|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[X]

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Ireland

|

|

Not Applicable

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

Treasury Building, Lower Grand Canal Street, Dublin 2, Ireland

|

|

-

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Large accelerated filer

|

[X]

|

Accelerated filer

|

[ ]

|

Non-accelerated filer

|

[ ]

|

(Do not check if smaller reporting company)

|

||||

|

Smaller reporting company

|

[ ]

|

Emerging growth company

|

[ ]

|

|||||||

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

[ ]

|

|||||||||

|

PAGE

NUMBER

|

||

|

PART I. FINANCIAL INFORMATION

|

||

|

1

|

||

|

2

|

||

|

3

|

||

|

4

|

||

|

5

|

||

|

6

|

||

|

7

|

||

|

8

|

||

|

9

|

||

|

10

|

||

|

11

|

||

|

12

|

||

|

13

|

||

|

14

|

||

|

15

|

||

|

16

|

||

|

PART II. OTHER INFORMATION

|

||

|

|

Three Months Ended

|

Nine Months Ended

|

|||||||||||||

|

|

September 30,

2017 |

October 1,

2016 |

September 30,

2017 |

October 1,

2016 |

|||||||||||

|

Net sales

|

$

|

1,231.3

|

|

$

|

1,261.6

|

|

$

|

3,663.1

|

|

$

|

3,949.3

|

|

|||

|

Cost of sales

|

733.5

|

|

777.1

|

|

2,196.4

|

|

2,385.2

|

|

|||||||

|

Gross profit

|

497.8

|

|

484.5

|

|

1,466.7

|

|

1,564.1

|

|

|||||||

|

Operating expenses

|

|||||||||||||||

|

Distribution

|

21.5

|

|

21.6

|

|

64.2

|

|

65.9

|

|

|||||||

|

Research and development

|

38.4

|

|

50.2

|

|

120.8

|

|

142.5

|

|

|||||||

|

Selling

|

143.5

|

|

154.6

|

|

454.1

|

|

506.9

|

|

|||||||

|

Administration

|

123.3

|

|

105.4

|

|

326.9

|

|

317.2

|

|

|||||||

|

Impairment charges

|

7.8

|

|

1,614.4

|

|

47.4

|

|

2,028.8

|

|

|||||||

|

Restructuring

|

3.8

|

|

6.6

|

|

54.7

|

|

17.9

|

|

|||||||

|

Other operating income

|

(2.9

|

)

|

—

|

|

(41.0

|

)

|

—

|

|

|||||||

|

Total operating expenses

|

335.4

|

|

1,952.8

|

|

1,027.1

|

|

3,079.2

|

|

|||||||

|

Operating income (loss)

|

162.4

|

|

(1,468.3

|

)

|

439.6

|

|

(1,515.1

|

)

|

|||||||

|

Change in financial assets

|

2.6

|

|

377.4

|

|

24.2

|

|

1,492.6

|

|

|||||||

|

Interest expense, net

|

34.7

|

|

54.6

|

|

133.1

|

|

163.2

|

|

|||||||

|

Other (income) expense, net

|

(3.6

|

)

|

1.0

|

|

(1.1

|

)

|

32.4

|

|

|||||||

|

Loss on extinguishment of debt

|

—

|

|

0.7

|

|

135.2

|

|

1.1

|

|

|||||||

|

Income (loss) before income taxes

|

128.7

|

|

(1,902.0

|

)

|

148.2

|

|

(3,204.4

|

)

|

|||||||

|

Income tax expense (benefit)

|

84.2

|

|

(311.8

|

)

|

101.8

|

|

(550.7

|

)

|

|||||||

|

Net income (loss)

|

$

|

44.5

|

|

$

|

(1,590.2

|

)

|

$

|

46.4

|

|

$

|

(2,653.7

|

)

|

|||

|

Earnings (loss) per share

|

|||||||||||||||

|

Basic

|

0.31

|

|

(11.10

|

)

|

$

|

0.33

|

|

$

|

(18.53

|

)

|

|||||

|

Diluted

|

$

|

0.31

|

|

$

|

(11.10

|

)

|

$

|

0.32

|

|

$

|

(18.53

|

)

|

|||

|

Weighted-average shares outstanding

|

|||||||||||||||

|

Basic

|

141.3

|

|

143.3

|

|

142.5

|

|

143.2

|

|

|||||||

|

Diluted

|

141.7

|

|

143.3

|

|

142.8

|

|

143.2

|

|

|||||||

|

Dividends declared per share

|

$

|

0.160

|

|

$

|

0.145

|

|

$

|

0.480

|

|

$

|

0.435

|

|

|||

|

Three Months Ended

|

Nine Months Ended

|

||||||||||||||

|

September 30,

2017 |

October 1,

2016 |

September 30,

2017 |

October 1,

2016 |

||||||||||||

|

Net income (loss)

|

$

|

44.5

|

|

$

|

(1,590.2

|

)

|

$

|

46.4

|

|

$

|

(2,653.7

|

)

|

|||

|

Other comprehensive income:

|

|||||||||||||||

|

Foreign currency translation adjustments

|

69.9

|

|

27.5

|

|

289.9

|

|

71.5

|

|

|||||||

|

Change in fair value of derivative financial instruments, net of tax

|

0.1

|

|

3.6

|

|

8.7

|

|

(3.5

|

)

|

|||||||

|

Change in fair value of investment securities, net of tax

|

(8.1

|

)

|

9.8

|

|

(24.4

|

)

|

18.4

|

|

|||||||

|

Change in post-retirement and pension liability, net of tax

|

(1.2

|

)

|

(0.2

|

)

|

(1.2

|

)

|

0.4

|

|

|||||||

|

Other comprehensive income, net of tax

|

60.7

|

|

40.7

|

|

273.0

|

|

86.8

|

|

|||||||

|

Comprehensive income (loss)

|

$

|

105.2

|

|

$

|

(1,549.5

|

)

|

$

|

319.4

|

|

$

|

(2,566.9

|

)

|

|||

|

September 30,

2017 |

December 31,

2016 |

||||||

|

Assets

|

|||||||

|

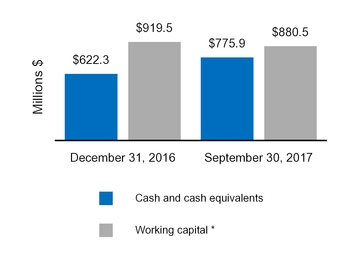

Cash and cash equivalents

|

$

|

775.9

|

|

$

|

622.3

|

|

|

|

Accounts receivable, net of allowance for doubtful accounts of $6.2 million and $6.3 million, respectively

