|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

|

51-0483352

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

777 Long Ridge Road

|

|

|

|

Stamford, Connecticut

|

06902

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Common stock, par value $0.001 per share

|

|

New York Stock Exchange

|

|

Title of class

|

||

|

None

|

||

|

Large accelerated filer

|

ý

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

o

|

|

Page

|

||

|

•

|

“we,” “us,” “our” and the “Company” are to SYNCHRONY FINANCIAL and its subsidiaries;

|

|

•

|

“Synchrony” are to SYNCHRONY FINANCIAL only;

|

|

•

|

“GE” are to General Electric Company and its subsidiaries;

|

|

•

|

“GECC” are to General Electric Capital Corporation (a subsidiary of GE) and its subsidiaries;

|

|

•

|

the “Bank” are to Synchrony Bank (a subsidiary of Synchrony);

|

|

•

|

the “Bank Term Loan” are to the term loan agreement, dated as of July 30, 2014, among Synchrony, as borrower, JPMorgan Chase Bank, N.A., as administrative agent, and the lenders from time to time party thereto, as amended;

|

|

•

|

the “Board of Directors” are to Synchrony’s board of directors;

|

|

•

|

the “GECC Term Loan” are to the term loan agreement, dated as of July 30, 2014, among Synchrony, as borrower, GECC, as administrative agent, and the other Lenders party thereto, as amended;

|

|

•

|

“FICO” score are to a credit score developed by Fair Isaac & Co., which is widely used as a means of evaluating the likelihood that credit users will pay their obligations; and

|

|

•

|

“EMV” are to new security technology that utilizes embedded security chips in our credit cards.

|

|

Programs commenced in 2016:

|

Programs expected to commence in 2017:

|

|

|

Citgo

|

Nissan

|

|

|

Marvel

|

At Home

|

|

|

Google Store

|

Cathay Pacific

|

|

|

Fareportal

|

||

|

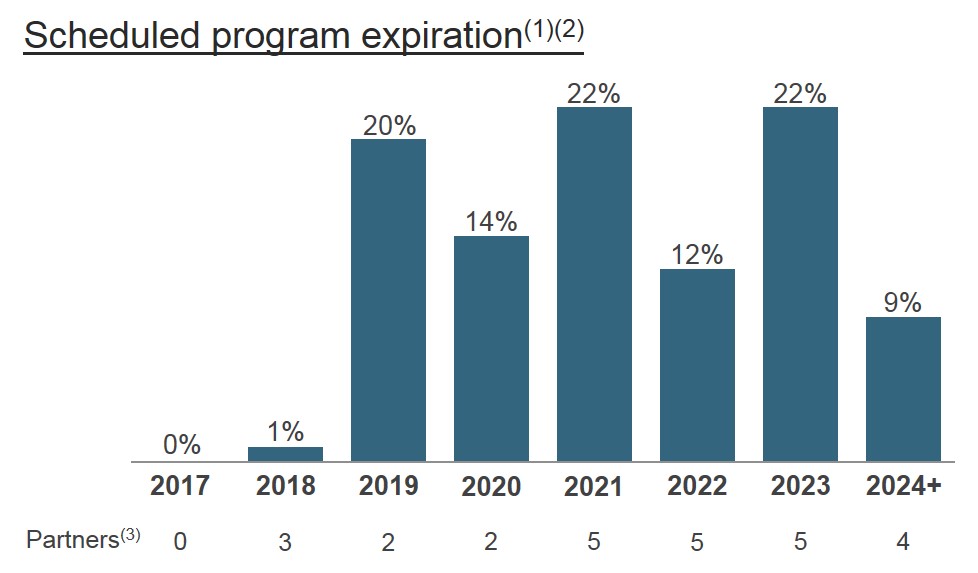

(1)

|

Percentages stated as a proportion of total Retail Card interest and fees on loans for the year ended December 31, 2016.

|

|

(2)

|

Existing partners as of December 31, 2016 and also reflects the renewal of the Belk program in January 2017.

|

|

(3)

|

Excludes certain credit card portfolios that were sold, have not been renewed, or expire in 2017, which represent less than 1% of our total Retail Card interest and fees on loans for the year ended December 31, 2016.

|

|

(1)

|

Based on interest and fees on loans for the year ended December 31, 2016.

|

|

(2)

|

Length of relationship based on Sleepy's, which was subsequently acquired by Mattress Firm.

|

|

Promotional Offer

|

|||||||||||

|

Credit Product

|

Standard Terms Only

|

Deferred Interest

|

Other Promotional

|

Total

|

|||||||

|

Credit cards

|

67.1

|

%

|

16.5

|

%

|

12.8

|

%

|

96.4

|

%

|

|||

|

Consumer installment loans

|

—

|

|

—

|

|

1.8

|

|

1.8

|

|

|||

|

Commercial credit products

|

1.7

|

%

|

—

|

|

—

|

|

1.7

|

|

|||

|

Other

|

0.1

|

|

—

|

|

—

|

|

0.1

|

|

|||

|

Total

|

68.9

|

%

|

16.5

|

%

|

14.6

|

%

|

100.0

|

%

|

|||

|

•

|

payment processing (more than

605 million

paper and electronic payments in

2016

);

|

|

•

|

embossing and mailing credit cards (more than

55 million

cards in

2016

);

|

|

•

|

printing and mailing and eService delivery of credit card statements (more than

720 million

paper and electronic statements in

2016

); and

|

|

•

|

other letters mailed or sent electronically (more than

80 million

in

2016

).

|

|

•

|

under the Basel III standardized approach, a common equity Tier 1 capital to risk-weighted assets ratio of 7% (the minimum of 4.5% plus a mandatory conservation buffer of

2.5%

, which will be fully phased-in by January 1, 2019), a Tier 1 capital to risk-weighted assets ratio of 8.5% (the minimum of 6% plus a phased-in mandatory conservation buffer of

2.5%

), and a total capital to risk-weighted assets ratio of 10.5% (a minimum of 8% plus a phased-in mandatory conservation buffer of

2.5%

); and

|

|

•

|

a leverage ratio of Tier 1 capital to total consolidated assets of

4%

.

|

|

•

|

under the Basel III standardized approach, a common equity Tier 1 capital to risk-weighted assets ratio of 7% (the minimum of 4.5% plus a mandatory conservation buffer of 2.5%, which will be fully phased-in by January 1, 2019), a Tier 1 capital to risk-weighted assets ratio of 8.5% (the minimum of 6% plus a phased-in mandatory conservation buffer of 2.5%), and a total capital to risk-weighted assets ratio of 10.5% (a minimum of 8% plus a phased-in mandatory conservation buffer of 2.5%); and

|

|

•

|

a leverage ratio of Tier 1 capital to total consolidated assets of 5%.

|

|

Location

|

Owned/Leased

(1)

|

|

|

Corporate Headquarters:

|

||

|

Stamford, CT

|

Leased

|

|

|

Bank Headquarters:

|

||

|

Draper, UT

|

Leased

|

|

|

Payment Processing Centers:

|

||

|

Atlanta, GA

|

Leased

|

|

|

Longwood, FL

|

Leased

|

|

|

Customer Service Centers:

|

||

|

Altamonte Springs, FL

|

Leased

|

|

|

Canton, OH

|

Leased

|

|

|

Charlotte, NC

|

Leased

|

|

|

Hyderabad, India

|

Leased

|

|

|

Kettering, OH

|

Leased

|

|

|

Manila, Philippines

|

Leased

|

|

|

Manila, Philippines (Alabang)

|

Leased

|

|

|

Merriam, KS

|

Owned

|

|

|

Phoenix, AZ

|

Leased

|

|

|

Rapid City, SD

|

Leased

|

|

|

San Juan, PR

|

Leased

|

|

|

Other Support Centers:

|

||

|

Alpharetta, GA

(2)

|

Leased

|

|

|

Bellevue, WA

|

Leased

|

|

|

Bentonville, AR

|

Leased

|

|

|

Chicago, IL

|

Leased

|

|

|

Costa Mesa, CA

|

Leased

|

|

|

Frisco, TX

|

Leased

|

|

|

San Francisco, CA

|

Leased

|

|

|

St. Paul, MN

|

Leased

|

|

|

Van Buren, MI

|

Leased

|

|

|

Walnut Creek, CA

|

Leased

|

|

|

Bank Retail Branch Location:

|

||

|

Bridgewater, NJ

|

Leased

|

|

|

(1)

|

In connection with the IPO, certain of these leased properties were assigned to us by GECC. There are two properties (Kettering, OH and Alpharetta, GA) where GECC continues to have liability for obligations under the leases, and we have agreed to indemnify GECC for any costs or expenses related to those obligations.

