|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ý

|

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

¨

|

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

South Carolina

(State or other jurisdiction of

incorporation or organization)

|

57-0965380

(I.R.S. Employer

Identification No.)

|

|

6 Logue Court

Greenville, South Carolina

(Address of principal executive offices)

|

29615

(Zip Code)

|

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

Common Stock, no par value

|

NASDAQ Global Select Market

|

|

|

Large accelerated filer

|

ý

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

(Do not check if a smaller reporting company)

|

¨

|

Smaller reporting company

|

¨

|

|

Class

|

Outstanding at August 22, 2013

|

|

|

Common Stock, no par value per share

|

28,070,326 shares

|

|

|

|

Page

|

|

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

Mine Safety Disclosures

|

|

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

Item 15.

|

||

|

•

|

AIDC technology incorporates the capabilities for electronic identification and data processing without the need for manual input and consists of a wide range of products that include portable data collection terminals, wireless products, bar code label printers and scanners. As AIDC technology has become more pervasive, applications have evolved from traditional uses such as inventory control, materials handling, distribution, shipping and warehouse management to more advanced applications, such as health care.

|

|

•

|

POS products include those computer-based systems that have replaced electronic cash registers in grocery, retail and hospitality environments. POS product lines include computer-based terminals, monitors, receipt printers, pole displays, cash drawers, keyboards, peripheral equipment and fully integrated processing units. In addition, ScanSource POS and Barcode business units sell products that attach to the POS network in the store, including kiosks, network access points, routers and digital signage displays.

|

|

•

|

Electronic physical security products include identification, access control, video surveillance and intrusion-related products, and networking. Physical security products are used every day across every vertical market to protect lives, property and information; there is a heavy penetration into schools, municipalities, correctional institutions and retail environments. Physical security products are deployed across both wired and wireless infrastructures and often serve as the backbone of the solution. These technology products require specialized knowledge to deploy effective solutions, and ScanSource Security offers in-depth training and education to its partners to enable them to maintain the appropriate skill levels.

|

|

•

|

In Communications, voice and data products include private branch exchanges ("PBXs"), key systems, telephone handsets and components used in voice, fax, data, voice recognition, call center management and IP communication applications. Converged communication products combine voice, data, fax and speech technologies to deliver communications solutions that combine computers, telecommunications and the Internet. Converged communications products include telephone and IP network interfaces, Voice over Internet Protocol ("VoIP") systems, PBX integration products and carrier-class board systems-level products. Video products include video and voice conferencing and network systems; and data networking products include switches, servers and routers.

|

|

•

|

Through our ScanSource Services Group business unit, we deliver value-added support programs and services, including education and training, customer configuration, marketing services, network assessments, WiFi services, and partnership programs, including our SUMO partner directory. ScanSource Services Group focuses on reducing complexity, building efficiency, and helping our resellers grow their businesses.

|

|

ITEM 1A.

|

Risk Factors.

|

|

•

|

Changes in international trade laws, such as the North American Free Trade Agreement, affecting our import and export activities, including export license requirements, restrictions on the export of certain technology, and tariff changes;

|

|

•

|

Difficulties in collecting accounts receivable and longer collection periods;

|

|

•

|

Changes in, or expiration of, various foreign incentives that provide economic benefits to us;

|

|

•

|

Changes in labor laws and regulations affecting our ability to hire and retain employees;

|

|

•

|

Difficulties in staffing and managing operations in foreign countries;

|

|

•

|

Fluctuations of foreign currency, exchange controls and currency devaluations;

|

|

•

|

Changes in the interpretation and enforcement of laws (in particular related to items such as duty and taxation);

|

|

•

|

Potential political and economic instability and changes in governments;

|

|

•

|

Compliance with foreign and domestic import and export regulations and anti-corruption laws, including the Iran Threat Reduction and Syria Human Rights Act of 2012, U.S. Foreign Corrupt Practices Act, or similar laws of other jurisdictions for our business activities outside the United States, the violation of which could result in severe penalties including monetary fines, criminal proceedings and suspension of export privileges;

|

|

•

|

Terrorist or military actions that result in destruction or seizure of our assets or suspension or disruption of our operations or those of our customers;

|

|

•

|

Natural disasters, power shortages, telecommunication failures, water shortages, fires, medical epidemics or pandemics, and other manmade or natural disasters or business interruptions in a region or specific country;

|

|

•

|

Potential regulatory changes, including foreign environmental restrictions; and

|

|

•

|

Different general economic conditions.

|

|

ITEM 2.

|

Properties.

|

|

ITEM 3.

|

Legal Proceedings.

|

|

ITEM 4.

|

Mine Safety Disclosures.

|

|

ITEM 5.

|

Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

|

High

|

Low

|

||||||

|

Fiscal Year 2013

|

|||||||

|

First quarter

|

$

|

33.78

|

|

$

|

26.41

|

|

|

|

Second quarter

|

32.55

|

|

27.06

|

|

|||

|

Third quarter

|

34.08

|

|

28.15

|

|

|||

|

Fourth quarter

|

34.84

|

|

25.83

|

|

|||

|

Fiscal Year 2012

|

|||||||

|

First quarter

|

$

|

40.00

|

|

$

|

27.20

|

|

|

|

Second quarter

|

38.05

|

|

28.53

|

|

|||

|

Third quarter

|

39.74

|

|

34.46

|

|

|||

|

Fourth quarter

|

38.06

|

|

28.03

|

|

|||

|

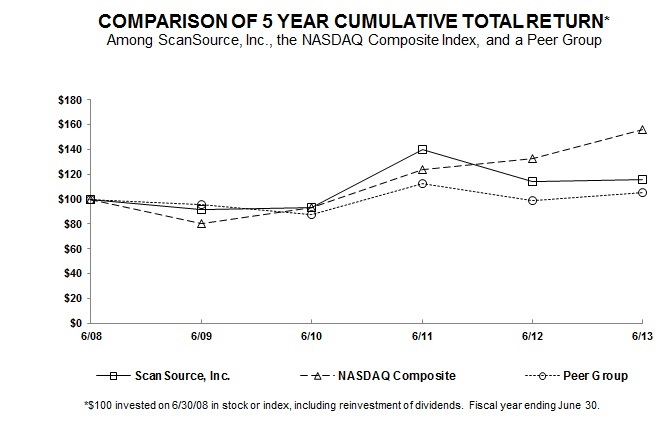

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

||||||||||||||||||

|

ScanSource, Inc.

