|

o

|

REGISTRATION STATEMENT PURSUANT TO SECTIONS 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

The Netherlands

|

|

(Jurisdiction of Incorporation or Organization)

|

|

Title of Each Class

|

Name of Each Exchange on which Registered

|

|

|

Common Shares, par value €0.01

|

New York Stock Exchange

|

|

|

Large accelerated filer

þ

|

Accelerated filer

o

|

Non-accelerated filer

o

|

||

|

Emerging growth company

o

|

||||

|

Page

|

||

|

BOARD OF DIRECTORS

|

|

Chairman

John Elkann

(3)

|

|

Chief Executive Officer

Michael Manley

|

|

Directors

John Abbott

Andrea Agnelli

Tiberto Brandolini d’Adda

Glenn Earle

(1)

Valerie A. Mars

(1),(2)

Ruth J. Simmons

(3)

Ronald L. Thompson

(1)

Michelangelo A. Volpi

(2)

Patience Wheatcroft

(1),(3)

Ermenegildo Zegna

(2)

|

|

INDEPENDENT AUDITOR

Ernst & Young Accountants LLP (EU Annual Report filing)

Ernst & Young S.p.A (SEC 20-F filing)

|

|

•

|

MESSAGE FROM THE CHAIRMAN AND THE CEO

|

|

•

|

CORPORATE GOVERNANCE

-

Responsibilities in Respect to the Annual Report

|

|

•

|

NON-FINANCIAL INFORMATION

|

|

•

|

CONTROLS AND PROCEDURES

-

Statement by the Board of Directors

|

|

•

|

2019 GUIDANCE

|

|

•

|

FCA N.V. COMPANY FINANCIAL STATEMENTS

|

|

•

|

Independent auditor’s report

(

Ernst & Young Accountants LLP

in respect of the AFM filing)

|

|

•

|

our ability to launch products successfully and to maintain vehicle shipment volumes;

|

|

•

|

changes in the global financial markets, general economic environment and changes in demand for automotive products, which is subject to cyclicality;

|

|

•

|

changes in local economic and political conditions, changes in trade policy and the imposition of global and regional tariffs or tariffs targeted to the automotive industry, the enactment of tax reforms or other changes in tax laws and regulations;

|

|

•

|

our ability to expand certain of our brands globally;

|

|

•

|

our ability to offer innovative, attractive products;

|

|

•

|

our ability to develop, manufacture and sell vehicles with advanced features, including enhanced electrification, connectivity and autonomous-driving characteristics;

|

|

•

|

various types of claims, lawsuits, governmental investigations and other contingencies affecting us, including product liability and warranty claims and environmental claims, investigations and lawsuits;

|

|

•

|

material operating expenditures in relation to compliance with environmental, health and safety regulations;

|

|

•

|

the intense level of competition in the automotive industry, which may increase due to consolidation;

|

|

•

|

exposure to shortfalls in the funding of our defined benefit pension plans;

|

|

•

|

our ability to provide or arrange for access to adequate financing for our dealers and retail customers, and associated risks related to the establishment and operations of financial services companies, including capital required to be deployed to financial services;

|

|

•

|

our ability to access funding to execute our business plan and improve our business, financial condition and results of operations;

|

|

•

|

a significant malfunction, disruption or security breach compromising our information technology systems or the electronic control systems contained in our vehicles;

|

|

•

|

our ability to realize anticipated benefits from joint venture arrangements;

|

|

•

|

our ability to successfully implement and execute strategic initiatives and transactions, including our plans to separate certain businesses;

|

|

•

|

disruptions arising from political, social and economic instability;

|

|

•

|

risks associated with our relationships with employees, dealers and suppliers;

|

|

•

|

increases in costs, disruptions of supply or shortages of raw materials;

|

|

•

|

developments in labor and industrial relations and developments in applicable labor laws;

|

|

•

|

exchange rate fluctuations, interest rate changes, credit risk and other market risks;

|

|

•

|

political and civil unrest;

|

|

•

|

earthquakes or other disasters; and

|

|

•

|

other factors discussed elsewhere in this report.

|

|

•

|

the Consolidated Financial Statements of FCA as of

December 31, 2018

and

2017

and for the years ended

December 31, 2018

,

2017

and

2016

, included elsewhere in this report; and

|

|

•

|

the Consolidated Financial Statements of FCA as of December 31,

2016

,

2015

and

2014

, for the years ended December 31,

2015

and

2014

, which are not included in this report.

|

|

Years ended December 31,

|

|||||||||||||||||||

|

2018

(1)

|

2017

(1)

|

2016

(1)

|

2015

(1,2)

|

2014

(1,2)

|

|||||||||||||||

|

(€ million, except per share amounts)

|

|||||||||||||||||||

|

Net revenues

|

€

|

110,412

|

|

€

|

105,730

|

|

€

|

105,798

|

|

€

|

105,859

|

|

€

|

89,350

|

|

||||

|

Profit before taxes

|

€

|

4,108

|

|

€

|

5,879

|

|

€

|

2,950

|

|

€

|

99

|

|

€

|

719

|

|

||||

|

Net profit/(loss) from continuing operations

|

€

|

3,330

|

|

€

|

3,291

|

|

€

|

1,713

|

|

€

|

(15

|

)

|

€

|

269

|

|

||||

|

Profit from discontinued operations, net of tax

|

€

|

302

|

|

€

|

219

|

|

€

|

101

|

|

€

|

392

|

|

€

|

363

|

|

||||

|

Net profit

|

€

|

3,632

|

|

€

|

3,510

|

|

€

|

1,814

|

|

€

|

377

|

|

€

|

632

|

|

||||

|

Net profit attributable to:

|

|||||||||||||||||||

|

Owners of the parent

|

€

|

3,608

|

|

€

|

3,491

|

|

€

|

1,803

|

|

€

|

334

|

|

€

|

568

|

|

||||

|

Non-controlling interests

|

€

|

24

|

|

€

|

19

|

|

€

|

11

|

|

€

|

43

|

|

€

|

64

|

|

||||

|

Earnings/(Loss) per share from continuing operations

|

|||||||||||||||||||

|

Basic earnings/(loss) per share

|

€

|

2.15

|

|

€

|

2.14

|

|

€

|

1.13

|

|

€

|

(0.01

|

)

|

€

|

0.20

|

|

||||

|

Diluted earnings/(loss) per share

|

€

|

2.12

|

|

€

|

2.11

|

|

€

|

1.12

|

|

€

|

(0.01

|

)

|

€

|

0.20

|

|

||||

|

Earnings per share from discontinued operations

|

|||||||||||||||||||

|

Basic earnings per share

|

€

|

0.18

|

|

€

|

0.14

|

|

€

|

0.06

|

|

€

|

0.23

|

|

€

|

0.27

|

|

||||

|

Diluted earnings per share

|

€

|

0.18

|

|

€

|

0.13

|

|

€

|

0.06

|

|

€

|

0.23

|

|

€

|

0.26

|

|

||||

|

Earnings per share from continuing and discontinued operations

|

|||||||||||||||||||

|

Basic earnings per share

|

€

|

2.33

|

|

€

|

2.27

|

|

€

|

1.19

|

|

€

|

0.22

|

|

€

|

0.46

|

|

||||

|

Diluted earnings per share

|

€

|

2.30

|

|

€

|

2.24

|

|

€

|

1.18

|

|

€

|

0.22

|

|

€

|

0.46

|

|

||||

|

Other Statistical Information (unaudited):

|

|||||||||||||||||||

|

Combined shipments (in thousands of units)