|

|

Common stock market price

|

Cash dividends declared

|

||||||||||

|

($ in dollars)

|

High

|

Low

|

|||||||||

|

2016

|

|||||||||||

|

Fourth quarter

|

$

|

37.26

|

|

$

|

26.37

|

|

$

|

0.13

|

|

||

|

Third quarter

|

$

|

28.40

|

|

$

|

25.12

|

|

$

|

0.13

|

|

||

|

Second quarter

|

$

|

31.95

|

|

$

|

23.36

|

|

N/A

|

|

|||

|

First quarter

|

$

|

30.11

|

|

$

|

24.48

|

|

N/A

|

|

|||

|

2015

|

|||||||||||

|

Fourth quarter

|

$

|

33.98

|

|

$

|

29.51

|

|

N/A

|

|

|||

|

Third quarter

|

$

|

35.99

|

|

$

|

30.56

|

|

N/A

|

|

|||

|

Second quarter

|

$

|

33.30

|

|

$

|

29.76

|

|

N/A

|

|

|||

|

First quarter

|

$

|

33.61

|

|

$

|

28.52

|

|

N/A

|

|

|||

|

July 31, 2014

|

December 31, 2014

|

December 31, 2015

|

December 31, 2016

|

||||||||||||

|

Synchrony Financial

|

$

|

100.00

|

|

$

|

129.35

|

|

$

|

132.22

|

|

$

|

159.07

|

|

|||

|

S&P 500

|

$

|

100.00

|

|

$

|

106.64

|

|

$

|

105.87

|

|

$

|

115.96

|

|

|||

|

S&P 500 Financials

|

$

|

100.00

|

|

$

|

110.42

|

|

$

|

106.58

|

|

$

|

128.05

|

|

|||

|

($ in millions, except per share data)

|

Total Number of Shares Purchased

(a)

|

|

Average Price Paid Per Share

(b)

|

|

Total Number of Shares Purchased as Part of Publicly Announced Program

(c)

|

|

Maximum Dollar Value of Shares That May Yet Be Purchased Under the Program

(b)

|

|

|||||

|

October 1 - 31, 2016

|

3,615,333

|

|

$

|

28.91

|

|

3,615,333

|

|

$

|

609.5

|

|

|||

|

November 1 - 30, 2016

|

4,534,485

|

|

$

|

29.44

|

|

4,534,485

|

|

$

|

476.0

|

|

|||

|

December 1 - 31, 2016

|

190

|

|

$

|

36.28

|

|

—

|

|

$

|

476.0

|

|

|||

|

Total

|

8,150,008

|

|

$

|

29.20

|

|

8,149,818

|

|

$

|

476.0

|

|

|||

|

(a)

|

Primarily represents repurchases of shares of common stock under our publicly announced share repurchase program of up to $952 million of our outstanding shares of common stock for the four quarters ending June 30, 2017. Also includes zero shares, zero shares and 190 shares withheld in October, November and December, respectively, to offset tax withholding obligations that occur upon the delivery of outstanding shares underlying restricted stock awards or upon the exercise of stock options.

|

|

(b)

|

Amounts exclude commission costs.

|

|

(c)

|

On July 7, 2016, our Board of Directors approved a share repurchase program of up to $952 million of our outstanding shares of common stock for the four quarters ending June 30, 2017.

|

|

Years Ended December 31,

|

|||||||||||||||||||

|

($ in millions, except per share data)

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

Interest income

|

$

|

14,778

|

|

$

|

13,228

|

|

$

|

12,242

|

|

$

|

11,313

|

|

$

|

10,309

|

|

||||

|

Interest expense

|

1,248

|

|

1,135

|

|

922

|

|

742

|

|

745

|

|

|||||||||

|

Net interest income

|

13,530

|

|

12,093

|

|

11,320

|

|

10,571

|

|

9,564

|

|

|||||||||

|

Retailer share arrangements

|

(2,902

|

)

|

(2,738

|

)

|

(2,575

|

)

|

(2,373

|

)

|

(1,984

|

)

|

|||||||||

|

Net interest income, after retailer share arrangements

|

10,628

|

|

9,355

|

|

8,745

|

|

8,198

|

|

7,580

|

|

|||||||||

|

Provision for loan losses

|

3,986

|

|

2,952

|

|

2,917

|

|

3,072

|

|

2,565

|

|

|||||||||

|

Net interest income, after retailer share arrangements and provision for loan losses

|

6,642

|

|

6,403

|

|

5,828

|

|

5,126

|

|

5,015

|

|

|||||||||

|

Other income

|

344

|

|

392

|

|

485

|

|

500

|

|

484

|

|

|||||||||

|

Other expense

|

3,416

|

|

3,264

|

|

2,927

|

|

2,484

|

|

2,123

|

|

|||||||||

|

Earnings before provision for income taxes

|

3,570

|

|

3,531

|

|

3,386

|

|

3,142

|

|

3,376

|

|

|||||||||

|

Provision for income taxes

|

1,319

|

|

1,317

|

|

1,277

|

|

1,163

|

|

1,257

|

|

|||||||||

|

Net earnings

|

$

|

2,251

|

|

$

|

2,214

|

|

$

|

2,109

|

|

$

|

1,979

|

|

$

|

2,119

|

|

||||

|

Weighted average shares outstanding (in millions)

|

|||||||||||||||||||

|

Basic

|

829.2

|

|

833.8

|

|

757.4

|

|

705.3

|

|

705.3

|

|

|||||||||

|

Diluted

|

831.5

|

|

835.5

|

|

757.6

|

|

705.3

|

|

705.3

|

|

|||||||||

|

Earnings per share

|

|||||||||||||||||||

|

Basic

|

$

|

2.71

|

|

$

|

2.66

|

|

$

|

2.78

|

|

$

|

2.81

|

|

$

|

3.00

|

|

||||

|

Diluted

|

$

|

2.71

|

|

$

|

2.65

|

|

$

|

2.78

|

|

$

|

2.81

|

|

$

|

3.00

|

|

||||

|

Dividends declared per common share

|

$

|

0.26

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

($ in millions)

|

At December 31,

|

||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||||

|

Assets:

|

|||||||||||||||||||

|

Cash and equivalents

|

$

|

9,321

|

|

$

|

12,325

|

|

$

|

11,828

|

|

$

|

2,319

|

|

$

|

1,334

|

|

||||

|

Investment securities

|

5,110

|

|

3,142

|

|

1,598

|

|

236

|

|

193

|

|

|||||||||

|

Loan receivables

|

76,337

|

|

68,290

|

|

61,286

|

|

57,254

|

|

52,313

|

|

|||||||||

|

Allowance for loan losses

|

(4,344

|

)

|

(3,497

|

)

|

(3,236

|

)

|

(2,892

|

)

|

(2,274

|

)