|

1,076.6

|

|

1,176.0

|

|

|||

|

Inventories

|

821.9

|

|

795.0

|

|

|||

|

Prepaid expenses and other current assets

|

297.4

|

|

212.0

|

|

|||

|

Total current assets

|

2,971.8

|

|

2,805.3

|

|

|||

|

Property, plant and equipment, net

|

822.3

|

|

870.1

|

|

|||

|

Financial assets

|

—

|

|

2,350.0

|

|

|||

|

Goodwill and other indefinite-lived intangible assets

|

4,255.4

|

|

4,163.9

|

|

|||

|

Other intangible assets, net

|

3,347.4

|

|

3,396.8

|

|

|||

|

Non-current deferred income taxes

|

22.4

|

|

72.1

|

|

|||

|

Other non-current assets

|

423.3

|

|

211.9

|

|

|||

|

Total non-current assets

|

8,870.8

|

|

11,064.8

|

|

|||

|

Total assets

|

$

|

11,842.6

|

|

$

|

13,870.1

|

|

|

|

Liabilities and Shareholders’ Equity

|

|||||||

|

Accounts payable

|

$

|

477.1

|

|

$

|

471.7

|

|

|

|

Payroll and related taxes

|

133.4

|

|

115.8

|

|

|||

|

Accrued customer programs

|

368.8

|

|

380.3

|

|

|||

|

Accrued liabilities

|

274.6

|

|

263.3

|

|

|||

|

Accrued income taxes

|

61.5

|

|

32.4

|

|

|||

|

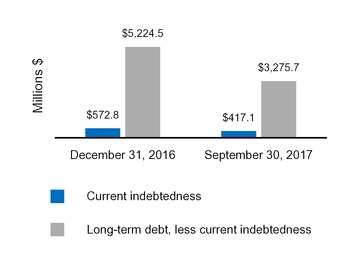

Current indebtedness

|

417.1

|

|

572.8

|

|

|||

|

Total current liabilities

|

1,732.5

|

|

1,836.3

|

|

|||

|

Long-term debt, less current portion

|

3,275.7

|

|

5,224.5

|

|

|||

|

Non-current deferred income taxes

|

357.7

|

|

389.9

|

|

|||

|

Other non-current liabilities

|

434.9

|

|

461.8

|

|

|||

|

Total non-current liabilities

|

4,068.3

|

|

6,076.2

|

|

|||

|

Total liabilities

|

5,800.8

|

|

7,912.5

|

|

|||

|

Commitments and contingencies - Note 14

|

|||||||

|

Shareholders’ equity

|

|||||||

|

Controlling interest:

|

|||||||

|

Preferred shares, $0.0001 par value, 10 million shares authorized

|

—

|

|

—

|

|

|||

|

Ordinary shares, €0.001 par value, 10 billion shares authorized

|

7,900.1

|

|

8,135.0

|

|

|||

|

Accumulated other comprehensive income (loss)

|

191.2

|

|

(81.8

|

)

|

|||

|

Retained earnings (accumulated deficit)

|

(2,049.6

|

)

|

(2,095.1

|

)

|

|||

|

Total controlling interest

|

6,041.7

|

|

5,958.1

|

|

|||

|

Noncontrolling interest

|

0.1

|

|

(0.5

|

)

|

|||

|

Total shareholders’ equity

|

6,041.8

|

|

5,957.6

|

|

|||

|

Total liabilities and shareholders' equity

|

$

|

11,842.6

|

|

$

|

13,870.1

|

|

|

|

Supplemental Disclosures of Balance Sheet Information

|

|||||||

|

Ordinary shares, issued and outstanding (in millions)

|

140.8

|

|

143.4

|

|

|||

|

Nine Months Ended

|

|||||||

|

|

September 30,

2017 |

October 1,

2016 |

|||||

|

Cash Flows From (For) Operating Activities

|

|||||||

|

Net income (loss)

|

$

|

46.4

|

|

$

|

(2,653.7

|

)

|

|

|

Adjustments to derive cash flows

|

|||||||

|

Depreciation and amortization

|

333.1

|

|

338.4

|

|

|||

|

Share-based compensation

|

28.1

|

|

15.3

|

|

|||

|

Impairment charges

|

47.4

|

|

2,028.8

|

|

|||

|

Change in financial assets

|

24.2

|

|

1,492.6

|

|

|||

|

Loss on extinguishment of debt

|

135.2

|

|

1.1

|

|

|||

|

Restructuring charges

|

54.7

|

|

17.9

|

|

|||

|

Deferred income taxes

|

(16.3

|

)

|

(674.1

|

)

|

|||

|

Amortization of debt premium

|

(18.4

|

)

|

(24.6

|

)

|

|||

|

Other non-cash adjustments, net

|

(27.2

|

)

|

34.5

|

|

|||

|

Subtotal

|

607.2

|

|

576.2

|

|

|||

|

Increase (decrease) in cash due to:

|

|||||||

|

Accounts receivable

|

38.4

|

|

113.0

|

|

|||

|

Inventories

|

(28.3

|

)

|

25.1

|

|

|||

|

Accounts payable

|

(6.0

|

)

|

(57.7

|

)

|

|||

|

Payroll and related taxes

|

(36.7

|

)

|

(40.0

|

)

|

|||

|

Accrued customer programs

|

(15.8

|

)

|

(73.7

|

)

|

|||

|

Accrued liabilities

|

(18.8

|

)

|

(90.0

|

)

|

|||

|

Accrued income taxes

|

(61.5

|

)

|

5.2

|

|

|||

|

Other, net

|

3.5

|

|

(9.4

|

)

|

|||

|

Subtotal

|

(125.2

|

)

|

(127.5

|

)

|

|||

|

Net cash from operating activities

|

482.0

|

|

448.7

|

|

|||

|

Cash Flows From (For) Investing Activities

|

|||||||

|

Proceeds from royalty rights

|

86.4

|

|

259.5

|

|

|||

|

Acquisitions of businesses, net of cash acquired

|

—

|

|

(436.8

|

)

|

|||

|

Asset acquisitions

|

—

|

|

(65.1

|

)

|

|||

|

Additions to property, plant and equipment

|

(55.2

|

)

|

(84.6

|

)

|

|||

|

Net proceeds from sale of business and other assets

|

46.7

|

|

58.5

|

|

|||

|

Proceeds from sale of the Tysabri

®

financial asset

|

2,200.0

|

|

—

|

|

|||

|

Other investing, net

|

(5.8

|

)

|

(1.0

|

)

|

|||

|

Net cash from (for) investing activities

|

2,272.1

|

|

(269.5

|

)

|

|||

|

Cash Flows From (For) Financing Activities

|

|||||||

|

Issuances of long-term debt

|

—

|

|

1,190.3

|

|

|||

|

Payments on long-term debt

|

(2,243.7

|

)

|

(545.8

|

)

|

|||

|

Borrowings (repayments) of revolving credit agreements and other financing, net

|

—

|

|

(803.6

|

)

|

|||

|

Deferred financing fees

|

(4.2

|

)

|

(2.8

|

)

|

|||

|

Premium on early debt retirement

|

(116.1

|

)

|

(0.6

|

)

|

|||

|

Issuance of ordinary shares

|

0.5

|

|

8.2

|

|

|||

|

Repurchase of ordinary shares

|

(191.5

|

)

|

—

|

|

|||

|

Cash dividends

|

(68.7

|

)

|

(62.4

|

)

|

|||

|

Other financing

|

2.7

|

|

(17.4

|

)

|

|||

|

Net cash (for) financing activities

|

(2,621.0

|

)

|

(234.1

|

)

|

|||

|

Effect of exchange rate changes on cash and cash equivalents

|

20.5

|

|

(0.2

|

)

|

|||

|

Net increase (decrease) in cash and cash equivalents

|

153.6

|

|

(55.1

|

)

|

|||

|

Cash and cash equivalents, beginning of period

|

622.3

|

|

417.8

|

|

|||

|

Cash and cash equivalents, end of period

|

$

|

775.9

|

|

$

|

362.7

|

|

|

|

Recently Issued Accounting Standards Adopted

|

||||||

|

Standard

|

Description

|

Date of adoption

|

Effect on the Financial Statements or Other Significant Matters

|

|||

|

Clarifying the Definition of a Business

|

This update clarifies the definition of a business and addresses whether transactions should be accounted for as asset acquisitions or business combinations (or divestitures). The guidance includes an initial threshold that an acquired set of assets will not be considered a business if substantially all of the fair value of the assets acquired is concentrated in a single tangible or identifiable intangible asset (or group of similar assets). If the acquired set does not pass the initial threshold, then the guidance requires that, to be a business, the set must include an input and a substantive process that together significantly contribute to the ability to create outputs. Different factors are considered to determine whether the set includes a substantive process, such as the inclusion of an organized workforce. Further, the guidance removes language stating that a business need not include all of the inputs and processes that the seller used in operating the business.

