|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

|

Form 10-K

|

|

THE PROCTER & GAMBLE COMPANY

|

|

One Procter & Gamble Plaza, Cincinnati, Ohio 45202

|

|

Telephone (513) 983-1100

|

|

IRS Employer Identification No. 31-0411980

|

|

State of Incorporation: Ohio

|

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Stock, without Par Value

|

New York Stock Exchange, NYSE Euronext-Paris

|

|

|

Total Number of Employees

|

||

|

2012

|

126,000

|

|

|

2011

|

129,000

|

|

|

2010

|

127,000

|

|

|

2009

|

132,000

|

|

|

2008

|

135,000

|

|

|

2007

|

135,000

|

|

|

|

2012

|

|

2011

|

|

2010

|

|||

|

North America

(1)

|

39

|

%

|

|

41

|

%

|

|

42

|

%

|

|

Western Europe

|

19

|

%

|

|

20

|

%

|

|

20

|

%

|

|

Asia

|

18

|

%

|

|

16

|

%

|

|

15

|

%

|

|

Latin America

|

10

|

%

|

|

9

|

%

|

|

9

|

%

|

|

CEEMEA

(2)

|

14

|

%

|

|

14

|

%

|

|

14

|

%

|

|

(1)

|

North America includes results for the United States and Canada only.

|

|

(2)

|

CEEMEA includes Central and Eastern Europe, Middle East and Africa.

|

|

United States

|

International

|

|

|

Net Sales (for the year ended June 30)

|

||

|

2012

|

$29.5

|

$54.2

|

|

2011

|

$29.9

|

$51.2

|

|

2010

|

$29.5

|

$48.1

|

|

Assets (as of June 30)

|

||

|

2012

|

$68.0

|

$64.2

|

|

2011

|

$70.3

|

$68.1

|

|

2010

|

$70.1

|

$58.1

|

|

•

|

compliance with U.S. laws affecting operations outside of the United States, such as the Foreign Corrupt Practices Act;

|

|

•

|

compliance with a variety of local regulations and laws;

|

|

•

|

changes in tax laws and the interpretation of those laws;

|

|

•

|

sudden changes in foreign currency exchange controls;

|

|

•

|

discriminatory or conflicting fiscal policies;

|

|

•

|

difficulties enforcing intellectual property and

|

|

•

|

greater risk of uncollectible accounts and longer collection cycles;

|

|

•

|

effective and immediate implementation of control environment processes across our diverse operations and employee base; and

|

|

•

|

imposition of more or new tariffs, quotas, trade barriers and similar restrictions on our sales outside the United States.

|

|

•

|

ordering and managing materials from suppliers;

|

|

•

|

converting materials to finished products;

|

|

•

|

shipping product to customers;

|

|

•

|

marketing and selling products to consumers;

|

|

•

|

collecting and storing customer, consumer, employee, investor, and other stakeholder information and personal data;

|

|

•

|

processing transactions;

|

|

•

|

summarizing and reporting results of operations;

|

|

•

|

hosting, processing, and sharing confidential and proprietary research, business plans, and financial information;

|

|

•

|

complying with regulatory, legal or tax requirements;

|

|

•

|

providing data security; and

|

|

•

|

handling other processes necessary to manage our business.

|

|

Name

|

|

Position

|

|

Age

|

|

First Elected to

Officer Position

|

|

|

Robert A. McDonald

|

|

Chairman of the Board, President and

Chief Executive Officer

|

|

59

|

|

|

1999

|

|

|

Director since July 1, 2009

|

|

|

||||

|

Jon R. Moeller

|

|

Chief Financial Officer

|

|

48

|

|

|

2009

|

|

Werner Geissler

|

|

Vice Chairman-Global Operations

|

|

59

|

|

|

2007

|

|

E. Dimitri Panayotopoulos

|

|

Vice Chairman-Global Business Units

|

|

60

|

|

|

2007

|

|

Bruce Brown

|

|

Chief Technology Officer

|

|

54

|

|

|

2008

|

|

Robert L. Fregolle, Jr.

|

|

Global Customer Business Development Officer

|

|

55

|

|

|

2009

|

|

Deborah P. Majoras

|

|

Chief Legal Officer and Secretary

|

|

48

|

|

|

2010

|

|

Moheet Nagrath

|

|

Global Human Resources Officer

|

|

53

|

|

|

2008

|

|

Filippo Passerini

|

|

Group President-Global Business Services and

Chief Information Officer

|

|

55

|

|

|

2003

|

|

Marc S. Pritchard

|

|

Global Brand Building Officer

|

|

52

|

|

|

2008

|

|

Valarie L. Sheppard

|

|

Senior Vice President & Comptroller

|

|

48

|

|

|

2005

|

|

Ioannis Skoufalos

|

Global Product Supply Officer

|

55

|

|

2011

|

|||

|

Period

|

|

Total Number of

Shares Purchased

(1

)

|

Average Price

Paid per Share

(2)

|

|

Total Number of

Shares Purchased as

Part of Publicly

Announced Plans or

Programs

(3)

|

|

Approximate Dollar Value of Shares That May Yet be Purchased Under our Share Repurchase Program

|

|

|

4/1/2012 - 4/30/2012

|

235

|

|

$66.95

|

0

|

0

|

|||

|

5/1/2012 - 5/31/2012

|

0

|

|

0

|

0

|

0

|

|||

|

6/1/2012 - 6/30/2012

|

0

|

|

0

|

0

|

0

|

|||

|

(1

|

)

|

The total number of shares purchased was 235 for the quarter. This represents shares acquired by the Company under various compensation and benefit plans. This table excludes shares withheld from employees to satisfy minimum tax withholding requirements on option exercises and other equity-based transactions. The Company administers cashless exercises through an independent, third party broker and does not repurchase stock in connection with cashless exercise.

|

|

(2

|

)

|

Average price paid per share is calculated on a settlement basis and excludes commission.

|

|

(3

|

)

|

On April 27, 2012, the Company stated that fiscal year 2011-12 share repurchases were estimated to be approximately $4.0 billion, notwithstanding any purchases under the Company's compensation and benefit plans. The share repurchases were authorized pursuant to a resolution issued by the Company's Board of Directors and were financed by issuing a combination of long-term and short-term debt. The total dollar value of shares purchased under the share repurchase plan was $4.0 billion. The share repurchase plan expired on June 30, 2012.

