|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

þ

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

|

95-2594729

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

26600 Telegraph Road, Suite 400

|

|

|

|

Southfield, Michigan

|

|

48033

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

TABLE OF CONTENTS

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page

|

|

PART I

|

-

|

FINANCIAL INFORMATION

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Item 1

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated

Statements of Operations

|

|

|

|

Condensed Consolidated Statements of Comprehensive

(Loss) Income

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Item 2

|

-

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Item 3

|

-

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Item 4

|

-

|

|

||

|

|

|

|

|

|

|

|

|

PART II

|

-

|

OTHER INFORMATION

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Item 1

|

-

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Item 1A

|

-

|

|

||

|

Item 2

|

-

|

|||||

|

|

|

|

|

|

|

|

|

Item 6

|

-

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Thirteen Weeks Ended

|

|||||||

|

|

March 27,

2016 |

March 29,

2015 |

||||||

|

NET SALES

|

$

|

186,065

|

|

$

|

173,729

|

|

||

|

Cost of sales:

|

|

|

||||||

|

Cost of sales

|

158,320

|

|

160,635

|

|

||||

|

Restructuring costs (Note 3)

|

30

|

|

1,872

|

|

||||

|

158,350

|

|

162,507

|

|

|||||

|

GROSS PROFIT

|

27,715

|

|

11,222

|

|

||||

|

Selling, general and administrative expenses

|

8,993

|

|

7,553

|

|

||||

|

INCOME FROM OPERATIONS

|

18,722

|

|

3,669

|

|

||||

|

Interest income, net

|

32

|

|

85

|

|

||||

|

Other income (expenses), net

|

268

|

|

(182

|

)

|

||||

|

INCOME BEFORE INCOME TAXES

|

19,022

|

|

3,572

|

|

||||

|

Income tax (provision) benefit

|

(4,558

|

)

|

762

|

|

||||

|

NET INCOME

|

$

|

14,464

|

|

$

|

4,334

|

|

||

|

EARNINGS PER SHARE - BASIC

|

$

|

0.56

|

|

$

|

0.16

|

|

||

|

EARNINGS PER SHARE - DILUTED

|

$

|

0.56

|

|

$

|

0.16

|

|

||

|

DIVIDENDS DECLARED PER SHARE

|

$

|

0.18

|

|

$

|

0.18

|

|

||

|

Thirteen Weeks Ended

|

|||||||

|

March 27, 2016

|

March 29, 2015

|

||||||

|

Net income

|

$

|

14,464

|

|

$

|

4,334

|

|

|

|

Other comprehensive (loss) income, net of tax:

|

|||||||

|

Foreign currency translation loss, net of tax

|

(1,845

|

)

|

(3,725

|

)

|

|||

|

Change in unrecognized gains (losses) on derivative instruments:

|

|||||||

|

Change in fair value of derivatives

|

1,318

|

|

(2,092

|

)

|

|||

|

Tax (provision) benefit

|

(266

|

)

|

994

|

|

|||

|

Change in unrecognized gains (losses) on derivative instruments, net of tax

|

1,052

|

|

(1,098

|

)

|

|||

|

Defined benefit pension plan:

|

|||||||

|

Actuarial gains on pension obligation, net of curtailments and amortization

|

84

|

|

134

|

|

|||

|

Tax provision

|

(33

|

)

|

(50

|

)

|

|||

|

Pension changes, net of tax

|

51

|

|

84

|

|

|||

|

Other comprehensive loss, net of tax

|

(742

|

)

|

(4,739

|

)

|

|||

|

Comprehensive income (loss)

|

$

|

13,722

|

|

$

|

(405

|

)

|

|

|

|

March 27, 2016

|

December 27, 2015

|

|||||

|

ASSETS

|

|

|

|||||

|

Current assets:

|

|

|

|||||

|

Cash and cash equivalents

|

$

|

45,524

|

|

$

|

52,036

|

|

|

|

Short-term investments

|

750

|

|

950

|

|

|||

|

Accounts receivable, net

|

112,905

|

|

112,588

|

|

|||

|

Inventories

|

63,826

|

|

61,769

|

|

|||

|

Income taxes receivable

|

760

|

|

1,104

|

|

|||

|

Other current assets

|

21,458

|

|

14,476

|

|

|||

|

Assets held for sale

|

2,897

|

|

2,897

|

|

|||

|

Total current assets

|

248,120

|

|

245,820

|

|

|||

|

Property, plant and equipment, net

|

230,406

|

|

234,646

|

|

|||

|

Investment in unconsolidated affiliate

|

2,000

|

|

2,000

|

|

|||

|

Non-current deferred income taxes, net

|

25,299

|

|

25,598

|

|

|||

|

Other non-current assets

|

34,199

|

|

31,865

|

|

|||

|

Total assets

|

$

|

540,024

|

|

$

|

539,929

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

|

|

|

|

|||

|

Current liabilities:

|

|

|

|

|

|||

|

Accounts payable

|

$

|

23,077

|

|

$

|

20,913

|

|

|

|

Accrued expenses

|

44,796

|

|

46,214

|

|

|||

|

Income taxes payable

|

5,584

|

|

6,735

|

|

|||

|

Total current liabilities

|

73,457

|

|

73,862

|

|

|||

|

Non-current income tax liabilities

|

4,930

|

|

4,510

|

|

|||

|

Non-current deferred income tax liabilities, net

|

7,960

|

|

8,094

|

|

|||

|

Other non-current liabilities

|

41,868

|

|

39,551

|

|

|||

|

Commitments and contingencies (Note 17)

|

—

|

|

—

|

|

|||

|

Shareholders' equity:

|

|

|

|

|

|||

|

Preferred stock, $0.01 par value

|

|

|

|

|

|||

|

Authorized - 1,000,000 shares

|

|

|

|

|

|||

|

Issued - none

|

—

|

|

—

|

|

|||

|

Common stock, $0.01 par value

|

|

|

|

|

|||

|

Authorized - 100,000,000 shares

|

|

|

|

|

|||

|

Issued and outstanding - 25,439,839 shares

|

|||||||

|

(26,098,895 shares at December 27, 2015)

|

86,605

|

|

88,108

|

|

|||

|

Accumulated other comprehensive loss

|

(102,455

|

)

|

(101,713

|

)

|

|||

|

Retained earnings

|

427,659

|

|

427,517

|

|

|||

|

Total shareholders' equity

|

411,809

|

|

413,912

|

|

|||

|

Total liabilities and shareholders' equity

|

$

|

540,024

|

|

$

|

539,929

|

|

|

|

|

Thirteen Weeks Ended

|

||||||

|

|

March 27, 2016

|

March 29, 2015

|

|||||

|

NET CASH PROVIDED (USED) BY OPERATING ACTIVITIES

|

$

|

16,041

|

|

$

|

(981

|

)

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|||

|

Additions to property, plant and equipment

|

(6,110

|

)

|

(14,983

|

)

|

|||

|

Proceeds from sales and maturities of investments

|

200

|

|

200

|

|

|||

|

Purchase of investments

|

—

|

|

(200

|

)

|

|||

|

Proceeds from sale of property, plant and equipment

|

1

|

|

1,758

|

|

|||

|

Other

|

—

|

|

37

|

|

|||

|

NET CASH USED IN INVESTING ACTIVITIES

|

(5,909

|

)

|

(13,188

|

)

|

|||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|||

|

Cash dividends paid

|

(4,676

|

)

|

(4,791

|

)

|

|||

|

Cash paid for common stock repurchase

|

(11,928

|

)

|

(2,069

|

)

|

|||

|

Proceeds from exercise of stock options

|

179

|

|

3,871

|

|

|||

|

Excess tax benefits from exercise of stock options

|

—

|

|

192

|

|

|||

|

NET CASH USED IN FINANCING ACTIVITIES

|

(16,425

|

)

|

(2,797

|

)

