|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM 10-K

|

||||

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Michigan

|

|

38-1239739

|

|

(State of incorporation)

|

|

(I.R.S. Employer Identification No.)

|

|

2825 Airview Boulevard, Kalamazoo, Michigan

|

|

49002

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Common Stock, $.10 par value

|

|

New York Stock Exchange

|

|

Large accelerated filer

x

|

|

Accelerated filer

¨

|

|

Non-accelerated filer

¨

|

|

Smaller reporting company

¨

|

|

PART I

|

|||

|

Item 1.

|

Business

|

1

|

|

|

Item 1A.

|

Risk Factors

|

3

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

6

|

|

|

Item 2.

|

Properties

|

6

|

|

|

Item 3.

|

Legal Proceedings

|

6

|

|

|

Item 4.

|

Removed and Reserved

|

6

|

|

|

PART II

|

|||

|

Item 5.

|

Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

7

|

|

|

Item 6.

|

Selected Financial Data

|

8

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

9

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

18

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

19

|

|

|

Report of Independent Registered Public Accounting Firm on Consolidated Financial Statements

|

19

|

|

|

|

Consolidated Statements of Earnings

|

20

|

|

|

|

Consolidated Balance Sheets

|

21

|

|

|

|

Consolidated Statements of Shareholders’ Equity

|

22

|

|

|

|

Consolidated Statements of Cash Flows

|

23

|

|

|

|

Notes to Consolidated Financial Statements

|

24

|

|

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

40

|

|

|

Item 9A.

|

Controls and Procedures

|

40

|

|

|

Item 9B.

|

Other Information

|

42

|

|

|

PART III

|

|||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

42

|

|

|

Item 11.

|

Executive Compensation

|

42

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

42

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

43

|

|

|

Item 14.

|

Principal Accounting Fees and Services

|

43

|

|

|

PART IV

|

|||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

43

|

|

|

ITEM 1.

|

BUSINESS.

|

|

1

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

2

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

ITEM 1A.

|

RISK FACTORS.

|

|

3

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

4

|

||

|

5

|

||

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS.

|

|

ITEM 2.

|

PROPERTIES.

|

|

Location

|

Segment

|

Square

Feet

|

Owned/

Leased

|

||||

|

Mahwah, New Jersey

|

Reconstructive

|

531,000

|

|

Owned

|

|||

|

Kiel, Germany

|

Reconstructive

|

174,000

|

|

Owned

|

|||

|

Suzhou, China

|

Reconstructive, Neurotechnology and Spine

|

155,000

|

|

Owned

|

|||

|

Carrigtwohill, Ireland

|

Reconstructive, MedSurg

|

154,000

|

|

Owned

|

|||

|

Limerick, Ireland

|

Reconstructive

|

130,000

|

|

Owned

|

|||

|

Newbury, UK

|

Reconstructive, MedSurg

|

99,000

|

|

Owned

|

|||

|

Malvern, Pennsylvania

|

Reconstructive

|

88,000

|

|

Leased

|

|||

|

Selzach, Switzerland

|

Reconstructive

|

78,000

|

|

Owned

|

|||

|

Newnan, Georgia

|

Reconstructive

|

54,000

|

|

Leased

|

|||

|

Portage, Michigan

|

MedSurg

|

1,034,000

|

|

Owned

|

|||

|

Arroyo, Puerto Rico

|

MedSurg

|

220,000

|

|

Leased

|

|||

|

San Jose, California

|

MedSurg

|

204,000

|

|

Leased

|

|||

|

Lakeland, Florida

|

MedSurg

|

125,000

|

|

Leased

|

|||

|

Flower Mound, Texas

|

MedSurg

|

114,000

|

|

Leased

|

|||

|

Buffalo, New York

|

MedSurg

|

112,000

|

|

Owned

|

|||

|

Freiburg, Germany

|

MedSurg, Neurotechnology and Spine

|

106,000

|

|

Owned

|

|||

|

Phoenix, Arizona

|

MedSurg

|

95,000

|

|

Leased

|

|||

|

Neuchâtel, Switzerland

|

Neurotechnology and Spine

|

88,000

|

|

Owned

|

|||

|

Bordeaux, France

|

Neurotechnology and Spine

|

79,000

|

|

Owned

|

|||

|

Bordeaux, France

|

Neurotechnology and Spine

|

35,000

|

|

Leased

|

|||

|

Stetten, Germany

|

Neurotechnology and Spine

|

33,000

|

|

Owned

|

|||

|

ITEM 3.

|

LEGAL PROCEEDINGS.

|

|

ITEM 4.

|

REMOVED AND RESERVED.

|

|

6

|

||

|

ITEM 5.

|

MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

|

|

|

2011 Quarter Ended

|

2010 Quarter Ended

|

||||||||||||||||||||||||||||||

|

|

Mar. 31

|

June 30

|

Sept. 30

|

Dec. 31

|

Mar. 31

|

June 30

|

Sept. 30

|

Dec. 31

|

||||||||||||||||||||||||

|

Dividends declared per share of common stock

|

$

|

0.18

|

|

$

|

0.18

|

|

$

|

0.18

|

|

$

|

0.2125

|

|

$

|

0.15

|

|

$

|

0.15

|

|

$

|

0.15

|

|

$

|

0.18

|

|

||||||||

|

Market price of common stock:

