|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

|

74-1677330

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

1980 Post Oak Blvd., Houston TX

|

|

77056

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Common Stock, $1 par value

|

|

New York Stock Exchange (NYSE)

|

|

(Title of each class of stock)

|

|

(Name of each exchange on which registered)

|

|

Large accelerated filer

þ

|

Accelerated filer

¨

|

Non-accelerated filer

¨

(Do not check if smaller reporting company)

|

Smaller reporting company

¨

|

|||

|

Emerging growth company

¨

|

||||||

|

Item

|

|

Page

|

|

1

|

||

|

1A.

|

||

|

1B.

|

||

|

2

|

||

|

3

|

||

|

4

|

||

|

5

|

||

|

6

|

||

|

7

|

||

|

7A.

|

||

|

8

|

||

|

9

|

||

|

9A.

|

||

|

9B.

|

||

|

10

|

||

|

11

|

||

|

12

|

||

|

13

|

||

|

14

|

||

|

15

|

||

|

•

|

conducting rule-making, supervision, and enforcement of Federal consumer protection laws;

|

|

•

|

restricting unfair, deceptive, or abusive acts or practices;

|

|

•

|

taking consumer complaints;

|

|

•

|

promoting financial education;

|

|

•

|

researching consumer behavior;

|

|

•

|

monitoring financial markets for new risks to consumers; and

|

|

•

|

enforcing laws that outlaw discrimination and other unfair treatment in consumer finance.

|

|

•

|

approving or setting of insurance premium rates;

|

|

•

|

standards of solvency and minimum amounts of statutory capital and surplus that must be maintained;

|

|

•

|

limitations on types and amounts of investments;

|

|

•

|

establishing reserves, including statutory premium reserves, for losses and loss adjustment expenses;

|

|

•

|

regulating underwriting and marketing practices;

|

|

•

|

regulating dividend payments and other transactions among affiliates;

|

|

•

|

prior approval for the acquisition and control of an insurance company or of any company controlling an insurance company;

|

|

•

|

licensing of insurers, agencies and, in certain states, escrow officers;

|

|

•

|

regulation of reinsurance;

|

|

•

|

restrictions on the size of risks that may be insured by a single company;

|

|

•

|

deposits of securities for the benefit of policyholders;

|

|

•

|

approval of policy forms;

|

|

•

|

methods of accounting; and

|

|

•

|

filing of annual and other reports with respect to financial condition and other matters.

|

|

High

|

Low

|

|||||||

|

2017:

|

||||||||

|

First quarter

|

$

|

46.50

|

|

$

|

42.09

|

|

||

|

Second quarter

|

48.03

|

|

42.12

|

|

||||

|

Third quarter

|

46.49

|

|

34.48

|

|

||||

|

Fourth quarter

|

43.75

|

|

36.80

|

|

||||

|

2016:

|

||||||||

|

First quarter

|

$

|

36.99

|

|

$

|

30.34

|

|

||

|

Second quarter

|

41.78

|

|

33.33

|

|

||||

|

Third quarter

|

48.60

|

|

41.06

|

|

||||

|

Fourth quarter

|

48.17

|

|

41.62

|

|

||||

|

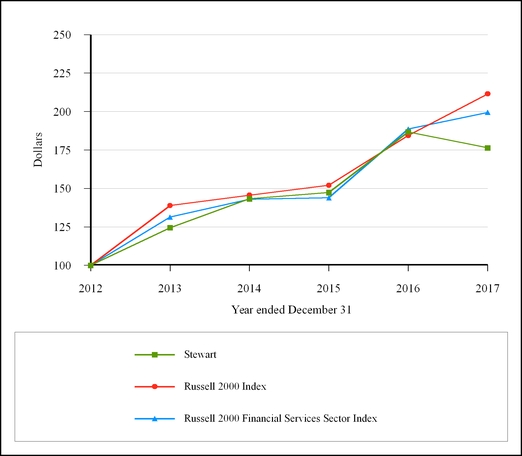

2012

|

2013

|

2014

|

2015

|

2016

|

2017

|

|||||||||||||

|

Stewart

|

100.00

|

|

124.50

|

|

143.29

|

|

147.38

|

|

186.78

|

|

176.39

|

|

||||||

|

Russell 2000 Index

|

100.00

|

|

138.83

|

|

145.62

|

|

152.04

|

|

184.39

|

|

211.45

|

|

||||||

|

Russell 2000 Financial Services Sector Index

|

100.00

|

|

131.40

|

|

143.04

|

|

143.90

|

|

188.58

|

|

199.44

|

|

||||||

|

2017

|

2016

|

2015

|

2014

|

2013

|

|||||||||||

|

|

($ millions, except percentage, share and per share data)

|

||||||||||||||

|

Total revenues

|

1,955.7

|

|

2,006.6

|

|

2,033.9

|

|

1,870.8

|

|

1,928.0

|

|

|||||

|

Title operating revenues

|

1,878.7

|

|

1,904.1

|

|

1,888.4

|

|

1,714.4

|

|

1,810.0

|

|

|||||

|

Ancillary services revenues

|

55.8

|

|

84.3

|

|

130.0

|

|

132.9

|

|

103.5

|

|

|||||

|

Investment income

|

18.9

|

|

18.9

|

|

16.9

|

|

16.8

|

|

15.5

|

|

|||||

|

Realized investment and other gains (losses) - net

|

2.2

|

|

(0.7

|

)

|

(1.4

|

)

|

6.7

|

|

(1.1

|

)

|

|||||

|

Title loss provisions

|

96.5

|

|

91.1

|

|

106.3

|

|

81.3

|

|

106.3

|

|

|||||

|

% title operating revenues

|

5.1

|

|

4.8

|

|

5.6

|

|

4.7

|

|

5.9

|

|

|||||

|

Pretax income

(1)

|

75.1

|

|

88.0

|

|

9.7

|

|

51.8

|

|

101.1

|

|

|||||

|

Net income (loss) attributable to Stewart

|

48.7

|

|

55.5

|

|

(6.2

|

)

|

29.8

|

|

63.0

|

|

|||||

|

Cash provided by operations

|

108.1

|

|

123.0

|

|

80.5

|

|

64.0

|

|

87.1

|

|

|||||

|

Total assets

|

1,405.9

|

|

1,341.7

|

|

1,321.6

|

|

1,392.5

|

|

1,326.1

|

|

|||||

|

Notes payable and convertible senior notes

|

109.3

|

|

106.8

|

|

102.4

|

|

71.2

|

|

39.5

|

|

|||||

|

Stockholders’ equity

|

678.8

|

|

648.8

|

|

637.1

|

|

700.5

|

|

663.1

|

|

|||||

|

Per share data:

