|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Missouri

|

000-21318

|

27-4358837

|

||

|

(State or other jurisdiction

|

Commission file

|

(I.R.S. Employer

|

||

|

of incorporation or organization)

|

number

|

Identification No.)

|

||

|

Title of Each Class

|

Name of Each Exchange on which Registered

|

|

|

Common Stock, $0.01 par value

|

The NASDAQ Stock Market LLC

|

|

|

(NASDAQ Global Select Market)

|

||

|

Document

|

Form 10-K Part

|

|

|

Proxy Statement for 2014 Annual Meeting of Shareholders (to be filed pursuant to Regulation 14A within 120 days of the end of registrant's most recently completed fiscal year)

|

Part III

|

|

|

Page

|

|||

|

•

|

new and remanufactured automotive hard parts, such as alternators, starters, fuel pumps, water pumps, brake system components, batteries, belts, hoses, temperature control, chassis parts and engine parts;

|

|

•

|

maintenance items, such as oil, antifreeze, fluids, filters, wiper blades, lighting, engine additives and appearance products; and

|

|

•

|

accessories, such as floor mats, seat covers and truck accessories.

|

|

•

|

used oil, oil filter and battery recycling

|

|

•

|

battery, wiper and bulb replacement

|

|

•

|

battery diagnostic testing

|

|

•

|

electrical and module testing

|

|

•

|

check engine light code extraction

|

|

•

|

loaner tool program

|

|

•

|

drum and rotor resurfacing

|

|

•

|

custom hydraulic hoses

|

|

•

|

professional paint shop mixing and related materials

|

|

•

|

machine shops

|

|

•

|

superior in-store service through highly-motivated, technically-proficient store personnel (“Professional Parts People”) using an advanced point-of-sale system

|

|

•

|

an extensive selection and availability of products

|

|

•

|

attractive stores in convenient locations

|

|

•

|

competitive pricing, supported by a good, better, best product assortment designed to meet all of our customers’ quality and value preferences

|

|

•

|

a robust point-of-sale system integrated with our proprietary electronic catalog, which contains a wide variety of product images, schematics and technical specifications, and equips our Team Members with highly effective tools to source products in our extensive supply network

