|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended February 1, 2014

|

|

|

OR

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from to

|

|

|

Minnesota

(State or other jurisdiction of

incorporation or organization)

|

|

41-0215170

(I.R.S. Employer

Identification No.)

|

|

1000 Nicollet Mall, Minneapolis, Minnesota

(Address of principal executive offices)

|

|

55403

(Zip Code)

|

|

Title of Each Class

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, par value $0.0833 per share

|

|

New York Stock Exchange

|

|

Large accelerated filer

x

|

Accelerated filer

o

|

Non-accelerated filer

o

(Do not check if a smaller reporting company)

|

Smaller reporting company

o

|

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

||||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

||||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

||||

|

|

|

|||

|

|

||||

|

|

||||

|

74

|

|

|||

|

Owned Brands

|

|

|

|

Archer Farms®

|

Gilligan & O'Malley®

|

Sutton & Dodge®

|

|

Simply Balanced™

|

Market Pantry®

|

Threshold™

|

|

Boots & Barkley®

|

Merona®

|

up & up®

|

|

CHEFS®

|

Room Essentials®

|

Wine Cube®

|

|

Circo®

|

Smith & Hawken®

|

Xhilaration®

|

|

Embark®

|

Spritz™

|

|

|

Exclusive Brands

|

|

|

|

Assets® by Sarah Blakely

|

Genuine Kids from OshKosh®

|

Nate Berkus for Target®

|

|

C9 by Champion®

|

Giada De Laurentiis™ for Target®

|

Nick & Nora®

|

|

Carlton®

|

Harajuku Mini for Target®

|

Shaun White

|

|

Chefmate®

|

Just One You made by Carter's

|

Simply Shabby Chic®

|

|

Cherokee®

|

Kid Made Modern®

|

Sonia Kashuk®

|

|

Converse® One Star®

|

Kitchen Essentials® from Calphalon®

|

Thomas O'Brien®

|

|

dENiZEN™ from Levi's®

|

Liz Lange® for Target

|

|

|

Fieldcrest®

|

Mossimo Supply Company®

|

|

|

U.S. Stores at February 1, 2014

|

Stores

|

|

Retail Sq. Ft.

(in thousands)

|

|

|

Stores

|

|

Retail Sq. Ft.

(in thousands)

|

|

|

|

Alabama

|

22

|

|

3,150

|

|

Montana

|

7

|

|

780

|

|

|

|

Alaska

|

3

|

|

504

|

|

Nebraska

|

14

|

|

2,006

|

|

|

|

Arizona

|

47

|

|

6,264

|

|

Nevada

|

19

|

|

2,461

|

|

|

|

Arkansas

|

9

|

|

1,165

|

|

New Hampshire

|

9

|

|

1,148

|

|

|

|

California

|

262

|

|

34,718

|

|

New Jersey

|

43

|

|

5,701

|

|

|

|

Colorado

|

41

|

|

6,215

|

|

New Mexico

|

10

|

|

1,185

|

|

|

|

Connecticut

|

20

|

|

2,672

|

|

New York

|

69

|

|

9,437

|

|

|

|

Delaware

|

3

|

|

440

|

|

North Carolina

|

48

|

|

6,360

|

|

|

|

District of Columbia

|

1

|

|

179

|

|

North Dakota

|

4

|

|

554

|

|

|

|

Florida

|

123

|

|

17,345

|

|

Ohio

|

64

|

|

8,002

|

|

|

|

Georgia

|

54

|

|

7,398

|

|

Oklahoma

|

16

|

|

2,285

|

|

|

|

Hawaii

|

4

|

|

695

|

|

Oregon

|

19

|

|

2,280

|

|

|

|

Idaho

|

6

|

|

664

|

|

Pennsylvania

|

64

|

|

8,384

|

|

|

|

Illinois

|

91

|

|

12,514

|

|

Rhode Island

|

4

|

|

517

|

|

|

|

Indiana

|

33

|

|

4,377

|

|

South Carolina

|

19

|

|

2,359

|

|

|

|

Iowa

|

22

|

|

3,015

|

|

South Dakota

|

5

|

|

580

|

|

|

|

Kansas

|

19

|

|

2,577

|

|

Tennessee

|

32

|

|

4,114

|

|

|

|

Kentucky

|

14

|

|

1,660

|

|

Texas

|

149

|

|

20,976

|

|

|

|

Louisiana

|

16

|

|

2,246

|

|

Utah

|

13

|

|

1,953

|

|

|

|

Maine

|

5

|

|

630

|

|

Vermont

|

—

|

|

—

|

|

|

|

Maryland

|

38

|

|

4,938

|

|

Virginia

|

57

|

|

7,650

|

|

|

|

Massachusetts

|

36

|

|

4,734

|

|

Washington

|

36

|

|

4,194

|

|

|

|

Michigan

|

59

|

|

7,057

|

|

West Virginia

|

6

|

|

755

|

|

|

|

Minnesota

|

75

|

|

10,777

|

|

Wisconsin

|

39

|

|

4,773

|

|

|

|

Mississippi

|

6

|

|

743

|

|

Wyoming

|

2

|

|

187

|

|

|

|

Missouri

|

36

|

|

4,736

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

1,793

|

|

240,054

|

|

||

|

Canadian Stores at February 1, 2014

|

Stores

|

|

Retail Sq. Ft.

(in thousands) |

|

|

Stores

|

|

Retail Sq. Ft.

(in thousands) |

|

|

|

Alberta

|

14

|

|

1,633

|

|

Nunavut

|

—

|

|

—

|

|

|

|

British Columbia

|

18

|

|

2,047

|

|

Ontario

|

50

|

|

5,772

|

|

|

|

Manitoba

|

4

|

|

457

|

|

Prince Edward Island

|

1

|

|

106

|

|

|

|

New Brunswick

|

3

|

|

320

|

|

Quebec

|

25

|

|

2,876

|

|

|

|

Newfoundland and Labrador

|

2

|

|

216

|

|

Saskatchewan

|

3

|

|

319

|

|

|

|

Northwest Territories

|

—

|

|

—

|

|

Yukon

|

—

|

|

—

|

|

|

|

Nova Scotia

|

4

|

|

443

|

|

||||||

|

|

|

|

|

Total

|

124

|

|

14,189

|

|

||

|

U.S. Stores and Distribution Centers at February 1, 2014

|

Stores

|

|

Distribution

Centers

(a)

|

|

|

Owned

|

1,535

|

|

31

|

|

|

Leased

|

91

|

|

6

|

|

|

Owned buildings on leased land

|

167

|

|

—

|

|

|

Total

|

1,793

|

|

37

|

|

|

(a)

|

The 37 distribution centers have a total of 50,111 thousand square feet.

