|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wisconsin

|

39-0520270

|

|

|

(State or other jurisdiction

of incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

P.O.

Box 2566

Oshkosh, Wisconsin

|

54903-2566

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

Title

of

each

class

|

Name

of

each

exchange

on

which

registered

|

|

|

Common Stock ($.01 par value)

|

New York Stock Exchange

|

|

|

Large accelerated filer

x

|

Accelerated filer

o

|

|

|

|

|

|

|

Non-accelerated filer

o

|

Smaller reporting company

o

|

|

|

Page

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

•

|

Combining the Company’s strategic purchasing teams globally into a single organization to capture its full purchasing power across all of its businesses and to promote low-cost-country sourcing;

|

|

•

|

Managing the business to target breakthrough objectives, including aggressive cost reduction targets, via the Company-wide use of strategy deployment scorecards to provide effective, timely assessment of progress toward objectives and implementation of countermeasures as needed;

|

|

•

|

Utilizing integrated project teams to reduce product and process costs across the Company;

|

|

•

|

Creating a single quality management system to drive enhanced quality throughout all of the Company’s businesses to improve customer satisfaction and lower the cost of quality;

|

|

•

|

Expanding its production capabilities with the launch of a new manufacturing facility in Leon, Mexico, which is expected to reduce the costs of components currently sourced from third party suppliers;

|

|

•

|

Launching and leveraging the Oshkosh Operating System (“OOS”) to create common practices across the Company to enhance its performance. The OOS is a system of doing business that is focused on serving and delighting customers by utilizing continuous improvement and lean practices. The Company has trained substantially all of its employees in elements of the OOS. The Company believes that the OOS enables it to sustain strong performance for its customers, shareholders, employees and other stakeholders;

|

|

•

|

Developing and communicating to shareholders a comprehensive capital allocation strategy that has resulted in reducing the Company's leverage to create options for internal investments, acquisitions and return of capital to shareholders; and

|

|

•

|

Returning value to shareholders through the reinstatement of a quarterly dividend and through executing the Company's stock repurchase program. Over the three-year period ended September 30, 2015, the Company returned over $900 million to shareholders through quarterly cash dividends and repurchases of the Company's Common Stock, including the repurchase of 19.3 million shares, or 21% of the shares outstanding and a 13% increase in the Company's quarterly cash dividend in December 2014 and an additional 12% increase in November 2015.

|

|

•

|

The L-ATV, which was selected by the U.S. DoD for the JLTV production contract, incorporates field-proven technologies, advanced armor solutions and expeditionary levels of mobility to redefine safety and performance standards;

|

|

•

|

The TAK-4 family of independent suspension systems, which the Company uses on multiple vehicle platforms in its defense and fire & emergency segments, including the TAK-4i “intelligent” independent suspension system, which the Company is using on the L-ATV for the JLTV program;

|

|

•

|

The JLG 185-foot self-propelled boom lift, the world's tallest self-propelled boom, which enables operators to tackle high level access needs for construction and maintenance projects;

|

|

•

|

The JLG 34-foot articulated hybrid boom, which is the world’s first true four-wheel electric-drive hybrid boom. This boom combines a diesel engine and an electric power system to provide the power and durability of a diesel powered machine while also allowing substantial fuel savings, quieter operation and lower carbon emissions;

|

|

•

|

The Power Towers Nano offers world class performance in low level access equipment. The Nano line includes manual and automated propulsion variants, providing a range of options for low level access needs;

|

|

•

|

The Pierce Ascendant heavy-duty aerial ladder, a highly maneuverable 107-foot steel aerial device that rides on a single rear axle fire truck configuration;

|

|

•

|

The Command Zone multiplexing technology, which the Company has applied to numerous products in each of its segments to control, monitor and diagnose electronic components;

|

|

•

|

The Pierce Ultimate Configuration (“PUC”) vehicle configuration, which eliminates the bulky pumphouse from firefighting vehicles, making such vehicles easier to use and service;

|

|

•

|

The redesigned Pierce Saber custom fire chassis. The new Saber chassis features a 96-inch wide cab with a single-piece bonded windshield. It also includes a smaller engine tunnel that is lower-placed, allowing more room for firefighters with ergonomic hip and elbow room for the driver and officer;

|

|

•

|

The integration of compressed natural gas to power McNeilus’ refuse collection vehicles and concrete mixers and Oshkosh Commercial's front-discharge mixer, which reduces fuel costs and emissions;

|

|

•

|

The Meridian Front Loader refuse collection vehicle, which offers the perfect balance between the performance of a lightweight vehicle with the strength and durability of a heavyweight vehicle;

|

|

•

|

The split-body refuse collection vehicle with automatic tailgate locks to collect and separate multiple waste streams and safely eject loads from inside the cab; and

|

|

•

|

The Pacific Series Ultra Front Loader refuse collection vehicle, which offers a lightweight alternative to traditional industry product offerings.

|

|

•

|

Engineering and testing.

Domestic and international vehicle contract competitions require significant defense engineering expertise to ensure that vehicle designs excel under demanding test conditions. The Company has teams of engineers and engages highly-specialized contract engineers to improve current products and develop new products. Oshkosh Defense engineers have significant expertise designing new vehicles, using sophisticated modeling and simulation, supporting disciplined testing programs at military and approved test sites, and producing detailed, comprehensive, successful contract proposals.

|

|

•

|

Proprietary components.

The Company's patented TAK-4 independent suspension family has been expanded to include the TAK-4 “intelligent” or TAK-4i configuration, which brings 25% more wheel travel and ride height control compared to the original TAK-4 to address the evolving requirements of the Company's customers. Integrating the TAK-4 suspension with the Company's proprietary power train components allows the Company to deliver the market-leading off-road performance for which its defense vehicles are known. In addition, because these are typically some of the higher cost components in a vehicle, the Company has a competitive cost advantage based on the in-house manufacturing and assembly of these items.

|

|

•

|

Past performance.

The Company has been building tactical wheeled vehicles for the DoD for more than 90 years. The Company believes its past success in delivering reliable, high quality vehicles on time, within budget and meeting specifications is a competitive advantage in future defense vehicle procurement programs. The Company understands tactical wheeled vehicle mission profiles, the special contract procedures used by the DoD and other international militaries and has developed substantial expertise in contract management, quality management, program management and accounting.

|

|

•

|

Flexible manufacturing.

The Company's ability to produce a variety of vehicle models on lean, automated assembly lines enables manufacturing efficiencies and a competitive cost position. In addition, the Company is able to leverage its global manufacturing scale to supplement its existing Oshkosh Defense vehicle manufacturing facilities in Oshkosh, Wisconsin.

|

|

•

|

Logistics.