|

January 1, 2017

|

We early adopted this new standard and will apply it prospectively when determining whether transactions should be accounted for as asset acquisitions (divestitures) or business combinations (divestitures). During the nine months ended September 30, 2017, we applied the new guidance when determining whether certain product divestitures represented sales of assets or businesses.

|

|||

|

Improvements to Employee Share-Based Payment Accounting

|

This guidance is intended to simplify several aspects of the accounting for share-based payment award transactions. It will require all income tax effects of awards to be recorded through the income statement when the awards vest or settle as opposed to certain amounts being recorded in additional paid-in capital. An entity will also have to elect whether to account for forfeitures as they occur or by estimating the number of awards expected to be forfeited and adjusting the estimate when it is likely to change (as currently required). The guidance will also increase the amount an employer can withhold to cover income taxes on awards.

|

January 1, 2017

|

We adopted this standard as of January 1, 2017. We elected to estimate the number of awards expected to be forfeited and adjust the estimate when it is likely to change, consistent with past practice. We did not change the amounts that we withhold to cover income taxes on awards. As the requirement to record all income tax effects of vested or settled awards through the income statement is prospective in nature, there was no cumulative effect of adopting the standard on our balance sheet.

|

|||

|

Recently Issued Accounting Standards Not Yet Adopted

|

||||||

|

Standard

|

Description

|

Effective Date

|

Effect on the Financial Statements or Other Significant Matters

|

|||

|

Revenue from Contracts with Customers

|

The core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. To achieve that core principle, an entity should apply the following steps: identify the contract(s) with a customer; identify the performance obligations in the contract; determine the transaction price; allocate the transaction price to the performance obligations in the contract; and recognize revenue when (or as) the entity satisfies a performance obligation. This guidance allows for two adoption methods, full retrospective approach or modified retrospective approach.

|

January 1, 2018

|

We continue to evaluate the implications of adoption of the new revenue standard on our Consolidated Financial Statements. We have completed an initial assessment and are in the process of quantifying the adoption impact, if any, related to certain topics identified through our evaluation process. Our assessment of the new revenue standard has been focused on, but has not been limited to, the concepts of over-time versus point-in-time revenue recognition patterns, variable consideration, and identification of performance obligations. We will not complete our final assessment and quantification of the impact of the new revenue standard on our Consolidated Financial Statements until the adoption date. Our analysis indicates that certain contract manufacturing and private label arrangements may require revenue recognition over-time in situations in which we produce products that have no alternative use and we have an enforceable right to payment for performance completed to date, inclusive of a reasonable profit margin. This may result in an acceleration of revenue recognition for certain contractual arrangements as compared to recognition under current accounting literature. We plan to adopt the new revenue standard effective January 1, 2018 using the modified retrospective method.

|

|||

|

Intra-Entity Asset Transfers of Assets Other Than Inventory

|

Under the new guidance, the tax impact to the seller on the profit from the transfers and the buyer’s deferred tax benefit on the increased tax basis would be recognized when the transfers occur, resulting in the recognition of expense sooner than under historical guidance. The guidance excludes intra-entity transfers of inventory. For intra-entity transfers of inventory, the Financial Accounting Standards Board ("FASB") decided to retain current GAAP, which requires an entity to recognize the income tax consequences when the inventory has been sold to an outside party.

|

January 1, 2018

|

We are currently evaluating the implications of adoption on our Consolidated Financial Statements.

|

|||

|

Financial Instruments - Recognition and Measurement of Financial Assets and Liabilities

|

The objective of this simplification update is to improve the decision usefulness of financial instrument reporting, and it principally affects accounting for equity investments currently classified as available for sale and financial liabilities where the fair value option has been elected. Entities will have to measure many equity investments at fair value and recognize changes in fair value in net income rather than other comprehensive income as required under current U.S. GAAP.

|

January 1, 2018

|

We have identified certain investments that will require an adjustment, however, at this time, we are unable to estimate the impact of adopting this standard as the significance of the impact will depend upon our equity investments as of the date of adoption.

|

|||

|

Recently Issued Accounting Standards Not Yet Adopted (continued)

|

||||||

|

Standard

|

Description

|

Effective Date

|

Effect on the Financial Statements or Other Significant Matters

|

|||

|

Leases

|

This guidance was issued to increase transparency and comparability among organizations by requiring recognition of lease assets and lease liabilities on the balance sheet and disclosure of key information about leasing arrangements. For leases with a term of 12 months or less, lessees are permitted to make an election to not recognize right-of-use assets and lease liabilities. Upon adoption, lessees will apply the new standard as of the beginning of the earliest comparative period presented in the financial statements, however lessees will be able to exclude leases that expire as of the implementation date. Early adoption is permitted.

|

January 1, 2019

|

We are currently evaluating the implications of adoption on our Consolidated Financial Statements and have commenced the first step of identifying a task force to take the lead in implementing the new Lease standard.

|

|||

|

Derivatives and Hedging

|

This update was issued to enable entities to better portray the economics of their risk management activities in the financial statements and enhance the transparency and understandability of hedge results. In addition, the amendments simplify the application of hedge accounting in certain situations. Under the new rule, the entity’s ability to hedge non-financial and financial risk components is expanded. The guidance eliminates the requirement to separately measure and report hedge ineffectiveness and also eases certain documentation and assessment requirements. Early adoption is permitted.

|

January 1, 2019

|

We are currently evaluating the implications of adoption on our Consolidated Financial Statements.

|

|||

|

Measurement of Credit Losses on Financial Instruments

|

This guidance changes the impairment model for most financial assets and certain other instruments, replacing the current "incurred loss" approach with an "expected loss" credit impairment model, which will apply to most financial assets measured at amortized cost and certain other instruments, including trade and other receivables, loans, held-to-maturity debt securities, and off-balance sheet credit exposures such as letters of credit. Early adoption is permitted.

|

January 1, 2020

|

We are currently evaluating the new standard for potential impacts on our receivables, debt, and other financial instruments.

|

|||

|

Intangibles - Goodwill and Other Simplifying the Test for Goodwill

|

The objective of this update is to reduce the cost and complexity of subsequent goodwill accounting by simplifying the impairment test by removing the Step 2 requirement to perform a hypothetical purchase price allocation when the carrying value of a reporting unit exceeds its fair value. If a reporting unit’s carrying value exceeds its fair value, an entity would record an impairment charge based on that difference, limited to the amount of goodwill attributed to that reporting unit. The proposal would not change the guidance on completing Step 1 of the goodwill impairment test. The proposed guidance would be applied prospectively. Early adoption is permitted.

