|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2014

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from______to_______

|

|

|

Ohio

|

|

34-0577130

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Identification No.)

|

|

4500 Mt. Pleasant St., N.W., North Canton, Ohio

|

|

44720-5450

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Common Stock, without par value

|

|

New York Stock Exchange

|

|

Large accelerated filer

|

x

|

Accelerated filer

|

o

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

o

|

|

Class

|

|

Outstanding at January 31, 2015

|

|

Common Shares, without par value

|

|

88,214,403 shares

|

|

Document

|

|

Parts Into Which Incorporated

|

|

Proxy Statement for the Annual Meeting of Shareholders to be held on or about May 7, 2015 (Proxy Statement)

|

|

Part III

|

|

|

|

|

PAGE

|

|

I.

|

|||

|

Item 1.

|

|||

|

Item 1A.

|

|||

|

Item 1B.

|

|||

|

Item 2.

|

|||

|

Item 3.

|

|||

|

Item 4.

|

|||

|

Item 4A.

|

|||

|

II.

|

|||

|

Item 5.

|

|||

|

Item 6.

|

|||

|

Item 7.

|

|||

|

Item 7A.

|

|||

|

Item 8.

|

|||

|

Item 9.

|

|||

|

Item 9A.

|

|||

|

Item 9B.

|

|||

|

III.

|

|||

|

Item 10.

|

|||

|

Item 11.

|

|||

|

Item 12.

|

|||

|

Item 13.

|

|||

|

Item 14.

|

|||

|

IV.

|

|||

|

Item 15.

|

|||

|

Exhibit 12

|

Computation of Ratio of Earnings to Fixed Charges

|

||

|

Exhibit 21

|

Subsidiaries of the Registrant

|

||

|

Exhibit 23

|

Consent of Independent Registered Public Accounting Firm

|

||

|

Exhibit 24

|

Power of Attorney

|

||

|

Exhibit 31.1

|

Principal Executive Officer’s Certifications

|

||

|

Exhibit 31.2

|

Principal Financial Officer’s Certifications

|

||

|

Exhibit 32

|

Certification Pursuant to 18 U.S.C. Section 1350, As Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

||

|

Exhibit 101

|

Extensible Business Reporting Language (XBRL)

|

||

|

|

December 31,

|

|||||

|

(Dollars in millions)

|

2014

|

2013

|

||||

|

Segment:

|

||||||

|

Mobile Industries

|

$

|

719.2

|

|

$

|

945.1

|

|

|

Process Industries

|

569.9

|

|

370.8

|

|

||

|

Total Company

|

$

|

1,289.1

|

|

$

|

1,315.9

|

|

|

•

|

changes in tariff regulations, which may make our products more costly to export or import;

|

|

•

|

difficulties establishing and maintaining relationships with local original equipment manufacturers (OEMs), distributors and dealers;

|

|

•

|

import and export licensing requirements;

|

|

•

|

compliance with a variety of foreign laws and regulations, including unexpected changes in taxation and environmental or other regulatory requirements, which could increase our operating and other expenses and limit our operations;

|

|

•

|

disadvantages of competing against companies from countries that are not subject to U.S. laws and regulations, including the Foreign Corrupt Practices Act (FCPA);

|

|

•

|

difficulty in staffing and managing geographically diverse operations; and

|

|

•

|

tax exposures related to cross-border intercompany transfer pricing and other tax risks unique to international operations.

|

|

Name

|

Age

|

Current Position and Previous Positions During Last Five Years

|

||

|

William R. Burkhart

|

49

|

2014 Executive Vice President, General Counsel and Secretary

|

||

|

2000 Senior Vice President and General Counsel

|

||||

|

Christopher A. Coughlin

|

54

|

2014 Executive Vice President, Group President

|

||

|

2012 Group President

|

||||

|

2011 President - Process Industries

|

||||

|

2010 President - Process Industries & Supply Chain

|

||||

|

Philip D. Fracassa

|

47

|

2014 Executive Vice President, Chief Financial Officer

|

||

|

2012 Senior Vice President - Planning and Development

|

||||

|

2010 Senior Vice President and Controller - B&PT

|

||||

|

Richard G. Kyle

|

49

|

2014 President and Chief Executive Officer; Director

|

||

|

2013 Chief Operating Officer - B&PT; Director

|

||||

|

2012 Group President

|

||||

|

2011 President - Mobile Industries & Aerospace

|

||||

|

2009 President - Mobile Industries

|

||||

|

J. Ted Mihaila

|

60

|

2006 Senior Vice President and Controller

|

||

|

|

2014

|

2013

|

|||||||||||||||||

|

Stock prices

|

Dividends

|

Stock prices

|

Dividends

|

||||||||||||||||

|

High

|

Low

|

per share

|

High

|

Low

|

per share

|

||||||||||||||

|

First quarter

|

$

|

61.37

|

|

$

|

52.51

|

|

$

|

0.25

|

|

$

|

58.50

|

|

$

|

47.67

|

|

$

|

0.23

|

|

|

|

Second quarter

|

$

|

69.51

|

|

$

|

57.69

|

|

$

|

0.25

|

|

$

|

59.44

|

|

$

|

50.22

|

|

$

|

0.23

|

|

|

|

Third quarter

|

$

|

49.96

|

|

$

|

42.34

|

|

$

|

0.25

|

|

$

|

64.35

|

|

$

|

55.00

|

|

$

|

0.23

|

|

|

|

Fourth quarter

|

$

|

44.30

|

|

$

|

37.62

|

|

$

|

0.25

|

|

$

|

61.57

|

|

$

|

50.22

|

|

$

|

0.23

|

|

|

|

Period

|

Total number

of shares purchased

(1)

|

Average

price paid per share

(2)

|

Total number of

shares purchased as

part of publicly

announced

plans or programs

|

Maximum number

of shares that may

yet be purchased

under the

plans or programs

(3)

|

||||||

|

10/1/2014 - 10/31/2014

|

150

|

|

$

|

42.68

|

|

$

|

—

|

|

8,997,807

|

|

|

11/1/2014 - 11/30/2014

|

30

|

|

43.64

|

|

—

|

|

8,997,807

|

|

||

|

12/1/2014 - 12/31/2014

|

100,036

|

|

43.54

|

|

100,000

|

|

8,897,807

|

|

||

|

Total

|

100,216

|

|

$

|

43.54

|

|

100,000

|

|

8,897,807

|

|

|

|

(1)

|

Of the shares purchased in October, November and December, 150, 30 and 36, respectively, represent common shares of the Company that were owned and tendered by employees to exercise stock options, and to satisfy withholding obligations in connection with the exercise of stock options and vesting of restricted shares.

