Total Current Liabilities

|

32,606

|

|

30,949

|

|

||||

|

Noncurrent Liabilities

|

|

|

||||||

|

Notes payable, net of unamortized debt issuance costs of $31 and $60 in 2019 and 2018, respectively

|

3,052

|

|

6,107

|

|

||||

|

Deferred compensation

|

6,014

|

|

6,100

|

|

||||

|

Pension and postretirement benefits

|

23,721

|

|

15,906

|

|

||||

|

Other

|

4,288

|

|

3,735

|

|

||||

|

Total Noncurrent Liabilities

|

37,075

|

|

31,848

|

|

||||

|

Total Liabilities

|

69,681

|

|

62,797

|

|

||||

|

Stockholders’ Equity

|

|

|

||||||

|

Common Stock, par value $.10 per share, issued 8,284,199 shares in 2019 and 8,086,849 shares in 2018

|

828

|

|

809

|

|

||||

|

Class B Stock, convertible, par value $.10 per share, issued 2,576,479 shares in 2019 and 2,468,979 shares in 2018

|

258

|

|

247

|

|

||||

|

Additional paid-in capital

|

41,300

|

|

38,473

|

|

||||

|

Retained earnings

|

164,756

|

|

158,935

|

|

||||

|

Noncontrolling interest

|

(14

|

)

|

(18

|

)

|

||||

|

Accumulated Other Comprehensive Loss

|

|

|

||||||

|

Pension and postretirement benefits

|

(14,891

|

)

|

(10,384

|

)

|

||||

|

Cumulative translation adjustment

|

(148

|

)

|

(231

|

)

|

||||

|

Total Accumulated Other Comprehensive Loss

|

(15,039

|

)

|

(10,615

|

)

|

||||

|

Less treasury stock, at cost (2,926,547 Common and 324,741 Class B shares in 2019 and 2,914,092 Common and 324,741 Class B shares in 2018)

|

(56,543

|

)

|

(55,946

|

)

|

||||

|

Total Stockholders’ Equity

|

135,546

|

|

131,885

|

|

||||

|

Total Liabilities and Stockholders’ Equity

|

$

|

205,227

|

|

$

|

194,682

|

|

||

|

|

Year Ended July 31,

|

|||||||

|

|

2019

|

2018

|

||||||

|

|

(in thousands, except for per share data)

|

|||||||

|

Net Sales

|

$

|

277,025

|

|

$

|

266,000

|

|

||

|

Cost of Sales (1)

|

(211,365

|

)

|

(194,078

|

)

|

||||

|

Gross Profit

|

65,660

|

|

71,922

|

|

||||

|

Selling, General and Administrative Expenses (1)

|

(55,248

|

)

|

(56,045

|

)

|

||||

|

Income from Operations

|

10,412

|

|

15,877

|

|

||||

|

Other Income (Expense)

|

|

|

||||||

|

Interest income

|

250

|

|

259

|

|

||||

|

Interest expense

|

(594

|

)

|

(676

|

)

|

||||

|

Foreign exchange loss

|

(243

|

)

|

—

|

|

||||

|

Other, net (1) (2)

|

4,723

|

|

(594

|

)

|

||||

|

Total Other Income (Expense), Net

|

4,136

|

|

(1,011

|

)

|

||||

|

Income Before Income Taxes

|

14,548

|

|

14,866

|

|

||||

|

Income Tax Expense

|

(1,933

|

)

|

(6,644

|

)

|

||||

|

Net Income

|

$

|

12,615

|

|

$

|

8,222

|

|

||

|

Net Income (Loss) Attributable to Noncontrolling Interest

|

4

|

|

(18

|

)

|

||||

|

Net Income Attributable to Oil-Dri

|

12,611

|

|

8,240

|

|

||||

|

Net Income Per Share

|

|

|

||||||

|

Basic Common

|

$

|

1.82

|

|

$

|

1.22

|

|

||

|

Basic Class B Common

|

$

|

1.36

|

|

$

|

0.91

|

|

||

|

Diluted Common

|

$

|

1.67

|

|

$

|

1.11

|

|

||

|

Average Shares Outstanding

|

|

|||||||

|

Basic Common

|

5,112

|

|

5,036

|

|

||||

|

Basic Class B Common

|

2,068

|

|

2,097

|

|

||||

|

Diluted Common

|

7,251

|

|

7,222

|

|

||||

|

|

Year Ended July 31,

|

|||||||

|

|

2019

|

2018

|

||||||

|

|

(in thousands)

|

|||||||

|

Net Income Attributable to Oil-Dri

|

$

|

12,611

|

|

$

|

8,240

|

|

||

|

Other Comprehensive (Loss) Income:

|

||||||||

|

Pension and postretirement benefits (net of tax)

|

(4,507

|

)

|

2,207

|

|

||||

|

Cumulative translation adjustment

|

83

|

|

(266

|

)

|

||||

|

Other Comprehensive (Loss) Income

|

(4,424

|

)

|

1,941

|

|

||||

|

Comprehensive Income

|

$

|

8,187

|

|

$

|

10,181

|

|

||

|

|

Number of Shares

|

(in thousands)

|

|||||||||||||||||||||||||||||||

|

Common

& Class B

Stock

|

Treasury

Stock

|

Common

& Class B

Stock

|

Additional

Paid-In

Capital

|

Retained

Earnings

|

Treasury

Stock

|

Accumulated

Other

Comprehensive

Loss

|

Non-Controlling Interest

|

Total

Stockholders’