(3)

|

4,842

|

|

4,740

|

|

4,720

|

|

4,738

|

|

4.743

|

|

|||||||||

|

Consolidated shipments (in thousands of units)

(4)

|

4,655

|

|

4,423

|

|

4,482

|

|

4,602

|

|

4.601

|

|

|||||||||

|

At December 31,

|

|||||||||||||||||||

|

2018

(1)

|

2017

(1)

|

2016

(1)

|

2015

(1,2)

|

2014

(1,2)

|

|||||||||||||||

|

(€ million, except shares issued data)

|

|||||||||||||||||||

|

Cash and cash equivalents

|

€

|

12,450

|

|

€

|

12,638

|

|

€

|

17,318

|

|

€

|

20,662

|

|

€

|

22,840

|

|

||||

|

Total assets

|

€

|

96,873

|

|

€

|

96,299

|

|

€

|

104,343

|

|

€

|

105,753

|

|

€

|

101,149

|

|

||||

|

Debt

|

€

|

14,528

|

|

€

|

17,971

|

|

€

|

24,048

|

|

€

|

27,786

|

|

€

|

33,724

|

|

||||

|

Total equity

|

€

|

24,903

|

|

€

|

20,987

|

|

€

|

19,353

|

|

€

|

16,968

|

|

€

|

14,377

|

|

||||

|

Equity attributable to owners of the parent

|

€

|

24,702

|

|

€

|

20,819

|

|

€

|

19,168

|

|

€

|

16,805

|

|

€

|

14,064

|

|

||||

|

Non-controlling interests

|

€

|

201

|

|

€

|

168

|

|

€

|

185

|

|

€

|

163

|

|

€

|

313

|

|

||||

|

Share capital

|

€

|

19

|

|

€

|

19

|

|

€

|

19

|

|

€

|

17

|

|

€

|

17

|

|

||||

|

Shares issued (in thousands):

|

|||||||||||||||||||

|

Common

(3)(4)

|

1,550,618

|

|

1,540,090

|

|

1,527,966

|

|

1,288,956

|

|

1,284,919

|

|

|||||||||

|

Special Voting

(4)

|

408,942

|

|

408,942

|

|

408,942

|

|

408,942

|

|

408,942

|

|

|||||||||

|

FCA Shareholders

|

Number of Issued Common Shares

|

Percentage Owned

|

||||

|

Exor N.V.

(1)

|

449,410,092

|

|

28.98

|

|

||

|

Tiger Global Management LLC

(2)

|

81,375,000

|

|

5.25

|

|

||

|

Harris Associates L.P.

(3)

|

59,119,458

|

|

3.81

|

|

||

|

(1)

|

In addition, Exor N.V. holds

375,803,870

special voting shares; Exor N.V.'s beneficial ownership in FCA is

42.11 percent

, calculated as the ratio of (i) the aggregate number of common and special voting shares owned by Exor N.V. and (ii) the aggregate number of outstanding common shares and issued special voting shares.

|

|

(2)

|

Tiger Global Management LLC,Charles P. Coleman III and Scott Shleifer beneficially own the aggregate amount of

81,375,000

common shares (

4.15 percent

of the issued shares).

|

|

(3)

|

Harris Associates L.P. beneficially owns

59,119,458

common shares (

3.02 percent

of the issued shares).

|

|

•

|

Continued emphasis on building strong brands by leveraging renewals of key products and portfolio expansion;

|

|

•

|

Through new white space products with particular focus on the Jeep, Ram, Maserati and Alfa Romeo brands;

|

|

•

|

Improve positioning of Maserati as a luxury brand, bridging product gap with specialty models and redirection of marketing to focus on Levante;

|

|

•

|

Refocus marketing in China to recently launched products, offer more efficient powertrain combinations and product quality improvements;

|

|

•

|

Continue to focus on industrial rationalization to deliver cost savings through manufacturing and purchasing efficiencies and implement actions to increase capacity utilization in EMEA;

|

|

•

|

Implementation of various electrified powertrain applications throughout the portfolio as part of our regulatory compliance strategy;

|

|

•

|

Continue to explore opportunities to develop partnerships to share technologies and platforms, enhance skill set related to autonomous driving technologies, preserve full optionality and ensure speed to market; and

|

|

•

|

Maintain a disciplined approach to the deployment of capital and re-establish consistent shareholder remuneration actions.

|

|

(i)

|

NAFTA

: our operations to support distribution and sale of mass-market vehicles in the United States, Canada, Mexico and Caribbean islands, primarily under the Jeep, Ram, Dodge, Chrysler, Fiat, Alfa Romeo and Abarth brands.

|

|

(ii)

|

LATAM

: our operations to support the distribution and sale of mass-market vehicles in South and Central America, primarily under the Fiat, Jeep, Dodge and Ram brands, with the largest focus of our business in Brazil and Argentina.

|

|

(iii)

|

APAC

: our operations to support the distribution and sale of mass-market vehicles in the Asia Pacific region (mostly in China, Japan, India, Australia and South Korea) carried out in the region through both subsidiaries and joint ventures, primarily under the Jeep, Fiat, Alfa Romeo, Abarth, Fiat Professional, Ram and Chrysler brands.

|

|

(iv)

|

EMEA

: our operations to support the distribution and sale of mass-market vehicles in Europe (which includes the 28 members of the European Union and the members of the European Free Trade Association), the Middle East and Africa, primarily under the Fiat, Fiat Professional, Jeep, Alfa Romeo, Lancia, Abarth, Ram and Dodge brands.

|

|

(v)

|

Maserati

: the design, engineering, development, manufacturing, worldwide distribution and sale of luxury vehicles under the Maserati brand.

|

|

Hourly

|

Salaried

|

Total

|

||||||||||||||||||||||||

|

2018

|

2017

(1)

|

2016

(1)

|

2018

|

2017

(1)

|

2016

(1)

|

2018

|

2017

(1)

|

2016

(1)

|

||||||||||||||||||

|

Europe

|

40,446

|

|

40,910

|

|

42,257

|

|

24,170

|

|

24,920

|

|

25,306

|

|

64,616

|

|

65,830

|

|

67,563

|

|

||||||||

|

North America

|

74,703

|

|

71,414

|

|

64,981

|

|

22,326

|

|

22,778

|

|

22,313

|

|

97,029

|

|

94,192

|

|

87,294

|

|

||||||||

|

Latin America

|

26,004

|

|

25,634

|

|

26,171

|

|

7,062

|

|

6,917

|

|

8,138

|

|

33,066

|

|

32,551

|

|

34,309

|

|

||||||||

|

Asia

|

253

|

|

271

|

|

266

|

|

3,313

|

|

3,486

|

|

3,394

|

|

3,566

|

|

3,757

|

|

3,660

|

|

||||||||

|

Rest of the world

|

46

|

|

4

|

|

4

|

|

222

|

|

177

|

|

160

|

|

268

|

|

181

|

|

164

|

|

||||||||

|

Total

|

141,452

|

|

138,233

|

|

133,679

|

|

57,093

|

|

58,278

|

|

59,311

|

|

198,545

|

|

196,511

|

|

192,990

|

|

||||||||

|

•

|

an annual bonus, calculated on the basis of production efficiencies achieved and the plant’s WCM audit status; and

|

|

•

|

a component linked to achievement of the financial targets established in the 2015-2018 period of the business plan for the EMEA region, including the activities of the premium brands Alfa Romeo and Maserati.

