|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

|

23-1147939

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. employer identification no.)

|

|

|

|

|

|

550 East Swedesford Road, Suite 400, Wayne, Pennsylvania

|

|

19087

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Title of Each Class

|

|

Name of Each Exchange On Which Registered

|

|

Common Stock, par value $1 per share

|

|

New York Stock Exchange

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

ý

No

¨

|

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes

¨

No

ý

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

x

No

¨

|

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes

x

No

¨

|

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

x

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

Large accelerated filer

x

|

|

Accelerated filer

¨

|

|

Non-accelerated filer

¨

|

|

Smaller reporting company

¨

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

¨

No

x

|

||||||

|

The aggregate market value of the Common Stock of the registrant held by non-affiliates of the registrant (31,133,991 shares) on June 24, 2016 (the last business day of the registrant’s most recently completed fiscal second quarter) was $5,331,695,959 (1) . The aggregate market value was computed by reference to the closing price of the Common Stock on such date, as reported by the New York Stock Exchange.

|

||||||

|

The registrant had 44,905,133 Common Shares outstanding as of February 20, 2017.

|

||||||

|

Certain provisions of the registrant’s definitive proxy statement in connection with its 2017 Annual Meeting of Stockholders, to be filed within 120 days of the close of the registrant’s fiscal year, are incorporated by reference in Part III hereof.

|

|

(1) For purposes of this computation only, the registrant has defined “affiliate” as including executive officers and directors of the registrant and owners of more than five percent of the common stock of the registrant, without conceding that all such persons are “affiliates” for purposes of the federal securities laws.

|

|

•

|

changes in business relationships with and purchases by or from major customers or suppliers, including delays or cancellations in shipments;

|

|

•

|

demand for and market acceptance of new and existing products;

|

|

•

|

our ability to integrate acquired businesses into our operations, realize planned synergies and operate such businesses profitably in accordance with our expectations;

|

|

•

|

our ability to effectively execute our restructuring programs;

|

|

•

|

our inability to realize savings resulting from restructuring plans and programs at anticipated levels;

|

|

•

|

the impact of recently passed healthcare reform legislation and changes in Medicare, Medicaid and third-party coverage and reimbursements, as well as additional changes that may result due to policy initiatives under the new presidential administration;

|

|

•

|

competitive market conditions and resulting effects on revenues and pricing;

|

|

•

|

increases in raw material costs that cannot be recovered in product pricing;

|

|

•

|

global economic factors, including currency exchange rates, interest rates and sovereign debt issues;

|

|

•

|

difficulties entering new markets; and

|

|

•

|

general economic conditions.

|

|

ITEM 1.

|

BUSINESS

|

|

•

|

development of new products and product line extensions;

|

|

•

|

investment in new technologies and broadening their applications;

|

|

•

|

expansion of the use of our products in existing markets and introduction of our products into new geographic markets;

|

|

•

|

achievement of economies of scale as we continue to expand by leveraging our direct sales force and distribution network for new products, as well as increasing efficiencies in our sales and marketing and research and development structures and our manufacturing and distribution facilities; and

|

|

•

|

expansion of our product portfolio through select acquisitions, licensing arrangements and business partnerships that enhance, extend or expedite our development initiatives or our ability to increase our market share.

|

|

•

|

Arrow Central Venous Catheters (CVCs): Arrow CVCs are inserted in the neck or shoulder area and come in multiple lengths and up to four channels, or lumens. The Arrow CVC has a pressure injectable option which gives clinicians who perform contrast-enhanced CT scans the ability to use an indwelling (in the body) pressure injectable Arrow CVC to inject contrast dye for the scan without having to insert a second catheter.

|

|

•

|

Arrow EZ-IO Intraosseous Vascular Access System: The Arrow EZ-IO system provides vascular access for the delivery of medications and fluids via intraosseous, or in the bone, infusion when traditional vascular access is difficult or impossible. Sales of the Arrow EZ-IO system to our hospital customers are included in our Vascular North America segment results. As discussed below, sales of the Arrow EZ-IO to pre-hospital care customers, such as emergency medical service providers, are included in our Anesthesia North America segment results.

|

|

•

|

Arrow Peripherally Inserted Central Catheters (PICCs): Arrow PICCs are soft, flexible catheters that are inserted in the upper arm and advanced into a vein that carries blood to the heart to administer various types of intravenous medications and therapies. Arrow PICCs have a pressure injectable option that can withstand the higher pressures required by the injection of contrast media for CT scans.

|

|

•

|

Arrow Jugular Axillo-subclavian Central Catheters (JACCs): Arrow JACCs are designed to be inserted in the neck or shoulder area and provide an alternative to traditional CVCs and PICCs for acute care. Arrow JACCs may be used for short or long term periods to treat patients who may have poor peripheral circulation.

|

|

•

|

Arrow Midline Catheters (Midlines): Arrow Midlines are made of medical grade, flexible polyurethane material and are inserted in the upper arm. Midlines are appropriate when patients face difficult intravenous catheter insertions or therapy will last no longer than one to four weeks.

|

|

•

|

Arrow® Catheter Tip Positioning Systems: We offer two distinct catheter tip positioning systems that are designed to facilitate precise placement of catheters within the heart. The first is our VPS G4 Vascular Positioning System, which is an advanced vascular positioning system designed to facilitate precise placement of CVCs within the heart. Indicated as an alternative to chest x-ray confirmation for CVC tip placement confirmation in adult patients, the VPS G4 analyzes multiple metrics, in real time, to help clinicians navigate through the circulatory system and identify the correct catheter tip placement in the heart. We also offer the Arrow® VPS Rhythm™ System, which provides electrocardiogram (ECG)-based tip confirmation in a highly portable, lightweight and versatile design. ECG technology facilitates catheter tip placement and confirmation within the superior vena-cava-cavatorial junction in the heart, and can be used with a broad range of catheter types. When paired with our VPS TipTracker™

|

|

•

|

Arrow Arterial Catheterization Sets: Our Arrow arterial catheterization sets facilitate arterial pressure monitoring and blood withdrawal for glucose, blood-gas and electrolyte measurement in a wide variety of critical care and intensive care settings.

|

|

•

|

Arrow Multi-Lumen Access Catheters (MAC): The Arrow MAC combines the access of a sheath introducer with the high-flow lumens of a central line. The MAC's hemostasis valve allows for easy access for additional devices, such as a thermodilution catheter or ARROW® MAC Companion Catheter, adding up to three additional lumens.

|

|

•

|

Arrow Percutaneous Sheath Introducers: Our Arrow percutaneous sheath introducers are used to insert cardiovascular and other catheterization devices into the vascular system during critical care procedures.

|

|

•

|

Arrow OnControl® Powered Bone Marrow / Bone Access System: The Arrow OnControl powered bone access system enables access for hematology and oncology diagnostic procedures. The system is used to obtain bone marrow samples, aspirate the bone and access bone lesions.

