|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| FOR THE FISCAL YEAR ENDED DECEMBER 31, 2012 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-11690

DDR Corp.

(Exact Name of Registrant as Specified in Its Charter)

|

Ohio |

34-1723097 |

|

|

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

3300 Enterprise Parkway, Beachwood, Ohio 44122

|

|

(Address of Principal Executive Offices — Zip Code)

(216) 755-5500

|

|

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Name of Each Exchange on

Which Registered |

|

|

Common Shares, Par Value $0.10 Per Share |

New York Stock Exchange | |

|

Depositary Shares, each representing 1/20 of a share of 7.375%

|

New York Stock Exchange | |

|

Depositary Shares, each representing 1/20 of a share of 6.5%

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the voting stock held by non-affiliates of the registrant at June 30, 2012, was $3.5 billion.

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

315,003,994 common shares outstanding as of February 15, 2013

|

|

DOCUMENTS INCORPORATED BY REFERENCE

The registrant incorporates by reference in Part III hereof portions of its definitive Proxy Statement for its 2013 Annual Meeting of Shareholders.

Table of Contents

|

Item No. |

Report

Page |

|||||

| PART I | ||||||

|

1. |

3 | |||||

|

1A. |

6 | |||||

|

1B. |

17 | |||||

|

2. |

17 | |||||

|

3. |

42 | |||||

|

4. |

43 | |||||

| PART II | ||||||

|

5. |

45 | |||||

|

6. |

47 | |||||

|

7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

49 | ||||

|

7A. |

86 | |||||

|

8. |

88 | |||||

|

9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

88 | ||||

|

9A. |

88 | |||||

|

9B. |

88 | |||||

| PART III | ||||||

|

10. |

89 | |||||

|

11. |

89 | |||||

|

12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

90 | ||||

|

13. |

Certain Relationships and Related Transactions, and Director Independence |

90 | ||||

|

14. |

90 | |||||

| PART IV | ||||||

|

15. |

91 | |||||

2

Table of Contents

| Item 1. | BUSINESS |

General Development of Business

DDR Corp., an Ohio corporation (the “Company” or “DDR”), a self-administered and self-managed real estate investment trust (“REIT”), is in the business of acquiring, owning, developing, redeveloping, expanding, leasing and managing shopping centers. In addition, the Company engages in the origination and acquisition of loans and debt securities, which are generally collateralized directly or indirectly by shopping centers. Unless otherwise provided, references herein to the Company or DDR include DDR Corp., its wholly-owned and majority-owned subsidiaries and its consolidated and unconsolidated joint ventures.

The Company is self-administered and self-managed and, therefore, does not engage or pay a REIT advisor. The Company manages substantially all of the Portfolio Properties as defined herein. At December 31, 2012, the Company owned more than 115 million total square feet of gross leasable area (“GLA”). These amounts do not include 44 assets that the Company has not managed since January 1, 2012, 40 of which the Company does not have an economic interest.

Financial Information About Industry Segments

The Company is in the business of acquiring, owning, developing, redeveloping, expanding, leasing and managing shopping centers. In addition, the Company engages in the origination and acquisition of loans and debt securities, which are generally collateralized directly or indirectly by shopping centers. See the Consolidated Financial Statements and Notes thereto included in Item 8 of this Annual Report on Form 10-K for certain information regarding the Company’s reportable segments, which is incorporated herein by reference to such information.

Narrative Description of Business

The Company’s portfolio as of February 15, 2013, consisted of 450 shopping centers (including 206 centers owned through unconsolidated joint ventures and three centers that are otherwise consolidated by the Company) and more than 1,500 acres of undeveloped land (of which approximately 110 acres are owned through unconsolidated joint ventures). The shopping centers and land are collectively referred to as the “Portfolio Properties.” The shopping center properties consist of shopping centers, and to a lesser extent, enclosed malls and lifestyle centers. From January 1, 2010, to February 15, 2013, the Company acquired 61 shopping centers (seven of which were acquired from unconsolidated joint ventures and 46 of which were acquired by one unconsolidated joint venture) containing an aggregate of 16.0 million square feet of GLA owned by the Company for an aggregate purchase price of $2.4 billion. From January 1, 2010, to February 15, 2013, the Company sold 148 shopping centers (including 52 properties owned through unconsolidated joint ventures) containing an aggregate of 18.0 million square feet of GLA owned by the Company for an aggregate sales price of $1.5 billion.

At December 31, 2012, the Company had 14 assets under development and/or redevelopment (consisting of 11 wholly-owned shopping centers and three joint venture shopping centers).

3

Table of Contents

The following tables present the operating statistics affecting base and percentage rental revenues summarized by the following portfolios: combined shopping center portfolio, wholly-owned shopping center portfolio and joint venture shopping center portfolio.

|

Shopping

Center

Portfolio (1) December 31, |

||||||||

| 2012 | 2011 | |||||||

|

Centers owned |

452 | 432 | ||||||

|

Aggregate occupancy rate |

91.5 | % | 89.1 | % | ||||

|

Average annualized base rent per occupied square foot (1) |

$ | 13.66 | (2) | $ | 13.81 | |||

|

Wholly-Owned

Shopping Centers December 31, |

Joint Venture

Shopping Centers (1) December 31, |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

|

Centers owned |

243 | 253 | 206 | 177 | ||||||||||||

|

Centers owned through consolidated joint ventures |

N/A | N/A | 3 | 2 | ||||||||||||

|

Aggregate occupancy rate |

91.9 | % | 88.8 | % | 90.9 | % | 89.5 | % | ||||||||

|

Average annualized base rent per occupied square foot |

$ | 12.92 | $ | 12.26 | $ | 14.58 | (2) | $ | 15.93 | |||||||

| (1) |

In 2012, excludes shopping centers owned through the Company’s joint venture with Coventry Real Estate Fund II (“Coventry II Fund”), which are no longer managed by the Company and in which the Company’s investment basis is not material. In 2011, excludes shopping centers owned by unconsolidated joint ventures in which the Company’s investment basis is zero and in which the Company is receiving no allocation of income or loss, which includes certain Coventry II Fund investments. |

| (2) |

Decrease within the joint venture portfolio primarily due to the impact of exchange rate fluctuations with the Brazilian Real, the sale of assets in Brazil and the inclusion of the BRE DDR Retail Holdings, LLC assets in 2012. |

Strategy and Philosophy

The Company’s mission is to enhance shareholder value by exceeding the expectations of its tenants, innovating to create new growth opportunities and fostering the talents of its employees while rewarding their successes. The Company’s vision is to be the most admired provider of retail destinations and the first consideration for tenants, investors, partners and employees.

The Company’s strategic objective is to improve the quality of its prime portfolio (i.e., market-dominant shopping centers with high-quality tenants located in attractive markets with strong demographic profiles, which are referred to as “Prime Portfolio” or “Prime Assets”) while lowering leverage and risk and at the same time preparing the Company for long-term growth and financial strength. The Company’s real estate strategy and philosophy has been to grow its business through a combination of leasing, expansion, acquisition, development and redevelopment. The Company may pursue the disposition of certain real estate assets that are not likely to generate superior growth and recycle the proceeds to repay debt, to reinvest in Prime Assets or for other corporate purposes.

