|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

25-1797617

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Identification No.)

|

|

1201 South 2

nd

Street

|

|

|

|

Milwaukee, Wisconsin

|

|

53204

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Common Stock, $1 Par Value

|

|

New York Stock Exchange

|

|

Large Accelerated Filer

|

☑

|

Accelerated Filer

|

☐

|

|||

|

Non-accelerated Filer

|

☐ (Do not check if smaller reporting company)

|

Smaller Reporting Company

|

☐

|

|||

|

Emerging Growth Company

|

☐

|

|||||

|

•

|

macroeconomic factors, including global and regional business conditions, the availability and cost of capital, commodity prices, the cyclical nature of our customers’ capital spending, sovereign debt concerns and currency exchange rates;

|

|

•

|

laws, regulations and governmental policies affecting our activities in the countries where we do business;

|

|

•

|

the successful development of advanced technologies and demand for and market acceptance of new and existing products;

|

|

•

|

the availability, effectiveness and security of our information technology systems;

|

|

•

|

competitive products, solutions and services and pricing pressures, and our ability to provide high quality products, solutions and services;

|

|

•

|

a disruption of our business due to natural disasters, pandemics, acts of war, strikes, terrorism, social unrest or other causes;

|

|

•

|

our ability to manage and mitigate the risk related to security vulnerabilities and breaches of our products, solutions and services;

|

|

•

|

intellectual property infringement claims by others and the ability to protect our intellectual property;

|

|

•

|

the uncertainty of claims by taxing authorities in the various jurisdictions where we do business;

|

|

•

|

our ability to attract, develop, and retain qualified personnel;

|

|

•

|

our ability to manage costs related to employee retirement and health care benefits;

|

|

•

|

the uncertainties of litigation, including liabilities related to the safety and security of the products, solutions and services we sell;

|

|

•

|

our ability to manage and mitigate the risks associated with our solutions and services businesses;

|

|

•

|

disruptions to our distribution channels or the failure of distributors to develop and maintain capabilities to sell our products;

|

|

•

|

the successful integration and management of acquired businesses and technologies;

|

|

•

|

the availability and price of components and materials;

|

|

•

|

the successful execution of our cost productivity initiatives; and

|

|

•

|

other risks and uncertainties, including but not limited to those detailed from time to time in our Securities and Exchange Commission (SEC) filings.

|

|

September 30,

|

||||||||

|

2017

|

2016

|

|||||||

|

Architecture & Software

|

$

|

205.1

|

|

$

|

185.8

|

|

||

|

Control Products & Solutions

|

1,091.6

|

|

1,024.6

|

|

||||

|

|

$

|

1,296.7

|

|

|

$

|

1,210.4

|

|

|

|

•

|

difficulties in integrating the purchased operations, technologies, products or services, retaining the acquired business’ customers and achieving the expected benefits of the acquisition, such as sales increases, access to technologies, cost savings and increases in geographic or product presence, in the desired time frames;

|

|

•

|

loss of key employees of the acquired business;

|

|

•

|

legal and compliance issues;

|

|

•

|

difficulties implementing and maintaining consistent standards, controls, procedures, policies and information systems; and

|

|

•

|

diversion of management’s attention from other business concerns.

|

|

•

|

poor quality or an insecure supply chain, which could adversely affect the reliability and reputation of our products;

|

|

•

|

changes in the cost of these purchases due to inflation, exchange rates, commodity market volatility or other factors;

|

|

•

|

intellectual property risks such as ownership of rights or alleged infringement by suppliers;

|

|

•

|

information security risks associated with providing confidential information to suppliers; and

|

|

•

|

shortages of components, commodities or other materials, which could adversely affect our manufacturing efficiencies and ability to make timely delivery.

|

|

|

|

|

|

|

Location

|

|

Segment/Region

|

|

|

|

|

|

|

|

Milwaukee, Wisconsin, United States

|

|

Global Headquarters and Control Products & Solutions

|

|

|

Mayfield Heights, Ohio, United States

|

|

Architecture & Software

|

|

|

Cambridge, Canada

|

|

Canada

|

|

|

Capelle, Netherlands / Diegem, Belgium

|

|

Europe, Middle East and Africa

|

|

|

Hong Kong

|

|

Asia Pacific

|

|

|

Weston, Florida, United States

|

|

Latin America

|

|

|

|

|||

|

The following table sets forth information regarding the manufacturing square footage of our principal locations as of September 30, 2017.

|

|||

|

Location

|

|

Manufacturing Square Footage

|

|

|

|

|

|

|

|

Monterrey, Mexico

|

|

637,000

|

|

|

Aarau, Switzerland

|

|

284,000

|

|

|

Twinsburg, Ohio, United States

|

|

257,000

|

|

|

Mequon, Wisconsin, United States

|

|

240,000

|

|

|

Cambridge, Canada

|

|

216,000

|

|

|

Harbin, China

|

|

162,000

|

|

|

Shanghai, China

|

141,000

|

|

|

|

Singapore

|

|

139,000

|

|

|

Katowice, Poland

|

|

138,000

|

|

|

Tecate, Mexico

|

|

135,000

|

|

|

Ladysmith, Wisconsin, United States

|

|

124,000

|

|

|

Richland Center, Wisconsin, United States

|

|

124,000

|

|

|

Jundiai, Brazil

|

115,000

|

|

|

|

|

|

|

|

Name, Office and Position, and Principal Occupations and Employment

|

Age

|

|

|

|

|

|

|

Blake D. Moret

— President and Chief Executive Officer since July 1, 2016; previously Senior Vice President

|

54

|

|

|

Sujeet Chand —

Senior Vice President and Chief Technology Officer

|

59

|

|

|

Patrick P. Goris

— Senior Vice President and Chief Financial Officer since February 7, 2017; previously Vice President, Finance, Architecture and Software and (from 2013-2015) Operating and Engineering Services, and (from July 2015) Vice President, Investor Relations

|

46

|

|

|

Theodore D. Crandall

— Senior Vice President since February 7, 2017; previously Senior Vice President and Chief Financial Officer

|

62

|

|

|

David M. Dorgan

— Vice President and Controller

|

53

|

|

|

Steven W. Etzel

— Vice President and Treasurer

|

57

|

|

|

Elik I. Fooks

— Senior Vice President since March 16, 2017; previously Vice President and General Manager, Sensing, Safety, and Connectivity Business

|

66

|

|

|

Rebecca W. House

— Senior Vice President, General Counsel and Secretary since January 3, 2017; previously Assistant General Counsel, Operations and Compliance, and Assistant Secretary at Harley-Davidson, Inc. (motorcycle manufacturer)

|

44

|

|

|

Frank C. Kulaszewicz —

Senior Vice President

|

53

|

|

|

John P. McDermott

— Senior Vice President

|

59

|

|

|

John M. Miller

— Vice President and Chief Intellectual Property Counsel

|

50

|

|

|

Robert B. Murphy

— Senior Vice President, Operations and Engineering Services since May 2, 2016; previously Vice President, Manufacturing Operations

|

58

|

|

|

Christopher Nardecchia

— Senior Vice President and Chief Information Officer since November 1, 2017; previously Vice President and Chief Information Officer, Global Operations and Supply Chain, Amgen, Inc. (biopharmaceutical company)

|

55

|

|

|

Susan J. Schmitt —

Senior Vice President, Human Resources

|

54

|

|

|

|

2017

|

2016

|

||||||||||||||

|

Fiscal Quarters

|

High

|

Low

|

High

|

Low

|

||||||||||||

|

First

|

$

|

139.64

|

|

$

|

114.46

|

|

$

|

111.03

|

|

$

|

98.47

|

|

||||

|

Second

|

157.30

|

|

135.18

|

|

115.62

|

|

87.53

|

|

||||||||

|

Third

|

165.39

|

|

148.31

|

|

120.60

|

|

107.17

|

|

||||||||

|

Fourth

|

179.50

|

|

158.00

|

|

123.11

|

|

110.89

|

|

||||||||

|

Period

|

Total Number of Shares Purchased

|

Average Price Paid Per Share

(1)

