|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Ireland

|

|

98-1141328

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification number)

|

|

43 London Wall, London, EC2M 5TF, United Kingdom

|

||

|

(Address of principal executive offices)

|

||

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Ordinary Shares, nominal value $0.01 per share

|

|

New York Stock Exchange

|

|

Large accelerated filer

þ

|

|

Accelerated filer

o

|

|

Non-accelerated filer

o

|

|

Smaller reporting

company

o

|

Emerging growth company

o

|

|

|

|

|

(Do not check if a smaller reporting company)

|

||||||

|

|

|

|

|

Page

|

|

PART I

|

||||

|

ITEM 1.

|

|

|

||

|

ITEM 1A.

|

|

|

||

|

ITEM 1B.

|

|

|

||

|

ITEM 2.

|

|

|

||

|

ITEM 3.

|

|

|

||

|

ITEM 4.

|

|

|

||

|

PART II

|

||||

|

ITEM 5.

|

|

|

||

|

ITEM 6.

|

|

|

||

|

ITEM 7.

|

|

|

||

|

ITEM 7A.

|

|

|

||

|

ITEM 8.

|

|

|

||

|

ITEM 9.

|

|

|

||

|

ITEM 9A.

|

|

|

||

|

ITEM 9B.

|

|

|

||

|

PART III

|

||||

|

ITEM 10.

|

|

|

||

|

ITEM 11.

|

|

|

||

|

ITEM 12.

|

|

|

||

|

ITEM 13.

|

|

|

||

|

ITEM 14.

|

|

|

||

|

PART IV

|

||||

|

ITEM 15.

|

|

|

||

|

ITEM 16.

|

|

|

||

|

|

|

|||

|

•

|

building operational excellence through the Pentair Integrated Management System ("PIMS") consisting of lean enterprise, growth and talent management;

|

|

•

|

driving long-term growth in sales, operating income and cash flows, through growth and productivity initiatives along with acquisitions;

|

|

•

|

developing new products and enhancing existing products;

|

|

•

|

penetrating attractive growth markets, particularly outside of the United States;

|

|

•

|

expanding multi-channel distribution; and

|

|

•

|

proactively managing our business portfolio for optimal value creation, including consideration of new business platforms.

|

|

|

December 31

|

||||||||||

|

In millions

|

2017

|

2016

|

$ change

|

% change

|

|||||||

|

Water

|

$

|

406.9

|

|

$

|

375.8

|

|

$

|

31.1

|

|

8.3

|

%

|

|

Electrical

|

280.4

|

|

266.3

|

|

14.1

|

|

5.3

|

|

|||

|

Total

|

$

|

687.3

|

|

$

|

642.1

|

|

$

|

45.2

|

|

7.0

|

%

|

|

•

|

execution of the proposed spin-off will require significant time and attention from management, which may distract management from the operation of our businesses and the execution of other initiatives that may have been beneficial to us;

|

|

•

|

our employees may also be distracted due to uncertainty about their future roles with each of the separate companies pending the completion of the spin-off;

|

|

•

|

some of our suppliers or customers may delay or defer decisions or may end their relationships with us;

|

|

•

|

we will be required to pay certain costs and expenses relating to the spin-off, such as legal, accounting and other professional fees, whether or not it is completed; and

|

|

•

|

we may experience negative reactions from the financial markets if we fail to complete the spin-off or fail to complete it on a timely basis.

|

|

•

|

diversion of management time and attention from daily operations;

|

|

•

|

difficulties integrating acquired businesses, technologies and personnel into our business;

|

|

•

|

difficulties in obtaining and verifying the financial statements and other business information of acquired businesses;

|

|

•

|

inability to obtain required regulatory approvals;

|

|

•

|

potential loss of key employees, key contractual relationships or key customers of acquired companies or of ours;

|

|

•

|

assumption of the liabilities and exposure to unforeseen liabilities of acquired companies, including risks relating to the U.S. Foreign Corrupt Practices Act (the "FCPA"); and

|

|

•

|

dilution of interests of holders of our shares through the issuance of equity securities or equity-linked securities.

|

|

•

|

changes in general economic and political conditions in countries where we operate, particularly in emerging markets;

|

|

•

|

relatively more severe economic conditions in some international markets than in the U.S.;

|

|

•

|

the difficulty of enforcing agreements and collecting receivables through non-U.S. legal systems;

|

|

•

|

the difficulty of communicating and monitoring standards and directives across our global facilities;

|

|

•

|

trade protection measures and import or export licensing requirements and restrictions;

|

|

•

|

the possibility of terrorist action affecting us or our operations;

|

|

•

|

the threat of nationalization and expropriation;

|

|

•

|

the imposition of tariffs, exchange controls or other trade restrictions;

|

|

•

|

difficulty in staffing and managing widespread operations in non-U.S. labor markets;

|

|

•

|

changes in tax treaties, laws or rulings that could have a material adverse impact on our effective tax rate;

|

|

•

|

limitations on repatriation of earnings;

|

|

•

|

the difficulty of protecting intellectual property in non-U.S. countries; and

|

|

•

|

changes in and required compliance with a variety of non-U.S. laws and regulations.

|

|

•

|

actual or anticipated fluctuations in our results of operations due to factors related to our business;

|

|

•

|

success or failure of our business strategy;

|

|

•

|

our quarterly or annual earnings, or those of other companies in our industry;

|

|

•

|

our ability to obtain third-party financing as needed;

|

|

•

|

announcements by us or our competitors of significant acquisitions or dispositions;

|

|

•

|

changes in accounting standards, policies, guidance, interpretations or principles;

|

|

•

|

changes in earnings estimates by us or securities analysts or our ability to meet those estimates;

|

|

•

|

the operating and share price performance of other comparable companies;

|

|

•

|

investor perception of us;

|

|

•

|

natural or other environmental disasters that investors believe may affect us;

|

|

•

|

overall market fluctuations;

|

|

•

|

results from any material litigation, including asbestos claims, government investigations or environmental liabilities;

|

|

•

|

changes in laws and regulations affecting our business; and

|

|

•

|

general economic conditions and other external factors.

|

|

Name

|

Age

|

Current Position and Business Experience

|

|||

|

Randall J. Hogan

|

62

|

|

Chief Executive Officer since 2001 and Chairman of the Board since 2002; President and Chief Operating Officer, 1999 — 2000; Executive Vice President and President of Pentair's Electrical and Electronic Enclosures Group, 1998 — 1999; United Technologies Carrier Transicold President, 1995 — 1997; Pratt & Whitney Industrial Turbines Vice President and General Manager, 1994 — 1995; General Electric various executive positions, 1988 — 1994; McKinsey & Company consultant, 1981 — 1987. It is expected that Mr. Hogan will retire from his positions as Chairman and Chief Executive Officer of the Company and become the Chairman of nVent Electric plc, effective upon the completion of the Proposed Separation.

