|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Pennsylvania

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

23-2530374

(I.R.S. Employer

Identification No.)

|

|

77 East King Street, P. O. Box 250,

Shippensburg, Pennsylvania

(Address of Principal Executive Offices)

|

|

17257

(Zip Code)

|

|

Title of Each Class

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, No Par Value

|

|

The NASDAQ Capital Market

|

|

Large accelerated filer

|

|

¨

|

|

Accelerated filer

|

|

x

|

|

Non-accelerated filer

|

|

¨

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

¨

|

|

|

|

Page

|

|

•

|

Privacy provisions of the Gramm-Leach-Bliley Act (the "GLB Act") and related regulations, which require us to maintain privacy policies intended to safeguard customer financial information, to disclose the policies to our customers and to allow customers to “opt out” of having their financial service providers disclose their confidential financial information to non-affiliated third parties, subject to certain exceptions;

|

|

•

|

Right to Financial Privacy Act, which imposes a duty to maintain confidentiality of consumer financial records and prescribes procedures for complying with administrative subpoenas of financial records;

|

|

•

|

Consumer protection rules for the sale of insurance products by depository institutions, adopted pursuant to the requirements of the GLB Act; and the

|

|

•

|

USA PATRIOT Act, which requires financial institutions to take certain actions to help prevent, detect and prosecute international money laundering and the financing of terrorism.

|

|

•

|

Loan delinquencies could increase;

|

|

•

|

Problem assets and foreclosures could increase;

|

|

•

|

Demand for our products and services could decline;

|

|

•

|

Collateral for loans made by us, especially real estate, could decline in value, reducing a customer’s borrowing power, and reducing the value of assets and collateral associated with our loans.

|

|

|

2016

|

2015

|

|||||||||||||||||||||

|

|

Market Price

|

Quarterly

Dividend

|

Market Price

|

Quarterly

Dividend

|

|||||||||||||||||||

|

|

High

|

Low

|

High

|

Low

|

|||||||||||||||||||

|

First quarter

|

$

|

18.11

|

|

$

|

16.60

|

|

$

|

0.08

|

|

$

|

17.50

|

|

$

|

16.31

|

|

$

|

0.00

|

|

|||||

|

Second quarter

|

19.95

|

|

17.05

|

|

0.09

|

|

18.00

|

|

16.02

|

|

0.07

|

|

|||||||||||

|

Third quarter

|

23.73

|

|

17.59

|

|

0.09

|

|

18.00

|

|

15.10

|

|

0.07

|

|

|||||||||||

|

Fourth quarter

|

23.75

|

|

18.05

|

|

0.09

|

|

18.45

|

|

16.24

|

|

0.08

|

|

|||||||||||

|

$

|

0.35

|

|

$

|

0.22

|

|

||||||||||||||||||

|

|

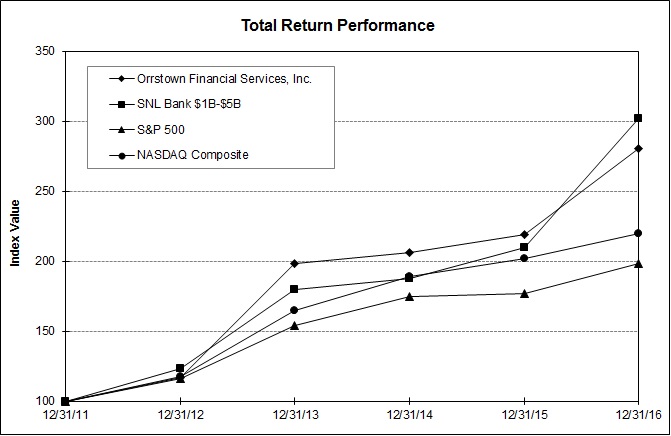

Period Ending

|

||||||||||||||||

|

Index

|

12/31/11

|

12/31/12

|

12/31/13

|

12/31/14

|

12/31/15

|

12/31/16

|

|||||||||||

|

Orrstown Financial Services, Inc.

|

100.00

|

|

116.85

|

|

198.18

|

|

206.06

|

|

219.00

|

|

280.21

|

|

|||||

|

SNL Bank $1B-$5B

|

100.00

|

|

123.31

|

|

179.31

|

|

187.48

|

|

209.86

|

|

301.92

|

|

|||||

|

S&P 500

|

100.00

|

|

116.00

|

|

153.57

|

|

174.60

|

|

177.01

|

|

198.18

|

|

|||||

|

NASDAQ Composite

|

100.00

|

|

117.45

|

|

164.57

|

|

188.84

|

|

201.98

|

|

219.89

|

|

|||||

|

|

Year Ended December 31,

|

||||||||||||||||||

|

(Dollars in thousands except per share data)

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

Summary of Operations

|

|||||||||||||||||||

|

Interest and dividend income

|

$

|

41,962

|

|

$

|

38,635

|

|

$

|

38,183

|

|

$

|

37,098

|

|

$

|

45,436

|

|

||||

|

Interest expense

|

5,417

|

|

4,301

|

|

4,159

|

|

5,011

|

|

7,548

|

|

|||||||||

|

Net interest income

|

36,545

|

|

34,334

|

|

34,024

|

|

32,087

|

|

37,888

|

|

|||||||||

|

Provision for loan losses

|

250

|

|

(603

|

)

|

(3,900

|

)

|

(3,150

|

)

|

48,300

|

|

|||||||||

|

Net interest income after provision for loan losses

|

36,295

|

|

34,937

|

|

37,924

|

|

35,237

|

|

(10,412

|

)

|

|||||||||

|

Investment securities gains

|

1,420

|

|

1,924

|

|

1,935

|

|

332

|

|

4,824

|

|

|||||||||

|

Noninterest income

|

18,319

|

|

17,254

|

|

16,919

|

|

17,476

|

|

18,438

|

|

|||||||||

|

Noninterest expenses

|

48,140

|

|

44,607

|

|

43,768

|

|

43,247

|

|

43,349

|

|

|||||||||

|

Income (loss) before income tax expense (benefit)

|

7,894

|

|

9,508

|

|

13,010

|

|

9,798

|

|

(30,499

|

)

|

|||||||||

|

Income tax expense (benefit)

|

1,266

|

|

1,634

|

|

(16,132

|

)

|

(206

|

)

|

7,955

|

|

|||||||||

|

Net income (loss)

|

$

|

6,628

|

|

$

|

7,874

|

|

$

|

29,142

|

|

$

|

10,004

|

|

$

|

(38,454

|

)

|

||||

|

Per Share Information

|

|||||||||||||||||||

|

Basic earning per share

|

$

|

0.82

|

|

$

|

0.97

|

|

$

|

3.59

|

|

$

|

1.24

|

|

$

|

(4.77

|

)

