|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

34-1531521

|

|

|

(State of Incorporation)

|

(IRS Employer Identification No.)

|

|

|

200 Nyala Farm Road, Westport, Connecticut

|

06880

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

YES

x

|

NO

o

|

|

|

YES

o

|

NO

x

|

|

|

YES

x

|

NO

o

|

|

|

YES

x

|

NO

o

|

|

|

Large Accelerated Filer

x

|

Accelerated Filer

o

|

Non-accelerated Filer

o

|

Smaller Reporting Company

o

|

|

YES

o

|

NO

x

|

|

|

•

|

our business is cyclical and weak general economic conditions affect the sales of our products and financial results;

|

|

•

|

the effect of the announcement and pendency of the merger with Konecranes Plc (“Konecranes”) on our customers, employees, suppliers, vendors, distributors, dealers, retailers, operating results and business generally, and the diversion of management’s time and attention;

|

|

•

|

our ability to successfully integrate acquired businesses, including the pending merger with Konecranes;

|

|

•

|

our need to comply with restrictive covenants contained in our debt agreements;

|

|

•

|

our ability to generate sufficient cash flow to service our debt obligations and operate our business;

|

|

•

|

our ability to access the capital markets to raise funds and provide liquidity;

|

|

•

|

our business is sensitive to government spending;

|

|

•

|

our business is highly competitive and is affected by our cost structure, pricing, product initiatives and other actions taken by competitors;

|

|

•

|

our retention of key management personnel;

|

|

•

|

the financial condition of suppliers and customers, and their continued access to capital;

|

|

•

|

our providing financing and credit support for some of our customers;

|

|

•

|

we may experience losses in excess of recorded reserves;

|

|

•

|

the carrying value of our goodwill and other indefinite-lived intangible assets could become impaired;

|

|

•

|

our ability to obtain parts and components from suppliers on a timely basis at competitive prices;

|

|

•

|

our business is global and subject to changes in exchange rates between currencies, commodity price changes, regional economic conditions and trade restrictions;

|

|

•

|

our operations are subject to a number of potential risks that arise from operating a multinational business, including compliance with changing regulatory environments, the Foreign Corrupt Practices Act and other similar laws, and political instability;

|

|

•

|

a material disruption to one of our significant facilities;

|

|

•

|

possible work stoppages and other labor matters;

|

|

•

|

compliance with changing laws and regulations, particularly environmental and tax laws and regulations;

|

|

•

|

litigation, product liability claims, intellectual property claims, class action lawsuits and other liabilities;

|

|

•

|

our ability to comply with an injunction and related obligations imposed by the United States Securities and Exchange Commission (“SEC”);

|

|

•

|

disruption or breach in our information technology systems; and

|

|

•

|

other factors.

|

|

PAGE

|

||

|

|

|

|

ITEM 1.

|

BUSINESS

|

|

•

|

Aerial work platform equipment is manufactured in Redmond and Moses Lake, Washington, Rock Hill, South Carolina, Umbertide, Italy, Coventry, England and Changzhou, China;

|

|

•

|

Telehandlers are manufactured in Oklahoma City, Oklahoma and Umbertide, Italy; and

|

|

•

|

Trailer-mounted light towers are manufactured in Rock Hill, South Carolina.

|

|

•

|

Rough terrain cranes are manufactured in Crespellano, Italy and Waverly, Iowa;

|

|

•

|

All-terrain cranes are manufactured in Montceau-les-Mines, France, Zweibrücken and Bierbach-Homburg, Germany;

|

|

•

|

Truck cranes are manufactured in Waverly, Iowa;

|

|

•

|

Truck-mounted cranes are manufactured in Waverly, Iowa;

|

|

•

|

Tower cranes are manufactured in Fontanafredda, Italy;

|

|

•

|

Lattice boom crawler cranes are manufactured in Oklahoma City, Oklahoma, Jinan, China, Zweibrücken and Bierbach-Homburg, Germany;

|

|

•

|

Pick and carry cranes are manufactured in Brisbane, Australia;

|

|

•

|

Lattice boom truck cranes are manufactured in Zweibrücken and Bierbach-Homburg, Germany;

|

|

•

|

Steel assemblies for cranes are manufactured in Bierbach-Homburg, Germany and Pecs, Hungary; and

|

|

•

|

Utility products are manufactured in Watertown and Huron, South Dakota, Fort Wayne, Indiana, Waukesha, Wisconsin, Betim, Brazil and Jinan, China.

|

|

•

|

Universal cranes are manufactured in Banbury, UK, Milan, Italy, Solon, Ohio, Cotia, Brazil, Boksburg, South Africa, Chakan, India and Shanghai, China;

|

|

•

|

Process cranes are manufactured in Slany, Czech Republic, Banbury, UK, Solon, Ohio, Boksburg, South Africa, Chakan, India, Shanghai, China and Cotia, Brazil;

|

|

•

|

Rope and chain hoists are manufactured in Wetter an der Ruhr, Germany, Shanghai, China, Milan, Italy and Cotia, Brazil;

|

|

•

|

Electric motors are manufactured in Uslar, Germany;

|

|

•

|

Light crane systems are manufactured in Shanghai, China, Cotia, Brazil, Chakan, India and Wetter an der Ruhr, Germany;

|

|

•

|

Mobile harbor cranes are manufactured in Düsseldorf, Germany and Xiamen, China;

|

|

•

|

Automated stacking cranes and automated guided vehicles are manufactured in Düsseldorf, Germany;

|

|

•

|

Rubber tired gantry cranes, rail mounted gantry cranes, ship-to-shore gantry cranes, reach stackers, empty container handlers and other material handling equipment are manufactured in Xiamen, China;

|

|

•

|

Reach stackers are manufactured in Montceau-les-Mines, France;

|

|

•

|

Straddle and sprinter carriers are manufactured in Würzburg, Germany; and

|

|

•

|

Empty container handlers, full container handlers and general cargo lift trucks are manufactured in Lentigione, Italy.

|

|

•

|

Mobile crushers, mobile screens and washing systems are manufactured in Omagh and Dungannon, Northern Ireland;

|

|

•

|

Mobile crushers, mobile screens, base crushers, base screens and washing systems are manufactured in Hosur, India, primarily for the Indian market;

|

|

•

|

Base crushers and base screens are manufactured in Subang Jaya, Malaysia and Oklahoma City, Oklahoma;

|

|

•

|

Screening equipment is manufactured in Durand, Michigan;

|

|

•

|

Base crushers are manufactured in Coalville, England; and

|

|

•

|

Wood processing, biomass and recycling equipment systems are manufactured in Newton, New Hampshire, Haid bei, Austria and Dungannon, Northern Ireland.

|

|

•

|

Compact construction equipment, including loader backhoes, mini and midi excavators, wheeled excavators, site dumpers, compaction rollers and wheel loaders; and

|

|

•

|

Specialty equipment, including material handlers, concrete mixer trucks and concrete pavers.

|

|

•

|

Site dumpers, compaction rollers and loader backhoes, as well as certain products for our AWP segment, are manufactured in Coventry, England;

|

|

•

|

A range of wheel loaders, wheeled excavators and mini, mobile, and midi excavators are manufactured in Crailsheim, Germany; and

|

|

•

|

Loader backhoes are manufactured in Greater Noida, Uttar Pradesh, India for markets in India and neighboring countries.