|

|

December 31, 2012

|

2013 Net, New and

Acquired Stores |

December 31, 2013

|

||||||||||||||||||

|

State

|

Store

Count |

% of Total Store Count

|

Store

Change |

% of Total Store Change

|

Store

Count |

% of Total Store Count

|

Cumulative % of Total Store Count

|

|||||||||||||

|

Texas

|

584

|

|

14.7

|

%

|

19

|

|

10.0

|

%

|

603

|

|

14.5

|

%

|

14.5

|

%

|

||||||

|

California

|

483

|

|

12.1

|

%

|

15

|

|

7.9

|

%

|

498

|

|

12.0

|

%

|

26.5

|

%

|

||||||

|

Missouri

|

183

|

|

4.6

|

%

|

2

|

|

1.1

|

%

|

185

|

|

4.4

|

%

|

30.9

|

%

|

||||||

|

Georgia

|

167

|

|

4.2

|

%

|

6

|

|

3.2

|

%

|

173

|

|

4.2

|

%

|

35.1

|

%

|

||||||

|

Illinois

|

147

|

|

3.7

|

%

|

12

|

|

6.2

|

%

|

159

|

|

3.8

|

%

|

38.9

|

%

|

||||||

|

Tennessee

|

142

|

|

3.6

|

%

|

6

|

|

3.2

|

%

|

148

|

|

3.6

|

%

|

42.5

|

%

|

||||||

|

Washington

|

145

|

|

3.6

|

%

|

2

|

|

1.1

|

%

|

147

|

|

3.5

|

%

|

46.0

|

%

|

||||||

|

North Carolina

|

130

|

|

3.3

|

%

|

3

|

|

1.6

|

%

|

133

|

|

3.2

|

%

|

49.2

|

%

|

||||||

|

Arizona

|

130

|

|

3.3

|

%

|

1

|

|

0.5

|

%

|

131

|

|

3.1

|

%

|

52.3

|

%

|

||||||

|

Ohio

|

115

|

|

2.9

|

%

|

15

|

|

7.9

|

%

|

130

|

|

3.0

|

%

|

55.3

|

%

|

||||||

|

Michigan

|

110

|

|

2.8

|

%

|

10

|

|

5.3

|

%

|

120

|

|

2.9

|

%

|

58.2

|

%

|

||||||

|

Oklahoma

|

112

|

|

2.8

|

%

|

3

|

|

1.6

|

%

|

115

|

|

2.8

|

%

|

61.0

|

%

|

||||||

|

Alabama

|

112

|

|

2.8

|

%

|

1

|

|

0.5

|

%

|

113

|

|

2.7

|

%

|

63.7

|

%

|

||||||

|

Minnesota

|

109

|

|

2.7

|

%

|

3

|

|

1.6

|

%

|

112

|

|

2.7

|

%

|

66.4

|

%

|

||||||

|

Indiana

|

95

|

|

2.4

|

%

|

9

|

|

4.6

|

%

|

104

|

|

2.5

|

%

|

68.9

|

%

|

||||||

|

Arkansas

|

101

|

|

2.5

|

%

|

1

|

|

0.5

|

%

|

102

|

|

2.4

|

%

|

71.3

|

%

|

||||||

|

Louisiana

|

90

|

|

2.3

|

%

|

6

|

|

3.2

|

%

|

96

|

|

2.3

|

%

|

73.6

|

%

|

||||||

|

Wisconsin

|

87

|

|

2.2

|

%

|

8

|

|

4.2

|

%

|

95

|

|

2.3

|

%

|

75.9

|

%

|

||||||

|

Florida

|

58

|

|

1.5

|

%

|

32

|

|

16.7

|

%

|

90

|

|

2.2

|

%

|

78.1

|

%

|

||||||

|

Colorado

|

84

|

|

2.1

|

%

|

2

|

|

1.1

|

%

|

86

|

|

2.1

|

%

|

80.2

|

%

|

||||||

|

South Carolina

|

72

|

|

1.8

|

%

|

6

|

|

3.2

|

%

|

78

|

|

1.9

|

%

|

82.1

|

%

|

||||||

|

Kansas

|

72

|

|

1.8

|

%

|

2

|

|

1.1

|

%

|

74

|

|

1.8

|

%

|

83.9

|

%

|

||||||

|

Mississippi

|

72

|

|

1.8

|

%

|

0

|

|

0.0

|

%

|

72

|

|

1.7

|

%

|

85.6

|

%

|

||||||

|

Iowa

|

67

|

|

1.7

|

%

|

1

|

|

0.5

|

%

|

68

|

|

1.6

|

%

|

87.2

|

%

|

||||||

|

Kentucky

|

65

|

|

1.6

|

%

|

2

|

|

1.1

|

%

|

67

|

|

1.6

|

%

|

88.8

|

%

|

||||||

|

Utah

|

56

|

|

1.4

|

%

|

1

|

|

0.5

|

%

|

57

|

|

1.4

|

%

|

90.2

|

%

|

||||||

|

Oregon

|

48

|

|

1.2

|

%

|

4

|

|

2.1

|

%

|

52

|

|

1.3

|

%

|

91.5

|

%

|

||||||

|

Nevada

|

48

|

|

1.2

|

%

|

2

|

|

1.1

|

%

|

50

|

|

1.2

|

%

|

92.7

|

%

|

||||||

|

Virginia

|

40

|

|

1.0

|

%

|

6

|

|

3.2

|

%

|

46

|

|

1.1

|

%

|

93.8

|

%

|

||||||

|

New Mexico

|

41

|

|

1.0

|

%

|

3

|

|

1.6

|

%

|

44

|

|

1.1

|

%

|

94.9

|

%

|

||||||

|

Maine

|

35

|

|

0.9

|

%

|

0

|

|

0.0

|

%

|

35

|

|

0.8

|

%

|

95.7

|

%

|

||||||

|

Idaho

|

33

|

|

0.8

|

%

|

1

|

|

0.5

|

%

|

34

|

|

0.8

|

%

|

96.5

|

%

|

||||||

|

Nebraska

|

30

|

|

0.8

|

%

|

2

|

|

1.1

|

%

|

32

|

|

0.7

|

%

|

97.2

|

%

|

||||||

|

Montana

|

24

|

|

0.6

|

%

|

0

|

|

0.0

|

%

|

24

|

|

0.6

|

%

|

97.8

|

%

|

||||||

|

New Hampshire

|

18

|

|

0.5

|

%

|

0

|

|

0.0

|

%

|

18

|

|

0.4

|

%

|

98.2

|

%

|

||||||

|

Wyoming

|

16

|

|

0.4

|

%

|

1

|

|

0.5

|

%

|

17

|

|

0.4

|

%

|

98.6

|

%

|

||||||

|

North Dakota

|

13

|

|

0.3

|

%

|

0

|

|

0.0

|

%

|

13

|

|

0.3

|

%

|

98.9

|

%

|

||||||

|

Alaska

|

13

|

|

0.3

|

%

|

0

|

|

0.0

|

%

|

13

|

|

0.3

|

%

|

99.2

|

%

|

||||||

|

Hawaii

|

11

|

|

0.3

|

%

|

1

|

|

0.5

|

%

|

12

|

|

0.3

|

%

|

99.5

|

%

|

||||||

|

South Dakota

|

11

|

|

0.3

|

%

|

1

|

|

0.5

|

%

|

12

|

|

0.3

|

%

|

99.8

|

%

|

||||||

|

West Virginia

|

4

|

|

0.1

|

%

|

1

|

|

0.5

|

%

|

5

|

|

0.1

|

%

|

99.9

|

%

|

||||||

|

Massachusetts

|

3

|

|

0.1

|

%

|

0

|

|

0.0

|

%

|

3

|

|

0.1

|

%

|

100.0

|

%

|

||||||

|

Total

|

3,976

|

|

100.0

|

%

|

190

|

|

100.0

|

%

|

4,166

|

|

100.0

|

%

|

||||||||

|

•

|

population density;

|

|

•

|

demographics including age, ethnicity, life style and per capita income;

|

|

•

|

market economic strength, retail draw and growth patterns;

|

|

•

|

number, age and percent of makes and models of registered vehicles;

|

|

•

|

the number, type and sales potential of existing automotive repair facilities;

|

|

•

|

the number of auto parts stores and other competitors within a predetermined radius and the operational strength of such competitors;

|

|

•

|

physical location, traffic count, size, economics and presentation of the site;

|

|

•

|

financial review of adjacent existing locations; and

|

|

•

|

the type and size of store that should be developed.

|

|

•

|

continue to implement voice picking technology in additional DCs;

|

|

•

|

continue to implement our warehouse management system in additional DCs;

|

|

•

|

continue to implement enhanced routing software to further enhance logistics efficiencies;

|

|

•

|

continue to implement labor management software to improve DC productivity and overall operating efficiency;

|

|

•

|

develop further automated paperless picking processes;

|

|

•

|

improve proof of delivery systems to further increase the accuracy of product movement to our stores;

|

|

•

|

continue to define and implement best practices in all DCs;

|

|

•

|

make proven, return-on-investment based capital enhancements to material handling equipment in DCs including conveyor systems, picking modules and lift equipment; and

|

|

•

|

expand our distribution network by adding two additional new DCs to our network and relocating one DC to a larger, state-of-the art facility.

|

|

•

|

broad selection of merchandise at competitive prices

|

|

•

|

dedicated Professional Service Specialists in our stores

|

|

•

|

multiple, daily deliveries from our stores

|

|

•

|

same-day or overnight access to an average of

147,000

SKUs through seven day store inventory replenishments

|

|

•

|

separate service counter and phone line in our stores dedicated exclusively to service professional service providers

|

|

•

|

trade credit for qualified accounts

|

|

•

|

Mitchell shop management systems

|

|

•

|

First Call Online, a dedicated Internet based catalog and ordering system designed to connect professional service providers directly to our inventory system

|

|

•

|

training and seminars covering topics of interest, such as technical updates, safety and general business management

|

|

•

|

access to a comprehensive inventory of products and equipment needed to operate and maintain their shop

|

|

•

|

Certified Auto Repair Center Program, a program that provides professional service providers with business tools they can utilize to profitably grow and market their shops

|

|

•

|

national retail and wholesale automotive parts chains (such as AutoZone, Inc., Advance Auto Parts, NAPA, CARQUEST and the Pep Boys - Manny, Moe and Jack, Inc.)

|

|

•

|

regional retail and wholesale automotive parts chains

|

|

•

|

independently owned parts stores

|

|

•

|

wholesalers or jobber stores (some of which are associated with national automotive parts distributors or associations such as NAPA, CARQUEST, Bumper to Bumper and Auto Value)

|

|

•

|

automobile dealers

|

|

•

|

mass merchandisers that carry automotive replacement parts, maintenance items and accessories (such as Wal-Mart Stores, Inc.)

|

|

•

|

we may not be able to continue to identify suitable acquisition targets or to acquire additional companies at favorable prices or on other favorable terms;

|

|

•

|

our management’s attention may be distracted;

|

|

•

|

we may fail to retain key personnel from acquired businesses;

|

|

•

|

we may assume unanticipated legal liabilities and other problems;

|

|

•

|

we may not be able to successfully integrate the operations (accounting and billing functions, for example) of businesses we acquire to realize economic, operational and other benefits; and

|

|

•

|

we may fail or be unable to discover liabilities of businesses that we acquire for which we, the subsequent owner or operator, may be liable.

