|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

13-3385513

|

|

(State or other jurisdiction of

|

(IRS Employer Identification No.)

|

|

incorporation or organization)

|

|

|

557 Broadway, New York, New York

|

10012

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Title of class

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $0.01 par value

|

The NASDAQ Stock Market LLC

|

|

x

Large accelerated filer

|

o

Accelerated filer

|

o

Non-accelerated filer

(

Do not check if a smaller reporting company)

|

o

Smaller reporting company

|

o

Emerging growth company

|

|

Table of Contents

|

|

|

|

|

|

PAGE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

(Amounts in millions)

|

|||||||||||

|

2018

|

2017

|

2016

|

|||||||||

|

Children’s Book Publishing and Distribution

|

$

|

961.5

|

|

$

|

1,052.1

|

|

$

|

1,000.9

|

|

||

|

Education

|

297.3

|

|

312.7

|

|

299.7

|

|

|||||

|

International

|

369.6

|

|

376.8

|

|

372.2

|

|

|||||

|

Total

|

$

|

1,628.4

|

|

$

|

1,741.6

|

|

$

|

1,672.8

|

|

||

|

•

|

Prepublication costs -

Prepublication costs are incurred in all of the Company’s reportable segments. Prepublication costs include costs incurred to create and develop the art, prepress, editorial, digital conversion and other content required for the creation of the master copy of a book or other media.

|

|

•

|

Royalty advances -

Royalty advances are incurred in all of the Company’s reportable segments, but are most prevalent in the

Children’s Book Publishing and Distribution

segment and enable the Company to obtain contractual commitments from authors to produce Content. The Company regularly provides authors with advances against expected future royalty payments, often before the books are written. Upon publication and sale of the books or other media, the authors generally will not receive further royalty payments until the contractual royalties earned from sales of such books or other media exceed such advances. The Company values its position in the market as the largest publisher and distributor of children's books in obtaining Content, and the Company’s experienced editorial staff aggressively acquires Content from both new and established authors.

|

|

•

|

Acquired intangible assets -

The Company may acquire fully or partially developed Content from third parties via acquisitions of entities or outright purchase of the rights to Content.

|

|

Name

|

Age

|

|

Employed by

Registrant Since

|

Previous Position(s) Held

|

|

Richard Robinson

|

81

|

|

1962

|

Chairman of the Board (since 1982), President (since 1974) and Chief Executive Officer (since 1975).

|

|

Kenneth J. Cleary

|

53

|

|

2008

|

Chief Financial Officer (since 2017), Senior Vice President, Chief Accounting Officer (2014-2017), Vice President, External Reporting and Compliance (2008-2014).

|

|

Iole Lucchese

|

51

|

|

1991

|

Executive Vice President (since 2016), Chief Strategy Officer (since 2014); President, Scholastic Canada (2015-2016);

and Co-President, Scholastic Canada (2003-2015).

|

|

Satbir Bedi

|

54

|

|

2012

|

Executive Vice President (since 2018), Senior Vice President and Chief Technology Officer (2012-2018).

|

|

Judith A. Newman

|

60

|

|

1993

|

Executive Vice President and President, Book Clubs (since 2014), Book Clubs and eCommerce (2011-2014), Book Clubs (2005-2011) and Scholastic At Home (2005-2006); Senior Vice President and President, Book Clubs and Scholastic At Home (2004-2005); and Senior Vice President, Book Clubs (1997-2004).

|

|

Alan Boyko

|

64

|

|

1988

|

President, Scholastic Book Fairs, Inc. (since 2005).

|

|

Andrew S. Hedden

|

77

|

|

2008

|

Executive Vice President, General Counsel and Secretary (since 2008) and member of the Board of Directors (since 1991).

|

|

•

|

The ability of the Company to successfully implement its strategies for its respective business units in a timely manner

|

|

•

|

The introduction and acceptance of new products and services, including the success of its digital strategy and its ability to implement and successfully market its new core literacy program, as well as other programs, in its educational publishing business, as well as through the Company's educational publishing operation in Singapore

|

|

•

|

The ability to expand in the global markets that it serves

|

|

•

|

The ability to meet demand for content meeting current standards in the United States

|

|

•

|

Continuing success in implementing on-going cost containment and reduction programs

|

|

|

For fiscal years ended May 31,

|

||||||||||||||

|

|

2018

|

2017

|

|||||||||||||

|

High

|

Low

|

High

|

Low

|

||||||||||||

|

First Quarter

|

$

|

46.59

|

|

$

|

37.75

|

|

$

|

42.22

|

|

$

|

37.44

|

|

|||

|

Second Quarter

|

41.23

|

|

33.51

|

|

46.51

|

|

35.20

|

|

|||||||

|

Third Quarter

|

42.60

|

|

36.38

|

|

49.38

|

|

42.89

|

|

|||||||

|

Fourth Quarter

|

45.73

|

|

33.84

|

|

46.57

|

|

41.04

|

|

|||||||

|

Period

|

|

Total number of

shares purchased |

Average

price paid per share |

|

Total number of shares purchased as part of publicly

announced plans or programs |

Maximum number of shares (or approximate dollar value in millions) that may yet be purchased under the plans or programs (i)