|

|||||||||||||||

|

Diluted average shares outstanding (millions)

|

23.6

|

|

23.5

|

|

23.5

|

|

24.7

|

|

24.7

|

|

|||||

|

Basic earnings (loss) attributable to Stewart

|

2.08

|

|

1.86

|

|

(0.26

|

)

|

1.31

|

|

2.85

|

|

|||||

|

Diluted earnings (loss) attributable to Stewart

|

2.06

|

|

1.85

|

|

(0.26

|

)

|

1.24

|

|

2.60

|

|

|||||

|

Cash dividends

|

1.20

|

|

1.20

|

|

0.80

|

|

0.10

|

|

0.10

|

|

|||||

|

Stockholders’ equity

|

28.62

|

|

27.69

|

|

27.30

|

|

29.18

|

|

29.47

|

|

|||||

|

Market price:

|

|||||||||||||||

|

High

|

48.03

|

|

48.60

|

|

44.01

|

|

37.87

|

|

34.39

|

|

|||||

|

Low

|

34.48

|

|

30.34

|

|

35.12

|

|

27.02

|

|

22.74

|

|

|||||

|

Year end

|

42.30

|

|

46.08

|

|

37.33

|

|

37.04

|

|

32.27

|

|

|||||

|

•

|

$2.9 million of third party advisory expenses recorded in other operating expenses in the ancillary services and corporate segment relating to our previously announced review of strategic alternatives,

|

|

•

|

$3.5 million of office closure costs, primarily lease termination and litigation expenses recorded in other operating expenses in the title segment,

|

|

•

|

$1.7 million of executive severance and retention expenses recorded in employee costs in the title and ancillary services and corporate segments,

|

|

•

|

$1.0 million of acquisition integration expenses recorded in other operating expenses in the title segment, and

|

|

•

|

$6.6 million of net income tax benefits related to the effects of the recently-enacted Tax Cuts and Jobs Act.

|

|

•

|

$5.4 million of net realized losses, primarily realized losses on the sale of assets related to certain ancillary services business lines, and

|

|

•

|

$2.4 million of income tax benefits related to previously unrecognized tax credits.

|

|

Quarter Ended December 31,

|

||||||||

|

|

2017

|

2016

|

% Change

|

|||||

|

Total revenues

|

514.6

|

|

511.6

|

|

1

|

%

|

||

|

Pretax income

|

27.0

|

|

38.1

|

|

(29

|

)%

|

||

|

Pretax margin

|

5.2

|

%

|

7.4

|

%

|

||||

|

|

Quarter Ended December 31,

|

|||||||

|

|

2017

|

2016

|

% Change

|

|||||

|

|

($ in millions)

|

|||||||

|

Non-commercial:

|

||||||||

|

Domestic

|

134.0

|

|

148.3

|

|

(10

|

)%

|

||

|

International

|

21.0

|

|

23.8

|

|

(12

|

)%

|

||

|

155.0

|

|

172.1

|

|

(10

|

)%

|

|||

|

Commercial:

|

||||||||

|

Domestic

|

59.1

|

|

52.7

|

|

12

|

%

|

||

|

International

|

12.4

|

|

5.4

|

|

130

|

%

|

||

|

71.5

|

|

58.1

|

|

23

|

%

|

|||

|

Total direct title revenues

|

226.5

|

|

230.2

|

|

(2

|

)%

|

||

|

Quarter Ended December 31,

|

||||||||

|

|

2017

|

2016

|

% Change

|

|||||

|

Total revenues

|

11.1

|

|

14.2

|

|

(22

|

)%

|

||

|

Pretax loss

|

(9.6

|

)

|

(15.1

|

)

|

37

|

%

|

||

|

2017

|

2016

|

2015

|

|||||||

|

|

($ in millions)

|

||||||||

|

Provisions – Known Claims:

|

|||||||||

|

Current year

|

18.2

|

|

20.6

|

|

14.1

|

|

|||

|

Prior policy years

|

59.3

|

|

64.8

|

|

81.0

|

|

|||

|

77.5

|

|

85.4

|

|

95.1

|

|

||||

|

Provisions – IBNR

|

|||||||||

|

Current year

|

53.8

|

|

52.0

|

|

54.0

|

|

|||

|

Prior policy years

|

24.5

|

|

18.5

|

|

38.2

|

|

|||

|

78.3

|

|

70.5

|

|

92.2

|

|

||||

|

Transferred IBNR to Known Claims

|

(59.3

|

)

|

(64.8

|

)

|

(81.0

|

)

|

|||

|

Total provisions

|

96.5

|

|

91.1

|

|

106.3

|

|

|||

|

•

|

mortgage interest rates;

|

|

•

|

availability of mortgage loans;

|

|

•

|

number and average value of mortgage loan originations;

|

|

•

|

ability of potential purchasers to qualify for loans;

|

|

•

|

inventory of existing homes available for sale;

|

|

•

|

ratio of purchase transactions compared with refinance transactions;

|

|

•

|

ratio of closed orders to open orders;

|

|

•

|

home prices;

|

|

•

|

consumer confidence, including employment trends;

|

|

•

|

demand by buyers;

|

|

•

|

number of households;

|

|

•

|

premium rates;

|

|

•

|

foreign currency exchange rates;

|

|

•

|

market share;

|

|

•

|

ability to attract and retain highly productive sales associates;

|

|

•

|

independent agency remittance rates;

|

|

•

|

opening of new offices and acquisitions;

|

|

•

|

number of commercial transactions, which typically yield higher premiums;

|

|

•

|

government or regulatory initiatives, including tax incentives and the implementation of the new integrated disclosure requirements;

|

|

•

|

acquisitions or divestitures of businesses;

|

|

•

|

volume of distressed property transactions; and

|

|

•

|

seasonality and/or weather.