|

$

|

100

|

|

$

|

92

|

|

$

|

93

|

|

$

|

140

|

|

$

|

115

|

|

$

|

116

|

|

|||||

|

NASDAQ Composite

|

$

|

100

|

|

$

|

81

|

|

$

|

93

|

|

$

|

124

|

|

$

|

132

|

|

$

|

156

|

|

|||||

|

SIC Code 5045 – Computers & Peripheral Equipment

|

$

|

100

|

|

$

|

96

|

|

$

|

88

|

|

$

|

112

|

|

$

|

99

|

|

$

|

105

|

|

|||||

|

|

Fiscal Year Ended June 30,

|

||||||||||||||||||

|

|

2013

|

2012

|

2011

|

2010

|

2009

|

||||||||||||||

|

|

(in thousands, except per share data)

|

||||||||||||||||||

|

Statement of income data:

|

|||||||||||||||||||

|

Net sales

|

$

|

2,876,964

|

|

$

|

3,015,296

|

|

$

|

2,666,531

|

|

$

|

2,114,979

|

|

$

|

1,847,969

|

|

||||

|

Cost of goods sold

|

2,584,090

|

|

2,713,272

|

|

2,392,224

|

|

1,896,052

|

|

1,639,121

|

|

|||||||||

|

Gross profit

|

292,874

|

|

302,024

|

|

274,307

|

|

218,927

|

|

208,848

|

|

|||||||||

|

Selling, general and administrative expenses

|

191,216

|

|

188,388

|

|

161,326

|

|

143,151

|

|

134,730

|

|

|||||||||

|

Impairment charges

|

48,772

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Change in fair value of contingent consideration

|

1,843

|

|

120

|

|

(128

|

)

|

—

|

|

—

|

|

|||||||||

|

Operating income

|

51,043

|

|

113,516

|

|

113,109

|

|

75,776

|

|

74,118

|

|

|||||||||

|

Interest (income) expense, net

|

(1,463

|

)

|

(1,247

|

)

|

511

|

|

85

|

|

771

|

|

|||||||||

|

Other (income) expense, net

|

(520

|

)

|

3,552

|

|

712

|

|

(50

|

)

|

(2,307

|

)

|

|||||||||

|

Income before income taxes

|

53,026

|

|

111,211

|

|

111,886

|

|

75,741

|

|

75,654

|

|

|||||||||

|

Provision for income taxes

|

18,364

|

|

36,923

|

|

38,363

|

|

26,929

|

|

27,966

|

|

|||||||||

|

Net income

|

$

|

34,662

|

|

$

|

74,288

|

|

$

|

73,523

|

|

$

|

48,812

|

|

$

|

47,688

|

|

||||

|

Net income per common share, basic

|

$

|

1.25

|

|

$

|

2.72

|

|

$

|

2.74

|

|

$

|

1.83

|

|

$

|

1.80

|

|

||||

|

Weighted-average shares outstanding, basic

|

27,774

|

|

27,362

|

|

26,872

|

|

26,605

|

|

26,445

|

|

|||||||||

|

Net income per common share, diluted

|

$

|

1.24

|

|

$

|

2.68

|

|

$

|

2.70

|

|

$

|

1.82

|

|

$

|

1.79

|

|

||||

|

Weighted-average shares outstanding, diluted

|

27,994

|

|

27,751

|

|

27,246

|

|

26,869

|

|

26,588

|

|

|||||||||

|

|

As of June 30,

|

||||||||||||||||||

|

|

2013

|

2012

|

2011

|

2010

|

2009

|

||||||||||||||

|

|

(in thousands)

|

||||||||||||||||||

|

Balance sheet data:

|

|||||||||||||||||||

|

Working capital

|

$

|

614,378

|

|

$

|

533,529

|

|

$

|

532,167

|

|

$

|

436,953

|

|

$

|

399,647

|

|

||||

|

Total assets

|

1,164,183

|

|

1,201,806

|

|

1,182,188

|

|

859,750

|

|

748,631

|

|

|||||||||

|

Total long-term debt (including short-term borrowings)

|

5,429

|

|

9,697

|

|

60,106

|

|

30,429

|

|

30,429

|

|

|||||||||

|

Total shareholders’ equity

|

$

|

695,956

|

|

$

|

652,311

|

|

$

|

587,394

|

|

$

|

486,851

|

|

$

|

445,446

|

|

||||

|

ITEM 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

|

Year ended June 30, 2013

|

|||||||||||

|

Pre-Tax Income

|

Net Income (Loss)

|

Diluted EPS

|

|||||||||

|

GAAP Measures

|

$

|

53,026

|

|

$

|

34,662

|

|

$

|

1.24

|

|

||

|

Adjustments:

|

|||||||||||

|

Costs associated with Belgian tax compliance and personnel replacement costs, including related professional fees

|

2,121

|

|

1,400

|

|

0.05

|

|

|||||

|

Impairment charges - ERP

|

28,210

|

|

18,015

|

|

0.64

|

|

|||||

|

Impairment charges - Goodwill

|

20,562

|

|

15,201

|

|

0.54

|

|

|||||

|

Non-GAAP measures

|

$

|

103,919

|

|

$

|

69,278

|

|

$

|

2.47

|

|

||

|

2013

|

2012

|

2011

|

||||||

|

Return on invested capital ratio

|

16.0

|

%

|

17.2

|

%

|

20.6

|

%

|

||

|

Reconciliation of EBITDA to Net Income

|

Fiscal Year Ended June 30,

|

||||||||||

|

|

2013

|

2012

|

2011

|

||||||||

|

|

(in thousands)

|

||||||||||

|

Net income (GAAP)

|

$

|

34,662

|

|

$

|

74,288

|

|

$

|

73,523

|

|

||

|

Plus: income taxes

|

18,364

|

|

36,923

|

|

38,363

|

|

|||||

|

Plus: interest expense

|

775

|

|

1,639

|

|

1,723

|

|

|||||

|

Plus: depreciation & amortization

|

8,457

|

|

9,580

|

|

6,464

|

|

|||||

|

EBITDA

|

62,258

|

|

122,430

|

|

120,073

|

|

|||||

|

Adjustments:

|

|||||||||||

|

Impairment charges, including ERP, goodwill & Belgian costs

|

50,893

|

|

—

|

|

—

|

|

|||||

|

Adjusted EBITDA (numerator for ROIC) (non-GAAP)

|

$

|

113,151

|

|

$

|

122,430

|

|

$

|

120,073

|

|

||

|

Invested capital calculations

|

Fiscal Year Ended June 30,

|

||||||||||

|

|

2013

|

2012

|

2011

|

||||||||

|

|

(in thousands)