|

||||||||

|

March 1, 2018 through March 31, 2018

|

|

56,144

|

|

$

|

36.56

|

|

|

56,144

|

|

|

$

|

61.4

|

|

|

|

April 1, 2018 through April 30, 2018

|

|

674

|

|

$

|

38.00

|

|

|

674

|

|

|

$

|

61.4

|

|

|

|

May 1, 2018 through May 31, 2018

|

|

—

|

|

$

|

—

|

|

|

—

|

|

|

$

|

61.4

|

|

|

|

Total

|

|

56,818

|

|

|

|

56,818

|

|

|

$

|

61.4

|

|

|||

|

|

Fiscal year ending May 31,

|

||||||||||||||||||||||

|

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

|||||||||||||||||

|

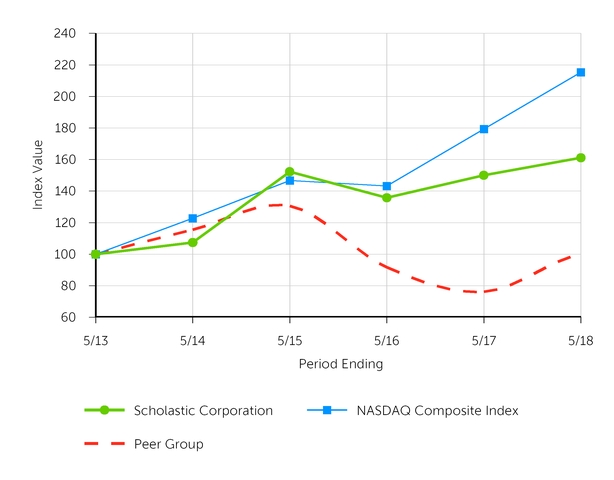

Scholastic Corporation

|

$

|

100.00

|

|

$

|

107.37

|

|

$

|

152.28

|

|

$

|

135.76

|

|

$

|

149.98

|

|

$

|

161.08

|

|

|||||

|

NASDAQ Composite Index

|

100.00

|

|

122.76

|

|

146.71

|

|

143.18

|

|

179.36

|

|

215.34

|

|

|||||||||||

|

Peer Group

|

100.00

|

|

115.54

|

|

130.57

|

|

91.75

|

|

76.25

|

|

100.01

|

|

|||||||||||

|

(Amounts in millions, except per share data)

For fiscal years ended May 31,

|

|||||||||||||||||||

|

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||||||

|

Statement of Operations Data:

|

|

|

|

|

|

||||||||||||||

|

Total revenues

|

$

|

1,628.4

|

|

$

|

1,741.6

|

|

$

|

1,672.8

|

|

$

|

1,635.8

|

|

$

|

1,561.5

|

|

||||

|

Cost of goods sold

(1)

|

744.6

|

|

814.5

|

|

762.3

|

|

758.5

|

|

725.0

|

|

|||||||||

|

Selling, general and administrative expenses (exclusive of depreciation and amortization)

(2)

|

763.2

|

|

777.5

|

|

773.6

|

|

765.6

|

|

726.0

|

|

|||||||||

|

Depreciation and amortization

|

43.9

|

|

38.7

|

|

38.9

|

|

47.9

|

|

60.3

|

|

|||||||||

|

Severance

(3)

|

9.9

|

|

14.9

|

|

11.9

|

|

9.6

|

|

10.5

|

|

|||||||||

|

Asset impairments

(4)

|

11.2

|

|

6.8

|

|

14.4

|

|

15.8

|

|

28.0

|

|

|||||||||

|

Operating income

|

55.6

|

|

89.2

|

|

71.7

|

|

38.4

|

|

11.7

|

|

|||||||||

|

Interest (income) expense, net

|

(1.1

|

)

|

1.0

|

|

1.1

|

|

3.5

|

|

6.9

|

|

|||||||||

|

Other components of net periodic benefit (cost)

(5)

|

(58.2

|

)

|

(0.3

|

)

|

(4.1

|

)

|

(5.5

|

)

|

(1.3

|

)

|

|||||||||

|

Gain (loss) on investments and other

(6)

|

0.0

|

|

—

|

|

2.2

|

|

0.5

|

|

(5.8

|

)

|

|||||||||

|

Earnings (loss) from continuing operations before income taxes

|

(1.5

|

)

|

|

87.9

|

|

|

68.7

|

|

|

29.9

|

|

|

(2.3

|

)

|

|||||

|

Provision (benefit) for income taxes

(7)

|

3.5

|

|

35.4

|

|

24.7

|

|

14.4

|

|

(15.6

|

)

|

|||||||||

|

Earnings (loss) from continuing operations

|

(5.0

|

)

|

52.5

|

|

44.0

|

|

15.5

|

|

13.3

|

|

|||||||||

|

Earnings (loss) from discontinued operations, net of tax

|

—

|

|

(0.2

|

)

|

(3.5

|

)

|

279.1

|

|

31.1

|

|

|||||||||

|

Net income (loss)

|

(5.0

|

)

|

52.3

|

|

40.5

|

|

294.6

|

|

44.4

|

|

|||||||||

|

Share Information:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Earnings (loss) from continuing operations:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Basic

|

$

|

(0.14

|

)

|

$

|

1.51

|

|

$

|

1.29

|

|

$

|

0.47

|

|

$

|

0.42

|

|

||||

|

Diluted

|

$

|

(0.14

|

)

|

$

|

1.48

|

|

$

|

1.26

|

|

$

|

0.46

|

|

$

|

0.41

|

|

||||

|

Earnings (loss) from discontinued operations:

|

|

|

|

|

|

|

|

|

|||||||||||

|

Basic

|

$

|

—

|

|

$

|

(0.00

|

)

|

$

|

(0.11

|

)

|

$

|

8.53

|

|

$

|

0.97

|

|

||||

|

Diluted

|

$

|

—

|

|

$

|

(0.01

|

)

|

$

|

(0.10

|

)

|

$

|

8.34

|

|

$

|

0.95

|

|

||||

|

Net income (loss):

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Basic

|

$

|

(0.14

|

)

|

|

$

|

1.51

|

|

|

$

|

1.18

|

|

$

|

9.00

|

|

$

|

1.39

|

|

||

|

Diluted

|

$

|

(0.14

|

)

|

|

$

|

1.47

|

|

|

$

|

1.16

|

|

$

|

8.80

|

|

$

|

1.36

|

|

||

|

Weighted average shares outstanding - basic

|

35.0

|

|

34.7

|

|

34.1

|

|

32.7

|

|

32.0

|

|

|||||||||

|

Weighted average shares outstanding - diluted

|

35.0

|

|

35.4

|

|

34.9

|

|

33.4

|

|

32.5

|

|

|||||||||

|

Dividends declared per common share

|

$

|

0.600

|

|

$

|

0.600

|

|

$

|

0.600

|

|

$

|

0.600

|

|

$

|

0.575

|

|

||||

|

Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Working Capital

|

$

|

512.5

|

|

$

|

583.4

|

|

$

|

571.8

|

|

$

|

562.4

|

|

$

|

233.2

|

|

||||

|

Cash and cash equivalents

|

391.9

|

|

444.1

|

|

399.7

|

|

506.8

|

|

20.9

|

|

|||||||||

|

Total assets

|

1,825.4

|

|

1,760.4

|

|

1,713.1

|

|

1,822.3

|

|

1,528.5

|

|

|||||||||

|

Long-term debt (excluding capital leases)

|

—

|

|

—

|

|

—

|

|

—

|

|

120.0

|

|

|||||||||

|

Total debt

|

7.9

|

|

6.2

|

|

6.3

|

|

6.0

|

|

135.8

|

|

|||||||||

|

Long-term capital lease obligations

|

6.2

|

|

6.5

|

|

7.5

|

|

0.4

|

|

—

|

|

|||||||||

|

Total capital lease obligations

|

7.5

|

|

7.6

|

|

8.6

|

|

0.7

|

|

—

|

|

|||||||||

|

Total stockholders’ equity

|

1,320.8

|

|

1,307.9

|

|

1,257.6

|

|

1,204.9

|

|

915.4

|

|

|||||||||

|

(1)

|

In fiscal 2018, the Company recognized pretax costs related to branch warehouse consolidation in Canada of