|

|||||||||

|

Loan receivables held for sale

|

—

|

|

—

|

|

332

|

|

—

|

|

—

|

|

|||||||||

|

Goodwill

|

949

|

|

949

|

|

949

|

|

949

|

|

936

|

|

|||||||||

|

Intangible assets, net

|

712

|

|

701

|

|

519

|

|

300

|

|

255

|

|

|||||||||

|

Other assets

|

2,122

|

|

2,080

|

|

2,258

|

|

822

|

|

592

|

|

|||||||||

|

Total assets

|

$

|

90,207

|

|

$

|

83,990

|

|

$

|

75,534

|

|

$

|

58,988

|

|

$

|

53,349

|

|

||||

|

Liabilities and Equity:

|

|||||||||||||||||||

|

Total deposits

|

$

|

52,055

|

|

$

|

43,367

|

|

$

|

34,859

|

|

$

|

25,641

|

|

$

|

18,717

|

|

||||

|

Total borrowings

|

20,147

|

|

24,279

|

|

27,383

|

|

24,302

|

|

27,789

|

|

|||||||||

|

Accrued expenses and other liabilities

|

3,809

|

|

3,740

|

|

2,814

|

|

3,085

|

|

2,261

|

|

|||||||||

|

Total liabilities

|

76,011

|

|

71,386

|

|

65,056

|

|

53,028

|

|

48,767

|

|

|||||||||

|

Total equity

|

14,196

|

|

12,604

|

|

10,478

|

|

5,960

|

|

4,582

|

|

|||||||||

|

Total liabilities and equity

|

$

|

90,207

|

|

$

|

83,990

|

|

$

|

75,534

|

|

$

|

58,988

|

|

$

|

53,349

|

|

||||

|

•

|

Private label credit cards

.

Private label credit cards are partner-branded credit cards (e.g., Lowe’s or Amazon) or program-branded credit cards (e.g., Synchrony Car Care or CareCredit) that are used primarily for the purchase of goods and services from the partner or within the program network. In addition, in some cases, cardholders may be permitted to access their credit card accounts for cash advances. In Retail Card, credit under our private label credit cards typically is extended on standard terms only, and in Payment Solutions and CareCredit, credit under our private label credit cards typically is extended pursuant to a promotional financing offer.

|

|

•

|

Dual Cards and General Purpose Co-Brand Cards

.

Our patented Dual Cards are credit cards that function as private label credit cards when used to purchase goods and services from our partners and as general purpose credit cards when used elsewhere. We also offer general purpose co-branded credit cards that do not also function as private label cards. Credit extended under our Dual Cards and general purpose co-branded credit cards typically is extended under standard terms only. Currently, only our Retail Card platform offers Dual Cards and general purpose co-branded credit cards. At

December 31, 2016

, we offered these credit cards through

18

of our

26

ongoing Retail Card programs, of which the majority are Dual Cards.

|

|

•

|

Growth in loan receivables and interest income

. We believe continuing improvement in the U.S. economy and employment rates will contribute to an increase in consumer credit spending. In addition, we expect the use of credit cards to continue to increase versus other forms of payment such as cash and checks. We anticipate that these trends, combined with our marketing and partner engagement strategies, will contribute to growth in our loan receivables. In the near-to-medium term, we expect our total interest income to continue to grow, driven by the expected growth in average loan receivables. Our historical growth rates in loan receivables and interest income have benefited from new partner acquisitions, and therefore, if we do not continue to acquire new partners, replace the programs that are not extended or otherwise grow our business, our growth rates in loan receivables and interest income in the future will be lower than in recent periods. In addition, we do not expect to make any significant changes to customer pricing or merchant discount pricing in the near term other than those associated with changes in the prime rate and LIBOR, and therefore we expect yields generated from interest and fees on interest-earning assets will remain relatively stable.

|

|

•

|

Extended duration of our Retail Card program agreements

. Our Retail Card program agreements typically have contract terms ranging from approximately five to ten years, and the average length of our relationship with our ongoing Retail Card partners is

19

years. We expect to continue to benefit from these programs on a long-term basis as indicated by the expiration schedule included in

“Item 1. Business—Our Sales Platforms—Retail Card”

, which indicates for each period the number of programs scheduled to expire and the proportion of interest and fees on loans that these programs comprised for the year ended

December 31, 2016

.

|

|

•

|

Increases in retailer share arrangement payments under extended program agreements.

We believe that as a result of both the overall growth of our programs, as well as amendments we have made to the terms of certain program agreements that we extended in recent years, the payments we make to our partners under these extended retailer share arrangements, in the aggregate, are likely to increase both in absolute terms and as a percentage of our net earnings.

|

|

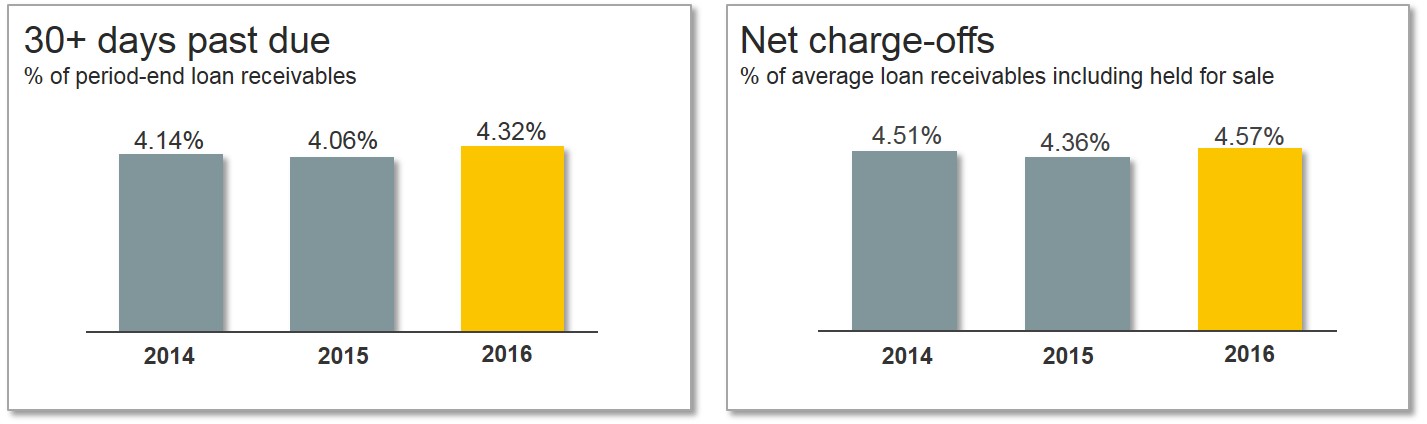

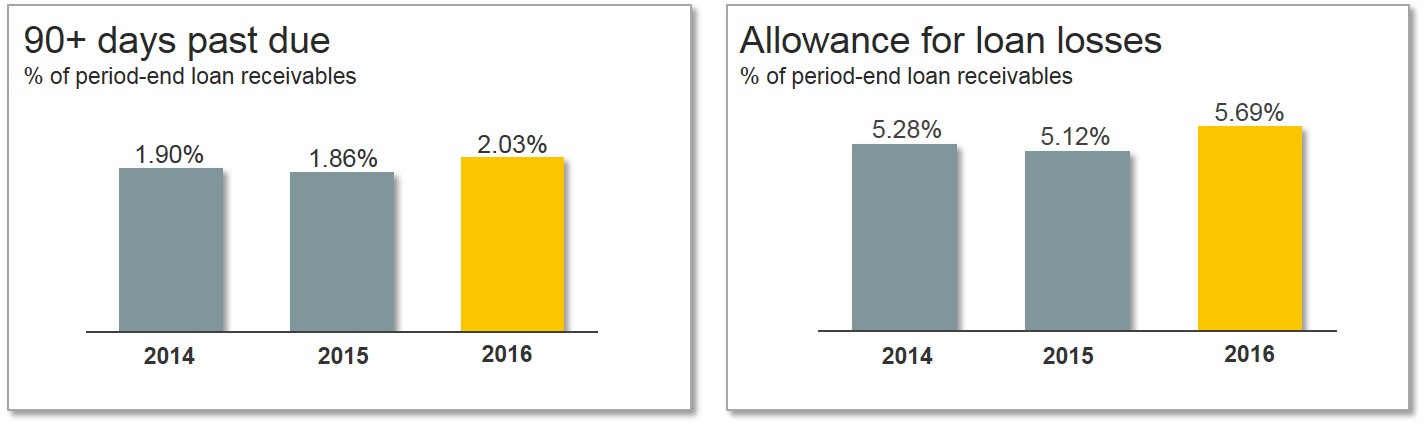

•

|

Stable asset quality.