The Company’s key strategies are summarized as follows:

| • |

Increase cash flows and property values through strategic leasing, re-tenanting, renovation and expansion of the Company’s portfolio to be the preeminent landlord to the world’s most successful retailers; |

| • |

Increase per share cash flows through the strategic disposition of non-prime assets and use the proceeds to repay debt and reinvest in other higher growth real estate assets and developments; |

4

Table of Contents

| • |

Address capital requirements by selling assets, including sales to joint ventures, retaining capital, maintaining dividend payments at the amount required to meet minimum REIT requirements, entering into new financings and, to the extent deemed appropriate, minimizing capital expenditures; |

| • |

Access equity capital through the public markets and other viable alternatives; |

| • |

Pursue de-leveraging goals, including extending the duration of the Company’s debt; |

| • |

Control spending within the Company’s development portfolio by phasing construction until sufficient pre-leasing is reached and financing is in place; |

| • |

Increase expected spending on redevelopment in order to best position centers for tenant demand and to generate attractive returns; |

| • |

Selectively pursue new investment opportunities only after sufficient equity and debt financings are identified and underwritten expected returns sufficiently exceed the Company’s cost of capital; |

| • |

Continue leasing strategy of enhancing tenant relationships at a high level through the Company’s national account program and increasing occupancy with high-quality tenants; |

| • |

Renew tenants’ extension options and execute leases in a timely manner; |

| • |

Dedicate Company resources to monitor major tenant vacancies, proactively identify potential space recapture opportunities and focus on marketing and re-tenanting those spaces; |

| • |

Selectively develop or sell the Company’s undeveloped parcels and acquire and develop new sites in areas with attractive demographics and |

| • |

Hold prime properties for long-term investment and place a strong emphasis on regular maintenance, periodic renovation and capital improvements. |

The strategy, philosophy, investment and financing policies of the Company, and its policies with respect to certain other activities including its growth, debt capitalization, dividends, status as a REIT and operating policies, are determined by the Board of Directors. Although the Board of Directors has no present intention to amend or revise its policies, the Board of Directors may do so from time to time without a vote of the Company’s shareholders.

Recent Developments

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in Item 7 and the Consolidated Financial Statements and Notes thereto included in Item 8 of this Annual Report on Form 10-K for the year ended December 31, 2012, for information on certain recent developments of the Company, which is incorporated herein by reference to such information.

Tenants and Competition

As one of the nation’s largest owners and operators of shopping centers (measured by total GLA), the Company has established close relationships with a large number of major national and regional retailers. The Company’s management is associated with and actively participates in many shopping center and REIT industry organizations.

Notwithstanding these relationships, numerous developers and real estate companies, private and public, compete with the Company in leasing space in shopping centers to tenants. The Company competes with other real estate companies and developers in terms of rental rate, property location, availability of other space, management services and maintenance.

5

Table of Contents

As of December 31, 2012, the annualized base rental revenues of the Company’s tenants that are equal to or exceed 1.5% of the Company’s aggregate annualized shopping center base rental revenues, including its proportionate share of joint venture aggregate annualized shopping center base rental revenues, are as follows:

|

Tenant |

% of Annualized Base

Rental Revenues |

|||

|

Walmart/Sam’s Club |

4.0 | % | ||

|

TJX Companies (1) |

2.5 | % | ||

|

Bed Bath & Beyond (2) |

2.5 | % | ||

|

PetSmart |

2.2 | % | ||

|

Kohl’s |

1.9 | % | ||

|

Best Buy |

1.7 | % | ||

|

Michaels |

1.7 | % | ||

|

Dick’s Sporting Goods |

1.5 | % | ||

|

Ross Stores |

1.5 | % | ||

| (1) |

Includes T.J. Maxx, Marshalls and Homegoods. |

| (2) |

Includes Bed Bath & Beyond, World Market and other retail concepts. |

Qualification as a Real Estate Investment Trust

As of December 31, 2012, the Company met the qualification requirements of a REIT under Sections 856-860 of the Internal Revenue Code of 1986, as amended (the “Code”). As a result, the Company, with the exception of its taxable REIT subsidiary (“TRS”), will not be subject to federal income tax to the extent it meets certain requirements of the Code.

Employees

As of January 31, 2013, the Company employed 607 full-time individuals including executive, administrative and field personnel. The Company considers its relations with its personnel to be good.

Corporate Headquarters

The Company is an Ohio corporation and was incorporated in 1992. The Company’s executive offices are located at 3300 Enterprise Parkway, Beachwood, Ohio 44122, and its telephone number is (216) 755-5500. The Company’s website is http://www.ddr.com. The Company uses its Investor Relations website, (http://www.ddr.com), as a channel for routine distribution of important information, including news releases, analyst presentations and financial information. The Company posts filings as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC, including the Company’s annual, quarterly and current reports on Forms 10-K, 10-Q and 8-K, the Company’s proxy statements and any amendments to those reports or statements. All such postings and filings are available on the Company’s Investor Relations website free of charge. In addition, this website allows investors and other interested persons to sign up to automatically receive e-mail alerts when the Company posts news releases and financial information on its website. The SEC also maintains a website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The content on, or accessible through, any website referred to in this Annual Report on Form 10-K for the fiscal year ended December 31, 2012, is not incorporated by reference into, and shall not be deemed part of, this Form 10-K unless expressly noted.

| Item 1A. | RISK FACTORS |

The risks described below could materially and adversely affect the Company’s results of operations, financial condition, liquidity and cash flows. These risks are not the only risks that the Company faces. The Company’s business operations could also be affected by additional factors that are not presently known to it or that the Company currently considers to be immaterial to its operations.

6

Table of Contents

The Economic Performance and Value of the Company’s Shopping Centers Depend on Many Factors, Each of Which Could Have an Adverse Impact on the Company’s Cash Flows and Operating Results

The economic performance and value of the Company’s real estate holdings can be affected by many factors, including the following:

| • |

Changes in the national, regional, local and international economic climate; |

| • |

Local conditions, such as an oversupply of space or a reduction in demand for real estate in the area; |

| • |

The attractiveness of the properties to tenants; |

| • |

Competition from other available space; |

| • |

The Company’s ability to provide adequate management services and to maintain its properties; |

| • |

Increased operating costs, if these costs cannot be passed through to tenants and |

| • |

The expense of periodically renovating, repairing and reletting spaces. |

Because the Company’s properties consist primarily of shopping centers, the Company’s performance is linked to general economic conditions in the market for retail space. The market for retail space has been and may continue to be adversely affected by weakness in the national, regional and local economies, the adverse financial condition of some large retailing companies, the ongoing consolidation in the retail sector, the excess amount of retail space in a number of markets and increasing consumer purchases through the Internet. To the extent that any of these conditions occur, they are likely to affect market rents for retail space. In addition, the Company may face challenges in the management and maintenance of its properties or incur increased operating costs, such as real estate taxes, insurance and utilities, which may make its properties unattractive to tenants. The loss of rental revenues from a number of the Company’s tenants and its inability to replace such tenants may adversely affect the Company’s profitability and ability to meet its debt and other financial obligations and make distributions to shareholders.

The Company Relies on Major Tenants, Making It Vulnerable to Changes in the Business and Financial Condition of, or Demand for Its Space by, Such Tenants

As of December 31, 2012, the annualized base rental revenues of the Company’s tenants that are equal to or exceed 1.5% of the Company’s aggregate annualized shopping center base rental revenues, including its proportionate share of joint venture aggregate annualized shopping center base rental revenues, are as follows:

|

Tenant |

% of Annualized Base

Rental Revenues |

|||

|

Walmart/Sam’s Club |

4.0 | % | ||

|

TJX Companies (1) |

2.5 | % | ||

|

Bed Bath & Beyond (2) |

2.5 | % | ||

|

PetSmart |

2.2 | % | ||

|

Kohl’s |

1.9 | % | ||

|

Best Buy |

1.7 | % | ||

|

Michaels |

1.7 | % | ||

|

Dick’s Sporting Goods |

1.5 | % | ||

|

Ross Stores |

1.5 | % | ||

| (1) |

Includes T.J. Maxx, Marshalls and Homegoods. |

| (2) |

Includes Bed Bath & Beyond, World Market and other retail concepts. |

The retail shopping sector has been affected by economic conditions as well as the competitive nature of the retail business and the competition for market share where stronger retailers have out-positioned some of the weaker retailers. These shifts have forced some market share away from weaker retailers and required them, in some cases, to declare bankruptcy and/or close stores.