|

|

•

|

Material handlers are manufactured in Bad Schönborn, Germany;

|

|

•

|

Concrete pavers are manufactured in Canton, South Dakota; and

|

|

•

|

Front and rear discharge concrete mixer trucks are manufactured in Fort Wayne, Indiana.

|

|

1.

|

Customer Responsiveness

|

|

2.

|

Operational Efficiency

|

|

3.

|

Global Growth

|

|

•

|

Customers

: We aim to be the most customer responsive company in the industry as determined by our customers.

|

|

•

|

Stakeholders

: We aim to be the most profitable company in the industry as measured by return on invested capital.

|

|

•

|

Team Members

: We aim to be the best place to work in the industry as determined by our team members.

|

|

•

|

Integrity

:

Integrity reflects honesty, ethics, transparency and accountability. We are committed to maintaining high ethical standards in all of our business dealings and we never sacrifice our integrity for profit.

|

|

•

|

Respect

: Respect incorporates concern for safety, health, teamwork, diversity, inclusion and performance. We treat all our team members, customers and suppliers with respect and dignity.

|

|

•

|

Improvement

: Improvement encompasses quality, problem-solving systems, a continuous improvement culture and collaboration. We continuously search for new and better ways of doing things, focusing on continuous improvement and the elimination of waste.

|

|

•

|

Servant Leadership

: Servant leadership requires service to others, humility, authenticity and leading by example. We work to serve the needs of our customers, investors and team members.

|

|

•

|

Courage

: Courage entails willingness to take risks, responsibility, action and empowerment. We have the courage to make a difference even when it is difficult.

|

|

•

|

Citizenship

:

Citizenship means social responsibility and environmental stewardship. We comply with all laws, respect all people’s values and cultures, and are good global, national and local citizens.

|

|

•

|

Portable material lifts are used primarily indoors in the construction, industrial and theatrical markets.

|

|

•

|

Portable aerial work platforms are used primarily indoors in a variety of markets to perform overhead maintenance.

|

|

•

|

Trailer-mounted articulating booms are used both indoors and outdoors. They provide versatile reach, and have the ability to be towed between job sites.

|

|

•

|

Self-propelled articulating booms are primarily used in construction and industrial applications, both indoors and outdoors. They feature lifting versatility with up, out and over position capabilities to access difficult to reach overhead areas.

|

|

•

|

Self-propelled telescopic booms are used outdoors in commercial and industrial construction, as well as highway and bridge maintenance projects.

|

|

•

|

Scissor lifts are used in outdoor and indoor applications in a variety of construction, industrial and commercial settings.

|

|

•

|

Rough terrain cranes move materials and equipment on rugged or uneven terrain and are often located on a single construction or work site for long periods. Rough terrain cranes cannot be driven on highways and accordingly must be transported by truck to the work site.

|

|

•

|

Truck cranes have two cabs and can travel rapidly from job site to job site at highway speeds. Truck cranes are often used for multiple local jobs, primarily in urban or suburban areas.

|

|

•

|

All-terrain cranes were developed in Europe as a cross between rough terrain and truck cranes, and are designed to travel across both rough terrain and highways.

|

|

•

|

Pick and carry cranes are designed for a wide variety of applications, including use at mine sites, large fabrication yards, building and construction sites and in machinery maintenance and installation. They combine high road speed with all terrain capability.

|

|

•

|

Self-erecting tower cranes unfold from sections and can be trailer mounted; certain larger models have a telescopic tower and folding jib. These cranes can be assembled on site in a few hours. Applications include residential and small commercial construction.

|

|

•

|

Hammerhead tower cranes have a tower and a horizontal jib assembled from sections. The tower extends above the jib to which suspension cables supporting the jib are attached. These cranes are assembled on-site in one to three days depending on height, and can increase in height with the project.

|

|

•

|

Flat top tower cranes have a tower and a horizontal jib assembled from sections. There is no A-frame above the jib, which is self-supporting and consists of reinforced jib sections. These cranes are assembled on-site in one to two days, and can increase in height with the project.

|

|

•

|

Luffing jib tower cranes have a tower and an angled jib assembled from sections. There is one A-frame above the jib to which suspension cables supporting the jib are attached. Unlike other tower cranes, there is no trolley to control linear movement of the load, which is accomplished by changing the jib angle. These cranes are assembled on-site in two to three days, and can increase in height with the project.

|

|

•

|

Digger derricks are used to dig holes, hoist and set utility poles, as well as lift transformers and other materials at job sites. Auger drills are used to dig holes for utility poles or construction foundations requiring larger diameter holes in difficult soil conditions.

|

|

•

|

Insulated aerial devices are used to elevate workers and material to work areas at the top of utility poles, energized transmission lines and for trimming trees near energized electrical lines, as well as for miscellaneous purposes such as sign maintenance. Non-insulated aerials are used in applications where energized electrical lines are not a hazard.

|

|

•

|

Cable placers are used to install fiber optic, copper and strand telephone and cable lines.

|

|

•

|

Universal cranes are configured individually from standardized modules for industrial infrastructure applications.

|

|

•

|

Process cranes are also made from largely standardized modules and are integrated individually into the customer’s specific production processes.

|

|

•

|

Rope hoists and chain hoists are used to facilitate the movement of materials in a factory. They can either be integrated as components in universal and process cranes or used as lifting devices in non-crane applications.

|

|

•

|

Light crane systems can be described as railway systems on ceilings that use hoists to move and lift materials in factories.

|

|

•

|

Wheel blocks, electric motors, gearboxes, converters and travel units are components that can be included in tailored solutions for drive applications that aid in the movement of materials in a factory. These components can also be used separately in non-crane applications.

|

|

•

|

Crane sets comprise component packages for customers who are constructing their own girders in a factory.

|

|

•

|

Mobile harbor cranes are used for material handling at ports, including general cargo handling, shipping containers and bulk materials such as coal, iron ore and grain. Mobile harbor cranes can travel around the port as needed and have the ability to move large loads. Mobile harbor cranes can be fitted with a variety of attachments for handling different types of cargo and can also be mounted on a portal or pontoons.

|

|

•

|

Ship-to-shore gantry cranes are used to load and unload container vessels at ports.

|

|

•

|

Rubber tired and rail mounted gantry cranes are used for space intensive shipping container stacking at port and railway facilities. These products have both horizontal and vertical lifting capabilities and can stack up to six containers on top of each other.

|

|

•

|

Straddle carriers pick up and carry shipping containers from or to a quay-side crane while straddling their load. Straddle carriers have the capability to stack up to four shipping containers on top of each other. Straddle carriers are used in port and railway facilities to move shipping containers and to load and unload shipping containers from on-highway trucks. Straddle carriers have both horizontal and vertical lifting capabilities.

|

|

•

|

Sprinter carriers operate in a similar manner to straddle carriers, but at higher speeds in horizontal transport and can stack only one container on top of another container.

|

|

•

|

Reach stackers are used to pick up and stack shipping containers at port and railway facilities. At the end of each reach stacker’s boom is a spreader that enables it to attach to shipping containers of varying lengths and weights and to rotate the container.

|

|

•

|

Empty container handlers, full container handlers and general cargo lift trucks are small to medium-sized highly mobile trucks for use with a variety of container handling applications at port and railway facilities and provide general cargo lifting capabilities.

|

|

•

|

Automated stacking cranes are able to stack and manage shipping container storage either automatically, semi-automatically or manually. They also form the link between quayside and landside equipment such as ship-to-shore cranes, transport vehicles and trucks.