|

|

Canadian Stores and Distribution Centers at February 1, 2014

|

Stores

|

|

Distribution

Centers

(a)

|

|

|

Owned

|

—

|

|

3

|

|

|

Leased

|

124

|

|

—

|

|

|

Total

|

124

|

|

3

|

|

|

(a)

|

The 3 distribution centers have a total of 3,963 thousand square feet.

|

|

Name

|

Title and Business Experience

|

Age

|

|

|

Timothy R. Baer

|

Executive Vice President, General Counsel and Corporate Secretary since March 2007.

|

53

|

|

|

Anthony S. Fisher

|

President, Target Canada since January 2011. Vice President, Merchandise Operations from February 2010 to January 2011. Divisional Merchandise Manager, Toys and Sporting Goods, from June 2008 to January 2010.

|

39

|

|

|

John D. Griffith

|

Executive Vice President, Property Development since February 2005.

|

52

|

|

|

Jeffrey J. Jones II

|

Executive Vice President and Chief Marketing Officer since April 2012. Partner and President of McKinney Ventures LLC from March 2006 to March 2012.

|

46

|

|

|

Jodeen A. Kozlak

|

Executive Vice President, Human Resources since March 2007.

|

50

|

|

|

John J. Mulligan

|

Executive Vice President and Chief Financial Officer since April 2012. Senior Vice President, Treasury, Accounting and Operations from February 2010 to April 2012. Vice President, Pay and Benefits from February 2007 to February 2010.

|

48

|

|

|

Tina M. Schiel

|

Executive Vice President, Stores since January 2011. Senior Vice President, New Business Development from February 2010 to January 2011. Senior Vice President, Stores from February 2001 to February 2010.

|

48

|

|

|

Gregg W. Steinhafel

|

Chairman of the Board, President and Chief Executive Officer since February 2009. President and Chief Executive Officer since May 2008. Director since January 2007. President since August 1999.

|

59

|

|

|

Kathryn A. Tesija

|

Executive Vice President, Merchandising and Supply Chain since October 2012. Executive Vice President, Merchandising from May 2008 to September 2012.

|

51

|

|

|

Laysha L. Ward

|

President, Community Relations and Target Foundation since July 2008.

|

46

|

|

|

Period

|

Total Number

of Shares

Purchased

(a)(b)

|

|

Average

Price Paid

per Share

(a)(b)

|

|

Total Number of

Shares Purchased

as Part of the

Current Program

(a)

|

|

Dollar Value of

Shares that May

Yet Be Purchased

Under the Program

|

|

||

|

November 3, 2013 through November 30, 2013

|

2,406

|

|

$

|

—

|

|

49,148,329

|

|

$

|

1,904,324,394

|

|

|

December 1, 2013 through January 4, 2014

|

18,310

|

|

—

|

|

49,148,329

|

|

1,904,324,394

|

|

||

|

January 5, 2014 through February 1, 2014

|

147,537

|

|

—

|

|

49,148,329

|

|

1,904,324,394

|

|

||

|

168,253

|

|

$

|

—

|

|

49,148,329

|

|

$

|

1,904,324,394

|

|

|

|

(a)

|

The table above includes shares reacquired upon settlement of prepaid forward contracts. At

February 1, 2014

, we held asset positions in prepaid forward contracts for 1 million shares of our common stock, for a total cash investment of $63 million, or an average per share price of $48.83. No shares were reacquired under such contracts during the fourth quarter. Refer to Notes 23 and 25 of the Notes to Consolidated Financial Statements included in Item 8, Financial Statements and Supplementary Data for further details of these contracts.

|

|

(b)

|

The number of shares above includes shares of common stock reacquired from team members who tendered owned shares to satisfy the tax withholding on equity awards as part of our long-term incentive plans or to satisfy the exercise price on stock option exercises. For the three months ended

February 1, 2014

,168,253 shares were reacquired at an weighted average per share price of $61.91 pursuant to our long-term incentive plan.

|

|

|

Fiscal Years Ended

|

|||||||||||||||||

|

|

January 31,

2009 |

|

January 30,

2010 |

|

January 29,

2011 |

|

January 28,

2012 |

|

February 2,

2013 |

|

February 1,

2014 |

|

||||||

|

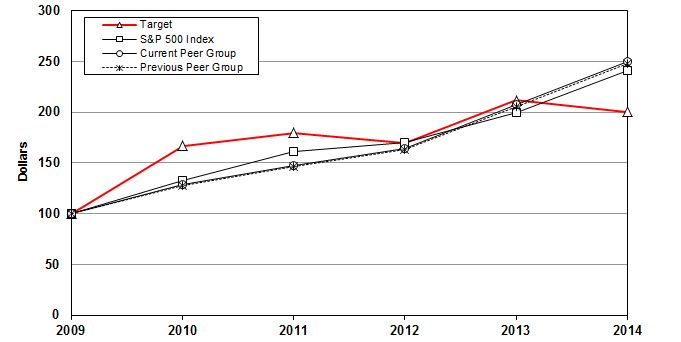

Target

|

$

|

100.00

|

|

$

|

167.08

|

|

$

|

179.93

|

|

$

|

169.27

|

|

$

|

211.54

|

|

$

|

200.64

|

|

|

S&P 500 Index

|

100.00

|

|

133.14

|

|

161.44

|

|

170.04

|

|

199.98

|

|

240.58

|

|

||||||

|

Previous Peer Group

|

100.00

|

|

128.10

|

|

146.82

|

|

163.21

|

|

205.64

|

|

247.92

|

|

||||||

|

Current Peer Group

|

100.00

|

|

128.46

|

|

147.71

|

|

164.25

|

|

207.23

|

|

249.77

|

|

||||||

|

|

As of or for the Year Ended

|

|||||||||||||||||

|

(millions, except per share data)

|

2013

|

|

2012

(a)

|

|

2011

|

|

2010

|

|

2009

|

|

2008

|

|

||||||

|

Financial Results:

|

|

|

|

|

|

|

||||||||||||

|

Total revenues

(b)

|

$

|

72,596

|

|

$

|

73,301

|

|

$

|

69,865

|

|

$

|

67,390

|

|

$

|

65,357

|

|

$

|

64,948

|

|

|

Net earnings

|

1,971

|

|

2,999

|

|

2,929

|

|

2,920

|

|

2,488

|

|

2,214

|

|

||||||

|

Per Share:

|

|

|

|

|

|

|

||||||||||||

|

Basic earnings per share

|

3.10

|

|

4.57

|

|

4.31

|

|

4.03

|

|

3.31

|

|

2.87

|

|

||||||

|

Diluted earnings per share

|

3.07

|

|

4.52

|

|

4.28

|

|

4.00

|

|

3.30

|

|

2.86

|

|

||||||

|

Cash dividends declared per share

|

1.65

|

|

1.38

|

|

1.15

|

|

0.92

|

|

0.67

|

|

0.62

|

|

||||||

|

Financial Position:

|

|

|

|

|

|

|

||||||||||||

|

Total assets

|

44,553

|

|

48,163

|

|

46,630

|

|

43,705

|

|

44,533

|

|

44,106

|

|

||||||

|

Long-term debt, including current portion

|

13,782

|

|

17,648

|

|

17,483

|

|

15,726

|

|

16,814

|

|

18,752

|

|

||||||

|

(a)

|

Consisted of 53 weeks.

|

|

(b)

|

For 2013, total revenues include sales generated by our U.S. and Canadian retail operations. For 2012 and prior, total revenues include sales generated by our U.S. retail operations and credit card revenues.

|

|

•

|

GAAP earnings per share were

$3.07

, including dilution of $1.13 related to the Canadian Segment.

|

|

•

|

Adjusted earnings per share were

$4.38

on a comparable sales decrease of 0.4 percent.

|

|

•

|

We paid dividends of

$1,006 million

and repurchased

21.9 million

of our shares for

$1,474 million

.

|

|

•

|

We opened 124 stores in Canada, marking the biggest single-year store opening cycle in the Company's history and first year of international retail operations.

|

|

•

|

We completed the sale of our U.S. consumer credit card portfolio to TD in March 2013 and recognized a gain of $391 million.

|

|

•

|

We used $1.4 billion of the net proceeds received from the sale of our U.S. consumer credit card portfolio to repurchase, at market value, $970 million of debt.

|

|

Earnings Per Share

|

|

|

|

Percent Change

|

|||||||||

|

|

2013

|

|

2012

(a)

|

|

2011

|

|

2013/2012

|

|

2012/2011

|

|

|||

|

GAAP diluted earnings per share

|

$

|

3.07

|

|

$

|

4.52

|

|

$

|

4.28

|

|

(32.1

|

)%

|

5.6

|

%

|

|

Adjustments

|

1.31

|

|

0.24

|

|

0.13

|

|

|

|

|

|

|||

|

Adjusted diluted earnings per share

|

$

|

4.38

|

|

$

|

4.76

|

|

$

|

4.41

|

|

(8.0

|

)%

|

7.9

|

%

|

|

(a)

|

Consisted of 53 weeks.

|

|

U.S. Segment Results

|

|

|

|

Percent Change

|

|||||||||

|

(dollars in millions)

|

2013

|

|

2012

(a)

|

|

2011

|

|

2013/2012

|

|

2012/2011

|

|

|||

|

Sales

|

$

|

71,279

|

|

$

|

71,960

|

|

$

|

68,466

|

|

(0.9

|

)%

|

5.1

|

%

|

|

Cost of sales

|

50,039

|

|

50,568

|

|

47,860

|

|

(1.0

|

)

|

5.7

|

|

|||

|

Gross margin

|

21,240

|

|

21,392

|

|

20,606

|

|

(0.7

|

)

|

3.8

|

|

|||

|

SG&A expenses

(b)

|

14,285

|

|

13,759

|

|

13,079

|

|

3.8

|

|

5.2

|

|

|||

|

EBITDA

|

6,955

|

|

7,633

|

|

7,527

|

|

(8.9

|

)

|

1.4

|

|

|||

|

Depreciation and amortization

|

1,996

|

|

2,044

|

|

2,084

|

|

(2.4

|

)

|

(1.9

|

)

|

|||

|

EBIT

|

$

|

4,959

|

|

$

|

5,589

|

|

$

|

5,443

|

|

(11.3

|

)%

|

2.7

|

%

|

|

(a)

|

Consisted of 53 weeks.

|

|

(b)

|

SG&A includes credit card revenues and expenses for all periods presented prior to the March 2013 sale of our U.S. consumer credit card portfolio to TD. For 2013, SG&A also includes $653 million of profit-sharing income from the arrangement with TD.

|

|

U.S. Segment Rate Analysis

|

Twelve Months Ended February 2, 2013

|

2013 U.S. Segment Change vs. 2012

|

||||||||||||||

|

|

Twelve Months Ended February 1, 2014

|

|

U.S. Segment,

as revised

|

|

Impact of

Historical U.S.

Credit Card

Segment

(a)

|

|

|

Historical

U.S. Retail

Segment

|

|

U.S. Segment,

as revised

|

|

Historical

U.S. Retail

Segment

|

||||

|

Gross margin rate

|

29.8

|

%

|

29.7

|

%

|

—

|

|

pp

|

29.7

|

%

|

0.1pp

|

|

0.1pp

|

||||

|

SG&A expense rate

|

20.0

|

|

19.1

|

|

(0.8

|

)

|

19.9

|

|

0.9

|

|

0.1

|

|||||

|

EBITDA margin rate

|

9.8

|

|

10.6

|

|

0.8

|

|

|

9.8

|

|

(0.8

|

)

|

—

|

||||

|

Depreciation and amortization expense rate

|

2.8

|

|

2.8

|

|

—

|

|

|

2.8

|

|

—

|

|

—

|

||||

|

EBIT margin rate

|

7.0

|

|

7.8

|

|

0.8

|

|

|

7.0

|

|

(0.8

|

)

|

—

|

||||

|

U.S. Segment Rate Analysis

|

Twelve Months Ended January 28, 2012

|

2012 U.S. Segment Change vs. 2011

|

|||||||||||||||

|

|

Twelve Months Ended February 2, 2013

|

|

U.S. Segment,

as revised

|

|

Impact of

Historical U.S.

