|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

DELAWARE

DELAWARE

DELAWARE

|

45-3763855

27-2198168

45-2685067

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

One Sylvan Way, Second Floor

Parsippany, New Jersey |

07054

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

Delaware

|

|

45-3763855

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

One Sylvan Way, Second Floor

Parsippany, New Jersey

|

|

07054

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Title of Each Class

|

|

Name of Each Exchange on Which Registered

|

|

Class A Common Stock, $0.001 par value

|

|

New York Stock Exchange

|

|

PBF Energy Inc.

|

x

Yes

o

No

|

|

PBF Holding Company LLC

|

o

Yes

x

No

|

|

PBF Finance Corporation

|

o

Yes

x

No

|

|

PBF Energy Inc.

|

o

Yes

x

No

|

|

PBF Holding Company LLC

|

o

Yes

x

No

|

|

PBF Finance Corporation

|

o

Yes

x

No

|

|

PBF Energy Inc.

|

x

Yes

¨

No

|

|

PBF Holding Company LLC

|

x

Yes

¨

No

|

|

PBF Finance Corporation

|

x

Yes

o

No

|

|

PBF Energy Inc.

|

x

Yes

o

No

|

|

PBF Holding Company LLC

|

x

Yes

o

No

|

|

PBF Finance Corporation

|

x

Yes

o

No

|

|

Large accelerated

filer |

Accelerated filer

|

Non-accelerated filer

(Do not check if a smaller reporting company) |

Smaller reporting

company |

||||

|

PBF Energy Inc.

|

x

|

¨

|

¨

|

¨

|

|||

|

PBF Holding Company LLC

|

¨

|

¨

|

x

|

¨

|

|||

|

PBF Finance Corporation

|

o

|

o

|

x

|

o

|

|||

|

PBF Energy Inc.

|

¨

Yes

x

No

|

|

PBF Holding Company LLC

|

¨

Yes

x

No

|

|

PBF Finance Corporation

|

o

Yes

x

No

|

|

PART I

|

|||

|

Item 1.

|

Business

|

||

|

Item 1A.

|

Risk Factors

|

||

|

Item 1B.

|

Unresolved Staff Comments

|

||

|

Item 2.

|

Properties

|

||

|

Item 3.

|

Legal Proceedings

|

||

|

Item 4.

|

Mine Safety Disclosures

|

||

|

PART II

|

|||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

|

||

|

Item 6.

|

Selected Financial Data

|

||

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

||

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

||

|

Item 8.

|

Financial Statements and Supplementary Data

|

||

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

||

|

Item 9A.

|

Controls and Procedures

|

||

|

Item 9B.

|

Other Information

|

||

|

PART III

|

|||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

||

|

Item 11.

|

Executive Compensation

|

||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

||

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

||

|

Item 14.

|

Principal Accountant Fees and Services

|

||

|

PART IV

|

|||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

||

|

Refinery Units

|

Nameplate

Capacity

|

|

|

Crude Distillation Unit

|

190,000

|

|

|

Vacuum Distillation Unit

|

102,000

|

|

|

Fluid Catalytic Cracking Unit (FCC)

|

82,000

|

|

|

Hydrotreating Units

|

160,000

|

|

|

Hydrocracking Unit

|

18,000

|

|

|

Catalytic Reforming Unit (CCR)

|

43,000

|

|

|

Benzene / Toluene Extraction Unit

|

15,000

|

|

|

Butane Isomerization Unit (ISOM)

|

6,000

|

|

|

Alkylation Unit (Alky)

|

11,000

|

|

|

Polymerization Unit (Poly)

|

16,000

|

|

|

Fluid Coking Unit (FCU/ Fluid Coker)

|

47,000

|

|

|

Refinery Units

|

Nameplate

Capacity

|

|

|

Crude Distillation Units

|

168,000

|

|

|

Vacuum Distillation Units

|

83,000

|

|

|

Fluid Catalytic Cracking Unit (FCC)

|

55,000

|

|

|

Hydrotreating Units

|

141,000

|

|

|

Catalytic Reforming Unit (CCR)

|

32,000

|

|

|

Alkylation Unit (Alky)

|

11,000

|

|

|

Lube Oil Processing Unit

|

12,000

|

|

|

Delayed Coking Unit (Coker)

|

27,000

|

|

|

Propane Deasphalting Unit

|

11,000

|

|

|

Refinery Units

|

Nameplate

Capacity

|

|

|

Crude Distillation Unit

|

170,000

|

|

|

Fluid Catalytic Cracking Unit (FCC)

|

79,000

|

|

|

Hydrotreating Units

|

95,000

|

|

|

Hydrocracking Unit (HCC)

|

45,000

|

|

|

Catalytic Reforming Units

|

45,000

|

|

|

Alkylation Unit (Alky)

|

10,000

|

|

|

Polymerization Unit (Poly)

|

7,000

|

|

|

UDEX Unit (BTX)

|

16,300

|

|

|

Name

|

Age

|

Position

|

|||

|

Thomas D. O’Malley

|

72

|

|

Executive Chairman of the Board of Directors

|

||

|

Thomas J. Nimbley

|

62

|

|

Chief Executive Officer

|

||

|

Michael D. Gayda

|

59

|

|

President

|

||

|

Matthew C. Lucey

|

40

|

|

Senior Vice President, Chief Financial Officer

|

||

|

Jeffrey Dill

|

52

|

|

Senior Vice President, General Counsel

|

||

|

Paul Davis

|

51

|

|

Vice President, Crude Oil and Feedstock

|

||

|

Todd O'Malley

|

40

|

|

Vice President, Products

|

||

|

•

|

denial or delay in issuing regulatory approvals and/or permits;

|

|

•

|

unplanned increases in the cost of construction materials or labor;

|

|

•

|

disruptions in transportation of modular components and/or construction materials;

|

|

•

|

severe adverse weather conditions, natural disasters or other events (such as equipment malfunctions, explosions, fires or spills) affecting our facilities, or those of vendors and suppliers;

|

|

•

|

shortages of sufficiently skilled labor, or labor disagreements resulting in unplanned work stoppages;

|

|

•

|

market-related increases in a project’s debt or equity financing costs; and/or

|

|

•

|

non-performance or force majeure by, or disputes with, vendors, suppliers, contractors or sub-contractors involved with a project.

|

|

•

|

the volumes of our actual use of crude oil or production of the applicable refined products is less than the volumes subject to the hedging arrangement;

|

|

•

|

accidents, interruptions in feedstock transportation, inclement weather or other events cause unscheduled shutdowns or otherwise adversely affect our refineries, or those of our suppliers or customers;

|

|

•

|

changes in commodity prices have a material impact on collateral and margin requirements under our hedging arrangements, resulting in our being subject to margin calls;

|

|

•

|

the counterparties to our futures contracts fail to perform under the contracts; or

|

|

•

|

a sudden, unexpected event materially impacts the commodity or crack spread subject to the hedging arrangement.

|

|

•

|

a significant portion of our cash flow from operations will be dedicated to the payment of principal of, and interest on, our indebtedness and will not be available for other purposes;

|

|

•

|

covenants contained in our existing debt arrangements limit our ability to borrow additional funds, dispose of assets and make certain investments;

|

|

•

|

these covenants also require us to meet or maintain certain financial tests, which may affect our flexibility in planning for, and reacting to, changes in our industry, such as being able to take advantage of acquisition opportunities when they arise;

|

|

•

|

our ability to obtain additional financing for working capital, capital expenditures, acquisitions, general corporate and other purposes may be limited; and

|

|

•

|

we may be at a competitive disadvantage to those of our competitors that are less leveraged; and we may be more vulnerable to adverse economic and industry conditions.