|

||||

|

Diluted earnings per share

|

0.81

|

|

0.97

|

|

3.59

|

|

1.24

|

|

(4.77

|

)

|

|||||||||

|

Dividends per share

|

0.35

|

|

0.22

|

|

0.00

|

|

0.00

|

|

0.00

|

|

|||||||||

|

Book value at December 31

|

16.28

|

|

16.08

|

|

15.40

|

|

11.28

|

|

10.85

|

|

|||||||||

|

Weighted average shares outstanding – basic

|

8,059,412

|

|

8,106,438

|

|

8,110,344

|

|

8,093,306

|

|

8,066,148

|

|

|||||||||

|

Weighted average shares outstanding – diluted

|

8,145,456

|

|

8,141,600

|

|

8,116,054

|

|

8,093,306

|

|

8,066,148

|

|

|||||||||

|

Stock Price Statistics

|

|||||||||||||||||||

|

Close

|

$

|

22.40

|

|

$

|

17.84

|

|

$

|

17.00

|

|

$

|

16.35

|

|

$

|

9.64

|

|

||||

|

High

|

23.75

|

|

18.45

|

|

17.50

|

|

18.00

|

|

11.29

|

|

|||||||||

|

Low

|

16.60

|

|

15.10

|

|

15.33

|

|

9.49

|

|

7.45

|

|

|||||||||

|

Price earnings ratio at close

|

27.3

|

|

18.4

|

|

4.7

|

|

13.2

|

|

(2.0

|

)

|

|||||||||

|

Diluted price earnings ratio at close

|

27.7

|

|

18.4

|

|

4.7

|

|

13.2

|

|

(2.0

|

)

|

|||||||||

|

Price to book at close

|

1.4

|

|

1.1

|

|

1.1

|

|

1.4

|

|

0.9

|

|

|||||||||

|

Year-End Data

|

|||||||||||||||||||

|

Total assets

|

$

|

1,414,504

|

|

$

|

1,292,816

|

|

$

|

1,190,443

|

|

$

|

1,177,812

|

|

$

|

1,232,668

|

|

||||

|

Loans

|

883,391

|

|

781,713

|

|

704,946

|

|

671,037

|

|

703,739

|

|

|||||||||

|

Total investment securities

|

408,124

|

|

402,844

|

|

384,549

|

|

416,864

|

|

311,774

|

|

|||||||||

|

Deposits – noninterest-bearing

|

150,747

|

|

131,390

|

|

116,302

|

|

116,371

|

|

121,090

|

|

|||||||||

|

Deposits – interest-bearing

|

1,001,705

|

|

900,777

|

|

833,402

|

|

884,019

|

|

963,949

|

|

|||||||||

|

Total deposits

|

1,152,452

|

|

1,032,167

|

|

949,704

|

|

1,000,390

|

|

1,085,039

|

|

|||||||||

|

Repurchase agreements

|

35,864

|

|

29,156

|

|

21,742

|

|

9,032

|

|

9,650

|

|

|||||||||

|

Borrowed money

|

76,163

|

|

84,495

|

|

79,812

|

|

66,077

|

|

37,470

|

|

|||||||||

|

Total shareholders’ equity

|

134,859

|

|

133,061

|

|

127,265

|

|

91,439

|

|

87,694

|

|

|||||||||

|

Assets under management – market value

|

1,174,143

|

|

966,362

|

|

1,017,013

|

|

1,085,216

|

|

992,378

|

|

|||||||||

|

Financial Ratios

|

|||||||||||||||||||

|

Average equity / average assets

|

10.41

|

%

|

10.66

|

%

|

8.63

|

%

|

7.45

|

%

|

8.07

|

%

|

|||||||||

|

Return on average equity

|

4.80

|

%

|

5.99

|

%

|

28.78

|

%

|

11.30

|

%

|

(35.22

|

)%

|

|||||||||

|

Return on average assets

|

0.50

|

%

|

0.64

|

%

|

2.48

|

%

|

0.84

|

%

|

(2.84

|

)%

|

|||||||||

|

|

2016

|

2015

|

2014

|

|||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

Average

Balance

|

Tax

Equivalent

Interest

|

Tax

Equivalent

Rate

|

Average

Balance

|

Tax

Equivalent

Interest

|

Tax

Equivalent

Rate

|

Average

Balance

|

Tax

Equivalent

Interest

|

Tax

Equivalent

Rate

|

|||||||||||||||||||||||

|

Assets

|

||||||||||||||||||||||||||||||||

|

Federal funds sold and interest-bearing bank balances

|

$

|

31,452

|

|

$

|

208

|

|

0.66

|

%

|

$

|

18,901

|

|

$

|

81

|

|

0.43

|

%

|

$

|

14,137

|

|

$

|

35

|

|

0.25

|

%

|

||||||||

|

Taxable securities

|

303,124

|

|

6,012

|

|

1.98

|

|

348,613

|

|

6,697

|

|

1.92

|

|

399,014

|

|

8,051

|

|

2.02

|

|

||||||||||||||

|

Tax-exempt securities

|

57,231

|

|

2,767

|

|

4.83

|

|

33,055

|

|

1,629

|

|

4.93

|

|

14,058

|

|

848

|

|

6.03

|

|

||||||||||||||

|

Total securities

|

360,355

|

|

8,779

|

|

2.44

|

|

381,668

|

|

8,326

|

|

2.18

|

|

413,072

|

|

8,899

|

|

2.15

|

|

||||||||||||||

|

Taxable loans

|

774,984

|

|

32,036

|

|

4.13

|

|

687,079

|

|

28,787

|

|

4.19

|

|

620,701

|

|

27,368

|

|

4.41

|

%

|

||||||||||||||

|

Tax-exempt loans

|

58,281

|

|

2,848

|

|

4.89

|

|

59,600

|

|

3,094

|

|

5.19

|

|

63,177

|

|

3,351

|

|

5.30

|

|

||||||||||||||

|

Total loans

|

833,265

|

|

34,884

|

|

4.19

|

|

746,679

|

|

31,881

|

|

4.27

|

|

683,878

|

|

30,719

|

|

4.49

|

|

||||||||||||||

|

Total interest-earning assets

|

1,225,072

|

|

43,871

|

|

3.58

|

|

1,147,248

|

|

40,288

|

|

3.51

|

|

1,111,087

|

|

39,653

|

|

3.57

|

|

||||||||||||||

|

Cash and due from banks

|

20,803

|

|

19,155

|

|

14,161

|

|

||||||||||||||||||||||||||

|

Bank premises and equipment

|

31,413

|

|

24,386

|

|

25,921

|

|

||||||||||||||||||||||||||

|

Other assets

|

61,391

|

|

56,894

|

|

41,499

|

|

||||||||||||||||||||||||||

|

Allowance for loan losses

|

(13,529

|

)

