|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| ☒ | Quarterly Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended June 30, 2017

OR

| ☐ | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number: 1-11859

PEGASYSTEMS INC.

(Exact name of Registrant as specified in its charter)

| Massachusetts | 04-2787865 | |

|

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

|

| One Rogers Street, Cambridge, MA | 02142-1209 | |

| (Address of principal executive offices) | (Zip Code) | |

(617) 374-9600

(Registrant’s telephone number including area code)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company,” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ (Do not check if smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

There were 77,624,615 shares of the Registrant’s common stock, $.01 par value per share, outstanding on July 28, 2017.

Table of Contents

PEGASYSTEMS INC.

2

Table of Contents

| ITEM 1. | UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

PEGASYSTEMS INC.

(in thousands)

|

June 30,

2017 |

December 31,

2016 |

|||||||

|

Assets |

||||||||

|

Current assets: |

||||||||

|

Cash and cash equivalents |

$ | 121,626 | $ | 70,594 | ||||

|

Marketable securities |

58,414 | 63,167 | ||||||

|

|

|

|

|

|||||

|

Total cash, cash equivalents, and marketable securities |

180,040 | 133,761 | ||||||

|

Trade accounts receivable, net of allowance of $5,590 and $4,126 |

217,020 | 265,028 | ||||||

|

Income taxes receivable |

22,081 | 14,155 | ||||||

|

Other current assets |

18,505 | 12,188 | ||||||

|

|

|

|

|

|||||

|

Total current assets |

437,646 | 425,132 | ||||||

|

Property and equipment, net |

38,881 | 38,281 | ||||||

|

Deferred income taxes |

71,096 | 69,898 | ||||||

|

Long-term other assets |

4,615 | 3,990 | ||||||

|

Intangible assets, net |

37,844 | 44,191 | ||||||

|

Goodwill |

72,890 | 73,164 | ||||||

|

|

|

|

|

|||||

|

Total assets |

$ | 662,972 | $ | 654,656 | ||||

|

|

|

|

|

|||||

|

Liabilities and Stockholders’ Equity |

||||||||

|

Current liabilities: |

||||||||

|

Accounts payable |

$ | 13,500 | $ | 14,414 | ||||

|

Accrued expenses |

38,237 | 36,751 | ||||||

|

Accrued compensation and related expenses |

44,287 | 60,660 | ||||||

|

Deferred revenue |

169,926 | 175,647 | ||||||

|

|

|

|

|

|||||

|

Total current liabilities |

265,950 | 287,472 | ||||||

|

Income taxes payable |

4,438 | 4,263 | ||||||

|

Long-term deferred revenue |

8,431 | 10,989 | ||||||

|

Other long-term liabilities |

15,518 | 16,043 | ||||||

|

|

|

|

|

|||||

|

Total liabilities |

294,337 | 318,767 | ||||||

|

|

|

|

|

|||||

|

Stockholders’ equity: |

||||||||

|

Preferred stock, 1,000 shares authorized; no shares issued and outstanding |

— | — | ||||||

|

Common stock, 200,000 shares authorized; 77,604 shares and 76,591 shares issued and outstanding |

776 | 766 | ||||||

|

Additional paid-in capital |

140,088 | 143,903 | ||||||

|

Retained earnings |

232,100 | 198,315 | ||||||

|

Accumulated other comprehensive loss |

(4,329 | ) | (7,095 | ) | ||||

|

|

|

|

|

|||||

|

Total stockholders’ equity |

368,635 | 335,889 | ||||||

|

|

|

|

|

|||||

|

Total liabilities and stockholders’ equity |

$ | 662,972 | $ | 654,656 | ||||

|

|

|

|

|

|||||

See notes to unaudited condensed consolidated financial statements.

3

Table of Contents

PEGASYSTEMS INC.

(in thousands, except per share amounts)

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

|

Revenue: |

||||||||||||||||

|

Software license |

$ | 61,037 | $ | 70,671 | $ | 153,427 | $ | 139,016 | ||||||||

|

Maintenance |

59,590 | 55,161 | 118,555 | 108,136 | ||||||||||||

|

Services |

77,353 | 63,164 | 149,245 | 120,702 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Total revenue |

197,980 | 188,996 | 421,227 | 367,854 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Cost of revenue: |

||||||||||||||||

|

Software license |

1,250 | 1,312 | 2,550 | 2,333 | ||||||||||||

|

Maintenance |

7,011 | 6,315 | 14,229 | 12,230 | ||||||||||||

|

Services |

59,614 | 52,473 | 119,186 | 102,047 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Total cost of revenue |

67,875 | 60,100 | 135,965 | 116,610 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Gross profit |

130,105 | 128,896 | 285,262 | 251,244 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Operating expenses: |

||||||||||||||||

|

Selling and marketing |

75,887 | 74,016 | 147,175 | 135,094 | ||||||||||||

|

Research and development |

39,762 | 35,574 | 80,058 | 70,494 | ||||||||||||

|

General and administrative |

12,706 | 11,294 | 25,041 | 22,342 | ||||||||||||

|

Acquisition-related |

— | 1,623 | — | 2,542 | ||||||||||||

|

Restructuring |

— | 29 | — | 287 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Total operating expenses |

128,355 | 122,536 | 252,274 | 230,759 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Income from operations |

1,750 | 6,360 | 32,988 | 20,485 | ||||||||||||

|

Foreign currency transaction (loss) gain |

(917 | ) | 306 | (241 | ) | 1,682 | ||||||||||

|

Interest income, net |

161 | 188 | 326 | 478 | ||||||||||||

|

Other income (expense), net |

566 | (1,356 | ) | 287 | (3,654 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Income before (benefit)/provision for income taxes |

1,560 | 5,498 | 33,360 | 18,991 | ||||||||||||

|

(Benefit)/provision for income taxes |

(9,846 | ) | 962 | (5,067 | ) | 4,055 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Net income |

$ | 11,406 | $ | 4,536 | $ | 38,427 | $ | 14,936 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Earnings per share: |

||||||||||||||||

|

Basic |

0.15 | 0.06 | 0.50 | 0.20 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Diluted |

0.14 | 0.06 | 0.47 | 0.19 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Weighted-average number of common shares outstanding: |

||||||||||||||||

|

Basic |

77,313 | 76,318 | 77,039 | 76,347 | ||||||||||||

|

Diluted |

82,945 | 79,422 | 82,412 | 79,329 | ||||||||||||

|

Cash dividends declared per share |

$ | 0.03 | $ | 0.03 | $ | 0.06 | $ | 0.06 | ||||||||

See notes to unaudited condensed consolidated financial statements.

4

Table of Contents

PEGASYSTEMS INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands)

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

|

Net income |

$ | 11,406 | $ | 4,536 | $ | 38,427 | $ | 14,936 | ||||||||

|

Other comprehensive income (loss), net of tax |

||||||||||||||||

|

Unrealized (loss) gain on available-for-sale marketable securities, net of tax |

(1 | ) | 56 | 126 | 342 | |||||||||||

|

Foreign currency translation adjustments |

1,859 | (1,224 | ) | 2,640 | (1,231 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Total other comprehensive income (loss), net of tax |

1,858 | (1,168 | ) | 2,766 | (889 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Comprehensive income |

$ | 13,264 | $ | 3,368 | $ | 41,193 | $ | 14,047 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to unaudited condensed consolidated financial statements.