7

Table of Contents

As information becomes available regarding the status of the Company’s leases with tenants in financial distress or the future plans for their spaces change, the Company may be required to write off and/or accelerate depreciation and amortization expense associated with a significant portion of the tenant-related deferred charges in future periods. The Company’s income and ability to meet its financial obligations could also be adversely affected in the event of the bankruptcy, insolvency or significant downturn in the business of one of these tenants or any of the Company’s other major tenants. In addition, the Company’s results could be adversely affected if any of these tenants do not renew their leases as they expire.

The Company’s Dependence on Rental Income May Adversely Affect Its Ability to Meet Its Debt Obligations and Make Distributions to Shareholders

Substantially all of the Company’s income is derived from rental income from real property. As a result, the Company’s performance depends on its ability to collect rent from tenants. The Company’s income and funds for distribution would be negatively affected if a significant number of its tenants, or any of its major tenants, were to do the following:

| • |

Experience a downturn in their business that significantly weakens their ability to meet their obligations to the Company; |

| • |

Delay lease commencements; |

| • |

Decline to extend or renew leases upon expiration; |

| • |

Fail to make rental payments when due or |

| • |

Close stores or declare bankruptcy. |

Any of these actions could result in the termination of tenants’ leases and the loss of rental income attributable to the terminated leases. Lease terminations by an anchor tenant or a failure by that anchor tenant to occupy the premises could also result in lease terminations or reductions in rent by other tenants in the same shopping centers under the terms of some leases. In addition, the Company cannot be certain that any tenant whose lease expires will renew that lease or that it will be able to re-lease space on economically advantageous terms. The loss of rental revenues from a number of the Company’s major tenants and its inability to replace such tenants may adversely affect the Company’s profitability and its ability to meet debt and other financial obligations and make distributions to shareholders.

The Company Has Variable-Rate Debt and Is Subject to Interest Rate Risk

The Company has indebtedness with interest rates that vary depending upon the market index. In addition, the Company has revolving credit facilities that bear interest at a variable rate on any amounts drawn on the facilities. The Company may incur additional variable-rate debt in the future. Increases in interest rates on variable-rate debt would increase the Company’s interest expense, which would negatively affect net earnings and cash available for payment of its debt obligations and distributions to its shareholders.

The Company’s Ability to Increase Its Debt Could Adversely Affect Its Cash Flow

At December 31, 2012, the Company had outstanding debt of $4.3 billion (excluding its proportionate share of unconsolidated joint venture mortgage debt aggregating $0.7 billion as of December 31, 2012). The Company intends to maintain a conservative ratio of debt to total market capitalization (the sum of the aggregate market value of the Company’s common shares and operating partnership units, the liquidation preference on any preferred shares outstanding and its total consolidated indebtedness). The Company is subject to limitations under its credit facilities and indentures relating to its ability to incur additional debt; however, the Company’s organizational documents do not contain any limitation on the amount or percentage of indebtedness it may incur. If the Company were to become more highly leveraged, its cash needs to fund debt service would increase

8

Table of Contents

accordingly. Under such circumstances, the Company’s risk of decreases in cash flow, due to fluctuations in the real estate market, reliance on its major tenants, acquisition and development costs and the other factors discussed in these risk factors, could subject the Company to an even greater adverse impact on its financial condition and results of operations. In addition, increased leverage could increase the risk of default on the Company’s debt obligations, which could further reduce its cash available for distribution and adversely affect its ability to dispose of its portfolio on favorable terms, which could cause the Company to incur losses and reduce its cash flows.

Disruptions in the Financial Markets Could Affect the Company’s Ability to Obtain Financing on Reasonable Terms and Have Other Adverse Effects on the Company and the Market Price of the Company’s Common Shares

The U.S. and global equity and credit markets have experienced significant price volatility, dislocations and liquidity disruptions over the last few years, which caused market prices of many stocks to fluctuate substantially and the spreads on prospective debt financings to widen considerably. These circumstances materially affected liquidity in the financial markets, making terms for certain financings less attractive and, in certain cases, resulting in the unavailability of certain types of financing. Uncertainty in the equity and credit markets may negatively affect the Company’s ability to access additional financing at reasonable terms or at all, which may negatively affect the Company’s ability to refinance its debt, obtain new financing or make acquisitions. These circumstances may also adversely affect the Company’s tenants, including their ability to enter into new leases, pay their rents when due and renew their leases at rates at least as favorable as their current rates.

A prolonged downturn in the equity or credit markets may cause the Company to seek alternative sources of potentially less attractive financing and may require it to adjust its business plan accordingly. In addition, these factors may make it more difficult for the Company to sell properties or may adversely affect the price it receives for properties that it does sell, as prospective buyers may experience increased costs of financing or difficulties in obtaining financing. These events in the equity and credit markets may make it more difficult or costly for the Company to raise capital through the issuance of its common shares or debt securities. These disruptions in the financial markets also may have a material adverse effect on the market value of the Company’s common shares and other adverse effects on the Company or the economy in general. There can be no assurances that government responses to the disruptions in the financial markets will restore consumer confidence, stabilize the markets or increase liquidity and the availability of equity or credit financing.

Changes in the Company’s Credit Ratings or the Debt Markets, as well as Market Conditions in the Credit Markets, Could Adversely Affect the Company’s Publicly Traded Debt and Revolving Credit Facilities

The market value for the Company’s publicly traded debt depends on many factors, including the following:

| • |

The Company’s credit ratings with major credit rating agencies; |

| • |

The prevailing interest rates being paid by, or the market price for publicly traded debt issued by, other companies similar to the Company; |

| • |

The Company’s financial condition, liquidity, leverage, financial performance and prospects and |

| • |

The overall condition of the financial markets. |

The condition of the financial markets and prevailing interest rates have fluctuated in the past and are likely to fluctuate in the future. The U.S. credit markets and the sub-prime residential mortgage market have experienced severe dislocations and liquidity disruptions in the last few years. Furthermore, uncertain market conditions can be exacerbated by leverage. The occurrence of these circumstances in the credit markets and/or additional fluctuations in the financial markets and prevailing interest rates could have an adverse effect on the Company’s ability to access capital and its cost of capital.

9

Table of Contents

In addition, credit rating agencies continually review their ratings for the companies they follow, including the Company. The credit rating agencies also evaluate the real estate industry as a whole and may change their credit rating for the Company based on their overall view of the industry. Any rating organization that rates the Company’s publicly traded debt may lower the rating or decide not to rate the publicly traded debt in its sole discretion. The ratings of the Company’s publicly traded debt are based primarily on the rating organization’s assessment of the likelihood of timely payment of interest when due and the payment of principal on the maturity date. A negative change in the Company’s rating could have an adverse effect on the Company’s revolving credit facilities and market price of the Company’s publicly traded debt as well as the Company’s ability to access capital and its cost of capital.

The Company’s Cash Flows and Operating Results Could Be Adversely Affected by Required Payments of Debt or Related Interest and Other Risks of Its Debt Financing

The Company is generally subject to the risks associated with debt financing. These risks include the following:

| • |

The Company’s cash flow may not satisfy required payments of principal and interest; |

| • |

The Company may not be able to refinance existing indebtedness on its properties as necessary, or the terms of the refinancing may be less favorable to the Company than the terms of existing debt; |

| • |

Required debt payments are not reduced if the economic performance of any property declines; |

| • |

Debt service obligations could reduce funds available for distribution to the Company’s shareholders and funds available for development, redevelopment and acquisitions; |

| • |

Any default on the Company’s indebtedness could result in acceleration of those obligations, which could result in the acceleration of other debt obligations and possible loss of property to foreclosure and |

| • |

The Company may not be able to finance necessary capital expenditures for purposes such as re-leasing space on favorable terms or at all. |

If a property is mortgaged to secure payment of indebtedness and the Company cannot make the mortgage payments, it may have to surrender the property to the lender with a consequent loss of any prospective income and equity value from such property, which may also adversely affect the Company’s credit ratings. Any of these risks can place strains on the Company’s cash flows, reduce its ability to grow and adversely affect its results of operations.