|

(14,134

|

)

|

(19,268

|

)

|

||||||||||||||||||||||||||

|

Total

|

$

|

1,325,150

|

|

$

|

1,233,549

|

|

$

|

1,173,400

|

|

|||||||||||||||||||||||

|

Liabilities and Shareholders’ Equity

|

||||||||||||||||||||||||||||||||

|

Interest-bearing demand deposits

|

$

|

565,524

|

|

1,195

|

|

0.21

|

|

$

|

500,474

|

|

908

|

|

0.18

|

|

$

|

491,046

|

|

823

|

|

0.17

|

|

|||||||||||

|

Savings deposits

|

90,272

|

|

144

|

|

0.16

|

|

85,068

|

|

136

|

|

0.16

|

|

83,941

|

|

135

|

|

0.16

|

|

||||||||||||||

|

Time deposits

|

289,574

|

|

3,472

|

|

1.20

|

|

263,414

|

|

2,562

|

|

0.97

|

|

292,149

|

|

2,720

|

|

0.93

|

|

||||||||||||||

|

Short-term borrowings

|

56,387

|

|

187

|

|

0.33

|

|

85,262

|

|

295

|

|

0.35

|

|

51,922

|

|

148

|

|

0.29

|

|

||||||||||||||

|

Long-term debt

|

24,335

|

|

419

|

|

1.72

|

|

22,522

|

|

400

|

|

1.78

|

|

17,773

|

|

333

|

|

1.87

|

|

||||||||||||||

|

Total interest-bearing liabilities

|

1,026,092

|

|

5,417

|

|

0.53

|

|

956,740

|

|

4,301

|

|

0.45

|

|

936,831

|

|

4,159

|

|

0.44

|

|

||||||||||||||

|

Demand deposits

|

147,473

|

|

134,040

|

|

123,224

|

|

||||||||||||||||||||||||||

|

Other

|

13,612

|

|

11,316

|

|

12,095

|

|

||||||||||||||||||||||||||

|

Total Liabilities

|

1,187,177

|

|

1,102,096

|

|

1,072,150

|

|

||||||||||||||||||||||||||

|

Shareholders’ Equity

|

137,973

|

|

131,453

|

|

101,250

|

|

||||||||||||||||||||||||||

|

Total

|

$

|

1,325,150

|

|

$

|

1,233,549

|

|

$

|

1,173,400

|

|

|||||||||||||||||||||||

|

Net interest income/net interest spread

|

38,454

|

|

3.05

|

%

|

35,987

|

|

3.06

|

%

|

35,494

|

|

3.13

|

%

|

||||||||||||||||||||

|

Net interest margin

|

3.14

|

%

|

3.14

|

%

|

3.20

|

%

|

||||||||||||||||||||||||||

|

Tax equivalent adjustment

|

(1,909

|

)

|

(1,653

|

)

|

(1,470

|

)

|

||||||||||||||||||||||||||

|

Net interest income - as reported

|

$

|

36,545

|

|

$

|

34,334

|

|

$

|

34,024

|

|

|||||||||||||||||||||||

|

Note:

|

Yields and interest income on tax-exempt assets have been adjusted to a tax equivalent basis using a marginal federal

|

|

income tax rate of 34% in 2016 and 35% in 2015 and 2014. For yield comparison purposes, nonaccruing loans are

|

|

|

included in the average loan balance.

|

|

|

|

2016 Versus 2015 Increase (Decrease)

Due to Change in |

2015 Versus 2014 Increase (Decrease)

Due to Change in |

|||||||||||||||||||||

|

(Dollars in thousands)

|

Average

Volume

|

Average

Rate

|

Total

|

Average

Volume

|

Average

Rate

|

Total

|

|||||||||||||||||

|

Interest Income

|

|||||||||||||||||||||||

|

Federal funds sold & interest-bearing deposits

|

$

|

54

|

|

$

|

73

|

|

$

|

127

|

|

$

|

12

|

|

$

|

34

|

|

$

|

46

|

|

|||||

|

Taxable securities

|

(874

|

)

|

189

|

|

(685

|

)

|

(1,017

|

)

|

(337

|

)

|

(1,354

|

)

|

|||||||||||

|

Tax-exempt securities

|

1,191

|

|

(53

|

)

|

1,138

|

|

1,146

|

|

(365

|

)

|

781

|

|

|||||||||||

|

Taxable loans

|

3,683

|

|

(434

|

)

|

3,249

|

|

2,927

|

|

(1,508

|

)

|

1,419

|

|

|||||||||||

|

Tax-exempt loans

|

(68

|

)

|

(178

|

)

|

(246

|

)

|

(190

|

)

|

(67

|

)

|

(257

|

)

|

|||||||||||

|

Total interest income

|

3,986

|

|

(403

|

)

|

3,583

|

|

2,878

|

|

(2,243

|

)

|

635

|

|

|||||||||||

|

Interest Expense

|

|||||||||||||||||||||||

|

Interest-bearing demand deposits

|

118

|

|

169

|

|

287

|

|

16

|

|

69

|

|

85

|

|

|||||||||||

|

Savings deposits

|

8

|

|

0

|

|

8

|

|

2

|

|

(1

|

)

|

1

|

|

|||||||||||

|

Time deposits

|

254

|

|

656

|

|

910

|

|

(268

|

)

|

110

|

|

(158

|

)

|

|||||||||||

|

Short-term borrowings

|

(100

|

)

|

(8

|

)

|

(108

|

)

|

95

|

|

52

|

|

147

|

|

|||||||||||

|

Long-term debt

|

32

|

|

(13

|

)

|

19

|

|

89

|

|

(22

|

)

|

67

|

|

|||||||||||

|

Total interest expense

|

312

|

|

804

|

|

1,116

|

|

(66

|

)

|

208

|

|

142

|

|

|||||||||||

|

Net Interest Income

|

$

|

3,674

|

|

$

|

(1,207

|

)

|

$

|

2,467

|

|

$

|

2,944

|

|

$

|

(2,451

|

)

|

$

|

493

|

|

|||||

|

Note:

|

The change attributed to volume is calculated by taking the average change in average balance times the prior year's

|

|

average rate and the remainder is attributable to rate.