5

Table of Contents

PEGASYSTEMS INC.

(in thousands)

|

Six Months Ended

June 30, |

||||||||

| 2017 | 2016 | |||||||

|

Operating activities: |

||||||||

|

Net income |

$ | 38,427 | $ | 14,936 | ||||

|

Adjustments to reconcile net income to cash provided by operating activities: |

||||||||

|

Deferred income taxes |

(465 | ) | (1,190 | ) | ||||

|

Depreciation and amortization |

12,356 | 11,675 | ||||||

|

Stock-based compensation expense |

26,440 | 19,816 | ||||||

|

Foreign currency transaction loss (gain) |

241 | (1,682 | ) | |||||

|

Other non-cash |

(408 | ) | 4,576 | |||||

|

Change in operating assets and liabilities: |

||||||||

|

Trade accounts receivable |

52,966 | 10,853 | ||||||

|

Income taxes receivable and other current assets |

(14,294 | ) | (18,349 | ) | ||||

|

Accounts payable and accrued expenses |

(17,734 | ) | (19,259 | ) | ||||

|

Deferred revenue |

(11,890 | ) | (11,222 | ) | ||||

|

Other long-term assets and liabilities |

130 | 1,415 | ||||||

|

|

|

|

|

|||||

|

Cash provided by operating activities |

85,769 | 11,569 | ||||||

|

|

|

|

|

|||||

|

Investing activities: |

||||||||

|

Purchases of marketable securities |

(16,656 | ) | (20,942 | ) | ||||

|

Proceeds from maturities and called marketable securities |

20,824 | 21,139 | ||||||

|

Sales of marketable securities |

— | 52,483 | ||||||

|

Payments for acquisitions, net of cash acquired |

(290 | ) | (49,113 | ) | ||||

|

Investment in property and equipment |

(5,037 | ) | (11,497 | ) | ||||

|

|

|

|

|

|||||

|

Cash used in investing activities |

(1,159 | ) | (7,930 | ) | ||||

|

|

|

|

|

|||||

|

Financing activities: |

||||||||

|

Dividend payments to shareholders |

(4,613 | ) | (4,592 | ) | ||||

|

Common stock repurchases for tax withholdings for net settlement of equity awards |

(27,261 | ) | (7,849 | ) | ||||

|

Common stock repurchases under share repurchase programs |

(2,986 | ) | (19,225 | ) | ||||

|

|

|

|

|

|||||

|

Cash used in financing activities |

(34,860 | ) | (31,666 | ) | ||||

|

|

|

|

|

|||||

|

Effect of exchange rates on cash and cash equivalents |

1,282 | (738 | ) | |||||

|

|

|

|

|

|||||

|

Net increase (decrease) in cash and cash equivalents |

51,032 | (28,765 | ) | |||||

|

Cash and cash equivalents, beginning of period |

70,594 | 93,026 | ||||||

|

|

|

|

|

|||||

|

Cash and cash equivalents, end of period |

$ | 121,626 | $ | 64,261 | ||||

|

|

|

|

|

|||||

See notes to unaudited condensed consolidated financial statements.

6

Table of Contents

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. BASIS OF PRESENTATION

Pegasystems Inc. (together with its subsidiaries, “the Company”) has prepared the accompanying unaudited condensed consolidated financial statements pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) regarding interim financial reporting. Accordingly, they do not include all of the information and footnotes required by accounting principles generally accepted in the United States of America (“U.S.”) for complete financial statements and should be read in conjunction with the Company’s audited financial statements included in the Annual Report on Form 10-K for the year ended December 31, 2016.

In the opinion of management, the Company has prepared the accompanying unaudited condensed consolidated financial statements on the same basis as its audited financial statements, and these financial statements include all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the results of the interim periods presented. The operating results for the interim periods presented are not necessarily indicative of the results expected for the full year 2017.

2. NEW ACCOUNTING PRONOUNCEMENTS

Stock-Based Compensation

In May 2017, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2017-09 “Stock Compensation (Topic 718), Scope of Modification Accounting” to clarify when to account for a change to the terms or conditions of a share-based payment award as a modification. Under the new guidance, modification accounting is required only if the fair value, the vesting conditions, or the classification of the award (as equity or liability) changes as a result of the change in terms or conditions. The effective date for the Company will be January 1, 2018. The Company does not expect the adoption of this standard to have a material effect on its financial position or results of operations.

Financial Instruments

In June 2016, the FASB issued ASU No. 2016-13, “Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments,” which requires measurement and recognition of expected credit losses for financial assets measured at amortized cost, including trade accounts receivable, upon initial recognition of that financial asset using a forward-looking expected loss model, rather than an incurred loss model for credit losses. Credit losses relating to available-for-sale debt securities should be recorded through an allowance for credit losses when the fair value is below the amortized cost of the asset, removing the concept of “other-than-temporary” impairments. The effective date for the Company will be January 1, 2020, with early adoption permitted. The Company is currently evaluating the effect this ASU will have on its consolidated financial statements and related disclosures.

Leases

In February 2016, the FASB issued ASU No. 2016-02, “Leases (Topic 842),” which requires lessees to record most leases on their balance sheets, recognizing a lease liability for the obligation to make lease payments and a right-of-use asset for the right to use the underlying asset for the lease term. The effective date for the Company will be January 1, 2019, with early adoption permitted. The Company expects that most of its operating lease commitments will be subject to this ASU and recognized as operating lease liabilities and right-of-use assets upon adoption with no material impact to its results of operations and cash flows.

Revenue

In May 2014, the FASB issued ASU No. 2014-09, “Revenue from Contracts with Customers (Topic 606)”. This ASU amends the guidance for revenue recognition, creating the new Accounting Standards Codification Topic 606 (“ASC 606”). ASC 606 requires entities to apportion consideration from contracts to performance obligations on a relative standalone selling price basis, based on a five-step model. Under ASC 606, revenue is recognized when a customer obtains control of a promised good or service and is recognized in an amount that reflects the consideration which the entity expects to receive in exchange for the good or service. In addition, ASC 606 requires disclosure of the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers.

The Company has elected the full retrospective adoption model, effective January 1, 2018. The Company’s quarterly results beginning with the quarter ending March 31, 2018 and comparative prior periods will be compliant with ASC 606. The Company’s Annual Report on Form 10-K for the year ended December 31, 2018 will be the Company’s first Annual Report that will be issued in compliance with ASC 606.

