|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

(State or other jurisdiction of incorporation or organization)

|

27-2228185

(IRS Employer Identification No.)

|

|

|

100 Thermon Drive, San Marcos, Texas

(Address of principal executive offices)

|

78666

(Zip Code)

|

|

|

Title of each class

|

Name of each exchange

on which registered

|

|

|

Common Stock, $0.001 par value per share

|

New York Stock Exchange

|

|

|

Large accelerated filer

x

|

Accelerated filer

|

|

|

Non-accelerated filer

o

|

Smaller reporting company

o

|

|

|

|

Page

|

|

PART I

|

|

|

|

|

|

PART II

|

|

|

PART III

|

|

|

|

|

|

PART IV

|

|

|

|

|

|

|

|

|

·

|

Energy.

Heat tracing is used to facilitate the processing, transportation and freeze protection of energy products in both upstream and downstream oil and gas applications. In order to meet growing demand and offset natural declines in existing oil and gas production, a significant increase in capital expenditures in upstream infrastructure will be required, with a particular focus on reservoirs that are in harsher climates, are deeper or have other complex characteristics that magnify the need for heat tracing. A&M estimated in 2012 that the oil and gas end market accounted for approximately 67% of the total market for electric heat tracing in 2012, or approximately $800 million.

|

|

·

|

Chemical Processing.

Heat tracing is required for temperature maintenance and freeze protection in a variety of chemical processing applications. Factors that may impact heat tracing demand in chemicals end markets include the rapid industrialization of the developing world, a shift in base chemical processing operations to low-cost feedstock regions, a transition of Western chemical processing activities from commodity products to specialty products and environmental compliance. A&M estimated in 2012 that the chemicals end market accounted for approximately 10% of the total market for electric heat tracing in 2012, or approximately $123 million.

|

|

·

|

Power Generation.

Heat tracing is required in high-temperature processes, freeze protection and environmental regulation compliance in coal and gas facilities and for safety injection systems in nuclear facilities. An important driver of demand for heat tracing solutions for power generation is increasing demand for electricity worldwide. A&M estimated in 2012 that the power generation end market accounted for approximately 20% of the total market for electric heat tracing in 2012, or approximately $243 million. The U.S. Energy Information Administration, or "EIA", projects that global net electricity generation will increase 24% between 2013 and 2040. We believe capital spending on new and existing power generation infrastructure will be required to meet this demand.

|

|

·

|

Continuing selection of electric-based heat tracing solutions over steam-based solutions.

Beginning in the 1960s, electric heat tracing products entered the market as an alternative to steam heat tracing products. While steam-based products are still used today for heavy oil, chemical and processing applications, electric-based products generally offer greater cost savings and operating efficiencies. As a consequence, Greenfield projects commissioned in recent years are increasingly designed to incorporate electric heat tracing.

|

|

•

|

self-regulating and power limiting heating cables, which automatically increase or decrease heat output as pipe temperature changes as well as constant wattage heating cables;

|

|

•

|

mineral insulated, or "MI", cable, which is a high performance heat tracing cable for generating high temperatures that is typically used in harsh environments;

|

|

•

|

skin effect trace heater, which can heat lines up to 15 miles long from a single power point;

|

|

•

|

heat traced tube bundles for environmental gas sampling systems;

|

|

•

|

heat transfer compounds and steam tracers for comprehensive steam tracing solutions;

|

|

•

|

control and monitoring systems for electric tracing of pipes, tanks, hoppers and instrument sampling systems;

|

|

•

|

turnkey solutions that provide customers with complete solutions for heat tracing, including design, optimization, installation and ongoing maintenance;

|

|

•

|

products and services from the Unitemp acquisition, which include heating, sensing, monitoring, controlling and calibration tools; and

|

|

•

|

products from the Sumac acquisition, which include for temporary electric power distribution and lighting products used in energy infrastructure construction projects and maintenance/turnaround projects.

|

|

•

|

changes in a specific country's or region's political, social or economic conditions, particularly in emerging markets;

|

|

•

|

trade relations between the United States and those foreign countries in which our customers and suppliers have operations, including protectionist measures such as tariffs, import or export licensing requirements and trade sanctions;

|

|

•

|

restrictions on our ability to own or operate subsidiaries in, expand in and, if necessary, repatriate cash from, foreign jurisdictions;

|

|

•

|

exchange controls and currency restrictions;

|

|

•

|

the burden of complying with numerous and potentially conflicting laws;

|

|

•

|

potentially negative consequences from changes in U.S. and foreign tax laws;

|

|

•

|

difficulty in staffing and managing (including ensuring compliance with internal policies and controls) geographically widespread operations;

|

|

•

|

different regulatory regimes controlling the protection of our intellectual property;

|

|

•

|

difficulty in the enforcement of contractual obligations in non-U.S. jurisdictions and the collection of accounts receivable from foreign accounts; and

|

|

•

|

transportation delays or interruptions.

|

|

•

|

diversion of management time and attention from daily operations;

|

|

•

|

difficulties integrating acquired businesses, technologies and personnel into our business;

|

|

•

|

realization of expected synergies and revenue creation or cross-selling opportunities;

|

|

•

|

potential loss of key employees, key contractual relationships or key customers of acquired companies or of us; and

|

|

•

|

assumption of the liabilities and exposure to unforeseen liabilities of acquired companies.

|

|

•

|

general economic conditions and cyclicality in the end markets we serve;

|

|

•

|

future growth of energy and chemical processing capital investments;

|

|

•

|

a material disruption at any of our manufacturing facilities;

|

|

•

|

delays in our customers' projects for which our products are a component;

|

|

•

|

the timing of completion of large Greenfield projects;

|

|

•

|

competition from various other sources providing similar heat tracing products and services, or other alternative technologies, to customers; and

|

|

•

|

the seasonality of demand for MRO/UE orders, which is typically highest during the second and third fiscal quarters.

|

|

•

|

quarterly fluctuations in our operating results;

|

|

•

|

changes in investors' and analysts' perception of the business risks and conditions of our business or our competitors;

|

|

•

|

our ability to meet the earnings estimates and other performance expectations of financial analysts or investors;

|

|

•

|

unfavorable commentary or downgrades of our stock by equity research analysts;

|

|

•

|

the emergence of new sales channels in which we are unable to compete effectively;

|

|

•

|

disruption to our operations;

|

|

•

|

fluctuations in the stock prices of our peer companies or in stock markets in general; and

|

|

•

|

general economic or political conditions.