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

|

Maximum Approx. Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs

(2)

|

||||||||||

|

July 1 – 31, 2017

|

149,700

|

|

$

|

164.73

|

|

149,700

|

|

$

|

618,311,524

|

|

||||

|

August 1 – 31, 2017

|

60,000

|

|

165.11

|

|

60,000

|

|

608,404,669

|

|

||||||

|

September 1 – 30, 2017

|

—

|

|

—

|

|

—

|

|

608,404,669

|

|

||||||

|

Total

|

209,700

|

|

164.84

|

|

209,700

|

|

|

|||||||

|

(1)

|

Average price paid per share includes brokerage commissions.

|

|

(2)

|

On April 6, 2016, the Board of Directors authorized us to expend $1.0 billion to repurchase shares of our common stock. Our repurchase program allows us to repurchase shares at management's discretion or at our broker’s discretion pursuant to a share repurchase plan subject to price and volume parameters.

|

|

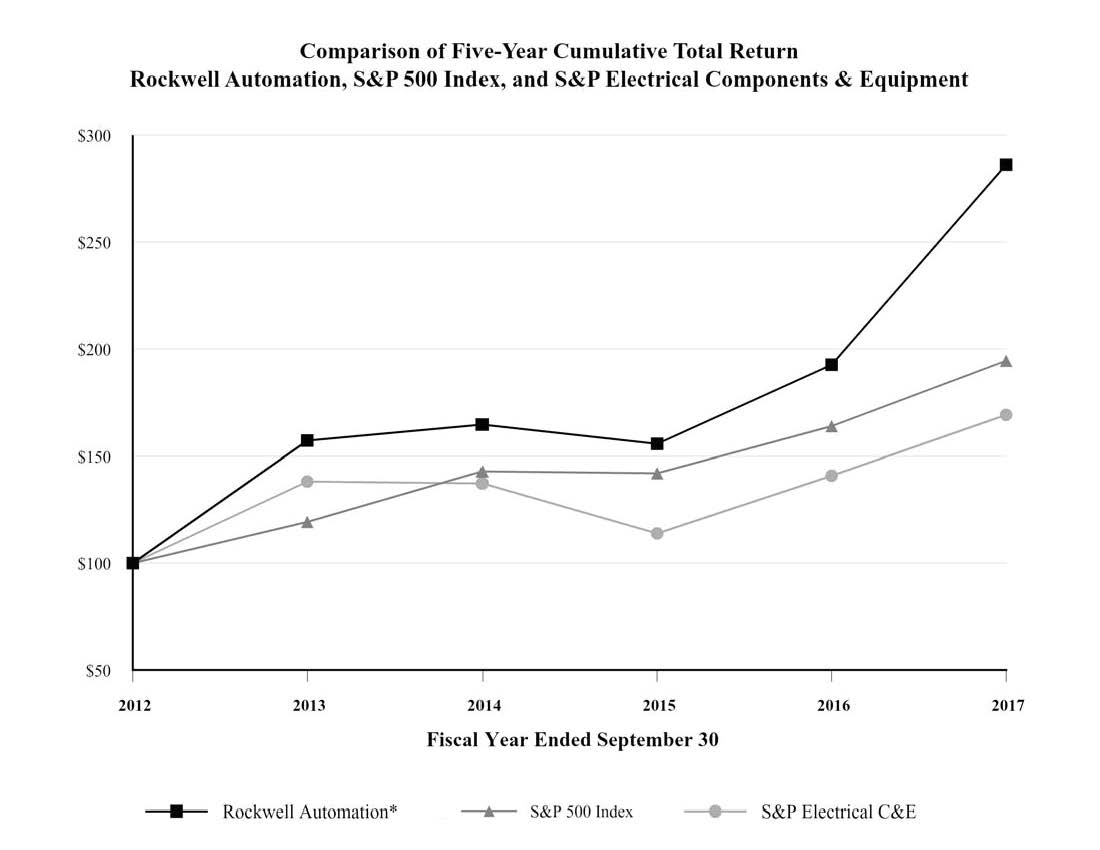

2012

|

2013

|

2014

|

2015

|

2016

|

2017

|

||||||||||||||||||

|

Rockwell Automation*

|

$

|

100.00

|

|

$

|

157.17

|

|

$

|

164.66

|

|

$

|

155.63

|

|

$

|

192.64

|

|

$

|

286.17

|

|

|||||

|

S&P 500 Index

|

100.00

|

|

119.34

|

|

142.89

|

|

142.02

|

|

163.93

|

|

194.44

|

|

|||||||||||

|

S&P Electrical Components & Equipment

|

100.00

|

|

138.10

|

|

137.20

|

|

113.89

|

|

140.88

|

|

169.23

|

|

|||||||||||

|

Cash dividends per common share

|

1.745

|

|

1.98

|

|

2.32

|

|

2.60

|

|

2.90

|

|

3.04

|

|

|||||||||||

|

|

Year Ended September 30,

|

|||||||||||||||||||

|

|

2017

|

2016

|

2015

|

2014

|

2013

|

|||||||||||||||

|

(in millions, except per share data)

|

||||||||||||||||||||

|

Consolidated Statement of Operations Data:

|

|

|

|

|

||||||||||||||||

|

Sales

|

$

|

6,311.3

|

|

$

|

5,879.5

|

|

$

|

6,307.9

|

|

$

|

6,623.5

|

|

$

|

6,351.9

|

|

|||||

|

Interest expense

|

76.2

|

|

71.3

|

|

63.7

|

|

59.3

|

|

60.9

|

|

||||||||||

|

Net income

(1)

|

825.7

|

|

729.7

|

|

827.6

|

|

826.8

|

|

756.3

|

|

||||||||||

|

Earnings per share:

|

|

|||||||||||||||||||

|

Basic

|

6.42

|

|

5.60

|

|

6.15

|

|

5.98

|

|

5.43

|

|

||||||||||

|

Diluted

|

6.35

|

|

5.56

|

|

6.09

|

|

5.91

|

|

5.36

|

|

||||||||||

|

Cash dividends per share

|

3.04

|

|

2.90

|

|

2.60

|

|

2.32

|

|

1.98

|

|

||||||||||

|

Consolidated Balance Sheet Data:

(at end of period)

|

|

|||||||||||||||||||

|

Total assets

|

$

|

7,161.7

|

|

$

|

7,101.2

|

|

$

|

6,404.7

|

|

$

|

6,224.3

|

|

$

|

5,844.6

|

|

|||||

|

Short-term debt and current portion of long-term debt

|

600.4

|

|

448.6

|

|

—

|

|

325.0

|

|

179.0

|

|

||||||||||

|

Long-term debt

|

1,243.4

|

|

1,516.3

|

|

1,500.9

|

|

900.4

|

|

905.1

|

|

||||||||||

|

Shareowners’ equity

|

2,663.6

|

|

1,990.1

|

|

2,256.8

|

|

2,658.1

|

|

2,585.5

|

|

||||||||||

|

Other Data:

|

|

|||||||||||||||||||

|

Capital expenditures

|

$

|

141.7

|

|

$

|

116.9

|

|

$

|

122.9

|

|

$

|

141.0

|

|

$

|

146.2

|

|

|||||

|

Depreciation

|

138.7

|

|

143.3

|

|

133.1

|

|

122.5

|

|

113.8

|

|

||||||||||

|

Intangible asset amortization

|

30.2

|

|

28.9

|

|

29.4

|

|

30.0

|

|

31.4

|

|

||||||||||

|

(1)

|

During the fourth quarter of fiscal 2017, we sold a product distribution business within our Control Products & Solutions segment. This business held no intellectual property and included products sold outside of our core channel and under different brands. We sold this business for approximately $94 million and recorded a pre-tax gain of

$60.8 million

, which is included within Other Income (Expense) in the Consolidated Statement of Operations.

|

|

•

|

investments in manufacturing, including upgrades, modifications and expansions of existing facilities or production lines and new facilities or production lines;

|

|

•

|

investments in basic materials production capacity, which may be related to commodity pricing levels;

|

|

•

|

our customers’ needs for faster time to market, lower total cost of ownership, improved asset utilization and optimization, and enterprise risk management;

|

|

•

|

our customers’ needs to continuously improve quality, safety and sustainability;

|

|

•

|

industry factors that include our customers’ new product introductions, demand for our customers’ products or services and the regulatory and competitive environments in which our customers operate;

|

|

•

|

levels of global industrial production and capacity utilization;

|

|

•

|

regional factors that include local political, social, regulatory and economic circumstances; and

|

|

•

|

the spending patterns of our customers due to their annual budgeting processes and their working schedules.

|

|

•

|

achieve organic sales growth in excess of the automation market by expanding our served market and strengthening our competitive differentiation;

|

|

•

|

diversify our sales streams by broadening our portfolio of products, solutions and services, expanding our global presence and serving a wider range of industries and applications;

|

|

•

|

grow market share by gaining new customers and by capturing a larger share of existing customers’ spending;

|

|

•

|

enhance our market access by building our channel capability and partner network;

|

|

•

|

acquire companies that serve as catalysts to organic growth by adding complementary technology, expanding our served market, or enhancing our domain expertise or market access;

|

|

•

|

deploy human and financial resources to strengthen our technology leadership and our intellectual capital business model;

|

|

•

|

continuously improve quality and customer experience; and

|

|

•

|

drive annual cost productivity.

|

|

•

|

The Industrial Production (IP) Index, published by the Federal Reserve, which measures the real output of manufacturing, mining, and electric and gas utilities. The IP Index is expressed as a percentage of real output in a base year, currently 2012. Historically there has been a meaningful correlation between the changes in the IP Index and the level of automation investment made by our U.S. customers in their manufacturing base.

|

|

•

|

The Manufacturing Purchasing Managers’ Index (PMI), published by the Institute for Supply Management (ISM), which indicates the current and near-term state of manufacturing activity in the U.S. According to the ISM, a PMI measure above 50 indicates that the U.S. manufacturing economy is generally expanding while a measure below 50 indicates that it is generally contracting.

|

|

•

|

Industrial Equipment Spending, compiled by the Bureau of Economic Analysis, which provides insight into spending trends in the broad U.S. industrial economy. This measure over the longer term has proven to demonstrate a reasonable correlation with our domestic growth.

|

|

•

|

Capacity Utilization (Total Industry), published by the Federal Reserve, which measures plant operating activity. Historically there has been a meaningful correlation between Capacity Utilization and levels of U.S. IP.

|

|

IP

Index

|

PMI

|

Industrial

Equipment

Spending

(in billions)

|

Capacity

Utilization

(percent)

|

|||||||||

|

Fiscal 2017 quarter ended:

|

|

|

|

|

||||||||

|

September 2017

|

104.7

|

|

60.8

|

|

245.5

|

|

76.1

|

|

||||

|

June 2017

|

105.1

|

|

57.8

|

|

241.7

|

|

76.6

|

|

||||

|

March 2017

|

103.7

|

|

57.2

|

|

234.3

|

|

75.8

|

|

||||

|

December 2016

|

103.3

|

|

54.5

|

|

229.0

|

|

75.8

|

|

||||

|

Fiscal 2016 quarter ended:

|

|

|

|

|||||||||

|

September 2016

|

103.1

|

|

51.7

|

|

226.0

|

|

75.8

|

|

||||

|

June 2016

|

102.9

|

|

52.8

|

|

224.4

|

|

75.7

|

|

||||

|

March 2016

|

103.1

|

|

51.7

|

|

220.6

|

|

75.8

|

|

||||

|

December 2015

|

103.4

|

|

47.9

|

|

224.0

|

|

76.0

|

|

||||

|

Fiscal 2015 quarter ended:

|

|

|

|

|||||||||

|

September 2015

|

104.4

|

|

50.1

|

|

220.7

|

|

76.7

|

|

||||

|

June 2015

|

104.3

|

|

53.0

|

|

221.9

|

|

76.8

|

|

||||

|

March 2015

|

105.4

|

|

52.3

|

|

216.8

|

|

77.8

|

|

||||

|

December 2014

|

106.3

|

|

54.9

|

|

216.5

|

|

78.6

|

|

||||

|

•

|

Logix reported and organic sales increased

10 percent

year over year compared to

2016

.

|

|

•

|

Process initiative sales increased 13 percent in

2017

compared to

2016

, and process initiative organic sales increased 4 percent. Currency translation reduced process sales by one percentage point, and acquisitions contributed 10 percentage points to process sales growth.

|

|

•

|

Sales in emerging countries increased 8.7 percent in

2017

compared to

2016

. Organic sales in emerging countries increased 10.1 percent year over year. Currency translation reduced sales in emerging countries by 1.5 percentage points, and acquisitions contributed 0.1 percentage points to sales growth.

|

|

|

Year Ended September 30,

|

|||||||||||

|

|

2017

|

2016

|

2015

|

|||||||||

|

Sales

|

|

|

|

|||||||||

|

Architecture & Software

|

$

|

2,899.3

|

|

$

|

2,635.2

|

|

$

|

2,749.5

|

|

|||

|

Control Products & Solutions

|

3,412.0

|

|

3,244.3

|

|

3,558.4

|

|

||||||

|

Total sales (a)

|

$

|

6,311.3

|

|

$

|

5,879.5

|

|

$

|

6,307.9

|

|

|||

|

Segment operating earnings

(1)

|

|

|

|

|||||||||

|

Architecture & Software

|

$

|

781.5

|

|

$

|

695.0

|

|

$

|

808.6

|

|

|||

|

Control Products & Solutions

|

451.6

|

|

493.7

|

|

551.9

|

|

||||||

|

Total segment operating earnings

(2)