|

|

(2)

|

For shares tendered in connection with the vesting of restricted shares, the average price paid per share is an average calculated using the daily high and low of the Company’s common shares as quoted on the New York Stock Exchange at the time of vesting. For shares tendered in connection with the exercise of stock options, the price paid is the real-time trading share price at the time the options are exercised.

|

|

(3)

|

On February 10, 2012, the Board of Directors of the Company approved a share purchase plan pursuant to which the Company may purchase up to ten million of its common shares in the aggregate. On June 13, 2014, the Board of Directors of the Company authorized an additional ten million common shares for repurchase under this plan. This share purchase plan expires on December 31, 2015. The Company may purchase shares

|

|

|

|||||||||||||||

|

2010

|

2011

|

2012

|

2013

|

2014

|

|||||||||||

|

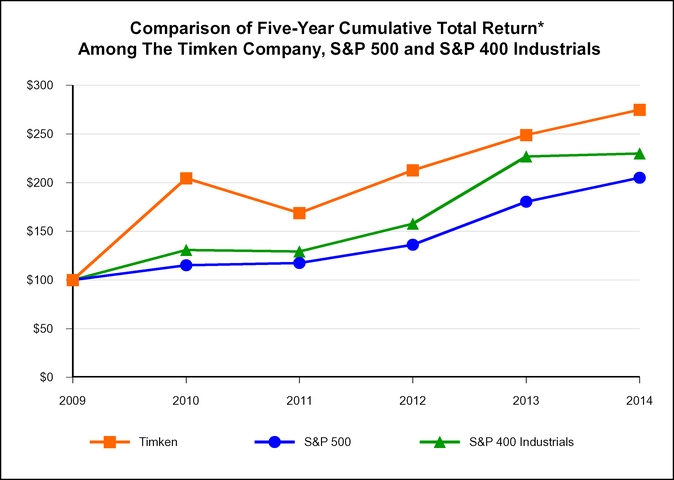

Timken

|

$

|

204

|

|

$

|

169

|

|

$

|

213

|

|

$

|

249

|

|

$

|

275

|

|

|

S&P 500

|

115

|

|

117

|

|

136

|

|

180

|

|

205

|

|

|||||

|

S&P 400 Industrials

|

131

|

|

129

|

|

158

|

|

227

|

|

230

|

|

|||||

|

(Dollars in millions, except per share and per employee data)

|

2014

|

2013

|

2012

|

2011

|

2010

|

||||||||||

|

Statements of Income

|

|||||||||||||||

|

Net sales

|

$

|

3,076.2

|

|

$

|

3,035.4

|

|

$

|

3,359.5

|

|

$

|

3,333.6

|

|

$

|

2,798.6

|

|

|

Gross profit

|

898.0

|

|

868.4

|

|

1,028.0

|

|

1,018.0

|

|

803.9

|

|

|||||

|

Selling, general and administrative expenses

|

542.5

|

|

546.6

|

|

554.5

|

|

540.6

|

|

484.8

|

|

|||||

|

Impairment and restructuring charges

|

113.4

|

|

8.7

|

|

29.5

|

|

14.4

|

|

21.7

|

|

|||||

|

Operating income

|

208.4

|

|

305.9

|

|

444.0

|

|

463.0

|

|

297.4

|

|

|||||

|

Other income (expense), net

|

19.9

|

|

6.7

|

|

102.0

|

|

(0.4

|

)

|

4.2

|

|

|||||

|

Interest expense, net

|

24.3

|

|

22.5

|

|

28.2

|

|

31.2

|

|

34.5

|

|

|||||

|

Income from continuing operations

|

149.3

|

|

175.5

|

|

331.5

|

|

280.8

|

|

179.2

|

|

|||||

|

Income from discontinued operations, net of income taxes

|

24.0

|

|

87.5

|

|

164.4

|

|

175.8

|

|

97.8

|

|

|||||

|

Net income attributable to The Timken Company

|

$

|

170.8

|

|

$

|

262.7

|

|

$

|

495.5

|

|

$

|

454.3

|

|

$

|

274.8

|

|

|

Balance Sheets

|

|||||||||||||||

|

Inventories, net

|

$

|

585.5

|

|

$

|

582.6

|

|

$

|

611.5

|

|

$

|

669.6

|

|

$

|

602.4

|

|

|

Property, plant and equipment, net

|

780.5

|

|

855.8

|

|

834.1

|

|

868.6

|

|

880.3

|

|

|||||

|

Total assets

|

3,001.4

|

|

4,477.9

|

|

4,244.2

|

|

4,327.4

|

|

4,180.4

|

|

|||||

|

Total debt:

|

|||||||||||||||

|

Short-term debt

|

7.4

|

|

18.6

|

|

14.3

|

|

22.0

|

|

22.4

|

|

|||||

|

Current portion of long-term debt

|

0.6

|

|

250.7

|

|

9.6

|

|

5.8

|

|

9.5

|

|

|||||

|

Long-term debt

|

522.1

|

|

176.4

|

|

424.9

|

|

448.6

|

|

443.0

|

|

|||||

|

Total debt

|

$

|

530.1

|

|

$

|

445.7

|

|

$

|

448.8

|

|

$

|

476.4

|

|

$

|

474.9

|

|

|

Net debt (cash)

|

|||||||||||||||

|

Total debt

|

530.1

|

|

445.7

|

|

448.8

|

|

476.4

|

|

474.9

|

|

|||||

|

Less: cash and cash equivalents and restricted cash

|

(294.1

|

)

|

(399.7

|

)

|

(601.5

|

)

|

(468.4

|

)

|

(877.1

|

)

|

|||||

|

Net debt (cash):