|

|

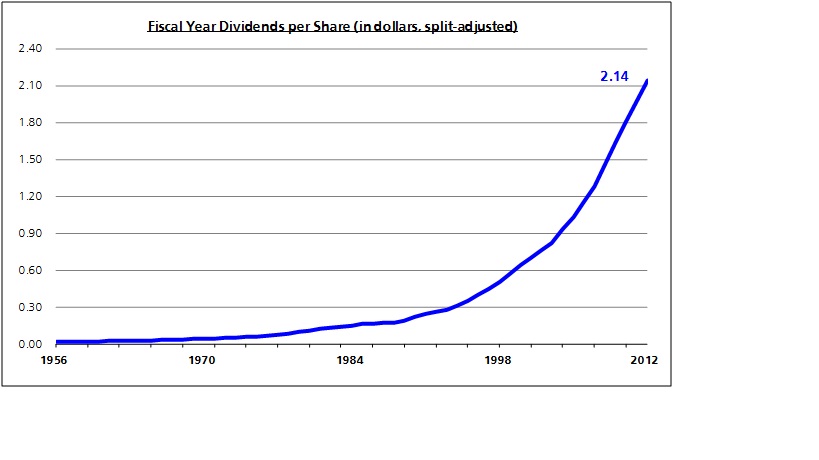

(in dollars; split-adjusted)

|

1956

|

1970

|

1984

|

1998

|

2012

|

|||||

|

Dividends per Share

|

$

|

0.01

|

$

|

0.04

|

$

|

0.15

|

$

|

0.51

|

$

|

2.14

|

|

Quarter Ended

|

2011 - 2012

|

2010 – 2011

|

|||||

|

September 30

|

$

|

0.5250

|

|

$

|

0.4818

|

|

|

|

December 31

|

0.5250

|

|

|

0.4818

|

|

||

|

March 31

|

0.5250

|

|

|

0.4818

|

|

||

|

June 30

|

0.5620

|

|

|

0.5250

|

|

||

|

|

2011 - 2012

|

|

2010 – 2011

|

||||||||||||

|

Quarter Ended

|

High

|

|

Low

|

|

High

|

|

Low

|

||||||||

|

September 30

|

$

|

65.14

|

|

|

$

|

57.56

|

|

|

$

|

63.36

|

|

|

$

|

58.92

|

|

|

December 31

|

66.98

|

|

|

61.00

|

|

|

65.38

|

|

|

59.68

|

|

||||

|

March 31

|

67.95

|

|

|

62.56

|

|

|

66.95

|

|

|

59.70

|

|

||||

|

June 30

|

67.92

|

|

|

59.08

|

|

|

67.72

|

|

|

61.47

|

|

||||

|

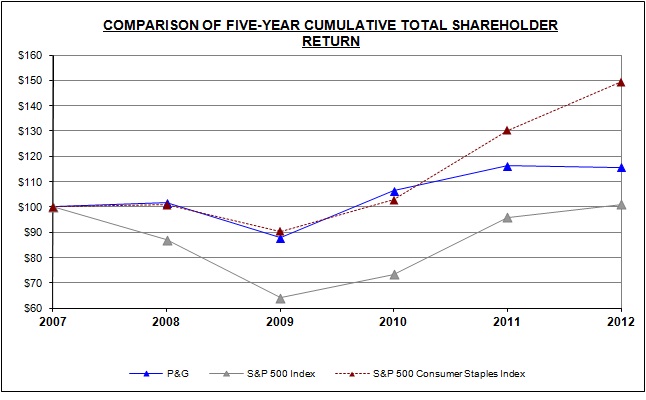

Cumulative Value of $100 Investment, through June 30

|

||||||||||||||||||

|

Company Name/Index

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

||||||||||||

|

P&G

|

$

|

100

|

|

$

|

102

|

|

$

|

88

|

|

$

|

106

|

|

$

|

116

|

|

$

|

116

|

|

|

S&P 500 Index

|

100

|

|

87

|

|

64

|

|

73

|

|

96

|

|

101

|

|

||||||

|

S&P 500 Consumer Staples Index

|

100

|

|

101

|

|

90

|

|

103

|

|

130

|

|

149

|

|

||||||

|

Amounts in millions, except per share amounts

|

2012

|

|

2011

|

|

2010

|

|

2009

|

|

2008

|

|

2007

|

||||||||||||

|

Net Sales

|

$

|

83,680

|

|

|

$

|

81,104

|

|

|

$

|

77,567

|

|

|

$

|

75,295

|

|

|

$

|

77,714

|

|

|

$

|

71,095

|

|

|

Gross Profit

|

41,289

|

|

|

41,245

|

|

|

40,525

|

|

|

37,644

|

|

|

39,534

|

|

|

36,607

|

|

||||||

|

Operating Income

|

13,292

|

|

|

15,495

|

|

|

15,732

|

|

|

15,188

|

|

|

15,743

|

|

|

14,236

|

|

||||||

|

Net Earnings from Continuing Operations

|

9,317

|

|

|

11,698

|

|

|

10,851

|

|

|

10,645

|

|

|

11,224

|

|

|

9,562

|

|

||||||

|

Net Earnings from Discontinued Operations

|

1,587

|

|

|

229

|

|

|

1,995

|

|

|

2,877

|

|

|

930

|

|

|

847

|

|

||||||

|

Net Earnings attributable to Procter & Gamble

|

10,756

|

|

|

11,797

|

|

|

12,736

|

|

|

13,436

|

|

|

12,075

|

|

|

10,340

|

|

||||||

|

Net Earnings Margin from Continuing Operations

|

11.1

|

%

|

|

14.4

|

%

|

|

14.0

|

%

|

|

14.1

|

%

|

|

14.4

|

%

|

|

13.4

|

%

|

||||||

|

Basic Net Earnings per Common Share

(1)

:

|

|

|

|

|

|

||||||||||||||||||

|

Earnings from continuing operations

|

$

|

3.24

|

|

|

$

|

4.04

|

|

|

$

|

3.63

|

|

|

$

|

3.51

|

|

|

$

|

3.56

|

|

|

$

|

2.95

|

|

|

Earnings from discontinued operations

|

0.58

|

|

|

0.08

|

|

|

0.69

|

|

|

0.98

|

|

|

0.30

|

|

|

0.27

|

|

||||||

|

Basic Net Earnings per Common Share

|

3.82

|

|

|

4.12

|

|

|

4.32

|

|

|

4.49

|

|

|

3.86

|

|

|

3.22

|

|

||||||

|

Diluted Net Earnings per Common Share

(1)

:

|

|

|

|

|

|

||||||||||||||||||

|

Earnings from continuing operations

|

3.12

|

|

|

3.85

|

|

|

3.47

|

|

|

3.35

|

|

|

3.36

|

|

|

2.79

|

|

||||||

|

Earnings from discontinued operations

|

0.54

|

|

|

0.08

|

|

|

0.64

|

|

|

0.91

|

|

|

0.28

|

|

|

0.25

|

|

||||||

|

Diluted Net Earnings per Common Share

|

3.66

|

|

|

3.93

|

|

|

4.11

|

|

|

4.26

|

|

|

3.64

|

|

|

3.04

|

|

||||||

|

Dividends per Common Share

|

2.14

|

|

|

1.97

|

|

|

1.80

|

|

|

1.64

|

|

|

1.45

|

|

|

1.28

|

|

||||||

|

Research and Development Expense

|

$

|

2,029

|

|

|

$

|

1,982

|

|

|

$

|

1,931

|

|

|

$

|

1,844

|

|

|

$

|

1,927

|

|

|

$

|

1,809

|

|

|

Advertising Expense

|

9,345

|

|

|

9,210

|

|

|

8,475

|

|

|

7,453

|

|

|

8,426

|

|

|

7,714

|

|

||||||

|

Total Assets

|

132,244

|

|

|

138,354

|

|

|

128,172

|

|

|

134,833

|

|

|

143,992

|

|

|

138,014

|

|

||||||

|

Capital Expenditures

|

3,964

|

|

|

3,306

|

|

|

3,067

|

|

|

3,238

|

|

|

3,046

|

|

|

2,945

|

|

||||||

|

Long-Term Debt

|

21,080

|

|

|

22,033

|

|

|

21,360

|

|

|

20,652

|

|

|

23,581

|

|

|

23,375

|

|

||||||

|

Shareholders' Equity

|

64,035

|

|

|

68,001

|

|

|

61,439

|

|

|

63,382

|

|

|

69,784

|

|

|

67,012

|

|

||||||

|

•

|

Overview

|

|

•

|

Summary of 2012 Results

|

|

•

|

Economic Conditions, Challenges and Risks

|

|

•

|

Results of Operations

|

|

•

|

Segment Results

|

|

•

|

Cash Flow, Financial Condition and Liquidity

|

|

•

|

Significant Accounting Policies and Estimates

|

|

•

|

Other Information

|

|

Reportable Segment

|

% of

Net Sales*

|

% of Net

Earnings*

|

Categories

|

Billion Dollar Brands

|

||

|

Beauty

|

24

|

%

|

22

|

%

|

Antiperspirant and Deodorant, Cosmetics, Hair Care, Hair Color, Personal Cleansing, Prestige Products, Salon Professional, Skin Care

|

Head & Shoulders, Olay, Pantene, SK-II, Wella

|

|

Grooming

|

10

|

%

|

16

|

%

|

Blades and Razors, Electronic Hair Removal Devices, Hair Care Appliances, Pre and Post Shave Products

|

Braun, Fusion, Gillette, Mach3

|

|

Health Care

|

15

|

%

|

17

|

%

|

Feminine Care, Gastrointestinal, Incontinence, Rapid Diagnostics, Respiratory, Toothbrush, Toothpaste, Other Oral Care, Other Personal Health Care, Vitamins/Minerals/Supplements

|

Always, Crest, Oral-B, Vicks

|

|

Fabric Care and Home Care

|

32

|

%

|

26

|

%

|

Bleach and Laundry Additives, Air Care, Batteries, Dish Care, Fabric Enhancers, Laundry Detergents, Pet Care, Professional, Surface Care

|

Ace, Ariel, Dawn, Downy, Duracell, Febreze, Gain, Iams, Tide

|

|

Baby Care and Family Care

|

19

|

%

|

19

|

%

|

Baby Wipes, Diapers and Pants, Paper Towels, Tissues, Toilet Paper

|

Bounty, Charmin, Pampers

|

|

•

|

Grow organic sales 1% to 2% faster than the market grows in the categories and geographies in which we compete,

|

|

•

|

Deliver Core EPS growth of high single digits to low double digits, and

|

|

•

|

Generate free cash flow productivity of 90% or greater.

|

|

•

|

Top 40 Businesses: We define our core business as the top 40 country/category combinations, 20 in Household Care and 20 in Beauty & Grooming, which generate the highest level of annual sales and profit.

|

|

•

|

Top 20 Innovations: Our 20 most important innovations offer significantly higher growth potential than the balance of the innovation portfolio. Therefore, the growth of the Company depends substantially on the success of our biggest innovations.

|

|

•

|

Top 10 Developing Markets: Maintaining the strong growth momentum we have established in developing markets is critical to delivering our near- and long-term growth objectives. We are focusing resources first on the markets that offer the greatest growth opportunity. We will assess the potential for further portfolio expansions beyond the top 10 developing markets based on the top- and bottom-line growth progress of the core business.

|

|

•

|

Reduction in overhead spending, with a target of approximately 5,700 non-manufacturing overhead positions by the end of fiscal year 2013.

|

|

•

|

Annual savings planned in cost of goods across raw materials, manufacturing and transportation and warehousing expenses.

|

|

•

|

Generating efficiencies to enable us to grow marketing costs at a slightly slower rate than sales growth while still increasing consumer reach and effectiveness, saving approximately $1 billion over the five year period.

|

|

Amounts in millions, except per share amounts

|

2012

|

|

Change vs. Prior Year

|

|

2011

|

|

Change vs. Prior Year

|

2010

|

|||||||

|

Net Sales

|

$

|

83,680

|

|

|

3%

|

|

$

|

81,104

|

|

|

5%

|

$

|

77,567

|

|

|

|

Operating Income

|

13,292

|

|

|

(14)%

|

|

15,495

|

|

|

(2)%

|

15,732

|

|

||||

|

Net Earnings from Continuing Operations

|

9,317

|

|

|

(20)%

|

|

11,698

|

|

|

8%

|

10,851

|

|

||||

|

Net Earnings from Discontinued Operations

|

1,587

|

|

|

593%

|

|

229

|

|

|

(89)%

|

1,995

|

|

||||

|

Net Earnings attributable to Procter & Gamble

|

10,756

|

|

(9)%

|

11,797

|

|

(7)%

|

12,736

|

|

|||||||

|

Diluted Net Earnings per Common Share

|

3.66

|

|

|

(7)%

|

|

3.93

|

|

|

(4)%

|

4.11

|

|

||||

|

Diluted Net Earnings per Share from Continuing Operations

|

3.12

|

|

(19)%

|

3.85

|

|

11%

|

3.47

|

|

|||||||

|

Core Earnings per Common Share

|

3.85

|

|

|

(1)%

|

|

3.87

|

|

|

7%

|

3.61

|

|

||||

|

•

|

Net sales increased 3% to $83.7 billion.

|

|

◦

|

Organic sales increased 3%.

|

|

◦

|

Unit volume was consistent with the prior year period as mid-single digit growth in developing regions was offset by a low single-digit decline in developed regions.

|

|

•

|

Net earnings attributable to Procter & Gamble were $10.8 billion, a decrease of $1.0 billion or 9% versus the prior year period.

|

|

◦

|

The decrease in net earnings attributable to Procter & Gamble was due to impairment charges, incremental restructuring charges and gross margin contraction, partially offset by net sales growth and the gain on the sale of the snacks business. The impairment charges included $1.6 billion of before-tax non-cash goodwill and intangible asset impairment charges associated with the Appliances and Salon Professional businesses. The incremental restructuring charges totaled $721 million before tax, resulting from the Company's productivity and cost savings plan announced during the year. A 160-basis point decline in gross

|

|

◦

|

Net earnings from discontinued operations increased $1.4 billion due to the gain on the sale of the snacks business.

|

|

•

|

Diluted net earnings per share from continuing operations decreased 19% to $3.12.

|

|

◦

|

Diluted net earnings per share decreased 7% to $3.66, including earnings from discontinued operations of $0.54 per share.

|

|

◦

|

Core EPS decreased 1% to $3.85.

