|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Ireland

|

|

98-1111119

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

|

Adelphi Plaza

Upper George's Street

Dún Laoghaire

Co. Dublin, A96 T927, Ireland

|

||

|

(Address of principal executive offices including Zip Code)

|

||

|

Title of Each Class

|

|

Name of Each Exchange on Which Registered

|

|

Ordinary Shares, par value $0.01 per share

|

|

The Nasdaq Global Select Market

|

|

Large accelerated filer

|

x

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

o

|

|

Emerging growth company

|

o

|

||

|

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

|

|||

|

|

Page

|

|

Item 1.

Business

|

|

|

Item 1B. Unresolved Staff Comments

|

|

|

Item 2.

Properties

|

|

|

Item 3.

Legal Proceedings

|

|

|

Item 4. Mine Safety Disclosures

|

|

|

Item 5.

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

|

Item 6.

Selected Financial Data

|

|

|

Item 8. Financial Statements

and Supplementary Data

|

|

|

Item 9.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

|

|

Item 9B.

Other Information

|

|

|

Item 10.

Directors, Executive Officers and Corporate Governance

|

|

|

Item 12.

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

|

|

Item 13.

Certain Relationships and Related Transactions, and Director Independence

|

|

|

Item 14.

Principal Accounting Fees and Services

|

|

|

Item 15.

Exhibits, Financial Statement Schedules

|

|

|

•

|

Concentrate our discovery and development efforts in areas where we have decades of scientific expertise and experience.

|

|

•

|

up to

$350.0 million

upon the achievement of additional development, regulatory and various first commercial sales milestones;

|

|

•

|

up to an additional $175.0 million in ex-U.S. commercial sales milestones; and

|

|

•

|

tiered, high single-digit to high double-digit royalties in the teens on ex-U.S. annual net sales, subject to certain adjustments.

|

|

•

|

Tau

, a protein implicated in diseases including Alzheimer's disease (AD), progressive supranuclear palsy (PSP), frontotemporal dementia (FTD), chronic traumatic encephalopathy (CTE ) and other tauopathies. Prothena has identified antibodies targeting novel epitopes on the tau protein with the potential to block misfolded tau from binding to cells and to inhibit cell-to-cell transmission, preventing downstream toxic functional effects.

|

|

•

|

Aβ, or Amyloid Beta,

a protein implicated in Alzheimer’s disease (AD). Prothena scientists have advanced the understanding of the biology of AD and made particularly impactful and fundamental discoveries that elucidated the role amyloid plays in the disease. Today, Prothena is advancing a new approach to design a more potent anti-Aβ antibody.

|

|

•

|

LECT2

, a protein implicated in ALECT2 amyloidosis. Similar to AL amyloidosis and ATTR amyloidosis, ALECT2 amyloidosis is a rare disease caused by deposits of misfolded aggregated protein in vital organs, most often the kidneys and liver. Prothena has identified novel epitopes on the misfolded forms of the protein

.

|

|

•

|

submission to the FDA of an Investigational New Drug Application (“IND”), which must become effective before human clinical trials may begin and must be updated annually;

|

|

•

|

completion of extensive nonclinical laboratory tests and animal studies, performed in accordance with the FDA’s Good Laboratory Practice (“GLP”) regulations;

|

|

•

|

performance of adequate and well-controlled human clinical trials to establish the efficacy and safety of the product for each proposed indication, all performed in accordance with FDA’s current good clinical practices (“cGCP”) requirements;

|

|

•

|

submission to the FDA of a BLA for a new biologic, after completion of all required clinical trials;

|

|

•

|

satisfactory completion of an FDA pre-approval inspection of the manufacturing facilities at which the product is produced and tested to assess compliance with regulatory requirements, including current good manufacturing practices (“cGMP”) regulations; and

|

|

•

|

FDA review and approval of a BLA for a new biologic, prior to any commercial marketing or sale of the product in the U.S.

|

|

•

|

Approximately 6 patent families related to AL or AA amyloidosis, including our NEOD001 program;

|

|

•

|

Approximately 14 patent families related to Parkinson’s disease and other synucleinopathies, including our PRX002 program;

|

|

•

|

Approximately 13 patent families related to inflammatory diseases including psoriasis, including our PRX003 program;

|

|

•

|

Approximately 7 patent families related to ATTR amyloidosis, including our PRX004 program; and

|

|

•

|

Approximately 12 patent families related to other potential targets of intervention and diseases.

|

|

•

|

conduct our Phase 2b, Phase 3 and open label extension (“OLE”) clinical trials for NEOD001, support the Phase 2 clinical trial for PRX002/RG7935 being conducted by Roche and initiate additional clinical trials for these and other programs, including PRX004;

|

|

•

|

develop and commercialize our product candidates, including NEOD001, PRX002/RG7935 and PRX004;

|

|

•

|

undertake nonclinical development of other product candidates and initiate clinical trials, if supported by positive nonclinical data; and

|

|

•

|

pursue our early stage research and seek to identify additional drug candidates and potentially acquire rights from third parties to drug candidates through licenses, acquisitions or other means.

|

|

•

|

the timing of initiation, progress, results and costs of our clinical trials, including our Phase 2b, Phase 3 and OLE clinical trials for NEOD001, the Phase 2 clinical trial for PRX002/RG7935 and our planned Phase 1 clinical trial for PRX004;

|

|

•

|

the timing, initiation, progress, results and costs of these and our other research, development and commercialization activities;

|

|

•

|

the results of our research and nonclinical studies;

|

|

•

|

the costs of manufacturing our drug candidates for clinical development as well as for future commercialization needs;

|

|

•

|

the costs of preparing for commercialization of our drug candidates, in particular NEOD001;

|

|

•

|

the costs of preparing, filing and prosecuting patent applications and maintaining, enforcing and defending intellectual property-related claims;

|

|

•

|

our ability to establish research collaborations, strategic collaborations, licensing or other arrangements;

|

|

•

|

the costs to satisfy our obligations under potential future collaborations; and

|

|

•

|

the timing, receipt, and amount of revenues or royalties, if any, from any approved drug candidates.

|

|

•

|

terminate or delay clinical trials or other development for one or more of our drug candidates;

|

|

•

|

delay arrangements for activities that may be necessary to commercialize our drug candidates;

|

|

•

|

curtail or eliminate our drug research and development programs that are designed to identify new drug candidates; or

|

|

•

|

cease operations.

|

|

•

|

offer improvement over existing treatment options;

|

|

•

|

be proven safe and effective in clinical trials; or

|

|

•

|

meet applicable regulatory standards.

|

|

•

|

obtaining and maintaining commercial manufacturing arrangements with third-party manufacturers;

|

|

•

|

developing the marketing and sales capabilities, internal and/or in collaboration with pharmaceutical companies or contract sales organizations, to market and sell any approved drug; and

|

|

•

|

acceptance of any approved drug in the medical community and by patients and third-party payors.