(1)

|

$

|

236.0

|

|

$

|

46.0

|

|

$

|

(152.7

|

)

|

$

|

8.0

|

|

$

|

(402.2

|

)

|

|

Total liabilities

|

1,412.3

|

|

1,829.3

|

|

1,997.6

|

|

2,284.9

|

|

2,238.6

|

|

|||||

|

Shareholders’ equity

|

$

|

1,589.1

|

|

$

|

2,648.6

|

|

$

|

2,246.6

|

|

$

|

2,042.5

|

|

$

|

1,940.7

|

|

|

Capital:

|

|||||||||||||||

|

Net debt (cash)

|

236.0

|

|

46.0

|

|

(152.7

|

)

|

8.0

|

|

(402.2

|

)

|

|||||

|

Shareholders’ equity

|

1,589.1

|

|

2,648.6

|

|

2,246.6

|

|

2,042.5

|

|

1,940.7

|

|

|||||

|

Net debt (cash) + shareholders’ equity (capital)

|

$

|

1,825.1

|

|

$

|

2,694.6

|

|

$

|

2,093.9

|

|

$

|

2,050.5

|

|

$

|

1,538.5

|

|

|

Other Comparative Data

|

|||||||||||||||

|

Income from continuing operations / Net sales

|

4.9

|

%

|

5.8

|

%

|

9.9

|

%

|

8.4

|

%

|

6.4

|

%

|

|||||

|

Net income attributable to The Timken Company / Net sales

|

5.6

|

%

|

8.7

|

%

|

14.7

|

%

|

13.6

|

%

|

9.8

|

%

|

|||||

|

Return on equity

(2)

|

9.4

|

%

|

6.6

|

%

|

14.8

|

%

|

13.7

|

%

|

9.2

|

%

|

|||||

|

Net sales per employee

(3)

|

$

|

188.2

|

|

$

|

181.6

|

|

$

|

192.0

|

|

$

|

189.9

|

|

$

|

169.3

|

|

|

Capital expenditures

|

126.8

|

|

133.6

|

|

118.3

|

|

105.5

|

|

72.1

|

|

|||||

|

Depreciation and amortization

|

137.0

|

|

142.4

|

|

149.6

|

|

146.7

|

|

143.7

|

|

|||||

|

Capital expenditures / Net sales

|

4.1

|

%

|

4.4

|

%

|

3.5

|

%

|

3.2

|

%

|

2.6

|

%

|

|||||

|

Dividends per share

|

$

|

1.00

|

|

$

|

0.92

|

|

$

|

0.92

|

|

$

|

0.78

|

|

$

|

0.53

|

|

|

Basic earnings per share - continuing operations

(4)

|

$

|

1.62

|

|

$

|

1.84

|

|

$

|

3.41

|

|

$

|

2.84

|

|

$

|

1.84

|

|

|

Diluted earnings per share - continuing operations

(4)

|

$

|

1.61

|

|

$

|

1.82

|

|

$

|

3.38

|

|

$

|

2.81

|

|

$

|

1.82

|

|

|

Basic earnings per share

(5)

|

$

|

1.89

|

|

$

|

2.76

|

|

$

|

5.11

|

|

$

|

4.65

|

|

$

|

2.83

|

|

|

Diluted earnings per share

(5)

|

$

|

1.87

|

|

$

|

2.74

|

|

$

|

5.07

|

|

$

|

4.59

|

|

$

|

2.81

|

|

|

Net debt (cash) to capital

(1)

|

12.9

|

%

|

1.7

|

%

|

(7.3

|

)%

|

0.4

|

%

|

(26.1

|

)%

|

|||||

|

Number of employees at year-end

(6)

|

16,345

|

|

16,717

|

|

17,500

|

|

17,558

|

|

16,534

|

|

|||||

|

Number of shareholders

(7)

|

44,217

|

|

52,218

|

|

50,783

|

|

44,238

|

|

39,118

|

|

|||||

|

(1)

|

The Company presents net debt (cash) because it believes net debt (cash) is more representative of the Company’s financial position than total debt due to the amount of cash and cash equivalents.

|

|

(2)

|

Return on equity is defined as income from continuing operations divided by ending shareholders’ equity.

|

|

(3)

|

Based on average number of employees employed during the year.

|

|

(4)

|

Based on average number of shares outstanding during the year.

|

|

(5)

|

Based on average number of shares outstanding during the year and includes discontinued operations for all periods presented.

|

|

(6)

|

Adjusted to exclude employees from the former Steel segment (which was spunoff in June 2014) for all periods.

|

|

(7)

|

Includes an estimated count of shareholders having common shares held for their accounts by banks, brokers and trustees for benefit plans.

|

|

•

|

Mobile Industries

offers an extensive portfolio of bearings, seals, lubrication devices and systems, as well as power transmission components, engineered chain, augers and related products and maintenance services, to OEMs of: off-highway equipment for the agricultural, construction and mining markets; on-highway vehicles including passenger cars, light trucks, and medium- and heavy-duty trucks; and rail cars, locomotives, rotor craft and fixed-wing aircraft. Beyond service parts sold to OEMs, aftermarket sales to individual end users, equipment owners, operators and maintenance shops are handled through the Company's extensive network of authorized automotive and heavy-truck distributors, and include hub units, specialty kits and more. Mobile Industries also provides power transmission systems and flight-critical components for civil and military aircraft, which include bearings, helicopter transmission systems, rotor-head assemblies, turbine engine components, gears and housings.

|

|

•

|

Process Industries

supplies industrial bearings and assemblies, power transmission components such as gears and gearboxes, couplings, seals, lubricants, chains and related products and services to OEMs and end users in industries that place heavy demands on operating equipment they make or use. This includes; metals, mining, cement and aggregate production; coal and wind power generation; oil and gas; pulp and paper in applications including printing presses; and cranes, hoists, drawbridges, wind energy turbines, gear drives, drilling equipment, coal conveyors, health and critical motion control equipment, marine equipment and food processing equipment. This segment also supports aftermarket sales and service needs through its global network of authorized industrial distributors. In addition, the Company’s industrial services group offers end users a broad portfolio of maintenance support and capabilities that include repair and service for bearings and gearboxes as well as electric motor rewind, repair and services.

|

|

•

|

Expanding in new and existing markets by applying the Timken team’s knowledge of metallurgy, friction management and mechanical power transmission to create value for our customers. Using a highly collaborative technical selling model, the Company places particular emphasis on creating unique solutions for challenging and/or demanding applications. The Company intends to grow in attractive market sectors, emphasizing those spaces that are highly fragmented, demand high service and value the reliability and efficiency offered by the Company's products. The Company also targets those applications that offer significant aftermarket demand, thereby providing product and services revenue throughout the equipment’s lifetime.

|

|

•

|

Performing with excellence, driving for exceptional results with a passion for superior execution, the Company embraces a continuous improvement culture that is charged with lowering costs, eliminating waste, increasing efficiency, encouraging organizational agility and building greater brand equity. As part of this effort, the Company may also reposition underperforming product lines and segments and divest non-strategic assets.

|

|

•

|

On November 30, 2014, the Company completed the acquisition of the assets of Revolvo Ltd. (Revolvo), a specialty bearing company based in Dudley, United Kingdom (U.K.). Revolvo makes and markets ball and roller bearings for industrial applications in process and heavy industries. Revolvo's split roller bearing housed units are widely used by mining, power generation, food and beverage, pulp and paper, metals, cements, marine and waste-water end users. Revolvo had full-year 2014 sales of approximately $9 million.