|

||||||||||||||||||||||||||||||||

|

High

|

65.20

|

|

64.61

|

|

60.64

|

|

51.13

|

|

58.49

|

|

59.72

|

|

53.29

|

|

55.00

|

|

||||||||||||||||

|

Low

|

53.50

|

|

56.58

|

|

43.73

|

|

44.56

|

|

49.85

|

|

48.76

|

|

42.74

|

|

48.13

|

|

||||||||||||||||

|

Period

|

Total Number

of Shares

Purchased

|

Average Price

Paid

Per Share

|

Total Number of

Shares Purchased as

Part of Publicly

Announced Plans

|

Maximum

Dollar Value

of Shares that may

yet be Purchased

Under the Plans

|

||||||||||

|

October 1, 2011—October 31, 2011

|

0.5

|

|

$

|

45.98

|

|

0.5

|

|

$

|

262

|

|

||||

|

November 1, 2011—November 30, 2011

|

0.9

|

|

$

|

46.95

|

|

0.9

|

|

$

|

219

|

|

||||

|

December 1, 2011—December 31, 2011

|

0.4

|

|

$

|

46.97

|

|

0.4

|

|

$

|

203

|

|

||||

|

Total

|

1.8

|

|

$

|

46.66

|

|

1.8

|

|

|

||||||

|

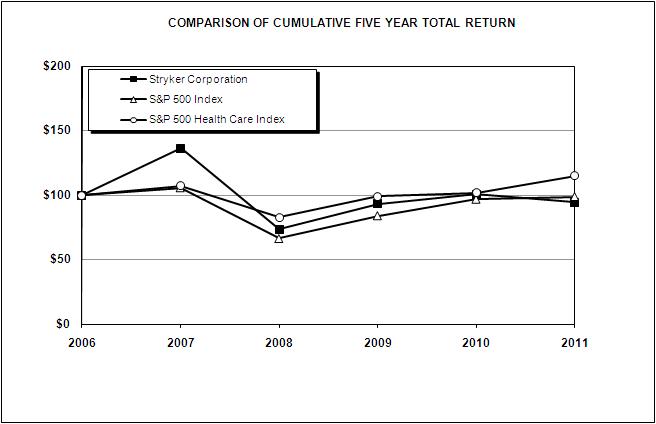

Company / Index

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

||||||||||||

|

Stryker Corporation

|

100.00

|

|

136.18

|

|

73.54

|

|

93.18

|

|

100.54

|

|

94.39

|

|

||||||

|

S&P 500 Index

|

100.00

|

|

105.49

|

|

66.46

|

|

84.05

|

|

96.71

|

|

98.76

|

|

||||||

|

S&P 500 Health Care Index

|

100.00

|

|

107.15

|

|

82.71

|

|

99.00

|

|

101.87

|

|

114.84

|

|

||||||

|

7

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

ITEM 6.

|

SELECTED FINANCIAL DATA.

|

|

CONSOLIDATED OPERTATIONS

|

2011

|

2010

|

2009

|

2008

|

2007

|

|||||||||||||||

|

Net sales

|

$

|

8,307

|

|

$

|

7,320

|

|

$

|

6,723

|

|

$

|

6,718

|

|

$

|

6,000

|

|

|||||

|

Cost of sales

|

2,811

|

|

2,286

|

|

2,184

|

|

2,131

|

|

1,865

|

|

||||||||||

|

Gross profit

|

5,496

|

|

5,034

|

|

4,539

|

|

4,587

|

|

4,135

|

|

||||||||||

|

Research, development and engineering expenses

|

462

|

|

394

|

|

336

|

|

368

|

|

375

|

|

||||||||||

|

Selling, general and administrative expenses

|

3,150

|

|

2,707

|

|

2,506

|

|

2,625

|

|

2,392

|

|

||||||||||

|

Intangibles amortization

|

122

|

|

58

|

|

36

|

|

40

|

|

41

|

|

||||||||||

|

Other (a)

|

76

|

|

124

|

|

67

|

|

35

|

|

20

|

|

||||||||||

|

3,810

|

|

3,283

|

|

2,945

|

|

3,068

|

|

2,828

|

|

|||||||||||

|

Operating income

|

1,686

|

|

1,751

|

|

1,594

|

|

1,519

|

|

1,307

|

|

||||||||||

|

Other income (expense)

|

—

|

|

(22

|

)

|

30

|

|

61

|

|

63

|

|

||||||||||

|

Earnings from continuing operations before income taxes

|

1,686

|

|

1,729

|

|

1,624

|

|

1,580

|

|

1,370

|

|

||||||||||

|

Income taxes

|

341

|

|

456

|

|

517

|

|

432

|

|

383

|

|

||||||||||

|

Net earnings from continuing operations

|

1,345

|

|

1,273

|

|

1,107

|

|

1,148

|

|

987

|

|

||||||||||

|

Net earnings and gain on sale of discontinued operations

|

—

|

|

—

|

|

—

|

|

—

|

|

30

|

|

||||||||||

|

Net earnings

|

$

|

1,345

|

|

$

|

1,273

|

|

$

|

1,107

|

|

$

|

1,148

|

|

$

|

1,017

|

|

|||||

|

PER SHARE DATA

|

||||||||||||||||||||

|

Net earnings from continuing operations per share of common stock:

|

||||||||||||||||||||

|

Basic

|

$

|

3.48

|

|

$

|

3.21

|

|

$

|

2.79

|

|

$

|

2.81

|

|

$

|

2.41

|

|

|||||

|

Diluted

|

$

|

3.45

|

|

$

|

3.19

|

|

$

|

2.77

|

|

$

|

2.78

|

|

$

|

2.37

|

|

|||||

|

Net earnings per share of common stock:

|

||||||||||||||||||||

|

Basic

|

$

|

3.48

|

|

$

|

3.21

|

|

$

|

2.79

|

|

$

|

2.81

|

|

$

|

2.48

|

|

|||||

|

Diluted

|

$

|

3.45

|

|

$

|

3.19

|

|

$

|

2.77

|

|

$

|

2.78

|

|

$

|

2.44

|

|

|||||

|

Dividends per share of common stock:

|

||||||||||||||||||||

|

Declared

|

$

|

0.7525

|

|

$

|

0.63

|

|

$

|

0.25

|

|

$

|

0.40

|

|

$

|

0.33

|

|

|||||

|

Paid

|

$

|

0.72

|

|

$

|

0.60

|

|

$

|

0.50

|

|

$

|

0.33

|

|

$

|

0.22

|

|

|||||

|

Average number of shares outstanding—in millions:

|

||||||||||||||||||||

|

Basic

|

386.5

|

|

396.4

|

|

397.4

|

|

408.1

|

|

409.7

|

|

||||||||||

|

Diluted

|

389.5

|

|

399.5

|

|

399.4

|

|

413.6

|

|

417.2

|

|

||||||||||

|

CONSOLIDATED FINANCIAL POSITION

|

||||||||||||||||||||

|

Cash and current marketable securities

|

$

|

3,418

|

|

$

|

4,380

|

|

$

|

2,955

|

|

$

|

2,196

|

|

$

|

2,411

|

|

|||||

|

Accounts Receivable—net

|

1,417

|

|

1,252

|

|

1,147

|

|

1,130

|

|

1,031

|

|

||||||||||

|

Inventory—net

|

1,283

|

|

1,057

|

|

943

|

|

953

|

|

796

|

|

||||||||||

|

Property, plant and equipment—net

|

888

|

|

798

|

|

948

|

|

964

|

|

992

|

|

||||||||||

|

Capital expenditures

|

226

|

|

182

|

|

131

|

|

155

|

|

188

|

|

||||||||||

|

Depreciation and amortization

|

481

|

|

410

|

|

385

|

|

388

|

|

367

|

|

||||||||||

|

Total assets

|

12,405

|

|

10,895

|

|

9,071

|

|

7,603

|

|

7,354

|

|

||||||||||

|

Accounts Payable—net

|

345

|

|

292

|

|

200

|

|

274

|

|

265

|

|

||||||||||

|

Long-term debt, including current maturities

|

1,768

|

|

1,021

|

|

18

|

|

21

|

|

17

|

|

||||||||||

|

Shareholders’ equity

|

7,683

|

|

7,174

|

|

6,595

|

|

5,407

|

|

5,379

|

|

||||||||||

|

Net cash provided by operating activities

|

1,434

|

|

1,547

|

|

1,461

|

|

1,176

|

|

1,028

|

|

||||||||||

|

OTHER DATA

|

||||||||||||||||||||

|

Number of shareholders of record

|

4,508

|

|

4,586

|

|

4,607

|

|

4,500

|

|

4,373

|

|

||||||||||

|

Number of employees

|

21,241

|

|

20,036

|

|

18,582

|

|

17,594

|

|

16,026

|

|

||||||||||

|

8

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

|

|

9

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

Percent Change

|

||||||||

|

2011

|

2010

|

2009

|

2011/ 2010

|

2010/ 2009

|

||||

|

Net Sales

|

$8,307

|

$7,320

|

$6,723

|

13.5

|

|

8.9

|

|

|

|

Gross Profit

|

5,496

|

5,034

|

4,539

|

9.2

|

|

10.9

|

|

|

|

Research, development & engineering expenses

|

462

|

394

|

336

|

17.3

|

|

17.3

|

|

|

|

Selling, general & administrative expenses

|

3,150

|

2,707

|

2,506

|

16.4

|

|

8.0

|

|

|

|

Intangible amortization

|

122

|

58

|

36

|

110.3

|

|

61.1

|

|

|

|

Property, plant and equipment impairment

|

—

|

124

|

—

|

(100.0

|

)

|

—

|

|

|

|

Restructuring charges

|

76

|

—

|

67

|

—

|

|

(100.0

|

)

|

|

|

Other income (expense)

|

—

|

(22)

|

30

|

(100.0

|

)

|

—

|

|

|

|

Income taxes

|

341

|

456

|

517

|

(25.2

|

)

|

(11.8

|

)

|

|

|

Net Earnings

|

$1,345

|

$1,273

|

$1,107

|

5.7

|

|

15.0

|

|

|

|

Diluted Net Earnings per share

|

$3.45

|

$3.19

|

$2.77

|

8.2

|

|

15.2

|

|

|

|

|

|

|

|

Percentage Change

|

||||||||||||||||||

|

|

2011/2010

|

2010/2009

|

||||||||||||||||||||

|

|

Net Sales

|

Reported

|

Constant

Currency

|

Reported

|

Constant

Currency

|

|||||||||||||||||

|

|

2011

|

2010

|

2009

|

|||||||||||||||||||

|

Geographic sales:

|

||||||||||||||||||||||

|

United States

|

$

|

5,269

|

|

$

|

4,793

|

|

$

|

4,317

|

|

9.9

|

9.9

|

|

11.0

|

11.0

|

|

|||||||

|

International

|

3,038

|

|

2,527

|

|

2,406

|

|

20.2

|

13.4

|

|

5.0

|

2.2

|

|

||||||||||

|

Total net sales

|

$

|

8,307

|

|

$

|

7,320

|

|

$

|

6,723

|

|

13.5

|

11.1

|

|

8.9

|

7.8

|

|

|||||||

|

Segment sales:

|

||||||||||||||||||||||

|

Reconstructive

|

$

|

3,710

|

|

$

|

3,549

|

|

$

|

3,384

|

|

4.5

|

1.5

|

|

4.9

|

3.5

|

|

|||||||

|

MedSurg

|

3,160

|

|

2,803

|

|

2,427

|

|

12.7

|

11.2

|

|

15.5

|

14.7

|

|

||||||||||

|

Neurotechnology and Spine

|

1,437

|

|

968

|

|

912

|

|

48.5

|

46.4

|

|

6.1

|

5.6

|

|

||||||||||

|

Total net sales

|

$

|

8,307

|

|

$

|

7,320

|

|

$

|

6,723

|

|

13.5

|

11.1

|

|

8.9

|

7.8

|

|

|||||||

|

10

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

Year Ended December 31

|

|||||||||||||

|

% Change

|

|||||||||||||

|

U.S.