|

|

•

|

authorizing our board of directors, without further action by the stockholders, to issue blank check preferred stock;

|

|

•

|

limiting the ability of our stockholders to call and bring business before special meetings and to take action by written consent in lieu of a meeting;

|

|

•

|

requiring advance notice of stockholder proposals for business to be conducted at meetings of our stockholders and for nominations of candidates for election to our board of directors;

|

|

•

|

authorizing our board of directors, without stockholder approval, to amend our amended and restated bylaws;

|

|

•

|

limiting the determination of the number of directors on our board of directors and the filling of vacancies or newly created seats on our board of directors to our board of directors then in office; and

|

|

•

|

subject to certain exceptions, limiting our ability to engage in certain business combinations with an “interested stockholder” for a three-year period following the time that the stockholder became an interested stockholder.

|

|

Location

|

Country

|

Approximate Size

|

Function

|

Owned/Leased

|

||||

|

Corporate Headquarters San Marcos ,TX

|

United States

|

219,000 sq. ft. on 30 acres

|

Manufacturing, fabrication, , sales, engineering, marketing, research & development, warehouse and Corporate Headquarters

|

Owned

|

||||

|

McCarty Lane Property San Marcos, TX

|

United States

|

9,300 sq. ft. on 6.6 acres

|

Storage

|

Owned

|

||||

|

Houston, TX

|

United States

|

41,000 sq. ft.

|

Fabrication, engineering, and sales

|

Leased

|

||||

|

Houston, TX

|

United States

|

44,000 sq. ft.

|

Office and warehouse

|

Owned

|

||||

|

Baton Rouge, LA

|

United States

|

10,000 sq. ft.

|

Sales, engineering and warehouse

|

Owned

|

||||

|

Newark, DE

|

United States

|

500 sq. ft.

|

Sales

|

Leased

|

||||

|

Office: Calgary, AB

|

Canada

|

34,000 sq. ft.

|

Fabrication, sales, engineering and warehouse

|

Leased

|

||||

|

MI Plant: Calgary, AB

|

Canada

|

46,000 sq. ft.

|

Manufacturing, fabrication, and warehouse

|

Leased

|

||||

|

Edmonton, AB

|

Canada

|

9,800 sq. ft.

|

Sales and warehouse

|

Leased

|

||||

|

Sarnia, ON

|

Canada

|

4,500 sq. ft.

|

Sales and warehouse

|

Leased

|

||||

|

London, ON

|

Canada

|

1,200 sq. ft.

|

Sales

|

Leased

|

||||

|

Fort McMurray, AB (a)

|

Canada

|

4,600 sq. ft.

|

Fabrication, sales, and warehouse

|

Leased

|

||||

|

Mexico City

|

Mexico

|

2,000 sq. ft.

|

Sales and engineering

|

Leased

|

||||

|

Rio de Janeiro

|

Brazil

|

625 sq. ft.

|

Sales,engineering and warehouse

|

Leased

|

||||

|

Pijnacker

|

Netherlands

|

35,000 sq. ft. on 1.5 acres

|

Manufacturing, fabrication, sales, engineering, warehouse, marketing and European Headquarters

|

Owned

|

||||

|

Moscow

|

Russia

|

2,600 sq. ft.

|

Sales and engineering

|

Leased

|

||||

|

Paris

|

France

|

4,300 sq. ft.

|

Sales and engineering

|

Leased

|

||||

|

Gateshead, Tyne & Wear

|

United Kingdom

|

5,000 sq. ft.

|

Sales, engineering, and warehouse

|

Leased

|

||||

|

Bergisch Gladbach

|

Germany

|

2,800 sq. ft.

|

Sales and engineering

|

Leased

|

||||

|

Cape Town

|

South Africa

|

21,250 sq. ft.

|

Sales, engineering, fabrication and warehouse

|

Leased

|

||||

|

Johannesburg

|

South Africa

|

11, 250 sq. ft.

|

Sales and warehouse

|

Leased

|

||||

|

Manama

|

Bahrain

|

1,100 sq. ft.

|

Sales and engineering

|

Leased

|

||||

|

Shanghai

|

China

|

2,500 sq. ft.

|

Sales and engineering

|

Leased

|

||||

|

Shanghai

|

China

|

4,600 sq. ft.

|

Warehouse

|

Leased

|

||||

|

Shanghai

|

China

|

400 sq. ft.

|

Warehouse

|

Leased

|

||||

|

Beijing

|

China

|

1,650 sq. ft.

|

Sales and engineering

|

Leased

|

||||

|

Mumbai

|

India

|

1,500 sq. ft.

|

Sales and engineering

|

Leased

|

||||

|

Koregon Bhima, Pune

|

India

|

15,000 sq. ft. on 3 acres

|

Manufacturing, fabrication and warehouse

|

Owned

|

||||

|

Noida

|

India

|

2,000 sq. ft.

|

Engineering

|

Leased

|

||||

|

Caringbah, New South Wales

|

Australia

|

200 sq. ft.

|

Sales

|

Leased

|

||||

|

Bayswater, Victoria

|

Australia

|

1,350 sq. ft.

|

Fabrication, sales, engineering and warehouse

|

Owned

|

||||

|

Kuala Lumpur

|

Malaysia

|

475 sq. ft.

|

Sales and engineering

|

Leased

|

||||

|

Yokohama

|

Japan

|

1,500 sq. ft.

|

Sales and engineering

|

Leased

|

||||

|

Seoul

|

South Korea

|

3,500 sq. ft.

|

Sales and engineering

|

Leased

|

||||

|

Seoul

|

South Korea

|

950 sq. ft.

|

Warehouse

|

Leased

|

||||

|

Thermon Common Stock

|

||||||||||||

|

High

|

Low

|

Dividends Paid

|

||||||||||

|

For the quarterly period ended:

|

||||||||||||

|

June 30, 2013

|

$

|

22.25

|

|

$

|

17.99

|

|

—

|

|

||||

|

September 30, 2013

|

$

|

23.23

|

|

$

|

19.01

|

|

—

|

|

||||

|

December 31, 2013

|

$

|

29.06

|

|

$

|

22.71

|

|

—

|

|

||||

|

March 31, 2014

|

$

|

28.63

|

|

$

|

22.70

|

|

—

|

|

||||

|

For the quarterly period ended:

|

||||||||||||

|

June 30, 2014

|

$

|

27.08

|

|

$

|

22.42

|

|

—

|

|

||||

|

September 30, 2014

|

$

|

28.31

|

|

$

|

24.14

|

|

—

|

|

||||

|

December 31, 2014

|

$

|

26.73

|

|

$

|

21.19

|

|

—

|

|

||||

|

March 31, 2015

|

$

|

24.95

|

|

$

|

20.24

|

|

—

|

|

||||

|

For the quarterly period ended:

|

||||||||||||

|

June 30, 2015 (Through May 26, 2015)

|

$

|

24.87

|

|

$

|

21.88

|

|

—

|

|

||||

|

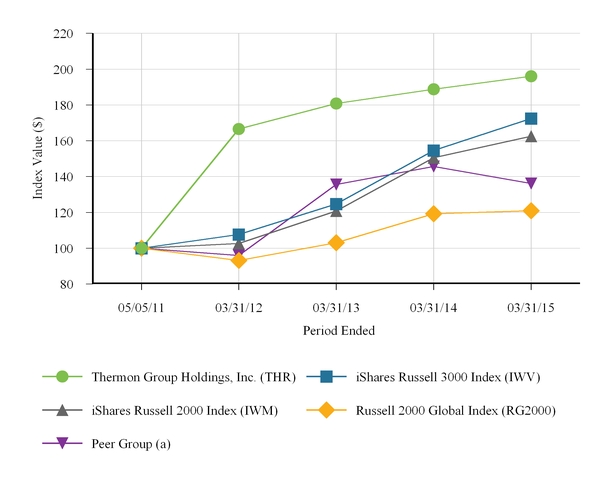

May 5, 2011

|

March 31, 2012

|

March 31, 2013

|

March 31, 2014

|

March 31, 2015

|

|||||||||||

|

Thermon Group Holdings, Inc.