|

|

2017

|

2016

|

2015

|

|||||||

|

Mortgage interest rates (30-year, fixed-rate) – %

|

|||||||||

|

Averages for the year

|

3.99

|

|

3.65

|

|

3.85

|

|

|||

|

First quarter

|

4.17

|

|

3.74

|

|

3.73

|

|

|||

|

Second quarter

|

3.99

|

|

3.59

|

|

3.83

|

|

|||

|

Third quarter

|

3.89

|

|

3.45

|

|

3.95

|

|

|||

|

Fourth quarter

|

3.92

|

|

3.81

|

|

3.90

|

|

|||

|

Mortgage originations – $ billions

|

1,830

|

|

2,052

|

|

1,730

|

|

|||

|

Refinancings – % of originations

|

37.5

|

|

48.7

|

|

46.7

|

|

|||

|

New home sales – in millions

|

0.61

|

|

0.56

|

|

0.50

|

|

|||

|

New home sales – median sales price in $ thousands

|

321.1

|

|

307.8

|

|

297.0

|

|

|||

|

Existing home sales – in millions

|

5.51

|

|

5.45

|

|

5.25

|

|

|||

|

Existing home sales – median sales price in $ thousands

|

247.3

|

|

233.8

|

|

222.4

|

|

|||

|

Year Ended December 31

|

% Change

|

|||||||||||||

|

|

2017

|

2016

|

2015

|

2017 vs. 2016

|

2016 vs. 2015

|

|||||||||

|

|

($ in millions)

|

|||||||||||||

|

Non-commercial

|

||||||||||||||

|

Domestic

|

551.8

|

|

606.4

|

|

616.6

|

|

(9

|

)%

|

(2

|

)%

|

||||

|

International

|

96.9

|

|

92.5

|

|

82.7

|

|

5

|

%

|

12

|

%

|

||||

|

648.7

|

|

698.9

|

|

699.3

|

|

(7

|

)%

|

—

|

%

|

|||||

|

Commercial:

|

||||||||||||||

|

Domestic

|

186.5

|

|

176.4

|

|

178.1

|

|

6

|

%

|

(1

|

)%

|

||||

|

International

|

27.2

|

|

19.0

|

|

19.7

|

|

43

|

%

|

(4

|

)%

|

||||

|

213.7

|

|

195.4

|

|

197.8

|

|

9

|

%

|

(1

|

)%

|

|||||

|

Total direct title revenues

|

862.4

|

|

894.3

|

|

897.1

|

|

(4

|

)%

|

—

|

%

|

||||

|

Year Ended December 31

|

% Change

|

|||||||||||

|

2017

|

2016

|

2015

|

2017 vs. 2016

|

2016 vs. 2015

|

||||||||

|

Opened Orders:

|

||||||||||||

|

Commercial

|

42,871

|

|

46,553

|

|

49,994

|

|

(8

|

)%

|

(7

|

)%

|

||

|

Purchase

|

239,148

|

|

245,697

|

|

245,169

|

|

(3

|

)%

|

—

|

%

|

||

|

Refinance

|

98,990

|

|

147,205

|

|

177,072

|

|

(33

|

)%

|

(17

|

)%

|

||

|

Other

|

17,610

|

|

12,648

|

|

21,133

|

|

39

|

%

|

(40

|

)%

|

||

|

Total

|

398,619

|

|

452,103

|

|

493,368

|

|

(12

|

)%

|

(8

|

)%

|

||

|

Closed Orders:

|

||||||||||||

|

Commercial

|

30,286

|

|

32,234

|

|

35,066

|

|

(6

|

)%

|

(8

|

)%

|

||

|

Purchase

|

184,532

|

|

192,303

|

|

190,771

|

|

(4

|

)%

|

1

|

%

|

||

|

Refinance

|

71,885

|

|

106,796

|

|

120,827

|

|

(33

|

)%

|

(12

|

)%

|

||

|

Other

|

12,523

|

|

16,594

|

|

18,556

|

|

(25

|

)%

|

(11

|

)%

|

||

|

Total

|

299,226

|

|

347,927

|

|

365,220

|

|

(14

|

)%

|

(5

|

)%

|

||

|

|

Amounts ($ millions)

|

Percentages

|

||||||||||||||||

|

|

2017

|

2016

|

2015

|

2017

|

2016

|

2015

|

||||||||||||

|

Texas

|

328

|

|

362

|

|

341

|

|

17

|

%

|

19

|

%

|

18

|

%

|

||||||

|

New York

|

226

|

|

226

|

|

250

|

|

12

|

%

|

12

|

%

|

13

|

%

|

||||||

|

California

|

140

|

|

125

|

|

142

|

|

8

|

%

|

7

|

%

|

8

|

%

|

||||||

|

International

|

131

|

|

116

|

|

107

|

|

7

|

%

|

6

|

%

|

6

|

%

|

||||||

|

Florida

|

78

|

|

87

|

|

88

|

|

4

|

%

|

5

|

%

|

5

|

%

|

||||||

|

All others

|

976

|

|

988

|

|

960

|

|

52

|

%

|

51

|

%

|

50

|

%

|

||||||

|

1,879

|

|

1,904

|

|

1,888

|

|

100

|

%

|

100

|

%

|

100

|

%

|

|||||||

|

|

Year Ended December 31

|

% Change

|

||||||||||||

|

|

2017

|

2016

|

2015

|

2017 vs. 2016

|

2016 vs. 2015

|

|||||||||

|

|

($ in millions)

|

|||||||||||||

|

Amounts retained by agencies

|

837.1

|

|

826.0

|

|

809.6

|

|

1

|

%

|

2

|

%

|

||||

|

As a % of agency revenues

|

82.4

|

%

|

81.8

|

%

|

81.7

|

%

|

||||||||

|

Employee costs

|

566.2

|

|

604.4

|

|

658.3

|

|

(6

|

)%

|

(8

|

)%

|

||||

|

As a % of operating revenues

|

29.3

|

%

|

30.4

|

%

|

32.6

|

%

|

||||||||

|

Other operating expenses

|

351.5

|

|

364.0

|

|

382.0

|

|

(3

|

)%

|

(5

|

)%

|

||||

|

As a % of operating revenues

|

18.2

|

%

|

18.3

|

%

|

18.9

|

%

|

||||||||

|

Title losses and related claims

|

96.5

|

|

91.1

|

|

106.3

|

|

6

|

%

|

(14

|

)%

|

||||

|

As a % of title revenues

|

5.1

|

%

|

4.8

|

%

|

5.6

|

%

|

||||||||

|

|

2017

|

2016

|

2015

|

|||

|

|

($000 omitted)

|

|||||

|

Title segment:

|

||||||

|

Office closures: early lease terminations and asset write-offs

|

3,178

|

|

—

|

|

—

|

|

|

Title365 acquisition and integration-related expenses

|

2,368

|

|

—

|

|

—

|

|

|

Severance and retention expenses

|

595

|

|

—

|

|

810

|

|

|

Litigation-related accruals

|

350

|

|

—

|

|

5,959

|

|

|

Prior policy reserve adjustments, net

|

—

|

|

(5,400

|

)