|

|

•

|

authorize the issuance of undesignated preferred stock, the terms of which may be established and the shares of which may be issued without stockholder approval;

|

|

•

|

prohibit stockholder action by written consent now that Blackstone and First Reserve collectively cease to beneficially own at least a majority of all of the outstanding shares of our capital stock entitled to vote;

|

|

•

|

restrict certain business combinations with stockholders who obtain beneficial ownership of a certain percentage of our outstanding common stock after the date Blackstone and First Reserve and their affiliates collectively cease to beneficially own at least 5% of all of the outstanding shares of our capital stock entitled to vote;

|

|

•

|

provide that special meetings of stockholders may be called only by the chairman of the board of directors, the chief executive officer or the board of directors, and establish advance notice procedures for the nomination of candidates for election as directors or for proposing matters that can be acted upon at stockholder meetings; and

|

|

•

|

provide now that Blackstone and First Reserve collectively cease to beneficially own a majority of all of the outstanding shares of our capital stock entitled to vote, our stockholders may only amend our bylaws with the approval of 75% or more of all of the outstanding shares of our capital stock entitled to vote.

|

|

•

|

variations in actual or anticipated operating results or dividends, if any, to stockholders;

|

|

•

|

changes in, or failure to meet, earnings estimates of securities analysts;

|

|

•

|

market conditions in the oil refining industry;

|

|

•

|

the impact of disruptions to crude or feedstock supply to any of our refineries, including disruptions due to problems with third party logistics infrastructure;

|

|

•

|

litigation and government investigations;

|

|

•

|

the timing and announcement of any potential acquisitions and subsequent impact of any future acquisitions on our capital structure, financial condition or results of operations;

|

|

•

|

changes or proposed changes in laws or regulations or differing interpretations or enforcement thereof affecting our business or industry, including any lifting by the federal government of the restrictions on exporting U.S. crude oil;

|

|

•

|

general economic and stock market conditions; and

|

|

•

|

the availability for sale, or sales, of a significant number of shares of our Class A common stock in the public market.

|

|

|

Sales Prices of the

Common Stock

|

Dividends

Per

Common Share

|

||||||||||

|

|

High

|

Low

|

||||||||||

|

2013:

|

||||||||||||

|

First Quarter ended March 31, 2013

|

$

|

42.50

|

|

$

|

27.10

|

|

$

|

0.30

|

|

|||

|

Second Quarter ended June 30, 2013

|

$

|

39.00

|

|

$

|

23.54

|

|

$

|

0.30

|

|

|||

|

Third Quarter ended September 30, 2013

|

$

|

26.66

|

|

$

|

20.15

|

|

$

|

0.30

|

|

|||

|

Fourth Quarter ended December 31, 2013

|

$

|

31.52

|

|

$

|

21.20

|

|

$

|

0.30

|

|

|||

|

2012:

|

||||||||||||

|

December 13 to December 31, 2012

|

$

|

29.05

|

|

$

|

26.00

|

|

$

|

—

|

|

|||

|

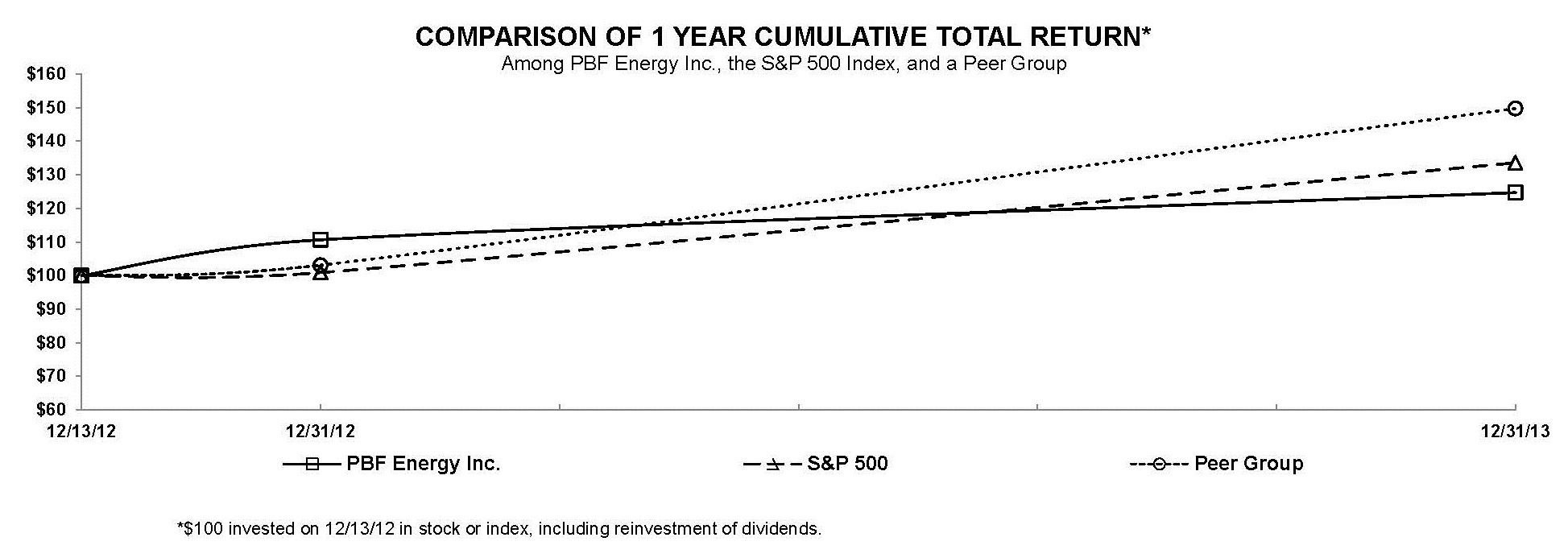

12/13/2012

|

12/31/2012

|

12/31/2013

|

||||||||||

|

PBF Energy Inc. Class A Common Stock

|

$

|

100.00

|

|

$

|

110.67

|

|

$

|

124.73

|

|

|||

|

S&P 500

|

100.00

|

|

100.91

|

|

133.59

|

|

||||||

|

Peer Group

|

100.00

|

|

103.11

|

|

149.73

|

|

||||||

|

|

Equity Compensation Plan Information

|

|||||||||

|

|

(A)

|

(B)

|

(C)

|

|||||||

|

|

Number of

securities to be

issued upon

exercise of

outstanding

options, warrants

and rights

|

Weighted-average

exercise price of

outstanding

options, warrants,

and rights

|

Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (A))

|

|||||||

|

Plan Category

|

||||||||||

|

Equity compensation plans approved by security holders

|

1,380,392

|

|

$

|

27.26

|

|

3,619,608

|

|

|||

|

Equity compensation plans not approved by security holders

|

—

|

|

—

|

|

—

|

|

||||

|

Total

|

1,380,392

|

|

$

|

27.26

|

|

3,619,608

|

|

|||

|

|

Year Ended December 31,

|

|||||||||||||||||||

|

|

2013

|

2012

|

2011

|

2010

|

2009 (3)

|

|||||||||||||||

|

Statement of operations data:

|

||||||||||||||||||||

|

Revenues (1)

|

$

|

19,151,455

|

|

$

|

20,138,687

|

|

$

|

14,960,338

|

|

$

|

210,671

|

|

$

|

228

|

|

|||||

|

Costs and expenses:

|

||||||||||||||||||||

|

Cost of sales, excluding depreciation

|

17,803,314

|

|

18,269,078

|

|

13,855,163

|

|

203,971

|

|

—

|

|

||||||||||

|

Operating expenses, excluding depreciation

|

812,652

|

|

738,824

|

|

658,831

|

|

25,140

|

|

—

|

|

||||||||||

|

General and administrative expenses

|

104,334

|

|

120,443

|

|

86,183

|

|

15,859

|

|

6,294

|

|

||||||||||

|

Gain on sale of asset

|

(183

|

)

|

(2,329

|

)

|

—

|

|

—

|

|

—

|

|

||||||||||

|

Acquisition-related expenses (2)

|

—

|

|

—

|

|

728

|

|

6,051

|

|

—

|

|

||||||||||

|

Depreciation and amortization expense

|

111,479

|

|

92,238

|

|

53,743

|

|

1,402

|

|

44

|

|

||||||||||

|

Income (loss) from operations

|

319,859

|

|

920,433

|

|

305,690

|

|

(41,752

|

)

|

(6,110

|

)

|

||||||||||

|

Other (expense) income:

|

||||||||||||||||||||

|

Change in fair value of catalyst lease obligation

|

—

|

|

(2,768

|

)

|

(5,215

|

)

|

(1,217

|

)

|

—

|

|

||||||||||

|

Change in fair value of contingent consideration

|

4,691

|

|

(3,724

|

)

|

7,316

|

|

—

|

|

—

|

|

||||||||||

|

Interest income (expense), net

|

(93,784

|

)

|

(108,629

|

)

|

(65,120

|

)

|

(1,388

|

)

|

10

|

|

||||||||||

|

Income before income taxes

|

230,766

|

|

805,312

|

|

242,671

|

|

(44,357

|

)

|

(6,100

|

)

|

||||||||||

|

Income tax expense

|

16,681

|

|

1,275

|

|

—

|

|

—

|

|

—

|

|

||||||||||

|

Net income (loss)

|

214,085

|

|

804,037

|

|

$

|

242,671

|

|

$

|

(44,357

|

)

|

$

|

(6,100

|

)

|

|||||||

|

Less: net income attributable to noncontrolling interest

|

174,545

|

|

802,081

|

|

||||||||||||||||

|

Net income attributable to PBF Energy Inc.

|

$

|

39,540

|

|

$

|

1,956

|

|

||||||||||||||

|

Weighted-average shares of Class A common stock outstanding:

|

||||||||||||||||||||

|

Basic

|

32,488,369

|

|

23,570,240

|

|

||||||||||||||||

|

Diluted

|

33,061,081

|

|

97,230,904

|

|

||||||||||||||||

|

Net income available to Class A common stock per share:

|

||||||||||||||||||||

|

Basic

|

$

|

1.22

|

|

$

|

0.08

|

|

||||||||||||||

|

Diluted

|

$

|

1.20

|

|

$

|

0.08

|

|

||||||||||||||

|

Balance sheet data (at end of period) :

|

||||||||||||||||||||

|

Total assets

|

$

|

4,413,808

|

|

$

|

4,253,702

|

|

$

|

3,621,109

|

|

$

|

1,274,393

|

|

$

|

19,150

|

|

|||||

|

Total long-term debt (4)

|

747,576

|

|

729,980

|

|

804,865

|

|

325,064

|

|

—

|

|

||||||||||

|

Total equity

|

1,715,256

|

|

1,723,545

|

|

1,110,918

|

|

458,661

|

|

18,694

|

|

||||||||||

|

Other financial data :

|

||||||||||||||||||||

|

Capital expenditures (5)

|

$

|

415,702

|

|

$

|

222,688

|

|

$

|

574,883

|

|

$

|

72,118

|

|

$

|

70

|

|

|||||

|

(1)

|

Consulting services income provided to a related party was $10 and $221 for the years ended December 31, 2010 and 2009, respectively. No consulting services income was earned subsequent to 2010.

|

|

(2)

|

Acquisition related expenses consist of consulting and legal expenses related to the Paulsboro and Toledo acquisition as well as non-consummated acquisitions.

|

|

(3)

|

December 31, 2009 financial statement data is that of PBF Investments LLC, which was converted to a limited liability company and renamed PBF Energy Company LLC in 2010.

|

|

(4)

|

Total long-term debt includes current maturities and our Delaware Economic Development Authority Loan.

|

|

(5)

|

Includes expenditures for construction in progress, property, plant and equipment, deferred turnaround costs and other assets.

|

|

•

|

Both PBF LLC’s financial statements and Paulsboro’s financial statements contain items which require management to make considerable judgments and estimates. There can be no assurance that the judgments and estimates made by PBF LLC’s management will be identical or even similar to the historical judgments and estimates made by Paulsboro’s former management.

|

|

•

|

The financial statements of Paulsboro contain allocations of certain general and administrative expenses and income taxes specific to Valero.

|

|

•

|

The financial statements of Paulsboro reflect depreciation and amortization expense and asset impairment losses based on Valero’s historical cost basis for the applicable assets. PBF LLC’s cost basis in such assets is different.

|

|

|

Period from

January 1,

2010 through

December 16,

2010

|

Year Ended December 31,

|

||||||

|

|

2009

|

|||||||

|

|

(in thousands)

|

|||||||

|

Statement of operations data:

|

||||||||

|

Operating revenues (1)

|

$

|

4,708,989

|

|

$

|

3,549,517

|

|

||

|

Cost and expenses:

|

||||||||

|

Cost of sales (2)

|

4,487,825

|

|

3,419,460

|

|

||||

|

Operating expenses

|

259,768

|

|

266,319

|

|

||||

|

General and administrative expenses (3)

|

14,606

|

|

15,594

|

|

||||

|

Asset impairment loss

|

895,642

|

|

8,478

|

|

||||

|

Depreciation and amortization expense

|

66,361

|

|

65,103

|

|

||||

|

Total costs and expenses

|

5,724,202

|

|

3,774,954

|

|

||||

|

Operating income (loss)

|

(1,015,213

|

)

|

(225,437

|

)

|

||||

|

Interest and other income and expense, net

|

500

|

|

1,249

|

|

||||

|

Income (loss) before income tax expense (benefit)

|

(1,014,713

|

)

|

(224,188

|

)

|

||||

|

Income tax expense (benefit) (4)

|

(322,962

|

)

|

(86,586

|

)

|

||||

|

Net income (loss)

|

$

|

(691,751

|

)

|

$

|

(137,602

|

)

|

||

|

Balance sheet data (at end of period):

|

||||||||

|

Total assets

|

$

|

510,205

|

|

$

|

1,440,557

|

|

||

|

Total liabilities

|

42,582

|

|

357,289

|

|

||||

|

Net parent investment

|

467,623

|

|

1,083,268

|

|

||||

|

Selected financial data:

|

||||||||

|

Capital expenditures

|

$

|

20,122

|

|

$

|

96,754

|

|

||

|

(1)

|

Operating revenues consist of refined products sold from Paulsboro to Valero that were recorded at intercompany transfer prices, which were market prices adjusted by quality, location, and other differentials on the date of the sale.

|

|

(2)

|

Cost of sales consist of the cost of feedstock acquired for processing, including transportation costs to deliver the feedstock to Paulsboro. Purchases of feedstock by Paulsboro from Valero were recorded at the cost paid to independent third parties by Valero.

|

|

(3)

|

General and administrative expenses include allocations and estimates of general and administrative costs of Valero that were attributable to the operations of Paulsboro.

|

|

(4)

|

The income tax provision represented the current and deferred income taxes that would have resulted if Paulsboro were a stand-alone taxable entity filing its own income tax returns. Accordingly, the calculations of current and deferred income tax provision require certain assumptions, allocations, and estimates that Paulsboro management believed were reasonable to reflect the tax reporting for Paulsboro as a stand-alone taxpayer.

