|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

þ

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

¨

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

||

|

For the fiscal year ended

|

December 31, 2015

|

For the transition period from to

|

|

|

State or other jurisdiction of incorporation or organization

|

Delaware

|

|

|

I.R.S. Employer Identification No.

|

95-4035997

|

|

|

Address of principal executive offices

|

5 Greenway Plaza, Suite 110, Houston, Texas

|

|

|

Zip Code

|

77046

|

|

|

Registrant's telephone number, including area code

|

(713) 215-7000

|

|

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

9 1/4% Senior Debentures due 2019

|

New York Stock Exchange

|

|

|

Common Stock, $0.20 par value

|

New York Stock Exchange

|

|

|

|

Large Accelerated Filer

|

þ

|

Accelerated Filer

|

¨

|

|

|

Non-Accelerated Filer

|

¨

|

Smaller Reporting Company

|

¨

|

|

TABLE OF CONTENTS

|

||

|

Page

|

||

|

Part I

|

|

|

|

Items 1 and 2

|

Business and Properties

.........................................................................................................................................................

|

|

|

General

.............................................................................................................................................................................

|

||

|

Oil and Gas Operations

....................................................................................................................................................

|

||

|

Chemical Operations

........................................................................................................................................................

|

||

|

Midstream and Marketing Operations

...............................................................................................................................

|

||

|

Capital Expenditures

.........................................................................................................................................................

|

||

|

Employees

........................................................................................................................................................................

|

||

|

Environmental Regulation

.................................................................................................................................................

|

||

|

Available Information

.........................................................................................................................................................

|

||

|

Item 1A

|

Risk Factors

............................................................................................................................................................................

|

|

|

Item 1B

|

Unresolved Staff Comments

...................................................................................................................................................

|

|

|

Item 3

|

Legal Proceedings

..................................................................................................................................................................

|

|

|

Item 4

|

Mine Safety Disclosures

.........................................................................................................................................................

|

|

|

Executive Officers

...................................................................................................................................................................

|

||

|

Part II

|

|

|

|

Item 5

|

||

|

Item 6

|

Selected Financial Data

..........................................................................................................................................................

|

|

|

Item 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A)

.....................................

|

|

|

Strategy

.............................................................................................................................................................................

|

||

|

Oil and Gas Segment

........................................................................................................................................................

|

||

|

Chemical Segment

............................................................................................................................................................

|

||

|

Midstream and Marketing Segment

..................................................................................................................................

|

||

|

Segment Results of Operations

and Significant Items Affecting Earnings........................................................................

|

||

|

Taxes

.................................................................................................................................................................................

|

||

|

Consolidated Results of Operations

.................................................................................................................................

|

||

|

Consolidated Analysis of Financial Position

......................................................................................................................

|

||

|

Liquidity and Capital Resources

.......................................................................................................................................

|

||

|

Off-Balance-Sheet Arrangements

.....................................................................................................................................

|

||

|

Contractual Obligations

.....................................................................................................................................................

|

||

|

Lawsuits, Claims and Contingencies

................................................................................................................................

|

||

|

Environmental Liabilities and Expenditures

......................................................................................................................

|

||

|

Foreign Investments

.........................................................................................................................................................

|

||

|

Critical Accounting Policies and Estimates

.......................................................................................................................

|

||

|

Significant Accounting and Disclosure Changes

...............................................................................................................

|

||

|

Safe Harbor Discussion Regarding Outlook and Other Forward-Looking Data

................................................................

|

||

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk

..................................................................................................

|

|

|

Item 8

|

Financial Statements and Supplementary Data

.....................................................................................................................

|

|

|

Report of Independent Registered Public Accounting Firm on Consolidated Financial Statements

.................................

|

||

|

Consolidated Balance Sheets

...........................................................................................................................................

|

||

|

Consolidated Statements of

Operations...........................................................................................................................

|

||

|

Consolidated Statements of Comprehensive Income

.......................................................................................................

|

||

|

Consolidated Statements of Stockholders' Equity

.............................................................................................................

|

||

|

Consolidated Statements of Cash Flows

..........................................................................................................................

|

||

|

Notes to Consolidated Financial Statements

....................................................................................................................

|

||

|

Quarterly Financial Data (Unaudited)

................................................................................................................................

|

||

|

Supplemental Oil and Gas Information (Unaudited)

.........................................................................................................

|

||

|

Schedule II – Valuation and Qualifying Accounts

..............................................................................................................

|

||

|

Item 9

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

.................................................

|

|

|

Item 9A

|

Controls and Procedures

........................................................................................................................................................

|

|

|

Management's Annual Assessment of and Report on Internal Control Over Financial Reporting

....................................

|

||

|

|

Disclosure Controls and Procedures

.................................................................................................................................

|

|

|

Item 9B

|

Other Information....................................................................................................................................................................

|

|

|

Part III

|

|

|

|

Item 10

|

Directors, Executive Officers and Corporate Governance

......................................................................................................

|

|

|

Item 11

|

Executive Compensation

........................................................................................................................................................

|

|

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management

Matters........................................................................

|

|

|

Item 13

|

Certain Relationships and Related Transactions and Director Independence

.......................................................................

|

|

|

Item 14

|

Principal Accounting Fees and Services

................................................................................................................................

|

|

|

Part IV

|

|

|

|

Item 15

|

Exhibits and Financial Statement Schedules

.........................................................................................................................

|

|

|

ITEMS 1 AND 2

|

BUSINESS AND PROPERTIES

|

|

|

2015

|

2014

|

2013

|

||||||||||||||||||||||||||||||||||

|

Proved Reserves

|

Oil

|

NGLs

|

Gas

|

BOE

|

(a)

|

Oil

|

NGLs

|

Gas

|

BOE

|

(a)

|

Oil

|

NGLs

|

Gas

|

BOE

|

(a)

|

||||||||||||||||||||||

|

United States

(b)

|

915

|

|

186

|

|

1,019

|

|

1,271

|

|

1,273

|

|

222

|

|

1,714

|

|

1,781

|

|

1,131

|

|

204

|

|

2,012

|

|

1,670

|

|

|||||||||||||

|

International

|

394

|

|

144

|

|

2,349

|

|

929

|

|

497

|

|

140

|

|

2,413

|

|

1,038

|

|

482

|

|

134

|

|

2,711

|

|

1,068

|

|

|||||||||||||

|

Total

|

1,309

|

|

330

|

|

3,368

|

|

2,200

|

|

1,770

|

|

362

|

|

4,127

|

|

2,819

|

|

1,613

|

|

338

|

|

4,723

|

|

2,738

|

|

|||||||||||||

|

Sales Volumes

|

|||||||||||||||||||||||||||||||||||||

|

United States

(b)

|

73

|

|

20

|

|

155

|

|

119

|

|

67

|

|

20

|

|

173

|

|

116

|

|

64

|

|

21

|

|

193

|

|

117

|

|

|||||||||||||

|

International

|

86

|

|

7

|

|

205

|

|

127

|

|

74

|

|

2

|

|

158

|

|

102

|

|

75

|

|

3

|

|

163

|

|

105

|

|

|||||||||||||

|

Total

|

159

|

|

27

|

|

360

|

|

246

|

|

141

|

|

22

|

|

331

|

|

218

|

|

139

|

|

24

|

|

356

|

|

222

|

|

|||||||||||||

|

(a)

|

Natural gas volumes are converted to BOE at six thousand cubic feet (Mcf) of gas per one barrel of oil. Barrels of oil equivalence does not necessarily result in price equivalence. The price of natural gas on a barrel of oil equivalent basis is currently substantially lower than the corresponding price for oil and has been similarly lower for a number of years. For example, in