Credit Card

Segment

(a)

|

|

|

Historical

U.S. Retail

Segment

|

|

U.S. Segment,

as revised

|

|

Historical

U.S. Retail

Segment

|

|

||||

|

Gross margin rate

|

29.7

|

%

|

30.1

|

%

|

—

|

|

pp

|

30.1

|

%

|

(0.4)pp

|

|

(0.4)pp

|

|

||||

|

SG&A expense rate

|

19.1

|

|

19.1

|

|

(1.0

|

)

|

20.1

|

|

—

|

|

(1.0

|

)

|

|||||

|

EBITDA margin rate

|

10.6

|

|

11.0

|

|

1.0

|

|

|

10.0

|

|

(0.4

|

)

|

0.6

|

|

||||

|

Depreciation and amortization expense rate

|

2.8

|

|

3.0

|

|

—

|

|

|

3.0

|

|

(0.2

|

)

|

(0.2

|

)

|

||||

|

EBIT margin rate

|

7.8

|

|

8.0

|

|

1.0

|

|

|

7.0

|

|

(0.2

|

)

|

0.8

|

|

||||

|

(a)

|

Represents the impact of combining the historical U.S. Credit Card Segment and the U.S. Retail Segment into one U.S. Segment. Compared with the historical U.S. Retail Segment results for the same period, segment results, as revised, reflect lower SG&A rates and increased EBIT and EBITDA margin rates resulting from the inclusion of credit card profits, net of expenses, within SG&A compared with historical U.S. Segment results for the same period.

|

|

Comparable Sales

|

2013

|

|

2012

|

|

2011

|

|

|

Comparable sales change

|

(0.4

|

)%

|

2.7

|

%

|

3.0

|

%

|

|

Drivers of change in comparable sales:

|

|

|

|

|||

|

Number of transactions

|

(2.7

|

)%

|

0.5

|

%

|

0.4

|

%

|

|

Average transaction amount

|

2.3

|

%

|

2.3

|

%

|

2.6

|

%

|

|

Selling price per unit

|

1.6

|

%

|

1.3

|

%

|

0.3

|

%

|

|

Units per transaction

|

0.7

|

%

|

1.0

|

%

|

2.3

|

%

|

|

U.S. Sales by Product Category

|

Percentage of Sales

|

|||||

|

|

2013

|

|

2012

|

|

2011

|

|

|

Household essentials

(a)

|

25

|

%

|

25

|

%

|

25

|

%

|

|

Hardlines

(b)

|

18

|

|

18

|

|

19

|

|

|

Apparel and accessories

(c)

|

19

|

|

19

|

|

19

|

|

|

Food and pet supplies

(d)

|

21

|

|

20

|

|

19

|

|

|

Home furnishings and décor

(e)

|

17

|

|

18

|

|

18

|

|

|

Total

|

100

|

%

|

100

|

%

|

100

|

%

|

|

(a)

|

Includes pharmacy, beauty, personal care, baby care, cleaning and paper products.

|

|

(b)

|

Includes electronics (including video game hardware and software), music, movies, books, computer software, sporting goods and toys.

|

|

(c)

|

Includes apparel for women, men, boys, girls, toddlers, infants and newborns, as well as intimate apparel, jewelry, accessories and shoes.

|

|

(d)

|

Includes dry grocery, dairy, frozen food, beverages, candy, snacks, deli, bakery, meat, produce and pet supplies.

|

|

(e)

|

Includes furniture, lighting, kitchenware, small appliances, home décor, bed and bath, home improvement, automotive and seasonal merchandise such as patio furniture and holiday décor.

|

|

REDcard Penetration

|

2013

|

|

2012

|

|

2011

|

|

|

Target Credit Cards

|

9.3

|

%

|

7.9

|

%

|

6.8

|

%

|

|

Target Debit Card

|

9.9

|

|

5.7

|

|

2.5

|

|

|

Total store REDcard Penetration

|

19.3

|

%

|

13.6

|

%

|

9.3

|

%

|

|

Change in Number of Stores

|

2013

|

|

2012

|

|

|

Beginning store count

|

1,778

|

|

1,763

|

|

|

Opened

|

19

|

|

23

|

|

|

Closed

|

(4

|

)

|

(5

|

)

|

|

Relocated

|

—

|

|

(3

|

)

|

|

Ending store count

|

1,793

|

|

1,778

|

|

|

Number of stores remodeled during the year

|

100

|

|

252

|

|

|

Number of Stores and

Retail Square Feet |

Number of Stores

|

Retail Square Feet

(a)

|

|||||||

|

February 1, 2014

|

|

February 2, 2013

|

|

February 1, 2014

|

|

February 2, 2013

|

|

||

|

Target general merchandise stores

|

289

|

|

391

|

|

33,843

|

|

46,584

|

|

|

|

Expanded food assortment stores

|

1,245

|

|

1,131

|

|

160,891

|

|

146,249

|

|

|

|

SuperTarget stores

|

251

|

|

251

|

|

44,500

|

|

44,500

|

|

|

|

CityTarget stores

|

8

|

|

5

|

|

820

|

|

514

|

|

|

|

Total

|

1,793

|

|

1,778

|

|

240,054

|

|

237,847

|

|

|

|

(a)

|

In thousands, reflects total square feet less office, distribution center and vacant space.

|

|

Canadian Segment Results

|

|

|

|

Percent Change

|

|||||||||

|

(dollars in millions)

|

2013

|

|

2012

|

|

2011

|

|

2013/2012

|

|

2012/2011

|

|

|||

|

Sales

|

$

|

1,317

|

|

$

|

—

|

|

$

|

—

|

|

n/a

|

|

n/a

|

|

|

Cost of sales

|

1,121

|

|

—

|

|

—

|

|

n/a

|

|

n/a

|

|

|||

|

Gross margin

|

196

|

|

—

|

|

—

|

|

n/a

|

|

n/a

|

|

|||

|

SG&A expenses

|

910

|

|

272

|

|

74

|

|

234.9

|

|

268.7

|

|

|||

|

EBITDA

|

(714

|

)

|

(272

|

)

|

(74

|

)

|

162.6

|

|

268.7

|

|

|||

|

Depreciation and amortization

|

227

|

|

97

|

|

48

|

|

133.6

|

|

103.2

|

|

|||

|

EBIT

|

$

|

(941

|

)

|

$

|

(369

|

)

|

$

|

(122

|

)

|

155.0

|

%

|

203.5

|

%

|

|

Canadian Segment Rate Analysis

|

2013

|

|

|

Gross margin rate

|

14.9

|

%

|

|

SG&A expense rate

|

69.1

|

|

|

EBITDA margin rate

|

(54.2

|

)

|

|

Depreciation and amortization expense rate

|

17.3

|

|

|

EBIT margin rate

|

(71.5

|

)