(b)

|

1,233.1

|

|

1,188.7

|

|

1,360.5

|

|

||||||

|

Purchase accounting depreciation and amortization

|

(21.4

|

)

|

(18.4

|

)

|

(21.0

|

)

|

||||||

|

General corporate — net

|

(76.3

|

)

|

(79.7

|

)

|

(85.6

|

)

|

||||||

|

Non-operating pension costs

|

(82.6

|

)

|

(76.2

|

)

|

(62.7

|

)

|

||||||

|

Gain on sale of business

(4)

|

60.8

|

|

—

|

|

—

|

|

||||||

|

Interest expense

|

(76.2

|

)

|

(71.3

|

)

|

(63.7

|

)

|

||||||

|

Income before income taxes (c)

|

1,037.4

|

|

943.1

|

|

1,127.5

|

|

||||||

|

Income tax provision

|

(211.7

|

)

|

(213.4

|

)

|

(299.9

|

)

|

||||||

|

Net income

|

$

|

825.7

|

|

$

|

729.7

|

|

$

|

827.6

|

|

|||

|

|

|

|

||||||||||

|

Diluted EPS

|

$

|

6.35

|

|

$

|

5.56

|

|

$

|

6.09

|

|

|||

|

Adjusted EPS

(3)

|

$

|

6.76

|

|

$

|

5.93

|

|

$

|

6.40

|

|

|||

|

Diluted weighted average outstanding shares

|

129.9

|

|

131.1

|

|

135.7

|

|

||||||

|

Total segment operating margin

(2)

(b/a)

|

19.5

|

%

|

20.2

|

%

|

21.6

|

%

|

||||||

|

Pre-tax margin (c/a)

|

16.4

|

%

|

16.0

|

%

|

17.9

|

%

|

||||||

|

(1)

|

See Note 16 in the Financial Statements for the definition of segment operating earnings.

|

|

(2)

|

Total segment operating earnings and total segment operating margin are non-GAAP financial measures. We exclude purchase accounting depreciation and amortization, general corporate – net, non-operating pension costs, interest expense and income tax provision because we do not consider these costs to be directly related to the operating performance of our segments. We believe that these measures are useful to investors as measures of operating performance. We use these measures to monitor and evaluate the profitability of our operating segments. Our measures of total segment operating earnings and total segment operating margin may be different from measures used by other companies.

|

|

(3)

|

Adjusted EPS is a non-GAAP earnings measure that excludes the non-operating pension costs and their related income tax effects. See

Adjusted Income, Adjusted EPS and Adjusted Effective Tax Rate Reconciliation

for more information on this non-GAAP measure.

|

|

(4)

|

During the fourth quarter of fiscal 2017, we sold a product distribution business within our Control Products & Solutions segment. This business held no intellectual property and included products sold outside of our core channel and under different brands. We sold this business for approximately $94 million and recorded a pre-tax gain of

$60.8 million

, which is included within Other Income (Expense) in the Consolidated Statement of Operations.

|

|

|

Year Ended September 30,

|

|||||||||||

|

|

2017

|

2016

|

2015

|

|||||||||

|

Purchase accounting depreciation and amortization

|

|

|

|

|||||||||

|

Architecture & Software

|

$

|

6.4

|

|

$

|

3.9

|

|

$

|

4.3

|

|

|||

|

Control Products & Solutions

|

14.0

|

|

13.5

|

|

15.7

|

|

||||||

|

Non-operating pension costs

|

||||||||||||

|

Architecture & Software

|

29.7

|

|

26.9

|

|

22.6

|

|

||||||

|

Control Products & Solutions

|

46.4

|

|

42.0

|

|

35.3

|

|

||||||

|

Year Ended September 30,

|

||||||||||||

|

2017

|

2016

|

2015

|

||||||||||

|

Service cost

|

$

|

97.0

|

|

$

|

88.0

|

|

$

|

85.7

|

|

|||

|

Amortization of prior service credit

|

(3.7

|

)

|

(2.9

|

)

|

(2.7

|

)

|

||||||

|

Operating pension costs

|

93.3

|

|

85.1

|

|

83.0

|

|

||||||

|

Interest cost

|

151.6

|

|

169.5

|

|

167.2

|

|

||||||

|

Expected return on plan assets

|

(225.2

|

)

|

(218.3

|

)

|

(223.2

|

)

|

||||||

|

Amortization of net actuarial loss

|

152.9

|

|

124.5

|

|

118.7

|

|

||||||

|

Special termination benefit

|

0.5

|

|

0.5

|

|

—

|

|

||||||

|

Settlements

|

2.8

|

|

—

|

|

—

|

|

||||||

|

Non-operating pension costs

|

82.6

|

|

76.2

|

|

62.7

|

|

||||||

|

Net periodic pension cost

|

$

|

175.9

|

|

$

|

161.3

|

|

$

|

145.7

|

|

|||

|

|

Year Ended September 30,

|

|||||||||||

|

|

2017

|

2016

|

2015

|

|||||||||

|

Income from continuing operations

|

$

|

825.7

|

|

$

|

729.7

|

|

$

|

827.6

|

|

|||

|

Non-operating pension costs

|

82.6

|

|

76.2

|

|

62.7

|

|

||||||

|

Tax effect of non-operating pension costs

|

(29.6

|

)

|

(27.5

|

)

|

(21.9

|

)

|

||||||

|

Adjusted Income

|

$

|

878.7

|

|

$

|

778.4

|

|

$

|

868.4

|

|

|||

|

Diluted EPS from continuing operations

|

$

|

6.35

|

|

$

|

5.56

|

|

$

|

6.09

|

|

|||

|

Non-operating pension costs per diluted share

|

0.64

|

|

0.58

|

|

0.46

|

|

||||||

|

Tax effect of non-operating pension costs per diluted share

|

(0.23

|

)

|

(0.21

|

)

|

(0.15

|

)

|

||||||

|

Adjusted EPS

|

$

|

6.76

|

|

$

|

5.93

|

|

$

|

6.40

|

|

|||

|

Effective tax rate

|

20.4

|

%

|

22.6

|

%

|

26.6

|

%

|

||||||

|

Tax effect of non-operating pension costs

|

1.1

|

%

|

1.0

|

%

|

0.4

|

%

|

||||||

|

Adjusted Effective Tax Rate

|

21.5

|

%

|

23.6

|

%

|

27.0

|

%

|

||||||

|

(in millions, except per share amounts)

|

2017

|

2016

|

Change

|

|||||||||

|

Sales

|

$

|

6,311.3

|

|

$

|

5,879.5

|

|

$

|

431.8

|

|

|||

|

Income before income taxes

|

1,037.4

|

|

943.1

|

|

94.3

|

|

||||||

|

Diluted EPS

|

6.35

|

|

5.56

|

|

0.79

|

|

||||||

|

Adjusted EPS

|

6.76

|

|

5.93

|

|

0.83

|

|

||||||

|

Change vs.

