|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minnesota

|

|

41-0215170

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

1000 Nicollet Mall, Minneapolis, Minnesota

|

|

55403

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Large accelerated filer

x

|

Accelerated filer

o

|

Non-accelerated filer

o

|

|||

|

Smaller reporting company

o

|

Emerging growth company

o

|

||||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

|||||||||||

|

|

Three Months Ended

|

Nine Months Ended

|

|||||||||||||

|

(millions, except per share data) (unaudited)

|

November 3,

2018 |

|

October 28,

2017 As Adjusted (a) |

|

November 3,

2018 |

|

October 28,

2017 As Adjusted (a) |

|

|||||||

|

Sales

|

$

|

17,590

|

|

$

|

16,647

|

|

$

|

51,699

|

|

$

|

49,052

|

|

|||

|

Other revenue

|

231

|

|

227

|

|

680

|

|

679

|

|

|||||||

|

Total revenue

|

17,821

|

|

16,874

|

|

52,379

|

|

49,731

|

|

|||||||

|

Cost of sales

|

12,535

|

|

11,712

|

|

36,400

|

|

34,330

|

|

|||||||

|

Selling, general and administrative expenses

|

3,937

|

|

3,733

|

|

11,347

|

|

10,686

|

|

|||||||

|

Depreciation and amortization (exclusive of depreciation included in cost of sales)

|

530

|

|

582

|

|

1,639

|

|

1,620

|

|

|||||||

|

Operating income

|

819

|

|

847

|

|

2,993

|

|

3,095

|

|

|||||||

|

Net interest expense

|

115

|

|

251

|

|

352

|

|

521

|

|

|||||||

|

Net other (income) / expense

|

(9

|

)

|

(15

|

)

|

(21

|

)

|

(44

|

)

|

|||||||

|

Earnings from continuing operations before income taxes

|

713

|

|

611

|

|

2,662

|

|

2,618

|

|

|||||||

|

Provision for income taxes

|

97

|

|

135

|

|

530

|

|

798

|

|

|||||||

|

Net earnings from continuing operations

|

616

|

|

476

|

|

2,132

|

|

1,820

|

|

|||||||

|

Discontinued operations, net of tax

|

6

|

|

2

|

|

7

|

|

7

|

|

|||||||

|

Net earnings

|

$

|

622

|

|

$

|

478

|

|

$

|

2,139

|

|

$

|

1,827

|

|

|||

|

Basic earnings per share

|

|||||||||||||||

|

Continuing operations

|

$

|

1.17

|

|

$

|

0.87

|

|

$

|

4.01

|

|

$

|

3.31

|

|

|||

|

Discontinued operations

|

0.01

|

|

—

|

|

0.01

|

|

0.01

|

|

|||||||

|

Net earnings per share

|

$

|

1.18

|

|

$

|

0.88

|

|

$

|

4.02

|

|

$

|

3.33

|

|

|||

|

Diluted earnings per share

|

|||||||||||||||

|

Continuing operations

|

$

|

1.16

|

|

$

|

0.87

|

|

$

|

3.98

|

|

$

|

3.30

|

|

|||

|

Discontinued operations

|

0.01

|

|

—

|

|

0.01

|

|

0.01

|

|

|||||||

|

Net earnings per share

|

$

|

1.17

|

|

$

|

0.87

|

|

$

|

3.99

|

|

$

|

3.31

|

|

|||

|

Weighted average common shares outstanding

|

|||||||||||||||

|

Basic

|

525.9

|

|

544.5

|

|

531.5

|

|

548.7

|

|

|||||||

|

Dilutive impact of share-based awards

|

5.3

|

|

3.4

|

|

4.7

|

|

3.1

|

|

|||||||

|

Diluted

|

531.2

|

|

547.9

|

|

536.2

|

|

551.8

|

|

|||||||

|

Antidilutive shares

|

—

|

|

4.5

|

|

—

|

|

4.1

|

|

|||||||

|

(a)

|

Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions, including impacts on previously reported results.

|

|

Consolidated Statements of Comprehensive Income

|

|

|

|||||||||||||

|

|

Three Months Ended

|

Nine Months Ended

|

|||||||||||||

|

(millions) (unaudited)

|

November 3,

2018 |

|

October 28,

2017

As Adjusted

(a)

|

|

November 3,

2018 |

|

October 28,

2017

As Adjusted

(a)

|

|

|||||||

|

Net earnings

|

$

|

622

|

|

$

|

478

|

|

$

|

2,139

|

|

$

|

1,827

|

|

|||

|

Other comprehensive income

|

|

|

|

|

|

|

|

|

|||||||

|

Pension, net of tax

|

13

|

|

8

|

|

42

|

|

22

|

|

|||||||

|

Currency translation adjustment and cash flow hedges, net of tax

|

(4

|

)

|

(2

|

)

|

(9

|

)

|

6

|

|

|||||||

|

Other comprehensive income

|

9

|

|

6

|

|

33

|

|

28

|

|

|||||||

|

Comprehensive income

|

$

|

631

|

|

$

|

484

|

|

$

|

2,172

|

|

$

|

1,855

|

|

|||

|

(a)

|

Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions, including impacts on previously reported results.

|

|

|

|

|

|

|

|

|

|||||

|

(millions) (unaudited)

|

November 3,

2018 |

|

February 3,

2018

As Adjusted

(a)

|

|

October 28,

2017

As Adjusted

(a)

|

|

|||||

|

Assets

|

|

|

|||||||||

|

Cash and cash equivalents

|

$

|

825

|

|

$

|

2,643

|

|

$

|

2,725

|

|

||

|

Inventory

|

12,393

|

|

8,597

|

|

10,517

|

|

|||||

|

Other current assets

|

1,421

|

|

1,300

|

|

1,444

|

|

|||||

|

Total current assets

|

14,639

|

|

12,540

|

|

14,686

|

|

|||||

|

Property and equipment

|

|

|

|

|

|

|

|||||

|

Land

|

6,069

|

|

6,095

|

|

6,087

|

|

|||||

|

Buildings and improvements

|

29,090

|

|

28,131

|

|

27,946

|

|

|||||

|

Fixtures and equipment

|

5,784

|

|

5,623

|

|

5,548

|

|

|||||

|

Computer hardware and software

|

2,660

|

|

2,645

|

|

2,658

|

|

|||||

|

Construction-in-progress

|

384

|

|

440

|

|

389

|

|

|||||

|

Accumulated depreciation

|

(18,380

|

)

|

(18,398

|

)