Equity

|

|||||||||||||||||||||||||

|

Balance, July 31, 2017

|

10,528,678

|

|

(3,232,111

|

)

|

$

|

1,053

|

|

$

|

36,242

|

|

$

|

154,735

|

|

$

|

(55,701

|

)

|

$

|

(10,292

|

)

|

$

|

—

|

|

$

|

126,037

|

|

||||||||

|

Net income

|

—

|

|

—

|

|

8,240

|

|

—

|

|

—

|

|

(18

|

)

|

8,222

|

|

|||||||||||||||||||

|

Other comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

1,941

|

|

—

|

|

1,941

|

|

|||||||||||||||||||

|

Reclassification upon adoption of accounting standard

|

—

|

|

—

|

|

2,264

|

|

—

|

|

(2,264

|

)

|

—

|

|

—

|

|

|||||||||||||||||||

|

Dividends declared

|

—

|

|

—

|

|

(6,304

|

)

|

—

|

|

—

|

|

—

|

|

(6,304

|

)

|

|||||||||||||||||||

|

Purchases of treasury stock

|

(622

|

)

|

—

|

|

—

|

|

—

|

|

(27

|

)

|

—

|

|

—

|

|

(27

|

)

|

|||||||||||||||||

|

Net issuance of stock under long-term incentive plans

|

27,150

|

|

(6,100

|

)

|

3

|

|

456

|

|

—

|

|

(218

|

)

|

—

|

|

—

|

|

241

|

|

|||||||||||||||

|

Amortization of restricted stock

|

—

|

|

1,775

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1,775

|

|

|||||||||||||||||||

|

Balance, July 31, 2018

|

10,555,828

|

|

(3,238,833

|

)

|

$

|

1,056

|

|

$

|

38,473

|

|

$

|

158,935

|

|

$

|

(55,946

|

)

|

$

|

(10,615

|

)

|

$

|

(18

|

)

|

$

|

131,885

|

|

||||||||

|

Net income

|

—

|

|

—

|

|

12,611

|

|

—

|

|

—

|

|

4

|

|

12,615

|

|

|||||||||||||||||||

|

Other comprehensive loss

|

—

|

|

—

|

|

—

|

|

—

|

|

(4,424

|

)

|

—

|

|

(4,424

|

)

|

|||||||||||||||||||

|

Dividends declared

|

—

|

|

—

|

|

(6,790

|

)

|

—

|

|

—

|

|

—

|

|

(6,790

|

)

|

|||||||||||||||||||

|

Purchases of treasury stock

|

(4,905

|

)

|

—

|

|

—

|

|

—

|

|

(147

|

)

|

—

|

|

—

|

|

(147

|

)

|

|||||||||||||||||

|

Net issuance of stock under long-term incentive plans

|

304,850

|

|

(7,550

|

)

|

30

|

|

419

|

|

—

|

|

(450

|

)

|

—

|

|

—

|

|

(1

|

)

|

|||||||||||||||

|

Amortization of restricted stock

|

—

|

|

2,408

|

|

—

|

|

—

|

|

—

|

|

—

|

|

2,408

|

|

|||||||||||||||||||

|

Balance, July 31, 2019

|

10,860,678

|

|

(3,251,288

|

)

|

$

|

1,086

|

|

$

|

41,300

|

|

$

|

164,756

|

|

$

|

(56,543

|

)

|

$

|

(15,039

|

)

|

$

|

(14

|

)

|

$

|

135,546

|

|

||||||||

|

|

Year-Ended July 31,

|

|||||||

|

|

2019

|

2018

|

||||||

|

(in thousands)

|

||||||||

|

Cash Flows from Operating Activities

|

||||||||

|

Net income

|

$

|

12,615

|

|

$

|

8,222

|

|

||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|||||||

|

Depreciation and amortization

|

13,330

|

|

12,756

|

|

||||

|

Amortization of investment discounts

|

(10

|

)

|

(129

|

)

|

||||

|

Non-cash stock compensation expense

|

2,407

|

|

1,600

|

|

||||

|

Deferred income taxes

|

(406

|

)

|

7,270

|

|

||||

|

Provision for bad debts and cash discounts

|

(179

|

)

|

252

|

|

||||

|

Loss on the sale of property, plant and equipment

|

6

|

|

84

|

|

||||

|

Life insurance benefits

|

—

|

|

(340

|

)

|

||||

|

(Increase) decrease in:

|

|

|||||||

|

Accounts receivable

|

(1,729

|

)

|

(522

|

)

|

||||

|

Inventories

|

(1,693

|

)