|

4,527

|

|

|

Total title segment

|

6,491

|

|

(5,400

|

)

|

11,296

|

|

|

Ancillary services and corporate segment:

|

||||||

|

Strategic alternatives review expenses

|

2,868

|

|

—

|

|

—

|

|

|

Severance and retention expenses

|

1,095

|

|

—

|

|

—

|

|

|

Litigation-related accruals

|

—

|

|

3,599

|

|

—

|

|

|

Class B Common Stock exchange expenses

|

—

|

|

2,193

|

|

—

|

|

|

Shareholder activism and settlement charges

|

—

|

|

1,186

|

|

3,542

|

|

|

Accelerated depreciation from the exit of delinquent loan servicing activities

|

—

|

|

1,089

|

|

1,452

|

|

|

Cost Management Program and severance expenses

|

—

|

|

442

|

|

21,344

|

|

|

Impairment of goodwill

|

—

|

|

—

|

|

35,749

|

|

|

Total ancillary services and corporate segment

|

3,963

|

|

8,509

|

|

62,087

|

|

|

Total

|

10,454

|

|

3,109

|

|

73,383

|

|

|

|

Employee Costs

|

Other Operating Expenses

|

||||||||||||||||

|

|

2017

|

2016

|

2015

|

2017

|

2016

|

2015

|

||||||||||||

|

Title

|

28.1

|

%

|

28.3

|

%

|

28.0

|

%

|

16.6

|

%

|

16.1

|

%

|

17.0

|

%

|

||||||

|

Ancillary services and corporate

|

67.6

|

%

|

77.5

|

%

|

99.0

|

%

|

69.2

|

%

|

67.9

|

%

|

47.3

|

%

|

||||||

|

|

2017

|

2016

|

||

|

|

($ in millions)

|

|||

|

Known claims

|

69.8

|

|

76.5

|

|

|

IBNR

|

411.2

|

|

386.1

|

|

|

Total estimated title losses

|

481.0

|

|

462.6

|

|

|

|

Payments due by period ($ millions)

|

||||||||||||||

|

|

Within

1 year

|

Over 1 to 3

years

|

Over 3 to 5

years

|

More than

5 years

|

Total

|

||||||||||

|

Credit facility

|

—

|

|

98.9

|

|

—

|

|

—

|

|

98.9

|

|

|||||

|

Other notes payable

|

7.4

|

|

3.0

|

|

—

|

|

—

|

|

10.4

|

|

|||||

|

Operating leases

|

52.1

|

|

67.2

|

|

30.0

|

|

17.8

|

|

167.1

|

|

|||||

|

Estimated title losses

|

105.8

|

|

168.4

|

|

86.6

|

|

120.2

|

|

481.0

|

|

|||||

|

165.3

|

|

337.5

|

|

116.6

|

|

138.0

|

|

757.4

|

|

||||||

|

2017

|

2016

|

2015

|

|||||||

|

|

($ millions)

|

||||||||

|

Net cash provided by operating activities

|

108.1

|

|

123.0

|

|

80.5

|

|

|||

|

Net cash used by investing activities

|

(103.9

|

)

|

(56.8

|

)

|

(68.8

|

)

|

|||

|

Net cash used by financing activities

|

(43.6

|

)

|

(59.3

|

)

|

(25.6

|

)

|

|||

|

Amortized

costs

|

Fair

values

|

|||||

|

|

($ thousands)

|

|||||

|

In one year or less

|

35,974

|

|

36,092

|

|

||

|

After one year through two years

|

48,843

|

|

49,056

|

|

||

|

After two years through three years

|

98,194

|

|

98,751

|

|

||

|

After three years through four years

|

107,851

|

|

109,341

|

|

||

|

After four years through five years

|

103,850

|

|

105,058

|

|

||

|

After five years

|

270,934

|

|

273,143

|

|

||

|

665,646

|

|

671,441

|

|

|||

|

Board of Directors:

|

|

|

|

Thomas G. Apel

|

|

Chairman of the Board of the Company and CEO of VLN, Inc.

|

|

Arnaud Ajdler

|

|

Managing Partner of Engine Capital LP

|

|

Clifford Allen Bradley, Jr.

|

Former Chairman of the board and CEO of Amerisafe, Inc.

|

|

|

James Chadwick

|

|

Director of Ancora Advisors LLC

|

|

Glenn C. Christenson

|

Managing Director of Velstand Investments, LLC

|

|

|

Robert L. Clarke

|

|

Of Counsel, Bracewell LLP

|

|

Frederick H. Eppinger

|

Director of Centene Corp. and former President and CEO of The Hanover Insurance Group, Inc.

|

|

|

Matthew W. Morris

|

|

Chief Executive Officer of Stewart

|

|

Clifford Press

|

|

Partner and Managing Member of Oliver Press Partners, LLC

|

|

Management Team:

|

|

|

|

Matthew W. Morris

|

|

Chief Executive Officer

|

|

John L. Killea

|

|

President, Chief Legal Officer and Chief Compliance Officer

|

|

David C. Hisey

|

|

Chief Financial Officer, Secretary and Treasurer

|

|

John Magness

|

Chief Corporate Development Officer

|

|

|

Brad Rable

|

|

Chief Information Officer

|

|

Ann Manal

|

|

Chief Human Resources Officer

|

|

Patrick Beall

|

|

Group President

|

|

David A. Fauth

|

Group President

|

|

|

(a)

|

Financial Statements and Financial Statement Schedules

|

|

(b)

|

Exhibits

|

|

By:

|

/s/ Matthew W. Morris

|

|

Matthew W. Morris, Chief Executive Officer

|

|

|

By:

|

/s/ David C. Hisey

|

|

David C. Hisey, Chief Financial Officer, Secretary and Treasurer

|

|

|

By:

|

/s/ Brian K. Glaze

|

|

Brian K. Glaze, Controller and

Principal Accounting Officer

|

|

|

/s/ Thomas G. Apel

|

/s/ James Chadwick

|

/s/ Frederick H. Eppinger

|

||

|

(Thomas G. Apel)

|

(James Chadwick)

|

|

(Frederick H. Eppinger)

|

|

|

/s/ Arnaud Ajdler

|

/s/ Glenn C. Christenson

|

/s/ Matthew W. Morris

|

||

|

(Arnaud Ajdler)

|

(Glenn C. Christenson)

|

(Matthew W. Morris)

|

||

|

/s/ Clifford Allen Bradley Jr.