|

|

REDcard Penetration

|

2013

|

|

|

Target Credit Cards

|

1.4

|

%

|

|

Target Debit Card

|

1.5

|

|

|

Total store REDcard Penetration

|

2.9

|

%

|

|

2013

|

2012

|

2011

|

||||||||||||||||||||||||||||||||||

|

(millions, except per share data)

|

Pretax

|

|

Net of Tax

|

|

Per Share Amounts

|

|

Pretax

|

|

Net of Tax

|

|

Per Share Amounts

|

|

Pretax

|

|

Net of Tax

|

|

Per Share Amounts

|

|

||||||||||||||||||

|

GAAP diluted earnings per share

|

$

|

3.07

|

|

$

|

4.52

|

|

$

|

4.28

|

|

|||||||||||||||||||||||||||

|

Adjustments

|

||||||||||||||||||||||||||||||||||||

|

Total Canadian losses

(a)

|

$

|

1,018

|

|

$

|

723

|

|

$

|

1.13

|

|

$

|

447

|

|

$

|

315

|

|

$

|

0.48

|

|

$

|

166

|

|

$

|

119

|

|

$

|

0.17

|

|

|||||||||

|

Loss on early retirement of debt

|

445

|

|

270

|

|

0.42

|

|

—

|

|

—

|

|

—

|

|

87

|

|

55

|

|

0.08

|

|

||||||||||||||||||

|

Gain on receivables transaction

(b)

|

(391

|

)

|

(247

|

)

|

(0.38

|

)

|

(152

|

)

|

(97

|

)

|

(0.15

|

)

|

—

|

|

—

|

|

—

|

|

||||||||||||||||||

|

Reduction of beneficial interest asset

|

98

|

|

61

|

|

0.09

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||||||||||

|

Other

(c)

|

64

|

|

40

|

|

0.06

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||||||||||

|

Data Breach related costs, net of insurance receivable

(d)

|

17

|

|

11

|

|

0.02

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||||||||||

|

Resolution of income tax matters

|

—

|

|

(16

|

)

|

(0.03

|

)

|

—

|

|

(58

|

)

|

(0.09

|

)

|

—

|

|

(85

|

)

|

(0.12

|

)

|

||||||||||||||||||

|

Adjusted diluted earnings per share

|

$

|

4.38

|

|

$

|

4.76

|

|

$

|

4.41

|

|

|||||||||||||||||||||||||||

|

Credit Ratings

|

Moody's

|

Standard and Poor's

|

Fitch

|

|

Long-term debt

|

A2

|

A+

|

A-

|

|

Commercial paper

|

P-1

|

A-1

|

F2

|

|

Commercial Paper

|

|

|

|

||||||

|

(dollars in millions)

|

2013

|

|

2012

|

|

2011

|

|

|||

|

Maximum daily amount outstanding during the year

|

$

|

1,465

|

|

$

|

970

|

|

$

|

1,211

|

|

|

Average amount outstanding during the year

|

408

|

|

120

|

|

244

|

|

|||

|

Amount outstanding at year-end

|

80

|

|

970

|

|

—

|

|

|||

|

Weighted average interest rate

|

0.13

|

%

|

0.16

|

%

|

0.11

|

%

|

|||

|

Capital Expenditures

|

2013

|

2012

|

2011

|

||||||||||||||||||||

|

(millions)

|

U.S.

|

|

Canada

|

|

Total

|

|

U.S.

|

|

Canada

|

|

Total

|

|

Total

|

||||||||||

|

New stores

|

$

|

536

|

|

$

|

1,451

|

|

$

|

1,987

|

|

$

|

673

|

|

$

|

417

|

|

$

|

1,090

|

|

$

|

2,058

|

|

||

|

Store remodels and expansions

|

281

|

|

—

|

|

281

|

|

690

|

|

—

|

|

690

|

|

1,289

|

|

|||||||||

|

Information technology, distribution and other

|

1,069

|

|

116

|

|

1,185

|

|

982

|

|

515

|

|

1,497

|

|

1,021

|

|

|||||||||

|

Total

|

$

|

1,886

|

|

$

|

1,567

|

|

$

|

3,453

|

|

$

|

2,345

|

|

$

|

932

|

|

$

|

3,277

|

|

$

|

4,368

|

|

||

|

Contractual Obligations as of

|

Payments Due by Period

|

||||||||||||||

|

February 1, 2014

|

Less than

|

|

1-3

|

|

3-5

|

|

After 5

|

|

|||||||

|

(millions)

|

Total

|

|

1 Year

|

|

Years

|

|

Years

|

|

Years

|

|

|||||

|

Recorded contractual obligations:

|

|

|

|

|

|

||||||||||

|

Long-term debt

(a)

|

$

|

11,708

|

|

$

|

1,001

|

|

$

|

778

|

|

$

|

2,453

|

|

$

|

7,476

|

|

|

Capital lease obligations

(b)

|

5,313

|

|

204

|

|

390

|

|

307

|

|

4,412

|

|

|||||

|

Real estate liabilities

(c)

|

144

|

|

144

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Deferred compensation

(d)

|

522

|

|

46

|

|

99

|

|

111

|

|

266

|

|

|||||

|

Tax contingencies

(e)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Loss contingencies

(f)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Unrecorded contractual obligations:

|

|

|

|

|

|

||||||||||

|

Interest payments – long-term debt

|

8,618

|

|

590

|

|

1,145

|

|

917

|

|

5,966

|

|

|||||

|

Operating leases

(b)

|

4,103

|

|

187

|

|

359

|

|

330

|

|

3,227

|

|

|||||

|

Real estate obligations

(g)

|

305

|

|

289

|

|

16

|

|

—

|

|

—

|

|

|||||

|

Purchase obligations

(h)

|

1,317

|

|

828

|

|

301

|

|

61

|

|

127

|

|

|||||

|

Future contributions to retirement plans

(i)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Contractual obligations

|

$

|

32,030

|

|

$

|

3,289

|

|

$

|

3,088

|

|

$

|

4,179

|

|

$

|

21,474

|

|

|

(a)

|

Represents principal payments only, and excludes any fair market value adjustments recorded in long-term debt under derivative and hedge accounting rules. See Note 18 of the Notes to Consolidated Financial Statements for further information.

|

|

(b)

|

Total contractual lease payments include $3,740 million and $2,105 million of capital and operating lease payments, respectively, related to options to extend the lease term that are reasonably assured of being exercised. These payments also include $80 million and $135 million of legally binding minimum lease payments for stores that are expected to open in 2014 or later for capital and operating leases, respectively. Capital lease obligations include interest. See Note 20 of the Notes to Consolidated Financial Statements for further information.