|

|

Years ended December 31,

|

|||||||||

|

2018

|

2017

|

2016

|

|||||||

|

(millions of units)

|

|||||||||

|

NAFTA

|

2.5

|

|

2.4

|

|

2.6

|

|

|||

|

LATAM

|

0.6

|

|

0.5

|

|

0.5

|

|

|||

|

APAC

|

0.2

|

|

0.3

|

|

0.2

|

|

|||

|

EMEA

|

1.4

|

|

1.5

|

|

1.4

|

|

|||

|

Total Mass-Market Vehicle Brands

|

4.7

|

|

4.7

|

|

4.7

|

|

|||

|

Maserati

|

0.04

|

|

0.05

|

|

0.04

|

|

|||

|

Total Worldwide

|

4.8

|

|

4.8

|

|

4.7

|

|

|||

|

Years ended December 31,

|

||||||||||||||||||

|

2018

(1),(2)

|

2017

(1),(2)

|

2016

(1),(2)

|

||||||||||||||||

|

NAFTA

|

Sales

|

Market Share

|

Sales

|

Market Share

|

Sales

|

Market Share

|

||||||||||||

|

Thousands of units (except percentages)

|

||||||||||||||||||

|

U.S.

|

2,235

|

|

12.6

|

%

|

2,059

|

|

11.7

|

%

|

2,244

|

|

12.6

|

%

|

||||||

|

Canada

|

225

|

|

11.3

|

%

|

267

|

|

13.0

|

%

|

279

|

|

14.2

|

%

|

||||||

|

Mexico and Other

|

74

|

|

5.1

|

%

|

86

|

|

5.5

|

%

|

88

|

|

5.3

|

%

|

||||||

|

Total

|

2,534

|

|

12.0

|

%

|

2,412

|

|

11.4

|

%

|

2,611

|

|

12.2

|

%

|

||||||

|

Years ended December 31

|

|||||||||

|

U.S.

|

2018

|

2017

|

2016

|

||||||

|

Automaker

|

Percentage of industry

|

||||||||

|

GM

|

16.7

|

%

|

17.1

|

%

|

17.0

|

%

|

|||

|

Ford

|

14.1

|

%

|

14.7

|

%

|

14.6

|

%

|

|||

|

Toyota

|

13.7

|

%

|

13.9

|

%

|

13.7

|

%

|

|||

|

FCA

|

12.6

|

%

|

11.7

|

%

|

12.6

|

%

|

|||

|

Honda

|

9.1

|

%

|

9.3

|

%

|

9.2

|

%

|

|||

|

Nissan

|

8.4

|

%

|

9.1

|

%

|

8.8

|

%

|

|||

|

Hyundai/Kia

|

7.2

|

%

|

7.3

|

%

|

8.0

|

%

|

|||

|

Other

|

18.2

|

%

|

16.9

|

%

|

16.1

|

%

|

|||

|

Total

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

|||

|

Years ended December 31,

|

||||||||||||||||||

|

2018

(1)

|

2017

(1)

|

2016

(1)

|

||||||||||||||||

|

LATAM

|

Sales

|

Market Share

|

Sales

|

Market Share

|

Sales

|

Market Share

|

||||||||||||

|

Thousands of units (except percentages)

|

||||||||||||||||||

|

Brazil

|

434

|

|

17.5

|

%

|

380

|

|

17.5

|

%

|

365

|

|

18.4

|

%

|

||||||

|

Argentina

|

99

|

|

12.8

|

%

|

105

|

|

12.2

|

%

|

79

|

|

11.6

|

%

|

||||||

|

Other LATAM

|

33

|

|

2.9

|

%

|

28

|

|

2.5

|

%

|

29

|

|

2.9

|

%

|

||||||

|

Total

|

566

|

|

12.8

|

%

|

513

|

|

12.4

|

%

|

473

|

|

12.9

|

%

|

||||||

|

Brazil

|

Years ended December 31,

|

||||||||

|

2018

(1)

|

2017

(1)

|

2016

(1)

|

|||||||

|

Automaker

|

Percentage of industry

|

||||||||

|

GM

|

17.6

|

%

|

18.1

|

%

|

17.4

|

%

|

|||

|

FCA

|

17.5

|

%

|

17.5

|

%

|

18.4

|

%

|

|||

|

Volkswagen

|

14.8

|

%

|

12.5

|

%

|

12.1

|

%

|

|||

|

Ford

|

9.2

|

%

|

9.5

|

%

|

9.1

|

%

|

|||

|

Other

|

40.9

|

%

|

42.4

|

%

|

43.0

|

%

|

|||

|

Total

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

|||

|

Years ended December 31,

|

||||||||||||||||||

|

2018

(1),(4)

|

2017

(1),(4)

|

2016

(1),(4)

|

||||||||||||||||

|

APAC

|

Sales

|

Market Share

|

Sales

|

Market Share

|

Sales

|

Market Share

|

||||||||||||

|

Thousands of units (except percentages)

|

||||||||||||||||||

|

China

(2)

|

163

|

|

0.8

|

%

|

215

|

|

0.9

|

%

|

176

|

|

0.8

|

%

|

||||||

|

Japan

|

22

|

|

0.5

|

%

|

21

|

|

0.5

|

%

|

20

|

|

0.5

|

%

|

||||||

|

India

(3)

|

19

|

|

0.6

|

%

|

15

|

|

0.5

|

%

|

7

|

|

0.2

|

%

|

||||||

|

Australia

|

11

|

|

1.0

|

%

|

13

|

|

1.1

|

%

|

18

|

|

1.6

|

%

|

||||||

|

South Korea

|

8

|

|

0.5

|

%

|

8

|

|

0.5

|

%

|

7

|

|

0.4

|

%

|

||||||

|

APAC 5 major Markets

|

223

|

|

0.7

|

%

|

272

|

|

0.8

|

%

|

228

|

|

0.7

|

%

|

||||||

|

Other APAC

|

5

|

|

—

|

|

5

|

|

—

|

|

5

|

|

—

|

|

||||||

|

Total

|

228

|

|

—

|

|

277

|

|

—

|

|

233

|

|

—

|

|

||||||

|

Years ended December 31

|

||||||||||||||||||

|

2018

(1),(2),(3)

|

2017

(1),(2),(3)

|

2016

(1),(2),(3)

|

||||||||||||||||

|

EMEA

Passenger Cars |

Sales

|

Market Share

|

Sales

|

Market Share

|

Sales

|

Market Share

|

||||||||||||

|

Thousands of units (except percentages)