$0.1

. In fiscal 2017, the Company recognized pretax exit costs related to its software distribution business in Australia of

$0.5

. In fiscal 2015, the Company recognized a pretax charge of

$1.5

related to a warehouse optimization project in Canada and a

$0.4

pretax charge related to unabsorbed burden associated with the former educational technology and services business. In fiscal 2014, the Company recognized a pretax charge of

$2.4

for royalties related to Storia

®

operating system-specific apps that are no longer supported and a

$0.3

pretax charge related to unabsorbed burden associated with the former educational technology and services business.

|

|

(2)

|

In fiscal 2018, the Company recognized pretax share-based compensation charges of

$0.7

due to the accelerated vesting of certain awards. In fiscal 2016, the Company recognized a pretax charge of

$1.5

related to a branch consolidation project in the Company's book fairs operations. In fiscal 2015, the Company recognized a pretax charge of

$15.4

related to unabsorbed burden associated with the former educational technology and services business and a

$0.4

pretax charge related to the relocation of the Company's Klutz® division. In fiscal 2014, the Company recognized a pretax charge of

$15.9

related to unabsorbed burden associated with the former educational technology and services business and a pretax charge of

$1.0

related to Storia operating system-specific apps.

|

|

(3)

|

In fiscal 2018, the Company recognized pretax severance expense of

$7.4

primarily related to cost reduction and restructuring programs. In fiscal 2017, the Company recognized pretax severance expense of

$12.9

as part of cost reduction programs. In fiscal 2016, the Company recognized pretax severance expense of

$9.5

as part of cost reduction and restructuring programs. In fiscal 2015, the Company recognized pretax severance expense of

$8.9

as part of cost reduction and restructuring programs. In fiscal 2014, the Company recognized pretax severance expense of

$9.9

as part of a cost savings initiative.

|

|

(4)

|

In fiscal 2018, the Company recognized pretax impairment charges of

$11.0

related to legacy building improvements and a pretax impairment charge of

$0.2

related to book fairs trucks. In fiscal 2017, the Company recognized a pretax impairment charge related to certain website development assets of

$5.7

and certain legacy prepublication assets of

$1.1

. In fiscal 2016, the Company recognized a pretax impairment charge of

$7.5

related to legacy building improvements in connection with the Company's headquarters renovation and a pretax charge of

$6.9

for certain legacy prepublication assets. In fiscal 2015, the Company recognized a pretax impairment charge of

$8.3

in connection with the restructuring of the Company's media and entertainment businesses, a

$4.6

pretax impairment charge related to the discontinuation of certain outdated technology platforms and a

$2.9

pretax impairment charge associated with the closure of the retail store located at the Company headquarters in New York City. In fiscal 2014, the Company recognized a pretax impairment charge of

$14.6

for assets related to Storia operating system-specific apps and a pretax impairment charge of

$13.4

related to goodwill associated with the book clubs reporting unit in the

Children's Book Publishing and Distribution

segment.

|

|

(5)

|

In fiscal 2018, the Company recognized pretax charges related to the final settlement of the Company's domestic defined benefit pension plan of

$57.3

. In fiscal 2015, the Company recognized a pretax pension settlement charge of

$4.3

. In fiscal 2014, the Company recognized a pretax pension settlement charge of

$1.7

.

|

|

(6)

|

In fiscal 2016, the Company recognized a pretax gain of

$2.2

on the sale of a China-based cost method investment. In fiscal 2015, the Company recognized a pretax gain of

$0.6

on the sale of a UK-based cost method investment. In fiscal 2014, the Company recognized a pretax loss of $1.0 and

$4.8

related to a U.S.-based equity method investment and a UK-based cost method investment, respectively.

|

|

(7)

|

In fiscal 2018, the Company recognized a benefit for income taxes on certain pretax charges of $

26.5

, partly offset by $

5.7

of income tax provision related to the remeasurement of the Company's U.S. deferred tax balance in connection with the Tax Cuts and Jobs Act of 2017. In fiscal 2017, the Company recognized a benefit for income taxes on certain pretax charges of $

7.8

. In fiscal 2016, the Company recognized a benefit for income taxes on certain pretax charges of $10.3. In fiscal 2015, the Company recognized a benefit for income taxes on certain pretax charges of $18.3. In fiscal 2014, the Company recognized previously unrecognized tax positions resulting in a benefit of

$13.8

, inclusive of interest, as a result of a settlement with the Internal Revenue Service related to the audits for the fiscal years ended May 31, 2007, 2008 and 2009, along with a benefit for income taxes on certain pretax charges of $25.4.

|

|

|

2018

|

2017

|

2016

|

|||||||||||||||||

|

$

|

%

(1)

|

$

|

%

(1)

|

$

|

%

(1)

|

|||||||||||||||

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Children’s Book Publishing and Distribution

|

$

|

961.5

|

|

59.0

|

|

$

|

1,052.1

|

|

60.4

|

|

$

|

1,000.9

|

|

59.8

|

|

|||||

|

Education

|

297.3

|

|

18.3

|

|

312.7

|

|

18.0

|

|

299.7

|

|

17.9

|

|

||||||||

|

International

|

369.6

|

|

22.7

|

|

376.8

|

|

21.6

|

|

372.2

|

|

22.3

|

|

||||||||

|

Total revenues

|

1,628.4

|

|

100.0

|

|

1,741.6

|

|

100.0

|

|

1,672.8

|

|

100.0

|

|

||||||||

|

Cost of goods sold

(2)

|

744.6

|

|

45.7

|

|

814.5

|

|

46.8

|

|

762.3

|

|

45.6

|

|

||||||||

|

Selling, general and administrative expenses (exclusive of depreciation and amortization)