|

|

March 1, 2008

|

|

PBF was formed.

|

|

June 1, 2010

|

|

The idle Delaware City refinery and its related assets were acquired from affiliates of Valero Energy Corporation (“Valero”) for approximately $220.0 million.

|

|

December 17, 2010

|

|

The Paulsboro refinery and its related assets were acquired from affiliates of Valero for approximately $357.7 million, excluding working capital.

|

|

March 1, 2011

|

|

The Toledo refinery and its related assets were acquired from Sunoco for approximately $400.0 million, excluding working capital.

|

|

October 2011

|

|

Delaware City became fully operational.

|

|

February 2012

|

|

Our subsidiary, PBF Holding, issued $675.5 million aggregate principal amount of 8.25% Senior Secured Notes due 2020.

|

|

December 2012

|

|

PBF Energy completed the initial public offering of its common equity selling a total of 23,567,686 Class A common shares. In connection with the initial public offering, PBF Energy became the sole managing member of PBF LLC.

|

|

June 2013

|

Blackstone and First Reserve completed a secondary public offering selling a total of 15,950,000 Class A common shares.

|

|

|

January 2014

|

Blackstone and First Reserve completed a secondary public offering selling a total of 15,000,000 Class A common shares.

|

|

|

•

|

the Delaware City refinery processes a slate of primarily medium and heavy, and sour crude oil, which has constituted approximately 65% to 70% of total throughput. The remaining throughput consists of sweet crude oil and other feedstocks and blendstocks. In addition, we are currently processing a significant volume of price-advantaged crude. Our total throughput costs have historically priced at a discount to Dated Brent; and

|

|

•

|

as a result of the heavy, sour crude slate processed at Delaware City, we produce low value products including sulfur and petroleum coke. These products are priced at a significant discount to gasoline, ULSD and heating oil and represent approximately 5.5% of our total production volume.

|

|

•

|

the Paulsboro refinery has generally processed a slate of primarily medium and heavy, and sour crude oil, which has historically constituted approximately 65% to 70% of total throughput. The remaining throughput consists of sweet crude oil and other feedstocks and blendstocks. We are now also running a significant volume of price advantaged domestic crudes. These feedstocks historically have priced at a discount to Dated Brent;

|

|

•

|

as a result of the heavy, sour crude slate processed at Paulsboro, we produce low value products including sulfur, petroleum coke and fuel oil. These products are priced at a significant discount to gasoline and heating oil and represent approximately 6% to 7.5% of our total production volume; and

|

|

•

|

the Paulsboro refinery produces Group I lubricants which, through an extensive production process, have a low volume yield which limits the volume expansion on crude inputs.

|

|

•

|

the Toledo refinery processes a slate of domestic sweet and Canadian synthetic crude oil. Historically, Toledo’s blended average crude costs have been higher than the market value of WTI crude oil;

|

|

•

|

the Toledo refinery is connected to its distribution network through a variety of third party product pipelines. While lower in cost when compared to barge or rail transportation, the inclusion of transportation costs increases our overall cost relative to the 4-3-1 benchmark refining margin; and

|

|

•

|

the Toledo refinery generates a pricing benefit on some of its products, primarily its petrochemicals.

|

|

|

Year Ended December 31,

|

|||||||||||

|

|

2013

|

2012

|

2011

|

|||||||||

|

Revenue

|

$

|

19,151,455

|

|

$

|

20,138,687

|

|

$

|

14,960,338

|

|

|||

|

Cost of sales, excluding depreciation

|

17,803,314

|

|

18,269,078

|

|

13,855,163

|

|

||||||

|

Gross refining margin (1)

|

1,348,141

|

|

1,869,609

|

|

1,105,175

|

|

||||||

|

Operating expenses, excluding depreciation

|

812,652

|

|

738,824

|

|

658,831

|

|

||||||

|

General and administrative expenses

|

104,334

|

|

120,443

|

|

86,183

|

|

||||||

|

Gain on sale of asset

|

(183

|

)

|

(2,329

|

)

|

—

|

|

||||||

|

Acquisition-related expenses

|

—

|

|

—

|

|

728

|

|

||||||

|

Depreciation and amortization expense

|

111,479

|

|

92,238

|

|

53,743

|

|

||||||

|

Income from operations

|

319,859

|

|

920,433

|

|

305,690

|

|

||||||

|

Change in fair value of contingent consideration

|

—

|

|

(2,768

|

)

|

(5,215

|

)

|

||||||

|

Change in fair value of catalyst leases

|

4,691

|

|

(3,724

|

)

|

7,316

|

|

||||||

|

Interest income (expense), net

|

(93,784

|

)

|

(108,629

|

)

|

(65,120

|

)

|

||||||

|

Income before income taxes

|

230,766

|

|

805,312

|

|

242,671

|

|

||||||

|

Income tax expense

|

16,681

|

|

1,275

|

|

—

|

|

||||||

|

Net income

|

214,085

|

|

804,037

|

|

$

|

242,671

|

|

|||||

|

Less: net income attributable to noncontrolling interest

|

174,545

|

|

802,081

|

|

||||||||

|

Net income attributable to PBF Energy Inc.

|

$

|

39,540

|

|

$

|

1,956

|

|

||||||

|

Gross margin

|

$

|

436,867

|

|

$

|

1,046,598

|

|

$

|

417,962

|

|

|||

|

Net income available to Class A common stock per share:

|

||||||||||||

|

Basic

|

$

|

1.22

|

|

$

|

0.08

|

|

||||||

|

Diluted

|

$

|

1.20

|

|

$

|

0.08

|

|

||||||

|

(1)

|

See Gross Refining Margin below.

|

|

|

Year Ended December 31,

|

|||||||||||

|

|

2013

|

2012

|

2011

|

|||||||||

|

(dollars per barrel, except as noted)

|

||||||||||||

|

Dated Brent Crude

|

$

|

108.66

|

|

$

|

111.67

|

|

$

|

111.26

|

|

|||

|

West Texas Intermediate (WTI) crude oil

|

$

|

97.99

|

|

$

|

94.13

|

|

$

|

95.04

|

|

|||

|

Crack Spreads

|

||||||||||||

|

Dated Brent (NYH) 2-1-1

|

$

|

12.34

|

|

$

|

14.29

|

|

$

|

9.93

|

|

|||

|

WTI (Chicago) 4-3-1

|

$

|

20.09

|

|

$

|

27.13

|

|

$

|

24.14

|

|

|||

|

Crude Oil Differentials

|

||||||||||||

|

Dated Brent (foreign) less WTI

|

$

|

10.67

|

|

$

|

17.54

|

|

$

|

16.22

|

|

|||

|

Dated Brent less Maya (heavy, sour)

|

$

|

11.38

|

|

$

|

12.04

|

|

$

|

12.63

|

|

|||

|

Dated Brent less WTS (sour)

|

$

|

13.31

|

|

$

|

22.95

|

|

$

|

18.28

|

|

|||

|

Dated Brent less ASCI (sour)

|

$

|

6.67

|

|

$

|

4.97

|

|

$

|

3.82

|

|

|||

|

WTI less WCS (heavy, sour)

|

$

|

24.62

|

|

$

|

21.80

|

|

$

|

15.63

|

|

|||

|

WTI less Bakken (light, sweet)

|

$

|

5.12

|

|

$

|

5.77

|

|

$

|

(3.31

|

)

|

|||

|

WTI less Syncrude (light, sweet)

|

$

|

0.63

|

|

$

|

0.96

|

|

$

|

(9.79

|

)

|

|||

|

Natural gas (dollars per MMBTU)

|

$

|

3.73

|

|

$

|

2.83

|

|

$

|

4.00

|

|

|||

|

Key Operating Information

|

||||||||||||

|

Production (barrels per day in thousands)

|

451.0

|

|

464.4

|

|

427.9

|

|

||||||

|

Crude oil and feedstocks throughput (barrels per day in thousands)

|

452.8

|

|

463.2

|

|

429.4

|

|

||||||

|

Total crude oil and feedstocks throughput (millions of barrels)

|

165.3

|

|

169.5

|

|

128.7

|

|

||||||

|

1

|

Assumed Exchange of

PBF LLC Series A Units

for

shares of PBF Energy

Class A common stock.