|

(17,979

|

)

|

|||||

|

Property and equipment, net

|

25,607

|

|

24,536

|

|

24,649

|

|

|||||

|

Operating lease assets

|

1,997

|

|

1,884

|

|

1,861

|

|

|||||

|

Other noncurrent assets

|

1,329

|

|

1,343

|

|

813

|

|

|||||

|

Total assets

|

$

|

43,572

|

|

$

|

40,303

|

|

$

|

42,009

|

|

||

|

Liabilities and shareholders’ investment

|

|

|

|

|

|

|

|||||

|

Accounts payable

|

$

|

11,959

|

|

$

|

8,677

|

|

$

|

9,986

|

|

||

|

Accrued and other current liabilities

|

4,096

|

|

4,094

|

|

3,875

|

|

|||||

|

Current portion of long-term debt and other borrowings

|

1,535

|

|

281

|

|

1,366

|

|

|||||

|

Total current liabilities

|

17,590

|

|

13,052

|

|

15,227

|

|

|||||

|

Long-term debt and other borrowings

|

10,104

|

|

11,117

|

|

11,090

|

|

|||||

|

Noncurrent operating lease liabilities

|

2,046

|

|

1,924

|

|

1,901

|

|

|||||

|

Deferred income taxes

|

970

|

|

693

|

|

915

|

|

|||||

|

Other noncurrent liabilities

|

1,782

|

|

1,866

|

|

1,784

|

|

|||||

|

Total noncurrent liabilities

|

14,902

|

|

15,600

|

|

15,690

|

|

|||||

|

Shareholders’ investment

|

|

|

|

|

|

|

|||||

|

Common stock

|

43

|

|

45

|

|

45

|

|

|||||

|

Additional paid-in capital

|

5,867

|

|

5,858

|

|

5,762

|

|

|||||

|

Retained earnings

|

5,884

|

|

6,495

|

|

5,895

|

|

|||||

|

Accumulated other comprehensive loss

|

(714

|

)

|

(747

|

)

|

(610

|

)

|

|||||

|

Total shareholders’ investment

|

11,080

|

|

11,651

|

|

11,092

|

|

|||||

|

Total liabilities and shareholders’ investment

|

$

|

43,572

|

|

$

|

40,303

|

|

$

|

42,009

|

|

||

|

(a)

|

Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions, including impacts on previously reported results.

|

|

|

|

|

|||||

|

|

Nine Months Ended

|

||||||

|

(millions) (unaudited)

|

November 3,

2018 |

|

October 28,

2017

As Adjusted

(a)

|

|

|||

|

Operating activities

|

|

|

|

|

|||

|

Net earnings

|

$

|

2,139

|

|

$

|

1,827

|

|

|

|

Earnings from discontinued operations, net of tax

|

7

|

|

7

|

|

|||

|

Net earnings from continuing operations

|

2,132

|

|

1,820

|

|

|||

|

Adjustments to reconcile net earnings to cash provided by operations

|

|

|

|

|

|||

|

Depreciation and amortization

|

1,826

|

|

1,809

|

|

|||

|

Share-based compensation expense

|

106

|

|

81

|

|

|||

|

Deferred income taxes

|

261

|

|

33

|

|

|||

|

Loss on debt extinguishment

|

—

|

|

123

|

|

|||

|

Noncash losses

/

(gains) and other, net

|

85

|

|

209

|

|

|||

|

Changes in operating accounts

|

|

|

|||||

|

Inventory

|

(3,796

|

)

|

(2,277

|

)

|

|||

|

Other assets

|

(140

|

)

|

(88

|

)

|

|||

|

Accounts payable

|

3,298

|

|

2,735

|

|

|||

|

Accrued and other liabilities

|

(158

|

)

|

(25

|

)

|

|||

|

Cash provided by operating activities—continuing operations

|

3,614

|

|

4,420

|

|

|||

|

Cash provided by

operating activities—discontinued operations

|

10

|

|

75

|

|

|||

|

Cash provided by operations

|

3,624

|

|

4,495

|

|

|||

|

Investing activities

|

|

|

|

|

|||

|

Expenditures for property and equipment

|

(2,873

|

)

|

(2,049

|

)

|

|||

|

Proceeds from disposal of property and equipment

|

39

|

|

27

|

|

|||

|

Other investments

|

15

|

|

(62

|

)

|

|||

|

Cash required for investing activities

|

(2,819

|

)

|

(2,084

|

)

|

|||

|

Financing activities

|

|

|

|

|

|||

|

Change in commercial paper, net

|

490

|

|

—

|

|

|||

|

Additions to long-term debt

|

—

|

|

739

|

|

|||

|

Reductions of long-term debt

|

(268

|

)

|

(1,093

|

)

|

|||

|

Dividends paid

|

(1,001

|

)

|

(1,001

|

)

|

|||

|

Repurchase of stock (Note 10)

|

(1,485

|

)

|

(618

|

)

|

|||

|

Accelerated share repurchase pending final settlement (Note 10)

|

(450

|

)

|

(250

|

)

|

|||

|

Stock option exercises

|

91

|

|

25

|

|

|||

|

Cash required for financing activities

|

(2,623

|

)

|

(2,198

|

)

|

|||

|

Net (decrease)

/

increase in cash and cash equivalents

|

(1,818

|

)

|

213

|

|

|||

|

Cash and cash equivalents at beginning of period

|

2,643

|

|

2,512

|

|

|||

|

Cash and cash equivalents at end of period

|

$

|

825

|

|

$

|

2,725

|

|

|

|

(a)

|

Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions, including impacts on previously reported results.

|

|

Consolidated Statements of Shareholders’ Investment

|

||||||||||||||||||||||

|

|

Common

|

|

Stock

|

|

Additional

|

|

|

|

Accumulated Other

|

|

|

|

||||||||||

|

|

Stock

|

|

Par

|

|

Paid-in

|

|

Retained

|

|

Comprehensive

|

|

|

|

||||||||||

|

(millions) (unaudited)

|

Shares

|

|

Value

|

|

Capital

|

|

Earnings

|

|

(Loss)