2015

, the average prices of West Texas Intermediate (WTI) oil and New York Mercantile Exchange (NYMEX) natural gas were

$48.80

per barrel and

$2.75

per Mcf, respectively, resulting in an oil to gas ratio of 18 to 1.

|

|

(b)

|

Excludes proved reserves and sales volumes for Occidental's California oil and gas operations, which were transferred to California Resources Corporation (California Resources) in November 2014, and has been treated as discontinued operations.

|

|

Principal Products

|

Major Uses

|

Annual Capacity

|

||

|

Basic Chemicals

|

||||

|

Chlorine

|

Raw material for ethylene dichloride (EDC), water treatment and pharmaceuticals

|

3.8 million tons

|

||

|

Caustic soda

|

Pulp, paper and aluminum production

|

4.0 million tons

|

||

|

Chlorinated organics

|

Refrigerants, silicones and pharmaceuticals

|

0.9 billion pounds

|

||

|

Potassium chemicals

|

Fertilizers, batteries, soaps, detergents and specialty glass

|

0.4 million tons

|

||

|

EDC

|

Raw material for vinyl chloride monomer (VCM)

|

2.1 billion pounds

|

||

|

Chlorinated isocyanurates

|

Swimming pool sanitation and disinfecting products

|

131 million pounds

|

||

|

Sodium silicates

|

Catalysts, soaps, detergents and paint pigments

|

0.6 million tons

|

||

|

Calcium chloride

|

Ice melting, dust control, road stabilization and oil field services

|

0.7 million tons

|

||

|

Vinyls

|

||||

|

VCM

|

Precursor for polyvinyl chloride (PVC)

|

6.2 billion pounds

|

||

|

PVC

|

Piping, building materials and automotive and medical products

|

3.7 billion pounds

|

||

|

Other Chemicals

|

||||

|

Resorcinol

|

Tire manufacture, wood adhesives and flame retardant synergist

|

50 million pounds

|

||

|

Location

|

Description

|

Capacity

|

||

|

Gas Plants

|

||||

|

Texas, New Mexico and Colorado

|

Occidental- and third-party-operated natural gas gathering, compression and processing systems, and CO

2

processing

|

2.4 billion cubic feet per day

|

||

|

United Arab Emirates

|

Natural gas processing facilities for the Al Hosn gas project.

|

1.0 billion cubic feet per day

|

||

|

Pipelines

|

||||

|

Texas, New Mexico, and Oklahoma

|

Common carrier oil pipeline and storage system

|

720,000 barrels of oil per day

7 million barrels of oil storage

2,900 miles of pipeline

|

||

|

Texas, New Mexico and Colorado

|

CO

2

fields and pipeline systems transporting CO

2

to oil and gas producing locations

|

2.4 billion cubic feet per day

|

||

|

Dolphin Pipeline - Qatar and United Arab Emirates

|

Equity investment in a natural gas pipeline

|

3.2 billion cubic feet of natural gas per day

(a)

|

||

|

Western and Southern United States and Canada

|

Equity investment in entity involved in pipeline transportation, storage, terminalling and marketing of oil, gas and related petroleum products

|

19,200 miles of pipeline and gathering systems

(b)

Storage for 135 million barrels of oil and other petroleum products and 97 billion cubic feet of natural gas

(b)

|

||

|

Marketing and Trading

|

||||

|

Texas and Singapore

|

Trades around its assets, including transportation and storage capacity, and purchases, markets and trades oil, NGLs, natural gas and power

|

Not applicable

|

||

|

Power Generation

|

||||

|

Texas and Louisiana

|

Occidental-operated power and steam generation facilities

|

1,200 megawatts per hour

and 1.6 million pounds of steam per hour

|

||

|

(a)

|

Pipeline currently transports 2.3 Bcf per day. Additional customer contracts and gas supply are required to reach capacity.

|

|

(b)

|

Amounts are gross, including interests held by third parties.

|

|

Ø

|

Forms 10-K, 10-Q, 8-K and amendments to these forms as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission (SEC);

|

|

Ø

|

Other SEC filings, including Forms 3, 4 and 5; and

|

|

Ø

|

Corporate governance information, including its Corporate Governance Policies, board-committee charters and Code of Business Conduct.

|

|

Ø

|

Worldwide and domestic supplies of, and demand for, crude oil, natural gas, NGLs and refined products.

|

|

Ø

|

The cost of exploring for, developing, producing, refining and marketing crude oil, natural gas, NGLs and refined products.

|

|

Ø

|

Operational impacts such as production disruptions, technological advances and regional market conditions, including available transportation capacity and infrastructure constraints in producing areas.

|

|

Ø

|

Changes in weather patterns and climatic changes.

|

|

Ø

|

The impacts of the members of OPEC and other producing nations that may agree to and maintain production levels.

|

|

Ø

|

The worldwide military and political environment, uncertainty or instability resulting from an escalation or outbreak of armed hostilities or acts of terrorism in the United States, or elsewhere.

|

|

Ø

|

The price and availability of alternative and competing fuels.

|

|

Ø

|

Domestic and foreign governmental regulations and taxes.

|

|

Ø

|

Additional or increased nationalization and expropriation activities by foreign governments.

|

|

Ø

|

General economic conditions worldwide.

|

|

Ø

|

New or amended laws and regulations, or interpretations of such laws and regulations, including those related to drilling, manufacturing or production processes (including well stimulation techniques such as hydraulic fracturing and acidization), labor and employment, taxes, royalty rates, permitted production rates, entitlements, import, export and use of raw materials, equipment or products, use or increased use of land, water and other natural resources, safety, security and environmental protection, all of which may restrict or prohibit activities of Occidental or its contractors, increase Occidental's costs or reduce demand for Occidental's products.

|

|

Ø

|

Refusal of, or delay in, the extension or grant of exploration, development or production contracts.

|

|

Ø

|

Development delays and cost overruns due to approval delays for, or denial of, drilling and other permits and authorizations.

|

|

ITEM 1B

|

UNRESOLVED STAFF COMMENTS

|

|

Name

Current Title

|

Age at February 26, 2016

|

Positions with Occidental and Subsidiaries and Employment History

|

||

|

Stephen I. Chazen

Chief Executive Officer

|

69

|

Chief Executive Officer since 2011 and President 2007-2015; Chief Operating Officer, 2010-2011; Director since 2010.