|

|

•

|

Automated guided vehicles can carry containers of varying size. The vehicles are controlled and supplied with data and orders by our proprietary designed software. Automated guided vehicles find their routes via transponders, which are powerful radio frequency identification chips that are embedded into the pavement of the terminal. In large container terminals involving container transport, storage and transloading, automated guided vehicles work hand-in-hand with automated stacking cranes.

|

|

•

|

Jaw crushers are used for crushing larger rock, primarily at the quarry face or on recycling duties. Applications include hard rock, sand and gravel and recycled materials. Cone crushers are used in secondary and tertiary applications to reduce a number of materials, including quarry rock and riverbed gravel.

|

|

•

|

Horizontal shaft impactors are primary and secondary crushers. They are typically applied to reduce soft to medium hard materials, as well as recycled materials. Vertical shaft impactors are secondary and tertiary crushers that reduce material utilizing various rotor configurations and are highly adaptable to any application.

|

|

•

|

Heavy duty inclined and horizontal screens and feeders, which are used in low to high tonnage applications and are available as either stationary or heavy-duty mobile equipment. Screens are used in all phases of plant design from handling quarried material to fine screening. Dry screening is used to process materials such as sand, gravel, quarry rock, coal, ore, construction and demolition waste, soil, compost and wood chips.

|

|

•

|

Feeders are used to unload materials from hoppers and bulk material storage at controlled rates. They are available for applications ranging from primary feed hoppers to fine material bin unloading. Our range includes apron feeders, grizzly feeders and pan feeders.

|

|

•

|

Loader backhoes incorporate a front-end loader and rear excavator arm. They are used for loading, excavating and lifting in many construction and agricultural related applications.

|

|

•

|

Our compaction rollers range from pedestrian single drum to ride-on tandem drum rollers.

|

|

•

|

Excavators in the compact equipment category include mini, wheeled and midi excavators used in the general construction, landscaping and rental businesses.

|

|

•

|

Wheel loaders are used for loading and unloading materials. Applications include residential and non-residential construction, waste management and general construction.

|

|

•

|

Site dumpers are used to move materials from one location to another, and are primarily used for construction applications.

|

|

•

|

Material handlers are designed for handling logs, scrap, recycling and other bulky materials with clamshell, magnet or grapple attachments.

|

|

•

|

Concrete mixer trucks are machines with a large revolving drum in which cement is mixed with other materials to make concrete. We offer models with custom chassis as well as rear discharge models mounted on commercial chassis, both with configurations from three to seven axles.

|

|

•

|

Our concrete pavers are used to finish bridges, concrete streets, highways and airport surfaces.

|

|

PERCENTAGE OF SALES

|

||||||||

|

PRODUCT CATEGORY

|

2015

|

2014

|

2013

|

|||||

|

Aerial Work Products

|

27

|

%

|

26

|

%

|

24

|

%

|

||

|

Mobile & Tower Cranes

|

17

|

|

18

|

|

21

|

|

||

|

Materials Processing Equipment

|

10

|

|

7

|

|

9

|

|

||

|

Port Equipment

|

10

|

|

11

|

|

9

|

|

||

|

Material Handling

|

8

|

|

10

|

|

10

|

|

||

|

Services

|

7

|

|

7

|

|

7

|

|

||

|

Telehandlers & Light Construction Equipment

|

6

|

|

6

|

|

5

|

|

||

|

Compact Construction Equipment

|

5

|

|

7

|

|

7

|

|

||

|

Utility Equipment

|

5

|

|

4

|

|

5

|

|

||

|

Specialty Equipment

|

5

|

|

4

|

|

3

|

|

||

|

TOTAL

|

100

|

%

|

100

|

%

|

100

|

%

|

||

|

December 31,

|

|||||||

|

2015

|

2014

|

||||||

|

(in millions)

|

|||||||

|

AWP

|

$

|

567.5

|

|

$

|

698.4

|

|

|

|

Cranes

|

431.9

|

|

538.5

|

|

|||

|

MHPS

|

538.7

|

|

574.8

|

|

|||

|

MP

|

54.3

|

|

51.4

|

|

|||

|

Construction

|

145.9

|

|

137.9

|

|

|||

|

Total

|

$

|

1,738.3

|

|

$

|

2,001.0

|

|

|

|

BUSINESS SEGMENT

|

PRODUCTS

|

PRIMARY COMPETITORS

|

||

|

Aerial Work Platforms

|

Portable Material Lifts and Portable Aerial Work Platforms

|

Oshkosh (JLG), Vestil, Sumner and Wesco

|

||

|

|

|

|

||

|

Boom Lifts

|

Oshkosh (JLG), Haulotte, Linamar (Skyjack), Xtreme/Tanfield (Snorkel) and Aichi

|

|||

|

Scissor Lifts

|

Oshkosh (JLG), Linamar (Skyjack), Haulotte, Manitou and Xtreme/Tanfield (Snorkel)

|

|||

|

|

|

|||

|

Telehandlers

|

Oshkosh (JLG, Skytrak, Caterpillar and Lull brands), JCB, CNH, Merlo and Manitou (Gehl)

|

|||

|

|

|

|||

|

Trailer-mounted Light Towers

|

Allmand Bros., Generac, Wacker Neuson

and Doosan

|

|||

|

Cranes

|

Mobile Telescopic Cranes

|

Liebherr, Manitowoc (Grove), Tadano-Faun, Sumitomo (Link-Belt), XCMG, Kato, Zoomlion and Sany

|

||

|

Tower Cranes

|

Liebherr, Manitowoc (Potain), Comansa, Jaso, Zoomlion, XCMG and Wolffkran

|

|||

|

|

|

|||

|

Lattice Boom Crawler Cranes

|

Manitowoc, Sumitomo (Link-Belt), Liebherr, Hitachi, Kobelco, XCMG, Zoomlion, Fushun and Sany

|

|||

|

|

|

|||

|

Lattice Boom Truck Cranes

|

Liebherr

|

|||

|

|

|

|||

|

Truck-Mounted Cranes

|

Manitowoc (National Crane), Altec and Manitex

|

|||

|

|

|

|||

|

Utility Equipment

|

Altec and Time Manufacturing

|

|||

|

Material Handling & Port Solutions

|

Industrial Cranes

|

Konecranes, Columbus McKinnon, ABUS, Kito, GH and OMIS

|

||

|

Mobile Harbor Cranes and Automated Port Technology

|

Liebherr, Konecranes, Cargotec (Kalmar), Zhenhua Port Machinery (ZMPC) and Künz

|

|||

|

Reach Stackers

|

Cargotec (Kalmar), Hyster, Konecranes (SMV), Taylor, Dalian, CVS Ferrari, Liebherr and Sany

|

|||

|

|

|

|||

|

BUSINESS SEGMENT

|

PRODUCTS

|

PRIMARY COMPETITORS

|

||

|

Straddle and Sprinter Carriers

|

Cargotec (Kalmar), CVS Ferrari, Konecranes and Liebherr

|

|||

|

|

|

|||

|

Rubber Tired and Rail Mounted Gantry Cranes

|

Zhenhua Port Machinery (ZMPC), Liebherr, Konecranes, Cargotec (Kalmar), Doosan, Hyundai, Mitsui Engineering & Shipbuilding and Künz

|

|||

|

|

|

|||

|

Ship-to-Shore Gantry Cranes

|

Zhenhua Port Machinery (ZMPC), Liebherr, Konecranes, Cargotec (Kalmar), Samsung, Doosan, Hyundai and Mitsui Engineering & Shipbuilding