|

|||

|

Effect of exchange rate changes on cash

|

(219

|

)

|

(810

|

)

|

|||

|

Net decrease in cash and cash equivalents

|

(6,512

|

)

|

(17,776

|

)

|

|||

|

Cash and cash equivalents at the beginning of the period

|

52,036

|

|

62,451

|

|

|||

|

Cash and cash equivalents at the end of the period

|

$

|

45,524

|

|

$

|

44,675

|

|

|

|

Common Stock

|

Accumulated Other Comprehensive (Loss) Income

|

|||||||||||||||||||||||||

|

|

Number of Shares

|

Amount

|

Unrecognized Gains/Losses on Derivative Instruments

|

Pension Obligations

|

Cumulative Translation Adjustment

|

Retained Earnings

|

Total

|

|||||||||||||||||||

|

Balance at December 27, 2015

|

26,098,895

|

|

$

|

88,108

|

|

$

|

(9,289

|

)

|

$

|

(4,140

|

)

|

$

|

(88,284

|

)

|

$

|

427,517

|

|

$

|

413,912

|

|

||||||

|

Net income

|

14,464

|

|

14,464

|

|

||||||||||||||||||||||

|

Change in unrecognized gains/losses on derivative instruments, net of tax

|

1,052

|

|

—

|

|

—

|

|

—

|

|

1,052

|

|

||||||||||||||||

|

Change in employee benefit plans, net of taxes

|

51

|

|

—

|

|

—

|

|

51

|

|

||||||||||||||||||

|

Net foreign currency translation adjustment

|

|

|

|

|

—

|

|

(1,845

|

)

|

—

|

|

(1,845

|

)

|

||||||||||||||

|

Stock options exercised

|

10,875

|

|

179

|

|

—

|

|

—

|

|

—

|

|

179

|

|

||||||||||||||

|

Restricted stock awards granted, net of forfeitures

|

2,552

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||||||

|

Stock-based compensation expense

|

—

|

|

556

|

|

—

|

|

—

|

|

—

|

|

556

|

|

||||||||||||||

|

Common stock repurchased

|

(672,483

|

)

|

(2,238

|

)

|

—

|

|

—

|

|

(9,690

|

)

|

(11,928

|

)

|

||||||||||||||

|

Cash dividends declared ($0.18 per share)

|

—

|

|

—

|

|

—

|

|

—

|

|

(4,632

|

)

|

(4,632

|

)

|

||||||||||||||

|

Balance at March 27, 2016

|

25,439,839

|

|

$

|

86,605

|

|

$

|

(8,237

|

)

|

$

|

(4,089

|

)

|

$

|

(90,129

|

)

|

$

|

427,659

|

|

$

|

411,809

|

|

||||||

|

(Dollars in thousands)

|

Costs Incurred Through December 27, 2015

|

Costs Incurred During the Thirteen Week Period Ended March 27, 2016

|

Costs Remaining

|

Total Expected Costs

|

Classification

|

||||||||||||

|

Accelerated and other depreciation of assets idled

|

$

|

7,006

|

|

$

|

103

|

|

$

|

672

|

|

$

|

7,781

|

|

Cost of sales, Restructuring costs

|

||||

|

Severance costs

|

2,011

|

|

—

|

|

—

|

|

2,011

|

|

Cost of sales, Restructuring costs

|

||||||||

|

Equipment removal and impairment, inventory write-down, lease termination and other costs

|

5,424

|

|

30

|

|

348

|

|

5,802

|

|

Cost of sales, Restructuring costs

|

||||||||

|

$

|

14,441

|

|

$

|

133

|

|

$

|

1,020

|

|

$

|

15,594

|

|

||||||

|

(Dollars in thousands)

|

|||

|

Balance December 28, 2014

|

$

|

215

|

|

|

Restructuring accruals

|

114

|

|

|

|

Cash payments

|

(304

|

)

|

|

|

Balance December 27, 2015

|

25

|

|

|

|

Restructuring accruals

|

—

|

|

|

|

Cash payments

|

(1

|

)