|

||

|

John L. Stauch

|

53

|

|

Executive Vice President and Chief Financial Officer since 2007; Chief Financial Officer of the Automation and Control Systems unit of Honeywell International Inc., 2005 — 2007; Vice President, Finance and Chief Financial Officer of the Sensing and Controls unit of Honeywell International Inc., 2004 — 2005; Vice President, Finance and Chief Financial Officer of the Automation & Control Products unit of Honeywell International Inc., 2002 — 2004; Chief Financial Officer and IT Director of PerkinElmer Optoelectronics, a unit of PerkinElmer, Inc., 2000 — 2002; Various executive, investor relations and managerial finance positions with Honeywell International Inc. and its predecessor AlliedSignal Inc., 1994 — 2000. It is expected that Mr. Stauch will become the Company’s Chief Executive Officer, effective upon the completion of the Proposed Separation.

|

||

|

Angela D. Jilek

|

49

|

|

Senior Vice President, General Counsel and Secretary since 2010; Assistant General Counsel, 2002 — 2010; Shareholder and Officer of the law firm of Henson & Efron, P.A., 2000 — 2002; Associate Attorney in the law firm of Henson & Efron, P.A. 1996 — 2000 and in the law firm of Felhaber Larson Fenlon & Vogt, P.A., 1992 — 1996. It is expected that Ms. Jilek will retire from the Company effective May 1, 2018.

|

||

|

John H. Jacko

|

60

|

|

Senior Vice President and Chief Marketing Officer since 2017; Vice President and Chief Marketing Officer of Kennametal Corporation, 2007 — 2016; Senior Vice President and Chief Marketing Officer of Flowserve Corporation, 2002 — 2007; Vice President of Marketing and Customer Management of Flowserve Corporation, 2001 — 2002; Various business leadership positions of Honeywell Aerospace, 1995 — 2001.

It is expected that Mr. Jacko will become the Company’s Chief Growth Officer, effective upon the completion of the Proposed Separation.

|

||

|

Mark C. Borin

|

50

|

|

Senior Vice President and Chief Accounting Officer since 2008 and Treasurer since 2015; Partner in the audit practice of the public accounting firm KPMG LLP, 2000 — 2008; Various positions in the audit practice of KPMG LLP, 1989 — 2000. It is expected that Mr. Borin will become the Company’s Chief Financial Officer, effective upon the completion of the Proposed Separation.

|

||

|

Karl R. Frykman

|

57

|

|

President, Water segment since 2017; President, Water Quality Systems Global Business Unit, 2007 — 2016; President of Aquatic Systems' National Pool Tile group, 1998— 2007; Vice President of Operations for American Products, 1995 — 1998; Vice President of Anthony Pools, 1990 — 1995; Vice President of Poolsaver, 1988 — 1990. It is expected that Mr. Frykman will become the Company’s Chief Operating Officer, effective upon the completion of the Proposed Separation.

|

||

|

Beth A. Wozniak

|

53

|

|

President, Electrical segment since 2017; President, Flow & Filtration Solutions Global Business Unit, 2015 — 2016; President of Environmental and Combustion Controls unit of Honeywell International Inc., 2011 — 2015; President of Sensing and Controls unit of Honeywell International Inc., 2006 — 2011; Various leadership positions at Honeywell International Inc. and its predecessor AlliedSignal Inc., 1990 — 2006. It is expected that Ms. Wozniak will resign from her position with the Company and become the Chief Executive Officer of nVent Electric plc, effective upon the completion of the Proposed Separation.

|

||

|

|

2017

|

2016

|

|||||||||||||||||||||||

|

|

First

|

Second

|

Third

|

Fourth

|

First

|

Second

|

Third

|

Fourth

|

|||||||||||||||||

|

High

|

$

|

63.45

|

|

$

|

69.03

|

|

$

|

68.50

|

|

$

|

71.76

|

|

$

|

54.54

|

|

$

|

63.39

|

|

$

|

66.99

|

|

$

|

64.39

|

|

|

|

Low

|

56.53

|

|

61.61

|

|

59.13

|

|

67.27

|

|

41.57

|

|

50.37

|

|

57.20

|

|

53.80

|

|

|||||||||

|

Close

|

62.78

|

|

66.54

|

|

67.96

|

|

70.62

|

|

54.26

|

|

58.29

|

|

64.24

|

|

56.07

|

|

|||||||||

|

Dividends paid

|

0.345

|

|

0.345

|

|

0.345

|

|

0.345

|

|

0.33

|

|

0.33

|

|

0.34

|

|

0.34

|

|

|||||||||

|

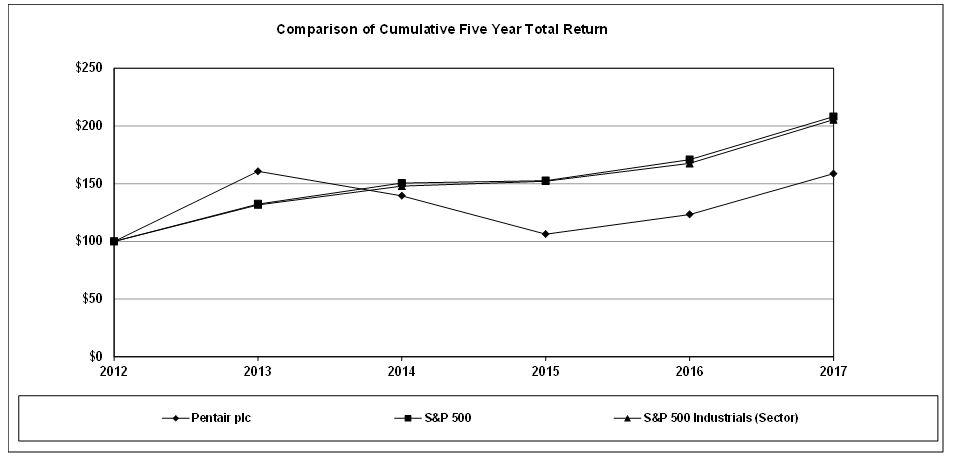

|

Base Period

December

|

INDEXED RETURNS

Years ended December 31

|

||||||||||

|

Company / Index

|

2012

|

2013

|

2014

|

2015

|

2016

|

2017

|

||||||

|

Pentair plc

|

100

|

160.70

|

|

139.55

|

|

106.31

|

|

123.32

|

|

158.68

|

|

|

|

S&P 500 Index

|

100

|

132.39

|

|

150.51

|

|

152.59

|

|

170.84

|

|

208.14

|

|

|

|

S&P 500 Industrials Index

|

100

|

131.64

|

|

147.91

|

|

152.19

|

|

167.59

|

|

205.41

|

|

|

|

(a)

|

(b)

|

(c)

|

(d)