|

|

|

(Dollars in thousands)

|

2016

|

2015

|

2014

|

% Change

|

|||||||||||||

|

2016-2015

|

2015-2014

|

||||||||||||||||

|

Service charges on deposit accounts

|

$

|

5,445

|

|

$

|

5,226

|

|

$

|

5,415

|

|

4.2

|

%

|

(3.5

|

)%

|

||||

|

Other service charges, commissions and fees

|

994

|

|

1,223

|

|

1,033

|

|

(18.7

|

)%

|

18.4

|

%

|

|||||||

|

Trust and investment management income

|

5,091

|

|

4,598

|

|

4,687

|

|

10.7

|

%

|

(1.9

|

)%

|

|||||||

|

Brokerage income

|

1,933

|

|

2,025

|

|

2,150

|

|

(4.5

|

)%

|

(5.8

|

)%

|

|||||||

|

Mortgage banking activities

|

3,412

|

|

2,747

|

|

2,207

|

|

24.2

|

%

|

24.5

|

%

|

|||||||

|

Earnings on life insurance

|

1,099

|

|

1,025

|

|

950

|

|

7.2

|

%

|

7.9

|

%

|

|||||||

|

Other income (loss)

|

345

|

|

410

|

|

477

|

|

(15.9

|

)%

|

(14.0

|

)%

|

|||||||

|

Subtotal before securities gains

|

18,319

|

|

17,254

|

|

16,919

|

|

6.2

|

%

|

2.0

|

%

|

|||||||

|

Investment securities gains

|

1,420

|

|

1,924

|

|

1,935

|

|

(26.2

|

)%

|

(0.6

|

)%

|

|||||||

|

Total noninterest income

|

$

|

19,739

|

|

$

|

19,178

|

|

$

|

18,854

|

|

2.9

|

%

|

1.7

|

%

|

||||

|

•

|

Service charges on deposit accounts increased $219,000 for 2016 compared with 2015, due principally to revenues generated from new cash management product offerings and higher interchange fees associated with increased usage by our customers

|

|

•

|

Other service charges, commissions and fees

decreased

$229,000

in comparing

2016

with 2015. In 2015, these revenues were favorably impacted by gains on sale of Small Business Administration and U.S. Department of Agriculture loans.

|

|

•

|

Trust, investment management and brokerage income increased $401,000 for 2016 compared with

2015

. Trust and brokerage income included increased estate fees partially offset by lower brokerage income. The addition of

|

|

•

|

Mortgage banking revenue increased $665,000 from 2015 to 2016. Favorable interest rate conditions have supported increased new home purchases and refinancing activity resulting in the increase.

|

|

•

|

Other income

decreased

$65,000

in comparing 2016 to 2015, reflecting, in part, decreased gains on sales of other real estate owned as well as changes due to customary business activities.

|

|

•

|

Security gains totaled

$1,420,000

for 2016, a $504,000 decrease compared with

$1,924,000

for

2015

. For both years, asset/liability management strategies and interest rate conditions resulted in gains on sales of securities, as market conditions presented opportunities to accelerate earnings on securities through gains, while also meeting the funding requirements of current and anticipated lending activity.

|

|

•

|

Service charges on deposit accounts decreased $189,000 in comparing 2015 with 2014, continuing a declining trend noted in 2014. The Company has experienced a decline in overdraft charges as consumers have greater awareness of their available balances given new technology, and are less likely to incur charges.

|

|

•

|

Other service charges, commissions and fees increased $190,000 from 2014 to 2015. In 2015, the Company's revenues were favorably impacted by $205,000 on the gain on sale of Small Business Administration (SBA) and U.S. Department of Agriculture (USDA) loans, with no similar gains in 2014.

|

|

•

|

Trust department and brokerage income decreased $214,000 for 2015 compared with 2014. Unfavorable market conditions, in which declines in the stock market were experienced, negatively impacted revenues.

|

|

•

|

Mortgage banking revenue for 2015 increased $540,000 from 2014 to 2015. Favorable real estate and interest rate market conditions led to the increase, as the Company was able to enhance its new home purchase mortgage revenues, and relied less on mortgage loan refinancings.

|

|

•

|

Other income decreased $67,000 for 2015 compared with 2014. A principal contributor was $234,000 in gains on sales of other real estate owned for 2015, compared with $299,000 in such gains for 2014.

|

|

•

|

Security gains totaled $1,924,000 for 2015, which was relatively comparable to $1,935,000 in 2014. For both years, asset/liability management strategies and interest rate conditions resulted in gains on sales of securities, as market conditions presented opportunities to realize earnings on securities through gains, while funding the cash requirements of lending activity.

|

|

|

|

|

|

% Change

|

|||||||||||||

|

(Dollars in thousands)

|

2016

|

2015

|

2014

|

2016-2015

|

2015-2014

|

||||||||||||

|

Salaries and employee benefits

|

$

|

26,370

|

|

$

|

24,056

|

|

$

|

23,658

|

|

9.6

|

%

|

1.7

|

%

|

||||

|

Occupancy

|

2,491

|

|

2,221

|

|

2,251

|

|

12.2

|

%

|

(1.3

|

)%

|

|||||||

|

Furniture and equipment

|

3,335

|

|

3,061

|

|

3,328

|

|

9.0

|

%

|

(8.0

|

)%

|

|||||||

|

Data processing

|

2,378

|

|

2,026

|

|

1,866

|

|

17.4

|

%

|

8.6

|

%

|

|||||||

|

Telephone and communication

|

740

|

|

692

|

|

569

|

|

6.9

|

%

|

21.6

|

%

|

|||||||

|

Automated teller machine and interchange fees

|

748

|

|

798

|

|

865

|

|

(6.3

|

)%

|

(7.7

|

)%

|

|||||||

|

Advertising and bank promotions

|

1,717

|

|

1,564

|

|

1,195

|

|

9.8

|

%

|

30.9

|

%

|

|||||||

|

FDIC insurance

|

775

|

|

859

|

|

1,621

|

|

(9.8

|

)%

|

(47.0

|

)%

|

|||||||

|

Legal

|

850

|

|

1,440

|

|

705

|

|

(41.0

|

)%

|

104.3

|

%

|

|||||||

|

Other professional services

|

1,332

|

|

1,262

|

|

1,580

|

|

5.5

|

%

|

(20.1

|

)%

|

|||||||

|

Directors' compensation

|

969

|

|

737

|

|

624

|

|

31.5

|

%

|

18.1

|

%

|

|||||||

|

Collection and problem loan

|

238

|

|

447

|

|

729

|

|

(46.8

|

)%

|

(38.7

|

)%

|

|||||||

|

Real estate owned

|

239

|

|

162

|

|

300

|

|

47.5

|

%

|

(46.0

|

)%

|

|||||||

|

Taxes other than income

|

767

|

|

916

|

|

562

|

|

(16.3

|

)%

|

63.0

|

%

|

|||||||

|

Regulatory settlement

|

1,000

|

|

0

|

|

0

|

|

100.0

|

%

|

0.0

|

%

|

|||||||

|

Other operating expenses

|

4,191

|

|

4,366

|

|

3,915

|

|

(4.0

|

)%

|

11.5

|

%

|

|||||||

|

Total noninterest expenses

|

$

|

48,140

|

|

$

|

44,607

|

|

$

|

43,768

|

|

7.9

|

%

|

1.9

|

%

|

||||

|

•

|

Salaries and employee benefits totaled

$26,370,000

for 2016, compared with

$24,056,000

in

2015

, an

increase

of

$2,314,000

. The increase reflects the impact of adding new customer-facing employees in markets targeted for expansion as well as merit increases. Other drivers were additional medical expense incurred for new employees and increased claim activity, increased expense associated with supplemental executive compensation and compensation related to share-based awards granted in 2016.

