|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2015

|

|

Commission file number 1-15399

|

|

Delaware

|

36-4277050

|

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

|

|

1955 West Field Court, Lake Forest, Illinois

|

60045

|

|

|

(Address of Prinicpal Executive Offices)

|

(Zip Code)

|

|

|

Title of Each Class

|

Name of Each Exchange On Which Registered

|

|

|

Common Stock, $0.01 par value

|

New York Stock Exchange

|

|

|

Large accelerated filer

|

x

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

¨

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

¨

|

|

PART I

|

||

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

PART II

|

||

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

PART III

|

||

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

PART IV

|

||

|

Item 15.

|

||

|

Item 1.

|

BUSINESS

|

|

First Quarter

|

Second Quarter

|

Third Quarter

|

Fourth Quarter (a)

|

Full Year

|

||||||||||||

|

Containerboard Production (b)

|

PCA

|

2015

|

882

|

|

938

|

|

933

|

|

903

|

|

3,656

|

|

||||

|

(thousand tons)

|

2014

|

821

|

|

846

|

|

858

|

|

927

|

|

3,452

|

|

|||||

|

2013

|

646

|

|

629

|

|

671

|

|

803

|

|

2,749

|

|

||||||

|

Boise

|

2013

|

171

|

|

188

|

|

196

|

|

50

|

|

605

|

|

|||||

|

Corrugated Shipments (BSF)

|

PCA

|

2015

|

11.9

|

|

12.4

|

|

12.5

|

|

12.1

|

|

48.9

|

|

||||

|

2014

|

11.6

|

|

12.1

|

|

12.4

|

|

12.1

|

|

48.2

|

|

||||||

|

2013

|

8.8

|

|

9.4

|

|

9.3

|

|

10.9

|

|

38.4

|

|

||||||

|

Boise

|

2013

|

2.4

|

|

2.5

|

|

2.4

|

|

0.7

|

|

8.0

|

|

|||||

|

Newsprint Production (b)

|

PCA

|

2015

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||

|

(thousand tons)

|

2014

|

56

|

|

56

|

|

50

|

|

—

|

|

162

|

|

|||||

|

2013

|

—

|

|

—

|

|

—

|

|

44

|

|

44

|

|

||||||

|

Boise

|

2013

|

53

|

|

58

|

|

60

|

|

15

|

|

186

|

|

|||||

|

White Paper (UFS) Production

|

PCA

|

2015

|

288

|

|

273

|

|

294

|

|

262

|

|

1,117

|

|

||||

|

(thousand tons)

|

2014

|

286

|

|

275

|

|

296

|

|

287

|

|

1,144

|

|

|||||

|

2013

|

—

|

|

—

|

|

—

|

|

208

|

|

208

|

|

||||||

|

Boise

|

2013

|

303

|

|

301

|

|

323

|

|

76

|

|

1,003

|

|

|||||

|

Market Pulp Production

|

PCA

|

2015

|

27

|

|

23

|

|

25

|

|

23

|

|

98

|

|

||||

|

(thousand tons)

|

2014

|

26

|

|

23

|

|

26

|

|

25

|

|

100

|

|

|||||

|

2013

|

—

|

|

—

|

|

—

|

|

20

|

|

20

|

|

||||||

|

Boise

|

2013

|

24

|

|

24

|

|

29

|

|

5

|

|

82

|

|

|||||

|

(a)

|

Production and shipments activity prior to the acquisition of Boise on

October 25, 2013

, is included in the "Boise" fourth quarter 2013 production and shipments. Activity subsequent to the acquisition of Boise is included in the "PCA" fourth quarter 2013 production and shipments.

|

|

(b)

|

PCA ceased production of newsprint and converted the No.3 newsprint machine at our DeRidder, Louisiana mill to containerboard in the third quarter of 2014. Sales of newsprint were recorded in the Packaging segment.

|

|

Food, beverages, and agricultural products

|

40

|

%

|

|

Paper and other products

|

23

|

%

|

|

Retail and wholesale trade

|

19

|

%

|

|

Miscellaneous manufacturing

|

10

|

%

|

|

Chemical, plastic, and rubber products

|

8

|

%

|

|

Item 1A.

|

RISK FACTORS

|

|

•

|

Unscheduled maintenance outages.

|

|

•

|

Prolonged power failures.

|

|

•

|

Equipment failure.

|

|

•

|

Explosion of a boiler.

|

|

•

|

Disruption in the supply of raw materials, such as wood fiber, energy, or chemicals.

|

|

•

|

A chemical spill or release.

|

|

•

|

Closure or curtailment related to environmental concerns.

|

|

•

|

Labor difficulties.

|

|

•

|

Disruptions in the transportation infrastructure, including roads, bridges, railroad tracks, and tunnels.

|

|

•

|

Fires, floods, earthquakes, hurricanes, or other catastrophes.

|

|

•

|

Terrorism or threats of terrorism.

|

|

•

|

Other operational problems.

|

|

•

|

Result in significant cash requirements to make interest and maturity payments on our outstanding indebtedness;

|

|

•

|

Increase our vulnerability to adverse changes in our business or industry conditions;

|

|

•

|

Increase our vulnerability to increases in interest rates;

|

|

•

|

Limit our ability to obtain additional financing for working capital, capital expenditures, general corporate, and other purposes;

|

|

•

|

Limit our flexibility in planning for, or reacting to, changes in our business and our industry; and

|

|

•

|

Limit our flexibility to make acquisitions.

|

|

Item 1B.

|

UNRESOLVED STAFF COMMENTS

|

|

Item 2.

|

PROPERTIES

|

|

Item 3.

|

LEGAL PROCEEDINGS

|

|

Item 4.

|

MINE SAFETY DISCLOSURE

|

|

Item 5.

|

MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

2015

|

2014

|

||||||||||||||||||||||

|

Sales Price

|

Dividends Declared

|

Sales Price

|

Dividends Declared

|

||||||||||||||||||||

|

Quarter Ended

|

High

|

Low

|

High

|

Low

|

|||||||||||||||||||

|

March 31

|

$

|

84.88

|

|

$

|

73.03

|

|

$

|

0.55

|

|

$

|

75.10

|

|

$

|

61.35

|

|

$

|

0.40

|

|

|||||

|

June 30

|

78.98

|

|

62.48

|

|

0.55

|

|

72.74

|

|

65.00

|

|

0.40

|

|

|||||||||||

|

September 30

|

73.60

|

|

58.29

|

|

0.55

|

|

72.82

|

|

63.11

|

|

0.40

|

|

|||||||||||

|

December 31

|

70.04

|

|

59.54

|

|

0.55

|

|

80.14

|

|

57.06

|

|

0.40

|

|

|||||||||||

|

Issuer Purchases of Equity Securities

|

||||||||||||||

|

Period

|

Total

Number of Shares Purchased (a) |

Average Price Paid Per Share

|

Total Number

of Shares Purchased as Part of Publicly Announced Plans or Programs |

Approximate Dollar Value of Shares

That May Yet Be Purchased Under the Plans or Programs (in millions) |

||||||||||

|

October 1-31, 2015

|

56,684

|

|

$

|

59.50

|

|

56,000

|

|

$

|

146.7

|

|

||||

|

November 1-30, 2015

|

4,854

|

|

69.15

|

|

—

|

|

146.7

|

|

||||||

|

December 1-31, 2015

|

872,621

|

|

62.14

|

|

858,099

|

|

93.4

|

|

||||||

|

Total

|

934,159

|

|

(a)

|

$

|

62.01

|

|

914,099

|

|

$

|

93.4

|

|

|||

|

(a)

|

20,060 shares were withheld from employees to cover income and payroll taxes on equity awards that vested during the period.