|

||||||||||

|

Equity – beginning of the year

|

$

|

652,311

|

|

$

|

587,394

|

|

$

|

486,851

|

|

||

|

Equity – end of the year

|

695,956

|

|

652,311

|

|

587,394

|

|

|||||

|

Add:

|

|||||||||||

|

Impairment charges, including ERP, goodwill & Belgian costs, net of tax

|

34,616

|

|

—

|

|

—

|

|

|||||

|

Average equity, adjusted

|

691,442

|

|

619,853

|

|

537,123

|

|

|||||

|

Average funded debt

(a)

|

15,405

|

|

92,125

|

|

46,186

|

|

|||||

|

Invested capital (denominator)

|

$

|

706,847

|

|

$

|

711,978

|

|

$

|

583,309

|

|

||

|

Return on invested capital

|

16.0

|

%

|

17.2

|

%

|

20.6

|

%

|

|||||

|

(a)

|

Average funded debt is calculated as the daily average amounts outstanding on our short-term and long-term interest-bearing debt.

|

|

|

Fiscal Year Ended June 30,

|

|||||||

|

|

2013

|

2012

|

2011

|

|||||

|

Statement of income data:

|

||||||||

|

Net sales

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||

|

Cost of goods sold

|

89.8

|

|

90.0

|

|

89.7

|

|

||

|

Gross profit

|

10.2

|

|

10.0

|

|

10.3

|

|

||

|

Selling, general and administrative expenses

|

6.6

|

|

6.2

|

|

6.0

|

|

||

|

Impairment charges

|

1.7

|

|

0.0

|

|

0.0

|

|

||

|

Change in fair value of contingent consideration

|

0.1

|

|

0.0

|

|

0.0

|

|

||

|

Operating income

|

1.8

|

|

3.8

|

|

4.2

|

|

||

|

Interest expense (income), net

|

0.0

|

|

0.0

|

|

0.0

|

|

||

|

Other expense (income), net

|

0.0

|

|

0.1

|

|

0.0

|

|

||

|

Income before income taxes and minority interest

|

1.8

|

|

3.7

|

|

4.2

|

|

||

|

Provision for income taxes

|

0.6

|

|

1.2

|

|

1.4

|

|

||

|

Net income

|

1.2

|

%

|

2.5

|

%

|

2.8

|

%

|

||

|

2013

|

2012

|

$ Change

|

% Change

|

|||||||||||

|

|

(in thousands)

|

|

||||||||||||

|

Worldwide Barcode & Security

|

$

|

1,828,219

|

|

$

|

1,837,307

|

|

$

|

(9,088

|

)

|

(0.5

|

)%

|

|||

|

Worldwide Communications & Services

|

1,048,745

|

|

1,177,989

|

|

(129,244

|

)

|

(11.0

|

)%

|

||||||

|

Total net sales

|

$

|

2,876,964

|

|

$

|

3,015,296

|

|

$

|

(138,332

|

)

|

(4.6

|

)%

|

|||

|

2013

|

2012

|

$ Change

|

% Change

|

|||||||||||

|

|

(in thousands)

|

|

||||||||||||

|

North American sales units

|

$

|

2,139,723

|

|

$

|

2,236,459

|

|

$

|

(96,736

|

)

|

(4.3

|

)%

|

|||

|

International sales units

|

737,241

|

|

778,837

|

|

(41,596

|

)

|

(5.3

|

)%

|

||||||

|

Total net sales

|

$

|

2,876,964

|

|

$

|

3,015,296

|

|

$

|

(138,332

|

)

|

(4.6

|

)%

|

|||

|

|

|

|

|

|

% of Sales

June 30,

|

|||||||||||||||

|

|

2013

|

2012

|

$ Change

|

% Change

|

2013

|

2012

|

||||||||||||||

|

|

(in thousands)

|

|

|

|

||||||||||||||||

|

Worldwide Barcode & Security

|

$

|

168,123

|

|

$

|

169,080

|

|

$

|

(957

|

)

|

(0.6

|

)%

|

9.2

|

%

|

9.2

|

%

|

|||||

|

Worldwide Communications & Services

|

124,751

|

|

132,944

|

|

(8,193

|

)

|

(6.2

|

)%

|

11.9

|

%

|

11.3

|

%

|

||||||||

|

Total gross profit

|

$

|

292,874

|

|

$

|

302,024

|

|

$

|

(9,150

|

)

|

(3.0

|

)%

|

10.2

|

%

|

10.0

|

%

|

|||||

|

|

|

|

|

|

% of Sales

June 30,

|

|||||||||||||||

|

|

2013

|

2012

|

$ Change

|

% Change

|

2013

|

2012

|

||||||||||||||

|

|

(in thousands)

|

|

|

|

|

|||||||||||||||

|

Selling, general and administrative expense

|

$

|

191,216

|

|

$

|

188,388

|

|

$

|

2,828

|

|

1.5

|

%

|

6.6

|

%

|

6.2

|

%

|

|||||

|

Impairment charges

|

48,772

|

|

—

|

|

48,772

|

|

100.0

|

%

|

1.7

|

%

|

—

|

%

|

||||||||

|

Change in fair value of contingent consideration

|

1,843

|

|

120

|

|

1,723

|

|

1,435.8

|

%

|

0.1

|

%

|

—

|

%

|

||||||||

|

Operating expense

|

$

|

241,831

|

|

$

|

188,508

|

|

$

|

53,323

|

|

28.3

|

%

|

8.4

|

%

|

6.2

|

%

|

|||||

|

|

|

|

|

|

% of Sales

June 30,

|

|||||||||||||||

|

|

2013

|

2012

|

$ Change

|

% Change

|

2013

|

2012

|

||||||||||||||

|

|

(in thousands)

|

|

|

|

|

|||||||||||||||

|

Worldwide Barcode & Security

|

$

|

34,665

|

|

$

|

56,669

|

|

$

|

(22,004

|

)

|

(38.8

|

)%

|

1.9

|

%

|

3.1

|

%

|

|||||

|

Worldwide Communications & Services

|

44,588

|

|

56,847

|

|

(12,259

|

)

|

(21.6

|

)%

|

4.3

|

%

|

4.8

|

%

|

||||||||

|

Corporate

|

(28,210

|

)

|

—

|

|

(28,210

|

)

|

nm

|

|

nm

|

|

—

|

%

|

||||||||

|

Total operating income

|

$

|

51,043

|

|

$

|

113,516

|

|

$

|

(62,473

|

)