|

|

•

|

Consistent with our growth strategy in which new facilities were acquired in Berks, Cumberland, Dauphin and Lancaster counties, we have experienced increases in occupancy, furniture and equipment expenses, which totaled a combined $5,826,000 for 2016 compared with $5,282,000 for

2015

, an increase of $544,000, or 10.3%.

|

|

•

|

Data processing charges increased $352,000 in comparing 2016 with 2015. Telephone and communication charges similarly increased $48,000. The

increases

reflect our volume and physical growth and costs associated with more sophisticated product and service offerings.

|

|

•

|

Advertising and bank promotion

increased

$153,000

from 2015 to 2016, principally due to $100,000 of incremental Educational Improvement Tax Credit (“EITC”) contributions (a component of Pennsylvania tax credits) made in 2016 and increased expenditures related to brand marketing and expansion in new markets.

|

|

•

|

FDIC insurance decreased $84,000 from 2015 to 2016. The Company benefited from a lower assessment rate as the FDIC reached its 1.15% of insured funds target on June 20, 2016.

|

|

•

|

Legal fees decreased $590,000 in comparing 2016 with 2015, as the Company had higher than normal legal expenses in 2015 as it attended to legal matters, including outstanding litigation against the Company and an investigation with the SEC which began in the second quarter of 2015 and concluded in the third quarter of 2016.

|

|

•

|

Directors' compensation increased $232,000 from 2015 to 2016. The increase includes fees associated with two new directors added to the Board of Directors in 2016 and increased expense in 2016 for share-based compensation. In 2015, share-based compensation was only in effect for seven months of the year.

|

|

•

|

Collection and problem loan expense decreased $209,000 from 2015 to 2016 as a result of a lower level of classified loans that are being worked out by the Company. Partially offsetting this expense benefit is an increase in real estate owned expense of $77,000 from

2015

to 2016.

|

|

•

|

Taxes, other than income, decreased $149,000 from 2015 to 2016. A significant portion of the decrease relates to incremental EITC credits for qualifying contributions made in 2016 versus 2015 and which largely offsets the related increase in advertising and bank promotions noted above.

|

|

•

|

The Company incurred and paid a civil money penalty of

$1,000,000

to the SEC in 2016 to settle administrative proceedings against the Company.

|

|

•

|

Other line items within noninterest expenses reflect modest changes from 2015 to 2016 and are generally attributable to normal fluctuations in the conduct of business.

|

|

•

|

Salaries and employee benefits increased $398,000 in comparing 2015 with 2014. The 2015 results were impacted by merit increases to employees, incentive compensation including incremental share-based compensation expense of $449,000, and severance costs that totaled approximately $446,000 that were recognized during 2015.

|

|

•

|

Furniture and equipment expense decreased $267,000 from 2014 to 2015. The decrease was due principally to lower depreciation charges and the absence of any losses on disposal of equipment, which totaled $41,000 for 2014.

|

|

•

|

Data processing charges increased $160,000 and telephone and communication charges increased $123,000 from 2014 to 2015. The annual increases are reflective of overall higher volumes and costs associated with more sophisticated product and service offerings.

|

|

•

|

Advertising and bank promotion increased $369,000 in comparing 2015 with 2014 and reflects the timing and advertising associated with the opening of our new full service branch in Lancaster, increased promotion of several of our products and general brand awareness.

|

|

•

|

FDIC insurance expenses decreased $762,000 from 2014 to 2015.The decrease was the result of a lower assessment rate as the Company’s risk profile improved.

|

|

•

|

Legal fees increased $735,000 from 2014 to 2015, primarily as a result of costs associated with certain legal matters, including outstanding litigation against the Company and an ongoing confidential investigation being conducted by the SEC as well as general corporate matters. It is anticipated that legal fees will continue to be at elevated levels until the litigation and the confidential investigation are completed.

|

|

•

|

Other professional services, which includes accounting and consulting, decreased $318,000 in comparing 2015 with 2014. The decrease is principally the result of less reliance on outside consulting firms, as some work previously handled by consultants was assumed by employees.

|

|

•

|

Directors' compensation increased $113,000 from 2014 to 2015. The increase was primarily attributed to share-based compensation awarded to the directors in May 2015, with a one year vesting period, which resulted in seven months of expense in 2015 with no similar charge in 2014.

|

|

•

|

Collection and problem loan expense decreased $282,000 from 2014 to 2015. Similarly, real estate owned expenses decreased $138,000 in comparing 2015 with 2014. The declines in collection and problem loan and real estate owned expenses reflect improvement in the level of classified assets between the two periods.

|

|

•

|

Taxes, other than income, increased $354,000 from 2014 to 2015 as Pennsylvania’s Bank Shares tax, which is based on shareholders’ equity at the beginning of the year, increased due to the combination of 2014’s earnings and an increase in other comprehensive income.

|

|

•

|

Other operating expenses increased $451,000 from 2014 to 2015. In 2015, incremental charges of $384,000 were incurred associated with the Company's investment in low-income housing projects compared with $150,000 in 2014, an increase of $234,000 or 156.0%. The prior year's results were positively impacted by favorable operating results of the partnerships, which resulted in less expense in 2014.

|

|

(Dollars in thousands)

|

2016

|

2015

|

2014

|

||||||||

|

U.S. Government Agencies

|

$

|

39,592

|

|

$

|

47,227

|

|

$

|

23,958

|

|

||

|

States and political subdivisions

|

164,282

|

|

125,961

|

|

52,401

|

|

|||||

|

GSE residential mortgage-backed securities

|

116,944

|

|

132,349

|

|

175,596

|

|

|||||

|

GSE residential CMOs

|

69,383

|

|

15,843

|

|

58,705

|

|

|||||

|

GSE commercial CMOs

|

4,856

|

|

63,770

|

|

65,472

|

|

|||||

|

Private label CMOs

|

5,006

|

|

8,901

|

|

0

|

|

|||||

|

Total debt securities

|

400,063

|

|

394,051

|

|

376,132

|

|

|||||

|

Equity securities

|

91

|

|

73

|

|

67

|

|

|||||

|

Totals

|

$

|

400,154

|

|

$

|

394,124

|

|

$

|

376,199

|

|

||

|

(Dollars in thousands)