|

|

|

Balance March 27, 2016

|

$

|

24

|

|

|

Fair Value Measurement at Reporting Date Using

|

|||||||||||||||

|

Quoted Prices

|

Significant Other

|

Significant

|

|||||||||||||

|

in Active Markets

|

Observable

|

Unobservable

|

|||||||||||||

|

for Identical Assets

|

Inputs

|

Inputs

|

|||||||||||||

|

March 27, 2016

|

Total

|

(Level 1)

|

(Level 2)

|

(Level 3)

|

|||||||||||

|

(Dollars in thousands)

|

|||||||||||||||

|

Assets

|

|||||||||||||||

|

Certificates of deposit

|

$

|

750

|

|

$

|

—

|

|

$

|

750

|

|

$

|

—

|

|

|||

|

Cash surrender value

|

7,012

|

|

—

|

|

7,012

|

|

—

|

|

|||||||

|

Derivative contracts

|

89

|

|

—

|

|

89

|

|

—

|

|

|||||||

|

Total

|

$

|

7,851

|

|

$

|

—

|

|

$

|

7,851

|

|

$

|

—

|

|

|||

|

|

|

|

|

|

|

|

|

||||||||

|

Liabilities

|

|

|

|

|

|

|

|

|

|||||||

|

Derivative contracts

|

$

|

13,536

|

|

$

|

—

|

|

$

|

13,536

|

|

$

|

—

|

|

|||

|

Total

|

$

|

13,536

|

|

$

|

—

|

|

$

|

13,536

|

|

$

|

—

|

|

|||

|

Fair Value Measurement at Reporting Date Using

|

|||||||||||||||

|

Quoted Prices

|

Significant Other

|

Significant

|

|||||||||||||

|

in Active Markets

|

Observable

|

Unobservable

|

|||||||||||||

|

for Identical Assets

|

Inputs

|

Inputs

|

|||||||||||||

|

December 27, 2015

|

Total

|

(Level 1)

|

(Level 2)

|

(Level 3)

|

|||||||||||

|

(Dollars in thousands)

|

|||||||||||||||

|

Assets

|

|||||||||||||||

|

Certificates of deposit

|

$

|

950

|

|

$

|

—

|

|

$

|

950

|

|

$

|

—

|

|

|||

|

Cash surrender value

|

6,923

|

|

—

|

|

6,923

|

|

—

|

|

|||||||

|

Derivative contracts

|

113

|

|

—

|

|

113

|

|

—

|

|

|||||||

|

Total

|

$

|

7,986

|

|

$

|

—

|

|

$

|

7,986

|

|

$

|

—

|

|

|||

|

|

|

|

|

|

|

|

|

||||||||

|

Liabilities

|

|

|

|

|

|

|

|

|

|||||||

|

Derivative contracts

|

$

|

14,159

|

|

$

|

—

|

|

$

|

14,159

|

|

$

|

—

|

|

|||

|

Total

|

$

|

14,159

|

|

$

|

—

|

|

$

|

14,159

|

|

$

|

—

|

|

|||

|

March 27, 2016

|

December 27, 2015

|

||||||||||||||||||||||

|

(Dollars in thousands)

|

Other Non-current Assets

|

Accrued Liabilities

|

Other Non-current Liabilities

|

Other Non-current Assets

|

Accrued Liabilities

|

Other Non-current Liabilities

|

|||||||||||||||||

|

Foreign exchange forward contracts and collars designated as hedging instruments

|

$

|

89

|

|

$

|

(8,752

|

)

|

$

|

(4,784

|

)

|

$

|

113

|

|

$

|

(9,629

|

)

|

$

|

(4,530

|

)

|

|||||

|

Total derivative instruments

|

$

|

89

|

|

$

|

(8,752

|

)

|

$

|

(4,784

|

)

|

$

|

113

|

|

$

|

(9,629

|

)

|

$

|

(4,530

|

)