|

|

•

|

On September 8, 2014, the Company announced plans to eliminate its Aerospace segment leadership positions and integrate substantially all aerospace business activities into Mobile Industries under the direction of its Group President. The Company also announced plans to close its aerospace engine overhaul business, located in Mesa, Arizona. The Company subsequently sold the aerospace engine overhaul assets in November 2014. In addition, the Company announced plans to evaluate strategic alternatives for its aerospace MRO parts business, also located in Mesa, and close its aerospace bearing facility located in Wolverhampton, U.K., which is expected to close in early 2016. The Company began reporting the aerospace business results primarily within the Mobile Industries segment starting with the fourth quarter of 2014.

|

|

•

|

In June 2014, the Company announced that it was committing $60 million to the DeltaX initiative, a multi-year investment to improve the Company's concept-to-commercialization efforts. DeltaX will integrate technology and tools designated to enable the Company to be more agile and competitive. The Company will replace its traditional functional infrastructure with a more product-focused infrastructure, supported by new customer-facing systems. DeltaX is intended to help the Company to execute on its strategy to grow, delivering to the market place much faster and more efficently those products that customers value. As part of the $60 million DeltaX initiative, the XSell project will leverage the SAP infrastructure deployed throughout our global operations. It will provide the global sales team with new customer relationship management capabilities, as well as more consistent, mobility-enabled sales processes and business tools.

|

|

•

|

On June 13, 2014, the Company's Board of Directors authorized the Company to purchase an additional 10 million of its common shares. The total number of shares that remained authorized for repurchase was 8.9 million shares at December 31, 2014.

|

|

•

|

On April 28, 2014, the Company completed the acquisition of assets from Schulz Group (Schulz). Based in New Haven, Connecticut, Schulz provides electric motor and generator repairs, motor rewinds, custom controls and panels, systems integration, pump services, machine rebuilds, hydro services and diagnostics for a broad range of commercial and industrial applications. Schulz had full-year 2013 sales of approximately $18 million and employed 125 associates.

|

|

2014

|

2013

|

$ Change

|

% Change

|

||||||||

|

Net sales

|

$

|

3,076.2

|

|

$

|

3,035.4

|

|

$

|

40.8

|

|

1.3

|

%

|

|

Income from continuing operations

|

149.3

|

|

175.5

|

|

(26.2

|

)

|

(14.9

|

)%

|

|||

|

Income from discontinued operations

|

24.0

|

|

87.5

|

|

(63.5

|

)

|

(72.6

|

)%

|

|||

|

Income attributable to noncontrolling interest

|

2.5

|

|

0.3

|

|

2.2

|

|

NM

|

|

|||

|

Net income attributable to The Timken Company

|

$

|

170.8

|

|

$

|

262.7

|

|

$

|

(91.9

|

)

|

(35.0

|

)%

|

|

Diluted earnings per share:

|

|

|

|||||||||

|

Continuing operations

|

$

|

1.61

|

|

$

|

1.82

|

|

$

|

(0.21

|

)

|

(11.5

|

)%

|

|

Discontinued operations

|

0.26

|

|

0.92

|

|

(0.66

|

)

|

(71.7

|

)%

|

|||

|

Diluted earnings per share

|

$

|

1.87

|

|

$

|

2.74

|

|

$

|

(0.87

|

)

|

(31.8

|

)%

|

|

Average number of shares—diluted

|

91,224,328

|

|

95,823,728

|

|

—

|

|

(4.8

|

)%

|

|||

|

2014

|

2013

|

$ Change

|

% Change

|

||||||||

|

Mobile Industries

|

$

|

1,685.4

|

|

$

|

1,775.8

|

|

$

|

(90.4

|

)

|

(5.1

|

)%

|

|

Process Industries

|

1,390.8

|

|

1,259.6

|

|

131.2

|

|

10.4

|

%

|

|||

|

Total Company

|

$

|

3,076.2

|

|

$

|

3,035.4

|

|

$

|

40.8

|

|

1.3

|

%

|

|

2014

|

2013

|

$ Change

|

Change

|

||||||||

|

Gross profit

|

$

|

898.0

|

|

$

|

868.4

|

|

$

|

29.6

|

|

3.4

|

%

|

|

Gross profit % to net sales

|

29.2

|

%

|

28.6

|

%

|

—

|

|

60

|

bps

|

|||

|

Rationalization expenses included in cost of products sold

|

$

|

3.6

|

|

$

|

5.9

|

|

$

|

(2.3

|

)

|

(39.0

|

%)

|

|

2014

|

2013

|

$ Change

|

Change

|

||||||||

|

Selling, general and administrative expenses

|

$

|

542.5

|

|

$

|

546.6

|

|

$

|

(4.1

|

)

|

(0.8)%

|

|

|

Selling, general and administrative expenses % to net

sales

|

17.6

|

%

|

18.0

|

%

|

—

|

|

(40

|

) bps

|

|||

|

2014

|

2013

|

$ Change

|

|||||||

|

Impairment charges

|

$

|

98.9

|

|

$

|

0.1

|

|

$

|

98.8

|

|

|

Severance and related benefit costs

|

10.7

|

|

9.2

|

|

1.5

|

|

|||

|

Exit costs

|

3.8

|

|

(0.6

|

)

|

4.4

|

|

|||

|

Total

|

$

|

113.4

|

|

$

|

8.7

|

|

$

|

104.7

|

|

|

2014

|

2013

|

$ Change

|

|||||||

|

Pension Settlement Charges

|

$

|

33.7

|

|

$

|

7.2

|

|

$

|

26.5

|

|

|

2014

|

2013

|

$ Change

|

% Change

|

||||||||

|

Interest (expense)

|

$

|

(28.7

|

)

|

$

|

(24.4

|

)

|

$

|

(4.3

|

)

|

17.6

|

%

|

|

Interest income

|

4.4

|

|

1.9

|

|

2.5

|

|

131.6

|

%

|

|||

|

2014

|

2013

|

$ Change

|

% Change

|

||||||||

|

Gain on sale of real estate

|

$

|

22.6

|

|

$

|

5.4

|

|

$

|

17.2

|

|

318.5

|

%

|

|

Other income (expense), net

|

(2.7

|

)

|

1.3

|

|

(4.0

|

)