|

|

•

|

Arrow Trerotola™ Percutaneous Thrombectomy Device ("PTD"): The Arrow Trerotola PTD is used for declotting of dialysis grafts and fistulas.

|

|

•

|

Arrow Chronic Hemodialysis Catheters: The Arrow chronic hemodialysis catheters include both antegrade and retrograde insertion options for split, step and symmetrical tip configurations.

|

|

•

|

ARROW-Clark™ VectorFlow™ Hemodialysis Catheter: The Arrow-Clark VectorFlow catheter is a symmetrical tip tunneled hemodialysis catheter designed to reduce loss of lock solution (which is used on catheters to reduce the risk of thrombosis), give sustained high flows and reduce the risk of thrombus accumulation due to platelet activation. Additionally, the specially designed catheter tip allows for placement flexibility with minimal impact on recirculation.

|

|

•

|

Arrow Acute Hemodialysis Catheters: Similar to the Arrow CVC portfolio, the Arrow Acute hemodialysis catheters are offered with or without ARROWg+ard antimicrobial surface treatment.

|

|

•

|

Arrow Polysite® Low Profile Hybrid Ports: The Arrow Polysite Low Profile Hybrid Port is used for long-term access to the central nervous system and to facilitate repeated vascular access. It is available in multiple standard French sizes. The hybrid design provides a strong titanium reservoir and lightweight plastic body delivering the strength and the comfort needed for long-term treatment in patients of all sizes.

|

|

•

|

LMA

®

Airways: Our LMA laryngeal masks are used by anesthesiologists and emergency responders to establish an airway to channel anesthesia gas or oxygen to a patient's lungs during surgery or trauma. The LMA Protector™ Airway, our latest airway management device, is the first single-use laryngeal mask with a dual gastric drainage channel and pharyngeal chamber designed specifically to channel high volume, high pressure gastric contents away from the airway. It also integrates our Second Seal™ technology to isolate the respiratory tract from the digestive tract, reducing the risk of aspiration of gastric contents. The LMA Protector Airway also includes our Cuff Pilot™ technology, which enables clinicians to confirm that the inserted cuff is properly inflated and to monitor pressure levels.

|

|

•

|

LMA

®

Atomization: Our LMA atomization portfolio includes products designed to facilitate atomized delivery of certain medications. Included in the portfolio is our LMA MAD Nasal™, an intranasal mucosal atomization device that is designed to provide a safe and painless way to deliver medications approved for intranasal delivery to a patient's blood stream without an intravenous line or needle.

|

|

•

|

RUSCH

®

Endotracheal Tubes and Laryngoscopes: We offer a broad portfolio of products to facilitate and support endotracheal intubation to administer oxygen, and anesthetic gases in multiple settings (surgery, critical care and emergency settings). We also provide a broad range of products for laryngoscopy, a procedure that is primarily used to obtain a view of the airway to facilitate tracheal intubation during general anesthesia or cardiopulmonary resuscitation ("CPR"). Among these products is the Rusch DispoLED™ Laryngoscope Handle and Green Rusch Lite Blade, a single-use system designed to help facilities comply with standards designed to reduce the potential for patient cross-contamination associated with reusable devices during intubation.

|

|

•

|

Arrow Epidural Catheters, Needles and Kits: We offer a broad range of Arrow epidural products, including the Arrow FlexTip Plus epidural catheter, to facilitate epidural analgesia. Epidural analgesia may be used separately for pain management, as an adjunct to general anesthesia, as a sole technique for surgical anesthesia and for post-operative pain management.

|

|

•

|

Arrow Peripheral Nerve Block ("PNB") Catheters, Pumps, Needles and Kits: Our portfolio of Arrow PNB products, which includes the Arrow Stimucath and FlexBlock catheters, are designed to be used by anesthesiologists to provide localized pain relief by injecting anesthetics to deliberately interrupt the signals traveling along a nerve. Nerve blocks are used in a variety of different procedures, including orthopedics.

|

|

•

|

AutoFuser Disposable Pain Pumps: Our AutoFuser Disposable Pain Pumps are designed for general infusion use, which includes regional anesthesia and pain management. Routes of administration include percutaneous, subcutaneous and epidural, and into the intra-operative (soft tissue/body cavity) sites. The AutoFuser offers multiple reservoir sizes and configurations to meet a variety of clinical demands.

|

|

•

|

Arrow EZ-IO System: The EZ-IO system, as described in the Vascular North America segment summary above, complements our pain management product portfolio when administered in pre-hospital emergency settings.

|

|

•

|

Weck

®

Ligation Systems: Our Weck Ligation Systems feature the Weck Ligating Clips and Hem-o-lok

®

Ligating Clips. Weck Ligating Clips are intended for use in procedures involving vessels or anatomic structures and are sold in various sizes, types and materials. Our Hem-o-lok Ligating Clips are intended for use in procedures involving ligation of vessels or tissue structures and are sold in various sizes.

|

|

•

|

Weck EFx Fascial Closure Systems: Our Weck fascial closure systems are used in laparoscopic surgical procedures and are intended to facilitate placement and withdrawal of suture loops to repair port site defects following laparoscopic surgery. Our Weck EFx endo fascial closure system is a port site closure device intended to minimize complications and costs associated with port-site herniation. We expanded this product line in 2015 to include the EFx Shield fascial closure system, which uses a shielded wing design for enhanced sharps protection, and a more basic cone and suture system called EFx Classic.

|

|

•

|

Percutaneous Surgical Systems: Our Mini-Lap surgical instruments, which we added to our product portfolio through our December 2014 acquisition of Mini-Lap Technologies, Inc. ("Mini-Lap"), are designed to be inserted percutaneously (through the skin) to enable surgeons to perform laparoscopic surgery without the need for a trocar. The MiniLap family of surgical instruments consists of a ThumbGrip option on a 2.3mm shaft or a pistol design called MiniGrip option on a 2.4mm shaft. In addition, we have developed the Percuvance

TM

percutaneous surgical system - 2.9mm device shaft with 5 mm operating tips. Percuvance, is used to penetrate soft tissue to access certain areas of the human abdomen and to grasp, hold and manipulate tissue, and, like Minilap, enables surgeon to access the abdominal cavity without the need for access ports. We received 510(k) clearance for this product in January 2015 and initiated a controlled launch of the product in the United States and Europe in 2015. In 2016, we initiated a limited market release in the United States and Europe.

|

|

•

|

device listing and establishment registration;

|

|

•

|

adherence to the Quality System Regulation (“QSR”) which requires stringent design, testing, control, documentation, complaint handling and other quality assurance procedures;

|

|

•

|

labeling requirements;

|

|

•

|

FDA prohibitions against the promotion of off-label uses or indications;

|

|

•

|

adverse event and malfunction reporting;

|

|

•

|

post-approval restrictions or conditions, potentially including post-approval clinical trials or other required testing;

|

|

•

|

post-market surveillance requirements;

|

|

•

|

the FDA’s recall authority, whereby it can require or ask for the recall of products from the market; and

|

|

•

|

voluntary corrections or removals reporting and documentation.