|

Within 1

year

|

After 1 year

but within 5

years

|

After 5 years

but within

10 years

|

After 10

years

|

Total

|

||||||||||||||

|

U. S. Government Agencies

|

|||||||||||||||||||

|

Book value

|

$

|

0

|

|

$

|

0

|

|

$

|

900

|

|

$

|

38,669

|

|

$

|

39,569

|

|

||||

|

Yield

|

0.00

|

%

|

0.00

|

%

|

1.97

|

%

|

2.53

|

%

|

2.52

|

%

|

|||||||||

|

Average maturity (years)

|

0.0

|

|

0.0

|

|

6.7

|

|

21.9

|

|

21.6

|

|

|||||||||

|

States and political subdivisions

|

|||||||||||||||||||

|

Book value

|

15

|

|

7,157

|

|

71,305

|

|

85,200

|

|

163,677

|

|

|||||||||

|

Yield

|

7.46

|

%

|

2.82

|

%

|

3.32

|

%

|

4.68

|

%

|

4.01

|

%

|

|||||||||

|

Average maturity (years)

|

0.9

|

|

4.3

|

|

7.5

|

|

17.8

|

|

12.7

|

|

|||||||||

|

GSE residential mortgage-backed securities

|

|||||||||||||||||||

|

Book value

|

0

|

|

0

|

|

5,040

|

|

110,982

|

|

116,022

|

|

|||||||||

|

Yield

|

0.00

|

%

|

0.00

|

%

|

1.70

|

%

|

2.07

|

%

|

2.06

|

%

|

|||||||||

|

Average maturity (years)

|

0.0

|

|

0.0

|

|

9.7

|

|

46.4

|

|

44.8

|

|

|||||||||

|

GSE residential CMOs

|

|||||||||||||||||||

|

Book value

|

0

|

|

0

|

|

0

|

|

72,411

|

|

72,411

|

|

|||||||||

|

Yield

|

0.00

|

%

|

0.00

|

%

|

0.00

|

%

|

1.88

|

%

|

1.88

|

%

|

|||||||||

|

Average maturity (years)

|

0.0

|

|

0.0

|

|

0.0

|

|

13.7

|

|

13.7

|

|

|||||||||

|

GSE commercial CMOs

|

|||||||||||||||||||

|

Book value

|

0

|

|

0

|

|

5,148

|

|

0

|

|

5,148

|

|

|||||||||

|

Yield

|

0.00

|

%

|

0.00

|

%

|

2.40

|

%

|

0.00

|

%

|

2.40

|

%

|

|||||||||

|

Average maturity (years)

|

0.0

|

|

0.0

|

|

8.7

|

|

0.0

|

|

8.7

|

|

|||||||||

|

Private label CMOs

|

|||||||||||||||||||

|

Book value

|

0

|

|

0

|

|

0

|

|

5,042

|

|

5,042

|

|

|||||||||

|

Yield

|

0.00

|

%

|

0.00

|

%

|

0.00

|

%

|

1.95

|

%

|

1.95

|

%

|

|||||||||

|

Average maturity (years)

|

0.0

|

|

0.0

|

|

0.0

|

|

19.6

|

|

19.6

|

|

|||||||||

|

Total

|

|||||||||||||||||||

|

Book value

|

$

|

15

|

|

$

|

7,157

|

|

$

|

82,393

|

|

$

|

312,304

|

|

$

|

401,869

|

|

||||

|

Yield

|

7.46

|

%

|

2.82

|

%

|

3.15

|

%

|

2.79

|

%

|

2.87

|

%

|

|||||||||

|

Average maturity (years)

|

0.9

|

|

4.3

|

|

7.7

|

|

27.5

|

|

23.1

|

|

|||||||||

|

(Dollars in thousands)

|

December 31, 2016

|

December 31, 2015

|

December 31, 2014

|

December 31, 2013

|

December 31, 2012

|

||||||||||||||

|

Commercial real estate:

|

|||||||||||||||||||

|

Owner-occupied

|

$

|

112,295

|

|

$

|

103,578

|

|

$

|

100,859

|

|

$

|

111,290

|

|

$

|

144,290

|

|

||||

|

Non-owner occupied

|

206,358

|

|

145,401

|

|

144,301

|

|

135,953

|

|

120,930

|

|

|||||||||

|

Multi-family

|

47,681

|

|

35,109

|

|

27,531

|

|

22,882

|

|

21,745

|

|

|||||||||

|

Non-owner occupied residential

|

62,533

|

|

54,175

|

|

49,315

|

|

55,272

|

|

66,381

|

|

|||||||||

|

Acquisition and development:

|

|||||||||||||||||||

|

1-4 family residential construction

|

4,663

|

|

9,364

|

|

5,924

|

|

3,338

|

|

2,850

|

|

|||||||||

|

Commercial and land development

|

26,085

|

|

41,339

|

|

24,237

|

|

19,440

|

|

30,375

|

|

|||||||||

|

Commercial and industrial

|

88,465

|

|

73,625

|

|

48,995

|

|

33,446

|

|

39,340

|

|

|||||||||

|

Municipal

|

53,741

|

|

57,511

|

|

61,191

|

|

60,996

|

|

68,018

|

|

|||||||||

|

Residential mortgage:

|

|||||||||||||||||||

|

First lien

|

139,851

|

|

126,022

|

|

126,491

|

|

124,728

|

|

108,601

|

|

|||||||||

|

Home equity – term

|

14,248

|

|

17,337

|

|

20,845

|

|

20,131

|

|

14,747

|

|

|||||||||

|

Home equity – lines of credit

|

120,353

|

|

110,731

|

|

89,366

|

|

77,377

|

|

79,448

|

|

|||||||||

|

Installment and other loans

|

7,118

|

|

7,521

|

|

5,891

|

|

6,184

|

|

7,014

|

|

|||||||||

|

$

|

883,391

|

|

$

|

781,713

|

|

$

|

704,946

|

|

$

|

671,037

|

|

$

|

703,739

|

|

|||||

|

(Dollars in thousands)

|

Balance

|

% of Total Loans

|

% of Total RBC

|

||

|

Office space

|

$93,883

|

10.6%

|

74.3%

|

||

|

Strip retail shopping centers

|

39,775

|

4.5%

|

31.5%

|

||

|

|

Due In

|

|

|||||||||||||

|

(Dollars in thousands)

|

One Year

or Less

|

One

Year Through

Five Years

|

After Five

Years

|

Total

|

|||||||||||

|

Acquisition and development:

|

|||||||||||||||

|

1-4 family residential construction

|

|||||||||||||||

|

Fixed rate

|

$

|

103

|

|

$

|

0

|

|

$

|

3,445

|

|

$

|

3,548

|

|

|||

|

Adjustable and floating rate

|

452

|

|

0

|

|

663

|

|

1,115

|

|

|||||||

|

555

|

|

0

|

|

4,108

|

|

4,663

|

|

||||||||

|

Commercial and land development

|

|||||||||||||||

|

Fixed rate

|

1,396

|

|

608

|

|

8,275

|

|

10,279

|

|

|||||||

|

Adjustable and floating rate

|

1,522

|

|

1,674

|

|

12,610

|

|

15,806

|

|

|||||||

|

2,918

|

|

2,282

|

|

20,885

|

|

26,085

|

|

||||||||

|

Commercial and industrial

|

|||||||||||||||

|

Fixed rate

|

353

|

|

16,557

|

|

15,865

|

|

32,775

|

|

|||||||

|

Adjustable and floating rate

|

33,434

|

|

6,975

|

|

15,281

|

|

55,690

|

|

|||||||

|

33,787

|

|

23,532

|

|

31,146

|

|

88,465

|

|

||||||||

|

$

|

37,260

|

|

$

|

25,814

|

|

$

|

56,139

|

|

$

|

119,213

|

|

||||

|

(Dollars in thousands)