|

225

|

|

||||

|

Prepaid expenses

|

(786

|

)

|

(807

|

)

|

||||

|

Other assets

|

(617

|

)

|

134

|

|

||||

|

Increase (decrease) in:

|

||||||||

|

Accounts payable

|

590

|

|

(2,436

|

)

|

||||

|

Accrued expenses

|

(589

|

)

|

771

|

|

||||

|

Deferred compensation

|

(86

|

)

|

(5,437

|

)

|

||||

|

Pension and postretirement benefits

|

3,307

|

|

(11,048

|

)

|

||||

|

Other liabilities

|

583

|

|

17

|

|

||||

|

Total Adjustments

|

14,128

|

|

2,390

|

|

||||

|

Net Cash Provided by Operating Activities

|

26,743

|

|

10,612

|

|

||||

|

Cash Flows from Investing Activities

|

|

|||||||

|

Capital expenditures

|

(15,029

|

)

|

(15,074

|

)

|

||||

|

Proceeds from sale of property, plant and equipment

|

7

|

|

48

|

|

||||

|

Acquisition of business

|

—

|

|

(730

|

)

|

||||

|

Purchases of short-term investments

|

(4,678

|

)

|

(35,911

|

)

|

||||

|

Dispositions of short-term investments

|

11,812

|

|

52,492

|

|

||||

|

Proceeds from life insurance

|

—

|

|

1,747

|

|

||||

|

Net Cash (Used in) Provided by Investing Activities

|

(7,888

|

)

|

2,572

|

|

||||

|

Cash Flows from Financing Activities

|

|

|||||||

|

Principal payments on notes payable

|

(3,083

|

)

|

(3,083

|

)

|

||||

|

Dividends paid

|

(6,656

|

)

|

(6,230

|

)

|

||||

|

Purchase of treasury stock

|

(147

|

)

|

(26

|

)

|

||||

|

Net Cash Used in Financing Activities

|

(9,886

|

)

|

(9,339

|

)

|

||||

|

Effect of exchange rate changes on cash and cash equivalents

|

136

|

|

(183

|

)

|

||||

|

Net Increase in Cash and Cash Equivalents

|

9,105

|

|

3,662

|

|

||||

|

Cash and Cash Equivalents, Beginning of Year

|

12,757

|

|

9,095

|

|

||||

|

Cash and Cash Equivalents, End of Year

|

$

|

21,862

|

|

$

|

12,757

|

|

||

|

Year-Ended July 31,

|

||||||||

|

2019

|

2018

|

|||||||

|

(in thousands)

|

||||||||

|

Supplemental disclosure:

|

||||||||

|

Other cash flows:

|

||||||||

|

Interest payments, net of amounts capitalized

|

$

|

305

|

|

$

|

282

|

|

||

|

Income tax (refund) payments

|

$

|

(713

|

)

|

$

|

1,994

|

|

||

|

Noncash investing and financing activities:

|

||||||||

|

Capital expenditures accrued, but not paid

|

$

|

2,263

|

|

$

|

997

|

|

||

|

Cash dividends declared and accrued, but not paid

|

$

|

1,761

|

|

$

|

1,627

|

|

||

|

2018

|

||||

|

U.S. Treasury securities

|

$

|

3,992

|

|

|

|

Certificates of deposit

|

3,132

|

|

||

|

Short-term investments

|

$

|

7,124

|

|

|

|

|

2019

|

2018

|

||||||

|

Finished goods

|

$

|

13,957

|

|

$

|

14,223

|

|

||

|

Packaging

|

5,681

|

|

5,349

|

|

||||

|

Other

|

4,525

|

|

2,949

|

|

||||

|

Inventories

|

$

|

24,163

|

|

$

|

22,521

|

|

||

|

2020

|

$

|

667

|

|

|

2021

|

$

|

484

|

|

|

2022

|

$

|

334

|

|

|

2023

|

$

|

201

|

|

|

2024

|

$

|

68

|

|

|

Weighted Average Amortization Period

|

|

|

Trademarks and patents

|

15.2

|

|

Debt issuance costs

|

1.1

|

|

Customer list

|

4.3

|

|

Total intangible assets subject to amortization

|

6.5

|

|

|

Years

|

||

|

Buildings and leasehold improvements

|

3

|

-

|

40

|

|

Machinery and equipment

|

|

||

|

Packaging

|

2

|

-

|

20

|

|

Processing

|

2

|

-

|

25

|

|

Mining and other

|

3

|

-

|

20

|

|

Office furniture and equipment

|

2

|

-

|

15

|

|

Vehicles

|

2

|

-

|

15

|

|

Business to Business Products Group

|

Retail and Wholesale Products Group

|

||||||||||||||

|

Year Ended July 31,

|

|||||||||||||||

|

Product

|

2019

|

2018

|

2019

|

2018

|

|||||||||||

|

Cat Litter

|

$

|

13,764

|

|

$

|

13,301

|

|

$

|

135,489

|

|

$

|

124,635

|

|

|||

|

Industrial and Sports

|

—

|

|

—

|

|

33,341

|

|

34,224

|

|

|||||||

|

Agricultural and Horticultural

|

24,311

|

|

23,897

|

|

—

|

|

—

|

|

|||||||

|

Bleaching Clay and Fluids Purification

|

51,905

|

|

49,783

|

|

2,318

|

|

2,098

|

|

|||||||

|

Animal Health and Nutrition

|

15,897

|

|

18,062

|

|

—

|

|

—

|

|

|||||||

|

Net Sales

|

$

|

105,877

|

|

$

|

105,043

|

|

$

|

171,148

|

|

$

|

160,957

|

|

|||

|

July 31,

|

||||||||||||||||

|

Assets

|

||||||||||||||||

|

2019

|

2018

|

|||||||||||||||

|

(in thousands)

|

||||||||||||||||

|

Business to Business Products

|

$

|

65,282

|

|

$

|

65,143

|

|

||||||||||

|

Retail and Wholesale Products

|

94,809

|

|

89,623

|

|

||||||||||||

|

Unallocated assets

|

45,136

|

|

39,916

|

|

||||||||||||

|

Total Assets

|

$

|

205,227

|

|

$

|

194,682

|

|

||||||||||

|

|

Year Ended July 31,

|

|||||||||||||||

|

|

Net Sales

|

Income

|

||||||||||||||

|

|

2019

|

2018

|

2019

|

2018

|

||||||||||||

|

|

(in thousands)

|

|||||||||||||||

|

Business to Business Products

|

$

|

105,877

|

|

$

|

105,043

|

|

$

|

31,388

|

|

$

|

35,120

|

|

||||

|

Retail and Wholesale Products

|

171,148

|

|

160,957

|

|

8,683

|

|

6,975

|

|

||||||||

|

Net Sales

|

$

|

277,025

|

|

$

|

266,000

|

|

|

|

|

|

||||||

|

Corporate Expenses

|

(29,659

|

)

|

(26,218

|

)

|

||||||||||||

|

Income from Operations

|

10,412

|

|

15,877

|

|

||||||||||||

|

Total Other Income (Expense), Net

|

4,136

|

|

(1,011

|

)

|

||||||||||||

|

Income Before Income Taxes

|

14,548

|

|

14,866

|

|

||||||||||||

|

Income Tax Expense

|

(1,933

|

)

|

(6,644

|

)

|

||||||||||||

|

Net Income

|

$

|

12,615

|

|

$

|

8,222

|

|

||||||||||

|

Net Income (Loss) Attributable to Noncontrolling Interest

|

$

|

4

|

|

$

|

(18

|

)

|

||||||||||

|

Net Income Attributable to Oil-Dri

|

$

|

12,611

|

|

$

|

8,240

|

|

||||||||||

|

|

2019

|

2018

|

||||||

|

Sales to unaffiliated customers by:

|

|

|

||||||

|

Domestic operations

|

$

|

264,476

|

|

$

|

254,158

|

|

||

|

Foreign subsidiaries

|

$

|

12,549

|

|

$

|

11,842

|

|

||

|

Sales or transfers between geographic areas:

|

|

|||||||

|

Domestic operations

|

$

|

5,097

|

|

$

|

5,570

|

|

||

|

Income before income taxes:

|

|

|||||||

|

Domestic operations

|

$

|

14,280

|

|

$

|

14,742

|

|

||

|

Foreign subsidiaries

|

$

|

268

|

|

$

|

124

|

|

||

|

Net Income (Loss) attributable to Oil-Dri:

|

|

|||||||

|

Domestic operations

|

$

|

12,456

|

|

$

|

8,249

|

|

||

|

Foreign subsidiaries

|

$

|

155

|

|

$

|

(9

|

)

|

||

|

Identifiable assets:

|

|

|||||||

|

Domestic operations

|

$

|

195,032

|

|

$

|

185,361

|

|

||

|

Foreign subsidiaries

|

$

|

10,195

|

|

$

|

9,321

|

|

||

|

|

2019

|

2018

|

||

|

Net sales for the years ended July 31

|

20%

|

18%

|

||

|

Net accounts receivable as of July 31

|

26%

|

26%

|

||

|

|

2019

|

2018

|

||||||

|

Senior notes payable in annual principal installments on August 1: $3,083 in each fiscal year 2020 through 2021. Interest is payable semiannually at an annual rate of 3.96%

|

$

|

6,167

|

|

$

|

9,250

|

|

||

|

Less current maturities of notes payable

|

(3,083

|

)

|

(3,083

|

)

|

||||

|

Less unamortized debt issuance costs

|

$

|

(32

|

)

|

$

|

(60

|

)

|

||

|

Noncurrent notes payable

|

$

|

3,052

|

|

$

|

6,107

|

|

||

|

2020

|

$

|

3,083

|

|

|

2021

|

3,084

|

|

|

|

Total

|

$

|

6,167

|

|

|

Level 1:

|

Financial assets and liabilities whose values are based on quoted market prices in active markets for identical assets or liabilities.