|

International

|

||||||||||||

|

2011

|

2010

|

As Reported

|

Constant Currency

|

As Reported

|

As Reported

|

Constant Currency

|

|||||||

|

Reconstructive

|

|||||||||||||

|

Hips

|

1,228

|

|

1,154

|

|

6.4

|

2.9

|

|

2.1

|

|

11.2

|

|

3.8

|

|

|

Knees

|

1,316

|

|

1,306

|

|

0.8

|

(1.5

|

)

|

(2.3

|

)

|

6.8

|

|

0.1

|

|

|

Trauma and Extremities

|

931

|

|

845

|

|

10.2

|

6.5

|

|

10.2

|

|

10.2

|

|

3.4

|

|

|

Total Reconstructive

|

3,710

|

|

3,549

|

|

4.5

|

1.5

|

|

0.9

|

|

9.3

|

|

2.3

|

|

|

MedSurg

|

|

|

|

|

|

|

|||||||

|

Instruments

|

1,187

|

|

1,085

|

|

9.4

|

7.4

|

|

9.4

|

|

9.5

|

|

2.9

|

|

|

Endoscopy

|

1,080

|

|

985

|

|

9.6

|

7.9

|

|

7.5

|

|

15.4

|

|

9.1

|

|

|

Medical

|

722

|

|

583

|

|

23.8

|

22.8

|

|

25.5

|

|

16.7

|

|

11.5

|

|

|

Total Medsurg

|

3,160

|

|

2,803

|

|

12.7

|

11.2

|

|

12.6

|

|

13.2

|

|

6.9

|

|

|

Neurotechnology and Spine

|

|

|

|

|

|

|

|||||||

|

Spine

|

687

|

|

648

|

|

6.0

|

4.0

|

|

2.5

|

|

14.4

|

|

7.6

|

|

|

Neurotechnology

|

750

|

|

320

|

|

134.4

|

132.3

|

|

78.6

|

|

283.6

|

|

275.7

|

|

|

Total Neurotechnology and Spine

|

1,437

|

|

968

|

|

48.5

|

46.4

|

|

28.1

|

|

99.6

|

|

92.4

|

|

|

Year Ended December 31

|

|||||||||||||

|

% Change

|

|||||||||||||

|

U.S.

|

International

|

||||||||||||

|

2010

|

2009

|

As Reported

|

Constant Currency

|

As Reported

|

As Reported

|

Constant Currency

|

|||||||

|

Reconstructive

|

|||||||||||||

|

Hips

|

1,154

|

|

1,098

|

|

5.1

|

3.1

|

|

4.9

|

|

5.3

|

|

1.2

|

|

|

Knees

|

1,306

|

|

1,255

|

|

4.1

|

2.8

|

|

5.6

|

|

1.2

|

|

(2.5

|

)

|

|

Trauma and Extremities

|

845

|

|

787

|

|

7.4

|

6.9

|

|

10.0

|

|

5.2

|

|

4.4

|

|

|

Total Reconstructive

|

3,549

|

|

3,384

|

|

4.9

|

3.5

|

|

5.6

|

|

3.9

|

|

0.8

|

|

|

MedSurg

|

|

|

|

|

|

|

|

||||||

|

Instruments

|

1,085

|

|

1,020

|

|

6.4

|

5.7

|

|

8.4

|

|

1.9

|

|

(0.2

|

)

|

|

Endoscopy

|

985

|

|

920

|

|

7.1

|

6.3

|

|

6.2

|

|

9.1

|

|

6.6

|

|

|

Medical

|

583

|

|

487

|

|

19.7

|

18.5

|

|

23.7

|

|

5.0

|

|

(0.3

|

)

|

|

Total Medsurg

|

2,803

|

|

2,427

|

|

15.5

|

14.7

|

|

19.5

|

|

5.0

|

|

2.4

|

|

|

Neurotechnology and Spine

|

|

|

|

|

|

|

|

||||||

|

Spine

|

648

|

|

632

|

|

2.5

|

2.2

|

|

0.6

|

|

8.1

|

|

6.5

|

|

|

Neurotechnology

|

320

|

|

280

|

|

14.3

|

13.3

|

|

11.9

|

|

20.9

|

|

17.2

|

|

|

Total Neurotechnology and Spine

|

968

|

|

912

|

|

6.1

|

5.6

|

|

4.1

|

|

11.8

|

|

9.6

|

|

|

11

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

12

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

2011

|

2010

|

2009

|

|||||||||

|

Reported net earnings

|

$

|

1,345

|

|

$

|

1,273

|

|

$

|

1,107

|

|

||

|

Acquisition and integration-related charges:

|

|||||||||||

|

Cost of sales - inventory step-up

|

97

|

|

—

|

|

—

|

|

|||||

|

Selling, general and administrative expenses - acquisition and integration-related charges

|

45

|

|

—

|

|

—

|

|

|||||

|

Restructuring charges

|

60

|

|

—

|

|

49

|

|

|||||

|

Uncertain income tax position adjustments

|

(99

|

)

|

—

|

|

—

|

|

|||||

|

Gain on sale of property, plant and equipment

|

—

|

|

(13

|

)

|

—

|

|

|||||

|

Income taxes on repatriation of foreign earnings

|

—

|

|

(7

|

)

|

67

|

|

|||||

|

Impairment of property, plant and equipment

|

—

|

|

76

|

|

—

|

|

|||||

|

Patent litigation gain

|

—

|

|

—

|

|

(43

|

)

|

|||||

|

Adjusted net earnings

|

$

|

1,448

|

|

$

|

1,329

|

|

$

|

1,180

|

|

||

|

2011

|

2010

|

2009

|

|||||||||

|

Diluted net earnings per share of common stock:

|

|||||||||||

|

Reported diluted net earnings per share

|

$

|

3.45

|

|

$

|

3.19

|

|

$

|

2.77

|

|

||

|

Acquisition and integration-related charges:

|

|||||||||||

|

Cost of sales - inventory set-up

|

0.25

|

|

—

|

|

—

|

|

|||||

|

Selling, general and administrative expenses - acquisition and integration-related charges

|

0.12

|

|

—

|

|

—

|

|

|||||

|

Restructuring charges

|

0.16

|

|

—

|

|

0.12

|

|

|||||

|

Uncertain income tax position adjustments

|

(0.26

|

)

|

—

|

|

—

|

|

|||||

|

Gain on sale of property, plant and equipment

|

—

|

|

(0.03

|

)

|

—

|

|

|||||

|

Income taxes on repatriation of foreign earnings

|

—

|

|

(0.02

|

)

|

0.17

|

|

|||||

|

Impairment of property, plant and equipment

|

—

|

|

0.19

|

|

—

|

|

|||||

|

Patent litigation gain

|

—

|

|

—

|

|

(0.11

|

)