|

$

|

100.00

|

|

$

|

166.53

|

|

$

|

180.86

|

|

$

|

188.76

|

|

$

|

196.01

|

|

|

iShares Russell 3000 Index

|

$

|

100.00

|

|

$

|

107.67

|

|

$

|

124.62

|

|

$

|

154.61

|

|

$

|

172.46

|

|

|

iShares Russell 2000 Index

|

$

|

100.00

|

|

$

|

102.57

|

|

$

|

120.80

|

|

$

|

150.55

|

|

$

|

162.53

|

|

|

Russell Global Index

|

$

|

100.00

|

|

$

|

93.13

|

|

$

|

103.04

|

|

$

|

119.19

|

|

$

|

120.89

|

|

|

Peer Group (a)

|

$

|

100.00

|

|

$

|

95.96

|

|

$

|

135.64

|

|

$

|

145.65

|

|

$

|

136.18

|

|

|

Successor

|

Predecessor/Successor Combined (Non-GAAP) (1)

|

||||||||||||||||||||

|

Year Ended March 31,

|

|||||||||||||||||||||

|

2015

|

2014

|

2013

|

2012

|

2011

|

|||||||||||||||||

|

(dollars in thousands, except per share data)

|

|||||||||||||||||||||

|

Consolidated Statements of Operations Data:

|

|||||||||||||||||||||

|

Sales

|

$

|

308,578

|

|

277,323

|

|

284,036

|

|

272,323

|

|

$

|

241,063

|

|

|||||||||

|

Cost of sales

|

153,874

|

|

142,153

|

|

151,204

|

|

140,208

|

|

131,348

|

|

|||||||||||

|

Purchase accounting adjustments (2)

|

—

|

|

—

|

|

—

|

|

—

|

|

7,614

|

|

|||||||||||

|

Gross profit

|

$

|

154,704

|

|

$

|

135,170

|

|

$

|

132,832

|

|

$

|

132,115

|

|

$

|

102,101

|

|

||||||

|

Operating expenses:

|

|||||||||||||||||||||

|

Marketing, general and administrative and engineering

|

76,868

|

|

65,463

|

|

64,633

|

|

76,280

|

|

58,893

|

|

|||||||||||

|

Amortization of intangible assets

|

10,775

|

|

11,090

|

|

11,211

|

|

11,379

|

|

18,245

|

|

|||||||||||

|

Income from operations

|

$

|

67,061

|

|

$

|

58,617

|

|

$

|

56,988

|

|

$

|

44,456

|

|

$

|

24,963

|

|

||||||

|

Interest income

|

460

|

|

246

|

|

112

|

|

122

|

|

49

|

|

|||||||||||

|

Interest expense (3)

|

(4,565

|

)

|

(10,019

|

)

|

(15,225

|

)

|

(19,584

|

)

|

(29,000

|

)

|

|||||||||||

|

Loss on retirement of debt

|

—

|

|

(15,485

|

)

|

—

|

|

(3,825

|

)

|

(630

|

)

|

|||||||||||

|

Success fees to owners related to the CHS Transactions (4)

|

—

|

|

—

|

|

—

|

|

—

|

|

(7,738

|

)

|

|||||||||||

|

Other expense (5)

|

(394

|

)

|

(596

|

)

|

(325

|

)

|

(1,671

|

)

|

(14,125

|

)

|

|||||||||||

|

Income (loss) from continuing

|

|||||||||||||||||||||

|

operations before provision for

|

|||||||||||||||||||||

|

income taxes

|

$

|

62,562

|

|

$

|

32,763

|

|

$

|

41,550

|

|

$

|

19,498

|

|

$

|

(26,481

|

)

|

||||||

|

Income tax expense (benefit)

|

13,176

|

|

6,964

|

|

14,576

|

|

7,468

|

|

(11,274

|

)

|

|||||||||||

|

Net income (loss)

|

$

|

49,386

|

|

$

|

25,799

|

|

$

|

26,974

|

|

$

|

12,030

|

|

$

|

(15,207

|

)

|

||||||

|

Net income (loss) per common share: (6)

|

|||||||||||||||||||||

|

Basic

|

$

|

1.54

|

|

$

|

0.82

|

|

$

|

0.88

|

|

$

|

0.41

|

|

$

|

—

|

|

||||||

|

Diluted

|

1.52

|

|

0.80

|

|

0.85

|

|

0.40

|

|

—

|

|

|||||||||||

|

Weighted-average shares used in

|

|||||||||||||||||||||

|

computing net income (loss) per

|

|||||||||||||||||||||

|

common share (thousands) (6):

|

|||||||||||||||||||||

|

Basic

|

32,027

|

|

31,595

|

|

30,797

|

|

29,083

|

|

—

|

|

|||||||||||

|

Diluted

|

32,407

|

|

32,154

|

|

31,797

|

|

30,454

|

|

—

|

|

|||||||||||

|

Cash dividends per share

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Other Financial and Operating Data:

|

|||||||||||||||||||||

|

Capital expenditures

|

6,075

|

|

3,367

|

|

6,264

|

|

8,883

|

|

1,799

|

|

|||||||||||

|

Backlog at end of period (7)

|

75,745

|

|

84,840

|

|

95,228

|

|

117,748

|

|

76,298

|

|

|||||||||||

|

At March 31,

|

||||||||||||||||||||

|

2015

|

2014

|

2013

|

2012

|

2011

|

||||||||||||||||

|

(dollars in thousands)

|

||||||||||||||||||||

|

Balance Sheet Data:

|

||||||||||||||||||||

|

Cash and cash equivalents

|

$

|

93,774

|

|

$

|

72,640

|

|

$

|

43,847

|

|

$

|

21,468

|

|

$

|

51,266

|

|

|||||

|

Accounts receivable, net

|

60,441

|

|

52,578

|

|

56,123

|

|

50,037

|

|

40,013

|

|

||||||||||

|

Inventory, net

|

41,008

|

|

37,316

|

|

34,391

|

|

38,453

|

|

31,118

|

|

||||||||||

|

Total assets

|

453,309

|

|

442,180

|

|

435,523

|

|

425,579

|

|

451,032

|

|

||||||||||

|

Total debt

|

108,000

|

|

121,500

|

|

118,145

|

|

139,145

|

|

212,063

|

|

||||||||||

|

Total shareholders' equity

|

271,766

|

|

250,466

|

|

226,047

|

|

192,480

|

|

126,532

|

|

||||||||||

|

(1)

|

The closing of the CHS Transactions on April 30, 2010 established a new basis of accounting that primarily affected inventory, intangible assets, goodwill, taxes, debt and equity. This resulted in additional amortization expense, interest expense and tax expense for the period from May 1, 2010 through March 31, 2011 (“successor”) as compared to the period from April 1, 2010 through April 30, 2010 (“predecessor”). Except for purchase accounting adjustments, the results for the two combined periods are comparable. Therefore, we believe that combining the two periods into a single period for comparative purposes gives the most clarity for the users of this financial information. Please also refer to our historical consolidated financial statements and notes thereto for the fiscal year ended March 31, 2011 included in our fiscal 2011 annual report filed with the Securities and Exchange Commission on June 20, 2011 for a separate presentation of the results for the predecessor and successor periods in accordance with U.S. generally accepted accounting principles (“GAAP”).

|

|

For the Period From May 1, 2010 Through March 31, 2011 (Successor)

|

For the Period from April 1, Through April 30 2010 (Predecessor)

|

Fiscal Year Ended March 31, 2011 (Predecessor/Successor Combined)

|

||||||||||

|

(dollars in thousands)

|

||||||||||||

|

Consolidated Statements of Operations Data:

|

||||||||||||

|

Sales

|

$

|

227,880

|

|

$

|

13,183

|

|

$

|

241,063

|

|

|||

|

Cost of sales

|

124,781

|

|

6,567

|

|

131,348

|

|

||||||

|

Purchase accounting non-cash adjustment

|

7,614

|

|

—

|

|

7,614

|

|

||||||

|

Gross profit

|

95,485

|

|

6,616

|

|

102,101

|

|

||||||

|

Marketing, general and administrative and engineering

|

54,630

|

|

4,263

|

|

58,893

|

|

||||||

|

Amortization of intangible assets

|

18,030

|

|

215

|

|

18,245

|

|

||||||

|

Income from operations

|

22,825

|

|

2,138

|

|

24,963

|

|

||||||

|

Interest income

|

42

|

|

7

|

|

49

|

|

||||||

|

Interest expense

|

(22,771

|

)

|

(6,229

|

)

|

(29,000

|

)

|

||||||

|

Loss on retirement of debt

|

(630

|

)

|

—

|

|

(630

|

)

|

||||||

|

Success fees to owners related to the CHS Transactions

|

(3,022

|

)

|

(4,716

|

)

|

(7,738

|

)

|

||||||

|

Other expense

|

(5,224

|

)

|

(8,901

|

)

|

(14,125

|

)

|

||||||

|

Loss before provision for income taxes

|

(8,780

|

)

|

(17,701

|

)

|

(26,481

|

)

|

||||||

|

Income tax expense (benefit)

|

6,160

|

|

(17,434

|

)

|

(11,274

|

)

|

||||||

|

Net loss

|

$

|

(14,940

|

)

|

$

|

(267

|

)

|

$

|

(15,207

|

)

|

|||

|

Statement of Cash Flows Data:

|

||||||||||||

|

Net cash used in:

|

||||||||||||

|

Capital expenditures

|

$

|

1,702

|

|

$

|

97

|

|

$

|

1,799

|

|

|||

|

(2)

|

In fiscal 2011, there was a non-cash negative impact of $7.6 million to cost of sales and, consequently, gross profit due to a purchase accounting adjustment related to the CHS Transactions.

|

|

(3)

|

Interest expense for fiscal 2014 included a $4.0 million acceleration of amortization on our deferred debt issuance costs related to the redemption of all $118.1 million of aggregate outstanding principal on our 9.5% senior secured notes and an additional $0.6 million of amortized deferred debt issuance costs. Interest expense for fiscal 2013 included a $2.3 million acceleration of the amortization of our deferred debt issuance costs due to partial redemptions of our senior secured notes and a refinancing of our prior revolving credit facility and $1.0 million of additional amortized deferred debt issuance costs. Interest expense for fiscal 2012 included a $3.1 million acceleration of the amortization of our deferred debt issuance costs due to certain partial redemptions of our senior secured notes and $1.0 million of additional amortized deferred debt issuance costs. Interest expense for fiscal 2011 of $29.0 million reflected in part increased interest expense on our senior secured notes issued in connection with the CHS Transactions. In addition, we recorded a $4.9 million acceleration of the amortization on our deferred debt issuance costs of the predecessor as well as $1.6 million of amortized deferred debt issuance costs related to the successor.

|

|

(4)

|

In fiscal 2011, we paid fees to both the predecessor and successor owners related to the successful completion of the CHS Transactions. As related party transactions, they were reported separately from other CHS Transaction expenses included in other expense.

|

|

(5)

|

Other expense for fiscal 2011 of $14.1 million consisted primarily of $15.0 million of non-recurring expenses related to the CHS Transactions, partially offset by $0.6 million of income related to the reversal of our compliance reserve.

|

|

(6)

|

While we have presented net income per common share and weighted-average shares used in computing net income per common share for fiscal 2015, fiscal 2014, fiscal 2013 and fiscal 2012, we have not presented such information for

|

|

(7)

|

Represents the future revenue attributable to signed, but unperformed, purchase orders that set forth specific revenue amounts at the end of the applicable period.

|

|

Fiscal Year Ended March 31,

|

|||||||||

|

2015

|

2014

|

2013

|

|||||||

|

Greenfield

|

41

|

%

|

33

|

%

|

42

|

%

|

|||

|

MRO/UE

|

59

|

%

|

67

|

%

|

58

|

%

|

|||

|

Fiscal Year Ended March 31,

|

|||||||||||||||||||||||

|

2015

|

2014

|

2013

|

|||||||||||||||||||||

|

(dollars in thousands)

|

|||||||||||||||||||||||

|

Consolidated Statements of Operations Data:

|

|||||||||||||||||||||||

|

Sales

|

$

|

308,578

|

|

100

|

%

|

$

|

277,323

|

|

100

|

%

|

$

|

284,036

|

|

100

|

%

|

||||||||

|

Cost of sales

|

153,874

|

|

50

|

|

142,153

|

|

51

|

|

151,204

|

|

53

|

|

|||||||||||

|

Gross profit

|

$

|

154,704

|

|

50

|

%

|

$

|

135,170

|

|

49

|

%

|

$

|

132,832

|

|

47

|

%

|

||||||||

|

Operating Expenses:

|

|||||||||||||||||||||||

|

Marketing, general, and

|

|||||||||||||||||||||||

|

administrative and engineering

|

76,868

|

|

25

|

%

|

65,463

|

|

24

|

%

|

64,633

|

|

23

|

%

|

|||||||||||

|

Amortization of intangible assets

|

10,775

|

|

3

|

|

11,090

|

|

4

|

|

11,211

|

|

4

|

|

|||||||||||

|

Income from operations

|

$

|

67,061

|

|

22

|

%

|

$

|

58,617

|

|

21

|

%

|

$

|

56,988

|

|

20

|

%

|

||||||||

|

Interest expense, net (1)

|

(4,105

|

)

|

(1

|

)

|

(9,773

|

)

|

(4

|

)

|

(15,113

|

)

|

(5

|

)

|

|||||||||||

|

Loss on redemption of debt

|

—

|

|

—

|

|

(15,485

|

)

|

(6

|

)

|

—

|

|

—

|

|

|||||||||||

|

Other expense

|

(394

|

)

|

—

|

|

(596

|

)

|

—

|

|

(325

|

)

|

—

|

|

|||||||||||

|

Income before provision for income taxes

|

$

|

62,562

|

|

20

|

%

|

$

|

32,763

|

|

12

|

%

|

$

|

41,550

|

|

15

|

%

|

||||||||

|

Income tax expense

|

13,176

|

|

4

|

|

6,964

|

|

3

|

|

14,576

|

|

5

|

|

|||||||||||

|

Net income

|

$

|

49,386

|

|

16

|

%

|

$

|

25,799

|

|

9

|

%

|

$

|

26,974

|

|

9

|

%

|

||||||||

|

(1)

|

Interest expense for fiscal 2014 included a $4.0 million acceleration of the amortization of our deferred debt issuance costs as we redeemed all $118.1 million of aggregate outstanding principal on our 9.5% senior secured notes. During the period we incurred an additional $0.6 million of amortized deferred debt issuance costs. Interest expense for fiscal 2013 included a $2.3 million acceleration of the amortization of our deferred debt issuance costs due to partial redemptions of our senior secured notes and a refinancing of our prior revolving credit facility. $1.0 million of additional amortized deferred debt issuance costs were recorded in fiscal 2013. Further reductions in our fiscal 2015 interest expense were due to the difference in interest rates on our 9.5% senior secured notes and our term loan whose interest rate was fixed at 3.12% after giving effect to our interest rate swap.

|

|

Payment Due By Period

|

|||||||||||||||||||||

|

Total

|

Less than 1 Year

|

1-3 Years

|

3-5 Years

|

More than 5 Years

|

|||||||||||||||||

|

(dollars in thousands)

|

|||||||||||||||||||||

|

Variable rate term loan (1)

|

$

|

108,000

|

|

$

|

13,500

|

|

$

|

33,750

|

|

$

|

60,750

|

|

$

|

—

|

|

||||||

|

Interest payments on variable rate term loan (2)

|

9,222

|

|

3,194

|

|

4,876

|

|

1,152

|

|

—

|

|

|||||||||||

|

Operating lease obligations (3)

|

8,420

|

|

2,672

|

|

3,111

|

|

1,399

|

|

1,238

|

|

|||||||||||

|

Information technology services agreements (4)

|

1,588

|

|

1,070

|

|

472

|

|

46

|

|

—

|

|

|||||||||||

|

Total

|

$

|

127,230

|

|

$

|

20,436

|

|

$

|

42,209

|

|

$

|

63,347

|

|

$

|

1,238

|

|

||||||

|

(1)

|

Consists of monthly principal payments of $1.1 million through March 31, 2017; increasing in April 2017 to $1.7 million through maturity with a lump-sum payment of $40.5 million due in April 2019.

|

|

(2)

|

Consists of estimated future term loan interest payments at an interest rate of 3.12%, based on our interest rate swap agreement (a) through April 30, 2016 and (b) after April 30, 2016 through the April 2019 maturity date, at a blended interest rate based on the amount of interest payments on outstanding principal that are fixed through our interest rate swap and our interest rate on LIBOR-based borrowings of 2.19% as of March 31, 2015 has been applied to any unhedged future interest payments.

|

|

(3)

|

We enter into operating leases in the normal course of business. Our operating leases include the leases on certain of our manufacturing and warehouse facilities, in addition to certain offices of our affiliates.

|

|

(4)

|

Represents the future annual service fees associated with certain information technology service agreements with several vendors.

|

|

Year Ended March 31,

|

||||||||||||||

|

2015

|

2014

|

2013

|

||||||||||||

|

Net income

|

$

|

49,386

|

|

$

|

25,799

|

|

$

|

26,974

|

|

|||||

|

Interest expense, net

|

4,105

|

|

9,773

|

|

15,113

|

|

||||||||

|

Income tax expense

|

13,176

|

|

6,964

|

|

14,576

|

|

||||||||

|

Depreciation and amortization

|

14,143

|

|

14,178

|

|

13,831

|

|

||||||||

|

Stock-based compensation

|

3,295

|

|

2,203

|

|

1,341

|

|

||||||||

|

Gain on settlement of CHS Transactions

|

(931

|

)

|

—

|

|

—

|

|

||||||||

|

Loss on retirement of debt (a)

|

—

|

|

15,485

|

|

—

|

|

||||||||

|

Secondary offering expenses (b)

|

—

|

|

—

|

|

536

|

|

||||||||

|

Adjusted EBITDA

|

$

|

83,174

|

|

$

|

74,402

|

|

$

|

72,371

|

|

|||||

|

Average total shareholders' equity for the twelve month period ended March 31

|

261,116

|

|

238,257

|

|

209,264

|

|

||||||||

|

Return on Equity - non-GAAP basis

|

32

|

%

|

31

|

%

|

35

|

%

|

||||||||

|

(a)

|

In fiscal 2014, we redeemed all $118.1 million of outstanding aggregate principal amount of our 9.5% senior secured notes. In connection with the redemption, we paid $15.5 million in related redemption premiums.

|

|

(b)

|

Represents legal, financial and other advisory and consulting fees and expenses incurred during fiscal 2013 in connection with our shelf registration and secondary offering in which our former private equity sponsors sold 11.5 million shares of our common stock.