|

||||||||||||||||||

|

Italy

|

500

|

|

26.2

|

%

|

558

|

|

28.3

|

%

|

528

|

|

28.9

|

%

|

||||||

|

Germany

|

105

|

|

3.1

|

%

|

104

|

|

3.0

|

%

|

97

|

|

2.9

|

%

|

||||||

|

France

|

100

|

|

4.6

|

%

|

88

|

|

4.2

|

%

|

80

|

|

4.0

|

%

|

||||||

|

Spain

|

81

|

|

6.1

|

%

|

67

|

|

5.4

|

%

|

60

|

|

5.2

|

%

|

||||||

|

UK

|

52

|

|

2.2

|

%

|

60

|

|

2.4

|

%

|

84

|

|

3.1

|

%

|

||||||

|

Other Europe

|

175

|

|

4.0

|

%

|

158

|

|

3.6

|

%

|

136

|

|

3.3

|

%

|

||||||

|

Europe*

|

1,013

|

|

6.5

|

%

|

1,035

|

|

6.6

|

%

|

985

|

|

6.5

|

%

|

||||||

|

Other EMEA**

|

102

|

|

—

|

|

116

|

|

—

|

|

113

|

|

—

|

|

||||||

|

Total

|

1,115

|

|

—

|

|

1,151

|

|

—

|

|

1,098

|

|

—

|

|

||||||

|

Years ended December 31

|

||||||||||||||||||

|

2018

(1),(2),(3)

|

2017

(1),(2),(3)

|

2016

(1),(2),(3)

|

||||||||||||||||

|

EMEA

Light Commercial Vehicles |

Group Sales

|

Market Share

|

Group Sales

|

Market Share

|

Group Sales

|

Market Share

|

||||||||||||

|

Thousands of units (except percentages)

|

||||||||||||||||||

|

Europe*

|

263

|

|

11.1

|

%

|

260

|

|

11.4

|

%

|

250

|

|

11.6

|

%

|

||||||

|

Other EMEA**

|

50

|

|

—

|

|

75

|

|

—

|

|

69

|

|

—

|

|

||||||

|

Total

|

313

|

|

—

|

|

335

|

|

—

|

|

319

|

|

—

|

|

||||||

|

Years ended December 31

|

|||||||||

|

Europe-Passenger Cars

|

2018

(*)

|

2017

(*)

|

2016

(*)

|

||||||

|

Automaker

|

Percentage of industry

|

||||||||

|

Volkswagen

|

23.9

|

%

|

23.8

|

%

|

24.1

|

%

|

|||

|

PSA

|

16.0

|

%

|

12.1

|

%

|

9.7

|

%

|

|||

|

Renault

|

10.5

|

%

|

10.4

|

%

|

10.1

|

%

|

|||

|

BMW

|

6.6

|

%

|

6.7

|

%

|

6.8

|

%

|

|||

|

FCA

(1)

|

6.5

|

%

|

6.7

|

%

|

6.6

|

%

|

|||

|

Ford

|

6.4

|

%

|

6.6

|

%

|

6.9

|

%

|

|||

|

Daimler

|

6.2

|

%

|

6.3

|

%

|

6.2

|

%

|

|||

|

Toyota

|

4.9

|

%

|

4.6

|

%

|

4.3

|

%

|

|||

|

GM

|

—

|

%

|

3.8

|

%

|

6.6

|

%

|

|||

|

Other

|

19.0

|

%

|

19.0

|

%

|

18.7

|

%

|

|||

|

Total

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

|||

|

As a percentage of 2018 sales

|

As a percentage of 2017 sales

|

As a percentage of 2016 sales

|

||||

|

U.S.

|

32

|

%

|

28

|

%

|

31

|

%

|

|

China

|

24

|

%

|

30

|

%

|

30

|

%

|

|

Europe Top 4 countries

(1)

|

17

|

%

|

16

|

%

|

15

|

%

|

|

Japan

|

4

|

%

|

4

|

%

|

3

|

%

|

|

Other countries

|

23

|

%

|

22

|

%

|

21

|

%

|

|

Total

|

100

|

%

|

100

|

%

|

100

|

%

|

|

Years ended December 31

|

|||||||||

|

(thousands of units)

|

2018

|

2017

|

2016

|

||||||

|

NAFTA

|

2,633

|

|

2,401

|

|

2,587

|

|

|||

|

LATAM

|

585

|

|

521

|

|

456

|

|

|||

|

APAC

|

84

|

|

85

|

|

91

|

|

|||

|

EMEA

|

1,318

|

|

1,365

|

|

1,306

|

|

|||

|

Maserati

|

35

|

|

51

|

|

42

|

|

|||

|

Total Consolidated shipments

|

4,655

|

|

4,423

|

|

4,482

|

|

|||

|

Joint venture shipments

|

187

|

|

317

|

|

238

|

|

|||

|

Total Combined shipments

|

4,842

|

|

4,740

|

|

4,720

|

|

|||

|

Years ended December 31,

|

||||||||||||

|

(€ million)

|

2018

|

2017

|

2016

|

|||||||||

|

Net revenues

|

€

|

110,412

|

|

€

|

105,730

|

|

€

|

105,798

|

|

|||

|

Cost of revenues

|

95,011

|

|

89,710

|

|

90,927

|

|

||||||

|

Selling, general and other costs

|

7,318

|

|

7,177

|

|

7,388

|

|

||||||

|

Research and development costs

|

3,051

|

|

2,903

|

|

2,930

|

|

||||||

|

Result from investments

|

235

|

|

399

|

|

310

|

|

||||||

|

Reversal of a Brazilian indirect tax liability

|

—

|

|

895

|

|

—

|

|

||||||

|

Gains on disposal of investments

|

—

|

|

76

|

|

13

|

|

||||||

|

Restructuring costs

|

103

|

|

86

|

|

68

|

|

||||||

|

Net financial expenses

|

1,056

|

|

1,345

|

|

1,858

|

|

||||||

|

Profit before taxes

|

4,108

|

|

5,879

|

|

2,950

|

|

||||||

|

Tax expense

|

778

|

|

2,588

|

|

1,237

|

|

||||||

|

Net profit from continuing operations

|

3,330

|

|

3,291

|

|

1,713

|

|

||||||

|

Profit from discontinued operations, net of tax

|

302

|

|

219

|

|

101

|

|

||||||

|

Net profit

|

€

|

3,632

|

|

€

|

3,510

|

|

€

|

1,814

|

|

|||

|

Net profit attributable to:

|

||||||||||||

|

Owners of the parent

|

€

|

3,608

|

|

€

|

3,491

|

|

€

|

1,803

|

|

|||

|

Non-controlling interests

|

€

|

24

|

|

€

|

19

|

|

€

|

11

|

|

|||

|

Net profit from continuing operations attributable to:

|

||||||||||||

|

Owners of the parent

|

€

|

3,323

|

|

€

|

3,281

|

|

€

|

1,708

|

|

|||

|

Non-controlling interests

|

€

|

7

|

|

€

|

10

|

|

€

|

5

|

|

|||

|

Net profit from discontinued operations attributable to:

|

||||||||||||

|

Owners of the parent

|

€

|

285

|

|

€

|

210

|

|

€

|

95

|

|

|||

|

Non-controlling interests

|

€

|

17

|

|

€

|

9

|

|

€

|

6

|

|

|||

|

Increase/(Decrease)

|

||||||||||||||||||||||||

|

Years ended December 31,

|

2018 vs. 2017

|

2017 vs. 2016

|

||||||||||||||||||||||

|

(€ million)

|

2018

|

2017

|

2016

|

% Actual

|

% CER

|

% Actual

|

% CER

|

|||||||||||||||||

|

Net revenues

|

€

|

110,412

|

|

€

|

105,730

|

|

€

|

105,798

|

|

4.4

|

%

|

9.3

|

%

|

(0.1

|

)%

|

0.1

|

%

|

|||||||

|

Increase/(Decrease)

|

||||||||||||||||||||||||

|

Years ended December 31,

|

2018 vs. 2017

|

2017 vs. 2016

|

||||||||||||||||||||||

|

(€ million)

|

2018

|

2017

|

2016

|

% Actual

|

% CER

|

% Actual

|

% CER

|

|||||||||||||||||

|

Cost of revenues

|

€

|

95,011

|

|

€

|

89,710

|

|

€

|

90,927

|

|

5.9

|

%

|

10.8

|

%

|

(1.3

|

)%

|

(0.3

|

)%

|

|||||||

|

Cost of revenues as % of Net revenues

|

86.1

|

%

|

84.8

|

%

|

85.9

|

%

|

||||||||||||||||||

|

Increase/(Decrease)

|

||||||||||||||||||||||||

|

Years ended December 31,

|

2018 vs. 2017

|

2017 vs. 2016

|

||||||||||||||||||||||

|

(€ million)

|

2018

|

2017

|

2016

|

% Actual

|

% CER

|

% Actual

|

% CER

|

|||||||||||||||||

|

Selling, general and other costs

|

€

|

7,318

|

|

€

|

7,177

|

|

€

|

7,388

|

|

2.0

|

%

|

6.1

|

%

|

(2.9

|

)%

|

(2.1

|

)%

|

|||||||

|

Selling, general and other costs as% of Net revenues

|

6.6

|

%

|

6.8

|

%

|

7.0

|

%

|

||||||||||||||||||

|

Increase/(Decrease)

|

||||||||||||||||||||||||

|

Years ended December 31,

|

2018 vs. 2017

|

2017 vs. 2016

|

||||||||||||||||||||||

|

(€ million)

|

2018

|

2017

|

2016

|

% Actual

|

% CER

|

% Actual

|

% CER

|

|||||||||||||||||

|

Research and development expenditures expensed

|

€

|

1,448

|

|

€

|

1,506

|

|

€

|

1,467

|

|

(3.9

|

)%

|

0.2

|

%

|

2.7

|

%

|

4.0

|

%

|

|||||||

|

Amortization of capitalized development expenditures

|

1,456

|

|

1,294

|

|

1,357

|

|

12.5

|

%

|

16.8

|

%

|

(4.6

|

)%

|

(4.6

|

)%

|

||||||||||

|

Impairment and write-off of capitalized development expenditures

|

147

|

|

103

|

|

106

|

|

42.7

|

%

|

43.7

|

%

|

(2.8

|

)%

|

(2.8

|

)%

|

||||||||||

|

Total Research and development costs

|

€

|

3,051

|

|

€

|

2,903

|

|

€

|

2,930

|

|

5.1

|

%

|

9.1

|

%

|

(0.9

|

)%

|

(0.2

|

)%

|

|||||||

|

Years ended December 31,

|

|||||||||

|

2018

|

2017

|

2016

|

|||||||

|

Research and development expenditures expensed as % of Net revenues

|

1.3

|

%

|

1.4

|

%

|

1.4

|

%

|

|||

|

Amortization of capitalized development expenditures as % of Net revenues

|

1.3

|

%

|

1.2

|

%

|

1.3

|

%

|

|||

|

Impairment and write-off of capitalized development expenditures as % of Net revenues

|

0.1

|

%

|

0.1

|

%

|

0.1

|

%

|

|||

|

Total Research and development costs as % of Net revenues

|

2.8

|

%

|

2.7

|

%

|

2.8

|

%

|

|||

|

Years ended December 31,

|

Increase/(Decrease)

|

|||||||||||||||||

|

(€ million)

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

|||||||||||||

|

Capitalized development expenditures

|

€

|

2,079

|

|

€

|

2,431

|

|

€

|

2,395

|

|

(14.5

|

)%

|

1.5

|

%

|

|||||

|

Research and development expenditures expensed

|

1,448

|

|

1,506

|

|

1,467

|

|

(3.9

|

)%

|

2.7

|

%

|

||||||||

|

Total Research and development expenditures

|

€

|

3,527

|

|

€

|

3,937

|

|

€

|

3,862

|

|

(10.4

|

)%

|

1.9

|

%

|

|||||

|

Capitalized development expenditures as % of Total Research and development expenditures

|

58.9

|

%

|

61.7

|

%

|

62.0

|

%

|

||||||||||||

|

Total Research and development expenditures as % of Net revenues

|

3.2

|

%

|

3.7

|

%

|

3.7

|

%

|

||||||||||||

|

Years ended December 31,

|

Increase/(Decrease)

|

|||||||||||||||||

|

(€ million)

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

|||||||||||||

|

Result from investments

|

€

|

235

|

|

€

|

399

|

|

€

|

310

|

|

(41.1

|

)%

|

28.7

|

%

|

|||||

|

Years ended December 31,

|

Increase/(Decrease)

|

|||||||||||||||||

|

(€ million)

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

|||||||||||||

|

Net financial expenses

|

€

|

1,056

|

|

€

|

1,345

|

|

€

|

1,858

|

|

(21.5

|

)%

|

(27.6

|

)%

|

|||||

|

Years ended December 31,

|

Increase/(Decrease)

|

|||||||||||||||||

|

(€ million)

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

|||||||||||||

|

Tax expense

|

€

|

778

|

|

€

|

2,588

|

|

€

|

1,237

|

|

(69.9

|

)%

|

109.2

|

%

|

|||||

|

Effective tax rate

|

18.5

|

%

|

44.2

|

%

|

40.5

|

%

|

-2570 bps

|

|

+370 bps

|

|

||||||||

|

•

|

€281 million related to the reversal of the Brazilian indirect tax liability mentioned above; and

|

|

•

|

€453 million that was written off as the Group revised its outlook on Brazil to reflect the slower pace of recovery and outlook for the subsequent years, largely resulting from increased political uncertainty, and concluded that a portion of the deferred tax assets in Brazil was no longer recoverable.

|

|

Years ended December 31,

|

Increase/(Decrease)

|

|||||||||||||||

|

(€ million)

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

|||||||||||

|

Profit from discontinued operations, net of tax

|

€

|

302

|

|

€

|

219

|

|

€

|

101

|

|

n.m.

|

n.m.

|

|||||

|

Years ended December 31,

|

Increase/(Decrease)

|

|||||||||||||||||

|

(€ million)

