|

o

|

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

OR

|

||

|

x

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For fiscal year ended

|

||

|

December 31, 2017

|

||

|

OR

|

||

|

o

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from ____ to ____

|

||

|

OR

|

||

|

o

|

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Date of event requiring this shell company report:

|

||

|

Large accelerated filer

o

|

Accelerated filer

o

|

Non-accelerated filer

x

|

|

Emerging growth company

o

|

||

|

US GAAP

|

International Financial Reporting Standards as issued by the International Accounting Standards Board

|

Other

|

|

o

|

x

|

o

|

|

F1 - F26

|

|

|

•

|

risks related to all of our products, including REOLYSIN

®

, being in the research and development stage and requiring further development and testing before they can be marketed commercially;

|

|

•

|

risks inherent in pharmaceutical research and development;

|

|

•

|

risks related to timing and possible delays in our clinical trials;

|

|

•

|

risks related to some of our clinical trials being conducted in, and subject to the laws of foreign countries;

|

|

•

|

risks related to our pharmaceutical products being subject to intense regulatory approval processes in the United States and other foreign jurisdictions;

|

|

•

|

risks related to being subject to government manufacturing and testing regulations;

|

|

•

|

risks related to the extremely competitive biotechnology industry and our competition with larger companies with greater resources;

|

|

•

|

risks related to our reliance on patents and proprietary rights to protect our technology;

|

|

•

|

risks related to potential products liability claims;

|

|

•

|

risks related to our limited manufacturing experience and reliance on third parties to commercially manufacture our products, if and when developed;

|

|

•

|

risks related to our new products not being accepted by the medical community or consumers;

|

|

•

|

risks related to our technologies becoming obsolete;

|

|

•

|

risks related to our dependence on third party relationships for research and clinical trials;

|

|

•

|

risks related to our license, development, supply and distribution agreement (the “Licensing Agreement”) with Adlai Nortye Biopharma Co. Ltd. (“Adlai”);

|

|

•

|

risks related to our lack of operating revenues and history of losses;

|

|

•

|

uncertainty regarding our ability to obtain third-party reimbursement for the costs of our product;

|

|

•

|

risks related to other third-party arrangements;

|

|

•

|

risks related to our ability to obtain additional financing to fund future research and development of our products and to meet ongoing capital requirements;

|

|

•

|

risks related to potential increases in the cost of director and officer liability insurance;

|

|

•

|

risks related to our dependence on key employees and collaborators;

|

|

•

|

risks related to Barbados law;

|

|

•

|

risks related to the effect of changes in the law on our corporate structure;

|

|

•

|

risks related to expenses in foreign currencies and our exposure to foreign currency exchange rate fluctuations;

|

|

•

|

risks related to our compliance with the Sarbanes-Oxley Act of 2002, as amended;

|

|

•

|

risks related to our status as a foreign private issuer;

|

|

•

|

risk related to possible “passive foreign investment company” status;

|

|

•

|

risks related to fluctuations in interest rates;

|

|

•

|

risks related to information technology systems; and

|

|

•

|

risks related to our common shares.

|

|

|

Canadian Dollars Per One US Dollar

|

||||

|

|

2017

|

2016

|

2015

|

2014

|

2013

|

|

Average for the period

|

1.2986

|

1.3248

|

1.2787

|

1.1045

|

1.0299

|

|

For the Month of

|

||||||

|

|

February

2018 |

January

2018 |

December

2017 |

November

2017 |

October

2017 |

September

2017 |

|

High for the period

|

1.2809

|

1.2535

|

1.2886

|

1.2888

|

1.2893

|

1.2480

|

|

Low for the period

|

1.2288

|

1.2293

|

1.2545

|

1.2683

|

1.2472

|

1.2128

|

|

A.

|

Selected Financial Data

|

|

2017

|

2016

|

2015

|

2014

|

2013

|

||||||

|

$

|

$

|

$

|

$

|

$

|

||||||

|

Revenues

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Net loss

(1)

|

(15,616,851

|

)

|

(15,139,979

|

)

|

(13,722,995

|

)

|

(18,619,335

|

)

|

(23,532,647

|

)

|

|

Net comprehensive loss

|

(15,797,181

|

)

|

(15,346,897

|

)

|

(13,242,060

|

)

|

(18,418,990

|

)

|

(23,395,834

|

)

|

|

Basic and diluted loss per share

(2)

|

(0.12

|

)

|

(0.13

|

)

|

(0.12

|

)

|

(0.21

|

)

|

(0.28

|

)

|

|

Total assets

(2)

|

18,150,449

|

|

14,758,284

|

|

27,383,798

|

|

17,193,190

|

|

28,222,027

|

|

|

Shareholders’ equity

(2)

|

8,283,846

|

|

10,689,620

|

|

24,674,306

|

|

13,819,193

|

|

22,213,366

|

|

|

Cash dividends declared per share

(3)

|

Nil

|

|

Nil

|

|

Nil

|

|

Nil

|

|

Nil

|

|

|

Weighted average number of common shares outstanding

|

132,395,752

|

|

119,880,200

|

|

112,613,845

|

|

87,869,149

|

|

83,530,981

|

|

|

1)

|

Included in net loss and net loss per share for the year ended December 31,

2017

are share based payment expenses of

$578,703

(

2016

-

$406,078

;

2015

-

$429,537

;

2014

-

$980,325

;

2013

-

$424,384

).

|

|

2)

|

We issued

20,547,500

common shares for net cash proceeds of

$12,812,704

in

2017

(

2016

-

3,106,600

common shares for net cash proceeds of

$956,133

;

2015

-

24,639,128

common shares for net cash proceeds of

$23,667,654

;

2014

-

8,708,676

common shares for net cash proceeds of

$9,044,492

;

2013

-

8,093,533

common shares for net cash proceeds of

30,398,036

).

|

|

3)

|

We have not declared or paid any dividends since incorporation.

|

|

B.

|

|

|

C.

|

Reasons for the Offer and Use of Proceeds

|

|

D.

|

Risk Factors

|

|

•

|

the discovery of unexpected toxicities or lack of sufficient efficacy of products which make them unattractive or unsuitable for human use;

|

|

•

|

preliminary results as seen in animal and/or limited human testing may not be substantiated in larger, controlled clinical trials;

|

|

•

|

manufacturing costs or other production factors may make manufacturing of products ineffective, impractical and non-competitive;

|

|

•

|

proprietary rights of third parties or competing products or technologies may preclude commercialization;

|

|

•

|

requisite regulatory approvals for the commercial distribution of products may not be obtained; and

|

|

•

|

other factors may become apparent during the course of research, up-scaling or manufacturing which may result in the discontinuation of research and other critical projects.

|

|

•

|

Our clinical trials may produce negative or inconclusive results, and we may decide, or regulatory authorities may require us, to conduct additional clinical trials or we may abandon projects that we expect to be promising;

|

|

•

|

The number of subjects required for our clinical trials may be larger than we anticipate, enrollment in our clinical trials may be slower than we anticipate, or participants may drop out of our clinical trials at a higher rate than we anticipate;

|

|

•

|

We might have to suspend or terminate our clinical trials if the participants are being exposed to unacceptable health risks;

|

|

•

|

Regulators or institutional review boards may require that we hold, suspend or terminate clinical research for various reasons, including noncompliance with regulatory requirements or our clinical protocols;

|

|

•

|

Regulators may refuse to accept or consider data from clinical trials for various reasons, including noncompliance with regulatory requirements or our clinical protocols;

|

|

•

|

The cost of our clinical trials may be greater than we anticipate; and

|

|

•

|

The supply or quality of our products or other materials necessary to conduct our clinical trials may be insufficient or inadequate.