|

|

•

|

conditions imposed on us by the FDA, the EMA or other comparable regulatory authorities regarding the scope or design of our clinical trials;

|

|

•

|

delays in obtaining, or our inability to obtain, required approvals from institutional review boards (“IRBs”) or other reviewing entities at clinical sites selected for participation in our clinical trials;

|

|

•

|

insufficient supply or deficient quality of our drug candidates or other materials necessary to conduct our clinical trials;

|

|

•

|

delays in obtaining regulatory agency agreement for the conduct of our clinical trials;

|

|

•

|

lower than anticipated enrollment and/or retention rate of subjects in our clinical trials, which can be impacted by a number of factors, including size of patient population, design of trial protocol, trial length, eligibility criteria, perceived risks and benefits of the study drug, patient proximity to trial sites, patient referral practices of physicians, availability of other treatments for the relevant disease and competition from other clinical trials;

|

|

•

|

slower than expected rates of events in trials with a composite primary endpoint that is event-based, such as our Phase 3 trial for NEOD001, in which all-cause mortality and/or cardiac hospitalizations are primary endpoints;

|

|

•

|

serious and unexpected drug-related side effects experienced by subjects in clinical trials; or

|

|

•

|

failure of our third-party contractors and collaborators to meet their contractual obligations to us or otherwise meet their development or other objectives in a timely manner.

|

|

•

|

failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols;

|

|

•

|

inspection of the clinical trial operations or trial sites by the FDA, the EMA or other regulatory authorities resulting in the imposition of a clinical hold on or imposition of additional conditions for the conduct of the trial;

|

|

•

|

interpretation of data by the FDA, the EMA or other regulatory authorities;

|

|

•

|

requirement by the FDA, the EMA or other regulatory authorities to perform additional studies;

|

|

•

|

failure to achieve primary or secondary endpoints or other failure to demonstrate efficacy or adequate safety;

|

|

•

|

unforeseen safety issues; or

|

|

•

|

lack of adequate funding to continue the clinical trial.

|

|

•

|

the FDA, the EMA or comparable regulatory authorities may disagree with the design, implementation or conduct of our clinical trials;

|

|

•

|

we may be unable to demonstrate to the satisfaction of the FDA, the EMA or comparable regulatory authorities that a drug candidate is safe and effective for its proposed indication;

|

|

•

|

the results of clinical trials may not meet the level of statistical significance required by the FDA, the EMA or comparable regulatory authorities for approval;

|

|

•

|

we may be unable to demonstrate that a drug candidate’s clinical and other benefits outweigh its safety risks;

|

|

•

|

the FDA, the EMA or comparable regulatory authorities may disagree with our interpretation of data from nonclinical studies or clinical trials;

|

|

•

|

the data collected from clinical trials of our drug candidates may not be sufficient to support the submission of a Biologic License Application (“BLA”) to the FDA, a Marketing Authorization Application (“MAA”) to the EMA or similar applications to comparable regulatory authorities;

|

|

•

|

the FDA, the EMA or comparable regulatory authorities may fail to approve the manufacturing processes or facilities of third-party manufacturers with which we contract for clinical and commercial supplies; or

|

|

•

|

the approval policies or regulations of the FDA, the EMA or comparable regulatory authorities may significantly change in a manner rendering our clinical data insufficient for approval.

|

|

•

|

restrictions on the marketing of our products or their manufacturing processes;

|

|

•

|

warning letters;

|

|

•

|

civil or criminal penalties;

|

|

•

|

fines;

|

|

•

|

injunctions;

|

|

•

|

product seizures or detentions;

|

|

•

|

import or export bans;

|

|

•

|

voluntary or mandatory product recalls and related publicity requirements;

|

|

•

|

suspension or withdrawal of regulatory approvals;

|

|

•

|

total or partial suspension of production; and

|

|

•

|

refusal to approve pending applications for marketing approval of new products or supplements to approved applications.

|

|

•

|

regulatory authorities may withdraw their approval of the product;

|

|

•

|

regulatory authorities may require the addition of labeling statements, such as warnings or contraindications, or impose additional safety monitoring or reporting requirements;

|

|

•

|

we may be required to change the way the product is administered, conduct additional clinical trials;

|

|

•

|

we could be sued and held liable for harm caused to patients; and

|

|

•

|

our reputation may suffer.

|

|

•

|

the indication and label for the product and the timing of introduction of competitive products;

|

|

•

|

demonstration of clinical safety and efficacy compared to other products;

|

|

•

|

prevalence and severity of adverse side effects;

|

|

•

|

availability of coverage and adequate reimbursement from managed care plans and other third-party payors;

|

|

•

|

convenience and ease of administration;

|

|

•

|

cost-effectiveness;

|

|

•

|

other potential advantages of alternative treatment methods; and

|

|

•

|

the effectiveness of marketing and distribution support of the product.

|

|

•

|

an annual, nondeductible fee on any entity that manufactures or imports certain branded prescription drugs and biologic agents, apportioned among these entities according to their market share in certain government healthcare programs;

|

|

•

|

an increase in the minimum rebates a manufacturer must pay under the U.S. Medicaid Drug Rebate Program to 23.1% and 13.0% of the average manufacturer price for branded and generic drugs, respectively;

|

|

•

|

expansion of healthcare fraud and abuse laws, including the U.S. False Claims Act and the U.S. Anti-Kickback Statute, new government investigative powers and enhanced penalties for non-compliance;

|

|

•

|

a new Medicare Part D coverage gap discount program, under which manufacturers must agree to offer 50 percent point-of-sale discounts off negotiated prices of applicable brand drugs to eligible beneficiaries during their coverage gap period, as a condition for the manufacturer’s outpatient drugs to be covered under Medicare Part D;

|

|

•

|

extension of manufacturers’ Medicaid rebate liability to covered drugs dispensed to individuals who are enrolled in Medicaid managed care organizations;

|

|

•

|

expansion of eligibility criteria for Medicaid programs by, among other things, allowing states to offer Medicaid coverage to additional individuals and by adding new mandatory eligibility categories for certain individuals with income at or below 133% of the federal poverty level, thereby potentially increasing a manufacturer’s Medicaid rebate liability;

|

|

•

|

a licensure framework for follow-on biologic products;

|

|

•

|

expansion of the entities eligible for discounts under the Public Health Service pharmaceutical pricing program;

|

|

•

|

new requirements under the federal Open Payments program and its implementing regulations;

|

|

•

|

a new requirement to annually report drug samples that manufacturers and distributors provide to physicians; and

|

|

•

|

a new Patient-Centered Outcomes Research Institute to oversee, identify priorities in, and conduct comparative clinical effectiveness research, along with funding for such research.