/

Income

|

|

Total

|

|

||||||||||

|

January 28, 2017

As Adjusted

(a)

|

556.2

|

|

$

|

46

|

|

$

|

5,661

|

|

$

|

5,846

|

|

$

|

(638

|

)

|

$

|

10,915

|

|

|||||

|

Net earnings

|

—

|

|

—

|

|

—

|

|

2,914

|

|

—

|

|

2,914

|

|

||||||||||

|

Other comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

8

|

|

8

|

|

||||||||||

|

Dividends declared

|

—

|

|

—

|

|

—

|

|

(1,356

|

)

|

—

|

|

(1,356

|

)

|

||||||||||

|

Repurchase of stock

|

(17.6

|

)

|

(1

|

)

|

—

|

|

(1,026

|

)

|

—

|

|

(1,027

|

)

|

||||||||||

|

Stock options and awards

|

3.1

|

|

—

|

|

197

|

|

—

|

|

—

|

|

197

|

|

||||||||||

|

Reclassification of tax effects to retained earnings

|

—

|

|

—

|

|

—

|

|

117

|

|

(117

|

)

|

—

|

|

||||||||||

|

February 3, 2018

As Adjusted

(a)

|

541.7

|

|

$

|

45

|

|

$

|

5,858

|

|

$

|

6,495

|

|

$

|

(747

|

)

|

$

|

11,651

|

|

|||||

|

Net earnings

|

—

|

|

—

|

|

—

|

|

2,139

|

|

—

|

|

2,139

|

|

||||||||||

|

Other comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

33

|

|

33

|

|

||||||||||

|

Dividends declared

|

—

|

|

—

|

|

—

|

|

(1,012

|

)

|

—

|

|

(1,012

|

)

|

||||||||||

|

Repurchase of stock

|

(19.0

|

)

|

(2

|

)

|

—

|

|

(1,451

|

)

|

—

|

|

(1,453

|

)

|

||||||||||

|

Accelerated share repurchase pending final settlement

|

(3.5

|

)

|

—

|

|

(163

|

)

|

(287

|

)

|

—

|

|

(450

|

)

|

||||||||||

|

Stock options and awards

|

2.6

|

|

—

|

|

172

|

|

—

|

|

—

|

|

172

|

|

||||||||||

|

November 3, 2018

|

521.8

|

|

$

|

43

|

|

$

|

5,867

|

|

$

|

5,884

|

|

$

|

(714

|

)

|

$

|

11,080

|

|

|||||

|

(a)

|

Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions, including impacts on previously reported results.

|

|

Effect of Accounting Standards Adoption on Consolidated Statement of Operations

|

||||||||||||||||||

|

|

Three Months

Ended

|

Effect of the Adoption of

|

Three Months

Ended

|

|||||||||||||||

|

ASC

Topic 606 (Revenue Recognition) |

ASC

Topic 842 (Leases) |

ASU

2017-07

(Pension)

|

||||||||||||||||

|

(millions, except per share data) (unaudited)

|

October 28,

2017

As Previously Reported

|

October 28,

2017

As Adjusted

|

||||||||||||||||

|

Sales

|

$

|

16,667

|

|

$

|

(20

|

)

|

(a)

|

$

|

—

|

|

$

|

—

|

|

$

|

16,647

|

|

||

|

Other revenue

|

—

|

|

227

|

|

(a)

|

—

|

|

—

|

|

227

|

|

|||||||

|

Total revenue

|

16,667

|

|

207

|

|

—

|

|

—

|

|

16,874

|

|

||||||||

|

Cost of sales

|

11,712

|

|

—

|

|

—

|

|

—

|

|

11,712

|

|

||||||||

|

Selling, general and administrative expenses

|

3,512

|

|

207

|

|

(a)

|

(2

|

)

|

(b)

|

15

|

|

(c)

|

3,733

|

|

|||||

|

Depreciation and amortization (exclusive of depreciation included in cost of sales)

|

574

|

|

—

|

|

9

|

|

(b)

|

—

|

|

582

|

|

|||||||

|

Operating income

|

869

|

|

—

|

|

(7

|

)

|

(15

|

)

|

847

|

|

||||||||

|

Net interest expense

|

254

|

|

—

|

|

(3

|

)

|

(b)

|

—

|

|

251

|

|

|||||||

|

Net other (income) / expense

|

—

|

|

—

|

|

—

|

|

(15

|

)

|

(c)

|

(15

|

)

|

|||||||

|

Earnings from continuing operations before income taxes

|

615

|

|

—

|

|

(4

|

)

|

—

|

|

611

|

|

||||||||

|

Provision for income taxes

|

137

|

|

—

|

|

(1

|

)

|

—

|

|

135

|

|

||||||||

|

Net earnings from continuing operations

|

478

|

|

—

|

|

(3

|

)

|

—

|

|

476

|

|

||||||||

|

Discontinued operations, net of tax

|

2

|

|

—

|

|

—

|

|

—

|

|

2

|

|

||||||||

|

Net earnings

|

$

|

480

|

|

$

|

—

|

|

$

|

(3

|

)

|

$

|

—

|

|

$

|

478

|

|

|||

|

Basic earnings per share

|

||||||||||||||||||

|

Continuing operations

|

$

|

0.88

|

|

$

|

0.87

|

|

||||||||||||

|

Discontinued operations

|

—

|

|

—

|

|

||||||||||||||

|

Net earnings per share

|

$

|

0.88

|

|

$

|

0.88

|

|

||||||||||||

|

Diluted earnings per share

|

||||||||||||||||||

|

Continuing operations

|

$

|

0.87

|

|

$

|

0.87

|

|

||||||||||||

|

Discontinued operations

|

—

|

|

—

|

|

||||||||||||||

|

Net earnings per share

|

$

|

0.88

|

|

$

|

0.87

|

|

||||||||||||

|

Effect of Accounting Standards Adoption on Consolidated Statement of Operations

|

||||||||||||||||||

|

|

Nine Months

Ended |

Effect of the Adoption of

|

Nine Months

Ended |

|||||||||||||||

|

ASC

Topic 606 (Revenue Recognition) |

ASC

Topic 842 (Leases) |

ASU

2017-07

(Pension)

|

||||||||||||||||

|

(millions, except per share data) (unaudited)

|

October 28,

2017

As Previously Reported

|

October 28,

2017

As Adjusted

|

||||||||||||||||

|

Sales

|

$

|

49,113

|

|

$

|

(61

|

)

|

(a)

|

$

|

—

|

|

$

|

—

|

|

$

|

49,052

|

|

||

|

Other revenue

|

—

|

|

679

|

|

(a)

|

—

|

|

—

|

|

679

|

|

|||||||

|

Total revenue

|

49,113

|

|

618

|

|

—

|

|

—

|

|

49,731

|

|

||||||||

|

Cost of sales

|

34,330

|

|

—

|

|

—

|

|

—

|

|

34,330

|

|

||||||||

|

Selling, general and administrative expenses

|

10,027

|

|

618

|

|

(a)