As a result of the assumed exchange of PBF LLC Series A Units, the noncontrolling interest related to these units is converted to controlling interest. Management believes that it is useful to provide the per-share effect associated with the assumed exchange of all PBF LLC Series A Units.

|

|

2

|

Income Taxes.

Prior to the initial public offering, we were organized as a limited liability company treated as a “flow-through” entity for income tax purposes, and even after our IPO, not all of our earnings are subject to corporate-level income taxes. Adjustments have been made to the Adjusted Pro Forma tax provisions and earnings to assume that we had adopted our post-IPO corporate tax structure for all periods presented and are taxed as a C corporation in the U.S. at the prevailing corporate rates. These assumptions are consistent with the assumption in clause 1 above that all PBF LLC Series A Units are exchanged for shares of PBF Energy Class A common stock, as the assumed exchange would change the amount of our earnings that is subject to corporate income tax.

|

|

3

|

Elimination of Certain Initial Public Offering-Related Expenses.

Adjusted Pro Forma results for 2012 also exclude one-time charges relating to our initial public offering. Management believes that this adjustment results in a more meaningful comparison with prior and succeeding period results.

|

|

|

Year Ended

December 31,

|

|||||||||||

|

|

2013

|

2012

|

2011

|

|||||||||

|

Net income attributable to PBF Energy Inc.

|

$

|

39,540

|

|

$

|

1,956

|

|

$

|

—

|

|

|||

|

Add: IPO-related expenses

(1)

|

—

|

|

8,187

|

|

—

|

|

||||||

|

Add: Net income attributable to the

noncontrolling interest

(2)

|

174,545

|

|

802,081

|

|

242,671

|

|

||||||

|

Less: Income tax expense

(3)

|

(70,167

|

)

|

(319,732

|

)

|

(95,758

|

)

|

||||||

|

Adjusted pro forma net income

|

$

|

143,918

|

|

$

|

492,492

|

|

$

|

146,913

|

|

|||

|

Diluted weighted-average shares outstanding of PBF Energy Inc.

(4)

|

33,061,081

|

|

97,230,904

|

|

||||||||

|

Conversion of PBF LLC Series A Units

(5)

|

64,164,045

|

|

—

|

|

97,230,904

|

|

||||||

|

Pro forma shares outstanding—diluted

(6)

|

97,225,126

|

|

97,230,904

|

|

97,230,904

|

|

||||||

|

Adjusted pro forma net income (loss) per fully

exchanged, fully diluted shares outstanding

|

$

|

1.48

|

|

$

|

5.07

|

|

$

|

1.51

|

|

|||

|

(1)

|

Represents the elimination of one-time charges associated with our initial public offering.

|

|

|

(2)

|

Represents the elimination of the noncontrolling interest associated with the ownership by the members of PBF LLC other than PBF Energy as if such members had fully exchanged their PBF LLC Series A Units for shares of PBF Energy's Class A common stock.

|

|

|

(3)

|

Represents an adjustment to apply PBF Energy's statutory tax rate of approximately 40.2% for the year ended December 31, 2013 and 39.5% for the years ended December 31, 2012 and 2011 to the noncontrolling interest. The adjustment assumes the full exchange of existing PBF LLC Series A Units as described in (2) above.

|

|

|

(4)

|

Represents weighted-average diluted shares outstanding assuming the conversion of all common stock equivalents, including options and warrants for units of PBF LLC Series A Units and options for shares of PBF Energy Class A common stock as calculated under the treasury stock method for the year ended December 31, 2013. Common stock equivalents exclude the effects of options to purchase 1,320,000 and 682,500 shares of PBF Energy's Class A common stock because they are anti-dilutive for the years ended December 31, 2013 and 2012, respectively.

|

|

|

(5)

|

Represents an adjustment to weighted-average diluted shares to assume the full exchange of existing PBF LLC Series A Units as described in (2) above.

|

|

|

(6)

|

Diluted pro forma shares outstanding for 2011 reflect the same number of diluted shares outstanding for 2012 in order to present such pre-IPO period on a comparable basis.

|

|

|

|

Year Ended December 31,

|

||||||||||||||||||||

|

|

2013

|

2012

|

2011

|

||||||||||||||||||

|

$

|

per barrel of throughput

|

$

|

per barrel of throughput

|

$

|

per barrel of throughput

|

||||||||||||||||

|

Reconciliation of gross margin to gross refining margin:

|

|||||||||||||||||||||

|

Gross margin

|

$

|

436,867

|

|

$

|

2.64

|

|

$

|

1,046,598

|

|

$

|

6.17

|

|

$

|

417,962

|

|

$

|

3.07

|

|

|||

|

Add:

|

|||||||||||||||||||||

|

Refinery operating expense

|

812,652

|

|

4.92

|

|

738,824

|

|

4.36

|

|

635,517

|

|

5.12

|

|

|||||||||

|

Refinery depreciation expense

|

98,622

|

|

0.60

|

|

84,187

|

|

0.50

|

|

51,696

|

|

0.40

|

|

|||||||||

|

Gross refining margin

|

$

|

1,348,141

|

|

$

|

8.16

|

|

$

|

1,869,609

|

|

$

|

11.03

|

|

$

|

1,105,175

|

|

$

|

8.59

|

|

|||

|

•

|

does not reflect depreciation expense or our cash expenditures, or future requirements, for capital expenditures or contractual commitments;

|

|

•

|

does not reflect changes in, or cash requirements for, our working capital needs;

|

|

•

|

does not reflect our interest expense, or the cash requirements necessary to service interest or principal payments, on our debt;

|

|

•

|

does not reflect realized and unrealized gains and losses from hedging activities, which may have a substantial impact on our cash flow;

|

|

•

|

does not reflect certain other non-cash income and expenses; and

|

|

•

|

excludes income taxes that may represent a reduction in available cash.