|

|

(c)

|

Real estate liabilities include costs incurred but not paid related to the construction or remodeling of real estate and facilities.

|

|

(d)

|

Deferred compensation obligations include commitments related to our nonqualified deferred compensation plans. The timing of deferred compensation payouts is estimated based on payments currently made to former employees and retirees, forecasted investment returns, and the projected timing of future retirements.

|

|

(e)

|

Estimated tax contingencies of $241 million, including interest and penalties, are not included in the table above because we are not able to make reasonably reliable estimates of the period of cash settlement. See Note 21 of the Notes to Consolidated Financial Statements for further information.

|

|

(f)

|

Estimated loss contingencies, including those related to the Data Breach, are not included in the table above because we are not able to make reasonably reliable estimates of the period of cash settlement. See Note 17 of the Notes to Consolidated Financial Statements for further information.

|

|

(g)

|

Real estate obligations include commitments for the purchase, construction or remodeling of real estate and facilities.

|

|

(h)

|

Purchase obligations include all legally binding contracts such as firm minimum commitments for inventory purchases, merchandise royalties, equipment purchases, marketing-related contracts, software acquisition/license commitments and service contracts. (Note: we expect to extend certain merchandise contracts during the first quarter of 2014, which could increase our minimum purchase commitment by approximately $1,500 million.) We issue inventory purchase orders in the normal course of business, which represent authorizations to purchase that are cancelable by their terms. We do not consider purchase orders to be firm inventory commitments; therefore, they are excluded from the table above. If we choose to cancel a purchase order, we may be obligated to reimburse the vendor for unrecoverable outlays incurred prior to cancellation. We also issue trade letters of credit in the ordinary course of business, which are excluded from this table as these obligations are conditioned on terms of the letter of credit being met.

|

|

(i)

|

We have not included obligations under our pension and postretirement health care benefit plans in the contractual obligations table above because no additional amounts are required to be funded as of

February 1, 2014

. Our historical practice regarding these plans has been to contribute amounts necessary to satisfy minimum pension funding requirements, plus periodic discretionary amounts determined to be appropriate.

|

|

|

|

|

Gregg W. Steinhafel

Chairman, President and Chief Executive Officer

March 14, 2014

|

|

John J. Mulligan

Executive Vice President and

Chief Financial Officer

|

|

|

|

|

Gregg W. Steinhafel

Chairman, President and Chief Executive Officer March 14, 2014 |

|

John J. Mulligan

Executive Vice President and

Chief Financial Officer

|

|

(millions, except per share data)

|

2013

|

|

2012

|

|

2011

|

|

|||

|

Sales

|

$

|

72,596

|

|

$

|

71,960

|

|

$

|

68,466

|

|

|

Credit card revenues

|

—

|

|

1,341

|

|

1,399

|

|

|||

|

Total revenues

|

72,596

|

|

73,301

|

|

69,865

|

|

|||

|

Cost of sales

|

51,160

|

|

50,568

|

|

47,860

|

|

|||

|

Selling, general and administrative expenses

|

15,375

|

|

14,914

|

|

14,106

|

|

|||

|

Credit card expenses

|

—

|

|

467

|

|

446

|

|

|||

|

Depreciation and amortization

|

2,223

|

|

2,142

|

|

2,131

|

|

|||

|

Gain on receivables transaction

|

(391

|

)

|

(161

|

)

|

—

|

|

|||

|

Earnings before interest expense and income taxes

|

4,229

|

|

5,371

|

|

5,322

|

|

|||

|

Net interest expense

|

1,126

|

|

762

|

|

866

|

|

|||

|

Earnings before income taxes

|

3,103

|

|

4,609

|

|

4,456

|

|

|||

|

Provision for income taxes

|

1,132

|

|

1,610

|

|

1,527

|

|

|||

|

Net earnings

|

$

|

1,971

|

|

$

|

2,999

|

|

$

|

2,929

|

|

|

Basic earnings per share

|

$

|

3.10

|

|

$

|

4.57

|

|

$

|

4.31

|

|

|

Diluted earnings per share

|

$

|

3.07

|

|

$

|

4.52

|

|

$

|

4.28

|

|

|

Weighted average common shares outstanding

|

|

|

|

||||||

|

Basic

|

635.1

|

|

656.7

|

|

679.1

|

|

|||

|

Dilutive effect of share-based awards

(a)

|

6.7

|

|

6.6

|

|

4.8

|

|

|||

|

Diluted

|

641.8

|

|

663.3

|

|

683.9

|

|

|||

|

(millions)

|

2013

|

|

2012

|

|

2011

|

|

|||

|

Net earnings

|

$

|

1,971

|

|

$

|

2,999

|

|

$

|

2,929

|

|

|

Other comprehensive income/(loss), net of tax

|

|

|

|

||||||

|

Pension and other benefit liabilities, net of provision/(benefit) for taxes of

$71,

$58 and $(56)

|

110

|

|

92

|

|

(83

|

)

|

|||

|

Currency translation adjustment and cash flow hedges, net of provision/(benefit) for taxes of

$11

, $8 and $(11)

|

(425

|

)

|

13

|

|

(17

|

)

|

|||

|

Other comprehensive income/(loss)

|

(315

|

)

|

105

|

|

(100

|

)

|

|||

|

Comprehensive income

|

$

|

1,656

|

|

$

|

3,104

|

|

$

|

2,829

|

|

|

(millions, except footnotes)

|

February 1,

2014 |

|

February 2,

2013 |

|

||

|

Assets

|

|

|

||||

|

Cash and cash equivalents, including short-term investments of

$3

and $130

|

$

|

695

|

|

$

|

784

|

|

|

Credit card receivables, held for sale

|

—

|

|

5,841

|

|

||

|

Inventory

|

8,766

|

|

7,903

|

|

||

|

Other current assets

|

2,112

|

|

1,860

|

|

||

|

Total current assets

|

11,573

|

|

16,388

|

|

||

|

Property and equipment

|

|

|

||||

|

Land

|

6,234

|

|

6,206

|

|

||

|

Buildings and improvements

|

30,356

|

|

28,653

|

|

||

|

Fixtures and equipment

|

5,583

|

|

5,362

|

|

||

|

Computer hardware and software

|

2,764

|

|

2,567

|

|

||

|

Construction-in-progress

|

843

|

|

1,176

|

|

||

|

Accumulated depreciation

|

(14,402

|

)

|

(13,311

|

)

