|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

13-3326724

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

1510 Cotner Avenue

|

|

|

Los Angeles, California

|

90025

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Title of Each Class

|

Name of each exchange on which registered

|

|

Common Stock, $.0001 par value

|

NASDAQ Global Market

|

|

Large Accelerated Filer

¨

|

Accelerated Filer

x

|

||

|

Non-Accelerated Filer

¨

(Do not check if a smaller reporting company)

|

Smaller Reporting Company

¨

|

|

FORM 10-K ITEM

|

PAGE

|

|

|

PART I.

|

||

|

Item 1.

|

Business

|

4

|

|

Item 1A.

|

Risk Factors

|

23

|

|

Item 1B.

|

Unresolved Staff Comments

|

33

|

|

Item 2.

|

Properties

|

33

|

|

Item 3.

|

Legal Proceedings

|

33

|

|

Item 4.

|

(Removed and Reserved).

|

33

|

|

PART II.

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

34

|

|

Item 6.

|

Selected Consolidated Financial Data

|

36

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

37

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

57

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

57

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

94

|

|

Item 9A.

|

Controls and Procedures

|

94

|

|

Item 9B.

|

Other Information

|

96

|

|

PART III.

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

96

|

|

Item 11.

|

Executive Compensation

|

96

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

96

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

96

|

|

Item 14.

|

Principal Accountant Fees and Services

|

96

|

|

PART IV.

|

||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

97

|

|

Item 1.

|

Business

|

|

·

|

MRI spectroscopy, which can differentiate malignant from benign lesions;

|

|

·

|

MRI angiography, which can produce three-dimensional images of body parts and assess the status of blood vessels;

|

|

·

|

enhancements in teleradiology systems, which permit the digital transmission of radiological images from one location to another for interpretation by radiologists at remote locations; and

|

|

·

|

the development of combined PET/CT scanners, which combine the technology from PET and CT to create a powerful diagnostic imaging system.

|

|

·

|

there is sufficient patient demand for outpatient diagnostic imaging services;

|

|

·

|

we believe we can gain significant market share;

|

|

·

|

we can build key referral relationships or we have already established such relationships; and

|

|

·

|

payors are receptive to our entry into the market.

|

|

·

|

patient-friendly, non-clinical environments;

|

|

·

|

a 24-hour turnaround on routine examinations;

|

|

·

|

interpretations within one to two hours, if needed;

|

|

·

|

flexible patient scheduling, including same-day appointments;

|

|

·

|

extended operating hours, including weekends;

|

|

·

|

reports delivered by courier, facsimile or email;

|

|

·

|

availability of second opinions and consultations;

|

|

·

|

availability of sub-specialty interpretations at no additional charge; and

|

|

·

|

standardized fee schedules by region.

|

|

·

|

The agreement expires on January 1, 2014. However, the agreement automatically renews for consecutive 10-year periods, unless either party delivers a notice of non-renewal to the other party no later than six months prior to the scheduled expiration date. Either party may terminate the agreement if the other party defaults under its obligations, after notice and an opportunity to cure. We may terminate the agreement if Dr. Berger no longer owns at least 60% of the equity of BRMG; as of December 31, 2010, he owned 99% of the equity of BRMG.

|

|

·

|

At its expense, BRMG employs or contracts with an adequate number of physicians necessary to provide all professional medical services at all of our California facilities, except for 10 facilities for which we contract with separate medical groups.

|

|

·

|

At our expense, we provide all furniture, furnishings and medical equipment located at the facilities and we manage and administer all non-medical functions at, and provide all nurses and other non-physician personnel required for the operation of, the facilities.

|

|

·

|

If BRMG wants to open a new facility, we have the right of first refusal to provide the space and services for the facility under the same terms and conditions set forth in the management agreement.

|

|

·

|

If we want to open a new facility, BRMG must use its best efforts to provide medical personnel under the same terms and conditions set forth in the management agreement. If BRMG cannot provide such personnel, we have the right to contract with other physicians to provide services at the facility.

|

|

·

|

BRMG must maintain medical malpractice insurance for each of its physicians with coverage limits not less than $1 million per incident and $3 million in the aggregate per year. BRMG also has agreed to indemnify us for any losses we suffer that arise out of the acts or omissions of BRMG and its employees, contractors and agents.

|

|

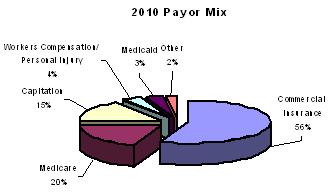

% of Net Revenue

|

||||||||||||

|

|

Year Ended

December 31,

2010

|

Year Ended

December 31,

2009

|

Year Ended

December 31,

2008

|

|||||||||

|

Commercial Insurance

(1)(2)

|

56%

|

56%

|

56%

|

|||||||||

|

Managed Care Capitated Payors

|

15%

|

15%

|

15%

|

|||||||||

|

Medicare

|

20%

|

20%

|

20%

|

|||||||||

|

·

|

Physician Education

At the inception of a new capitation agreement, we provide the new referring physicians with binders of educational material comprised of proprietary information that we have prepared and third-party information we have compiled, which are designed to address diagnostic strategies for common diseases. We distribute additional material according to the referral practices of the group as determined in the retrospective analysis described below.

|

|

·

|

Prospective Review

Referring physicians are required to submit authorization requests for non-emergency high-intensity services: MRI, CT, special procedures and nuclear medicine studies. The UM medical staff, according to accepted practice guidelines, considers the necessity and appropriateness of each request. Notification is then sent to the imaging facility, referring physician and medical group. Appeals for cases not approved are directed to us. The capitated payor has the final authority to uphold or deny our recommendation.

|

|

·

|

Retrospective Review

We collect and sort encounter activity by payor, place of service, referring physician, exam type and date of service. The data is then presented in quantitative and analytical form to facilitate understanding of utilization activity and to provide a comparison between fee-for-service and Medicare equivalents. Our Medical Director prepares a quarterly report for each payor and referring physician, which we send to them. When we find that a referring physician is over utilizing services, we work with the physician to modify referral patterns.

|

| Year Ended December 31 | ||||||||||||||||||||

|

2006

|

2007

|

2008

|

2009

|

2010

|

||||||||||||||||

|

Total facilities owned or managed (at beginning of the year)

|

57 | 132 | 141 | 164 | 180 | |||||||||||||||

|

Facilities added by:

|

||||||||||||||||||||

|

Acquisition *

|

78 | 12 | 24 | 14 | 28 | |||||||||||||||

|

Internal development

|

4 | 2 | 4 | 3 | 8 | |||||||||||||||

|

Facilities closed or sold

|

(7) | (5) | (5) | (1) | (15) | |||||||||||||||

|

Total facilities owned (at year end)

|

132* | 141 | 164 | 180 | 201 | |||||||||||||||

|

* Includes 69 Radiologix facilities acquired on November 15, 2006

|

||||||||||||||||||||

|

MRI

|

Open/MRI

|

CT

|

PET/CT

|

Mammo

|

Ultrasound

|

X-ray

|

NucMed

|

Fluoroscopy

|

Total

|

|

|

California

|

47

|

23

|

31

|

18

|

68

|

118

|

71

|

17

|

57

|

450

|

|

Florida

|

2

|

1

|

2

|

1

|

6

|

5

|

4

|

2

|

2

|

25

|

|

Delaware

|

8

|

1

|

6

|

1

|

4

|

13

|

16

|

1

|

4

|

54

|

|

New Jersey

|

15

|

2

|

8

|

-

|

8

|

23

|

8

|

-

|

11

|

75

|

|

New York

|

16

|

1

|

11

|

3

|

16

|

36

|

20

|

2

|

9

|

114

|

|

Maryland

|

26

|

9

|

25

|

9

|

33

|

88

|

49

|

19

|

16

|

274

|

|

Total

|

114

|

37

|

83

|

32

|

135

|

283

|

168

|

41

|

99

|

992

|

|

·

|

capture patient demographic, history and billing information at point-of-service;

|

|

·

|

automatically generate bills and electronically file claims with third-party payors;

|

|

·

|

record and store diagnostic report images in digital format;

|

|

·

|

digitally transmit in real-time diagnostic images from one location to another, thus enabling networked radiologists to cover larger geographic markets by using the specialized training of other networked radiologists;

|

|

·

|

perform claims, rejection and collection analysis; and

|

|

·

|

perform sophisticated financial analysis, such as analyzing cost and profitability, volume, charges, current activity and patient case mix, with respect to each of our managed care contracts.