|

|||

|

|

|

|||

|

Empty Container Handlers, Full Container Handlers and General Cargo Lift Trucks

|

Cargotec (Kalmar), Hyster, Linde, CVS Ferrari, Konecranes (SMV), Svetruck and Sany

|

|||

|

Materials Processing

|

Crushing Equipment

|

Metso, Astec Industries, Sandvik, McCloskey, Komatsu and Kleemann

|

||

|

|

|

|

||

|

Screening Equipment

|

Metso, Astec Industries, McCloskey, Kleeman and Sandvik

|

|||

|

Washing systems

|

McLanahan, Astec Industries and CDE Global

|

|||

|

Wood processing biomass and recycling

|

Vermeer, Bandit, Astec Inductries, Doppstadt, Komptech and Hammell

|

|||

|

Construction

|

Material Handlers

|

Liebherr, Sennebogen, Linkbelt, Exodus and Caterpillar

|

||

|

|

|

|||

|

Wheel Loaders

|

Caterpillar, Volvo, Kubota, Kawasaki, John Deere, Komatsu, Hitachi, CNH, Liebherr and Doosan

|

|||

|

Loader Backhoes

|

Caterpillar, CNH, JCB, John Deere, and Mahindra

|

|||

|

|

|

|||

|

Mini Excavators

|

Doosan (Bobcat), Yanmar, Volvo, Takeuchi, IHI, CNH, Caterpillar, John Deere, Neuson and Kubota

|

|||

|

|

|

|||

|

Midi Excavators

|

Komatsu, Hitachi, Volvo and Yanmar

|

|||

|

|

|

|||

|

Wheeled Excavators

|

Wacker Neuson and Doosan (Bobcat)

|

|||

|

Site Dumpers

|

Thwaites, Wacker Neuson, JCB and AUSA

|

|||

|

|

|

|||

|

Compaction Rollers

|

Bomag, Hamm, JCB and Ammann

|

|||

|

Concrete Pavers

|

Gomaco, Wirtgen, Power Curbers and Guntert & Zimmerman

|

|||

|

|

|

|||

|

Concrete Mixer Trucks

|

Oshkosh, Kimble and Continental Manufacturing

|

|||

|

|

|

|||

|

ITEM 1A.

|

RISK FACTORS

|

|

•

|

Our employees may experience uncertainty about their future roles with the combined company, which might adversely affect our ability to retain and hire key personnel and other employees;

|

|

•

|

the attention of our management may be directed toward completion of the merger and transaction-related considerations and may be diverted from the day-to-day operations and pursuit of other opportunities that could have been beneficial to our businesses;

|

|

•

|

customers, distributors, vendors or suppliers may seek to modify or terminate their business relationships with us, or delay or defer decisions concerning Terex;

|

|

•

|

we have incurred and will continue to incur significant transaction costs in connection with the merger; and

|

|

•

|

we may be required to pay, in certain circumstances, a termination fee of up to $37 million to Konecranes.

|

|

•

|

difficulties in achieving anticipated cost savings, synergies (including sourcing synergies), business opportunities and growth prospects from the combination;

|

|

•

|

difficulties in the integration of operations and systems;

|

|

•

|

potential expense due to loss of tax attributes, gain recognition, and changes to consolidated group filing statuses due to the merger transaction and subsequent tax costs related to potential reduced ability to use tax attributes and costs of making cash available to the Finnish parent company and other potential material negative tax synergies if the combined company remains domiciled in Finland for an extended period of time;

|

|

•

|

conforming standards, controls, procedures and accounting and other policies, business cultures and compensation structures between the two companies;

|

|

•

|

difficulties in the assimilation of employees;

|

|

•

|

challenges in retaining key personnel;

|

|

•

|

higher than anticipated transaction and integration costs; and

|

|

•

|

higher interest rates on debt resulting in increased interest expense.

|

|

•

|

the business culture of the acquired business may not match well with our culture;

|

|

•

|

technological and product synergies, economies of scale and cost reductions may not occur as expected;

|

|

•

|

we may acquire or assume unexpected liabilities;

|

|

•

|

faulty assumptions may be made regarding the integration process;

|

|

•

|

unforeseen difficulties may arise in integrating operations and systems;

|

|

•

|

we may fail to retain, motivate and integrate key management and other employees of the acquired business;

|

|

•

|

higher than expected finance costs may arise due to unforeseen changes in tax, trade, environmental, labor, safety, payroll or pension policies in any jurisdiction in which the acquired business conducts its operations; and

|

|

•

|

we may experience problems in retaining customers.

|

|

•

|

trade protection measures and currency exchange controls;

|

|

•

|

labor unrest;

|

|

•

|

global and regional economic conditions;

|

|

•

|

political instability;

|

|

•

|

terrorist activities and the U.S. and international response thereto;

|

|

•

|

restrictions on the transfer of funds into or out of a country;

|

|

•

|

export duties and quotas;

|

|

•

|

domestic and foreign customs and tariffs;

|

|

•

|

current and changing regulatory environments;

|

|

•

|

difficulties protecting our intellectual property;

|

|

•

|

transportation delays and interruptions;

|

|

•

|

costs and difficulties in integrating, staffing and managing international operations, especially in developing markets such as China, India, Brazil, Russia and the Middle East;

|

|

•

|

difficulty in obtaining distribution support; and

|

|

•

|

current and changing tax laws.

|

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

|

ITEM 2.

|

PROPERTIES

|

|

BUSINESS UNIT

|

FACILITY LOCATION

|

BUSINESS UNIT

|

FACILITY LOCATION

|

|||

|

Terex (Corporate Offices)

|

Westport, Connecticut

(1)

|

MHPS

|

Solon, Ohio

|

|||

|

Schaeffhausen, Switzerland

|

Salzburg, Austria

|

|||||

|

AWP

|

Oklahoma City, Oklahoma

|

Cotia, Brazil

|

||||

|

Rock Hill, South Carolina

|

Shanghai, China

(1)

|

|||||

|

Moses Lake, Washington

(1)

|

Xiamen, China

|

|||||

|

North Bend, Washington

(1)

|

Slany, Czech Republic

|

|||||

|

Redmond, Washington

(1)

|

Banbury, England

(1)

|

|||||

|

Darra, Australia

(1)

|

Düsseldorf, Germany

|

|||||

|

Changzhou, China

|

Uslar, Germany

|

|||||

|

Umbertide, Italy

|

Wetter an der Ruhr, Germany

|

|||||

|

Cranes

|

Waverly, Iowa

|

Würzburg, Germany

|

||||

|

Watertown, South Dakota

(1)

|

Chakan, India

(1)

|

|||||

|

Huron, South Dakota

|

Lentigione, Italy

|

|||||

|

Brisbane, Australia

(1)

|

Milan, Italy

(1)

|

|||||

|

Betim, Brazil

(1)

|

Boksburg, South Africa

|

|||||

|

Jinan, China

|

Dietlikon, Switzerland

|

|||||

|

Long Crendon, England

|

MP

|

Louisville, Kentucky

|

||||

|

Montceau-les-Mines, France

|

Durand, Michigan

|

|||||

|

Bierbach-Homburg, Germany

(1)

|

Coalville, England

|

|||||

|

Zweibrücken-Dinglerstrasse, Germany

|

Hosur, India

|

|||||

|

Zweibrücken-Wallerscheid, Germany

(1)

|

Subang Jaya, Malaysia

(1)

|

|||||

|

Pecs, Hungary

(1)

|

Omagh, Northern Ireland

(1)

|

|||||

|

Crespellano, Italy

|

Dungannon, Northern Ireland

(1)

|

|||||

|

Fontanafredda, Italy

|

Newton, New Hampshire

|

|||||

|

Waukesha, Wisconsin

(1)

|

Ballymoney, Northern Ireland

|

|||||

|

Haid bei, Austria

(1)

|

||||||

|

Construction

|

Fort Wayne, Indiana

|

|||||

|

Southaven, Mississippi

(1)

|

||||||

|

Canton, South Dakota

|

||||||

|

Coventry, England

(1)

|

||||||

|

Bad Schönborn, Germany

|

||||||

|

Crailsheim, Germany

|

||||||

|

Greater Noida, Uttar Pradesh, India

(1)

|

||||||

|

Gerabronn, Germany

(1)

|

||||||

|

Oklahoma City, Oklahoma

|

||||||

|

(1)

|

These facilities are either leased or subleased.