|

|

Name

|

Age

|

Positions and Offices with Company

|

|||

|

Benson F. Smith

|

69

|

|

Chairman, Chief Executive Officer and Director

|

||

|

Liam J. Kelly

|

50

|

|

President and Chief Operating Officer

|

||

|

Thomas E. Powell

|

55

|

|

Executive Vice President and Chief Financial Officer

|

||

|

Thomas A. Kennedy

|

54

|

|

Senior Vice President, Global Operations

|

||

|

Karen T. Boylan

|

45

|

|

Vice President, Global RA/QA

|

||

|

Cameron P. Hicks

|

52

|

|

Vice President, Global Human Resources

|

||

|

James J. Leyden

|

50

|

|

Vice President, General Counsel and Secretary

|

||

|

•

|

identify viable new products;

|

|

•

|

obtain adequate intellectual property protection;

|

|

•

|

gain market acceptance of new products; or

|

|

•

|

successfully obtain regulatory approvals.

|

|

•

|

partial suspension or total shutdown of manufacturing;

|

|

•

|

product shortages;

|

|

•

|

delays in product manufacturing;

|

|

•

|

warning or untitled letters;

|

|

•

|

fines or civil penalties;

|

|

•

|

delays in obtaining new regulatory clearances or approvals;

|

|

•

|

withdrawal or suspension of required clearances, approvals or licenses;

|

|

•

|

product seizures or recalls;

|

|

•

|

injunctions;

|

|

•

|

criminal prosecution;

|

|

•

|

advisories or other field actions;

|

|

•

|

operating restrictions; and

|

|

•

|

prohibitions against exporting of products to, or importing products from, countries outside the United States.

|

|

•

|

the federal healthcare anti-kickback statute, which, among other things, prohibits persons from knowingly and willfully offering or paying remuneration to induce either the referral of an individual for, or the purchase, order or recommendation of, any good or service for which payment may be made under federal healthcare programs such as Medicare and Medicaid, or soliciting payment for such referrals, purchases, orders and recommendations;

|

|

•

|

federal false claims laws which, among other things, prohibit individuals or entities from knowingly presenting, or causing to be presented, false or fraudulent claims for payment from the federal government, including Medicare, Medicaid or other third-party payors;

|

|

•

|

the federal Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), which prohibits schemes to defraud any healthcare benefit program and false statements relating to healthcare matters; and

|

|

•

|

state law equivalents of each of the above federal laws, such as anti-kickback and false claims laws which may apply to items or services reimbursed by any third-party payor, including commercial insurers.

|

|

•

|

established a 2.3% excise tax on sales of medical devices with respect to any entity that manufactures or imports specified medical devices offered for sale in the United States, although this tax has been suspended for 2016 and 2017 as a result of the enactment of the Consolidated Appropriations Act of 2016;

|

|

•

|

established a new Patient-Centered Outcomes Research Institute to oversee, identify priorities in and conduct comparative clinical effectiveness research;

|

|

•

|

implemented payment system reforms, including a national pilot program to encourage hospitals, physicians and other providers to improve the coordination, quality and efficiency of certain health care services through bundled payment models; and

|

|

•

|

created an independent payment advisory board that will submit recommendations to reduce Medicare spending if projected Medicare spending exceeds a specified growth rate.

|

|

•

|

exchange controls, currency restrictions and fluctuations in currency values;

|

|

•

|

trade protection measures;

|

|

•

|

potentially costly and burdensome import or export requirements;

|

|

•

|

laws and business practices that favor local companies;

|

|

•

|

changes in foreign medical reimbursement policies and procedures;

|

|

•

|

subsidies or increased access to capital for firms that currently are or may emerge as competitors in countries in which we have operations;

|

|

•

|

substantial foreign tax liabilities, including potentially negative consequences resulting from changes in tax laws;

|

|

•

|

restrictions and taxes related to the repatriation of foreign earnings;

|

|

•

|

differing labor regulations;

|

|

•

|

additional United States and foreign government controls or regulations;

|

|

•

|

difficulties in the protection of intellectual property; and

|

|

•

|

unsettled political and economic conditions and possible terrorist attacks against American interests.

|

|

•

|

the intense competition for skilled personnel in our industry;

|

|

•

|

fluctuations in global economic and industry conditions;

|

|

•

|

changes in our organizational structure;

|

|

•

|

our restructuring initiatives;

|

|

•

|

competitors’ hiring practices; and

|

|

•

|

the effectiveness of our compensation programs.

|

|

•

|

increase our vulnerability to general adverse economic and industry conditions;

|

|

•

|

require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, research and development efforts and other general corporate purposes;

|

|

•

|

limit our ability to borrow additional funds for such general corporate purposes;

|

|

•

|

limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

|

|

•

|

restrict us from exploiting business opportunities; and

|

|

•

|

place us at a competitive disadvantage compared to our competitors that have less indebtedness.

|

|

•

|

refinance all or a portion of our indebtedness;

|

|

•

|

sell assets;

|

|

•

|

reduce or delay capital expenditures; or

|

|

•

|

seek to raise additional capital.

|

|

•

|

incur additional indebtedness or issue preferred stock or otherwise disqualified stock;

|

|

•

|

create liens;

|

|

•

|

pay dividends, make investments or make other restricted payments;

|

|

•

|

sell assets;

|

|

•

|

use the proceeds of permitted sales of our assets;

|

|

•

|

merge, consolidate, sell or otherwise dispose of all or substantially all of our assets; and

|

|

•

|

enter into transactions with our affiliates.

|

|

•

|

the generation, storage, use and transportation of hazardous materials;

|

|

•

|

emissions or discharges of substances into the environment; and

|

|

•

|

the health and safety of our employees.

|

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

|

ITEM 2.

|

PROPERTIES

|

|

Location

|

Square

Footage |

Owned or

Leased |

||

|

Olive Branch, MS

|

627,000

|

Leased

|

||

|

Nuevo Laredo, Mexico

|

277,000

|

Leased

|

||

|

Asheboro, NC

|

204,000

|

Owned

|

||

|

Reading, PA

|

166,000

|

Owned

|

||

|

Tongeren, Belgium

|

163,000

|

Leased

|

||

|

Chihuahua, Mexico

|

153,000

|

Owned

|

||

|

Morrisville, NC

|

162,000

|

Leased

|

||

|

Kernen, Germany

|

112,000

|

Leased

|

||

|

Zdar nad Sazavou, Czech Republic

|

108,000

|

Owned

|

||

|

Kamunting, Malaysia

|

102,000

|

Owned

|

||

|

Chihuahua, Mexico

|

100,000

|

Leased

|

||

|

Tecate, Mexico

|

96,000

|

Leased

|

||

|

Hradec Kralove, Czech Republic

|

92,000

|

Owned

|

||

|

Chelmsford, MA

|

91,000

|

Leased

|

||

|

Kulim, Malaysia

|

90,000

|

Owned

|

||

|

Kernen, Germany

|

86,000

|

Owned

|

||

|

Arlington Heights, IL

|

86,000

|

Leased

|

||

|

Wayne, PA

|

84,000

|

Leased

|

||

|

Jaffrey, NH

|

81,000

|

Owned

|

||

|

Kamunting, Malaysia

|

77,000

|

Leased

|

||

|

Chihuahua, Mexico

|

68,000

|

Leased

|

||

|

Chihuahua, Mexico

|

63,000

|

Owned

|

||

|

Limerick, Ireland

|

59,000

|

Leased

|

||

|

Everett, MA

|

56,000

|

Leased

|

||

|

Bad Liebenzell, Germany

|

53,000

|

Leased

|

||

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

|

ITEM 4.