|

|

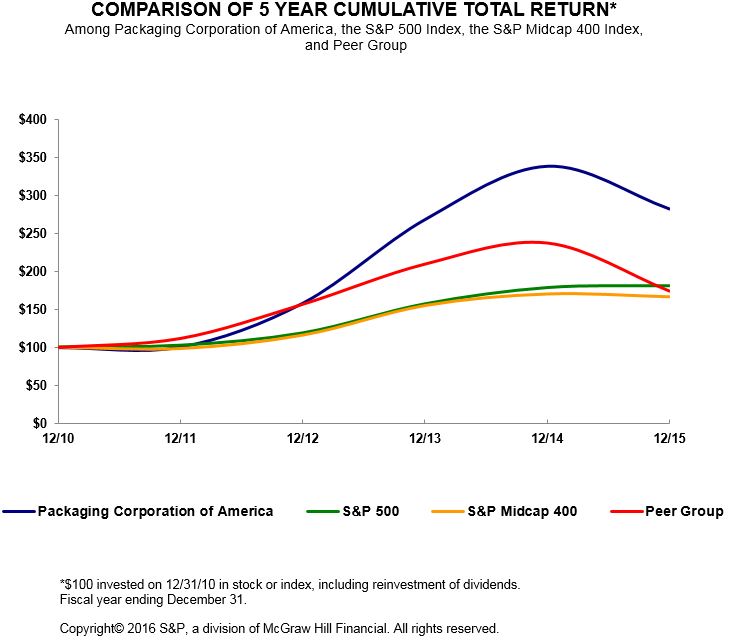

Cumulative Total Return

|

|||||||||||||||||||||||

|

December 31

|

|||||||||||||||||||||||

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

||||||||||||||||||

|

Packaging Corporation of America

|

$

|

100.00

|

|

$

|

100.67

|

|

$

|

158.40

|

|

$

|

268.32

|

|

$

|

338.33

|

|

$

|

282.21

|

|

|||||

|

S&P 500

|

100.00

|

|

102.11

|

|

118.45

|

|

156.82

|

|

178.29

|

|

180.75

|

|

|||||||||||

|

S&P Midcap 400

|

100.00

|

|

98.27

|

|

115.84

|

|

154.64

|

|

169.75

|

|

166.05

|

|

|||||||||||

|

Peer Group

|

100.00

|

|

111.91

|

|

156.67

|

|

209.20

|

|

236.78

|

|

173.84

|

|

|||||||||||

|

Item 6.

|

SELECTED FINANCIAL DATA

|

|

Year Ended December 31

|

|||||||||||||||||||

|

2015 (a)

|

2014 (a)

|

2013 (a)

|

2012

|

2011

|

|||||||||||||||

|

Statement of Income Data (b):

|

|||||||||||||||||||

|

Net Sales

|

$

|

5,741.7

|

|

$

|

5,852.6

|

|

$

|

3,665.3

|

|

$

|

2,843.9

|

|

$

|

2,620.1

|

|

||||

|

Net Income

|

436.8

|

|

392.6

|

|

441.3

|

|

160.2

|

|

158.8

|

|

|||||||||

|

Net income per common share:

|

|||||||||||||||||||

|

— basic

|

4.47

|

|

3.99

|

|

4.57

|

|

1.66

|

|

1.60

|

|

|||||||||

|

— diluted

|

4.47

|

|

3.99

|

|

4.52

|

|

1.64

|

|

1.58

|

|

|||||||||

|

Weighted average common shares outstanding:

|

|||||||||||||||||||

|

— basic

|

96.6

|

|

97.0

|

|

96.6

|

|

96.4

|

|

99.3

|

|

|||||||||

|

— diluted

|

96.7

|

|

97.1

|

|

97.5

|

|

97.5

|

|

100.4

|

|

|||||||||

|

Earnings, before interest, taxes, depreciation, and amortization (EBITDA) (c)

|

$

|

1,106.5

|

|

$

|

1,083.7

|

|

$

|

683.7

|

|

$

|

608.3

|

|

$

|

437.6

|

|

||||

|

Cash dividends declared per common share

|

2.20

|

|

1.60

|

|

1.51

|

|

1.00

|

|

0.80

|

|

|||||||||

|

Balance Sheet Data (b):

|

|||||||||||||||||||

|

Total assets

|

$

|

5,284.6

|

|

$

|

5,272.8

|

|

$

|

5,196.2

|

|

$

|

2,494.9

|

|

$

|

2,442.9

|

|

||||

|

Total debt obligations

|

2,332.0

|

|

2,379.3

|

|

2,572.7

|

|

819.5

|

|

830.3

|

|

|||||||||

|

Stockholders' equity

|

1,633.3

|

|

1,521.4

|

|

1,356.8

|

|

1,008.2

|

|

971.2

|

|

|||||||||

|

(a)

|

On October 25, 2013, we acquired Boise Inc. (Boise). Our financial results include Boise subsequent to acquisition.

|

|

(b)

|

Effective December 31, 2015, the Company adopted Accounting Standards Update 2015-17,

Balance Sheet Classification of Deferred Taxes.