|

|

•

|

significantly greater financial, technical and human resources than we have and may be better equipped to discover, develop, manufacture and commercialize drug candidates;

|

|

•

|

more extensive experience in nonclinical testing and clinical trials, obtaining regulatory approvals and manufacturing and marketing pharmaceutical products;

|

|

•

|

drug candidates that have been approved or are in late-stage clinical development; and/or

|

|

•

|

collaborative arrangements in our target markets with leading companies and research institutions.

|

|

•

|

the U.S. Anti-Kickback Statute, which prohibits, among other things, persons from knowingly and willfully soliciting, receiving, offering or paying remuneration, directly or indirectly, in cash or in kind, to induce or reward, or in return for, either the referral of an individual for, or the purchase or recommendation of an item or service reimbursable under a federal healthcare program, such as the Medicare and Medicaid programs;

|

|

•

|

U.S. federal and state false claims laws, including the False Claims Act, which impose criminal and civil penalties, including civil whistleblower or qui tam actions, against individuals or entities for knowingly presenting, or causing to be presented, claims for payment from Medicare, Medicaid, or other third-party payors that are false or fraudulent or making a false statement to avoid, decrease or conceal an obligation to pay money to the federal government;

|

|

•

|

the U.S. Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), which imposes criminal and civil liability for executing a scheme to defraud any healthcare benefit program and making false statements in connection with the delivery of or payment for healthcare benefits, items or services, and under the Health Information Technology for Economic and Clinical Health Act of 2009 (“HITECH”) imposes obligations, including mandatory contractual terms, on certain types of individuals and entities with respect to safeguarding the privacy, security and transmission of individually identifiable health information and places restrictions on the use of such information for marketing communications;

|

|

•

|

the U.S. Physician Payment Sunshine Act, which requires applicable manufacturers of drugs, devices, biologics and medical supplies for which payment is available under Medicare, Medicaid or the Children’s Health Insurance Program, with specific exceptions, to report annually to the Centers for Medicare & Medicaid Services (“CMS”) information related to “payments or other transfers of value” made to physicians and teaching hospitals and applicable manufacturers and applicable group purchasing organizations to report annually to CMS ownership and investment interests held by the physicians and their immediate family members;

|

|

•

|

laws and regulations that apply to sales or marketing arrangements; apply to healthcare items or services reimbursed by non-governmental third-party payors, including private insurers; require pharmaceutical companies to comply with the pharmaceutical industry’s voluntary compliance guidelines; that restrict payments that may be made to healthcare providers; require drug manufacturers to report information related to payments and other transfers of value to physicians and other healthcare providers or marketing expenditures; and

|

|

•

|

similar and other laws and regulations in the U.S. (federal, state and local), in the EU (including member countries) and other countries and jurisdictions.

|

|

•

|

decreased demand for any approved drug candidates;

|

|

•

|

impairment of our business reputation;

|

|

•

|

withdrawal of clinical trial participants;

|

|

•

|

costs of related litigation;

|

|

•

|

distraction of management’s attention;

|

|

•

|

substantial monetary awards to patients or other claimants; and

|

|

•

|

loss of revenues; and the inability to successfully commercialize any approved drug candidates.

|

|

•

|

the patentability of our inventions relating to our drug candidates; and/or

|

|

•

|

the enforceability, validity or scope of protection offered by our patents relating to our drug candidates.

|

|

•

|

incur substantial monetary damages;

|

|

•

|

encounter significant delays in bringing our drug candidates to market; and/or

|

|

•

|

be precluded from participating in the manufacture, use or sale of our drug candidates or methods of treatment requiring licenses.

|

|

•

|

our ability to obtain financing as needed;

|

|

•

|

progress in and results from our ongoing or future clinical trials;

|

|

•

|

our collaboration with Roche pursuant to the License Agreement to develop and commercialize PRX002/RG7935, as well as any future Licensed Products targeting

α-

synuclein;

|

|

•

|

failure or delays in advancing our nonclinical drug candidates or other drug candidates we may develop in the future, into clinical trials;

|

|

•

|

results of clinical trials conducted by others on drugs that would compete with our drug candidates;

|

|

•

|

issues in manufacturing our drug candidates;

|

|

•

|

regulatory developments or enforcement in the U.S. and other countries;

|

|

•

|

developments or disputes concerning patents or other proprietary rights;

|

|

•

|

introduction of technological innovations or new commercial products by our competitors;

|

|

•

|

changes in estimates or recommendations by securities analysts, if any, who cover our company;

|

|

•

|

public concern over our drug candidates;

|

|

•

|

litigation;

|

|

•

|

future sales of our ordinary shares;

|

|

•

|

general market conditions;

|

|

•

|

changes in the structure of healthcare payment systems;

|

|

•

|

failure of any of our drug candidates, if approved, to achieve commercial success;

|

|

•

|

economic and other external factors or other disasters or crises;

|

|

•

|

period-to-period fluctuations in our financial results;

|

|

•

|

overall fluctuations in U.S. equity markets;

|

|

•

|

our quarterly or annual results, or those of other companies in our industry;

|

|

•

|

announcements by us or our competitors of significant acquisitions or dispositions;

|

|

•

|

the operating and ordinary share price performance of other comparable companies;

|

|

•

|

investor perception of our company and the drug development industry;

|

|

•

|

natural or environmental disasters that investors believe may affect us;

|

|

•

|

changes in tax laws or regulations applicable to our business or the interpretations of those tax laws and regulations by taxing authorities; or

|

|

•

|

fluctuations in the budgets of federal, state and local governmental entities around the world.