|

MINE SAFETY DISCLOSURES

|

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

2016

|

High

|

Low

|

Dividends

|

|||||||||

|

First Quarter

|

$

|

155.05

|

|

$

|

125.28

|

|

$

|

0.34

|

|

|||

|

Second Quarter

|

$

|

176.84

|

|

$

|

154.22

|

|

$

|

0.34

|

|

|||

|

Third Quarter

|

$

|

188.79

|

|

$

|

168.00

|

|

$

|

0.34

|

|

|||

|

Fourth Quarter

|

$

|

170.92

|

|

$

|

136.53

|

|

$

|

0.34

|

|

|||

|

2015

|

High

|

Low

|

Dividends

|

|||||||||

|

First Quarter

|

$

|

123.09

|

|

$

|

107.45

|

|

$

|

0.34

|

|

|||

|

Second Quarter

|

$

|

137.29

|

|

$

|

118.83

|

|

$

|

0.34

|

|

|||

|

Third Quarter

|

$

|

140.50

|

|

$

|

122.13

|

|

$

|

0.34

|

|

|||

|

Fourth Quarter

|

$

|

135.00

|

|

$

|

122.14

|

|

$

|

0.34

|

|

|||

|

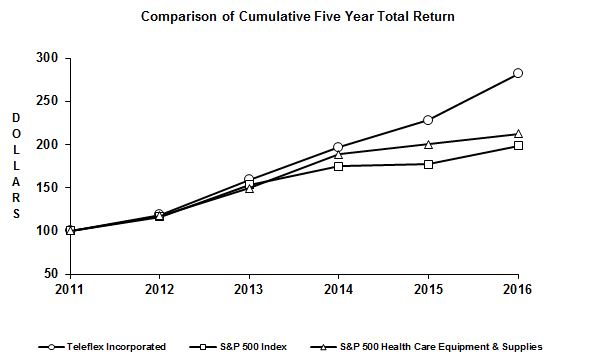

Company / Index

|

2011

|

|

2012

|

|

2013

|

|

2014

|

|

2015

|

|

2016

|

|

||||||

|

Teleflex Incorporated

|

100

|

|

119

|

|

159

|

|

197

|

|

228

|

|

282

|

|

||||||

|

S&P 500 Index

|

100

|

|

116

|

|

154

|

|

175

|

|

177

|

|

198

|

|

||||||

|

S&P 500 Healthcare Equipment & Supply Index

|

100

|

|

117

|

|

150

|

|

188

|

|

200

|

|

212

|

|

||||||

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

|

2016

(1)

|

2015

(1)

|

2014

(1)

|

2013

(1)

|

2012

(1)

|

|||||||||||||||||

|

|

(Dollars in thousands, except per share)

|

||||||||||||||||||||

|

Statement of Income Data:

|

|||||||||||||||||||||

|

Net revenues

|

$

|

1,868,027

|

|

$

|

1,809,690

|

|

$

|

1,839,832

|

|

$

|

1,696,271

|

|

$

|

1,551,009

|

|

||||||

|

Income (loss) from continuing operations before interest, loss on extinguishment of debt and taxes

|

$

|

319,453

|

|

$

|

315,891

|

|

$

|

284,862

|

|

$

|

233,261

|

|

|

$

|

(97,375

|

)

|

(2)

|

||||

|

Income (loss) from continuing operations

|

$

|

237,651

|

|

$

|

236,808

|

|

$

|

191,460

|

|

$

|

152,183

|

|

|

$

|

(181,782

|

)

|

(2)

|

||||

|

Amounts attributable to common shareholders for income (loss) from continuing operations

|

$

|

237,187

|

|

$

|

235,958

|

|

$

|

190,388

|

|

$

|

151,316

|

|

|

$

|

(182,737

|

)

|

(2)

|

||||

|

Per Share Data:

|

|||||||||||||||||||||

|

Income (loss) from continuing operations — basic

|

$

|

5.47

|

|

$

|

5.68

|

|

$

|

4.60

|

|

$

|

3.68

|

|

$

|

(4.47

|

)

|

||||||

|

Income (loss) from continuing operations — diluted

|

$

|

4.98

|

|

$

|

4.91

|

|

$

|

4.10

|

|

$

|

3.46

|

|

$

|

(4.47

|

)

|

||||||

|

Cash dividends

|

$

|

1.36

|

|

$

|

1.36

|

|

$

|

1.36

|

|

$

|

1.36

|

|

$

|

1.36

|

|

||||||

|

Balance Sheet Data:

|

|||||||||||||||||||||

|

Total assets

(3)

|

$

|

3,891,213

|

|

$

|

3,871,774

|

|

$

|

3,912,431

|

|

$

|

4,151,193

|

|

$

|

3,674,449

|

|

||||||

|

Long-term borrowings

(3)

|

$

|

850,252

|

|

$

|

641,850

|

|

$

|

693,720

|

|

$

|

927,496

|

|

$

|

954,291

|

|

||||||

|

Common shareholders’ equity

|

$

|

2,137,517

|

|

$

|

2,009,272

|

|

$

|

1,911,309

|

|

$

|

1,913,527

|

|

$

|

1,778,950

|

|

||||||

|

Statement of Cash Flows Data:

|

|||||||||||||||||||||

|

Net cash provided by operating activities from continuing operations

|

$

|

410,590

|

|

$

|

303,446

|

|

$

|

290,241

|

|

$

|

231,299

|

|

$

|

194,618

|

|

||||||

|

Net cash (used in) provided by investing activities from continuing operations

|

$

|

(56,974

|

)

|

$

|

(154,848

|

)

|

$

|

(108,137

|

)

|

$

|

(372,638

|

)

|

$

|

(368,258

|

)

|

||||||

|

Net cash (used in) provided by financing activities from continuing operations

|

$

|

(118,692

|

)

|

$

|

(85,583

|

)

|

$

|

(287,703

|

)

|

$

|

231,170

|

|

$

|

(65,653

|

)

|

||||||

|

Supplemental Data:

|

|||||||||||||||||||||

|

Free cash flow

(4)

|

$

|

357,455

|

|

$

|

241,998

|

|

$

|

222,670

|

|

$

|

167,719

|

|

$

|

129,224

|

|

||||||

|

(1)

|

Amounts include the impact of businesses acquired during the period. See

Note 3

to the consolidated financial statements included in this Annual Report on Form 10-K for additional information.