|

|||||

|

March 27, 2016

|

December 27, 2015

|

||||||||||||||

|

(Dollars in thousands)

|

U.S. Dollar Notional Amount

|

Fair Value

|

U.S. Dollar Notional Amount

|

Fair Value

|

|||||||||||

|

Foreign exchange forward contracts and collars designated as hedging instruments

|

$

|

120,310

|

|

$

|

(13,447

|

)

|

$

|

162,590

|

|

$

|

(14,046

|

)

|

|||

|

Total derivative financial instruments

|

$

|

120,310

|

|

$

|

(13,447

|

)

|

$

|

162,590

|

|

$

|

(14,046

|

)

|

|||

|

Thirteen Week Period Ended March 27, 2016

|

Amount of Gain or (Loss) Recognized in OCI on Derivatives (Effective Portion)

|

Amount of Pre-tax Gain or (Loss) Reclassified from AOCI into Income (Effective Portion)

|

Amount of Pre-tax Gain or (Loss) Recognized in Income on Derivatives (Ineffective Portion and Amount Excluded from Effectiveness Testing)

|

|||||||||

|

(Dollars in thousands)

|

||||||||||||

|

Foreign exchange forward contracts and collars

|

$

|

1,052

|

|

$

|

(3,237

|

)

|

$

|

5

|

|

|||

|

Total

|

$

|

1,052

|

|

$

|

(3,237

|

)

|

$

|

5

|

|

|||

|

(Dollars in thousands)

|

Thirteen Weeks Ended

|

|||||||

|

Net sales:

|

March 27,

2016 |

March 29,

2015 |

||||||

|

U.S.

|

$

|

37,396

|

|

$

|

43,619

|

|

||

|

Mexico

|

148,669

|

|

130,110

|

|

||||

|

Consolidated net sales

|

$

|

186,065

|

|

$

|

173,729

|

|

||

|

Long Lived Assets

|

||||||||

|

Long-lived assets includes property, plant and equipment, net, by geographic location as follows:

|

||||||||

|

Property, plant and equipment, net:

|

March 27,

2016 |

December 27,

2015 |

||||||

|

U.S.

|

$

|

42,691

|

|

$

|

44,274

|

|

||

|

Mexico

|

187,715

|

|

190,372

|

|

||||

|

Consolidated property, plant and equipment, net

|

$

|

230,406

|

|

$

|

234,646

|

|

||

|

(Dollars in thousands)

|

|

|

|||||

|

|

March 27, 2016

|

December 27, 2015

|

|||||

|

Trade receivables

|

$

|

103,345

|

|

$

|

103,202

|

|

|

|

Other receivables

|

10,787

|

|

10,253

|

|

|||

|

|

114,132

|

|

113,455

|

|

|||

|

Allowance for doubtful accounts

|

(1,227

|

)

|

(867

|

)

|

|||

|

Accounts receivable, net

|

$

|

112,905

|

|

$

|

112,588

|

|

|

|

(Dollars in thousands)

|

|

|

|||||

|

|

March 27, 2016

|

December 27, 2015

|

|||||

|

Raw materials

|

$

|

21,337

|

|

$

|

19,148

|

|

|

|

Work in process

|

21,037

|

|

21,063

|

|

|||

|

Finished goods

|

21,452

|

|

21,558

|

|

|||

|

Inventories

|

$

|

63,826

|

|

$

|

61,769

|

|

|

|

(Dollars in thousands)

|

|

|

|||||

|

|

March 27, 2016

|

December 27, 2015

|

|||||

|

Land and buildings

|

$

|

73,011

|

|

$

|

73,803

|

|

|

|

Machinery and equipment

|

492,277

|

|

486,612

|

|

|||

|

Leasehold improvements and others

|

4,464

|

|

4,204

|

|

|||

|

Construction in progress

|

18,735

|

|

20,455

|

|

|||

|

|

588,487

|

|

585,074

|

|

|||

|

Accumulated depreciation

|

(358,081

|

)

|

(350,428

|

)