The guidance eliminates the requirement to classify deferred taxes between current and noncurrent and requires that all deferred tax assets and liabilities, along with any related valuation allowance, be classified as noncurrent on the balance sheet. Our total assets for all periods presented have been updated to reflect this adoption.

|

|

(c)

|

EBITDA represents income before interest (interest expense and interest income), income tax provision (benefit), and depreciation, amortization, and depletion. We present EBITDA because it provides a means to evaluate our performance on an ongoing basis using the same measure that is used by our management and because it is frequently used by investors and other interested parties in the evaluation of companies. EBITDA, however, is not a measure of our liquidity or financial performance under generally accepted accounting principles (GAAP) and should not be considered as an alternative to net income, income from operations, or any other performance measure derived in accordance with GAAP or as an alternative to cash flow from operating activities as a measure of our liquidity. Any analysis of non-GAAP financial measures should be done in conjunction with results presented in accordance with GAAP. The non-GAAP measures are not intended to be substitutes for GAAP financial measures and should not be used as such. See "Reconciliations of Non-GAAP Financial Measures to Reported Amounts" included in "Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" of this Form 10-K for a reconciliation of non-GAAP measures to the most comparable GAAP measure.

|

|

Item 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

Year Ended December 31

|

|||||||

|

2015

|

2014

|

||||||

|

Earnings per diluted share

|

$

|

4.47

|

|

$

|

3.99

|

|

|

|

Special items:

|

|||||||

|

DeRidder restructuring (a)

|

0.01

|

|

0.43

|

|

|||

|

Integration-related and other costs (b)

|

0.10

|

|

0.13

|

|

|||

|

Sale of St. Helens paper mill site (c)

|

(0.05

|

)

|

—

|

|

|||

|

Class action lawsuit settlement (d)

|

—

|

|

0.11

|

|

|||

|

Total special items

|

0.06

|

|

0.67

|

|

|||

|

Earnings per diluted share, excluding special items

|

$

|

4.53

|

|

$

|

4.66

|

|

|

|

(a)

|

Includes amounts from restructuring activities at our mill in DeRidder, Louisiana, including costs related to the conversion of the No. 3 newsprint machine to containerboard, our exit from the newsprint business, and other improvements. The restructuring charges primarily related to accelerated depreciation.

|

|

(b)

|

Includes Boise acquisition integration-related and other costs. These costs primarily relate to professional fees, severance, retention, relocation, travel, and other integration-related costs. 2014 also includes $1.5 million of expense related to write-off of deferred financing costs in connection with the debt refinancing.

|

|

(c)

|

In September 2015, we sold the remaining land, buildings, and equipment at our paper mill site in St. Helens, Oregon, where we ceased paper production in December 2012. We recorded a $6.7 million gain on the sale.

|

|

(d)

|

Includes $17.6 million of costs for the settlement of the

Kleen Products LLC v Packaging Corp. of America et al

class action lawsuit.

|

|

Year Ended December 31

|

|||||||||||

|

2015

|

2014

|

Change

|

|||||||||

|

Packaging

|

$

|

4,477.3

|

|

$

|

4,540.3

|

|

$

|

(63.0

|

)

|

||

|

Paper

|

1,143.1

|

|

1,201.4

|

|

(58.3

|

)

|

|||||

|

Corporate and other and eliminations

|

121.3

|

|

110.9

|

|

10.4

|

|

|||||

|

Net sales

|

$

|

5,741.7

|

|

$

|

5,852.6

|

|

$

|

(110.9

|

)

|

||

|

Packaging

|

$

|

714.9

|

|

$

|

663.2

|

|

$

|

51.7

|

|

||

|

Paper

|

112.5

|

|

135.4

|

|

(22.9

|

)

|

|||||

|

Corporate and other and eliminations

|

(77.4

|

)

|

(95.9

|

)

|

18.5

|

|

|||||

|

Income from operations

|

$

|

750.0

|

|

$

|

702.7

|

|

$

|

47.3

|

|

||

|

Interest expense, net

|

(85.5

|

)

|

(88.4

|

)

|

2.9

|

|

|||||

|

Income before taxes

|

664.5

|

|

614.3

|

|

50.2

|

|

|||||

|

Income tax expense

|

(227.7

|

)

|

(221.7

|

)

|

(6.0

|

)

|

|||||

|

Net income

|

$

|

436.8

|

|

$

|

392.6

|

|

$

|

44.2

|

|

||

|

Net income excluding special items (a)

|

$

|

442.6

|

|

$

|

458.6

|

|

$

|

(16.0

|

)

|

||

|

EBITDA (a)

|

$

|

1,106.5

|

|

$

|

1,083.7

|

|

$

|

22.8

|

|

||

|

EBITDA excluding special items (a)

|

$

|

1,106.2

|

|

$

|

1,143.6

|

|

$

|

(37.4

|

)

|

||

|

(a)

|

See "Reconciliations of Non-GAAP Financial Measures to Reported Amounts" included in this Item 7 for a reconciliation of non-GAAP measures to the most comparable GAAP measure.

|

|

Year Ended December 31

|

|||||||||||

|

2014 (a)

|

2013 (a)

|

Change

|

|||||||||

|

Packaging

|

$

|

4,540.3

|

|

$

|

3,431.7

|

|

$

|

1,108.6

|

|

||

|

Paper

|

1,201.4

|

|

216.9

|

|

984.5

|

|

|||||

|

Corporate and other and eliminations

|

110.9

|

|

16.7

|

|

94.2

|

|

|||||

|

Net sales

|

$

|

5,852.6

|

|

$

|

3,665.3

|

|

$

|

2,187.3

|

|

||

|

Packaging

|

$

|

663.2

|

|

$

|

554.2

|

|

$

|

109.0

|

|

||

|

Paper

|

135.4

|

|

13.5

|

|

121.9

|

|

|||||

|

Corporate and other and eliminations

|

(95.9

|

)

|

(85.8

|

)

|

(10.1

|

)

|

|||||

|

Income from operations

|

$

|

702.7

|

|

$

|

481.9

|

|

$

|

220.8

|

|

||

|

Interest expense, net

|

(88.4

|

)

|

(58.3

|

)

|

(30.1

|

)

|

|||||

|

Income before taxes

|

614.3

|

|

423.6

|

|

190.7

|

|

|||||

|

Income tax (expense) benefit

|

(221.7

|

)

|

17.7

|

|

(239.4

|

)

|

|||||

|

Net income

|

$

|

392.6

|

|

$

|

441.3

|

|

$

|

(48.7

|

)

|

||

|

Net income excluding special items (b)

|

$

|

458.6

|

|

$

|

325.2

|

|

$

|

133.4

|

|

||

|

EBITDA (b)

|

$

|

1,083.7

|

|

$

|

683.7

|

|

$

|

400.0

|

|

||

|

EBITDA excluding special items (b)

|

$

|

1,143.6

|

|

$

|

750.7

|

|

$

|

392.9

|

|

||

|

(a)

|

On October 25, 2013, we acquired Boise Inc. (Boise). Our financial results include Boise subsequent to acquisition.

|

|

(b)

|

See "Reconciliations of Non-GAAP Financial Measures to Reported Amounts" included in this Item 7 for a reconciliation of non-GAAP measures to the most comparable GAAP measure.

