|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Colorado

|

20-5566275

|

|

|

(State or other jurisdiction of

Incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

Yes þ No o

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | þ |

| (Do not check if a s maller reporting company) |

|

Page No.

|

|||||

|

Index

|

|||||

|

PART I

|

|||||

|

Item 1.

|

Business

|

4 | |||

|

Item 1A.

|

Risk Factors

|

8 | |||

|

Item 1B.

|

Unresolved Staff Comments

|

18 | |||

|

Item 2

|

Properties

|

18 | |||

|

Item 3.

|

Legal Proceedings

|

18 | |||

|

Item 4.

|

Submission of Matters to a Vote of Security Holders

|

18 | |||

|

PART II

|

|||||

|

Item 5.

|

Market for the Registrant’s Common Equity and Related Stockholder Matters

and Issuer Purchases of Equity Securities

|

19 | |||

|

Item 6.

|

Selected Financial Data

|

21 | |||

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

|

21 | |||

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

24 | |||

|

Item 8.

|

Financial Statements and Supplementary Data

|

24 | |||

|

Item 9.

|

Changes in and Disagreements on Accounting and Financial Disclosure

|

25 | |||

|

Item 9A.

|

Controls and Procedures

|

25 | |||

|

Item 9B.

|

Other Information

|

26 | |||

|

PART III

|

|||||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

27 | |||

|

Item 11.

|

Executive Compensation

|

28 | |||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management

and Related Stockholder Matters

|

29 | |||

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

30 | |||

|

Item 14.

|

Principal Accounting Fees and Services

|

31 | |||

|

PART IV

|

|||||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

32 | |||

|

Signatures

|

33 | ||||

|

•

|

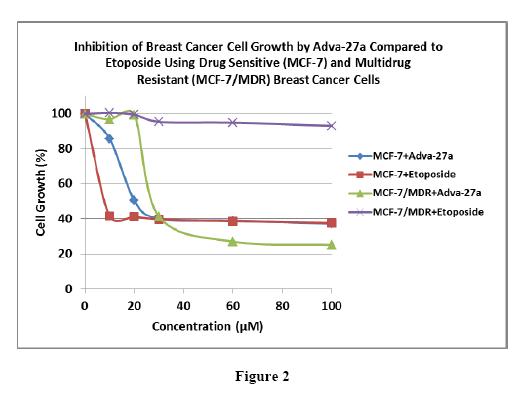

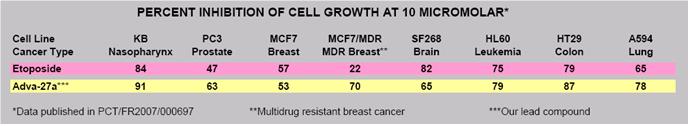

Adva-27a is 16-times more effective at killing multidrug resistant breast cancer cells than Etoposide.

|

|

•

|

Adva-27a is unaffected by P-Glycoprotein, the enzyme responsible for making cancer cells resistant to anti-tumor drugs.

|

|

•

|

Adva-27a has excellent clearance time (half-life = 54 minutes) as indicated by human microsomes stability studies and pharmacokinetics data in rats.

|

|

•

|

Adva-27a clearance is independent of Cytochrome P450, a mechanism that is less likely to produce toxic intermediates.

|

|

•

|

Adva-27a is an excellent inhibitor of Topoisomerase II with an IC50 of only 13.7 micromolar.

|

|

•

|

Adva-27a has shown excellent pharmacokinetics profile as indicated by studies done in rats.

|

|

•

|

GMP Manufacturing (for use in IND-Enabling Studies and Phase I Clinical Trials)

|

|

•

|

IND-Enabling Studies

|

|

•

|

Regulatory Filing (Fast-Track Status Anticipated)

|

|

•

|

Phase I Clinical Trials (Multidrug Resistant Breast Cancer Indication)

|

|

•

|

Prepare and carry out for the development of Adva-27a; |

|

•

|

Expand our research and development activities;

|

|

•

|

Increase our required corporate infrastructure and overhead.

|

We have not conducted any significant business operations yet and have been unprofitable to date.

|

•

|

difficulty recruiting and retaining adequate numbers of effective sales and marketing personnel;

|

|

•

|

the inability of sales personnel to obtain access to, or persuade adequate numbers of, physicians to prescribe our products;

|

|

•

|

the lack of complementary products to be offered by sales personnel, which may put us at a competitive disadvantage against companies with broader product lines; and

|

|

•

|

unforeseen costs associated with creating an independent sales and marketing organization.