|

|||||||

|

Total number of

shares

purchased

|

Average price

paid per share

|

Total number of

shares

purchased as

part of publicly

announced

plans or

programs

|

Dollar value

of

shares that may

yet be purchased

under the plans or

programs

|

|||||||

|

October 1 – October 28, 2017

|

1,146

|

|

$

|

67.96

|

|

—

|

|

$

|

700,000,054

|

|

|

October 29 – November 25, 2017

|

17,792

|

|

69.28

|

|

—

|

|

700,000,054

|

|

||

|

November 26 – December 31, 2017

|

1,432,297

|

|

69.80

|

|

1,432,297

|

|

600,000,119

|

|

||

|

Total

|

1,451,235

|

|

1,432,297

|

|

||||||

|

(a)

|

The purchases in this column include

1,146

shares for the period

October 1 – October 28, 2017

,

17,792

shares for the period

October 29 – November 25, 2017

, and

no

shares for the period

November 26 – December 31, 2017

deemed surrendered to us by participants in our 2012 Stock and Incentive Plan (the "2012 Plan") and earlier stock incentive plans that are now outstanding under the 2012 Plan (collectively the "Plans") to satisfy the exercise price or withholding of tax obligations related to the exercise of stock options and vesting of restricted shares.

|

|

(b)

|

The average price paid in this column includes shares repurchased as part of our publicly announced plans and shares deemed surrendered to us by participants in the Plans to satisfy the exercise price of stock options and withholding tax obligations due upon stock option exercises and vesting of restricted shares.

|

|

(c)

|

The number of shares in this column represents the number of shares repurchased as part of our publicly announced plans to repurchase our ordinary shares up to a maximum dollar limit of $1.0 billion.

|

|

(d)

|

In December 2014, our Board of Directors authorized the repurchase of our ordinary shares up to a maximum dollar limit of

$1.0 billion

. This authorization expires on

December 31, 2019

. We have

$600.0 million

remaining availability for repurchases under the 2014 authorization.

|

|

|

Years ended December 31

|

||||||||||||||

|

In millions, except per-share data

|

2017

|

2016

|

2015

|

2014

|

2013

|

||||||||||

|

Consolidated statements of operations and comprehensive income data

|

|||||||||||||||

|

Net sales

|

$

|

4,936.5

|

|

$

|

4,890.0

|

|

$

|

4,616.4

|

|

$

|

4,666.8

|

|

$

|

4,553.7

|

|

|

Operating income

|

680.8

|

|

700.7

|

|

616.1

|

|

538.5

|

|

529.2

|

|

|||||

|

Net income from continuing operations attributable to Pentair plc

|

480.0

|

|

451.6

|

|

397.1

|

|

356.6

|

|

354.8

|

|

|||||

|

Per-share data

|

|

||||||||||||||

|

Basic:

|

|

||||||||||||||

|

Earnings per ordinary share from continuing operations attributable to Pentair plc

|

$

|

2.64

|

|

$

|

2.49

|

|

$

|

2.20

|

|

$

|

1.87

|

|

$

|

1.76

|

|

|

Weighted average shares

|

181.7

|

|

181.3

|

|

180.3

|

|

190.6

|

|

201.1

|

|

|||||

|

Diluted:

|

|

||||||||||||||

|

Earnings per ordinary share from continuing operations attributable to Pentair plc

|

$

|

2.61

|

|

$

|

2.47

|

|

$

|

2.17

|

|

$

|

1.84

|

|

$

|

1.73

|

|

|

Weighted average shares

|

183.7

|

|

183.1

|

|

182.6

|

|

193.7

|

|

204.6

|

|

|||||

|

Cash dividends declared and paid per ordinary share

|

$

|

1.38

|

|

$

|

1.34

|

|

$

|

1.28

|

|

$

|

1.10

|

|

$

|

0.96

|

|

|

Cash dividends declared and unpaid per ordinary share

|

0.35

|

|

0.345

|

|

0.33

|

|

0.64

|

|

0.50

|

|

|||||

|

Consolidated balance sheets data

|

|

||||||||||||||

|

Total assets

|

$

|

8,633.7

|

|

$

|

11,534.8

|

|

$

|

11,833.4

|

|

$

|

10,643.8

|

|

$

|

11,732.5

|

|

|

Total debt

|

1,440.7

|

|

4,279.2

|

|

4,685.8

|

|

2,988.4

|

|

2,532.6

|

|

|||||

|

Total equity

|

5,037.8

|

|

4,254.4

|

|

4,008.8

|

|

4,663.8

|

|

6,217.7

|

|

|||||

|

•

|

During 2017 and 2016, we continued execution of certain business restructuring initiatives aimed at reducing our fixed cost structure and, during 2017, began realigning our business in contemplation of the Proposed Separation. We expect that these actions will contribute to margin growth in 2018.

|

|

•

|

We have identified specific product and geographic market opportunities that we find attractive and continue to pursue, both within and outside the United States. We are reinforcing our businesses to more effectively address these opportunities through research and development and additional sales and marketing resources. Unless we successfully penetrate these markets, our core sales growth will likely be limited or may decline.

|

|

•

|

We have experienced material and other cost inflation. We strive for productivity improvements, and we implement increases in selling prices to help mitigate this inflation. We expect the current economic environment will result in continuing price volatility for many of our raw materials, and we are uncertain as to the timing and impact of these market changes.

|

|

•

|

Complete the execution of the Proposed Separation to create two industry-leading pure-play companies in Water and Electrical.

|

|

•

|

Driving operating excellence through PIMS, with specific focus on sourcing and supply management, cash flow management and lean operations;

|

|

•

|

Achieving differentiated revenue growth through new products and global and market expansion;

|

|

•

|

Optimizing our technological capabilities to increasingly generate innovative new products; and

|

|

•

|

Focusing on developing global talent in light of our global presence.

|

|

Years ended December 31

|

% / point change

|

|||||||||||||

|

In millions

|

2017

|

2016

|

2015

|

2017 vs 2016

|

2016 vs 2015

|

|||||||||

|

Net sales

|

$

|

4,936.5

|

|

$

|

4,890.0

|

|

$

|

4,616.4

|

|

1.0

|

%

|

5.9

|

%

|

|

|

Cost of goods sold

|

3,107.4

|

|

3,095.9

|

|

3,017.6

|

|

0.4

|

%

|

2.6

|

%

|

||||

|

Gross profit

|

1,829.1

|

|

1,794.1

|

|

1,598.8

|

|

2.0

|

%

|

12.2

|

%

|

||||

|

% of net sales

|

37.1

|

%

|

36.7

|

%

|

34.6

|

%

|

0.4

|

pts

|

2.1

|

pts

|

||||

|

Selling, general and administrative

|

1,032.5

|

|

979.3

|

|

884.0

|

|

5.4

|

%

|

10.8

|

%

|

||||

|

% of net sales

|

20.9

|

%

|

20.0

|

%

|

19.1

|

%

|

0.9

|

pts

|

0.9

|

pts

|

||||

|

Research and development

|

115.8

|

|

114.1

|

|

98.7

|

|

1.5

|

%

|

15.6

|

%

|

||||

|

% of net sales

|

2.3

|

%

|

2.3

|

%

|

2.1

|

%

|

—

|

|

0.2

|

pts

|

||||

|

Operating income

|

680.8

|

|

700.7

|

|

616.1

|

|

(2.8

|

)%

|

13.7

|

%

|

||||

|

% of net sales

|

13.8

|

%

|

14.3

|

%

|

13.3

|

%

|

(0.5

|

) pts

|

1.0

|

pts

|

||||

|

Other (income) expense

|

||||||||||||||

|

Loss on sale of businesses

|

4.2

|

|

3.9

|

|

3.2

|

|

7.7

|

%

|

21.9

|

%

|

||||

|

Loss on early extinguishment of debt

|

101.4

|

|

—

|

|

—

|

|

N.M.