|

||

|

Property and equipment, net

|

31,378

|

|

30,653

|

|

||

|

Other noncurrent assets

|

1,602

|

|

1,122

|

|

||

|

Total assets

|

$

|

44,553

|

|

$

|

48,163

|

|

|

Liabilities and shareholders' investment

|

|

|

||||

|

Accounts payable

|

$

|

7,683

|

|

$

|

7,056

|

|

|

Accrued and other current liabilities

|

3,934

|

|

3,981

|

|

||

|

Current portion of long-term debt and other borrowings

|

1,160

|

|

2,994

|

|

||

|

Total current liabilities

|

12,777

|

|

14,031

|

|

||

|

Long-term debt and other borrowings

|

12,622

|

|

14,654

|

|

||

|

Deferred income taxes

|

1,433

|

|

1,311

|

|

||

|

Other noncurrent liabilities

|

1,490

|

|

1,609

|

|

||

|

Total noncurrent liabilities

|

15,545

|

|

17,574

|

|

||

|

Shareholders' investment

|

|

|

||||

|

Common stock

|

53

|

|

54

|

|

||

|

Additional paid-in capital

|

4,470

|

|

3,925

|

|

||

|

Retained earnings

|

12,599

|

|

13,155

|

|

||

|

Accumulated other comprehensive loss

|

|

|

||||

|

Pension and other benefit liabilities

|

(422

|

)

|

(532

|

)

|

||

|

Currency translation adjustment and cash flow hedges

|

(469

|

)

|

(44

|

)

|

||

|

Total shareholders' investment

|

16,231

|

|

16,558

|

|

||

|

Total liabilities and shareholders' investment

|

$

|

44,553

|

|

$

|

48,163

|

|

|

(millions)

|

2013

|

|

2012

|

|

2011

|

|

|||

|

Operating activities

|

|

|

|

||||||

|

Net earnings

|

$

|

1,971

|

|

$

|

2,999

|

|

$

|

2,929

|

|

|

Adjustments to reconcile net earnings to cash provided by operations:

|

|

|

|

||||||

|

Depreciation and amortization

|

2,223

|

|

2,142

|

|

2,131

|

|

|||

|

Share-based compensation expense

|

110

|

|

105

|

|

90

|

|

|||

|

Deferred income taxes

|

(254

|

)

|

(14

|

)

|

371

|

|

|||

|

Bad debt expense

(a)

|

41

|

|

206

|

|

154

|

|

|||

|

Gain on receivables transaction

|

(391

|

)

|

(161

|

)

|

—

|

|

|||

|

Loss on debt extinguishment

|

445

|

|

—

|

|

—

|

|

|||

|

Noncash (gains)/losses and other, net

|

82

|

|

14

|

|

22

|

|

|||

|

Changes in operating accounts:

|

|

|

|

||||||

|

Accounts receivable originated at Target

|

157

|

|

(217

|

)

|

(187

|

)

|

|||

|

Proceeds on sale of accounts receivable originated at Target

|

2,703

|

|

—

|

|

—

|

|

|||

|

Inventory

|

(885

|

)

|

15

|

|

(322

|

)

|

|||

|

Other current assets

|

(267

|

)

|

(123

|

)

|

(150

|

)

|

|||

|

Other noncurrent assets

|

19

|

|

(98

|

)

|

43

|

|

|||

|

Accounts payable

|

625

|

|

199

|

|

232

|

|

|||

|

Accrued and other current liabilities

|

(9

|

)

|

138

|

|

218

|

|

|||

|

Other noncurrent liabilities

|

(50

|

)

|

120

|

|

(97

|

)

|

|||

|

Cash provided by operations

|

6,520

|

|

5,325

|

|

5,434

|

|

|||

|

Investing activities

|

|

|

|

||||||

|

Expenditures for property and equipment

|

(3,453

|

)

|

(3,277

|

)

|

(4,368

|

)

|

|||

|

Proceeds from disposal of property and equipment

|

86

|

|

66

|

|

37

|

|

|||

|

Change in accounts receivable originated at third parties

|

121

|

|

254

|

|

259

|

|

|||

|

Proceeds from sale of accounts receivable originated at third parties

|

3,002

|

|

—

|

|

—

|

|

|||

|

Cash paid for acquisitions, net of cash assumed

|

(157

|

)

|

—

|

|

—

|

|

|||

|

Other investments

|

130

|

|

102

|

|

(108

|

)

|

|||

|

Cash required for investing activities

|

(271

|

)

|

(2,855

|

)

|

(4,180

|

)

|

|||

|

Financing activities

|

|

|

|

||||||

|

Change in commercial paper, net

|

(890

|

)

|

970

|

|

—

|

|

|||

|

Additions to short-term debt

|

—

|

|

—

|

|

1,500

|

|

|||

|

Reductions of short-term debt

|

—

|

|

(1,500

|

)

|

—

|

|

|||

|

Additions to long-term debt

|

—

|

|

1,971

|

|

1,994

|

|

|||

|

Reductions of long-term debt

|

(3,463

|

)

|

(1,529

|

)

|

(3,125

|

)

|

|||

|

Dividends paid

|

(1,006

|

)

|

(869

|

)

|

(750

|

)

|

|||

|

Repurchase of stock

|

(1,461

|

)

|

(1,875

|

)

|

(1,842

|

)

|

|||

|

Stock option exercises and related tax benefit

|

456

|

|

360

|

|

89

|

|

|||

|

Other

|

—

|

|

(16

|

)

|

(6

|

)

|

|||

|

Cash required for financing activities

|

(6,364

|

)

|

(2,488

|

)

|

(2,140

|

)

|

|||

|

Effect of exchange rate changes on cash and cash equivalents

|

26

|

|

8

|

|

(32

|

)

|

|||

|

Net decrease in cash and cash equivalents

|

(89

|

)

|

(10

|

)

|

(918

|

)

|

|||

|

Cash and cash equivalents at beginning of period

|

784

|

|

794

|

|

1,712

|

|

|||

|

Cash and cash equivalents at end of period

|

$

|

695

|

|

$

|

784

|

|

$

|

794

|

|

|

Supplemental information

|

|

|

|

||||||

|

Interest paid, net of capitalized interest

|

$

|

1,120

|

|

$

|

775

|

|

$

|

816

|

|

|

Income taxes paid

|

1,386

|

|

1,603

|

|

1,109

|

|

|||

|

Noncash financing activities

|

|

|

|

||||||

|

Property and equipment acquired through capital lease obligations

|

211

|

|

282

|

|

1,388

|

|

|||

|

(a)

|

Includes net write-offs of credit card receivables prior to the sale of our U.S. consumer credit card receivables on March 13, 2013, and bad debt expense on credit card receivables during the twelve months ended February 2, 2013.