(3)

|

763.2

|

|

46.9

|

|

777.5

|

|

44.6

|

|

773.6

|

|

46.2

|

|

||||||||

|

Depreciation and amortization

|

43.9

|

|

2.7

|

|

38.7

|

|

2.2

|

|

38.9

|

|

2.3

|

|

||||||||

|

Severance

(4)

|

9.9

|

|

0.6

|

|

14.9

|

|

0.9

|

|

11.9

|

|

0.7

|

|

||||||||

|

Asset impairments

(5)

|

11.2

|

|

0.7

|

|

6.8

|

|

0.4

|

|

14.4

|

|

0.9

|

|

||||||||

|

Operating income

|

55.6

|

|

3.4

|

|

89.2

|

|

5.1

|

|

71.7

|

|

4.3

|

|

||||||||

|

Interest income

|

3.1

|

|

0.2

|

|

1.4

|

|

0.1

|

|

1.1

|

|

0.1

|

|

||||||||

|

Interest expense

|

(2.0

|

)

|

(0.1

|

)

|

(2.4

|

)

|

(0.2

|

)

|

(2.2

|

)

|

(0.1

|

)

|

||||||||

|

Other components of net periodic benefit (cost)

(6)

|

(58.2

|

)

|

(3.6

|

)

|

(0.3

|

)

|

(0.0

|

)

|

(4.1

|

)

|

(0.3

|

)

|

||||||||

|

Gain (loss) on investments and other

(7)

|

0.0

|

|

0.0

|

|

—

|

|

—

|

|

2.2

|

|

0.1

|

|

||||||||

|

Earnings (loss) from continuing operations before income taxes

|

(1.5

|

)

|

(0.1

|

)

|

87.9

|

|

5.0

|

|

68.7

|

|

4.1

|

|

||||||||

|

Provision (benefit) for income taxes

(8)

|

3.5

|

|

0.2

|

|

35.4

|

|

2.0

|

|

24.7

|

|

1.5

|

|

||||||||

|

Earnings (loss) from continuing operations

|

(5.0

|

)

|

(0.3

|

)

|

52.5

|

|

3.0

|

|

44.0

|

|

2.6

|

|

||||||||

|

Earnings (loss) from discontinued operations, net of tax

|

—

|

|

—

|

|

(0.2

|

)

|

(0.0

|

)

|

(3.5

|

)

|

(0.2

|

)

|

||||||||

|

Net income (loss)

|

$

|

(5.0

|

)

|

(0.3

|

)

|

$

|

52.3

|

|

3.0

|

|

$

|

40.5

|

|

2.4

|

|

|||||

|

Earnings (loss) per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Basic:

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Earnings (loss) from continuing operations

|

$

|

(0.14

|

)

|

|

|

$

|

1.51

|

|

|

|

$

|

1.29

|

|

|

|

|||||

|

Earnings (loss) from discontinued operations

|

$

|

—

|

|

|

|

$

|

(0.00

|

)

|

|

|

$

|

(0.11

|

)

|

|

|

|||||

|

Net income (loss)

|

$

|

(0.14

|

)

|

|

|

$

|

1.51

|

|

|

|

$

|

1.18

|

|

|

|

|||||

|

Diluted:

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Earnings (loss) from continuing operations

|

$

|

(0.14

|

)

|

|

|

$

|

1.48

|

|

|

|

$

|

1.26

|

|

|

|

|||||

|

Earnings (loss) from discontinued operations

|

$

|

—

|

|

|

|

$

|

(0.01

|

)

|

|

|

$

|

(0.10

|

)

|

|

|

|||||

|

Net income (loss)

|

$

|

(0.14

|

)

|

|

|

$

|

1.47

|

|

|

|

$

|

1.16

|

|

|

|

|||||

|

(1)

|

Represents percentage of total revenues.

|

|

(2)

|

In fiscal 2018, the Company recognized pretax costs associated with the consolidation of a Canadian book fair warehouse of

$0.1

. In fiscal 2017, the Company recognized pretax exit costs related to its software distribution business in Australia of

$0.5

.

|

|

(3)

|

In fiscal 2018, the Company recognized pretax share-based compensation charges of

$0.7

due to the accelerated vesting of certain awards. In fiscal 2016, the Company recognized a pretax charge of

$1.5

related to a branch consolidation project in the Company's book fairs operations.

|

|

(4)

|

In fiscal 2018, the Company recognized pretax severance of

$7.4

primarily related to cost reduction and restructuring programs. In fiscal 2017, the Company recognized pretax severance expense of

$12.9

as part of cost reduction programs. In fiscal 2016, the Company recognized pretax severance expense of

$9.5

as part of cost reduction and restructuring programs.

|

|

(5)

|

In fiscal 2018, the Company recognized pretax impairment charges of

$11.0

related to legacy building improvements and a pretax impairment charge of

$0.2

related to book fairs trucks. In fiscal 2017, the Company recognized pretax impairment charges related to certain website development assets of

$5.7

and certain legacy prepublication assets of

$1.1

. In fiscal 2016, the Company recognized a pretax impairment charge of

$7.5

related to legacy building improvements in connection with the Company's headquarters renovation and a pretax charge of

$6.9

for certain legacy prepublication assets.

|

|

(6)

|

In fiscal 2018, the Company recognized pretax charges related to the settlement of the Company's domestic defined benefit pension plan of

$57.3

.

|

|

(7)

|

In fiscal 2016, the Company recognized a pretax gain of

$2.2

on the sale of a China-based cost method investment.

|

|

(8)

|

In fiscal 2018, the Company recognized a benefit for income taxes on certain pretax charges of $

26.5

, partly offset by $

5.7

of income tax provision related to the remeasurement of the Company's U.S. deferred tax balance in connection with the passage of the Tax Cuts and Jobs Act of 2017. In fiscal 2017, the Company recognized a benefit for income taxes on certain pretax charges of $

7.8

. In fiscal 2016, the Company recognized a benefit for income taxes on certain pretax charges of $10.3.