|

|||

|

Level 2:

|

Financial assets and liabilities whose values are based on:

|

|||

|

|

1)

|

Quoted prices for similar assets or liabilities in active markets.

|

||

|

|

2)

|

Quoted prices for identical or similar assets or liabilities in markets that are not active.

|

||

|

|

3)

|

Valuation models whose inputs are observable, directly or indirectly, for substantially the full term of the asset or liability.

|

||

|

Level 3:

|

Financial assets and liabilities whose values are based on valuation techniques that require inputs that are both unobservable and significant to the overall fair value measurement. These inputs may reflect estimates of the assumptions that market participants would use in valuing the financial assets and liabilities.

|

|||

|

|

2019

|

2018

|

||||||

|

Current

|

|

|

||||||

|

Federal

|

$

|

(529

|

)

|

$

|

4,490

|

|

||

|

Foreign

|

(5

|

)

|

57

|

|

||||

|

State

|

1,416

|

|

149

|

|

||||

|

Current Income Tax Total

|

882

|

|

4,696

|

|

||||

|

Deferred

|

|

|

||||||

|

Federal

|

1,344

|

|

1,491

|

|

||||

|

Foreign

|

113

|

|

94

|

|

||||

|

State

|

(406

|

)

|

363

|

|

||||

|

Deferred Income Tax Total

|

1,051

|

|

1,948

|

|

||||

|

Total Income Tax Expense

|

$

|

1,933

|

|

$

|

6,644

|

|

||

|

|

2019

|

2018

|

||||

|

U.S. federal income tax rate

|

21.0

|

%

|

26.9

|

%

|

||

|

Depletion deductions allowed for mining

|

(8.2

|

)

|

(10.1

|

)

|

||

|

State income tax expense, net of federal tax expense

|

2.5

|

|

2.5

|

|

||

|

Difference in effective tax rate of foreign subsidiaries

|

0.2

|

|

0.1

|

|

||

|

Prior year income taxes

|

(1.9

|

)

|

0.2

|

|

||

|

Change in federal tax rate applied to deferred tax assets and liabilities

|

—

|

|

26.8

|

|

||

|

Deduction for domestic production activities

|

—

|

|

(1.4

|

)

|

||

|

Other

|

(0.3

|

)

|

(0.3

|

)

|

||

|

Effective income tax rate

|

13.3

|

%

|

44.7

|

%

|

||

|

|

2019

|

2018

|

||||||||||||||

|

|

Assets

|

Liabilities

|

Assets

|

Liabilities

|

||||||||||||

|

Depreciation

|

$

|

—

|

|

$

|

3,995

|

|

$

|

—

|

|

$

|

3,284

|

|

||||

|

Deferred compensation

|

2,121

|

|

—

|

|

2,057

|

|

—

|

|

||||||||

|

Postretirement benefits

|

6,100

|

|

—

|

|

4,164

|

|

—

|

|

||||||||

|

Allowance for doubtful accounts

|

81

|

|

—

|

|

118

|

|

—

|

|

||||||||

|

Deferred marketing expenses

|

—

|

|

326

|

|

—

|

|

13

|

|

||||||||

|

Other assets

|

390

|

|

—

|

|

374

|

|

—

|

|

||||||||

|

Accrued expenses

|

2,076

|

|

—

|

|

2,131

|

|

—

|

|

||||||||

|

Tax credits

|

250

|

|

—

|

|

683

|

|

—

|

|

||||||||

|

Amortization

|

166

|

|

—

|

|

200

|

|

—

|

|

||||||||

|

Inventories

|

264

|

|

—

|

|

570

|

|

—

|

|

||||||||

|

Depletion

|

—

|

|

173

|

|

—

|

|

293

|

|

||||||||

|

Stock-based compensation

|

556

|

|

—

|

|

367

|

|

—

|

|

||||||||

|

Reclamation

|

392

|

|

—

|

|

309

|

|

—

|

|

||||||||

|

Other assets – foreign

|

585

|

|

—

|

|

755

|

|

—

|

|

||||||||

|

Valuation allowance

|

(732

|

)

|

—

|

|

(789

|

)

|

—

|

|

||||||||

|

Total deferred taxes

|

$

|

12,249

|

|

$

|

4,494

|

|

$

|

10,939

|

|

$

|

3,590

|

|

||||

|

Pension and Postretirement Health Benefits

|

Cumulative Translation Adjustment

|

Total Accumulated Other Comprehensive (Loss) Income

|

|||||||||

|

Balance as of July 31, 2017

|

$

|

(10,327

|

)

|

$

|

35

|

|

(10,292

|

)

|

|||

|

Other comprehensive income (loss) before reclassifications, net of tax

|

1,310

|

|

a)

|

(266

|

)

|

1,044

|

|

||||

|

Amounts reclassified from accumulated other comprehensive income, net of tax

|

897

|

|

b)

|

—

|

|

897

|

|

||||

|

Net current-period other comprehensive income (loss), net of tax

|

2,207

|

|

(266

|

)