The Company’s Financial Condition Could Be Adversely Affected by Financial Covenants

The Company’s credit facilities and the indentures under which its senior and subordinated unsecured indebtedness is, or may be, issued contain certain financial and operating covenants, including, among other things, leverage ratios and certain coverage ratios, as well as limitations on the Company’s ability to incur secured and unsecured indebtedness, sell all or substantially all of its assets and engage in mergers and certain acquisitions. These credit facilities and indentures also contain customary default provisions including the failure to pay principal and interest issued thereunder in a timely manner, the failure to comply with the Company’s financial and operating covenants, the occurrence of a material adverse effect on the Company and the failure of the Company or its majority-owned subsidiaries (i.e., entities in which the Company has a greater than 50% interest) to pay when due certain indebtedness in excess of certain thresholds beyond applicable grace and cure periods. These covenants could limit the Company’s ability to obtain additional funds needed to address cash shortfalls or pursue growth opportunities or transactions that would provide substantial return to its shareholders. In addition, a breach of these covenants could cause a default or accelerate some or all of the Company’s indebtedness, which could have a material adverse effect on its financial condition.

10

Table of Contents

Property Ownership Through Partnerships and Joint Ventures Could Limit the Company’s Control of Those Investments and Reduce Its Expected Return

Partnership or joint venture investments may involve risks not otherwise present for investments made solely by the Company, including the possibility that the Company’s partner or co-venturer might become bankrupt, that its partner or co-venturer might at any time have different interests or goals than the Company and that its partner or co-venturer may take action contrary to the Company’s instructions, requests, policies or objectives, including the Company’s policy with respect to maintaining its qualification as a REIT. Other risks of joint venture investments include impasse on decisions, such as a sale, because neither the Company’s partner or co-venturer nor the Company would have full control over the partnership or joint venture. These factors could limit the return that the Company receives from such investments or cause its cash flows to be lower than its estimates. There is no limitation under the Company’s Articles of Incorporation, or its code of regulations, as to the amount of funds that the Company may invest in partnerships or joint ventures. In addition, a partner or co-venturer may not have access to sufficient capital to satisfy its funding obligations to the joint venture. Furthermore, if credit conditions in the capital markets deteriorate, the Company could be required to reduce the carrying value of its equity method investments if a loss in the carrying value of the investment is considered an other than temporary decline. As of December 31, 2012, the Company had $613.0 million of investments in and advances to unconsolidated joint ventures holding 206 operating shopping centers.

The Company’s Real Estate Assets May Be Subject to Impairment Charges

On a periodic basis, the Company assesses whether there are any indicators that the value of its real estate assets and other investments may be impaired. A property’s value is impaired only if the estimate of the aggregate future cash flows (undiscounted and without interest charges) to be generated by the property are less than the carrying value of the property. In the Company’s estimate of cash flows, it considers factors such as expected future operating income, trends and prospects, the effects of demand, competition and other factors. If the Company is evaluating the potential sale of an asset or development alternatives, the undiscounted future cash flow considerations include the most likely course of action at the balance sheet date based on current plans, intended holding periods and available market information. The Company is required to make subjective assessments as to whether there are impairments in the value of its real estate assets and other investments. These assessments have a direct impact on the Company’s earnings because recording an impairment charge results in an immediate negative adjustment to earnings. There can be no assurance that the Company will not take additional charges in the future related to the impairment of its assets. Any future impairment could have a material adverse effect on the Company’s results of operations in the period in which the charge is taken.

The Company’s Acquisition Activities May Not Produce the Cash Flows That It Expects and May Be Limited by Competitive Pressures or Other Factors

The Company intends to acquire existing retail properties only to the extent that suitable acquisitions can be made on advantageous terms. Acquisitions of commercial properties entail risks, such as the following:

| • |

The Company’s estimates on expected occupancy and rental rates may differ from actual conditions; |

| • |

The Company’s estimates of the costs of any redevelopment or repositioning of acquired properties may prove to be inaccurate; |

| • |

The Company may be unable to operate successfully in new markets where acquired properties are located due to a lack of market knowledge or understanding of local economies; |

| • |

The properties may become subject to environmental liabilities that the Company was unaware of at the time the Company acquired the property; |

| • |

The Company may be unable to successfully integrate new properties into its existing operations or |

| • |

The Company may have difficulty obtaining financing on acceptable terms or paying the operating expenses and debt service associated with acquired properties prior to sufficient occupancy. |

11

Table of Contents

In addition, the Company may not be in a position or have the opportunity in the future to make suitable property acquisitions on advantageous terms due to competition for such properties with others engaged in real estate investment that may have greater financial resources than the Company. The Company’s inability to successfully acquire new properties may affect the Company’s ability to achieve its anticipated return on investment, which could have an adverse effect on its results of operations.

Real Estate Property Investments Are Illiquid; Therefore, the Company May Not Be Able to Dispose of Properties When Desired or on Favorable Terms

Real estate investments generally cannot be disposed of quickly. In addition, the federal income tax code imposes restrictions, which are not applicable to other types of real estate companies, on the ability of a REIT to dispose of properties. Therefore, the Company may not be able to diversify its portfolio in response to economic or other conditions promptly or on favorable terms, which could cause the Company to incur losses and reduce its cash flows and adversely affect distributions to shareholders.

The Company’s Development and Construction Activities Could Affect Its Operating Results

The Company intends to continue the selective development and construction of retail properties in accordance with its development underwriting policies as opportunities arise. The Company expects to phase in construction until sufficient pre-leasing is reached and financing is in place. The Company’s development and construction activities include the following risks:

| • |

The Company may abandon development opportunities after expending resources to determine feasibility; |

| • |

Construction costs of a project may exceed the Company’s original estimates; |

| • |

Occupancy rates and rents at a newly completed property may not be sufficient to make the property profitable; |

| • |

Rental rates per square foot could be less than projected; |

| • |

Financing may not be available to the Company on favorable terms for development of a property; |

| • |

The Company may not complete construction and lease-up on schedule, resulting in increased debt service expense and construction costs and |

| • |

The Company may not be able to obtain, or may experience delays in obtaining, necessary zoning, land use, building, occupancy and other required governmental permits and authorizations. |

Additionally, the time frame required for development, construction and lease-up of these properties means that the Company may wait several years for a significant cash return. If any of the above events occur, the development of properties may hinder the Company’s growth and have an adverse effect on its results of operations and cash flows. In addition, new development activities, regardless of whether they are ultimately successful, typically require substantial time and attention from management.

If the Company Fails To Qualify as a REIT in Any Taxable Year, It Will Be Subject to U.S. Federal Income Tax as a Regular Corporation and Could Have Significant Tax Liability

The Company intends to operate in a manner that allows it to qualify as a REIT for U.S. federal income tax purposes. However, REIT qualification requires that the Company satisfy numerous requirements (some on an annual or quarterly basis) established under highly technical and complex provisions of the Code, for which there are a limited number of judicial or administrative interpretations. The Company’s status as a REIT requires an analysis of various factual matters and circumstances that are not entirely within its control. Accordingly, it is not certain that the Company will be able to qualify and remain qualified as a REIT for U.S. federal income tax

12

Table of Contents

purposes. Even a technical or inadvertent violation of the REIT requirements could jeopardize the Company’s REIT qualification. Furthermore, Congress or the Internal Revenue Service (“IRS”) might change the tax laws or regulations and the courts could issue new rulings, in each case potentially having retroactive effect that could make it more difficult or impossible for the Company to continue to qualify as a REIT. If the Company fails to qualify as a REIT in any tax year, the following would result:

| • |

The Company would be taxed as a regular domestic corporation, which, among other things, means that it would be unable to deduct distributions to its shareholders in computing its taxable income and would be subject to U.S. federal income tax on its taxable income at regular corporate rates; |

| • |

Any resulting tax liability could be substantial and would reduce the amount of cash available for distribution to shareholders and could force the Company to liquidate assets or take other actions that could have a detrimental effect on its operating results and |

| • |

Unless the Company were entitled to relief under applicable statutory provisions, it would be disqualified from treatment as a REIT for the four taxable years following the year during which the Company lost its qualification, and its cash available for debt service obligations and distribution to its shareholders, therefore, would be reduced for each of the years in which the Company does not qualify as a REIT. |

Even if the Company remains qualified as a REIT, it may face other tax liabilities that reduce its cash flow. The Company may also be subject to certain federal, state and local taxes on its income and property either directly or at the level of its subsidiaries. Any of these taxes would decrease cash available for debt service obligations and distribution to the Company’s shareholders.