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

|||||||||||||

|

Net profit from continuing operations

|

€

|

3,330

|

|

€

|

3,291

|

|

€

|

1,713

|

|

1.2

|

%

|

92.1

|

%

|

|||||

|

Increase/(Decrease)

|

||||||||||||||||||||||||

|

Years ended December 31,

|

2018 vs. 2017

|

2017 vs. 2016

|

||||||||||||||||||||||

|

(€ million)

|

2018

|

2017

|

2016

|

% Actual

|

% CER

|

% Actual

|

% CER

|

|||||||||||||||||

|

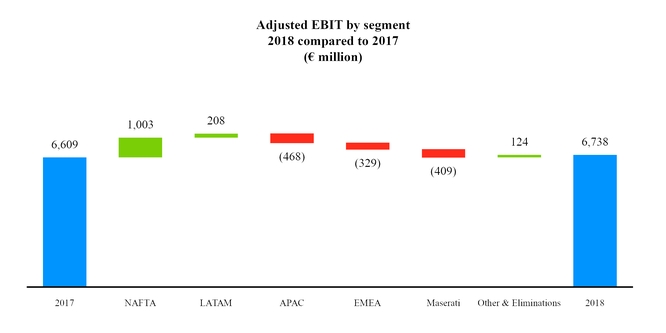

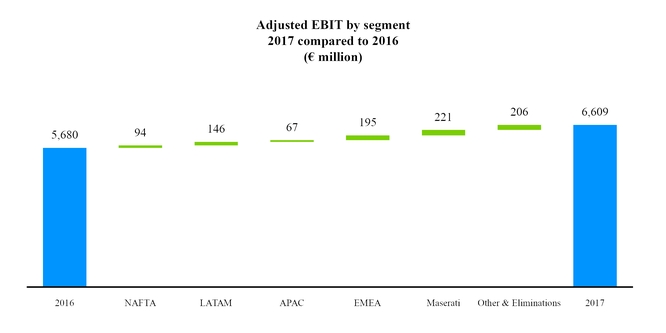

Adjusted EBIT

|

€

|

6,738

|

|

€

|

6,609

|

|

€

|

5,680

|

|

2.0

|

%

|

7.9

|

%

|

16.4

|

%

|

25.5

|

%

|

|||||||

|

Adjusted EBIT margin (%)

|

6.1

|

%

|

6.3

|

%

|

5.4

|

%

|

-20 bps

|

|

—

|

|

+90 bps

|

|

—

|

|

||||||||||

|

Years ended December 31,

|

||||||||||||

|

(€ million)

|

2018

|

2017

|

2016

|

|||||||||

|

Net profit from continuing operations

|

€

|

3,330

|

|

€

|

3,291

|

|

€

|

1,713

|

|

|||

|

Tax expense

|

778

|

|

2,588

|

|

1,237

|

|

||||||

|

Net financial expenses

|

1,056

|

|

1,345

|

|

1,858

|

|

||||||

|

Adjustments:

|

||||||||||||

|

Charge for U.S. diesel emissions matters

|

748

|

|

—

|

|

—

|

|

||||||

|

Impairment expense and supplier obligations

|

353

|

|

219

|

|

177

|

|

||||||

|

China inventory impairment

|

129

|

|

—

|

|

—

|

|

||||||

|

Costs for recall, net of recovery - airbag inflators

|

114

|

|

102

|

|

414

|

|

||||||

|

U.S. special bonus payment

|

111

|

|

—

|

|

—

|

|

||||||

|

Restructuring costs, net of reversals

|

103

|

|

86

|

|

68

|

|

||||||

|

Employee benefits settlement losses

|

92

|

|

—

|

|

—

|

|

||||||

|

Port of Savona (Italy) flood and fire

|

43

|

|

—

|

|

—

|

|

||||||

|

Deconsolidation of Venezuela

|

—

|

|

42

|

|

—

|

|

||||||

|

Currency devaluations

|

—

|

|

—

|

|

19

|

|

||||||

|

Tianjin (China) port explosions insurance recoveries

|

—

|

|

(68

|

)

|

(55

|

)

|

||||||

|

Gains on disposal of investments

|

—

|

|

(76

|

)

|

(13

|

)

|

||||||

|

(Recovery of)/costs for recall - contested with supplier

|

(50

|

)

|

—

|

|

132

|

|

||||||

|

NAFTA capacity realignment

|

(60

|

)

|

(38

|

)

|

156

|

|

||||||

|

Brazilian indirect tax - reversal of liability/recognition of credits

|

(72

|

)

|

(895

|

)

|

—

|

|

||||||

|

Other

|

63

|

|

13

|

|

(26

|

)

|

||||||

|

Total Adjustments

|

1,574

|

|

(615

|

)

|

872

|

|

||||||

|

Adjusted EBIT

|

€

|

6,738

|

|

€

|

6,609

|

|

€

|

5,680

|

|

|||

|

•

|

€748 million

provision recognized for costs related to final settlements reached on civil, environmental and consumer claims related to U.S. diesel emissions matters (refer to Note

25

-

Guarantees granted, commitments and contingent liabilities

to the Consolidated Financial Statements included elsewhere in this report);

|

|

•

|

€129 million

relating to impairment of inventory in connection with the accelerated adoption of new emission standards in China and slower than expected sales;

|

|

•

|

€114 million

costs for recall, net of recovery in relation to Takata airbag inflators. During 2017, €

102 million

costs were recorded in Cost of revenues, relating to an expansion of the scope of the Takata airbag inflator recalls, of which €29 million related to the previously announced recall in NAFTA and €73 million related to the preventative safety campaigns in LATAM. During 2016, estimated costs of recall campaigns related to Takata airbag inflators of €

414 million

were recorded within Cost of revenues in the Consolidated Income Statement for the year ended December 31, 2016, to adjust the warranty provision for an expansion in May 2016 of the population recalled. As the charges for the warranty adjustment were due to an industry-wide recall resulting from parts manufactured by Takata, and, due to the financial uncertainty of Takata, we determined these charges were unusual in nature, and as such, the charges for 2016, 2017 and 2018 were excluded from Adjusted EBIT (refer to Note 25,

Guarantees granted, commitments and contingent liabiliti

es, within our Consolidated Financial Statements included elsewhere in this report for additional information);

|

|

•

|

€111 million

charge in relation to a special bonus payment, announced January 11, 2018, of $2,000 to approximately 60,000 hourly and salaried employees in the United States, excluding senior management, as a result of the Tax Cuts and Jobs Act;

|

|

•

|

€103 million

relating to restructuring costs, which included

€123 million

of costs in EMEA offset by a

€28 million

reversal of previously recorded restructuring costs in LATAM;

|

|

•

|

€92 million

charge arising on settlement of a portion of a supplemental retirement plan and an annuity buyout in NAFTA;

|

|

•

|

€43 million

charge in relation to costs incurred in relation to the flood and fire in the Port of Savona (Italy);

|

|

•

|

€50 million

gain from the partial recovery of amounts accrued in 2016 in relation to costs for a recall which were contested with a supplier;

|

|

•

|

€60 million

reduction of costs previously provided in relation to the NAFTA capacity realignment plan. During the year ended December 31, 2015, as part of the plan to improve margins in NAFTA, the Group realigned a portion of its manufacturing capacity in the region to better meet market demand for Ram pickup trucks and Jeep vehicles within the Group's existing plant infrastructure. During the year ended December 31, 2016, net incremental costs of €