|

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

|

ITEM 4.

|

MINE SAFETY DISCLOSURE

|

|

|

|

|

ITEM 5.

|

MARKET FOR THE REGISTRANT

’

S COMMON EQUITY RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

2015

|

2014

|

||||||||||||||||||||||||||||||

|

Fourth

|

Third

|

Second

|

First

|

Fourth

|

Third

|

Second

|

First

|

||||||||||||||||||||||||

|

High

|

$

|

22.76

|

|

$

|

27.11

|

|

$

|

29.32

|

|

$

|

28.53

|

|

$

|

32.54

|

|

$

|

42.53

|

|

$

|

44.72

|

|

$

|

45.46

|

|

|||||||

|

Low

|

$

|

17.29

|

|

$

|

16.54

|

|

$

|

22.25

|

|

$

|

22.01

|

|

$

|

25.40

|

|

$

|

31.52

|

|

$

|

37.99

|

|

$

|

37.02

|

|

|||||||

|

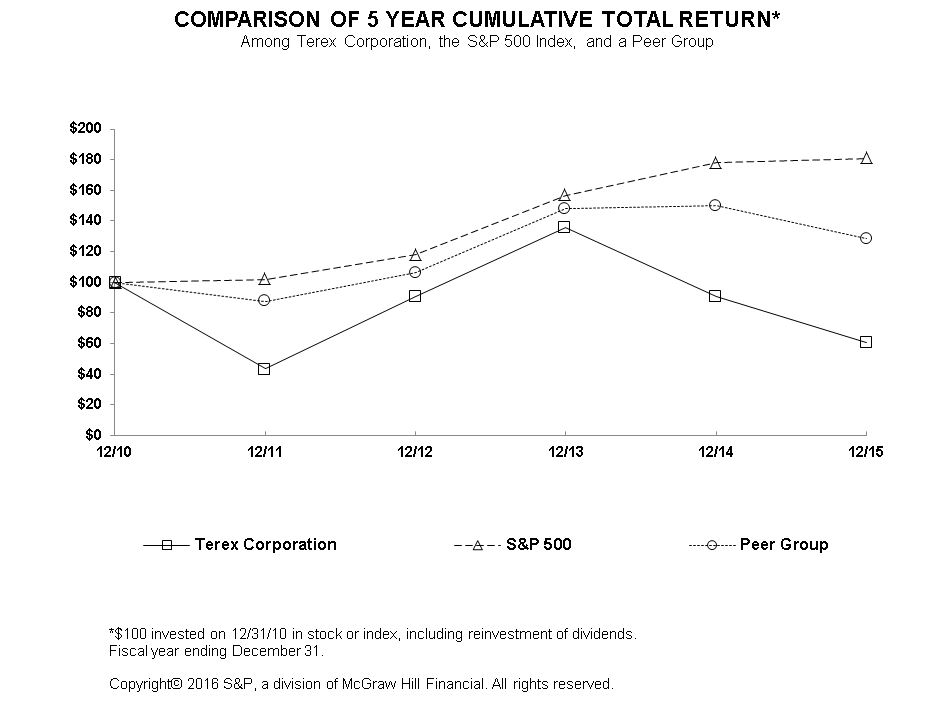

12/10

|

|

12/11

|

|

12/12

|

|

12/13

|

|

12/14

|

|

12/15

|

|

|

|

Terex Corporation

|

100.00

|

|

43.52

|

|

90.56

|

|

135.46

|

|

90.44

|

|

50.57

|

|

|

S&P 500

|

100.00

|

|

102.11

|

|

118.45

|

|

156.82

|

|

178.29

|

|

180.75

|

|

|

Peer Group

|

100.00

|

|

87.31

|

|

106.27

|

|

148.22

|

|

149.89

|

|

128.40

|

|

|

Copyright© 2016 Standard & Poor's, a division of The McGraw-Hill Companies Inc. All rights reserved. (www.researchdatagroup.com/S&P.htm)

|

||||||||||||

|

Issuer Purchases of Equity Securities

|

||||||||

|

Period

|

(a) Total Number of Shares Purchased

|

(b) Average Price Paid per Share

|

(c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

(1)

|

(d) Approximate Dollar Value of Shares that May Yet be Purchased

Under the Plans or Programs (in thousands)

(1)

|

||||

|

October 1, 2015 – October 31, 2015

|

12,800 (2)

|

$18.41

|

—

|

$150,000

|

||||

|

November 1, 2015 – November 30, 2015

|

—

|

$—

|

—

|

$150,000

|

||||

|

December 1, 2015 – December 31, 2015

|

6,412 (2)

|

$19.78

|

—

|

$150,000

|

||||

|

Total

|

19,212

|

$18.87

|

—

|

$150,000

|

||||

|

(1)

|

In February 2015, our Board of Directors authorized and the Company publicly announced the repurchase of up to $200 million of the Company’s outstanding common shares.

|

|

(2)

|

In October and December 2015 the Company purchased shares of common stock to satisfy requirements under its deferred compensation obligations to employees.

|

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

|

AS OF OR FOR THE YEAR ENDED DECEMBER 31,

|

|||||||||||||||||||

|

2015

|

2014

|

2013

|

2012

|

2011

|

|||||||||||||||

|

SUMMARY OF OPERATIONS

|

|||||||||||||||||||

|

Net sales

|

$

|

6,543.1

|

|

$

|

7,308.9

|

|

$

|

7,084.0

|

|

$

|

6,982.2

|

|

$

|

6,158.0

|

|

||||

|

Income (loss) from operations

|

355.2

|

|

423.1

|

|

419.1

|

|

366.8

|

|

59.9

|

|

|||||||||

|

Income (loss) from continuing operations

|

145.6

|

|

259.5

|

|

203.9

|

|

74.8

|

|

20.2

|

|

|||||||||

|

Income (loss) from discontinued operations – net of tax

|

—

|

|

1.4

|

|

14.4

|

|

28.4

|

|

19.7

|

|

|||||||||

|

Gain (loss) on disposition of discontinued operations – net of tax

|

3.4

|

|

58.6

|

|

2.6

|

|

0.4

|

|

0.8

|

|

|||||||||

|

Net income (loss) attributable to common stockholders

|

145.9

|

|

319.0

|

|

226.0

|

|

105.8

|

|

45.2

|

|

|||||||||

|

Per Common and Common Equivalent Share:

|

|||||||||||||||||||

|

Basic attributable to common stockholders

|

|||||||||||||||||||

|

Income (loss) from continuing operations

|

$

|

1.33

|

|

$

|

2.36

|

|

$

|

1.88

|

|

$

|

0.70

|

|

$

|

0.22

|

|

||||

|

Income (loss) from discontinued operations – net of tax

|

—

|

|

0.01

|

|

0.13

|

|

0.26

|

|

0.18

|

|

|||||||||

|

Gain (loss) on disposition of discontinued operations – net of tax

|

0.03

|

|

0.54

|

|

0.02

|

|

—

|

|

0.01

|

|

|||||||||

|

Net income (loss) attributable to common stockholders

|

1.36

|

|

2.91

|

|

2.03

|

|

0.96

|

|

0.41

|

|

|||||||||

|

Diluted attributable to common stockholders

|

|||||||||||||||||||

|

Income (loss) from continuing operations

|

$

|

1.30

|

|

$

|

2.27

|

|

$

|

1.79

|

|

$

|

0.68

|

|

$

|

0.22

|

|

||||

|

Income (loss) from discontinued operations – net of tax

|

—

|

|

0.01

|

|

0.12

|

|

0.25

|

|

0.18

|

|

|||||||||

|

Gain (loss) on disposition of discontinued operations – net of tax

|

0.03

|

|

0.51

|

|

0.02

|

|

—

|

|

0.01

|

|

|||||||||

|

Net income (loss) attributable to common stockholders

|

1.33

|

|

2.79

|

|

1.93

|

|

0.93

|

|

0.41

|

|

|||||||||

|

CURRENT ASSETS AND LIABILITIES

|

|||||||||||||||||||

|

Current assets

|

$

|

3,144.2

|

|

$

|

3,356.2

|

|

$

|

3,639.4

|

|

$

|

3,797.4

|

|

$

|

4,053.2

|

|

||||

|

Current liabilities

|

1,458.6

|

|

1,643.1

|

|

1,724.7

|

|

1,708.8

|

|

1,890.9

|

|

|||||||||

|

PROPERTY, PLANT AND EQUIPMENT

|

|||||||||||||||||||

|

Net property, plant and equipment

|

$

|

675.8

|

|

$

|

690.3

|

|

$

|

789.4

|

|

$

|

806.8

|

|

$

|

829.7

|

|

||||

|

Capital expenditures

|

(103.8

|

)

|

(80.0

|

)

|

(79.5

|

)

|

(81.2

|

)

|

(77.9

|

)

|

|||||||||

|

Depreciation

|

98.4

|

|

110.4

|

|

104.4

|

|

99.7

|

|

88.5

|

|

|||||||||

|

TOTAL ASSETS

|

$

|

5,637.1

|

|

$

|

5,928.0

|

|

$

|

6,536.7

|

|

$

|

6,746.2

|

|

$

|

7,063.4

|

|

||||

|

CAPITALIZATION

|

|||||||||||||||||||

|

Long-term debt and notes payable (includes capital leases)

|

$

|

1,831.2

|

|

$

|

1,788.8

|

|

$

|

1,976.7

|

|

$

|

2,098.7

|

|

$

|

2,300.4

|

|

||||

|

Total Terex Corporation Stockholders’ Equity

|

1,877.4

|

|

2,005.9

|

|

2,190.1

|

|

2,007.7

|

|

1,910.3

|

|

|||||||||

|

Dividends per share of Common Stock

|

0.24

|

|

0.20

|

|

0.05

|

|

—

|

|

—

|

|

|||||||||

|

Shares of Common Stock outstanding at year end

|

107.7

|

|

105.4

|

|

109.9

|

|

109.9

|

|

108.8

|

|

|||||||||

|

EMPLOYEES

|

20,400

|

|

20,400

|

|

20,500

|

|

20,900

|

|

22,100

|

|

|||||||||

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

Dec ’15

|

Sep ’15

|

Jun ’15

|

Mar ’15

|

Dec ’14

|

|||||||||||

|

Provision for (benefit from) income taxes

|

$

|

5.6

|

|

$

|

30.8

|

|

$

|

33.0

|

|

$

|

11.6

|

|

|||

|

Divided by: Income (loss) before income taxes

|

20.3

|

|

76.9

|

|

119.3

|

|

10.1

|

|

|||||||

|

Effective tax rate

|

27.6

|

%

|

40.1

|

%

|

27.7

|

%

|

114.9

|

%

|

|||||||

|

Income (loss) from operations as adjusted

|

$

|

53.1

|

|

$

|

109.4

|

|

$

|

147.2

|

|

$

|

46.5

|

|

|||

|

Multiplied by: 1 minus Effective tax rate

|

72.4

|

%

|

59.9

|

%

|

72.3

|

%

|

(14.9

|

)%

|

|||||||

|

Adjusted net operating income (loss) after tax

|

$

|

38.4

|

|

$

|

65.5

|

|

$

|

106.4

|

|

$

|

(6.9

|

)

|

|||

|

Debt (as defined above)

|

$

|

1,831.2

|

|

$

|

1,897.6

|

|

$

|

1,906.6

|

|

$

|

1,872.9

|

|

$

|

1,788.8

|

|

|

Less: Cash and cash equivalents

|

(466.5

|

)

|

(301.1

|

)

|

(332.7

|

)

|

(351.3

|

)

|

(478.2

|

)

|

|||||

|

Debt less Cash and cash equivalents

|

$

|

1,364.7

|

|

$

|

1,596.5

|

|

$

|

1,573.9

|

|

$

|

1,521.6

|

|

$

|

1,310.6

|

|

|

Total Terex Corporation stockholders’ equity as adjusted

|

$

|

1,528.0

|

|

$

|

1,549.7

|

|

$

|

1,630.8

|

|

$

|

1,543.3

|

|

$

|

1,843.2

|

|

|

Debt less Cash and cash equivalents plus Total Terex Corporation stockholders’ equity as adjusted

|

$

|

2,892.7

|

|

$

|

3,146.2

|

|

$

|

3,204.7

|

|

$

|

3,064.9

|

|

$

|

3,153.8

|

|

|

December 31, 2015 ROIC

|

6.6

|

%

|

|

|

NOPAT as adjusted (last 4 quarters)

|

$

|

203.4

|

|

|

Average Debt less Cash and cash equivalents plus Total Terex Corporation stockholders’ equity as adjusted (5 quarters)

|

$

|

3,092.5

|

|

|

Three months ended 12/31/15

|

Three months ended 9/30/15

|

Three months ended 06/30/15

|

Three months ended 03/31/15

|

||||||||||||

|

Reconciliation of income (loss) from operations:

|

|||||||||||||||

|

Income (loss) from operations as reported

|

$

|

50.8

|

|

$

|

111.9

|

|

$

|

148.3

|

|

$

|

44.2

|

|

|||

|

(Income) loss from operations for TFS

|

2.3

|

|

(2.5

|

)

|

(1.1

|

)

|

2.3

|

|

|||||||

|

Income (loss) from operations as adjusted

|

$

|

53.1

|

|

$

|

109.4

|

|

$

|

147.2

|

|

$

|

46.5

|

|

|||

|

Reconciliation of Terex Corporation stockholders’ equity:

|

As of 12/31/15

|

As of 9/30/15

|

As of 06/30/15

|

As of 03/31/15

|

As of 12/31/14

|

||||||||||

|

Terex Corporation stockholders’ equity as reported

|

$

|

1,877.4

|

|

$

|

1,889.9

|

|

$

|

1,915.0

|

|

$

|

1,747.8

|

|

$

|

2,005.9

|

|

|

TFS Assets

|

(349.4

|

)