|

/s/ Robert L. Clarke

|

/s/ Clifford Press

|

||

|

(Clifford Allen Bradley)

|

(Robert L. Clarke)

|

(Clifford Press)

|

||

|

Stewart Information Services Corporation and Subsidiaries’ Consolidated Financial Statements:

|

||

|

Financial Statement Schedules:

|

||

|

|

For the Years Ended December 31,

|

|||||||

|

|

2017

|

2016

|

2015

|

|||||

|

|

($000 omitted, except per share)

|

|||||||

|

Revenues

|

||||||||

|

Title insurance:

|

||||||||

|

Direct operations

|

862,392

|

|

894,313

|

|

897,118

|

|

||

|

Agency operations

|

1,016,356

|

|

1,009,797

|

|

991,332

|

|

||

|

Ancillary services

|

55,837

|

|

84,271

|

|

129,954

|

|

||

|

Operating revenues

|

1,934,585

|

|

1,988,381

|

|

2,018,404

|

|

||

|

Investment income

|

18,932

|

|

18,925

|

|

16,850

|

|

||

|

Realized investment and other gains (losses) – net

|

2,207

|

|

(666

|

)

|

(1,369

|

)

|

||

|

1,955,724

|

|

2,006,640

|

|

2,033,885

|

|

|||

|

Expenses

|

||||||||

|

Amounts retained by agencies

|

837,100

|

|

826,022

|

|

809,564

|

|

||

|

Employee costs

|

566,178

|

|

604,353

|

|

658,266

|

|

||

|

Other operating expenses

|

351,511

|

|

363,986

|

|

381,954

|

|

||

|

Title losses and related claims

|

96,532

|

|

91,147

|

|

106,265

|

|

||

|

Impairment of goodwill

|

—

|

|

—

|

|

35,749

|

|

||

|

Depreciation and amortization

|

25,878

|

|

30,044

|

|

30,298

|

|

||

|

Interest

|

3,458

|

|

3,062

|

|

2,096

|

|

||

|

1,880,657

|

|

1,918,614

|

|

2,024,192

|

|

|||

|

Income before taxes and noncontrolling interests

|

75,067

|

|

88,026

|

|

9,693

|

|

||

|

Income tax expense

|

14,921

|

|

19,605

|

|

5,650

|

|

||

|

Net income

|

60,146

|

|

68,421

|

|

4,043

|

|

||

|

Less net income attributable to noncontrolling interests

|

11,487

|

|

12,943

|

|

10,247

|

|

||

|

Net income (loss) attributable to Stewart

|

48,659

|

|

55,478

|

|

(6,204

|

)

|

||

|

Net income

|

60,146

|

|

68,421

|

|

4,043

|

|

||

|

Other comprehensive income (loss), net of taxes:

|

||||||||

|

Foreign currency translation adjustments

|

8,354

|

|

(3,367

|

)

|

(11,145

|

)

|

||

|

Change in unrealized net gains on investments

|

1,766

|

|

354

|

|

(3,741

|

)

|

||

|

Reclassification adjustment for net gains included in net income

|

(2,086

|

)

|

(1,911

|

)

|

(1,626

|

)

|

||

|

Other comprehensive income (loss), net of taxes

|

8,034

|

|

(4,924

|

)

|

(16,512

|

)

|

||

|

Comprehensive income (loss)

|

68,180

|

|

63,497

|

|

(12,469

|

)

|

||

|

Less comprehensive income attributable to noncontrolling interests

|

11,487

|

|

12,943

|

|

10,247

|

|

||

|

Comprehensive income (loss) attributable to Stewart

|

56,693

|

|

50,554

|

|

(22,716

|

)

|

||

|

Basic average shares outstanding (000)

|

23,445

|

|

23,364

|

|

23,544

|

|

||

|

Basic earnings (loss) per share attributable to Stewart

|

2.08

|

|

1.86

|

|

(0.26

|

)

|

||

|

Diluted average shares outstanding (000)

|

23,597

|

|

23,472

|

|

23,544

|

|

||

|

Diluted earnings (loss) per share attributable to Stewart

|

2.06

|

|

1.85

|

|

(0.26

|

)

|

||

|

|

As of December 31,

|

||||

|

|

2017

|

2016

|

|||

|

|

($000 omitted)

|

||||

|

Assets

|

|||||

|

Cash and cash equivalents

|

150,079

|

|

185,772

|

|

|

|

Short-term investments

|

24,463

|

|

22,239

|

|

|

|

Investments in debt and equity securities available-for-sale, at fair value:

|

|||||

|

Statutory reserve funds

|

490,824

|

|

485,409

|

|

|

|

Other

|

218,531

|

|

146,094

|

|

|

|

709,355

|

|

631,503

|

|

||

|

Receivables:

|

|||||

|

Premiums from agencies

|

27,903

|

|

31,246

|

|

|

|

Trade and other

|

51,299

|

|

41,897

|

|

|

|

Income taxes

|

1,267

|

|

4,878

|

|

|

|

Notes

|

3,203

|

|

3,402

|

|

|

|

Allowance for uncollectible amounts

|

(5,156

|

)

|

(9,647

|

)

|

|

|

78,516

|

|

71,776

|

|

||

|

Property and equipment, at cost:

|

|||||

|

Land

|

3,991

|

|

3,991

|

|

|

|

Buildings

|

22,849

|

|

22,529

|

|

|

|

Furniture and equipment

|

226,461

|

|

217,105

|

|

|

|

Accumulated depreciation

|

(186,279

|

)

|

(173,119

|

)

|

|

|

67,022

|

|

70,506

|

|

||

|

Title plants, at cost

|

74,237

|

|

75,313

|

|

|

|

Investments in investees, on an equity method basis

|

9,202

|

|

9,796

|

|

|

|

Goodwill

|

231,428

|

|

217,094

|

|

|

|

Intangible assets, net of amortization

|

9,734

|

|

10,890

|

|

|

|

Deferred tax assets, net

|

4,186

|

|

3,860

|

|

|

|

Other assets

|

47,664

|

|

42,975

|

|

|

|

1,405,886

|

|

1,341,724

|

|

||

|

Liabilities

|

|||||

|

Notes payable

|

109,312

|

|

106,808

|

|

|

|

Accounts payable and accrued liabilities

|

117,740

|

|

115,640

|

|

|

|

Estimated title losses

|

480,990

|

|

462,572

|

|

|

|

Deferred tax liabilities, net

|

19,034

|

|

7,856

|

|

|

|

727,076

|

|

692,876

|

|

||

|

Contingent liabilities and commitments

|

|

|

|||

|

Stockholders’ equity

|

|||||

|

Common Stock – $1 par, authorized 50,000,000; issued 24,071,683 and 23,783,440; outstanding 23,719,522 and 23,431,279, respectively