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

Nonaccrual loans (cash basis)

|

$

|

7,043

|

|

$

|

16,557

|

|

$

|

14,432

|

|

$

|

19,347

|

|

$

|

17,943

|

|

||||

|

Other real estate owned (OREO)

|

346

|

|

710

|

|

932

|

|

987

|

|

1,876

|

|

|||||||||

|

Total nonperforming assets

|

7,389

|

|

17,267

|

|

15,364

|

|

20,334

|

|

19,819

|

|

|||||||||

|

Restructured loans still accruing

|

930

|

|

793

|

|

1,100

|

|

5,988

|

|

3,092

|

|

|||||||||

|

Loans past due 90 days or more and still accruing

|

0

|

|

24

|

|

0

|

|

0

|

|

0

|

|

|||||||||

|

Total nonperforming and other risk assets

|

$

|

8,319

|

|

$

|

18,084

|

|

$

|

16,464

|

|

$

|

26,322

|

|

$

|

22,911

|

|

||||

|

Loans 30-89 days past due

|

$

|

1,218

|

|

$

|

2,532

|

|

$

|

1,612

|

|

$

|

3,963

|

|

$

|

3,578

|

|

||||

|

Ratio of:

|

|||||||||||||||||||

|

Total nonperforming loans to loans

|

0.80

|

%

|

2.12

|

%

|

2.05

|

%

|

2.88

|

%

|

2.55

|

%

|

|||||||||

|

Total nonperforming assets to assets

|

0.52

|

%

|

1.34

|

%

|

1.29

|

%

|

1.73

|

%

|

1.61

|

%

|

|||||||||

|

Total nonperforming assets to total loans and OREO

|

0.84

|

%

|

2.21

|

%

|

2.18

|

%

|

3.03

|

%

|

2.81

|

%

|

|||||||||

|

Total risk assets to total loans and OREO

|

0.94

|

%

|

2.31

|

%

|

2.33

|

%

|

3.92

|

%

|

3.25

|

%

|

|||||||||

|

Total risk assets to total assets

|

0.59

|

%

|

1.40

|

%

|

1.38

|

%

|

2.23

|

%

|

1.86

|

%

|

|||||||||

|

Allowance for loan losses to total loans

|

1.45

|

%

|

1.74

|

%

|

2.09

|

%

|

3.12

|

%

|

3.29

|

%

|

|||||||||

|

Allowance for loan losses to nonperforming loans

|

181.39

|

%

|

81.95

|

%

|

102.18

|

%

|

108.36

|

%

|

129.11

|

%

|

|||||||||

|

Allowance for loan losses to nonperforming loans and restructured loans still accruing

|

160.23

|

%

|

78.20

|

%

|

94.95

|

%

|

82.75

|

%

|

110.13

|

%

|

|||||||||

|

|

2016

|

2015

|

|||||||||||||||||||||

|

(Dollars in thousands)

|

Nonaccrual

Loans

|

Restructured

Loans Still

Accruing

|

Total

|

Nonaccrual

Loans

|

Restructured

Loans Still

Accruing

|

Total

|

|||||||||||||||||

|

Commercial real estate:

|

|||||||||||||||||||||||

|

Owner occupied

|

$

|

1,070

|

|

$

|

0

|

|

$

|

1,070

|

|

$

|

2,109

|

|

$

|

0

|

|

$

|

2,109

|

|

|||||

|

Non-owner occupied

|

736

|

|

0

|

|

736

|

|

7,856

|

|

0

|

|

7,856

|

|

|||||||||||

|

Multi-family

|

199

|

|

0

|

|

199

|

|

233

|

|

0

|

|

233

|

|

|||||||||||

|

Non-owner occupied residential

|

452

|

|

0

|

|

452

|

|

895

|

|

0

|

|

895

|

|

|||||||||||

|

Acquisition and development

|

|||||||||||||||||||||||

|

Commercial and land development

|

1

|

|

0

|

|

1

|

|

5

|

|

0

|

|

5

|

|

|||||||||||

|

Commercial and industrial

|

595

|

|

0

|

|

595

|

|

734

|

|

0

|

|

734

|

|

|||||||||||

|

Residential mortgage:

|

|||||||||||||||||||||||

|

First lien

|

3,396

|

|

896

|

|

4,292

|

|

4,015

|

|

793

|

|

4,808

|

|

|||||||||||

|

Home equity – term

|

93

|

|

34

|

|

127

|

|

103

|

|

0

|

|

103

|

|

|||||||||||

|

Home equity – lines of credit

|

495

|

|

0

|

|

495

|

|

590

|

|

0

|

|

590

|

|

|||||||||||

|

Installment and other loans

|

6

|

|

0

|

|

6

|

|

17

|

|

0

|

|

17

|

|

|||||||||||

|

$

|

7,043

|

|

$

|

930

|

|

$

|

7,973

|

|

$

|

16,557

|

|

$

|

793

|

|

$

|

17,350

|

|

||||||

|

(Dollars in thousands)

|

# of

Relationships

|

Recorded

Investment

|

Partial

Charge-offs

to Date

|

Specific

Reserves

|

||||||||||

|

December 31, 2016

|

||||||||||||||

|

Relationships greater than $1,000,000

|

0

|

|

$

|

0

|

|

$

|

0

|

|

$

|

0

|

|

|||

|

Relationships greater than $500,000 but less than $1,000,000

|

2

|

|

1,327

|

|

620

|

|

0

|

|

||||||

|

Relationships greater than $250,000 but less than $500,000

|

2

|

|

640

|

|

120

|

|

0

|

|

||||||

|

Relationships less than $250,000

|

75

|

|

6,006

|

|

1,184

|

|

43

|

|

||||||

|

79

|

|

$

|

7,973

|

|

$

|

1,924

|

|

$

|

43

|

|

||||

|

December 31, 2015

|

||||||||||||||

|

Relationships greater than $1,000,000

|

1

|

|

$

|

6,542

|

|

$

|

0

|

|

$

|

0

|

|

|||

|

Relationships greater than $500,000 but less than $1,000,000

|

2

|

|

1,578

|

|

475

|

|

164

|

|

||||||

|

Relationships greater than $250,000 but less than $500,000

|

7

|

|

2,659

|

|

188

|

|

0

|

|

||||||

|

Relationships less than $250,000

|

74

|

|

6,571

|

|

1,294

|

|

125

|

|

||||||

|

84

|

|

$

|

17,350

|

|

$

|

1,957

|

|

$

|

289

|

|

||||

|

(Dollars in thousands)