|

Change in Organic

Sales

(1)

vs.

|

|||||||||

|

Year Ended September 30, 2017

|

Year Ended September 30, 2016

|

Year Ended September 30, 2016

|

||||||||

|

United States

|

$

|

3,458.4

|

|

7.6

|

%

|

5.2

|

%

|

|||

|

Canada

|

343.4

|

|

8.5

|

%

|

7.7

|

%

|

||||

|

Europe, Middle East and Africa

|

1,193.7

|

|

4.1

|

%

|

3.8

|

%

|

||||

|

Asia Pacific

|

866.4

|

|

13.3

|

%

|

13.9

|

%

|

||||

|

Latin America

|

449.4

|

|

2.6

|

%

|

4.1

|

%

|

||||

|

Total sales

|

$

|

6,311.3

|

|

7.3

|

%

|

6.1

|

%

|

|||

|

(1)

|

Organic sales are sales excluding the effect of changes in currency exchange rates and acquisitions. See

Supplemental Sales Information

for information on this non-GAAP measure.

|

|

•

|

Sales in the United States increased year over year, led by strength in the automotive and consumer industries.

|

|

•

|

Sales in Canada grew, with growth led by the pulp and paper, consumer, and automotive industries.

|

|

•

|

EMEA sales increased compared to the prior year, with growth in both emerging and developed countries.

|

|

•

|

Asia Pacific sales increased year over year, with strong growth across the region, particularly within the semiconductor industry.

|

|

•

|

Sales growth in Latin America was mixed with growth led by Mexico, partially offset by declines across the rest of the region.

|

|

(in millions, except percentages)

|

2017

|

2016

|

Change

|

|

||||||||||

|

Sales

|

$

|

2,899.3

|

|

$

|

2,635.2

|

|

$

|

264.1

|

|

|

||||

|

Segment operating earnings

|

781.5

|

|

695.0

|

|

86.5

|

|

|

|||||||

|

Segment operating margin

|

27.0

|

%

|

26.4

|

%

|

0.6

|

|

pts

|

|||||||

|

(in millions, except percentages)

|

2017

|

2016

|

Change

|

|

||||||||||

|

Sales

|

$

|

3,412.0

|

|

$

|

3,244.3

|

|

$

|

167.7

|

|

|

||||

|

Segment operating earnings

|

451.6

|

|

493.7

|

|

(42.1

|

)

|

|

|||||||

|

Segment operating margin

|

13.2

|

%

|

15.2

|

%

|

(2.0

|

)

|

pts

|

|||||||

|

(in millions, except per share amounts)

|

2016

|

2015

|

Change

|

|||||||||

|

Sales

|

$

|

5,879.5

|

|

$

|

6,307.9

|

|

$

|

(428.4

|

)

|

|||

|

Income before income taxes

|

943.1

|

|

1,127.5

|

|

(184.4

|

)

|

||||||

|

Diluted EPS

|

5.56

|

|

6.09

|

|

(0.53

|

)

|

||||||

|

Adjusted EPS

|

5.93

|

|

6.40

|

|

(0.47

|

)

|

||||||

|

Change vs.

|

Change in Organic

Sales

(1)

vs.

|

|||||||||

|

Year Ended September 30, 2016

|

Year Ended September 30, 2015

|

Year Ended September 30, 2015

|

||||||||

|

United States

|

$

|

3,213.4

|

|

(6.8

|

)%

|

(6.9

|

)%

|

|||

|

Canada

|

316.4

|

|

(13.7

|

)%

|

(6.8

|

)%

|

||||

|

Europe, Middle East and Africa

|

1,147.2

|

|

(2.3

|

)%

|

1.8

|

%

|

||||

|

Asia Pacific

|

764.4

|

|

(8.4

|

)%

|

(4.8

|

)%

|

||||

|

Latin America

|

438.1

|

|

(9.9

|

)%

|

7.2

|

%

|

||||

|

Total sales

|

$

|

5,879.5

|

|

(6.8

|

)%

|

(3.9

|

)%

|

|||

|

(1)

|

Organic sales are sales excluding the effect of changes in currency exchange rates and acquisitions. See

Supplemental Sales Information

for information on this non-GAAP measure.

|

|

•

|

Sales in the United States declined year over year, mainly due to weakness in heavy industries, particularly oil and gas.

|

|

•

|

Sales in Canada decreased due to the unfavorable impact of currency translation as well as declines in heavy industries, particularly oil and gas.

|

|

•

|

EMEA sales decreased due to the unfavorable impact of currency translation. Organic sales increased in both mature Europe and emerging countries.

|

|

•

|

Asia Pacific sales declined due to the unfavorable impact of currency translation as well as a decrease in organic sales in China.

|

|

•

|

Latin America sales decreased due to the unfavorable impact of currency translation. Organic sales growth in the region was led by Mexico.

|

|

(in millions, except percentages)

|

2016

|

2015

|

Change

|

|

||||||||||

|

Sales

|

$

|

2,635.2

|

|

$

|

2,749.5

|

|

$

|

(114.3

|

)

|

|

||||

|

Segment operating earnings

|

695.0

|

|

808.6

|

|

(113.6

|

)

|

|

|||||||

|

Segment operating margin

|

26.4

|

%

|

29.4

|

%

|

(3.0

|

)

|

pts

|

|||||||

|

(in millions, except percentages)

|

2016

|

2015

|

Change

|

|

||||||||||

|

Sales

|

$

|

3,244.3

|

|

$

|

3,558.4

|

|

$

|

(314.1

|

)

|

|

||||

|

Segment operating earnings

|

493.7

|

|

551.9

|

|

(58.2

|

)

|

|

|||||||

|

Segment operating margin

|

15.2

|

%

|

15.5

|

%

|

(0.3

|

)

|

pts

|

|||||||

|

|

Year Ended September 30,

|

|||||||||||

|

|

2017

|

2016

|

2015

|

|||||||||

|

Cash provided by (used for):

|

|

|

|

|||||||||

|

Operating activities

|

$

|

1,034.0

|

|

$

|

947.3

|

|

$

|

1,187.7

|

|

|||

|

Investing activities

|

(516.7

|

)

|

(440.0

|

)

|

(246.9

|

)

|

||||||

|

Financing activities

|

(649.6

|

)

|

(397.7

|

)

|

(608.1

|

)

|

||||||

|

Effect of exchange rate changes on cash

|

16.8

|

|

(10.5

|

)

|

(96.7

|

)

|

||||||

|

Cash (used for) provided by continuing operations

|

$

|

(115.5

|

)

|

$

|

99.1

|

|

$

|

236.0

|

|

|||

|

|

Year Ended September 30,

|

|||||||||||

|

|

2017

|

2016

|

2015

|

|||||||||

|

Cash provided by continuing operating activities

|

$

|

1,034.0

|

|

$

|

947.3

|

|

$

|

1,187.7

|

|

|||

|

Capital expenditures

|

(141.7

|

)

|

(116.9

|

)

|

(122.9

|

)