|

|

(2)

|

Includes a pretax goodwill impairment charge of $332.1 million, or $315.1 million net of tax.

|

|

(3)

|

Includes the impact of adopting, as of January 1, 2016, the accounting guidance related to the classification of debt issuance costs. See Note 2 to the consolidated financial statements included in this Annual Report on Form 10-K for additional information.

|

|

(4)

|

Free cash flow is calculated by subtracting capital expenditures from cash provided by operating activities from continuing operations. Free cash flow is considered a non-GAAP financial measure. This financial measure is used in addition to and in conjunction with results presented in accordance with generally accepted accounting principles in the United States, or GAAP, and should not be considered a substitute for net cash provided by operating activities from continuing operations, the most comparable GAAP financial measure. Management believes that free cash flow is a useful measure to investors because it facilitates an assessment of funds available to satisfy current and future obligations, pay dividends and fund acquisitions. We also use this financial measure for internal managerial purposes and to evaluate period-to-period comparisons. Free cash flow is not a measure of cash available for discretionary expenditures since we have certain non-discretionary obligations, such as debt service, that are not deducted from the measure. We strongly encourage investors to review our financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure. The following is a reconciliation of free cash flow to the most comparable GAAP measure.

|

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

|

(Dollars in thousands)

|

||||||||||||||||||

|

Net cash provided by operating activities from continuing operations

|

$

|

410,590

|

|

$

|

303,446

|

|

$

|

290,241

|

|

$

|

231,299

|

|

$

|

194,618

|

|

||||

|

Less: Capital expenditures

|

53,135

|

|

61,448

|

|

67,571

|

|

63,580

|

|

65,394

|

|

|||||||||

|

Free cash flow

|

$

|

357,455

|

|

$

|

241,998

|

|

$

|

222,670

|

|

$

|

167,719

|

|

$

|

129,224

|

|

||||

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

|

2016

|

2015

|

2014

|

||||||||

|

|

(Dollars in millions)

|

||||||||||

|

Net Revenues

|

$

|

1,868.0

|

|

$

|

1,809.7

|

|

$

|

1,839.8

|

|

||

|

|

2016

|

2015

|

2014

|

||||||||

|

|

(Dollars in millions)

|

||||||||||

|

Gross profit

|

$

|

996.2

|

|

$

|

944.4

|

|

$

|

942.4

|

|

||

|

Percentage of revenues

|

53.3

|

%

|

52.2

|

%

|

51.2

|

%

|

|||||

|

|

2016

|

2015

|

2014

|

||||||||

|

|

(Dollars in millions)

|

||||||||||

|

Selling, general and administrative

|

$

|

563.3

|

|

$

|

569.0

|

|

$

|

578.7

|

|

||

|

Percentage of revenues

|

30.2

|

%

|

31.4

|

%

|

31.5

|

%

|

|||||

|

|

2016

|

2015

|

2014

|

||||||||

|

|

(Dollars in millions)

|

||||||||||

|

Research and development

|

$

|

58.6

|

|

$

|

52.1

|

|

$

|

61.0

|

|

||

|

Percentage of revenues

|

3.1

|

%

|

2.9

|

%

|

3.3

|

%

|

|||||

|

|

2016

|

2015

|

2014

|

||||||||

|

|

(Dollars in millions)

|

||||||||||

|

Other 2016 restructuring programs

|

$

|

3.2

|

|

$

|

—

|

|

$

|

—

|

|

||

|

2016 Manufacturing footprint realignment plan

|

12.5

|

|

—

|

|

—

|

|

|||||

|

2015 Restructuring programs

|

0.1

|

|

6.3

|

|

—

|

|

|||||

|

2014 Manufacturing footprint realignment plan

|

0.1

|

|

1.7

|

|

9.3

|

|

|||||

|

2014 European restructuring plan

|

—

|

|

(0.1

|

)

|

7.8

|

|

|||||

|

Other 2014 restructuring programs

|

—

|

|

—

|

|

3.6

|

|

|||||

|

LMA restructuring program

|

—

|

|

—

|

|

(3.3

|

)

|

|||||

|

Other restructuring programs

|

(0.1

|

)

|

(0.1

|

)

|

0.5

|

|

|||||

|

Other impairment charges

|

43.4

|

|

—

|

|

$

|

—

|

|

||||

|

Total

|

$

|

59.2

|

|

$

|

7.8

|

|

$

|

17.9

|

|

||

|

2016

|

2015

|

2014

|

|||||||||

|

(Dollars in millions)

|

|||||||||||

|

Interest expense

|

$

|

54.9

|

|

$

|

61.3

|

|

$

|

65.5

|

|

||

|

Average interest rate on debt during the year

|

3.80

|

%

|

3.84

|

%

|

4.10

|

%

|

|||||

|

2016

|

2015

|

2014

|

|||||||||

|

(Dollars in millions)

|

|||||||||||

|

Loss on extinguishment of debt

|

$

|

19.3

|

|

$

|

10.5

|

|

$

|

—

|

|

||

|

|

2016

|

2015

|

2014

|

||||||||

|

|

(Dollars in millions)

|

||||||||||

|

Gain on sale of assets

|

$

|

4.4

|

|

$

|

0.4

|

|

$

|

—

|

|

||

|

|

2016

|

2015

|

2014

|

|||||

|

Effective income tax rate

|

3.3

|

%

|

3.2

|

%

|

13.0

|

%

|

||

|

|

Year Ended December 31

|

% Increase/(Decrease)

|

|||||||||||||||

|

|

2016

|

2015

|

2014

|

2016 vs 2015

|

2015 vs 2014

|

||||||||||||

|

|

(Dollars in millions)