The credit environment remained favorable during 2016. Our actual net charge-off rates have remained relatively stable, increasing by 21 basis points to

4.57%

for the year ended

December 31, 2016

compared to

4.36%

for the year ended

December 31, 2015

, which represents a modest increase from the low credit trends we have experienced in the last two years. The assessment of our credit profile includes the evaluation of portfolio mix, account maturation, as well as broader consumer trends, such as payment behavior and overall indebtedness. During 2016, these factors contributed to increases in our delinquent accounts and our forecasted net charge-off rate over the next twelve months. Accordingly, we also experienced a corresponding increase in our allowance coverage ratio, as we reserved for these forecasted losses inherent in our loan portfolio. In the near term, we expect U.S. unemployment rates to continue to stabilize and we do not anticipate making significant changes to our underwriting standards. In this credit environment, we expect the trend of modest increases in our net charge-off rates, delinquencies and allowance coverage to continue in 2017.

|

|

•

|

Growth in interchange revenues and loyalty program costs.

We believe that as a result of the overall growth in Dual Card and general purpose co-branded credit card transactions occurring outside of our Retail Card partners’ locations, interchange revenues will continue to increase. The expected growth in these transactions is driven, in part, by both existing and new loyalty programs with our Retail Card partners. In addition, we continue to offer and add new loyalty programs for our private label credit cards, for which we do not receive interchange fees. The growth in these existing and new loyalty programs will result in an increase in costs associated with these programs. Overall, we expect both our interchange revenues and loyalty program costs to grow in excess of the growth of our Retail Card loan receivables, and expect the increase in loyalty program costs to be higher than that expected for interchange revenues due to the additional loyalty programs for our private label credit cards where we do not charge interchange fees. These increases have been contemplated in our program agreements with our Retail Card partners and are a component of the calculation of our payments due under our retailer share arrangements.

|

|

•

|

Capital and liquidity levels.

We continue to expect to maintain sufficient capital and liquidity resources to support our daily operations, our business growth, and our credit ratings as well as regulatory and compliance requirements in a cost effective and prudent manner through expected and unexpected market environments. In July 2016, we established both dividend and share repurchase programs, and accordingly, during the year ended

December 31, 2016

, we declared and paid dividends of $

214

million and repurchased $476 million of our outstanding common stock. While these programs have now been established, and we expect to continue to deploy capital through both dividends and share repurchases, subject to regulatory approval, we also continue to expect to maintain capital ratios well in excess of minimum regulatory requirements. At

December 31, 2016

, the Company had a Basel III common equity Tier 1 ratio under transitional guidelines of

17.2%

. We also expect that our liquidity portfolio will continue to be sufficient to support all of our business objectives and to meet all regulatory requirements.

|

|

(a) Calculated under Basel III regulatory capital standards, subject to transition provisions.

|

|

•

|

Net earnings increased

1.7%

to

$2,251 million

for the

year ended

December 31, 2016

, driven by higher net interest income, partially offset by increases in provision for loan losses and other expense and a decrease in other income.

|

|

•

|

Loan receivables increased

11.8%

to

$76,337 million

at

December 31, 2016

compared to

December 31, 2015

, primarily driven by higher purchase volume and average active account growth.

|

|

•

|

Net interest income increased

11.9%

to

$13,530 million

for the

year ended

December 31, 2016

, primarily due to higher average loan receivables.

|

|

•

|

Retailer share arrangements increased

6.0%

to

$2,902 million

for the

year ended

December 31, 2016

, primarily as a result of growth and improved performance of the programs in which we have retailer share arrangements, partially offset by higher provision for loan losses and loyalty costs associated with these programs.

|

|

•

|

Over-30 day loan delinquencies as a percentage of period-end loan receivables increased 26 basis points to

4.32%

at

December 31, 2016

, and net charge-off rate increased 21 basis points to

4.57%

for the

year ended

December 31, 2016

.

|

|

•

|

Provision for loan losses increased by

$1,034 million

, or

35.0%

, for the

year ended

December 31, 2016

, due to a higher loan loss reserve and receivables growth. Our allowance coverage ratio (allowance for loan losses as a percent of end of period loan receivables) increased to

5.69%

at

December 31, 2016

, as compared to

5.12%

at

December 31, 2015

.

|

|

•

|

Other expense increased by

$152 million

, or

4.7%

, for the year ended

December 31, 2016

, primarily driven by business growth, partially offset by lower marketing and other expenses, as well as EMV re-issue costs in the prior year that did not repeat.

|

|

•

|

We continue to invest in our direct banking activities to grow our deposit base. Total deposits increased

20.0%

to

$52.1 billion

at

December 31, 2016

, compared to December 31, 2015, driven primarily by growth in our direct deposits of

27.6%

to

$37.9 billion

, partially offset by a reduction in our brokered deposits.

|

|

•

|

During the

year ended

December 31, 2016

, we repurchased

$476 million

of our outstanding common stock, and also declared and paid cash dividends of

$0.26

per share, or $214 million.

|

|

•

|

We extended our Retail Card program agreements with TJX Companies and Stein Mart, launched our new programs with Citgo, Marvel, Google Store and Fareportal and announced our new partnerships with Cathay Pacific, Nissan and At Home, and in January 2017, renewed our program with Belk.

|

|

•

|

We extended our Payment Solutions program agreements with Ashley Furniture HomeStore, hhgregg, La-Z-Boy, Nationwide Marketing Group and Suzuki and launched our new programs with Mattress Firm and The Container Store.

|

|

•

|

In our CareCredit sales platform, we renewed VCA Animal Hospitals in our network of providers and renewed our endorsements with the American Dental Association and American Society of Plastic Surgeons.

|

|

•

|

Net earnings increased 5.0% to $2,214 million for the year ended December 31, 2015, driven by higher net interest income, partially offset by increases in retailer share arrangements, provision for loan losses and other expense.

|

|

•

|

Loan receivables increased 11.4% to $68,290 million at December 31, 2015 compared to December 31, 2014, primarily driven by higher purchase volume and average active account growth, and included growth associated with the BP portfolio acquired in the second quarter of 2015.

|

|

•

|

Net interest income increased 6.8% to $12,093 million for the year ended December 31, 2015, primarily due to higher average loan receivables, partially offset by higher interest expense driven by increased liquidity, funding mix and growth.

|

|

•

|

Retailer share arrangements increased 6.3% to $2,738 million for the year ended December 31, 2015, primarily as a result of growth and improved performance of the programs in which we have retailer share arrangements, partially offset with increased other expense and loyalty costs associated with these programs.

|

|

•

|

Loan delinquencies as a percentage of period-end loan receivables decreased with the over-30 day delinquency rate decreasing to 4.06% at December 31, 2015 from 4.14% at December 31, 2014, primarily driven by improving asset quality trends and general improvement in the U.S. economy. Net charge-off rates decreased 15 basis points to 4.36% for the year ended December 31, 2015, from 4.51% for the year ended December 31, 2014 reflecting these same trends.