|

|

•

|

our ability to provide acceptable evidence of safety and efficacy;

|

|

•

|

relative convenience and ease of administration;

|

|

•

|

the prevalence and severity of any adverse side effects;

|

|

•

|

the availability of alternative treatments;

|

|

•

|

the details of FDA labeling requirements, including the scope of approved indications and any safety warnings;

|

|

•

|

pricing and cost effectiveness;

|

|

•

|

the effectiveness of our or our collaborators' sales and marketing strategy;

|

|

•

|

our ability to obtain sufficient third-party insurance coverage or reimbursement; and

|

|

•

|

our ability to have the product listed on insurance company formularies.

|

|

•

|

demonstrating sufficient safety to obtain regulatory approval to commence a clinical trial;

|

|

•

|

reaching agreement on acceptable terms with prospective research organizations and trial sites;

|

|

•

|

manufacturing sufficient quantities of a product candidate;

|

|

•

|

obtaining institutional review board approvals to conduct clinical trials at prospective sites; and

|

|

•

|

procuring adequate financing to fund the work.

|

|

•

|

we were the first to make the inventions covered by each of our pending patent applications;

|

|

•

|

we were the first to file patent applications for these inventions;

|

|

•

|

others will not independently develop similar or alternative technologies or duplicate any of our technologies;

|

|

•

|

our pending patent applications will result in issued patents;

|

|

•

|

any patents issued to us or our collaborators will provide a basis for commercially viable products, will provide us with any competitive advantages or will not be challenged by third parties;

|

|

•

|

we will develop additional proprietary technologies that are patentable; or

|

|

•

|

the patents of others will not have a negative effect on our ability to do business.

|

|

•

|

competitive pricing pressures;

|

|

•

|

our ability to produce and sell our products on a cost-effective and timely basis;

|

|

•

|

our inability to obtain working capital financing;

|

|

•

|

the introduction and announcement of one or more new alternatives to our products by our competitors;

|

|

•

|

changing conditions in the market;

|

|

•

|

changes in market valuations of similar companies;

|

|

•

|

stock market price and volume fluctuations generally;

|

|

•

|

regulatory developments;

|

|

•

|

fluctuations in our quarterly or annual operating results;

|

|

•

|

additions or departures of key personnel; and

|

|

•

|

future sales of our Common Stock or other securities.

|

|

Quarter Ended

|

High

|

Low

|

||||||

|

March 31, 2011

|

$ | 0.70 | $ | 0.125 | ||||

|

June 30, 2011

|

$ | 0.75 | $ | 0.10 | ||||

|

September 31, 2011

|

$ | 1.36 | $ | 0.25 | ||||

|

December 31, 2011

|

$ | 0.60 | $ | 0.12 | ||||

|

March 31, 2010

|

$ | 1.25 | $ | 0.00 | ||||

|

June 30, 2010

|

$ | 0.99 | $ | 0.00 | ||||

|

September 31, 2010

|

$ | 1.15 | $ | 0.45 | ||||

|

December 31, 2010

|

$ | 1.25 | $ | 0.35 |

|

•

|

contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;

|

|

•

|

contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of the Securities Act of 1934, as amended;

|

|

•

|

contains a brief, clear, narrative description of a dealer market, including "bid" and "ask" prices for penny stocks and the significance of the spread between the bid and ask price;

|

|

•

|

contains a toll-free telephone number for inquiries on disciplinary actions;

|

|

•

|

defines significant terms in the disclosure document or in the conduct of trading penny stocks; and

|

|

•

|

contains such other information and is in such form (including language, type, size and format) as the Securities and Exchange Commission shall require by rule or regulation;

|

|

•

|

the bid and offer quotations for the penny stock;

|

|

•

|

the compensation of the broker-dealer and its salesperson in the transaction;

|

|

•

|

the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and

|

|

•

|

monthly account statements showing the market value of each penny stock held in the customer's account.

|

|

Page No.