|

|

N.M.

|

|

||||

|

Net interest expense

|

87.3

|

|

140.1

|

|

101.9

|

|

(37.7

|

)%

|

37.5

|

%

|

||||

|

Income from continuing operations before income taxes

|

489.2

|

|

561.0

|

|

512.5

|

|

(12.8

|

)%

|

9.5

|

%

|

||||

|

Provision for income taxes

|

9.2

|

|

109.4

|

|

115.4

|

|

(91.6

|

)%

|

(5.2

|

) %

|

||||

|

Effective tax rate

|

1.9

|

%

|

19.5

|

%

|

22.5

|

%

|

(17.6

|

) pts

|

(3.0

|

) pts

|

||||

|

2017 vs 2016

|

2016 vs 2015

|

||||

|

Volume

|

(1.0

|

)%

|

(1.7

|

)%

|

|

|

Price

|

0.5

|

|

0.3

|

|

|

|

Core growth

|

(0.5

|

)

|

(1.4

|

)

|

|

|

Acquisition

|

0.9

|

|

8.1

|

|

|

|

Currency

|

0.6

|

|

(0.8

|

)

|

|

|

Total

|

1.0

|

%

|

5.9

|

%

|

|

|

•

|

increased sales volume in our industrial business primarily in the U.S.;

|

|

•

|

increased sales related to business acquisitions that occurred in the fourth quarter of 2016 and the first quarter of 2017; and

|

|

•

|

favorable foreign currency effects during the year ended December 31, 2017.

|

|

•

|

continued lower project sales volume particularly in the energy and industrial businesses;

|

|

•

|

large job adjustments to net sales of $9.7 million in 2017.

|

|

•

|

sales of

$516.1 million

in

2016

as a result of the ERICO Acquisition, compared to sales of

$147.0 million

in

2015

; and

|

|

•

|

increased volume driving core sales growth in our North America pool business.

|

|

•

|

continued slowdown in capital spending, driving core sales declines in our industrial and energy businesses;

|

|

•

|

slowing economic activity in certain developing regions, including China and Brazil; and

|

|

•

|

a strong U.S. dollar causing unfavorable foreign currency effects.

|

|

•

|

selective increases in selling prices to mitigate inflationary cost increases;

|

|

•

|

favorable mix as a result of the decline in lower margin project sales and growth in higher margin product sales; and

|

|

•

|

higher contribution margin as a result of savings generated from our Pentair Integrated Management System ("PIMS") initiatives including lean and supply management practices.

|

|

•

|

inflationary increases related to raw materials and labor costs; and

|

|

•

|

large job adjustments negatively impacting gross profit by $16.4 million in 2017.

|

|

•

|

higher sales volumes, which resulted in increased leverage on fixed expenses included in cost of goods sold;

|

|

•

|

higher contribution margin as a result of savings generated from our Pentair Integrated Management System ("PIMS") initiatives including lean and supply management practices; and

|

|

•

|

a decrease in cost of goods sold of $35.7 million in 2016 compared to 2015 as a result of inventory fair value step-up recorded as part of the Electrical acquisitions in 2015.

|

|

•

|

inflationary increases related to raw materials and labor costs.

|

|

•

|

restructuring costs of

$30.7 million

in

2017

, compared to

$20.6 million

in

2016

;

|

|

•

|

costs incurred in anticipation of the Proposed Separation of

$53.1 million

in 2017;

|

|

•

|

non-cash charges of

$32.0 million

related to trade name and other impairments; and

|

|

•

|

increased investment in sales and marketing to drive growth.

|

|

•

|

savings generated from back-office consolidation, reduction in personnel and other lean initiatives;

|

|

•

|

a benefit from the reversal of a $13.3 million indemnification liability in 2017 related to our 2012 transaction with Tyco (now known as Johnson Controls International plc); and

|

|

•

|

"mark-to-market" actuarial losses related to pension and other post-retirement benefit plans of

$1.6 million

in 2017, compared to

$4.2 million

in 2016.

|

|

•

|

"mark-to-market" actuarial losses related to pension and other post-retirement benefit plans of

$4.2 million

in 2016, compared to "mark-to-market" actuarial gains of $23.0 million in 2015;

|

|

•

|

an increase in intangible asset amortization as a result of the ERICO Acquisition that occurred at the end of the third quarter in 2015;

|

|

•

|

a non-cash impairment charge of

$13.3 million

related to a trade name intangible asset in Electrical; and

|

|

•

|

increased investment in sales and marketing to drive growth.

|

|

•

|

restructuring costs of

$24.5 million

in

2016

, compared to $41.3 million in 2015;

|

|

•

|

deal related costs and expenses of $14.3 million in 2015, which did not occur in 2016; and

|

|

•

|

savings generated from back-office consolidation, reduction in personnel and other lean initiatives.

|

|

•

|

the impact of lower debt levels during 2017 compared to 2016. In May 2017, a portion of the proceeds from the sale of the Valves & Controls business was utilized to repay all commercial paper and revolving long term debt and for the early extinguishment of $1,659.3 million aggregate principal amount of certain series of fixed rate outstanding notes.

|

|

•

|

increased overall interest rates in effect on our outstanding debt during 2017 compared to 2016.

|

|

•

|

the impact of higher debt levels during 2016, compared to 2015, primarily as the result of the September 2015 issuance of senior notes used to finance the ERICO Acquisition; and

|

|

•

|

increased overall interest rates in effect on our outstanding debt.

|

|

•

|

a net provisional tax benefit of $84.8 million recognized in 2017 as a result of the enactment of U.S. tax reform legislation. We expect our effective tax rate to approximate 18% in future periods, which is an improvement from our historical rate of 20%; and

|

|

•

|

the unfavorable tax impact of restructuring costs in 2016 in jurisdictions with low tax benefits.

|

|

•

|

the mix of global earnings toward lower tax jurisdictions; and

|

|

•

|

the unfavorable tax impact of transaction costs in 2015 related to the ERICO Acquisition.