|

|

•

|

make it more difficult to satisfy our financial obligations, including those relating to the notes and our credit facility;

|

|

•

|

increase our vulnerability to adverse economic and industry conditions;

|

|

•

|

limit our flexibility in planning for, or reacting to, changes and opportunities in our industry, which may place us at a competitive disadvantage;

|

|

•

|

require us to dedicate a substantial portion of our cash flows to service the principal and interest on the debt, reducing the funds available for other business purposes, such as working capital, capital expenditures or other cash requirements;

|

|

•

|

limit our ability to incur additional debt on acceptable terms, if at all; and

|

|

•

|

expose us to fluctuations in interest rates.

|

|

Location

|

|

Principal Use(s)

|

|

Operating Square Footage

(1)

|

|

Nature of Occupancy

|

|

Lease Term Expiration

|

|

|

Atlanta, GA

|

|

Distribution Center

|

|

492,350

|

|

|

Leased

|

|

10/31/2024

|

|

Belleville, MI

|

|

Distribution Center

|

|

333,262

|

|

|

Leased

|

|

2/28/2025

|

|

Billings, MT

|

|

Distribution Center

|

|

128,300

|

|

|

Leased

|

|

1/31/2031

|

|

Dallas, TX

|

|

Distribution Center

|

|

442,000

|

|

|

Owned

|

|

|

|

Denver, CO

|

|

Distribution Center

|

|

321,242

|

|

|

Owned

|

|

|

|

Des Moines, IA

|

|

Distribution Center

|

|

253,886

|

|

|

Owned

|

|

|

|

Devens, MA

|

|

Distribution Center (to open in 2014)

|

|

370,545

|

|

|

Owned

|

|

|

|

Greensboro, NC

|

|

Distribution Center

|

|

441,600

|

|

|

Owned

|

|

|

|

Houston, TX

|

|

Distribution Center

|

|

532,615

|

|

|

Owned

|

|

|

|

Indianapolis, IN

|

|

Distribution Center

|

|

657,603

|

|

|

Owned

|

|

|

|

Kansas City, MO

|

|

Distribution Center

|

|

299,018

|

|

|

Owned

|

|

|

|

Knoxville, TN

|

|

Distribution Center

|

|

150,766

|

|

|

Owned

|

|

|

|

Lakeland, FL

|

|

Distribution Center (opened in January, 2014)

|

|

569,419

|

|

|

Owned

|

|

|

|

Lewiston, ME

|

|

Distribution Center (to be relocated in 2014)

|

|

131,184

|

|

|

Leased

|

|

12/31/2014

|

|

Little Rock, AR

|

|

Distribution Center

|

|

122,969

|

|

|

Leased

|

|

3/31/2017

|

|

Lubbock, TX

|

|

Distribution Center

|

|

276,896

|

|

|

Owned

|

|

|

|

Mobile, AL

|

|

Distribution Center

|

|

301,068

|

|

|

Leased

|

|

12/31/2022

|

|

Moreno Valley, CA

|

|

Distribution Center

|

|

547,478

|

|

|

Owned

|

|

|

|

Naperville, IL

|

|

Distribution Center (to open in 2014)

|

|

499,471

|

|

|

Owned

|

|

|

|

Nashville, TN

|

|

Distribution Center

|

|

315,977

|

|

|

Leased

|

|

12/31/2018

|

|

Oklahoma City, OK

|

|

Distribution Center

|

|

320,667

|

|

|

Owned

|

|

|

|

Phoenix, AZ

|

|

Distribution Center

|

|

383,570

|

|

|

Leased

|

|

6/22/2015

|

|

Salt Lake City, UT

|

|

Distribution Center

|

|

294,932

|

|

|

Owned

|

|

|

|

Seattle, WA

|

|

Distribution Center

|

|

533,790

|

|

|

Owned

|

|

|

|

Springfield, MO

|

|

Distribution Center

|

|

294,486

|

|

|

Owned

|

|

|

|

St. Paul, MN

|

|

Distribution Center

|

|

324,668

|

|

|

Owned

|

|

|

|

Stockton, CA

|

|

Distribution Center

|

|

720,836

|

|

|

Leased

|

|

6/30/2025

|

|

Auburn, WA

|

|

Bulk Facility

|

|

81,761

|

|

|

Leased

|

|

6/30/2018

|

|

McAllen, TX

|

|

Bulk Facility

|

|

24,560

|

|

|

Leased

(2)

|

|

4/30/2017

|

|

Springfield, MO

|

|

Bulk Facility

|

|

35,200

|

|

|

Owned

|

|

|

|

Springfield, MO

|

|

Return/Deconsolidation Facility, Corporate Offices

|

|

290,580

|

|

|

Owned

|

|

|

|

Phoenix, AZ

|

|

Corporate Offices

|

|

12,327

|

|

|

Leased

|

|

11/30/2022

|

|

Springfield, MO

|

|

Corporate Offices

|

|

435,600

|

|

|

Owned

|

|

|

|

Springfield, MO

|

|

Corporate Offices

|

|

46,970

|

|

|

Leased

|

|

8/31/2024

|

|

Springfield, MO

|

|

Corporate Offices, Training and Technical Center

|

|

22,000

|

|

|

Owned

|

|

|

|

|

|

Total operating square footage

|

|

11,009,596

|

|

|

|

|

|

|

(1)

|

Includes floor and mezzanine operating square footage, excludes subleased square footage.

|

|

(2)

|

Occupied under the terms of a lease with an affiliated party.

|

|

2013

|

2012

|

||||||||||||||

|

High

|

Low

|

High

|

Low

|

||||||||||||

|

First Quarter

|

$

|

104.70

|

|

$

|

87.74

|

|

$

|

91.51

|

|

$

|

78.15

|

|

|||

|

Second Quarter

|

113.09

|

|

98.67

|

|

106.71

|

|

81.34

|

|

|||||||

|

Third Quarter

|

128.20

|

|

113.91

|

|

94.56

|

|

80.37

|

|

|||||||

|

Fourth Quarter

|

135.19

|

|

120.96

|

|

94.08

|

|

79.92

|

|

|||||||

|

For the Year

|

$

|

135.19

|

|

$

|

87.74

|

|

$

|

106.71

|

|

$

|

78.15

|

|

|||

|

Period

|

Total Number of Shares Purchased

|

Average Price Paid per Share

|

Total Number of Shares Purchased as Part of Publicly Announced Programs

|

Maximum Dollar Value of Shares that May Yet Be Purchased Under the Programs

(1)