|

January 1, 2020

|

We are currently evaluating the implications of adoption on our Consolidated Financial Statements.

|

|||

|

Reporting Segments:

|

December 31,

2016 |

Business divestitures

|

Re-class to assets held-for-sale

|

Currency translation adjustment

|

September 30,

2017 |

|||||||||||||||

|

CHCA

|

$

|

1,810.6

|

|

$

|

—

|

|

$

|

—

|

|

$

|

2.9

|

|

$

|

1,813.5

|

|

|||||

|

CHCI

|

1,070.8

|

|

(4.1

|

)

|

—

|

|

122.3

|

|

1,189.0

|

|

||||||||||

|

RX

|

1,086.6

|

|

—

|

|

—

|

|

6.5

|

|

1,093.1

|

|

||||||||||

|

Other

|

81.4

|

|

—

|

|

(32.6

|

)

|

7.6

|

|

56.4

|

|

||||||||||

|

Total goodwill

|

$

|

4,049.4

|

|

$

|

(4.1

|

)

|

$

|

(32.6

|

)

|

$

|

139.3

|

|

$

|

4,152.0

|

|

|||||

|

|

September 30, 2017

|

December 31, 2016

|

|||||||||||||

|

|

Gross

|

Accumulated Amortization

|

Gross

|

Accumulated Amortization

|

|||||||||||

|

Definite-lived intangibles

:

|

|||||||||||||||

|

Distribution and license agreements, supply agreements

|

$

|

310.2

|

|

$

|

157.5

|

|

$

|

305.6

|

|

$

|

120.4

|

|

|||

|

Developed product technology, formulations, and product rights

|

1,355.4

|

|

568.8

|

|

1,418.1

|

|

526.0

|

|

|||||||

|

Customer relationships and distribution networks

|

1,623.7

|

|

424.5

|

|

1,489.9

|

|

307.5

|

|

|||||||

|

Trademarks, trade names, and brands

|

1,317.5

|

|

111.0

|

|

1,189.3

|

|

55.3

|

|

|||||||

|

Non-compete agreements

|

14.7

|

|

12.3

|

|

14.3

|

|

11.2

|

|

|||||||

|

Total definite-lived intangibles

|

$

|

4,621.5

|

|

$

|

1,274.1

|

|

$

|

4,417.2

|

|

$

|

1,020.4

|

|

|||

|

Indefinite-lived intangibles

:

|

|||||||||||||||

|

Trademarks, trade names, and brands

|

$

|

52.0

|

|

$

|

—

|

|

$

|

50.5

|

|

$

|

—

|

|

|||

|

In-process research and development

|

51.4

|

|

—

|

|

64.0

|

|

—

|

|

|||||||

|

Total indefinite-lived intangibles

|

103.4

|

|

—

|

|

114.5

|

|

—

|

|

|||||||

|

Total other intangible assets

|

$

|

4,724.9

|

|

$

|

1,274.1

|

|

$

|

4,531.7

|

|

$

|

1,020.4

|

|

|||

|

September 30,

2017 |

December 31,

2016 |

||||||

|

Finished goods

|

$

|

471.4

|

|

$

|

431.1

|

|

|

|

Work in process

|

146.8

|

|

165.7

|

|

|||

|

Raw materials

|

203.7

|

|

198.2

|

|

|||

|

Total inventories

|

$

|

821.9

|

|

$

|

795.0

|

|

|

|

Level 1:

|

Quoted prices for identical instruments in active markets.

|

|

Level 2:

|

Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs are observable in active markets.

|

|

Level 3:

|

Valuations derived from valuation techniques in which one or more significant inputs are not observable.

|

|

Fair Value

|

||||||||||

|

Fair Value Hierarchy

|

September 30,

2017 |

December 31,

2016 |

||||||||

|

Measured at fair value on a recurring basis:

|

||||||||||

|

Assets:

|

||||||||||

|

Investment securities

|

Level 1

|

$

|

6.1

|

|

$

|

38.2

|

|

|||

|

Foreign currency forward contracts

|

Level 2

|

$

|

13.1

|

|

$

|

3.8

|

|

|||

|

Funds associated with Israeli severance liability

|

Level 2

|

16.1

|

|

15.9

|

|

|||||

|

Total level 2 assets

|

$

|

29.2

|

|

$

|

19.7

|

|

||||

|

Royalty Pharma contingent milestone payments

|

Level 3

|

$

|

143.2

|

|

$

|

—

|

|

|||

|

Financial assets

|

Level 3

|

—

|

|

2,350.0

|

|

|||||

|

Total level 3 assets

|

$

|

143.2

|

|

$

|

2,350.0

|

|

||||

|

Liabilities:

|

||||||||||

|

Foreign currency forward contracts

|

Level 2

|

$

|

3.3

|

|

$

|

5.0

|

|

|||

|

Contingent consideration

|

Level 3

|

$

|

44.9

|

|

$

|

69.9

|

|

|||

|

Measured at fair value on a non-recurring basis:

|

||||||||||

|

Assets:

|

||||||||||

|

Goodwill

(1)

|

Level 3

|

$

|

—

|

|

$

|

1,148.4

|

|

|||

|

Indefinite-lived intangible assets

(2)

|

Level 3

|

13.3

|

|

0.3

|

|

|||||

|

Definite-lived intangible assets

(3)

|

Level 3

|

11.5

|

|

758.0

|

|

|||||

|

Assets held for sale, net

|

Level 3

|

95.1

|

|

18.2

|

|

|||||

|

Total level 3 assets

|

$

|

119.9

|

|

$

|

1,924.9

|

|

||||

|

(1)

|

As of December 31, 2016, goodwill with a carrying amount of

$2.2 billion

was written down to its implied fair value of

$1.1 billion

.

|

|

(2)

|

As of September 30, 2017, indefinite-lived intangible assets with a carrying amount of

$26.0 million

were written down to a fair value of

$13.3 million

. As of December 31, 2016, indefinite-lived intangible assets with a carrying amount of

$0.7 million

were written down to a fair value of

$0.3 million

.

|

|

(3)

|

As of July 1, 2017, definite-lived intangible assets with a carrying amount of

$31.1 million

were written down to a fair value of

$11.5 million

. As of December 31, 2016, definite-lived intangible assets with a carrying amount of

$2.3 billion

were written down to a fair value of

$758.0 million

. Included in this balance are indefinite-lived intangible assets with a fair value of

$364.5 million

and

$674.2 million

that were reclassified to definite-lived assets at April 3, 2016 and October 2, 2016, respectively.