7

Table of Contents

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

The Company is still in the process of quantifying the implications of the adoption of ASC 606. However the Company expects the following impacts:

| • | Currently, the Company recognizes revenue from term licenses and perpetual licenses with extended payment terms over the term of the agreement as payments become due or earlier if prepaid, provided all other criteria for revenue recognition have been met, and any corresponding maintenance over the term of the agreement. The adoption of ASC 606 will result in revenue for performance obligations being recognized as they are satisfied. Therefore, revenue from the term and perpetual license performance obligations with extended payment terms is recognized when control is transferred to the customer. Revenue from the maintenance performance obligations is expected to be recognized on a straight-line basis over the contractual term. Due to the revenue from term and perpetual licenses with extended payment terms being recognized prior to amounts being billed to the customer, the Company expects to recognize a net contract asset on the balance sheet. |

| • | Currently, the Company allocates revenue to licenses under the residual method when it has VSOE for the remaining undelivered elements which allocates any future credits or significant discounts entirely to the license. The adoption of ASC 606 will result in the future credits, significant discounts, and material rights under ASC 606, being allocated to all performance obligations based upon their relative selling price. Under ASC 606, additional license revenue from the reallocation of such arrangement considerations will be recognized when control is transferred to the customer. |

| • | Currently, the Company does not have VSOE for fixed price services, time and materials services in certain geographical areas, and unspecified future products, which results in revenue being deferred in such instances until such time as VSOE exists for all undelivered elements or recognized ratably over the longest performance period. The adoption of ASC 606 eliminates the requirement for VSOE and replaces it with the concept of a stand-alone selling price. Once the transaction price is allocated to each of the performance obligations, the Company can recognize revenue as the performance obligations are delivered, either at a point in time or over time. Under ASC 606, license revenue will be recognized when control is transferred to the customer. |

| • | Sales commissions and other third party acquisition costs resulting directly from securing contracts with customers are currently expensed when incurred. ASC 606 will require these costs to be recognized as an asset when incurred and to be expensed over the associated contract term. As a practical expedient, if the term of the contract is one year or less, the Company will expense the costs resulting directly from securing the contracts with customers as incurred. The Company expects this change to impact its multi-year cloud offerings and term and perpetual licenses with additional rights of use that extend beyond one year. |

| • | ASC 606 provides additional accounting guidance for contract modifications whereby changes must be accounted for either as a retrospective change (creating either a catch up or deferral of past revenues), prospectively with a reallocation of revenues amongst identified performance obligations, or prospectively as separate contracts which will not require any reallocation. This may result in a difference in the timing of the recognition of revenue as compared to how current contract modifications are recognized. |

| • | There will be a corresponding effect on tax liabilities in relation to all of the above impacts. |

3. MARKETABLE SECURITIES

The Company’s marketable securities are as follows:

| June 30, 2017 | ||||||||||||||||

| (in thousands) |

Amortized

Cost |

Unrealized

Gains |

Unrealized

Losses |

Fair

Value |

||||||||||||

|

Municipal bonds |

$ | 32,238 | $ | 11 | $ | (30 | ) | $ | 32,219 | |||||||

|

Corporate bonds |

26,234 | 3 | (42 | ) | 26,195 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 58,472 | $ | 14 | $ | (72 | ) | $ | 58,414 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| December 31, 2016 | ||||||||||||||||

| (in thousands) |

Amortized

Cost |

Unrealized

Gains |

Unrealized

Losses |

Fair

Value |

||||||||||||

|

Municipal bonds |

$ | 36,746 | $ | — | $ | (139 | ) | $ | 36,607 | |||||||

|

Corporate bonds |

26,610 | 1 | (51 | ) | 26,560 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 63,356 | $ | 1 | $ | (190 | ) | $ | 63,167 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

8

Table of Contents

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

As of June 30, 2017, the Company did not hold any investments with unrealized losses that are considered to be other-than-temporary.

As of June 30, 2017, remaining maturities of marketable debt securities ranged from July 2017 to September 2020, with a weighted-average remaining maturity of approximately 15 months.

4. DERIVATIVE INSTRUMENTS

The Company has historically used foreign currency forward contracts (“forward contracts”) to hedge its exposure to fluctuations in foreign currency exchange rates associated with its foreign currency denominated cash, accounts receivable, and intercompany receivables and payables held primarily by the U.S. parent company and its United Kingdom (“U.K.”) subsidiary.

The Company is primarily exposed to foreign currency exchange rate fluctuations in the Euro relative to the U.S. dollar for the U.S. parent and in the U.S. dollar, the Euro, and the Australian dollar relative to the British pound for the Company’s U.K. subsidiary. The forward contracts are not designated as hedging instruments. As a result, the Company records the fair value of these contracts at the end of each reporting period in the accompanying unaudited condensed consolidated balance sheets as other current assets for unrealized gains and accrued expenses for unrealized losses, with any fluctuations in the value of these contracts recognized in other expense, net, in the accompanying unaudited condensed consolidated statements of operations. The cash flows related to these forward contracts are classified as operating activities in the accompanying unaudited condensed consolidated statements of cash flows. The Company does not enter into any forward contracts for trading or speculative purposes.

In May 2017, the Company discontinued its forward contracts program, however, it will continue to periodically evaluate its foreign exchange exposures and may re-initiate this program if it is deemed necessary. At December 31, 2016, the total notional value of the Company’s outstanding forward contracts was $128.4 million.

The fair value of the Company’s outstanding forward contracts was as follows:

|

December 31, 2016 |

||||||

| (in thousands) |

Recorded In: |

Fair Value | ||||

|

Asset Derivatives |

||||||

|

Foreign currency forward contracts |

Other current assets | $ | 628 | |||

|

Liability Derivatives |

||||||

|

Foreign currency forward contracts |

Accrued expenses | $ | 883 | |||

As of June 30, 2017, the Company did not have any forward contracts outstanding.

The Company had forward contracts outstanding with total notional values as of June 30, 2016 as follows:

| (in thousands) | ||||

|

Euro |

€ | 24,735 | ||

|

British pound |

£ | 7,885 | ||

|

Australian dollar |

A$ | 25,830 | ||

|

Indian rupee |

Rs | 353,500 | ||

|

United States dollar |

$ | 93,460 | ||

The income statement impact of the Company’s outstanding forward contracts and foreign currency transactions was as follows:

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||

| (in thousands) | 2017 | 2016 | 2017 | 2016 | ||||||||||||

|

Gain (loss) from the change in the fair value of forward contracts included in other income (expense), net |

$ | 565 | $ | (1,421 | ) | $ | 286 | $ | (3,718 | ) | ||||||

|

Foreign currency transaction (loss) gain from the remeasurement of foreign currency assets and liabilities |

$ | (917 | ) | $ | 306 | $ | (241 | ) | $ | 1,682 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | (352 | ) | $ | (1,115 | ) | $ | 45 | $ | (2,036 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

9

Table of Contents

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

5. FAIR VALUE MEASUREMENTS

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The Company records its money market funds, marketable securities, and forward contracts at fair value on a recurring basis. Fair value is an exit price, representing the amount that would be received from the sale of an asset or paid to transfer a liability in an orderly transaction between market participants based on assumptions that market participants would use in pricing an asset or liability. As a basis for classifying the fair value measurements, a three-tier fair value hierarchy, which classifies the fair value measurements based on the inputs used in measuring fair value, was established as follows: (Level 1) observable inputs such as quoted prices in active markets for identical assets or liabilities; (Level 2) significant other inputs that are observable either directly or indirectly; and (Level 3) significant unobservable inputs on which there is little or no market data, which require the Company to develop its own assumptions. This hierarchy requires the Company to use observable market data, when available, and to minimize the use of unobservable inputs when determining fair value.

The Company’s money market funds are classified within Level 1 of the fair value hierarchy. The Company’s marketable securities classified within Level 2 of the fair value hierarchy are valued based on a market approach using quoted prices, when available, or matrix pricing compiled by third party pricing vendors, using observable market inputs such as interest rates, yield curves, and credit risk. The Company’s foreign currency forward contracts, which were all classified within Level 2 of the fair value hierarchy, are valued based on the notional amounts and rates under the contracts and observable market inputs such as currency exchange rates and credit risk. If applicable, the Company will recognize transfers into and out of levels within the fair value hierarchy at the end of the reporting period in which the actual event or change in circumstance occurs. There were no transfers between Level 1 and Level 2 during the six months ended June 30, 2017.