|

|

•

|

Cash flow from operating activities was $13.3 billion.

|

|

◦

|

Free cash flow was $9.3 billion.

|

|

◦

|

Free cash flow productivity was 85%.

|

|

Comparisons as a percentage of net sales; Years ended June 30

|

2012

|

|

Basis Point

Change

|

|

2011

|

|

Basis Point

Change

|

|

2010

|

|||||

|

Gross margin

|

49.3

|

%

|

(160

|

)

|

|

50.9

|

%

|

|

(140

|

)

|

|

52.3

|

%

|

|

|

Selling, general and administrative expense

|

31.5

|

%

|

(30

|

)

|

|

31.8

|

%

|

|

(20

|

)

|

|

32.0

|

%

|

|

|

Operating margin

|

15.9

|

%

|

(320

|

)

|

|

19.1

|

%

|

|

(120

|

)

|

|

20.3

|

%

|

|

|

Earnings from continuing operations before income taxes

|

15.3

|

%

|

(320

|

)

|

|

18.5

|

%

|

|

(70

|

)

|

|

19.2

|

%

|

|

|

Net earnings from continuing operations

|

11.1

|

%

|

(330

|

)

|

|

14.4

|

%

|

|

40

|

|

|

14.0

|

%

|

|

|

Net earnings attributable to Procter & Gamble

|

12.9

|

%

|

(170

|

)

|

14.6

|

%

|

(180

|

)

|

16.4

|

%

|

||||

|

Net Sales Change Drivers vs. Year Ago (2012 vs. 2011)

|

Volume with

Acquisitions

& Divestitures

|

|

Volume

Excluding

Acquisitions

& Divestitures

|

|

Foreign

Exchange

|

|

Price

|

|

Mix/Other

|

|

Net Sales

Growth

|

||||||

|

Beauty

|

2

|

%

|

|

2

|

%

|

|

0

|

%

|

|

3

|

%

|

|

-3

|

%

|

|

2

|

%

|

|

Grooming

|

1

|

%

|

|

1

|

%

|

|

-1

|

%

|

|

2

|

%

|

|

-1

|

%

|

|

1

|

%

|

|

Health Care

|

1

|

%

|

|

0

|

%

|

|

0

|

%

|

|

3

|

%

|

|

-1

|

%

|

|

3

|

%

|

|

Fabric Care and Home Care

|

-1

|

%

|

|

-1

|

%

|

|

0

|

%

|

|

5

|

%

|

|

-1

|

%

|

|

3

|

%

|

|

Baby Care and Family Care

|

1

|

%

|

|

1

|

%

|

|

0

|

%

|

|

5

|

%

|

|

0

|

%

|

|

6

|

%

|

|

TOTAL COMPANY

|

0

|

%

|

|

0

|

%

|

|

0

|

%

|

|

4

|

%

|

|

-1

|

%

|

|

3

|

%

|

|

($ millions)

|

2012

|

|

Change vs.

Prior Year

|

|

2011

|

|

Change vs.

Prior Year

|

||||||

|

Volume

|

n/a

|

|

|

+2

|

%

|

|

n/a

|

|

|

+4

|

%

|

||

|

Net sales

|

$

|

20,318

|

|

|

+2

|

%

|

|

$

|

19,937

|

|

|

+4

|

%

|

|

Net earnings

|

$

|

2,390

|

|

|

-6

|

%

|

|

$

|

2,542

|

|

|

-1

|

%

|

|

($ millions)

|

2012

|

|

Change vs.

Prior Year

|

|

2011

|

|

Change vs.

Prior Year

|

||||||

|

Volume

|

n/a

|

|

|

+1

|

%

|

|

n/a

|

|

|

+3

|

%

|

||

|

Net sales

|

$

|

8,339

|

|

|

+1

|

%

|

|

$

|

8,245

|

|

|

+5

|

%

|

|

Net earnings

|

$

|

1,807

|

|

|

+2

|

%

|

|

$

|

1,775

|

|

|

+10

|

%

|

|

($ millions)

|

2012

|

|

Change vs.

Prior Year

|

|

2011

|

|

Change vs.

Prior Year

|

||||||

|

Volume

|

n/a

|

|

|

+1

|

%

|

|

n/a

|

|

|

+5

|

%

|

||

|

Net sales

|

$

|

12,421

|

|

|

+3

|

%

|

|

$

|

12,033

|

|

|

+5

|

%

|

|

Net earnings

|

$

|

1,826

|

|

|

+2

|

%

|

|

$

|

1,796

|

|

|

-3

|

%

|

|

($ millions)

|

2012

|

|

Change vs.

Prior Year

|

|

2011

|

|

Change vs.

Prior Year

|

||||||

|

Volume

|

n/a

|

|

|

-1

|

%

|

|

n/a

|

|

|

+6

|

%

|

||

|

Net sales

|

$

|

27,254

|

|

|

+3

|

%

|

|

$

|

26,536

|

|

|

+4

|

%

|

|

Net earnings

|

$

|

2,915

|

|

|

-6

|

%

|

|

$

|

3,109

|

|

|

-12

|

%

|

|

($ millions)

|

2012

|

|

Change vs.

Prior Year

|

|

2011

|

|

Change vs.

Prior Year

|

||||||

|

Volume

|

n/a

|

|

|

+1

|

%

|

|

n/a

|

|

|

+8

|

%

|

||

|

Net sales

|

$

|

16,493

|

|

|

+6

|

%

|

|

$

|

15,606

|

|

|

+6

|

%

|

|

Net earnings

|

$

|

2,123

|

|

|

+7

|

%

|

|

$

|

1,978

|

|

|

-3

|

%

|

|

($ millions)

|

Total

|

|

Less Than

1 Year

|

|

1-3 Years

|

|

3-5 Years

|

|

After

5 Years

|

||||||||||

|

RECORDED LIABILITIES

|

|

|

|

|

|||||||||||||||

|

Total debt

|

$

|

29,490

|

|

|

$

|

8,672

|

|

$

|

6,927

|

|

$

|

3,356

|

|

$

|

10,535

|

|

|||

|

Capital leases

|

45

|

|

|

16

|

|

14

|

|

14

|

|

1

|

|

||||||||

|

Uncertain tax positions

(1)

|

33

|

|

|

33

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|||||

|

OTHER

|

|

|

|

|

|||||||||||||||

|

Interest payments relating to long-term debt

|

8,866

|

|

|

909

|

|

1,546

|

|

1,170

|

|

5,241

|

|

||||||||

|

Operating leases

(2)

|

1,817

|

|

|

289

|

|

498

|

|

393

|

|

637

|

|

||||||||

|

Minimum pension funding

(3)

|

1,032

|

|

|

352

|

|

680

|

|

—

|

|

—

|

|

||||||||

|

Purchase obligations

(4)

|

2,187

|

|

|

1,094

|

|

596

|

|

215

|

|

282

|

|

||||||||

|

TOTAL CONTRACTUAL COMMITMENTS

|

$

|

43,470

|

|

|

$

|

11,365

|

|

|

$

|

10,261

|

|

|

$

|

5,148

|

|

|

$

|

16,696

|

|

|

(1)

|

As of June 30, 2012, the Company's Consolidated Balance Sheet reflects a liability for uncertain tax positions of $2.3 billion, including $505 million of interest and penalties. Due to the high degree of uncertainty regarding the timing of future cash outflows of liabilities for uncertain tax positions beyond one year, a reasonable estimate of the period of cash settlement beyond twelve months from the balance sheet date of June 30, 2012 cannot be made.