|

|

Three Months Ended

|

Nine Months Ended

|

||||||

|

September 30,

2017 |

September 30,

2017 |

||||||

|

Royalty Pharma Contingent Milestone Payments

|

|||||||

|

Beginning balance

|

$

|

145.8

|

|

$

|

—

|

|

|

|

Additions

|

—

|

|

184.5

|

|

|||

|

Foreign currency effect

|

0.3

|

|

0.8

|

|

|||

|

Change in fair value

|

(2.9

|

)

|

(42.1

|

)

|

|||

|

Ending balance

|

$

|

143.2

|

|

$

|

143.2

|

|

|

|

Three Months Ended

|

Nine Months Ended

|

||||||||||||||

|

September 30,

2017 |

October 1,

2016 |

September 30,

2017 |

October 1,

2016 |

||||||||||||

|

Contingent Consideration

|

|||||||||||||||

|

Beginning balance

|

$

|

49.7

|

|

$

|

44.9

|

|

$

|

69.9

|

|

$

|

17.9

|

|

|||

|

Net realized losses

|

(2.9

|

)

|

(0.4

|

)

|

(18.5

|

)

|

(4.0

|

)

|

|||||||

|

Purchases or additions

|

—

|

|

30.6

|

|

—

|

|

61.1

|

|

|||||||

|

Foreign currency effect

|

0.2

|

|

—

|

|

1.5

|

|

0.1

|

|

|||||||

|

Settlements

|

(2.1

|

)

|

(0.1

|

)

|

(8.0

|

)

|

(0.1

|

)

|

|||||||

|

Ending balance

|

$

|

44.9

|

|

$

|

75.0

|

|

$

|

44.9

|

|

$

|

75.0

|

|

|||

|

Nine Months Ended

|

|

|

September 30, 2017

|

|

|

Lumara

|

|

|

5-year average growth rate

|

(4.1)%

|

|

Discount rate

|

13.5%

|

|

Valuation method

|

MPEEM

|

|

Year Ended

|

|||||||||

|

December 31, 2016

|

|||||||||

|

Omega - Lifestyle

|

Omega - XLS

|

Entocort

®

- Branded Products

|

Entocort

®

- AG Products

|

Herron Trade Names and Trademarks

|

|||||

|

5-year average growth rate

|

2.5%

|

3.2%

|

(31.7)%

|

(30.4)%

|

4.6%

|

||||

|

Long-term growth rates

|

2.0%

|

NA

|

(10.0)%

|

(4.7)%

|

2.5%

|

||||

|

Discount rate

|

9.3%

|

9.5%

|

13.0%

|

10.5%

|

10.8%

|

||||

|

Royalty rate

|

NA

|

4.0%

|

NA

|

NA

|

11.0%

|

||||

|

Valuation method

|

MPEEM

|

Relief from Royalty

|

MPEEM

|

MPEEM

|

Relief from Royalty

|

||||

|

September 30,

2017 |

December 31, 2016

|

||||||

|

Equity securities, at cost less impairments

|

$

|

15.5

|

|

$

|

16.5

|

|

|

|

Gross unrealized gains

|

—

|

|

21.7

|

|

|||

|

Gross unrealized losses

|

(9.4

|

)

|

—

|

|

|||

|

Estimated fair value of equity securities

|

$

|

6.1

|

|

$

|

38.2

|

|

|

|

Asset Derivatives

|

|||||||||

|

Balance Sheet Location

|

Fair Value

|

||||||||

|

|

September 30,

2017 |

December 31,

2016 |

|||||||

|

Designated derivatives:

|

|||||||||

|

Foreign currency forward contracts

|

Other current assets

|

$

|

4.6

|

|

$

|

3.1

|

|

||

|

Non-designated derivatives:

|

|||||||||

|

Foreign currency forward contracts

|

Other current assets

|

$

|

8.5

|

|

$

|

0.7

|

|

||

|

Liability Derivatives

|

|||||||||

|

Balance Sheet Location

|

Fair Value

|

||||||||

|

|

September 30,

2017 |

December 31,

2016 |

|||||||

|

Designated derivatives:

|

|||||||||

|

Foreign currency forward contracts

|

Accrued liabilities

|

$

|

2.6

|

|

$

|

3.0

|

|

||

|

Non-designated derivatives:

|

|||||||||

|

Foreign currency forward contracts

|

Accrued liabilities

|

$

|

0.7

|

|

$

|

2.0

|

|

||

|

Amount of Gain/(Loss) Recorded in OCI

(Effective Portion) |

||||||||||||||||

|

Three Months Ended

|

Nine Months Ended

|

|||||||||||||||

|

Designated Cash Flow Hedges

|

September 30,

2017 |

October 1,

2016 |

September 30,

2017 |

October 1,

2016 |

||||||||||||

|

Interest rate swap agreements

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

(9.0

|

)

|

||||

|

Foreign currency forward contracts

|

1.1

|

|

3.4

|

|

6.3

|

|

4.7

|

|

||||||||

|

Total

|

$

|

1.1

|

|

$

|

3.4

|

|

$

|

6.3

|

|

$

|

(4.3

|

)

|

||||

|

Amount of Gain/(Loss) Reclassified from AOCI into Earnings

(Effective Portion) |

||||||||||||||||||

|

Three Months Ended

|

Nine Months Ended

|

|||||||||||||||||

|

Designated Cash Flow Hedges

|

Income Statement Location

|

September 30,

2017 |

October 1,

2016 |

September 30,

2017 |

October 1,

2016 |

|||||||||||||

|

Treasury locks

|

Interest expense, net

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

(0.1

|

)

|

|||||

|

Interest rate swap agreements

|

Interest expense, net

|

(0.4

|

)

|

(0.6

|

)

|

(1.7

|

)

|

(1.7

|

)

|

|||||||||

|

Other (income) expense, net

|

—

|

|

—

|

|

(5.9

|

)

|

—

|

|

||||||||||

|

Foreign currency forward contracts

|

Net sales

|

—

|

|

(0.1

|

)

|

0.9

|

|

0.3

|

|

|||||||||

|

Cost of sales

|

1.8

|

|

0.9

|

|

3.5

|

|

1.8

|

|

||||||||||

|

Interest expense, net

|

(0.7

|

)

|

(0.4

|

)

|

(1.8

|

)

|

(1.3

|

)

|

||||||||||

|

Other (income) expense, net

|

(1.2

|

)

|

(1.2

|

)

|

(1.7

|

)

|

0.7

|

|

||||||||||

|

Total

|

$

|

(0.5

|

)

|

$

|

(1.4

|

)

|

$

|

(6.7

|

)

|

$

|

(0.3

|

)

|

||||||

|

Amount of Gain/(Loss) Recognized against Earnings

(Ineffective Portion) |

||||||||||||||||||

|

Three Months Ended

|

Nine Months Ended

|

|||||||||||||||||

|

Designated Cash Flow Hedges

|

Income Statement

Location

|

September 30,

2017 |

October 1,

2016 |

September 30,

2017 |

October 1,

2016 |

|||||||||||||

|

Interest rate swap agreements

|

Other (income) expense, net

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

(0.1

|

)

|

|||||

|

Foreign currency forward contracts

|

Net sales

|

0.2

|

|

—

|

|

0.1

|

|

0.1

|

|

|||||||||

|

Cost of sales

|

0.1

|

|

—

|

|

0.1

|

|

—

|

|

||||||||||

|

Other (income) expense, net

|

—

|

|

—

|

|

1.0

|

|

0.6

|

|

||||||||||

|

Total

|

$

|

0.3

|

|

$

|

—

|

|

$

|

1.2

|

|

$

|

0.6

|

|

||||||

|

Amount of Gain/(Loss) Recognized against Earnings

|

||||||||||||||||||

|

Three Months Ended

|

Nine Months Ended

|

|||||||||||||||||

|

Non-Designated Derivatives

|

Income Statement Location

|

September 30,

2017 |

October 1,

2016 |

September 30,

2017 |

October 1,

2016 |

|||||||||||||

|

Foreign currency forward contracts

|

Other (income) expense, net

|

$

|

10.1

|

|

$

|

(0.2

|

)