|

||||

|

Independent Accountant’s Audit Report

|

F-3 | |||

|

Independent Accountant’s Audit Report

|

F-4 | |||

|

Consolidated Balance Sheet

|

F-5 | |||

|

Consolidated Statement of Operations

|

F-6 | |||

|

Consolidated Statement of Cash Flow

|

F-7 | |||

|

Statement of Shareholders’ Equity

|

F-8-F-10 | |||

|

Notes to the Consolidated Financial Statements

|

F-11-F-16 | |||

| Aurora, Colorado | Ronald R. Chadwick, P.C. |

| March 16, 2012 | Ronald R. Chadwick, P.C. |

|

December 31,

|

December 31,

|

|||||||

|

2011

|

2010

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets:

|

||||||||

|

Cash and cash equivalents

|

$ | 60,692 | $ | 162,391 | ||||

|

Prepaid expenses

|

45,745 | 45,233 | ||||||

|

Total Current Assets

|

106,437 | 207,624 | ||||||

|

TOTAL ASSETS

|

$ | 106,437 | $ | 207,624 | ||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts payable

|

3,434 | 11,404 | ||||||

|

TOTAL LIABILITIES

|

3,434 | 11,404 | ||||||

|

SHAREHOLDERS' EQUITY

|

||||||||

|

Preferred stock, $0.10 par value per share;Authorized 5,000,000 Shares;

|

||||||||

|

Issued and outstanding -0- and 850,000 shares respectively

|

- | 73,000 | ||||||

|

Common Stock, $0.001 per share;

Authorized 200,000,000 Shares; Issued

|

||||||||

|

and outstanding 48,728,842 and 30,691,342 shares respectively

|

48,729 | 30,691 | ||||||

|

Capital paid in excess of par value

|

2,348,988 | 1,831,041 | ||||||

|

(Deficit) accumulated during the development stage

|

(2,294,714 | ) | (1,738,512 | ) | ||||

|

TOTAL SHAREHOLDERS' EQUITY

|

103,003 | 196,220 | ||||||

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

|

$ | 106,437 | $ | 207,624 | ||||

|

August 17, 2009

|

August 17, 2009

|

|||||||||||

|

(inception) through

|

(inception) through

|

|||||||||||

|

December 31,

|

December 31,

|

December 31,

|

||||||||||

|

2011

|

2010

|

2011

|

||||||||||

|

Revenue:

|

$ | - | $ | - | $ | - | ||||||

|

Expenses:

|

||||||||||||

|

Research & Development

|

142,650 | - | 142,650 | |||||||||

|

Accounting

|

12,050 | 11,795 | 31,445 | |||||||||

|

Financial consulting

|

15,000 | 145,302 | 162,357 | |||||||||

|

Licenses

|

200,000 | 250,000 | 450,000 | |||||||||

|

Office

|

7,254 | 761 | 11,723 | |||||||||

|

Legal

|

30,012 | 65,333 | 141,088 | |||||||||

|

Merger costs

|

- | - | 155,150 | |||||||||

|

Public relations

|

140,504 | 60,366 | 241,768 | |||||||||

|

Stock transfer

|

8,732 | 3,825 | 12,557 | |||||||||

|

Writedown of intangible assets

|

- | - | 945,976 | |||||||||

|

Total Expenses

|

556,202 | 537,382 | 2,294,714 | |||||||||

|

Net (Loss)

|

$ | (556,202 | ) | $ | (537,382 | ) | $ | (2,294,714 | ) | |||

|

Basic (Loss) per common share

|

(0.02 | ) | (0.02 | ) | ||||||||

|

Weighted Average Common Shares Outstanding

|

30,881,676 | 29,855,924 | ||||||||||

|

August 17,

|

August 17,

|

|||||||||||

|

2009 (inception)

|

2009 (inception)

|

|||||||||||

|

through

|

through

|

|||||||||||

|

December 31,

|

December 31,

|

December 31,

|

||||||||||

|

2011

|

2010

|

2011

|

||||||||||

|

Cash Flows From Operating Activities:

|

||||||||||||

|

Net (Loss)

|

$ | (556,202 | ) | $ | (537,382 | ) | $ | (2,294,714 | ) | |||

|

Adjustments to reconcile net loss to net cash used in

|

||||||||||||

|

operating activities:

|

||||||||||||

|

Stock issued for licenses, services, and other assets

|

267,385 | 237,200 | 1,154,517 | |||||||||

|

Increase in prepaid expenses

|

(512 | ) | (45,233 | ) | (45,745 | ) | ||||||

|

Increase (Decrease) in Accounts Payable

|

(7,970 | ) | (2,910 | ) | 3,434 | |||||||

|

Net Cash Flows (used) in operations

|

(297,299 | ) | (348,325 | ) | (1,182,508 | ) | ||||||

|

Cash Flows From Investing Activities:

|

||||||||||||

|

Net Cash Flows (used) in Investing activities

|

- | - | - | |||||||||

|

Cash Flows From Financing Activities:

|

||||||||||||

|

Issuance of common stock for cash

|

195,600 | 398,600 | 1,243,200 | |||||||||

|

Net Cash Flows provided by financing activities

|

195,600 | 398,600 | 1,243,200 | |||||||||

|

Net Increase (Decrease) In Cash and cash equivalents

|

(101,699 | ) | 50,275 | 60,692 | ||||||||

|

Cash and cash equivalents at beginning of period

|

162,391 | 112,116 | - | |||||||||

|

Cash and cash equivalents at end of period

|

$ | 60,692 | $ | 162,391 | $ | 60,692 | ||||||

|

Supplementary Disclosure Of Cash Flow Information:

|

||||||||||||

|

Stock issued for services, licenses and other assets

|

$ | 267,385 | $ | 240,200 | $ | 890,132 | ||||||

|

Stock issued for note conversions

|

$ | - | $ | - | $ | 29,465 | ||||||

|

Stock issued for net deficit of MWBS

|

$ | - | $ | - | $ | (29,465 | ) | |||||

|

Cash paid for interest

|

$ | - | $ | - | $ | - | ||||||

|

Cash paid for income taxes

|

$ | - | $ | - | $ | - | ||||||

|

Number Of Common

Shares Issued

|

Common

Stock

|

Capital Paid

in Excess

|

Number Of

Preferred

|

Preferred

Stock

|

Stock

Subscription

|

Comprehensive

Income

|

Deficit accumulated

During the development stage

|

Total

|

||||||||||||||||||||||||||||

|

Balance at August 17, 2009 (Inception)

|

- | $ | - | $ | - | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||||||||

|

August 17, 2009 issued 703,118 shares of par value $.001 common stock for services valued at or $.004 per share

|

703,118 | 703 | 2,297 | 3,000 | ||||||||||||||||||||||||||||||||

|

August 19, 2009 issued 218,388 shares of par value $.001 common stock for services valued at or $.004 per share

|

218,388 | 218 | 714 | 932 | ||||||||||||||||||||||||||||||||

|

August 20, 2009 issued 17,109,194 shares of par value $.001 common stock and 730,000 share of par value $0.10 preferred stock for license agreement Advanomics: Common valued at or $.004 per shareand Preferred valued at or $.086 per share

|

17,109,194 | 17,109 | 55,891 | 850,000 | 73,000 | 146,000 | ||||||||||||||||||||||||||||||

|

September 24, 2009: Private Placement-The Company undertook to sell 2,220,552 shares of par value $.001 common stock for cash of $649,000 or $.2922 per share. Company bought 1,150,693 share of par value $.001 stock for cash of $336,312 or $.2922 per share; the remaining 1,069,859 shares were collected for cash of $312,688 in October 2009.

|

1,150,693 | 1,151 | 335,161 | 336,312 | ||||||||||||||||||||||||||||||||

| September 24, 2009 Common stock subscription (see notation above) for 1,069,074 shares of par value $.001 common stock valued at $.2922 per share | (312,688 | ) | 312,688 | - | ||||||||||||||||||||||||||||||||

|

September 30, 2009 issued 1,710,748 shares of par value $.001 common stock for asset purchase from Sunshine Bio Investment valued at or $.2922 per share

|

1,710,748 | 1,711 | 498,289 | - | 500,000 | |||||||||||||||||||||||||||||||

|

Net (Loss)

|

(650,130 | ) | (650,130 | ) | ||||||||||||||||||||||||||||||||

|

Balance at September 30, 2009

|

20,892,141 | 20,892 | 892,352 | 850,000 | 73,000 | (312,688 | ) | 312,688 | (650,130 | ) | 336,114 | |||||||||||||||||||||||||

|

October 31, 2009 issuance of common stock subscription, upon receipt of cash 1,069,859 shs of par value $.001 common stock valued at $.2922 per share

|

1,069,859 | 1,070 | 311,618 | 312,688 | (312,688 | ) | 312,688 | |||||||||||||||||||||||||||||

|

October 31, 2009 Outstanding stock of MWBS counted as issued for MWBS net deficit

|

888,000 | 888 | (30,353 | ) | (29,465 | ) | ||||||||||||||||||||||||||||||

|

Subtotal-at October 31, 2009 reverse merger date for accounting purposes

|

22,850,000 | 22,850 | 1,173,617 | 850,000 | 73,000 | - | - | (650,130 | ) | 619,337 | ||||||||||||||||||||||||||