|

(4

|

)

|

(b)

|

44

|

|

(c)

|

10,686

|

|

|||||

|

Depreciation and amortization (exclusive of depreciation included in cost of sales)

|

1,596

|

|

—

|

|

24

|

|

(b)

|

—

|

|

1,620

|

|

|||||||

|

Operating income

|

3,160

|

|

—

|

|

(20

|

)

|

(44

|

)

|

3,095

|

|

||||||||

|

Net interest expense

|

532

|

|

—

|

|

(10

|

)

|

(b)

|

—

|

|

521

|

|

|||||||

|

Net other (income) / expense

|

—

|

|

—

|

|

—

|

|

(44

|

)

|

(c)

|

(44

|

)

|

|||||||

|

Earnings from continuing operations before income taxes

|

2,628

|

|

—

|

|

(10

|

)

|

—

|

|

2,618

|

|

||||||||

|

Provision for income taxes

|

802

|

|

—

|

|

(4

|

)

|

—

|

|

798

|

|

||||||||

|

Net earnings from continuing operations

|

1,826

|

|

—

|

|

(6

|

)

|

—

|

|

1,820

|

|

||||||||

|

Discontinued operations, net of tax

|

7

|

|

—

|

|

—

|

|

—

|

|

7

|

|

||||||||

|

Net earnings

|

$

|

1,833

|

|

$

|

—

|

|

$

|

(6

|

)

|

$

|

—

|

|

$

|

1,827

|

|

|||

|

Basic earnings per share

|

||||||||||||||||||

|

Continuing operations

|

$

|

3.33

|

|

$

|

3.31

|

|

||||||||||||

|

Discontinued operations

|

0.01

|

|

0.01

|

|

||||||||||||||

|

Net earnings per share

|

$

|

3.34

|

|

$

|

3.33

|

|

||||||||||||

|

Diluted earnings per share

|

||||||||||||||||||

|

Continuing operations

|

$

|

3.31

|

|

$

|

3.30

|

|

||||||||||||

|

Discontinued operations

|

0.01

|

|

0.01

|

|

||||||||||||||

|

Net earnings per share

|

$

|

3.32

|

|

$

|

3.31

|

|

||||||||||||

|

(a)

|

For the three and nine months ended October 28, 2017, we reclassified

$170 million

and

$512 million

, respectively, of profit-sharing income under our credit card program agreement to Other Revenue from SG&A. In addition, we reclassified certain advertising, rental, and other miscellaneous revenues, none of which was individually significant, from Sales and SG&A to Other Revenues.

|

|

(b)

|

Relates to lease-term changes under the hindsight practical expedient.

|

|

(c)

|

Relates to non-service cost components reclassified to Net Other (Income) / Expense from SG&A.

|

|

Effect of Accounting Standards Adoption on Consolidated Statement of Financial Position

|

|||||||||||||||

|

Effect of the Adoption of

|

|||||||||||||||

|

(millions) (unaudited)

|

February 3,

2018

As Previously Reported

|

ASC

Topic 606 (Revenue Recognition) |

ASC

Topic 842 (Leases) |

February 3,

2018

As Adjusted

|

|||||||||||

|

Assets

|

|

|

|||||||||||||

|

Cash and cash equivalents

|

$

|

2,643

|

|

$

|

—

|

|

$

|

—

|

|

$

|

2,643

|

|

|||

|

Inventory

|

8,657

|

|

(60

|

)

|

(a)

|

—

|

|

8,597

|

|

||||||

|

Other current assets

|

1,264

|

|

60

|

|

(a)

|

(24

|

)

|

(b)

|

1,300

|

|

|||||

|

Total current assets

|

12,564

|

|

—

|

|

(24

|

)

|

12,540

|

|

|||||||

|

Property and equipment

|

|

|

|

|

|||||||||||

|

Land

|

6,095

|

|

—

|

|

—

|

|

6,095

|

|

|||||||

|

Buildings and improvements

|

28,396

|

|

—

|

|

(265

|

)

|

(c)

|

28,131

|

|

||||||

|

Fixtures and equipment

|

5,623

|

|

—

|

|

—

|

|

5,623

|

|

|||||||

|

Computer hardware and software

|

2,645

|

|

—

|

|

—

|

|

2,645

|

|

|||||||

|

Construction-in-progress

|

440

|

|

—

|

|

—

|

|

440

|

|

|||||||

|

Accumulated depreciation

|

(18,181

|

)

|

—

|

|

(217

|

)

|

(c)

|

(18,398

|

)

|

||||||

|

Property and equipment, net

|

25,018

|

|

—

|

|

(482

|

)

|

24,536

|

|

|||||||

|

Operating lease assets

|

—

|

|

—

|

|

1,884

|

|

(d)

|

1,884

|

|

||||||

|

Other noncurrent assets

|

1,417

|

|

—

|

|

(74

|

)

|

(e)

|

1,343

|

|

||||||

|

Total assets

|

$

|

38,999

|

|

$

|

—

|

|

$

|

1,304

|

|

$

|

40,303

|

|

|||

|

Liabilities and shareholders’ investment

|

|

|

|

|

|||||||||||

|

Accounts payable

|

$

|

8,677

|

|

$

|

—

|

|

$

|

—

|

|

$

|

8,677

|

|

|||

|

Accrued and other current liabilities

|

4,254

|

|

(14

|

)

|

(k)

|

(146

|

)

|

(f)

|

4,094

|

|

|||||

|

Current portion of long-term debt and other borrowings

|

270

|

|

—

|

|

11

|

|

(g)

|

281

|

|

||||||

|

Total current liabilities

|

13,201

|

|

(14

|

)

|

(135

|

)

|

13,052

|

|

|||||||

|

Long-term debt and other borrowings

|

11,317

|

|

—

|

|

(200

|

)

|

(g)

|

11,117

|

|

||||||

|

Noncurrent operating lease liabilities

|

—

|

|

—

|

|

1,924

|

|

(h)

|

1,924

|

|

||||||

|

Deferred income taxes

|

713

|

|

4

|

|

(24

|

)

|

693

|

|

|||||||

|

Other noncurrent liabilities

|

2,059

|

|

—

|

|

(192

|

)

|

(i)