The Company has gained significant experience in the development of operators' manuals and training and in the delivery of parts and services worldwide in accordance with its customers' expectations and requirements, which differ materially from commercial practices. The Company has logistics capabilities to permit the DoD to order parts, receive invoices and remit payments electronically.

|

|

•

|

A lower or slower than expected recovery in housing starts and non-residential construction spending in the U.S., including a scenario where lower oil and gas industry activity as a result of lower oil and gas prices leads to a broader slowdown in residential and non-residential construction activity;

|

|

•

|

A slower or less significant recovery in any of our global markets than we expect, especially in the access equipment markets in Europe, Australia and Latin America and the refuse collection vehicle market in North America where the recovery has been slower than expected;

|

|

•

|

Greater than expected declines in DoD tactical wheeled vehicle spending;

|

|

•

|

The potential that the protest by our competitor of the JLTV contract award to us in August 2015 will be successful, which could result in the DoD revoking part or all of the JLTV contract and our inability to recover amounts we have expended during the protest period in anticipation of the protest being denied, or that a decision regarding the protest will be delayed;

|

|

•

|

Adverse impacts of a continued strong U.S. dollar compared to other currencies globally on the competitiveness of our U.S. exports to global markets and on the translation of foreign operating results into U.S. dollars;

|

|

•

|

Our inability to design new products that meet our customers’ requirements and bring them to market;

|

|

•

|

Our inability to adjust our cost structure in response to lower access equipment and concrete mixer sales;

|

|

•

|

Higher costs than anticipated to launch new products or delays in new product launches;

|

|

•

|

Greater than expected pressure on municipal budgets;

|

|

•

|

Our inability to raise prices to offset cost increases or increase margins;

|

|

•

|

The possibility that commodity cost escalations could erode profits;

|

|

•

|

Low cost competitors aggressively entering one or more of our markets with significantly lower pricing;

|

|

•

|

Primary competitors vying for share gains through aggressive price competition;

|

|

•

|

Our inability to obtain and retain adequate resources to support production ramp-ups, including management personnel;

|

|

•

|

The inability of our supply base to keep pace with the economic recovery;

|

|

•

|

Our failure to realize product, process and overhead cost reduction targets;

|

|

•

|

Slow adoption of our products in emerging markets and/or our inability to successfully execute our emerging market growth strategy; and

|

|

•

|

Not winning key large international defense tactical wheeled vehicle contracts, including our inability to finalize and enter into international vehicle contracts for a significant quantity of M-ATVs for sales starting in 2016.

|

|

•

|

Our business is susceptible to changes in the U.S. defense budget, which may reduce revenues that we expect from our defense business, especially in light of federal budget pressures in part caused by U.S. economic weakness, the withdrawal of U.S. troops from Iraq and Afghanistan, sequestration and the level of defense funding that will be allocated to the DoD’s tactical wheeled vehicle strategy generally.

|

|

•

|

The U.S. government may not appropriate funding that we expect for our U.S. government contracts, which may prevent us from realizing revenues under current contracts or receiving additional orders that we anticipate we will receive. Current and projected DoD budgets include significantly lower funding for our vehicles than we experienced during the Iraq and Afghanistan conflicts.

|

|

•

|

The funding of U.S. government programs is subject to an annual congressional budget authorization and appropriation process. In years when the U.S. government does not complete its budget process before the end of its fiscal year, government operations are typically funded pursuant to a “continuing resolution,” which allows federal government agencies to operate at spending levels approved in the previous budget cycle, but does not authorize new spending initiatives. The U.S. government is currently operating under a continuing resolution, which may continue for some time. When the U.S. government operates under a continuing resolution, delays can occur in the procurement of the products, services and solutions that we provide and may result in new initiatives being cancelled, or funds could be reprogrammed away from our programs to pay for higher priority operational needs. In years when the U.S. government fails to complete its budget process or to provide for a continuing resolution, a federal government shutdown may result, similar to that which occurred in October 2013. This could in turn result in the delay or cancellation of key programs, which could have a negative effect on our cash flows and adversely affect our future results. In addition, payments to contractors for services performed during a federal government shutdown may be delayed, which would have a negative effect on our cash flows.

|

|

•

|

Competitions for the award of defense truck contracts are intense, and we cannot provide any assurance that we will be successful in the defense truck procurement competitions in which we participate.

|

|

•

|

Certain of our government contracts for the U.S. Army and U.S. Marine Corps could be suspended or terminated, and all such contracts expire in the future and may not be replaced, which could reduce revenues that we expect under the contracts and negatively affect margins in our defense segment.

|

|

•

|

The Competition in Contracting Act requires competition for U.S. defense programs in certain circumstances. Competition for DoD programs that we currently have could result in the U.S. government awarding future contracts to another manufacturer or the U.S. government awarding the contracts to us at lower prices and operating margins than we experience under the current contracts. In addition, the U.S. government has become more aggressive in seeking to acquire the design rights to our current and potential future programs to facilitate competition for manufacturing our

|

|

•

|

Defense truck contract awards that we receive may be subject to protests by competing bidders, which protests, if successful, could result in the DoD revoking part or all of any defense truck contract it awards to us and our inability to recover amounts we have expended in anticipation of initiating production under any such contract. In particular, a competitor has protested the recent award of the JLTV contract to us.

|

|

•

|

Most of our government contracts, including the JLTV contract, are fixed-price contracts with price escalation factors included for those contracts that extend beyond one year. Our actual costs on any of these contracts may exceed our projected costs, which could result in profits lower than historically realized or than we anticipate or net losses under these contracts.

|

|

•

|

We must spend significant sums on product development and testing, bid and proposal activities and pre-contract engineering, tooling and design activities in competitions to have the opportunity to be awarded these contracts.

|

|

•

|

Our defense products undergo rigorous testing by the customer and are subject to highly technical requirements. Our products are inspected extensively by the DoD prior to acceptance to determine adherence to contractual technical and quality requirements. Any failure to pass these tests or to comply with these requirements could result in unanticipated retrofit and rework costs, vehicle design changes, delayed acceptance of vehicles, late or no payments under such contracts or cancellation of the contract to provide vehicles to the U.S. government.

|

|

•

|

As a U.S. government contractor, our U.S. government contracts and systems are subject to audit and review by the Defense Contract Audit Agency and the Defense Contract Management Agency. These agencies review our performance under our U.S. government contracts, our cost structure and our compliance with laws and regulations applicable to U.S. government contractors. Systems that are subject to review include, but are not limited to, our accounting systems, estimating systems, material management systems, earned value management systems, purchasing systems and government property systems. If improper or illegal activities, errors or system inadequacies come to the attention of the U.S. government, as a result of an audit or otherwise, then we may be subject to civil and criminal penalties, contract adjustments and/or agreements to upgrade existing systems as well as administrative sanctions that may include the termination of our U.S. government contracts, forfeiture of profits, suspension of payments, fines and, under certain circumstances, suspension or debarment from future U.S. government contracts for a period of time. Whether or not illegal activities are alleged and regardless of materiality, the U.S. government also has the ability to decrease or withhold certain payments when it deems systems subject to its review to be inadequate. These laws and regulations affect how we do business with our customers and, in many instances, impose added costs on our business.