The Company’s assets and liabilities measured at fair value on a recurring basis consisted of the following:

|

Fair Value Measurements at

Reporting Date Using |

||||||||||||

| (in thousands) |

June 30,

2017 |

Level 1 | Level 2 | |||||||||

|

Fair Value Assets: |

||||||||||||

|

Money market funds |

$ | 5,633 | $ | 5,633 | $ | — | ||||||

|

Marketable securities: |

||||||||||||

|

Municipal bonds |

$ | 32,219 | $ | — | $ | 32,219 | ||||||

|

Corporate bonds |

26,195 | — | 26,195 | |||||||||

|

|

|

|

|

|

|

|||||||

|

Total marketable securities |

$ | 58,414 | $ | — | $ | 58,414 | ||||||

|

Fair Value Measurements at

Reporting Date Using |

||||||||||||

| (in thousands) |

December 31,

2016 |

Level 1 | Level 2 | |||||||||

|

Fair Value Assets: |

||||||||||||

|

Money market funds |

$ | 458 | $ | 458 | $ | — | ||||||

|

Marketable securities: |

||||||||||||

|

Municipal bonds |

$ | 36,607 | $ | — | $ | 36,607 | ||||||

|

Corporate bonds |

26,560 | — | 26,560 | |||||||||

|

|

|

|

|

|

|

|||||||

|

Total marketable securities |

$ | 63,167 | $ | — | $ | 63,167 | ||||||

|

Foreign currency forward contracts |

$ | 628 | $ | — | $ | 628 | ||||||

|

Fair Value Liabilities: |

||||||||||||

|

Foreign currency forward contracts |

$ | 883 | $ | — | $ | 883 | ||||||

10

Table of Contents

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

For certain other financial instruments, including accounts receivable and accounts payable, the carrying value approximates their fair value due to the relatively short maturity of these items.

Assets Measured at Fair Value on a Nonrecurring Basis

Assets recorded at fair value on a nonrecurring basis, such as property and equipment and intangible assets, are recognized at fair value when they are impaired. During the six months ended June 30, 2017 and 2016, the Company did not recognize any impairments of its assets recorded at fair value on a nonrecurring basis.

6. TRADE ACCOUNTS RECEIVABLE, NET OF ALLOWANCE

| (in thousands) |

June 30,

2017 |

December 31,

2016 |

||||||

|

Trade accounts receivable |

$ | 188,304 | $ | 234,473 | ||||

|

Unbilled trade accounts receivable |

34,306 | 34,681 | ||||||

|

|

|

|

|

|||||

|

Total accounts receivable |

222,610 | 269,154 | ||||||

|

Allowance for sales credit memos |

(5,590 | ) | (4,126 | ) | ||||

|

|

|

|

|

|||||

| $ | 217,020 | $ | 265,028 | |||||

|

|

|

|

|

|||||

Unbilled trade accounts receivable primarily relate to services earned under time and materials arrangements and to license, maintenance, and cloud arrangements that have commenced or been delivered in excess of scheduled invoicing.

7. GOODWILL AND OTHER INTANGIBLE ASSETS

The changes in the carrying amount of goodwill are:

| (in thousands) | 2017 | |||

|

Balance as of January 1, |

$ | 73,164 | ||

|

Purchase price adjustments to goodwill |

(354 | ) | ||

|

Currency translation adjustments |

80 | |||

|

|

|

|||

|

Balance as of June 30, |

$ | 72,890 | ||

|

|

|

|||

Intangible assets are recorded at cost and are amortized using the straight-line method over their estimated useful lives:

| (in thousands) |

Range of

Remaining Useful Lives |

Cost |

Accumulated

Amortization |

Net Book

Value |

||||||||||||

|

June 30, 2017 |

||||||||||||||||

|

Customer related intangibles |

4-10 years | $ | 63,132 | $ | (41,322 | ) | $ | 21,810 | ||||||||

|

Technology |

3-10 years | 58,942 | (42,908 | ) | 16,034 | |||||||||||

|

Other intangibles |

— | 5,361 | (5,361 | ) | — | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| $ | 127,435 | $ | (89,591 | ) | $ | 37,844 | ||||||||||

|

|

|

|

|

|

|

|||||||||||

|

December 31, 2016 |

||||||||||||||||

|

Customer related intangibles |

4-10 years | $ | 63,091 | $ | (37,573 | ) | $ | 25,518 | ||||||||

|

Technology |

3-10 years | 58,942 | (40,269 | ) | 18,673 | |||||||||||

|

Other intangibles |

— | 5,361 | (5,361 | ) | — | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| $ | 127,394 | $ | (83,203 | ) | $ | 44,191 | ||||||||||

|

|

|

|

|

|

|

|||||||||||

11

Table of Contents

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

Amortization expense of intangibles assets is reflected in the Company’s unaudited condensed consolidated statements of operations as follows:

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||

| (in thousands) | 2017 | 2016 | 2017 | 2016 | ||||||||||||

|

Cost of revenue |

$ | 1,305 | $ | 1,638 | $ | 2,639 | $ | 2,984 | ||||||||

|

Operating expenses |

1,869 | 1,966 | 3,735 | 3,585 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Total amortization expense |

$ | 3,174 | $ | 3,604 | $ | 6,374 | $ | 6,569 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Future estimated amortization expense related to intangible assets as of June 30, 2017 is as follows:

| (in thousands) | ||||

|

Remainder of 2017 |

$ | 5,953 | ||

|

2018 |

11,343 | |||

|

2019 |

5,551 | |||

|

2020 |

2,655 | |||

|

2021 |

2,631 | |||

|

2022 and thereafter |

9,711 | |||

|

|

|

|||

| $ | 37,844 | |||

|

|

|

|||

8. ACCRUED EXPENSES

| (in thousands) |

June 30,

2017 |

December 31,

2016 |

||||||

|

Professional services contractor fees |

$ | 7,125 | $ | 6,550 | ||||

|

Other taxes |

5,338 | 9,031 | ||||||

|

Marketing and sales program expenses |

5,188 | 1,508 | ||||||

|

Professional fees |

3,276 | 3,654 | ||||||

|

Other |

3,084 | 2,411 | ||||||

|

Self-insurance health and dental claims |

2,523 | 2,182 | ||||||

|

Fixed assets in progress |

2,417 | 855 | ||||||

|

Dividends payable |

2,328 | 2,298 | ||||||

|

Employee reimbursable expenses |

2,120 | 1,624 | ||||||

|

Short-term deferred rent |

1,954 | 1,770 | ||||||

|

Partner commissions |

1,748 | 2,199 | ||||||

|

Income taxes payable |

1,038 | 1,391 | ||||||

|

Restructuring |

98 | 105 | ||||||

|

Acquisition-related expenses and merger consideration |

— | 290 | ||||||

|

Foreign currency forward contracts |

— | 883 | ||||||

|

|

|

|

|

|||||

| $ | 38,237 | $ | 36,751 | |||||

|

|

|

|

|

|||||

12

Table of Contents

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

9. DEFERRED REVENUE

| (in thousands) |

June 30,

2017 |

December 31,

2016 |

||||||

|

Term license |

$ | 6,294 | $ | 15,843 | ||||

|

Perpetual license |

24,709 | 23,189 | ||||||

|

Maintenance |

111,759 | 112,397 | ||||||

|

Cloud |

17,677 | 13,604 | ||||||

|

Services |

9,487 | 10,614 | ||||||

|

|

|

|

|

|||||

|

Current deferred revenue |

169,926 | 175,647 | ||||||

|

Term license |

— | — | ||||||

|

Perpetual license |

5,833 | 7,909 | ||||||

|

Maintenance |

1,465 | 1,802 | ||||||

|

Cloud |

1,133 | 1,278 | ||||||

|

|

|

|

|

|||||

|

Long-term deferred revenue |

8,431 | 10,989 | ||||||

|

|

|

|

|

|||||

| $ | 178,357 | $ | 186,636 | |||||

|

|

|

|

|

|||||

10. STOCK-BASED COMPENSATION

Stock-based compensation expense is reflected in the Company’s unaudited condensed consolidated statements of operations as follows:

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||

| (in thousands) | 2017 | 2016 | 2017 | 2016 | ||||||||||||

|

Cost of revenues |

$ | 3,677 | $ | 2,914 | $ | 7,299 | $ | 5,594 | ||||||||

|

Operating expenses |

$ | 10,255 | $ | 7,967 | $ | 19,141 | $ | 14,222 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Total stock-based compensation before tax |

$ | 13,932 | $ | 10,881 | $ | 26,440 | $ | 19,816 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Income tax benefit |

$ | (4,287 | ) | $ | (3,085 | ) | $ | (8,102 | ) | $ | (5,690 | ) | ||||

During the six months ended June 30, 2017, the Company issued approximately 1,068,000 shares of common stock to its employees and 13,000 shares of common stock to its non-employee directors under the Company’s stock-based compensation plans.

During the six months ended June 30, 2017, the Company granted approximately 954,000 restricted stock units (“RSUs”) and 1,441,000 non-qualified stock options to its employees with total fair values of approximately $41.9 million and $19.2 million, respectively. This includes approximately 175,000 RSUs which were granted in connection with the election by employees to receive 50% of their 2017 target incentive compensation under the Company’s Corporate Incentive Compensation Plan in the form of RSUs instead of cash. Stock-based compensation of approximately $7.7 million associated with this RSU grant will be recognized over a one-year period beginning on the grant date.

The Company recognizes stock based compensation on the accelerated recognition method, treating each vesting tranche as if it were an individual grant. As of June 30, 2017, the Company had approximately $64.7 million of unrecognized stock-based compensation expense, net of estimated forfeitures, related to all unvested RSUs and unvested stock options that is expected to be recognized over a weighted-average period of 2.1 years.

13

Table of Contents

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

11. EARNINGS PER SHARE

Basic earnings per share is computed using the weighted-average number of common shares outstanding during the applicable period. Diluted earnings per share is computed using the weighted-average number of common shares outstanding during the applicable period, plus the dilutive effect of outstanding options and RSUs, using the treasury stock method. Certain shares related to some of the Company’s outstanding stock options and RSUs were excluded from the computation of diluted earnings per share because they were anti-dilutive in the periods presented, but could be dilutive in the future.

The calculation of the Company’s basic and diluted earnings per share is as follows:

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||

| (in thousands, except per share amounts) | 2017 | 2016 | 2017 | 2016 | ||||||||||||

|

Basic |

||||||||||||||||

|

Net income |

$ | 11,406 | $ | 4,536 | $ | 38,427 | $ | 14,936 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Weighted-average common shares outstanding |

77,313 | 76,318 | 77,039 | 76,347 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Earnings per share, basic |

$ | 0.15 | $ | 0.06 | $ | 0.50 | $ | 0.20 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Diluted |

||||||||||||||||

|

Net income |

$ | 11,406 | $ | 4,536 | $ | 38,427 | $ | 14,936 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Weighted-average effect of dilutive securities: |

||||||||||||||||

|

Stock options |

3,694 | 1,924 | 3,439 | 1,808 | ||||||||||||

|

RSUs |

1,938 | 1,180 | 1,934 | 1,174 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Effect of assumed exercise of stock options and RSUs |

5,632 | 3,104 | 5,373 | 2,982 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Weighted-average common shares outstanding, assuming dilution |

82,945 | 79,422 | 82,412 | 79,329 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Earnings per share, diluted |

$ | 0.14 | $ | 0.06 | $ | 0.47 | $ | 0.19 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Outstanding stock options and RSUs excluded as impact would be anti-dilutive |

237 | 315 | 276 | 404 | ||||||||||||

12. GEOGRAPHIC INFORMATION AND MAJOR CLIENTS

Geographic Information

Operating segments are defined as components of an enterprise, about which separate financial information is available that is evaluated regularly by the chief operating decision maker (“CODM”) in deciding how to allocate resources and in assessing performance.

The Company develops and licenses software applications for customer engagement and its Pega ® Platform, and provides consulting services, maintenance, and training related to its offerings. The Company derives substantially all of its revenue from the sale and support of one group of similar products and services—software that provides case management, business process management, and real-time decisioning solutions to improve customer engagement and operational excellence in the enterprise applications market. To assess performance, the Company’s CODM, who is the chief executive officer, reviews financial information on a consolidated basis. Therefore, the Company determined it has one reportable segment—Customer Engagement Solutions and one reporting unit.

14

Table of Contents

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

The Company’s international revenue is from clients based outside of the U.S. The Company derived its revenue from the following geographic areas:

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | 2017 | 2016 | ||||||||||||||||||||||||||||

|

U.S. |

$ | 118,447 | 60 | % | $ | 103,547 | 55 | % | $ | 256,056 | 60 | % | $ | 196,775 | 53 | % | ||||||||||||||||

|

Other Americas |

12,086 | 6 | % | 15,983 | 8 | % | 21,577 | 5 | % | 41,542 | 12 | % | ||||||||||||||||||||

|

U.K. |

19,228 | 10 | % | 31,336 | 17 | % | 49,418 | 12 | % | 55,691 | 15 | % | ||||||||||||||||||||

|

Other EMEA (1) |

27,395 | 13 | % | 22,391 | 12 | % | 49,241 | 12 | % | 43,658 | 12 | % | ||||||||||||||||||||

|

Asia Pacific |

20,824 | 11 | % | 15,739 | 8 | % | 44,935 | 11 | % | 30,188 | 8 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| $ | 197,980 | 100 | % | $ | 188,996 | 100 | % | $ | 421,227 | 100 | % | $ | 367,854 | 100 | % | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (1) | Includes Europe, the Middle East and Africa, but excludes the United Kingdom. |

Major Clients

No client accounted for 10% or more of the Company’s total revenue during the three and six months ended June 30, 2017 or 2016.

No client accounted for 10% or more of the Company’s total outstanding trade receivables as of June 30, 2017 or December 31, 2016.