|

|

•

|

Provision for loan losses increased by $35 million, or 1.2%, to $2,952 million for the year ended December 31, 2015, primarily due to portfolio growth, partially offset by improving asset quality trends. Our allowance coverage ratio (allowance for loan losses as a percent of end of period loan receivables) decreased to 5.12% at December 31, 2015, as compared to 5.28% at December 31, 2014

,

reflecting the recent improvements in our asset quality trends.

|

|

•

|

Other expense increased by $337 million, or 11.5%, for the year ended December 31, 2015, driven by investments in growth and infrastructure build in preparation for separation from GE and also included expenses for the completion of the EMV card rollout for active Dual Card accounts.

|

|

•

|

We continue to invest in our direct banking activities to grow our deposit base. Total deposits increased 24.4% to $43.4 billion at December 31, 2015, compared to December 31, 2014, driven primarily by growth in our direct deposits of 50.8% to $29.7 billion, partially offset by a reduction in our brokered deposits.

|

|

•

|

During the year ended December 31, 2015, we extended our Retail Card program agreements with Amazon, Chevron, Dick's Sporting Goods and PayPal, launched our new program with BP, and announced our new partnerships with Citgo and Stash Hotel Rewards.

|

|

•

|

During the year ended December 31, 2015, we entered into new program agreements in our Payment Solutions sales platform with Guitar Center, Mattress Firm, The Container Store and Newegg and extended our program agreements with Discount Tire, Sleepy's, P.C. Richard & Son, Conn's, Polaris Industries, Mohawk Flooring, Art Van Furniture and MEGA Group USA, a national home furnishings buying group of independent retailers.

|

|

•

|

During the year ended December 31, 2015, in our CareCredit sales platform, we added Rite Aid to our network of providers, added a new endorsement with VSP, the nation’s largest vision insurance provider, and renewed our endorsement with the American Society of Plastic Surgeons.

|

|

Years ended December 31 ($ in millions)

|

2016

|

2015

|

2014

|

||||||||

|

Interest income

|

$

|

14,778

|

|

$

|

13,228

|

|

$

|

12,242

|

|

||

|

Interest expense

|

1,248

|

|

1,135

|

|

922

|

|

|||||

|

Net interest income

|

13,530

|

|

12,093

|

|

11,320

|

|

|||||

|

Retailer share arrangements

|

(2,902

|

)

|

(2,738

|

)

|

(2,575

|

)

|

|||||

|

Net interest income, after retailer share arrangements

|

10,628

|

|

9,355

|

|

8,745

|

|

|||||

|

Provision for loan losses

|

3,986

|

|

2,952

|

|

2,917

|

|

|||||

|

Net interest income, after retailer share arrangements and provision for loan losses

|

6,642

|

|

6,403

|

|

5,828

|

|

|||||

|

Other income

|

344

|

|

392

|

|

485

|

|

|||||

|

Other expense

|

3,416

|

|

3,264

|

|

2,927

|

|

|||||

|

Earnings before provision for income taxes

|

3,570

|

|

3,531

|

|

3,386

|

|

|||||

|

Provision for income taxes

|

1,319

|

|

1,317

|

|

1,277

|

|

|||||

|

Net earnings

|

$

|

2,251

|

|

$

|

2,214

|

|

$

|

2,109

|

|

||

|

At and for the years ended December 31 ($ in millions)

|

2016

|

2015

|

2014

|

||||||||

|

Financial Position Data (Average):

|

|||||||||||

|

Loan receivables, including held for sale

|

$

|

68,649

|

|

$

|

61,655

|

|

$

|

57,101

|

|

||

|

Total assets

|

$

|

84,400

|

|

$

|

76,828

|

|

$

|

66,019

|

|

||

|

Deposits

|

$

|

47,399

|

|

$

|

38,262

|

|

$

|

30,257

|

|

||

|

Borrowings

|

$

|

20,142

|

|

$

|

24,006

|

|

$

|

24,568

|

|

||

|

Total equity

|

$

|

13,620

|

|

$

|

11,683

|

|

$

|

7,888

|

|

||

|

Selected Performance Metrics:

|

|||||||||||

|

Purchase volume

(3)

|

$

|

125,468

|

|

$

|

113,615

|

|

$

|

103,149

|

|

||

|

Retail Card

|

$

|

101,242

|

|

$

|

92,190

|

|

$

|

83,591

|

|

||

|

Payment Solutions

|

$

|

15,641

|

|

$

|

13,668

|

|

$

|

12,447

|

|

||

|

CareCredit

|

$

|

8,585

|

|

$

|

7,757

|

|

$

|

7,111

|

|

||

|

Average active accounts (in thousands)

(4)

|

66,928

|

|

62,643

|

|

60,009

|

|

|||||

|

Net interest margin

(5)

|

16.10

|

%

|

15.85

|

%

|

17.20

|

%

|

|||||

|

Net charge-offs

|

$

|

3,139

|

|

$

|

2,691

|

|

$

|

2,573

|

|

||

|

Net charge-offs as a % of average loan receivables, including held for sale

|

4.57

|

%

|

4.36

|

%

|

4.51

|

%

|

|||||

|

Allowance coverage ratio

(6)

|

5.69

|

%

|

5.12

|

%

|

5.28

|

%

|

|||||

|

Return on assets

(7)

|

2.7

|

%

|

2.9

|

%

|

3.2

|

%

|

|||||

|

Return on equity

(8)

|

16.5

|

%

|

19.0

|

%

|

26.7

|

%

|

|||||

|

Equity to assets

(9)

|

16.14

|

%

|

15.21

|

%

|

11.95

|

%

|

|||||

|

Other expense as a % of average loan receivables, including held for sale

|

4.98

|

%

|

5.29

|

%

|

5.13

|

%

|

|||||

|

Efficiency ratio

(10)

|

31.1

|

%

|

33.5

|

%

|

31.7

|

%

|

|||||

|

Effective income tax rate

|

36.9

|

%

|

37.3

|

%

|

37.7

|

%

|

|||||

|

Selected Period End Data:

|

|||||||||||

|

Loan receivables

|

$

|

76,337

|

|

$

|

68,290

|

|

$

|

61,286

|

|

||

|

Allowance for loan losses

|

$

|

4,344

|

|

$

|

3,497

|

|

$

|

3,236

|

|

||

|

30+ days past due as a % of period-end loan receivables

(11)

|

4.32

|

%

|

4.06

|

%

|

4.14

|

%

|

|||||

|

90+ days past due as a % of period-end loan receivables

(11)

|

2.03

|

%

|

1.86

|

%

|

1.90

|

%

|

|||||

|

Total active accounts (in thousands)

(4)

|

71,890

|

|

68,314

|

|

64,286

|

|

|||||

|

(1)

|

Average balances and related selected metrics for the years ended December 31, 2016 and 2015 are now presented in the table above based upon daily balances. Average balances and related selected metrics for the year ended December 31, 2014 are based on monthly balances, including beginning of period balances, except where monthly balances are unavailable and quarterly balances are used. See “—

Average Balance Sheet

” for additional information.

|

|

(2)

|

Certain balance sheet amounts and related metrics have been updated to reflect the adoption of ASU 2015-03. See Note 2.