|

1,866

|

|

||||||

|

Total noncurrent liabilities

|

14,089

|

|

4

|

|

1,508

|

|

15,600

|

|

|||||||

|

Shareholders’ investment

|

|

|

|

|

|||||||||||

|

Common stock

|

45

|

|

—

|

|

—

|

|

45

|

|

|||||||

|

Additional paid-in capital

|

5,858

|

|

—

|

|

—

|

|

5,858

|

|

|||||||

|

Retained earnings

|

6,553

|

|

10

|

|

(k)

|

(69

|

)

|

(j)

|

6,495

|

|

|||||

|

Accumulated other comprehensive loss

|

(747

|

)

|

—

|

|

—

|

|

(747

|

)

|

|||||||

|

Total shareholders’ investment

|

11,709

|

|

10

|

|

(69

|

)

|

11,651

|

|

|||||||

|

Total liabilities and shareholders’ investment

|

$

|

38,999

|

|

$

|

—

|

|

$

|

1,304

|

|

$

|

40,303

|

|

|||

|

Effect of Accounting Standards Adoption on Consolidated Statement of Financial Position

|

|||||||||||||||

|

Effect of the Adoption of

|

|||||||||||||||

|

(millions) (unaudited)

|

October 28,

2017

As Previously Reported

|

ASC

Topic 606

(Revenue Recognition) |

ASC

Topic 842

(Leases)

|

October 28,

2017

As Adjusted

|

|||||||||||

|

Assets

|

|

|

|||||||||||||

|

Cash and cash equivalents

|

$

|

2,725

|

|

$

|

—

|

|

$

|

—

|

|

$

|

2,725

|

|

|||

|

Inventory

|

10,586

|

|

(69

|

)

|

(a)

|

—

|

|

10,517

|

|

||||||

|

Other current assets

|

1,398

|

|

69

|

|

(a)

|

(23

|

)

|

(b)

|

1,444

|

|

|||||

|

Total current assets

|

14,709

|

|

—

|

|

(23

|

)

|

14,686

|

|

|||||||

|

Property and equipment

|

|

|

|

|

|||||||||||

|

Land

|

6,087

|

|

—

|

|

—

|

|

6,087

|

|

|||||||

|

Buildings and improvements

|

28,310

|

|

—

|

|

(363

|

)

|

(c)

|

27,946

|

|

||||||

|

Fixtures and equipment

|

5,548

|

|

—

|

|

—

|

|

5,548

|

|

|||||||

|

Computer hardware and software

|

2,658

|

|

—

|

|

—

|

|

2,658

|

|

|||||||

|

Construction-in-progress

|

389

|

|

—

|

|

—

|

|

389

|

|

|||||||

|

Accumulated depreciation

|

(17,880

|

)

|

—

|

|

(99

|

)

|

(c)

|

(17,979

|

)

|

||||||

|

Property and equipment, net

|

25,112

|

|

—

|

|

(462

|

)

|

24,649

|

|

|||||||

|

Operating lease assets

|

—

|

|

—

|

|

1,861

|

|

(d)

|

1,861

|

|

||||||

|

Other noncurrent assets

|

887

|

|

—

|

|

(74

|

)

|

(e)

|

813

|

|

||||||

|

Total assets

|

$

|

40,708

|

|

$

|

—

|

|

$

|

1,302

|

|

$

|

42,009

|

|

|||

|

Liabilities and shareholders’ investment

|

|

|

|

|

|||||||||||

|

Accounts payable

|

$

|

9,986

|

|

$

|

—

|

|

$

|

—

|

|

$

|

9,986

|

|

|||

|

Accrued and other current liabilities

|

4,036

|

|

(14

|

)

|

(k)

|

(149

|

)

|

(f)

|

3,875

|

|

|||||

|

Current portion of long-term debt and other borrowings

|

1,354

|

|

—

|

|

12

|

|

(g)

|

1,366

|

|

||||||

|

Total current liabilities

|

15,376

|

|

(14

|

)

|

(137

|

)

|

15,227

|

|

|||||||

|

Long-term debt and other borrowings

|

11,277

|

|

—

|

|

(187

|

)

|

(g)

|

11,090

|

|

||||||

|

Noncurrent operating lease liabilities

|

—

|

|

—

|

|

1,901

|

|

(h)

|

1,901

|

|

||||||

|

Deferred income taxes

|

944

|

|

6

|

|

(34

|

)

|

915

|

|

|||||||

|

Other noncurrent liabilities

|

1,974

|

|

—

|

|

(189

|

)

|

(i)

|

1,784

|

|

||||||

|

Total noncurrent liabilities

|

14,195

|

|

6

|

|

1,491

|

|

15,690

|

|

|||||||

|

Shareholders’ investment

|

|

|

|

|

|||||||||||

|

Common stock

|

45

|

|

—

|

|

—

|

|

45

|

|

|||||||

|

Additional paid-in capital

|

5,762

|

|

—

|

|

—

|

|

5,762

|

|

|||||||

|

Retained earnings

|

5,940

|

|

8

|

|

(k)

|

(52

|

)

|

(j)

|

5,895

|

|

|||||

|

Accumulated other comprehensive loss

|

(610

|

)

|

—

|

|

—

|

|

(610

|

)

|

|||||||

|

Total shareholders’ investment

|

11,137

|

|

8

|

|

(52

|

)

|

11,092

|

|

|||||||

|

Total liabilities and shareholders’ investment

|

$

|

40,708

|

|

$

|

—

|

|

$

|

1,302

|

|

$

|

42,009

|

|

|||

|

(a)

|

Represents estimated merchandise returns, which were reclassified from Inventory to Other Current Assets.

|

|

(b)

|

Represents prepaid rent reclassified to Operating Lease Assets.

|

|

(c)

|

For both periods presented, represents impact of changes in finance lease terms and related leasehold improvements (net of accumulated depreciation) under the hindsight practical expedient and derecognition of approximately

$135 million

of non-Target owned properties that were consolidated under previously existing build-to-suit accounting rules.

|

|

(d)

|

Represents capitalization of operating lease assets and reclassification of leasehold acquisition costs, straight-line rent accrual, and tenant incentives.

|

|

(e)

|

Represents reclassification of leasehold acquisition costs to Operating Lease Assets.

|

|

(f)

|

Represents reclassification of straight-line rent accrual to Operating Lease Assets, partially offset by recognition of the current portion of operating lease liabilities.

|

|

(g)

|

Represents the impact of changes in financing lease terms for certain leases due to the election of the hindsight practical expedient.

|

|

(h)

|

Represents recognition of operating lease liabilities.