15

Table of Contents

Forward-Looking Statements

This Quarterly Report on Form 10-Q contains or incorporates forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements about our future financial performance and business plans, the adequacy of our liquidity and capital resources, the continued payment of quarterly dividends by the Company, and the timing of revenue recognition under existing license and cloud arrangements and are described more completely in Part I of our Annual Report on Form 10-K for the year ended December 31, 2016. These forward-looking statements are based on current expectations, estimates, forecasts, and projections about the industry and markets in which we operate, and management’s beliefs and assumptions. In addition, other written or oral statements that constitute forward-looking statements may be made by us or on our behalf. Words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “could,” “estimate,” “may,” “target,” “strategy,” “is intended to,” “project,” “guidance,” “likely,” “usually,” or variations of such words and similar expressions are intended to identify such forward-looking statements.

These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions that are difficult to predict. Important factors that could cause actual future activities and results to differ materially from those expressed in such forward-looking statements include, among others, variation in demand for our products and services and the difficulty in predicting the completion of product acceptance and other factors affecting the timing of license revenue recognition; the ongoing consolidation in the financial services, insurance, healthcare, and communications markets; reliance on third party relationships; the potential loss of vendor specific objective evidence for our consulting services; the inherent risks associated with international operations and the continued uncertainties in international economies; foreign currency exchange rates; the financial impact of the Company’s past acquisitions and any future acquisitions; the potential legal and financial liabilities and reputation damage due to cyber-attacks and security breaches; and management of the Company’s growth. These risks, and other factors that could cause actual results to differ materially from those expressed in such forward-looking statements, are described more completely in Item 1A of Part I of our Annual Report on Form 10-K for the year ended December 31, 2016. We have no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or risks. New information, future events or risks may cause the forward-looking events we discuss in this report not to occur or to materially change.

Business overview

We develop, market, license, and support software applications for marketing, sales, service, and operations. In addition, we license our Pega ® Platform for clients that wish to build and extend their own applications. The Pega Platform assists our clients in building, deploying, and evolving enterprise applications, creating an environment in which business and IT can collaborate to manage back office operations, front office sales, marketing, and/or customer service needs. We also provide consulting services, maintenance, and training for our software. Our software applications and Pega Platform can be deployed on Pega, partner, or customer-managed cloud architectures.

Our clients include Global 3000 companies and government agencies that seek to manage complex enterprise systems and customer service issues with greater agility and cost-effectiveness. Our strategy is to sell a client a series of licenses, each focused on a specific purpose or area of operations in support of longer term enterprise-wide digital transformation initiatives.

Our license revenue is primarily derived from sales of our applications and our Pega Platform. Our cloud revenue is derived from the licensing of our hosted Pega Platform and software application environments. Our consulting services revenue is primarily related to new license implementations.

Financial and Performance Metrics

To provide additional insight into how management evaluates our financial performance, we have used a number of performance metrics to supplement our selected financial metrics. These performance metrics are periodically revisited to reflect any changes in our business. Historically, Recurring Revenue and License and Cloud Backlog have been our primary performance metrics. However, due to the change in the revenue recognition patterns of term license arrangements as a result of the expected implementation of the new revenue accounting standard (ASC 606 “Revenue from Contracts with Customers”) in the first quarter of 2018, we have started tracking the performance measure Annualized Contract Value (“ACV”). The change in ACV measures the growth and predictability of future cash flows from committed term license, cloud, and maintenance arrangements as of the end of the particular reporting period. Additional information about our future adoption of the new revenue standard and its impact can be found in Note 2. “New Accounting Pronouncements” contained elsewhere in this Quarterly Report on Form 10-Q.

16

Table of Contents

Selected Financial Metrics

|

(Dollars in thousands, except per share amounts) |

Three Months Ended

June 30, |

Change |

Six Months Ended

June 30, |

|||||||||||||||||||||||||||||

| 2017 | 2016 | 2017 | 2016 | Change | ||||||||||||||||||||||||||||

|

Total revenue |

197,980 | 188,996 | 8,984 | 5 | % | 421,227 | 367,854 | 53,373 | 15 | % | ||||||||||||||||||||||

|

Operating margin |

1 | % | 3 | % | 8 | % | 6 | % | ||||||||||||||||||||||||

|

Diluted earnings per share |

0.14 | 0.06 | 0.08 | 133 | % | $ | 0.47 | $ | 0.19 | $ | 0.28 | 147 | % | |||||||||||||||||||

|

Cash flow provided by operating activities |

85,769 | 11,569 | 74,200 | 641 | % | |||||||||||||||||||||||||||

Recurring Revenue

A measure of the predictability and repeatability of our revenue.

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||||||||||

|

Recurring revenue: |

||||||||||||||||||||||||||||||||

|

Term license |

30,782 | 18,864 | 84,492 | 73,196 | ||||||||||||||||||||||||||||

|

Maintenance |

59,590 | 55,161 | 118,555 | 108,136 | ||||||||||||||||||||||||||||

|

Cloud |

12,733 | 11,269 | 23,560 | 19,767 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Total recurring revenue |

103,105 | 85,294 | $ | 17,811 | 21 | % | 226,607 | 201,099 | $ | 25,508 | 13 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Recurring revenue as a percent of total revenue |

52 | % | 45 | % | 54 | % | 55 | % | ||||||||||||||||||||||||

The increase in recurring revenue was primarily driven by increased term license revenue recognized from term backlog and a large term license renewal for which the first year of the term was prepaid and recognized as revenue in the three months ended June 30, 2017. The increase in term revenue would have been greater if not for a large term deal greater than $10 million for which the license fee for the full license term was recognized in the first quarter of 2016.

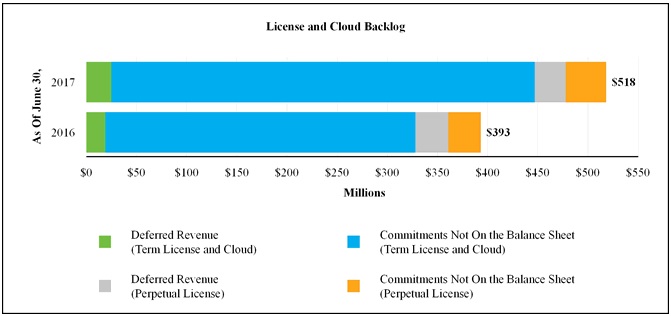

License and Cloud Backlog

A measure of the continued growth of our business as a result of future contractual commitments by our clients.

It is computed by adding deferred license and cloud revenue recorded on the balance sheet (See Note 9 “Deferred Revenue”) and client license and cloud contractual commitments, which are not recorded on our balance sheet because we have not yet invoiced our clients, nor have we recognized the associated revenues (See “Future Cash Receipts from Committed License and Cloud Arrangements” which can be found in “Liquidity and Capital Resources” contained elsewhere in this Quarterly Report on Form 10-Q for additional information). License and cloud backlog may vary in any given period depending on the amount and timing of when the arrangements are executed, as well as the mix between perpetual, term, and cloud license arrangements, which may depend on our clients’ deployment preferences.