|

|

Year Ended December 31

|

|||||||||||

|

2015

|

2014

|

2013

|

|||||||||

|

Net cash provided by (used for):

|

|||||||||||

|

Operating activities

|

$

|

762.6

|

|

$

|

736.1

|

|

$

|

608.2

|

|

||

|

Investing activities

|

(298.1

|

)

|

(451.1

|

)

|

(1,411.4

|

)

|

|||||

|

Financing activities

|

(405.2

|

)

|

(351.1

|

)

|

786.8

|

|

|||||

|

Net increase (decrease) in cash and cash equivalents

|

$

|

59.3

|

|

$

|

(66.1

|

)

|

$

|

(16.4

|

)

|

||

|

Year Ended December 31

|

||||||||||||

|

2015

|

2014

|

2013

|

||||||||||

|

Packaging

|

$

|

250.3

|

|

$

|

362.1

|

|

$

|

222.2

|

|

|||

|

Paper

|

58.5

|

|

51.7

|

|

10.0

|

|

||||||

|

Corporate and Other

|

5.7

|

|

6.4

|

|

2.2

|

|

||||||

|

$

|

314.5

|

|

$

|

420.2

|

|

$

|

234.4

|

|

||||

|

Payments Due by Period

|

|||||||||||||||||||

|

Total

|

Less Than

1 Year

|

1-3 Years

|

3-5 Years

|

More Than

5 Years

|

|||||||||||||||

|

Term loan, due October 2018

|

$

|

25.0

|

|

$

|

—

|

|

$

|

25.0

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

Term loan, due October 2020

|

637.0

|

|

6.5

|

|

13.0

|

|

617.5

|

|

—

|

|

|||||||||

|

6.50% Senior Notes, due March 2018

|

150.0

|

|

—

|

|

150.0

|

|

—

|

|

—

|

|

|||||||||

|

3.90% Senior Notes, due June 2022

|

400.0

|

|

—

|

|

—

|

|

—

|

|

400.0

|

|

|||||||||

|

4.50% Senior notes, due November 2023

|

700.0

|

|

—

|

|

—

|

|

—

|

|

700.0

|

|

|||||||||

|

3.65% Senior notes, due September 2024

|

400.0

|

|

—

|

|

—

|

|

—

|

|

400.0

|

|

|||||||||

|

Total short-term and long-term debt (a)

|

2,312.0

|

|

6.5

|

|

188.0

|

|

617.5

|

|

1,500.0

|

|

|||||||||

|

Interest on long-term debt (b)

|

560.4

|

|

85.5

|

|

162.7

|

|

146.0

|

|

166.2

|

|

|||||||||

|

Capital lease obligations, including interest

|

33.9

|

|

2.7

|

|

5.4

|

|

5.4

|

|

20.4

|

|

|||||||||

|

Operating leases (c)

|

248.4

|

|

54.4

|

|

81.9

|

|

42.9

|

|

69.2

|

|

|||||||||

|

Capital commitments

|

83.7

|

|

83.7

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Purchase commitments:

|

|||||||||||||||||||

|

Raw materials (d)

|

271.2

|

|

63.4

|

|

79.4

|

|

51.4

|

|

77.0

|

|

|||||||||

|

Energy related (e)

|

40.8

|

|

31.9

|

|

8.9

|

|

—

|

|

—

|

|

|||||||||

|

Other long-term liabilities reflected on our Consolidated Balance Sheet (f):

|

|||||||||||||||||||

|

Compensation and benefits (g)

|

354.3

|

|

30.1

|

|

91.4

|

|

104.4

|

|

128.4

|

|

|||||||||

|

Other (h)

|

73.5

|

|

20.7

|

|

8.7

|

|

4.2

|

|

39.9

|

|

|||||||||

|

$

|

3,978.2

|

|

$

|

378.9

|

|

$

|

626.4

|

|

$

|

971.8

|

|

$

|

2,001.1

|

|

|||||

|

(a)

|

The table assumes our long-term debt is held to maturity and includes the current portion of long-term debt. See Note

10

,

Debt

, of the Notes to Consolidated Financial Statements in "Part II, Item 8. Financial Statements and Supplementary Data" of this Form 10-K. Amounts are reported gross and do not include unamortized debt discounts of $2.8 million at

December 31, 2015

.

|

|

(b)

|

Amounts represent estimated future interest payments as of

December 31, 2015

, assuming our long-term debt is held to maturity and using interest rates in effect at

December 31, 2015

. See "Item 7A. Quantitative and Qualitative Disclosures About Market Risk” for the impact of changes in interest rates on PCA’s future cash flows.

|

|

(c)

|

We enter into operating leases in the normal course of business. We lease some of our operating facilities, as well as other property and equipment, under operating leases. Some lease agreements provide us with the option to renew the lease or purchase the leased property. Our operating lease obligations would change if we exercised these renewal options and/or if we entered into additional operating lease agreements.

|

|

(d)

|

Included among our raw materials purchase obligations are contracts to purchase approximately

$237.3 million

of wood fiber. Purchase prices under most of these agreements are set quarterly, semiannually, or annually based on regional market prices, and the estimate is based on contract terms or first quarter

2016

pricing. Except for deposits required pursuant to wood supply contracts, these obligations are not recorded in our consolidated financial statements until contract payment terms take effect. Our log, fiber, and wood chip obligations are subject to change based on, among other things, the effect of governmental laws and regulations, our manufacturing operations not operating in the normal course of business, log and fiber availability, and the status of environmental appeals.

|

|

(e)

|

We enter into utility contracts for the purchase of electricity and natural gas. We also purchase these services under utility tariffs. The contractual and tariff arrangements include multiple-year commitments and minimum annual purchase requirements. Our payment obligations were based upon prices in effect on

December 31, 2015

, or contract language, if available.

|

|

(f)

|

Long-term deferred income taxes of

$347.0 million

and unrecognized tax benefits of $6.7 million, including interest and penalties, are excluded from this table, because the timing of their future cash outflows are uncertain.

|

|

(g)

|

Amounts primarily consist of pension and postretirement obligations, including current portion of

$2.9 million

. We have minimum qualified pension contributions of approximately $27 million in

2016

. See Note

11

,

Employee Benefit Plans and Other Postretirement Benefits

, of the Notes to Consolidated Financial Statements in "Part II, Item 8. Financial Statements and Supplementary Data" of this Form 10-K, for additional information.

|

|

(h)

|

Amounts primarily consist of workers compensation, environmental, and asset retirement obligations.