|

|

•

|

Our defense truck contracts are large in size and require significant personnel and production resources, and when our defense truck customers allow such contracts to expire or significantly reduce their vehicle requirements under such contracts, we must make adjustments to personnel and production resources. The start and completion of existing and new contract awards that we may receive can cause our defense business to fluctuate significantly. During the past two years, we have completed significant reductions to our production and office workforce in our defense segment. We expect that the start-up of the JLTV contract will result in our hiring back employees previously laid off and our hiring of hundreds of new employees. If we are unable to effectively ramp up our workforce, our future earnings and cash flows would be adversely affected.

|

|

•

|

In the event of component availability constraints, the U.S. government has the ability to unilaterally divert the supply of components used on multiple government programs to those programs rated most urgent (DX-rated programs). This could result in the U.S. government diverting the supply of component parts necessary for the production of vehicles under our U.S. defense contracts to other contractors.

|

|

•

|

We periodically experience difficulties with sourcing sufficient vehicle carcasses from the U.S. military to maintain our defense truck remanufacturing schedule, which can create uncertainty and inefficiencies for this area of our business.

|

|

•

|

Render us more vulnerable to general adverse economic and industry conditions in our highly cyclical markets or economies generally;

|

|

•

|

Require us to dedicate a portion of our cash flow from operations to interest costs or required payments on debt, thereby reducing the availability of such cash flow to fund working capital, capital expenditures, research and development, share repurchases, dividends and other general corporate activities;

|

|

•

|

Limit our ability to obtain additional financing in the future to fund growth working capital, capital expenditures, new product development expenses and other general corporate requirements;

|

|

•

|

Limit our ability to enter into additional foreign currency and interest rate derivative contracts;

|

|

•

|

Make us vulnerable to increases in interest rates as our debt under our credit agreement is at variable rates;

|

|

•

|

Limit our flexibility in planning for, or reacting to, changes in our business and the markets we serve;

|

|

•

|

Place us at a competitive disadvantage compared to less leveraged competitors; and

|

|

•

|

Limit our ability to pursue strategic acquisitions that may become available in our markets or otherwise capitalize on business opportunities if we had additional borrowing capacity.

|

|

Segment

|

Location (# of facilities)

|

Segment

|

Location (# of facilities)

|

|||

|

Access Equipment

|

McConnellsburg, Pennsylvania (3)

|

Fire & Emergency

|

Appleton, Wisconsin (3)

|

|||

|

Orrville, Ohio (1)

|

Bradenton, Florida (1)

|

|||||

|

Shippensburg, Pennsylvania (1)

|

Kewaunee, Wisconsin (1)

|

|||||

|

Greencastle, Pennsylvania (1)

|

Clearwater, Florida (1)

(a)

|

|||||

|

Riverside, California (1)

(a)

|

||||||

|

Medias, Romania (1)

(a)

|

Commercial

|

Dodge Center, Minnesota (1)

|

||||

|

Tianjin, China (1)

|

Garner, Iowa (1)

|

|||||

|

Maasmechelen, Belgium (1)

(a)

|

Blair, Nebraska (1)

|

|||||

|

Tonneins, France (1)

(a)

|

Riceville, Iowa (1)

|

|||||

|

Port Macquarie, Australia (1)

|

Audubon, Iowa (1)

|

|||||

|

Wigston, United Kingdom (1)

|

London, Canada (1)

(a)

|

|||||

|

Leicester, United Kingdom (1)

(a)

|

||||||

|

Defense

|

Oshkosh, Wisconsin (4)

|

Corporate

|

Leon, Mexico (1)

|

|||

|

Name

|

Age

|

Title

|

||

|

Charles L. Szews

|

58

|

Chief Executive Officer

|

||

|

Wilson R. Jones

|

54

|

President and Chief Operating Officer

|

||

|

Gregory L. Fredericksen

|

54

|

Executive Vice President and Chief Procurement Officer

|

||

|

Janet L. Hogan

|

51

|

Executive Vice President and Chief Human Resources Officer

|

||

|

James W. Johnson

|

50

|

Executive Vice President and President, Fire & Emergency Segment

|

||

|

Joseph H. Kimmitt

|

65

|

Executive Vice President, Government Operations and Industry Relations

|

||

|

Frank R. Nerenhausen

|

51

|

Executive Vice President and President, Access Equipment Segment

|

||

|

David M. Sagehorn

|

52

|

Executive Vice President and Chief Financial Officer

|

||

|

John M. Urias

|

62

|

Executive Vice President and President, Defense Segment

|

||

|

Ignacio A. Cortina

|

44

|

Senior Vice President, General Counsel and Secretary

|

||

|

Marek W. May

|

46

|

Senior Vice President, Operations

|

||

|

Robert S. Messina

|

45

|

Senior Vice President, Engineering and Technology

|

||

|

Colleen R. Moynihan

|

55

|

Senior Vice President, Quality & Continuous Improvement

|

||

|

Bradley M. Nelson

|

46

|

Senior Vice President and President, Commercial Segment

|

||

|

Mark M. Radue

|

51

|

Senior Vice President, Business Development

|

||

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

Period

|

Total Number of Shares Purchased

|

Average Price Paid per Share

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (1)

|

Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs (1)

|

|||||||||

|

July 1 - July 31

|

—

|

|

$

|

—

|

|

—

|

|

2,898,921

|

|

||||

|

August 1 - August 31

|

2,359,581

|

|

38.28

|

|

2,359,581

|

|

10,539,340

|

|

|||||

|

September 1 - September 30

|

574,082

|

|

38.11

|

|

574,082

|

|

9,965,258

|

|

|||||

|

Total

|

2,933,663

|

|

38.25

|

|

2,933,663

|

|

9,965,258

|

|

|||||

|

(1)

|

On August, 31 2015, the Company's Board of Directors increased the Company's authorization to repurchase shares of the Company's Common Stock by 10,000,000 shares, taking the authorized number of shares of Common Stock available for repurchase to 10,299,198 as of that date. As of

September 30, 2015

, the Company had repurchased 333,940 shares of Common Stock under this authorization. As a result, 9,965,258 shares of Common Stock remained available for repurchase under the repurchase authorization at

September 30, 2015

. The Company can use this authorization at any time as there is no expiration date associated with the authorization. From time to time, the Company may enter into a Rule 10b5-1 trading plan for the purpose of repurchasing shares under this authorization.