|

||

|

Vicki A. Hollub

Chief Operating Officer and President

|

56

|

President, Chief Operating Officer and Director since December 2015; Senior Executive Vice President and President, Oxy Oil and Gas 2015; Executive Vice President and President Oxy Oil and Gas - Americas 2014-2015; Vice President and Executive Vice President, U.S. Operations, Oxy Oil and Gas 2013-2014; Executive Vice President - California Operations 2012-2013; Oxy Permian CO

2

President and General Manager 2011-2012.

|

||

|

Edward A. “Sandy” Lowe

Executive Vice President

|

64

|

Executive Vice President since 2015, Vice President 2008-2015; President - Oxy Oil & Gas, International since 2009.

|

||

|

Marcia E. Backus

Senior Vice President

|

61

|

Senior Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary since 2015, Vice President, General Counsel and Corporate Secretary 2014-2015, Vice President and General Counsel 2013-2014; Vinson & Elkins: Partner, 1990-2013.

|

||

|

Christopher G. Stavros

Senior Vice President

|

52

|

Senior Vice President since 2015; Chief Financial Officer since 2014; Executive Vice President 2014-2015; Vice President, Investor Relations and Treasurer 2012-2014; Vice President, Investor Relations 2006-2012.

|

||

|

Cynthia L. Walker

Senior Vice President

|

39

|

Senior Vice President - Marketing and Midstream Operations & Development, since 2016, Senior Vice President, Strategy and Development 2015; Executive Vice President, Strategy and Development 2014-2015; Executive Vice President and Chief Financial Officer 2012-2014; Goldman, Sachs & Co.: Managing Director 2010-2012.

|

||

|

Jennifer M. Kirk

Vice President

|

41

|

Vice President and Controller since 2014; Controller, Occidental Oil and Gas Corporation 2012-2014; Finance Director 2008-2012.

|

||

|

ITEM 5

|

MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

a)

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

b)

|

Weighted-average exercise price of outstanding options, warrants and rights

|

c)

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities in column (a))

|

||

|

3,763,156

(1)

|

77.58

(2)

|

33,461,851

(3)

|

|||||

|

(1)

|

Includes shares reserved to be issued pursuant to stock options (Options), stock appreciation rights (SARs) and performance-based awards. Shares for performance-based awards are included assuming maximum payout, but may be paid out at lesser amounts, or not at all, according to achievement of performance goals.

|

|

(2)

|

Price applies only to the Options and SARs included in column (a). Exercise price is not applicable to the other awards included in column (a).

|

|

(3)

|

A plan provision requires each share covered by an award (other than Options and SARs) to be counted as if three shares were issued in determining the number of shares that are available for future awards. Accordingly, the number of shares available for future awards may be less than the amount shown depending on the type of award granted. Additionally, under the plan, the amount shown may increase, depending on the award type, by the number of shares currently unvested or forfeitable, or three times that number as applicable, that (i) fail to vest, (ii) are forfeited or canceled, or (iii) correspond to the portion of any stock-based awards settled in cash.

|

|

Period

|

Total

Number

of Shares Purchased

|

Average

Price

Paid

per Share

|

Total Number of Shares Purchased as Part of Publicly Announced

Plans or Programs

|

Maximum Number of Shares that May Yet Be Purchased Under the

Plans or Programs

|

|||||||||||||||||

|

First Quarter 2015

|

2,750,835

|

|

(a)

|

$

|

75.07

|

|

2,650,000

|

|

|||||||||||||

|

Second Quarter 2015

|

4,769,624

|

|

$

|

78.05

|

|

4,769,624

|

|

||||||||||||||

|

Third Quarter 2015

|

105,386

|

|

(a)

|

$

|

65.73

|

|

—

|

|

|||||||||||||

|

October 1 - 31, 2015

|

—

|

|

$

|

—

|

|

—

|

|

||||||||||||||

|

November 1 - 30, 2015

|

104,291

|

|

(a)

|

$

|

75.10

|

|

—

|

|

|||||||||||||

|

December 1 - 31, 2015

|

—

|

|

$

|

—

|

|

—

|

|

||||||||||||||

|

Fourth Quarter 2015

|

104,291

|

|

$

|

75.10

|

|

—

|

|

||||||||||||||

|

Total 2015

|

7,730,136

|

|

$

|

76.78

|

|

7,419,624

|

|

63,756,544

|

|

(b)

|

|||||||||||

|

(a)

|

Includes purchases from the trustee of Occidental's defined contribution savings plan that are not part of publicly announced plans or programs.

|

|

(b)

|

Represents the total number of shares remaining at year end under Occidental's share repurchase program of 185 million shares. The program was initially announced in 2005. The program does not obligate Occidental to acquire any specific number of shares and may be discontinued at any time.

|

|

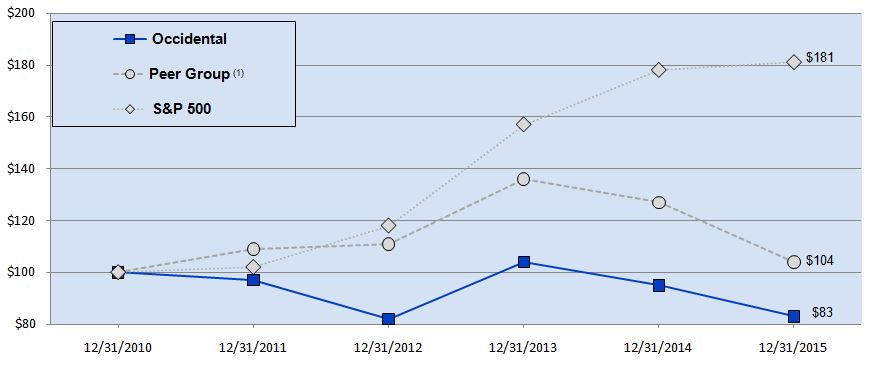

12/31/2010

|

12/31/2011

|

12/31/2012

|

12/31/2013

|

12/31/2014

|

12/31/2015

|

||||||||||||

|

$

|

100

|

$

|

97

|

$

|

82

|

$

|

104

|

$

|

95

|

$

|

83

|

|||||

|

100

|

109

|

111

|

136

|

127

|

104

|

|||||||||||

|

100

|

102

|

118

|

157

|

178

|

181

|

|||||||||||

|

(1)

|

The cumulative total return of the peer group companies' common stock includes the cumulative total return of Occidental's common stock.