|

Pass

|

Special

Mention

|

Non-Impaired

Substandard

|

Impaired -

Substandard

|

Doubtful

|

Total

|

|||||||||||||||||

|

December 31, 2016

|

|||||||||||||||||||||||

|

Commercial real estate:

|

|||||||||||||||||||||||

|

Owner-occupied

|

$

|

103,652

|

|

$

|

5,422

|

|

$

|

2,151

|

|

$

|

1,070

|

|

$

|

0

|

|

$

|

112,295

|

|

|||||

|

Non-owner occupied

|

190,726

|

|

4,791

|

|

10,105

|

|

736

|

|

0

|

|

206,358

|

|

|||||||||||

|

Multi-family

|

42,473

|

|

4,222

|

|

787

|

|

199

|

|

0

|

|

47,681

|

|

|||||||||||

|

Non-owner occupied residential

|

59,982

|

|

949

|

|

1,150

|

|

452

|

|

0

|

|

62,533

|

|

|||||||||||

|

Acquisition and development:

|

|||||||||||||||||||||||

|

1-4 family residential construction

|

4,560

|

|

103

|

|

0

|

|

0

|

|

0

|

|

4,663

|

|

|||||||||||

|

Commercial and land development

|

25,435

|

|

10

|

|

639

|

|

1

|

|

0

|

|

26,085

|

|

|||||||||||

|

Commercial and industrial

|

87,588

|

|

251

|

|

32

|

|

594

|

|

0

|

|

88,465

|

|

|||||||||||

|

Municipal

|

53,741

|

|

0

|

|

0

|

|

0

|

|

0

|

|

53,741

|

|

|||||||||||

|

Residential mortgage:

|

|||||||||||||||||||||||

|

First lien

|

135,558

|

|

0

|

|

0

|

|

4,293

|

|

0

|

|

139,851

|

|

|||||||||||

|

Home equity – term

|

14,155

|

|

0

|

|

0

|

|

93

|

|

0

|

|

14,248

|

|

|||||||||||

|

Home equity – lines of credit

|

119,681

|

|

82

|

|

61

|

|

529

|

|

0

|

|

120,353

|

|

|||||||||||

|

Installment and other loans

|

7,112

|

|

0

|

|

0

|

|

6

|

|

0

|

|

7,118

|

|

|||||||||||

|

$

|

844,663

|

|

$

|

15,830

|

|

$

|

14,925

|

|

$

|

7,973

|

|

$

|

0

|

|

$

|

883,391

|

|

||||||

|

December 31, 2015

|

|||||||||||||||||||||||

|

Commercial real estate:

|

|||||||||||||||||||||||

|

Owner-occupied

|

$

|

96,715

|

|

$

|

1,124

|

|

$

|

3,630

|

|

$

|

2,109

|

|

$

|

0

|

|

$

|

103,578

|

|

|||||

|

Non-owner occupied

|

125,043

|

|

12,394

|

|

108

|

|

7,856

|

|

0

|

|

145,401

|

|

|||||||||||

|

Multi-family

|

31,957

|

|

1,779

|

|

1,140

|

|

233

|

|

0

|

|

35,109

|

|

|||||||||||

|

Non-owner occupied residential

|

50,601

|

|

1,305

|

|

1,374

|

|

895

|

|

0

|

|

54,175

|

|

|||||||||||

|

Acquisition and development:

|

|||||||||||||||||||||||

|

1-4 family residential construction

|

9,364

|

|

0

|

|

0

|

|

0

|

|

0

|

|

9,364

|

|

|||||||||||

|

Commercial and land development

|

40,181

|

|

219

|

|

934

|

|

5

|

|

0

|

|

41,339

|

|

|||||||||||

|

Commercial and industrial

|

70,967

|

|

1,380

|

|

544

|

|

734

|

|

0

|

|

73,625

|

|

|||||||||||

|

Municipal

|

57,511

|

|

0

|

|

0

|

|

0

|

|

0

|

|

57,511

|

|

|||||||||||

|

Residential mortgage:

|

|||||||||||||||||||||||

|

First lien

|

121,214

|

|

0

|

|

0

|

|

4,808

|

|

0

|

|

126,022

|

|

|||||||||||

|

Home equity – term

|

17,234

|

|

0

|

|

0

|

|

103

|

|

0

|

|

17,337

|

|

|||||||||||

|

Home equity – lines of credit

|

109,731

|

|

230

|

|

180

|

|

590

|

|

0

|

|

110,731

|

|

|||||||||||

|

Installment and other loans

|

7,504

|

|

0

|

|

0

|

|

17

|

|

0

|

|

7,521

|

|

|||||||||||

|

$

|

738,022

|

|

$

|

18,431

|

|

$

|

7,910

|

|

$

|

17,350

|

|

$

|

0

|

|

$

|

781,713

|

|

||||||

|

(Dollars in thousands)

|

Average

Impaired

Balance

|

Interest

Income

Recognized

|

Interest

Earned

But Not

Recognized

|

||||||||

|

December 31, 2016

|

|||||||||||

|

Commercial real estate:

|

|||||||||||

|

Owner-occupied

|

$

|

1,758

|

|

$

|

0

|

|

$

|

124

|

|

||

|

Non-owner occupied

|

6,831

|

|

0

|

|

326

|

|

|||||

|

Multi-family

|

216

|

|

0

|

|

17

|

|

|||||

|

Non-owner occupied residential

|

645

|

|

0

|

|

35

|

|

|||||

|

Acquisition and development:

|

|||||||||||

|

Commercial and land development

|

3

|

|

0

|

|

1

|

|

|||||

|

Commercial and industrial

|

575

|

|

0

|

|

25

|

|

|||||

|

Residential mortgage:

|

|||||||||||

|

First lien

|

4,525

|

|

33

|

|

175

|

|

|||||

|

Home equity – term

|

98

|

|

0

|

|

6

|

|

|||||

|

Home equity – lines of credit

|

455

|

|

0

|

|

19

|

|

|||||

|

Installment and other loans

|

12

|

|

0

|

|

3

|

|

|||||

|

$

|

15,118

|

|

$

|

33

|

|

$

|

731