|

|

•

|

The size and nature of the subject population;

|

|

•

|

The proximity of subjects to clinical sites;

|

|

•

|

The eligibility criteria for the trial;

|

|

•

|

The design of the clinical trial;

|

|

•

|

Competing clinical trials; and

|

|

•

|

Clinicians’ and subjects’ perceptions as to the potential advantages of the medication being studied in relation to other available therapies, including any new medications that may be approved for the indications we are investigating.

|

|

•

|

competition in relation to alternative treatments, including efficacy advantages and cost advantages;

|

|

•

|

perceived ease of use;

|

|

•

|

the availability of coverage or reimbursement by third-party payors;

|

|

•

|

uncertainties regarding marketing and distribution support; and

|

|

•

|

distribution or use restrictions imposed by regulatory authorities.

|

|

•

|

different regulatory requirements for drug approvals in foreign countries;

|

|

•

|

different standards of care in various countries that could complicate the evaluation of our product candidates;

|

|

•

|

different U.S. and foreign drug import and export rules;

|

|

•

|

reduced protection for intellectual property rights in certain countries;

|

|

•

|

unexpected changes in tariffs, trade barriers and regulatory requirements;

|

|

•

|

different reimbursement systems and different competitive drugs indicated to treat the indications for which our product candidates are being developed;

|

|

•

|

economic weakness, including inflation, or political instability in particular foreign economies and markets;

|

|

•

|

compliance with the FCPA, and other anti-corruption and anti-bribery laws;

|

|

•

|

U.S. and foreign taxes;

|

|

•

|

foreign currency fluctuations, which could result in reduced revenues, and other obligations incident to doing business in another country;

|

|

•

|

a reliance on CROs, clinical trial sites, principal investigators and other third parties that may be less experienced with clinical trials or have different methods of performing such clinical trials than we are used to in the U.S.;

|

|

•

|

potential liability resulting from development work conducted by foreign distributors; and

|

|

•

|

business interruptions resulting from geopolitical actions, including war and terrorism, or natural disasters.

|

|

A.

|

History and Development of the Company

|

|

B.

|

Business Overview

|

|

•

|

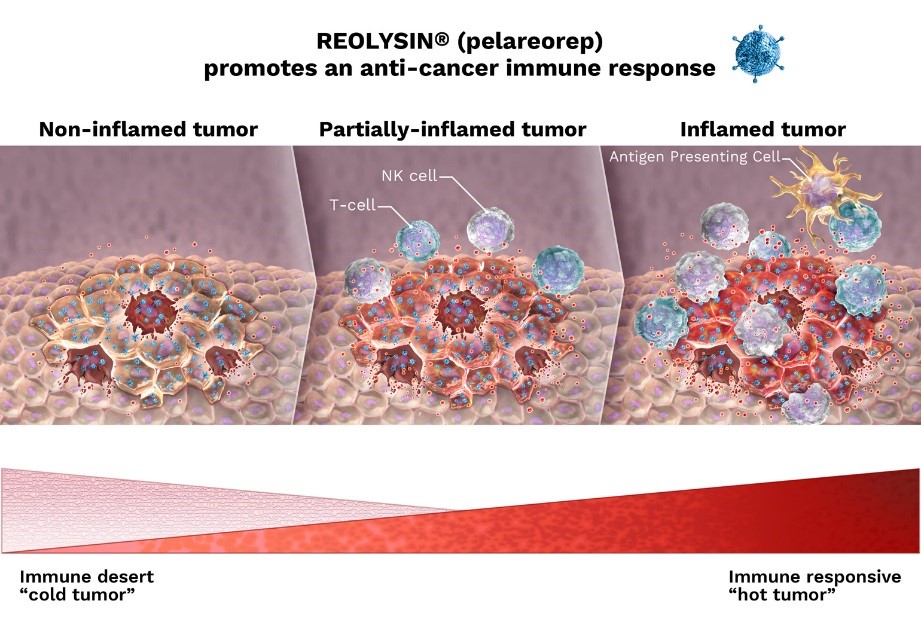

Selective viral replication in permissive cancer cells which leads to tumor cell lysis.

|

|

•

|

Activation of innate immunity in response to the infection which results in a cascade of chemokines/cytokines causing natural killer (NK) cells to be activated and attack cancer cells.

|

|

•

|

A specific adaptive immune response triggered by tumor- and viral-associated antigens displayed by antigen-presenting cells (APCs, infected tumor cells and/or dendritic cells) to T cells.

|

|

•

|

Pelareorep has anticancer effects in models of metastatic cancers that can prolong survival in these models when using immuno-competent rodents.

|

|

•

|

The survival benefit in animal models can be enhanced when pelareorep is given in combination with chemotherapy, immunotherapy (e.g., checkpoint inhibitors, IMiDs, rituximab, etc.) or radiotherapy.

|

|

•

|

A toxic dose of reovirus T3D has not been reached/established in animal models and infection presents with minimal side-effects.

|

|

•

|

More than 1,400 patients have been enrolled in clinical studies conducted in the US, Canada and EU. Of these, more than 1,000 patients received pelareorep, with over 930 via intravenous (IV) administration and over 90 by intratumoral injections (ITu). The remaining patients were randomized to control arms.

|

|

•

|

Pelareorep has been administered as single or multiple doses (intratumoral or intravenous), either as a mono-therapy or in combination with chemotherapy, immunotherapy (e.g., checkpoint inhibitors), and radiotherapy.

|

|

•

|

No Maximum Tolerated Dose (MTD) for intravenous pelareorep as mono-therapy was defined in the two Phase 1 trials (REO 004 and 005). Dose-limiting toxicities (DLTs) were seen in some of the combination trials with pelareorep and chemotherapy, which generally enrolled heavily pre-treated patients.

|

|

•

|

When combined with chemotherapeutic agents, pelareorep does not appear to enhance either the frequency or severity of the adverse effects of the chemotherapeutic agents.

|

|

•

|

There is emerging evidence that pelareorep may impact overall survival (OS) in metastatic breast cancer (MBC) and metastatic adenocarcinoma of the pancreas (MAP):

|

|

•

|

In a randomized, controlled Phase 2 study of paclitaxel with pelareorep versus paclitaxel alone in MBC (CCTG IND.213) median survival time was greater for subjects treated with paclitaxel and pelareorep (median 17.4 months) than subjects treated with paclitaxel alone (10.4 months, hazard ratio [HR] 0.65).

|

|

•

|

In a single arm study with gemcitabine plus pelareorep in first line MAP (REO 017) the median overall survival (mOS) was 10 months with a 1 year and 2-year survival of 46% and 24%, respectively.

|

|

•

|

In a two-arm Phase 2 randomized study (NCI 8601), patients with MAP were randomized to receive either carboplatin, paclitaxel and pelareorep (test arm) or carboplatin and paclitaxel alone (control arm). The median OS was similar for both arms, but the probability of survival at Year 2 was 20% in the test arm vs 9% in the control arm.

|

|

1.

|

Direct cell lysis - Reovirus Replication in Permissive Cancer Cells

|

|

2.

|

Induction of Innate Immunity

|

|

3.

|

Induction of Adaptive Immunity

|

|

1.