|

|

Year Ended December 31,

|

|||||||||||||

|

2013

|

2012

|

2011

|

|||||||||||

|

Reconciliation of net (loss) income to EBITDA:

|

|||||||||||||

|

Net income

(1)

|

$

|

214,085

|

|

$

|

804,037

|

|

$

|

242,671

|

|

||||

|

Add:Depreciation and amortization expense

|

111,479

|

|

92,238

|

|

53,743

|

|

|||||||

|

Add: Interest expense, net

|

93,784

|

|

108,629

|

|

65,120

|

|

|||||||

|

Add: Income tax expense

(1)

|

16,681

|

|

1,275

|

|

—

|

|

|||||||

|

EBITDA

|

$

|

436,029

|

|

$

|

1,006,179

|

|

$

|

361,534

|

|

||||

|

Reconciliation of EBITDA to Adjusted EBITDA:

|

|||||||||||||

|

EBITDA

|

$

|

436,029

|

|

$

|

1,006,179

|

|

$

|

361,534

|

|

||||

|

Stock based compensation

|

3,753

|

|

2,954

|

|

2,516

|

|

|||||||

|

Change in tax receivable agreement liability

|

8,540

|

|

—

|

|

—

|

|

|||||||

|

Non-cash change in fair value of catalyst lease obligations

|

(4,691

|

)

|

3,724

|

|

(7,316

|

)

|

|||||||

|

Non-cash change in fair value of contingent consideration

|

—

|

|

2,768

|

|

5,215

|

|

|||||||

|

Non-cash change in fair value of inventory repurchase

obligations

|

(12,985

|

)

|

9,271

|

|

(1,396

|

)

|

|||||||

|

Non-cash deferral of gross profit on

finished product sales

|

(31,329

|

)

|

19,177

|

|

(6,771

|

)

|

|||||||

|

Adjusted EBITDA

|

$

|

399,317

|

|

$

|

1,044,073

|

|

$

|

353,782

|

|

||||

|

|

Payments due by period

|

|||||||||||||||||||

|

|

Total

|

Less than

1 year

|

1-3 Years

|

3-5 Years

|

More than

5 years

|

|||||||||||||||

|

Long-term debt (a)

|

$

|

743,589

|

|

$

|

26,887

|

|

$

|

41,202

|

|

$

|

—

|

|

$

|

675,500

|

|

|||||

|

Interest payments on debt facilities (a)

|

423,417

|

|

72,466

|

|

143,312

|

|

124,046

|

|

83,593

|

|

||||||||||

|

Delaware Economic Development Authority Loan (b)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||

|

Operating Leases (c)

|

311,323

|

|

59,410

|

|

101,721

|

|

81,877

|

|

68,315

|

|

||||||||||

|

Purchase obligations (d):

|

||||||||||||||||||||

|

Crude Supply and Offtake Agreements

|

454,893

|

|

454,893

|

|

—

|

|

—

|

|

—

|

|

||||||||||

|

Other Supply and Capacity Agreements

|

483,351

|

|

60,023

|

|

98,207

|

|

91,544

|

|

233,577

|

|

||||||||||

|

Construction obligations

|

13,088

|

|

13,088

|

|

—

|

|

—

|

|

—

|

|

||||||||||

|

Environmental obligations (e)

|

14,874

|

|

2,907

|

|

1,492

|

|

1,439

|

|

9,036

|

|

||||||||||

|

Pension and post-retirement obligations (f)

|

96,023

|

|

6,669

|

|

9,287

|

|

17,257

|

|

62,810

|

|

||||||||||

|

Tax receivable agreement obligations (g)

|

287,316

|

|

12,541

|

|

53,604

|

|

32,821

|

|

188,350

|

|

||||||||||

|

Total contractual cash obligations

|

$

|

2,827,874

|

|

$

|

708,884

|

|

$

|

448,825

|

|

$

|

348,984

|

|

$

|

1,321,181

|

|

|||||

|

(a)

|

Long-term Debt and Interest Payments on Debt Facilities

|

|

(b)

|

Delaware Economic Development Authority Loan

|

|

(c)

|

Operating Leases

|

|

(d)

|

Purchase Obligations

|

|

(e)

|

Environmental Obligations

|

|

(f)

|

Pension and Post-retirement Obligations

|

|

(g)

|

Tax Receivable Agreement Obligations

|

|

Number

|

|

Description

|

|

3.1

|

|

Amended and Restated Certificate of Incorporation of PBF Energy Inc. (Incorporated by reference to Exhibit 3.1 filed with PBF Energy Inc.’s Amendment No. 4 to Registration Statement on Form S-1 (Registration No. 333-177933))

|

|

3.2

|

|

Amended and Restated Bylaws of PBF Energy Inc. (Incorporated by reference to Exhibit 3.2 filed with PBF Energy Inc.’s Amendment No. 4 to Registration Statement on Form S-1 (Registration No. 333-177933))

|

|

3.3

|

Certificate of Formation of PBF Holding Company LLC (Incorporated by reference to Exhibit 3.1 filed with PBF Holding Company LLC’s Registration Statement on Form S-4 (File No. 333-186007))

|

|

|

3.4

|

Limited Liability Company Agreement of PBF Holding Company LLC (Incorporated by reference to Exhibit 3.2 filed with PBF Holding Company LLC’s Registration Statement on Form S-4 (File No. 333-186007))

|

|

|

3.5

|

Certificate of Incorporation of PBF Finance Corporation (Incorporated by reference to Exhibit 3.3 filed with PBF Holding Company LLC’s Registration Statement on Form S-4 (File No. 333-186007))

|

|

|

3.6

|

Bylaws of PBF Finance Corporation (Incorporated by reference to Exhibit 3.4 filed with PBF Holding Company LLC’s Registration Statement on Form S-4 (File No. 333-186007))

|

|

|

4.1

|

|

Amended and Restated Registration Rights Agreement of PBF Energy Inc. dated as of December 12, 2012 (Incorporated by reference to Exhibit 4.1 filed with PBF Energy Inc.’s Current Report on Form 8-K dated December 18, 2012 (File No. 001-35764))

|

|

4.2

|

|

Indenture, dated as of February 9, 2012, among PBF Holding Company LLC, PBF Finance Corporation, the Guarantors party thereto, Wilmington Trust, National Association and Deutsche Bank Trust Company Americas (Incorporated by reference to Exhibit 4.2 filed with PBF Energy Inc.’s Amendment No. 2 to Registration Statement on Form S-1 (Registration No. 333-177933))

|

|

10.1†

|

|

Offtake Agreement, dated as of March 1, 2011, by and between Toledo Refining Company LLC and Sunoco, Inc. (R&M) (Incorporated by reference to Exhibit 10.4 filed with PBF Energy Inc.’s Amendment No. 1 to Registration Statement on Form S-1 (Registration No. 333-177933))

|

|

10.1.1

|

|

Assignment and Assumption Agreement, dated as of March 1, 2012, by and between Toledo Refining Company LLC, PBF Holding Company LLC, and Sunoco, Inc. (R&M) (Incorporated by reference to Exhibit 10.4.1 filed with PBF Energy Inc.’s Amendment No. 2 to Registration Statement on Form S-1 (Registration No. 333-177933))

|

|

Number

|

|

Description

|

|

10.2†

|

|

Amended and Restated Crude Oil Acquisition Agreement, dated as of March 1, 2012, by and between Morgan Stanley Capital Group Inc. and PBF Holding Company LLC (Incorporated by reference to Exhibit 10.23 filed with PBF Energy Inc.’s Amendment No. 2 to Registration Statement on Form S-1 (Registration No. 333-177933))

|

|

10.2.1

|

|

First Amendment to Amended and Restated Crude Oil Acquisition Agreement, dated as of June 28, 2012, by and between PBF Holding Company LLC and Morgan Stanley Capital Group Inc. (Incorporated by reference to Exhibit 10.23.1 filed with PBF Energy Inc.’s Amendment No. 3 to Registration Statement on Form S-1 (Registration No. 333-177933))

|

|

10.2.2

|

|

Second Amendment to Amended and Restated Crude Oil Acquisition Agreement, dated as of October 11, 2012, by and between PBF Holding Company LLC and Morgan Stanley Capital Group Inc. (Incorporated by reference to Exhibit 10.23.2 filed with PBF Energy Inc.’s Amendment No. 4 to Registration Statement on Form S-1 (Registration No. 333-177933))

|

|

10.2.3*

|

|

Third Amendment to Amended and Restated Crude Oil Acquisition Agreement, dated as of January 15, 2014, by and between PBF Holding Company LLC and Morgan Stanley Capital Group Inc.