|

|

Fiscal 2015

|

Fiscal 2014

|

||||||||||||||

|

Quarter Ended

|

High

|

Low

|

High

|

Low

|

|||||||||||

|

September 30

|

$

|

43.34

|

|

$

|

32.56

|

|

$

|

57.99

|

|

$

|

44.03

|

|

|||

|

June 30

|

55.69

|

|

42.36

|

|

60.45

|

|

51.26

|

|

|||||||

|

March 31

|

49.40

|

|

38.64

|

|

59.24

|

|

48.93

|

|

|||||||

|

December 31

|

49.50

|

|

39.72

|

|

53.70

|

|

45.66

|

|

|||||||

|

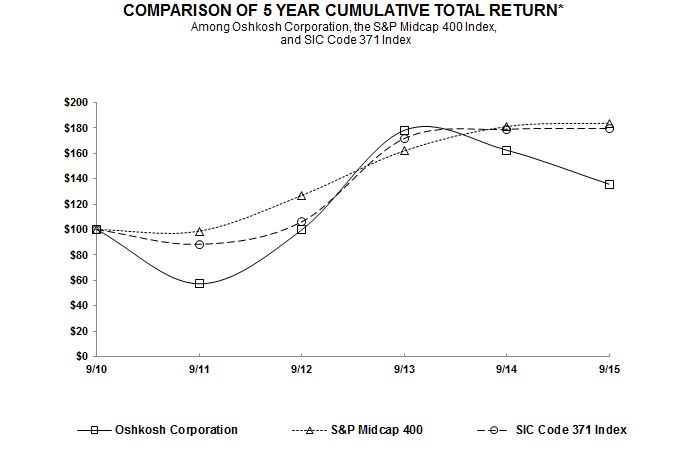

September 30,

|

||||||||||||||||||||

|

2011

|

2012

|

2013

|

2014

|

2015

|

||||||||||||||||

|

Oshkosh Corporation

|

$

|

57.24

|

|

$

|

99.75

|

|

$

|

178.11

|

|

$

|

162.44

|

|

$

|

135.68

|

|

|||||

|

S&P MidCap 400 market index

|

98.72

|

|

126.90

|

|

162.02

|

|

181.17

|

|

183.70

|

|

||||||||||

|

SIC Code 371 Index

|

88.35

|

|

106.12

|

|

171.69

|

|

178.94

|

|

179.61

|

|

||||||||||

|

Fiscal Year Ended September 30,

|

||||||||||||||||||||

|

(In millions, except per share amounts)

|

2015

|

2014

|

2013

|

2012

|

2011

|

|||||||||||||||

|

Income Statement Data:

|

||||||||||||||||||||

|

Net sales

|

$

|

6,098.1

|

|

$

|

6,808.2

|

|

$

|

7,665.1

|

|

$

|

8,141.1

|

|

$

|

7,538.5

|

|

|||||

|

Gross income

|

1,039.2

|

|

1,182.7

|

|

1,191.8

|

|

1,006.9

|

|

1,091.3

|

|

||||||||||

|

Intangible asset impairment charges

|

—

|

|

—

|

|

9.0

|

|

—

|

|

2.0

|

|

||||||||||

|

Depreciation

|

64.9

|

|

65.3

|

|

65.3

|

|

65.5

|

|

77.9

|

|

||||||||||

|

Amortization of purchased intangibles, deferred financing costs and stock-based compensation

(1)

|

81.0

|

|

86.5

|

|

85.9

|

|

83.2

|

|

79.9

|

|

||||||||||

|

Operating income

(2)

|

398.6

|

|

503.3

|

|

505.7

|

|

387.7

|

|

526.1

|

|

||||||||||

|

Income (loss) attributable to Oshkosh Corporation common shareholders:

|

||||||||||||||||||||

|

From continuing operations

|

229.0

|

|

308.1

|

|

314.3

|

|

244.6

|

|

290.6

|

|

||||||||||

|

From discontinued operations

(3)

|

—

|

|

—

|

|

1.7

|

|

(14.4

|

)

|

(17.6

|

)

|

||||||||||

|

Net income

|

229.0

|

|

308.1

|

|

316.0

|

|

230.2

|

|

273.0

|

|

||||||||||

|

Income (loss) attributable to Oshkosh Corporation common shareholders per share assuming dilution:

|

||||||||||||||||||||

|

From continuing operations

|

$

|

2.90

|

|

$

|

3.61

|

|

$

|

3.53

|

|

$

|

2.67

|

|

$

|

3.18

|

|

|||||

|

From discontinued operations

(3)

|

—

|

|

—

|

|

0.02

|

|

(0.16

|

)

|

(0.19

|

)

|

||||||||||

|

Net income

|

2.90

|

|

3.61

|

|

3.55

|

|

2.51

|

|

2.99

|

|

||||||||||

|

Dividends per share

|

$

|

0.68

|

|

$

|

0.60

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

|||||

|

Balance Sheet Data:

|

||||||||||||||||||||

|

Cash and cash equivalents

|

$

|

42.9

|

|

$

|

313.8

|

|

$

|

733.5

|

|

$

|

540.7

|

|

$

|

428.5

|

|

|||||

|

Total assets

|

4,613.0

|

|

4,586.7

|

|

4,765.7

|

|

4,947.8

|

|

4,826.9

|

|

||||||||||

|

Net working capital

|

971.2

|

|

1,072.7

|

|

1,172.7

|

|

990.0

|

|

762.8

|

|

||||||||||

|

Long-term debt (including current maturities)

|

938.5

|

|

895.0

|

|

955.0

|

|

955.0

|

|

1,060.1

|

|

||||||||||

|

Oshkosh Corporation shareholders’ equity

|

1,911.1

|

|

1,985.0

|

|

2,107.8

|

|

1,853.5

|

|

1,596.5

|

|

||||||||||

|

Other Financial Data:

|

||||||||||||||||||||

|

Expenditures for property, plant and equipment

|

$

|

131.7

|

|

$

|

92.2

|

|

$

|

46.0

|

|

$

|

55.9

|

|

$

|

82.3

|

|

|||||

|

Backlog

|

2,607.4

|

|

1,891.0

|

|

2,838.0

|

|

4,046.2

|

|

6,478.4

|

|

||||||||||

|

Book value per share

|

$

|

25.33

|

|

$

|

24.86

|

|

$

|

24.36

|

|

$

|

20.24

|

|

$

|

17.48

|

|

|||||

|

(1)

|

Includes amortization of deferred financing costs of

$6.4 million

in fiscal 2015,

$6.2 million

in fiscal 2014,

$4.9 million

in fiscal 2013, $7.0 million in fiscal 2012 and $5.1 million in fiscal 2011.

|

|

(2)

|

Includes costs incurred by the Company in connection with an unsolicited tender offer for the Company's Common Stock and a threatened proxy contest of $16.3 million in fiscal 2013 and costs incurred by the Company in connection with a proxy contest of $6.6 million in fiscal 2012.

|

|

(3)

|

In fiscal 2013, the Company discontinued production of ambulances, which the Company sold under the Medtec brand name. In fiscal 2012, the Company completed the sale of its European mobile medical business, Oshkosh Specialty Vehicles (UK), Limited and AK Specialty Vehicles and its wholly-owned subsidiary (together, "SMIT"), and discontinued production of U.S. mobile medical units.

|

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

•

|

The Company delivered higher sales and margins in its fire & emergency and commercial segments. Due largely to market share gains, in marginally improving markets, sales grew by 7.8% and 12.9% in the fire & emergency and commercial segments, respectively, in fiscal 2015. Importantly, by executing strategic growth road maps for each segment, operating income margins increased by 190 and 40 basis points, respectively, which yielded a combined 35% increase in the operating income of these two segments. The improvement in commercial segment margins was muted by investments intended to raise margins further in fiscal 2016.