|

|

Price Range Per Share

|

||||||||

|

|

High

|

Low

|

||||||

|

Fiscal 2017

|

||||||||

|

Fourth quarter

|

$

|

64.96

|

|

$

|

34.85

|

|

||

|

Third quarter

|

$

|

70.00

|

|

$

|

52.92

|

|

||

|

Second quarter

|

$

|

59.10

|

|

$

|

48.23

|

|

||

|

First quarter

|

$

|

63.14

|

|

$

|

45.13

|

|

||

|

Fiscal 2016

|

||||||||

|

Fourth quarter

|

$

|

68.18

|

|

$

|

40.58

|

|

||

|

Third quarter

|

$

|

64.50

|

|

$

|

35.04

|

|

||

|

Second quarter

|

$

|

51.45

|

|

$

|

33.53

|

|

||

|

First quarter

|

$

|

67.32

|

|

$

|

28.20

|

|

||

|

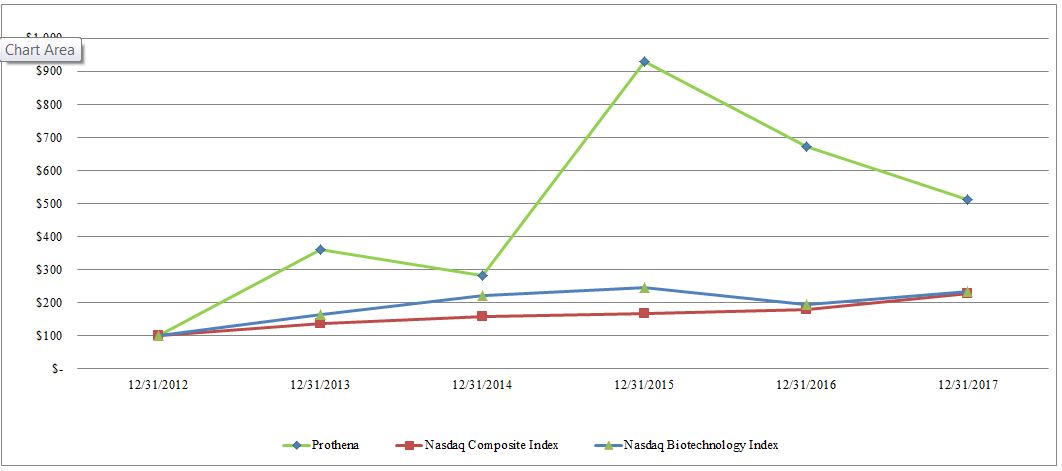

Cumulative Total Return as of

|

12/31/2012

|

12/31/2013

|

12/31/2014

|

12/31/2015

|

12/31/2016

|

12/31/2017

|

||||||||||||||||

|

Prothena Corporation plc

|

$100

|

$

|

362

|

|

$

|

283

|

|

$

|

929

|

|

$

|

671

|

|

$

|

511

|

|

||||||

|

Nasdaq Composite Index

|

$100

|

$

|

138

|

|

$

|

157

|

|

$

|

166

|

|

$

|

178

|

|

$

|

229

|

|

||||||

|

Nasdaq Biotechnology Index

|

$100

|

$

|

166

|

|

$

|

222

|

|

$

|

247

|

|

$

|

194

|

|

$

|

235

|

|

||||||

|

Year Ended December 31,

|

||||||||||||||||||||

|

2017

|

2016

|

2015

|

2014

|

2013

|

||||||||||||||||

|

Consolidated Statement of Operations Data:

|

||||||||||||||||||||

|

Collaboration revenue

|

$

|

27,519

|

|

$

|

1,055

|

|

$

|

1,607

|

|

$

|

50,320

|

|

$

|

—

|

|

|||||

|

Revenue—related party

|

—

|

|

—

|

|

—

|

|

534

|

|

676

|

|

||||||||||

|

Total revenue

|

27,519

|

|

1,055

|

|

1,607

|

|

50,854

|

|

676

|

|

||||||||||

|

Operating expenses:

|

||||||||||||||||||||

|

Research and development

|

134,547

|

|

119,534

|

|

58,439

|

|

38,452

|

|

26,052

|

|

||||||||||

|

General and administrative

|

48,226

|

|

41,056

|

|

23,105

|

|

19,051

|

|

15,051

|

|

||||||||||

|

Total operating expenses

|

182,773

|

|

160,590

|

|

81,544

|

|

57,503

|

|

41,103

|

|

||||||||||

|

Loss from operations

|

(155,254

|

)

|

(159,535

|

)

|

(79,937

|

)

|

(6,649

|

)

|

(40,427

|

)

|

||||||||||

|

Other income (expense):

|

||||||||||||||||||||

|

Interest income (expense), net

|

(142

|

)

|

556

|

|

196

|

|

79

|

|

71

|

|

||||||||||

|

Other income (expense), net

|

(2,207

|

)

|

15

|

|

(170

|

)

|

231

|

|

(225

|

)

|

||||||||||

|

Total other income (expense), net

|

(2,349

|

)

|

571

|

|

26

|

|

310

|

|

(154

|

)

|

||||||||||

|

Loss before income taxes

|

(157,603

|

)

|

(158,964

|

)

|

(79,911

|

)

|

(6,339

|

)

|

(40,581

|

)

|

||||||||||

|

Provision for (benefit from) income taxes

|

(4,366

|

)

|

1,144

|

|

701

|

|

811

|

|

415

|

|

||||||||||

|

Net loss

|

$

|

(153,237

|

)

|

$

|

(160,108

|

)

|

$

|

(80,612

|

)

|

$

|

(7,150

|

)

|

$

|

(40,996

|

)

|

|||||

|

Basic and diluted net loss per share

|

$

|

(4.07

|

)

|

$

|

(4.66

|

)

|

$

|

(2.66

|

)

|

$

|

(0.29

|

)

|

$

|

(2.20

|

)

|

|||||

|

Shares used to compute basic and diluted net loss per share

|

37,654

|

|

34,351

|

|

30,326

|

|

24,672

|

|

18,615

|

|

||||||||||

|

Year Ended December 31,

|

||||||||||||||||||||

|

2017

|

2016

|

2015

|

2014

|

2013

|

||||||||||||||||

|

Consolidated Balance Sheet Data:

|

||||||||||||||||||||

|

Cash and cash equivalents and restricted cash

|

$

|

421,676

|

|

$

|

390,979

|

|

$

|

370,586

|

|

$

|

293,579

|

|

$

|

176,677

|

|

|||||

|

Total assets

|

496,329

|

|

459,976

|

|

385,236

|

|

304,116

|

|

182,410

|

|

||||||||||

|

Other non-current liabilities

|

51,769

|

|

53,498

|

|

2,351

|

|

2,188

|

|

1,734

|

|

||||||||||

|

Total liabilities

|

89,140

|

|

94,573

|

|

24,567

|

|

14,227

|

|

9,140

|

|

||||||||||

|

Shareholders’ equity

|

407,189

|

|

365,403

|

|

360,669

|

|

289,889

|

|

173,270

|

|

||||||||||

|

•

|

our ability to obtain additional financing in future offerings and/or obtain funding from future collaborations;

|

|

•

|

our operating losses;

|

|

•

|

our ability to successfully complete research and development of our drug candidates;

|

|

•

|

our ability to develop, manufacture and commercialize products;

|

|

•

|

our collaboration with Roche pursuant to the License Agreement;

|

|

•

|

our ability to protect our patents and other intellectual property;

|

|

•

|

our ability to hire and retain key employees;

|

|

•

|

tax treatment of our separation from Elan and subsequent distribution of our ordinary shares;

|

|

•

|

our ability to maintain financial flexibility and sufficient cash, cash equivalents and investments and other assets capable of being monetized to meet our liquidity requirements;

|

|

•

|

potential disruptions in the U.S. and global capital and credit markets;

|

|

•

|

government regulation of our industry;

|

|

•

|

the volatility of our ordinary share price;

|

|

•

|

business disruptions; and

|

|

•

|

the other risks and uncertainties described in Item 1A - Risk Factors of this Form 10-K.