|

|

Years ended December 31

|

% / point change

|

|||||||||||||

|

In millions

|

2017

|

2016

|

2015

|

2017 vs 2016

|

2016 vs 2015

|

|||||||||

|

Net sales

|

$

|

2,844.4

|

|

$

|

2,777.7

|

|

$

|

2,808.3

|

|

2.4

|

%

|

(1.1

|

)%

|

|

|

Segment income

|

546.0

|

|

494.0

|

|

469.0

|

|

10.5

|

%

|

5.3

|

%

|

||||

|

% of net sales

|

19.2

|

%

|

17.8

|

%

|

16.7

|

%

|

1.4

|

pts

|

1.1

|

pts

|

||||

|

2017 vs 2016

|

2016 vs 2015

|

||||

|

Volume

|

—

|

%

|

(1.0

|

)%

|

|

|

Price

|

0.8

|

|

0.9

|

|

|

|

Core growth

|

0.8

|

|

(0.1

|

)

|

|

|

Acquisition (divestiture)

|

1.1

|

|

(0.5

|

)

|

|

|

Currency

|

0.5

|

|

(0.5

|

)

|

|

|

Total

|

2.4

|

%

|

(1.1

|

)%

|

|

|

•

|

increased sales volume in our industrial and residential & commercial businesses primarily in the U.S.;

|

|

•

|

selective increases in selling prices to mitigate inflationary cost increases; and

|

|

•

|

increased sales related to business acquisitions that occurred in the fourth quarter of 2016 and first quarter of 2017.

|

|

•

|

sales volume declines in our infrastructure and food & beverage verticals due to customer delays in capital spending; and

|

|

•

|

large job adjustments to net sales of $9.7 million in 2017.

|

|

•

|

continued slowdown in industrial capital spending, driving core sales declines in our industrial business;

|

|

•

|

core sales declines in the food & beverage business due mainly to weak irrigation sales and lower project sales;

|

|

•

|

continued sales declines in China, Southeast Asia and Brazil as the result of economic uncertainty; and

|

|

•

|

a strong U.S. dollar causing unfavorable foreign currency effects.

|

|

•

|

core sales growth related to higher sales of certain pool products primarily serving North American residential housing in 2016 and higher sales of pump and filtration solutions serving the infrastructure business; and

|

|

•

|

selective increases in selling prices to mitigate inflationary cost increases.

|

|

2017

|

2016

|

|||

|

Growth

|

(0.2

|

) pts

|

0.1

|

pts

|

|

Acquisition

|

(0.1

|

)

|

—

|

|

|

Inflation

|

(1.2

|

)

|

(1.2

|

)

|

|

Productivity/Price

|

2.9

|

|

2.2

|

|

|

Total

|

1.4

|

pts

|

1.1

|

pts

|

|

•

|

favorable material savings for certain raw materials and product mix offsetting inflation;

|

|

•

|

selective increases in selling prices to mitigate inflationary cost increases; and

|

|

•

|

cost savings generated from PIMS initiatives including lean and supply management practices.

|

|

•

|

inflationary increases related to labor costs and certain raw materials; and

|

|

•

|

continued growth investments in research & development and sales & marketing.

|

|

•

|

price increases more than offsetting inflationary cost increases; and

|

|

•

|

cost savings generated from back-office consolidation, reduction in personnel and other lean initiatives.

|

|

•

|

inflationary increases related to labor costs and certain raw materials.

|

|

Years ended December 31

|

% / point change

|

|||||||||||||

|

In millions

|

2017

|

2016

|

2015

|

2017 vs 2016

|

2016 vs 2015

|

|||||||||

|

Net sales

|

$

|

2,097.9

|

|

$

|

2,116.0

|

|

$

|

1,809.3

|

|

(0.9

|

)%

|

17.0

|

%

|

|

|

Segment income

|

447.0

|

|

447.2

|

|

395.0

|

|

—

|

%

|

13.2

|

%

|

||||

|

% of net sales

|

21.3

|

%

|

21.1

|

%

|

21.8

|

%

|

0.2

|

pts

|

(0.7

|

) pts

|

||||

|

2017 vs 2016

|

2016 vs 2015

|

||||

|

Volume

|

(2.2

|

)%

|

(2.1

|

)%

|

|

|

Price

|

0.1

|

|

(0.4

|

)

|

|

|

Core growth

|

(2.1

|

)

|

(2.5

|

)

|

|

|

Acquisition

|

0.7

|

|

20.6

|

|

|

|

Currency

|

0.5

|

|

(1.1

|

)

|

|

|

Total

|

(0.9

|

)%

|

17.0

|

%

|

|

|

•

|

lower project sales volume as a result of the impact of three large Canadian Oil Sands projects in 2016 that did not recur in 2017.

|

|

•

|

sales volume growth in our industrial business primarily in the U.S.;

|

|

•

|

favorable foreign currency effect during 2017;

|

|

•

|

selective increases in selling prices to mitigate inflationary cost increases; and

|

|

•

|

increased sales related to a business acquisition that occurred in the first quarter of 2017.

|

|

•

|

sales of

$516.1 million

in

2016

as a result of the ERICO Acquisition, compared to sales of

$147.0 million

in

2015

; and

|

|

•

|

core growth in our industrial and residential & commercial businesses.

|

|

•

|

continued slowdown in capital spending, particularly in the energy and infrastructure businesses, driving core sales declines; and

|

|

•

|

a strong U.S. dollar causing unfavorable foreign currency effects.

|

|

2017

|

2016

|

|||

|

Growth

|

1.2

|

pts

|

(1.5

|

) pts

|

|

Acquisition

|

(0.1

|

)

|

0.6

|

|

|

Inflation

|

(2.0

|

)

|

(1.2

|

)

|

|

Productivity/Price

|

1.1

|

|

1.4

|

|

|

Total

|

0.2

|

pts

|

(0.7

|

) pts

|

|

•

|

favorable mix as a result of the decline in lower margin project sales and growth in higher margin product sales in 2017, compared to 2016;

|

|

•

|

higher core sales in our industrial business, which resulted in increased leverage on fixed operating expenses; and

|

|

•

|

cost control and savings generated from back-office consolidation, reduction in personnel and other lean initiatives.

|

|

•

|

inflationary increases related to labor costs and certain raw materials;

|

|

•

|

lower core sales volumes in our energy and infrastructure businesses, which resulted in decreased leverage on operating expenses; and

|

|

•

|

higher cost of sales during 2017 due to manufacturing footprint rationalization and a new U.S. distribution center. We expect these investments will result in increased productivity and operating leverage in future periods.

|

|

•

|

lower margin project sales not offsetting the decline in higher margin product sales; and

|

|

•

|

inflationary increases related to labor costs and certain raw materials.

|

|

•

|

higher core sales in our industrial and residential & commercial businesses, which resulted in increased leverage on fixed operating expenses; and

|

|

•

|

strong contribution and integration synergies as a result of the ERICO Acquisition.