|

|

•

|

The Company set the foundation for defense segment earnings recovery in fiscal 2016. Extensive efforts over multiple years expanding the number of M-ATV variants and marketing them globally resulted in the defense segment securing an order in August 2015 from an international customer for an additional 273 M-ATVs for sale in fiscal 2016. In addition, the defense segment expects to secure a contract for more than 1,000 additional M-ATVs in the first quarter of fiscal 2016, the majority of which the Company expects to sell in fiscal 2016. The Company's defense segment continues to pursue opportunities to sell thousands of M-ATVs over the next few years.

|

|

•

|

The Company's defense segment achieved a historic award of the JLTV production contract. The award of the $6.7 billion JLTV contract positions the defense business with a strong, profitable base of business for at least the next eight years. The JLTV will become the tactical workhorse for transporting the next generation of U.S. soldiers and Marines around the battlefield. The JLTV contract award is currently being protested by one of the competing bidders, and the DoD has issued a stop-work order on the JLTV program pending resolution of the protest. The Company expects a decision on the protest in December 2015.

|

|

•

|

M

arket recovery and growth

— The Company plans to capture or improve its historical share of a market recovery. The Company estimated at its Analyst Day in September 2012 that even a modest market recovery represented a $220 million operating income opportunity in its non-defense businesses between fiscal 2012 and fiscal 2015 at historical margins and assuming no major market share gains. As a result of the impact of adverse weather in the Northeast and Southern U.S. in 2015 on the construction season in the U.S. and the impact of the sudden and significant decline in oil and gas prices on exploration activity, access equipment demand and, to a lesser extent, concrete mixer demand did not meet the Company's expectations and as a result, the Company fell short of its fiscal 2015 target for the Market Recovery and Growth initiative.

|

|

•

|

O

ptimize cost and capital structure

— The Company is executing plans to optimize its cost and capital structure (“O” initiative) to provide value for customers and shareholders by aggressively attacking its product, process and overhead costs. The Company had targeted 250 basis points of operating income margin improvement between fiscal 2012 and fiscal 2015 through this initiative. The Company's actual operating income margin improvement from cost optimization activities exceeded the 250 basis point target.

|

|

•

|

V

alue innovation

— The Company has maintained its emphasis on new product development as it seeks to expand sales and margins by leading its core markets in the introduction of new or improved products and new technologies. The Company had targeted this initiative to achieve $350 million of incremental annual revenue by fiscal 2015 compared to fiscal 2012. As part of this initiative, the Company launched more than 20 new products in fiscal 2014 and approximately 30 new products in fiscal 2015. The Company's incremental revenue from new products in fiscal 2015 compared to fiscal 2012 exceeded the Company's $350 million target.

|

|

•

|

E

merging market expansion

— The Company is driving expansion in targeted international geographies where it believes that there are significant opportunities for growth. The Company targeted to derive 25% of its revenues from outside the U.S. by fiscal 2015. The Company has continued to invest in international business development resources, including opening new access equipment segment sales and service offices in fiscal 2014 and 2015. The Company's revenue from outside of the U.S. in fiscal 2015 was approximately

21%

, 23% on a constant currency basis, of its consolidated fiscal 2015 revenues. Achievement of the original target was adversely impacted by significant weakening of currencies against the U.S. dollar in fiscal 2015.

|

|

Fiscal Year Ended September 30,

|

||||||||

|

2015

|

2012

|

|||||||

|

Adjusted earnings per share from continuing operations-diluted (non-GAAP)

|

$

|

3.02

|

|

$

|

2.30

|

|

||

|

Discrete tax benefits

|

—

|

|

0.49

|

|

||||

|

Debt extinguishment costs, net of tax

|

(0.12

|

)

|

—

|

|

||||

|

Pension and OPEB curtailment/settlement, net of tax

|

0.03

|

|

(0.02

|

)

|

||||

|

Workforce reduction charges, net of tax

|

(0.03

|

)

|

—

|

|

||||

|

Tender offer and proxy contest costs, net of tax

|

—

|

|

(0.05

|

)

|

||||

|

Performance share valuation adjustment, net of tax

|

—

|

|

(0.05

|

)

|

||||

|

Earnings per share from continuing operations-diluted (GAAP)

|

$

|

2.90

|

|

$

|

2.67

|

|

||

|

Fiscal Year Ended September 30,

|

|||||||||||

|

2015

|

2014

|

2013

|

|||||||||

|

Net sales:

|

|||||||||||

|

Access equipment

|

$

|

3,400.6

|

|

$

|

3,506.5

|

|

$

|

3,120.8

|

|

||

|

Defense

|

939.8

|

|

1,724.5

|

|

3,049.7

|

|

|||||

|

Fire & emergency

|

815.1

|

|

756.5

|

|

792.4

|

|

|||||

|

Commercial

|

978.0

|

|

865.9

|

|

766.9

|

|

|||||

|

Intersegment eliminations

|

(35.4

|

)

|

(45.2

|

)

|

(64.7

|

)

|

|||||

|

Consolidated

|

$

|

6,098.1

|

|

$

|

6,808.2

|

|

$

|

7,665.1

|

|

||

|

Fiscal Year Ended September 30,

|

|||||||||||

|

2015

|

2014

|

2013

|

|||||||||

|

Net sales:

|

|||||||||||

|

United States

|

$

|

4,789.3

|

|

$

|

5,247.7

|

|

$

|

6,034.5

|

|

||

|

Other North America

|

302.8

|

|

351.2

|

|

235.2

|

|

|||||

|

Europe, Africa and the Middle East

|

564.4

|

|

672.3

|

|

898.7

|

|

|||||

|

Rest of the world

|

441.6

|

|

537.0

|

|

496.7

|

|

|||||

|

Consolidated

|

$

|

6,098.1

|

|

$

|

6,808.2

|

|

$

|

7,665.1

|

|

||

|

Fiscal Year Ended September 30,

|

|||||||||||

|

2015

|

2014

|

2013

|

|||||||||

|

Cost of sales:

|

|||||||||||

|

Access equipment

|

$

|

2,697.7

|

|

$

|

2,706.5

|

|

$

|

2,459.2

|

|

||

|

Defense

|

862.7

|

|

1,566.4

|

|

2,725.0

|

|

|||||

|

Fire & emergency

|

703.9

|

|

666.3

|

|

700.9

|

|

|||||

|

Commercial

|

820.6

|

|

727.6

|

|

649.2

|

|

|||||

|

Intersegment eliminations

|

(26.0

|

)

|

(41.3

|

)

|

(61.0

|

)

|

|||||

|

Consolidated

|

$

|

5,058.9

|

|

$

|

5,625.5

|

|

$

|

6,473.3

|

|

||

|

Fiscal Year Ended September 30,

|

|||||||||||

|

2015

|

2014

|

2013

|

|||||||||

|

Operating income (loss):