156 million

from the implementation of the plan were recognized and also excluded from Adjusted EBIT. During the year ended December 31, 2017, €

38 million

income related to adjustments to reserves were recognized and excluded from Adjusted EBIT; and

|

|

•

|

€72 million

of gains in relation to the recognition of credits for amounts paid in prior years in relation to indirect taxes in Brazil.

|

|

•

|

€

219 million

charge relating to asset impairments, primarily in LATAM and EMEA, resulting from changes in the product portfolio, as well as, impairments of certain real estate assets in Venezuela;

|

|

•

|

€

102 million

charge for the estimated costs of recall campaigns related to Takata airbag inflators, referred to above;

|

|

•

|

€

86 million

restructuring costs, primarily of which €75 million related to workforce restructuring costs in LATAM;

|

|

•

|

€

42 million

net loss resulting from deconsolidation of our operations in Venezuela. Refer to Note 3 -

Scope of consolidation

;

|

|

•

|

€

68 million

income reflecting final insurance recoveries related to the explosions at the Port of Tianjin, China. On August 12, 2015, a series of explosions which occurred at a container storage station at the Port of Tianjin impacted several storage areas containing approximately 25,000 FCA branded vehicles, of which approximately 13,300 were owned by FCA and approximately 11,400 vehicles were previously sold to our distributor. As a result of the explosions, nearly all of the vehicles at the Port of Tianjin were affected and some were destroyed. During the year ended December 31, 2016, €

55 million

of insurance recoveries relating to Tianjin were excluded from Adjusted EBIT. Insurance recoveries related to losses incurred in connection with the explosions at the Port of Tianjin are excluded from Adjusted EBIT to the extent the insured loss to which the recovery relates was excluded from Adjusted EBIT. Insurance recoveries are included in Adjusted EBIT to the extent they relate to costs, increased incentives or business interruption losses that were included in Adjusted EBIT;

|

|

•

|

€

76 million

gain on disposal of investments, primarily related to a €49 million gain on the disposal of the Group's publishing business;

|

|

•

|

€

38 million

income related to adjustments to reserves for the NAFTA capacity realignment plan referred to above; and

|

|

•

|

€

895 million

gain on the reversal of a liability for Brazilian indirect taxes, as reported above.

|

|

•

|

€

177 million

charges relating to asset impairments, primarily resulting from the Group's capacity realignment to SUV production in China, which resulted in an impairment charge of €90 million for locally-produced Fiat Viaggio and Ottimo vehicles, and €73 million of impairment losses and asset write-offs, of which €43 million related to certain of FCA Venezuela's assets due to the continued deterioration of the economic conditions in Venezuela;

|

|

•

|

€

414 million

charge for the estimated costs of recall campaigns related to Takata airbag inflators, referred to above;

|

|

•

|

€

68 million

restructuring costs, primarily relating to LATAM and Components;

|

|

•

|

€

55 million

insurance recoveries relating to the Tianjin port explosions referred to above;

|

|

•

|

€

156 million

relating to the NAFTA capacity alignment referred to above; and

|

|

•

|

€

132 million

which was recorded within Cost of revenues in the Consolidated Income Statement, related to estimated costs associated with a recall for which costs were contested with a supplier. Although FCA believed the supplier has responsibility for the recall, only a partial recovery of the estimated costs was recognized pursuant to a cost sharing agreement.

|

|

Years ended December 31,

|

Increase/(Decrease)

|

|||||||||||||||||

|

(€ million)

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

|||||||||||||

|

Adjusted net profit

|

€

|

4,707

|

|

€

|

3,512

|

|

€

|

2,353

|

|

34.0

|

%

|

49.3

|

%

|

|||||

|

Years ended December 31,

|

||||||||||||

|

(€ million)

|

2018

|

2017

|

2016

|

|||||||||

|

Net profit from continuing operations

|

€

|

3,330

|

|

€

|

3,291

|

|

€

|

1,713

|

|

|||

|

Adjustments (as above)

|

1,574

|

|

(615

|

)

|

872

|

|

||||||

|

Tax impact on adjustments

|

(125

|

)

|

14

|

|

(232

|

)

|

||||||

|

Brazil deferred tax assets write-off

|

—

|

|

453

|

|

—

|

|

||||||

|

Reduction of deferred tax assets related to reversal of a Brazilian indirect tax liability

|

—

|

|

281

|

|

—

|

|

||||||

|

Impact of U.S. tax reform

|

(72

|

)

|

88

|

|

—

|

|

||||||

|

Total adjustments, net of taxes

|

1,377

|

|

221

|

|

640

|

|

||||||

|

Adjusted net profit

|

€

|

4,707

|

|

€

|

3,512

|

|

€

|

2,353

|

|

|||

|

•

|

€

125 million

gain reflecting the tax impact on the items excluded from Adjusted EBIT above; and

|

|

•

|

€

72 million

gain relating to the impact of December 2017 U.S. tax reform.

|

|

•

|

€

14 million

expense reflecting the tax impact on the items excluded from Adjusted EBIT above;

|

|

•

|

€

453 million

expense relating to the write-off of deferred tax assets in Brazil as reported above;

|

|

•

|

€

281 million

expense arising on decrease in deferred tax assets related to the release of the Brazilian indirect tax liability noted above; and

|

|

•

|

€

88 million

expense relating to the impact of December 2017 U.S. tax reform.

|

|

•

|

€

232 million

gain, reflecting the tax impact on the items excluded from Adjusted EBIT above.

|

|

(€ million, except shipments which are in thousands of units)

|

Net revenues

|

Adjusted EBIT

|

Shipments

|

||||||||||||||||||||||||||||||

|

Years ended December 31

|

|||||||||||||||||||||||||||||||||

|

2018

|

2017

|

2016

|

2018

|

2017

|

2016

|

2018

|

2017

|

2016

|

|||||||||||||||||||||||||

|

NAFTA

|

€

|

72,384

|

|

€

|

66,094

|

|

€

|

69,094

|

|

€

|

6,230

|

|

€

|

5,227

|

|

€

|

5,133

|

|

2,633

|

|

2,401

|

|

2,587

|

|

|||||||||

|

LATAM

|

8,152

|

|

8,004

|

|

6,197

|

|

359

|

|

151

|

|

5

|

|

585

|

|

521

|

|

456

|

|

|||||||||||||||

|

APAC

|

2,703

|

|

3,250

|

|

3,662

|

|

(296

|

)

|

172

|

|

105

|

|

84

|

|

85

|

|

91

|

|

|||||||||||||||

|

EMEA

|

22,815

|

|

22,700

|

|

21,860

|

|

406

|

|

735

|

|

540

|

|

1,318

|

|

1,365

|

|

1,306

|

|

|||||||||||||||

|

Maserati

|

2,663

|

|

4,058

|

|

3,479

|

|

151

|

|

560

|

|

339

|

|

35

|

|

51

|

|

42

|

|

|||||||||||||||

|

Other activities

|

2,888

|

|

3,248

|

|

3,116

|

|

(40

|

)