|

|

|

Years ended December 31

|

||||||||||||||||||||

|

In millions

|

2018

|

2019

|

2020

|

2021

|

2022

|

Thereafter

|

Total

|

||||||||||||||

|

Debt obligations

|

$

|

—

|

|

$

|

1,162.1

|

|

$

|

74.0

|

|

$

|

103.8

|

|

$

|

88.3

|

|

$

|

19.3

|

|

$

|

1,447.5

|

|

|

Interest obligations on fixed-rate debt

|

39.8

|

|

32.4

|

|

11.4

|

|

6.2

|

|

3.6

|

|

1.6

|

|

95.0

|

|

|||||||

|

Operating lease obligations, net of sublease rentals

|

34.0

|

|

29.1

|

|

21.2

|

|

15.6

|

|

13.1

|

|

15.1

|

|

128.1

|

|

|||||||

|

Purchase and marketing obligations

|

56.8

|

|

3.9

|

|

3.1

|

|

3.2

|

|

2.4

|

|

7.1

|

|

76.5

|

|

|||||||

|

Pension and other post-retirement plan contributions

|

13.7

|

|

12.8

|

|

6.7

|

|

6.7

|

|

6.8

|

|

33.6

|

|

80.3

|

|

|||||||

|

Total contractual obligations, net

|

$

|

144.3

|

|

$

|

1,240.3

|

|

$

|

116.4

|

|

$

|

135.5

|

|

$

|

114.2

|

|

$

|

76.7

|

|

$

|

1,827.4

|

|

|

|

Years ended December 31

|

||||||||

|

In millions

|

2017

|

2016

|

2015

|

||||||

|

Net cash provided by (used for) operating activities of continuing operations

|

$

|

674.0

|

|

$

|

702.4

|

|

$

|

597.7

|

|

|

Capital expenditures

|

(70.9

|

)

|

(117.8

|

)

|

(91.3

|

)

|

|||

|

Proceeds from sale of property and equipment

|

7.9

|

|

24.7

|

|

4.6

|

|

|||

|

Free cash flow from continuing operations

|

$

|

611.0

|

|

$

|

609.3

|

|

$

|

511.0

|

|

|

Net cash provided by (used for) operating activities of discontinued operations

|

(53.8

|

)

|

159.0

|

|

141.6

|

|

|||

|

Capital expenditures of discontinued operations

|

(6.8

|

)

|

(20.4

|

)

|

(43.0

|

)

|

|||

|

Proceeds from sale of property and equipment of discontinued operations

|

0.3

|

|

21.9

|

|

22.7

|

|

|||

|

Free cash flow

|

$

|

550.7

|

|

$

|

769.8

|

|

$

|

632.3

|

|

|

•

|

it requires us to make assumptions about matters that were uncertain at the time we were making the estimate; and

|

|

•

|

changes in the estimate or different estimates that we could have selected would have had a material impact on our financial condition or results of operations.

|

|

Randall J. Hogan

|

|

John L. Stauch

|

|

Chairman and Chief Executive Officer

|

|

Executive Vice President and Chief Financial Officer

|

|

|

Years ended December 31

|

||||||||

|

In millions, except per-share data

|

2017

|

2016

|

2015

|

||||||

|

Net sales

|

$

|

4,936.5

|

|

$

|

4,890.0

|

|

$

|

4,616.4

|

|

|

Cost of goods sold

|

3,107.4

|

|

3,095.9

|

|

3,017.6

|

|

|||

|

Gross profit

|

1,829.1

|

|

1,794.1

|

|

1,598.8

|

|

|||

|

Selling, general and administrative

|

1,032.5

|

|

979.3

|

|

884.0

|

|

|||

|

Research and development

|

115.8

|

|

114.1

|

|

98.7

|

|

|||

|

Operating income

|

680.8

|

|

700.7

|

|

616.1

|

|

|||

|

Other (income) expense

|

|||||||||

|

Loss on sale of businesses

|

4.2

|

|

3.9

|

|

3.2

|

|

|||

|

Loss on early extinguishment of debt

|

101.4

|

|

—

|

|

—

|

|

|||

|

Equity income of unconsolidated subsidiaries

|

(1.3

|

)

|

(4.3

|

)

|

(1.5

|

)

|

|||

|

Interest income

|

(9.9

|

)

|

(8.3

|

)

|

(4.7

|

)

|

|||

|

Interest expense

|

97.2

|

|

148.4

|

|

106.6

|

|

|||

|

Income from continuing operations before income taxes

|

489.2

|

|

561.0

|

|

512.5

|

|

|||

|

Provision for income taxes

|

9.2

|

|

109.4

|

|

115.4

|

|

|||

|

Net income from continuing operations

|

480.0

|

|

451.6

|

|

397.1

|

|

|||

|

Income (loss) from discontinued operations, net of tax

|

5.4

|

|

70.0

|

|

(466.8

|

)

|

|||

|

Gain (loss) from sale / impairment of discontinued operations, net of tax

|

181.1

|

|

0.6

|

|

(6.7

|

)

|

|||

|

Net income (loss)

|

$

|

666.5

|

|

$

|

522.2

|

|

$

|

(76.4

|

)

|

|

Comprehensive income (loss), net of tax

|

|||||||||

|

Net income (loss)

|

$

|

666.5

|

|

$

|

522.2

|

|

$

|

(76.4

|

)

|

|

Changes in cumulative translation adjustment (inclusive of divestiture of business reclassified to gain from sale of $374.2 for the year ended December 31, 2017)

|

497.5

|

|

(83.0

|

)

|

(264.9

|

)

|

|||

|

Changes in market value of derivative financial instruments, net of tax

|

(4.6

|

)

|

(8.3

|

)

|

0.2

|

|

|||

|

Comprehensive income (loss)

|

$

|

1,159.4

|

|

$

|

430.9

|

|

$

|

(341.1

|

)

|

|

Earnings (loss) per ordinary share

|

|||||||||

|

Basic

|

|||||||||

|

Continuing operations

|

$

|

2.64

|

|

$

|

2.49

|

|

$

|

2.20

|

|

|

Discontinued operations

|

1.03

|

|

0.39

|

|

(2.62

|

)

|

|||

|

Basic earnings (loss) per ordinary share

|

$

|

3.67

|

|

$

|

2.88

|

|

$

|

(0.42

|

)

|

|

Diluted

|

|||||||||

|

Continuing operations

|

$

|

2.61

|

|

$

|

2.47

|

|

$

|

2.17

|

|

|

Discontinued operations

|

1.02

|

|

0.38

|

|

(2.59

|

)

|

|||

|

Diluted earnings (loss) per ordinary share

|

$

|

3.63

|

|

$

|

2.85

|

|

$

|

(0.42

|

)