|

|

•

|

Expected lease term- Our expected lease term includes the contractual lease period. The expected lease term is used in determining the depreciable life of the asset or the straight-line rent recognition period for the portion of the lease payment allocable to the land component.

|

|

•

|

Incremental borrowing rate- We estimate our incremental borrowing rate. For build-to-suit leases recorded on our consolidated balance sheets with a related build-to-suit lease obligation, the incremental borrowing rate is used in allocating our rental payments between interest expense and a reduction of the outstanding build-to-suit lease obligation.

|

|

•

|

Fair market value of leased asset- The fair market value of a build-to-suit lease property is based on replacement cost of the pre-construction shell and comparable market data. Fair market value is used in determining the amount of the property asset and related build-to-suit lease obligation to be recognized on our consolidated balance sheet for build-to-suit leases.

|

|

Year Ended December 31,

|

Percentage Change

|

||||||||||||||||

|

2017

|

2016

|

2015

|

2017/2016

|

2016/2015

|

|||||||||||||

|

(Dollars in thousands)

|

|||||||||||||||||

|

Collaboration revenue

|

$

|

27,519

|

|

$

|

1,055

|

|

$

|

1,607

|

|

2,508

|

%

|

(34

|

)%

|

||||

|

Total revenue

|

$

|

27,519

|

|

$

|

1,055

|

|

$

|

1,607

|

|

2,508

|

%

|

(34

|

)%

|

||||

|

Year Ended December 31,

|

Percentage Change

|

||||||||||||||||

|

2017

|

2016

|

2015

|

2017/2016

|

2016/2015

|

|||||||||||||

|

(Dollars in thousands)

|

|||||||||||||||||

|

Research and development

|

$

|

134,547

|

|

$

|

119,534

|

|

$

|

58,439

|

|

13

|

%

|

105

|

%

|

||||

|

General and administrative

|

48,226

|

|

41,056

|

|

23,105

|

|

17

|

%

|

78

|

%

|

|||||||

|

Total operating expenses

|

$

|

182,773

|

|

$

|

160,590

|

|

$

|

81,544

|

|

14

|

%

|

97

|

%

|

||||

|

Year Ended December 31,

|

Cumulative to Date

|

|||||||||||||||

|

2017

|

2016

|

2015

|

||||||||||||||

|

NEOD001

(1)

|

$

|

101,492

|

|

$

|

81,405

|

|

$

|

33,872

|

|

$

|

252,208

|

|

||||

|

PRX002/RG7935

(2)

|

6,412

|

|

6,554

|

|

7,472

|

|

50,748

|

|

||||||||

|

PRX003

(3)

|

9,234

|

|

15,135

|

|

8,580

|

|

58,674

|

|

||||||||

|

Other R&D

(4)

|

17,409

|

|

16,440

|

|

8,515

|

|

||||||||||

|

$

|

134,547

|

|

$

|

119,534

|

|

$

|

58,439

|

|

||||||||

|

(1)

|

Cumulative R&D costs to date for NEOD001 include the costs incurred from the date when the program has been separately tracked in preclinical development. Expenditures in the early discovery stage are not tracked by program and accordingly have been excluded from this cumulative amount.

|

|

(2)

|

Cumulative R&D costs to date for PRX002/RG7935 and related antibodies include the costs incurred from the date when the program has been separately tracked in nonclinical development. Expenditures in the early discovery stage are not tracked by program and accordingly have been excluded from this cumulative amount. PRX002/RG7935 cost include payments to Roche for our share of the development expenses incurred by Roche related to PRX002/RG7935 programs and is net of reimbursements from Roche for development and supply services recorded as an offset to R&D expense. For the

years ended December 31, 2017, 2016 and 2015

,

$5.1 million

,

$3.6 million

, and $4.9 million, respectively, were recorded as an offset to R&D expenses including

$3.4 million

for a portion of the

$30.0 million

milestone payment received from Roche in the

year ended December 31, 2017

.

|

|

(3)

|

Cumulative R&D costs to date for PRX003 include the costs incurred from the date when the program has been separately tracked in nonclinical development. Expenditures in the early discovery stage are not tracked by program and accordingly have been excluded from this cumulative amount. Based on the Phase 1b multiple ascending dose study results announced in September 2017, we announced that we will not advance PRX003 into mid-stage clinical development for psoriasis or psoriatic arthritis as previously planned.

|

|

(4)

|

Other R&D is comprised of preclinical development and discovery programs that have not progressed to first patient dosing in a Phase 1 clinical trial.

|

|

Year Ended December 31,

|

Percentage Change

|

||||||||||||||||

|

2017

|

2016

|

2015

|

2017/2016

|

2016/2015

|

|||||||||||||

|

(Dollars in thousands)

|

|||||||||||||||||

|

Interest income

|

$

|

3,546

|

|

$

|

1,419

|

|

$

|

196

|

|

150

|

%

|

624

|

%

|

||||

|

Interest expense

|

(3,688

|

)

|

(863

|

)

|

—

|

|

327

|

%

|

nm

|

|

|||||||

|

Interest income (expense), net

|

(142

|

)

|

556

|

|

196

|

|

(126

|

)%

|

184

|

%

|

|||||||

|

Other income (expense), net

|

(2,207

|

)

|

15

|

|

(170

|

)

|

nm

|

|

(109

|

)%

|

|||||||

|

Total Other Expense, net

|

$

|

(2,349

|

)

|

$

|

571

|

|

$

|

26

|

|

(511

|

)%

|

2,096

|

%

|

||||

|

Year Ended December 31,

|

Percentage Change

|

||||||||||||||||

|

2017

|

2016

|

2015

|

2017/2016

|

2016/2015

|

|||||||||||||

|

(Dollars in thousands)

|

|||||||||||||||||

|

Provision for (benefit from) income taxes

|

$

|

(4,366

|

)

|

$

|

1,144

|

|

$

|

701

|

|

(482

|

)%

|

63

|

%

|

||||

|

December 31,

|

|||||||

|

2017

|

2016

|

||||||

|

Working capital

|

$

|

388,956

|

|

$

|

350,287

|

|

|

|

Cash and cash equivalents

|

417,620

|

|

386,923

|

|

|||

|

Total assets

|

496,329

|

|

459,976

|

|

|||

|

Total liabilities

|

89,140

|

|

94,573

|

|

|||

|

Total shareholders’ equity

|

407,189

|

|

365,403

|

|

|||

|

Year Ended December 31,

|

|||||||||||

|

|

2017

|

2016

|

2015

|

||||||||

|

Net cash used in operating activities

|

$

|

(131,183

|

)

|

$

|

(116,250

|

)

|

$

|

(58,600

|

)

|

||

|

Net cash used in investing activities

|

(3,521

|

)

|

(16,644

|

)

|

(1,382

|

)