|

(340.2

|

)

|

(284.2

|

)

|

(204.5

|

)

|

(162.7

|

)

|

|||||

|

Terex Corporation stockholders’ equity as adjusted

|

$

|

1,528.0

|

|

$

|

1,549.7

|

|

$

|

1,630.8

|

|

$

|

1,543.3

|

|

$

|

1,843.2

|

|

|

|

2015

|

2014

|

|

|

||||||||||||

|

|

|

% of

Sales

|

|

% of

Sales

|

|

% Change In Reported Amounts

|

||||||||||

|

|

($ amounts in millions)

|

|

|

|||||||||||||

|

Net sales

|

$

|

6,543.1

|

|

—

|

|

$

|

7,308.9

|

|

—

|

|

|

(10.5

|

)%

|

|||

|

Gross profit

|

$

|

1,308.5

|

|

20.0

|

%

|

$

|

1,453.5

|

|

19.9

|

%

|

|

(10.0

|

)%

|

|||

|

SG&A

|

$

|

918.6

|

|

14.0

|

%

|

$

|

1,030.4

|

|

14.1

|

%

|

|

(10.9

|

)%

|

|||

|

Goodwill and intangible asset impairment

|

$

|

34.7

|

|

0.5

|

%

|

$

|

—

|

|

—

|

%

|

*

|

|

||||

|

Income from operations

|

$

|

355.2

|

|

5.4

|

%

|

$

|

423.1

|

|

5.8

|

%

|

|

(16.0

|

)%

|

|||

|

*

|

Not meaningful as a percentage

|

|

|

2015

|

2014

|

|

|

||||||||||||

|

|

|

% of

Sales

|

|

% of

Sales

|

|

% Change In Reported Amounts

|

||||||||||

|

|

($ amounts in millions)

|

|

|

|||||||||||||

|

Net sales

|

$

|

2,213.4

|

|

|

—

|

|

$

|

2,369.7

|

|

|

—

|

|

|

(6.6

|

)%

|

|

|

Income from operations

|

$

|

269.3

|

|

|

12.2

|

%

|

$

|

302.8

|

|

|

12.8

|

%

|

|

(11.1

|

)%

|

|

|

|

2015

|

2014

|

|

|

||||||||||||

|

|

|

% of

Sales

|

|

% of

Sales

|

|

% Change In Reported Amounts

|

||||||||||

|

|

($ amounts in millions)

|

|

|

|||||||||||||

|

Net sales

|

$

|

1,699.7

|

|

|

—

|

|

$

|

1,791.1

|

|

|

—

|

|

|

(5.1

|

)%

|

|

|

Income from operations

|

$

|

57.5

|

|

|

3.4

|

%

|

$

|

85.9

|

|

|

4.8

|

%

|

|

(33.1

|

)%

|

|

|

|

2015

|

2014

|

|

|||||||||||||

|

|

|

% of

Sales

|

|

% of

Sales

|

% Change In

Reported Amounts

|

|||||||||||

|

|

($ amounts in millions)

|

|

||||||||||||||

|

Net sales

|

$

|

1,445.8

|

|

—

|

|

$

|

1,783.4

|

|

—

|

|

(18.9

|

)%

|

||||

|

Loss from operations

|

$

|

(8.6

|

)

|

(0.6

|

)%

|

$

|

(17.2

|

)

|

(1.0

|

)%

|

(50.0

|

)%

|

||||

|

|

2015

|

2014

|

|

|

||||||||||||

|

|

|

% of

Sales

|

|

% of

Sales

|

|

% Change In Reported Amounts

|

||||||||||

|

|

($ amounts in millions)

|

|

|

|||||||||||||

|

Net sales

|

$

|

636.5

|

|

|

—

|

|

$

|

653.1

|

|

|

—

|

|

|

(2.5

|

)%

|

|

|

Income from operations

|

$

|

57.1

|

|

|

9.0

|

%

|

$

|

60.6

|

|

|

9.3

|

%

|

|

(5.8

|

)%

|

|

|

|

2015

|

2014

|

|

|

||||||||||||

|

|

|

% of

Sales

|

|

% of

Sales

|

|

% Change In Reported Amounts

|

||||||||||

|

|

($ amounts in millions)

|

|

|

|||||||||||||

|

Net sales

|

$

|

673.6

|

|

|

—

|

|

$

|

836.6

|

|

|

—

|

|

|

(19.5

|

)%

|

|

|

Income (loss) from operations

|

$

|

(10.2

|

)

|

|

(1.5

|

)%

|

$

|

1.2

|

|

|

0.1

|

%

|

|

*

|

|

|

|

|

2015

|

2014

|

|

|

|||||||||||

|

|

|

% of

Sales

|

|

% of

Sales

|

|

% Change In Reported Amounts

|

|||||||||

|

|

($ amounts in millions)

|

|

|

||||||||||||

|

Net sales

|

$

|

(125.9

|

)

|

|

—

|

|

$

|

(125.0

|

)

|

|

—

|

|

|

*

|

|

|

Loss from operations

|

$

|

(9.9

|

)

|

|

*

|

|

$

|

(10.2

|

)

|

|

*

|

|

|

*

|

|

|

*

|

Not meaningful as a percentage

|

|

|

2014

|

2013

|

|

|

||||||||||||

|

|

|

% of

Sales

|

|

% of

Sales

|

|

% Change In Reported Amounts

|

||||||||||

|

|

($ amounts in millions)

|

|

|

|||||||||||||

|

Net sales

|

$

|

7,308.9

|

|

—

|

|

$

|

7,084.0

|

|

—

|

|

|

3.2

|

%

|

|||

|

Gross profit

|

$

|

1,453.5

|

|

19.9

|

%

|

$

|

1,439.5

|

|

20.3

|

%

|

|

1.0

|

%

|

|||

|

SG&A

|

$

|

1,030.4

|

|

14.1

|

%

|

$

|

1,020.4

|

|

14.4

|

%

|

|

1.0

|

%

|

|||

|

Income from operations

|

$

|

423.1

|

|

5.8

|

%

|

$

|

419.1

|

|

5.9

|

%

|

|

1.0

|

%

|

|||

|

|

2014

|

2013

|

|

|

||||||||||||

|

|

|

% of

Sales

|

|

% of

Sales

|

|

% Change In Reported Amounts

|

||||||||||

|

|

($ amounts in millions)

|

|

|

|||||||||||||

|

Net sales

|

$

|

2,369.7

|

|

|

—

|

|

$

|

2,131.0

|

|

|

—

|

|

|

11.2

|

%

|

|

|

Income from operations

|

$

|

302.8

|

|

|

12.8

|

%

|

$

|

325.8

|

|

|

15.3

|

%

|

|

(7.1

|

)%

|

|

|

|

2014

|

2013

|

|

|

||||||||||||

|

|

|

% of

Sales

|

|

% of

Sales

|

|

% Change In Reported Amounts

|

||||||||||

|

|

($ amounts in millions)