|

|

|

($ amounts in millions)

|

||||||||||||||

|

|

2018

|

% of revenue

|

2017

|

% of revenue

|

2016

|

% of revenue

|

|||||||||

|

Product, service and production costs

|

$

|

409.1

|

|

25.1

|

%

|

$

|

432.6

|

|

24.8

|

%

|

$

|

432.4

|

|

25.8

|

%

|

|

Royalty costs

|

103.6

|

|

6.4

|

|

146.4

|

|

8.4

|

|

92.0

|

|

5.5

|

|

|||

|

Prepublication and production amortization

|

21.9

|

|

1.3

|

|

23.5

|

|

1.3

|

|

27.1

|

|

1.6

|

|

|||

|

Postage, freight, shipping, fulfillment and all other costs

|

210.0

|

|

12.9

|

|

212.0

|

|

12.3

|

|

210.8

|

|

12.7

|

|

|||

|

Total cost of goods sold

|

$

|

744.6

|

|

45.7

|

%

|

$

|

814.5

|

|

46.8

|

%

|

$

|

762.3

|

|

45.6

|

%

|

|

($ amounts in millions)

|

|

|

|

|

|

|

2018 compared to 2017

|

|

2017 compared to 2016

|

|||||||||||||||||||

|

|

2018

|

|

2017

|

|

2016

|

|

$ change

|

|

% change

|

|

$ change

|

|

% change

|

|||||||||||||||

|

Revenues

|

$

|

961.5

|

|

$

|

1,052.1

|

|

$

|

1,000.9

|

|

$

|

(90.6

|

)

|

|

-8.6

|

%

|

|

$

|

51.2

|

|

5.1

|

%

|

|||||||

|

Cost of goods sold

|

407.9

|

|

462.1

|

|

415.9

|

|

(54.2

|

)

|

|

-11.7

|

|

|

46.2

|

|

11.1

|

|

||||||||||||

|

Other operating expenses *

|

447.8

|

|

446.9

|

|

464.4

|

|

0.9

|

|

|

0.2

|

|

|

(17.5

|

)

|

(3.8

|

)

|

||||||||||||

|

Asset impairments

|

0.2

|

|

—

|

|

—

|

|

0.2

|

|

|

100.0

|

|

|

—

|

|

N/A

|

|

||||||||||||

|

Operating income (loss)

|

$

|

105.6

|

|

$

|

143.1

|

|

$

|

120.6

|

|

$

|

(37.5

|

)

|

|

(26.2

|

)%

|

|

$

|

22.5

|

|

18.7

|

%

|

|||||||

|

Operating margin

|

|

11.0

|

%

|

|

|

13.6

|

%

|

|

12.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

($ amounts in millions)

|

|

|

|

2018 compared to 2017

|

2017 compared to 2016

|

|||||||||||||||||||||||

|

|

2018

|

2017

|

2016

|

$ change

|

% change

|

$ change

|

% change

|

|||||||||||||||||||||

|

Revenues

|

$

|

297.3

|

$

|

312.7

|

$

|

299.7

|

$

|

(15.4

|

)

|

-4.9

|

%

|

$

|

13.0

|

|

4.3

|

%

|

||||||||||||

|

Cost of goods sold

|

97.9

|

103.2

|

101.5

|

(5.3

|

)

|

(5.1

|

)

|

1.7

|

|

1.7

|

|

|||||||||||||||||

|

Other operating expenses *

|

165.3

|

157.7

|

148.5

|

7.6

|

|

4.8

|

|

9.2

|

|

6.2

|

|

|||||||||||||||||

|

Asset impairments

|

—

|

1.1

|

6.9

|

(1.1

|

)

|

(100.0

|

)

|

(5.8

|

)

|

(84.1

|

)

|

|||||||||||||||||

|

Operating income (loss)

|

$

|

34.1

|

$

|

50.7

|

$

|

42.8

|

$

|

(16.6

|

)

|

-32.7

|

%

|

$

|

7.9

|

|

18.5

|

%

|

||||||||||||

|

Operating margin

|

11.5

|

%

|

16.2

|

%

|

14.3

|

%

|

|

|

|

|

|

|

|

|

||||||||||||||

|

($ amounts in millions)

|

|

|

|

2018 compared to 2017

|

2017 compared to 2016

|

|||||||||||||||||||||||

|

|

2018

|

2017

|

2016

|

$ change

|

% change

|

$ change

|

% change

|

|||||||||||||||||||||

|

Revenues

|

$

|

369.6

|

$

|

376.8

|

$

|

372.2

|

$

|

(7.2

|

)

|

(1.9

|

)%

|

$

|

4.6

|

|

1.2

|

%

|

||||||||||||

|

Cost of goods sold

|

186.0

|

197.2

|

194.4

|

(11.2

|

)

|

(5.7

|

)

|

2.8

|

|

1.4

|

|

|||||||||||||||||

|

Other operating expenses *

|

165.9

|

159.9

|

165.3

|

6.0

|

|

3.8

|

|

(5.4

|

)

|

(3.3

|

)

|

|||||||||||||||||

|

Operating income (loss)

|

$

|

17.7

|

$

|

19.7

|

$

|

12.5

|

$

|

(2.0

|

)

|

(10.2

|

)%

|

$

|

7.2

|

|

57.6

|

%

|

||||||||||||

|

Operating margin

|

4.8

|

%

|

5.2

|

%

|

3.4

|

%

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

$ amounts in millions

|

|||||||||||||||

|

|

Payments Due By Period

|

||||||||||||||||||

|

Contractual Obligations

|

1 Year or Less

|

Years 2-3

|

Years 4-5

|

After Year 5

|

Total

|

||||||||||||||

|

Minimum print quantities

|

$

|

46.3

|

|

$

|

47.1

|

|

$

|

—

|

|

$

|

—

|

|

$

|

93.4

|

|

||||

|

Royalty advances

|

10.9

|

|

7.1

|

|

0.6

|

|

—

|

|

18.6

|

|

|||||||||

|

Lines of credit and short-term debt

|

7.9

|

|

—

|

|

—

|

|

—

|

|

7.9

|

|

|||||||||

|

Capital leases

(1)

|

1.5

|

|

2.8

|

|

2.4

|

|

1.6

|

|

8.3

|

|

|||||||||

|

Pension and postretirement plans

(2)

|

3.2

|

|

6.2

|

|

7.1

|

|

18.1

|

|

34.6

|

|

|||||||||

|

Operating leases

|

26.9

|

|

38.2

|

|

19.7

|

|

8.1

|

|

92.9

|

|

|||||||||

|

Total

|

$

|

96.7

|

|

$

|

101.4

|

|

$

|

29.8

|

|

$

|

27.8

|

|

$

|

255.7

|

|

||||

|

|

|

|

|

|

|

$ amounts in millions

|

|||||||||||||||||||||||||

|

|

Fiscal Year Maturity

|

|

Fair Value

|

||||||||||||||||||||||||||||

|

|

2019

|

2020

|

2021

|

2022

|

2023

|

Thereafter

|

Total

|

2018

|

|||||||||||||||||||||||

|

Debt Obligations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Lines of credit and current portion of long-term debt

|

$

|

7.9

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

7.9

|

|

$

|

7.9

|

|

|||||||

|

Average interest rate

|

2.9

|

%

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

|

|

|

|||||||||||||||

|

|

|

Page

|

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

The following consolidated financial statement schedule for the years ended May 31, 2018, 2017 and 2016 is filed with this annual report on Form 10-K:

|

|

|

|

|

|

|

|

|

||

|

|

(Amounts in millions, except per share data)