|

|

ITEM 6

|

SELECTED FINANCIAL DATA

|

|

As of and for the years ended December 31,

|

2015

|

2014

|

2013

|

2012

|

2011

|

|||||||||||||||

|

RESULTS OF OPERATIONS

(a)

|

||||||||||||||||||||

|

Net sales

|

$

|

12,480

|

|

$

|

19,312

|

|

$

|

20,170

|

|

$

|

20,100

|

|

$

|

20,001

|

|

|||||

|

Income (loss) from continuing operations

|

$

|

(8,146

|

)

|

$

|

(130

|

)

|

$

|

4,932

|

|

$

|

3,829

|

|

$

|

5,527

|

|

|||||

|

Net income (loss) attributable to common stock

|

$

|

(7,829

|

)

|

$

|

616

|

|

$

|

5,903

|

|

$

|

4,598

|

|

$

|

6,771

|

|

|||||

|

Basic earnings (loss) per common share from continuing operations

|

$

|

(10.64

|

)

|

$

|

(0.18

|

)

|

$

|

6.12

|

|

$

|

4.72

|

|

$

|

6.79

|

|

|||||

|

Basic earnings (loss) per common share

|

$

|

(10.23

|

)

|

$

|

0.79

|

|

$

|

7.33

|

|

$

|

5.67

|

|

$

|

8.32

|

|

|||||

|

Diluted earnings (loss) per common share

|

$

|

(10.23

|

)

|

$

|

0.79

|

|

$

|

7.32

|

|

$

|

5.67

|

|

$

|

8.32

|

|

|||||

|

FINANCIAL POSITION

(a)

|

||||||||||||||||||||

|

Total assets

|

$

|

43,437

|

|

$

|

56,259

|

|

$

|

69,443

|

|

$

|

64,210

|

|

$

|

60,044

|

|

|||||

|

Long-term debt, net

|

$

|

6,883

|

|

$

|

6,838

|

|

$

|

6,939

|

|

$

|

7,023

|

|

$

|

5,871

|

|

|||||

|

Stockholders’ equity

|

$

|

24,350

|

|

$

|

34,959

|

|

$

|

43,372

|

|

$

|

40,048

|

|

$

|

37,620

|

|

|||||

|

MARKET CAPITALIZATION

(b)

|

$

|

51,632

|

|

$

|

62,119

|

|

$

|

75,699

|

|

$

|

61,710

|

|

$

|

75,992

|

|

|||||

|

CASH FLOW FROM CONTINUING OPERATIONS

|

||||||||||||||||||||

|

Operating:

|

||||||||||||||||||||

|

Cash flow from continuing operations

|

$

|

3,254

|

|

$

|

8,871

|

|

$

|

10,229

|

|

$

|

9,050

|

|

$

|

9,740

|

|

|||||

|

Investing:

|

||||||||||||||||||||

|

Capital expenditures

|

$

|

(5,272

|

)

|

$

|

(8,930

|

)

|

$

|

(7,357

|

)

|

$

|

(7,874

|

)

|

$

|

(5,354

|

)

|

|||||

|

Cash provided (used) by all other investing activities, net

|

$

|

(151

|

)

|

$

|

2,686

|

|

$

|

1,040

|

|

$

|

(1,989

|

)

|

$

|

(3,530

|

)

|

|||||

|

Financing:

|

||||||||||||||||||||

|

Cash dividends paid

|

$

|

(2,264

|

)

|

$

|

(2,210

|

)

|

$

|

(1,553

|

)

|

(c)

|

$

|

(2,128

|

)

|

(c)

|

$

|

(1,436

|

)

|

|||

|

Purchases of treasury stock

|

$

|

(593

|

)

|

$

|

(2,500

|

)

|

$

|

(943

|

)

|

$

|

(583

|

)

|

$

|

(274

|

)

|

|||||

|

Cash provided (used) by all other financing activities, net

|

$

|

4,341

|

|

$

|

2,384

|

|

$

|

(437

|

)

|

$

|

1,865

|

|

$

|

535

|

|

|||||

|

DIVIDENDS PER COMMON SHARE

|

$

|

2.97

|

|

$

|

2.88

|

|

$

|

2.56

|

|

$

|

2.16

|

|

$

|

1.84

|

|

|||||

|

WEIGHTED AVERAGE BASIC SHARES OUTSTANDING (millions)

|

766

|

|

781

|

|

804

|

|

809

|

|

812

|

|

||||||||||

|

(a)

|

See the MD&A section of this report and the Notes to Consolidated Financial Statements for information regarding acquisitions and dispositions, discontinued operations and other items affecting comparability.

|

|

(b)

|

Market capitalization is calculated by multiplying the year-end total shares of common stock outstanding, net of shares held as treasury stock, by the year-end closing stock price.

|

|

(c)

|

The 2012 amount includes an accelerated fourth quarter dividend payment, which normally would have been accrued as of year-end 2012 and paid in the first quarter of 2013.

|

|

Ø

|

Invest in projects that generate long-term value;

|

|

Ø

|

Allocate and deploy capital with a focus on achieving returns well in excess of its cost of capital; and

|

|

Ø

|

Maintain financial discipline and a strong balance sheet.

|

|

Ø

|

Sold its interest in the Williston Basin in November 2015 and entered into an agreement to sell its Piceance Basin assets, which is expected to close March 2016; and

|

|

Ø

|

Minimized or ceased its involvement in non-core operations in the Middle East and North Africa, including Bahrain, Iraq, Libya and Yemen.

|

|

Ø

|

Operating and developing areas where reserves are known to exist and to increase production from core areas, primarily in the Permian Basin, Colombia and parts of the Middle East;

|

|

Ø

|

Using enhanced oil recovery techniques, such as CO

2

, water and

steam floods, in mature fields;

|

|

Ø

|

Focusing a sizable portion of Occidental's drilling activities on unconventional opportunities, primarily in the Permian Basin; and

|

|

Ø

|

Maintaining a disciplined approach towards domestic acquisitions and divestitures and the execution of international contracts, with an emphasis on creating value and further enhancing Occidental's existing positions.

|

|

Ø

|

Health, environmental, safety and process metrics;

|

|

Ø

|

Total Shareholder Return, including funding the dividend;

|

|

Ø

|

Return on equity (ROE) and return on capital employed (ROCE); and

|

|

Ø

|

Segment specific measures such as per-unit profit, production cost, cash flow, finding and development costs and reserves replacement percentages.

|

|

2015

|

2014

|

|||||||

|

WTI oil ($/barrel)

|

$

|

48.80

|

|

$

|

93.00

|

|

||

|

Brent oil ($/barrel)

|

$

|

53.64

|

|

$

|

99.51

|

|

||

|

NYMEX gas ($/Mcf)

|

$

|

2.75

|

|

$

|

4.34

|

|

||

|

2015

|

2014

|

|||||

|

Worldwide oil as a percentage of average WTI

|

97

|

%

|

97

|

%

|

||

|

Worldwide oil as a percentage of average Brent

|

88

|

%

|

91

|

%

|

||

|

Worldwide NGLs as a percentage of average WTI

|

33

|

%

|

40

|

%

|

||

|

Domestic natural gas as a percentage of NYMEX

|

78

|

%

|

91

|

%

|

||

|

•

|

Excludes volumes from the Argentine operations sold in 2011 and California Resources which was separated on November 30, 2014. Both operations have been reflected as discontinued operations for all applicable periods.

|

|

•

|

Excludes Williston (sold in November 2015) average daily production volumes of 16 MBOE, 20 MBOE, 18 MBOE, 14 MBOE

and 7 MBOE for

2015

,

2014

,

2013

,

2012

and

2011

, respectively.