|

|

·

|

to the extent it is necessary to protect a legitimate business interest of the party seeking enforcement;

|

|

·

|

if it does not unreasonably restrain the party against whom enforcement is sought; and

|

|

·

|

if it is not contrary to public interest.

|

|

Item 1A.

|

Risk Factors

|

|

●

|

make it difficult for us to satisfy our obligations with respect to our outstanding indebtedness;

|

|

|

●

|

require us to dedicate a substantial portion of our cash flow from operations to payments on our debt, reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions and other general corporate purposes;

|

|

|

●

|

expose us to the risk of interest rate increases on our variable rate borrowings, including borrowings under our new senior secured credit facilities;

|

|

|

●

|

increase our vulnerability to adverse general economic and industry conditions;

|

|

|

●

|

limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

|

|

|

●

|

place us at a competitive disadvantage compared to our competitors that have less debt; and

|

|

|

●

|

limit our ability to borrow additional funds on terms that are satisfactory to us or at all.

|

|

|

●

|

pay dividends or make certain other restricted payments or investments;

|

|

|

●

|

incur additional indebtedness and issue preferred stock;

|

|

|

●

|

create liens (other than permitted liens) securing indebtedness or trade payables unless the notes are secured on an equal and ratable basis with the obligations so secured, and, if such liens secure subordinated indebtedness, the notes are secured by a lien senior to such liens;

|

|

|

●

|

sell certain assets or merge with or into other companies or otherwise dispose of all or substantially all of our assets;

|

|

|

●

|

enter into certain transactions with affiliates;

|

|

|

●

|

create restrictions on dividends or other payments by our restricted subsidiaries; and

|

|

|

●

|

create guarantees of indebtedness by restricted subsidiaries.

|

|

·

|

identify attractive and willing candidates for acquisitions;

|

|

·

|

identify locations in existing or new markets for development of new facilities;

|

|

·

|

comply with legal requirements affecting our arrangements with contracted radiology practices, including state prohibitions on fee-splitting, corporate practice of medicine and self-referrals;

|

|

·

|

obtain regulatory approvals where necessary and comply with licensing and certification requirements applicable to our diagnostic imaging facilities, the contracted radiology practices and the physicians associated with the contracted radiology practices;

|

|

·

|

recruit a sufficient number of qualified radiology technologists and other non-medical personnel;

|

|

·

|

expand our infrastructure and management; and

|

|

·

|

compete for opportunities. We may not be able to compete effectively for the acquisition of diagnostic imaging facilities. Our competitors may have more established operating histories and greater resources than we do. Competition may also make any acquisitions more expensive.

|

|

·

|

inability to obtain adequate financing;

|

|

·

|

possible adverse effects on our operating results;

|

|

·

|

diversion of management’s attention and resources;

|

|

·

|

failure to retain key personnel;

|

|

·

|

difficulties in integrating new operations into our existing infrastructure; and

|

|

·

|

amortization or write-offs of acquired intangible assets, including goodwill.

|

|

·

|

earthquakes, fires, floods and other natural disasters;

|

|

·

|

power losses, computer systems failures, internet and telecommunications or data network failures, operator negligence, improper operation by or supervision of employees, physical and electronic losses of data and similar events; and

|

|

·

|

computer viruses, penetration by hackers seeking to disrupt operations or misappropriate information and other breaches of security.

|

|

·

|

the federal False Claims Act;

|

|

·

|

the federal Medicare and Medicaid Anti-Kickback Laws, and state anti-kickback prohibitions;

|

|

·

|

federal and state billing and claims submission laws and regulations;

|

|

·

|

the federal Health Insurance Portability and Accountability Act of 1996, as amended by the Health Information Technology for Economic and Clinical Health Act of 2009, and comparable state laws;

|

|

·

|

the federal physician self-referral prohibition commonly known as the Stark Law and the state equivalent of the Stark Law;

|

|

·

|

state laws that prohibit the practice of medicine by non-physicians and prohibit fee-splitting arrangements involving physicians;

|

|

·

|

federal and state laws governing the diagnostic imaging and therapeutic equipment we use in our business concerning patient safety, equipment operating specifications and radiation exposure levels; and

|

|

·

|

state laws governing reimbursement for diagnostic services related to services compensable under workers compensation rules.

|

|

·

|

changes in expectations as to future financial performance or buy/sell recommendations of securities analysts;

|

|

·

|

our, or a competitor’s, announcement of new services, or significant acquisitions, strategic partnerships, joint ventures or capital commitments; and

|

|

·

|

the operating and stock price performance of other comparable companies.

|

|

·

|

permit the board of directors to increase its own size, within the maximum limitations set forth in the bylaws, and fill the resulting vacancies;

|

|

·

|

authorize the issuance of additional shares of preferred stock in one or more series without a stockholder vote;

|

|

·

|

establish an advance notice procedure for stockholder proposals to be brought before an annual meeting of our stockholders, including proposed nominations of persons for election to the board of directors; and

|

|

·

|

prohibit transfers and/or acquisitions of stock that would result in any stockholder owning greater than 5% of the currently outstanding stock resulting in a limitation on net operating loss carryovers, capital loss carryovers, general business credit carryovers, alternative minimum tax credit carryovers and foreign tax credit carryovers, as well as any loss or deduction attributable to a "net unrealized built-in loss" within the meaning of Section 382 of the internal revenue code of 1986, as amended.

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

Item 3.

|

Legal Proceedings

|

|

Item 4.

|

(

Removed and Reserved)

|

|

Item 5.

|

Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

Low

|

High

|

|||||||

|

Quarter Ended

|

||||||||

|

December 31, 2010

|

$

|

2.00

|

$

|

2.96

|

||||

|

September 30, 2010

|

1.83

|

2.58

|

||||||

|

June 30, 2010

|

2.37

|

4.04

|

||||||

|

March 31, 2010

|

2.04

|

3.18

|

||||||

|

December 31, 2009

|

$

|

1.90

|

$

|

3.39

|

||||

|

September 30, 2009

|

2.01

|

3.18

|

||||||

|

June 30, 2009

|

1.00

|

2.79

|

||||||

|

March 31, 2009

|

0.85

|

3.96

|

||||||

|

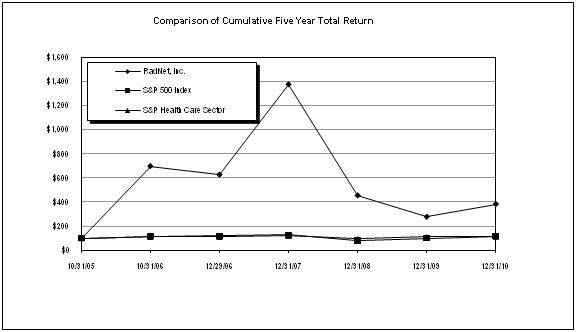

ANNUAL RETURN PERCENTAGE

Years Ending

|

|||||||

|

Company / Index

|

10/31/06

|

12/29/06

|

12/31/07

|

12/31/08

|

12/31/09

|

12/31/10

|

|

|

RadNet, Inc.

|

594.59

|

-10.12

|

119.70

|

-67.00

|

-39.10

|

38.24

|

|

|

S&P 500 Index

|

16.34

|

3.33

|

5.49

|

-37.00

|

26.46

|

15.06

|

|

|

S&P Health Care Sector

|

11.36

|

0.91

|

7.15

|

-22.81

|

19.70

|

2.90

|

|

|

INDEXED RETURNS

|

|||||||

|

Base

|

Years Ending

|

||||||

|

Period

|

|||||||

|

Company / Index

|

10/31/05

|

10/31/06

|

12/29/06

|

12/31/07

|

12/31/08

|

12/31/09

|

12/31/10

|

|

RadNet, Inc.