|

Chemo combinations

- Our primary focus has been on the investigation of chemotherapy combination clinical trials investigating the use of different chemotherapy agents in various cancer indications. In 2017, we reported additional clinical data from our randomized clinical program which includes the clinical trial collaborations with the Canadian Cancer Trials Group (CCTG, formerly known as the National Cancer Institute of Canada). Specifically, subgroup analysis in the IND.213 trial in MBC revealed a significant improvement in overall survival of patients that are hormone receptor positive (HR+) / human epidermal growth factor receptor 2 negative (HER2-). In HR+/HER2- patients, REOLYSIN therapy in combination with paclitaxel doubled the overall survival from 10.8 month with paclitaxel therapy alone to 21.8 months with REOLYSIN plus paclitaxel. This increase in overall survival is consistent with previous survival data reported from our NCI pancreatic trial which suggests a long term survival benefit when comparing test and control arms at 24 months.

|

|

2.

|

Combination with IMiDs/targeted therapy

- Our second program focuses on the potential of pelareorep to stimulate a patient's innate immunity and the potential for an infection to cause a cascade of chemokines/cytokines activating natural killer (NK) cells to attack cancer cells. In 2017, patient enrollment commenced on a clinical collaboration with Myeloma UK and Celgene that combines pelareorep with immune modulator therapies (IMiDs) which enhance NK cell activation.

|

|

3.

|

Immunotherapy combinations

- Our third program focuses on the potential for pelareorep to cause a specific adaptive immune response triggered by tumor- and viral-associated antigens displayed by antigen-presenting cells (APCs, infected tumor cells and/or dendritic cells) to T cells. In 2017 we announced our first data set combining a checkpoint inhibitor with pelareorep and pembrolizumab (Keytruda®) in pancreatic cancer, which demonstrated safety and tolerability and in five efficacy evaluable patients, one had a partial response (six-month duration) and two had stable disease (lasting 126 and 221 days). Additional basket study concepts are now being planned.

|

|

•

|

Develop pelareorep through our clinical development plan assessing the safety and efficacy in human subjects;

|

|

•

|

Establish collaborations with experts to assist us with scientific and clinical developments of this new potential pharmaceutical product;

|

|

•

|

Implement strategic alliances with selected pharmaceutical and biotechnology companies and selected laboratories, at a time and in a manner where such alliances may complement and expand our research and development efforts on the product and provide sales and marketing capabilities;

|

|

•

|

Utilize our broadening patent base and collaborator network as a mechanism to meet our strategic objectives; and

|

|

•

|

Develop relationships with companies that could be instrumental in assisting us to access other innovative therapeutics.

|

|

•

|

Pre-Pharmacological Studies

- Pre-Pharmacological studies involve extensive testing on laboratory animals to determine if a potential therapeutic product has utility in an

in vivo

disease model and has any adverse toxicology in a disease model.

|

|

•

|

Investigational New Drug Application

- An Investigational New Drug ("IND") Submission, or the equivalent, must be submitted to the appropriate regulatory authority prior to conducting Pharmacological Studies.

|

|

•

|

Pharmacological Studies

(or Phase 1 Clinical Trials)

- Pharmacological studies are designed to assess the potential harmful or other side effects that an individual receiving the therapeutic compound may experience. These studies, usually short in duration, are often conducted with healthy volunteers or actual patients and use up to the maximum expected therapeutic dose.

|

|

•

|

Therapeutic Studies

(or Phase 2 and 3 Clinical Trials) - Therapeutic studies are designed primarily to determine the appropriate manner for administering a drug to produce a preventive action or a significant beneficial effect against a disease. These studies are conducted using actual patients with the condition that the therapeutic is designed to remedy. Prior to initiating these studies, the organization sponsoring the program is required to satisfy a number of requirements via the submission of documentation to support the approval for a clinical trial.

|

|

•

|

New Drug Submission

- After all three phases of a clinical trial have been completed, the results are submitted with the original IND Submission to the appropriate regulatory authority for marketing approval. Once marketing approval is granted, the product is approved for commercial sales.

|

|

C.

|

Organizational Structure

|

|

A.

|

Operating Results

|

|

B.

|

Liquidity and Capital Resources

|

|

C.

|

Research and Development, Patents, and Licenses, etc.

|

|

D.

|

Trend Information

|

|

E.

|

Off-Balance Sheet Arrangements

|

|

F.

|

Tabular Disclosure of Contractual Obligations

|

|

Contractual Obligations

|

Payments Due by Period

|

|||||||||

|

Total

$

|

Less than 1 year

$

|

2 -3 years

$

|

4 - 5 years

$

|

After 5 years

$

|

||||||

|

Capital lease obligations

|

Nil

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Operating lease

(1)

|

740,850

|

|

285,987

|

|

411,733

|

|

43,130

|

|

—

|

|

|

Purchase obligations

|

5,980,454

|

|

5,980,454

|

|

—

|

|

—

|

|

—

|

|

|

Other long term obligations

|

Nil

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Total contractual obligations

|

6,721,304

|

|

6,266,441

|

|

411,733

|

|

43,130

|

|

—

|

|

|

(1)

|

Our operating leases are comprised of our office leases and exclude our portion of operating costs.

|

|

G.

|

Safe Harbor

|

|

A.

|

Directors and Senior Management

|

|

Name and Place of Residence

|

Position with the Company

|

Principal Occupation

|

Director of the Company Since

|

|

Deborah M. Brown, BSc, MBA

(1)(2)

Ontario, Canada

|

Director

|

In addition to being a Management Consultant since 2014, Ms. Brown is currently the Managing Partner at Accelera CANADA, a specialty consultancy firm that assists emerging biopharma ventures in the United States and Europe with the development and implementation of Canadian market strategies. She held progressively senior roles at EMD Serono from 2000 to 2014, including Executive Vice President of Neuroimmunology for the company's U.S. operations, and President and Managing Director of the company's Canadian operations. In 2012, Ms. Brown was Chair of the Canadian National Pharmaceutical Organization (now Innovative Medicines Canada) and served on its Board of Directors from 2007 to 2014. She currently sits on the Boards of Life Sciences Ontario, the Strategic Executive Advisory Council for Canadian Cancer Trials Group, and her local SPCA. Ms. Brown holds an MBA from University of Western Ontario's Ivey School of Business, an Hons B.Sc. from the University of Guelph and completed the Merck executive development programme at the University of Hong Kong, INSEAD and Northwestern University's Kellogg School of Management.

|

November 2, 2017

|

|

Matthew C. Coffey, PhD

Alberta, Canada

|

Chief Executive Officer and Director

|

A co-founder of the Company, Dr. Coffey has been the President and Chief Executive Officer of the Company since January 2017. Dr. Coffey completed his doctorate degree in oncology at the University of Calgary with a focus on the oncolytic capabilities of the reovirus. The results of his research have been published in various respected scientific journals, including Science, Human Gene Therapy, and The EMBO Journal. Dr. Coffey has held the positions of Interim President and Chief Executive Officer from November 2016 to January 2017, Chief Operating Officer of the Company from December 2008 to November 2016, Chief Scientific Officer from December 2004 to December 2008, Vice-President of Product Development from July 1999 to December 2004 and Chief Financial Officer from September 1999 to May 2000.

|

May 11, 2011

|

|

Andrew de Guttadauro

California, USA

|

Global Head of Business Development, President, Oncolytics Biotech (U.S.) Inc.

|

Andrew de Guttadauro has more than 25 years of biopharmaceutical commercialization and business development experience in. He has held executive and senior-level positions at leading pharmaceutical and biotechnology companies, working on initiatives across both developed and emerging markets globally.