|

307.7

|

%

|

|||

|

Total

|

$

|

19.9

|

|

$

|

6.7

|

|

$

|

13.2

|

|

197.0

|

%

|

|

2014

|

2013

|

$ Change

|

Change

|

||||||||

|

Income tax expense

|

$

|

54.7

|

|

$

|

114.6

|

|

$

|

(59.9

|

)

|

(52.3)%

|

|

|

Effective tax rate

|

26.8

|

%

|

39.5

|

%

|

—

|

|

(1,270

|

) bps

|

|||

|

2014

|

2013

|

$ Change

|

Change

|

||||||||

|

Net Sales

|

$

|

786.2

|

|

$

|

1,305.8

|

|

$

|

(519.6

|

)

|

(39.8)%

|

|

|

Income before income taxes

|

40.0

|

|

127.1

|

|

(87.1

|

)

|

(68.5)%

|

|

|||

|

Income taxes

|

16.0

|

|

39.6

|

|

(23.6

|

)

|

(59.6)%

|

|

|||

|

Operating results, net of tax

|

$

|

24.0

|

|

$

|

87.5

|

|

$

|

(110.7

|

)

|

(72.6)%

|

|

|

2014

|

2013

|

$ Change

|

Change

|

||||||||

|

Net sales

|

$

|

1,685.4

|

|

$

|

1,775.8

|

|

$

|

(90.4

|

)

|

(5.1)%

|

|

|

EBIT

|

$

|

65.6

|

|

$

|

193.7

|

|

$

|

(128.1

|

)

|

(66.1)%

|

|

|

EBIT margin

|

3.9

|

%

|

10.9

|

%

|

—

|

|

(700) bps

|

|

|||

|

|

2014

|

2013

|

$ Change

|

% Change

|

|||||||

|

Net sales

|

$

|

1,685.4

|

|

$

|

1,775.8

|

|

$

|

(90.4

|

)

|

(5.1)%

|

|

|

Less: Acquisitions

|

3.6

|

|

—

|

|

3.6

|

|

NM

|

|

|||

|

Currency

|

(17.1

|

)

|

—

|

|

(17.1

|

)

|

NM

|

|

|||

|

Net sales, excluding the impact of acquisitions and currency

|

$

|

1,698.9

|

|

$

|

1,775.8

|

|

$

|

(76.9

|

)

|

(4.3)%

|

|

|

2014

|

2013

|

$ Change

|

Change

|

||||||||

|

Net sales

|

$

|

1,390.8

|

|

$

|

1,259.6

|

|

$

|

131.2

|

|

10.4%

|

|

|

EBIT

|

$

|

267.1

|

|

$

|

189.3

|

|

$

|

77.8

|

|

41.1%

|

|

|

EBIT margin

|

19.2

|

%

|

15.0

|

%

|

—

|

|

420

|

bps

|

|||

|

|

2014

|

2013

|

$ Change

|

% Change

|

|||||||

|

Net sales

|

$

|

1,390.8

|

|

$

|

1,259.6

|

|

$

|

131.2

|

|

10.4%

|

|

|

Less: Acquisitions

|

16.0

|

|

—

|

|

16.0

|

|

NM

|

|

|||

|

Currency

|

(13.3

|

)

|

—

|

|

(13.3

|

)

|

NM

|

|

|||

|

Net sales, excluding the impact of acquisitions and currency

|

$

|

1,388.1

|

|

$

|

1,259.6

|

|

$

|

128.5

|

|

10.2%

|

|

|

2014

|

2013

|

$ Change

|

Change

|

||||||||

|

Corporate expenses

|

$

|

71.4

|

|

$

|

70.4

|

|

$

|

1.0

|

|

1.4 %

|

|

|

Corporate expenses % to net sales

|

2.3

|

%

|

2.3

|

%

|

—

|

|

—

|

|

|||

|

2013

|

2012

|

$ Change

|

% Change

|

||||||||

|

Net sales

|

$

|

3,035.4

|

|

$

|

3,359.5

|

|

$

|

(324.1

|

)

|

(9.6

|

)%

|

|

Income from continuing operations

|

175.5

|

|

331.5

|

|

(156.0

|

)

|

(47.1

|

)%

|

|||

|

Income from discontinued operations

|

87.5

|

|

164.4

|

|

(76.9

|

)

|

(46.8

|

)%

|

|||

|

Income attributable to noncontrolling interest

|

0.3

|

|

0.4

|

|

(0.1

|

)

|

(25.0

|

)%

|

|||

|

Net income attributable to The Timken Company

|

$

|

262.7

|

|

$

|

495.5

|

|

$

|

(232.8

|

)

|

(47.0

|

)%

|

|

Diluted earnings per share:

|

|||||||||||

|

Continuing operations

|

$

|

1.82

|

|

$

|

3.38

|

|

$

|

(1.56

|

)

|

(46.2

|

)%

|

|

Discontinued operations

|

0.92

|

|

1.69

|

|

(0.77

|

)

|

(45.6

|

)%

|

|||

|

Diluted earnings per share

|

$

|

2.74

|

|

$

|

5.07

|

|

$

|

(2.33

|

)

|

(46.0

|

)%

|

|

Average number of shares - diluted

|

95,823,728

|

|

97,602,481

|

|

—

|

|

(1.8

|

)%

|

|||

|

2013

|

2012

|

$ Change

|

% Change

|

||||||||

|

Mobile Industries

|

$

|

1,775.8

|

|

$

|

1,987.4

|

|

$

|

(211.6

|

)

|

(10.6

|

)%

|

|

Process Industries

|

1,259.6

|

|

1,372.1

|

|

(112.5

|

)

|

(8.2

|

)%

|

|||

|

Total Company

|

$

|

3,035.4

|

|

$

|

3,359.5

|

|

$

|

(324.1

|

)

|

(9.6

|

)%

|

|

2013

|

2012

|

$ Change

|

Change

|

||||||||

|

Gross profit

|

$

|

868.4

|

|

$

|

1,028.0

|

|

$

|

(159.6

|

)

|

(15.5) %

|

|

|

Gross profit % to net sales

|

28.6

|

%

|

30.6

|

%

|

—

|

|

(200

|

) bps

|

|||

|

Rationalization expenses included in cost of products sold

|

$

|

5.9

|

|

$

|

8.3

|

|

$

|

(2.4

|

)

|

(28.9) %

|

|

|

2013

|

2012

|

$ Change

|

Change

|

||||||||

|

Selling, general and administrative expenses

|

$

|

546.6

|

|

$

|

554.5

|

|

$

|

(7.9

|

)