|

November 16, 2009 Note conversions, several, Principle of $26,500 and interest of $2,965

|

6,810,000 | 6,810 | 22,655 | 29,465 | ||||||||||||||||||||||||||||||||

|

Fractional Shares

|

7 | - | ||||||||||||||||||||||||||||||||||

|

Net (Loss)

|

(551,000 | ) | (551,000 | ) | ||||||||||||||||||||||||||||||||

|

Balance at December 31, 2009

|

29,660,007 | 29,660 | 1,196,272 | 850,000 | 73,000 | - | - | (1,201,130 | ) | 97,802 | ||||||||||||||||||||||||||

|

June 2, 2010 issued 1,675,000

shares of par value $.001 common stock for services valued at or $.94 per share

|

1,675,000 | 1,675 | 1,572,825 | 1,574,500 | ||||||||||||||||||||||||||||||||

|

September 30, 2010 reversed issuance of 1,625,000 shares of par value $.001 common stock for services valued at or $.94 per share

|

(1,625,000 | ) | (1,625 | ) | (1,525,875 | ) | (1,527,500 | ) | ||||||||||||||||||||||||||||

|

September 30, 2010 issued 166,667 shares of par value $.001 common stock for cash at or $.60 per share

|

166,667 | 167 | 99,833 | 100,000 | ||||||||||||||||||||||||||||||||

|

October 1, 2010 issued 217,000

shares of par value $.001 common stock for services valued at or $.60 per share

|

217,000 | 217 | 129,983 | 130,200 |

| October 29, 2010 issued 100,000 | ||||||||||||||||||||||||||||||||||||

| shares of par value $.001 common stock | ||||||||||||||||||||||||||||||||||||

|

for services valued at or $.60 per share

|

100,000 | 100 | 59,900 | 60,000 | ||||||||||||||||||||||||||||||||

| October 31, 2010 issued 419,334 | ||||||||||||||||||||||||||||||||||||

| shares of par value $.001 common stock | ||||||||||||||||||||||||||||||||||||

|

for cash at or $.60 per share

|

419,334 | 419 | 251,181 | 251,600 | ||||||||||||||||||||||||||||||||

| November 30, 2010 issued 78,334 | ||||||||||||||||||||||||||||||||||||

| shares of par value $.001 common stock | ||||||||||||||||||||||||||||||||||||

|

for cash at or $.60 per share

|

78,334 | 78 | 46,922 | 47,000 | ||||||||||||||||||||||||||||||||

|

Net (Loss)

|

(537,382 | ) | (537,382 | ) | ||||||||||||||||||||||||||||||||

|

Balance at December 30, 2010

|

30,691,342 | $ | 30,691 | $ | 1,831,040 | 850,000 | $ | 73,000 | $ | - | $ | - | $ | (1,738,512 | ) | $ | 196,220 | |||||||||||||||||||

|

March 29, 2011 issued 20,000

shares of par value $.001 common stock for services valued at $ 12,000 or $.60 per share

|

20,000 | 20 | 11,980 | 12,000 | ||||||||||||||||||||||||||||||||

| September 1, 2011 issued 326,00 shares | ||||||||||||||||||||||||||||||||||||

| of par value $.001 common stock in a | ||||||||||||||||||||||||||||||||||||

|

private offering for cash at $0.60 per share

|

326,000 | 326 | 195,274 | 195,600 | ||||||||||||||||||||||||||||||||

|

November 3, 2011 issued 400,000 shares

of par value $.001 common stock for services for services valued at $ 200,000 or $.50 per share

|

400,000 | 400 | 199,600 | 200,000 | ||||||||||||||||||||||||||||||||

|

December 16, 2011 issued 291,500 shares of par value $.001 common stock for services

for services valued at $ 55,385 or $.19 per share

|

291,500 | 292 | 55,093 | 55,385 | ||||||||||||||||||||||||||||||||

|

December 21, 2011 converted 850,000 shares of preferred stock into 17,000,000 shares of par value $.001 common stock

|

17,000,000 | 17,000 | 56,000 | (850,000 | ) | (73,000 | ) | - | ||||||||||||||||||||||||||||

|

Net (Loss)

|

- | (556,202 | ) | (556,202 | ) | |||||||||||||||||||||||||||||||

|

Balance at December 31, 2011

|

48,728,842 | $ | 48,729 | $ | 2,348,987 | - | $ | - | $ | - | $ | - | $ | (2,294,714 | ) | $ | 103,003 |

|

•

|

Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the company;

|

|

•

|

Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and the receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the Company; and

|

|

•

|

Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisitions, use or disposition of the company’s assets that could have a material effect on the financial statements.