|

24,072

|

|

23,783

|

|

|

|

Additional paid-in capital

|

159,954

|

|

157,176

|

|

|

|

Retained earnings

|

491,698

|

|

471,788

|

|

|

|

Accumulated other comprehensive (loss) income:

|

|||||

|

Foreign currency translation adjustments

|

(8,373

|

)

|

(16,727

|

)

|

|

|

Net unrealized gains on investments available-for-sale

|

7,526

|

|

7,846

|

|

|

|

Treasury stock – 352,161 common shares, at cost, for 2017 and 2016

|

(2,666

|

)

|

(2,666

|

)

|

|

|

Total stockholders’ equity attributable to Stewart

|

672,211

|

|

641,200

|

|

|

|

Noncontrolling interests

|

6,599

|

|

7,648

|

|

|

|

Total stockholders’ equity

|

678,810

|

|

648,848

|

|

|

|

1,405,886

|

|

1,341,724

|

|

||

|

|

For the Years Ended December 31,

|

|||||||

|

|

2017

|

2016

|

2015

|

|||||

|

|

($000 omitted)

|

|||||||

|

Reconciliation of net income to cash provided by operating activities:

|

||||||||

|

Net income

|

60,146

|

|

68,421

|

|

4,043

|

|

||

|

Add (deduct):

|

||||||||

|

Depreciation and amortization

|

25,878

|

|

30,044

|

|

30,298

|

|

||

|

Provision for bad debt

|

207

|

|

3,349

|

|

3,396

|

|

||

|

Realized investment and other (gains) losses – net

|

(2,207

|

)

|

666

|

|

1,369

|

|

||

|

Amortization of net premium on investments available-for-sale

|

6,806

|

|

7,215

|

|

6,540

|

|

||

|

Payments for title losses less than (in excess of) provisions

|

12,937

|

|

(1,056

|

)

|

(17,154

|

)

|

||

|

Adjustments for insurance recoveries of title losses

|

(654

|

)

|

(173

|

)

|

213

|

|

||

|

Impairment of goodwill

|

—

|

|

—

|

|

35,749

|

|

||

|

(Increase) decrease in receivables – net

|

(6,910

|

)

|

7,759

|

|

12,894

|

|

||

|

(Increase) decrease in other assets – net

|

(4,512

|

)

|

391

|

|

3,073

|

|

||

|

Increase (decrease) in payables and accrued liabilities – net

|

1,933

|

|

(3,888

|

)

|

2,088

|

|

||

|

Decrease (increase) in net deferred income taxes

|

8,328

|

|

7,446

|

|

(5,800

|

)

|

||

|

Net income from equity investees

|

(2,163

|

)

|

(2,834

|

)

|

(3,579

|

)

|

||

|

Dividends received from equity investees

|

2,493

|

|

2,640

|

|

3,811

|

|

||

|

Stock based compensation expense

|

5,303

|

|

2,982

|

|

4,445

|

|

||

|

Other – net

|

483

|

|

—

|

|

(872

|

)

|

||

|

Cash provided by operating activities

|

108,068

|

|

122,962

|

|

80,514

|

|

||

|

Investing activities:

|

||||||||

|

Proceeds from investments available-for-sale sold

|

76,942

|

|

81,091

|

|

69,280

|

|

||

|

Proceeds from investments available-for-sale matured

|

33,912

|

|

27,125

|

|

42,195

|

|

||

|

Purchases of investments available-for-sale

|

(179,732

|

)

|

(166,444

|

)

|

(147,697

|

)

|

||

|

Net (purchases) sales of short-term investments

|

(2,224

|

)

|

17,468

|

|

(14,664

|

)

|

||

|

Purchases of property and equipment, title plants and real estate

|

(16,396

|

)

|

(18,155

|

)

|

(19,658

|

)

|

||

|

Proceeds from the sale of land, buildings, property and equipment, and real estate

|

502

|

|

692

|

|

4,214

|

|

||

|

Net cash (paid for acquisition) received from disposal of subsidiaries and other assets

|

(17,359

|

)

|

1,268

|

|

(3,958

|

)

|

||

|

Other – net

|

458

|

|

181

|

|

1,497

|

|

||

|

Cash used by investing activities

|

(103,897

|

)

|

(56,774

|

)

|

(68,791

|

)

|

||

|

Financing activities:

|

||||||||

|

Proceeds from notes payable

|

56,493

|

|

57,758

|

|

52,651

|

|

||

|

Payments on notes payable

|

(56,467

|

)

|

(60,339

|

)

|

(22,494

|

)

|

||

|

Purchase of remaining interest of consolidated subsidiaries

|

(1,810

|

)

|

(991

|

)

|

(209

|

)

|

||

|

Cash dividends paid

|

(28,135

|

)

|

(27,840

|

)

|

(18,010

|

)

|

||

|

Cash paid on Class B Common Shares conversion

|

—

|

|

(12,000

|

)

|

—

|

|

||

|

Distributions to noncontrolling interests

|

(11,651

|

)

|

(12,961

|

)

|

(9,706

|

)

|

||

|

Repurchases of Common Stock

|

(727

|

)

|

(1,053

|

)

|

(27,950

|

)

|

||

|

Payment of contingent consideration related to an acquisition

|

(1,298

|

)

|

(2,002

|

)

|

—

|

|

||

|

Other - net

|

—

|

|

86

|

|

168

|

|

||

|

Cash used by financing activities

|

(43,595

|

)

|

(59,342

|

)

|

(25,550

|

)

|

||

|

Effects of changes in foreign currency exchange rates

|

3,731

|

|

(141

|

)

|

(7,664

|

)

|

||

|

(Decrease) increase in cash and cash equivalents

|

(35,693

|

)

|

6,705

|

|

(21,491

|

)

|

||

|

Cash and cash equivalents at beginning of year

|

185,772

|

|

179,067

|

|

200,558

|

|

||

|

Cash and cash equivalents at end of year

|

150,079

|

|

185,772

|

|

179,067

|

|

||

|

|

For the Years Ended December 31,

|

||||||||

|

|

2017

|

2016

|

2015

|

||||||

|

($000 omitted)