|

|

(millions, except footnotes)

|

Common

Stock

Shares

|

|

Stock

Par

Value

|

|

Additional

Paid-in

Capital

|

|

Retained

Earnings

|

|

Accumulated Other

Comprehensive

Income/(Loss)

|

|

Total

|

|

|||||

|

January 29, 2011

|

704.0

|

|

$

|

59

|

|

$

|

3,311

|

|

$

|

12,698

|

|

$

|

(581

|

)

|

$

|

15,487

|

|

|

Net earnings

|

—

|

|

—

|

|

—

|

|

2,929

|

|

—

|

|

2,929

|

|

|||||

|

Other comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

(100

|

)

|

(100

|

)

|

|||||

|

Dividends declared

|

—

|

|

—

|

|

—

|

|

(777

|

)

|

—

|

|

(777

|

)

|

|||||

|

Repurchase of stock

|

(37.2

|

)

|

(3

|

)

|

—

|

|

(1,891

|

)

|

—

|

|

(1,894

|

)

|

|||||

|

Stock options and awards

|

2.5

|

|

—

|

|

176

|

|

—

|

|

—

|

|

176

|

|

|||||

|

January 28, 2012

|

669.3

|

|

$

|

56

|

|

$

|

3,487

|

|

$

|

12,959

|

|

$

|

(681

|

)

|

$

|

15,821

|

|

|

Net earnings

|

—

|

|

—

|

|

—

|

|

2,999

|

|

—

|

|

2,999

|

|

|||||

|

Other comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

105

|

|

105

|

|

|||||

|

Dividends declared

|

—

|

|

—

|

|

—

|

|

(903

|

)

|

—

|

|

(903

|

)

|

|||||

|

Repurchase of stock

|

(32.2

|

)

|

(3

|

)

|

—

|

|

(1,900

|

)

|

—

|

|

(1,903

|

)

|

|||||

|

Stock options and awards

|

8.2

|

|

1

|

|

438

|

|

—

|

|

—

|

|

439

|

|

|||||

|

February 2, 2013

|

645.3

|

|

$

|

54

|

|

$

|

3,925

|

|

$

|

13,155

|

|

$

|

(576

|

)

|

$

|

16,558

|

|

|

Net earnings

|

—

|

|

—

|

|

—

|

|

1,971

|

|

—

|

|

1,971

|

|

|||||

|

Other comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

(315

|

)

|

(315

|

)

|

|||||

|

Dividends declared

|

—

|

|

—

|

|

—

|

|

(1,051

|

)

|

—

|

|

(1,051

|

)

|

|||||

|

Repurchase of stock

|

(21.9

|

)

|

(2

|

)

|

—

|

|

(1,476

|

)

|

—

|

|

(1,478

|

)

|

|||||

|

Stock options and awards

|

9.5

|

|

1

|

|

545

|

|

—

|

|

—

|

|

546

|

|

|||||

|

February 1, 2014

|

632.9

|

|

$

|

53

|

|

$

|

4,470

|

|

$

|

12,599

|

|

$

|

(891

|

)

|

$

|

16,231

|

|

|

Cost of Sales

|

Selling, General and Administrative Expenses

|

|

Total cost of products sold including

• Freight expenses associated with moving

merchandise from our vendors to our

distribution centers and our retail stores, and

among our distribution and retail facilities

• Vendor income that is not reimbursement of

specific, incremental and identifiable costs

Inventory shrink

Markdowns

Outbound shipping and handling expenses

associated with sales to our guests

Payment term cash discounts

Distribution center costs, including compensation

and benefits costs

Import costs

|

Compensation and benefit costs including

• Stores

• Headquarters

Occupancy and operating costs of retail and

headquarters facilities

Advertising, offset by vendor income that is a

reimbursement of specific, incremental and

identifiable costs

Pre-opening costs of stores and other facilities

U.S. credit cards servicing expenses and profit

sharing

Litigation and defense costs and related insurance

recovery

Other administrative costs

|

|

Advertising Costs

(millions)

|

2013

|

|

2012

|

|

2011

|

|

|||

|

Gross advertising costs

|

$

|

1,744

|

|

$

|

1,653

|

|

$

|

1,589

|

|

|

Vendor income

(a)

|

76

|

|

231

|

|

229

|

|

|||

|

Net advertising costs

|

$

|

1,668

|

|

$

|

1,422

|

|

$

|

1,360

|

|

|

Fair Value Measurements – Recurring Basis

|

|||||||||||||||||||

|

Fair Value at February 1, 2014

|

Fair Value at February 2, 2013

|

||||||||||||||||||

|

(millions)

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

|||||||

|

Assets

|

|

|

|

|

|

|

|||||||||||||

|

Cash and cash equivalents

|

|

|

|

|

|

|

|||||||||||||

|

Short-term investments

|

$

|

3

|

|

$

|

—

|

|

$

|

—

|

|

$

|

130

|

|

$

|

—

|

|

$

|

—

|

|

|

|

Other current assets

|

|

|

|

|

|

|

|||||||||||||

|

Interest rate swaps

(a)

|

—

|

|

1

|

|

—

|

|

—

|

|

4

|

|

—

|

|

|||||||

|

Prepaid forward contracts

|

73

|

|

—

|

|

—

|

|

73

|

|

—

|

|

—

|

|

|||||||

|

Beneficial interest asset

(b)

|

—

|

|

—

|

|

71

|

|

—

|

|

—

|

|

—

|

|

|||||||

|

Other noncurrent assets

|

|

|

|

|

|

|

|||||||||||||

|

Interest rate swaps

(a)

|

—

|

|

62

|

|

—

|

|

—

|

|

85

|

|

—

|

|

|||||||

|

Company-owned life insurance investments

(c)

|

—

|

|

305

|

|

—

|

|

—

|

|

269

|

|

—

|

|

|||||||

|

Beneficial interest asset

(b)

|

—

|

|

—

|

|

56

|

|

—

|

|

—

|

|

—

|

|

|||||||

|

Total

|

$

|

76

|

|

$

|

368

|

|

$

|

127

|

|

$

|

203

|

|

$

|

358

|

|

$

|

—

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|||||||||||||

|

Other current liabilities

|

|

|

|

|

|

|

|||||||||||||

|

Interest rate swaps

(a)

|

$

|

—

|