|

|

•

|

Excludes Hugoton (sold in April 2014), average daily production volumes of 6 MBOE, 18 MBOE, 19 MBOE and 20 MBOE for 2014, 2013, 2012 and 2011, respectively.

|

|

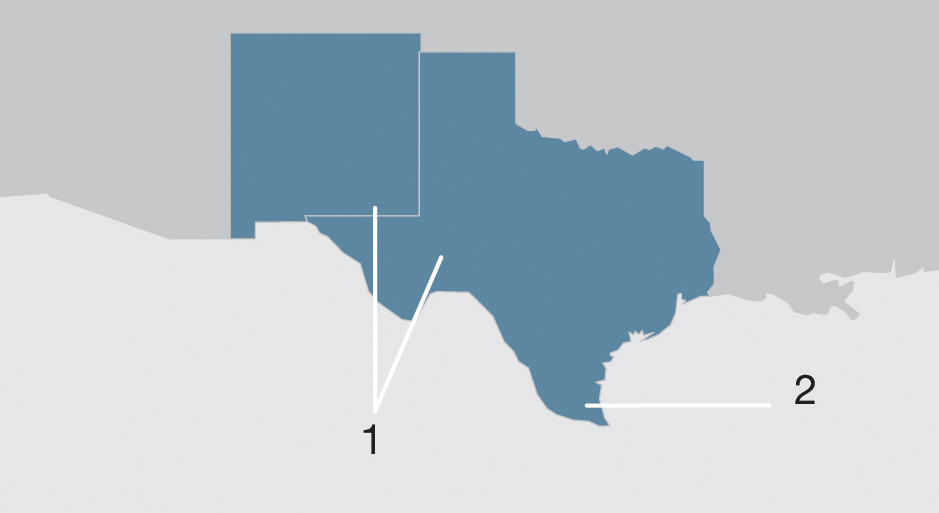

1.

|

Permian Basin

|

|

2.

|

South Texas and Other interests

|

|

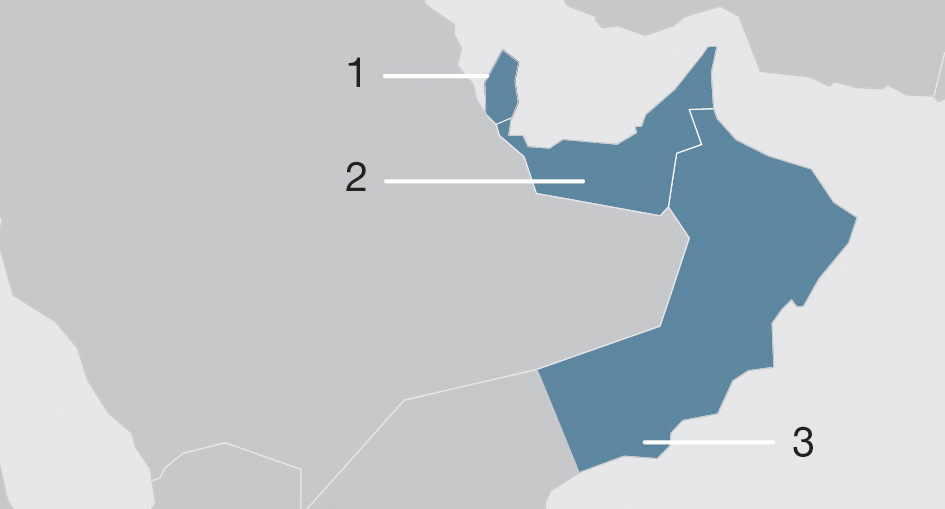

1.

|

Qatar

|

|

2.

|

United Arab Emirates

|

|

3.

|

Oman

|

|

Latin America

1. Colombia

|

|

|

(in millions of BOE)

|

2015

|

|

|

|

Improved recovery

|

144

|

|

|

|

Extensions and discoveries

|

5

|

|

|

|

Purchases

|

—

|

|

|

|

Revisions of previous estimates

|

(315

|

)

|

|

|

Total

|

(166

|

)

|

|

|

(in millions, except per share amounts)

|

||||||||||||

|

For the years ended December 31,

|

2015

|

2014

|

2013

|

|||||||||

|

NET SALES

(a)

|

|

|

|

|||||||||

|

Oil and Gas

|

$

|

8,304

|

|

$

|

13,887

|

|

$

|

15,008

|

|

|||

|

Chemical

|

3,945

|

|

4,817

|

|

4,673

|

|

||||||

|

Midstream and Marketing

|

891

|

|

1,373

|

|

1,174

|

|

||||||

|

Eliminations

(a)

|

(660

|

)

|

(765

|

)

|

(685

|

)

|

||||||

|

|

$

|

12,480

|

|

$

|

19,312

|

|

$

|

20,170

|

|

|||

|

SEGMENT RESULTS

|

||||||||||||

|

Domestic

|

$

|

(4,151

|

)

|

$

|

(2,381

|

)

|

$

|

1,938

|

|

|||

|

Foreign

|

(3,747

|

)

|

2,935

|

|

4,581

|

|

||||||

|

Exploration

|

(162

|

)

|

(126

|

)

|

(108

|

)

|

||||||

|

Oil and Gas

(b,c,d)

|

(8,060

|

)

|

428

|

|

6,411

|

|

||||||

|

Chemical

(e)

|

542

|

|

420

|

|

743

|

|

||||||

|

Midstream and Marketing

(f,g)

|

(1,194

|

)

|

2,564

|

|

1,523

|

|

||||||

|

|

(8,712

|

)

|

3,412

|

|

8,677

|

|

||||||

|

Unallocated corporate items

|

|

|

|

|||||||||

|

Interest expense, net

|

(141

|

)

|

(71

|

)

|

(124

|

)

|

||||||

|

Income taxes

|

1,330

|

|

(1,685

|

)

|

(3,214

|

)

|

||||||

|

Other

(h)

|

(623

|

)

|

(1,800

|

)

|

(407

|

)

|

||||||

|

Income (loss) from continuing operations

|

(8,146

|

)

|

(144

|

)

|

4,932

|

|

||||||

|

Discontinued operations, net

(i)

|

317

|

|

760

|

|

971

|

|

||||||

|

Net Income attributable to common stock

|

$

|

(7,829

|

)

|

$

|

616

|

|

$

|

5,903

|

|

|||

|

Basic Earnings per Common Share

|

$

|

(10.23

|

)

|

$

|

0.79

|

|

$

|

7.33

|

|

|||

|

Benefit (Charge) (in millions)

|

2015

|

2014

|

2013

|

|||||||||

|

OIL AND GAS

|

||||||||||||

|

Asset sales gains

(b)

|

$

|

10

|

|

$

|

531

|

|

$

|

—

|

|

|||

|

Asset impairments and related items domestic

(c)

|

(3,457

|

)

|

(4,766

|

)

|

(607

|

)

|

||||||

|

Asset impairments and related items international

(d)

|

(5,050

|

)

|

(1,066

|

)

|

—

|

|

||||||

|

Total Oil and Gas

|

$

|

(8,497

|

)