|

|||||||||

|

October 1, 2013, to October 31, 2013

|

325

|

|

$

|

125.55

|

|

325

|

|

$

|

350,747

|

|

|||

|

November 1, 2013, to November 30, 2013

|

857

|

|

123.77

|

|

857

|

|

244,689

|

|

|||||

|

December 1, 2013, to December 31, 2013

|

799

|

|

123.88

|

|

799

|

|

145,734

|

|

|||||

|

Total as of December 31, 2013

|

1,981

|

|

$

|

124.11

|

|

1,981

|

|

||||||

|

(1)

|

Under our share repurchase program, as approved by our Board of Directors on January 11, 2011, we may, from time to time, repurchase shares of our common stock, solely through open market purchases effected through a broker dealer at prevailing market prices, based on a variety of factors such as price, corporate trading policy requirements and overall market conditions not to exceed a dollar limit authorized by the Board of Directors. We may increase or otherwise modify, renew, suspend or terminate the share repurchase program at any time, without prior notice. On May 29, 2013, our Board of Directors approved a resolution to increase the authorization under the share repurchase program by an additional $500 million, raising the cumulative authorization under the share repurchase program to $

3.5 billion

, which was previously announced. The additional $

500 million

authorization is effective for a three-year period, beginning on May 29, 2013. The current authorization under the share repurchase program is scheduled to expire on May 29, 2016. No other share repurchase programs existed during the three or twelve months ended December 31, 2013.

|

|

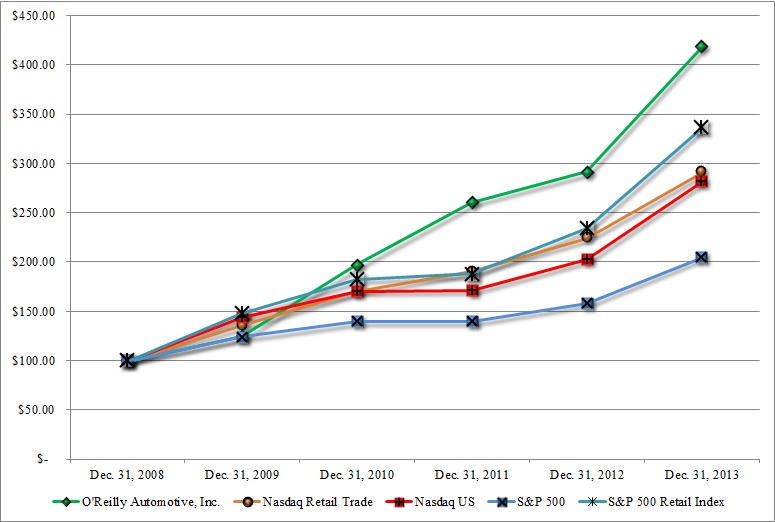

Company/Index

|

Dec 31, 2008

|

Dec 31, 2009

|

Dec 31, 2010

|

Dec 31, 2011

|

Dec 31, 2012

|

Dec 31, 2013

|

||||||||||||

|

O'Reilly Automotive, Inc.

|

$

|

100

|

|

$

|

124

|

|

$

|

197

|

|

$

|

260

|

|

$

|

291

|

|

$

|

419

|

|

|

Nasdaq Retail Trade

|

100

|

|

136

|

|

170

|

|

191

|

|

225

|

|

292

|

|

||||||

|

Nasdaq US

|

100

|

|

144

|

|

170

|

|

171

|

|

202

|

|

282

|

|

||||||

|

S&P 500

|

100

|

|

123

|

|

139

|

|

139

|

|

158

|

|

205

|

|

||||||

|

S&P 500 Retail Index

|

100

|

|

147

|

|

182

|

|

187

|

|

234

|

|

337

|

|

||||||

|

Years ended December 31,

|

2013

|

2012

|

2011

|

2010

|

2009

|

2008

|

2007

|

2006

|

2005

|

2004

|

||||||||||

|

(In thousands, except per share data)

|

||||||||||||||||||||

|

INCOME STATEMENT DATA:

|

||||||||||||||||||||

|

Sales ($)

|

6,649,237

|

|

6,182,184

|

|

5,788,816

|

|

5,397,525

|

|

4,847,062

|

|

3,576,553

|

|

2,522,319

|

|

2,283,222

|

|

2,045,318

|

|

1,721,241

|

|

|

Cost of goods sold, including warehouse and distribution expenses

|

3,280,236

|

|

3,084,766

|

|

2,951,467

|

|

2,776,533

|

|

2,520,534

|

|

1,948,627

|

|

1,401,859

|

|

1,276,511

|

|

1,152,815

|

|

978,076

|

|

|

Gross profit

|

3,369,001

|

|

3,097,418

|

|

2,837,349

|

|

2,620,992

|

|

2,326,528

|

|

1,627,926

|

|

1,120,460

|

|

1,006,711

|

|

892,503

|

|

743,165

|

|

|

Selling, general and administrative expenses

|

2,265,516

|

|

2,120,025

|

|

1,973,381

|

|

1,887,316

|

|

1,788,909

|

|

1,292,309

|

|

815,309

|

|

724,396

|

|

639,979

|

|

552,707

|

|

|

Former CSK officer clawback

|

—

|

|

—

|

|

(2,798

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Legacy CSK DOJ investigation charge

|

—

|

|

—

|

|

—

|

|

20,900

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Operating income

|

1,103,485

|

|

977,393

|

|

866,766

|

|

712,776

|

|

537,619

|

|

335,617

|

|

305,151

|

|

282,315

|

|

252,524

|

|

190,458

|

|

|

Write-off of asset-based revolving credit agreement debt issuance costs

|

—

|

|

—

|

|

(21,626

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Termination of interest rate swap agreements

|

—

|

|

—

|

|

(4,237

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Gain on settlement of note receivable

|

—

|

|

—

|

|

—

|

|

11,639

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Other income (expense), net

|

(44,543

|

)

|

(35,872

|

)

|

(25,130

|

)

|

(35,042

|

)

|

(40,721

|

)

|

(33,085

|

)

|

2,337

|

|

(50

|

)

|

(1,455

|

)

|

(2,721

|

)

|

|

Total other income (expense)

|

(44,543

|

)

|

(35,872

|

)

|

(50,993

|

)

|

(23,403

|

)

|

(40,721

|

)

|

(33,085

|

)

|

2,337

|

|

(50

|

)

|

(1,455

|

)

|

(2,721

|

)

|

|

Income before income taxes and cumulative effect of accounting change

|

1,058,942

|

|

941,521

|

|

815,773

|

|

689,373

|

|

496,898

|

|

302,532

|

|

307,488

|

|

282,265

|

|

251,069

|

|

187,737

|

|

|

Provision for income taxes

|

388,650

|

|

355,775

|

|

308,100

|

|

270,000

|

|

189,400

|

|

116,300

|

|

113,500

|

|

104,180

|

|

86,803

|

|

70,063

|

|

|

Income before cumulative effect of accounting change

|

670,292

|

|

585,746

|

|

507,673

|

|

419,373

|

|

307,498

|

|

186,232

|

|

193,988

|

|

178,085

|

|

164,266

|

|

117,674

|

|

|

Cumulative effect of accounting change, net of tax (a)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