|

100

|

694.59

|

624.32

|

1371.62

|

452.70

|

275.68

|

381.08

|

|

S&P 500 Index

|

100

|

116.34

|

120.22

|

126.82

|

79.90

|

101.04

|

116.27

|

|

S&P Health Care Sector

|

100

|

111.36

|

112.38

|

120.41

|

92.95

|

111.26

|

114.48

|

|

·

|

In January 2010, we issued 75,000 shares of our common stock, valued at approximately $153,000 on the date of acquisition, to an individual as part of the purchase price for acquisition of a group of imaging center in Union, New Jersey.

|

|

·

|

In April 2010, we issued 375,000 shares of our common stock, valued at approximately $1.2 million on the date of acquisition, to an individual as part of the purchase price for acquisition of a group of imaging center in Bakersfield, California.

|

|

Item 6.

|

Selected Consolidated Financial Data

|

|

Years Ended

|

Two Months Ended

|

Years Ended

|

||||||||||||||||||||||||||

|

December 31,

|

December 31,

|

October 31,

|

||||||||||||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

2006

|

2006

|

||||||||||||||||||||||

|

(unaudited)

|

||||||||||||||||||||||||||||

|

(dollars in thousands, except per share data)

|

||||||||||||||||||||||||||||

|

Statement of Operations Data:

|

||||||||||||||||||||||||||||

|

Net revenue

|

$ | 548,537 | $ | 524,368 | $ | 498,815 | $ | 423,576 | $ | 192,859 | $ | 57,374 | $ | 161,005 | ||||||||||||||

|

Operating expenses:

|

||||||||||||||||||||||||||||

|

Operating expenses

|

420,973 | 397,753 | 384,297 | 330,550 | 147,226 | 46,033 | 120,342 | |||||||||||||||||||||

|

Depreciation and amortization

|

53,997 | 53,800 | 53,548 | 45,281 | 19,542 | 5,907 | 16,394 | |||||||||||||||||||||

|

Provision for bad bebts

|

33,158 | 32,704 | 30,832 | 27,467 | 10,707 | 3,907 | 7,626 | |||||||||||||||||||||

|

Loss (gain) on disposal of equipment, net

|

1,136 | 523 | 516 | 72 | 335 | (38 | ) | 373 | ||||||||||||||||||||

|

Gain from sale of joint venture interests

|

- | - | - | (1,868 | ) | - | - | - | ||||||||||||||||||||

|

Gain on bargin purchase

|

- | (1,387 | ) | - | - | - | - | - | ||||||||||||||||||||

|

Loss on extinguishment of debt

|

9,871 | - | - | - | - | - | - | |||||||||||||||||||||

|

Net loss

|

(12,852 | ) | (2,267 | ) | (12,836 | ) | (18,131 | ) | (17,722 | ) | (10,983 | ) | (6,894 | ) | ||||||||||||||

|

Basic and diluted loss per share

|

(0.35 | ) | (0.06 | ) | (0.36 | ) | (0.52 | ) | (0.57 | ) | (0.35 | ) | (0.33 | ) | ||||||||||||||

|

Balance Sheet Data:

|

||||||||||||||||||||||||||||

|

Cash and cash equivalents

|

$ | 627 | $ | 10,094 | $ | - | $ | 18 | $ | 3,221 | $ | 3,221 | $ | 2 | ||||||||||||||

|

Total assets

|

539,514 | 480,671 | 495,572 | 433,620 | 394,766 | 394,766 | 131,636 | |||||||||||||||||||||

|

Total long-term liabilities

|

516,723 | 456,727 | 469,994 | 428,743 | 381,903 | 381,903 | 179,288 | |||||||||||||||||||||

|

Total liabilities

|

621,987 | 555,432 | 576,602 | 503,244 | 440,508 | 440,508 | 210,430 | |||||||||||||||||||||

|

Working capital (deficit)

|

5,761 | 9,204 | 2,720 | 23,180 | 31,230 | 31,230 | 2,896 | |||||||||||||||||||||

|

Stockholders' deficit

|

(82,473 | ) | (74,761 | ) | (81,030 | ) | (69,830 | ) | (46,996 | ) | (46,996 | ) | (78,794 | ) | ||||||||||||||

|

Item 7

.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

Years Ended December 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

NET REVENUE

|

100.0% | 100.0% | 100.0% | |||||||||

|

OPERATING EXPENSES

|

||||||||||||

|

Cost of operations

|

76.7% | 75.9% | 77.0% | |||||||||

|

Depreciation and amortization

|

9.8% | 10.3% | 10.7% | |||||||||

|

Provision for bad debts

|

6.0% | 6.2% | 6.2% | |||||||||

|

Loss on sale of equipment

|

0.2% | 0.1% | 0.1% | |||||||||

|

Severance costs

|

0.2% | 0.1% | 0.1% | |||||||||

|

Total operating expenses

|

93.0% | 92.6% | 94.1% | |||||||||

|

INCOME FROM OPERATIONS

|

7.0% | 7.4% | 5.9% | |||||||||

|

OTHER EXPENSES (INCOME)

|

||||||||||||

|

Interest expense

|

8.8% | 9.5% | 10.4% | |||||||||

|

Gain on bargain purchase

|

0.0% | -0.3% | 0.0% | |||||||||

|

Loss on extinguishment of debt

|

1.8% | 0.0% | 0.0% | |||||||||

|

Other expenses (income)

|

0.1% | 0.1% | 0.0% | |||||||||

|

Total other expenses

|

10.7% | 9.4% | 10.4% | |||||||||

|

LOSS BEFORE INCOME TAXES AND EQUITY

|

||||||||||||

|

IN EARNINGS OF JOINT VENTURES

|

-3.7% | -1.9% | -4.5% | |||||||||

|

Provision for income taxes

|

-0.1% | -0.1% | 0.0% | |||||||||

|

Equity in earnings of joint ventures

|

1.5% | 1.6% | 2.0% | |||||||||

|

NET LOSS

|

-2.3% | -0.4% | -2.6% | |||||||||

|

Net income attributable to noncontrolling interests

|

0.0% | 0.0% | 0.0% | |||||||||

|

NET LOSS ATTRIBUTABLE TO RADNET, INC.

|

||||||||||||

|

COMMON STOCKHOLDERS

|

-2.3% | -0.4% | % | -2.6% | ||||||||

|

Years Ended December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Salaries and professional reading fees, excluding stock-based compensation

|

$ | 231,922 | $ | 215,095 | ||||

|

Stock-based compensation

|

3,718 | 3,607 | ||||||

|

Building and equipment rental

|

47,938 | 43,346 | ||||||

|

Medical supplies

|

30,413 | 32,507 | ||||||

|

Other operating expenses

*

|

106,982 | 103,198 | ||||||

|

Cost of operations

|

420,973 | 397,753 | ||||||

|

Depreciation and amortization

|

53,997 | 53,800 | ||||||

|

Provision for bad debts

|

33,158 | 32,704 | ||||||

|

Loss on sale of equipment

|

1,136 | 523 | ||||||

|

Severance costs

|

838 | 731 | ||||||

|

Total operating expenses

|

$ | 510,102 | $ | 485,511 | ||||

|

·

|

Salaries and professional reading fees, excluding stock-based compensation and severance

|

|

·

|

Stock-based compensation

|

|

·

|

Building and equipment rental

|

|

·

|

Medical supplies

|

|

·

|

Depreciation and amortization expense

|

|

·

|

Provision for bad debts

|

|

·

|

Loss on sale of equipment

|

|

·

|

Severance costs

|

|

Years Ended December 31,

|

||||||||

|

2009

|

2008

|

|||||||

|

Salaries and professional reading fees, excluding stock-based compensation

|

$

|

215,095

|

$

|

210,450

|

||||

|

Stock-based compensation

|

3,607

|

2,902

|

||||||

|

Building and equipment rental

|

43,346

|

43,478

|

||||||

|

Medical supplies

|

32,507

|

29,848

|

||||||

|

Other operating expenses

*

|

103,198

|

97,619

|

||||||

|

Cost of operations

|

397,753

|

384,297

|

||||||

|

Depreciation and amortization

|

53,800

|

53,548

|

||||||

|

Provision for bad debts

|

32,704

|

30,832

|

||||||

|

Loss on sale of equipment, net

|

523

|

516

|

||||||

|

Severance costs

|

731

|

335

|

||||||

|

Total operating expenses

|

$

|

485,511

|

$

|

469,528

|

||||

* Includes billing fees, office supplies, repairs and maintenance, insurance, business tax and license, outside services, utilities, marketing, travel and other expenses.