|

|

10.3†

|

|

Crude Oil/Feedstock Supply/Delivery and Services Agreement, effective as of April 7, 2011, by and between Statoil Marketing & Trading (US) Inc. and Delaware City Refining Company LLC, as amended as of July 29, 2011 (Incorporated by reference to Exhibit 10.8 filed with PBF Energy Inc.’s Amendment No. 2 to Registration Statement on Form S-1 (Registration No. 333-177933))

|

|

10.3.1

|

|

Agreement on Modification to the DCR Crude Supply Agreement, effective as of October 31, 2012, by and between Statoil Marketing & Trading (US) Inc. and Delaware City Refining Company LLC (Incorporated by reference to Exhibit 10.8.1 filed with PBF Energy Inc.’s Amendment No. 4 to Registration Statement on Form S-1 (Registration No. 333-177933))

|

|

10.4

|

|

Second Amended and Restated Revolving Credit Agreement dated as of October 26, 2012, among PBF Holding Company LLC, Delaware City Refining Company LLC, Paulsboro Refining Company LLC and Toledo Refining Company LLC, the lenders party thereto in their capacities as lenders thereunder, UBS AG, Stamford Branch, as Administrative Agent and Co-Collateral Agent, and Bank of America, N.A. and Wells Fargo Bank, N.A., as Co-Collateral Agents (Incorporated by reference to Exhibit 10.11 filed with PBF Energy Inc.’s Amendment No. 4 to Registration Statement on Form S-1 (Registration No. 333-177933))

|

|

10.4.1

|

|

Amendment No. 1 and Increase Joinder Agreement to Second Amended and Restated Revolving Credit Agreement, dated as of December 28, 2012, entered into by and among PBF Holding Company LLC, Delaware City Refining Company LLC, Paulsboro Refining Company LLC and Toledo Refining Company LLC, each other loan party thereto, the lenders party thereto and UBS AG, Stamford Branch, as Administrative Agent (Incorporated by reference to Exhibit 10.10.1 filed with PBF Holding Company LLC’s Registration Statement on Form S-4 (Registration No. 333-186007))

|

|

10.5†

|

Inventory Intermediation Agreement dated as of June 26, 2013 (as amended) between J. Aron & Company and PBF Holding Company LLC and Paulsboro Refining Company LLC. (Incorporated by reference to Exhibit 10.1 filed with PBF Energy Inc.'s June 30, 2013 Form 10-Q (File No. 001-35764))

|

|

|

10.6†

|

Inventory Intermediation Agreement dated as of June 26, 2013 (as amended) between J. Aron & Company and PBF Holding Company LLC and Delaware City Refining Company LLC. (Incorporated by reference to Exhibit 10.1 filed with PBF Energy Inc.'s June 30, 2013 Form 10-Q (File No. 001-35764))

|

|

|

10.7

|

|

Amended and Restated Limited Liability Company Agreement of PBF Energy Company LLC (Incorporated by reference to Exhibit 10.1 filed with PBF Energy Inc.’s Current Report on Form 8-K dated December 18, 2012 (File No. 001-35764))

|

|

10.8

|

|

Exchange Agreement, dated as of December 12, 2012 (Incorporated by reference to Exhibit 10.3 filed with PBF Energy Inc.’s Current Report on Form 8-K dated December 18, 2012 (File No. 001-35764))

|

|

10.9

|

|

Tax Receivable Agreement, dated as of December 12, 2012 (Incorporated by reference to Exhibit 10.2 filed with PBF Energy Inc.’s Current Report on Form 8-K dated December 18, 2012 (File No. 001-35764))

|

|

Number

|

|

Description

|

|

10.10

|

|

Stockholders’ Agreement of PBF Energy Inc. (Incorporated by reference to Exhibit 10.4 filed with PBF Energy Inc.’s Current Report on Form 8-K dated December 18, 2012 (File No. 001-35764))

|

|

10.11**

|

|

Second Amended and Restated Employment Agreement dated as of December 17, 2012, between PBF Investments LLC and Thomas D. O’Malley (Incorporated by reference to Exhibit 10.7 filed with PBF Energy Inc.’s Current Report on Form 8-K dated December 18, 2012 (File No. 001-35764))

|

|

10.12**

|

|

Amended and Restated Employment Agreement dated as of December 17, 2012, between PBF Investments LLC and Thomas J. Nimbley (Incorporated by reference to Exhibit 10.8 filed with PBF Energy Inc.’s Current Report on Form 8-K dated December 18, 2012 (File No. 001-35764))

|

|

10.13**

|

|

Second Amended and Restated Employment Agreement, dated as of December 17, 2012, between PBF Investments LLC and Matthew C. Lucey (Incorporated by reference to Exhibit 10.9 filed with PBF Energy Inc.’s Current Report on Form 8-K dated December 18, 2012 (File No. 001-35764))

|

|

10.14**

|

|

Second Amended and Restated Employment Agreement, dated as of December 17, 2012, between PBF Investments LLC and Donald F. Lucey (Incorporated by reference to Exhibit 10.10 filed with PBF Energy Inc.’s Current Report on Form 8-K dated December 18, 2012 (File No. 001-35764))

|

|

10.15**

|

|

Amended and Restated Employment Agreement, dated as of December 17, 2012, between PBF Investments LLC and Michael D. Gayda (Incorporated by reference to Exhibit 10.11 filed with PBF Energy Inc.’s Current Report on Form 8-K dated December 18, 2012 (File No. 001-35764))

|

|

10.16**

|

|

Restated Warrant and Purchase Agreement between PBF Energy Company LLC and the officers party thereto, as amended (Incorporated by reference to Exhibit 10.17 filed with PBF Energy Inc.’s Amendment No. 4 to Registration Statement on Form S-1 (Registration No. 333-177933))

|

|

10.17

|

|

Form of Indemnification Agreement, dated December 12, 2012, between PBF Energy Inc. and each of the executive officers and directors of PBF Energy Inc. (Incorporated by reference to Exhibit 10.5 filed with PBF Energy Inc.’s Current Report on Form 8-K dated December 18, 2012 (File No. 001-35764))

|

|

10.18**

|

|

PBF Energy Inc. 2012 Equity Incentive Plan (Incorporated by reference to Exhibit 10.6 filed with PBF Energy Inc.’s Current Report on Form 8-K dated December 18, 2012 (File No. 001-35764))

|

|

10.19**

|

|

Form of Non-Qualified Stock Option Agreement under the PBF Energy Inc. 2012 Equity Incentive Plan (Incorporated by reference to Exhibit 10.28 filed with PBF Energy Inc.’s Amendment No. 6 to Registration Statement on Form S-1 (Registration No. 333-177933))

|

|

10.20**

|

|

Form of Restricted Stock Award Agreement for Directors under the PBF Energy Inc. 2012 Equity Incentive Plan (Incorporated by reference to Exhibit 10.20 filed with PBF Energy Inc.’s December 31, 2012 Form 10-K (File No. 001-35764))

|

|

12.1*

|

Computation of Ratios of Earnings to Fixed Charge of PBF Holding Company LLC.

|

|

|

21.1*

|

|

Subsidiaries of PBF Energy Inc. and PBF Holding Company LLC.

|

|

23.1*

|

|

Consent of Deloitte & Touche LLP

|

|

24.1*

|

|

Power of Attorney of PBF Energy Inc. (included on signature page)

|

|

24.2*

|

Power of Attorney of PBF Holding Company LLC (included on signature page)

|

|

|

31.1*

|

|

Certification by Chief Executive Officer of PBF Energy Inc. pursuant to Rule 13a-14(a)/15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