|

(1.4) %

|

|

|

Selling, general and administrative expenses % to net sales

|

18.0

|

%

|

16.5

|

%

|

—

|

|

150

|

bps

|

|||

|

2013

|

2012

|

$ Change

|

|||||||

|

Impairment charges

|

$

|

0.1

|

|

$

|

6.6

|

|

$

|

(6.5

|

)

|

|

Severance and related benefit costs

|

9.2

|

|

18.4

|

|

(9.2

|

)

|

|||

|

Exit costs

|

(0.6

|

)

|

4.5

|

|

(5.1

|

)

|

|||

|

Total

|

$

|

8.7

|

|

$

|

29.5

|

|

$

|

(20.8

|

)

|

|

2013

|

2012

|

$ Change

|

% Change

|

||||||||

|

Interest (expense)

|

$

|

(24.4

|

)

|

$

|

(31.1

|

)

|

$

|

6.7

|

|

(21.5

|

)%

|

|

Interest income

|

$

|

1.9

|

|

$

|

2.9

|

|

$

|

(1.0

|

)

|

(34.5

|

)%

|

|

2013

|

2012

|

$ Change

|

% Change

|

||||||||

|

CDSOA receipts (expense), net

|

$

|

(2.8

|

)

|

$

|

108.0

|

|

$

|

(110.8

|

)

|

(102.6

|

)%

|

|

Gain on sale of real estate in Sao Paulo

|

5.4

|

|

—

|

|

5.4

|

|

NM

|

|

|||

|

Other income (expense)

|

4.1

|

|

(6.0

|

)

|

10.1

|

|

(168.3

|

)%

|

|||

|

Total

|

6.7

|

|

102.0

|

|

(95.3

|

)

|

(93.4

|

)%

|

|||

|

2013

|

2012

|

$ Change

|

Change

|

||||||||

|

Income tax expense

|

$

|

114.6

|

|

$

|

186.3

|

|

$

|

(71.7

|

)

|

(38.5) %

|

|

|

Effective tax rate

|

39.5

|

%

|

36.0

|

%

|

—

|

|

350

|

bps

|

|||

|

2013

|

2012

|

$ Change

|

Change

|

||||||||

|

Net sales

|

$

|

1,775.8

|

|

$

|

1,987.4

|

|

$

|

(211.6

|

)

|

(10.6

|

)%

|

|

EBIT

|

$

|

193.7

|

|

$

|

245.2

|

|

$

|

(51.5

|

)

|

(21.0

|

)%

|

|

EBIT margin

|

10.9

|

%

|

12.3

|

%

|

—

|

|

(140) bps

|

||||

|

|

2013

|

2012

|

$ Change

|

% Change

|

|||||||

|

Net sales

|

$

|

1,775.8

|

|

$

|

1,987.4

|

|

$

|

(211.6

|

)

|

(10.6

|

)%

|

|

Less: Acquisitions

|

27.0

|

|

—

|

|

27.0

|

|

NM

|

|

|||

|

Currency

|

(11.0

|

)

|

—

|

|

(11.0

|

)

|

NM

|

|

|||

|

Net sales, excluding the impact of acquisitions and currency

|

$

|

1,759.8

|

|

$

|

1,987.4

|

|

$

|

(227.6

|

)

|

(11.5

|

)%

|

|

2013

|

2012

|

$ Change

|

Change

|

||||||||

|

Net sales

|

$

|

1,259.6

|

|

$

|

1,372.1

|

|

$

|

(112.5

|

)

|

(8.2) %

|

|

|

EBIT

|

$

|

189.3

|

|

$

|

261.8

|

|

$

|

(72.5

|

)

|

(27.7) %

|

|

|

EBIT margin

|

15.0

|

%

|

19.1

|

%

|

—

|

|

(410

|

) bps

|

|||

|

|

2013

|

2012

|

$ Change

|

% Change

|

|||||||

|

Net sales

|

$

|

1,259.6

|

|

$

|

1,372.1

|

|

$

|

(112.5

|

)

|

(8.2) %

|

|

|

Less: Acquisitions

|

58.8

|

|

—

|

|

58.8

|

|

NM

|

|

|||

|

Currency

|

0.7

|

|

—

|

|

0.7

|

|

NM

|

|

|||

|

Net sales, excluding the impact of acquisitions and currency

|

$

|

1,200.1

|

|

$

|

1,372.1

|

|

$

|

(172.0

|

)

|

(12.5) %

|

|

|

2013

|

2012

|

$ Change

|

Change

|

||||||||

|

Corporate expenses

|

$

|

70.4

|

|

$

|

69.0

|

|

$

|

1.4

|

|

2.0%

|

|

|

Corporate expenses % to net sales

|

2.3

|

%

|

2.1

|

%

|

—

|

|

20

|

bps

|

|||

|

|

December 31,

|

|

|

||||||||

|

|

2014

|

2013

|

$ Change

|

% Change

|

|||||||

|

Cash and cash equivalents

|

$

|

278.8

|

|

$

|

384.6

|

|

$

|

(105.8

|

)

|

(27.5

|

)%

|

|

Restricted cash

|

15.3

|

|

15.1

|

|

0.2

|

|

1.3

|

%

|

|||

|

Accounts receivable, net

|

475.7

|

|

444.0

|

|

31.7

|

|

7.1

|

%

|

|||

|

Inventories, net

|

585.5

|

|

582.6

|

|

2.9

|

|

0.5

|

%

|

|||

|

Deferred income taxes

|

49.9

|

|

56.2

|

|

(6.3

|

)

|

(11.2

|

)%

|

|||

|

Deferred charges and prepaid expenses

|

25.2

|

|

26.8

|

|

(1.6

|

)

|

(6.0

|

)%

|

|||

|

Other current assets

|

51.5

|

|

61.7

|

|

(10.2

|

)

|

(16.5

|

)%

|

|||

|

Current assets, discontinued operations

|

—

|

|

366.5

|

|

(366.5

|

)

|

(100.0

|

)%

|

|||

|

Total current assets

|

$

|

1,481.9

|

|

$

|

1,937.5

|

|

$

|

(455.6

|

)

|

(23.5

|

)%

|

|

|

December 31,

|

|

|

||||||||

|

|

2014

|

2013

|

$ Change

|

% Change

|

|||||||

|

Property, plant and equipment

|

$

|

2,164.1

|

|

$

|

2,395.3

|

|

$

|

(231.2

|

)

|

(9.7

|

)%

|

|

Less: allowances for depreciation

|

(1,383.6

|

)

|

(1,539.5

|

)

|

155.9

|

|

10.1

|

%

|

|||

|

Property, plant and equipment, net

|

$

|

780.5

|

|

$

|

855.8

|

|

$

|

(75.3

|

)