|

|

(i)

|

For both periods presented, represents derecognition of approximately

$135 million

of liabilities related to non-Target owned properties that were consolidated under previously existing build-to-suit accounting rules and reclassification of tenant incentives to Operating Lease Assets.

|

|

(j)

|

Represents the retained earnings impact of lease-term changes due to the use of hindsight, primarily from the shortening of lease terms for certain existing leases and useful lives of corresponding leasehold improvements.

|

|

(k)

|

Primarily represents the impact of a change in timing of revenue recognition for certain promotional gift card programs.

|

|

Revenues

|

Three Months Ended

|

Nine Months Ended

|

|||||||||||||

|

(millions)

|

November 3,

2018 |

|

October 28,

2017 |

|

November 3,

2018 |

|

October 28,

2017 |

|

|||||||

|

Apparel and accessories

|

$

|

3,622

|

|

$

|

3,456

|

|

$

|

10,969

|

|

$

|

10,515

|

|

|||

|

Beauty and household essentials

|

4,385

|

|

4,135

|

|

13,023

|

|

12,293

|

|

|||||||

|

Food and beverage

|

3,611

|

|

3,442

|

|

10,570

|

|

10,108

|

|

|||||||

|

Hardlines

|

2,478

|

|

2,278

|

|

7,292

|

|

6,898

|

|

|||||||

|

Home furnishings and décor

|

3,476

|

|

3,316

|

|

9,781

|

|

9,174

|

|

|||||||

|

Other

|

18

|

|

20

|

|

64

|

|

64

|

|

|||||||

|

Sales

|

17,590

|

|

16,647

|

|

51,699

|

|

49,052

|

|

|||||||

|

Credit card profit sharing

|

169

|

|

170

|

|

503

|

|

512

|

|

|||||||

|

Other

|

62

|

|

57

|

|

177

|

|

167

|

|

|||||||

|

Other revenue

|

231

|

|

227

|

|

680

|

|

679

|

|

|||||||

|

Total revenue

|

$

|

17,821

|

|

$

|

16,874

|

|

$

|

52,379

|

|

$

|

49,731

|

|

|||

|

(millions)

|

February 3,

2018 |

|

Gift Cards Issued During Current Period But Not Redeemed

(a)

|

|

Revenue Recognized From Beginning Liability

|

|

November 3,

2018 |

|

|||||||

|

Gift card liability

|

$

|

709

|

|

$

|

357

|

|

$

|

(469

|

)

|

$

|

597

|

|

|||

|

(a)

|

Net of estimated breakage.

|

|

Fair Value Measurements - Recurring Basis

|

Fair Value at

|

||||||||||||

|

(millions)

|

Classification

|

Pricing Category

|

November 3,

2018 |

|

February 3,

2018 |

|

October 28,

2017 |

|

|||||

|

Assets

|

|

|

|

|

|

|

|||||||

|

Short-term investments

|

Cash and Cash Equivalents

|

Level 1

|

$

|

42

|

|

$

|

1,906

|

|

$

|

2,003

|

|

||

|

Prepaid forward contracts

|

Other Current Assets

|

Level 1

|

23

|

|

23

|

|

30

|

|

|||||

|

Interest rate swaps

|

Other Noncurrent Assets

|

Level 2

|

—

|

|

—

|

|

1

|

|

|||||

|

Liabilities

|

|

|

|

|

|

|

|||||||

|

Interest rate swaps

|

Other Current Liabilities

|

Level 2

|

6

|

|

—

|

|

—

|

|

|||||

|

Interest rate swaps

|

Other Noncurrent Liabilities

|

Level 2

|

7

|

|

6

|

|

—

|

|

|||||

|

Significant Financial Instruments not Measured at Fair Value

(a)

(millions)

|

November 3, 2018

|

February 3, 2018

|

October 28, 2017

|

|||||||||||||||||

|

Carrying

Amount

|

|

Fair

Value

|

|

Carrying

Amount

|

|

Fair

Value

|

|

Carrying

Amount

|

|

Fair

Value

|

|

|||||||||

|

Long-term debt, including current portion

(b)

|

$

|

10,245

|

|

$

|

10,396

|

|

$

|

10,440

|

|

$

|

11,155

|

|

$

|

11,522

|

|

$

|

12,403

|

|

||

|

(a)

|

The carrying amounts of certain other current assets, commercial paper, accounts payable, and certain accrued and other current liabilities approximate fair value due to their short-term nature.

|

|

(b)

|

The carrying amount and estimated fair value of debt exclude commercial paper, unamortized swap valuation adjustments and lease liabilities.

|

|

Leases

(millions)

|

Classification

|

November 3,

2018 |

|

February 3,

2018 |

|

October 28,

2017 |

|

|||

|

Assets

|

||||||||||

|

Operating lease assets

|

Operating Lease Assets

|

$

|

1,997

|

|

$

|

1,884

|

|

$

|

1,861

|

|

|

Finance lease assets

|

Buildings and Improvements, net of Accumulated Depreciation

(a)

|

781

|

|

836

|

|

811

|

|

|||

|

Total leased assets

|

$

|

2,778

|

|

$

|

2,720

|

|

$

|

2,672

|

|

|

|

Liabilities

|

||||||||||

|

Current

|

||||||||||

|

Operating

|

Accrued and Other Current Liabilities

|

$

|

162

|

|

$

|

147

|

|

$

|

140

|

|

|

Finance

|

Current Portion of Long-term Debt and Other Borrowings

|

50

|

|

80

|

|

79

|

|

|||

|

Noncurrent

|

||||||||||

|

Operating

|

Noncurrent Operating Lease Liabilities

|

2,046

|

|

1,924

|

|

1,901

|

|

|||

|

Finance

|

Long-term Debt and Other Borrowings

|

867

|

|

885

|

|

854

|

|

|||

|

Total lease liabilities

|

$

|

3,125

|

|

$

|

3,036

|

|

$

|

2,974

|

|

|

|

(a)

|

Finance lease assets are recorded net of accumulated amortization of

$352 million

,

$317 million

, and

$300 million

as of

November 3, 2018

, February 3, 2018, and

October 28, 2017

, respectively.