For fiscal years ended May 31,

|

||||||||||

|

|

2018

|

2017

|

2016

|

||||||||

|

Revenues

|

$

|

1,628.4

|

|

$

|

1,741.6

|

|

$

|

1,672.8

|

|

||

|

Operating costs and expenses:

|

|

|

|

|

|

|

|||||

|

Cost of goods sold

|

744.6

|

|

814.5

|

|

762.3

|

|

|||||

|

Selling, general and administrative expenses

|

763.2

|

|

777.5

|

|

773.6

|

|

|||||

|

Depreciation and amortization

|

43.9

|

|

38.7

|

|

38.9

|

|

|||||

|

Severance

|

9.9

|

|

14.9

|

|

11.9

|

|

|||||

|

Asset impairments

|

11.2

|

|

6.8

|

|

14.4

|

|

|||||

|

Total operating costs and expenses

|

1,572.8

|

|

1,652.4

|

|

1,601.1

|

|

|||||

|

Operating income

|

55.6

|

|

89.2

|

|

71.7

|

|

|||||

|

Interest income

|

3.1

|

|

1.4

|

|

1.1

|

|

|||||

|

Interest expense

|

(2.0

|

)

|

(2.4

|

)

|

(2.2

|

)

|

|||||

|

Other components of net periodic benefit (cost)

|

(58.2

|

)

|

(0.3

|

)

|

(4.1

|

)

|

|||||

|

Gain (loss) on investments and other

|

0.0

|

|

—

|

|

2.2

|

|

|||||

|

Earnings (loss) from continuing operations before income taxes

|

(1.5

|

)

|

87.9

|

|

68.7

|

|

|||||

|

Provision (benefit) for income taxes

|

3.5

|

|

35.4

|

|

24.7

|

|

|||||

|

Earnings (loss) from continuing operations

|

(5.0

|

)

|

52.5

|

|

44.0

|

|

|||||

|

Earnings (loss) from discontinued operations, net of tax

|

—

|

|

(0.2

|

)

|

(3.5

|

)

|

|||||

|

Net income (loss)

|

$

|

(5.0

|

)

|

$

|

52.3

|

|

$

|

40.5

|

|

||

|

Basic and diluted earnings (loss) per share of Class A and Common Stock

|

|

|

|

|

|

|

|||||

|

Basic:

|

|

|

|

|

|

|

|||||

|

Earnings (loss) from continuing operations

|

$

|

(0.14

|

)

|

$

|

1.51

|

|

$

|

1.29

|

|

||

|

Earnings (loss) from discontinued operations

|

$

|

—

|

|

$

|

(0.00

|

)

|

$

|

(0.11

|

)

|

||

|

Net income (loss)

|

$

|

(0.14

|

)

|

$

|

1.51

|

|

$

|

1.18

|

|

||

|

Diluted:

|

|

|

|

|

|

|

|||||

|

Earnings (loss) from continuing operations

|

$

|

(0.14

|

)

|

$

|

1.48

|

|

$

|

1.26

|

|

||

|

Earnings (loss) from discontinued operations

|

$

|

—

|

|

$

|

(0.01

|

)

|

$

|

(0.10

|

)

|

||

|

Net income (loss)

|

$

|

(0.14

|

)

|

$

|

1.47

|

|

$

|

1.16

|

|

||

|

Dividends declared per common share

|

$

|

0.600

|

|

$

|

0.600

|

|

$

|

0.600

|

|

||

|

|

(Amounts in millions)

For fiscal years ended May 31,

|

||||||||||

|

|

2018

|

2017

|

2016

|

||||||||

|

Net income (loss)

|

$

|

(5.0

|

)

|

$

|

52.3

|

|

$

|

40.5

|

|

||

|

Other comprehensive income (loss), net:

|

|

|

|

|

|

|

|||||

|

Foreign currency translation adjustments (net of tax)

|

3.4

|

|

(5.3

|

)

|

(8.1

|

)

|

|||||

|

Pension and postretirement adjustments (net of tax)

|

35.1

|

|

(2.2

|

)

|

(1.6

|

)

|

|||||

|

Total other comprehensive income (loss)

|

$

|

38.5

|

|

$

|

(7.5

|

)

|

$

|

(9.7

|

)

|

||

|

Comprehensive income (loss)

|

$

|

33.5

|

|

$

|

44.8

|

|

$

|

30.8

|

|

||

|

(Amounts in millions)

Balances at May 31,

|

|||||||

|

ASSETS

|

2018

|

2017

|

|||||

|

Current Assets:

|

|

|

|

|

|||

|

Cash and cash equivalents

|

$

|

391.9

|

|

$

|

444.1

|

|

|

|

Accounts receivable, net

|

204.9

|

|

199.2

|

|

|||

|

Inventories, net

|

294.9

|

|

282.5

|

|

|||

|

Prepaid expenses and other current assets

|

66.6

|

|

44.3

|

|

|||

|

Current assets of discontinued operations

|

—

|

|

0.4

|

|

|||

|

Total current assets

|

958.3

|

|

970.5

|

|

|||

|

Noncurrent Assets:

|

|

|

|

|

|||

|

Property, plant and equipment, net

|

555.6

|

|

475.3

|

|

|||

|

Prepublication costs, net

|

55.3

|

|

43.3

|

|

|||

|

Royalty advances, net

|

44.8

|

|

41.8

|

|

|||

|

Goodwill

|

119.2

|

|

118.9

|

|

|||

|

Noncurrent deferred income taxes

|

25.2

|

|

53.7

|

|

|||

|

Other assets and deferred charges

|

67.0

|

|

56.9

|

|

|||

|

Total noncurrent assets

|

867.1

|

|

789.9

|

|

|||

|

Total assets

|

$

|

1,825.4

|

|

$

|

1,760.4

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|||||||

|

Current Liabilities:

|

|||||||

|

Lines of credit and current portion of long-term debt

|

$

|

7.9

|

|

$

|

6.2

|

|

|

|

Accounts payable

|

198.9

|

|

141.2

|

|

|||

|

Accrued royalties

|

34.6

|

|

34.2

|

|

|||

|

Deferred revenue

|

24.7

|

|

24.2

|

|

|||

|

Other accrued expenses

|

177.9

|

|

178.0

|

|

|||

|

Accrued income taxes

|

1.8

|

|

2.8

|

|

|||

|

Current liabilities of discontinued operations

|

—

|

|

0.5

|

|

|||

|

Total current liabilities

|

445.8

|

|

387.1

|

|

|||

|

Noncurrent Liabilities:

|

|

|

|

|

|||

|

Long-term debt

|

—

|

|

—

|

|

|||

|

Other noncurrent liabilities

|

58.8

|

|

65.4

|

|

|||

|

Total noncurrent liabilities

|

58.8

|

|

65.4

|

|

|||

|

Commitments and Contingencies:

|

—

|

|

—

|

|

|||

|

Stockholders’ Equity:

|

|

|

|

|

|||

|

Preferred Stock, $1.00 par value: Authorized, 2.0 shares; Issued and Outstanding, none

|

—

|

|

—

|

|

|||

|

Class A Stock, $0.01 par value: Authorized, 4.0 shares; Issued and Outstanding, 1.7 shares

|

0.0

|

|

0.0

|

|

|||

|

Common Stock, $0.01 par value: Authorized, 70.0 shares; Issued, 42.9 shares; Outstanding, 33.3 and 33.4 shares, respectively

|

0.4

|

|

0.4

|

|

|||

|

Additional paid-in capital

|

614.4

|

|

606.8

|

|

|||

|

Accumulated other comprehensive income (loss)

|

(55.7

|

)

|

(94.2

|

)

|

|||

|

Retained earnings

|

1,065.2

|

|

1,091.2

|

|

|||

|

Treasury stock at cost

|

(303.5

|

)

|

(296.3

|

)

|

|||

|

Total stockholders’ equity

|

1,320.8

|

|

1,307.9

|

|

|||

|

Total liabilities and stockholders’ equity

|

$

|

1,825.4

|

|

$

|

1,760.4

|

|

|

|

|

|

|

(Amounts in millions)

|

|||||||||||||||||||||||||||||

|

|

Class A Stock

|

Common Stock

|

Additional Paid-in Capital

|

Accumulated

Other Comprehensive

Income (Loss)

|

Retained

Earnings

|

Treasury Stock

At Cost

|

Total

Stockholders'

Equity

|

|||||||||||||||||||||||||

|

|

Shares

|

Amount

|

Shares

|

Amount

|

||||||||||||||||||||||||||||

|

Balance at May 31, 2015

|

1.7

|

|

$

|

0.0

|

|

31.5

|

|

$

|

0.4

|

|

$

|

591.5

|

|

$

|

(77.0

|

)

|

$

|

1,039.9

|

|

$

|

(349.9

|

)

|

$

|

1,204.9

|

|

|||||||

|

Net Income (loss)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

40.5

|

|

—

|

|

40.5

|

|

||||||||||||||

|

Foreign currency translation adjustment

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(8.1

|

)

|

—

|

|

—

|

|

(8.1

|

)

|

||||||||||||||

|

Pension and postretirement adjustments (net of tax of $(1.8))

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(1.6

|

)

|

—

|

|

—

|

|

(1.6

|

)

|

||||||||||||||

|

Stock-based compensation

|

—

|

|

—

|

|

—

|

|

—

|

|

9.7

|

|

—

|

|

—

|

|

—

|

|

9.7

|

|

||||||||||||||

|

Proceeds pursuant to stock-based compensation plans

|

—

|

|

—

|

|

—

|

|

—

|

|

47.2

|

|

—

|

|

—

|

|

—

|

|

47.2

|

|

||||||||||||||

|

Purchases of treasury stock at cost

|

—

|

|

—

|

|

(0.4

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(14.4

|

)

|

(14.4

|

)

|

||||||||||||||

|

Treasury stock issued pursuant to equity-based plans

|

—

|

|

—

|

|

1.6

|

|

—

|

|

(47.7

|

)

|

—

|

|

—

|

|

47.7

|

|

—

|

|

||||||||||||||

|

Dividends

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(20.6

|

)

|

—

|

|

(20.6

|

)

|

||||||||||||||

|

Balance at May 31, 2016

|

1.7

|

|

$

|

0.0

|

|

32.7

|

|

$

|

0.4

|

|

$

|

600.7

|

|

$

|

(86.7

|

)

|

$

|

1,059.8

|

|

$

|

(316.6

|

)

|

$

|

1,257.6

|

|

|||||||

|

Net Income (loss)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

52.3

|

|

—

|

|

52.3

|

|

||||||||||||||

|

Foreign currency translation adjustment

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(5.3

|

)

|

—

|

|

—

|

|

(5.3

|

)

|

||||||||||||||

|

Pension and postretirement adjustments (net of tax of $0.4)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(2.2

|

)

|

—

|

|

—

|

|

(2.2

|

)

|

||||||||||||||

|

Stock-based compensation

|

—

|

|

—

|

|

—

|

|

—

|

|

10.1

|

|

—

|

|

—

|

|

—

|

|

10.1

|

|

||||||||||||||

|

Proceeds pursuant to stock-based compensation plans

|

—

|

|

—

|

|

—

|

|

—

|

|

22.5

|

|

—

|

|

—

|

|

—

|

|

22.5

|

|

||||||||||||||

|

Purchases of treasury stock at cost

|

—

|

|

—

|

|

(0.2

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(6.9

|

)

|

(6.9

|

)

|

||||||||||||||

|

Treasury stock issued pursuant to equity-based plans

|

—

|

|

—

|

|

0.9

|

|

—

|

|

(26.5

|

)

|

—

|

|

—

|

|

27.2

|

|

0.7

|

|

||||||||||||||

|

Dividends

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(20.9

|

)

|

—

|

|

(20.9

|

)

|

||||||||||||||

|

Balance at May 31, 2017

|

1.7

|

|

$

|

0.0

|

|

33.4

|

|

$

|

0.4

|

|

$

|

606.8

|

|

$

|

(94.2

|

)

|

$

|

1,091.2

|

|

$

|

(296.3

|

)

|

$

|

1,307.9

|

|

|||||||

|

Net Income (loss)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(5.0

|

)

|

—

|

|

(5.0

|

)

|

||||||||||||||

|

Foreign currency translation adjustment

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

3.4

|

|

—

|

|

—

|

|

3.4

|

|

||||||||||||||

|

Pension and postretirement adjustments (net of tax of $20.9)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