|

|

2015 Fuel Purchased (millions of MMBTU's)

|

2015 Avg.

|

||||||||||||||||||

|

Fuel Type

|

First Quarter

|

Second Quarter

|

Third Quarter

|

Fourth Quarter

|

Full Year

|

Cost / MMBTU

|

|||||||||||||

|

Natural gas

|

5.14

|

|

4.89

|

|

5.29

|

|

5.69

|

|

21.01

|

|

$

|

3.65

|

|

||||||

|

Purchased bark

|

2.56

|

|

2.53

|

|

2.21

|

|

2.52

|

|

9.82

|

|

2.66

|

|

|||||||

|

Coal

|

1.03

|

|

0.46

|

|

0.10

|

|

0.03

|

|

1.62

|

|

3.91

|

|

|||||||

|

Other fuels

|

0.42

|

|

0.56

|

|

0.45

|

|

0.43

|

|

1.86

|

|

3.58

|

|

|||||||

|

Total mills

|

9.15

|

|

8.44

|

|

8.05

|

|

8.67

|

|

34.31

|

|

$

|

3.38

|

|

||||||

|

2015 Purchased Electricity (millions of CkWh)

|

2015 Avg.

|

||||||||||||||||||

|

First Quarter

|

Second Quarter

|

Third Quarter

|

Fourth Quarter

|

Full Year

|

Cost / CkWh

|

||||||||||||||

|

Purchased electricity

|

5.66

|

|

5.51

|

|

5.78

|

|

5.15

|

|

22.10

|

|

$

|

5.69

|

|

||||||

|

•

|

Resource Conservation and Recovery Act (RCRA);

|

|

•

|

Clean Water Act (CWA);

|

|

•

|

Clean Air Act (CAA);

|

|

•

|

The Emergency Planning and Community Right-to-Know-Act (EPCRA);

|

|

•

|

Toxic Substance Control Act (TSCA); and

|

|

•

|

Safe Drinking Water Act (SDWA).

|

|

Year Ending December 31, 2016

|

Year Ended December 31

|

||||||||||

|

2015

|

2014

|

||||||||||

|

Pension expense

|

$

|

26.8

|

|

$

|

31.3

|

|

$

|

25.3

|

|

||

|

Assumptions

|

|||||||||||

|

Discount rate

|

4.50

|

%

|

4.14

|

%

|

5.00

|

%

|

|||||

|

Expected rate of return on plan assets

|

6.57

|

%

|

6.73

|

%

|

6.69

|

%

|

|||||

|

Base Expense

|

Increase (Decrease) in Pension Expense (a)

|

||||||||||

|

0.25% Increase

|

0.25% Decrease

|

||||||||||

|

2015 Expense

|

|||||||||||

|

Discount rate

|

$

|

31.3

|

|

$

|

(3.0

|

)

|

$

|

3.5

|

|

||

|

Expected rate of return on plan assets

|

31.3

|

|

(2.0

|

)

|

2.0

|

|

|||||

|

2016 Expense (b)

|

|||||||||||

|

Discount rate

|

$

|

26.8

|

|

$

|

(2.2

|

)

|

$

|

2.9

|

|

||

|

Expected rate of return on plan assets

|

26.8

|

|

(1.9

|

)

|

1.9

|

|

|||||

|

(a)

|

The sensitivities shown above are specific to

2015

and

2016

. The sensitivities may not be additive, so the impact of changing multiple factors simultaneously cannot be calculated by combining the individual sensitivities shown.

|

|

(b)

|

Beginning in 2016, we refined the method used to determine the service and interest cost components of our net periodic benefit cost. Previously, the cost was determined using a single weighted-average discount rate derived from the yield curve. Under the refined method, known as the spot rate approach, we will use individual spot rates along the yield curve that correspond with the timing of each benefit payment. We believe this change provides a more precise measurement of service and interest costs by improving the correlation between projected cash outflows and corresponding spot rates on the yield curve. Compared to the previous method, the spot rate approach will decrease the service and interest components of our benefit costs by about $8 million in 2016.

|

|

•

|

Management reviews PCA’s deferred tax assets for realizability. Valuation allowances are established when management believes that it is more likely than not that some portion of the deferred tax assets will not be realized. Changes in valuation allowances from period to period are included in the tax provision.

|

|

•

|

PCA establishes accruals for unrecognized tax benefits when, despite the belief that PCA’s tax return positions are fully supported, PCA believes that an uncertain tax position does not meet the recognition threshold of ASC 740, "Income Taxes." The tax contingency accruals are adjusted in light of changing facts and circumstances, such as the progress of tax audits, the expiration of the statute of limitations for the relevant taxing authority to examine a tax return, case law and emerging legislation. While it is difficult to predict the final outcome or timing of resolution for any particular tax matter, PCA believes that the accruals for unrecognized tax benefits at

December 31, 2015

, reflect the likely outcome of known tax contingencies as of such date in accordance with accounting for uncertainty in income taxes under ASC 740.

|

|

Year Ended December 31

|

|||||||||||||||||||||||

|

2015

|

2014

|

2013 (a)

|

|||||||||||||||||||||

|

Income

from

Operations

|

Net

Income

|

Income

from

Operations

|

Net

Income

|

Income

from

Operations

|

Net

Income

|

||||||||||||||||||

|

As reported in accordance with GAAP

|

$

|

750.0

|

|

$

|

436.8

|

|

$

|

702.7

|

|

$

|

392.6

|

|

$

|

481.9

|

|

$

|

441.3

|

|

|||||

|

Special items:

|

|||||||||||||||||||||||

|

DeRidder restructuring (b)

|

2.0

|

|

1.3

|

|

65.8

|

|

42.1

|

|

—

|

|

—

|

|

|||||||||||

|

Integration-related and other costs (c)

|

13.4

|

|

8.9

|

|

18.4

|

|

12.7

|

|

17.4

|

|

11.0

|

|

|||||||||||

|

Sale of St. Helens paper mill site (d)

|

(6.7

|

)

|

(4.4

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Class action lawsuit settlement (e)

|

—

|

|

—

|

|

17.6

|

|

11.2

|

|

—

|

|

—

|

|

|||||||||||

|

Alternative energy tax credits (f)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(166.0

|

)

|

|||||||||||

|

Acquisition inventory step-up (g)

|

—

|

|

—

|

|

—

|

|

—

|

|

21.5

|

|

13.6

|

|

|||||||||||

|

Acquisition-related costs (h)

|

—

|

|

—

|

|

—

|

|

—

|

|

17.2

|

|

10.9

|

|

|||||||||||

|

Acquisition-related financing costs (h)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

7.4

|

|

|||||||||||

|

Pension curtailment charges (i)

|

—

|

|

—

|

|

—

|

|

—

|

|

10.9

|

|

7.0

|

|

|||||||||||

|

Total special items

|

8.7

|

|

5.8

|

|

101.8

|

|

66.0

|

|

67.0

|

|

(116.1

|

)

|

|||||||||||

|

Excluding special items

|

$

|

758.7

|

|

$

|

442.6

|

|

$

|

804.5

|

|

$

|

458.6

|

|

$

|

548.9

|

|

$

|

325.2

|

|

|||||

|

(a)

|

On October 25, 2013, we acquired Boise Inc. Our financial results include Boise subsequent to acquisition.

|

|

(b)

|

2015 and 2014 include amounts from restructuring activities at our mill in DeRidder, Louisiana including costs related to the conversion of the No. 3 newsprint machine to containerboard, our exit from the newsprint business, and other improvements.

|

|

(c)

|

All periods presented included include Boise acquisition integration-related and other costs, primarily for severance, retention, travel, and professional fees. 2014 also includes $1.5 million of expense related to the write-off of deferred financing costs in connection with the debt refinancing.