|

1,941

|

|

|||||

|

Reclassification to retained earnings upon adoption of accounting standard

|

$

|

(2,264

|

)

|

$

|

—

|

|

$

|

(2,264

|

)

|

||

|

Balance as of July 31, 2018

|

$

|

(10,384

|

)

|

$

|

(231

|

)

|

$

|

(10,615

|

)

|

||

|

Other comprehensive (loss) income before reclassifications, net of tax

|

(5,089

|

)

|

a)

|

83

|

|

(5,006

|

)

|

||||

|

Amounts reclassified from accumulated other comprehensive income, net of tax

|

582

|

|

b)

|

—

|

|

582

|

|

||||

|

Net current-period other comprehensive (loss) income, net of tax

|

(4,507

|

)

|

83

|

|

(4,424

|

)

|

|||||

|

Balance as of July 31, 2019

|

$

|

(14,891

|

)

|

$

|

(148

|

)

|

$

|

(15,039

|

)

|

||

|

a)

|

Amounts are net of taxes of $

1,607,000

and

$413,000

in fiscal years

2019

and

2018

, respectively, and are included in Other Comprehensive Loss.

|

|

b)

|

Amounts are net of taxes of

$185,000

and

$373,000

in fiscal years

2019

and

2018

, respectively. Amounts are included in the components of net periodic benefit cost for the pension and postretirement health plans.

|

|

Number of

Shares

(in thousands)

|

Weighted

Average

Grant Date

Fair Value

|

Weighted

Average

Remaining

Contractual

Term

(Years)

|

Unamortized

Expense

(in thousands)

|

|||||||||

|

Non-vested restricted stock outstanding at July 31, 2017

|

185

|

|

$

|

30.96

|

|

2.8

|

$

|

3,893

|

|

|||

|

Granted

|

27

|

|

$

|

42.59

|

|

|||||||

|

Vested

|

(28

|

)

|

$

|

29.88

|

|

|

|

|

||||

|

Forfeited

|

(6

|

)

|

$

|

35.90

|

|

|||||||

|

Non-vested restricted stock outstanding at July 31, 2018

|

178

|

|

$

|

32.74

|

|

1.7

|

$

|

3,050

|

|

|||

|

Granted

|

321

|

|

$

|

32.89

|

|

|||||||

|

Vested

|

(61

|

)

|

$

|

31.90

|

|

|

|

|

||||

|

Forfeited

|

(24

|

)

|

$

|

30.85

|

|

|||||||

|

Non-vested restricted stock outstanding at July 31, 2019

|

414

|

|

$

|

33.09

|

|

4.5

|

$

|

10,474

|

|

|||

|

|

Pension Benefits

|

Postretirement Health Benefits

|

||||||||||||||

|

|

2019

|

2018

|

2019

|

2018

|

||||||||||||

|

Change in benefit obligation

:

|

|

|

|

|

||||||||||||

|

Benefit obligation, beginning of year

|

$

|

54,267

|

|

$

|

53,742

|

|

$

|

2,667

|

|

$

|

2,925

|

|

||||

|

Service cost

|

1,626

|

|

1,723

|

|

105

|

|

106

|

|

||||||||

|

Interest cost

|

2,114

|

|

2,022

|

|

97

|

|

84

|

|

||||||||

|

Actuarial loss (gain)

|

5,125

|

|

(1,811

|

)

|

97

|

|

(363

|

)

|

||||||||

|

Benefits paid

|

(1,579

|

)

|

(1,409

|

)

|

(8

|

)

|

(85

|

)

|

||||||||

|

Benefit obligation, end of year

|

61,553

|

|

54,267

|

|

2,958

|

|

2,667

|

|

||||||||

|

Change in plan assets:

|

|

|

|

|

||||||||||||

|

Fair value of plan assets, beginning of year

|

40,971

|

|

27,457

|

|

—

|

|

—

|

|

||||||||

|

Actual return on plan assets

|

1,333

|

|

1,719

|

|

—

|

|

—

|

|

||||||||

|

Employer contribution

|

—

|

|

13,204

|

|

8

|

|

85

|

|

||||||||

|

Benefits paid

|

(1,579

|

)

|

(1,409

|

)

|

(8

|

)

|

(85

|

)

|

||||||||

|

Fair value of plan assets, end of year

|

40,725

|

|

40,971

|

|

—

|

|

—

|

|

||||||||

|

Funded status, recorded in Consolidated Balance Sheets

|

$

|

(20,828

|

)

|

$

|

(13,296

|

)

|

$

|

(2,958

|

)

|

$

|

(2,667

|

)

|

||||

|

Pension Benefits

|

Postretirement Health

Benefits

|

|||||||||||||||

|

|

2019

|

2018

|

2019

|

2018

|

||||||||||||

|

Deferred income taxes

|

$

|

5,346

|

|

$

|

3,525

|

|

$

|

754

|

|

$

|

639

|

|

||||

|

Other current liabilities

|

$

|

—

|

|

$

|

—

|

|

$

|

(65

|

)

|

$

|

(57

|

)