|

(98

|

)

|

(175

|

)

|

—

|

|

—

|

|

—

|

|

|||||||||||||||

|

Unallocated items & eliminations

(1)

|

(1,193

|

)

|

(1,624

|

)

|

(1,610

|

)

|

(72

|

)

|

(138

|

)

|

(267

|

)

|

—

|

|

—

|

|

—

|

|

|||||||||||||||

|

Total

|

€

|

110,412

|

|

€

|

105,730

|

|

€

|

105,798

|

|

€

|

6,738

|

|

€

|

6,609

|

|

€

|

5,680

|

|

4,655

|

|

4,423

|

|

4,482

|

|

|||||||||

|

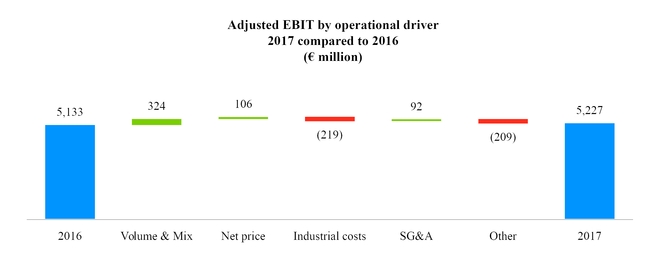

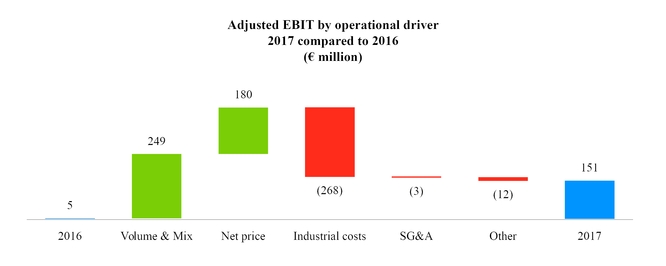

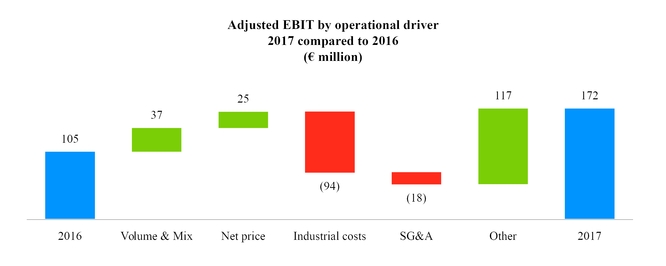

•

|

Volume

: reflects changes in products sold to our customers, primarily dealers and fleet customers. Change in volumes is driven by industry volume, market share and changes in dealer stock levels. Vehicles manufactured and distributed by our unconsolidated subsidiaries are not included within volume;

|

|

•

|

Mix

: generally reflects the changes in product mix, including mix among vehicle brands and models, as well as changes in regional market and distribution channel mix, including mix between retail and fleet customers;

|

|

•

|

Net price

: primarily reflects changes in prices to our customers including higher pricing related to content enhancement, net of discounts, price rebates and other sales incentive programs, as well as related foreign currency transaction effects;

|

|

•

|

Industrial costs

: primarily include cost changes to manufacturing and purchasing of materials that are associated with content, technology and enhancement of vehicle features, as well as industrial efficiencies and inefficiencies, recall campaign and warranty costs, research and development costs and related foreign currency transaction effects;

|

|

•

|

Selling, general and administrative costs (“SG&A”)

: primarily include costs for advertising and promotional activities, purchased services, information technology costs and other costs not directly related to the development and manufacturing of our products; and

|

|

•

|

Other

: includes other items not mentioned above, such as foreign currency exchange translation and results from joint ventures and associates.

|

|

Increase/(Decrease)

|

||||||||||||||||||||||||

|

Years ended December 31

|

2018 vs. 2017

|

2017 vs. 2016

|

||||||||||||||||||||||

|

2018

|

2017

|

2016

|

% Actual

|

% CER

|

% Actual

|

% CER

|

||||||||||||||||||

|

Shipments (thousands of units)

|

2,633

|

|

2,401

|

|

2,587

|

|

9.7

|

%

|

(7.2

|

)%

|

—

|

|

||||||||||||

|

Net revenues (€ million)

|

€

|

72,384

|

|

€

|

66,094

|

|

€

|

69,094

|

|

9.5

|

%

|

14.5

|

%

|

(4.3

|

)%

|

(2.6

|

)%

|

|||||||

|

Adjusted EBIT (€ million)

|

€

|

6,230

|

|

€

|

5,227

|

|

€

|

5,133

|

|

19.2

|

%

|

24.9

|

%

|

1.8

|

%

|

4.0

|

%

|

|||||||

|

Adjusted EBIT margin (%)

|

8.6

|

%

|

7.9

|

%

|

7.4

|

%

|

+70 bps

|

|

—

|

|

+50 bps

|

|

—

|

|

||||||||||

|

•

|

higher shipments and favorable vehicle and market mix;

|

|

•

|

positive net pricing, primarily for new vehicles and pricing actions on existing vehicles, net of higher incentives; and

|

|

•

|

lower selling, general and administrative expenses primarily due to lower advertising expense.

|

|

•

|

higher industrial costs, which mainly related to product content for approximately €3 billion, launch costs, logistic costs for approximately €1 billion and depreciation and amortization related to new vehicles, partially offset by purchasing efficiencies and lower warranties; and

|

|

•

|

negative foreign currency translation effects.

|

|

•

|

favorable mix, net of lower shipments, as described above;

|

|

•

|

positive pricing, partially offset by higher incentives and foreign exchange impacts due to the Canadian Dollar; and

|

|

•

|

lower SG&A expenditures, primarily due to lower advertising costs.

|

|

•

|

higher industrial costs due to higher product costs for content enhancements and increased costs for the capacity realignment plan, partially offset by purchasing efficiencies and lower warranty costs;

|

|

•

|

negative foreign exchange translation effects; and

|

|

•

|

a prior year one-off residual values adjustment, included within Other above.

|

|

Increase/(Decrease)

|

||||||||||||||||||||||||

|

Years ended December 31

|

2018 vs. 2017

|

2017 vs. 2016

|

||||||||||||||||||||||

|

2018

|

2017

|

2016

|

% Actual

|

% CER

|

% Actual

|

% CER

|

||||||||||||||||||

|

Shipments (thousands of units)

|

585

|

|

521

|

|

456

|

|

12.3

|

%

|

—

|

|

14.3

|

%

|

—

|

|

||||||||||

|

Net revenues (€ million)

|

€

|

8,152

|

|

€

|

8,004

|

|

€

|

6,197

|

|

1.8

|

%

|

21.0

|

%

|

29.2

|

%

|

23.6

|

%

|

|||||||

|

Adjusted EBIT (€ million)

|

€

|

359

|

|

€

|

151

|

|

€

|

5