|

|

(d)

|

In September 2015, we sold the remaining land, buildings, and equipment at our paper mill site in St. Helens, Oregon where we ceased paper production in December 2012. We recorded a $6.7 million gain on the sale.

|

|

(e)

|

Includes $17.6 million of costs for the settlement of the

Kleen Products LLC v Packaging Corp. of America et al

class action lawsuit. See Note

19

,

Commitments, Guarantees, Indemnifications, and Legal Proceedings

, for more information.

|

|

(f)

|

2013 includes the reversal of $166.0 million of tax reserves related to alternative energy tax credits. Approximately $103.9 million of the reversal is due to the completion of the IRS audit of PCA's Filer City mill's cellulosic biofuel tax credits and $62.1 million is from the reversal of a reserve for the taxability of the alternative energy tax credits acquired in the acquisition of Boise.

|

|

(g)

|

Generally accepted accounting principles required us to value the inventory from the acquisition of Boise at fair value, which increased the value of the inventory by $21.5 million. This reduced the profit on the sale of the acquired inventory to that portion attributable to the selling effort. This step-up in value increased expenses by $21.5 million as the acquired inventory was sold and charged to cost of sales.

|

|

(h)

|

Includes acquisition-related costs, primarily for professional fees related to transaction-advisory services and expenses related to financing the acquisition of Boise.

|

|

(i)

|

Includes $10.9 million of non-cash pension curtailment charges related to pension plan changes in which certain hourly corrugated and containerboard mill employees will transition from a defined benefit pension plan to a defined contribution 401k plan.

|

|

|

Year Ended December 31

|

||||||||||||||||||

|

|

2015

|

2014

|

2013

|

2012

|

2011

|

||||||||||||||

|

Net income

|

$

|

436.8

|

|

$

|

392.6

|

|

$

|

441.3

|

|

$

|

160.2

|

|

$

|

158.8

|

|

||||

|

Interest expense, net

|

85.5

|

|

88.4

|

|

58.3

|

|

62.9

|

|

29.2

|

|

|||||||||

|

Provision (benefit) for income taxes

|

227.7

|

|

221.7

|

|

(17.7

|

)

|

214.5

|

|

86.0

|

|

|||||||||

|

Depreciation, amortization, and depletion

|

356.5

|

|

381.0

|

|

201.8

|

|

170.8

|

|

163.6

|

|

|||||||||

|

EBITDA (a)

|

$

|

1,106.5

|

|

$

|

1,083.7

|

|

$

|

683.7

|

|

$

|

608.4

|

|

$

|

437.6

|

|

||||

|

Special items:

|

|||||||||||||||||||

|

DeRidder restructuring

|

$

|

(7.0

|

)

|

$

|

23.9

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

Integration-related and other costs

|

13.4

|

|

18.4

|

|

17.4

|

|

—

|

|

—

|

|

|||||||||

|

Sale of St. Helens paper mill site

|

(6.7

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Class action lawsuit settlement

|

—

|

|

17.6

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Acquisition inventory step-up

|

—

|

|

—

|

|

21.5

|

|

—

|

|

—

|

|

|||||||||

|

Acquisition-related costs

|

—

|

|

—

|

|

17.2

|

|

—

|

|

—

|

|

|||||||||

|

Pension curtailment charges

|

—

|

|

—

|

|

10.9

|

|

—

|

|

—

|

|

|||||||||

|

Plant closure charges

|

—

|

|

—

|

|

—

|

|

2.0

|

|

7.4

|

|

|||||||||

|

Alternative energy tax credits

|

—

|

|

—

|

|

—

|

|

(95.5

|

)

|

—

|

|

|||||||||

|

Medical benefits reserve adjustment

|

—

|

|

—

|

|

—

|

|

—

|

|

(1.6

|

)

|

|||||||||

|

EBITDA excluding special items (a)

|

$

|

1,106.2

|

|

$

|

1,143.6

|

|

$

|

750.7

|

|

$

|

514.9

|

|

$

|

443.4

|

|

||||

|

(a)

|

EBITDA and EBITDA, excluding special items, are non-GAAP financial measures. We present these measures because they provide a means to evaluate the performance of our segments and our company on an ongoing basis using the same measures that are used by our management and because these measures are frequently used by investors and other interested parties in the evaluation of companies and the performance of their segments. For each non-GAAP financial measure, we provide a reconciliation to the most directly comparable financial measure presented in accordance with GAAP. These measures may differ from similarly captioned measures of other companies. Any analysis of non-GAAP financial measures should be done in conjunction with results presented in accordance with GAAP. The non-GAAP measures are not intended to be substitutes for GAAP financial measures and should not be used as such.

|

|

Year Ended December 31

|

|||||||||||

|

2015

|

2014

|

2013

|

|||||||||

|

Packaging

|

|||||||||||

|

Segment income

|

$

|

714.9

|

|

$

|

663.2

|

|

$

|

554.2

|

|

||

|

Depreciation, amortization, and depletion

|

297.3

|

|

323.0

|

|

190.2

|

|

|||||

|

EBITDA

|

1,012.2

|

|

986.2

|

|

744.4

|

|

|||||

|

DeRidder restructuring

|

(7.0

|

)

|

23.9

|

|

—

|

|

|||||

|

Integration-related and other costs

|

4.1

|

|

4.9

|

|

1.4

|

|

|||||

|

Acquisition inventory step-up

|

—

|

|

—

|

|

18.0

|

|

|||||

|

Pension curtailment charges

|

—

|

|

—

|

|

10.9

|

|

|||||

|

EBITDA excluding special items

|

$

|

1,009.3

|

|

$

|

1,015.0

|

|

$

|

774.7

|

|

||

|

Paper

|

|||||||||||

|

Segment income

|

$

|

112.5

|

|

$

|

135.4

|

|

$

|

13.5

|

|

||

|

Depreciation, amortization, and depletion

|

54.9

|

|

50.6

|

|

9.1

|

|

|||||

|

EBITDA

|

167.4

|

|

186.0

|

|

22.6

|

|

|||||

|

Sale of St. Helens paper mill site

|

(6.7

|

)

|

—

|

|

—

|

|

|||||

|

Integration-related and other costs

|

—

|

|

—

|

|

(1.9

|

)

|

|||||

|

Acquisition inventory step-up

|

—

|

|

—

|

|

3.5

|

|

|||||

|

EBITDA excluding special items

|

$

|

160.7

|

|

$

|

186.0

|

|

$

|

24.2

|

|

||

|

Corporate and Other

|

|||||||||||

|

Segment income (loss)

|

$

|

(77.4

|

)

|

$

|

(95.9

|

)

|

$

|

(85.8

|

)