|

·

|

Salaries and professional reading fees, excluding stock-based compensation and severance

|

|

·

|

Stock-based compensation

|

|

·

|

Building and equipment rental

|

|

·

|

Medical supplies

|

|

·

|

Depreciation and amortization expense

|

|

·

|

Provision for bad debts

|

|

·

|

Loss on sale of equipment

|

|

·

|

Severance costs

|

|

Years Ended

|

||||||||||||

|

December 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

Net Loss Attributable to RadNet, Inc. Common Stockholders

|

$ | (12,852 | ) | $ | (2,267 | ) | $ | (12,836 | ) | |||

|

Plus Provision for Income Taxes

|

576 | 443 | 151 | |||||||||

|

Plus Other Expenses (Income)

|

505 | 416 | - | |||||||||

|

Plus Interest Expense

|

48,398 | 50,016 | 51,811 | |||||||||

|

Plus Severence Costs

|

838 | 731 | 335 | |||||||||

|

Plus Loss on Sale of Equipment

|

1,136 | 523 | 516 | |||||||||

|

Plus Gain on Bargain Purchase

|

- | (1,387 | ) | - | ||||||||

|

Plus Loss on Extinguishment of Debt

|

9,871 | - | - | |||||||||

|

Plus other one-time expenses

|

- | - | 1,976 | |||||||||

|

Plus Depreciation and Amortization

|

53,997 | 53,800 | 53,548 | |||||||||

|

Plus Non Cash Employee Stock Based Compensation

|

3,718 | 3,607 | 2,902 | |||||||||

|

Adjusted EBITDA

|

$ | 106,187 | $ | 105,882 | $ | 98,403 | ||||||

|

·

|

maximizing performance at our existing facilities;

|

|

·

|

focusing on profitable contracting;

|

|

·

|

expanding MRI, CT and PET applications;

|

|

·

|

optimizing operating efficiencies; and

|

|

·

|

expanding our networks.

|

|

|

·

|

rank equally in right of payment with

any existing and future unsecured

senior indebtedness of the guarantors;

|

|

|

·

|

rank senior in right of payment to all existing and future subordinated indebtedness of the Guarantors;

|

|

|

·

|

are effectively subordinated in right of payment to any secured indebtedness of the guarantors (including indebtedness under the New Credit Facilities) to the extent of the value of the assets securing such indebtedness; and

|

|

|

·

|

are structurally subordinated in right of payment to all existing and future indebtedness and other liabilities of any of the Company’s subsidiaries that is not a guarantor of the Notes.

|

|

·

|

pay dividends or make certain other restricted payments or investments;

|

|

·

|

incur additional indebtedness and issue preferred stock;

|

|

·

|

create liens (other than permitted liens) securing indebtedness or trade payables unless the notes are secured on an equal and ratable basis with the obligations so secured, and, if such liens secure subordinated indebtedness, the notes are secured by a lien senior to such liens;

|

|

·

|

sell certain assets or merge with or into other companies or otherwise dispose of all or substantially all of our assets;

|

|

·

|

enter into certain transactions with affiliates;

|

|

·

|

create restrictions on dividends or other payments by our restricted subsidiaries; and

|

|

·

|

create guarantees of indebtedness by restricted subsidiaries.

|

|

2011

|

2012

|

2013

|

2014

|

2015

|

Future

|

Total

|

||||||||||||||||||||||

|

Notes Payable (1)

|

$ | 45,636,928 | $ | 42,011,750 | $ | 40,689,377 | $ | 40,018,349 | $ | 39,195,163 | $ | 524,348,805 | $ | 731,900,372 | ||||||||||||||

|

Capital Leases (2)

|

9,944,313 | 4,663,009 | 1,226,132 | 74,558 | - | - | 15,908,012 | |||||||||||||||||||||

|

Operating Leases (3)

|

38,958,456 | 33,856,693 | 28,302,381 | 22,054,510 | 17,545,846 | 75,475,216 | 216,193,103 | |||||||||||||||||||||

|

Total

|

$ | 94,539,697 | $ | 80,531,453 | $ | 70,217,890 | $ | 62,147,418 | $ | 56,741,009 | $ | 599,824,021 | $ | 964,001,488 | ||||||||||||||

|

·

|

our reported amounts of assets and liabilities in our consolidated balance sheets at the dates of the financial statements;

|

|

·

|

our disclosure of contingent assets and liabilities at the dates of the financial statements; and

|

|

·

|

our reported amounts of net revenue and expenses in our consolidated statements of operations during the reporting periods.

|

|

Cash

|

$ | 25,650 | ||

|

Fair value of warrant issued

|

306 | |||

|

Promissory note

|

2,250 | |||

|

Total combined purchase price for the Group

|

$ | 28,206 |

|

Current assets

|

$ | 1,907 | ||

|

Property and equipment, net

|

5,284 | |||

|

Identifiable intangible assets

|

4,343 | |||

|

Goodwill

|

20,183 | |||

|

Current liabilities

|

(2,299 | ) | ||

|

Capital lease obligations and other

|

(1,212 | ) | ||

| $ | 28,206 |

|

Estimated

|

|||||||||

|

Estimated

|

Amortization

|

Annual

|

|||||||

|

Fair Value

|

Period

|

Amortization

|

|||||||

|

Trade Name

|

$ | 258 |

Indefinite

|

Not applicable

|

|||||

|

Customer Relationships

|

1,397 |

5 Years

|

279 | ||||||

|

Developed Technology and In-Process R&D

|

2,688 |

5 Years

|

538 | ||||||

| $ | 4,343 | $ | 817 | ||||||

|

Net Revenue

|

$ | 5,433 | ||

|

Net Income

|

409 | |||

|

Years Ended

|

||||||||

|

December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Net Revenue

|

566,696 | 547,587 | ||||||

|

Net loss

|

(11,023 | ) | (973 | ) | ||||

|

Pro-forma net loss per share

|

(0.30 | ) | (0.03 | ) | ||||

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

|

|

/s/ Ernst & Young LLP

|

|

|

December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

ASSETS

|

||||||||

|

CURRENT ASSETS

|

||||||||

|

Cash and cash equivalents

|

$ | 627 | $ | 10,094 | ||||

|

Accounts receivable, net

|

96,094 | 87,825 | ||||||

|

Prepaid expenses and other current assets

|

14,304 | 9,990 | ||||||

|

Total current assets

|

111,025 | 107,909 | ||||||

|

PROPERTY AND EQUIPMENT, NET

|

194,230 | 182,571 | ||||||

|

OTHER ASSETS

|

||||||||

|

Goodwill

|

143,353 | 106,502 | ||||||

|

Other intangible assets

|

57,348 | 54,313 | ||||||

|

Deferred financing costs, net

|

15,486 | 8,229 | ||||||

|

Investment in joint ventures

|

15,444 | 18,741 | ||||||

|

Deposits and other

|

2,628 | 2,406 | ||||||

|

Total assets

|

$ | 539,514 | $ | 480,671 | ||||

|

LIABILITIES AND EQUITY DEFICIT

|

||||||||

|

CURRENT LIABILITIES

|

||||||||

|

Accounts payable and accrued expenses

|

$ | 82,619 | $ | 69,641 | ||||

|

Due to affiliates

|

2,975 | 7,456 | ||||||

|

Deferred revenue

|

1,568 | - | ||||||

|

Current portion of notes payable

|

8,218 | 6,927 | ||||||

|

Current portion of deferred rent

|

745 | 560 | ||||||

|

Current portion of obligations under capital leases

|

9,139 | 14,121 | ||||||

|

Total current liabilities

|

105,264 | 98,705 | # | |||||

|

LONG-TERM LIABILITIES

|

||||||||

|

Deferred rent, net of current portion

|

10,379 | 8,920 | ||||||

|

Deferred taxes

|

277 | 277 | ||||||

|

Notes payable, net of current portion

|

481,578 | 416,699 | ||||||

|

Obligations under capital lease, net of current portion

|

5,639 | 13,568 | ||||||

|

Other non-current liabilities

|

18,850 | 17,263 | ||||||

|

Total liabilities

|

621,987 | 555,432 | ||||||

|

COMMITMENTS AND CONTINGENCIES

|

||||||||

|

EQUITY DEFICIT

|

||||||||

|

Common stock - $.0001 par value, 200,000,000 shares authorized;