Compliance with REIT Requirements May Negatively Affect the Company’s Operating Decisions

To maintain its status as a REIT for U.S. federal income tax purposes, the Company must meet certain requirements on an ongoing basis, including requirements regarding its sources of income, the nature and diversification of its assets, the amounts the Company distributes to its shareholders and the ownership of its shares. The Company may also be required to make distributions to its shareholders when it does not have funds readily available for distribution or at times when the Company’s funds are otherwise needed to fund capital expenditures or debt service obligations.

As a REIT, the Company must distribute at least 90% of its annual net taxable income (excluding net capital gains) to its shareholders. To the extent that the Company satisfies this distribution requirement, but distributes less than 100% of its net taxable income, the Company will be subject to U.S. federal corporate income tax on its undistributed taxable income. In addition, the Company will be subject to a 4% non-deductible excise tax if the actual amount paid to its shareholders in a calendar year is less than the minimum amount specified under U.S. federal tax laws. From time to time, the Company may generate taxable income greater than its income for financial reporting purposes, or its net taxable income may be greater than its cash flow available for distribution to its shareholders. If the Company does not have other funds available in these situations, it could be required to borrow funds, sell its securities or a portion of its properties at unfavorable prices or find other sources of funds in order to meet the REIT distribution requirements and avoid corporate income tax and the 4% excise tax.

In addition, the REIT provisions of the Code impose a 100% tax on income from “prohibited transactions.” Prohibited transactions generally include sales of assets that constitute inventory or other property held for sale to customers in the ordinary course of business, other than foreclosure property. This 100% tax could affect the Company’s decisions to sell property if it believes such sales could be treated as a prohibited transaction. However, the Company would not be subject to this tax if it were to sell assets through its TRS. The Company will also be subject to a 100% tax on certain amounts if the economic arrangements between the Company and its TRS are not comparable to similar arrangements among unrelated parties.

13

Table of Contents

Dividends Paid by REITs Generally Do Not Qualify for Reduced Tax Rates

In general, the maximum U.S. federal income tax rate for dividends paid to individual U.S. shareholders is 20%. Due to its REIT status, the Company’s distributions to individual shareholders generally are not eligible for the reduced rates.

The Company’s Inability to Realize Anticipated Returns from Its Retail Real Estate Investments Outside the United States Could Adversely Affect Its Results of Operations

The Company may not realize the intended benefits of transactions outside the United States, as the Company may not have any prior experience with the local economies or culture. The assets may not perform as well as the Company anticipated or may not be successfully integrated, or the Company may not realize the improvements in occupancy and operating results that it anticipated. The Company could be subject to local laws governing these properties, with which it has no prior experience, and which may present new challenges for the management of the Company’s operations. In addition, financing may not be available at acceptable rates, and equity requirements may be different from the Company’s strategy in the United States. Each of these factors may adversely affect the Company’s ability to achieve anticipated return on investment, which could have an adverse effect on its results of operations.

The Company’s Investments in Real Estate Assets Outside United States Will Be Subject to Additional Risks

International investments and operations generally are subject to various political and other risks that are different from and in addition to risks inherent in the investment in real estate generally discussed in these risk factors and elsewhere in this Annual Report on Form 10-K for the year ended December 31, 2012. The Company’s investments in consolidated and unconsolidated joint ventures with international real estate assets in Brazil, Russia and Canada will be subject to fluctuations in foreign currency exchange rates and the uncertainty of foreign laws and markets including, but not limited to, unexpected changes in the regulatory requirements such as the enactment of laws prohibiting or restricting the foreign ownership of property, political and economic instability in certain geographic locations, labor disruptions, difficulties in managing international operations, potentially adverse tax consequences, laws restricting the Company’s ability to return profits to the United States, additional accounting and control expenses and the administrative burden associated with complying with a variety of foreign laws. Furthermore, the Company is subject to laws and regulations, such as the Foreign Corrupt Practices Act or similar local anti-bribery laws, that generally prohibit companies and their employees, agents and contractors from making improper payments to governmental officials for the purpose of obtaining or retaining business. Failure to comply with these laws could subject the Company to civil and criminal penalties that could materially adversely affect the Company’s results of operations or the value of the Company’s international investments.

Changes in foreign currency exchange rates may also adversely impact the fair values and earnings streams of the Company’s international holdings and thus the returns on the Company’s non-U.S.-dollar denominated investments. Although the Company may hedge some or all of its foreign currency risk, subject to the REIT income qualification tests, the Company may not be able to do so successfully and may incur losses on these investments as a result of exchange rate fluctuations.

The Company Is Subject to Litigation That Could Adversely Affect Its Results of Operations

The Company is a defendant from time to time in lawsuits and regulatory proceedings relating to its business. Due to the inherent uncertainties of litigation and regulatory proceedings, the Company cannot accurately predict the ultimate outcome of any such litigation or proceedings. An unfavorable outcome could adversely affect the Company’s business, financial condition or results of operations.

14

Table of Contents

Any such litigation could also lead to increased volatility of the trading price of the Company’s common shares. For a further discussion of litigation risks, see “Legal Matters” in Note 9 — Commitments and Contingencies to the Consolidated Financial Statements.

The Company’s Real Estate Investments May Contain Environmental Risks That Could Adversely Affect Its Results of Operations

The acquisition of properties may subject the Company to liabilities, including environmental liabilities. The Company’s operating expenses could be higher than anticipated due to the cost of complying with existing or future environmental laws and regulations. In addition, under various federal, state and local laws, ordinances and regulations, the Company may be considered an owner or operator of real property or to have arranged for the disposal or treatment of hazardous or toxic substances. As a result, the Company may become liable for the costs of removal or remediation of certain hazardous substances released on or in its properties. The Company may also be liable for other potential costs that could relate to hazardous or toxic substances (including governmental fines and injuries to persons and property). The Company may incur such liability whether or not it knew of, or was responsible for, the presence of such hazardous or toxic substances. Such liability could be of substantial magnitude and divert management’s attention from other aspects of the Company’s business and, as a result, could have a material adverse effect on the Company’s operating results and financial condition, as well as its ability to make distributions to shareholders.

An Uninsured Loss on the Company’s Properties or a Loss That Exceeds the Limits of the Company’s Insurance Policies Could Subject the Company to Lost Capital or Revenue on Those Properties

Under the terms and conditions of the leases currently in effect on the Company’s properties, tenants generally are required to indemnify and hold the Company harmless from liabilities resulting from injury to persons, air, water, land or property, on or off the premises, due to activities conducted on the properties, except for claims arising from the negligence or intentional misconduct of the Company or its agents. Additionally, tenants are generally required, at the tenant’s expense, to obtain and keep in full force during the term of the lease liability and full replacement value property damage insurance policies. The Company has obtained comprehensive liability, casualty, flood and rental loss insurance policies on its properties. All of these policies may involve substantial deductibles and certain exclusions. In addition, tenants could fail to properly maintain their insurance policies or be unable to pay the deductibles. Should a loss occur that is uninsured or is in an amount exceeding the combined aggregate limits for the policies noted above, or in the event of a loss that is subject to a substantial deductible under an insurance policy, the Company could lose all or part of its capital invested in, and anticipated revenue from, one or more of the properties, which could have a material adverse effect on the Company’s operating results and financial condition, as well as its ability to make distributions to shareholders.