|

|||||

|

Net cash provided by financing activities

|

165,401

|

|

153,287

|

|

136,989

|

|

|||||

|

Net increase in cash and cash equivalents and restricted cash

|

$

|

30,697

|

|

$

|

20,393

|

|

$

|

77,007

|

|

||

|

Total

|

2018

|

2019

|

2020

|

2021

|

2022

|

Thereafter

|

||||||||||||||||||||||

|

Operating leases

(1)

|

$

|

1,983

|

|

$

|

330

|

|

$

|

248

|

|

$

|

248

|

|

$

|

248

|

|

$

|

248

|

|

$

|

661

|

|

|||||||

|

Minimum cash payments under build-to-suit lease obligation

(1)

|

35,747

|

|

4,915

|

|

5,803

|

|

5,979

|

|

6,165

|

|

6,350

|

|

6,535

|

|

||||||||||||||

|

Purchase obligations

|

40,876

|

|

24,585

|

|

16,291

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||||||

|

Contractual obligations under license agreements

(2)

|

1,560

|

|

370

|

|

130

|

|

100

|

|

100

|

|

85

|

|

775

|

|

||||||||||||||

|

Total

|

$

|

80,166

|

|

$

|

30,200

|

|

$

|

22,472

|

|

$

|

6,327

|

|

$

|

6,513

|

|

$

|

6,683

|

|

$

|

7,971

|

|

|||||||

|

Page

|

|

|

Consolidated Financial Statements:

|

|

|

Reports of Independent Registered Public Accounting Firm

|

|

|

Consolidated Balance Sheets as of December 31, 2017 and 2016

|

|

|

Consolidated Statements of Operations for the years ended December 31, 2017, 2016, and 2015

|

|

|

Consolidated Statements of Cash Flows for the years ended December 31, 2017, 2016, and 2015

|

|

|

Consolidated Statements of Shareholders’ Equity for the years ended December 31, 2017, 2016, and 2015

|

|

|

Notes to the Consolidated Financial Statements

|

|

|

December 31,

|

|||||||

|

2017

|

2016

|

||||||

|

Assets

|

|||||||

|

Current assets:

|

|||||||

|

Cash and cash equivalents

|

$

|

417,620

|

|

$

|

386,923

|

|

|

|

Receivable from Roche

|

240

|

|

178

|

|

|||

|

Prepaid expenses and other current assets

|

8,467

|

|

4,261

|

|

|||

|

Total current assets

|

426,327

|

|

391,362

|

|

|||

|

Non-current assets:

|

|||||||

|

Property and equipment, net

|

54,990

|

|

56,452

|

|

|||

|

Deferred tax assets

|

8,113

|

|

5,913

|

|

|||

|

Restricted cash

|

4,056

|

|

4,056

|

|

|||

|

Other non-current assets

|

2,843

|

|

2,193

|

|

|||

|

Total non-current assets

|

70,002

|

|

68,614

|

|

|||

|

Total assets

|

$

|

496,329

|

|

$

|

459,976

|

|

|

|

Liabilities and Shareholders’ Equity

|

|||||||

|

Current liabilities:

|

|||||||

|

Accounts payable

|

$

|

13,633

|

|

$

|

13,069

|

|

|

|

Accrued research and development

|

13,509

|

|

19,073

|

|

|||

|

Income taxes payable, current

|

311

|

|

378

|

|

|||

|

Build-to-suit lease obligation, current

|

733

|

|

—

|

|

|||

|

Other current liabilities

|

9,185

|

|

8,555

|

|

|||

|

Total current liabilities

|

37,371

|

|

41,075

|

|

|||

|

Non-current liabilities:

|

|||||||

|

Income taxes payable, non-current

|

—

|

|

98

|

|

|||

|

Deferred rent

|

254

|

|

2,080

|

|

|||

|

Build-to-suit lease obligation, non-current

|

51,515

|

|

51,320

|

|

|||

|

Total non-current liabilities

|

51,769

|

|

53,498

|

|

|||

|

Total liabilities

|

89,140

|

|

94,573

|

|

|||

|

Commitments and contingencies (Note 7)

|

|

|

|||||

|

Shareholders’ equity:

|

|||||||

|

Euro deferred shares, €22 nominal value:

|

—

|

|

—

|

|

|||

|

Authorized shares — 10,000 at December 31, 2017 and 2016

|

|||||||

|

Issued and outstanding shares — none at December 31, 2017 and 2016

|

|||||||

|

Ordinary shares, $0.01 par value:

|

385

|

|

348

|

|

|||

|

Authorized shares — 100,000,000 at December 31, 2017 and 2016

|

|||||||

|

Issued and outstanding shares — 38,482,764 and 34,752,116 at December 31, 2017 and 2016, respectively

|

|||||||

|

Additional paid-in capital

|

849,154

|

|

654,266

|

|

|||

|

Accumulated deficit

|

(442,350

|

)

|

(289,211

|

)

|

|||

|

Total shareholders’ equity

|

407,189

|

|

365,403

|

|

|||

|

Total liabilities and shareholders’ equity

|

$

|

496,329

|

|

$

|

459,976

|

|

|

|

Year Ended December 31,

|

||||||||||||

|

2017

|

2016

|

2015

|

||||||||||

|

Collaboration revenue

|

$

|

27,519

|

|

$

|

1,055

|

|

$

|

1,607

|

|

|||

|

Total revenue

|

27,519

|

|

1,055

|

|

1,607

|

|

||||||

|

Operating expenses:

|

||||||||||||

|

Research and development

|

134,547

|

|

119,534

|

|

58,439

|

|

||||||

|

General and administrative

|

48,226

|

|

41,056

|

|

23,105

|

|

||||||

|

Total operating expenses

|

182,773

|

|

160,590

|

|

81,544

|

|

||||||

|

Loss from operations

|

(155,254

|

)

|

(159,535

|

)

|

(79,937

|

)

|

||||||

|

Other income (expense):

|

||||||||||||

|

Interest income (expense), net

|

(142

|

)

|

556

|

|

196

|

|

||||||

|

Other income (expense), net

|

(2,207

|

)

|

15

|

|

(170

|

)

|

||||||

|

Total other income (expense), net

|

(2,349

|

)

|

571

|

|

26

|

|

||||||

|

Loss before income taxes

|

(157,603

|

)

|

(158,964

|

)

|

(79,911

|

)

|

||||||

|

Provision for (benefit from) income taxes

|

(4,366

|

)

|

1,144

|

|

701

|

|

||||||

|

Net loss

|

$

|

(153,237

|

)

|

$

|

(160,108

|

)

|

$

|

(80,612

|

)

|

|||

|

Basic and diluted net loss per share

|

$

|

(4.07

|

)

|

$

|

(4.66

|

)

|

$

|

(2.66

|

)