37,223,475 and 36,259,279 shares issued and outstanding at December 31, 2010 and 2009, respectively |

4 | 4 | ||||||

|

Paid-in-capital

|

162,444 | 156,758 | ||||||

|

Accumulated other comprehensive loss

|

(2,137 | ) | (1,588 | ) | ||||

|

Accumulated deficit

|

(242,841 | ) | (229,989 | ) | ||||

|

Total Radnet, Inc.'s equity deficit

|

(82,530 | ) | (74,815 | ) | ||||

|

Noncontrolling interests

|

57 | 54 | ||||||

|

Total equity deficit

|

(82,473 | ) | (74,761 | ) | ||||

|

Total liabilities and equity deficit

|

$ | 539,514 | $ | 480,671 | ||||

|

Years Ended December 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

NET REVENUE

|

$ | 548,537 | $ | 524,368 | $ | 498,815 | ||||||

|

OPERATING EXPENSES

|

||||||||||||

|

Cost of operations

|

420,973 | 397,753 | 384,297 | |||||||||

|

Depreciation and amortization

|

53,997 | 53,800 | 53,548 | |||||||||

|

Provision for bad debts

|

33,158 | 32,704 | 30,832 | |||||||||

|

Loss on sale of equipment

|

1,136 | 523 | 516 | |||||||||

|

Severance costs

|

838 | 731 | 335 | |||||||||

|

Total operating expenses

|

510,102 | 485,511 | 469,528 | |||||||||

|

INCOME FROM OPERATIONS

|

38,435 | 38,857 | 29,287 | |||||||||

|

OTHER EXPENSES (INCOME)

|

||||||||||||

|

Interest expense

|

48,398 | 50,016 | 51,811 | |||||||||

|

Gain on bargain purchase

|

- | (1,387 | ) | - | ||||||||

|

Loss on extinguishment of debt

|

9,871 | - | - | |||||||||

|

Other expenses (income)

|

505 | 416 | (151 | ) | ||||||||

|

Total other expenses

|

58,774 | 49,045 | 51,660 | |||||||||

|

LOSS BEFORE INCOME TAXES AND EQUITY

|

||||||||||||

|

IN EARNINGS OF JOINT VENTURES

|

(20,339 | ) | (10,188 | ) | (22,373 | ) | ||||||

|

Provision for income taxes

|

(576 | ) | (443 | ) | (151 | ) | ||||||

|

Equity in earnings of joint ventures

|

8,230 | 8,456 | 9,791 | |||||||||

|

NET LOSS

|

(12,685 | ) | (2,175 | ) | (12,733 | ) | ||||||

|

Net income attributable to noncontrolling interests

|

167 | 92 | 103 | |||||||||

|

NET LOSS ATTRIBUTABLE TO RADNET, INC.

|

||||||||||||

|

COMMON STOCKHOLDERS

|

$ | (12,852 | ) | $ | (2,267 | ) | $ | (12,836 | ) | |||

|

BASIC AND DILUTED NET LOSS PER SHARE ATTRIBUTABLE

|

||||||||||||

|

TO RADNET, INC. COMMON STOCKHOLDERS

|

$ | (0.35 | ) | $ | (0.06 | ) | $ | (0.36 | ) | |||

|

WEIGHTED AVERAGE SHARES OUTSTANDING

|

||||||||||||

|

Basic and Diluted

|

36,853,477 | 36,047,033 | 35,721,028 | |||||||||

|

Common Stock

Shares

|

Amount

|

Paid-in

Capital

|

Accumulated

Deficit

|

Accumulated

Other

|

Total

Radnet, Inc.'s

|

Noncontrolling

Interests

|

Total

Equity Deficit

|

|||||||||||||||||||||||||

|

BALANCE - DECEMBER 31, 2007

|

35,239,558 | $ | 4 | $ | 149,631 | $ | (214,886 | ) | $ | (4,579 | ) | $ | (69,830 | ) | $ | 206 | $ | (69,624 | ) | |||||||||||||

|

Issuance of common stock upon e

xercise of options/warrants

|

671,916 | - | 473 | - | - | 473 | - | 473 | ||||||||||||||||||||||||

|

Stock-based compensation

|

- | - | 2,902 | - | - | 2,902 | - | 2,902 | ||||||||||||||||||||||||

|

Dividends paid to noncontrolling i

nterests

|

- | - | - | - | - | - | (231 | ) | (231 | ) | ||||||||||||||||||||||

|

Change in fair value of

cash flow hedge

|

- | - | - | - | (1,817 | ) | (1,817 | ) | - | (1,817 | ) | |||||||||||||||||||||

|

Net loss

|

- | - | - | (12,836 | ) | - | (12,836 | ) | 103 | (12,733 | ) | |||||||||||||||||||||

|

Comprehensive loss

|

(14,653 | ) | 103 | (14,550 | ) | |||||||||||||||||||||||||||

|

BALANCE - DECEMBER 31, 2008

|

35,911,474 | $ | 4 | $ | 153,006 | $ | (227,722 | ) | $ | (6,396 | ) | $ | (81,108 | ) | $ | 78 | $ | (81,030 | ) | |||||||||||||

|

Issuance of common stock to

shareholders of Ridgewood Diagnostics

|

50,000 | $ | - | 129 | $ | - | $ | - | 129 | - | 129 | |||||||||||||||||||||

|

Issuance of common stock upon exercise of options/warrants

|

297,805 | - | 16 | - | - | 16 | - | 16 | ||||||||||||||||||||||||

|

Stock-based compensation

|

- | - | 3,607 | - | - | 3,607 | - | 3,607 | ||||||||||||||||||||||||

|

Dividends paid to noncontrolling interests

|

- | - | - | - | - | - | (116 | ) | (116 | ) | ||||||||||||||||||||||

|

Change in fair value of cash flow hedge

|

- | - | - | - | (1,311 | ) | (1,311 | ) | - | (1,311 | ) | |||||||||||||||||||||

|

Change in fair value of cash flow hedge from p

rior periods reclassified to earnings

|

- | - | - | - | 6,119 | 6,119 | - | 6,119 | ||||||||||||||||||||||||

|

Net loss

|

(2,267 | ) | (2,267 | ) | 92 | (2,175 | ) | |||||||||||||||||||||||||

|

Comprehensive income

|

- | - | - | - | - | 2,541 | 92 | 2,633 | ||||||||||||||||||||||||

|

BALANCE - DECEMBER 31, 2009

|

36,259,279 | $ | 4 | $ | 156,758 | $ | (229,989 | ) | $ | (1,588 | ) | $ | (74,815 | ) | $ | 54 | $ | (74,761 | ) | |||||||||||||

|

Issuance of common stock to sellers of Truxtun Imaging

|

375,000 | - | 1,238 | - | - | 1,238 | - | 1,238 | ||||||||||||||||||||||||

|

Issuance of common stock to sellers of Union Imaging

|

75,000 | - | 153 | - | - | 153 | - | 153 | ||||||||||||||||||||||||

|

Issuance of warrant to sellers of Rutherford Imaging

|

- | - | 306 | - | - | 306 | - | 306 | ||||||||||||||||||||||||

|

Issuance of common stock upon exercise of options/warrants

|

514,196 | 271 | - | - | 271 | - | 271 | |||||||||||||||||||||||||

|

Stock-based compensation

|

- | 3,718 | - | - | 3,718 | - | 3,718 | |||||||||||||||||||||||||

|

Non-controlling interests assumed from the acquisition of Progressive imaging

|

(33 | ) | (33 | ) | ||||||||||||||||||||||||||||

|

Dividends paid to noncontrolling interests

|

- | - | - | - | - | - | (131 | ) | (131 | ) | ||||||||||||||||||||||

|

Change in cumulative foreign currency translation adjustment

|

- | - | - | - | 6 | 6 | 6 | |||||||||||||||||||||||||

|

Change in fair value of cash flow hedge

|

- | - | - | - | (1,472 | ) | (1,472 | ) | - | (1,472 | ) | |||||||||||||||||||||

|

Change in fair value of cash flow hedge from prior periods reclassified to earnings