|

$

|

(5,301

|

)

|

$

|

(607

|

)

|

|||

|

CHEMICAL

|

||||||||||||

|

Asset sales gains

(e)

|

$

|

98

|

|

$

|

—

|

|

$

|

131

|

|

|||

|

Asset impairments and related items

|

(121

|

)

|

(149

|

)

|

—

|

|

||||||

|

Total Chemical

|

$

|

(23

|

)

|

$

|

(149

|

)

|

$

|

131

|

|

|||

|

MIDSTREAM AND MARKETING

|

||||||||||||

|

Asset sale gains

(f)

|

$

|

—

|

|

$

|

1,984

|

|

$

|

1,044

|

|

|||

|

Asset impairments and related items

(g)

|

(1,259

|

)

|

31

|

|

(58

|

)

|

||||||

|

Total Midstream and Marketing

|

$

|

(1,259

|

)

|

$

|

2,015

|

|

$

|

986

|

|

|||

|

CORPORATE

|

||||||||||||

|

Asset sale losses

|

$

|

(8

|

)

|

$

|

—

|

|

$

|

—

|

|

|||

|

Asset impairments

(h)

|

(235

|

)

|

(1,358

|

)

|

(55

|

)

|

||||||

|

Severance, spin-off and other

|

(118

|

)

|

(61

|

)

|

—

|

|

||||||

|

Tax effect of pre-tax and other adjustments

|

1,903

|

|

927

|

|

(167

|

)

|

||||||

|

Discontinued operations, net of tax

(i)

|

317

|

|

760

|

|

971

|

|

||||||

|

Total Corporate

|

$

|

1,859

|

|

$

|

268

|

|

$

|

749

|

|

|||

|

(a)

|

Intersegment sales eliminate upon consolidation and are generally made at prices approximating those that the selling entity would be able to obtain in third-party transactions.

|

|

(b)

|

The 2014 amount represented the gain on sale of the Hugoton properties.

|

|

(c)

|

The 2015 amount included approximately $1.6 billion of impairment and related charges associated with non-core domestic oil and gas assets in the Williston Basin (sold in November 2015) and Piceance Basin (held for sale as of December 31, 2015). The remaining 2015 charges are mainly associated with the decline in commodity prices and management changes to future development plans. The 2014 and 2013 amounts were mainly comprised of impairment and related charges on the Williston and Piceance assets.

|

|

(d)

|

The 2015 amount included impairment and related charges of approximately $1.7 billion for operations where Occidental is exiting or reducing its involvement in and $3.4 billion related to the decline in commodity prices.

|

|

(e)

|

The 2015 amount included the gain on sale of an idled facility. The 2013 amount included the gain on sale of the investment in Carbocloro, a Brazilian chemical facility.

|

|

(f)

|

The 2014 amount included a $633 million gain on sale of Occidental’s interest in BridgeTex Pipeline Company, LLC, and a $1.4 billion gain on sale of a portion of Occidental’s investment in Plains Pipeline. The 2013 amount included a $1.0 billion gain on sale of a portion of Occidental’s investment in Plains Pipeline.

|

|

(g)

|

The 2015 amount included an impairment charge of $814 million related to the Century gas processing plant as a result of SandRidge’s inability to provide volumes to the plant and meet its contractual obligations to deliver CO

2

.

|

|

(h)

|

The 2015 amount included a $227 million other-than-temporary loss on Occidental’s investment in California Resources. The 2014 amount included an $805 million impairment charge for the Joslyn oil sand project and a $553 million other-than-temporary loss on the investment in California Resources

|

|

(i)

|

The 2015 amount included a $322 million pre-tax gain related to the Ecuador settlement. See Note 2 of the consolidated financial statements. The 2014 and 2013 amounts include the results of Occidental's California operations.

|

|

(in millions)

|

2015

|

2014

|

2013

|

|||||||||

|

Segment Sales

|

$

|

8,304

|

|

$

|

13,887

|

|

$

|

15,008

|

|

|||

|

Segment Results

|

||||||||||||

|

Domestic

|

$

|

(4,151

|

)

|

$

|

(2,381

|

)

|

$

|

1,938

|

|

|||

|

Foreign

|

(3,747

|

)

|

2,935

|

|

4,581

|

|

||||||

|

Exploration

|

(162

|

)

|

(126

|

)

|

(108

|

)

|

||||||

|

$

|

(8,060

|

)

|

$

|

428

|

|

$

|

6,411

|

|

||||

|

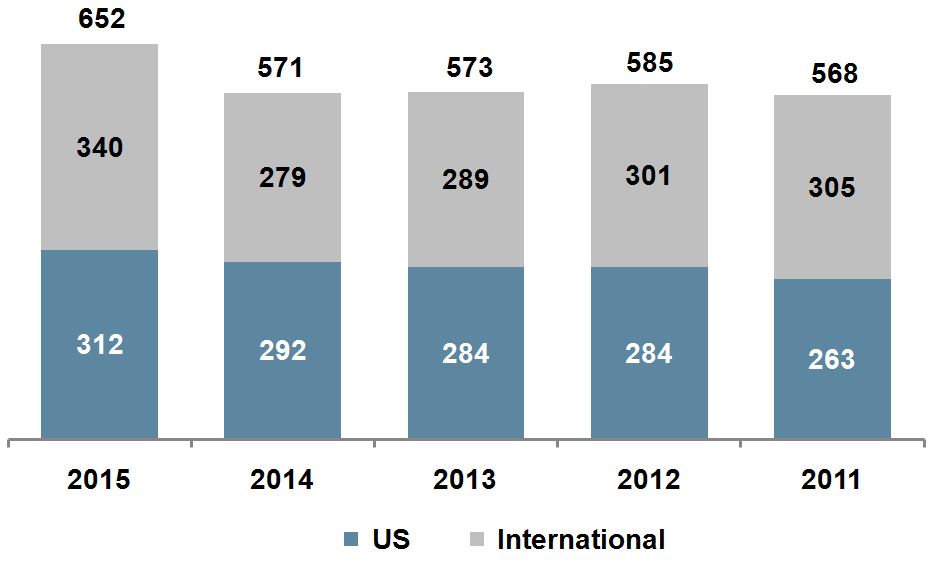

Production per Day (MBOE)

|

2015

|

2014

|

2013

|

||||||

|

United States

|

|

|

|

||||||

|

Permian Resources

|

110

|

|

75

|

|

65

|

|

|||

|

Permian EOR

|

145

|

|

147

|

|

147

|

|

|||

|

Midcontinent and Other

|

57

|

|

70

|

|

72

|

|

|||

|

Total

|

312

|

|

292

|

|

284

|

|

|||

|

Latin America

|

37

|

|

29

|

|

31

|

|

|||

|

Middle East/North Africa

|

|||||||||

|

Al Hosn

|

35

|

|

—

|

|

—

|

|

|||

|

Dolphin

|

41

|

|

38

|

|

37

|

|

|||

|

Oman

|

89

|

|

76

|

|

74

|

|

|||

|

Qatar

|

66

|

|

69

|

|

68

|

|

|||

|

Other

|

72

|

|

67

|

|

79

|

|

|||

|

Total

|

303

|

|

250

|

|

258

|

|

|||

|

Total Production Ongoing Operations

|

652

|

|

571

|

|

573

|

|

|||

|

Sold assets - Hugoton

|

—

|

|

6

|

|

18

|

|

|||

|

Sold assets - Williston

|

16

|

|

20

|

|

18

|

|

|||

|

Total Production (MBOE)