| June 30, | ||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | |||||||||||||||||

|

Deferred license and cloud revenue on the balance sheet: |

||||||||||||||||||||

|

Term license and cloud |

$ | 25,104 | 45 | % | $ | 19,021 | 37 | % | 32 | % | ||||||||||

|

Perpetual license |

30,542 | 55 | % | 32,834 | 63 | % | (7 | )% | ||||||||||||

|

|

|

|

|

|||||||||||||||||

|

Total deferred license and cloud revenue |

55,646 | 100 | % | 51,855 | 100 | % | 7 | % | ||||||||||||

|

|

|

|

|

|||||||||||||||||

|

License and cloud contractual commitments not on the balance sheet: |

||||||||||||||||||||

|

Term license and cloud |

422,414 | 91 | % | 309,338 | 91 | % | 37 | % | ||||||||||||

|

Perpetual license |

39,949 | 9 | % | 31,439 | 9 | % | 27 | % | ||||||||||||

|

|

|

|

|

|||||||||||||||||

|

Total license and cloud commitments |

462,363 | 100 | % | 340,777 | 100 | % | 36 | % | ||||||||||||

|

|

|

|

|

|||||||||||||||||

|

Total license (term and perpetual) and cloud backlog |

$ | 518,009 | $ | 392,632 | 32 | % | ||||||||||||||

|

|

|

|

|

|||||||||||||||||

|

Total term license and cloud backlog |

447,518 | 86 | % | 328,359 | 84 | % | 36 | % | ||||||||||||

|

|

|

|

|

|||||||||||||||||

17

Table of Contents

Annualized Contract Value (“ACV” )

The change in ACV measures the growth and predictability of future cash flows from committed term license, cloud, and maintenance arrangements as of the end of the particular reporting period.

ACV is the sum of the following two components:

| • | Term and Cloud contract value divided by the number of committed contract years |

| • | Quarterly Maintenance revenue reported for the three months ended multiplied by 4. |

Critical accounting policies

Management’s Discussion and Analysis of Financial Condition and Results of Operations is based upon our unaudited condensed consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the U.S. and the rules and regulations of the SEC for interim financial reporting. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues, and expenses, and the related disclosure of contingent assets and liabilities. We base our estimates and judgments on historical experience, knowledge of current conditions, and expectations of what could occur in the future given available information.

18

Table of Contents

There have been no changes in our critical accounting policies as disclosed in our Annual Report on Form 10-K for the year ended December 31, 2016. For more information regarding our critical accounting policies, we encourage you to read the discussion contained in Item 7 under the heading “Critical Accounting Estimates and Significant Judgments” and Note 2 “Significant Accounting Policies” included in the notes to the Consolidated Financial Statements contained in our Annual Report on Form 10-K for the year ended December 31, 2016.

Results of Operations

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||||||||||

|

Total revenue |

$ | 197,980 | $ | 188,996 | $ | 8,984 | 5 | % | $ | 421,227 | $ | 367,854 | $ | 53,373 | 15 | % | ||||||||||||||||

|

Gross profit |

$ | 130,105 | $ | 128,896 | $ | 1,209 | 1 | % | $ | 285,262 | $ | 251,244 | $ | 34,018 | 14 | % | ||||||||||||||||

|

Total operating expenses |

$ | 128,355 | $ | 122,536 | $ | 5,819 | 5 | % | $ | 252,274 | $ | 230,759 | $ | 21,515 | 9 | % | ||||||||||||||||

|

Income from operations |

$ | 1,750 | $ | 6,360 | $ | (4,610 | ) | (72 | )% | $ | 32,988 | $ | 20,485 | $ | 12,503 | 61 | % | |||||||||||||||

|

Operating margin |

1 | % | 3 | % | 8 | % | 6 | % | ||||||||||||||||||||||||

|

Income before (benefit)/provision for income taxes |

$ | 1,560 | $ | 5,498 | $ | (3,938 | ) | (72 | )% | $ | 33,360 | $ | 18,991 | $ | 14,369 | 76 | % | |||||||||||||||

Revenue

Software license revenue

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||||||||||||||||||||||||||

|

Perpetual license |

$ | 30,255 | 50 | % | $ | 51,807 | 73 | % | $ | (21,552 | ) | (42 | )% | $ | 68,935 | 45 | % | $ | 65,820 | 47 | % | $ | 3,115 | 5 | % | |||||||||||||||||||||||

|

Term license |

30,782 | 50 | % | 18,864 | 27 | % | 11,918 | 63 | % | 84,492 | 55 | % | 73,196 | 53 | % | 11,296 | 15 | % | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

Total license revenue |

$ | 61,037 | 100 | % | $ | 70,671 | 100 | % | $ | (9,634 | ) | (14 | )% | $ | 153,427 | 100 | % | $ | 139,016 | 100 | % | $ | 14,411 | 10 | % | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

The mix between perpetual and term license arrangements executed in a particular period varies based on client needs. A change in the mix may cause our revenues to vary materially from period to period. A higher proportion of term license arrangements executed would generally result in more license revenue being recognized over longer periods. Additionally, some of our perpetual license arrangements include extended payment terms or additional rights of use, which may also result in the recognition of revenue over longer periods.

The decrease in perpetual license revenue in the three months ended June 30, 2017 was primarily due to a lower percentage of perpetual arrangements executed and recognized in revenue in the current period and a decrease in the average value of perpetual arrangements executed. The increase in perpetual license revenue in the six months ended June 30, 2017 was primarily due to the higher value of perpetual arrangements executed and higher percentage of perpetual arrangements recognized in revenue during the three months ended March 31, 2017 compared to the three months ended March 31, 2016.

The increase in term license revenue in the three months ended June 30, 2017 was primarily due to an increase in revenue from term license backlog and a large term license renewal for which the first year of the term was prepaid and recognized as revenue in the three months ended June 30, 2017. The increase in term license revenue in the six months ended June 30, 2017 was primarily due to revenue from term license backlog and a term license renewal for which the first year of the term was prepaid and recognized as revenue in the three months ended June 30, 2017, partially offset by the effect of a large three year term license arrangement which was paid in advance and recognized in full in the three months ended March 31, 2016.

The aggregate value of future revenue expected to be recognized under all noncancellable perpetual licenses was $39.9 million as of June 30, 2017 compared to $31.4 million as of June 30, 2016. We expect to recognize $14.6 million of the $39.9 million as revenue during the remainder of 2017. The aggregate value of future revenue expected to be recognized under all noncancellable term and cloud licenses was $422.4 million as of June 30, 2017 compared to $309.3 million as of June 30, 2016. We expect to recognize $57.1 million of the $422.4 million as revenue during the remainder of 2017. See “Future Cash Receipts from Committed License and Cloud Arrangements” which can be found in “Liquidity and Capital Resources.”

19

Table of Contents

Maintenance revenue

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||||||||||

|

Maintenance |

$ | 59,590 | $ | 55,161 | $ | 4,429 | 8 | % | $ | 118,555 | $ | 108,136 | $ | 10,419 | 10 | % | ||||||||||||||||

The increases were primarily due to the continued growth in the aggregate value of the installed base of our software and continued strong renewal rates significantly in excess of 90%.

Services revenue

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||||||||||||||||||||||||||

|

Consulting services |

$ | 62,660 | 81 | % | $ | 50,258 | 79 | % | $ | 12,402 | 25 | % | $ | 121,912 | 82 | % | $ | 97,434 | 81 | % | $ | 24,478 | 25 | % | ||||||||||||||||||||||||

|

Cloud |

12,733 | 16 | % | 11,269 | 18 | % | 1,464 | 13 | % | 23,560 | 16 | % | 19,767 | 16 | % | 3,793 | 19 | % | ||||||||||||||||||||||||||||||

|

Training |

1,960 | 3 | % | 1,637 | 3 | % | 323 | 20 | % | 3,773 | 2 | % | 3,501 | 3 | % | 272 | 8 | % | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

Total services |

$ | 77,353 | 100 | % | $ | 63,164 | 100 | % | $ | 14,189 | 22 | % | $ | 149,245 | 100 | % | $ | 120,702 | 100 | % | $ | 28,543 | 24 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

Consulting services revenue is primarily generated from new license implementations. Our consulting services revenue may fluctuate in future periods depending on the mix of new implementation projects we perform as compared to those performed by our enabled clients or led by our partners.