|

- | - | - | - | 917 | 917 | - | 917 | ||||||||||||||||||||||||

|

Net loss

|

(12,852 | ) | (12,852 | ) | 167 | (12,685 | ) | |||||||||||||||||||||||||

|

Comprehensive loss

|

- | - | - | - | - | (13,401 | ) | 167 | (13,234 | ) | ||||||||||||||||||||||

|

BALANCE - DECEMBER 31, 2010

|

37,223,475 | $ | 4 | $ | 162,444 | $ | (242,841 | ) | $ | (2,137 | ) | $ | (82,530 | ) | $ | 57 | $ | (82,473 | ) | |||||||||||||

|

Years Ended December 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

||||||||||||

|

Net loss

|

$ | (12,685 | ) | $ | (2,175 | ) | $ | (12,733 | ) | |||

|

Adjustments to reconcile net loss

|

||||||||||||

|

to net cash provided by operating activities:

|

||||||||||||

|

Depreciation and amortization

|

53,997 | 53,800 | 53,548 | |||||||||

|

Provision for bad debts

|

33,158 | 32,704 | 30,832 | |||||||||

|

Equity in earnings of joint ventures

|

(8,230 | ) | (8,456 | ) | (9,791 | ) | ||||||

|

Distributions from joint ventures

|

10,917 | 7,667 | 7,982 | |||||||||

|

Deferred rent amortization

|

1,848 | 1,094 | 3,514 | |||||||||

|

Amortization of deferred financing cost

|

2,797 | 2,678 | 2,567 | |||||||||

|

Amortization of bond discount

|

164 | - | - | |||||||||

|

Net loss on disposal of assets

|

1,136 | 523 | 516 | |||||||||

|

Loss on extinguishment of debt

|

9,871 | - | - | |||||||||

|

Gain on bargain purchase

|

- | (1,387 | ) | - | ||||||||

|

Gain on extinguishment of debt

|

- | - | (47 | ) | ||||||||

|

Amortization of cash flow hedge

|

917 | 6,119 | - | |||||||||

|

Stock-based compensation

|

3,718 | 3,607 | 2,902 | |||||||||

|

Changes in operating assets and liabilities, net of assets

|

||||||||||||

|

acquired and liabilities assumed in purchase transactions:

|

||||||||||||

|

Accounts receivable

|

(35,985 | ) | (24,432 | ) | (36,297 | ) | ||||||

|

Other current assets

|

(3,226 | ) | 4,206 | (1,515 | ) | |||||||

|

Other assets

|

24 | 51 | 684 | |||||||||

|

Deferred revenue

|

207 | |||||||||||

|

Accounts payable and accrued expenses

|

8,256 | 619 | 3,270 | |||||||||

|

Net cash provided by operating activities

|

66,884 | 76,618 | 45,432 | |||||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

||||||||||||

|

Purchase of imaging facilities

|

(61,774 | ) | (6,085 | ) | (28,859 | ) | ||||||

|

Proceeds from sale of imaging facilities

|

- | 650 | - | |||||||||

|

Purchase of property and equipment

|

(40,293 | ) | (30,752 | ) | (29,199 | ) | ||||||

|

Proceeds from sale of equipment

|

685 | 219 | 2,961 | |||||||||

|

Purchase of equity interest in joint ventures

|

- | (315 | ) | (938 | ) | |||||||

|

Net cash used in investing activities

|

(101,382 | ) | (36,283 | ) | (56,035 | ) | ||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

||||||||||||

|

Principal payments on notes and leases payable

|

(21,463 | ) | (23,660 | ) | (19,112 | ) | ||||||

|

Proceeds from borrowings on notes payable

|

- | - | 35,000 | |||||||||

|

Proceeds from borrowings upon refinancing

|

482,360 | - | 1,212 | |||||||||

|

Repayment of bebt

|

(412,000 | ) | ||||||||||

|

Deferred financing costs

|

(17,613 | ) | - | (4,277 | ) | |||||||

|

Net payments on line of credit

|

- | (1,742 | ) | (2,480 | ) | |||||||

|

Payments to counterparties of interest rate swaps, net of amounts received

|

(6,382 | ) | (4,739 | ) | - | |||||||

|

Distributions to noncontrolling interests

|

(131 | ) | (116 | ) | (231 | ) | ||||||

|

Proceeds from issuance of common stock upon exercise of options/warrants

|

271 | 16 | 473 | |||||||||

|

Net cash provided by (used in) financing activities

|

25,042 | (30,241 | ) | 10,585 | ||||||||

|

EFFECT OF EXCHANGE RATE CHANGES ON CASH

|

(11 | ) | - | - | ||||||||

|

NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS

|

(9,467 | ) | 10,094 | (18 | ) | |||||||

|

CASH AND CASH EQUIVALENTS, beginning of period

|

10,094 | - | 18 | |||||||||

|

CASH AND CASH EQUIVALENTS, end of period

|

$ | 627 | $ | 10,094 | $ | - | ||||||

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION

|

||||||||||||

|

Cash paid during the period for interest

|

$ | 40,352 | $ | 40,092 | $ | 49,236 | ||||||

|

Cash paid during the period for income taxes

|

$ | 659 | $ | 348 | $ | 389 | ||||||

|

●

|

Hardware

– Revenue is recognized when the hardware is shipped. The hardware qualifies as a separate unit of accounting under ASC 605-25-25-5, as it meets the following criteria:

|

|||

|

o

|

The hardware has standalone value as it is sold separately by other vendors and the customer could resell the hardware on a standalone basis; and

|

|||

|

o

|

Delivery or performance of the undelivered items is probable and substantially within our control.

|

|

●

|

Software

– We sell essential and non-essential software. In the case of essential software, revenue is recognized along with the related hardware revenue. In those cases where essential software is sold without hardware, revenue is deferred and recognized over the term of the PCS as we have not established vendor specific objective evidence (VSOE) for our PCS offering.

|

|

●

|

Installation

– Installation revenue related to essential software that is sold with hardware, is recognized when the installation is completed, as it qualifies as a separate unit of account once delivered as it can be provided by a third party. Installation related to essential software sold without hardware, and non-essential software, is deferred and recognized over the term of the PCS, as there is a lack of VSOE. Total installation revenue is allocated between essential and non-essential software based on relative values.

|

|

●

|

Post-Contract Support

– Revenue is recognized over the term of the agreement, usually one year.

|

|

Years Ended December 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

Net loss attributable to Radnet, Inc.'s common stockholders

|

$ | (12,852 | ) | $ | (2,267 | ) | $ | (12,836 | ) | |||

|

BASIC LOSS PER SHARE ATTRIBUTABLE TO RADNET, INC.'S COMMON STOCKHOLDERS

|

||||||||||||

|

Weighted average number of common shares outstanding during the year

|

36,853,477 | 36,047,033 | 35,721,028 | |||||||||

|

Basic loss per share attributable to Radnet, Inc.'s common stockholders

|

$ | (0.35 | ) | $ | (0.06 | ) | $ | (0.36 | ) | |||

|

DILUTED LOSS PER SHARE ATTRIBUTABLE TO RADNET, INC.'S COMMON STOCKHOLDERS

|

||||||||||||

|

Weighted average number of common shares outstanding during the year

|

36,853,477 | 36,047,033 | 35,721,028 | |||||||||

|

Add additional shares issuable upon exercise of stock options and warrants

|

- | - | - | |||||||||

|

Weighted average number of common shares used in calculating diluted loss per share

|

36,853,477 | 36,047,033 | 35,721,028 | |||||||||

|

Diluted loss per share attributable to Radnet, Inc.'s common stockholders

|

$ | (0.35 | ) | $ | (0.06 | ) | $ | (0.36 | ) | |||

|

December 31,

|

|||||||||||

|

Balance Sheet Data:

|

2010

|

2009

|

|||||||||

|

Current assets

|

$ | 15,941 | $ | 20,920 | |||||||

|

Noncurrent assets

|

27,369 | 27,243 | |||||||||

|

Current liabilities

|

(6,844 | ) | (5,929 | ) | |||||||

|

Noncurrent liabilities

|

(8,220 | ) | (7,692 | ) | |||||||

|

Total net assets

|

$ | 28,246 | $ | 34,542 | |||||||

|

Book value of Radnet joint venture interests

|

$ | 11,805 | $ | 14,934 | |||||||

|

Cost in excess of book value of acquired joint venture interests

|

3,383 | 3,383 | |||||||||

|

Elimination of intercompany profit remaining on Radnet's consolidated balance sheet

|

256 | 424 | |||||||||

|

Total value of Radnet joint venture interests

|

$ | 15,444 | $ | 18,741 | |||||||

|

Total book value of other joint venture partner interests

|

$ | 16,441 | $ | 19,608 | |||||||

|

Income statement data for the years ended December 31,

|

2010

|

2009

|

2008

|

|||||||||

|

Net revenue

|

$ | 76,937 | $ | 76,557 | $ | 80,948 | ||||||

|

Net income

|

$ | 12,639 | $ | 12,744 | $ | 17,758 | ||||||

|

Cash

|

$ | 25,650 | ||

|

Fair value of warrant issued

|

306 | |||

|

Promissory note

|

2,250 | |||

|

Total combined purchase price for the Group

|

$ | 28,206 |

|

Current assets

|

$ | 1,907 | ||

|

Property and equipment, net

|

5,284 | |||

|

Identifiable intangible assets

|

4,343 | |||

|

Goodwill

|

20,183 | |||

|

Current liabilities

|

(2,299 | ) | ||

|

Capital lease obligations and other

|

(1,212 | ) | ||

| $ | 28,206 |

|

Estimated

|

|||||||||

|

Estimated

|

Amortization

|

Annual

|

|||||||

|

Fair Value

|

Period

|

Amortization

|

|||||||

|

Trade Name

|

$ | 258 |

Indefinite

|

Not applicable

|

|||||

|

Customer Relationships

|

1,397 |

5 Years

|

279 | ||||||

|

Developed Technology and In-Process R&D

|

2,688 |

5 Years

|

538 | ||||||

| $ | 4,343 | $ | 817 | ||||||

|

Net Revenue

|

$ | 5,433 | ||

|

Net Income

|

409 |

|

Years Ended

|

||||||||

|

December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Net Revenue

|

566,696 | 547,587 | ||||||

|

Net loss

|

(11,023 | ) | (973 | ) | ||||

|

Pro-forma net loss per share

|

(0.30 | ) | (0.03 | ) | ||||

|

Balance as of December 31, 2007

|

$ | 84,395 | ||

|

Adjustments to our preliminary allocation of the purchase price of Borg Imaging Group

|

(254 | ) | ||

|

Adjustments to our preliminary allocation of the purchase price of Valley Imaging Center, Inc.

|

212 | |||

|

Goodwill acquired through the acquisition of Rolling Oaks Imaging Group

|

5,612 | |||

|

Goodwill acquired through the acquisition of Papastavros Associates Medical Imaging

|

3,649 | |||

|

Goodwill acquired through the acquisition of BreastLink Medical Group, Inc

|

2,048 | |||

|

Goodwill acquired through the acquisition of InSight Health Corp.

|

5,560 | |||

|

Goodwill acquired through the acquisition of Simi Valley Advanced Medical

|

313 | |||

|

Goodwill acquired through the acquisition of NeuroSciences Imaging Center

|

2,613 | |||

|

Goodwill acquired through the acquisition of imaging practice of Parvis Gamagami, M.D

|

600 | |||

|

Goodwill acquired through the acquisition of Middletown Imaging

|

530 | |||

|

Balance as of December 31, 2008

|

105,278 | |||

|

Goodwill acquired through the acquisition of Elite Diagnostic Imaging, LLC

|

100 | |||

|

Goodwill acquired through the acquisition of Ridgewood Diagnostics and Unity Hospital

|

1,105 | |||

|

Goodwill acquired through the acquisition of Chesapeake Urology Associates

|

19 | |||

|

Balance as of December 31, 2009

|

106,502 | |||

|

Goodwill acquired through the acquisition of Union Imaging

|

3,748 | |||

|

Goodwill acquired through the acquisition of Anaheim Open MRI

|

305 | |||

|

Goodwill acquired through the acquisition of Truxtun Medical Group

|

10,652 | |||

|

Goodwill acquired through the acquisition of Sonix Medical Resources

|

884 | |||

|

Goodwill acquired through the acquisition of Health Diagnostics

|

977 | |||

|

Goodwill acquired through the acquisition of Image Medical Corporation

|

7,327 | |||

|

Goodwill acquired through the acquisition of Progressive Health

|

12,856 | |||

|

Goodwill acquired through the acquisition of two imaging centers from Presgar Imaging

|

102 | |||

|

Balance as of December 31, 2010

|

$ | 143,353 |

|

2011

|

2012

|

2013

|

2014

|

2015

|

Thereafter |

Total

|

||||||||||||||||||||||

|

Management Service Contracts

|

$ | 2,315 | $ | 2,315 | $ | 2,315 | $ | 2,315 | $ | 2,315 | $ | 36,754 | $ | 48,329 | ||||||||||||||

|

Covenant not to compete contracts

|

801 | 619 | 244 | 173 | 61 | - | 1,898 | |||||||||||||||||||||

|

Customer relationships

|

280 | 280 | 280 | 280 | 207 | 1,327 | ||||||||||||||||||||||

|

Developed technology and in-process R&D

|

538 | 538 | 538 | 538 | 402 | 2,554 | ||||||||||||||||||||||

|

Trade Names

|

150 | 150 | 112 | - | 2,828 | 3,240 | ||||||||||||||||||||||

|

Total Annual Amortization

|

$ | 4,084 | $ | 3,902 | $ | 3,489 | $ | 3,306 | $ | 2,985 | $ | 39,582 | $ | 57,348 | ||||||||||||||

|

December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Land

|

$ | 250 | $ | 250 | ||||

|

Medical equipment

|

226,315 | 200,471 | ||||||

|

Office equipment, furniture and fixtures

|

57,292 | 56,136 | ||||||

|

Leasehold improvements

|

131,411 | 101,904 | ||||||

|

Equipment under capital lease

|

43,735 | 57,421 | ||||||

| 459,003 | 416,182 | |||||||

|

Accumulated depreciation and amortization

|

(264,773 | ) | (233,611 | ) | ||||

| $ | 194,230 | $ | 182,571 | |||||

|

December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Accounts payable

|

$ | 24,659 | $ | 17,717 | ||||

|

Accrued expenses

|

34,814 | 32,305 | ||||||

|

Accrued payroll and vacation

|

15,626 | 13,153 | ||||||

|

Accrued professional fees

|

7,803 | 6,466 | ||||||

|

Total

|

$ | 82,902 | $ | 69,641 | ||||

|

|

·

|

rank equally in right of payment with

any existing and future unsecured

senior indebtedness of the guarantors;

|

|

|

·

|

rank senior in right of payment to all existing and future subordinated indebtedness of the Guarantors;

|

|

|

·

|

are effectively subordinated in right of payment to any secured indebtedness of the guarantors (including indebtedness under the New Credit Facilities) to the extent of the value of the assets securing such indebtedness; and

|

|

|

·

|

are structurally subordinated in right of payment to all existing and future indebtedness and other liabilities of any of the Company’s subsidiaries that is not a guarantor of the Notes.

|

|

·

|

pay dividends or make certain other restricted payments or investments;

|

|

·

|

incur additional indebtedness and issue preferred stock;

|

|

·

|

create liens (other than permitted liens) securing indebtedness or trade payables unless the notes are secured on an equal and ratable basis with the obligations so secured, and, if such liens secure subordinated indebtedness, the notes are secured by a lien senior to such liens;

|

|

·

|

sell certain assets or merge with or into other companies or otherwise dispose of all or substantially all of our assets;

|

|

·

|

enter into certain transactions with affiliates;

|

|

·

|

create restrictions on dividends or other payments by our restricted subsidiaries; and

|

|

·

|

create guarantees of indebtedness by restricted subsidiaries.