|

|||

|

Property, plant and equipment, net

|

$

|

230,406

|

|

$

|

234,646

|

|

|

|

(Dollars in Thousands)

|

March 27, 2016

|

December 27, 2015

|

||||||

|

Unamortized Preproduction Costs

|

||||||||

|

Preproduction costs

|

$

|

76,145

|

|

$

|

73,095

|

|

||

|

Accumulated amortization

|

(59,678

|

)

|

(58,632

|

)

|

||||

|

Net preproduction costs

|

$

|

16,467

|

|

$

|

14,463

|

|

||

|

Deferred Tooling Revenues

|

||||||||

|

Accrued expenses

|

$

|

4,310

|

|

$

|

2,908

|

|

||

|

Other non-current liabilities

|

3,175

|

|

1,266

|

|

||||

|

Total deferred tooling revenues

|

$

|

7,485

|

|

$

|

4,174

|

|

||

|

(In thousands, except per share amounts)

|

Thirteen Weeks Ended

|

|||||||

|

|

March 27,

2016 |

March 29,

2015 |

||||||

|

Basic Income Per Share:

|

|

|

||||||

|

Reported net income

|

$

|

14,464

|

|

$

|

4,334

|

|

||

|

Basic income per share

|

$

|

0.56

|

|

$

|

0.16

|

|

||

|

Weighted average shares outstanding - Basic

|

25,603

|

|

26,860

|

|

||||

|

|

|

|||||||

|

Diluted Income Per Share:

|

|

|

||||||

|

Reported net income

|

$

|

14,464

|

|

$

|

4,334

|

|

||

|

Diluted income per share

|

$

|

0.56

|

|

$

|

0.16

|

|

||

|

Weighted average shares outstanding

|

25,603

|

|

26,860

|

|

||||

|

Weighted average dilutive stock options and restricted stock units

|

41

|

|

91

|

|

||||

|

Weighted average shares outstanding - Diluted

|

25,644

|

|

26,951

|

|

||||

|

(Dollars in thousands)

|

Thirteen Weeks Ended

|

||||||

|

|

March 27, 2016

|

March 29, 2015

|

|||||

|

Service cost

|

$

|

—

|

|

$

|

11

|

|

|

|

Interest cost

|

304

|

|

307

|

|

|||

|

Net amortization

|

84

|

|

134

|

|

|||

|

Net periodic pension cost

|

$

|

388

|

|

$

|

452

|

|

|

|

•

|

40% of the PSUs vest upon certain Return on Invested Capital targets for 2016 and 2015 units

|

|

•

|

40% of the PSUs vest upon certain Cumulative EPS targets for 2016 units

|

|

•

|

40% of the PSUs vest upon certain EBITDA margin targets for 2015 units

|

|

•

|

20% of the PSUs vest upon certain market based Shareholder Return targets for 2016 and 2015 units.

|

|

•

|

26,841

time value based RSUs with a grant date fair value of

$22.82

per unit

|

|

•

|

32,051

time value based RSUs with a grant date fair value of

$18.72

per unit

|

|

•

|

10,736

PSUs with an initial grant date fair value of

$22.82

per unit

|

|

•

|

12,821

PSUs with an initial grant date fair value of

$18.72

per unit

|

|

•

|

42,946

market based PSUs with a grant date fair value of

$22.82

per unit

|

|

•

|

51,282

market based PSUs with a grant date fair value of

$18.72

per unit

|

|

•

|

44,503

time value based RSUs with a grant date fair value of

$18.78

per unit

|

|

•

|

82,770

PSUs with an initial grant date fair value of

$18.78

per unit

|

|

•

|

20,692

market based PSUs with a grant date fair value of

$24.81

per unit.