|

$

|

(3.8

|

)

|

$

|

(8.7

|

)

|

|||||

|

Interest expense, net

|

(1.8

|

)

|

(1.0

|

)

|

(2.9

|

)

|

(1.5

|

)

|

||||||||||

|

Total

|

$

|

8.3

|

|

$

|

(1.2

|

)

|

$

|

(6.7

|

)

|

$

|

(10.2

|

)

|

||||||

|

September 30,

2017 |

December 31,

2016 |

||||||||||

|

Other

|

CHCA

|

Other

|

|||||||||

|

Assets held for sale

|

|||||||||||

|

Current assets

|

$

|

44.0

|

|

$

|

—

|

|

$

|

5.1

|

|

||

|

Goodwill

|

32.6

|

|

—

|

|

5.5

|

|

|||||

|

Intangible assets

|

5.5

|

|

—

|

|

—

|

|

|||||

|

Property, plant and equipment

|

45.9

|

|

13.5

|

|

33.2

|

|

|||||

|

Other assets

|

3.1

|

|

—

|

|

3.8

|

|

|||||

|

Less: impairment reserves

|

(3.3

|

)

|

(3.7

|

)

|

(35.3

|

)

|

|||||

|

Total assets held for sale

|

$

|

127.8

|

|

$

|

9.8

|

|

$

|

12.3

|

|

||

|

Liabilities held for sale

|

|||||||||||

|

Current liabilities

|

$

|

7.6

|

|

$

|

0.1

|

|

$

|

1.9

|

|

||

|

Other liabilities

|

25.1

|

|

—

|

|

1.9

|

|

|||||

|

Total liabilities held for sale

|

$

|

32.7

|

|

$

|

0.1

|

|

$

|

3.8

|

|

||

|

September 30,

2017 |

December 31,

2016 |

||||||||||

|

Term loans

|

|||||||||||

|

2014 term loan due December 5, 2019

|

(1)

|

$

|

428.3

|

|

$

|

420.7

|

|

||||

|

Notes and Bonds

|

|||||||||||

|

Coupon

|

Due

|

||||||||||

|

4.500%

|

May 23, 2017

|

(1)(2)

|

—

|

|

189.3

|

|

|||||

|

5.125%

|

December 12, 2017

|

(1)(2)

|

354.5

|

|

315.6

|

|

|||||

|

2.300%

|

November 8, 2018

|

|

—

|

|

600.0

|

|

|||||

|

5.000%

|

May 23, 2019

|

(1)(2)

|

141.8

|

|

126.2

|

|

|||||

|

3.500%

|

March 15, 2021

|

|

280.4

|

|

500.0

|

|

|||||

|

3.500%

|

December 15, 2021

|

|

309.6

|

|

500.0

|

|

|||||

|

5.105%

|

July 19, 2023

|

(1)(2)

|

159.5

|

|

142.0

|

|

|||||

|

4.000%

|

November 15, 2023

|

|

215.6

|

|

800.0

|

|

|||||

|

3.900%

|

December 15, 2024

|

|

700.0

|

|

700.0

|

|

|||||

|

4.375%

|

March 15, 2026

|

|

700.0

|

|

700.0

|

|

|||||

|

5.300%

|

November 15, 2043

|

|

90.5

|

|

400.0

|

|

|||||

|

4.900%

|

December 15, 2044

|

|

303.9

|

|

400.0

|

|

|||||

|

Total notes and bonds

|

3,255.8

|

|

5,373.1

|

|

|||||||

|

Other financing

|

2.9

|

|

3.6

|

|

|||||||

|

Unamortized premium (discount), net

|

24.8

|

|

33.0

|

|

|||||||

|

Deferred financing fees

|

(19.0

|

)

|

(33.1

|

)

|

|||||||

|

Total borrowings outstanding

|

3,692.8

|

|

5,797.3

|

|

|||||||

|

Current indebtedness

|

(417.1

|

)

|

(572.8

|

)

|

|||||||

|

Total long-term debt less current portion

|

$

|

3,275.7

|

|

$

|

5,224.5

|

|

|||||

|

(1)

|

Debt denominated in Euros subject to fluctuations in the euro-to-U.S. dollar exchange rate.

|

|

(2)

|

Debt assumed from Omega.

|

|

Date

|

Series

|

Transaction Type

|

Principal Retired

|

|||||

|

April 1, 2017

|

2014 term loan due December 5, 2019

|

Scheduled quarterly payment

|

$

|

13.3

|

|

|||

|

July 1, 2017

|

2014 term loan due December 5, 2019

|

Scheduled quarterly payment

|

14.3

|

|

||||

|

September 30, 2017

|

2014 term loan due December 5, 2019

|

Scheduled quarterly payment

|

14.8

|

|

||||

|

May 8, 2017

|

$600.0 2.300% senior notes due 2018

|

Early redemption

|

600.0

|

|

||||

|

May 23, 2017

|

€180.0 4.500% retail bonds due 2017

|

Scheduled maturity

|

201.3

|

|

||||

|

June 15, 2017

|

$500.0 3.500% senior notes due 2021

|

Tender offer

|

190.4

|

|

||||

|

June 15, 2017

|

$500.0 3.500% senior notes due 2021

|

Tender offer

|

219.6

|

|

||||

|

June 15, 2017

|

$800.0 4.000% senior notes due 2023

|

Tender offer

|

584.4

|

|

||||

|

June 15, 2017

|

$400.0 5.300% senior notes due 2043

|

Tender offer

|

309.5

|

|

||||

|

June 15, 2017

|

$400.0 4.900% senior notes due 2044

|

Tender offer

|

96.1

|

|

||||

|

$

|

2,243.7

|

|

||||||

|

Premium on debt repayment

|

$

|

116.1

|

|

|

|

Transaction costs

|

3.8

|

|

||

|

Write-off of deferred financing fees

|

10.6

|

|

||

|

Write-off of remaining discount on bond

|

4.7

|

|

||

|

Total loss on extinguishment of debt

|

$

|

135.2

|

|

|

|

|

Three Months Ended

|

Nine Months Ended

|

|||||||||||||

|

|

September 30,

2017 |

October 1,

2016 |

September 30,

2017 |

October 1,

2016 |

|||||||||||

|

Numerator:

|

|||||||||||||||

|

Net income (loss)

|

$

|

44.5

|

|

$

|

(1,590.2

|

)

|

$

|

46.4

|

|

$

|

(2,653.7

|

)

|

|||

|

Denominator:

|

|||||||||||||||

|

Weighted average shares outstanding for basic EPS

|

141.3

|

|

143.3

|

|

142.5

|

|

143.2

|

|

|||||||

|

Dilutive effect of share-based awards*

|

0.4

|

|

—

|

|

0.3

|

|

—

|

|

|||||||

|

Weighted average shares outstanding for diluted EPS

|

141.7

|

|

143.3

|

|

142.8

|

|

143.2

|

|

|||||||

|

Anti-dilutive share-based awards excluded from

computation of diluted EPS*

|

1.0

|

|

—

|

|

0.8

|

|

—

|

|

|||||||

|

Three Months Ended

|

Nine Months Ended

|

|||||||||

|

September 30,

2017 |

October 1,

2016 |

September 30,

2017 |

October 1,

2016 |

|||||||

|

99,800

|

|

185,000

|

|

146,100

|

|

283,000

|

|

|||

|

Foreign currency translation adjustments

|

Fair value of derivative financial instruments, net of tax

|

Fair value of investment securities, net of tax

|

Post-retirement and pension liability adjustments, net of tax

|

Total AOCI

|

|||||||||||||||

|

Balance at December 31, 2016

|

$

|

(67.9

|

)

|

$

|

(19.5

|

)

|

$

|

15.1

|

|

$

|

(9.5

|

)

|

$

|

(81.8

|

)

|

||||

|

OCI before reclassifications

|

289.9

|

|

4.4

|

|

(22.8

|

)

|

(1.2

|

)

|

270.3

|

|

|||||||||

|

Amounts reclassified from AOCI

|

—

|

|

4.3

|

|

(1.6

|

)

|

—

|

|

2.7

|

|

|||||||||

|

Other comprehensive income (loss)

|

289.9

|

|

8.7

|

|

(24.4

|

)

|

(1.2

|

)

|

273.0

|

|

|||||||||

|

Balance at September 30, 2017

|

$

|

222.0

|

|

$

|

(10.8

|

)

|

$

|

(9.3

|

)

|

$

|

(10.7

|

)

|

$

|

191.2

|

|

||||

|

Three Months Ended

|

Nine Months Ended

|

|||||||||

|

September 30,

2017 |

October 1,

2016 |

September 30,

2017 |

October 1,

2016 |

|||||||

|

65.5

|

%

|

16.4

|

%

|

68.7

|

%

|

17.2

|

%

|

|||

|

Three Months Ended

|

Nine Months Ended

|

||||||||||||||

|

September 30,

2017 |

October 1,

2016 |

September 30,

2017 |

October 1,

2016 |

||||||||||||

|

Beginning balance

|

$

|

39.7

|

|

$

|

12.2

|

|

$

|

19.7

|

|

$

|

20.7

|

|

|||

|

Additional charges

|

3.8

|

|

6.6

|

|

54.7

|

|

17.9

|

|

|||||||

|

Payments

|

(17.8

|

)

|

(8.6

|

)

|

(47.6

|

)

|

(33.3

|

)

|

|||||||

|

Non-cash adjustments

|

0.4

|

|

0.1

|

|

(0.7

|

)

|

5.0

|

|

|||||||

|

Ending balance

|

$

|

26.1

|

|

$

|

10.3

|

|

$

|

26.1

|

|

$

|

10.3

|

|

|||

|

•

|

CHCA

,

comprises our U.S., Mexico and Canada consumer healthcare business (OTC, contract, infant formula and animal health categories).

|

|

•

|

CHCI

,

comprises our legacy Branded Consumer Healthcare segment and now includes our consumer focused businesses in the U.K., Australia, and Israel. This segment also includes our U.K. liquid licensed products business.

|

|

•

|

RX

,

comprises our U.S. Prescription Pharmaceuticals business.

|

|

Total Assets

|

||||||||

|

September 30,

2017 |

December 31,

2016 |

|||||||

|

CHCA

|

$

|

3,833.7

|

|

$

|

3,351.3

|

|

||

|

CHCI

|

5,114.2

|

|

4,795.2

|

|

||||

|

RX

|

2,597.0

|

|

2,646.4

|

|

||||

|

Specialty Sciences

|

—

|

|

2,775.8

|

|

||||

|

Other

|

297.7

|

|

301.4

|

|

||||

|

Total

|

$

|

11,842.6

|

|

$

|

13,870.1

|

|

||

|

Three Months Ended

|

|||||||||||||||||||||||

|

September 30, 2017

|

October 1, 2016

|

||||||||||||||||||||||

|

Net

Sales

|

Operating Income (Loss)

|

Intangible Asset Amortization

|

Net

Sales

|

Operating Income (Loss)

|

Intangible Asset Amortization

|

||||||||||||||||||

|

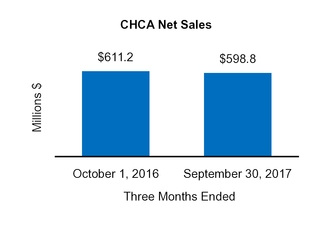

CHCA

|

$

|

598.8

|

|

$

|

124.3

|

|

$

|

16.9

|

|

$

|

611.2

|

|

$

|

99.0

|

|

$

|

17.6

|

|

|||||

|

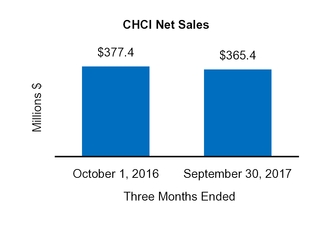

CHCI

|

365.4

|

|

4.6

|

|

50.2

|

|

377.4

|

|

(1,615.5

|

)

|

44.4

|

|

|||||||||||

|

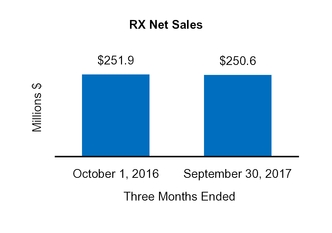

RX

|

250.6

|

|

82.1

|

|

21.0

|

|

251.9

|

|

74.4

|

|

27.2

|

|

|||||||||||

|

Specialty Sciences

|

—

|

|

—

|

|

—

|

|

—

|

|

3.2

|

|

—

|

|

|||||||||||

|

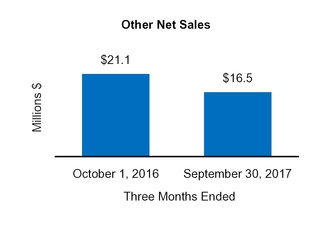

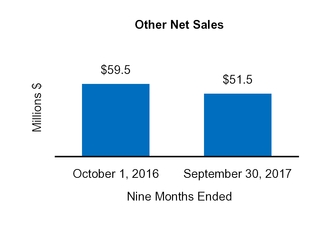

Other

|

16.5

|

|

(0.4

|

)

|

0.4

|

|

21.1

|

|

(1.5

|

)

|

0.5

|

|

|||||||||||

|

Unallocated

|

—

|

|

(48.2

|

)

|

—

|

|

—

|

|

(27.9

|

)

|

—

|

|

|||||||||||

|

Total

|

$

|

1,231.3

|

|

$

|

162.4

|

|

$

|

88.5

|

|

$

|

1,261.6

|

|

$

|

(1,468.3

|

)

|

$

|

89.7

|

|

|||||

|

Nine Months Ended

|

|||||||||||||||||||||||

|

September 30, 2017

|

October 1, 2016

|

||||||||||||||||||||||

|

Net

Sales

|

Operating Income (Loss)

|

Intangible Asset Amortization

|

Net

Sales

|

Operating Income (Loss)