|

|

Year ended March 31,

|

||||||||||||||

|

2015

|

2014

|

2013

|

||||||||||||

|

Net income

|

$

|

49,386

|

|

$

|

25,799

|

|

$

|

26,974

|

|

|||||

|

Premium charges on long term debt

|

—

|

|

15,485

|

|

—

|

|

||||||||

|

Acceleration of unamortized debt costs

|

—

|

|

4,010

|

|

2,318

|

|

||||||||

|

Discrete tax items related to the CHS Transactions

|

—

|

|

(575

|

)

|

—

|

|

||||||||

|

Release of liability for uncertain tax positions

|

—

|

|

(1,047

|

)

|

—

|

|

||||||||

|

Release of deferred tax liability for undistributed foreign earnings

|

(3,224

|

)

|

—

|

|

—

|

|

||||||||

|

Secondary offering expenses

|

—

|

|

—

|

|

536

|

|

||||||||

|

Release of valuation allowance for foreign net operating loss carry forward

|

(634

|

)

|

—

|

|

—

|

|

||||||||

|

Gain on settlement of CHS Transactions

|

(931

|

)

|

||||||||||||

|

Tax effect of financial adjustments

|

—

|

|

(5,088

|

)

|

(1,007

|

)

|

||||||||

|

Adjusted Net Income - non-GAAP basis

|

$

|

44,597

|

|

$

|

38,584

|

|

$

|

28,821

|

|

|||||

|

Adjusted fully-diluted earnings per common share - non-GAAP basis

|

$

|

1.38

|

|

$

|

1.20

|

|

$

|

0.91

|

|

|||||

|

Fully-diluted common shares - non-GAAP basis (thousands)

|

32,407

|

|

32,154

|

|

31,797

|

|

||||||||

|

Year Ended March 31,

|

|||||||||

|

2015

|

2014

|

2013

|

|||||||

|

Cash provided by operating activities

|

51,731

|

|

46,114

|

|

41,370

|

|

|||

|

Less: Purchases of property, plant and equipment

|

(6,075

|

)

|

(3,367

|

)

|

(6,264

|

)

|

|||

|

Free cash flow provided

|

45,656

|

|

42,747

|

|

35,106

|

|

|||

|

Page

|

|

|

Audited Financial Statements of Thermon Group Holdings, Inc. and its Consolidated Subsidiaries

|

|

|

Year Ended March 31, 2015

|

Year Ended March 31, 2014

|

Year Ended March 31, 2013

|

||||||||||

|

Sales

|

$

|

308,578

|

|

$

|

277,323

|

|

$

|

284,036

|

|

|||

|

Cost of sales

|

153,874

|

|

142,153

|

|

151,204

|

|

||||||

|

Gross profit

|

154,704

|

|

135,170

|

|

132,832

|

|

||||||

|

Operating expenses:

|

||||||||||||

|

Marketing, general and administrative and engineering

|

76,868

|

|

65,463

|

|

64,633

|

|

||||||

|

Amortization of intangible assets

|

10,775

|

|

11,090

|

|

11,211

|

|

||||||

|

Income from operations

|

67,061

|

|

58,617

|

|

56,988

|

|

||||||

|

Other income/(expenses):

|

||||||||||||

|

Interest income

|

460

|

|

246

|

|

112

|

|

||||||

|

Interest expense

|

(4,565

|

)

|

(10,019

|

)

|

(15,225

|

)

|

||||||

|

Loss on retirement of senior secured notes

|

—

|

|

(15,485

|

)

|

—

|

|

||||||

|

Other expense

|

(394

|

)

|

(596

|

)

|

(325

|

)

|

||||||

|

Income before provision for income taxes

|

62,562

|

|

32,763

|

|

41,550

|

|

||||||

|

Income tax expense

|

13,176

|

|

6,964

|

|

14,576

|

|

||||||

|

Net income

|

$

|

49,386

|

|

$

|

25,799

|

|

$

|

26,974

|

|

|||

|

Other comprehensive income:

|

||||||||||||

|

Net income

|

$

|

49,386

|

|

$

|

25,799

|

|

$

|

26,974

|

|

|||

|

Foreign currency translation adjustment

|

(32,667

|

)

|

(6,724

|

)

|

(4,133

|

)

|

||||||

|

Derivative valuation, net of tax

|

(404

|

)

|

70

|

|

—

|

|

||||||

|

Other

|

(449

|

)

|

—

|

|

(304

|

)

|

||||||

|

Total comprehensive income

|

$

|

15,866

|

|

$

|

19,145

|

|

$

|

22,537

|

|

|||

|

Net income per common share:

|

||||||||||||

|

Basic

|

$

|

1.54

|

|

$

|

0.82

|

|

$

|

0.88

|

|

|||

|

Diluted

|

1.52

|

|

0.80

|

|

0.85

|

|

||||||

|

Weighted-average shares used in computing net income per common share:

|

||||||||||||

|

Basic

|

32,027,115

|

|

31,595,019

|

|

30,796,675

|

|

||||||

|

Diluted

|

32,407,266

|

|

32,153,912

|

|

31,796,830

|

|

||||||

|

|

March 31,

2015 |

March 31,

2014 |

|||||

|

Assets

|

|

|

|

|

|||

|

Current assets:

|

|

|

|

|

|||

|

Cash and cash equivalents

|

$

|

93,774

|

|

$

|

72,640

|

|

|

|

Accounts receivable, net of allowance for doubtful accounts of $785 and $751 as of March 31, 2015 and 2014, respectively

|

60,441

|

|

52,578

|

|

|||

|

Inventories, net

|

41,008

|

|

37,316

|

|

|||

|

Costs and estimated earnings in excess of billings on uncompleted contracts

|

6,804

|

|

2,880

|

|

|||

|

Income taxes receivable

|

—

|

|

3,310

|

|

|||

|

Prepaid expenses and other current assets

|

5,128

|

|

5,058

|

|

|||

|

Deferred income taxes

|

3,549

|

|

2,046

|

|

|||

|

Total current assets

|

210,704

|

|

175,828

|

|

|||

|

Property, plant and equipment, net

|

34,824

|

|

31,532

|

|

|||

|

Goodwill

|

105,232

|

|

114,112

|

|

|||

|

Intangible assets, net

|

100,813

|

|

118,917

|

|

|||

|

Debt issuance costs, net

|

1,358

|

|

1,528

|

|

|||

|

Other long term assets

|

378

|

|

263

|

|

|||

|

Total assets

|

$

|

453,309

|

|

$

|

442,180

|

|

|

|

Liabilities and shareholders’ equity

|

|

|

|

|

|||

|

Current liabilities:

|

|

|

|

|

|||

|

Accounts payable

|

$

|

17,145

|

|

$

|

17,066

|

|

|

|

Accrued liabilities

|

17,417

|

|

9,869

|

|

|||

|

Current portion of long term debt

|

13,500

|

|

13,500

|

|

|||

|

Billings in excess of costs and estimated earnings on uncompleted contracts

|

2,366

|

|

1,749

|

|

|||

|

Income taxes payable

|

2,710

|

|

956

|

|

|||

|

Obligations due to settle the CHS Transactions

|

—

|

|

567

|

|

|||

|

Total current liabilities

|

53,138

|

|

43,707

|

|

|||

|

Long-term debt, net of current maturities

|

94,500

|

|

108,000

|

|

|||

|

Deferred income taxes

|

30,835

|

|

37,617

|

|

|||

|

Other noncurrent liabilities

|

3,070

|

|

2,390

|

|

|||

|

Total liabilities

|

181,543

|

|

|

191,714

|

|

||

|

Common stock: $.001 par value; 150,000,000 authorized; 32,082,393 and 31,920,865 shares issued and outstanding at March 31, 2015 and 2014, respectively

|

32

|

|

32

|

|

|||

|

Preferred stock: $.001 par value; 10,000,000 authorized; no shares issued and outstanding

|

—

|

|

—

|

|

|||

|

Additional paid in capital

|

213,885

|

|

208,451

|

|

|||

|

Accumulated other comprehensive loss

|

(41,400

|

)

|

(7,880

|

)

|

|||

|

Retained earnings

|

99,249

|

|

49,863

|

|

|||

|

Shareholders’ equity

|

271,766

|

|

250,466

|

|

|||

|

Total liabilities and shareholders' equity

|

$

|

453,309

|

|

$

|

442,180

|

|

|

|

Thermon Group Holdings, Inc.