|

||

|

Depreciation, amortization, and depletion

|

4.3

|

|

7.4

|

|

2.5

|

|

|||||

|

EBITDA

|

(73.1

|

)

|

(88.5

|

)

|

(83.3

|

)

|

|||||

|

Integration-related and other costs

|

9.3

|

|

13.5

|

|

17.9

|

|

|||||

|

Class action lawsuit settlement

|

—

|

|

17.6

|

|

—

|

|

|||||

|

Acquisition-related costs

|

—

|

|

—

|

|

17.2

|

|

|||||

|

EBITDA excluding special items

|

$

|

(63.8

|

)

|

$

|

(57.4

|

)

|

$

|

(48.2

|

)

|

||

|

EBITDA

|

$

|

1,106.5

|

|

$

|

1,083.7

|

|

$

|

683.7

|

|

||

|

EBITDA excluding special items

|

$

|

1,106.2

|

|

$

|

1,143.6

|

|

$

|

750.7

|

|

||

|

Item 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

|

Item 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

|

Packaging Corporation of America Consolidated Financial Statements

|

|

|

Year Ended December 31

|

|||||||||||

|

|

2015

|

2014

|

2013

|

||||||||

|

Statements of Income:

|

|||||||||||

|

Net sales

|

$

|

5,741.7

|

|

$

|

5,852.6

|

|

$

|

3,665.3

|

|

||

|

Cost of sales

|

(4,533.7

|

)

|

(4,623.1

|

)

|

(2,797.8

|

)

|

|||||

|

Gross profit

|

1,208.0

|

|

1,229.5

|

|

867.5

|

|

|||||

|

Selling, general, and administrative expenses

|

(451.3

|

)

|

(469.5

|

)

|

(326.6

|

)

|

|||||

|

Other expense, net

|

(6.7

|

)

|

(57.3

|

)

|

(59.0

|

)

|

|||||

|

Income from operations

|

750.0

|

|

702.7

|

|

481.9

|

|

|||||

|

Interest expense, net

|

(85.5

|

)

|

(88.4

|

)

|

(58.3

|

)

|

|||||

|

Income before taxes

|

664.5

|

|

614.3

|

|

423.6

|

|

|||||

|

(Provision) benefit for income taxes

|

(227.7

|

)

|

(221.7

|

)

|

17.7

|

|

|||||

|

Net income

|

$

|

436.8

|

|

$

|

392.6

|

|

$

|

441.3

|

|

||

|

Net income per common share

|

|||||||||||

|

Basic

|

$

|

4.47

|

|

$

|

3.99

|

|

$

|

4.57

|

|

||

|

Diluted

|

$

|

4.47

|

|

$

|

3.99

|

|

$

|

4.52

|

|

||

|

Dividends declared per common share

|

$

|

2.20

|

|

$

|

1.60

|

|

$

|

1.51

|

|

||

|

Statements of Comprehensive Income:

|

|||||||||||

|

Net income

|

$

|

436.8

|

|

$

|

392.6

|

|

$

|

441.3

|

|

||

|

Other comprehensive income (loss), net of tax:

|

|||||||||||

|

Foreign currency translation adjustment

|

2.7

|

|

(2.6

|

)

|

(0.1

|

)

|

|||||

|

Reclassification adjustments to cash flow hedges included in net income, net of tax of

$2.2 million

,

$2.2 million,

and $

2.2 million

for 2015, 2014, and 2013, respectively

|

3.5

|

|

3.5

|

|

3.5

|

|

|||||

|

Amortization of pension and postretirement plans actuarial loss and prior service cost, net of tax of

$5.6 million

,

$2.8 million

, and

$8.5 million

for 2015, 2014, and 2013, respectively

|

8.8

|

|

4.2

|

|

13.4

|

|

|||||

|

Changes in unfunded employee benefit obligations, net of tax of

$8.9 million

,

$59.2 million

, and

$20.4 million

for 2015, 2014, and 2013, respectively

|

14.0

|

|

(94.0

|

)

|

32.2

|

|

|||||

|

Other comprehensive income (loss)

|

29.0

|

|

(88.9

|

)

|

49.0

|

|

|||||

|

Comprehensive income

|

$

|

465.8

|

|

$

|

303.7

|

|

$

|

490.3

|

|

||

|

December 31

|

|||||||

|

2015

|

2014

|

||||||

|

ASSETS

|

|||||||

|

Current assets:

|

|||||||

|

Cash and cash equivalents

|

$

|

184.2

|

|

$

|

124.9

|

|

|

|

Accounts receivable, net of allowance for doubtful accounts and customer deductions of $10.3 million and $11.3 million as of December 31, 2015 and 2014, respectively

|

636.5

|

|

646.1

|

|

|||

|

Inventories

|

676.8

|

|

664.9

|

|

|||

|

Prepaid expenses and other current assets

|

28.8

|

|

61.9

|

|

|||

|

Federal and state income taxes receivable

|

28.2

|

|

5.1

|

|

|||

|

Total current assets

|

1,554.5

|

|

1,502.9

|

|

|||

|

Property, plant, and equipment, net

|

2,832.1

|

|

2,857.6

|

|

|||

|

Goodwill

|

544.0

|

|

546.8

|

|

|||

|

Intangible assets, net

|

270.8

|

|

293.5

|

|

|||

|

Other long-term assets

|

83.2

|

|

72.0

|

|

|||

|

Total assets

|

$

|

5,284.6

|

|

$

|

5,272.8

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|||||||

|

Current liabilities:

|

|||||||

|

Current maturities of long-term debt

|

$

|

6.5

|

|

$

|

6.5

|

|

|

|

Capital lease obligations

|

1.2

|

|

1.1

|

|

|||

|

Accounts payable

|

294.2

|

|

330.5

|

|

|||

|

Dividends payable

|

53.4

|

|

39.4

|

|

|||

|

Accrued liabilities

|

193.5

|

|

220.0

|

|

|||

|

Accrued interest

|

13.1

|

|

13.5

|

|

|||

|

Total current liabilities

|

561.9

|

|

611.0

|

|

|||

|

Long-term liabilities:

|

|||||||

|

Long-term debt

|

2,302.7

|

|

2,348.9

|

|

|||

|

Capital lease obligations

|

21.6

|

|

22.8

|

|

|||

|

Deferred income taxes

|

347.0

|

|

334.2

|

|

|||

|

Compensation and benefits

|

358.6

|

|

361.7

|

|

|||

|

Other long-term liabilities

|

59.5

|

|

72.8

|

|

|||

|

Total long-term liabilities

|

3,089.4

|

|

3,140.4

|

|

|||

|

Commitments and contingent liabilities

|

|

|

|

|

|||

|

Stockholders' equity:

|

|||||||

|

Common stock, par value $0.01 per share, 300.0 million shares authorized, 96.1 million and