The increases in consulting services revenue were primarily due to higher billable hours during the three and six months ended June 30, 2017 driven by a large project which began in the second half of 2016.

Cloud revenue represents revenue from our Pega Cloud offerings. The increases in cloud revenue were primarily due to continued growth of our cloud client base.

Gross profit

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||||||||||

|

Software license |

$ | 59,787 | $ | 69,359 | $ | (9,572 | ) | (14 | )% | $ | 150,877 | $ | 136,683 | $ | 14,194 | 10 | % | |||||||||||||||

|

Maintenance |

52,579 | 48,846 | 3,733 | 8 | % | 104,326 | 95,906 | 8,420 | 9 | % | ||||||||||||||||||||||

|

Services |

17,739 | 10,691 | 7,048 | 66 | % | 30,059 | 18,655 | 11,404 | 61 | % | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Total gross profit |

$ | 130,105 | $ | 128,896 | $ | 1,209 | 1 | % | $ | 285,262 | $ | 251,244 | $ | 34,018 | 14 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Total gross profit % |

66 | % | 68 | % | 68 | % | 68 | % | ||||||||||||||||||||||||

|

Software license gross profit % |

98 | % | 98 | % | 98 | % | 98 | % | ||||||||||||||||||||||||

|

Maintenance gross profit % |

88 | % | 89 | % | 88 | % | 89 | % | ||||||||||||||||||||||||

|

Services gross profit % |

23 | % | 17 | % | 20 | % | 15 | % | ||||||||||||||||||||||||

The increase in total gross profit was primarily due to increased total revenue.

The increase in service gross profit percent was driven by a large project which began in the second half of 2016.

Operating expenses

Selling and marketing

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||||||||||

|

Selling and marketing |

$ | 75,887 | $ | 74,016 | $ | 1,871 | 3 | % | $ | 147,175 | $ | 135,094 | $ | 12,081 | 9 | % | ||||||||||||||||

|

As a percent of total revenue |

38 | % | 39 | % | 35 | % | 37 | % | ||||||||||||||||||||||||

|

Selling and marketing headcount at June 30 |

916 | 855 | 61 | 7 | % | |||||||||||||||||||||||||||

20

Table of Contents

Selling and marketing expenses include compensation, benefits, and other headcount-related expenses associated with our selling and marketing personnel as well as advertising, promotions, trade shows, seminars, and other programs. Selling and marketing expenses also include the amortization of customer related intangibles.

The increase in the three and six months ended June 30, 2017 was primarily due to increases in compensation and benefits of $3 million and $10.7 million, respectively, driven by increased head count and equity compensation partially offset by decreases in brand marketing program expenses of approximately $2.2 million in both periods.

The increase in headcount reflects our efforts to increase our sales capacity to target new accounts in existing industries, as well as to expand coverage in new industries and geographies and to increase the number of our sales opportunities.

Research and development

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||||||||||

|

Research and development |

$ | 39,762 | $ | 35,574 | $ | 4,188 | 12 | % | $ | 80,058 | $ | 70,494 | $ | 9,564 | 14 | % | ||||||||||||||||

|

As a percent of total revenue |

20 | % | 19 | % | 19 | % | 19 | % | ||||||||||||||||||||||||

|

Research and development headcount at June 30 |

1,455 | 1,374 | 81 | 6 | % | |||||||||||||||||||||||||||

Research and development expenses include compensation, benefits, contracted services, and other headcount-related expenses associated with the creation and development of our products, as well as enhancements and design changes to existing products and integration of acquired technologies.

The increases were due to higher compensation and benefits expense driven by increased head count and equity compensation.

General and administrative

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||||||||||

|

General and administrative |

$ | 12,706 | $ | 11,294 | $ | 1,412 | 13 | % | $ | 25,041 | $ | 22,342 | $ | 2,699 | 12 | % | ||||||||||||||||

|

As a percent of total revenue |

6 | % | 6 | % | 6 | % | 6 | % | ||||||||||||||||||||||||

|

General and administrative headcount at June 30 |

401 | 378 | 23 | 6 | % | |||||||||||||||||||||||||||

General and administrative expenses include compensation, benefits, and other headcount-related expenses associated with finance, legal, corporate governance, and other administrative headcount. They also include accounting, legal, and other professional consulting and administrative fees. The general and administrative headcount includes employees in human resources, information technology, and corporate services departments whose costs are partially allocated to other operating expense areas.

The increase in the three and six months ended June 30, 2017 was primarily due to increases in compensation and benefits of $1.4 million and $3.5 million, respectively, caused by increased head count and equity compensation, partially offset in six months ended June 30, 2017 by a decrease of $1.5 million in legal fees.

Stock-based compensation

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||||||||||

|

Cost of revenues |

$ | 3,677 | $ | 2,914 | $ | 763 | 26 | % | $ | 7,299 | $ | 5,594 | $ | 1,705 | 30 | % | ||||||||||||||||

|

Operating expenses |

10,255 | 7,967 | 2,288 | 29 | % | 19,141 | 14,222 | 4,919 | 35 | % | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Total stock-based compensation before tax |

$ | 13,932 | $ | 10,881 | $ | 3,051 | 28 | % | $ | 26,440 | $ | 19,816 | $ | 6,624 | 33 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Income tax benefit |

$ | (4,287 | ) | $ | (3,085 | ) | $ | (8,102 | ) | $ | (5,690 | ) | ||||||||||||||||||||

The increases were primarily due to the increased value of our annual periodic equity awards granted in March 2016 and 2017. These awards generally have a five-year vesting schedule.

21

Table of Contents

Amortization of intangibles

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||||||||||

|

Cost of revenue |

$ | 1,305 | $ | 1,638 | $ | (333 | ) | (20 | )% | $ | 2,639 | $ | 2,984 | $ | (345 | ) | (12 | )% | ||||||||||||||

|

Operating expenses |

1,869 | 1,966 | (97 | ) | (5 | )% | 3,735 | 3,585 | 150 | 4 | % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| $ | 3,174 | $ | 3,604 | $ | (430 | ) | (12 | )% | $ | 6,374 | $ | 6,569 | $ | (195 | ) | (3 | )% | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

The decrease in amortization of intangibles in the three and six months ended June 30, 2017 was due to the amortization in full of certain intangibles acquired through past acquisitions.

Non-operating income and expenses, net

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||||||||||

|

Foreign currency transaction (loss) gain |

$ | (917 | ) | $ | 306 | $ | (1,223 | ) | (400 | )% | $ | (241 | ) | $ | 1,682 | $ | (1,923 | ) | (114 | )% | ||||||||||||

|

Interest income, net |

161 | 188 | $ | (27 | ) | (14 | )% | 326 | 478 | (152 | ) | (32 | )% | |||||||||||||||||||

|

Other income (expense), net |

566 | (1,356 | ) | $ | 1,922 | (142 | )% | 287 | (3,654 | ) | 3,941 | (108 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|