|

||||||

|

Excess income tax benefit from share-based compensation

|

—

|

|

3.3

|

|

12.4

|

|

||||||

|

Free cash flow

|

$

|

892.3

|

|

$

|

833.7

|

|

$

|

1,077.2

|

|

|||

|

|

|

|

|

|||

|

Credit Rating Agency

|

Short Term Rating

|

Long Term Rating

|

Outlook

|

|||

|

Standard & Poor’s

|

A-1

|

A

|

Stable

|

|||

|

Moody’s

|

P-2

|

A3

|

Stable

|

|||

|

Fitch Ratings

|

F1

|

A

|

Stable

|

|||

|

|

Payments by Period

|

|||||||||||||||||||||||||||

|

|

Total

|

2018

|

2019

|

2020

|

2021

|

2022

|

Thereafter

|

|||||||||||||||||||||

|

Long-term debt and interest (a)

|

$

|

2,969.3

|

|

$

|

314.6

|

|

$

|

57.6

|

|

$

|

354.0

|

|

$

|

51.4

|

|

$

|

51.4

|

|

$

|

2,140.3

|

|

|||||||

|

Minimum operating lease payments

|

285.0

|

|

73.3

|

|

62.4

|

|

52.1

|

|

36.6

|

|

25.8

|

|

34.8

|

|

||||||||||||||

|

Postretirement benefits (b)

|

77.8

|

|

9.7

|

|

9.3

|

|

6.0

|

|

4.9

|

|

4.7

|

|

43.2

|

|

||||||||||||||

|

Pension funding contribution (c)

|

53.8

|

|

53.8

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||||||

|

Purchase obligations (d)

|

48.2

|

|

22.2

|

|

10.0

|

|

10.2

|

|

3.1

|

|

0.6

|

|

2.1

|

|

||||||||||||||

|

Other long-term liabilities (e)

|

83.0

|

|

11.0

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||||||

|

Unrecognized tax benefits (f)

|

35.1

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||||||

|

Total

|

3,552.2

|

|

484.6

|

|

139.3

|

|

422.3

|

|

96.0

|

|

|

82.5

|

|

2,220.4

|

|

|||||||||||||

|

(a)

|

The amounts for long-term debt assume that the respective debt instruments will be outstanding until their scheduled maturity dates. The amounts include interest but exclude the amounts to be paid or received under interest rate swap contracts, including the

$4.6 million

fair value adjustment recorded for the interest rate swap contracts at

September 30, 2017

and the unamortized discount of

$44.8 million

at

September 30, 2017

. The 2018 amount includes the

$250.0 million

5.65% notes due in December 2017. See Note 5 in the Financial Statements for more information regarding our long-term debt.

|

|

(b)

|

Our postretirement benefit plans are unfunded and are subject to change. Amounts reported are estimates of future benefit payments, to the extent estimable.

|

|

(c)

|

Amounts reported for pension funding contributions reflect current estimates of known commitments. Contributions to our pension plans beyond

2018

will depend on future investment performance of our pension plan assets, changes in discount rate assumptions and governmental regulations in effect at the time. Amounts subsequent to

2018

are excluded from the summary above, as these amounts cannot be estimated with certainty. The minimum contribution for our U.S. pension plan as required by the Employee Retirement Income Security Act (ERISA) is currently zero. We may make additional contributions to this plan at the discretion of management.

|

|

(d)

|

This item includes contractual commitments for capital expenditures, certain materials purchases and long-term obligations under agreements with various service providers.

|

|

(e)

|

Other long-term liabilities include environmental remediation costs, conditional asset retirement obligations and indemnification liabilities, net of related receivables. Amounts subsequent to

2018

are excluded from the summary above, as we are unable to make a reasonably reliable estimate of when the liabilities will be paid.

|

|

(f)

|

Amount for unrecognized tax benefits includes accrued interest and penalties. We are unable to make a reasonably reliable estimate of when the liabilities for unrecognized tax benefits will be settled or paid.

|

|

Year Ended September 30, 2016

|

|||||||||||||||||||||||

|

|

Year Ended September 30, 2017

|

||||||||||||||||||||||

|

Sales

|

Effect of

Changes in

Currency

|

Sales

Excluding

Changes in

Currency

|

Effect of

Acquisitions

|

Organic

Sales

|

Sales

|

||||||||||||||||||

|

United States

|

$

|

3,458.4

|

|

$

|

0.5

|

|

$

|

3,458.9

|

|

$

|

(77.9

|

)

|

$

|

3,381.0

|

|

$

|

3,213.4

|

|

|||||

|

Canada

|

343.4

|

|

(2.5

|

)

|

340.9

|

|

(0.1

|

)

|

340.8

|

|

316.4

|

|

|||||||||||

|

Europe, Middle East and Africa

|

1,193.7

|

|

3.7

|

|

1,197.4

|

|

(6.8

|

)

|

1,190.6

|

|

1,147.2

|

|

|||||||||||

|

Asia Pacific

|

866.4

|

|

6.5

|

|

872.9

|

|

(2.4

|

)

|

870.5

|

|

764.4

|

|

|||||||||||

|

Latin America

|

449.4

|

|

6.9

|

|

456.3

|

|

(0.2

|

)

|

456.1

|

|

438.1

|

|

|||||||||||

|

Total Company Sales

|

$

|

6,311.3

|

|

$

|

15.1

|

|

$

|

6,326.4

|

|

$

|

(87.4

|

)

|

$

|

6,239.0

|

|

$

|

5,879.5

|

|

|||||

|

Year Ended September 30, 2015

|

|||||||||||||||||||||||

|

|

Year Ended September 30, 2016

|

||||||||||||||||||||||

|

Sales

|

Effect of

Changes in

Currency

|

Sales

Excluding

Changes in

Currency

|

Effect of

Acquisitions

|

Organic

Sales

|

Sales

|

||||||||||||||||||

|

United States

|

$

|

3,213.4

|

|

$

|

2.1

|

|

$

|

3,215.5

|

|

$

|

(6.9

|

)

|

$

|

3,208.6

|

|

$

|

3,446.8

|

|

|||||

|

Canada

|

316.4

|

|

25.1

|

|

341.5

|

|

—

|

|

341.5

|

|

366.6

|

|

|||||||||||

|

Europe, Middle East and Africa

|

1,147.2

|

|

49.1

|

|

1,196.3

|

|

(1.1

|

)

|

1,195.2

|

|

1,174.0

|

|

|||||||||||

|

Asia Pacific

|

764.4

|

|

31.7

|

|

796.1

|

|

(1.6

|

)

|

794.5

|

|

834.5

|

|

|||||||||||

|

Latin America

|

438.1

|

|

83.0

|

|

521.1

|

|

—

|

|

521.1

|

|

486.0

|

|

|||||||||||

|

Total Company Sales

|

$

|

5,879.5

|

|

$

|

191.0

|

|

$

|

6,070.5

|

|

$

|

(9.6

|

)