21,892

|

|

|

Net income ($)

|

670,292

|

|

585,746

|

|

507,673

|

|

419,373

|

|

307,498

|

|

186,232

|

|

193,988

|

|

178,085

|

|

164,266

|

|

139,566

|

|

|

BASIC EARNINGS PER COMMON SHARE: (b)

|

||||||||||||||||||||

|

Income before cumulative effect of accounting change ($)

|

6.14

|

|

4.83

|

|

3.77

|

|

3.02

|

|

2.26

|

|

1.50

|

|

1.69

|

|

1.57

|

|

1.47

|

|

1.07

|

|

|

Cumulative effect of accounting change (a)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

0.20

|

|

|

Earnings per share – basic ($)

|

6.14

|

|

4.83

|

|

3.77

|

|

3.02

|

|

2.26

|

|

1.50

|

|

1.69

|

|

1.57

|

|

1.47

|

|

1.27

|

|

|

Weighted-average common shares outstanding – basic

|

109,244

|

|

121,182

|

|

134,667

|

|

138,654

|

|

136,230

|

|

124,526

|

|

114,667

|

|

113,253

|

|

111,613

|

|

110,020

|

|

|

EARNINGS PER COMMON SHARE-ASSUMING DILUTION:

|

||||||||||||||||||||

|

Income before cumulative effect of accounting change ($)

|

6.03

|

|

4.75

|

|

3.71

|

|

2.95

|

|

2.23

|

|

1.48

|

|

1.67

|

|

1.55

|

|

1.45

|

|

1.05

|

|

|

Cumulative effect of accounting change (a)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

0.20

|

|

|

Earnings per share – assuming dilution ($)

|

6.03

|

|

4.75

|

|

3.71

|

|

2.95

|

|

2.23

|

|

1.48

|

|

1.67

|

|

1.55

|

|

1.45

|

|

1.25

|

|

|

Weighted-average common shares outstanding – assuming dilution

|

111,101

|

|

123,314

|

|

136,983

|

|

141,992

|

|

137,882

|

|

125,413

|

|

116,080

|

|

115,119

|

|

113,385

|

|

111,423

|

|

|

Years ended December 31,

|

2013

|

2012

|

2011

|

2010

|

2009

|

2008

|

2007

|

2006

|

2005

|

2004

|

||||||||||

|

SELECTED OPERATING DATA:

|

||||||||||||||||||||

|

Number of Team Members at year end

|

61,909

|

|

53,063

|

|

49,324

|

|

46,858

|

|

44,880

|

|

40,735

|

|

23,576

|

|

21,920

|

|

19,614

|

|

17,410

|

|

|

Number of stores at year end (c)

|

4,166

|

|

3,976

|

|

3,740

|

|

3,570

|

|

3,421

|

|

3,285

|

|

1,830

|

|

1,640

|

|

1,470

|

|

1,249

|

|

|

Total store square footage at year end (in 000s)(d)

|

30,077

|

|

28,628

|

|

26,530

|

|

25,315

|

|

24,200

|

|

23,205

|

|

12,439

|

|

11,004

|

|

9,801

|

|

8,318

|

|

|

Sales per weighted-average store (in 000s)(d)($)

|

1,614

|

|

1,590

|

|

1,566

|

|

1,527

|

|

1,424

|

|

1,379

|

|

1,430

|

|

1,439

|

|

1,478

|

|

1,443

|

|

|

Sales per weighted-average square foot (in 000s)(d)($)

|

224

|

|

224

|

|

221

|

|

216

|

|

202

|

|

201

|

|

212

|

|

215

|

|

220

|

|

217

|

|

|

Percentage increase in same store sales (e)(f)

|

4.3

|

%

|

3.8

|

%

|

4.6

|

%

|

8.8

|

%

|

4.6

|

%

|

1.5

|

%

|

3.7

|

%

|

3.3

|

%

|

7.5

|

%

|

6.8

|

%

|

|

Years ended December 31,

|

2013

|

2012

|

2011

|

2010

|

2009

|

2008

|

2007

|

2006

|

2005

|

2004

|

||||||||||

|

(In thousands, except ratio data)

|

||||||||||||||||||||

|

BALANCE SHEET DATA:

|

||||||||||||||||||||

|

Working capital ($)

|

412,191

|

|

460,083

|

|

1,027,600

|

|

1,072,294

|

|

1,007,576

|

|

821,932

|

|

573,328

|

|

566,892

|

|

424,974

|

|

479,662

|

|

|

Total assets ($)

|

6,067,208

|

|

5,749,187

|

|

5,500,501

|

|

5,047,827

|

|

4,781,471

|

|

4,193,317

|

|

2,279,737

|

|

1,977,496

|

|

1,718,896

|

|

1,432,357

|

|

|

Inventory turnover

|

1.4

|

|

1.4

|

|

1.5

|

|

1.4

|

|

1.4

|

|

1.6

|

|

1.6

|

|

1.6

|

|

1.7

|

|

1.6

|

|

|

Inventory turnover, net of payables

|

10.7

|

|

7.4

|

|

3.4

|

|

2.5

|

|

2.6

|

|

3.1

|

|

3.0

|

|

2.8

|

|

2.8

|

|

2.5

|

|

|

Accounts payable to inventory

|

86.6

|

%

|

84.7

|

%

|

64.4

|

%

|

44.3

|

%

|

42.8

|

%

|

46.9

|

%

|

43.2

|

%

|

39.2

|

%

|

40.3

|

%

|

38.5

|

%

|

|

Current portion of long-term debt and short-term debt ($)

|

67

|

|

222

|

|

662

|

|

1,431

|

|

106,708

|

|

8,131

|

|

25,320

|

|

309

|

|

75,313

|

|

592

|

|

|

Long-term debt, less current portion ($)

|

1,396,141

|

|

1,095,734

|

|

796,912

|

|

357,273

|

|

684,040

|

|

724,564

|

|

75,149

|

|

110,170

|

|

25,461

|

|

100,322

|

|

|

Shareholders’ equity ($)

|

1,966,321

|

|

2,108,307

|

|

2,844,851

|

|

3,209,685

|

|

2,685,865

|

|

2,282,218

|

|

1,592,477

|

|

1,364,096

|

|

1,145,769

|

|

947,817

|

|

|

Years ended December 31,

|

2013

|

2012

|

2011

|

2010

|

2009

|

2008

|

2007

|

2006

|

2005

|

2004

|

||||||||||

|

(In thousands)