|

|||||||||

|

Supplemental information:

|

|||||||||

|

Net changes in financial statement amounts due to purchase and disposal of subsidiaries and other assets:

|

|||||||||

|

Goodwill acquired (disposed)

|

14,334

|

|

(628

|

)

|

7,220

|

|

|||

|

Intangible assets acquired (disposed)

|

2,598

|

|

(1,730

|

)

|

38

|

|

|||

|

Receivables and other assets disposed

|

(60

|

)

|

(1,272

|

)

|

—

|

|

|||

|

Liabilities disposed (recognized)

|

327

|

|

(499

|

)

|

(3,300

|

)

|

|||

|

Net realized loss on the disposal

|

160

|

|

2,861

|

|

—

|

|

|||

|

Net cash paid for acquisition (received from disposal) of subsidiaries and other assets

|

17,359

|

|

(1,268

|

)

|

3,958

|

|

|||

|

Assets purchased through capital lease obligations

|

2,477

|

|

6,990

|

|

1,062

|

|

|||

|

Income taxes – net (refunded) paid

|

(1,642

|

)

|

15,265

|

|

14,982

|

|

|||

|

Interest paid

|

3,466

|

|

3,020

|

|

1,873

|

|

|||

|

Common

and Class B Common Stock ($1 par value) (Note 12) |

Additional

paid-in

capital

|

Accumulated

other

comprehensive

income (loss)

|

Retained

Earnings

|

Treasury

stock

|

Noncontrolling

interests

|

Total

|

||||||||||||||

|

|

($000 omitted)

|

|||||||||||||||||||

|

Balances at January 1, 2015

|

24,358

|

|

179,205

|

|

12,555

|

|

479,733

|

|

(2,666

|

)

|

7,268

|

|

700,453

|

|

||||||

|

Net loss attributable to Stewart

|

—

|

|

—

|

|

—

|

|

(6,204

|

)

|

—

|

|

—

|

|

(6,204

|

)

|

||||||

|

Dividends on Common Stock ($0.80 per share)

|

—

|

|

—

|

|

—

|

|

(18,010

|

)

|

—

|

|

—

|

|

(18,010

|

)

|

||||||

|

Stock bonuses and other (including tax effects)

|

93

|

|

4,758

|

|

—

|

|

—

|

|

—

|

|

—

|

|

4,851

|

|

||||||

|

Exercise of stock options

|

4

|

|

126

|

|

—

|

|

—

|

|

—

|

|

—

|

|

130

|

|

||||||

|

Stock repurchases

|

(762

|

)

|

(27,188

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(27,950

|

)

|

||||||

|

Purchase of remaining interest of consolidated subsidiary

|

—

|

|

(209

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(209

|

)

|

||||||

|

Net change in unrealized gains and losses on investments (net of tax)

|

—

|

|

—

|

|

(3,741

|

)

|

—

|

|

—

|

|

—

|

|

(3,741

|

)

|

||||||

|

Net realized gain reclassification (net of tax)

|

—

|

|

—

|

|

(1,626

|

)

|

—

|

|

—

|

|

—

|

|

(1,626

|

)

|

||||||

|

Foreign currency translation (net of tax)

|

—

|

|

—

|

|

(11,145

|

)

|

—

|

|

—

|

|

—

|

|

(11,145

|

)

|

||||||

|

Net income attributable to noncontrolling interests

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

10,247

|

|

10,247

|

|

||||||

|

Distributions to noncontrolling interests

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(9,706

|

)

|

(9,706

|

)

|

||||||

|

Net effect of changes in ownership and other

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

38

|

|

38

|

|

||||||

|

Balances at December 31, 2015

|

23,693

|

|

156,692

|

|

(3,957

|

)

|

455,519

|

|

(2,666

|

)

|

7,847

|

|

637,128

|

|

||||||

|

Cumulative effect adjustment on adoption of ASU 2016-09 (Note 12)

|

—

|

|

(631

|

)

|

—

|

|

631

|

|

—

|

|

—

|

|

—

|

|

||||||

|

Net income attributable to Stewart

|

—

|

|

—

|

|

—

|

|

55,478

|

|

—

|

|

—

|

|

55,478

|

|

||||||

|

Dividends on Common Stock ($1.20 per share)

|

—

|

|

—

|

|

—

|

|

(27,840

|

)

|

—

|

|

—

|

|

(27,840

|

)

|

||||||

|

Cash paid on Class B Common Shares conversion

|

—

|

|

—

|

|

—

|

|

(12,000

|

)

|

—

|

|

—

|

|

(12,000

|

)

|

||||||

|

Stock bonuses and other (including tax effects)

|

110

|

|

2,872

|

|

—

|

|

—

|

|

—

|

|

—

|

|

2,982

|

|

||||||

|

Exercise of stock options

|

3

|

|

83

|

|

—

|

|

—

|

|

—

|

|

—

|

|

86

|

|

||||||

|

Stock repurchases

|

(23

|

)

|

(1,030

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(1,053

|

)

|

||||||

|

Purchase of remaining interest of consolidated subsidiary

|

—

|

|

(810

|

)

|

—

|

|

—

|

|

—

|

|

(181

|

)

|

(991

|

)

|

||||||

|

Net change in unrealized gains and losses on investments (net of tax)

|

—

|

|

—

|

|

354

|

|

—

|

|

—

|

|

—

|

|

354

|

|

||||||

|

Net realized gain reclassification (net of tax)

|

—

|

|

—

|

|

(1,911

|

)

|

—

|

|

—

|

|

—

|

|

(1,911

|

)

|

||||||

|

Foreign currency translation (net of tax)

|

—

|

|

—

|

|

(3,367

|

)

|

—

|

|

—

|

|

—

|

|

(3,367

|

)

|

||||||

|

Net income attributable to noncontrolling interests

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

12,943

|

|

12,943

|

|

||||||

|

Distributions to noncontrolling interests

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(12,961

|

)

|

(12,961

|

)

|

||||||

|

Balances at December 31, 2016

|

23,783

|

|

157,176

|

|

(8,881

|

)

|

471,788

|

|

(2,666

|

)

|

7,648

|

|

648,848

|

|

||||||

|

Net income attributable to Stewart

|

—

|

|

—

|

|

—

|

|

48,659

|

|

—

|

|

—

|

|

48,659

|

|

||||||

|

Dividends on Common Stock ($1.20 per share)