(a)

|

668

|

|

597

|

|

609

|

|

|||

|

(See footnote following the Average Realized Prices table)

|

|||||||||

|

Production per Day by Products

|

2015

|

2014

|

2013

|

||||||

|

United States

|

|

|

|

||||||

|

Oil (MBBL)

|

|||||||||

|

Permian Resources

|

71

|

|

43

|

|

35

|

|

|||

|

Permian EOR

|

110

|

|

111

|

|

111

|

|

|||

|

Midcontinent and Other

|

6

|

|

8

|

|

7

|

|

|||

|

Total

|

187

|

|

162

|

|

153

|

|

|||

|

NGLs (MBBL)

|

|||||||||

|

Permian Resources

|

16

|

|

12

|

|

10

|

|

|||

|

Permian EOR

|

29

|

|

30

|

|

29

|

|

|||

|

Midcontinent and Other

|

10

|

|

12

|

|

15

|

|

|||

|

Total

|

55

|

|

54

|

|

54

|

|

|||

|

Natural gas (MMCF)

|

|||||||||

|

Permian Resources

|

137

|

|

120

|

|

117

|

|

|||

|

Permian EOR

|

37

|

|

38

|

|

40

|

|

|||

|

Midcontinent and Other

|

246

|

|

296

|

|

311

|

|

|||

|

Total

|

420

|

|

454

|

|

468

|

|

|||

|

Latin America

|

|||||||||

|

Oil (MBBL) – Colombia

|

35

|

|

27

|

|

29

|

|

|||

|

Natural gas (MMCF) – Bolivia

|

10

|

|

11

|

|

12

|

|

|||

|

Middle East/North Africa

|

|||||||||

|

Oil (MBBL)

|

|||||||||

|

Al Hosn

|

7

|

|

—

|

|

—

|

|

|||

|

Dolphin

|

7

|

|

7

|

|

6

|

|

|||

|

Oman

|

82

|

|

69

|

|

66

|

|

|||

|

Qatar

|

66

|

|

69

|

|

68

|

|

|||

|

Other

|

32

|

|

28

|

|

39

|

|

|||

|

Total

|

194

|

|

|

173

|

|

|

179

|

|

|

|

NGLs (MBBL)

|

|||||||||

|

Al Hosn

|

10

|

|

—

|

|

—

|

|

|||

|

Dolphin

|

8

|

|

7

|

|

7

|

|

|||

|

Total

|

18

|

|

|

7

|

|

|

7

|

|

|

|

Natural gas (MMCF)

|

|||||||||

|

Al Hosn

|

109

|

|

—

|

|

—

|

|

|||

|

Dolphin

|

158

|

|

143

|

|

142

|

|

|||

|

Oman

|

44

|

|

43

|

|

51

|

|

|||

|

Other

|

237

|

|

236

|

|

241

|

|

|||

|

Total

|

548

|

|

|

422

|

|

|

434

|

|

|

|

Total Production Ongoing Operations

|

652

|

|

571

|

|

573

|

|

|||

|

Sold assets - Hugoton

|

—

|

|

6

|

|

18

|

|

|||

|

Sold assets - Williston

|

16

|

|

20

|

|

18

|

|

|||

|

Total Production (MBOE)

(a)

|

668

|

|

|

597

|

|

|

609

|

|

|

|

(See footnote following the Average Realized Prices table)

|

|||||||||

|

Sales Volumes per Day by Products

|

2015

|

2014

|

2013

|

||||||

|

United States

|

|

|

|

||||||

|

Oil (MBBL)

|

187

|

|

162

|

|

153

|

|

|||

|

NGLs (MBBL)

|

55

|

|

54

|

|

54

|

|

|||

|

Natural gas (MMCF)

|

420

|

|

454

|

|

468

|

|

|||

|

Latin America

|

|||||||||

|

Oil (MBBL) – Colombia

|

35

|

|

29

|

|

27

|

|

|||

|

Natural gas (MMCF) – Bolivia

|

10

|

|

11

|

|

12

|

|

|||

|

Middle East/North Africa

|

|||||||||

|

Oil (MBBL)

|

|||||||||

|

Al Hosn

|

7

|

|

—

|

|

—

|

|

|||

|

Dolphin

|

8

|

|

7

|

|

6

|

|

|||

|

Oman

|

82

|

|

69

|

|

68

|

|

|||

|

Qatar

|

67

|

|

69

|

|

67

|

|

|||

|

Other

|

36

|

|

27

|

|

38

|

|

|||

|

Total

|

200

|

|

172

|

|

179

|

|

|||

|

NGLs (MBBL)

|

|

|

|

||||||

|

Al Hosn

|

10

|

|

—

|

|

—

|

|

|||

|

Dolphin

|

8

|

|

7

|

|

7

|

|

|||

|

Total

|

18

|

|

7

|

|

7

|

|

|||

|

Natural gas (MMCF)

|

548

|

|

422

|

|

434

|

|

|||

|

Total Sales Ongoing Operations

|

658

|

|

572

|

|

572

|

|

|||

|

Sold assets - Hugoton

|

—

|

|

6

|

|

18

|

|

|||

|

Sold assets - Williston

|

16

|

|

20

|

|

18

|

|

|||

|

Total Sales Volumes (MBOE)

(a)

|

674

|

|

598

|

|

608

|

|

|||

|

|

|

|

|

|

|||||

|

(See footnote following the Average Realized Prices table)

|

|||||||||

|

|

2015

|

2014

|

2013

|

|||||||||

|

Average Realized Prices

|

|

|

|

|||||||||

|

Oil Prices

($ per bbl)

|

|

|

|

|||||||||

|

United States

|

$

|

45.04

|

|

$

|

84.73

|

|

$

|

92.48

|

|

|||

|

Latin America

|

$

|

44.49

|

|

$

|

88.00

|

|

$

|

103.21

|

|

|||

|

Middle East/North Africa

|

$

|

49.65

|

|

$

|

96.34

|

|

$

|

104.48

|

|

|||

|

Total worldwide

|

$

|

47.10

|

|

$

|

90.13

|

|

$

|

98.81

|

|

|||

|

NGLs Prices

($ per bbl)

|

||||||||||||

|

United States

|

$

|

15.35

|

|

$

|

37.79

|

|

$

|

38.65

|

|

|||

|

Middle East/North Africa

|

$

|

17.88

|

|

$

|

30.98

|

|

$

|

33.00

|

|

|||

|

Total worldwide

|

$

|

15.96

|

|

$

|

37.01

|

|

$

|

38.00

|

|

|||

|

Gas Prices

($ per Mcf)

|

||||||||||||

|

United States

|

$

|

2.15

|

|

$

|

3.97

|

|

$

|

3.22

|

|

|||

|

Latin America

|

$

|

5.20

|

|

$

|

8.94

|

|

$

|

11.17

|

|

|||

|

Total worldwide

(a)

|

$

|

1.49

|

|

$

|

2.55

|

|

$

|

2.23

|

|

|||

|

(a)

|

Natural gas volumes have been converted to BOE based on energy content of six Mcf of gas to one barrel of oil. Barrels of oil equivalence does not necessarily result in price equivalence.