|

||||

|

Other noncurrent liabilities

|

$

|

(20,828

|

)

|

$

|

(13,296

|

)

|

$

|

(2,893

|

)

|

$

|

(2,610

|

)

|

||||

|

Accumulated other comprehensive loss – net of tax:

|

||||||||||||||||

|

Net actuarial loss

|

$

|

14,731

|

|

$

|

10,301

|

|

$

|

184

|

|

$

|

110

|

|

||||

|

Prior service cost (income)

|

$

|

—

|

|

$

|

2

|

|

$

|

(24

|

)

|

$

|

(29

|

)

|

||||

|

|

Pension Cost

|

Postretirement Health Benefit Cost

|

||||||||||||||

|

|

2019

|

2018

|

2019

|

2018

|

||||||||||||

|

Service cost

|

$

|

1,626

|

|

$

|

1,723

|

|

$

|

105

|

|

$

|

106

|

|

||||

|

Interest cost

|

2,114

|

|

2,022

|

|

97

|

|

84

|

|

||||||||

|

Expected return on plan assets

|

(2,809

|

)

|

(2,168

|

)

|

—

|

|

—

|

|

||||||||

|

Amortization of:

|

||||||||||||||||

|

Prior service costs (income)

|

2

|

|

2

|

|

(6

|

)

|

(6

|

)

|

||||||||

|

Other actuarial loss

|

771

|

|

1,274

|

|

—

|

|

—

|

|

||||||||

|

Net periodic benefit cost

|

$

|

1,704

|

|

$

|

2,853

|

|

$

|

196

|

|

$

|

184

|

|

||||

|

|

Pension Benefits

|

Postretirement Health Benefits

|

||||||||||||||

|

|

2019

|

2018

|

2019

|

2018

|

||||||||||||

|

Net actuarial loss (gain)

|

$

|

5,016

|

|

$

|

(1,034

|

)

|

$

|

73

|

|

$

|

(276

|

)

|

||||

|

Amortization of:

|

||||||||||||||||

|

Prior service (cost) income

|

(1

|

)

|

(2

|

)

|

5

|

|

1

|

|

||||||||

|

Amortization of actuarial (loss) gain

|

(586

|

)

|

(901

|

)

|

—

|

|

5

|

|

||||||||

|

Total recognized in other comprehensive loss (income)

|

$

|

4,429

|

|

$

|

(1,937

|

)

|

$

|

78

|

|

$

|

(270

|

)

|

||||

|

Amortization of:

|

Pension Benefits

|

Postretirement Health Benefits

|

||||||

|

Net actuarial loss

|

$

|

1,087

|

|

$

|

—

|

|

||

|

Prior service income

|

—

|

|

(5

|

)

|

||||

|

Total to be recognized as other comprehensive loss (income)

|

$

|

1,087

|

|

$

|

(5

|

)

|

||

|

Pension

Benefits

|

Postretirement

Health Benefits

|

|||||||

|

2020

|

$

|

1,686

|

|

$

|

66

|

|

||

|

2021

|

$

|

1,763

|

|

$

|

98

|

|

||

|

2022

|

$

|

1,864

|

|

$

|

108

|

|

||

|

2023

|

$

|

1,902

|

|

$

|

147

|

|

||

|

2024

|

$

|

2,013

|

|

$

|

236

|

|

||

|

2025-29

|

$

|

13,969

|

|

$

|

1,412

|

|

||

|

|

Pension Benefits

|

Postretirement Health Benefits

|

||||||

|

|

2019

|

2018

|

2019

|

2018

|

||||

|

Discount rate for net periodic benefit costs

|

4.04%

|

3.75%

|

3.81%

|

3.26%

|

||||

|

Discount rate for year-end obligations

|

3.35%

|

4.04%

|

2.93%

|

3.81%

|

||||

|

Rate of increase in compensation levels for net periodic benefit costs

|

3.50%

|

3.50%

|

—

|

—

|

||||

|

Rate of increase in compensation levels for year-end obligations

|

3.50%

|

3.50%

|

—

|

—

|

||||

|

Long-term expected rate of return on assets

|

7.00%

|

7.00%

|

—

|

—

|

||||

|

One-Percentage Point

Increase

|

One-Percentage

Point Decrease

|

|||

|

Effect on total service and interest cost

|

$26

|

$(22)

|

||

|

Effect on accumulated postretirement benefit obligation

|

$301

|

$(267)

|

||

|

Asset Allocation

|

Target fiscal 2020

|

2019

|

2018

|

|||

|

Cash and accrued income

|

2%

|

—%

|

—%

|

|||

|

Fixed income

|

38%

|

42%

|

36%

|

|||

|

Equity

|

60%

|

58%

|

64%

|

|||

|

Fair Value At July 31, 2019

|

||||||||||||

|

Total

|

Quoted

Prices in

Active

Markets for

Identical

Assets

(Level 1)

|

Significant

Observable

Inputs

(Level 2)

|

||||||||||

|

Asset Class

|

|

|

|

|||||||||

|

Cash and cash equivalents

(a)

|

$

|

66

|

|

$

|

66

|

|

$

|

—

|

|

|||

|

Equity securities

(b)