Basis of Presentation and Summary of Significant Accounting Policies

to our consolidated and combined financial statements for a more detailed discussion.

|

|

(3)

|

Purchase volume, or net credit sales, represents the aggregate amount of charges incurred on credit cards or other credit product accounts less returns during the period. Purchase volume includes activity related to our portfolios classified as held for sale.

|

|

(4)

|

Active accounts represent credit card or installment loan accounts on which there has been a purchase, payment or outstanding balance in the current month.

|

|

(5)

|

Net interest margin represents net interest income divided by average interest-earning assets.

|

|

(6)

|

Allowance coverage ratio represents allowance for loan losses divided by total period-end loan receivables.

|

|

(7)

|

Return on assets represents net earnings as a percentage of average total assets.

|

|

(8)

|

Return on equity represents net earnings as a percentage of average total equity.

|

|

(9)

|

Equity to assets represents average equity as a percentage of average total assets.

|

|

(10)

|

Efficiency ratio represents (i) other expense, divided by (ii) net interest income, after retailer share arrangements, plus other income.

|

|

(11)

|

Based on customer statement-end balances extrapolated to the respective period-end date.

|

|

|

2016

|

2015

|

2014

|

|||||||||||||||||||||||||||||

|

Years ended December 31 ($ in millions)

|

Average

Balance

(1)

|

Interest

Income /

Expense

|

Average

Yield /

Rate

(3)

|

Average

Balance

(1)

|

Interest

Income/

Expense

|

Average

Yield /

Rate

(3)

|

Average

Balance

(2)

|

Interest

Income/

Expense

|

Average

Yield /

Rate

(3)

|

|||||||||||||||||||||||

|

Assets

|

||||||||||||||||||||||||||||||||

|

Interest-earning assets:

|

||||||||||||||||||||||||||||||||

|

Interest-earning cash and equivalents

(4)

|

$

|

12,152

|

|

$

|

63

|

|

0.52

|

%

|

$

|

11,409

|

|

$

|

28

|

|

0.25

|

%

|

$

|

8,230

|

|

$

|

16

|

|

0.19

|

%

|

||||||||

|

Securities available for sale

|

3,220

|

|

33

|

|

1.02

|

%

|

3,240

|

|

21

|

|

0.65

|

%

|

487

|

|

10

|

|

2.05

|

%

|

||||||||||||||

|

Loan receivables

(5)

:

|

||||||||||||||||||||||||||||||||

|

Credit cards, including held for sale

|

65,947

|

|

14,424

|

|

21.87

|

%

|

59,118

|

|

12,932

|

|

21.87

|

%

|

54,686

|

|

11,967

|

|

21.88

|

%

|

||||||||||||||

|

Consumer installment loans

|

1,274

|

|

117

|

|

9.18

|

%

|

1,119

|

|

104

|

|

9.29

|

%

|

1,025

|

|

99

|

|

9.66

|

%

|

||||||||||||||

|

Commercial credit products

|

1,372

|

|

139

|

|

10.13

|

%

|

1,373

|

|

142

|

|

10.34

|

%

|

1,373

|

|

149

|

|

10.85

|

%

|

||||||||||||||

|

Other

|

56

|

|

2

|

|

3.57

|

%

|

45

|

|

1

|

|

2.22

|

%

|

17

|

|

1

|

|

5.88

|

%

|

||||||||||||||

|

Total loan receivables

|

68,649

|

|

14,682

|

|

21.39

|

%

|

61,655

|

|

13,179

|

|

21.38

|

%

|

57,101

|

|

12,216

|

|

21.39

|

%

|

||||||||||||||

|

Total interest-earning assets

|

84,021

|

|

14,778

|

|

17.59

|

%

|

76,304

|

|

13,228

|

|

17.34

|

%

|

65,818

|

|

12,242

|

|

18.60

|

%

|

||||||||||||||

|

Non-interest-earning assets:

|

||||||||||||||||||||||||||||||||

|

Cash and due from banks

|

965

|

|

1,086

|

|

881

|

|

||||||||||||||||||||||||||

|

Allowance for loan losses

|

(3,872

|

)

|

(3,341

|

)

|

(3,039

|

)

|

||||||||||||||||||||||||||

|

Other assets

|

3,286

|

|

2,779

|

|

2,359

|

|

||||||||||||||||||||||||||

|

Total non-interest-earning assets

|

379

|

|

524

|

|

201

|

|

||||||||||||||||||||||||||

|

Total assets

|

$

|

84,400

|

|

$

|

76,828

|

|

$

|

66,019

|

|

|||||||||||||||||||||||

|

Liabilities

|

||||||||||||||||||||||||||||||||

|

Interest-bearing liabilities:

|

||||||||||||||||||||||||||||||||

|

Interest-bearing deposit accounts

|

$

|

47,194

|

|

$

|

727

|

|

1.54

|

%

|

$

|

38,060

|

|

$

|

607

|

|

1.59

|

%

|

$

|

30,017

|

|

$

|

470

|

|

1.57

|

%

|

||||||||

|

Borrowings of consolidated securitization entities

|

12,428

|

|

244

|

|

1.96

|

%

|

13,760

|

|

215

|

|

1.56

|

%

|

14,820

|

|

215

|

|

1.45

|

%

|

||||||||||||||

|

Bank term loan

(6)

|

556

|

|

31

|

|

5.58

|

%

|

5,164

|

|

136

|

|

2.63

|

%

|

3,039

|

|

74

|

|

2.44

|

%

|

||||||||||||||

|

Senior unsecured notes

|

7,158

|

|

246

|

|

3.44

|

%

|

4,996

|

|

173

|

|

3.46

|

%

|

1,374

|

|

50

|

|

3.64

|

%

|

||||||||||||||

|

Related party debt

|

—

|

|

—

|

|

—

|

%

|

86

|

|

4

|

|

4.65

|

%

|

5,335

|

|

113

|

|

2.12

|

%

|

||||||||||||||

|

Total interest-bearing liabilities

|

67,336

|

|

1,248

|

|

1.85

|

%

|

62,066

|

|

1,135

|

|

1.83

|

%

|

54,585

|

|

922

|

|

1.69

|

%

|

||||||||||||||

|

Non-interest-bearing liabilities:

|

||||||||||||||||||||||||||||||||

|

Non-interest-bearing deposit accounts

|

205

|

|

202

|

|

240

|

|

||||||||||||||||||||||||||

|

Other liabilities

|

3,239

|

|

2,877

|

|

3,306

|

|

||||||||||||||||||||||||||

|

Total non-interest-bearing liabilities

|

3,444

|

|

3,079

|

|

3,546

|

|

||||||||||||||||||||||||||

|

Total liabilities

|

70,780

|

|

65,145

|

|

58,131

|

|

||||||||||||||||||||||||||

|

Equity

|

||||||||||||||||||||||||||||||||

|

Total equity

|

13,620

|

|

11,683

|

|

7,888

|

|

||||||||||||||||||||||||||

|

Total liabilities and equity

|

$

|

84,400

|

|

$

|

76,828

|

|

|

$

|

66,019

|

|

||||||||||||||||||||||

|

Interest rate spread

(7)

|

15.74

|

%

|

15.51

|

%

|

16.91

|

%

|

||||||||||||||||||||||||||

|

Net interest income

|

$

|

13,530

|

|

$

|

12,093

|

|

$

|

11,320

|

|

|||||||||||||||||||||||

|

Net interest margin

(8)

|

16.10

|

%

|

15.85

|

%

|

17.20

|

%

|

||||||||||||||||||||||||||

|

(1)

|

Average balances for the year ended

December 31, 2016

are now presented in the table above, and throughout

Management's Discussion and Analysis of Financial Condition and Results of Operations

where applicable, based upon daily balances. Average balances for the year ended December 31, 2015 have been revised to conform to the current year presentation.

|

|

(2)

|

Average balances for the year ended December 31, 2014 are based on monthly balances, including beginning of period balances, except where monthly balances are unavailable and quarterly balances are used. Collection of daily averages for this period involves undue burden and expense. We believe our average balance sheet data appropriately incorporates the seasonality in the level of our loan receivables and is representative of our operations.

|

|

(3)

|

Average yields/rates are based on total interest income/expense over average balances.

|

|

(4)

|

Includes average restricted cash balances of

$436 million

,

$527 million

and

$331 million

for the years ended

December 31, 2016

,

2015

and

2014

, respectively.