|

|

(2)

|

Operating lease obligations are shown net of guaranteed sublease income.

|

|

(3)

|

Represents future pension payments to comply with local funding requirements. These future pension payments assume the Company continues to meet its future statutory funding requirements. Considering the current economic environment in which the Company operates, the Company believes its cash flows are adequate to meet the above future statutory funding requirements. The projected payments beyond fiscal year 2015 are not currently determinable.

|

|

(4)

|

Primarily reflects future contractual payments under various take-or-pay arrangements entered into as part of the normal course of business. Commitments made under take-or-pay obligations represent future purchases in line with expected usage to obtain favorable pricing. Approximately 22% relates to service contracts for information technology, human resources management and facilities management activities that have been outsourced. While the amounts listed represent contractual obligations, we do not believe it is likely that the full contractual amount would be paid if the underlying contracts were canceled prior to maturity. In such cases, we generally are able to negotiate new contracts or cancellation penalties, resulting in a reduced payment. The amounts do not include obligations related to the put of our Spanish joint venture discussed further in Note 10 to the Consolidated Financial Statements (approximately $1 billion) and other contractual purchase obligations that are not take-or-pay arrangements. Such contractual purchase obligations are primarily purchase orders at fair value that are part of normal operations and are reflected in historical operating cash flow trends. We do not believe such purchase obligations will adversely affect our liquidity position.

|

|

Year ended June 30, 2012

|

Net Sales

Growth

|

|

Foreign

Exchange

Impact

|

|

Acquisition/

Divestiture

Impact*

|

|

Organic

Sales

Growth

|

||||

|

Beauty

|

2

|

%

|

|

0

|

%

|

|

0

|

%

|

|

2

|

%

|

|

Grooming

|

1

|

%

|

|

1

|

%

|

|

0

|

%

|

|

2

|

%

|

|

Health Care

|

3

|

%

|

|

0

|

%

|

|

-1

|

%

|

|

2

|

%

|

|

Fabric Care and Home Care

|

3

|

%

|

|

0

|

%

|

|

0

|

%

|

|

3

|

%

|

|

Baby Care and Family Care

|

6

|

%

|

|

0

|

%

|

|

0

|

%

|

|

6

|

%

|

|

TOTAL P&G

|

3

|

%

|

|

0

|

%

|

|

0

|

%

|

|

3

|

%

|

|

Year ended June 30, 2011

|

Net Sales

Growth

|

|

|

Foreign

Exchange

Impact

|

|

|

Acquisition/

Divestiture

Impact*

|

|

|

Organic

Sales

Growth

|

|

|

Beauty

|

4

|

%

|

|

-1

|

%

|

|

0

|

%

|

|

3

|

%

|

|

Grooming

|

5

|

%

|

|

0

|

%

|

|

0

|

%

|

|

5

|

%

|

|

Health Care

|

5

|

%

|

|

0

|

%

|

|

0

|

%

|

|

5

|

%

|

|

Fabric Care and Home Care

|

4

|

%

|

|

0

|

%

|

|

-2

|

%

|

|

2

|

%

|

|

Baby Care and Family Care

|

6

|

%

|

|

1

|

%

|

|

0

|

%

|

|

7

|

%

|

|

TOTAL P&G

|

5

|

%

|

|

0

|

%

|

|

-1

|

%

|

|

4

|

%

|

|

Years ended June 30

|

2012

|

|

2011

|

|

2010

|

||||||

|

Diluted Net Earnings Per Share - Continuing Operations

|

$

|

3.12

|

|

|

$

|

3.85

|

|

|

$

|

3.47

|

|

|

Impairment Charges

|

0.51

|

|

|

—

|

|

|

—

|

|

|||

|

Incremental Restructuring Charges

|

0.20

|

|

|

—

|

|

|

—

|

|

|||

|

Settlement from U.S. Tax Litigation

|

—

|

|

|

(0.08

|

)

|

|

—

|

|

|||

|

Charges for Pending European Legal Matters

|

0.03

|

|

|

0.10

|

|

|

0.09

|

|

|||

|

Charge for Taxation of Retiree Healthcare Subsidy

|

—

|

|

|

—

|

|

|

0.05

|

|

|||

|

Rounding

|

(0.01

|

)

|

|

—

|

|

|

—

|

|

|||

|

CORE EPS

|

$

|

3.85

|

|

|

$

|

3.87

|

|

|

$

|

3.61

|

|

|

Core EPS Growth

|

(1

|

)%

|

|

7

|

%

|

|

|||||

|

Operating

Cash Flow

|

Capital

Spending

|

Free

Cash Flow

|

Net

Earnings

|

Free

Cash Flow

Productivity

|

||||||||||

|

2012

|

$

|

13,284

|

|

$

|

(3,964

|

)

|

$

|

9,320

|

|

$

|

10,904

|

|

85

|

%

|

|

2011

|

13,330

|

|

(3,306

|

)

|

10,024

|

|

11,927

|

|

84

|

%

|

||||

|

2010

|

16,131

|

|

(3,067

|

)

|

13,064

|

|

12,846

|

|

102

|

%

|

||||

|

Amounts in millions except per share amounts; Years ended June 30

|

2012

|

|

2011

|

|

2010

|

||||||

|

NET SALES

|

$

|

83,680

|

|

|

$

|

81,104

|

|

|

$

|

77,567

|

|

|

Cost of products sold

|

42,391

|

|

|

39,859

|

|

|

37,042

|

|

|||

|

Selling, general and administrative expense

|

26,421

|

|

|

25,750

|

|

|

24,793

|

|

|||

|

Goodwill and indefinite lived intangible asset impairment charges

|

1,576

|

|

—

|

|

—

|

|

|||||

|

OPERATING INCOME

|

13,292

|

|

|

15,495

|

|

|

15,732

|

|

|||

|

Interest expense

|

769

|

|

|

831

|

|

|

946

|

|

|||

|

Other non-operating income, net

|

262

|

|

|

333

|

|

|

82

|

|

|||

|

EARNINGS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES

|

12,785

|

|

|

14,997

|

|

|

14,868

|

|

|||

|

Income taxes on continuing operations

|

3,468

|

|

|

3,299

|

|

|

4,017

|

|

|||

|

NET EARNINGS FROM CONTINUING OPERATIONS

|

9,317

|

|

|

11,698

|

|

|

10,851

|

|

|||

|

NET EARNINGS FROM DISCONTINUED OPERATIONS

|

1,587

|

|

|

229

|

|

|

1,995

|

|

|||

|

NET EARNINGS

|

10,904

|

|

|

11,927

|

|

|

12,846

|

|

|||

|

Less: Net earnings attributable to noncontrolling interests

|

148

|

|

130

|

|

110

|

|

|||||

|

NET EARNINGS ATTRIBUTABLE TO PROCTER & GAMBLE

|

$

|

10,756

|

|

$

|

11,797

|

|

$

|

12,736

|

|

||

|

BASIC NET EARNINGS PER COMMON SHARE

(1)