|

|

Weighted average ordinary shares outstanding

|

|||||||||

|

Basic

|

181.7

|

|

181.3

|

|

180.3

|

|

|||

|

Diluted

|

183.7

|

|

183.1

|

|

182.6

|

|

|||

|

|

December 31

|

|||||

|

In millions, except per-share data

|

2017

|

2016

|

||||

|

Assets

|

||||||

|

Current assets

|

||||||

|

Cash and cash equivalents

|

$

|

113.3

|

|

$

|

238.5

|

|

|

Accounts and notes receivable, net of allowances of $22.6 and $25.6, respectively

|

831.6

|

|

764.0

|

|

||

|

Inventories

|

581.0

|

|

524.2

|

|

||

|

Other current assets

|

222.9

|

|

253.4

|

|

||

|

Current assets held for sale

|

—

|

|

891.9

|

|

||

|

Total current assets

|

1,748.8

|

|

2,672.0

|

|

||

|

Property, plant and equipment, net

|

545.5

|

|

538.6

|

|

||

|

Other assets

|

||||||

|

Goodwill

|

4,351.1

|

|

4,217.4

|

|

||

|

Intangibles, net

|

1,558.4

|

|

1,631.8

|

|

||

|

Other non-current assets

|

429.9

|

|

182.1

|

|

||

|

Non-current assets held for sale

|

—

|

|

2,292.9

|

|

||

|

Total other assets

|

6,339.4

|

|

8,324.2

|

|

||

|

Total assets

|

$

|

8,633.7

|

|

$

|

11,534.8

|

|

|

Liabilities and Equity

|

||||||

|

Current liabilities

|

||||||

|

Current maturities of long-term debt and short-term borrowings

|

$

|

—

|

|

$

|

0.8

|

|

|

Accounts payable

|

495.7

|

|

436.6

|

|

||

|

Employee compensation and benefits

|

186.6

|

|

166.1

|

|

||

|

Other current liabilities

|

517.1

|

|

511.5

|

|

||

|

Current liabilities held for sale

|

—

|

|

356.2

|

|

||

|

Total current liabilities

|

1,199.4

|

|

1,471.2

|

|

||

|

Other liabilities

|

||||||

|

Long-term debt

|

1,440.7

|

|

4,278.4

|

|

||

|

Pension and other post-retirement compensation and benefits

|

285.6

|

|

253.4

|

|

||

|

Deferred tax liabilities

|

394.8

|

|

609.5

|

|

||

|

Other non-current liabilities

|

275.4

|

|

162.0

|

|

||

|

Non-current liabilities held for sale

|

—

|

|

505.9

|

|

||

|

Total liabilities

|

3,595.9

|

|

7,280.4

|

|

||

|

Equity

|

||||||

|

Ordinary shares $0.01 par value, 426.0 authorized, 180.3 and 181.8 issued at December 31, 2017 and December 31, 2016, respectively

|

1.8

|

|

1.8

|

|

||

|

Additional paid-in capital

|

2,797.7

|

|

2,920.8

|

|

||

|

Retained earnings

|

2,481.7

|

|

2,068.1

|

|

||

|

Accumulated other comprehensive loss

|

(243.4

|

)

|

(736.3

|

)

|

||

|

Total equity

|

5,037.8

|

|

4,254.4

|

|

||

|

Total liabilities and equity

|

$

|

8,633.7

|

|

$

|

11,534.8

|

|

|

|

Years ended December 31

|

||||||||

|

In millions

|

2017

|

2016

|

2015

|

||||||

|

Operating activities

|

|||||||||

|

Net income (loss)

|

$

|

666.5

|

|

$

|

522.2

|

|

$

|

(76.4

|

)

|

|

(Income) loss from discontinued operations, net of tax

|

(5.4

|

)

|

(70.0

|

)

|

466.8

|

|

|||

|

(Gain) loss from sale / impairment of discontinued operations, net of tax

|

(181.1

|

)

|

(0.6

|

)

|

6.7

|

|

|||

|

Adjustments to reconcile net income (loss) from continuing operations to net cash provided by (used for) operating activities of continuing operations

|

|||||||||

|

Equity income of unconsolidated subsidiaries

|

(1.3

|

)

|

(4.3

|

)

|

(1.5

|

)

|

|||

|

Depreciation

|

85.2

|

|

84.6

|

|

81.2

|

|

|||

|

Amortization

|

97.7

|

|

96.4

|

|

68.1

|

|

|||

|

Loss on sale of businesses

|

4.2

|

|

3.9

|

|

3.2

|

|

|||

|

Deferred income taxes

|

(159.7

|

)

|

(16.1

|

)

|

(2.3

|

)

|

|||

|

Share-based compensation

|

39.6

|

|

34.2

|

|

33.0

|

|

|||

|

Trade name and other impairment

|

32.0

|

|

13.3

|

|

—

|

|

|||

|

Loss on early extinguishment of debt

|

101.4

|

|

—

|

|

—

|

|

|||

|

Excess tax benefits from share-based compensation

|

—

|

|

(8.0

|

)

|

(6.0

|

)

|

|||

|

Amortization of bridge financing debt issuance costs

|

—

|

|

—

|

|

10.8

|

|

|||

|

Pension and other post-retirement expense

|

29.2

|

|

31.8

|

|

9.4

|

|

|||

|

Pension and other post-retirement contributions

|

(15.7

|

)

|

(13.5

|

)

|

(12.7

|

)

|

|||

|

Changes in assets and liabilities, net of effects of business acquisitions

|

|||||||||

|

Accounts and notes receivable

|

(30.9

|

)

|

21.3

|

|

(6.2

|

)

|

|||

|

Inventories

|

(29.4

|

)

|

34.3

|

|

54.7

|

|

|||

|

Other current assets

|

(5.9

|

)

|

(15.8

|

)

|

(27.3

|

)

|

|||

|

Accounts payable

|

32.6

|

|

38.0

|

|

10.6

|

|

|||

|

Employee compensation and benefits

|

10.2

|

|

7.0

|

|

(15.6

|

)

|

|||

|

Other current liabilities

|

(29.3

|

)

|

51.6

|

|

(16.6

|

)

|

|||

|

Other non-current assets and liabilities

|

34.1

|

|

(107.9

|

)

|

17.8

|

|

|||

|

Net cash provided by (used for) operating activities of continuing operations

|

674.0

|

|

702.4

|

|

597.7

|

|

|||

|

Net cash provided by (used for) operating activities of discontinued operations

|

(53.8

|

)

|

159.0

|

|

141.6

|

|

|||

|

Net cash provided by (used for) operating activities

|

620.2

|

|

861.4

|

|

739.3

|

|

|||

|

Investing activities

|

|||||||||

|

Capital expenditures

|

(70.9

|

)

|

(117.8

|

)

|

(91.3

|

)

|

|||

|

Proceeds from sale of property and equipment

|

7.9

|

|

24.7

|

|

4.6

|

|

|||

|

Proceeds from sale of businesses and other

|

2,759.4

|

|

(5.2

|

)

|

(3.0

|

)

|

|||

|

Acquisitions, net of cash acquired

|

(59.5

|

)

|

(25.0

|

)