|

||||||||||||||||||||

|

CASH FLOW DATA:

|

||||||||||||||||||||

|

Cash provided by operating activities ($)

|

908,026

|

|

1,251,555

|

|

1,118,991

|

|

703,687

|

|

285,200

|

|

298,542

|

|

299,418

|

|

185,928

|

|

206,685

|

|

226,536

|

|

|

Capital expenditures

|

395,881

|

|

300,719

|

|

328,319

|

|

365,419

|

|

414,779

|

|

341,679

|

|

282,655

|

|

228,871

|

|

205,159

|

|

173,486

|

|

|

Free cash flow (g)

|

512,145

|

|

950,836

|

|

790,672

|

|

338,268

|

|

(129,579

|

)

|

(43,137

|

)

|

16,763

|

|

(42,943

|

)

|

1,526

|

|

53,050

|

|

|

(a)

|

The cumulative change in accounting method, effective January 1, 2004, changed the method of applying last-in, first-out accounting policy for certain inventory costs. Under the new method, included in the value of inventory are certain procurement, warehousing and distribution center costs. The previous method was to recognize those costs as incurred, reported as a component of costs of goods sold.

|

|

(b)

|

Adjusted for a 2-for-1 stock split in 2005.

|

|

(c)

|

In 2005, 2008 and 2012, the Company acquired Midwest Auto Parts Distributors (“Midwest”), CSK Auto Corporation (“CSK”) and VIP Parts, Tires & Service (“VIP”), respectively. The 2005 Midwest acquisition added 72 stores, the 2008 CSK acquisition added 1,342 stores and the 2012 VIP acquisition added 56 stores to the O’Reilly store count. Financial results for these acquired companies have been included in the Company’s consolidated financial statements from the dates of the acquisitions forward.

|

|

(d)

|

Total square footage includes normal selling, office, stockroom and receiving space. Sales per weighted-average store and square foot are weighted to consider the approximate dates of store openings, expansions, closures or acquisitions.

|

|

(e)

|

Same-store sales are calculated based on the change in sales of stores open at least one year. Percentage increase in same-store sales is calculated based on store sales results, which exclude sales of specialty machinery, sales by outside salesmen, sales to Team Members and sales during the one to two week period certain CSK branded stores were closed for conversion.

|

|

(f)

|

Same-store sales for 2008 include sales for stores acquired in the CSK acquisition. Comparable store sales for stores operating on O’Reilly systems open at least one year increased 2.6% for the year ended December 31, 2008. Comparable store sales for stores operating on the legacy CSK system open at least one year decreased 1.7% for the portion of CSK’s sales in 2008 since the July 11, 2008, acquisition.

|

|

(g)

|

Free cash flow is calculated as net cash provided by operating activities, less capital expenditures for the period.

|

|

•

|

an overview of the key drivers of the automotive aftermarket industry;

|

|

•

|

key events and recent developments within our company;

|

|

•

|

our results of operations for the years ended 2013, 2012 and 2011;

|

|

•

|

our liquidity and capital resources;

|

|

•

|

any contractual obligations to which we are committed;

|

|

•

|

any off-balance sheet arrangements we utilize;

|

|

•

|

our critical accounting estimates;

|

|

•

|

the inflation and seasonality of our business;

|

|

•

|

our quarterly results for the years ended December 31, 2013, and 2012; and

|

|

•

|

recent accounting pronouncements that may affect our company.

|

|

•

|

Number of Miles Driven

- The number of total miles driven in the U.S. influences the demand for repair and maintenance products sold within the automotive aftermarket. According to the Department of Transportation, prior to 2007, the annual number of total miles driven in the U.S. had steadily increased; however, since that time, as the U.S. experienced difficult macroeconomic conditions and historically high levels of unemployment, the number of total miles driven in the U.S. have remained relatively flat. Although total miles driven have not significantly increased since 2007, vehicles in the U.S. continue to be driven approximately three trillion miles per year, resulting in ongoing wear and tear and continued demand for the repair and maintenance products sold within the automotive aftermarket. In addition, we believe that as the U.S. economy continues to recover and the level of unemployment declines, total miles driven in the U.S. will return to a period of annual growth, supporting continued demand for automotive aftermarket products.

|

|

•

|

Number of U.S. Registered Vehicles, New Light Vehicle Registrations and Average Vehicle Age

- The total number of vehicles on the road and the average age of the vehicle population heavily influence the demand for products sold within the automotive aftermarket industry. As reported by the Automotive Aftermarket Industry Association (“AAIA”), the total number of registered vehicles has increased

8%

over the past decade, from

229 million

light vehicles in 2002 to

247 million

light vehicles in 2012. Annual new light vehicle registrations declined

14%

over the past decade, from

16.7 million

registrations in 2002 to

14.3 million

registrations in 2012; however, the seasonally adjusted annual rate (the “SAAR”) of sales of light vehicles in the U.S. increased to

15 million

as of December 31, 2013, indicating that the trend of declining new light vehicle registrations has reversed. In addition, during the past decade, vehicle scrappage rates remained relatively stable, ranging from just 4.6% to 5.7% annually. The stable scrappage rates over the past decade have contributed to an increase in the average age of the U.S. vehicle population over that period, growing

16%

, from

9.6

years in 2002 to

11.1

years in 2012. We believe this increase in average age can be attributed to better engineered and manufactured vehicles, which can be reliably driven at higher mileages due to better quality power trains and interiors and exteriors, and the consumer’s willingness to invest in maintaining these higher-mileage, better built vehicles. As the average age of the vehicle on the road increases, a larger percentage of miles are being driven by vehicles which are outside of a manufacturer warranty. These out-of-warranty, older vehicles generate strong demand for automotive aftermarket products as they go through more routine maintenance cycles, have more frequent mechanical failures and generally require more maintenance than newer vehicles. As the U.S. economy recovers, we believe consumers will continue to invest in these reliable, higher-quality, higher-mileage vehicles and these investments, along with an increasing total light vehicle fleet, will support continued demand for automotive aftermarket products.

|

|

•

|

Unemployment

- Unemployment, underemployment, the threat of future joblessness and the continued uncertainty surrounding the overall economic health of the U.S. have had a negative impact on consumer confidence and the level of consumer discretionary spending. Long-term trends of high unemployment could continue to impede the growth of annual miles driven, as well as decrease consumer discretionary spending, both of which negatively impact demand for products sold in the automotive aftermarket industry. However, as of December 31, 2013, the U.S. unemployment rate decreased to