|

$

|

6,060.9

|

|

$

|

6,307.9

|

|

|||||

|

Year Ended September 30, 2016

|

|||||||||||||||||||||||

|

|

Year Ended September 30, 2017

|

||||||||||||||||||||||

|

Sales

|

Effect of

Changes in

Currency

|

Sales

Excluding

Changes in

Currency

|

Effect of

Acquisitions

|

Organic

Sales

|

Sales

|

||||||||||||||||||

|

Architecture & Software

|

$

|

2,899.3

|

|

$

|

7.1

|

|

$

|

2,906.4

|

|

$

|

(22.5

|

)

|

$

|

2,883.9

|

|

$

|

2,635.2

|

|

|||||

|

Control Products & Solutions

|

3,412.0

|

|

8.0

|

|

3,420.0

|

|

(64.9

|

)

|

3,355.1

|

|

3,244.3

|

|

|||||||||||

|

Total Company Sales

|

$

|

6,311.3

|

|

$

|

15.1

|

|

$

|

6,326.4

|

|

$

|

(87.4

|

)

|

$

|

6,239.0

|

|

$

|

5,879.5

|

|

|||||

|

Year Ended September 30, 2015

|

|||||||||||||||||||||||

|

|

Year Ended September 30, 2016

|

||||||||||||||||||||||

|

Sales

|

Effect of

Changes in

Currency

|

Sales

Excluding

Changes in

Currency

|

Effect of

Acquisitions

|

Organic

Sales

|

Sales

|

||||||||||||||||||

|

Architecture & Software

|

$

|

2,635.2

|

|

$

|

83.7

|

|

$

|

2,718.9

|

|

$

|

(9.3

|

)

|

$

|

2,709.6

|

|

$

|

2,749.5

|

|

|||||

|

Control Products & Solutions

|

3,244.3

|

|

107.3

|

|

3,351.6

|

|

(0.3

|

)

|

3,351.3

|

|

3,558.4

|

|

|||||||||||

|

Total Company Sales

|

$

|

5,879.5

|

|

$

|

191.0

|

|

$

|

6,070.5

|

|

$

|

(9.6

|

)

|

$

|

6,060.9

|

|

$

|

6,307.9

|

|

|||||

|

Asset Category

|

Target Allocations

|

Expected Return

|

||||

|

Equity securities

|

55%

|

9%

|

–

|

10%

|

||

|

Debt securities

|

40%

|

4%

|

–

|

6%

|

||

|

Other

|

5%

|

6%

|

–

|

11%

|

||

|

|

Pension Benefits

|

|||||||

|

Change in

Projected Benefit

Obligation

|

Change in Net Periodic Benefit Cost

(1)

|

|||||||

|

Discount rate

|

$

|

130.4

|

|

$

|

12.7

|

|

||

|

Return on plan assets

|

—

|

|

6.7

|

|

||||

|

|

September 30,

|

||||||

|

|

2017

|

2016

|

|||||

|

ASSETS

|

|||||||

|

Current assets:

|

|

|

|||||

|

Cash and cash equivalents

|

$

|

1,410.9

|

|

$

|

1,526.4

|

|

|

|

Short-term investments

|

1,124.6

|

|

902.8

|

|

|||

|

Receivables

|

1,135.5

|

|

1,079.0

|

|

|||

|

Inventories

|

558.7

|

|

526.6

|

|

|||

|

Other current assets

|

191.0

|

|

150.2

|

|

|||

|

Total current assets

|

4,420.7

|

|

4,185.0

|

|

|||

|

Property, net

|

583.9

|

|

578.3

|

|

|||

|

Goodwill

|

1,077.7

|

|

1,073.9

|

|

|||

|

Other intangible assets, net

|

238.0

|

|

255.3

|

|

|||

|

Deferred income taxes

|

443.6

|

|

633.9

|

|

|||

|

Other assets

|

397.8

|

|

374.8

|

|

|||

|

Total

|

$

|

7,161.7

|

|

$

|

7,101.2

|

|

|

|

LIABILITIES AND SHAREOWNERS’ EQUITY

|

|||||||

|

Current liabilities:

|

|

|

|||||

|

Short-term debt

|

$

|

350.4

|

|

$

|

448.6

|

|

|

|

Current portion of long-term debt

|

250.0

|

|

—

|

|

|||

|

Accounts payable

|

623.2

|

|

543.1

|

|

|||

|

Compensation and benefits

|

272.6

|

|

145.6

|

|

|||

|

Advance payments from customers and deferred revenue

|

240.6

|

|

214.5

|

|

|||

|

Customer returns, rebates and incentives

|

188.8

|

|

176.5

|

|

|||

|

Other current liabilities

|

220.2

|

|

447.6

|

|

|||

|

Total current liabilities

|

2,145.8

|

|

1,975.9

|

|

|||

|

Long-term debt

|

1,243.4

|

|

1,516.3

|

|

|||

|

Retirement benefits

|

892.5

|

|

1,430.2

|

|

|||

|

Other liabilities

|

216.4

|

|

188.7

|

|

|||

|

Commitments and contingent liabilities (Note 15)

|

|

|

|||||

|

Shareowners’ equity:

|

|

|

|||||

|

Common stock ($1.00 par value, shares issued: 181.4)

|

181.4

|

|

181.4

|

|

|||

|

Additional paid-in capital

|

1,638.0

|

|

1,588.2

|

|

|||

|

Retained earnings

|

6,103.4

|

|

5,668.4

|

|

|||

|

Accumulated other comprehensive loss

|

(1,179.2

|

)

|

(1,538.8

|

)

|

|||

|

Common stock in treasury, at cost (shares held: 2017, 53.0; 2016, 52.9)

|

(4,080.0

|

)

|

(3,909.1

|

)

|

|||

|

Total shareowners’ equity

|

2,663.6

|

|

1,990.1

|

|

|||

|

Total

|

$

|

7,161.7

|

|

$

|

7,101.2

|

|

|

|

|

Year Ended September 30,

|

||||||||||

|

|

2017

|

2016

|

2015

|

||||||||

|

Sales

|

|

|

|

||||||||

|

Products and solutions

|

$

|

5,628.9

|

|

$

|

5,239.3

|

|

$

|

5,652.2

|

|

||

|

Services

|

682.4

|

|

640.2

|

|

655.7

|

|

|||||

|

|

6,311.3

|

|

5,879.5

|

|

6,307.9

|

|

|||||

|

Cost of sales

|

|

|

|

||||||||

|

Products and solutions

|

(3,254.3

|

)

|

(2,982.1

|

)

|

(3,157.2

|

)

|

|||||

|

Services

|

(432.8

|

)

|

(421.9

|

)

|

(447.6

|

)

|

|||||

|

|

(3,687.1

|

)

|

(3,404.0

|

)

|

(3,604.8

|

)

|

|||||

|

Gross profit

|

2,624.2

|

|

2,475.5

|

|

2,703.1

|

|

|||||

|

Selling, general and administrative expenses

|

(1,591.5

|

)

|

(1,467.4

|

)

|

(1,506.4

|

)

|

|||||

|

Other income (expense) (Note 13)

|

80.9

|

|

6.3

|

|

(5.5

|

)

|

|||||

|

Interest expense

|

(76.2

|

)

|

(71.3

|

)

|

(63.7

|

)

|

|||||

|

Income before income taxes

|

1,037.4

|

|

943.1

|

|

1,127.5

|

|

|||||

|

Income tax provision (Note 14)