The Company’s Properties Could Be Subject to Damage from Weather-Related Factors

A number of the Company’s properties are located in areas that are subject to natural disasters. Certain of the Company’s properties are located in California and in other areas with higher risk of earthquakes. In addition, many of the Company’s properties are located in coastal regions, including 15 properties located on the island of Puerto Rico as of February 15, 2013, and would therefore be affected by any future increases in sea levels or in the frequency or severity of hurricanes and tropical storms, whether such increases are caused by global climate changes or other factors.

Compliance with the Americans with Disabilities Act and Fire, Safety and Other Regulations May Require the Company to Make Unplanned Expenditures That Adversely Affect the Company’s Cash Flows

All of the Company’s properties are required to comply with the Americans with Disabilities Act, or ADA. The ADA has separate compliance requirements for “public accommodations” and “commercial facilities,” but

15

Table of Contents

generally requires that buildings be made accessible to people with disabilities. Compliance with the ADA requirements could require removal of access barriers, and non-compliance could result in imposition of fines by the U.S. government or an award of damages to private litigants, or both. While the tenants to whom the Company leases properties are obligated by law to comply with the ADA provisions, and are typically obligated to cover costs of compliance, if required changes involve greater expenditures than anticipated, or if the changes must be made on a more accelerated basis than anticipated, the ability of these tenants to cover costs could be adversely affected. As a result, the Company could be required to expend funds to comply with the provisions of the ADA, which could adversely affect the results of operations and financial condition and the Company’s ability to make distributions to shareholders. In addition, the Company is required to operate the properties in compliance with fire and safety regulations, building codes and other land use regulations, as they may be adopted by governmental agencies and bodies and become applicable to the properties. The Company may be required to make substantial capital expenditures to comply with those requirements, and these expenditures could have a material adverse effect on its ability to meet its financial obligations and make distributions to shareholders.

The Company’s Articles of Incorporation Contain Limitations on Acquisitions and Changes in Control

In order to maintain the Company’s status as a REIT, its Articles of Incorporation prohibit any person, except for certain shareholders as set forth in the Company’s Articles of Incorporation, from owning more than 5% of the Company’s outstanding common shares. This restriction is likely to discourage third parties from acquiring control of the Company without consent of its Board of Directors even if a change in control were in the best interests of shareholders.

The Company Has a Number of Shareholders Who Beneficially Own a Significant Portion of Its Outstanding Common Shares, and Their Interests May Differ from the Interests of Other Shareholders

The Company’s significant shareholders are in a position to influence any matters that are brought to a vote of the holders of the Company’s common shares, including, among others, the election of the Company’s Board of Directors and any amendments to its Articles of Incorporation and code of regulations. Without the support of the Company’s significant shareholders, certain transactions, such as mergers, tender offers, sales of assets and business combinations that could give shareholders the opportunity to realize a premium over the then-prevailing market prices for common shares may be more difficult to consummate. The interests of the Company’s significant shareholders may differ from the interests of other shareholders. If the Company’s significant shareholders sell substantial amounts of the Company’s common shares in the public market, the trading price of the Company’s common shares could decline significantly.

Changes in Market Conditions Could Adversely Affect the Market Price of the Company’s Publicly Traded Securities

As with other publicly traded securities, the market price of the Company’s publicly traded securities depends on various market conditions, which may change from time to time. Among the market conditions that may affect the market price of the Company’s publicly traded securities are the following:

| • |

The extent of institutional investor interest in the Company; |

| • |

The reputation of REITs generally and the reputation of REITs with similar portfolios; |

| • |

The attractiveness of the securities of REITs in comparison to securities issued by other entities (including securities issued by other real estate companies); |

| • |

The Company’s financial condition and performance; |

| • |

The market’s perception of the Company’s growth potential and future cash dividends; |

| • |

An increase in market interest rates, which may lead prospective investors to demand a higher distribution rate in relation to the price paid for the Company’s shares and |

| • |

General economic and financial market conditions. |

16

Table of Contents

The Company May Issue Additional Securities Without Shareholder Approval

The Company can issue preferred shares and common shares without shareholder approval subject to certain limitations in the Company’s Articles of Incorporation. Holders of preferred shares have priority over holders of common shares, and the issuance of additional shares reduces the interest of existing holders in the Company.

| Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

| Item 2. | PROPERTIES |

At December 31, 2012, the Portfolio Properties included 452 shopping centers (including 206 centers owned through unconsolidated joint ventures and three that were otherwise consolidated by the Company). The shopping centers consist of 434 community shopping centers and 18 enclosed malls and lifestyle centers. At December 31, 2012, the Portfolio Properties also included more than 1,500 acres of undeveloped land, primarily development sites and parcels, located adjacent to certain of the shopping centers. At December 31, 2012, the shopping centers aggregated 89.2 million square feet of Company-owned GLA (115.7 million square feet of total GLA) located in 39 states, plus Puerto Rico and Brazil. These centers are principally in the Southeast and Midwest, with significant concentrations in Florida, Georgia, New York, North Carolina and Ohio. The Company also owns land in Canada and Russia.

The Company’s shopping centers are designed to attract local area customers and are typically anchored by two or more national tenant anchors (such as Walmart, Kohl’s or Target). The properties often include a supermarket, drug store, junior department store and/or other major “category-killer” discount retailers as additional anchors or tenants. The tenants of the shopping centers typically offer day-to-day necessities rather than high-priced luxury items. As one of the nation’s largest owners and operators of shopping centers (measured by total GLA), the Company has established close relationships with a large number of major national and regional retailers, many of which occupy space in the shopping centers.

At December 31, 2012, shopping centers made up the largest portion of the Company’s portfolio, constituting 82.1 million square feet (92.1% square feet of Company-owned GLA), while enclosed malls and lifestyle centers accounted for 7.1 million square feet (7.9% of Company-owned GLA). At December 31, 2012, the average annualized base rent per square foot of Company-owned GLA of the Company’s 243 wholly-owned shopping centers was $12.92. For the 206 shopping centers owned through unconsolidated joint ventures and three consolidated joint ventures, annualized base rent per square foot was $14.58 at December 31, 2012.

The Company’s average annualized base rent per square foot does not consider tenant expense reimbursements. The Company generally does not enter into significant tenant concessions on a lease by lease basis.

Information as to the Company’s 10 largest tenants based on total annualized rental revenues and Company-owned GLA at December 31, 2012, is set forth in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in Item 7 of this Annual Report on Form 10-K for the year ended December 31, 2012. In addition, as of December 31, 2012, unless otherwise indicated, with respect to the 452 shopping centers:

| • |

135 of these properties are anchored by a Walmart, Kohl’s or Target store; |

| • |

These properties range in size from approximately 9,500 square feet to approximately 1,500,000 square feet of total GLA (with 233 properties exceeding 200,000 square feet of total GLA, of which 87 properties exceed 400,000 square feet of total GLA); |

| • |

72.2% of the aggregate Company-owned GLA of these properties is leased to national tenants, including subsidiaries of national tenants, 11.5% is leased to regional tenants, and 7.8% is leased to local tenants; |