|

|

December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Revolving lines of credit

|

$

|

-

|

$

|

-

|

||||

|

Senior secured term loan

|

282,862

|

-

|

||||||

|

Senior unsecured notes

|

200,000

|

-

|

||||||

|

Discount on Notes

|

(2,476

|

)

|

-

|

|||||

|

GE credit facility

|

-

|

412,625

|

||||||

|

Equipment notes payable at interest rates ranging from 8.8% to 13.5%, due through 2013, collateralized by medical equipment

|

9,410

|

11,001

|

||||||

|

Obligations under capital leases at interest rates ranging from 9.1% to 13.0%, due through 2010, collateralized by medical and office equipment

|

14,778

|

27,689

|

||||||

|

504,574

|

451,315

|

|||||||

|

Less: current portion

|

(17,357

|

)

|

(21,048

|

)

|

||||

|

$

|

487,217

|

$

|

430,267

|

|||||

|

2011

|

$ | 8,218 | ||

|

2012

|

5,022 | |||

|

2013

|

3,985 | |||

|

2014

|

3,532 | |||

|

2015

|

2,897 | |||

|

Thereafter

|

468,618 | |||

| $ | 492,272 |

|

2011

|

$ | 9,944 | ||

|

2012

|

4,663 | |||

|

2013

|

1,226 | |||

|

2014

|

75 | |||

|

Total minimum payments

|

15,908 | |||

|

Amount representing interest

|

(1,130 | ) | ||

|

Present value of net minimum lease payments

|

14,778 | |||

|

Less current portion

|

(9,139 | ) | ||

|

Long-term portion

|

$ | 5,639 |

| Subsidiary | Guarantor | Non-Guarantor | ||||||||||||||||||||||

|

Parent

|

Issuer

|

Subsidiaries

|

Subsidiaries

|

Eliminations

|

Consolidated

|

|||||||||||||||||||

|

ASSETS

|

||||||||||||||||||||||||

|

CURRENT ASSETS

|

||||||||||||||||||||||||

|

Cash and cash equivalents

|

$ | - | $ | 205 | $ | - | $ | 422 | $ | - | $ | 627 | ||||||||||||

|

Accounts receivable, net

|

- | - | 52,493 | 43,601 | - | 96,094 | ||||||||||||||||||

|

Prepaid expenses and other current assets

|

- | 8,481 | 5,543 | 280 | - | 14,304 | ||||||||||||||||||

| Total current assets | - | 8,686 | 58,036 | 44,303 | - | 111,025 | ||||||||||||||||||

|

PROPERTY AND EQUIPMENT, NET

|

- | 46,893 | 145,770 | 1,567 | - | 194,230 | ||||||||||||||||||

|

OTHER ASSETS

|

- | |||||||||||||||||||||||

|

Goodwill

|

- | 41,768 | 101,585 | - | - | 143,353 | ||||||||||||||||||

|

Other intangible assets

|

- | 137 | 57,211 | - | - | 57,348 | ||||||||||||||||||

|

Deferred financing costs, net

|

- | 15,486 | - | - | - | 15,486 | ||||||||||||||||||

|

Investment in subsidiaries

|

(82,813 | ) | 218,110 | 9,223 | - | (144,520 | ) | - | ||||||||||||||||

|

Investment in joint ventures

|

- | - | 15,444 | - | - | 15,444 | ||||||||||||||||||

|

Deposits and other

|

- | 1,320 | 1,308 | - | - | 2,628 | ||||||||||||||||||

| Total assets | $ | (82,813 | ) | $ | 332,400 | $ | 388,577 | $ | 45,870 | $ | (144,520 | ) | $ | 539,514 | ||||||||||

|

LIABILITIES AND EQUITY DEFICIT

|

||||||||||||||||||||||||

|

CURRENT LIABILITIES

|

||||||||||||||||||||||||

|

Intercompany

|

$ | - | $ | (133,637 | ) | $ | 107,258 | $ | 26,379 | - | ||||||||||||||

|

Accounts payable and accrued expenses

|

- | 44,450 | 30,997 | 7,172 | - | 82,619 | ||||||||||||||||||

|

Due to affiliates

|

- | - | 1,082 | 1,893 | - | 2,975 | ||||||||||||||||||

|

Deferred revenue

|

- | - | 1,568 | - | - | 1,568 | ||||||||||||||||||

|

Current portion of notes payable

|

- | 3,082 | 5,136 | - | - | 8,218 | ||||||||||||||||||

|

Current portion of deferred rent

|

- | 321 | 424 | - | - | 745 | ||||||||||||||||||

|

Obligations under capital leases

|

- | 5,640 | 3,150 | 349 | - | 9,139 | ||||||||||||||||||

| Total current liabilities | - | (80,144 | ) | 149,615 | 35,793 | - | 105,264 | |||||||||||||||||

|

LONG-TERM LIABILITIES

|

||||||||||||||||||||||||

|

Deferred rent, net of current portion

|

- | 6,086 | 4,293 | - | - | 10,379 | ||||||||||||||||||

|

Deferred taxes

|

- | - | 277 | - | - | 277 | ||||||||||||||||||

|

Notes payable, net of current portion

|

- | 475,231 | 6,347 | - | - | 481,578 | ||||||||||||||||||

|

Obligations under capital leases,

net of current portion

|

- | 3,535 | 1,307 | 797 | - | 5,639 | ||||||||||||||||||

|

Other non-current liabilities

|

- | 10,505 | 8,345 | - | - | 18,850 | ||||||||||||||||||

| Total liabilities | - | 415,213 | 170,184 | 36,590 | - | 621,987 | ||||||||||||||||||

|

EQUITY DEFICIT

|

||||||||||||||||||||||||

|

Total Radnet, Inc.'s equity deficit

|

(82,813 | ) | (82,813 | ) | 218,393 | 9,223 | (144,520 | ) | (82,530 | ) | ||||||||||||||

|

Noncontrolling interests

|

- | - | - | 57 | - | 57 | ||||||||||||||||||

| Total equity deficit | (82,813 | ) | (82,813 | ) | 218,393 | 9,280 | (144,520 | ) | (82,473 | ) | ||||||||||||||

| Total liabilities and equity deficit | $ | (82,813 | ) | $ | 332,400 | $ | 388,577 | $ | 45,870 | $ | (144,520 | ) | $ | 539,514 | ||||||||||

| Subsidiary | Guarantor | Non-Guarantor | ||||||||||||||||||||||

| Parent |

Issuer

|

Subsidiaries

|

Subsidiaries

|

Eliminations | Consolidated | |||||||||||||||||||

|

ASSETS

|

||||||||||||||||||||||||

|

CURRENT ASSETS

|

||||||||||||||||||||||||

|

Cash and cash equivalents

|

$ | - | $ | 10,094 | $ | - | $ | - | $ | - | $ | 10,094 | ||||||||||||

|

Accounts receivable, net

|

- | - | 47,616 | 40,209 | - | 87,825 | ||||||||||||||||||

|

Prepaid expenses and other current assets

|

- | 5,810 | 3,979 | 201 | - | 9,990 | ||||||||||||||||||

|

Total current assets

|

- | 15,904 | 51,595 | 40,410 | - | 107,909 | ||||||||||||||||||

|

PROPERTY AND EQUIPMENT, NET

|

- | 47,777 | 134,276 | 518 | - | 182,571 | ||||||||||||||||||

|

OTHER ASSETS

|

- | |||||||||||||||||||||||

|

Goodwill

|

- | 41,462 | 65,040 | - | - | 106,502 | ||||||||||||||||||

|

Other intangible assets

|

- | 224 | 54,089 | - | - | 54,313 | ||||||||||||||||||

|

Deferred financing costs, net

|

- | 8,229 | - | - | - | 8,229 | ||||||||||||||||||

|

Investment in subsidiaries

|

(74,815 | ) | 192,129 | 9,459 | - | (126,773 | ) | - | ||||||||||||||||

|

Investment in joint ventures

|

- | - | 18,741 | - | - | 18,741 | ||||||||||||||||||

|

Deposits and other

|

- | 2,196 | 210 | - | - | 2,406 | ||||||||||||||||||

|

Total assets

|

$ | (74,815 | ) | $ | 307,921 | $ | 333,410 | $ | 40,928 | $ | (126,773 | ) | $ | 480,671 | ||||||||||

|

LIABILITIES AND EQUITY DEFICIT

|

||||||||||||||||||||||||

|

CURRENT LIABILITIES

|