|

|

Lease Cost

|

Three Months Ended

|

Nine Months Ended

|

||||||||||||

|

(millions)

|

Classification

|

November 3,

2018 |

|

October 28,

2017 |

|

November 3,

2018 |

|

October 28,

2017 |

|

|||||

|

Operating lease cost

(a)

|

SG&A Expenses

|

$

|

63

|

|

$

|

55

|

|

$

|

186

|

|

$

|

162

|

|

|

|

Finance lease cost

|

||||||||||||||

|

Amortization of leased assets

|

Depreciation and Amortization

(b)

|

16

|

|

16

|

|

49

|

|

46

|

|

|||||

|

Interest on lease liabilities

|

Net Interest Expense

|

10

|

|

10

|

|

32

|

|

31

|

|

|||||

|

Sublease income

(c)

|

Other Revenue

|

(3

|

)

|

(2

|

)

|

(8

|

)

|

(6

|

)

|

|||||

|

Net lease cost

|

$

|

86

|

|

$

|

79

|

|

$

|

259

|

|

$

|

233

|

|

||

|

(a)

|

Includes short-term leases and variable lease costs, which are immaterial.

|

|

(b)

|

Supply chain-related amounts are included in Cost of Sales.

|

|

(c)

|

Sublease income excludes rental income from owned properties of

$12 million

and

$36 million

for the three and nine months ended

November 3, 2018

, respectively, and

$12 million

and

$35 million

for the three and nine months ended

October 28, 2017

, respectively, which is included in Other Revenue.

|

|

Maturity of Lease Liabilities

(millions)

|

Operating

Leases

(a)

|

|

Finance

Leases

(b)

|

|

Total

|

|

|||

|

2018

|

$

|

59

|

|

$

|

22

|

|

$

|

81

|

|

|

2019

|

246

|

|

91

|

|

337

|

|

|||

|

2020

|

237

|

|

88

|

|

325

|

|

|||

|

2021

|

230

|

|

88

|

|

318

|

|

|||

|

2022

|

224

|

|

90

|

|

314

|

|

|||

|

After 2022

|

1,970

|

|

940

|

|

2,910

|

|

|||

|

Total lease payments

|

$

|

2,966

|

|

$

|

1,319

|

|

$

|

4,285

|

|

|

Less: Interest

|

758

|

|

402

|

|

|

|

|||

|

Present value of lease liabilities

|

$

|

2,208

|

|

$

|

917

|

|

|

|

|

|

(a)

|

Operating lease payments include

$813 million

related to options to extend lease terms that are reasonably certain of being exercised and exclude

$363 million

of legally binding minimum lease payments for leases signed but not yet commenced.

|

|

(b)

|

Finance lease payments include

$122 million

related to options to extend lease terms that are reasonably certain of being exercised and exclude

$257 million

of legally binding minimum lease payments for leases signed but not yet commenced.

|

|

Lease Term and Discount Rate

|

November 3,

2018 |

|

February 3,

2018 |

|

October 28,

2017 |

|

|

Weighted-average remaining lease term (years)

|

||||||

|

Operating leases

|

14.4

|

|

15.2

|

|

15.5

|

|

|

Finance leases

|

15.4

|

|

15.4

|

|

15.0

|

|

|

Weighted-average discount rate

|

||||||

|

Operating leases

|

3.89

|

%

|

3.88

|

%

|

3.89

|

%

|

|

Finance leases

|

4.70

|

%

|

4.64

|

%

|

4.61

|

%

|

|

Other Information

|

Nine Months Ended

|

|||||

|

(millions)

|

November 3,

2018 |

|

October 28,

2017 |

|

||

|

Cash paid for amounts included in the measurement of lease liabilities

|

||||||

|

Operating cash flows from operating leases

|

$

|

160

|

|

$

|

146

|

|

|

Operating cash flows from finance leases

|

32

|

|

31

|

|

||

|

Financing cash flows from finance leases

|

67

|

|

30

|

|

||

|

Leased assets obtained in exchange for new finance lease liabilities

|

29

|

|

97

|

|

||

|

Leased assets obtained in exchange for new operating lease liabilities

|

228

|

|

153

|

|

||

|

Three Months Ended

|

Nine Months Ended

|

||||||||||||||

|

(dollars in millions)

|

November 3,

2018 |

|

October 28,

2017 |

|

November 3,

2018 |

|

October 28,

2017 |

|

|||||||

|

Income tax expense

|

$

|

97

|

|

$

|

135

|

|

$

|

530

|

|

$

|

798

|

|

|||

|

Effective tax rate

|

13.6

|

%

|

22.2

|

%

|

19.9

|

%

|

30.5

|

%

|

|||||||

|

Three Months Ended

|

Nine Months Ended

|

|||||||||||||

|

(millions, except per share data)

|

November 3,

2018 |

|

October 28,

2017 |

|

November 3,

2018 |

|

October 28,

2017 |

|

||||||

|

Total number of shares purchased

|

6.3

|

|

0.2

|

|

19.0

|

|

10.8

|

|

||||||

|

Average price paid per share

|

$

|

84.00

|

|

$

|

58.74

|

|

$

|

76.38

|

|

$

|

56.80

|

|

||

|

Total investment

|

$

|

526

|

|

$

|

10

|

|

$

|

1,451

|

|

$

|

611

|

|

||

|

Net Pension Benefits Expense

|

Three Months Ended

|

Nine Months Ended

|

|||||||||||||

|

(millions)

|

November 3,

2018 |

|

October 28,

2017 |

|

November 3,

2018 |

|

October 28,

2017 |

|

|||||||

|

Service cost

|

$

|

24

|

|

$

|

21

|

|

$

|

72

|

|

$

|

63

|

|

|||

|

Interest cost

|

37

|

|

34

|

|

110

|

|

103

|

|

|||||||

|

Expected return on assets

|

(62

|

)

|

(61

|

)

|

(185

|

)

|

(184

|

)

|

|||||||

|

Amortization of losses

|

20

|

|

15

|

|

61

|

|

45

|

|

|||||||

|

Amortization of prior service cost

|

(3

|

)

|

(3

|

)

|

(8

|

)

|

(8

|

)

|

|||||||

|

Settlement charges

|

1

|

|

—

|

|

4

|

|

—

|

|

|||||||

|

Total

|

$

|

17

|

|

$

|

6

|

|

$

|

54

|

|

$

|

19

|

|

|||

|

(millions)

|

Cash Flow

Hedges

|

|

Currency

Translation

Adjustment

|

|

Pension

|

|

Total

|

|

|||||||

|

February 3, 2018

|

$

|

(14

|

)

|

$

|

(13

|

)

|

$

|

(720

|

)

|

$

|

(747

|

)

|

|||

|

Other comprehensive income before reclassifications, net of tax

|

—

|

|

(10

|

)

|

—

|

|

(10

|

)

|

|||||||

|

Amounts reclassified from AOCI, net of tax

|

1

|

|

—

|

|

42

|

|

43

|

|

|||||||

|

November 3, 2018

|

$

|

(13

|

)

|

$

|

(23

|

)

|

$

|

(678

|

)

|

$

|

(714

|

)

|

|||

|

•

|

GAAP earnings per share from continuing operations were

$1.16

.