:

|

|

|

|||||||||

|

Earnings from continuing operations

|

$

|

3.24

|

|

|

$

|

4.04

|

|

|

$

|

3.63

|

|

|

Earnings from discontinued operations

|

0.58

|

|

|

0.08

|

|

|

0.69

|

|

|||

|

BASIC NET EARNINGS PER COMMON SHARE

|

3.82

|

|

|

4.12

|

|

|

4.32

|

|

|||

|

DILUTED NET EARNINGS PER COMMON SHARE

(1)

:

|

|

|

|||||||||

|

Earnings from continuing operations

|

3.12

|

|

|

3.85

|

|

|

3.47

|

|

|||

|

Earnings from discontinued operations

|

0.54

|

|

|

0.08

|

|

|

0.64

|

|

|||

|

DILUTED NET EARNINGS PER COMMON SHARE

|

3.66

|

|

|

3.93

|

|

|

4.11

|

|

|||

|

DIVIDENDS PER COMMON SHARE

|

$

|

2.14

|

|

|

$

|

1.97

|

|

|

$

|

1.80

|

|

|

(1)

|

Basic net earnings per share and diluted net earnings per share are calculated on net earnings attributable to Procter & Gamble.

|

|

Amounts in millions; June 30

|

|

||||||

|

Assets

|

2012

|

|

2011

|

||||

|

CURRENT ASSETS

|

|

||||||

|

Cash and cash equivalents

|

$

|

4,436

|

|

|

$

|

2,768

|

|

|

Accounts receivable

|

6,068

|

|

|

6,275

|

|

||

|

INVENTORIES

|

|

||||||

|

Materials and supplies

|

1,740

|

|

|

2,153

|

|

||

|

Work in process

|

685

|

|

|

717

|

|

||

|

Finished goods

|

4,296

|

|

|

4,509

|

|

||

|

Total inventories

|

6,721

|

|

|

7,379

|

|

||

|

Deferred income taxes

|

1,001

|

|

|

1,140

|

|

||

|

Prepaid expenses and other current assets

|

3,684

|

|

|

4,408

|

|

||

|

TOTAL CURRENT ASSETS

|

21,910

|

|

|

21,970

|

|

||

|

PROPERTY, PLANT AND EQUIPMENT

|

|

||||||

|

Buildings

|

7,324

|

|

|

7,753

|

|

||

|

Machinery and equipment

|

32,029

|

|

|

32,820

|

|

||

|

Land

|

880

|

|

|

934

|

|

||

|

Total property, plant and equipment

|

40,233

|

|

|

41,507

|

|

||

|

Accumulated depreciation

|

(19,856

|

)

|

|

(20,214

|

)

|

||

|

NET PROPERTY, PLANT AND EQUIPMENT

|

20,377

|

|

|

21,293

|

|

||

|

GOODWILL AND OTHER INTANGIBLE ASSETS

|

|

||||||

|

Goodwill

|

53,773

|

|

|

57,562

|

|

||

|

Trademarks and other intangible assets, net

|

30,988

|

|

|

32,620

|

|

||

|

NET GOODWILL AND OTHER INTANGIBLE ASSETS

|

84,761

|

|

|

90,182

|

|

||

|

OTHER NONCURRENT ASSETS

|

5,196

|

|

|

4,909

|

|

||

|

TOTAL ASSETS

|

$

|

132,244

|

|

|

$

|

138,354

|

|

|

Liabilities and Shareholders' Equity

|

2012

|

|

2011

|

||||

|

CURRENT LIABILITIES

|

|

||||||

|

Accounts payable

|

$

|

7,920

|

|

|

$

|

8,022

|

|

|

Accrued and other liabilities

|

8,289

|

|

|

9,290

|

|

||

|

Debt due within one year

|

8,698

|

|

|

9,981

|

|

||

|

TOTAL CURRENT LIABILITIES

|

24,907

|

|

|

27,293

|

|

||

|

LONG-TERM DEBT

|

21,080

|

|

|

22,033

|

|

||

|

DEFERRED INCOME TAXES

|

10,132

|

|

|

11,070

|

|

||

|

OTHER NONCURRENT LIABILITIES

|

12,090

|

|

|

9,957

|

|

||

|

TOTAL LIABILITIES

|

68,209

|

|

|

70,353

|

|

||

|

SHAREHOLDERS' EQUITY

|

|

||||||

|

Convertible Class A preferred stock, stated value $1 per share

(600 shares authorized)

|

1,195

|

|

|

1,234

|

|

||

|

Non-Voting Class B preferred stock, stated value $1 per share

(200 shares authorized)

|

—

|

|

|

—

|

|

||

|

Common stock, stated value $1 per share

(10,000 shares authorized; shares issued: 2012 - 4,008.4, 2011 - 4,007.9)

|

4,008

|

|

|

4,008

|

|

||

|

Additional paid-in capital

|

63,181

|

|

|

62,405

|

|

||

|

Reserve for ESOP debt retirement

|

(1,357

|

)

|

|

(1,357

|

)

|

||

|

Accumulated other comprehensive income/(loss)

|

(9,333

|

)

|

|

(2,054

|

)

|

||

|

Treasury stock, at cost

(shares held: 2012 - 1,260.4, 2011 - 1,242.2)

|

(69,604

|

)

|

|

(67,278

|

)

|

||

|

Retained earnings

|

75,349

|

|

|

70,682

|

|

||

|

Noncontrolling interest

|

596

|

|

|

361

|

|

||

|

TOTAL SHAREHOLDERS' EQUITY

|

64,035

|

|

|

68,001

|

|

||

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

|

$

|

132,244

|

|

|

$

|

138,354

|

|

|

Dollars in millions/Shares in thousands

|

Common

Shares

Outstanding

|

|

Common Stock

|

|

Preferred

Stock

|

|

Additional

Paid-In

Capital

|

|

Reserve

for

ESOP Debt

Retirement

|

|

Accumulated

Other

Comprehensive

Income/ (loss)

|

|

Treasury

Stock

|

|

Retained

Earnings

|

|

Non-

controlling

Interest

|

|

Total

|

|

|||||||||

|

BALANCE JUNE 30, 2009

|

2,917,035

|

|

$

|

4,007

|

|

$

|

1,324

|

|

$

|

61,118

|

|

$

|

(1,340

|

)

|

$

|

(3,358

|

)

|

$

|

(55,961

|

)