|

(55.0

|

)%

|

1.8

|

%

|

3.8

|

%

|

|||||

|

|

|

|

|

|

% of Sales

June 30,

|

|||||||||||||||

|

|

2013

|

2012

|

$ Change

|

% Change

|

2013

|

2012

|

||||||||||||||

|

|

(in thousands)

|

|

|

|

||||||||||||||||

|

Interest expense

|

$

|

775

|

|

$

|

1,639

|

|

$

|

(864

|

)

|

(52.7

|

)%

|

—

|

%

|

0.1

|

%

|

|||||

|

Interest income

|

(2,238

|

)

|

(2,886

|

)

|

648

|

|

(22.5

|

)%

|

(0.1

|

)%

|

(0.1

|

)%

|

||||||||

|

Net foreign exchange losses (gains)

|

(32

|

)

|

3,766

|

|

(3,798

|

)

|

(100.8

|

)%

|

—

|

%

|

0.1

|

%

|

||||||||

|

Other, net

|

(488

|

)

|

(214

|

)

|

(274

|

)

|

128.0

|

%

|

—

|

%

|

—

|

%

|

||||||||

|

Total other (income) expense

|

$

|

(1,983

|

)

|

$

|

2,305

|

|

$

|

(4,288

|

)

|

(186.0

|

)%

|

(0.1

|

)%

|

0.1

|

%

|

|||||

|

2012

|

2011

|

$ Change

|

% Change

|

|||||||||||

|

|

(in thousands)

|

|||||||||||||

|

Worldwide Barcode & Security

|

$

|

1,837,307

|

|

$

|

1,615,461

|

|

$

|

221,846

|

|

13.7

|

%

|

|||

|

Worldwide Communications & Services

|

1,177,989

|

|

1,051,070

|

|

126,919

|

|

12.1

|

%

|

||||||

|

Total net sales

|

$

|

3,015,296

|

|

$

|

2,666,531

|

|

$

|

348,765

|

|

13.1

|

%

|

|||

|

2012

|

2011

|

$ Change

|

% Change

|

|||||||||||

|

|

(in thousands)

|

|||||||||||||

|

North American distribution sales units

|

$

|

2,236,459

|

|

$

|

2,022,668

|

|

$

|

213,791

|

|

10.6

|

%

|

|||

|

International distribution sales units

|

778,837

|

|

643,863

|

|

134,974

|

|

21.0

|

%

|

||||||

|

Total net sales

|

$

|

3,015,296

|

|

$

|

2,666,531

|

|

$

|

348,765

|

|

13.1

|

%

|

|||

|

|

|

|

|

|

% of Sales

June 30,

|

|||||||||||||||

|

|

2012

|

2011

|

$ Change

|

% Change

|

2012

|

2011

|

||||||||||||||

|

|

(in thousands)

|

|

|

|

||||||||||||||||

|

Worldwide Barcode & Security

|

$

|

169,080

|

|

$

|

154,035

|

|

$

|

15,045

|

|

9.8

|

%

|

9.2

|

%

|

9.5

|

%

|

|||||

|

Worldwide Communications & Services

|

132,944

|

|

120,272

|

|

12,672

|

|

10.5

|

%

|

11.3

|

%

|

11.4

|

%

|

||||||||

|

Total gross profit

|

$

|

302,024

|

|

$

|

274,307

|

|

$

|

27,717

|

|

10.1

|

%

|

10.0

|

%

|

10.3

|

%

|

|||||

|

|

|

|

|

|

% of Sales

June 30,

|

|||||||||||||||

|

|

2012

|

2011

|

$ Change

|

% Change

|

2012

|

2011

|

||||||||||||||

|

|

(in thousands)

|

|

|

|

||||||||||||||||

|

Selling, general and administrative expense

|

$

|

188,388

|

|

$

|

161,326

|

|

$

|

27,062

|

|

16.8

|

%

|

6.3

|

%

|

6.0

|

%

|

|||||

|

Change in fair value of contingent consideration

|

120

|

|

(128

|

)

|

248

|

|

(193.8

|

)%

|

—

|

%

|

—

|

%

|

||||||||

|

Operating expense

|

$

|

188,508

|

|

$

|

161,198

|

|

$

|

27,310

|

|

16.9

|

%

|

6.3

|

%

|

6.0

|

%

|

|||||

|

|

|

|

|

|

% of Sales

June 30,

|

|||||||||||||||

|

|

2012

|

2011

|

$ Change

|

% Change

|

2012

|

2011

|

||||||||||||||

|

|

(in thousands)

|

|

|

|

||||||||||||||||

|

Worldwide Barcode & Security

|

$

|

56,669

|

|

$

|

56,918

|

|

$

|

(249

|

)

|

(0.4

|

)%

|

3.1

|

%

|

3.5

|

%

|

|||||

|

Worldwide Communications & Services

|

56,847

|

|

53,091

|

|

3,756

|

|

7.1

|

%

|

4.8

|

%

|

5.1

|

%

|

||||||||

|

Corporate

|

—

|

|

3,100

|

|

(3,100

|

)

|

nm

|

|

—

|

%

|

nm

|

|

||||||||

|

Total operating income

|

$

|

113,516

|

|

$

|

113,109

|

|

$

|

407

|

|

0.4

|

%

|

3.8

|

%

|

4.2

|

%

|

|||||

|

|

|

|

|

|

% of Sales

June 30,

|

|||||||||||||||

|

|

2012

|

2011

|

$ Change

|

% Change

|

2012

|

2011

|

||||||||||||||

|

|

(in thousands)

|

|

|

|

||||||||||||||||

|

Interest expense

|

$

|

1,639

|

|

$

|

1,723

|

|

$

|

(84

|

)

|

(4.9

|

)%

|

0.1

|

%

|

0.1

|

%

|

|||||

|

Interest income

|

(2,886

|

)

|

(1,212

|

)

|

(1,674

|

)

|

138.1

|

%

|

(0.1

|

)

|

(0.1

|

)

|

||||||||

|

Net foreign exchange losses

|

3,766

|

|

965

|

|

2,801

|

|

290.3

|

%

|

0.1

|

%

|

—

|

%

|

||||||||

|

Other, net

|

(214

|

)

|

(253

|

)

|

39

|

|

(15.4

|

)%

|

—

|

%

|

—

|

%

|

||||||||

|

Total other (income) expense

|

$

|

2,305

|

|

$

|

1,223

|

|

$

|

1,082

|

|

88.5

|

%

|

0.1

|

%

|

—

|

%

|

|||||

|

|

|

|

|

|

% of Sales

June 30,

|

|||||||||||||||

|

|

2012

|

2011

|

$ Change

|

% Change

|

2012

|

2011

|

||||||||||||||

|

|

(in thousands)