|

—

|

|

—

|

|

—

|

|

(28,749

|

)

|

—

|

|

—

|

|

(28,749

|

)

|

||||||

|

Stock bonuses and other (including tax effects)

|

306

|

|

4,997

|

|

—

|

|

—

|

|

—

|

|

—

|

|

5,303

|

|

||||||

|

Stock repurchases

|

(17

|

)

|

(710

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(727

|

)

|

||||||

|

Purchase of remaining interest of consolidated subsidiary

|

—

|

|

(1,509

|

)

|

—

|

|

—

|

|

—

|

|

(301

|

)

|

(1,810

|

)

|

||||||

|

Net change in unrealized gains and losses on investments (net of tax)

|

—

|

|

—

|

|

1,766

|

|

—

|

|

—

|

|

—

|

|

1,766

|

|

||||||

|

Net realized gain reclassification (net of tax)

|

—

|

|

—

|

|

(2,086

|

)

|

—

|

|

—

|

|

—

|

|

(2,086

|

)

|

||||||

|

Foreign currency translation (net of tax)

|

—

|

|

—

|

|

8,354

|

|

—

|

|

—

|

|

—

|

|

8,354

|

|

||||||

|

Net income attributable to noncontrolling interests

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

11,487

|

|

11,487

|

|

||||||

|

Distributions to noncontrolling interests

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(11,651

|

)

|

(11,651

|

)

|

||||||

|

Net effect of changes in ownership and other

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(584

|

)

|

(584

|

)

|

||||||

|

Balances at December 31, 2017

|

24,072

|

|

159,954

|

|

(847

|

)

|

491,698

|

|

(2,666

|

)

|

6,599

|

|

678,810

|

|

||||||

|

|

2017

|

2016

|

|||||||||

|

|

Amortized

costs

|

Fair

values

|

Amortized

costs

|

Fair

values

|

|||||||

|

|

($000 omitted)

|

||||||||||

|

Debt securities:

|

|||||||||||

|

Municipal

|

71,581

|

|

72,669

|

|

72,284

|

|

72,432

|

|

|||

|

Corporate

|

351,477

|

|

357,933

|

|

338,365

|

|

343,047

|

|

|||

|

Foreign

|

229,750

|

|

228,237

|

|

165,735

|

|

167,027

|

|

|||

|

U.S. Treasury Bonds

|

12,838

|

|

12,602

|

|

12,795

|

|

12,613

|

|

|||

|

Equity securities

|

32,132

|

|

37,914

|

|

30,255

|

|

36,384

|

|

|||

|

697,778

|

|

709,355

|

|

619,434

|

|

631,503

|

|

||||

|

|

2017

|

2016

|

|||||||||

|

|

Gains

|

Losses

|

Gains

|

Losses

|

|||||||

|

|

($000 omitted)

|

||||||||||

|

Debt securities:

|

|||||||||||

|

Municipal

|

1,263

|

|

175

|

|

723

|

|

575

|

|

|||

|

Corporate

|

6,953

|

|

497

|

|

6,871

|

|

2,189

|

|

|||

|

Foreign

|

1,742

|

|

3,255

|

|

2,912

|

|

1,620

|

|

|||

|

U.S. Treasury Bonds

|

—

|

|

236

|

|

4

|

|

186

|

|

|||

|

Equity securities

|

6,367

|

|

585

|

|

6,800

|

|

671

|

|

|||

|

16,325

|

|

4,748

|

|

17,310

|

|

5,241

|

|

||||

|

Amortized

costs

|

Fair

values

|

||||

|

|

($000 omitted)

|

||||

|

In one year or less

|

35,974

|

|

36,092

|

|

|

|

After one year through five years

|

358,738

|

|

362,206

|

|

|

|

After five years through ten years

|

221,792

|

|

221,994

|

|

|

|

After ten years

|

49,142

|

|

51,149

|

|

|

|

665,646

|

|

671,441

|

|

||

|

|

Less than 12 months

|

More than 12 months

|

Total

|

||||||||||||||

|

|

Losses

|

Fair values

|

Losses

|

Fair values

|

Losses

|

Fair values

|

|||||||||||

|

|

($000 omitted)

|

||||||||||||||||

|

Debt securities:

|

|||||||||||||||||

|

Municipal

|

58

|

|

17,023

|

|

117

|

|

5,784

|

|

175

|

|

22,807

|

|

|||||

|

Corporate

|

386

|

|

81,632

|

|

111

|

|

4,926

|

|

497

|

|

86,558

|

|

|||||

|

Foreign

|

1,528

|

|

116,130

|

|

1,727

|

|

39,031

|

|

3,255

|

|

155,161

|

|

|||||

|

U.S. Treasury Bonds

|

53

|

|

5,830

|

|

183

|

|

6,772

|

|

236

|

|

12,602

|

|

|||||

|

Equity securities:

|

555

|

|

6,475

|

|

30

|

|

860

|

|

585

|

|

7,335

|

|

|||||

|

2,580

|

|

227,090

|

|

2,168

|

|

57,373

|

|

4,748

|

|

284,463

|

|

||||||

|

|

Less than 12 months

|

More than 12 months

|

Total

|

||||||||||||||

|

|

Losses

|

Fair values

|

Losses

|

Fair values

|

Losses

|

Fair values

|

|||||||||||

|

|

($000 omitted)

|

||||||||||||||||

|

Debt securities:

|

|||||||||||||||||

|

Municipal

|

575

|

|

32,038

|

|

—

|

|

—

|

|

575

|

|

32,038

|

|

|||||

|

Corporate

|

2,189

|

|

119,965

|

|

—

|

|

—

|

|

2,189

|

|

119,965

|

|

|||||

|

Foreign

|

1,427

|

|

70,012

|

|

193

|

|

3,160

|

|

1,620

|

|

73,172

|

|

|||||

|

U.S. Treasury Bonds

|

186

|

|

11,847

|

|

—

|

|

—

|

|

186

|

|

11,847

|

|

|||||

|

Equity securities:

|

424

|

|

5,950

|

|

247

|

|

2,250

|

|

671

|

|

8,200

|

|

|||||

|

4,801

|

|

239,812

|

|

440

|

|

5,410

|

|

5,241

|

|

245,222

|

|

||||||

|

•

|

Level 1 – quoted prices in active markets for identical assets or liabilities;

|

|

•

|

Level 2 – observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets and liabilities in active markets; quoted prices for identical or similar assets and liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data; and

|

|

•

|