|

|

(5)

|

Interest income on loan receivables includes fees on loans of

$2,458 million

,

$2,235 million

and

$2,129 million

for the years ended

December 31, 2016

,

2015

and

2014

, respectively.

|

|

(6)

|

The effective interest rates for the Bank term loan for the years ended

December 31, 2016

and

2015

were 2.48% and 2.23%, respectively. The Bank term loan effective rate excludes the impact of charges incurred in connection with prepayments of the loan.

|

|

(7)

|

Interest rate spread represents the difference between the yield on total interest-earning assets and the rate on total interest-bearing liabilities.

|

|

(8)

|

Net interest margin represents net interest income divided by average total interest-earning assets.

|

|

2016 vs. 2015

|

2015 vs. 2014

|

||||||||||||||||||||||

|

Increase (decrease) due to change in:

|

Increase (decrease) due to change in:

|

||||||||||||||||||||||

|

($ in millions)

|

Average Volume

|

Average Yield / Rate

|

Net Change

|

Average Volume

|

Average Yield / Rate

|

Net Change

|

|||||||||||||||||

|

Interest-earning assets:

|

|||||||||||||||||||||||

|

Interest-earning cash and equivalents

|

$

|

2

|

|

$

|

33

|

|

$

|

35

|

|

$

|

7

|

|

$

|

5

|

|

$

|

12

|

|

|||||

|

Securities available for sale

|

—

|

|

12

|

|

12

|

|

22

|

|

(11

|

)

|

11

|

|

|||||||||||

|

Loan receivables:

|

|||||||||||||||||||||||

|

Credit cards, including held for sale

|

1,492

|

|

—

|

|

1,492

|

|

970

|

|

(5

|

)

|

965

|

|

|||||||||||

|

Consumer installment loans

|

14

|

|

(1

|

)

|

13

|

|

9

|

|

(4

|

)

|

5

|

|

|||||||||||

|

Commercial credit products

|

—

|

|

(3

|

)

|

(3

|

)

|

—

|

|

(7

|

)

|

(7

|

)

|

|||||||||||

|

Other

|

—

|

|

1

|

|

1

|

|

1

|

|

(1

|

)

|

—

|

|

|||||||||||

|

Total loan receivables

|

1,506

|

|

(3

|

)

|

1,503

|

|

980

|

|

(17

|

)

|

963

|

|

|||||||||||

|

Change in interest income from total interest-earning assets

|

$

|

1,508

|

|

$

|

42

|

|

$

|

1,550

|

|

$

|

1,009

|

|

$

|

(23

|

)

|

$

|

986

|

|

|||||

|

Interest-bearing liabilities:

|

|||||||||||||||||||||||

|

Interest-bearing deposit accounts

|

$

|

140

|

|

$

|

(20

|

)

|

$

|

120

|

|

$

|

131

|

|

$

|

6

|

|

$

|

137

|

|

|||||

|

Borrowings of consolidated securitization entities

|

(22

|

)

|

51

|

|

29

|

|

(15

|

)

|

15

|

|

—

|

|

|||||||||||

|

Bank term loan

|

(129

|

)

|

24

|

|

(105

|

)

|

56

|

|

6

|

|

62

|

|

|||||||||||

|

Senior unsecured notes

|

74

|

|

(1

|

)

|

73

|

|

125

|

|

(2

|

)

|

123

|

|

|||||||||||

|

Related party debt

|

(4

|

)

|

—

|

|

(4

|

)

|

(171

|

)

|

62

|

|

(109

|

)

|

|||||||||||

|

Change in interest expense from total interest-bearing liabilities

|

59

|

|

54

|

|

113

|

|

126

|

|

87

|

|

213

|

|

|||||||||||

|

Total change in net interest income

|

$

|

1,449

|

|

$

|

(12

|

)

|

$

|

1,437

|

|

$

|

883

|

|

$

|

(110

|

)

|

$

|

773

|

|

|||||

|

•

|

purchase volumes, which are influenced by a number of factors including macroeconomic conditions and consumer confidence generally, our partners’ sales and our ability to increase our share of those sales;

|

|

•

|

payment rates, reflecting the extent to which customers maintain a credit balance;

|

|

•

|

charge-offs, reflecting the receivables that are deemed not to be collectible;

|

|

•

|

the size of our liquidity portfolio; and

|

|

•

|

portfolio acquisitions when we enter into new partner relationships.

|

|

•

|

pricing (contractual rates of interest, movement in prime rates, late fees and merchant discount rates);

|

|

•

|

changes to our mix of loans (e.g., the number of loans bearing promotional rates as compared to standard rates);

|

|

•

|

frequency of late fees incurred when account holders fail to make their minimum payment by the required due date;

|

|

•

|

credit performance and accrual status of our loans; and

|

|

•

|

yield earned on our liquidity portfolio.

|

|

Years ended December 31 ($ in millions)

|

2016

|

2015

|

2014

|

||||||||

|

Loan receivables, including held for sale

|

$

|

68,649

|

|

$

|

61,655

|

|

$

|

57,101

|

|

||

|

Liquidity portfolio and other

|

15,372

|

|

14,649

|

|

8,717

|

|

|||||

|

Total average interest-earning assets

|

$

|

84,021

|

|

$

|

76,304

|

|

$

|

65,818

|

|

||

|

•

|

the amounts outstanding of our deposits and borrowings;

|

|

•

|

the interest rate environment and its effect on interest rates paid on our funding sources; and

|

|

•

|

the changing mix in our funding sources.

|

|

Years ended December 31 ($ in millions)

|

2016

|

2015

|

2014

|

||||||||

|

Interest-bearing deposit accounts

|

$

|

47,194

|

|

$

|

38,060

|

|

$

|

30,017

|

|

||

|

Borrowings of consolidated securitization entities

|

12,428

|

|

13,760

|

|

14,820

|

|

|||||

|

Third-party debt

|

7,714

|

|

10,160

|

|

4,413

|

|

|||||

|

Related party debt

|

—

|

|

86

|

|

5,335

|

|

|||||

|

Total average interest-bearing liabilities

|

$

|

67,336

|

|

$

|

62,066

|

|

$

|

54,585

|

|

||

|

Years ended December 31 ($ in millions)

|

2016

|

2015

|

2014

|

||||||||

|

Interchange revenue

|

$

|

602

|

|

$

|

505

|

|

$

|

389

|

|

||

|

Debt cancellation fees

|

262

|

|

249

|

|

275

|

|

|||||

|

Loyalty programs

|

(547

|

)

|

(419

|

)

|

(281

|

)

|

|||||

|

Other

|

27

|

|

57

|

|

102

|

|

|||||

|

Total other income

|

$

|

344

|

|

$

|

392

|

|

$

|

485

|

|

||

|

Years ended December 31 ($ in millions)

|

2016

|

2015

|

2014

|

||||||||

|

Employee costs

|

$

|

1,207

|

|

$

|

1,042

|

|

$

|

866

|

|

||

|

Professional fees

|

638

|

|

645

|

|

563

|

|

|||||

|

Marketing and business development

|

423

|

|

433

|

|

460

|

|

|||||

|

Information processing

|

338

|

|

297

|

|

212

|

|

|||||

|

Other

|

810

|

|

847

|

|

826

|

|

|||||

|

Total other expense

|

$

|

3,416

|

|

$

|

3,264

|

|

$

|

2,927

|

|

||

|

Years ended December 31 ($ in millions)

|

2016

|

2015

|

2014

|

||||||||

|

Effective tax rate

|

36.9

|

%

|

37.3

|

%

|

37.7

|

%

|

|||||

|

Provision for income taxes

|

$

|

1,319

|

|

$

|

1,317

|

|

$

|

1,277

|

|

||

|

Years ended December 31 ($ in millions)