|

(211.7

|

)

|

(213.4

|

)

|

(299.9

|

)

|

|||||

|

Net income

|

$

|

825.7

|

|

$

|

729.7

|

|

$

|

827.6

|

|

||

|

Earnings per share:

|

|

|

|

||||||||

|

Basic

|

$

|

6.42

|

|

$

|

5.60

|

|

$

|

6.15

|

|

||

|

Diluted

|

$

|

6.35

|

|

$

|

5.56

|

|

$

|

6.09

|

|

||

|

Weighted average outstanding shares:

|

|

|

|

||||||||

|

Basic

|

128.4

|

|

130.2

|

|

134.5

|

|

|||||

|

Diluted

|

129.9

|

|

131.1

|

|

135.7

|

|

|||||

|

|

Year Ended September 30,

|

||||||||||

|

|

2017

|

2016

|

2015

|

||||||||

|

Net income

|

$

|

825.7

|

|

$

|

729.7

|

|

$

|

827.6

|

|

||

|

Other comprehensive income (loss):

|

|

|

|

||||||||

|

Pension and other postretirement benefit plan adjustments (net of tax expense (benefit) of $159.3, ($73.7) and ($106.6))

|

312.8

|

|

(142.7

|

)

|

(187.7

|

)

|

|||||

|

Currency translation adjustments

|

57.2

|

|

(42.5

|

)

|

(199.9

|

)

|

|||||

|

Net change in unrealized gains and losses on cash flow hedges (net of tax (benefit) expense of ($2.8), ($6.7) and $4.5)

|

(10.3

|

)

|

(19.0

|

)

|

1.0

|

|

|||||

|

Net change in unrealized gains and losses on available-for-sale investments

|

(0.1

|

)

|

—

|

|

—

|

|

|||||

|

Other comprehensive income (loss)

|

359.6

|

|

(204.2

|

)

|

(386.6

|

)

|

|||||

|

Comprehensive income

|

$

|

1,185.3

|

|

$

|

525.5

|

|

$

|

441.0

|

|

||

|

|

Year Ended September 30,

|

|||||||||||

|

|

2017

|

2016

|

2015

|

|||||||||

|

Operating activities:

|

|

|

|

|||||||||

|

Net income

|

$

|

825.7

|

|

$

|

729.7

|

|

$

|

827.6

|

|

|||

|

Adjustments to arrive at cash provided by operating activities:

|

|

|

|

|||||||||

|

Depreciation

|

138.7

|

|

143.3

|

|

133.1

|

|

||||||

|

Amortization of intangible assets

|

30.2

|

|

28.9

|

|

29.4

|

|

||||||

|

Share-based compensation expense

|

38.5

|

|

40.5

|

|

41.5

|

|

||||||

|

Retirement benefit expense

|

176.0

|

|

157.1

|

|

141.3

|

|

||||||

|

Pension contributions

|

(254.9

|

)

|

(44.3

|

)

|

(41.0

|

)

|

||||||

|

Deferred income taxes

|

33.8

|

|

(70.5

|

)

|

(29.3

|

)

|

||||||

|

Gain on sale of business

|

(60.8

|

)

|

—

|

|

—

|

|

—

|

|

||||

|

Net loss (gain) on disposition of property

|

0.1

|

|

1.7

|

|

(0.1

|

)

|

||||||

|

Excess income tax benefit from share-based compensation

|

—

|

|

(3.3

|

)

|

(12.4

|

)

|

||||||

|

Changes in assets and liabilities, excluding effects of acquisitions and foreign currency adjustments:

|

||||||||||||

|

Receivables

|

(53.0

|

)

|

(18.9

|

)

|

73.4

|

|

||||||

|

Inventories

|

(30.4

|

)

|

4.6

|

|

(2.5

|

)

|

||||||

|

Accounts payable

|

81.1

|

|

32.3

|

|

17.3

|

|

||||||

|

Advance payments from customers and deferred revenue

|

21.3

|

|

11.7

|

|

20.7

|

|

||||||

|

Compensation and benefits

|

124.7

|

|

(81.1

|

)

|

(33.9

|

)

|

||||||

|

Income taxes

|

(22.2

|

)

|

(8.9

|

)

|

27.3

|

|

||||||

|

Other assets and liabilities

|

(14.8

|

)

|

24.5

|

|

(4.7

|

)

|

||||||

|

Cash provided by operating activities

|

1,034.0

|

|

947.3

|

|

1,187.7

|

|

||||||

|

Investing activities:

|

|

|

|

|||||||||

|

Capital expenditures

|

(141.7

|

)

|

(116.9

|

)

|

(122.9

|

)

|

||||||

|

Acquisition of businesses, net of cash acquired

|

(1.1

|

)

|

(139.1

|

)

|

(21.2

|

)

|

||||||

|

Purchases of investments

|

(1,444.2

|

)

|

(1,070.7

|

)

|

(867.6

|

)

|

||||||

|

Proceeds from maturities of investments

|

912.6

|

|

886.3

|

|

762.7

|

|

||||||

|

Proceeds from sale of investments

|

62.6

|

|

—

|

|

—

|

|

||||||

|

Proceeds from sale of business

|

94.0

|

|

—

|

|

—

|

|

||||||

|

Proceeds from sale of property

|

1.1

|

|

0.4

|

|

2.1

|

|

||||||

|

Cash used for investing activities

|

(516.7

|

)

|

(440.0

|

)

|

(246.9

|

)

|

||||||

|

Financing activities:

|

|

|

|

|||||||||

|

Net (repayment) issuance of short-term debt

|

(98.2

|

)

|

448.6

|

|

(325.0

|

)

|

||||||

|

Issuance of long-term debt, net of discount and issuance costs

|

—

|

|

—

|

|

594.3

|

|

||||||

|

Cash dividends

|

(390.7

|

)

|

(378.2

|

)

|

(350.1

|

)

|

||||||

|

Purchases of treasury stock

|

(342.6

|

)

|

(507.6

|

)

|

(598.4

|

)

|

||||||

|

Proceeds from the exercise of stock options

|

181.9

|

|

36.2

|

|

60.3

|

|

||||||

|

Excess income tax benefit from share-based compensation

|

—

|

|

3.3

|

|

12.4

|

|

||||||

|

Other financing activities

|

—

|

|

—

|

|

(1.6

|

)

|

||||||

|

Cash used for financing activities

|

(649.6

|

)

|

(397.7

|

)

|

(608.1

|

)

|

||||||

|

Effect of exchange rate changes on cash

|

16.8

|

|

(10.5

|

)

|

(96.7

|

)

|

||||||

|

(Decrease) increase in cash and cash equivalents

|

(115.5

|

)

|

99.1

|

|

236.0

|

|

||||||

|

Cash and cash equivalents at beginning of year

|

1,526.4

|

|

1,427.3

|

|

1,191.3

|

|

||||||

|

Cash and cash equivalents at end of year

|

$

|

1,410.9

|

|

$

|

1,526.4

|

|

$

|

1,427.3

|

|

|||

|

|

Year Ended September 30,

|

||||||||||

|

|

2017

|

2016

|

2015