|

|||||||||||||||||||||

|

Consolidated Statements of Shareholders' Equity

|

|||||||||||||||||||||

|

(Dollars in Thousands)

|

|||||||||||||||||||||

|

Common Stock Outstanding

|

Stock/Capital Account

|

Retained Earnings/ (Deficit)

|

Accumulated Other Comprehensive Income (Loss)

|

Total

|

|||||||||||||||||

|

Balances at March 31, 2012

|

30,208,084

|

|

$

|

192,028

|

|

$

|

(2,910

|

)

|

$

|

3,362

|

|

$

|

192,480

|

|

|||||||

|

Issuance of common stock in exercise of stock options

|

1,086,486

|

|

5,558

|

|

—

|

|

—

|

|

5,558

|

|

|||||||||||

|

Stock-based compensation expense

|

—

|

|

1,341

|

|

—

|

|

—

|

|

1,341

|

|

|||||||||||

|

Issuance of restricted stock as deferred compensation to employees and directors

|

13,012

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Excess tax deduction from stock option exercises

|

—

|

|

4,131

|

|

—

|

|

—

|

|

4,131

|

|

|||||||||||

|

Net income

|

—

|

|

—

|

|

26,974

|

|

—

|

|

26,974

|

|

|||||||||||

|

Foreign currency translation adjustment

|

—

|

|

—

|

|

—

|

|

(4,133

|

)

|

(4,133

|

)

|

|||||||||||

|

Other

|

—

|

|

—

|

|

—

|

|

(304

|

)

|

(304

|

)

|

|||||||||||

|

Balances at March 31, 2013

|

31,307,582

|

|

$

|

203,058

|

|

$

|

24,064

|

|

$

|

(1,075

|

)

|

$

|

226,047

|

|

|||||||

|

Issuance of common stock in exercise of stock options

|

566,487

|

|

3,340

|

|

—

|

|

—

|

|

3,340

|

|

|||||||||||

|

Issuance of restricted stock as deferred compensation to employees and directors

|

17,416

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Issuance of common stock as deferred compensation to employees

|

18,786

|

|

—

|

|

|

—

|

|

|

—

|

|

—

|

|

|||||||||

|

Issuance of common stock as deferred compensation to named executive officers

|

10,594

|

|

—

|

|

|

—

|

|

|

—

|

|

—

|

|

|||||||||

|

Stock compensation expense

|

—

|

|

2,203

|

|

—

|

|

—

|

|

2,203

|

|

|||||||||||

|

Excess tax deduction from stock options

|

—

|

|

(118

|

)

|

—

|

|

—

|

|

(118

|

)

|

|||||||||||

|

Net income

|

—

|

|

—

|

|

25,799

|

|

—

|

|

25,799

|

|

|||||||||||

|

Foreign currency translation adjustment

|

—

|

|

—

|

|

—

|

|

(6,724

|

)

|

(6,724

|

)

|

|||||||||||

|

Interest Rate Swap

|

—

|

|

—

|

|

—

|

|

(81

|

)

|

(81

|

)

|

|||||||||||

|

Balances at March 31, 2014

|

31,920,865

|

|

$

|

208,483

|

|

$

|

49,863

|

|

$

|

(7,880

|

)

|

$

|

250,466

|

|

|||||||

|

Issuance of common stock in exercise of stock options

|

88,050

|

|

547

|

|

—

|

|

—

|

|

547

|

|

|||||||||||

|

Issuance of common stock as deferred compensation to directors

|

11,956

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Issuance of common stock as deferred compensation to employees

|

46,360

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Issuance of common stock as deferred compensation to executive officers

|

15,162

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Stock compensation expense

|

—

|

|

3,295

|

|

—

|

|

—

|

|

3,295

|

|

|||||||||||

|

Excess tax deduction from stock options

|

—

|

|

1,592

|

|

—

|

|

—

|

|

1,592

|

|

|||||||||||

|

Net income

|

—

|

|

—

|

|

49,386

|

|

—

|

|

49,386

|

|

|||||||||||

|

Foreign currency translation adjustment

|

—

|

|

—

|

|

—

|

|

(32,667

|

)

|

(32,667

|

)

|

|||||||||||

|

Interest rate swap

|

—

|

|

—

|

|

—

|

|

(404

|

)

|

(404

|

)

|

|||||||||||

|

Other

|

—

|

|

—

|

|

—

|

|

(449

|

)

|

$

|

(449

|

)

|

||||||||||

|

Balances at March 31, 2015

|

32,082,393

|

|

$

|

213,917

|

|

$

|

99,249

|

|

$

|

(41,400

|

)

|

$

|

271,766

|

|

|||||||

|

Year Ended March 31, 2015

|

Year Ended March 31, 2014

|

Year Ended March 31, 2013

|

|||||||||

|

Operating activities

|

|

|

|

|

|||||||

|

Net income

|

$

|

49,386

|

|

$

|

25,799

|

|

$

|

26,974

|

|

||

|

Adjustment to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|||||||

|

Depreciation and amortization

|

14,143

|

|

14,178

|

|

13,831

|

|

|||||

|

Amortization of debt costs

|

464

|

|

4,572

|

|

3,321

|

|

|||||

|

Stock compensation expense

|

3,295

|

|

2,203

|

|

1,341

|

|

|||||

|

Deferred income taxes

|

(7,164

|

)

|

(4,429

|

)

|

(1,919

|

)

|

|||||

|

Premiums paid on redemptions, included as financing activities

|

—

|

|

15,485

|

|

—

|

|

|||||

|

Other non-cash operating activities

|

1,833

|

|

(177

|

)

|

551

|

|

|||||

|

Changes in operating assets and liabilities:

|

|

|

|

|

|||||||

|

Accounts receivable

|

(12,242

|

)

|

2,894

|

|

(7,120

|

)

|

|||||

|

Inventories

|

(6,862

|

)