Mr. de Guttadauro began his career at TAP Pharmaceuticals, supporting the launch of blockbuster drugs, Lupron® and Prevacid®. He held a variety of marketing positions at Amgen, contributing to the success of Enbrel®, Aranesp®, and Epogen® before joining MedImmune to lead marketing efforts for the FluMist® inhaled influenza vaccine. Following a two-year assignment overseeing the commercial development of Zevalin®, the first radioimmunotherapy product approved for use in the United States, Mr. de Guttadauro took on the role of Senior Director of Strategy at Biogen Idec. He then served as Vice President of Corporate Development at Vical, supporting the execution of distribution agreements for Allovectin®. Prior to joining Oncolytics, Mr. de Guttadauro was a Principal at 1798 Consultants Inc., a healthcare consulting firm providing commercialization, market access, and compliance strategic advice to leading and emerging biopharmaceutical companies.

Mr. de Guttadauro has a Bachelor of Science degree in engineering from the United States Military Academy at West Point.

|

N/A

|

|

Name and Place of Residence

|

Position with the Company

|

Principal Occupation

|

Director of the Company Since

|

|

Andres A. Gutierrez, MD, PhD

New Jersey, USA

|

Chief Medical Officer

|

Dr. Gutierrez is board certified in internal medicine and completed a fellowship in medical oncology. Most recently he has held progressively senior clinical development positions designing and implementing both early and later-stage oncology clinical studies at a range of U.S. and European companies including Sellas Life Sciences Group, Bristol-Myers Squibb, Sunesis Pharmaceuticals Inc., Biomarin Pharmaceutical Inc., Proteolix, and Oculus Innovative Sciences. Prior to that, he held a series of academic and consulting positions. Over his 32 year career, he has authored and co-authored more than 90 peer-reviewed publications and abstracts and presented at numerous conferences. He received his MD and a PhD in Biomedical Sciences from the National Autonomous University of Mexico.

|

N/A

|

|

Angela Holtham, MBA, FCPA, FCMA, ICD.D

(1)(2)

Ontario, Canada

|

Director

|

Ms. Holtham held a number of financial positions over a 19-year career with the Canadian subsidiary of Nabisco Inc., rising to become Senior Vice President and Chief Financial Officer. Then in 2002, she joined Toronto, Ontario-based Hospital for Sick Children as Vice President, Finance and Chief Financial Officer, a position she held for eight years. Through her career she has participated in many initiatives ranging from traditional finance functions and operations oversight to intellectual property portfolio management and mergers and acquisitions. Ms. Holtham is an FCPA, FCMA, holds an MBA from the University of Toronto and has completed the Institute of Corporate Directors Designation (ICD.D). Ms. Holtham holds a number of board and audit committee positions in both private and public sectors, including audit committee chair and director of Jamieson Wellness.

|

June 18, 2014

|

|

J. Mark Lievonen, CM, FCPA, FCA, LLD

(1)(3)

Ontario, Canada

|

Director

|

Mr. Lievonen held the position of President of Sanofi Pasteur Limited, a vaccine development, manufacturing and marketing company, from 1999 to 2016. He is a Director of Acerus Pharmeceuticals Corporation, Quest PharmaTech Inc., and the Gairdner Foundation. Mr. Lievonen has served on a number of industry and not-for-profit boards including as the chair of Rx&D (now Innovative Medicines Canada), BIOTECanada, and the Markham Stouffville Hospital Foundation, as Vice-Chair of the Ontario Institute for Cancer Research, as a Director of the Public Policy Forum, and as a Governor of York University Mr. Lievonen was appointed to the Order of Canada in 2015, named a Chevalier de l'Ordre National de Mérite by the government of France in 2007, and inducted into the Canadian Healthcare Marketing Hall of Fame in 2013.

|

April 5, 2004

|

|

Kirk J. Look, CA

Alberta, Canada

|

Chief Financial Officer

|

Mr. Look is a Chartered Accountant with more than fifteen years of experience in accounting, finance, tax and treasury. Mr. Look joined Oncolytics as the Company's Controller in April 2003, and assumed the role of Chief Financial Officer in November 2012. Prior to joining Oncolytics, from 2000 to April 2003, Mr. Look was Manager of Audit and Assurance Services with Ernst & Young LLP in Canada. From 1998 to the end of 1999, Mr. Look held the positions of Audit Manager and Senior Accountant at Ernst & Young LLP in Chile.

|

N/A

|

|

Wayne Pisano, MBA

(1)(2)(5)

New Jersey, USA

|

Chair of the Board

|

Mr. Pisano has more than 30 years of experience as a pharmaceutical industry executive and was recognized in 2010 as Pharma Executive of the Year by the World Vaccine Congress. Mr. Pisano is the former president and CEO of Sanofi Pasteur, one of the largest vaccine companies in the world. He is credited with driving Sanofi Pasteur's leadership within the worldwide influenza market and capturing 50 percent of global sales. He also laid the foundation for the company's global pediatric vaccines strategy. During his tenure as CEO, Mr. Pisano bolstered the Sanofi Pasteur pipeline with the acquisitions of Acambis PLC, a bio-tech based in Boston in 2008 and Shantha Biotechnics, a highly regarded Indian vaccine company in 2010. Prior to joining Sanofi Pasteur, he spent 11 years with Novartis (formerly Sandoz). He has a bachelor's degree in biology from St. John Fisher College, New York and an MBA from the University of Dayton, Ohio. Mr. Pisano is a Board director and Chairman of the compensation and Governance Committee for Immunovaccine; a biotech based in Halifax.

|

May 9, 2013

|

|

Name and Place of Residence

|

Position with the Company

|

Principal Occupation

|

Director of the Company Since

|

|

William G. Rice, PhD

(3)(4)

California, USA

|

Director

|

Dr. Rice holds the position of Chairman, President and Chief Executive Officer of Aptose Biosciences Inc. since 2013. Also, from 2003 to present, he has served as Chairman, President and Chief Executive Officer of Cylene Pharmaceutics Inc., prior to which he was the Founder, President, Chief Executive Officer and Director of Achillion Pharmaceuticals, Inc. He served as Senior Scientist and Head of the Drug Mechanism Laboratory at the National Cancer Institute-Frederick Cancer Research and Development Center, and as a faculty member in the Division of Pediatric Hematology and Oncology at Emory School of Medicine. Dr. Rice holds a PhD in biochemistry from Emory University and was a post-doctoral trainee in the Department of Internal Medicine, Division of Hematology and Oncology at the University of Michigan Medical Center.

|

June 8, 2015

|

|

Bernd R. Seizinger, MD, PhD

(2)(4)

New Jersey, USA and Munich, Germany

|

Director

|

Dr. Seizinger is currently Chairman and/or Board member of a number of biotech companies in the U.S. and Europe, including: Oxford BioTherapeutics Ltd., CryptoMedicx Inc., Opsona Ltd., Aprea AB, and Vaccibody AS. From 1998 to 2009, he served as President and Chief Executive Officer of GPC Biotech. He also served as Vice President of Oncology Drug Discovery and, in parallel, Vice President of Corporate and Academic Alliances at Bristol-Myers Squibb in Princeton, NJ. Prior to his appointments in the biotechnology and pharmaceuticals sectors, Dr. Seizinger held professorships and senior staff appointments at Harvard Medical School, Princeton University and Massachusetts General Hospital.

|

June 8, 2015

|

|

(1)

|

Member of the Audit Committee. Ms. Holtham is Chair of this Committee.

|

|

(2)

|

Member of the Compensation Committee. Mr. Pisano is Chair of this Committee.

|

|

(3)

|

Member of the Governance Committee. Mr. Lievonen is Chair of this Committee.

|

|

(4)

|

Member of the Science and Technology Committee. Dr.'s Rice and Seizinger serve as Co-Chairs of this Committee.