|

|||||||||||

|

Access equipment

|

$

|

407.0

|

|

$

|

501.1

|

|

$

|

379.6

|

|

||

|

Defense

|

9.2

|

|

76.4

|

|

224.9

|

|

|||||

|

Fire & emergency

|

43.8

|

|

26.6

|

|

23.8

|

|

|||||

|

Commercial

|

64.5

|

|

53.9

|

|

41.3

|

|

|||||

|

Corporate

|

(126.0

|

)

|

(154.7

|

)

|

(163.9

|

)

|

|||||

|

Intersegment eliminations

|

0.1

|

|

—

|

|

—

|

|

|||||

|

Consolidated

|

$

|

398.6

|

|

$

|

503.3

|

|

$

|

505.7

|

|

||

|

September 30,

|

|||||||

|

2015

|

2014

|

||||||

|

Cash and cash equivalents

|

$

|

42.9

|

|

$

|

313.8

|

|

|

|

Total debt

|

938.5

|

|

895.0

|

|

|||

|

Total shareholders’ equity

|

1,911.1

|

|

1,985.0

|

|

|||

|

Total capitalization (debt plus equity)

|

2,849.6

|

|

2,880.0

|

|

|||

|

Debt to total capitalization

|

32.9

|

%

|

31.1

|

%

|

|||

|

•

|

Leverage Ratio: A maximum leverage ratio (defined as, with certain adjustments, the ratio of the Company’s consolidated indebtedness to consolidated net income before interest, taxes, depreciation, amortization, non-cash charges and certain other items (“EBITDA”)) as of the last day of any fiscal quarter of 4.50 to 1.0.

|

|

•

|

Interest Coverage Ratio: A minimum interest coverage ratio (defined as, with certain adjustments, the ratio of the Company’s consolidated EBITDA to the Company’s consolidated cash interest expense) as of the last day of any fiscal quarter of 2.50 to 1.0.

|

|

•

|

Senior Secured Leverage Ratio: A maximum senior secured leverage ratio (defined as, with certain adjustments, the ratio of the Company’s consolidated secured indebtedness to the Company’s consolidated EBITDA) of 3.00 to 1.0.

|

|

i.

|

50% of the consolidated net income of the Company and its subsidiaries (or if such consolidated net income is a deficit, minus 100% of such deficit), accrued on a cumulative basis during the period beginning on January 1, 2010 and ending on the last day of the fiscal quarter immediately preceding the date of the applicable proposed dividend or distribution; and

|

|

ii.

|

100% of the aggregate net proceeds received by the Company subsequent to March 3, 2010 either as a contribution to its common equity capital or from the issuance and sale of its Common Stock.

|

|

Payments Due by Period

|

|||||||||||||||||||

|

Less Than

|

More Than

|

||||||||||||||||||

|

Total

|

1 Year

|

1-3 Years

|

3-5 Years

|

5 Years

|

|||||||||||||||

|

Contractual Obligations

|

|||||||||||||||||||

|

Long-term debt (including interest)

(1)

|

$

|

1,107.2

|

|

$

|

53.2

|

|

$

|

105.4

|

|

$

|

371.3

|

|

$

|

577.3

|

|

||||

|

Operating leases

|

57.9

|

|

22.9

|

|

25.5

|

|

7.1

|

|

2.4

|

|

|||||||||

|

Purchase obligations

(2)

|

707.0

|

|

705.5

|

|

1.5

|

|

—

|

|

—

|

|

|||||||||

|

Other long-term liabilities:

|

|

|

|||||||||||||||||

|

Uncertain tax positions

(3)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Other

(4)

|

542.9

|

|

54.7

|

|

68.6

|

|

46.1

|

|

373.5

|

|

|||||||||

|

Total contractual obligations

|

$

|

2,415.0

|

|

$

|

836.3

|

|

$

|

201.0

|

|

$

|

424.5

|

|

$

|

953.2

|

|

||||

|

(1)

|

Interest was calculated based upon the interest rate in effect on

September 30, 2015

.

|

|

(2)

|

The Company utilizes blanket purchase orders to communicate expected annual requirements to many of its suppliers or contractors. Requirements under blanket purchase orders generally do not become “firm” until four weeks prior to the Company’s scheduled unit production. The purchase obligations amounts included above represent the values of commitments considered firm, plus the value of all outstanding subcontracts.

|

|

(3)

|

Due to the uncertainty of the timing of settlement with taxing authorities, the Company is unable to make reasonably reliable estimates of the period of cash settlement of unrecognized tax benefits for the remaining uncertain tax liabilities. Therefore,

$27.0 million

of unrecognized tax benefits as of

September 30, 2015

have been excluded from the Contractual Obligations table above. See Note 19 of the Notes to Consolidated Financial Statements for additional information regarding the Company’s unrecognized tax benefits as of

September 30, 2015

.

|

|

(4)

|

Represents other long-term liabilities on the Company's Consolidated Balance Sheet, including the current portion of these liabilities. The projected timing of cash flows associated with these obligations is based on management's estimates, which are based largely on historical experience. This amount also includes all liabilities under the Company's pension and other postretirement benefit plans. See Note 18 of the Notes to Consolidated Financial Statements for information regarding these liabilities and the plan assets available to satisfy them.

|

|

Amount of Commitment Expiration Per Period

|

|||||||||||||||||||

|

Less Than

|

More Than

|

||||||||||||||||||

|

Total

|

1 Year

|

1-3 Years

|

3-5 Years

|

5 Years

|

|||||||||||||||

|

Commitments

|

|||||||||||||||||||

|

Customer financing guarantees to third parties

|

$

|

120.4

|

|

$

|

44.1

|

|

$

|

32.9

|

|

$

|

22.1

|

|

$

|

21.3

|

|

||||

|

Standby letters of credit

|

62.6

|

|

40.1

|

|

22.3

|

|

0.2

|

|

—

|

|

|||||||||

|

Total commercial commitments

|

$

|

183.0

|

|

$

|

84.2

|

|

$

|

55.2

|

|

$

|

22.3

|

|

$

|

21.3

|

|

||||

|

Expected Maturity Date

|

|||||||||||||||||||||||||||||||

|

2016

|

2017

|

2018

|

2019

|

2020

|

Thereafter

|

Total

|

Fair

Value

|

||||||||||||||||||||||||

|

Liabilities

|

|||||||||||||||||||||||||||||||

|

Long-term debt:

|

|||||||||||||||||||||||||||||||

|

Variable rate ($US)

|

$

|

20.0

|

|

$

|

20.0

|

|

$

|

20.0

|

|

$

|

315.0

|

|

$

|

—

|

|

$

|

—

|

|

$

|

375.0

|

|

$

|

375.0

|

|

|||||||

|

Average interest rate

|

1.9904

|

%

|

2.5064

|

%

|

2.9770

|

%

|

3.2418

|

%

|

—

|

%

|

—

|

%

|

3.1217

|

%

|

|||||||||||||||||

|

Fixed rate ($US)