31.2*

|

|

Certification by Chief Financial Officer of PBF Energy Inc. pursuant to Rule 13a-14(a)/15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

Number

|

|

Description

|

|

31.3*

|

|

Certification by Chief Executive Officer of PBF Holding Company LLC pursuant to Rule 13a-14(a)/15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

31.4*

|

|

Certification by Chief Financial Officer of PBF Holding Company LLC pursuant to Rule 13a-14(a)/15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

32.1*

(1)

|

|

Certification by Chief Executive Officer of PBF Energy Inc. pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

32.2*

(1)

|

|

Certification by Chief Financial Officer of PBF Energy Inc. pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

32.3*

(1)

|

|

Certification by Chief Executive Officer of PBF Holding Company LLC pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

32.4*

(1)

|

|

Certification by Chief Financial Officer of PBF Holding Company LLC pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

101.INS

|

XBRL Instance Document.

|

|

|

101.SCH

|

XBRL Taxonomy Extension Schema Document.

|

|

|

101.CAL

|

XBRL Taxonomy Extension Calculation Linkbase Document.

|

|

|

101.DEF

|

XBRL Taxonomy Extension Definition Linkbase Document.

|

|

|

101.LAB

|

XBRL Taxonomy Extension Label Linkbase Document.

|

|

|

101.PRE

|

XBRL Taxonomy Extension Presentation Linkbase Document.

|

|

|

*

|

Filed herewith.

|

|

**

|

Indicates management compensatory plan or arrangement.

|

|

†

|

Confidential treatment has been granted by the SEC as to certain portions, which portions have been omitted and filed separately with the SEC.

|

|

(1)

|

This exhibit should not be deemed to be “filed” for purposes of Section 18 of the Exchange Act.

|

|

Reports of Independent Registered Public Accounting Firm

|

|

|

|

PBF Energy Inc.

|

||

|

Consolidated Balance Sheets as of December 31, 2013 and 2012

|

||

|

Consolidated Statements of Operations For the Years Ended December 31, 2013, 2012 and 2011

|

||

|

Consolidated Statements of Comprehensive Income For the Years Ended December 31, 2013, 2012 and 2011

|

||

|

Consolidated Statements of Changes in Equity For the Years Ended December 31, 2013, 2012 and 2011

|

||

|

Consolidated Statements of Cash Flows For the Years Ended December 31, 2013, 2012 and 2011

|

||

|

PBF Holding Company LLC

|

||

|

Consolidated Balance Sheets as of December 31, 2013 and 2012

|

||

|

Consolidated Statements of Operations For the Years Ended December 31, 2013, 2012 and 2011

|

||

|

Consolidated Statements of Comprehensive Income For the Years Ended December 31, 2013, 2012 and 2011

|

||

|

Consolidated Statements of Changes in Equity For the Years Ended December 31, 2013, 2012 and 2011

|

||

|

Consolidated Statements of Cash Flows For the Years Ended December 31, 2013, 2012 and 2011

|

||

|

Notes to Consolidated Financial Statements

|

||

|

PBF Energy Inc.'s Quarterly Financial Data (Unaudited)

|

||

|

December 31,

2013 |

December 31,

2012 |

||||||

|

ASSETS

|

|||||||

|

Current assets:

|

|||||||

|

Cash and cash equivalents

|

$

|

76,970

|

|

$

|

285,884

|

|

|

|

Accounts receivable

|

596,647

|

|

503,796

|

|

|||

|

Inventories

|

1,445,517

|

|

1,497,119

|

|

|||

|

Deferred tax asset

|

25,529

|

|

7,717

|

|

|||

|

Prepaid expense and other current assets

|

55,843

|

|

13,388

|

|

|||

|

Total current assets

|

2,200,506

|

|

2,307,904

|

|

|||

|

Property, plant and equipment, net

|

1,781,589

|

|

1,635,587

|

|

|||

|

Deferred tax assets

|

169,234

|

|

112,862

|

|

|||

|

Deferred charges and other assets, net

|

262,479

|

|

197,349

|

|

|||

|

Total assets

|

$

|

4,413,808

|

|

$

|

4,253,702

|

|

|

|

LIABILITIES AND EQUITY

|

|||||||

|

Current liabilities:

|

|||||||

|

Accounts payable

|

$

|

402,293

|

|

$

|

360,057

|

|

|

|

Accrued expenses

|

1,209,881

|

|

1,031,467

|

|

|||

|

Payable to related parties pursuant to tax receivable agreement

|

12,541

|

|

1,007

|

|

|||

|

Current portion of long-term debt

|

12,029

|

|

—

|

|

|||

|

Deferred revenue

|

7,766

|

|

210,543

|

|

|||

|

Total current liabilities

|

1,644,510

|

|

1,603,074

|

|

|||

|

Delaware Economic Development Authority loan

|

12,000

|

|

20,000

|

|

|||

|

Long-term debt

|

723,547

|

|

709,980

|

|

|||

|

Payable to related parties pursuant to tax receivable agreement

|

274,775

|

|

159,004

|

|

|||

|

Other long-term liabilities

|

43,720

|

|

38,099

|

|

|||

|

Total liabilities

|

2,698,552

|

|

2,530,157

|

|

|||

|

Commitments and contingencies (Note 14)

|

|

|

|||||

|

Equity:

|

|||||||

|

Class A common stock, $0.001 par value, 1,000,000,000 shares authorized, 39,665,473 shares outstanding at December 31, 2013, 23,571,221 shares outstanding at December 31, 2012

|

40

|

|

24

|

|

|||

|

Class B common stock, $0.001 par value, 1,000,000 shares authorized, 40 shares outstanding at December 31, 2013, 41 shares outstanding at December 31, 2012

|

—

|

|

—

|

|

|||

|

Preferred stock, $0.001 par value, 100,000,000 shares authorized, no shares outstanding at December 31, 2013 and 2012

|

—

|

|

—

|

|

|||

|

Additional paid in capital

|

657,499

|

|

417,835

|

|

|||

|

Retained earnings

|

3,579

|

|

1,956

|

|

|||

|

Accumulated other comprehensive loss

|

(6,988

|

)

|

(61

|

)

|

|||

|

Total PBF Energy Inc. equity

|

654,130

|

|

419,754

|

|

|||

|

Noncontrolling interest

|

1,061,126

|

|

1,303,791

|

|

|||

|

Total equity

|

1,715,256

|

|

1,723,545

|

|

|||

|

Total liabilities and equity

|

$

|

4,413,808

|

|

$

|

4,253,702

|

|

|

|

Year Ended December 31,

|

|||||||||||

|

2013

|

2012

|

2011

|

|||||||||

|

Revenues

|

$

|

19,151,455

|

|

$

|

20,138,687

|

|

$

|

14,960,338

|

|

||

|

Cost and expenses:

|

|||||||||||

|

Cost of sales, excluding depreciation

|

17,803,314

|

|

18,269,078

|

|

13,855,163

|

|

|||||

|

Operating expenses, excluding depreciation

|

812,652

|

|

738,824

|

|

658,831

|

|

|||||

|

General and administrative expenses

|

104,334

|

|

120,443

|

|

86,183

|

|

|||||

|

Gain on sale of assets

|

(183

|

)

|

(2,329

|

)

|

—

|

|

|||||

|

Acquisition related expenses

|

—

|

|

—

|

|

728

|

|

|||||

|

Depreciation and amortization expense

|

111,479

|

|

92,238

|

|

53,743

|

|

|||||

|

18,831,596

|

|

19,218,254

|

|

14,654,648

|

|

||||||