|

|

Name

|

Age

|

Position(s)

|

||

|

Dr. Steve N. Slilaty

|

59

|

President, Chief Executive Officer, and Chairman

|

||

|

Michele Di Turi

|

34

|

Chief Operating Officer and Director

|

||

|

Camille Sebaaly

|

52

|

Chief Financial Officer, Secretary and Director

|

|

Title of

Class

|

Name and Address

Of Beneficial Owner

|

Amount and Nature

Of Beneficial Ownership

|

Percent

Of Class

|

|||||

|

Common

|

Dr. Steve N. Slilaty

(1)

579 rue Lajeunesse

Laval, Quebec

Canada H7X 3K4

|

34,343,567 | (2) | 70.5 | % | |||

|

Common

|

Michele Di Turi

(1)

3100 Boulevard Des Gouverneurs

Laval, Quebec

Canada H7E 5J3

|

234,373 | * | |||||

|

Common

|

Camille Sebaaly

(1)

14464 Gouin W, #B

Montreal, Quebec

Canada H9H 1B1

|

234,373 | * | |||||

|

Common

|

All Officers and Directors

As a Group (3 persons)

|

34,812,313 | 71.4 | % | ||||

|

*

|

Less than 1%

|

|

(1)

|

Officer and Director of our Company.

|

|

(2)

|

Includes 34,109,194 shares held in the name of Advanomics Corporation. Dr. Slilaty is an officer, director and principal shareholder of Advanomics Corporation and as a result, controls the disposition of these shares.

|

|

December 31, 2011

|

December 31, 2010

|

December 31, 2009

|

||||||||||

|

Audit Fees

|

$ | 11,500 | $ | 7,500 | $ | 11,550 | ||||||

|

Audit Related Fees

|

- | - | - | |||||||||

|

Tax Fees

|

- | - | - | |||||||||

|

All Other Fees

|

- | - | - | |||||||||

|

Total

|

$ | 11,500 | $ | 7,500 | $ | 11,550 | ||||||

|

Exhibit No.

|

Description

|

|

|

Certification of Chief Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

||

|

Certification of Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

||

|

Certification of Chief Executive Officer and Chief Financial Officer Pursuant to 18 U.S.C. Section 1350

|

|

No.

|

Description

|

Filed With

|

Date

|

|||

|

3.1

|

Articles of Incorporation

|

Form SB-2 Registration Statement

|

October 19, 2007

|

|||

|

3.2

|

Bylaws

|

Form SB-2 Registration Statement

|

October 19, 2007

|

|||

|

3.3

|

Articles of Amendment

(Name Change)

|

Form 8-K Dated November 2, 2009

|

November 6, 2009

|

|||

|

10.1

|

Share Exchange Agreement with Sunshine Biopharma, Inc.

|

Form 8-K Dated October 15, 2009

|

October 20, 2009

|

|||

|

10.2

|

License Agreement with Advanomics Corp.

|

Form 8-KA1 Dated October 15, 2009

|

January 19, 2010

|

|||

|

10.3

|

Amendment No. 1 to License Agreement

|

Form 8-KA1 Dated October 15, 2009

|

January 19, 2010

|

|||

| 10.4 | Amendment No. 2 to License Agreement | Form 8-K Dated December 21, 2011 | December 23, 2011 | |||

|

21.1

|

List of Subsidiaries

|

Form 10-K For FYE July 31, 2009

|

October 29, 2009

|

| SUNSHINE BIOPHARMA, INC. | |||

|

Dated: March 19, 2012

|

By:

|

/s/ Dr. Steve N. Slilaty | |

| Dr. Steve N. Slilaty, Chief Executive Officer | |||

| /s/ Camille Sebaaly | |||

| Camille Sebaaly, Chief Financial Officer | |||

|

|

/s/ Dr. Steve N. Slilaty | ||

| Dr. Steve N. Slilaty, Director | |||

| /s/ Camille Sebaaly | |||

|

Camille Sebaaly, Director

|

|||

| /s/ Michele Di Turi | |||

| Michele Di Turi, Director |