|

|

|

|

||||||||||||||||

|

Net income

|

$

|

74,288

|

|

$

|

73,523

|

|

$

|

765

|

|

1.0

|

%

|

2.5

|

%

|

2.8

|

%

|

|||||

|

|

Three Months Ended

|

||||||||||||||||||||||||||||||

|

|

Fiscal 2013

|

Fiscal 2012

|

|||||||||||||||||||||||||||||

|

|

Jun. 30

2013

|

Mar. 31

2013

|

Dec. 31

2012

|

Sept. 30

2012

|

Jun. 30

2012

|

Mar. 31

2012

|

Dec. 31

2011

|

Sept. 30

2011

|

|||||||||||||||||||||||

|

|

(in thousands, except per share data)

|

||||||||||||||||||||||||||||||

|

Net sales

|

$

|

712,678

|

|

$

|

682,965

|

|

$

|

747,716

|

|

$

|

733,605

|

|

$

|

754,470

|

|

$

|

707,883

|

|

$

|

782,684

|

|

$

|

770,259

|

|

|||||||

|

Cost of goods sold

|

637,027

|

|

614,133

|

|

673,365

|

|

659,565

|

|

680,643

|

|

638,615

|

|

702,845

|

|

691,169

|

|

|||||||||||||||

|

Gross profit

|

$

|

75,651

|

|

$

|

68,832

|

|

$

|

74,351

|

|

$

|

74,040

|

|

$

|

73,827

|

|

$

|

69,268

|

|

$

|

79,839

|

|

$

|

79,090

|

|

|||||||

|

Net income

|

$

|

(13,315

|

)

|

$

|

13,978

|

|

$

|

16,357

|

|

$

|

17,642

|

|

$

|

19,785

|

|

$

|

14,756

|

|

$

|

21,367

|

|

$

|

18,380

|

|

|||||||

|

Weighted-average shares outstanding, basic

|

27,922

|

|

27,847

|

|

27,713

|

|

27,618

|

|

27,579

|

|

27,489

|

|

27,244

|

|

27,138

|

|

|||||||||||||||

|

Weighted-average shares outstanding, diluted

|

27,922

|

|

28,024

|

|

27,958

|

|

27,901

|

|

27,886

|

|

27,926

|

|

27,674

|

|

27,551

|

|

|||||||||||||||

|

Net income (loss) per common share, basic

|

$

|

(0.48

|

)

|

$

|

0.50

|

|

$

|

0.59

|

|

$

|

0.64

|

|

$

|

0.72

|

|

$

|

0.54

|

|

$

|

0.78

|

|

$

|

0.68

|

|

|||||||

|

Net income (loss) per common share, diluted

|

$

|

(0.48

|

)

|

$

|

0.50

|

|

$

|

0.59

|

|

$

|

0.63

|

|

$

|

0.71

|

|

$

|

0.53

|

|

$

|

0.77

|

|

$

|

0.67

|

|

|||||||

|

•

|

Industry weighted-average cost of capital ("WACC"): We utilized a WACC relative to each reporting unit's respective geography and industry as the discount rate for estimated future cash flows. The WACC is intended to represent a rate of return that would be expected by a market place participant in each respective geography.

|

|

•

|

Operating income: We utilized historical and expected revenue growth rates, gross margins and operating expense percentages, which varied based on the projections of each reporting unit being evaluated.

|

|

•

|

Cash flows from working capital changes: We utilized a projected cash flow impact pertaining to expected changes in working capital as each of our goodwill reporting units grow.

|

|

|

Payments Due by Period

|

||||||||||||||||||

|

|

Total

|

Year 1

|

Years 2-3

|

Years 4-5

|

Greater than

5 Years

|

||||||||||||||

|

|

(in thousands)

|

||||||||||||||||||

|

Contractual Obligations

|

|||||||||||||||||||

|

Principal debt payments

|

$

|

5,429

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

5,429

|

|

||||

|

Non-cancelable operating leases

(1)

|

17,774

|

|

4,703

|

|

7,196

|

|

4,164

|

|

1,711

|

|

|||||||||

|

Contingent consideration

(2)

|

12,545

|

|

3,732

|

|

8,813

|

|

—

|

|

—

|

|

|||||||||

|

Other

(3)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Total obligations

|

$

|

35,748

|

|

$

|

8,435

|

|

$

|

16,009

|

|

$

|

4,164

|

|

$

|

7,140

|

|

||||

|

(1)

|

Amounts to be paid in future periods for real estate taxes, insurance, and other operating expenses applicable to the properties pursuant to the respective operating leases have been excluded from the table above as the amounts payable in future periods are generally not specified in the lease agreements and are dependent upon amounts which are not known at this time. Such amounts were not material in the current fiscal year.

|

|

(2)

|

Amounts disclosed regarding future CDC earnout payments are presented at their discounted fair value. Estimated future, undiscounted earnout payments total

$16.6 million

as of

June 30, 2013

.

|

|

(3)

|

Amounts totaling

$13.8 million

of deferred compensation which are included in current and other non-current liabilities in our Consolidated Balance Sheets as of

June 30, 2013

have been excluded from the table above due to the uncertainty of the timing of the payment of these obligations, which are generally at the discretion of the individual employees or upon death of the former employee, respectively.

|

|

ITEM 7A.

|

Quantitative and Qualitative Disclosures about Market Risk.

|

|

ITEM 8.

|

Financial Statements and Supplementary Data.

|

|

|

|

|

Page

|

|

|

Financial Statements

|

|

|

/s/ Ernst & Young LLP

|

||

|

/s/ Ernst & Young LLP

|

|

|

June 30,

2013 |

June 30,

2012 |

||||||

|

Assets

|

|||||||

|

Current assets:

|

|||||||

|

Cash and cash equivalents

|

$

|

148,164

|

|

$

|

29,173

|

|

|

|

Accounts receivable, less allowance of $25,479 at June 30, 2013

and $24,405 at June 30, 2012

|

435,028

|

|

458,341

|

|

|||

|

Inventories

|

402,307

|

|

487,946

|

|

|||

|

Prepaid expenses and other assets

|

40,105

|

|

41,846

|

|

|||

|

Deferred income taxes

|

16,456

|

|

14,624

|

|

|||

|

Total current assets

|

1,042,060

|

|

1,031,930

|

|

|||

|

Property and equipment, net

|

20,203

|

|

48,785

|

|

|||

|

Goodwill

|

31,795

|

|

53,885

|

|

|||

|

Other assets, including identifiable intangible assets

|

70,125

|

|

67,206

|

|

|||

|

Total assets

|

$

|

1,164,183

|

|

$

|

1,201,806

|

|

|

|

Liabilities and Shareholders’ Equity

|

|||||||

|

Current liabilities:

|

|||||||

|

Short-term borrowings

|

$

|

—

|

|

$

|

4,268

|

|

|

|

Current portion of contingent consideration

|

3,732

|

|

4,976

|

|

|||

|

Accounts payable

|

362,271

|

|

419,683

|

|

|||

|

Accrued expenses and other liabilities

|

59,983

|

|

67,776

|

|

|||

|

Income taxes payable

|

1,696

|

|

1,698

|

|

|||

|

Total current liabilities

|

427,682

|

|

498,401

|

|

|||

|

Deferred income taxes

|

205

|

|

—

|

|

|||

|

Long-term debt

|

5,429

|

|

5,429

|

|

|||

|

Borrowings under revolving credit facility

|

—

|

|

—

|

|

|||

|

Long-term portion of contingent consideration

|

8,813

|

|

11,677

|

|

|||

|

Other long-term liabilities

|

26,098

|

|

33,988

|

|

|||

|

Total liabilities

|

468,227

|

|

549,495

|

|

|||

|

Commitments and contingencies

|

|

|

|||||

|

Shareholders’ equity:

|

|||||||

|

Preferred stock, no par value; 3,000,000 shares authorized, none issued

|

—

|

|

—

|

|

|||

|

Common stock, no par value; 45,000,000 shares authorized, 27,971,809 and 27,604,840 shares issued and outstanding at June 30, 2013 and June 30, 2012, respectively

|

149,821

|

|

139,557

|

|

|||

|

Retained earnings

|

569,107

|

|

534,445

|

|

|||

|

Accumulated other comprehensive (loss) income

|

(22,972

|

)

|

(21,691

|

)

|

|||

|

Total shareholders’ equity

|

695,956

|

|

652,311

|

|

|||

|

Total liabilities and shareholders’ equity

|

$

|

1,164,183

|

|

$

|

1,201,806

|

|

|

|

2013

|

2012

|

2011

|

|||||||||

|

Net sales

|

$

|

2,876,964

|

|

$

|

3,015,296

|

|

$

|

2,666,531

|

|

||

|

Cost of goods sold

|

2,584,090

|

|

2,713,272

|

|

2,392,224

|

|

|||||

|

Gross profit

|

292,874

|

|

302,024

|

|

274,307

|

|

|||||

|

Selling, general and administrative expenses

|

191,216

|

|

188,388

|

|

161,326

|

|

|||||

|

Impairment charges, including ERP and goodwill

|

48,772

|

|

—

|

|

—

|

|

|||||

|

Change in fair value of contingent consideration

|

1,843

|

|

120

|

|

(128

|

)

|

|||||

|

Operating income

|

51,043

|

|

113,516

|

|

113,109

|

|

|||||

|

Interest expense

|

775

|

|

1,639

|

|

1,723

|

|

|||||

|

Interest income

|

(2,238

|

)

|

(2,886

|

)

|

(1,212

|

)

|

|||||

|

Other expense (income), net

|

(520

|

)

|

3,552

|

|

712

|

|

|||||

|

Income before income taxes

|

53,026

|

|

111,211

|

|

111,886

|

|

|||||

|

Provision for income taxes

|

18,364

|

|

36,923

|

|

38,363

|

|

|||||

|

Net income

|

$

|

34,662

|

|

$

|

74,288

|

|

$

|

73,523

|

|

||

|

Per share data:

|

|||||||||||

|

Net income per common share, basic

|

$

|

1.25

|

|

$

|

2.72

|

|

$

|

2.74

|

|

||

|

Weighted-average shares outstanding, basic

|

27,774

|

|

27,362

|

|

26,872

|

|

|||||

|

Net income per common share, diluted

|

$

|

1.24

|

|

$

|

2.68

|

|

$

|

2.70

|

|

||

|

Weighted-average shares outstanding, diluted

|

27,994

|

|

27,751

|

|

27,246

|

|

|||||

|

|

2013

|

2012

|

2011

|

||||||||

|

Net income

|

$

|

34,662

|

|

$

|

74,288

|

|

$

|

73,523

|

|

||

|

Unrealized gain on hedged transaction, net of tax

|

—

|

|

139

|

|

468

|

|

|||||

|

Foreign currency translation adjustment

|

(1,281

|

)

|

(25,459

|

)

|

14,895

|

|

|||||

|

Comprehensive income

|

$

|

33,381

|

|

$

|

48,968

|

|

$

|

88,886

|

|

||

|

See accompanying notes to these consolidated financial statements.

|

|||||||||||

|

Common

Stock

(Shares)

|

Common

Stock

(Amount)

|

Retained

Earnings

|

Accumulated

Other

Comprehensive

Income (Loss)

|

Total

|

||||||||||||||

|

Balance at June 30, 2010

|

26,703,038

|

|

$

|

111,951

|

|

$

|

386,634

|

|

$

|

(11,734

|

)

|

$

|

486,851

|

|

||||

|

Net income

|

—

|

|

—

|

|

73,523

|

|

—

|

|

73,523

|

|

||||||||

|

Unrealized gain on hedged transaction, net of tax of $272

|

—

|

|

—

|

|

—

|

|

468

|

|

468

|

|

||||||||

|

Foreign currency translation adjustment

|

—

|

|

—

|

|

—

|

|

14,895

|

|

14,895

|

|

||||||||

|

Exercise of stock options and shares issued under share-based compensation plans, net of shares withheld for employee taxes

|

406,894

|

|

6,373

|

|

—

|

|

—

|

|

6,373

|

|

||||||||

|

Share based compensation

|

—

|

|

5,081

|

|

—

|

|

—

|

|

5,081

|

|

||||||||

|

Tax benefit of deductible compensation arising from exercise or vesting of share based payment arrangements

|

—

|

|

203

|

|

—

|

|

—

|

|

203

|

|

||||||||

|

Balance at June 30, 2011

|

27,109,932

|

|

$

|

123,608

|

|

$

|

460,157

|

|

$

|

3,629

|

|

$

|

587,394

|

|

||||

|

Net income

|

—

|

|

—

|

|

74,288

|

|

—

|

|

74,288

|

|

||||||||

|

Unrealized gain on hedged transaction, net of tax of $76

|

—

|

|

—

|

|

—

|

|

139

|

|

139

|

|

||||||||

|

Foreign currency translation adjustment

|

—

|

|

—

|

|

—

|

|

(25,459

|

)