35.1

|

|

—

|

|

—

|

|

35.1

|

|

||||||||||||||

|

Stock-based compensation

|

—

|

|

—

|

|

—

|

|

—

|

|

10.7

|

|

—

|

|

—

|

|

—

|

|

10.7

|

|

||||||||||||||

|

Proceeds pursuant to stock-based compensation plans

|

—

|

|

—

|

|

—

|

|

—

|

|

15.8

|

|

—

|

|

—

|

|

—

|

|

15.8

|

|

||||||||||||||

|

Purchases of treasury stock at cost

|

—

|

|

—

|

|

(0.7

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(27.2

|

)

|

(27.2

|

)

|

||||||||||||||

|

Treasury stock issued pursuant to equity-based plans

|

—

|

|

—

|

|

0.6

|

|

—

|

|

(18.9

|

)

|

—

|

|

—

|

|

20.0

|

|

1.1

|

|

||||||||||||||

|

Dividends

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(21.0

|

)

|

—

|

|

(21.0

|

)

|

||||||||||||||

|

Balance at May 31, 2018

|

1.7

|

|

$

|

0.0

|

|

33.3

|

|

$

|

0.4

|

|

$

|

614.4

|

|

$

|

(55.7

|

)

|

$

|

1,065.2

|

|

$

|

(303.5

|

)

|

$

|

1,320.8

|

|

|||||||

|

|

|

(Amounts in millions)

Years ended May 31,

|

|||||||||

|

|

2018

|

2017

|

2016

|

||||||||

|

Cash flows - operating activities:

|

|

|

|

|

|

|

|||||

|

Net income (loss)

|

$

|

(5.0

|

)

|

$

|

52.3

|

|

$

|

40.5

|

|

||

|

Earnings (loss) from discontinued operations, net of tax

|

—

|

|

(0.2

|

)

|

(3.5

|

)

|

|||||

|

Earnings (loss) from continuing operations

|

(5.0

|

)

|

52.5

|

|

44.0

|

|

|||||

|

Adjustments to reconcile earnings (loss) from continuing operations to

net cash provided by (used in) operating activities of continuing operations:

|

|

|

|

|

|

|

|||||

|

Provision for losses on accounts receivable

|

9.5

|

|

11.0

|

|

12.3

|

|

|||||

|

Provision for losses on inventory

|

18.4

|

|

16.0

|

|

12.0

|

|

|||||

|

Provision for losses on royalty advances

|

4.1

|

|

4.3

|

|

4.1

|

|

|||||

|

Pension settlement

|

57.3

|

|

—

|

|

—

|

|

|||||

|

Amortization of prepublication and production costs

|

21.8

|

|

23.3

|

|

26.4

|

|

|||||

|

Depreciation and amortization

|

44.2

|

|

39.1

|

|

39.3

|

|

|||||

|

Amortization of pension and postretirement actuarial gains and losses

|

2.2

|

|

2.1

|

|

4.4

|

|

|||||

|

Deferred income taxes

|

7.7

|

|

15.5

|

|

18.8

|

|

|||||

|

Stock-based compensation

|

10.7

|

|

10.1

|

|

9.7

|

|

|||||

|

Income from equity investments

|

(4.8

|

)

|

(5.3

|

)

|

(3.5

|

)

|

|||||

|

Non cash write off related to asset impairments

|

11.2

|

|

6.8

|

|

14.4

|

|

|||||

|

Unrealized (gain) loss on investments

|

—

|

|

—

|

|

(2.2

|

)

|

|||||

|

Changes in assets and liabilities, net of amounts acquired:

|

|

|

|

|

|

|

|||||

|

Accounts receivable

|

(12.9

|

)

|

(15.2

|

)

|

(18.7

|

)

|

|||||

|

Inventories

|

(27.4

|

)

|

(29.4

|

)

|

(27.8

|

)

|

|||||

|

Prepaid expenses and other current assets

|

(22.1

|

)

|

24.9

|

|

(34.4

|

)

|

|||||

|

Royalty advances

|

(7.0

|

)

|

(2.3

|

)

|

(9.1

|

)

|

|||||

|

Accounts payable

|

45.9

|

|

(6.0

|

)

|

(12.7

|

)

|

|||||

|

Other accrued expenses

|

(3.1

|

)

|

3.1

|

|

2.8

|

|

|||||

|

Accrued income taxes

|

(1.1

|

)

|

1.2

|

|

(155.2

|

)

|

|||||

|

Accrued royalties

|

(0.3

|

)

|

2.9

|

|

5.2

|

|

|||||

|

Deferred revenue

|

0.2

|

|

0.8

|

|

2.2

|

|

|||||

|

Pension and postretirement obligations

|

(4.3

|

)

|

(5.3

|

)

|

(2.1

|

)

|

|||||

|

Other noncurrent liabilities

|

(1.1

|

)

|

(3.7

|

)

|

0.4

|

|

|||||

|

Other, net

|

(2.6

|

)

|

(4.2

|

)

|

1.7

|

|

|||||

|

Total adjustments

|

146.5

|

|

89.7

|

|

(112.0

|

)

|

|||||

|

Net cash provided by (used in) operating activities of continuing operations

|

141.5

|

|

142.2

|

|

(68.0

|

)

|

|||||

|

Net cash provided by (used in) operating activities of discontinued operations

|

—

|

|

(0.8

|

)

|

(10.9

|

)

|

|||||

|

Net cash provided by (used in) operating activities

|

141.5

|

|

141.4

|

|

(78.9

|

)

|

|||||

|

Cash flows - investing activities:

|

|

|

|

|

|

|

|||||

|

Prepublication and production expenditures

|

(36.1

|

)

|

(26.9

|

)

|

(25.2

|

)

|

|||||

|

Additions to property, plant and equipment

|

(121.5

|

)

|

(65.7

|

)

|

(35.6

|

)

|

|||||

|

Proceeds from sale of assets

|

—

|

|

—

|

|

3.3

|

|

|||||

|

Other investment and acquisition related payments

|

(4.4

|

)

|

(10.1

|

)

|

(3.7

|

)

|

|||||

|

Net cash provided by (used in) investing activities of continuing operations

|

(162.0

|

)

|

(102.7

|

)

|

(61.2

|

)

|

|||||

|

Working capital adjustment/Proceeds from sale of discontinued assets

|

—

|

|

—

|

|

(2.9

|

)

|

|||||

|

Changes in restricted cash held in escrow for discontinued assets