17

Table of Contents

| • |

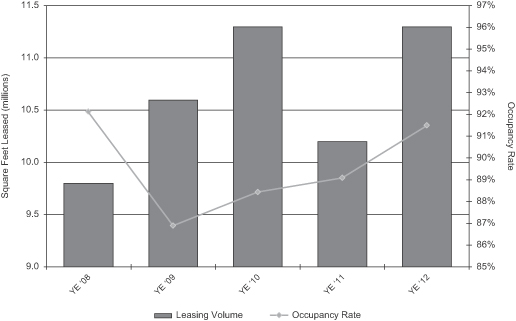

91.5% of the aggregate Company-owned GLA of these properties was occupied as of December 31, 2012. With respect to the properties owned by the Company, including its unconsolidated joint ventures, as of December 31 of each of the last five years beginning with 2008, between 86.8% and 92.1% of the aggregate Company-owned GLA of these properties was occupied and |

| • |

The Company had 14 assets under development and/or redevelopment (consisting of 11 wholly-owned shopping centers and three joint venture shopping centers). |

Tenant Lease Expirations and Renewals

The following table shows the impact of tenant lease expirations through 2022 at the Company’s 243 wholly-owned shopping centers, assuming that none of the tenants exercise any of their renewal options:

|

Expiration Year |

No. of

Leases Expiring |

Approximate

GLA in Square Feet (Thousands) |

Annualized

Base Rent Under Expiring Leases (Thousands) |

Average

Base Rent per Square Foot Under Expiring Leases |

Percentage of

Total GLA Represented by Expiring Leases |

Percentage of

Total Base Rental Revenues Represented by Expiring Leases |

||||||||||||||||||

|

2013 |

571 | 3,099 | $ | 46,744 | $ | 15.08 | 6.7 | % | 8.7 | % | ||||||||||||||

|

2014 |

604 | 4,756 | 62,735 | 13.19 | 10.2 | % | 11.7 | % | ||||||||||||||||

|

2015 |

580 | 5,191 | 65,773 | 12.67 | 11.2 | % | 12.3 | % | ||||||||||||||||

|

2016 |

588 | 5,378 | 75,695 | 14.08 | 11.6 | % | 14.2 | % | ||||||||||||||||

|

2017 |

512 | 6,472 | 74,418 | 11.50 | 13.9 | % | 13.9 | % | ||||||||||||||||

|

2018 |

277 | 3,505 | 44,390 | 12.66 | 7.5 | % | 8.3 | % | ||||||||||||||||

|

2019 |

145 | 2,811 | 33,991 | 12.09 | 6.1 | % | 6.4 | % | ||||||||||||||||

|

2020 |

117 | 1,355 | 18,466 | 13.63 | 2.9 | % | 3.5 | % | ||||||||||||||||

|

2021 |

167 | 3,084 | 35,476 | 11.51 | 6.6 | % | 6.6 | % | ||||||||||||||||

|

2022 |

187 | 2,829 | 36,127 | 12.77 | 6.1 | % | 6.8 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Total |

3,748 | 38,480 | $ | 493,815 | $ | 12.83 | 82.8 | % | 92.4 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The following table shows the impact of tenant lease expirations at the joint venture level through 2022 at the Company’s 206 shopping centers owned through unconsolidated joint ventures and three consolidated joint ventures, assuming that none of the tenants exercise any of their renewal options:

|

Expiration

|

No. of

Leases Expiring |

Approximate

GLA in Square Feet (Thousands) |

Annualized

Base Rent Under Expiring Leases (Thousands) |

Average

Base Rent per Square Foot Under Expiring Leases |

Percentage of

Total GLA Represented by Expiring Leases |

Percentage of

Total Base Rental Revenues Represented by Expiring Leases |

||||||||||||||||||

|

2013 |

895 | 3,016 | $ | 56,811 | $ | 18.84 | 8.1 | % | 11.8 | % | ||||||||||||||

|

2014 |

849 | 4,697 | 71,920 | 15.31 | 12.6 | % | 14.9 | % | ||||||||||||||||

|

2015 |

698 | 4,272 | 63,001 | 14.75 | 11.5 | % | 13.0 | % | ||||||||||||||||

|

2016 |

679 | 4,528 | 69,131 | 15.27 | 12.2 | % | 14.3 | % | ||||||||||||||||

|

2017 |

788 | 4,505 | 73,704 | 16.36 | 12.1 | % | 15.3 | % | ||||||||||||||||

|

2018 |

179 | 2,643 | 32,941 | 12.46 | 7.1 | % | 6.8 | % | ||||||||||||||||

|

2019 |

94 | 2,060 | 26,253 | 12.74 | 5.5 | % | 5.4 | % | ||||||||||||||||

|

2020 |

77 | 1,632 | 17,443 | 10.69 | 4.4 | % | 3.6 | % | ||||||||||||||||

|

2021 |

104 | 1,701 | 22,800 | 13.40 | 4.6 | % | 4.7 | % | ||||||||||||||||

|

2022 |

109 | 2,149 | 24,904 | 11.59 | 5.8 | % | 5.2 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Total |

4,472 | 31,203 | $ | 458,908 | $ | 14.71 | 83.9 | % | 95.0 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The rental payments under certain of these leases will remain constant until the expiration of their base terms, regardless of inflationary increases. There can be no assurance that any of these leases will be renewed or that any replacement tenants will be obtained if not renewed.

18

Table of Contents

DDR Corp.

Shopping Center Property List at December 31, 2012

|

Location |

Center/Property |

Zip

Code |

Type of

Property (1) |

Ownership

Interest |

Year

Developed/ Redeveloped |

Year

Acquired |

DDR

Ownership Interest |

Company

Owned Gross Leasable Area (SF) |

Total

Annualized Base Rent |

Average

Base Rent (Per SF) (2) |

Anchor Tenants |

|||||||||||||||||||||||||||

| Brazil | ||||||||||||||||||||||||||||||||||||||

| 1 | Campinas |

Parque Dom Pedro Avenue Guilherme Campos, 500 |

01387-001 | MM | Fee | 2001/2010 | 2006 | 29.9 | % | 1,143,950 | $ | 37,867,712 | $ | 34.25 | Barbacoa, Bodytech, Casas Bahia, C&A, Centauro, Colombo, Etna, Fast Shop, Fnac, Le Biscuit, Livraria Leitura, Lojas Americanas, Marisa, Me Move, Multiplex, Pernambucanas, Renner, Riachuelo, Telhanorte, Walmart, Zara | |||||||||||||||||||||||

| 2 | Franca |

Franca Shopping Avenue Rio Negro, 1100 |

14406-901 | MM | Fee | 1993 | 2006 | 25.6 | % | 199,438 | $ | 3,951,402 | $ | 19.99 | C&A, C&C , Casas Bahia, Centauro, Lojas Americanas, Magazine Luiza, Marisa, Moviecom, Renner | |||||||||||||||||||||||

| 3 | Manaus |

Manauara Shopping Avenue Mario Ypiranga,1300 |

69057-002 | MM | Fee (3) | 2009 | 2007 | 33.3 | % | 505,229 | $ | 17,143,109 | $ | 34.34 | Bemol, C&A, Centauro, Cia Athletica, Dinamica, Hitech Imports, Marisa, Pbkids Brinquedos, Playarte, Ramsons, Renner, Riachuelo, Saraiva Mega Store, Siberian/Crawford | |||||||||||||||||||||||

| 4 | Sao Paulo |

Campo Limpo Shopping Estrada Do Campo Limpo 459 |

05777-001 | MM | Fee | 2005/2011 | 2006 | 6.7 | % | 239,735 | $ | 7,215,154 | $ | 30.32 | B-Mart, C&A, Casas Bahia, Cinema Multiplex, Extra, Lojas Marabraz, Marisa, Zelo | |||||||||||||||||||||||

| 5 | Sao Paulo |

Plaza Sul Praca Leonor Kaupa |

04151-100 | MM | Fee | 1994 | 2006 | 20 | % | 251,087 | $ | 13,557,381 | $ | 55.18 | Camicado, C&A, Lojas Americanas, Luigi Bertolli, Monday Academia, Playarte, Renner | |||||||||||||||||||||||