|

Intangible Asset Amortization

|

||||||||||||||||||

|

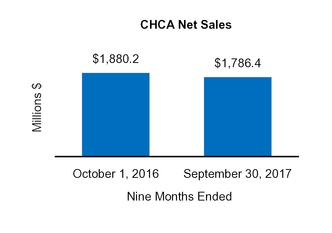

CHCA

|

$

|

1,786.4

|

|

$

|

303.6

|

|

$

|

51.1

|

|

$

|

1,880.2

|

|

$

|

316.4

|

|

$

|

53.3

|

|

|||||

|

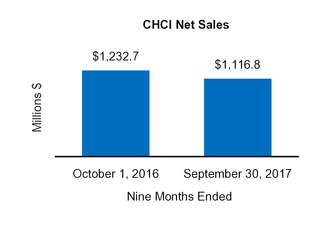

CHCI

|

1,116.8

|

|

8.7

|

|

143.4

|

|

1,232.7

|

|

(2,011.3

|

)

|

130.6

|

|

|||||||||||

|

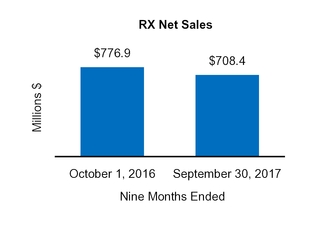

RX

|

708.4

|

|

239.6

|

|

65.6

|

|

776.9

|

|

258.3

|

|

78.6

|

|

|||||||||||

|

Specialty Sciences

|

—

|

|

—

|

|

—

|

|

—

|

|

(1.9

|

)

|

—

|

|

|||||||||||

|

Other

|

51.5

|

|

9.4

|

|

1.2

|

|

59.5

|

|

2.6

|

|

1.4

|

|

|||||||||||

|

Unallocated

|

—

|

|

(121.7

|

)

|

—

|

|

—

|

|

(79.2

|

)

|

—

|

|

|||||||||||

|

Total

|

$

|

3,663.1

|

|

$

|

439.6

|

|

$

|

261.3

|

|

$

|

3,949.3

|

|

$

|

(1,515.1

|

)

|

$

|

263.9

|

|

|||||

|

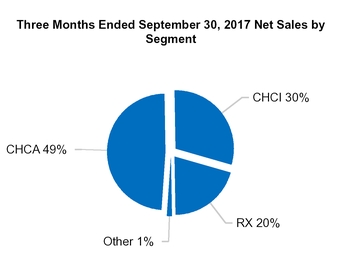

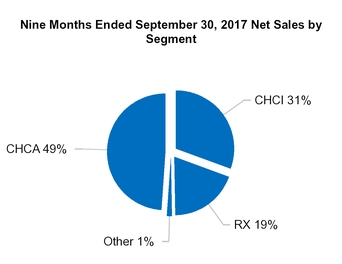

•

|

Consumer Healthcare Americas

(

"CHCA"

), comprises our U.S., Mexico and Canada consumer healthcare business (OTC, contract, infant formula and animal health categories).

|

|

•

|

Consumer Healthcare International

(

"

CHCI

"

),

comprises our legacy Branded Consumer Healthcare segment and now includes our consumer focused businesses in the U.K., Australia, and Israel. This segment also includes our U.K. liquid licensed products business.

|

|

•

|

Prescription Pharmaceuticals

(

"

RX

"

),

comprises our U.S. Prescription Pharmaceuticals business.

|

|

•

|

On

March 27, 2017

, we completed the sale of our Tysabri

®

financial asset, effective January 1, 2017, to Royalty Pharma for up to

$2.85 billion

, which consists of

$2.2 billion

in cash and up to

$250.0 million

and

$400.0 million

in milestone payments if the royalties on global net sales of Tysabri

®

that are received by Royalty Pharma meet specific thresholds in 2018 and 2020, respectively. As a result of this transaction, we derecognized the Tysabri

®

financial asset and recorded a

$17.1 million

gain (refer to

Item 1. Note 6

).

|

|

•

|

On

April 6, 2017

, we completed the sale of our India API business to Strides Shasun Limited for

$22.2 million

, inclusive of an estimated working capital adjustment. The sale did not have a material impact on our operations (refer to

Item 1. Note 2

).

|

|

•

|

On

August 4, 2017

, we signed a definitive agreement for the sale of our Israel API business to SK Capital for

$110.0 million

in cash, inclusive of a net debt adjustment. We expect to finalize the sale within the next three months. The sale is not expected to have a material impact on our operations (refer to

Item 1. Note 9

).

|

|

•

|

We completed

$2.2 billion

of debt repayments during the

nine months ended

September 30, 2017

(refer to

Item 1. Note 10

).

|

|

•

|

On

August 25, 2017

, we completed the sale of our Russian business to Alvogen Pharma LLC and Alvogen CEE Kft. for

€12.7 million

(

$15.1 million

), inclusive of an estimated working capital adjustment. The sale did not have a material impact on our operations (refer to

Item 1. Note 2

).

|

|

|

Three Months Ended

|

Nine Months Ended

|

|||||||||||||

|

($ in millions)

|

October 1,

2016 |

September 30,

2017 |

October 1,

2016 |

September 30,

2017 |

|||||||||||

|

Net sales

|

$

|

1,261.6

|

|

$

|

1,231.3

|

|

$

|

3,949.3

|

|

$

|

3,663.1

|

|

|||

|

Gross profit

|

$

|

484.5

|

|

$

|

497.8

|

|

$

|

1,564.1

|

|

$

|

1,466.7

|

|

|||

|

Gross profit %

|

38.4

|

%

|

40.4

|

%

|

39.6

|

%

|

40.0

|

%

|

|||||||

|

Operating expenses

|

$

|

1,952.8

|

|

$

|

335.4

|

|

$

|

3,079.2

|

|

$

|

1,027.1

|

|

|||

|

Operating expenses %

|

154.8

|

%

|

27.2

|

%

|

78.0

|

%

|

28.0

|

%

|

|||||||

|

Operating income (loss)

|

$

|

(1,468.3

|

)

|

$

|

162.4

|

|

$

|

(1,515.1

|

)

|

$

|

439.6

|

|

|||

|

Operating income (loss) %

|

(116.4

|

)%

|

13.2

|

%

|

(38.4

|

)%

|

12.0

|

%

|

|||||||

|

Change in financial assets

|

$

|

377.4

|

|

$

|

2.6

|

|

$

|

1,492.6

|

|

$

|

24.2

|

|

|||

|

Interest and other, net

|

$

|

55.6

|

|

$

|

31.1

|

|

$

|

195.6

|

|

$

|

132.0

|

|

|||

|

Loss on extinguishment of debt

|

$

|

0.7

|

|

$

|

—

|

|

$

|

1.1

|

|

$

|

135.2

|

|

|||

|

Income tax expense (benefit)

|

$

|

(311.8

|

)

|

$

|

84.2

|

|

$

|

(550.7

|

)

|

$

|

101.8

|

|

|||

|

Net income (loss)

|

$

|

(1,590.2

|

)

|

$

|

44.5

|

|

$

|

(2,653.7

|

)

|

$

|

46.4

|

|

|||

|

•

|

We continue to experience a reduction in pricing expectations within our

CHCA

segment, primarily in the cough/cold, animal health, and analgesics categories due to various factors, including increased focus from customers to capture supply chain productivity savings and competition in specific product categories. We expect this pricing environment to continue to impact our

CHCA

segment for the foreseeable future.

|

|

•

|

We completed the sale of the animal health pet treats plant fixed assets on