|

|

(in millions)

|

2015

|

2014

|

2013

|

|||||||||

|

Segment Sales

|

$

|

3,945

|

|

$

|

4,817

|

|

$

|

4,673

|

|

|||

|

Segment Results

|

$

|

542

|

|

$

|

420

|

|

$

|

743

|

|

|||

|

(in millions)

|

2015

|

2014

|

2013

|

|||||||||

|

Segment Sales

|

$

|

891

|

|

$

|

1,373

|

|

$

|

1,174

|

|

|||

|

Segment Results

|

$

|

(1,194

|

)

|

$

|

2,564

|

|

$

|

1,523

|

|

|||

|

(in millions)

|

2015

|

2014

|

2013

|

|||||||||

|

SEGMENT RESULTS

|

|

|

|

|||||||||

|

Oil and Gas

|

$

|

(8,060

|

)

|

$

|

428

|

|

$

|

6,411

|

|

|||

|

Chemical

|

542

|

|

420

|

|

743

|

|

||||||

|

Midstream and Marketing

(a)

|

(1,194

|

)

|

2,564

|

|

1,523

|

|

||||||

|

Unallocated Corporate Items

|

(764

|

)

|

(1,871

|

)

|

(531

|

)

|

||||||

|

Pre-tax (loss) income

|

(9,476

|

)

|

1,541

|

|

8,146

|

|

||||||

|

Income tax (benefit) expense

|

|

|

|

|

|

|

||||||

|

Federal and State

|

(2,070

|

)

|

(157

|

)

|

1,061

|

|

||||||

|

Foreign

|

740

|

|

1,842

|

|

2,153

|

|

||||||

|

Total income tax (benefit) expense

|

(1,330

|

)

|

1,685

|

|

3,214

|

|

||||||

|

Income (loss) from continuing operations

(a)

|

$

|

(8,146

|

)

|

$

|

(144

|

)

|

$

|

4,932

|

|

|||

|

Worldwide effective tax rate

|

14

|

%

|

109

|

%

|

40

|

%

|

||||||

|

(a)

|

Represents amounts attributable to income from continuing operations after deducting a non controlling interest amount of $14 million in 2014. The non controlling interest amount has been netted in the midstream and marketing segment earnings.

|

|

(in millions)

|

2015

|

2014

|

2013

|

|||||||||

|

Net sales

|

$

|

12,480

|

|

$

|

19,312

|

|

$

|

20,170

|

|

|||

|

Interest, dividends and other income

|

$

|

118

|

|

$

|

130

|

|

$

|

107

|

|

|||

|

Gain on sale of equity investments and other assets

|

$

|

101

|

|

$

|

2,505

|

|

$

|

1,175

|

|

|||

|

(in millions)

|

2015

|

2014

|

2013

|

|||||||||

|

Cost of sales

|

$

|

5,804

|

|

$

|

6,803

|

|

$

|

6,497

|

|

|||

|

Selling, general and administrative and other operating expenses

|

$

|

1,270

|

|

$

|

1,503

|

|

$

|

1,544

|

|

|||

|

Depreciation, depletion and amortization

|

$

|

4,544

|

|

$

|

4,261

|

|

$

|

4,203

|

|

|||

|

Asset impairments and related items

|

$

|

10,239

|

|

$

|

7,379

|

|

$

|

621

|

|

|||

|

Taxes other than on income

|

$

|

343

|

|

$

|

550

|

|

$

|

564

|

|

|||

|

Exploration expense

|

$

|

36

|

|

$

|

150

|

|

$

|

140

|

|

|||

|

Interest and debt expense, net

|

$

|

147

|

|

$

|

77

|

|

$

|

132

|

|

|||

|

Income/(expense) (in millions)

|

2015

|

2014

|

2013

|

|||||||||

|

Provision for income taxes

|

$

|

1,330

|

|

$

|

(1,685

|

)

|

$

|

(3,214

|

)

|

|||

|

Income from equity investments

|

$

|

208

|

|

$

|

331

|

|

$

|

395

|

|

|||

|

Discontinued operations, net

|

$

|

317

|

|

$

|

760

|

|

$

|

971

|

|

|||

|

(in millions)

|

2015

|

2014

|

||||||

|

CURRENT ASSETS

|

|

|

||||||

|

Cash and cash equivalents

|

$

|

3,201

|

|

$

|

3,789

|

|

||

|

Restricted cash

|

1,193

|

|

4,019

|

|

||||

|

Trade receivables, net

|

2,970

|

|

4,206

|

|

||||

|

Inventories

|

986

|

|

1,052

|

|

||||

|

Assets held for sale

|

141

|

|

—

|

|

||||

|

Other current assets

|

911

|

|

807

|

|

||||

|

Total current assets

|

$

|

9,402

|

|

$

|

13,873

|

|

||

|

Investments in unconsolidated entities

|

$

|

1,267

|

|

$

|

1,171

|

|

||

|

Available for sale investment

|

$

|

167

|

|

$

|

394

|

|

||

|

Property, plant and equipment, net

|

$

|

31,639

|

|

$

|

39,730

|

|

||

|

Long-term receivables and other assets, net

|

$

|

962

|

|

$

|

1,091

|

|

||

|

CURRENT LIABILITIES

|

|

|||||||

|

Current maturities of long-term debt

|

$

|

1,450

|

|

$

|

—

|

|

||

|

Accounts payable

|

3,069

|

|

5,229

|

|

||||

|

Accrued liabilities

|

2,213

|

|

2,601

|

|

||||

|

Domestic and foreign income taxes

|

—

|

|

414

|

|

||||

|

Liabilities of assets held for sale

|

110

|

|

—

|

|

||||

|

Total current liabilities

|

$

|

6,842

|

|

$

|

8,244

|

|

||

|

Long-term debt, net

|

$

|

6,883

|

|

$

|

6,838

|

|

||

|

Deferred credits and other liabilities-income taxes

|

$

|

1,323

|

|

$

|

3,015

|

|

||

|

Deferred credits and other liabilities-other

|

$

|

4,039

|

|

$

|

3,203

|

|

||

|

Stockholders’ equity

|

$

|

24,350

|

|

$

|

34,959

|

|

||

|

Cash provided by operating activities

|

||||||||||||

|

(in millions)

|

2015

|

2014

|

2013

|

|||||||||

|

Operating cash flow from continuing operations

|

$

|

3,254

|

|

$

|

8,871

|

|

$

|

10,229

|

|

|||

|