6.7%

, its lowest rate in over five years. We believe that as the economy continues to recover, unemployment rates should decline and we would expect to see a corresponding increase in commuter traffic as unemployed individuals return to work. Aided by the anticipated increase in commuter miles, we believe overall annual U.S. miles driven should return to a period of annual growth, resulting in continued demand for automotive aftermarket products.

|

|

•

|

Under the Company’s share repurchase program, as approved by the Board of Directors in January of 2011, the Company may, from time to time, repurchase shares of its common stock, solely through open market purchases effected through a broker dealer at prevailing market prices, based on a variety of factors such as price, corporate trading policy requirements and overall market conditions. The Company and its Board of Directors may increase or otherwise modify, renew, suspend or terminate the share repurchase program at any time, without prior notice. The Company’s Board of Directors approved resolutions to increase the authorization under the share repurchase program by an additional $500 million, which was announced on May 29, 2013, and an additional $500 million, which was announced on February 5, 2014, raising the cumulative authorization under the share repurchase program to $

4.0 billion

. These additional $

500 million

authorizations are effective for a three-year period following

|

|

•

|

On

June 20, 2013, the Company issued $

300 million

aggregate principal amount of unsecured 3.850% Senior Notes due 2023 (“3.850% Senior Notes due 2023”) at a price to the public of

99.992%

of their face value with United Missouri Bank, N.A. (“UMB”) as trustee. Interest on the

3.850%

Senior Notes due 2023 is payable on June 15 and December 15 of each year, which began on December 15, 2013, and is computed on the basis of a

360

-day year.

|

|

•

|

On July 2, 2013, the Company amended its credit agreement, which it entered into in January of 2011. The amendment lowered the maximum borrowing capacity under the unsecured revolving credit facility to $

600 million

, extended the maturity date of the credit agreement to July of 2018 and lowered the interest rate margins on borrowings under the unsecured revolving credit facility and facility fees applicable to the commitments thereunder.

|

|

For the Year Ended December 31,

|

||||||||

|

2013

|

2012

|

2011

|

||||||

|

Sales

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||

|

Cost of goods sold, including warehouse and distribution expenses

|

49.3

|

|

49.9

|

|

51.0

|

|

||

|

Gross profit

|

50.7

|

|

50.1

|

|

49.0

|

|

||

|

Selling, general and administrative expenses

|

34.1

|

|

34.3

|

|

34.1

|

|

||

|

Former CSK officer clawback

|

—

|

|

—

|

|

(0.1

|

)

|

||

|

Operating income

|

16.6

|

|

15.8

|

|

15.0

|

|

||

|

Interest expense

|

(0.7

|

)

|

(0.7

|

)

|

(0.5

|

)

|

||

|

Interest income

|

—

|

|

0.1

|

|

0.1

|

|

||

|

Write-off of asset-based revolving credit facility debt issuance costs

|

—

|

|

—

|

|

(0.4

|

)

|

||

|

Termination of interest rate swap agreements

|

—

|

|

—

|

|

(0.1

|

)

|

||

|

Income before income taxes

|

15.9

|

|

15.2

|

|

14.1

|

|

||

|

Provision for income taxes

|

5.8

|

|

5.7

|

|

5.3

|

|

||

|

Net income

|

10.1

|

%

|

9.5

|

%

|

8.8

|

%

|

||

|

Increase in Sales for the Year Ended December 31, 2013, Compared to the Same Period in 2012

|

|||

|

Store sales:

|

|||

|

Comparable store sales

|

$

|

259

|

|

|

Non-comparable store sales:

|

|||

|

Sales for stores opened throughout 2012, excluding stores open at least one year that are included in comparable store sales

|

74

|

|

|

|

Sales in 2012 for stores that have closed

|

(3

|

)

|

|

|

Sales for stores opened throughout 2013 and acquired VIP stores

|

134

|

|

|

|

Non-store sales:

|

|||

|

Includes sales of machinery and sales to independent parts stores and Team Members

|

3

|

|

|

|

Total increase in sales

|

$

|

467

|

|

|

Increase in Sales for the Year Ended December 31, 2012, Compared to the Same Period in 2011

|

|||

|

Store sales:

|

|||

|

Comparable store sales

|

$

|

215

|

|

|

Non-comparable store sales:

|

|||

|

Sales for stores opened throughout 2011, excluding stores open at least one year that are included in comparable store sales

|

78

|

|

|

|

Sales in 2011 for stores that have closed

|

(3

|

)

|

|

|

Sales for stores opened throughout 2012

|

96

|

|

|

|

Non-store sales:

|

|||

|

Includes sales of machinery and sales to independent parts stores and Team Members

|

7

|

|

|

|

Total increase in sales

|

$

|

393

|

|

|

For the Year Ended December 31,

|

|||||||||||||

|

2012

|

2011

|

||||||||||||

|

Amount

|

% of Sales

|

Amount

|

% of Sales

|

||||||||||

|

GAAP Operating income

|

$

|

977,393

|

|

15.8

|

%

|

$

|

866,766

|

|

15.0

|

%

|

|||

|

Former CSK officer clawback

|

—

|

—

|

%

|

(2,798

|

)

|

(0.1

|

)%

|

||||||

|

Non-GAAP adjusted operating income

|

$

|

977,393

|

|

15.8

|

%

|

$

|

863,968

|

|

14.9

|

%

|

|||

|

GAAP net income

|

$

|

585,746

|

|

9.5

|

%

|

$

|

507,673

|

|

8.8

|

%

|

|||

|

Write-off of asset-based revolving credit facility debt issuance costs, net of tax

|

—

|

|

—

|

%

|

13,458

|

|

0.2

|

%

|

|||||

|

Termination of interest rate swap agreements, net of tax

|

—

|

|

—

|

%

|

2,637

|

|

—

|

%

|

|||||

|

Former CSK officer clawback, net of tax

|

—

|

|

—

|

%

|

(1,741

|

)

|

—

|

%

|

|||||

|

Non-GAAP adjusted net income

|

$

|

585,746

|

|

9.5

|

%

|

$

|

522,027

|

|

9.0

|

%

|

|||

|

GAAP diluted earnings per common share

|

4.75

|

|

$

|

3.71

|

|

||||||||

|

Write-off of asset-based revolving credit facility debt issuance costs, net of tax

|

—

|

|

0.09

|

|

|||||||||

|

Termination of interest rate swap agreements, net of tax

|

—

|

|

0.02

|

|

|||||||||

|

Former CSK DOJ officer clawback, net of tax

|

—

|

|

(0.01

|

)

|

|||||||||

|

Non-GAAP adjusted diluted earnings per common share

|

$

|

4.75

|

|

$

|

3.81

|

|

|||||||

|

Weighted-average common shares outstanding - assuming dilution

|

123,314

|

|

136,983

|

|

|||||||||

|

December 31,

|

Percentage

|

|||||||||

|

Liquidity and Related Ratios

|

2013

|

2012

|

Change

|

|||||||

|

Current assets

|

$

|

2,835

|

|

$

|

2,733

|

|

3.7

|

%

|

||

|

Current liabilities

|

2,423

|

|

2,273

|

|

6.6

|

%

|

||||

|

Working capital

(1)

|

412

|

|

460

|

|

(10.4

|

)%

|

||||

|

Total debt

|

1,396

|

|

1,096

|

|

27.4

|

%

|

||||

|

Total equity

|

1,966

|

|

2,108

|

|

(6.7

|

)%

|

||||

|

Debt to equity

(2)

|

0.71:1

|

|

0.52:1

|

|

36.5

|

%

|

||||

|

(1)

|

Working capital is calculated as current assets less current liabilities.