|

|||

|

Shares used to compute basic and diluted net loss per share

|

37,654

|

|

34,351

|

|

30,326

|

|

||||||

|

Year Ended December 31,

|

|||||||||||

|

2017

|

2016

|

2015

|

|||||||||

|

Operating activities

|

|||||||||||

|

Net loss

|

$

|

(153,237

|

)

|

$

|

(160,108

|

)

|

$

|

(80,612

|

)

|

||

|

Adjustments to reconcile net loss to cash used in operating activities:

|

|||||||||||

|

Depreciation and amortization

|

3,067

|

|

2,427

|

|

806

|

|

|||||

|

Share-based compensation

|

26,764

|

|

24,929

|

|

10,414

|

|

|||||

|

Deferred income taxes

|

(2,200

|

)

|

(3,248

|

)

|

(963

|

)

|

|||||

|

Interest expense under build-to-suit lease obligation

|

3,688

|

|

863

|

|

—

|

|

|||||

|

Gain from early lease retirement

|

(2,096

|

)

|

—

|

|

—

|

|

|||||

|

Gain from disposal of fixed assets

|

(5

|

)

|

—

|

|

20

|

|

|||||

|

Loss on sublease

|

—

|

|

—

|

|

261

|

|

|||||

|

Changes in operating assets and liabilities:

|

|||||||||||

|

Receivable from Roche

|

(62

|

)

|

331

|

|

1,220

|

|

|||||

|

Receivable from related party

|

—

|

|

—

|

|

30

|

|

|||||

|

Prepaid and other assets

|

(7,249

|

)

|

3,363

|

|

(937

|

)

|

|||||

|

Accounts payable, accruals and other liabilities

|

147

|

|

15,193

|

|

11,161

|

|

|||||

|

Net cash used in operating activities

|

(131,183

|

)

|

(116,250

|

)

|

(58,600

|

)

|

|||||

|

Investing activities

|

|||||||||||

|

Purchases of property and equipment

|

(3,626

|

)

|

(16,644

|

)

|

(1,382

|

)

|

|||||

|

Proceeds from disposal of fixed assets

|

105

|

|

—

|

|

—

|

|

|||||

|

Net cash used in investing activities

|

(3,521

|

)

|

(16,644

|

)

|

(1,382

|

)

|

|||||

|

Financing activities

|

|||||||||||

|

Proceeds from issuance of ordinary shares in public offering, net

|

150,323

|

|

128,777

|

|

131,341

|

|

|||||

|

Proceeds from issuance of ordinary shares upon exercise of stock options

|

17,838

|

|

10,516

|

|

5,648

|

|

|||||

|

Reduction of build-to-suit lease obligation

|

(2,760

|

)

|

(169

|

)

|

—

|

|

|||||

|

Proceeds from tenant improvement allowance under build-to-suit transaction

|

—

|

|

14,163

|

|

—

|

|

|||||

|

Net cash provided by financing activities

|

165,401

|

|

153,287

|

|

136,989

|

|

|||||

|

Net increase in cash, cash equivalents and restricted cash

|

30,697

|

|

20,393

|

|

77,007

|

|

|||||

|

Cash, cash equivalents and restricted cash, beginning of the year

|

390,979

|

|

370,586

|

|

293,579

|

|

|||||

|

Cash, cash equivalents and restricted cash, end of the period

|

$

|

421,676

|

|

$

|

390,979

|

|

$

|

370,586

|

|

||

|

Supplemental disclosures of cash flow information

|

|||||||||||

|

Cash paid for income taxes, net of refunds

|

$

|

294

|

|

$

|

575

|

|

$

|

442

|

|

||

|

Supplemental disclosures of non-cash investing and financing activities

|

|||||||||||

|

Acquisition of property and equipment included in accounts payable and accrued liabilities

|

$

|

175

|

|

$

|

575

|

|

$

|

185

|

|

||

|

Stock option shortfall

|

$

|

—

|

|

$

|

(258

|

)

|

$

|

—

|

|

||

|

Offering costs included in accounts payable and accrued liabilities

|

$

|

—

|

|

$

|

—

|

|

$

|

18

|

|

||

|

Amounts capitalized under build-to-suit lease transaction

|

$

|

—

|

|

$

|

36,805

|

|

$

|

—

|

|

||

|

Interest capitalized during construction period for build-to-suit lease transaction

|

$

|

—

|

|

$

|

1,179

|

|

$

|

—

|

|

||

|

Ordinary Shares

|

Additional

Paid-in Capital |

Accumulated

Deficit |

Total

Shareholders' Equity |

|||||||||||

|

Shares

|

Amount

|

|||||||||||||

|

Balances at December 31, 2014

|

27,388,005

|

|

274

|

|

338,106

|

|

(48,491

|

)

|

289,889

|

|

||||

|

Issuance of ordinary shares in public offering, net of issuance costs of $8.9 million

|

3,795,000

|

|

38

|

|

131,443

|

|

—

|

|

131,481

|

|

||||

|

Share-based compensation

|

—

|

|

—

|

|

10,414

|

|

—

|

|

10,414

|

|

||||

|

Excess tax benefit from share-based award exercises

|

—

|

|

—

|

|

3,855

|

|

—

|

|

3,855

|

|

||||

|

Issuance of ordinary shares upon exercise of stock options

|

561,097

|

|

5

|

|

5,637

|

|

—

|

|

5,642

|

|

||||

|

Net loss

|

—

|

|

—

|

|

—

|

|

(80,612

|

)

|

(80,612

|

)

|

||||

|

Balances at December 31, 2015

|

31,744,102

|

|

317

|

|

489,455

|

|

(129,103

|

)

|

360,669

|

|

||||

|

Issuance of ordinary shares in public offering, net of issuance costs of $8.5 million

|

2,587,500

|

|

26

|

|

128,610

|

|

—

|

|

128,636

|

|

||||

|

Share-based compensation

|

—

|

|

—

|

|

24,929

|

|

—

|

|

24,929

|

|

||||

|

Excess tax benefit from share-based award exercises

|

—

|

|

—

|

|

761

|

|

—

|

|

761

|

|

||||

|

Issuance of ordinary shares upon exercise of stock options

|

420,514

|

|

5

|

|

10,511

|

|

—

|

|

10,516

|

|

||||

|

Net loss

|

—

|

|

—

|

|

—

|

|

(160,108

|

)

|

(160,108

|

)

|

||||

|

Balances at December 31, 2016

|

34,752,116

|

|

348

|

|

654,266

|

|

(289,211

|

)

|

365,403

|

|

||||

|

Issuance of ordinary shares in public offering, net of issuance costs of $4.9 million

|

2,700,000

|

|

27

|

|

150,296

|

|

—

|

|

150,323

|

|

||||

|

Share-based compensation

|

—

|

|

—

|

|

26,764

|

|

—

|

|

26,764

|

|

||||

|

Issuance of ordinary shares upon exercise of stock options

|

1,030,648

|

|

10

|

|

17,828

|

|

—

|

|

17,838

|

|

||||

|

Cumulative adjustment to accumulated deficit upon adoption of ASU 2016-09

|

—

|

|

—

|

|

—

|

|

98

|

|

98

|

|

||||

|

Net loss

|

—

|

|

—

|

|

—

|

|

(153,237

|

)

|

(153,237

|

)

|

||||

|

Balances at December 31, 2017

|

38,482,764

|

|

385

|

|

849,154

|

|

(442,350

|

)

|

407,189

|

|

||||

|

1.