|

|

|

|||||||||||||

|

Net sales

|

$

|

1,791.1

|

|

|

—

|

|

$

|

1,925.5

|

|

|

—

|

|

|

(7.0

|

)%

|

|

|

Income from operations

|

$

|

85.9

|

|

|

4.8

|

%

|

$

|

110.5

|

|

|

5.7

|

%

|

|

(22.3

|

)%

|

|

|

|

2014

|

2013

|

|

|||||||||||||

|

|

|

% of

Sales

|

|

% of

Sales

|

% Change In

Reported Amounts

|

|||||||||||

|

|

($ amounts in millions)

|

|

||||||||||||||

|

Net sales

|

$

|

1,783.4

|

|

—

|

|

$

|

1,698.5

|

|

—

|

|

5.0

|

%

|

||||

|

Loss from operations

|

$

|

(17.2

|

)

|

(1.0

|

)%

|

$

|

(41.8

|

)

|

(2.5

|

)%

|

*

|

|

||||

|

|

2014

|

2013

|

|

|

||||||||||||

|

|

|

% of

Sales

|

|

% of

Sales

|

|

% Change In Reported Amounts

|

||||||||||

|

|

($ amounts in millions)

|

|

|

|||||||||||||

|

Net sales

|

$

|

653.1

|

|

|

—

|

|

$

|

628.2

|

|

|

—

|

|

|

4.0

|

%

|

|

|

Income from operations

|

$

|

60.6

|

|

|

9.3

|

%

|

$

|

71.8

|

|

|

11.4

|

%

|

|

(15.6

|

)%

|

|

|

|

2014

|

2013

|

|

|

||||||||||||

|

|

|

% of

Sales

|

|

% of

Sales

|

|

% Change In Reported Amounts

|

||||||||||

|

|

($ amounts in millions)

|

|

|

|||||||||||||

|

Net sales

|

$

|

836.6

|

|

|

—

|

|

$

|

820.0

|

|

|

—

|

|

|

2.0

|

%

|

|

|

Income (loss) from operations

|

$

|

1.2

|

|

|

0.1

|

%

|

$

|

(24.8

|

)

|

|

(3.0

|

)%

|

|

*

|

|

|

|

|

2014

|

2013

|

|

|

|||||||||||

|

|

|

% of

Sales

|

|

% of

Sales

|

|

% Change In Reported Amounts

|

|||||||||

|

|

($ amounts in millions)

|

|

|

||||||||||||

|

Net sales

|

$

|

(125.0

|

)

|

|

—

|

|

$

|

(119.2

|

)

|

|

—

|

|

|

*

|

|

|

Loss from operations

|

$

|

(10.2

|

)

|

|

*

|

|

$

|

(22.4

|

)

|

|

*

|

|

|

*

|

|

|

a)

|

Persuasive evidence that an arrangement exists;

|

|

b)

|

The price to the buyer is fixed or determinable;

|

|

c)

|

Collectability is reasonably assured; and

|

|

d)

|

We have no significant obligations for future performance.

|

|

a)

|

Persuasive evidence that an arrangement exists;

|

|

b)

|

Delivery has occurred or services have been rendered;

|

|

c)

|

The price to the buyer is fixed or determinable;

|

|

d)

|

Collectability is reasonably assured;

|

|

e)

|

We have no significant obligations for future performance; and

|

|

f)

|

We are not entitled to direct the disposition of the goods, cannot rescind the transaction, cannot prohibit the customer from moving, selling, or otherwise using the goods in the ordinary course of business and have no other rights of holding title that rest with a titleholder of property that is subject to a lien under the UCC.

|

|

a)

|

Persuasive evidence that an arrangement exists;

|

|

b)

|

Delivery has occurred or services have been rendered;

|

|

c)

|

The price to the buyer is fixed or determinable;

|

|

d)

|

Collectability is reasonably assured; and

|

|

e)

|

The customer has given their acceptance, the time period for acceptance has elapsed or we have otherwise objectively demonstrated that the criteria specified in the acceptance provisions have been satisfied.

|

|

a)

|

Persuasive evidence that an arrangement exists;

|

|

b)

|

Delivery has occurred or services have been rendered;

|

|

c)

|

The price to the buyer is fixed or determinable; and

|

|

d)

|

Collectability is reasonably assured.

|

|

Increase

|

Decrease

|

||||||||||||||

|

Discount Rate

|

Expected long-

term rate of return

|

Discount Rate

|

Expected long-

term rate of return

|

||||||||||||

|

($ amounts in millions)

|

|||||||||||||||

|

U. S. Plan:

|

|||||||||||||||

|

Net pension expense

|

$

|

(0.2

|

)

|

$

|

(0.3

|

)

|

$

|

0.2

|

|

$

|

0.3

|

|

|||

|

Projected benefit obligation

|

$

|

(5.2

|

)

|

$

|

—

|

|

$

|

5.4

|

|

$

|

—

|

|

|||

|

Non-U.S. Plans:

|

|||||||||||||||

|

Net pension expense

|

$

|

0.1

|

|

$

|

(0.4

|

)

|

$

|

(0.2

|

)

|

$

|

0.4

|

|

|||

|

Projected benefit obligation

|

$

|

(18.5

|

)

|

$

|

—

|

|

$

|

19.5

|

|

$

|

—

|

|

|||

|

Year Ended

12/31/2015 |

||||

|

Net cash provided by (used in) operating activities

|

212.9

|

|

||

|

Plus: Increase (decrease) in TFS assets

|

186.7

|

|

||

|

Less: Increase in cash for securitization settlement

|

(6.2

|

)

|

||

|

Less: Capital expenditures

|

(103.8

|

)

|

||

|

Free cash flow

|

$

|

289.6

|

|

|

|

•

|

Many of our customers fund their purchases through third-party finance companies that extend credit based on the credit-worthiness of the customers and the expected residual value of our equipment. Changes either in customers’ credit profile or used equipment values may affect the ability of customers to purchase equipment. There can be no assurance that third-party finance companies will continue to extend credit to our customers as they have in the past.

|

|

•

|

As our sales change, the absolute amount of working capital needed to support our business may change.

|

|

•

|

Our suppliers extend payment terms to us based on our overall credit rating. Declines in our credit rating may influence suppliers’ willingness to extend terms and in turn increase the cash requirements of our business.

|

|

•

|

Sales of our products are subject to general economic conditions, weather, competition, the translation effect of foreign currency exchange rate changes, and other factors that in many cases are outside our direct control. For example, during periods of economic uncertainty, our customers have delayed purchasing decisions, which reduces cash generated from operations.

|

|

Three months ended 12/31/15

|

|||

|

Net Sales

|

$

|

1,577.7

|

|

|

x

|

4

|

|

|

|

Trailing Three Month Annualized Net Sales

|

$

|

6,310.8

|

|

|

As of 12/31/15

|

|||

|

Inventories

|

$

|

1,445.7

|

|

|

Trade Receivables

|

939.2

|

|

|

|

Less: Trade Accounts Payable

|

(737.7

|

)

|

|

|

Less: Customer advances

|

(142.7

|

)

|

|

|

Total Working Capital

|

$

|

1,504.5

|

|

|

Payments due by period

|

|||||||||||||||||||

|

Total

|

< 1 year

|

1-3 years

|

3-5 years

|

> 5 years

|

|||||||||||||||

|

Long-term debt obligations

|

$

|

2,286.3

|

|

$

|

166.9

|

|

$

|

284.0

|

|

$

|

527.4

|

|

$

|

1,308.0

|

|

||||

|

Capital lease obligations

|

5.1

|

|

1.1

|

|

2.0

|

|

1.2

|

|

0.8

|

|

|||||||||

|

Operating lease obligations

|

222.7

|

|