|

|

|||||||||||||||

|

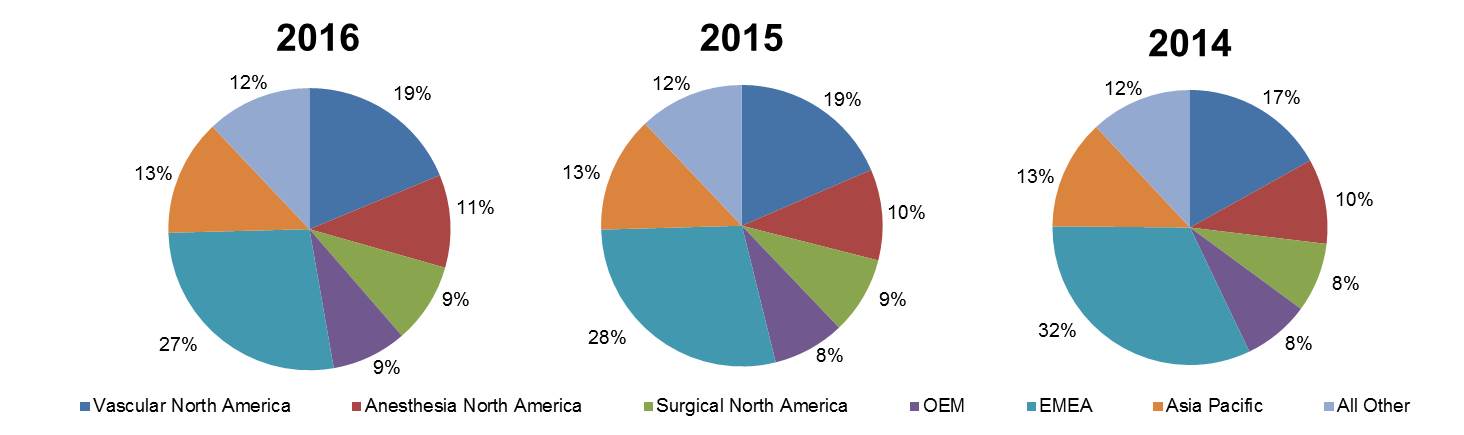

Vascular North America

|

$

|

350.5

|

|

$

|

334.9

|

|

$

|

311.1

|

|

4.6

|

|

7.6

|

|

||||

|

Anesthesia North America

|

198.8

|

|

189.2

|

|

183.9

|

|

5.0

|

|

2.9

|

|

|||||||

|

Surgical North America

|

172.2

|

|

161.3

|

|

150.1

|

|

6.8

|

|

7.4

|

|

|||||||

|

EMEA

|

510.9

|

|

514.5

|

|

593.1

|

|

(0.7

|

)

|

(13.3

|

)

|

|||||||

|

Asia

|

249.4

|

|

241.7

|

|

237.7

|

|

3.2

|

|

1.7

|

|

|||||||

|

OEM

|

161.0

|

|

149.4

|

|

144.0

|

|

7.8

|

|

3.8

|

|

|||||||

|

All other

|

225.2

|

|

218.7

|

|

219.9

|

|

3.0

|

|

(0.6

|

)

|

|||||||

|

Segment Net Revenues

|

$

|

1,868.0

|

|

$

|

1,809.7

|

|

$

|

1,839.8

|

|

3.2

|

|

(1.6

|

)

|

||||

|

|

Year Ended December 31,

|

% Increase/(Decrease)

|

|||||||||||||||

|

|

2016

|

2015

|

2014

|

2016 vs 2015

|

2015 vs 2014

|

||||||||||||

|

|

(Dollars in millions)

|

|

|||||||||||||||

|

Vascular North America

|

$

|

97.1

|

|

$

|

73.3

|

|

$

|

53.8

|

|

32.5

|

|

36.2

|

|

||||

|

Anesthesia North America

|

55.6

|

|

48.3

|

|

34.6

|

|

15.0

|

|

39.8

|

|

|||||||

|

Surgical North America

|

56.6

|

|

52.5

|

|

49.6

|

|

7.8

|

|

5.9

|

|

|||||||

|

EMEA

|

84.4

|

|

92.3

|

|

114.6

|

|

(8.6

|

)

|

(19.5

|

)

|

|||||||

|

Asia

|

75.7

|

|

67.9

|

|

62.2

|

|

11.6

|

|

9.2

|

|

|||||||

|

OEM

|

33.6

|

|

33.2

|

|

30.6

|

|

1.4

|

|

8.2

|

|

|||||||

|

All other

|

19.8

|

|

20.4

|

|

19.8

|

|

(2.8

|

)

|

3.0

|

|

|||||||

|

Segment Operating Profit

(1)

|

$

|

422.8

|

|

$

|

387.9

|

|

$

|

365.2

|

|

9.0

|

|

6.2

|

|

||||

|

(1)

|

See

Note 16

to the consolidated financial statements included in this Annual Report on Form 10-K for a reconciliation of segment operating profit to our consolidated income from continuing operations before interest, loss on extinguishment of debt and taxes.

|

|

Year Ended December 31,

|

|||||||||||

|

2016

|

2015

|

2014

|

|||||||||

|

(Dollars in millions)

|

|||||||||||

|

Cash flows from continuing operations provided by (used in):

|

|||||||||||

|

Operating activities

|

$

|

410.6

|

|

$

|

303.4

|

|

$

|

290.2

|

|

||

|

Investing activities

|

(57.0

|

)

|

(154.8

|

)

|

(108.1

|

)

|

|||||

|

Financing activities

|

(118.7

|

)

|

(85.6

|

)

|

(287.7

|

)

|

|||||

|

Cash flows used in discontinued operations

|

(2.1

|

)

|

(2.6

|

)

|

(3.7

|

)

|

|||||

|

Effect of exchange rate changes on cash and cash equivalents

|

(27.4

|

)

|

(25.3

|

)

|

(19.4

|

)

|

|||||

|

Increase (decrease) in cash and cash equivalents

|

$

|

205.4

|

|

$

|

35.1

|

|

$

|

(128.7

|

)

|

||

|

2016

|

2015

|

||||||

|

(Dollars in millions)

|

|||||||

|

Net debt includes:

|

|||||||

|

Current borrowings

|

$

|

183.1

|

|

$

|

417.4

|

|

|

|

Long-term borrowings

|

850.3

|

|

641.8

|

|

|||

|

Unamortized debt discount

|

2.7

|

|

23.0

|

|

|||

|

Unamortized debt issuance costs

|

10.0

|

|

6.7

|

|

|||

|

Total debt

|

1,046.1

|

|

1,088.9

|

|

|||

|

Less: Cash and cash equivalents

|

543.8

|

|

338.4

|

|

|||

|

Net debt

|

502.3

|

|

750.5

|

|

|||

|

Total capital includes:

|

|

|

|

|

|||

|

Net debt

|

502.3

|

|

750.5

|

|

|||

|

Common shareholders’ equity

|

2,137.5

|

|

2,009.3

|

|

|||

|

Total capital

|

$

|

2,639.8

|

|

$

|

2,759.8

|

|

|

|

Percent of net debt to total capital

|

19.0

|

%

|

27.2

|

%

|

|||

|

Market Price Per Share

|

Shares Issuable Upon Conversion of

Convertible Notes

|

Shares Issuable Upon Exercise of Warrants

|

Total Treasury

Stock Method Incremental Shares(1) |

Shares Deliverable to

Teleflex upon Settlement of the Hedge Agreements |

Incremental

Shares Issuable upon Concurrent Conversion of Convertible Notes, Exercise of Warrants and Settlement of the Hedge Agreements |

||||||||||

|

(Shares in thousands)

|

|||||||||||||||

|

$70

|

90

|

|

—

|

|

90

|

|

(90

|

)

|

—

|

|

|||||

|

$85

|

201

|

|

88

|

|

289

|

|

(201

|

)

|

88

|

|

|||||

|

$100

|

280

|

|

184

|

|

464

|

|

(280

|

)

|

184

|

|

|||||

|

$115

|

337

|

|

254

|

|

591

|

|

(337

|

)

|

254

|

|

|||||

|

$130

|

382

|

|

309

|

|

691

|

|

(382

|

)

|

309

|

|

|||||

|

$145

|

417

|

|

352

|

|

769

|

|

(417

|

)

|

352

|

|

|||||

|

$160

|

446

|

|

387

|

|

833

|

|

(446

|

)

|

387

|

|

|||||

|

$175

|

470

|

|

416

|

|

886

|

|

(470

|

)

|

416

|

|

|||||

|

$190

|

490

|

|

440

|

|

930

|

|

(490

|

)

|

440

|

|

|||||

|

$205

|

507

|

|

460

|

|

967

|

|

(507

|

)

|

460

|

|

|||||

|

(1)

|

Represents the number of incremental shares that must be included in the calculation of fully diluted shares under GAAP.