|

$

|

57,309

|

|

$

|

283

|

|

$

|

63,382

|

|

|

Net earnings

|

12,736

|

|

110

|

|

12,846

|

|

|||||||||||||||||||||||

|

Other comprehensive income:

|

|||||||||||||||||||||||||||||

|

Financial statement translation

|

(4,194

|

)

|

(4,194

|

)

|

|||||||||||||||||||||||||

|

Hedges and investment securities, net of $520 tax

|

867

|

|

867

|

|

|||||||||||||||||||||||||

|

Defined benefit retirement plans, net of $465 tax

|

(1,137

|

)

|

(1,137

|

)

|

|||||||||||||||||||||||||

|

Total comprehensive income

|

$

|

8,382

|

|

||||||||||||||||||||||||||

|

Dividends to shareholders:

|

|||||||||||||||||||||||||||||

|

Common

|

(5,239

|

)

|

(5,239

|

)

|

|||||||||||||||||||||||||

|

Preferred, net of tax benefits

|

(219

|

)

|

(219

|

)

|

|||||||||||||||||||||||||

|

Treasury purchases

|

(96,759

|

)

|

(6,004

|

)

|

(6,004

|

)

|

|||||||||||||||||||||||

|

Employee plan issuances

|

17,616

|

|

1

|

|

574

|

|

616

|

|

1,191

|

|

|||||||||||||||||||

|

Preferred stock conversions

|

5,579

|

|

(47

|

)

|

7

|

|

40

|

|

—

|

|

|||||||||||||||||||

|

ESOP debt impacts

|

(10

|

)

|

27

|

|

17

|

|

|||||||||||||||||||||||

|

Noncontrolling interest, net

|

(2

|

)

|

(69

|

)

|

(71

|

)

|

|||||||||||||||||||||||

|

BALANCE JUNE 30, 2010

|

2,843,471

|

|

4,008

|

|

1,277

|

|

61,697

|

|

(1,350

|

)

|

(7,822

|

)

|

(61,309

|

)

|

64,614

|

|

324

|

|

61,439

|

|

|||||||||

|

Net earnings

|

11,797

|

|

130

|

|

11,927

|

|

|||||||||||||||||||||||

|

Other comprehensive income:

|

|||||||||||||||||||||||||||||

|

Financial statement translation

|

6,493

|

|

6,493

|

|

|||||||||||||||||||||||||

|

Hedges and investment securities, net of $711 tax

|

(1,178

|

)

|

(1,178

|

)

|

|||||||||||||||||||||||||

|

Defined benefit retirement plans, net of $302 tax

|

453

|

|

453

|

|

|||||||||||||||||||||||||

|

Total comprehensive income

|

$

|

17,695

|

|

||||||||||||||||||||||||||

|

Dividends to shareholders:

|

|||||||||||||||||||||||||||||

|

Common

|

(5,534

|

)

|

(5,534

|

)

|

|||||||||||||||||||||||||

|

Preferred, net of tax benefits

|

(233

|

)

|

(233

|

)

|

|||||||||||||||||||||||||

|

Treasury purchases

|

(112,729

|

)

|

(7,039

|

)

|

(7,039

|

)

|

|||||||||||||||||||||||

|

Employee plan issuances

|

29,729

|

|

|

702

|

|

1,033

|

|

1,735

|

|

||||||||||||||||||||

|

Preferred stock conversions

|

5,266

|

|

(43

|

)

|

6

|

|

37

|

|

—

|

|

|||||||||||||||||||

|

ESOP debt impacts

|

(7

|

)

|

38

|

|

31

|

|

|||||||||||||||||||||||

|

Noncontrolling interest, net

|

|

(93

|

)

|

(93

|

)

|

||||||||||||||||||||||||

|

BALANCE JUNE 30, 2011

|

2,765,737

|

|

4,008

|

|

1,234

|

|

62,405

|

|

(1,357

|

)

|

(2,054

|

)

|

(67,278

|

)

|

70,682

|

|

361

|

|

68,001

|

|

|||||||||

|

Net earnings

|

10,756

|

|

148

|

|

10,904

|

|

|||||||||||||||||||||||

|

Other comprehensive income:

|

|||||||||||||||||||||||||||||

|

Financial statement translation

|

(5,990

|

)

|

(5,990

|

)

|

|||||||||||||||||||||||||

|

Hedges and investment securities, net of $438 tax

|

721

|

|

721

|

|

|||||||||||||||||||||||||

|

Defined benefit retirement plans, net of $993 tax

|

(2,010

|

)

|

(2,010

|

)

|

|||||||||||||||||||||||||

|

Total comprehensive income

|

$

|

3,625

|

|

||||||||||||||||||||||||||

|

Dividends to shareholders:

|

|||||||||||||||||||||||||||||

|

Common

|

(5,883

|

)

|

(5,883

|

)

|

|||||||||||||||||||||||||

|

Preferred, net of tax benefits

|

(256

|

)

|

(256

|

)

|

|||||||||||||||||||||||||

|

Treasury purchases

|

(61,826

|

)

|

(4,024

|

)

|

(4,024

|

)

|

|||||||||||||||||||||||

|

Employee plan issuances

|

39,546

|

|

|

550

|

|

1,665

|

|

2,215

|

|

||||||||||||||||||||

|

Preferred stock conversions

|

4,576

|

|

(39

|

)

|

6

|

|

33

|

|

—

|

|

|||||||||||||||||||

|

ESOP debt impacts

|

|

|

50

|

|

50

|

|

|||||||||||||||||||||||

|

Noncontrolling interest, net

|

220

|

|

87

|

|

307

|

|

|||||||||||||||||||||||

|

BALANCE JUNE 30, 2012

|

2,748,033

|

|

$

|

4,008

|

|

$

|

1,195

|

|

$

|

63,181

|

|

$

|

(1,357

|

)

|

$

|

(9,333

|

)

|

$

|

(69,604

|

)

|

$

|

75,349

|

|

$

|

596

|

|

$

|

64,035

|

|

|

Amounts in millions; Years ended June 30

|

2012

|

|

2011

|

|

2010

|

||||||

|

CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR

|

$

|

2,768

|

|

|

$

|

2,879

|

|

|

$

|

4,781

|

|

|

OPERATING ACTIVITIES

|

|

|

|||||||||

|

Net earnings

|

10,904

|

|

|

11,927

|

|

|

12,846

|

|

|||

|

Depreciation and amortization

|

3,204

|

|

|

2,838

|

|

|

3,108

|

|

|||

|

Share-based compensation expense

|

377

|

|

|

414

|

|

|

453

|

|

|||

|

Deferred income taxes

|

(65

|

)

|

|

128

|

|

|

36

|

|

|||

|

Gain on sale of businesses

|

(2,106

|

)

|

|

(203

|

)

|

|

(2,670

|

)

|

|||

|

Goodwill and indefinite lived intangible asset impairment charges

|

1,576

|

|

—

|

|

—

|

|

|||||

|

Change in accounts receivable

|

(427

|

)

|

|

(426

|

)

|

|

(14

|

)

|

|||

|

Change in inventories

|

77

|

|

|

(501

|

)