|

(8.8

|

)%

|

|

|

December 31,

|

|

|

||||||||

|

|

2014

|

2013

|

$ Change

|

% Change

|

|||||||

|

Goodwill

|

$

|

259.5

|

|

$

|

346.1

|

|

$

|

(86.6

|

)

|

(25.0

|

)%

|

|

Non-current pension assets

|

176.2

|

|

223.5

|

|

(47.3

|

)

|

(21.2

|

)%

|

|||

|

Other intangible assets

|

239.8

|

|

207.4

|

|

32.4

|

|

15.6

|

%

|

|||

|

Other non-current assets

|

63.5

|

|

58.4

|

|

5.1

|

|

8.7

|

%

|

|||

|

Non-current assets, discontinued operations

|

—

|

|

849.2

|

|

(849.2

|

)

|

(100.0

|

)%

|

|||

|

Total other assets

|

$

|

739.0

|

|

$

|

1,684.6

|

|

$

|

(945.6

|

)

|

(56.1

|

)%

|

|

|

December 31,

|

|

|

||||||||

|

|

2014

|

2013

|

$ Change

|

% Change

|

|||||||

|

Short-term debt

|

$

|

7.4

|

|

$

|

18.6

|

|

$

|

(11.2

|

)

|

(60.2

|

)%

|

|

Accounts payable

|

143.9

|

|

139.9

|

|

4.0

|

|

2.9

|

%

|

|||

|

Salaries, wages and benefits

|

146.7

|

|

131.1

|

|

15.6

|

|

11.9

|

%

|

|||

|

Income taxes payable

|

80.2

|

|

106.7

|

|

(26.5

|

)

|

(24.8

|

)%

|

|||

|

Other current liabilities

|

155.0

|

|

180.8

|

|

(25.8

|

)

|

(14.3

|

)%

|

|||

|

Current portion of long-term debt

|

0.6

|

|

250.7

|

|

(250.1

|

)

|

(99.8

|

)%

|

|||

|

Current liabilities, discontinued operations

|

—

|

|

152.3

|

|

(152.3

|

)

|

(100.0

|

)%

|

|||

|

Total current liabilities

|

$

|

533.8

|

|

$

|

980.1

|

|

$

|

(446.3

|

)

|

(45.5

|

)%

|

|

|

December 31,

|

|

|

||||||||

|

|

2014

|

2013

|

$ Change

|

% Change

|

|||||||

|

Long-term debt

|

$

|

522.1

|

|

$

|

176.4

|

|

$

|

345.7

|

|

196.0

|

%

|

|

Accrued pension cost

|

165.9

|

|

159.0

|

|

6.9

|

|

4.3

|

%

|

|||

|

Accrued postretirement benefits cost

|

141.8

|

|

138.3

|

|

3.5

|

|

2.5

|

%

|

|||

|

Deferred income taxes

|

4.1

|

|

82.9

|

|

(78.8

|

)

|

(95.1

|

)%

|

|||

|

Other non-current liabilities

|

44.6

|

|

55.9

|

|

(11.3

|

)

|

(20.2

|

)%

|

|||

|

Non-current liabilities, discontinued operations

|

—

|

|

236.7

|

|

(236.7

|

)

|

(100.0

|

)%

|

|||

|

Total non-current liabilities

|

$

|

878.5

|

|

$

|

849.2

|

|

$

|

29.3

|

|

3.5

|

%

|

|

|

December 31,

|

|

|

||||||||

|

|

2014

|

2013

|

$ Change

|

% Change

|

|||||||

|

Common stock

|

$

|

952.5

|

|

$

|

949.5

|

|

$

|

3.0

|

|

0.3

|

%

|

|

Earnings invested in the business

|

1,615.4

|

|

2,586.4

|

|

(971.0

|

)

|

(37.5

|

)%

|

|||

|

Accumulated other comprehensive loss

|

(482.5

|

)

|

(626.1

|

)

|

143.6

|

|

(22.9

|

)%

|

|||

|

Treasury shares

|

(509.2

|

)

|

(273.2

|

)

|

(236.0

|

)

|

(86.4

|

)%

|

|||

|

Noncontrolling interest

|

12.9

|

|

12.0

|

|

0.9

|

|

7.5

|

%

|

|||

|

Total equity

|

$

|

1,589.1

|

|

$

|

2,648.6

|

|

$

|

(1,059.5

|

)

|

(40.0

|

)%

|

|

2014

|

2013

|

$ Change

|

|||||||

|

Net cash provided by operating activities - continuing operations

|

$

|

281.5

|

|

$

|

292.8

|

|

$

|

(11.3

|

)

|

|

Net cash provided by operating activities - discontinued operations

|

25.5

|

|

137.2

|

|

(111.7

|

)

|

|||

|

Net cash provided by operating activities

|

307.0

|

|

430.0

|

|

(123.0

|

)

|

|||

|

Net cash used by investing activities - continuing operations

|

(117.7

|

)

|

(184.1

|

)

|

66.4

|

|

|||

|

Net cash used by investing activities - discontinued operations

|

(77.0

|

)

|

(191.9

|

)

|

114.9

|

|

|||

|

Net cash used by investing activities

|

(194.7

|

)

|

(376.0

|

)

|

181.3

|

|

|||

|

Net cash used by financing activities - continuing operations

|

(302.2

|

)

|

(249.3

|

)

|

(52.9

|

)

|

|||

|

Net cash provided by financing activities - discontinued operations

|

100.0

|

|

—

|

|

100.0

|

|

|||

|

Net cash used by financing activities

|

(202.2

|

)

|

(249.3

|

)

|

47.1

|

|

|||

|

Effect of exchange rate changes on cash

|

(15.9

|

)

|

(6.5

|

)

|

(9.4

|

)

|

|||

|

(Decrease) in cash and cash equivalents

|

$

|

(105.8

|

)

|

$

|

(201.8

|

)

|

$

|

96.0

|

|

|

2014

|

2013

|

|||||

|

Cash Provided (Used):

|

||||||

|

Accounts receivable

|

$

|

(48.3

|

)

|

$

|

(4.6

|

)

|

|

Inventories

|

(26.8

|

)

|

34.6

|

|

||

|

Trade accounts payable

|

8.0

|

|

0.9

|

|

||

|

Other accrued expenses

|

2.2

|

|

(39.6

|

)