|

|

|

Payments due by period

|

||||||||||||||||||

|

Total

|

Less than

1 year |

1-3

years |

3-5

years |

More than

5 years |

|||||||||||||||

|

|

(Dollars in thousands)

|

||||||||||||||||||

|

Total borrowings

|

$

|

1,046,076

|

|

$

|

186,076

|

|

$

|

210,000

|

|

$

|

—

|

|

$

|

650,000

|

|

||||

|

Interest obligations

(1)

|

298,698

|

|

46,345

|

|

68,712

|

|

65,250

|

|

118,391

|

|

|||||||||

|

Operating lease obligations

|

140,988

|

|

29,546

|

|

43,573

|

|

31,205

|

|

36,664

|

|

|||||||||

|

Purchase and other obligations

(2)

|

109,314

|

|

107,013

|

|

2,196

|

|

105

|

|

—

|

|

|||||||||

|

Pension and other postretirement benefits

|

43,576

|

|

4,048

|

|

8,062

|

|

8,448

|

|

23,018

|

|

|||||||||

|

Total contractual obligations

|

$

|

1,638,652

|

|

$

|

373,028

|

|

$

|

332,543

|

|

$

|

105,008

|

|

$

|

828,073

|

|

||||

|

(1)

|

Interest payments on floating rate debt are based on the interest rate in effect on

December 31, 2016

.

|

|

Assumed Discount Rate

|

Expected Return on Plan Assets

|

Assumed Healthcare Trend Rate

|

|||||||||||||||||

|

50 Basis Point Increase

|

50 Basis Point Decrease

|

50 Basis Point Change

|

1.0% Increase

|

1.0% Decrease

|

|||||||||||||||

|

(Dollars in millions)

|

|||||||||||||||||||

|

Net periodic pension and postretirement healthcare expense

|

$

|

(0.2

|

)

|

$

|

0.2

|

|

$

|

1.5

|

|

$

|

0.2

|

|

$

|

(0.2

|

)

|

||||

|

Projected benefit obligation

|

$

|

(28.0

|

)

|

$

|

30.9

|

|

N/A

|

|

$

|

3.4

|

|

$

|

(3.0

|

)

|

|||||

|

Year of Maturity

|

|

|

|||||||||||||||||||||||||

|

2017

|

2018

|

2019

|

2020

|

2021

|

Thereafter

|

Total

|

|||||||||||||||||||||

|

(Dollars in thousands)

|

|||||||||||||||||||||||||||

|

Fixed rate debt

|

$

|

136,076

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

650,000

|

|

$

|

786,076

|

|

||||||

|

Average interest rate

|

3.875

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

5.019

|

%

|

4.821

|

%

|

|||||||||||||

|

Variable rate debt

|

$

|

50,000

|

|

$

|

210,000

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

260,000

|

|

||||||

|

Average interest rate

|

1.522

|

%

|

2.270

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

2.126

|

%

|

|||||||||||||

|

|

Buy/(Sell)

|

|||

|

|

(in thousands)

|

|||

|

Designated

|

Non-designated

|

|||

|

Australian dollar

|

(8,341

|

)

|

4,240

|

|

|

British pound

|

(4,300

|

)

|

(5,115

|

)

|

|

Canadian dollar

|

(8,496

|

)

|

(7,793

|

)

|

|

Chinese renminbi

|

(96,770

|

)

|

(85,679

|

)

|

|

Czech koruna

|

305,880

|

|

83,751

|

|

|

Euro

|

5,461

|

|

48,738

|

|

|

Japanese yen

|

(785,010

|

)

|

(1,538,166

|

)

|

|

Korean won

|

(3,581,250

|

)

|

(2,595,892

|

)

|

|

Malaysian ringgit

|

66,440

|

|

9,525

|

|

|

Mexican peso

|

354,640

|

|

78,786

|

|

|

Singapore dollar

|

7,945

|

|

—

|

|

|

South African rand

|

(40,750

|

)

|

(37,236

|

)

|

|

Swiss franc

|

(3,410

|

)

|

—

|

|

|

United States dollar

|

(9,091

|

)

|

(14,859

|

)

|

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

|

ITEM 9A.

|

CONTROLS AND PROCEDURES

|

|

ITEM 9B.

|

OTHER INFORMATION

|

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

|

ITEM 11.

|

EXECUTIVE COMPENSATION

|

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

|

Plan Category

|

Number of Securities

to be Issued Upon Exercise of Outstanding Options, Warrants and Rights |

Weighted-Average

Exercise Price of Outstanding Options, Warrants and Rights |

Number of Securities

Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (A)) |

|||

|

|

(A)

|

(B)

|

(C)

|

|||

|

Equity compensation plans approved by security holders

|

1,607,745

|

$99.51

|

3,999,156

|

|||

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

|

ITEM 14.

|

PRINCIPAL ACCOUNTING FEES AND SERVICES

|

|

ITEM 15.

|

EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

|

(a)

|

Consolidated Financial Statements:

|

|

(b)

|

Exhibits:

|

|

ITEM 16.

|

FORM 10-K SUMMARY

|

|

TELEFLEX INCORPORATED

|

|||

|

By:

|

/s/ Benson F. Smith

|

||

|

Benson F. Smith

|

|||

|

Chairman and Chief Executive Officer

(Principal Executive Officer) |

|||

|

By:

|

/s/ Thomas E. Powell

|

||

|

Thomas E. Powell

|

|||

|

Executive Vice President and Chief

Financial Officer

|

|||

|

(Principal Financial and Accounting Officer)

|

|||

|

By:

|

/s/ George Babich, Jr.

|

By:

|

/s/ Jeffrey A. Graves

|

|||

|

George Babich, Jr.