|

|

•

|

Adjusted earnings per share from continuing operations were

$1.09

.

|

|

•

|

Sales increased

5.7 percent

.

|

|

•

|

Comparable sales increased

5.1

percent, driven by a

5.3 percent

increase in traffic.

|

|

◦

|

Comparable store sales grew 3.2 percent.

|

|

◦

|

Digital channel sales increased 49 percent, contributing 1.9 percentage points to comparable sales.

|

|

Earnings Per Share from Continuing Operations

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

|

|||||||||||||||

|

November 3,

2018 |

|

October 28,

2017

As Adjusted

(a)

|

|

Change

|

|

November 3,

2018 |

|

October 28,

2017

As Adjusted

(a)

|

|

Change

|

|

||||||||||

|

GAAP diluted earnings per share

|

$

|

1.16

|

|

$

|

0.87

|

|

33.6

|

%

|

$

|

3.98

|

|

$

|

3.30

|

|

20.5

|

%

|

|||||

|

Adjustments

|

(0.07

|

)

|

0.04

|

|

(0.11

|

)

|

0.03

|

|

|

|

|||||||||||

|

Adjusted diluted earnings per share

|

$

|

1.09

|

|

$

|

0.90

|

|

20.2

|

%

|

$

|

3.87

|

|

$

|

3.33

|

|

16.2

|

%

|

|||||

|

(a)

|

Lease standard adoption resulted in a $0.01 reduction in GAAP diluted earnings per share from continuing operations (GAAP EPS) for the nine months ended October 28, 2017, and in Adjusted EPS for both the three and nine months ended October 28, 2017, and less than $0.01 in GAAP EPS for the three months ended October 28, 2017.

|

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

|

||||||||||||||||

|

(dollars in millions)

|

November 3,

2018 |

|

October 28,

2017

As Adjusted

|

|

Change

|

|

November 3,

2018 |

|

October 28,

2017

As Adjusted

|

|

Change

|

|

|||||||||

|

Sales

|

$

|

17,590

|

|

$

|

16,647

|

|

5.7

|

%

|

$

|

51,699

|

|

$

|

49,052

|

|

5.4

|

%

|

|||||

|

Other revenue

|

231

|

|

227

|

|

1.6

|

|

680

|

|

679

|

|

0.2

|

|

|||||||||

|

Total revenue

|

17,821

|

|

16,874

|

|

5.6

|

|

52,379

|

|

49,731

|

|

5.3

|

|

|||||||||

|

Cost of sales

|

12,535

|

|

11,712

|

|

7.0

|

|

36,400

|

|

34,330

|

|

6.0

|

|

|||||||||

|

Selling, general and administrative expenses

|

3,937

|

|

3,733

|

|

5.5

|

|

11,347

|

|

10,686

|

|

6.2

|

|

|||||||||

|

Depreciation and amortization (exclusive of depreciation included in cost of sales)

|

530

|

|

582

|

|

(9.0

|

)

|

1,639

|

|

1,620

|

|

1.2

|

|

|||||||||

|

Operating income

|

$

|

819

|

|

$

|

847

|

|

(3.3

|

)%

|

$

|

2,993

|

|

$

|

3,095

|

|

(3.3

|

)%

|

|||||

|

Rate Analysis

|

Three Months Ended

|

Nine Months Ended

|

|||||||||

|

November 3,

2018 |

|

October 28,

2017

As Adjusted

|

|

November 3,

2018 |

|

October 28,

2017

As Adjusted

|

|

||||

|

Gross margin rate

|

28.7

|

%

|

29.6

|

%

|

29.6

|

%

|

30.0

|

%

|

|||

|

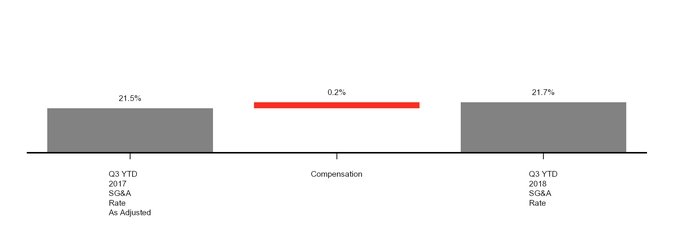

SG&A expense rate

|

22.1

|

|

22.1

|

|

21.7

|

|

21.5

|

|

|||

|

Depreciation and amortization (exclusive of depreciation included in cost of sales) expense rate

|

3.0

|

|

3.4

|

|

3.1

|

|

3.3

|

|

|||

|

Operating income margin rate

|

4.6

|

|

5.0

|

|

5.7

|

|

6.2

|

|

|||

|

Comparable Sales

|

Three Months Ended

|

Nine Months Ended

|

|||||||||

|

|

November 3,

2018 |

|

October 28,

2017 |

|

November 3,

2018 |

|

October 28,

2017 |

|

|||

|

Comparable sales change

|

5.1

|

%

|

0.9

|

%

|

4.9

|

%

|

0.3

|

%

|

|||

|

Drivers of change in comparable sales

|

|

|

|

|

|

|

|

|

|||

|

Number of transactions

|

5.3

|

|

1.4

|

|

5.1

|

|

0.9

|

|

|||

|

Average transaction amount

|

(0.2

|

)

|

(0.5

|

)

|

(0.2

|

)

|

(0.6

|

)

|

|||

|

Contribution to Comparable Sales Change

|

Three Months Ended

|

Nine Months Ended

|

|||||||||

|

|

November 3,

2018 |

|

October 28,

2017 |

|

November 3,

2018 |

|

October 28,

2017 |

|

|||

|

Stores channel comparable sales change

|

3.2

|

%

|

—

|

%

|

3.4

|

%

|

(0.6

|

)%

|

|||

|

Digital channel contribution to comparable sales change

|

1.9

|

|

0.8

|

|

1.5

|

|

0.9

|

|

|||

|

Total comparable sales change

|

5.1

|

%

|

0.9

|

%

|

4.9

|

%

|

0.3

|

%

|

|||

|

Sales by Channel

|

Three Months Ended

|

Nine Months Ended

|

|||||||||

|

|

November 3,

2018 |

|

October 28,

2017

As Adjusted

|

|

November 3,

2018 |

|