|

|

(Dollars in thousands)

|

Thirteen Weeks Ended

|

||||||

|

|

March 27,

2016 |

March 29,

2015 |

|||||

|

Cost of sales

|

$

|

76

|

|

$

|

92

|

|

|

|

Selling, general and administrative expenses

|

480

|

|

467

|

|

|||

|

Stock-based compensation expense before income taxes

|

556

|

|

559

|

|

|||

|

Income tax benefit

|

(133

|

)

|

(210

|

)

|

|||

|

Total stock-based compensation expense after income taxes

|

$

|

423

|

|

$

|

349

|

|

|

|

(Dollars in thousands, except per share amounts)

|

||||||||||||

|

|

Thirteen Weeks Ended

|

|||||||||||

|

Selected data

|

March 27,

2016 |

March 29,

2015 |

Change

|

|||||||||

|

Net sales

|

$

|

186,065

|

|

$

|

173,729

|

|

$

|

12,336

|

|

|||

|

Value added sales

(1)

|

$

|

102,339

|

|

$

|

82,263

|

|

$

|

20,076

|

|

|||

|

Gross profit

|

$

|

27,715

|

|

$

|

11,222

|

|

$

|

16,493

|

|

|||

|

Percentage of net sales

|

14.9

|

%

|

6.5

|

%

|

8.4

|

%

|

||||||

|

Income from operations

|

$

|

18,722

|

|

$

|

3,669

|

|

$

|

15,053

|

|

|||

|

Percentage of net sales

|

10.1

|

%

|

2.1

|

%

|

8.0

|

%

|

||||||

|

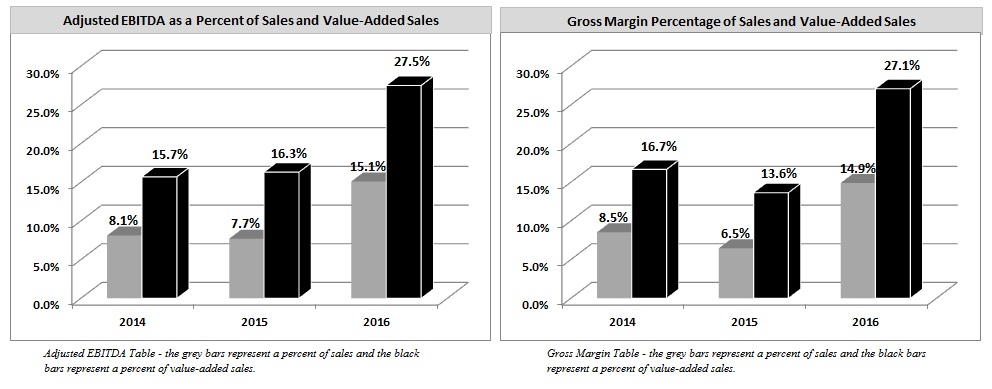

Adjusted EBITDA

(2)

|

$

|

28,102

|

|

$

|

13,370

|

|

$

|

14,732

|

|

|||

|

Percentage of net sales

(3)

|

15.1

|

%

|

7.7

|

%

|

7.4

|

%

|

||||||

|

Percentage of value added sales

(4)

|

27.5

|

%

|

16.3

|

%

|

11.2

|

%

|

||||||

|

Net income

|

$

|

14,464

|

|

$

|

4,334

|

|

$

|

10,130

|

|

|||

|

Percentage of net sales

|

7.8

|

%

|

2.5

|

%

|

5.3

|

%

|

||||||

|

Diluted income per share

|

$

|

0.56

|

|

$

|

0.16

|

|

$

|

0.40

|

|

|||

|

(Dollars in thousands)

|

Thirteen Weeks Ended

|

|||||||||||

|

March 27, 2016

|

March 29, 2015

|

Change

|

||||||||||

|

Net cash provided by operating activities

|

$

|

16,041

|

|

$

|

(981

|

)

|

$

|

17,022

|

|

|||

|

Net cash used in investing activities

|

(5,909

|

)

|

(13,188

|

)

|

7,279

|

|

||||||

|

Net cash used in financing activities

|

(16,425

|

)

|

(2,797

|

)

|

(13,628

|

)

|

||||||

|

Effect of exchange rate changes on cash

|

(219

|

)