|

(25,459

|

)

|

||||||||

|

Exercise of stock options and shares issued under share-based compensation plans, net of shares withheld for employee taxes

|

494,908

|

|

7,642

|

|

—

|

|

—

|

|

7,642

|

|

||||||||

|

Share based compensation

|

—

|

|

7,004

|

|

—

|

|

—

|

|

7,004

|

|

||||||||

|

Tax benefit of deductible compensation arising from exercise or vesting of share based payment arrangements

|

—

|

|

1,303

|

|

—

|

|

—

|

|

1,303

|

|

||||||||

|

Balance at June 30, 2012

|

27,604,840

|

|

$

|

139,557

|

|

$

|

534,445

|

|

$

|

(21,691

|

)

|

$

|

652,311

|

|

||||

|

Net income

|

—

|

|

—

|

|

34,662

|

|

—

|

|

34,662

|

|

||||||||

|

Foreign currency translation adjustment

|

—

|

|

—

|

|

—

|

|

(1,281

|

)

|

(1,281

|

)

|

||||||||

|

Exercise of stock options and shares issued under share-based compensation plans, net of shares withheld for employee taxes

|

366,969

|

|

4,024

|

|

—

|

|

—

|

|

4,024

|

|

||||||||

|

Share based compensation

|

—

|

|

5,692

|

|

—

|

|

—

|

|

5,692

|

|

||||||||

|

Tax benefit of deductible compensation arising from exercise or vesting of share based payment arrangements

|

—

|

|

548

|

|

—

|

|

—

|

|

548

|

|

||||||||

|

Balance at June 30, 2013

|

27,971,809

|

|

$

|

149,821

|

|

$

|

569,107

|

|

$

|

(22,972

|

)

|

$

|

695,956

|

|

||||

|

2013

|

2012

|

2011

|

|||||||||

|

Cash flows from operating activities:

|

|||||||||||

|

Net income

|

$

|

34,662

|

|

$

|

74,288

|

|

$

|

73,523

|

|

||

|

Adjustments to reconcile net income to net cash provided by (used in) operating activities:

|

|||||||||||

|

Depreciation and amortization

|

8,457

|

|

9,580

|

|

6,464

|

|

|||||

|

Amortization of debt issue costs

|

345

|

|

342

|

|

198

|

|

|||||

|

Provision for doubtful accounts

|

10,333

|

|

7,134

|

|

7,488

|

|

|||||

|

Share-based compensation and restricted stock

|

5,618

|

|

6,840

|

|

4,877

|

|

|||||

|

Impairment charges, including ERP and goodwill

|

48,772

|

|

—

|

|

—

|

|

|||||

|

Deferred income taxes

|

(19,630

|

)

|

(6,377

|

)

|

(1,431

|

)

|

|||||

|

Excess tax benefits from share-based payment arrangements

|

(849

|

)

|

(1,720

|

)

|

(203

|

)

|

|||||

|

Change in fair value of contingent consideration

|

1,843

|

|

120

|

|

(128

|

)

|

|||||

|

Changes in operating assets and liabilities, net of acquisitions:

|

|||||||||||

|

Accounts receivable

|

13,746

|

|

(34,322

|

)

|

(76,956

|

)

|

|||||

|

Inventories

|

86,821

|

|

(29,387

|

)

|

(80,003

|

)

|

|||||

|

Prepaid expenses and other assets

|

(28

|

)

|

(4,103

|

)

|

(17,392

|

)

|

|||||

|

Other noncurrent assets

|

9,441

|

|

1,166

|

|

(10,279

|

)

|

|||||

|

Accounts payable

|

(56,837

|

)

|

28,306

|

|

78,298

|

|

|||||

|

Accrued expenses and other liabilities

|

(14,145

|

)

|

8,371

|

|

31,060

|

|

|||||

|

Income taxes payable

|

895

|

|

(280

|

)

|

(4,828

|

)

|

|||||

|

Net cash provided by (used in) operating activities

|

129,444

|

|

59,958

|

|

10,688

|

|

|||||

|

Cash flows from investing activities:

|

|||||||||||

|

Capital expenditures

|

(4,831

|

)

|

(12,790

|

)

|

(14,869

|

)

|

|||||

|

Cash paid for business acquisitions, net of cash acquired

|

—

|

|

—

|

|

(36,228

|

)

|

|||||

|

Net cash provided by (used in) investing activities

|

(4,831

|

)

|

(12,790

|

)

|

(51,097

|

)

|

|||||

|

Cash flows from financing activities:

|

|||||||||||

|

Increases (decreases) in short-term borrowings, net

|

(4,459

|

)

|

1,345

|

|

1,706

|

|

|||||

|

Borrowings on revolving credit, net of expenses

|

515,262

|

|

1,408,522

|

|

769,545

|

|

|||||

|

Repayments on revolving credit, net of expenses

|

(515,877

|

)

|

(1,433,161

|

)

|

(744,169

|

)

|

|||||

|

Repayments on long-term debt

|

—

|

|

(25,000

|

)

|

—

|

|

|||||

|

Debt issuance costs

|

—

|

|

(1,360

|

)

|

—

|

|

|||||

|

Contingent consideration payments

|

(4,777

|

)

|

(2,000

|

)

|

—

|

|

|||||

|

Exercise of stock options

|

4,024

|

|

7,642

|

|

6,372

|

|

|||||

|

Excess tax benefits from share-based payment arrangements

|

849

|

|

1,720

|

|

203

|

|

|||||

|

Net cash provided by (used in) financing activities

|

(4,978

|

)

|

(42,292

|

)

|

33,657

|

|

|||||

|

Effect of exchange rate changes on cash and cash equivalents

|

(644

|

)

|

(4,450

|

)

|

894

|

|

|||||

|

Increase (decrease) in cash and cash equivalents

|

118,991

|

|

426

|

|

(5,858

|

)

|

|||||

|

Cash and cash equivalents at beginning of period

|

29,173

|

|

28,747

|

|

34,605

|

|

|||||

|

Cash and cash equivalents at end of period

|

$

|

148,164

|

|

$

|

29,173

|

|

$

|

28,747

|

|

||

|

Supplemental disclosure of cash flow information:

|

|||||||||||

|

Interest paid during the year

|

$

|

796

|

|

$

|

1,578

|

|

$

|

1,705

|

|

||

|

Income taxes paid during the year

|

$

|

35,582

|

|

$

|

46,057

|

|

$

|

43,233

|

|

||

|

(1)

|

Business and Summary of Significant Accounting Policies

|

|

•

|

Industry weighted-average cost of capital ("WACC"): We utilized a WACC relative to each reporting unit's respective geography and industry as the discount rate for estimated future cash flows. The WACC is intended to represent a rate of return that would be expected by a market place participant in each respective geography.