|

|

(5)

|

Mr. Pisano, as Chair of the Board, serves as an ex-officio member of the Governance and Science and Technology Committees.

|

|

B.

|

Compensation

|

|

Name

|

Fees Earned

($)

(1)

|

Share-

Based Awards

($)

(2)

|

Option-

Based Awards

($)

(2)

|

Non-Equity Incentive Plan Compensation

($)

|

Pension Value

($)

|

All Other Compensation

($)

|

Total

($)

|

|

Deborah Brown

(3)

|

17,249

|

25,278

|

14,666

|

Nil

|

N/A

|

Nil

|

57,193

|

|

Angela Holtham

|

53,003

|

82,275

|

Nil

|

Nil

|

N/A

|

Nil

|

135,278

|

|

Mark Lievonen

|

75,270

|

53,278

|

Nil

|

Nil

|

N/A

|

Nil

|

128,548

|

|

Wayne Pisano

|

75,270

|

92,770

|

Nil

|

Nil

|

N/A

|

Nil

|

168,040

|

|

William Rice

|

75,270

|

53,278

|

Nil

|

Nil

|

N/A

|

Nil

|

128,548

|

|

Bernd Seizinger

|

30,108

|

99,164

|

Nil

|

Nil

|

N/A

|

Nil

|

129,272

|

|

(1)

|

Directors are paid fees in US Dollars. These amounts are presented in Canadian dollars and have been converted at a US/CDN exchange rate of $1.2545.

|

|

(2)

|

The value of share based and option based awards are based on the grant date assumptions as disclosed in note 8 "

Share Based Payments"

in our

2017

audited consolidated financial statements.

|

|

(3)

|

Ms. Brown was appointed as a director on November 2, 2017.

|

|

Name and principal position

|

Year

|

Salary

$ |

Share-

based awards $ (1) |

Option-

based

awards

$

(1)

|

Bonus

$

|

Non-equity incentive

plan compensation $ |

Pension value

$ |

All other compensation

$ (2) |

Total

compensation

$

|

|

Dr. Matthew C. Coffey

(3)

Chief Executive Officer

|

2017

|

430,000

|

—

|

61,964

|

172,000

|

N/A

|

N/A

|

62,235

|

726,199

|

|

Kirk J. Look

Chief Financial Officer

|

2017

|

345,000

|

—

|

46,473

|

120,750

|

N/A

|

N/A

|

55,223

|

567,446

|

|

Dr. Andres A. Gutierrez

(4)

Chief Medical Officer

|

2017

|

376,350

|

—

|

—

|

131,723

|

N/A

|

N/A

|

35,482

|

543,555

|

|

Andrew de Guttadauro

(4)(5)

President, Oncolytics Biotech (US) Inc.

|

2017

|

144,267

|

31,200

|

38,487

|

72,134

|

N/A

|

N/A

|

13,815

|

299,903

|

|

(1)

|

The value of share and option based awards are based on the grant date assumptions as disclosed in note 8 "

Share Based Payments"

in our

2017

audited consolidated financial statements.

|

|

(2)

|

The dollar amounts set forth under this column are related to contributions to the officers' respective retirement savings plan and amounts provided for health care benefits by the Company.

|

|

(3)

|

None of the compensation paid to Dr. Coffey related to his role as a director of the Company.

|

|

(4)

|

US Employees are paid salaries, bonuses and other compensation in US Dollars. These amounts are presented in Canadian dollars and have been converted at a US/CDN exchange rate of $1.2545, $1.3427 and $1.3840 for the years 2017, 2016 and 2015, respectively.

|

|

(5)

|

Mr. de Guttadauro was appointed as President, Oncolytics Biotech (US) Inc., a wholly-owned subsidiary of the Corporation, on June 29, 2017.

|

|

Name and principal position

|

Year

|

Salary

$

|

|

|

Dr. Matthew C. Coffey

Chief Executive Officer

|

2018

|

475,000

|

|

|

Kirk J. Look, C.A.

Chief Financial Officer

|

2018

|

365,000

|

|

|

Dr. Andres A. Gutierrez

(1)

Chief Medical Officer

|

2018

|

330,000

|

|

|

Andrew de Guttadauro

(1)

President, Oncolytics Biotech (US) Inc.

|

2018

|

253,000

|

|

|

Name

|

Termination without Cause Severance

(1)

$

|

Change of Control Severance

(2)

$

|

||

|

Dr. Matthew C. Coffey

Chief Executive Officer |

541,168

|

|

1,082,335

|

|

|

Kirk J. Look, C.A.

Chief Financial Officer |

422,093

|

|

844,185

|

|

|

Dr. Andres A. Gutierrez

(3)

Chief Medical Officer |

349,619

|

|

699,238

|

|

|

Andrew de Guttadauro

(3)

President, Oncolytics Biotech (US) Inc.

|

131,727

|

|

526,908

|

|

|

(1)

|

As at December 31,

2017

, all options granted to Officers had fully vested except for the options granted on December 1, 2015, November 10, 2016 and July 3, 2017. As a result, all Officers shall be entitled to exercise all or any part of their vested Options, within the period ending on the earlier of the date of expiration of the Option and the 90th day after the date such Officer is terminated unless otherwise approved by the Board of Directors.

|

|

(2)

|

On a change of control of the Company, the Officers shall be entitled to exercise all or a part of their Options, whether vested or not, within the period ending on the earlier of the date of expiration of the Option and the 90th day after the date such Officer is terminated.

|

|

(3)

|

US Employees are paid in US Dollars and are presented in US dollars.

|

|

C.

|

Board Practices

|

|

Name and Place of Residence

|

Position with the Corporation

|

Director of the Corporation Since

|

Date of Expiration of Current Term of Office

|

|

Matthew C. Coffey Ph.D

Alberta, Canada

|

President and Chief Executive Officer and Director

|

May 11, 2011

|

Date of 2018 Annual General Meeting of the Shareholders

|

|

Deborah Brown, B.Sc., MBA

Ontario, Canada

|

Director

|

November 2, 2017

|

Date of 2018 Annual General Meeting of the Shareholders

|

|

Angela Holtham

FCPA, FCMA, ICD.D

Ontario, Canada

|

Director

|

June 18, 2014

|

Date of 2018 Annual General Meeting of the Shareholders

|

|

J. Mark Lievonen, CM, FCPA, FCA, LLD

Ontario, Canada

|

Director

|

April 5, 2004

|

Date of 2018 Annual General Meeting of the Shareholders

|

|

Wayne Pisano, MBA

New Jersey, USA

|

Chair and Director

|

May 9, 2013

|

Date of 2018 Annual General Meeting of the Shareholders

|

|

William G. Rice, Ph.D.

California, USA

|

Director

|

June 8, 2015

|

Date of 2018 Annual General Meeting of the Shareholders

|

|

Bernd R. Seizinger, M.D., Ph.D.