|

(1,913.9

|

)

|

|||

|

Net cash provided by (used for) investing activities of continuing operations

|

2,636.9

|

|

(123.3

|

)

|

(2,003.6

|

)

|

|||

|

Net cash provided by (used for) investing activities of discontinued operations

|

(6.5

|

)

|

1.5

|

|

38.1

|

|

|||

|

Net cash provided by (used for) investing activities

|

2,630.4

|

|

(121.8

|

)

|

(1,965.5

|

)

|

|||

|

Financing activities

|

|||||||||

|

Net receipts (repayments) of short-term borrowings

|

(0.8

|

)

|

0.8

|

|

(2.3

|

)

|

|||

|

Net receipts (repayments) of commercial paper and revolving long-term debt

|

(913.1

|

)

|

(385.3

|

)

|

363.5

|

|

|||

|

Proceeds from long-term debt

|

—

|

|

—

|

|

1,714.8

|

|

|||

|

Repayment of long-term debt

|

(2,009.3

|

)

|

(0.7

|

)

|

(356.6

|

)

|

|||

|

Debt issuance costs

|

—

|

|

—

|

|

(26.8

|

)

|

|||

|

Premium paid on early extinguishment of debt

|

(94.9

|

)

|

—

|

|

—

|

|

|||

|

Excess tax benefits from share-based compensation

|

—

|

|

8.0

|

|

6.0

|

|

|||

|

Shares issued to employees, net of shares withheld

|

37.2

|

|

20.7

|

|

19.4

|

|

|||

|

Repurchases of ordinary shares

|

(200.0

|

)

|

—

|

|

(200.0

|

)

|

|||

|

Dividends paid

|

(251.7

|

)

|

(243.6

|

)

|

(231.7

|

)

|

|||

|

Net cash provided by (used for) financing activities

|

(3,432.6

|

)

|

(600.1

|

)

|

1,286.3

|

|

|||

|

Effect of exchange rate changes on cash and cash equivalents

|

56.8

|

|

(27.3

|

)

|

(44.2

|

)

|

|||

|

Change in cash and cash equivalents

|

(125.2

|

)

|

112.2

|

|

15.9

|

|

|||

|

Cash and cash equivalents, beginning of year

|

238.5

|

|

126.3

|

|

110.4

|

|

|||

|

Cash and cash equivalents, end of year

|

$

|

113.3

|

|

$

|

238.5

|

|

$

|

126.3

|

|

|

In millions

|

Ordinary shares

|

Treasury shares

|

Additional paid-in capital

|

Retained earnings

|

Accumulated other comprehensive loss

|

Total

|

|||||||||||||||||

|

Number

|

Amount

|

Number

|

Amount

|

||||||||||||||||||||

|

Balance - December 31, 2014

|

202.4

|

|

$

|

2.0

|

|

(19.9

|

)

|

$

|

(1,251.9

|

)

|

$

|

4,250.0

|

|

$

|

2,044.0

|

|

$

|

(380.3

|

)

|

$

|

4,663.8

|

|

|

|

Net loss

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(76.4

|

)

|

—

|

|

(76.4

|

)

|

|||||||

|

Other comprehensive loss, net of tax

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(264.7

|

)

|

(264.7

|

)

|

|||||||

|

Tax benefit of share-based compensation

|

—

|

|

—

|

|

—

|

|

—

|

|

5.7

|

|

—

|

|

—

|

|

5.7

|

|

|||||||

|

Dividends declared

|

—

|

|

—

|

|

—

|

|

—

|

|

1.5

|

|

(175.9

|

)

|

—

|

|

(174.4

|

)

|

|||||||

|

Share repurchase

|

(3.1

|

)

|

—

|

|

—

|

|

—

|

|

(200.0

|

)

|

—

|

|

—

|

|

(200.0

|

)

|

|||||||

|

Cancellation of treasury shares

|

(19.1

|

)

|

(0.2

|

)

|

19.1

|

|

1,210.9

|

|

(1,210.7

|

)

|

—

|

|

—

|

|

—

|

|

|||||||

|

Exercise of options, net of shares tendered for payment

|

0.1

|

|

—

|

|

0.7

|

|

34.6

|

|

(3.5

|

)

|

—

|

|

—

|

|

31.1

|

|

|||||||

|

Issuance of restricted shares, net of cancellations

|

0.3

|

|

—

|

|

0.2

|

|

9.4

|

|

(9.4

|

)

|

—

|

|

—

|

|

—

|

|

|||||||

|

Shares surrendered by employees to pay taxes

|

(0.1

|

)

|

—

|

|

(0.1

|

)

|

(3.0

|

)

|

(6.3

|

)

|

—

|

|

—

|

|

(9.3

|

)

|

|||||||

|

Share-based compensation

|

—

|

|

—

|

|

—

|

|

—

|

|

33.0

|

|

—

|

|

—

|

|

33.0

|

|

|||||||

|

Balance - December 31, 2015

|

180.5

|

|

$

|

1.8

|

|

—

|

|

$

|

—

|

|

$

|

2,860.3

|

|

$

|

1,791.7

|

|

$

|

(645.0

|

)

|

$

|

4,008.8

|

|

|

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

522.2

|

|

—

|

|

522.2

|

|

|||||||

|

Other comprehensive loss, net of tax

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(91.3

|

)

|

(91.3

|

)

|

|||||||

|

Tax benefit of share-based compensation

|

—

|

|

—

|

|

—

|

|

—

|

|

5.5

|

|

—

|

|

—

|

|

5.5

|

|

|||||||

|

Dividends declared

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(245.8

|

)

|

—

|

|

(245.8

|

)

|

|||||||

|

Exercise of options, net of shares tendered for payment

|

1.0

|

|

—

|

|

—

|

|

—

|

|

31.6

|

|

—

|

|

—

|

|

31.6

|

|

|||||||

|

Issuance of restricted shares, net of cancellations

|

0.5

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||

|

Shares surrendered by employees to pay taxes

|

(0.2

|

)

|

—

|

|

—

|

|

—

|

|

(10.8

|

)

|

—

|

|

—

|

|

(10.8

|

)

|

|||||||

|

Share-based compensation

|

—

|

|

—

|

|

—

|

|

—

|

|

34.2

|

|

—

|

|

—

|

|

34.2

|

|

|||||||

|

Balance - December 31, 2016

|

181.8

|

|

$

|

1.8

|

|

—

|

|

$

|

—

|

|

$

|

2,920.8

|

|

$

|

2,068.1

|

|

$

|

(736.3

|

)

|

$

|

4,254.4

|

|

|

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

666.5

|

|

—

|

|

666.5

|

|

|||||||

|

Other comprehensive income, net of tax

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

492.9

|

|

492.9

|

|

|||||||

|

Dividends declared

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(252.9

|

)

|

—

|

|

(252.9

|

)

|

|||||||

|

Share repurchases

|

(3.0

|

)

|

—