|

|

•

|

Operating income: We utilized historical and expected revenue growth rates, gross margins and operating expense percentages, which varied based on the projections of each reporting unit being evaluated.

|

|

•

|

Cash flows from working capital changes: We utilized a projected cash flow impact pertaining to expected changes in working capital as each of our goodwill reporting units grow.

|

|

(2)

|

Earnings per Share

|

|

Fiscal Year Ended June 30,

|

|||||||||||

|

2013

|

2012

|

2011

|

|||||||||

|

|

(in thousands, except per share data)

|

||||||||||

|

Net income

|

$

|

34,662

|

|

$

|

74,288

|

|

$

|

73,523

|

|

||

|

Denominator:

|

|

|

|

|

|||||||

|

Weighted-average shares, basic

|

27,774

|

|

27,362

|

|

26,872

|

|

|||||

|

Dilutive effect of share-based payments

|

220

|

|

389

|

|

374

|

|

|||||

|

Weighted-average shares, diluted

|

27,994

|

|

27,751

|

|

27,246

|

|

|||||

|

|

|

|

|

||||||||

|

Net income per common share, basic

|

$

|

1.25

|

|

$

|

2.72

|

|

$

|

2.74

|

|

||

|

Net income per common share, diluted

|

$

|

1.24

|

|

$

|

2.68

|

|

$

|

2.70

|

|

||

|

|

June 30,

|

||||||

|

|

2013

|

2012

|

|||||

|

|

(in thousands)

|

||||||

|

Land

|

$

|

3,009

|

|

$

|

3,009

|

|

|

|

Buildings and leasehold improvements

|

20,020

|

|

18,231

|

|

|||

|

Computer software and equipment

|

14,338

|

|

13,829

|

|

|||

|

Furniture, fixtures and equipment

|

14,852

|

|

14,739

|

|

|||

|

Construction in Progress

|

629

|

|

29,045

|

|

|||

|

52,848

|

|

78,853

|

|

||||

|

Less accumulated depreciation

|

(32,645

|

)

|

(30,068

|

)

|

|||

|

$

|

20,203

|

|

$

|

48,785

|

|

||

|

(4)

|

Acquisitions

|

|

|

Amount

|

||

|

Identified intangible assets

|

(in thousands)

|

||

|

Trade names (2 year useful life)

|

$

|

2,746

|

|

|

Customer relationships (6 year useful life)

|

18,965

|

|

|

|

Non-compete agreements (5 year useful life)

|

894

|

|

|

|

Total identified intangible assets

|

$

|

22,605

|

|

|

June 30, 2013

|

June 30, 2012

|

June 30, 2011

|

|||||||||

|

|

(in thousands)

|

||||||||||

|

Assets

|

|||||||||||

|

Prepaid expenses and other assets (current)

|

$

|

5,061

|

|

$

|

3,886

|

|

$

|

—

|

|

||

|

Other assets (noncurrent)

|

$

|

2,905

|

|

$

|

5,112

|

|

$

|

16,250

|

|

||

|

Liabilities

|

|||||||||||

|

Other current liabilities

|

$

|

5,061

|

|

$

|

3,886

|

|

$

|

—

|

|

||

|

Other long-term liabilities

|

$

|

2,905

|

|

$

|

5,112

|

|

$

|

16,250

|

|

||

|

|

June 30,

|

||

|

|

2011

|

||

|

Unaudited, Supplemental Pro Forma Information

|

(in thousand, except

per share information)

|

||

|

Net sales

|

$

|

2,786,905

|

|

|

Net income

|

$

|

75,328

|

|

|

Diluted earnings per share

|

$

|

2.76

|

|

|

(5)

|

Goodwill, Other Identifiable Intangible Assets and Debt Issuance Costs

|

|

Barcode & Security Segment

|

Communications & Services Segment

|

Total

|

|||||||||

|

|

(in thousands)

|

||||||||||

|

Balance as of June 30, 2011

|

$

|

37,975

|

|

$

|

21,115

|

|

$

|

59,090

|

|

||

|

CDC measurement period adjustments

|

914

|

|

—

|

|

914

|

|

|||||

|

Unrealized gain (loss) on foreign currency translation

|

(5,881

|

)

|

(238

|

)

|

(6,119

|

)

|

|||||

|

Balance as of June 30, 2012

|

$

|

33,008

|

|

$

|

20,877

|

|

$

|

53,885

|

|

||

|

Impairment charges

|

(15,143

|

)

|

(5,419

|

)

|

(20,562

|

)

|

|||||

|

Unrealized gain (loss) on foreign currency translation

|

(1,536

|

)

|

8

|

|

(1,528

|

)

|

|||||

|

Balance as of June 30, 2013

|

$

|

16,329

|

|

$

|

15,466

|

|

$

|

31,795

|

|

||

|

|

June 30, 2013

|

June 30, 2012

|

|||||||||||||||||||||

|

|

Gross

Carrying

Amount

|

Accumulated

Amortization

|

Net

Book

Value

|

Gross

Carrying

Amount

|

Accumulated

Amortization

|

Net

Book

Value

|

|||||||||||||||||

|

|

(in thousands)

|

||||||||||||||||||||||

|

Amortized intangible assets:

|

|||||||||||||||||||||||

|

Customer relationships

|

$

|

33,166

|

|

$

|

14,191

|

|

$

|

18,975

|

|

$

|

34,483

|

|

$

|

10,864

|

|

$

|

23,619

|

|

|||||

|

Trade names

|

1,941

|

|

1,941

|

|

—

|

|

2,127

|

|

1,285

|

|

842

|

|

|||||||||||

|

Non-compete agreements

|

888

|

|

535

|

|

353

|

|

938

|

|

379

|

|

559

|

|

|||||||||||

|

Distributor agreements

|

637

|

|

153

|

|

484

|

|

610

|

|

105

|

|

505

|

|

|||||||||||

|

Total intangibles

|

36,632

|

|

16,820

|

|

19,812

|

|

38,158

|

|

12,633

|

|

25,525

|

|

|||||||||||

|

Debt issuance costs

|

2,499

|

|

1,312

|

|

1,187

|

|

2,499

|

|

967

|

|

1,532

|

|

|||||||||||

|

Total

|

$

|

39,131

|

|

$

|

18,132

|

|

$

|

20,999

|

|

$

|

40,657

|

|

$

|

13,600