New Jersey, USA and Munich Germany

|

Director

|

June 8, 2015

|

Date of 2018 Annual General Meeting of the Shareholders

|

|

1.

|

Policy Statement

|

|

2.

|

Composition of Committee

|

|

(a)

|

The Committee shall consist of a minimum of three (3) directors. The Board shall appoint the members (“Members”) of the Committee and may seek the advice and assistance of the Governance Committee in identifying qualified candidates. The Board shall appoint one Member of the Committee to be the Chair of the Committee, or delegate such authority to appoint the Chair of the Committee to the Committee.

|

|

(b)

|

The Chair of the Committee shall be responsible for the leadership of the Committee, including preparing or approving the agenda, presiding over the meetings, and making committee assignments.

|

|

(c)

|

Each director appointed to the Committee by the Board shall be an outside director who is unrelated. An outside, unrelated director is a director who meets the requirements of NASDAQ Rule 5605 and National Instrument 58-101 who is independent of management and is free from any interest, any business or other relationship which could, or could reasonably be perceived, to materially interfere with the director’s ability to be independent of management and to act with a view to the best interests of the Corporation, including, but not limited to the source of compensation of such director, including any consulting, advisory or other compensatory fee paid by the Corporation to such director and whether such director is affiliated with the Corporation, a subsidiary of the Corporation or an affiliate of a subsidiary of the Corporation other than interests and relationships arising from shareholding. In determining whether a director is independent of management, the Board shall make reference to the then current legislation, rules, policies and instruments of applicable regulatory authorities.

|

|

(d)

|

Each Member shall be appointed by the Board annually at the next scheduled meeting of the Board following the AGM. The Members will be appointed to hold office until the next annual general meeting of shareholders or until their successors are appointed. The Board may remove a Member at any time and may fill any vacancy occurring on the Committee. A Member may resign at any time and a Member will automatically cease to be a Member upon ceasing to be a director.

|

|

(e)

|

The Chair of the Board shall be an ex officio Member of the committee.

|

|

3.

|

Meetings of the Committee

|

|

(a)

|

The Committee shall meet a minimum of twice per year at such time and place as may be designated by the Chair of the Committee and whenever a meeting is requested by the Board, a Member of the Committee, or the Chief Executive Officer of the Corporation (the "CEO").

|

|

(b)

|

Notice of each meeting of the Committee shall be given to each Member of the Committee. The CEO shall attend each meeting of the Committee whenever requested to do so by a Member of the Committee.

|

|

(c)

|

Notice of a meeting of the Committee shall:

|

|

(i)

|

be in writing, including by electronic communication facilities;

|

|

(ii)

|

state the nature of the business to be transacted at the meeting in reasonable detail;

|

|

(iii)

|

to the extent practicable, be accompanied by copies of documentation to be considered at the meeting; and

|

|

(iv)

|

be given at least two business days prior to the time stipulated for the meeting or such shorter period as the Members of the Committee may permit.

|

|

(d)

|

A quorum for the transaction of business at a meeting of the Committee shall consist of a majority of the Members of the Committee.

|

|

(e)

|

A Member or Members of the Committee may participate in a meeting of the Committee by means of such telephonic, electronic or other communication facilities, as permits all persons participating in the meeting to communicate adequately with each other. A Member participating in such a meeting by any such means is deemed to be present at the meeting.

|

|

(f)

|

In the absence of the Chair of the Committee, the Members of the Committee shall choose one of the Members present to be Chair of the meeting. If the Board has appointed a Corporate Secretary, the Corporate Secretary

|

|

(g)

|

Minutes shall be kept of all meetings of the Committee and shall be signed by the Chair and the secretary of the meeting. Minutes of the meetings of the Committee shall be distributed to members of the Committee, to other members of the Board and, with the exception of “

in camera

” items, to the Chief Executive Officer and Chief Financial Officer. Notwithstanding the foregoing, distribution of minutes of meetings or parts thereof may be restricted to independent directors in the event of a conflict of interest or potential conflict of interest or if otherwise necessary for the Committee to properly discharge its responsibilities, but only for as long as is reasonably necessary.

|

|

4.

|

Duties and Responsibilities of the Committee

|

|

(a)

|

The Committee shall, at the earliest opportunity after each meeting, report to the Board the results of its activities and any reviews undertaken and make recommendations to the Board as deemed appropriate.

|

|

(b)

|

The Committee’s primary duties and responsibilities are to review and make recommendations to the Board in respect of:

|

|

(i)

|

human resource policies, practices and structures (to monitor consistency with the Corporation’s goals and near and long-term strategies, support of operational effectiveness and efficiency, and maximization of human resources potential);

|

|

(ii)

|

compensation policies and guidelines;

|

|

(iii)

|

management incentive and perquisite plans and any non-standard remuneration plans;

|

|

(iv)

|

senior management, executive and officer appointments and their compensation;

|

|

(v)

|

management succession plans, management training and development plans, termination policies and termination arrangements; and

|

|

(vi)

|

Board compensation matters.

|

|

(c)

|

In carrying out its duties and responsibilities, the Committee shall:

|

|

(i)

|

annually assess and make a recommendation to the Board with regard to the competitiveness and appropriateness of the compensation package of the CEO, all other officers of the Corporation and such other key employees of the Corporation or any subsidiary of the Corporation as may be identified by the CEO and approved by the Committee (collectively, the "Designated Employees");

|

|

(ii)

|

annually review the performance goals and criteria for the CEO and evaluate the performance of the CEO against such goals and criteria and recommend to the Board the amount of regular and incentive compensation to be paid to the CEO;

|

|

(iii)

|

annually, review and make a recommendation to the Board regarding the CEO’s performance evaluation of Designated Employees and the CEO’s recommendations with respect to the amount of regular and incentive compensation to be paid to such Designated Employees;

|

|

(iv)

|

review and make a recommendation to the Board regarding any employment contracts or arrangements with each of the Designated Employees, including any retiring allowance arrangements or any similar arrangements to take effect in the event of a termination of employment;

|

|

(v)

|

periodically, review the compensation philosophy statement of the Corporation and make recommendations for change to the Board as considered necessary;

|

|

(vi)

|

from time to time, review and make recommendations to the Board in respect of the design, benefit provisions, investment options and text of applicable pension, retirement and savings plans or related matters;

|

|

(vii)

|

annually, in conjunction with the Corporation’s general and administrative budget, review and make recommendations to the Board regarding compensation guidelines for the forthcoming budget period;

|

|

(viii)

|

when requested by the CEO, review and make recommendations to the Board regarding short term incentive or reward plans and, to the extent delegated by the Board, approve awards to eligible participants;

|

|

(ix)

|

review and make recommendations to the Board regarding incentive stock option plans or any other long term incentive plans and to the extent delegated by the Board, approve grants to participants and the magnitude and terms of their participation;

|

|

(x)

|

as required, fulfill the obligations assigned to the Committee pursuant to any other employee benefit plans approved by the Board;

|

|

(xi)

|

annually, prepare or review the report on executive compensation required to be disclosed in the Corporation’s information circular or any other human resource or compensation matter required to be publicly disclosed by the Corporation;

|

|

(xii)

|

annually, review and make a recommendation to the Board regarding the compensation of the Board of Directors;

|

|

(xiii)

|

as determined in the sole discretion of the Committee, retain independent advice in respect of human resources and compensation matters from a compensation consultant, legal counsel or other advisor (the “Advisor”) and, if deemed necessary by the Committee, meet separately with the Advisor; the Committee shall be directly responsible for the appointment, compensation and oversight of the work of the Advisor retained by the Committee;

|

|

(xiv)

|

select, or receive advice from, an Advisor to the Committee, other than in-house legal counsel, after taking into consideration the following factors:

|

|

(i)

|

the provision of other services to the Corporation by the entity that employs the Advisor ;

|

|

(ii)

|

the amount of fees received from the Corporation by the entity that employs the Advisor, as a percentage of the total revenue of the entity that employs the Advisor;

|

|

(iii)

|

the policies and procedures of the entity that employs the Advisor that are designed to prevent conflicts of interest;

|

|

(iv)

|

any business or personal relationship of the Advisor with a member of the Board;

|

|

(v)

|

any stock of the Corporation owned by the Advisor; and

|

|

(vi)

|

any business or personal relationship of the Advisor or the entity employing the Advisor with an executive officer of the Corporation;

|

|

(xv)

|

review and consider the implications of the risks associated with the Corporation’s compensation policies and practices, specifically, situations that could potentially encourage an insider to expose the Corporation to inappropriate or excessive risks; and

|

|

(xvi)

|

assess, on an annual basis, the adequacy of this Mandate and the performance of the Committee.