:

|

||||||||||||

|

U.S. companies

|

13,775

|

|

4,147

|

|

9,628

|

|

||||||

|

International companies

|

2,609

|

|

2,609

|

|

—

|

|

||||||

|

Equity securities - international mutual funds:

|

||||||||||||

|

Developed market

(c)

|

5,275

|

|

—

|

|

5,275

|

|

||||||

|

Emerging markets

(d)

|

1,141

|

|

—

|

|

1,141

|

|

||||||

|

Commodities

(e)

|

637

|

|

—

|

|

637

|

|

||||||

|

Fixed Income:

|

||||||||||||

|

U.S. Treasuries

|

3,273

|

|

—

|

|

3,273

|

|

||||||

|

Debt securities

(f)

|

8,103

|

|

—

|

|

8,103

|

|

||||||

|

Government sponsored entities

(g)

|

2,087

|

|

—

|

|

2,087

|

|

||||||

|

Multi-strategy bond fund

(h)

|

813

|

|

—

|

|

813

|

|

||||||

|

Money market fund

(i)

|

557

|

|

—

|

|

557

|

|

||||||

|

Other

(j)

|

2,389

|

|

—

|

|

2,389

|

|

||||||

|

Total

|

$

|

40,725

|

|

$

|

6,822

|

|

$

|

33,903

|

|

|||

|

Fair Value At July 31, 2018

|

||||||||||||

|

Total

|

Quoted

Prices in

Active

Markets for

Identical

Assets

(Level 1)

|

Significant

Observable

Inputs

(Level 2)

|

||||||||||

|

Asset Class

|

||||||||||||

|

Cash and cash equivalents

(a)

|

$

|

1,102

|

|

$

|

1,102

|

|

$

|

—

|

|

|||

|

Equity securities

(b)

:

|

||||||||||||

|

U.S. companies

|

14,253

|

|

5,519

|

|

8,734

|

|

||||||

|

International companies

|

3,157

|

|

3,157

|

|

—

|

|

||||||

|

Equity securities - international mutual funds:

|

||||||||||||

|

Developed market

(c)

|

5,851

|

|

—

|

|

5,851

|

|

||||||

|

Emerging markets

(d)

|

905

|

|

—

|

|

905

|

|

||||||

|

Commodities

(e)

|

687

|

|

—

|

|

687

|

|

||||||

|

Fixed Income:

|

||||||||||||

|

U.S. Treasuries

|

1,929

|

|

—

|

|

1,929

|

|

||||||

|

Debt securities(f)

|

8,325

|

|

—

|

|

8,325

|

|

||||||

|

Government sponsored entities

(g)

|

1,814

|

|

—

|

|

1,814

|

|

||||||

|

Money market fund

(i)

|

1,567

|

|

—

|

|

1,567

|

|

||||||

|

Other

(j)

|

1,381

|

|

—

|

|

1,381

|

|

||||||

|

Total

|

$

|

40,971

|

|

$

|

9,778

|

|

$

|

31,193

|

|

|||

|

(a)

|

Cash and cash equivalents consists of highly liquid investments which are traded in active markets.

|

|

(b)

|

This class represents equities traded on regulated exchanges, as well as funds that invest in a portfolio of such stocks.

|

|

(c)

|

These mutual funds seek long-term capital growth by investing no less than

80%

of their assets in stocks of non- U.S. companies that are primarily in developed markets, but also may invest in emerging and less developed markets.

|

|

(d)

|

These mutual funds seek to track the performance of a benchmark index that measures the investment return of stock issued by companies located in emerging market countries.

|

|

(e)

|

These investments seek attractive total return by investing primarily in a diversified portfolio of commodity futures contracts and fixed income investments.

|

|

(f)

|

This class includes bonds and loans of U.S. and non-U.S. corporate issuers from diverse industries and bonds of domestic and foreign municipalities.

|

|

(g)

|

This class represents a beneficial ownership interest in a pool of single-family residential mortgage loans. These investments are generally not backed by the full faith and credit of the United States government, except for securities valued at

$377,000

in our portfolio as of

July 31, 2019

and

$443,000

as of

July 31, 2018

.

|

|

(h)

|

This class invests at least 80% of its net assets in bonds and other fixed income instruments issued by governmental or private-sector entities. More than 50% of its net assets are invested in mortgage-backed securities. The fund may invest up to 33 1/3% of its net assets in high-yield bonds, bank loans and assignments and credit default swaps.

|

|

(i)

|

These money market mutual funds seek to provide current income consistent with liquidity and stability of principal by investing in a diversified portfolio of high quality, short-term, dollar-denominated debt securities. These funds may include securities issued or guaranteed as to principal and interest by the U.S. government or its agencies, short-term securities issued by domestic or foreign banks, domestic and dollar-denominated foreign commercial papers, and other short-term corporate obligations and obligations issued or guaranteed by one or more foreign governments.

|

|

(j)

|