|

|||||

|

Adjusted diluted net earnings per share

|

$

|

3.72

|

|

$

|

3.33

|

|

$

|

2.95

|

|

||

|

Weighted-average diluted shares outstanding

|

389.5

|

|

399.5

|

|

399.4

|

|

|||||

|

13

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

14

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

|

Payment Period

|

||||||||||||||||||||||||||

|

|

2012

|

2013

|

2014

|

2015

|

2016

|

After 2016

|

Total

|

||||||||||||||||||||

|

Short-term and Long-term debt

|

$

|

17

|

|

$

|

—

|

|

$

|

—

|

|

$

|

500

|

|

$

|

—

|

|

$

|

1,251

|

|

$

|

1,768

|

|

||||||

|

Unconditional purchase obligations

|

518

|

|

135

|

|

127

|

|

100

|

|

8

|

|

2

|

|

890

|

|

|||||||||||||

|

Operating leases

|

57

|

|

46

|

|

32

|

|

27

|

|

22

|

|

44

|

|

228

|

|

|||||||||||||

|

Contributions to defined benefit plans

|

22

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

22

|

|

|||||||||||||

|

Other

|

6

|

|

2

|

|

2

|

|

2

|

|

1

|

|

40

|

|

53

|

|

|||||||||||||

|

$

|

620

|

|

$

|

183

|

|

$

|

161

|

|

$

|

629

|

|

$

|

31

|

|

$

|

1,337

|

|

$

|

2,961

|

|

|||||||

|

15

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

16

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

17

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

|

18

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

|

|

19

|

||

|

|

Years Ended December 31

|

|||||||||||

|

|

2011

|

2010

|

2009

|

|||||||||

|

Net sales

|

$

|

8,307

|

|

$

|

7,320

|

|

$

|

6,723

|

|

|||

|

Cost of sales

|

2,811

|

|

2,286

|

|

2,184

|

|

||||||

|

Gross profit

|

5,496

|

|

5,034

|

|

4,539

|

|

||||||

|

Research, development and engineering expenses

|

462

|

|

394

|

|

336

|

|

||||||

|

Selling, general and administrative expenses

|

3,150

|

|

2,707

|

|

2,506

|

|

||||||

|

Intangible asset amortization

|

122

|

|

58

|

|

36

|

|

||||||

|

Property, plant and equipment impairment

|

—

|

|

124

|

|

—

|

|

||||||

|

Restructuring charges

|

76

|

|

—

|

|

67

|

|

||||||

|

Total operating expenses

|

3,810

|

|

3,283

|

|

2,945

|

|

||||||

|

Operating income

|

1,686

|

|

1,751

|

|

1,594

|

|

||||||

|

Other income (expense)

|

—

|

|

(22

|

)

|

30

|

|

||||||

|

Earnings before income taxes

|

1,686

|

|

1,729

|

|

1,624

|

|

||||||

|

Income taxes

|

341

|

|

456

|

|

517

|

|

||||||

|

Net earnings

|

$

|

1,345

|

|

$

|

1,273

|

|

$

|

1,107

|

|

|||

|

Net earnings per share of common stock:

|

||||||||||||

|

Basic net earnings per share of common stock

|

$

|

3.48

|

|

$

|

3.21

|

|

$

|

2.79

|

|

|||

|

Diluted net earnings per share of common stock

|

$

|

3.45

|

|

$

|

3.19

|

|

$

|

2.77

|

|

|||

|

Weighted-average shares outstanding—in millions:

|

||||||||||||

|

Basic

|

386.5

|

|

396.4

|

|

397.4

|

|

||||||

|

Employee stock options

|

10.8

|

|

10.6

|

|

20.1

|

|

||||||

|

Less antidilutive stock options

|

(7.8

|

)

|

(7.5

|

)

|

(18.1

|

)

|

||||||

|

Net effect of dilutive employee stock options

|

3.0

|

|

3.1

|

|

2.0

|

|

||||||

|

Diluted

|

389.5

|

|

399.5

|

|

399.4

|

|

||||||

|

20

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

|

December 31

|

|||||||

|

2011

|

2010

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets

|

||||||||

|

Cash and cash equivalents

|

$

|

905

|

|

$

|

1,758

|

|

||

|

Marketable securities

|

2,513

|

|

2,622

|

|

||||

|

Accounts receivable, less allowance of

$56

($57 in 2010)

|

1,417

|

|

1,252

|

|

||||

|

Inventories

|

||||||||

|

Materials and supplies

|

185

|

|

158

|

|

||||

|

Work in process

|

46

|

|

65

|

|

||||

|

Finished goods

|

1,052

|

|

834

|

|

||||

|

Total inventories

|

1,283

|

|

1,057

|

|

||||

|

Deferred income taxes

|

820

|

|

653

|

|

||||

|

Prepaid expenses and other current assets

|

273

|

|

290

|

|

||||

|

Total current assets

|

7,211

|

|

7,632

|

|

||||

|

Property, Plant and Equipment

|

||||||||

|

Land, buildings and improvements

|

600

|

|

554

|

|

||||

|

Machinery and equipment

|

1,455

|

|

1,296

|

|

||||

|

Total Property, Plant and Equipment

|

2,055

|

|

1,850

|

|

||||

|

Less allowance for depreciation

|

1,167

|

|

1,052

|

|

||||

|

Net Property, Plant and Equipment

|

888

|

|

798

|

|

||||

|

Other Assets

|

||||||||

|

Goodwill

|

2,072

|

|

1,072

|

|

||||

|

Other intangibles, less accumulated amortization of $535 ($465 in 2010)

|

1,442

|

|

703

|

|

||||

|

Loaner instrumentation, less accumulated amortization of

$795

($684 in 2010)

|

318

|

|

291

|

|

||||

|

Deferred income taxes

|

317

|

|

248

|

|

||||

|

Other

|

157

|

|

151

|

|

||||

|

Total assets

|

$

|

12,405

|

|

$

|

10,895

|

|

||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts payable

|

$

|

345

|

|

$

|

292

|

|

||

|

Accrued compensation

|

444

|

|

418

|

|

||||

|

Income taxes

|

116

|

|

47

|

|

||||

|

Dividend payable

|

81

|

|

70

|

|

||||

|

Accrued expenses and other liabilities

|

825

|

|

753

|

|

||||

|

Current maturities of long-term debt

|

17

|

|

25

|

|

||||

|

Total current liabilities

|

1,828

|

|

1,605

|

|

||||

|

Long-Term Debt, excluding current maturities

|

1,751

|

|

996

|

|

||||

|

Other Liabilities

|

1,143

|

|

1,120

|

|

||||

|

Shareholders’ Equity

|

||||||||

|

Common stock, $0.10 par value:

|

||||||||

|

Authorized: 1 billion shares, Outstanding: 381 million shares (391 million in 2010)

|

38

|

|

39

|

|

||||

|

Additional paid-in capital

|

1,022

|

|

964

|

|

||||

|

Retained earnings

|

6,479

|

|

6,017

|

|

||||

|

Accumulated other comprehensive gain

|

144

|

|

154

|

|

||||

|

Total shareholders’ equity

|

7,683

|

|

7,174

|

|

||||

|

Total liabilities & shareholders’ equity

|

$

|

12,405

|

|

$

|

10,895

|

|

||

|

21

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

Common

Stock

|

Additional

Paid-In

Capital

|

Retained

Earnings

|

Accumulated

Other

Comprehensive

Gain (Loss)

|

Total

|

||||||||||||||||

|

Balances at January 1, 2009

|

$

|

40

|

|

$

|

813

|

|

$

|

4,390

|

|

$

|

165

|

|

$

|

5,408

|

|

|||||

|

Net earnings for 2009

|

1,107

|

|

1,107

|

|

||||||||||||||||

|

Unrealized gains on securities, including $1.4 income tax expense

|

2

|

|

2

|

|

||||||||||||||||

|

Unfunded pension gains, net of $8 income tax expense

|

17

|

|

17

|

|

||||||||||||||||

|

Foreign currency translation adjustments

|

74

|

|

74

|

|

||||||||||||||||

|

Comprehensive earnings for 2009

|

1,200

|

|

||||||||||||||||||

|

Issuance of 1.4 million shares of common stock under stock option and benefit plans, including $7 excess income tax benefit

|

25

|

|

25

|

|

||||||||||||||||

|

Share-based compensation

|

62

|

|

62

|

|

||||||||||||||||

|

Cash dividend declared of $0.25 per share of common stock

|

(99

|

)

|

(99

|

)

|

||||||||||||||||

|

Balances at December 31, 2009

|

40

|

|

900

|

|

5,398

|

|

258

|

|

6,596

|

|

||||||||||

|

Net earnings for 2010

|

1,273

|

|

1,273

|

|

||||||||||||||||

|

Unrealized loss on securities, including $0.3 income tax benefit

|

(2

|

)

|

(2

|

)

|

||||||||||||||||

|

Unfunded pension loss, net of $14 income tax benefit

|

(21

|

)

|

(21

|

)

|

||||||||||||||||

|

Foreign currency translation adjustments

|

(81

|

)

|

(81

|

)

|

||||||||||||||||

|

Comprehensive earnings for 2010

|

1,169

|

|

||||||||||||||||||

|

Issuance of 1.5 million shares of common stock under stock option and benefit plans, including $11 excess income tax benefit

|

15

|

|

15

|

|

||||||||||||||||

|

Share-based compensation

|

69

|

|

69

|

|

||||||||||||||||

|

Cash dividends declared of $0.63 per share of common stock

|

(249

|

)

|

(249

|

)

|

||||||||||||||||

|

Repurchase and retirement of 8.3 shares of common stock

|

(1

|

)

|

(20

|

)

|

(405

|

)

|

(426

|

)

|

||||||||||||

|

Balances at December 31, 2010

|

$

|

39

|

|

$

|

964

|

|

$

|

6,017

|

|

$

|

154

|

|

$

|

7,174

|

|

|||||

|

Net earnings for 2011

|

1,345

|

|

1,345

|

|

||||||||||||||||

|

Unrealized loss on securities, including $1.2 income tax benefit

|

(2

|

)

|

(2

|

)

|

||||||||||||||||

|

Unfunded pension gain, net of $8 income tax benefit

|

12

|

|

12

|

|

||||||||||||||||

|

Foreign currency translation adjustments

|

(20

|

)

|

(20

|

)

|

||||||||||||||||

|

Comprehensive earnings for 2011

|

1,335

|

|

||||||||||||||||||

|

Issuance of 1.6 million shares of common stock under stock option and benefit plans, including $6 excess income tax benefit

|

13

|

|

13

|

|

||||||||||||||||

|

Share-based compensation

|

75

|

|

75

|

|

||||||||||||||||

|

Cash dividends declared of $0.75 per share of common stock

|

(292

|

)

|

(292

|

)

|

||||||||||||||||

|

Repurchase and retirement of 11.8 million shares of common stock

|

(1

|

)

|

(30

|

)

|

(591

|

)

|

(622

|

)

|

||||||||||||

|

Balances at December 31, 2011

|

$

|

38

|

|

$

|

1,022

|

|

$

|

6,479

|

|

$

|

144

|

|

$

|

7,683

|

|

|||||

|

22

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

|

Years Ended December 31

|

|||||||||||

|

|

2011

|

2010

|

2009

|

|||||||||

|

Operating Activities

|

||||||||||||

|

Net earnings

|

$

|

1,345

|

|

$

|

1,273

|

|

$

|

1,107

|

|

|||

|

Adjustments to reconcile net earnings to net cash provided by operating activities:

|

||||||||||||

|

Depreciation

|

160

|

|

165

|

|

165

|

|

||||||

|

Amortization

|

321

|

|

245

|

|

220

|

|

||||||

|

Share-based compensation

|

75

|

|

69

|

|

62

|

|

||||||

|

Restructuring charges

|

76

|

|

—

|

|

67

|

|

||||||

|

Property, plant and equipment impairment

|

—

|

|

124

|

|

—

|

|

||||||

|

Payments of restructuring charges

|

(29

|

)

|

(9

|

)

|

(47

|

)

|

||||||

|

Sale of inventory stepped-up to fair value at acquisition

|

143

|

|

7

|

|

—

|

|

||||||

|

Deferred income tax credit

|

(164

|

)

|

(104

|

)