|

Organization

|

|

2.

|

Summary of Significant Accounting Policies

|

|

Useful Life

|

||

|

Machinery and equipment

|

4-7 years

|

|

|

Leasehold improvements

|

Shorter of expected useful life or lease term

|

|

|

Purchased computer software

|

4 years

|

|

|

Build-to-suit property

|

30 years

|

|

|

3.

|

Fair Value Measurements

|

|

Level 2 —

|

Include other inputs that are based upon quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques for which all significant inputs are observable in the market or can be derived from observable market data. Where applicable, these models project future cash flows and discount the future amounts to a present value using market-based observable inputs including interest rate curves, foreign exchange rates, and credit ratings.

|

|

Level 3 —

|

Unobservable inputs that are supported by little or no market activities, which would require the Company to develop its own assumptions.

|

|

4.

|

Composition of Certain Balance Sheet Items

|

|

December 31,

|

|||||||

|

2017

|

2016

|

||||||

|

Machinery and equipment

|

$

|

9,078

|

|

$

|

9,629

|

|

|

|

Leasehold improvements

|

579

|

|

2,769

|

|

|||

|

Purchased computer software

|

1,316

|

|

363

|

|

|||

|

Build-to-suit property

|

51,760

|

|

51,359

|

|

|||

|

62,733

|

|

64,120

|

|

||||

|

Less: accumulated depreciation and amortization

|

(7,743

|

)

|

(7,668

|

)

|

|||

|

Property and equipment, net

|

$

|

54,990

|

|

$

|

56,452

|

|

|

|

December 31, 2017

|

December 31, 2016

|

||||||

|

Payroll and related expenses

|

$

|

7,342

|

|

$

|

6,629

|

|

|

|

Professional services

|

438

|

|

435

|

|

|||

|

Deferred rent

|

49

|

|

363

|

|

|||

|

Other

|

1,356

|

|

1,128

|

|

|||

|

Other current liabilities

|

$

|

9,185

|

|

$

|

8,555

|

|

|

|

5.

|

Net Loss Per Ordinary Share

|

|

Year Ended December 31,

|

||||||||||||

|

2017

|

2016

|

2015

|

||||||||||

|

Numerator:

|

||||||||||||

|

Net loss

|

$

|

(153,237

|

)

|

$

|

(160,108

|

)

|

$

|

(80,612

|

)

|

|||

|

Denominator:

|

||||||||||||

|

Weighted-average ordinary shares outstanding

|

37,654

|

|

34,351

|

|

30,326

|

|

||||||

|

Net loss per share:

|

||||||||||||

|

Basic and diluted net loss per share

|

$

|

(4.07

|

)

|

$

|

(4.66

|

)

|

$

|

(2.66

|

)

|

|||

|

|

Year Ended December 31,

|

|||||||

|

|

2017

|

2016

|

2015

|

|||||

|

Stock options to purchase ordinary shares

|

4,407

|

|

4,064

|

|

3,142

|

|

||

|

7.

|

Commitments and Contingencies

|

|

Year Ended December 31,

|

Operating Lease

|

|||

|

2018

|

$

|

330

|

|

|

|

2019

|

248

|

|

||

|

2020

|

248

|

|

||

|

2021

|

248

|

|

||

|

2022

|

248

|

|

||

|

Thereafter

|

661

|

|

||

|

Total

|

$

|

1,983

|

|

|

|

Year Ended December 31,

|

Expected Cash Payments Under Build-To-Suit Lease Obligation

|

|||

|

2018

|

$

|

4,915

|

|

|

|

2019

|

5,803

|

|

||

|

2020

|

5,979

|

|

||

|

2021

|

6,165

|

|

||

|

2022

|

6,350

|

|

||

|

Thereafter

|

6,535

|

|

||

|

Total

|

$

|

35,747

|

|

|

|

Total

|

2018

|

2019

|

2020

|

2021

|

2022

|

Thereafter

|

||||||||||||||||||||||

|

Purchase Obligations

|

$

|

40,876

|

|

$

|

24,585

|

|

$

|

16,291

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

|||||||

|

Contractual obligations under license agreements

(1)

|

1,560

|

|

370

|

|

130

|

|

100

|

|

100

|

|

85

|

|

775

|

|

||||||||||||||

|

Total

|

$

|

42,436

|

|

$

|

24,955

|

|

$

|

16,421

|

|

$

|

100

|

|

$

|

100

|

|

$

|

85

|

|

$

|

775

|

|

|||||||

|

8.

|

Roche License Agreement

|

|

9.

|

Shareholders' Equity

|

|

Year Ended December 31,

|

|||||||||||

|

2017

|

2016

|

2015

|

|||||||||

|

Research and development

(1)

|

$

|

10,914

|

|

$

|

7,094

|

|

$

|

4,301

|

|

||

|

General and administrative

(2)

|

15,850

|

|

17,835

|

|

6,113

|

|

|||||

|

Total share-based compensation expense

|

$

|

26,764

|

|

$

|

24,929

|

|

$

|

10,414

|

|

||

|

(1)

|

Includes

$nil

,

$nil

and

$42,000

for the

years ended December 31, 2017, 2016 and 2015

, respectively, of share-based compensation expense related to options granted to a consultant.

|

|

(2)

|

Includes

$nil

,

$6.5 million

and

$nil

for the

years ended December 31, 2017, 2016 and 2015

,

respectively, of share-based compensation expense related to the accelerated vesting of stock options to the Company's former CEO upon his death.

|

|

Year Ended December 31,

|

|||||

|

2017

|

2016

|

2015

|

|||

|

Expected volatility

|

72.4%

|

75.2%

|

76.3%

|

||

|

Risk-free interest rate

|

2.0%

|

1.5%

|

1.7%

|

||

|

Expected dividend yield

|

—%

|

—%

|

—%

|

||

|

Expected life (in years)

|

6.0

|

6.0

|

6.0

|

||

|

Weighted average grant date fair value

|

$35.71

|

$26.41

|

$23.12

|

||

|

Options

|

Weighted

Average Exercise Price |

Weighted

Average Remaining Contractual Term (years) |

Aggregate

Intrinsic Value (in thousands) |

|||||||||

|