98.4 million

shares issued as of December 31, 2015 and 2014, respectively

|

1.0

|

|

1.0

|

|

|||

|

Additional paid in capital

|

439.9

|

|

432.1

|

|

|||

|

Retained earnings

|

1,317.3

|

|

1,242.2

|

|

|||

|

Accumulated other comprehensive loss

|

(124.9

|

)

|

(153.9

|

)

|

|||

|

Total stockholders' equity

|

1,633.3

|

|

1,521.4

|

|

|||

|

Total liabilities and stockholders' equity

|

$

|

5,284.6

|

|

$

|

5,272.8

|

|

|

|

Year Ended December 31

|

|||||||||||

|

|

2015

|

2014

|

2013

|

||||||||

|

Cash Flows from Operating Activities:

|

|||||||||||

|

Net income

|

$

|

436.8

|

|

$

|

392.6

|

|

$

|

441.3

|

|

||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|||||||||||

|

Depreciation, depletion, and amortization of intangibles and deferred financing costs

|

364.3

|

|

390.8

|

|

217.9

|

|

|||||

|

Share-based compensation expense

|

18.2

|

|

15.6

|

|

14.8

|

|

|||||

|

Deferred income tax provision (benefit)

|

1.7

|

|

2.6

|

|

(160.3

|

)

|

|||||

|

Alternative energy tax credits

|

—

|

|

—

|

|

76.3

|

|

|||||

|

Loss on disposals of property, plant, and equipment

|

0.5

|

|

7.0

|

|

9.4

|

|

|||||

|

Pension and post retirement benefits expense, net of contributions

|

31.2

|

|

25.4

|

|

18.5

|

|

|||||

|

Other, net

|

(20.3

|

)

|

(0.9

|

)

|

(1.0

|

)

|

|||||

|

Changes in operating assets and liabilities, net of acquisitions:

|

|||||||||||

|

Decrease (increase) in assets —

|

|||||||||||

|

Accounts receivable

|

9.5

|

|

(8.5

|

)

|

(31.2

|

)

|

|||||

|

Inventories

|

(11.9

|

)

|

(72.4

|

)

|

25.0

|

|

|||||

|

Prepaid expenses and other current assets

|

4.1

|

|

(5.1

|

)

|

(1.9

|

)

|

|||||

|

Increase (decrease) in liabilities —

|

|||||||||||

|

Accounts payable

|

(37.3

|

)

|

(36.0

|

)

|

54.2

|

|

|||||

|

Accrued liabilities

|

(15.5

|

)

|

7.0

|

|

(22.1

|

)

|

|||||

|

Federal and state income tax payable/receivable

|

(18.7

|

)

|

18.0

|

|

(32.7

|

)

|

|||||

|

Net cash provided by operating activities

|

762.6

|

|

736.1

|

|

608.2

|

|

|||||

|

Cash Flows from Investing Activities:

|

|||||||||||

|

Additions to property, plant, and equipment

|

(314.5

|

)

|

(420.2

|

)

|

(234.4

|

)

|

|||||

|

Proceeds from sale of a business

|

23.0

|

|

—

|

|

—

|

|

|||||

|

Acquisitions of businesses, net of cash acquired

|

—

|

|

(20.5

|

)

|

(1,174.5

|

)

|

|||||

|

Additions to other long term assets

|

(12.3

|

)

|

(12.5

|

)

|

(3.1

|

)

|

|||||

|

Other

|

5.7

|

|

2.1

|

|

0.6

|

|

|||||

|

Net cash used for investing activities

|

(298.1

|

)

|

(451.1

|

)

|

(1,411.4

|

)

|

|||||

|

Cash Flows from Financing Activities:

|

|||||||||||

|

Proceeds from issuance of debt

|

—

|

|

398.9

|

|

1,998.1

|

|

|||||

|

Repayments of debt

|

(47.6

|

)

|

(592.5

|

)

|

(1,074.8

|

)

|

|||||

|

Financing costs paid

|

—

|

|

(3.4

|

)

|

(19.4

|

)

|

|||||

|

Common stock dividends paid

|

(200.8

|

)

|

(157.4

|

)

|

(109.1

|

)

|

|||||

|

Repurchases of common stock

|

(154.7

|

)

|

—

|

|

(7.8

|

)

|

|||||

|

Proceeds from exercise of stock options

|

—

|

|

3.7

|

|

2.9

|

|

|||||

|

Excess tax benefits from stock-based awards

|

6.0

|

|

12.2

|

|

7.8

|

|

|||||

|

Shares withheld to cover employee restricted stock taxes

|

(8.7

|

)

|

(13.2

|

)

|

(11.0

|

)

|

|||||

|

Other

|

0.6

|

|

0.6

|

|

0.1

|

|

|||||

|

Net cash (used for) provided by financing activities

|

(405.2

|

)

|

(351.1

|

)

|

786.8

|

|

|||||

|

Net increase (decrease) in cash and cash equivalents

|

59.3

|

|

(66.1

|

)

|

(16.4

|

)

|

|||||

|

Cash and cash equivalents, beginning of year

|

124.9

|

|

191.0

|

|

207.4

|

|

|||||

|

Cash and cash equivalents, end of year

|

$

|

184.2

|

|

$

|

124.9

|

|

$

|

191.0

|

|

||

|

Common Stock

|

Treasury Stock

|

Additional Paid in Capital

|

Retained Earnings

|

Accumulated Other Comprehensive Loss

|

Total Stockholders' Equity

|

||||||||||||||||||||||||

|

|

Shares

|

Amount

|

Shares

|

Amount

|

|||||||||||||||||||||||||

|

Balance at January 1, 2013

|

98,143

|

|

$

|

1.0

|

|

—

|

|

$

|

—

|

|

$

|

378.8

|

|

$

|

742.5

|

|

$

|

(114.0

|

)

|

$

|

1,008.3

|

|

|||||||

|

Common stock repurchases and retirements

|

(171

|

)

|

—

|

|

—

|

|

—

|

|

(1.1

|

)

|

(6.7

|

)

|

—

|

|

(7.8

|

)

|

|||||||||||||

|

Common stock withheld and retired to cover taxes on vested stock awards

|

(224

|

)

|

—

|

|

—

|

|

—

|

|

(1.4

|

)

|

(9.6

|

)

|

—

|

|

(11.0

|

)

|

|||||||||||||

|

Common stock dividends declared

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(148.4

|

)

|

—

|

|

(148.4

|

)

|

|||||||||||||

|

Restricted stock grants and cancellations

|

297

|

|

—

|

|

—

|

|

—

|

|

6.9

|

|

—

|

|

—

|

|

6.9

|

|

|||||||||||||

|

Exercise of stock options

|

127

|

|

—

|

|

—

|

|

—

|

|

3.7

|

|

—

|

|

—

|

|

3.7

|

|

|||||||||||||

|

Share-based compensation expense

|

—

|

|

—

|

|

—

|

|

—

|

|

14.8