|

|

86

|

|

|||

|

Change in accounts payable, accrued and other liabilities

|

(22

|

)

|

|

358

|

|

|

2,446

|

|

|||

|

Change in other operating assets and liabilities

|

(444

|

)

|

|

(1,221

|

)

|

|

(356

|

)

|

|||

|

Other

|

210

|

|

|

16

|

|

|

196

|

|

|||

|

TOTAL OPERATING ACTIVITIES

|

13,284

|

|

|

13,330

|

|

|

16,131

|

|

|||

|

INVESTING ACTIVITIES

|

|

|

|||||||||

|

Capital expenditures

|

(3,964

|

)

|

|

(3,306

|

)

|

|

(3,067

|

)

|

|||

|

Proceeds from asset sales

|

2,893

|

|

|

225

|

|

|

3,068

|

|

|||

|

Acquisitions, net of cash acquired

|

(134

|

)

|

|

(474

|

)

|

|

(425

|

)

|

|||

|

Change in investments

|

112

|

|

|

73

|

|

|

(173

|

)

|

|||

|

TOTAL INVESTING ACTIVITIES

|

(1,093

|

)

|

|

(3,482

|

)

|

|

(597

|

)

|

|||

|

FINANCING ACTIVITIES

|

|

|

|||||||||

|

Dividends to shareholders

|

(6,139

|

)

|

|

(5,767

|

)

|

|

(5,458

|

)

|

|||

|

Change in short-term debt

|

(3,412

|

)

|

|

151

|

|

|

(1,798

|

)

|

|||

|

Additions to long-term debt

|

3,985

|

|

|

1,536

|

|

|

3,830

|

|

|||

|

Reductions of long-term debt

|

(2,549

|

)

|

|

(206

|

)

|

|

(8,546

|

)

|

|||

|

Treasury stock purchases

|

(4,024

|

)

|

|

(7,039

|

)

|

|

(6,004

|

)

|

|||

|

Impact of stock options and other

|

1,729

|

|

|

1,203

|

|

|

662

|

|

|||

|

TOTAL FINANCING ACTIVITIES

|

(10,410

|

)

|

|

(10,122

|

)

|

|

(17,314

|

)

|

|||

|

EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS

|

(113

|

)

|

|

163

|

|

|

(122

|

)

|

|||

|

CHANGE IN CASH AND CASH EQUIVALENTS

|

1,668

|

|

|

(111

|

)

|

|

(1,902

|

)

|

|||

|

CASH AND CASH EQUIVALENTS, END OF YEAR

|

$

|

4,436

|

|

|

$

|

2,768

|

|

|

$

|

2,879

|

|

|

SUPPLEMENTAL DISCLOSURE

|

|

|

|||||||||

|

Cash payments for:

|

|

|

|||||||||

|

Interest

|

$

|

740

|

|

|

$

|

806

|

|

|

$

|

1,184

|

|

|

Income taxes

|

4,348

|

|

|

2,992

|

|

|

4,175

|

|

|||

|

Assets acquired through non-cash capital leases

|

24

|

|

|

13

|

|

|

20

|

|

|||

|

|

Beauty

|

Grooming

|

Health Care

|

Fabric Care and Home Care

|

Baby Care and Family Care

|

Corporate

|

Total Company

|

||||||||||||||

|

GOODWILL at JUNE 30, 2010

|

$

|

16,631

|

|

$

|

21,328

|

|

$

|

7,859

|

|

$

|

6,360

|

|

$

|

1,445

|

|

$

|

389

|

|

$

|

54,012

|

|

|

Acquisitions and divestitures

|

(7

|

)

|

(7

|

)

|

(7

|

)

|

115

|

|

(1

|

)

|

11

|

|

104

|

|

|||||||

|

Translation and other

|

1,415

|

|

1,329

|

|

327

|

|

260

|

|

109

|

|

6

|

|

3,446

|

|

|||||||

|

GOODWILL at JUNE 30, 2011

|

18,039

|

|

22,650

|

|

8,179

|

|

6,735

|

|

1,553

|

|

406

|

|

57,562

|

|

|||||||

|

Acquisitions and divestitures

|

(3

|

)

|

(12

|

)

|

474

|

|

34

|

|

—

|

|

(92

|

)

|

401

|

|

|||||||

|

Goodwill impairment charges

|

(431

|

)

|

(899

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(1,330

|

)

|

|||||||

|

Translation and other

|

(1,176

|

)

|

(1,059

|

)

|

(314

|

)

|

(212

|

)

|

(94

|

)

|

(5

|

)

|

(2,860

|

)

|

|||||||

|

GOODWILL at JUNE 30, 2012

|

16,429

|

|

20,680

|

|

8,339

|

|

6,557

|

|

1,459

|

|

309

|

|

53,773

|

|

|||||||

|

|

2012

|

2011

|

||||||||||

|

June 30

|

Gross

Carrying

Amount

|

Accumulated

Amortization

|

Gross

Carrying

Amount

|

Accumulated

Amortization

|

||||||||

|

INTANGIBLE ASSETS WITH DETERMINABLE LIVES

|

||||||||||||

|

Brands

|

$

|

3,297

|

|

$

|

1,687

|

|

$

|

3,392

|

|

$

|

1,553

|

|

|

Patents and technology

|

3,164

|

|

2,021

|

|

3,195

|

|

1,840

|

|

||||

|

Customer relationships

|

2,048

|

|

642

|

|

2,121

|

|

602

|

|

||||

|

Other

|

352

|

|

218

|

|

335

|

|

217

|

|

||||

|

TOTAL

|

8,861

|

|

4,568

|

|

9,043

|

|

4,212

|

|

||||

|

INTANGIBLE ASSETS WITH INDEFINITE LIVES

|

||||||||||||

|

Brands

|

$

|

26,695

|

|

$

|

—

|

|

$

|

27,789

|

|

$

|

—

|

|

|

TOTAL

|

35,556

|

|

4,568

|

|

36,832

|

|

4,212

|

|

||||

|

Years ended June 30

|

2012

|

|

2011

|

|

2010

|

||||||

|

Intangible asset amortization

|

$

|

500

|

|

|

$

|

546

|

|

|

$

|

601

|

|

|

Years ended June 30

|

2013

|

2014

|

2015

|

2016

|

2017

|

||||||||||

|

Estimated amortization expense

|

$

|

481

|

|

$

|

448

|

|

$

|

419

|

|

$

|

381

|

|

$

|

345

|

|

|

June 30

|

2012

|

|

2011

|

||||

|

ACCRUED AND OTHER LIABILITIES - CURRENT

|

|

||||||

|

Marketing and promotion

|

$

|

2,880

|

|

|

$

|

3,058

|

|

|

Compensation expenses

|

1,660

|

|

|

1,753

|

|

||

|

Restructuring reserves

|

343

|

|

151

|

|

|||

|

Taxes payable

|

414

|

|

|

786

|

|

||

|

Legal and environmental

|

264

|

|

885

|

|

|||