| 6 | Sao Paulo |

Boavista Shopping Rua Borba Gato, 59 |

04747-030 | MM | Fee (3) | 2004 | 2006 | 33.3 | % | 171,554 | $ | 3,742,888 | $ | 24.20 | Americanas Express, C&A, Centauro, Marisa, Moviecom, Sonda | |||||||||||||||||||||||

| 7 | Sao Bernardo Do C |

Shopping Metropole Praca Samuel Sabatine, 200 |

09750-902 | MM | Fee (3) |

1980/1995/

1997/2011 |

2006 | 33.3 | % | 286,596 | $ | 13,203,424 | $ | 46.20 | B-Mart, C&A, Lojas Americanas, Fastshop, Marisa, Outback, Playarte, Playland, Renner, Zelo | |||||||||||||||||||||||

| 8 | Uberlandia - Mg - |

Uberlandia Shopping Avenue Paulo Gracindo, 15 |

38411-145 | MM | Fee (3) | 2012 | 1 | * | 33.3 | % | 487,920 | $ | 7,514,489 | $ | 17.12 | B-Mart, Centauro, Cinemark, Fastshop, Kalunga, Le Biscuit, Le Lis Blanc, Leroy Merlin, Luigi Bertolli, Ponto Frio, Renner, Walmart | ||||||||||||||||||||||

|

|

United States and Puerto Rico |

|||||||||||||||||||||||||||||||||||||

| Alabama | ||||||||||||||||||||||||||||||||||||||

| 9 | Birmingham, AL |

Brook Highland Plaza 5291 Highway 280 South |

35242 | SC | Fee | 1994/2003 | 1994 | 100 | % | 551,898 | $ | 4,315,451 | $ | 9.95 | Big Lots, Books-A-Million, Dick’s Sporting Goods, HomeGoods, Lowe’s, Michaels, OfficeMax, Ross Dress For Less, Stein Mart | |||||||||||||||||||||||

| 10 | Birmingham, AL |

Riverchase Promenade Montgomery Highway |

35244 | SC | Fee (3) | 1989 | 2012 | 5 | % | 120,108 | $ | 1,756,202 | $ | 16.34 | 2nd & Charles (Not Owned), Jo-Ann Fabric and Craft Stores, Toys “R” Us (Not Owned) | |||||||||||||||||||||||

| 11 | Birmingham, AL |

River Ridge U.S. Highway 280 |

35242 | SC | Fee (3) | 2001 | 2007 | 15 | % | 172,262 | $ | 2,289,979 | $ | 17.26 | Best Buy, Staples, Target (Not Owned) | |||||||||||||||||||||||

| 12 | Dothan, AL |

Shops on the Circle 3500 Ross Clark Circle |

36303 | SC | Fee | 2000 | 2007 | 100 | % | 182,991 | $ | 1,891,596 | $ | 10.52 | Big Lots, OfficeMax, Old Navy, T.J. Maxx | |||||||||||||||||||||||

| 13 | Florence, AL |

Cox Creek Shopping Center 374-398 Cox Creek Parkway |

35360 | SC | Fee (3) | 2001 | 2007 | 15 | % | 173,940 | $ | 1,659,248 | $ | 10.82 | Best Buy, Burke’s Outlet, Dick’s Sporting Goods, Sam’s Club (Not Owned), Target (Not Owned) | |||||||||||||||||||||||

| 14 | Huntsville, AL |

Westside Centre 6275 University Drive |

35806 | SC | Fee (3) | 2002 | 2007 | 15 | % | 476,146 | $ | 4,262,700 | $ | 12.45 | Big Lots, Dick’s Sporting Goods, Marshalls, Michaels, Ross Dress For Less, Stein Mart, Target (Not Owned) | |||||||||||||||||||||||

| 15 | Scottsboro, AL |

Scottsboro Marketplace 24833 John P. Reid Parkway |

35766 | SC | Fee | 1999 | 2003 | 100 | % | 40,560 | $ | 303,540 | $ | 8.44 | Burke’s Outlet, Walmart (Not Owned) | |||||||||||||||||||||||

| 16 | Tuscaloosa, AL |

McFarland Plaza 2600 Mcfarland Boulevard East |

35404 | SC | Fee (3) | 1999 | 2007 | 15 | % | 234,146 | $ | 1,566,645 | $ | 8.01 | Michaels, OfficeMax, Ross Dress For Less, Stein Mart, Toys “R” Us | |||||||||||||||||||||||

| Arizona | ||||||||||||||||||||||||||||||||||||||

| 17 | Phoenix, AZ |

Deer Valley Towne Center

2805 West Aqua Fria Freeway |

85027 | SC | Fee | 1996 | 1999 | 100 | % | 197,009 | $ | 3,418,317 | $ | 17.21 | AMC Theatres (Not Owned), Michaels, OfficeMax, PetSmart, Ross Dress For Less, Target (Not Owned) | |||||||||||||||||||||||

| 18 | Phoenix, AZ |

Ahwatukee Foothills Towne

Center 4711 East Ray Road |

85044 | SC | Fee | 1996/1997/1999 | 1998 | 100 | % | 666,979 | $ | 9,465,299 | $ | 15.93 | AMC Theatres, Ashley Furniture, Babies “R” Us, Barnes & Noble, Best Buy, Jo-Ann Fabric and Craft Stores, OfficeMax, Old Navy, Party City, Petco, RoomStore, Ross Dress For Less, Sprouts Farmers Market | |||||||||||||||||||||||

19

Table of Contents

DDR Corp.

Shopping Center Property List at December 31, 2012

|

Location |

Center/Property |

Zip

Code |

Type of

Property (1) |

Ownership

Interest |

Year

Developed/ Redeveloped |

Year

Acquired |

DDR

Ownership Interest |

Company

Owned Gross Leasable Area (SF) |

Total

Annualized Base Rent |

Average

Base Rent (Per SF) (2) |

Anchor Tenants |

|||||||||||||||||||||||||||

| 19 | Phoenix, AZ |

Arrowhead Crossing

7553 West Bell Road |

85382 | SC | Fee | 1995 | 1996 | 100 | % | 346,327 | $ | 4,562,656 | $ | 13.79 | Barnes & Noble, David’s Bridal (Not Owned), DSW, Golfsmith, Hobby Lobby, HomeGoods, Nordstrom Rack, Savers (Not Owned), Staples, T.J. Maxx | |||||||||||||||||||||||

| 20 | Phoenix, AZ |

Paradise Village Gateway

Tatum and Shea Boulevards |

85028 | SC | Fee | 1997/2004 | 2003 | 67 | % | 295,311 | $ | 4,712,693 | $ | 19.51 | Albertsons, Bed Bath & Beyond, PetSmart, Ross Dress For Less, Staples | |||||||||||||||||||||||

| 21 | Tucson, AZ | Tucson Spectrum Shopping Center Southwest Corner I-19 and Irvington Road | 85706 | SC | Fee | 2008 | 2012 | 100 | % | 709,811 | $ | 9,251,735 | $ | 15.77 | Bed Bath & Beyond, Best Buy, Dollar Tree, Food City, Harkins Theatre, JCPenney, LA Fitness, Marshalls, Michaels, OfficeMax, Old Navy, Party City, PetSmart, Ross Dress For Less, Sports Authority, Home Depot (Not Owned), Target (Not Owned) | |||||||||||||||||||||||

| Arkansas | ||||||||||||||||||||||||||||||||||||||

| 22 | Fayetteville, AR |

Steele Crossing

3533-3595 North Shiloh Drive |

72703 | SC | Fee (3) | 2003 | 2012 | 5 | % | 136,898 | $ | 949,225 | $ | 15.37 | Kohl’s, Target (Not Owned) | |||||||||||||||||||||||

| 23 | Fayetteville, AR |

Spring Creek Centre

464 East Joyce Boulevard |

72703 | SC | Fee (3) |

1997/1999/

2000/ 2001 |