|

|

(d)

|

In addition to the foregoing, the Committee shall undertake on behalf of the Board such other initiatives as may be necessary or desirable to assist the Board in discharging its responsibility for the Corporation’s human resources development, performance evaluation, compensation and succession planning programs are in place and operating effectively.

|

|

(e)

|

The Committee shall assess, on an annual basis, the adequacy of this Mandate and the performance of the Committee.

|

|

5.

|

Reporting

|

|

6.

|

External Advisors

|

|

7.

|

Date of Mandate

|

|

1.

|

Policy Statement

|

|

(a)

|

The Audit Committee shall consist of a minimum of three (3) directors. The Board shall appoint the members (“Members”) of the Audit Committee and may seek the advice and assistance of the Governance Committee in identifying qualified candidates. The Board shall appoint one Member of the Audit Committee to be the Chair of the Audit Committee, or delegate such authority to appoint the Chair of the Audit Committee to the Audit Committee.

|

|

(b)

|

The Chair of the Committee shall be responsible for leadership of the Committee, including preparing or approving the agenda, presiding over the meetings, and making committee assignments.

|

|

(c)

|

Each director appointed to the Audit Committee by the Board shall be an outside director who is unrelated and independent. An outside, unrelated and independent director is a director who meets the requirements of NASDAQ Rule 5605(a)(2) and National Instrument 52-110. A director appointed to the audit committee shall also meet the requirements of NASDAQ Rule 5605(c)(2) and Rule 10A-3(b)(1) of the United States Securities Exchange Act of 1934, as amended. Such director shall be independent of management and free from any interest, any business or other relationship which could, or could reasonably be perceived, to materially interfere with the director’s ability to act with a view to the best interests of the Corporation, other than interests and relationships arising from shareholding. In determining whether a director is independent of management, the Board shall make reference to the abovementioned rules and any applicable revisions thereto, and any additional relevant and then current legislation, rules, policies and instruments of applicable regulatory authorities.

|

|

(d)

|

Each Member of the Audit Committee shall be financially literate. In order to be financially literate, a director must be, at a minimum, able to read and understand financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by the Corporation's financial statements. At least one Member shall have accounting or related financial management expertise, meaning the ability to analyze and interpret a full set of financial statements, including the notes attached thereto, in accordance with generally accepted accounting principles and shall be a “financial expert” as defined in Item 407 of Regulation S-K promulgated by the U.S. Securities and Exchange Commission and “financially sophisticated” as defined in NASDAQ Rule 5605(c)(2).

|

|

(e)

|

In determining whether a Member of the Audit Committee is financially literate or has accounting or related financial expertise, reference shall be made to the then current legislation, rules, policies and instruments of applicable regulatory authorities.

|

|

(f)

|

Each Member of the Audit Committee shall be appointed by the Board annually at the next scheduled meeting of the Board following the AGM. The Members will be appointed to hold office until the next annual general meeting of shareholders or until their successors are appointed. The Board may remove a Member at any time and may fill any vacancy occurring on the Audit Committee. A Member may resign at any time and a Member will automatically cease to be a Member upon ceasing to be a director.

|

|

(g)

|

The Chair of the Board shall be an ex officio Member of the committee.

|

|

3.

|

Meetings of the Committee

|

|

(a)

|

The Audit Committee shall convene a minimum of four times each year at such times and places as may be designated by the Chair of the Audit Committee and whenever a meeting is requested by the Board, a Member of the Audit Committee, the auditors, or senior management of the Corporation. Scheduled meetings of the

|

|

(b)

|

Notice of each meeting of the Audit Committee shall be given to each Member of the Audit Committee and to the auditors, who shall be entitled to attend each meeting of the Audit Committee and shall attend whenever requested to do so by a Member of the Audit Committee.

|

|

(c)

|

Notice of a meeting of the Audit Committee shall:

|

|

(i)

|

be in writing, including by electronic communication facilities;

|

|

(ii)

|

state the nature of the business to be transacted at the meeting in reasonable detail;

|

|

(iii)

|

to the extent practicable, be accompanied by copies of documentation to be considered at the meeting; and

|

|

(iv)

|

be given at least two business days prior to the time stipulated for the meeting or such shorter period as the Members of the Audit Committee may permit.

|

|

(d)

|

A quorum for the transaction of business at a meeting of the Audit Committee shall consist of a majority of the Members of the Audit Committee. However, it shall be the practice of the Audit Committee to require review, and, if necessary, approval of certain important matters by all Members of the Audit Committee.

|

|

(e)

|

A Member or Members of the Audit Committee may participate in a meeting of the Audit Committee by means of such telephonic, electronic or other communication facilities, as permits all persons participating in the meeting to communicate adequately with each other. A Member participating in such a meeting by any such means is deemed to be present at the meeting.

|

|

(f)

|

In the absence of the Chair of the Audit Committee, the Members of the Audit Committee shall choose one of the Members present to be Chair of the meeting. If the Board has appointed a Corporate Secretary, the Corporate Secretary shall act as the secretary of the meeting. If the Board has not appointed a Corporate Secretary, the Members of the Committee shall choose one of the persons present to be the secretary of the meeting or may have another person who is not a Member of the Committee present to record the minutes of the meeting.

|

|

(g)

|

A member of the Board, senior management of the Corporation and other parties may attend meetings of the Audit Committee; however the Audit Committee (i) shall, at each meeting, meet with the external auditors independent of other individuals other than the Audit Committee; (ii) may exclude: (A) management, (B) directors who are not independent directors, or (C) any party that has a conflict of interest or potential conflict of interest, from part or all of a meeting of the Audit Committee if reasonably necessary for the Audit Committee to properly discharge its responsibilities; and (iii) may meet separately with management.

|

|

(h)

|

The Chief Executive Officer and the Chief Financial Officer shall each attend meetings of the Audit Committee when requested to do so by a Member of the Audit Committee.

|

|

(i)

|

Minutes shall be kept of all meetings of the Audit Committee and shall be signed by the Chair and the secretary of the meeting. Minutes of the meetings of the Audit Committee shall be distributed to Members of the Audit Committee, to other members of the Board and, with the exception of “

in camera

” items, to the Chief Executive Officer and Chief Financial Officer. Notwithstanding the foregoing, distribution of minutes of meetings or parts thereof may be restricted to independent directors in the event of a conflict of interest or potential conflict of interest or if otherwise necessary for the Audit Committee to properly discharge its responsibilities, but only for as long as is reasonably necessary.

|

|

4.