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

500.0

|

|

$

|

500.0

|

|

$

|

501.0

|

|

|||||||

|

Average interest rate

|

5.3750

|

%

|

5.3750

|

%

|

5.3750

|

%

|

5.3750

|

%

|

5.3750

|

%

|

5.3750

|

%

|

5.3750

|

%

|

|||||||||||||||||

|

Foreign Exchange

Gain/(Loss) From:

|

||||||||||||||||||

|

Notional

Amount

|

Average

Contractual

Exchange Rate

|

Fair Value

|

10%

Appreciation of

Sell Currency

|

10%

Depreciation of

Sell Currency

|

||||||||||||||

|

Sell AUD / Buy USD

|

$

|

53.2

|

|

1.3752

|

|

$

|

—

|

|

$

|

5.3

|

|

$

|

(5.3

|

)

|

||||

|

Sell USD / Buy EUR

|

17.9

|

|

1.1228

|

|

(0.1

|

)

|

1.8

|

|

(1.8

|

)

|

||||||||

|

Sell EUR / Buy SEK

|

17.6

|

|

9.4049

|

|

0.1

|

|

2.0

|

|

(1.6

|

)

|

||||||||

|

Sell EUR / Buy USD

|

17.3

|

|

1.1222

|

|

0.2

|

|

1.7

|

|

(1.7

|

)

|

||||||||

|

Sell CAD / Buy USD

|

10.5

|

|

0.0761

|

|

0.3

|

|

0.8

|

|

(0.8

|

)

|

||||||||

|

Sell USD / Buy GBP

|

9.4

|

|

1.5427

|

|

(0.2

|

)

|

0.9

|

|

(0.9

|

)

|

||||||||

|

Sell CAD / Buy EUR

|

6.6

|

|

1.4910

|

|

—

|

|

0.7

|

|

(0.7

|

)

|

||||||||

|

Sell GBP / Buy EUR

|

3.2

|

|

1.3751

|

|

—

|

|

0.3

|

|

(0.3

|

)

|

||||||||

|

Sell GBP / Buy USD

|

2.8

|

|

1.5336

|

|

—

|

|

0.3

|

|

(0.3

|

)

|

||||||||

|

Fiscal Year Ended September 30,

|

|||||||||||

|

2015

|

2014

|

2013

|

|||||||||

|

Net sales

|

$

|

6,098.1

|

|

$

|

6,808.2

|

|

$

|

7,665.1

|

|

||

|

Cost of sales

|

5,058.9

|

|

5,625.5

|

|

6,473.3

|

|

|||||

|

Gross income

|

1,039.2

|

|

1,182.7

|

|

1,191.8

|

|

|||||

|

Operating expenses:

|

|||||||||||

|

Selling, general and administrative

|

587.4

|

|

624.1

|

|

620.5

|

|

|||||

|

Amortization of purchased intangibles

|

53.2

|

|

55.3

|

|

56.6

|

|

|||||

|

Intangible asset impairment charge

|

—

|

|

—

|

|

9.0

|

|

|||||

|

Total operating expenses

|

640.6

|

|

679.4

|

|

686.1

|

|

|||||

|

Operating income

|

398.6

|

|

503.3

|

|

505.7

|

|

|||||

|

Other income (expense):

|

|||||||||||

|

Interest expense

|

(70.1

|

)

|

(71.4

|

)

|

(66.0

|

)

|

|||||

|

Interest income

|

2.5

|

|

2.0

|

|

11.4

|

|

|||||

|

Miscellaneous, net

|

(4.9

|

)

|

(2.0

|

)

|

(6.1

|

)

|

|||||

|

Income from continuing operations before income taxes and equity in earnings of unconsolidated affiliates

|

326.1

|

|

431.9

|

|

445.0

|

|

|||||

|

Provision for income taxes

|

99.2

|

|

125.0

|

|

131.7

|

|

|||||

|

Income from continuing operations before equity in earnings of unconsolidated affiliates

|

226.9

|

|

306.9

|

|

313.3

|

|

|||||

|

Equity in earnings of unconsolidated affiliates

|

2.6

|

|

2.4

|

|

3.0

|

|

|||||

|

Income from continuing operations, net of tax

|

229.5

|

|

309.3

|

|

316.3

|

|

|||||

|

Discontinued operations (Note 3):

|

|

|

|

|

|

|

|||||

|

Income from discontinued operations

|

—

|

|

—

|

|

2.6

|

|

|||||

|

Income tax provision

|

—

|

|

—

|

|

(0.9

|

)

|

|||||

|

Income from discontinued operations, net of tax

|

—

|

|

—

|

|

1.7

|

|

|||||

|

Net income

|

$

|

229.5

|

|

$

|

309.3

|

|

$

|

318.0

|

|

||

|

Earnings per share-basic:

|

|||||||||||

|

From continuing operations

|

$

|

2.94

|

|

$

|

3.66

|

|

$

|

3.58

|

|

||

|

From discontinued operations

|

—

|

|

—

|

|

0.02

|

|

|||||

|

$

|

2.94

|

|

$

|

3.66

|

|

$

|

3.60

|

|

|||

|

Earnings per share-diluted:

|

|

|

|

|

|

|

|||||

|

From continuing operations

|

$

|

2.90

|

|

$

|

3.61

|

|

$

|

3.53

|

|

||

|

From discontinued operations

|

—

|

|

—

|

|

0.02

|

|

|||||

|

$

|

2.90

|

|

$

|

3.61

|

|

$

|

3.55

|

|

|||

|

Fiscal Year Ended September 30,

|

|||||||||||

|

2015

|

2014

|

2013

|

|||||||||

|

Net income

|

$

|

229.5

|

|

$

|

309.3

|

|

$

|

318.0

|

|

||

|

Other comprehensive income (loss), net of tax:

|

|||||||||||

|

Change in fair value of derivative instruments

|

0.1

|

|

—

|

|

—

|

|

|||||

|

Employee pension and postretirement benefits

|

(2.2

|

)

|

(21.2

|

)

|

76.6

|

|

|||||

|

Currency translation adjustments

|

(73.1

|

)

|

(33.4

|

)

|

10.2

|

|

|||||

|

Total other comprehensive income (loss), net of tax

|

(75.2

|

)

|

(54.6

|

)

|

86.8

|

|

|||||

|

Comprehensive income

|

$

|

154.3

|

|

$

|

254.7

|

|

$

|

404.8

|

|

||

|

September 30,

|

|||||||

|

2015

|

2014

|

||||||

|

Assets

|

|||||||

|

Current assets:

|

|||||||

|

Cash and cash equivalents

|

$

|

42.9

|

|

$

|

313.8

|

|

|

|

Receivables, net

|

964.6

|

|

974.9

|

|

|||

|

Inventories

|

1,301.7

|

|

960.9

|

|

|||

|

Deferred income taxes, net

|

52.2

|

|

66.3

|

|

|||

|

Prepaid income taxes

|

22.8

|

|

22.7

|

|

|||

|

Other current assets

|

45.1

|

|

45.7

|

|

|||

|

Total current assets

|

2,429.3

|

|

2,384.3

|

|

|||

|

Investment in unconsolidated affiliates

|

16.2

|

|

21.1

|

|

|||

|

Property, plant and equipment, net

|

475.8

|

|

405.5

|

|

|||

|

Goodwill

|

1,001.1

|

|

1,025.5

|

|

|||

|

Purchased intangible assets, net

|

606.7

|

|

657.9

|

|

|||

|

Other long-term assets

|

83.9

|

|

92.4

|

|

|||

|

Total assets

|

$

|

4,613.0

|

|

$

|

4,586.7

|

|

|

|

Liabilities and Shareholders' Equity

|

|||||||

|

Current liabilities:

|

|||||||

|

Revolving credit facility and current maturities of long-term debt

|

$

|

83.5

|

|

$

|

20.0

|

|

|

|

Accounts payable

|

552.8

|

|

586.7

|

|

|||

|

Customer advances

|

440.2

|

|

310.1

|

|

|||

|

Payroll-related obligations

|

116.6

|

|

147.2

|

|

|||

|

Accrued warranty

|

76.9

|

|

91.2

|

|

|||

|

Other current liabilities

|

188.1

|

|

156.4

|

|

|||

|

Total current liabilities

|

1,458.1

|

|

1,311.6

|

|

|||

|

Long-term debt, less current maturities

|

855.0

|

|

875.0

|

|

|||

|

Deferred income taxes, net

|

91.7

|

|

125.0

|

|

|||

|

Other long-term liabilities

|

297.1

|

|

290.1

|

|

|||

|

Commitments and contingencies

|

|

|

|

|

|||

|

Shareholders' Equity:

|

|||||||

|

Preferred Stock ($.01 par value; 2,000,000 shares authorized; none issued and outstanding)

|

—

|

|

—

|

|

|||

|

Common Stock ($.01 par value; 300,000,000 shares authorized; 92,101,465 shares issued)

|

0.9

|

|

0.9

|

|

|||

|

Additional paid-in capital

|

771.5

|

|

758.0

|

|

|||

|

Retained earnings

|

2,016.5

|

|

1,840.1

|

|

|||

|

Accumulated other comprehensive loss

|

(144.4

|

)

|

(69.2

|

)

|

|||

|

Common Stock in treasury, at cost (16,647,031 and 12,256,103 shares, respectively)

|

(733.4

|

)

|

(544.8

|

)

|

|||

|

Total shareholders’ equity

|

1,911.1

|

|

1,985.0

|

|

|||

|

Total liabilities and shareholders' equity

|

$

|

4,613.0

|

|

$

|

4,586.7

|

|

|

|

Common

Stock

|

Additional

Paid-In

Capital

|

Retained

Earnings

|

Accumulated

Other

Comprehensive

Income (Loss)

|

Common

Stock in

Treasury

at Cost

|

Total

|

||||||||||||||||||

|

Balance at September 30, 2012

|

$

|

0.9

|

|

$

|

703.5

|

|

$

|

1,263.5

|

|

$

|

(101.4

|

)

|

$

|

(13.0

|

)

|

$

|

1,853.5

|

|

|||||

|

Net income

|

—

|

|

—

|

|

318.0

|

|

—

|

|

—

|

|

318.0

|

|

|||||||||||

|

Employee pension and postretirement benefits, net of tax of $44.6

|

—

|

|

—

|

|

—

|

|

76.6

|

|

—

|

|

76.6

|

|

|||||||||||

|

Currency translation adjustments

|

—

|

|

—

|

|

—

|

|

10.2

|

|

—

|

|

10.2

|

|

|||||||||||

|

Repurchases of Common Stock

|

—

|

|

—

|

|

—

|

|

—

|

|

(201.8

|

)

|

(201.8

|

)

|

|||||||||||

|

Exercise of stock options

|

—

|

|

(0.5

|

)

|

—

|

|

—

|

|

31.9

|

|

31.4

|

|

|||||||||||

|

Stock-based compensation expense

|

—

|

|

24.4

|

|

—

|

|

—

|

|

—

|

|

24.4

|

|

|||||||||||

|

Excess tax benefit (shortfall) from stock-based compensation

|

—

|

|

(1.0

|

)

|

—

|

|

—

|

|

—

|

|

(1.0

|

)

|

|||||||||||

|

Shares tendered for taxes on stock-based compensation

|

—

|

|

—

|

|

—

|

|

—

|

|

(3.5

|

)

|

(3.5

|

)

|

|||||||||||

|

Other

|

—

|

|

(0.8

|

)

|

—

|

|

—

|

|

0.8

|

|

—

|

|

|||||||||||

|

Balance at September 30, 2013

|

0.9

|

|

725.6

|

|

1,581.5

|

|

(14.6

|

)

|

(185.6

|

)

|

2,107.8

|

|

|||||||||||

|

Net income

|

—

|

|

—

|

|

309.3

|

|

—

|

|

—

|

|

309.3

|

|

|||||||||||

|

Employee pension and postretirement benefits, net of tax of $(12.4)

|

—

|

|

—

|

|

—

|

|

(21.2

|

)

|

—

|

|

(21.2

|

)

|

|||||||||||

|

Currency translation adjustments

|

—

|

|

—

|

|

—

|

|

(33.4

|

)

|

—

|

|

(33.4

|

)

|

|||||||||||

|

Cash dividends ($0.60 per share)

|

—

|

|

—

|

|

(50.7

|

)

|

—

|

|

—

|

|

(50.7

|

)

|

|||||||||||

|

Repurchases of Common Stock

|

—

|

|

—

|

|

—

|

|

—

|

|

(403.3

|

)

|

(403.3

|

)

|

|||||||||||

|

Exercise of stock options

|

—

|

|

6.2

|

|

—

|

|

—

|

|

44.7

|

|

50.9

|

|

|||||||||||

|

Stock-based compensation expense

|

—

|

|

25.0

|

|

—

|

|

—

|

|

—

|

|

25.0

|

|

|||||||||||

|

Excess tax benefit from stock-based compensation

|

—

|

|

6.4

|

|

—

|

|

—

|

|

—

|

|

6.4

|

|

|||||||||||

|

Payment of earned performance shares

|

—

|

|

(5.1

|

)

|

—

|

|

—

|

|

5.1

|

|

—

|

|

|||||||||||

|

Shares tendered for taxes on stock-based compensation

|

—

|

|

—

|

|

—

|

|

—

|

|

(6.2

|

)

|

(6.2

|

)

|

|||||||||||

|

Other

|

—

|

|

(0.1

|

)

|

—

|

|

—

|

|

0.5

|

|

0.4

|

|

|||||||||||

|

Balance at September 30, 2014

|

0.9

|

|

758.0

|

|

1,840.1

|

|

(69.2

|

)

|

(544.8

|

)

|

1,985.0

|

|

|||||||||||

|

Net income

|

—

|

|

—

|

|

229.5

|

|

—

|

|

—

|

|

229.5

|

|

|||||||||||

|

Gains on derivative instruments, net of tax

|

—

|

|

—

|

|

—

|

|

0.1

|

|

—

|

|

0.1

|

|

|||||||||||

|

Employee pension and postretirement benefits, net of tax of $(1.2)

|

—

|

|

—