|

(3,500

|

)

|

3,389

|

|

|||||

|

Costs and estimated earnings in excess of billings on uncompleted contracts

|

(3,512

|

)

|

648

|

|

(1,807

|

)

|

|||||

|

Other current and noncurrent assets

|

(841

|

)

|

1,477

|

|

611

|

|

|||||

|

Accounts payable

|

(297

|

)

|

(3,157

|

)

|

4,895

|

|

|||||

|

Accrued liabilities and noncurrent liabilities

|

8,396

|

|

(11,069

|

)

|

(3,354

|

)

|

|||||

|

Income taxes payable

|

5,132

|

|

1,190

|

|

657

|

|

|||||

|

Net cash provided by operating activities

|

51,731

|

|

46,114

|

|

41,370

|

|

|||||

|

Investing activities

|

|

|

|

|

|||||||

|

Purchases of property, plant and equipment

|

(6,075

|

)

|

(3,367

|

)

|

(6,264

|

)

|

|||||

|

Cash paid for acquisitions

|

(3,890

|

)

|

—

|

|

—

|

|

|||||

|

Cash paid to settle the CHS Transactions

|

—

|

|

(2,055

|

)

|

(289

|

)

|

|||||

|

Net cash used in investing activities

|

(9,965

|

)

|

(5,422

|

)

|

(6,553

|

)

|

|||||

|

Financing activities

|

|

|

|

|

|||||||

|

Proceeds from long term debt

|

—

|

|

135,000

|

|

—

|

|

|||||

|

Payments on senior secured notes

|

—

|

|

(118,145

|

)

|

(21,000

|

)

|

|||||

|

Payments on long term debt

|

(13,500

|

)

|

(13,500

|

)

|

—

|

|

|||||

|

Proceeds or payments on revolving lines of credit

|

—

|

|

—

|

|

—

|

|

|||||

|

Lease financing, net

|

(186

|

)

|

59

|

|

—

|

|

|||||

|

Issuance costs associated with debt financing

|

(290

|

)

|

(1,728

|

)

|

(248

|

)

|

|||||

|

Issuance of common stock including exercise of stock options

|

547

|

|

3,340

|

|

5,558

|

|

|||||

|

Benefit (loss) from excess tax deduction from option exercises

|

1,592

|

|

(118

|

)

|

4,131

|

|

|||||

|

Premium paid on redemption of senior secured notes

|

—

|

|

(15,485

|

)

|

(630

|

)

|

|||||

|

Net cash used in financing activities

|

(11,837

|

)

|

(10,577

|

)

|

(12,189

|

)

|

|||||

|

Effect of exchange rate changes on cash and cash equivalents

|

(8,795

|

)

|

(1,321

|

)

|

(249

|

)

|

|||||

|

Change in cash and cash equivalents

|

21,134

|

|

28,794

|

|

22,379

|

|

|||||

|

Cash and cash equivalents at beginning of period

|

$

|

72,640

|

|

43,847

|

|

21,468

|

|

||||

|

Cash and cash equivalents at end of period

|

$

|

93,774

|

|

$

|

72,640

|

|

$

|

43,847

|

|

||

|

Cash paid for interest and income taxes

|

|||||||||||

|

Interest

|

$

|

4,057

|

|

$

|

10,138

|

|

$

|

12,734

|

|

||

|

Income taxes paid

|

$

|

17,262

|

|

$

|

11,098

|

|

$

|

10,639

|

|

||

|

Income tax refunds received

|

$

|

3,577

|

|

$

|

2,004

|

|

$

|

207

|

|

||

|

Thermon Group Holdings, Inc.

|

||||

|

Notes to Consolidated Financial Statements

|

||||

|

(Dollars in Thousands, Except Share and Per Share Data)

|

||||

|

March 31, 2015

|

||||

|

Balance at March 31, 2012

|

$

|

1,434

|

|

|||

|

Reduction in reserve

|

(21

|

)

|

||||

|

Write-off of uncollectible accounts

|

(272

|

)

|

||||

|

Balance at March 31, 2013

|

1,141

|

|

||||

|

Reduction in reserve

|

(175

|

)

|

||||

|

Write-off of uncollectible accounts

|

(215

|

)

|

||||

|

Balance at March 31, 2014

|

751

|

|

||||

|

Additions charged to expense

|

175

|

|

||||

|

Write-off of uncollectible accounts

|

(141

|

)

|

||||

|

Balance at March 31, 2015

|

$

|

785

|

|

|||

|

Useful Lives in Years

|

|||||

|

Land improvements

|

15

|

-

|

20

|

||

|

Buildings and improvements

|

10

|

-

|

40

|

||

|

Machinery and equipment

|

3

|

-

|

25

|

||

|

Office furniture and equipment

|

3

|

-

|

10

|

||

|

Internally developed software

|

5

|

-

|

7

|

||

|

•

|

Level 1 — uses quoted prices in active markets for identical assets or liabilities we have the ability to access.

|

|

•

|

Level 2 — uses observable inputs other than quoted prices in Level 1, such as quoted prices for similar assets and liabilities in active markets; quoted prices for identical or similar assets and liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data.

|

|

•

|

Level 3 — uses one or more significant inputs that are unobservable and supported by little or no market activity, and that reflect the use of significant management judgment.

|

|

|

March 31, 2015

|

March 31, 2014

|

|

||||||

|

|

Carrying

Value

|

Fair Value

|

Carrying

Value

|

Fair Value

|

Valuation Technique

|

||||

|

Financial Liabilities

|

|

|

|

|

|

||||

|

Senior secured credit facility

|

$108,000

|

$108,000

|

$121,500

|

$121,500

|

Level 2 - Market Approach

|

||||

|

Notional amount of foreign exchange forward contracts by currency

|

|||||||

|

March 31, 2015

|

March 31, 2014

|

||||||

|

Russian Ruble

|

$

|

1,374

|

|

$

|

772

|

|

|

|

Euro

|

467

|

|

2,386

|

|

|||

|

Canadian Dollar

|

243

|

|

—

|

|

|||

|

South Korean Won

|

3,347

|

|

532

|

|

|||

|

Indian Rupee

|

—

|

|

2,574

|

|

|||

|

Mexican Peso

|

873

|

|

1,077

|

|

|||

|

Australian Dollar

|

1,104

|

|

147

|

|

|||

|

Japanese Yen

|

815

|

|

296

|

|

|||

|

Great Britain Pound

|

—

|

|

202

|

|

|||

|

Chinese Renminbi

|

—

|

|

192

|

|

|||

|

Total notional amounts

|

$

|

8,223

|

|

$

|

8,178

|

|

|

|

March 31, 2015

|

March 31, 2014

|

|||||||||||||

|

Fair Value

|

Fair Value

|

|||||||||||||

|

Assets

|

Liabilities

|

Assets

|

Liabilities

|

|||||||||||

|