|

2016

|

2015

|

2014

|

||||||||

|

Purchase volume

|

$

|

101,242

|

|

$

|

92,190

|

|

$

|

83,591

|

|

||

|

Period-end loan receivables

|

$

|

52,701

|

|

$

|

47,412

|

|

$

|

42,308

|

|

||

|

Average loan receivables, including held for sale

|

$

|

46,963

|

|

$

|

42,327

|

|

$

|

39,278

|

|

||

|

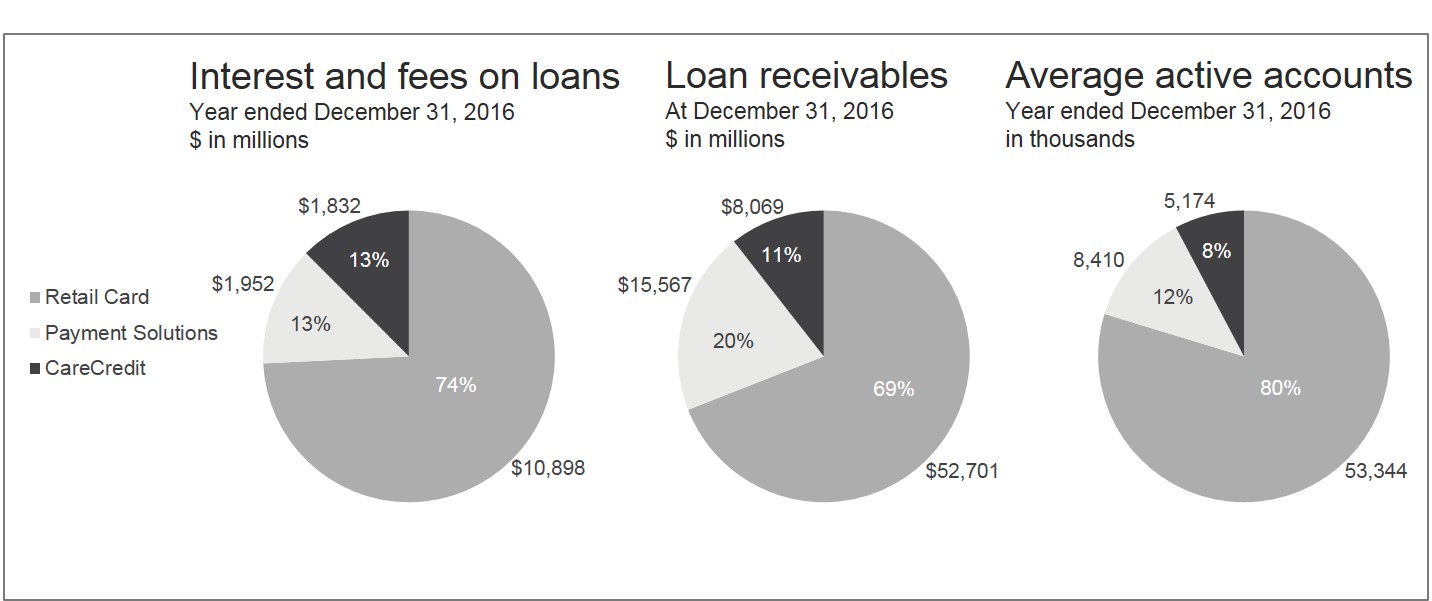

Average active accounts (in thousands)

|

53,344

|

|

50,358

|

|

48,599

|

|

|||||

|

Interest and fees on loans

|

$

|

10,898

|

|

$

|

9,774

|

|

$

|

9,040

|

|

||

|

Retailer share arrangements

|

$

|

(2,870

|

)

|

$

|

(2,688

|

)

|

$

|

(2,530

|

)

|

||

|

Other income

|

$

|

288

|

|

$

|

339

|

|

$

|

407

|

|

||

|

Years ended December 31 ($ in millions)

|

2016

|

2015

|

2014

|

||||||||

|

Purchase volume

|

$

|

15,641

|

|

$

|

13,668

|

|

$

|

12,447

|

|

||

|

Period-end loan receivables

|

$

|

15,567

|

|

$

|

13,543

|

|

$

|

12,095

|

|

||

|

Average loan receivables

|

$

|

14,110

|

|

$

|

12,364

|

|

$

|

11,171

|

|

||

|

Average active accounts (in thousands)

|

8,410

|

|

7,478

|

|

6,869

|

|

|||||

|

Interest and fees on loans

|

$

|

1,952

|

|

$

|

1,719

|

|

$

|

1,582

|

|

||

|

Retailer share arrangements

|

$

|

(26

|

)

|

$

|

(45

|

)

|

$

|

(41

|

)

|

||

|

Other income

|

$

|

13

|

|

$

|

17

|

|

$

|

32

|

|

||

|

Years ended December 31 ($ in millions)

|

2016

|

2015

|

2014

|

||||||||

|

Purchase volume

|

$

|

8,585

|

|

$

|

7,757

|

|

$

|

7,111

|

|

||

|

Period-end loan receivables

|

$

|

8,069

|

|

$

|

7,335

|

|

$

|

6,883

|

|

||

|

Average loan receivables

|

$

|

7,576

|

|

$

|

6,964

|

|

$

|

6,652

|

|

||

|

Average active accounts (in thousands)

|

5,174

|

|

4,807

|

|

4,541

|

|

|||||

|

Interest and fees on loans

|

$

|

1,832

|

|

$

|

1,686

|

|

$

|

1,594

|

|

||

|

Retailer share arrangements

|

$

|

(6

|

)

|

$

|

(5

|

)

|

$

|

(4

|

)

|

||

|

Other income

|

$

|

43

|

|

$

|

36

|

|

$

|

46

|

|

||

|

|

2016

|

2015

|

2014

|

||||||||||||||||||||

|

At December 31 ($ in millions)

|

Amortized

Cost

|

Estimated Fair Value

|

Amortized

Cost

|

Estimated Fair Value

|

Amortized

Cost |

Estimated Fair Value

|

|||||||||||||||||

|

Debt:

|

|||||||||||||||||||||||

|

U.S. government and federal agency

|

$

|

3,676

|

|

$

|

3,676

|

|

$

|

2,768

|

|

$

|

2,761

|

|

$

|

1,252

|

|

$

|

1,252

|

|

|||||

|

State and municipal

|

47

|

|

46

|

|

51

|

|

49

|

|

57

|

|

57

|

|

|||||||||||

|

Residential mortgage-backed

|

1,400

|

|

1,373

|

|

323

|

|

317

|

|

271

|

|

271

|

|

|||||||||||

|

U.S. corporate debt

|

—

|

|

—

|

|

—

|

|

—

|

|

3

|

|

3

|

|

|||||||||||

|

Equity

|

15

|

|

15

|

|

15

|

|

15

|

|

15

|

|

15

|

|

|||||||||||

|

Total

|

$

|

5,138

|

|

$

|

5,110

|

|

$

|

3,157

|

|

$

|

3,142

|

|

$

|

1,598

|

|

$

|

1,598

|

|

|||||

|

($ in millions)

|

Due in 1 Year

or Less

|

Due After 1

through

5 Years

|

Due After 5

through

10 Years

|

Due After

10 years

|

Total

|

||||||||||||||

|

Debt:

|

|||||||||||||||||||

|

U.S. government and federal agency

|

$

|

3,476

|

|

$

|

200

|

|

$

|

—

|

|

$

|

—

|

|

$

|

3,676

|

|

||||

|

State and municipal

|

—

|

|

1

|

|

1

|

|

44

|

|

46

|

|

|||||||||

|

Residential mortgage-backed

|

—

|

|

—

|

|

—

|

|

1,373

|

|

1,373

|

|

|||||||||

|

Total

(1)

|

$

|

3,476

|

|

$

|

201

|

|

$

|

1

|

|

$

|

1,417

|

|

$

|

5,095

|