Director

|

Jeffrey A. Graves

Director

|

|||||

|

By:

|

/s/ Patricia C. Barron

|

By:

|

/s/ Gretchen R. Haggerty

|

|||

|

Patricia C. Barron

Director

|

Gretchen Haggerty

Director

|

|||||

|

By:

|

/s/ William R. Cook

|

By:

|

/s/ Dr. Stephen K. Klasko

|

|||

|

William R. Cook

Director

|

Dr. Stephen K. Klasko

Director

|

|||||

|

By:

|

/s/ Candace H. Duncan

|

By:

|

/s/ Stuart A. Randle

|

|||

|

Candace H. Duncan

Director

|

Stuart A. Randle

Director

|

|||||

|

By:

|

/s/ W. Kim Foster

|

By:

|

/s/ Benson F. Smith

|

|||

|

W. Kim Foster

Director

|

Benson F. Smith

Chairman, Chief Executive Officer & Director

(Principal Executive Officer)

|

|||||

|

|

Page

|

|

Management's Report on Internal Control Over Financial Reporting

|

F-2

|

|

Report of Independent Registered Public Accounting Firm

|

F-3

|

|

Consolidated Statements of Income for 2016, 2015 and 2014

|

F-4

|

|

Consolidated Statements of Comprehensive Income for 2016, 2015 and 2014

|

F-5

|

|

Consolidated Balance Sheets as of December 31, 2016 and December 31, 2015

|

F-6

|

|

Consolidated Statements of Cash Flows for 2016, 2015 and 2014

|

F-7

|

|

Consolidated Statements of Changes in Equity for 2016, 2015 and 2014

|

F-8

|

|

Notes to Consolidated Financial Statements

|

F-9

|

|

Quarterly Data

|

62

|

|

|

Page

|

|

Schedule II Valuation and qualifying accounts

|

63

|

|

/s/ Benson F. Smith

|

/s/ Thomas E. Powell

|

|

|

Benson F. Smith

Chairman and Chief Executive Officer

|

Thomas E. Powell

Executive Vice President and Chief Financial Officer

|

|

|

|

Year Ended December 31,

|

||||||||||

|

|

2016

|

2015

|

2014

|

||||||||

|

|

(Dollars and shares in thousands, except

per share)

|

||||||||||

|

Net revenues

|

$

|

1,868,027

|

|

$

|

1,809,690

|

|

$

|

1,839,832

|

|

||

|

Cost of goods sold

|

871,827

|

|

865,287

|

|

897,404

|

|

|||||

|

Gross profit

|

996,200

|

|

944,403

|

|

942,428

|

|

|||||

|

Selling, general and administrative expenses

|

563,308

|

|

568,982

|

|

578,657

|

|

|||||

|

Research and development expenses

|

58,579

|

|

52,119

|

|

61,040

|

|

|||||

|

Restructuring and other impairment charges

|

59,227

|

|

7,819

|

|

17,869

|

|

|||||

|

Gain on sale of assets

|

(4,367

|

)

|

(408

|

)

|

—

|

|

|||||

|

Income from continuing operations before interest, loss on extinguishment of debt and taxes

|

319,453

|

|

315,891

|

|

284,862

|

|

|||||

|

Interest expense

|

54,941

|

|

61,323

|

|

65,458

|

|

|||||

|

Interest income

|

(474

|

)

|

(532

|

)

|

(706

|

)

|

|||||

|

Loss on extinguishment of debt

|

19,261

|

|

10,454

|

|

—

|

|

|||||

|

Income from continuing operations before taxes

|

245,725

|

|

244,646

|

|

220,110

|

|

|||||

|

Taxes on income from continuing operations

|

8,074

|

|

7,838

|

|

28,650

|

|

|||||

|

Income from continuing operations

|

237,651

|

|

236,808

|

|

191,460

|

|

|||||

|

Operating loss from discontinued operations

|

(922

|

)

|

(1,730

|

)

|

(3,407

|

)

|

|||||

|

Tax benefit on loss from discontinued operations

|

(1,112

|

)

|

(10,635

|

)

|

(698

|

)

|

|||||

|

Income (loss) on discontinued operations

|

190

|

|

8,905

|

|

(2,709

|

)

|

|||||

|

Net income

|

237,841

|

|

245,713

|

|

188,751

|

|

|||||

|

Less: Income from continuing operations attributable to noncontrolling interest

|

464

|

|

850

|

|

1,072

|

|

|||||

|

Net income attributable to common shareholders

|

$

|

237,377

|

|

$

|

244,863

|

|

$

|

187,679

|

|

||

|

Earnings per share available to common shareholders:

|

|||||||||||

|

Basic:

|

|||||||||||

|

Income from continuing operations

|

$

|

5.47

|

|

$

|

5.68

|

|

$

|

4.60

|

|

||

|

Income (loss) on discontinued operations

|

0.01

|

|

0.21

|

|

(0.06

|

)

|

|||||

|

Net income

|

$

|

5.48

|

|

$

|

5.89

|

|

$

|

4.54

|

|

||

|

Diluted:

|

|||||||||||

|

Income from continuing operations

|

$

|

4.98

|

|

$

|

4.91

|

|

$

|

4.10

|

|

||

|

Income (loss) on discontinued operations

|

—

|

|

0.19

|

|

(0.06

|

)

|

|||||

|

Net income

|

$

|

4.98

|

|

$

|

5.10

|

|

$

|

4.04

|

|

||

|

Dividends per share

|

$

|

1.36

|

|

$

|

1.36

|

|

$

|

1.36

|

|

||

|

Weighted average common shares outstanding:

|

|||||||||||

|

Basic

|

43,325

|

|

41,558

|

|

41,366

|

|

|||||

|

Diluted

|

47,646

|

|

48,058

|

|

46,470

|

|

|||||

|

Amounts attributable to common shareholders:

|

|||||||||||

|

Income from continuing operations, net of tax

|

$

|

237,187

|

|

$

|

235,958

|

|

$

|

190,388

|

|

||

|

Income (loss) from discontinued operations, net of tax

|

190

|

|

8,905

|

|

(2,709

|

)

|

|||||

|

Net income

|

$

|

237,377

|

|

$

|

244,863

|

|

$

|

187,679

|

|

||

|

Year Ended December 31,

|

|||||||||||

|

|

2016

|

2015

|

2014

|

||||||||

|

|

(Dollars in thousands)

|

||||||||||

|

Net income

|

$

|

237,841

|

|

$

|

245,713

|

|

$

|

188,751

|

|

||

|

Other comprehensive income, net of tax:

|

|||||||||||

|

Foreign currency:

|

|||||||||||

|

Foreign currency translation continuing operations adjustments, net of tax of $10,977, $24,150, and $24,818, respectively

|

(69,162

|

)

|

(110,671

|

)

|

(105,410

|

)

|

|||||

|

Foreign currency translation, net of tax

|

(69,162

|

)

|

(110,671

|

)

|

(105,410

|

)

|

|||||

|

Pension and other postretirement benefits plans:

|

|||||||||||

|

Prior service cost recognized in net periodic cost, net of tax of $(20), $0, and $9 respectively

|

36

|

|

—

|

|

(12

|

)

|

|||||

|

Unamortized (loss) gain arising during the period, net of tax of $1,849, $1,469, and $26,624, respectively

|

(3,255

|

)

|

(2,137

|

)

|

(48,245

|

)

|

|||||

|

Net loss recognized in net periodic cost, net of tax of $(2,489), $(2,242), and $(1,544), respectively

|

4,476

|

|

4,133

|

|

2,841

|

|

|||||

|