|

(810

|

)

|

591

|

|

||||||

|

Net decrease in cash and cash equivalents

|

$

|

(6,512

|

)

|

$

|

(17,776

|

)

|

$

|

11,264

|

|

|||

|

(Dollars in thousands)

|

Thirteen Weeks Ended

|

||||||

|

March 27, 2016

|

March 29, 2015

|

||||||

|

Net Sales

|

$

|

186,065

|

|

$

|

173,729

|

|

|

|

Less, aluminum value and outside service provider costs

|

(83,726

|

)

|

(91,466

|

)

|

|||

|

Value added sales

|

$

|

102,339

|

|

$

|

82,263

|

|

|

|

(Dollars in thousands)

|

Thirteen Weeks Ended

|

|||||||

|

March 27, 2016

|

March 29, 2015

|

|||||||

|

Net income

|

$

|

14,464

|

|

$

|

4,334

|

|

||

|

Interest (income), net

|

(32

|

)

|

(85

|

)

|

||||

|

Income tax provision (benefit)

|

4,558

|

|

(762

|

)

|

||||

|

Depreciation

|

8,643

|

|

8,528

|

|

||||

|

Closure costs (excluding accelerated depreciation)

|

469

|

|

1,355

|

|

||||

|

Adjusted EBITDA

|

$

|

28,102

|

|

$

|

13,370

|

|

||

|

Adjusted EBITDA as a percentage of net sales

|

15.1

|

%

|

7.7

|

%

|

||||

|

Adjusted EBITDA as a percentage of value added sales

|

27.5

|

%

|

|

16.3

|

%

|

|||

|

|

Total Number of Shares Purchased

|

Average Price Paid per Share

|

Total Number of Shares Purchased as Part of Publicly Announced Plans and Programs

|

Maximum Approximate Dollar Value of Shares That May Yet be Purchased Under the Plans or Programs

|

|||||||||

|

(Thousands of dollars, except per share amounts)

|

|||||||||||||

|

December 28, 2015 - January 24, 2016

|

397,834

|

|

$

|

17.55

|

|

397,834

|

|

||||||

|

January 25, 2016 - February 21, 2016

|

267,349

|

|

$

|

18.03

|

|

267,349

|

|

||||||

|

February 22, 2016 - March 27, 2016

|

7,300

|

|

$

|

21.96

|

|

7,300

|

|

||||||

|

Total

|

672,483

|

|

672,483

|

|

$

|

48,348

|

|

||||||

|

10.1

|

|

Superior Industries International, Inc. Annual Incentive Performance Plan (incorporated by reference to Annex A to the Registrant's Definitive Proxy Statement on Schedule 14-A filed on March 28, 2016).*

|

|

31.1

|

|

Certification of Donald J. Stebbins, Chief Executive Officer and President, Pursuant to Exchange Act Rules 13a-14(a) and 15d-14(a), as Adopted Pursuant to Section 302(a) of the Sarbanes-Oxley Act of 2002 (filed herewith).

|

|

31.2

|

|

Certification of Kerry A. Shiba, Executive Vice President and Chief Financial Officer, Pursuant to Exchange Act Rules 13a-14(a) and 15d-14(a), as Adopted Pursuant to Section 302(a) of the Sarbanes-Oxley Act of 2002 (filed herewith).

|

|

32.1

|

|

Certification of Donald J. Stebbins, Chief Executive Officer and President, and Kerry A. Shiba, Executive Vice President and Chief Financial Officer, Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (furnished herewith).

|

|

101

|

|

Interactive data file (furnished electronically herewith pursuant to Rule 406T of Regulation S-T).

|

|

Date:

|

April 29, 2016

|

|

/s/ Donald J. Stebbins

|

|

|

|

|

Donald J. Stebbins

Chief Executive Officer and President

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

April 29, 2016

|

|

/s/ Kerry A. Shiba

|

|

|

|

|

Kerry A. Shiba

Executive Vice President and Chief Financial Officer

|

|

|