|

(73

|

)

|

||||||

|

Changes in operating assets and liabilities, net of effects of acquisitions:

|

||||||||||||

|

Accounts receivable

|

(152

|

)

|

(121

|

)

|

(10

|

)

|

||||||

|

Inventories

|

(166

|

)

|

(131

|

)

|

34

|

|

||||||

|

Loaner instrumentation

|

(224

|

)

|

(193

|

)

|

(188

|

)

|

||||||

|

Accounts payable

|

44

|

|

96

|

|

(80

|

)

|

||||||

|

Accrued expenses and other liabilities

|

158

|

|

91

|

|

66

|

|

||||||

|

Income taxes

|

(95

|

)

|

(24

|

)

|

192

|

|

||||||

|

Other

|

(58

|

)

|

59

|

|

(54

|

)

|

||||||

|

Net cash provided by operating activities

|

1,434

|

|

1,547

|

|

1,461

|

|

||||||

|

Investing Activities

|

||||||||||||

|

Acquisitions, net of cash acquired

|

(2,066

|

)

|

(265

|

)

|

(570

|

)

|

||||||

|

Purchases of marketable securities

|

(6,779

|

)

|

(5,619

|

)

|

(4,602

|

)

|

||||||

|

Proceeds from sales of marketable securities

|

6,869

|

|

5,210

|

|

3,974

|

|

||||||

|

Purchases of property, plant and equipment

|

(226

|

)

|

(182

|

)

|

(131

|

)

|

||||||

|

Proceeds from sales of property, plant and equipment

|

67

|

|

61

|

|

1

|

|

||||||

|

Net cash used in investing activities

|

(2,135

|

)

|

(795

|

)

|

(1,328

|

)

|

||||||

|

Financing Activities

|

||||||||||||

|

Proceeds from borrowings

|

178

|

|

100

|

|

17

|

|

||||||

|

Payments on borrowings

|

(190

|

)

|

(81

|

)

|

(20

|

)

|

||||||

|

Proceeds from issuance of long-term debt, net

|

749

|

|

996

|

|

—

|

|

||||||

|

Dividends paid

|

(279

|

)

|

(238

|

)

|

(198

|

)

|

||||||

|

Repurchase and retirement of common stock

|

(622

|

)

|

(426

|

)

|

—

|

|

||||||

|

Other

|

3

|

|

59

|

|

8

|

|

||||||

|

Net cash provided by (used in) financing activities

|

(161

|

)

|

410

|

|

(193

|

)

|

||||||

|

Effect of exchange rate changes on cash and cash equivalents

|

9

|

|

(63

|

)

|

18

|

|

||||||

|

Increase (decrease) in cash and cash equivalents

|

(853

|

)

|

1,099

|

|

(42

|

)

|

||||||

|

Cash and cash equivalents at beginning of year

|

1,758

|

|

659

|

|

701

|

|

||||||

|

Cash and cash equivalents at end of year

|

$

|

905

|

|

$

|

1,758

|

|

$

|

659

|

|

|||

|

Supplemental cash flow disclosure:

|

||||||||||||

|

Cash paid for income taxes, net of refunds

|

$

|

574

|

|

$

|

579

|

|

$

|

406

|

|

|||

|

23

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

24

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

25

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

2011

|

2010

|

2009

|

|||||||

|

Risk-free interest rate

|

2.9

|

%

|

3.0

|

%

|

2.5

|

%

|

|||

|

Expected dividend yield

|

1.4

|

%

|

1.4

|

%

|

0.7

|

%

|

|||

|

Expected stock price volatility

|

26.9

|

%

|

28.6

|

%

|

27.7

|

%

|

|||

|

Expected option life

|

6.9 years

|

|

6.8 years

|

|

6.8 years

|

|

|||

|

Unrealized

Gains (Losses)

on Securities

|

Unfunded

Pension

Gains (Losses)

|

Foreign

Currency

Translation

Adjustments

|

Accumulated

Other

Comprehensive

Gain (Loss)

|

|||||||||||||

|

Balances at January 1, 2010

|

$

|

4

|

|

$

|

(23

|

)

|

$

|

277

|

|

$

|

258

|

|

||||

|

Other comprehensive loss for 2010

|

(2

|

)

|

(21

|

)

|

(81

|

)

|

(104

|

)

|

||||||||

|

Balances at December 31, 2010

|

2

|

|

(44

|

)

|

196

|

|

154

|

|

||||||||

|

Other comprehensive loss for 2011

|

(2

|

)

|

12

|

|

(20

|

)

|

(10

|

)

|

||||||||

|

Balances at December 31, 2011

|

$

|

—

|

|

$

|

(32

|

)

|

$

|

176

|

|

$

|

144

|

|

||||

|

26

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

27

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

Total

|

(Level 1)

|

(Level 2)

|

(Level 3)

|

|||||||||||||||||||||

|

2011

|

2010

|

2011

|

2010

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||||||

|

Assets:

|

||||||||||||||||||||||||

|

Cash and cash equivalents

|

$

|

905

|

|

$

|

1,758

|

|

$

|

905

|

|

$

|

1,758

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

|

Available-for-sale marketable securities

|

||||||||||||||||||||||||

|

Corporate and asset-backed debt securities

|

1,350

|

|

1,620

|

|

—

|

|

—

|

|

1,349

|

|

1,619

|

|

1

|

|

1

|

|

||||||||

|

Foreign government debt securities

|

747

|

|

523

|

|

—

|

|

—

|

|

747

|

|

522

|

|

—

|

|

1

|

|

||||||||

|

U.S. agency debt securities

|

241

|

|

315

|

|

—

|

|

—

|

|

241

|

|

315

|

|

—

|

|

—

|

|

||||||||

|

Certificates of deposit

|

36

|

|

71

|

|

—

|

|

—

|

|

36

|

|

71

|

|

—

|

|

—

|

|

||||||||

|

Other

|

140

|

|

95

|

|

—

|

|

—

|

|

140

|

|

95

|

|

—

|

|

—

|

|

||||||||

|

Total available-for-sale marketable securities

|

2,514

|

|

2,624

|

|

—

|

|

—

|

|

2,513

|

|

2,622

|

|

1

|

|

2

|

|

||||||||

|

Trading marketable securities

|

50

|

|

48

|

|

50

|

|

48

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||

|

Foreign currency exchange contracts

|

1

|

|

2

|

|

—

|

|

—

|

|

1

|

|

2

|

|

—

|

|

—

|

|

||||||||

|

$

|

3,470

|

|

$

|

4,432

|

|

$

|

955

|

|

$

|

1,806

|

|

$

|

2,514

|

|

$

|

2,624

|

|

$

|

1

|

|

$

|

2

|

|

|

|

Liabilities:

|

||||||||||||||||||||||||

|

Deferred compensation arrangements

|

$

|

50

|

|

$

|

48

|

|

$

|

50

|

|

$

|

48

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

|

Foreign currency exchange contracts

|

9

|

|

1

|

|

—

|

|

—

|

|

9

|

|

1

|

|

—

|

|

—

|

|

||||||||

|

$

|

59

|

|

$

|

49

|

|

$

|

50

|

|

$

|

48

|

|

$

|

9

|

|

$

|

1

|

|

$

|

—

|

|

$

|

—

|

|

|

|

Total

|

Corporate and Asset-Backed Debt Securities

|

Foreign Government Debt Securities

|

Municipal Debt Securities (ARS)

|

ARS Rights

|

||||||||||||||||||||||||||||||

|

2011

|

2010

|

2011

|

2010

|

2011

|

2010

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||||||||||||||

|

Balance as of January 1

|

$

|

2

|

|

$

|

157

|

|

$

|

1

|

|

$

|

1

|

|

$

|

1

|

|

$

|

—

|

|

$

|

—

|

|

$

|

139

|

|

$

|

—

|

|

$

|

17

|

|

||||

|

Transfers into Level 3

|

—

|

|

1

|

|

—

|

|

—

|

|

—

|

|

1

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||||||

|

Transfers out of Level 3

|

(1

|

)

|

—

|

|

—

|

|

—

|

|

(1

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||||||

|

Gains or (losses) included in earnings

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

17

|

|

—

|

|

(17

|

)

|

||||||||||||||

|

Sales

|

—

|

|

(154

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(154

|

)

|

—

|

|

—

|

|

||||||||||||||

|

Settlements

|

—

|

|

(2

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(2

|

)

|

—

|

|

—

|

|

||||||||||||||

|

Balance as of December 31

|

$

|

1

|

|

$

|

2

|

|

$

|

1

|

|

$

|

1

|

|

$

|

—

|

|

$

|

1

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

Amortized Cost

|

Gross Unrealized Gains

|

Gross Unrealized (Losses)

|

Estimated

Fair Value |

|||||||||||||||||||||

|

2011

|

2010

|

2011

|

2010

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||||||

|

Available-for-sale marketable securities:

|

||||||||||||||||||||||||

|

Corporate and asset-backed debt securities

|

$

|

1,353

|

|

$

|

1,618

|

|

$

|

2

|

|

$

|

4

|

|

$

|

(5

|

)

|

$

|

(2

|

)

|

$

|

1,350

|

|

$

|

1,620

|

|

|

Foreign government debt securities

|

745

|

|

523

|

|

3

|

|

1

|

|

(1

|

)

|

(1

|

)

|

747

|

|

523

|

|

||||||||

|

U.S. agency debt securities

|

241

|

|

314

|

|

—

|

|

—

|

|

—

|

|

—

|

|

241

|

|

314

|

|

||||||||

|

Certificates of deposit

|

36

|

|

71

|

|

—

|

|

—

|

|

—

|

|

—

|

|

36

|

|

71

|

|

||||||||

|

Other

|

140

|

|

95

|

|

—

|

|

—

|

|

—

|

|

—

|

|

140

|

|

95

|

|

||||||||

|

Total available-for-sale marketable securities

|

$

|

2,515

|

|

$

|

2,621

|

|

$

|

5

|

|

$

|

5

|

|

$

|

(6

|

)

|

$

|

(3

|

)

|

2,514

|

|

2,623

|

|

||

|

Trading marketable securities

|

50

|

|

48

|

|

||||||||||||||||||||

|

Total marketable securities

|

$

|

2,564

|

|

$

|

2,671

|

|

||||||||||||||||||

|

Reported as:

|

||||||||||||||||||||||||

|

Current assets-Marketable securities

|

$

|

2,513

|

|

$

|

2,622

|

|

||||||||||||||||||

|

Noncurrent assets-Other

|

51

|

|

49

|

|

||||||||||||||||||||

|

$

|

2,564

|

|

$

|

2,671

|

|

|||||||||||||||||||

|

28

|

Dollar amounts in millions except per share amounts or as otherwise specified.

|

|

|

Cost

|

Estimated

Fair Value

|

|||||||

|

Due in one year or less

|

$

|

499

|

|

$

|

499

|

|

||

|

Due after one year through three years

|

1,956

|

|

1,955

|

|

||||

|

Due after three years

|

60

|

|

60

|

|

||||

|

$

|

2,515

|

|

$

|

2,514

|

|

|||

|

Corporate and Asset-Backed Debt Securities

|

Foreign Government Debt Securities

|

U.S. Agency Debt Securities

|

Other

|

Total

|

|||||||||||||||||||||||||||||||

|

Less Than 12 Months

|

Total

|

Less Than 12 Months

|

Total

|

Less Than 12 Months

|

Total

|

Less Than 12 Months

|

Total

|

Less Than 12 Months

|

Total

|

||||||||||||||||||||||||||

|

Number of Investments

|

2011

|

266

|

|

266

|

|

58

|

|

58

|

|

60

|

|

60

|

|

33

|

|

33

|

|

417

|

|

417

|

|

||||||||||||||

|

2010

|

216

|

|

216

|

|

42

|

|

42

|

|

32

|

|

32

|

|

—

|

|

—

|

|

290

|

|

290

|

|

|||||||||||||||

|

Fair Value

|

2011

|

$

|

573

|

|

$

|

573

|

|

$

|

285

|

|

$

|

285

|

|

$

|

145

|

|

$

|

145

|