|

|

(2)

|

Debt to equity is calculated as total debt divided by total equity.

|

|

For the Year Ended December 31,

|

|||||||||||

|

Liquidity

|

2013

|

2012

|

2011

|

||||||||

|

Total cash provided by (used in):

|

|||||||||||

|

Operating activities

|

$

|

908,026

|

|

$

|

1,251,555

|

|

$

|

1,118,991

|

|

||

|

Investing activities

|

(388,754

|

)

|

(317,407

|

)

|

(319,653

|

)

|

|||||

|

Financing activities

|

(536,082

|

)

|

(1,047,572

|

)

|

(467,507

|

)

|

|||||

|

Increase (decrease) in cash and cash equivalents

|

$

|

(16,810

|

)

|

$

|

(113,424

|

)

|

$

|

331,831

|

|

||

|

Capital expenditures

|

$

|

395,881

|

|

$

|

300,719

|

|

$

|

328,319

|

|

||

|

Free cash flow

(a)

|

512,145

|

|

950,836

|

|

790,672

|

|

|||||

|

(a)

|

Calculated as net cash provided by operating activities, less capital expenditures for the period.

|

|

For the Year Ended December 31,

|

|||||||

|

2013

|

2012

|

||||||

|

GAAP net income

|

$

|

670,292

|

|

$

|

585,746

|

|

|

|

Add: Interest expense

|

49,074

|

|

40,200

|

|

|||

|

Rent expense

|

254,892

|

|

240,869

|

|

|||

|

Provision for income taxes

|

388,650

|

|

355,775

|

|

|||

|

Depreciation expense

|

183,220

|

|

176,705

|

|

|||

|

Amortization (benefit) expense

|

(40

|

)

|

401

|

|

|||

|

Non-cash share-based compensation

|

21,722

|

|

22,026

|

|

|||

|

Non-GAAP adjusted net income (EBITDAR)

|

$

|

1,567,810

|

|

$

|

1,421,722

|

|

|

|

Interest expense

|

$

|

49,074

|

|

$

|

40,200

|

|

|

|

Capitalized interest

|

10,644

|

|

6,064

|

|

|||

|

Rent expense

|

254,892

|

|

240,869

|

|

|||

|

Total fixed charges

|

$

|

314,610

|

|

$

|

287,133

|

|

|

|

Consolidated fixed charge coverage ratio

|

4.98

|

4.95

|

|||||

|

GAAP debt

|

$

|

1,396,208

|

|

$

|

1,095,956

|

|

|

|

Stand-by letters of credit

|

51,715

|

|

57,281

|

|

|||

|

Discount on senior notes

|

3,890

|

|

4,366

|

|

|||

|

Six-times rent expense

|

1,529,352

|

|

1,445,214

|

|

|||

|

Non-GAAP adjusted debt

|

$

|

2,981,165

|

|

$

|

2,602,817

|

|

|

|

Consolidated leverage ratio

|

1.90

|

1.83

|

|||||

|

For the Year Ended December 31,

|

|||||||

|

2013

|

2012

|

||||||

|

Shares repurchased

|

8,529

|

|

16,201

|

|

|||

|

Average price per share

|

$

|

109.38

|

|

$

|

89.20

|

|

|

|

Total investment

|

$

|

932,900

|

|

$

|

1,445,044

|

|

|

|

Payments Due By Period

|

|||||||||||||||||||

|

Total

|

Before

1 Year |

Years

1 and 2

|

Years

3 and 4

|

Years 5

and Over |

|||||||||||||||

|

(In thousands)

|

|||||||||||||||||||

|

Contractual Obligations:

|

|||||||||||||||||||

|

Long-term debt principal and interest payments

(1)

|

$

|

1,905,981

|

|

$

|

61,200

|

|

$

|

122,400

|

|

$

|

122,400

|

|

$

|

1,599,981

|

|

||||

|

Future minimum lease payments under capital leases

(2)

|

103

|

|

77

|

|

26

|

|

—

|

|

—

|

|

|||||||||

|

Future minimum lease payments under operating leases

(2)

|

1,941,490

|

|

247,126

|

|

445,887

|

|

355,336

|

|

893,141

|

|

|||||||||

|

Other obligations

|

1,800

|

|

600

|

|

1,200

|

|

—

|

|

—

|

|

|||||||||

|

Self-insurance reserves

(3)

|

126,715

|

|

57,700

|

|

38,292

|

|

17,805

|

|

12,918

|

|

|||||||||

|

Construction commitments

|

80,803

|

|

80,803

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Total contractual cash obligations

|

$

|

4,056,892

|

|

$

|

447,506

|

|

$

|

607,805

|

|

$

|

495,541

|

|

$

|

2,506,040

|

|

||||

|

(1)

|

Our Revolving Credit Facility, which has a maximum aggregate commitment of $

600 million

and matures in July of 2018, bears interest (other than swing line loans), at our option, at either the Base Rate or Eurodollar Rate (both as defined in the agreement) plus a margin, that will vary from

0.975%

to

1.600%

in the case of loans bearing interest at the Eurodollar Rate and

0.000%

to

0.600%

in the case of loans bearing interest at the Base Rate, in each case based upon the better of the ratings assigned to our debt by Moody’s Investor Service, Inc. and Standard & Poor’s Rating Services, subject to limited exceptions. Swing line loans made under the Revolving Credit Facility bear interest at the Base Rate plus the applicable margin described above. In addition, we pay a facility fee on the aggregate amount of the commitments in an amount equal to a percentage of such commitments, varying from

0.150%

to

0.400%

based upon the better of the ratings assigned to our debt by Moody’s Investor Service, Inc. and Standard & Poor’s Rating Services, subject to limited exceptions. Based on our current credit ratings, our margin for Base Rate loans is

0.000%

, our margin for Eurodollar Rate loans is

0.975%

and our facility fee is

0.150%

. As of December 31, 2013, we had no outstanding borrowings under our Revolving Credit Facility.

|

|

(2)

|