|

Duties and Responsibilities of the Committee

|

|

(a)

|

The Audit Committee’s primary duties and responsibilities are to:

|

|

(i)

|

identify and monitor the management of the principal risks that could impact the financial reporting of the Corporation;

|

|

(ii)

|

monitor the integrity of the Corporation’s financial reporting process and system of internal controls regarding financial reporting and accounting compliance;

|

|

(iii)

|

monitor the independence and performance of the Corporation’s external auditors. This will include receipt, review and evaluation, at least annually, of a formal written statement from the independent auditors confirming their independence, and qualifications, including their compliance with the requirements of the relevant oversight boards and actively engage in a dialogue with the auditors with respect to any disclosed relationships or services that may impact objectivity and independence of the auditors and take, or recommend that the full board take, appropriate action to oversee the independence of the external auditors;

|

|

(iv)

|

deal directly with the external auditors to pre-approve external audit plans, other services (if any) and fees;

|

|

(v)

|

directly oversee the external audit process and results (in addition to items described in Section 4(d) below);

|

|

(vi)

|

provide an avenue of communication among the external auditors, management and the Board;

|

|

(vii)

|

carry out a review designed to ensure that an effective "whistle blowing" procedure exists to permit stakeholders to express any concerns to an appropriately independent individual;

|

|

(viii)

|

pre-approve any related party transactions to be entered into by the Company, and ensure appropriate disclosure thereof;

|

|

(ix)

|

ensure financial disclosure incorporates inclusion of any material correcting adjustments required by the external auditors; and

|

|

(x)

|

require and ensure that the external auditors are directly responsible to the Audit Committee, to whom they report.

|

|

(b)

|

The Audit Committee shall have the authority to:

|

|

(i)

|

inspect any and all of the books and records of the Corporation and its affiliates;

|

|

(ii)

|

discuss with the management of the Corporation and its affiliates, any affected party and the external auditors, such accounts, records and other matters as any Member of the Audit Committee considers necessary and appropriate;

|

|

(iii)

|

engage independent counsel and other advisors as it determines necessary to carry out its duties. The Audit Committee shall keep the Board apprised of both the selection of experts and the expert’s findings through the Audit Committee’s regular reports to the Board. The Audit Committee may restrict such reports to independent directors in the event of a conflict of interest or potential conflict of interest or if otherwise necessary for the Audit Committee to properly discharge its responsibilities, but only for as long as is reasonably necessary;

|

|

(iv)

|

communicate directly with the external auditors; and

|

|

(v)

|

set and pay the compensation for (A) any external auditor engaged for the purpose of preparing or issuing an audit report or performing other audit, review, or attest services for the Corporation, (b) any advisors employed by the Audit Committee, and (C) ordinary administrative expenses of the Audit Committee.

|

|

(c)

|

The Audit Committee shall, at the earliest opportunity after each meeting, report to the Board the results of its activities and any reviews undertaken and make recommendations to the Board as deemed appropriate. The Audit Committee may restrict such reports to independent directors in the event of a conflict of interest or potential conflict of interest or if otherwise necessary for the Audit Committee to properly discharge its responsibilities, but only for as long as is reasonably necessary.

|

|

(d)

|

The Audit Committee shall:

|

|

(i)

|

review the audit plan with the Corporation’s external auditors and with management;

|

|

(ii)

|

review with the independent auditors the matters required to be discussed relating to the conduct of the audit, including (a) the proposed scope of their examination, with emphasis on accounting and financial areas where the Committee, the independent auditors or management believes special attention should be directed; (b) the results of their audit, including their audit findings report and resulting letter, if any, of recommendations for management; (c) their evaluation of the adequacy and effectiveness of the Company’s internal controls over financial reporting; (d) significant areas of disagreement, if any, with management; (e) co-operation received from management in the conduct of the audit; (f) significant accounting, reporting, regulatory or industry developments affecting the Company; and (g) any proposed changes in major accounting policies or principles proposed or contemplated by the independent auditors or management, the presentation and impact of material risks and uncertainties and key estimates and judgements of management that may be material to financial reporting;

|

|

(iii)

|

review with management and with the external auditors material financial reporting issues arising during the most recent fiscal period and the resolution or proposed resolution of such issues;

|

|

(iv)

|

review any problems experienced or concerns expressed by the external auditors in performing an audit, including any restrictions imposed by management or material accounting issues on which there was a disagreement with management;

|

|

(v)

|

review with senior management the process of identifying, monitoring and reporting the principal risks affecting financial reporting;

|

|

(vi)

|

review audited annual financial statements (including management discussion and analysis) and related documents in conjunction with the report of the external auditors and obtain an explanation from management of all material variances between comparative reporting periods. Without restricting the generality of the foregoing, the committee will discuss with management and the independent auditors to the extent required, any issues and disclosure requirements regarding (a) the use of “pro forma” or “adjusted” non-GAAP information, as well as financial information and earnings guidance provided to analysts and rating agencies, (b) any off balance sheet arrangements, and (c) any going concern qualification.

|

|

(vii)

|

consider and review with management, the internal control memorandum or management letter containing the recommendations of the external auditors and management’s response, if any, including

|

|

(viii)

|

review with financial management and the external auditors the quarterly unaudited financial statements, management discussion and analysis, letter to shareholders and press release (all to be considered the “Quarterly Financial Reports”) and recommend the Quarterly Financial Reports to the Board for approval by the Board before release to the public;

|

|

(ix)

|

before release, review and if appropriate, recommend for approval by the Board, all public disclosure documents containing audited or unaudited financial information, including any prospectuses, financial statements, including the notes thereto, annual reports, annual information forms, management discussion and analysis and press releases; and

|

|

(x)

|

oversee, any of the financial affairs of the Corporation or its affiliates, and, if deemed appropriate, make recommendations to the Board, external auditors or management.

|

|

(e)

|

The Audit Committee shall:

|

|

(i)

|

evaluate the independence and performance of the external auditors;

|

|

(ii)

|

recommend the nomination of the external auditors to the Board for appointment by the shareholders at the Corporation’s annual general meeting;

|

|

(iii)

|

recommend the discharge of the external auditor when circumstances warrant;

|

|

(iv)

|

monitor the rotation of the audit partner of the external auditors as required by applicable law or regulations;

|

|

(v)

|

consider the recommendations of management in respect of the appointment of the external auditors;

|

|

(vi)

|

pre-approve all non-audit services to be provided to the Corporation or its subsidiary entities by its external auditors, or the external auditors of affiliates of the Corporation subject to the over-riding principle that the external auditors are not permitted to be retained by the Corporation to perform specifically listed categories of non-audit services as set forth by the Securities and Exchange Commission as well as internal audit outsourcing services, financial information systems work and expert services. Notwithstanding, the foregoing the pre-approval of non-audit services may be delegated to a Member of the Audit Committee, with any decisions of the Member with the delegated authority reporting to the Audit Committee at the next scheduled meeting;

|

|

(vii)

|

approve the engagement letter for non-audit services to be provided by the external auditors or affiliates, together with estimated fees, and considering the potential impact of such services on the independence of the external auditors;

|

|

(viii)

|

when there is to be a change of external auditors, review all issues and provide documentation related to the change, including the information to be included in the Notice of Change of Auditors and documentation required pursuant to the then current legislation, rules, policies and instruments of applicable regulatory authorities and the planned steps for an orderly transition period; and

|

|

(ix)

|

review all reportable events, including disagreements, unresolved issues and consultations, as defined by applicable securities policies, on a routine basis, whether or not there is to be a change of external auditors.

|

|

(f)

|

The Audit Committee shall enquire into and determine the appropriate resolution of any conflict of interest in respect of audit or financial matters, which are directed to the Audit Committee.

|

|

(g)

|

The Audit Committee shall review the Corporation’s accounting and reporting of revenues, costs, liabilities and contingencies.

|

|

(h)

|

The Audit Committee shall establish and maintain procedures for:

|

|

(i)

|

the receipt, retention and treatment of complaints received by the Corporation regarding accounting, internal controls, or auditing matters; and

|

|

(ii)

|

the confidential, anonymous submission by employees of the Corporation or concerns regarding questionable accounting or auditing matters.

|

|

(i)

|