|

||

|

|

December 31,

|

|||||

|

|

2014

|

2013

|

||||

|

Short-term debt

|

$

|

7.4

|

|

$

|

18.6

|

|

|

Current portion of long-term debt

|

0.6

|

|

250.7

|

|

||

|

Long-term debt

|

522.1

|

|

176.4

|

|

||

|

Total debt

|

$

|

530.1

|

|

$

|

445.7

|

|

|

Less: Cash and cash equivalents

|

278.8

|

|

384.6

|

|

||

|

Restricted cash

|

15.3

|

|

15.1

|

|

||

|

Net debt

|

$

|

236.0

|

|

$

|

46.0

|

|

|

|

December 31,

|

|||||

|

|

2014

|

2013

|

||||

|

Net debt

|

$

|

236.0

|

|

$

|

46.0

|

|

|

Total equity

|

1,589.1

|

|

2,648.6

|

|

||

|

Capital (net debt + total equity)

|

$

|

1,825.1

|

|

$

|

2,694.6

|

|

|

Ratio of net debt to capital

|

12.9

|

%

|

1.7

|

%

|

||

|

Contractual Obligations

|

Total

|

Less than

1 Year

|

1-3 Years

|

3-5 Years

|

More than

5 Years

|

||||||||||

|

Interest payments

|

$

|

272.4

|

|

$

|

25.8

|

|

$

|

49.5

|

|

$

|

48.4

|

|

$

|

148.7

|

|

|

Long-term debt, including current portion

|

522.7

|

|

0.6

|

|

20.7

|

|

—

|

|

501.4

|

|

|||||

|

Short-term debt

|

7.4

|

|

7.4

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Operating leases

|

96.3

|

|

28.6

|

|

37.9

|

|

19.5

|

|

10.3

|

|

|||||

|

Purchase commitments

|

44.8

|

|

16.0

|

|

7.3

|

|

21.5

|

|

—

|

|

|||||

|

Retirement benefits

|

1,736.9

|

|

206.9

|

|

353.0

|

|

362.7

|

|

814.3

|

|

|||||

|

Total

|

$

|

2,680.5

|

|

$

|

285.3

|

|

$

|

468.4

|

|

$

|

452.1

|

|

$

|

1,474.7

|

|

|

Net actuarial losses at December 31, 2009

|

$

|

1,072.3

|

|

||||

|

Plus/minus actuarial (gains) and losses recognized:

|

|||||||

|

Net actuarial gains recognized in 2010

|

$

|

(51.1

|

)

|

||||

|

Net actuarial losses recognized in 2011

|

404.6

|

|

|||||

|

Net actuarial losses recognized in 2012

|

263.1

|

|

|||||

|

Net actuarial gains recognized in 2013

|

(376.3

|

)

|

|||||

|

Net actuarial losses recognized in 2014

|

161.2

|

|

|||||

|

401.5

|

|

||||||

|

Minus amortization of net actuarial losses:

|

|||||||

|

Amortization of net actuarial losses in 2010

|

$

|

(51.9

|

)

|

||||

|

Amortization of net actuarial losses in 2011

|

(56.0

|

)

|

|||||

|

Amortization of net actuarial losses in 2012

|

(83.3

|

)

|

|||||

|

Amortization of net actuarial losses in 2013

|

(116.8

|

)

|

|||||

|

Amortization of net actuarial losses in 2014

|

(60.9

|

)

|

|||||

|

(368.9

|

)

|

||||||

|

Curtailment loss recognized in 2012

|

(9.5

|

)

|

|||||

|

Settlement loss recognized in 2013

|

(7.2

|

)

|

|||||

|

Settlement loss recognized in 2014

|

(33.5

|

)

|

|||||

|

Spinoff of TimkenSteel

|

(347.4

|

)

|

|||||

|

Foreign currency impact

|

(8.5

|

)

|

|||||

|

Net actuarial losses at December 31, 2014

|

$

|

698.8

|

|

||||

|

+ / - Change at December 31, 2015

|

||||||||||||||

|

Change

|

PBO

|

Equity

|

2014 Expense

|

|||||||||||

|

Assumption:

|

||||||||||||||

|

Discount rate

|

+/- 0.25%

|

$

|

48.4

|

|

$

|

48.4

|

|

$

|

3.0

|

|

||||

|

Actual return on plan assets

|

+/- 0.25%

|

N/A

|

|

4.4

|

|

0.2

|

|

|||||||

|

Expected return on assets

|

+/- 0.25%

|

N/A

|

|

N/A

|

|

4.1

|

|

|||||||

|

+ / - Change at December 31, 2015

|

||||||||||||||

|

Change

|

ABO

|

Equity

|

2014 Expense

|

|||||||||||

|

Assumption:

|

||||||||||||||

|

Discount rate

|

+/- 0.25%

|

$

|

5.8

|

|

$

|

5.8

|

|

$

|

0.4

|

|

||||

|

Actual return on plan assets

|

+/- 0.25%

|

N/A

|

|

0.3

|

|

—

|

|

|||||||

|

Expected return on assets

|

+/- 0.25%

|

N/A

|

|

N/A

|

|

0.3

|

|

|||||||

|

(a)

|

deterioration in world economic conditions, or in economic conditions in any of the geographic regions in which the Company conducts business, including additional adverse effects from the global economic slowdown, terrorism or hostilities. This includes: political risks associated with the potential instability of governments and legal systems in countries in which the Company or its customers conduct business, and changes in currency valuations;

|

|

(b)

|

the effects of fluctuations in customer demand on sales, product mix and prices in the industries in which the Company operates. This includes: the ability of the Company to respond to rapid changes in customer demand, the effects of customer bankruptcies or liquidations, the impact of changes in industrial business cycles, and whether conditions of fair trade continue in the U.S. markets;

|

|

(c)

|

competitive factors, including changes in market penetration, increasing price competition by existing or new foreign and domestic competitors, the introduction of new products by existing and new competitors, and new technology that may impact the way the Company’s products are sold or distributed;

|

|

(d)

|

changes in operating costs. This includes: the effect of changes in the Company’s manufacturing processes; changes in costs associated with varying levels of operations and manufacturing capacity; availability and cost of raw materials and energy; changes in the expected costs associated with product warranty claims; changes resulting from inventory management and cost reduction initiatives and different levels of customer demands; the effects of unplanned plant shutdowns; and changes in the cost of labor and benefits;

|

|

(e)

|

the success of the Company’s operating plans, announced programs, initiatives and capital investments; the ability to integrate acquired companies; the ability of acquired companies to achieve satisfactory operating results, including results being accretive to earnings; and the Company’s ability to maintain appropriate relations with unions that represent Company associates in certain locations in order to avoid disruptions of business;

|

|

(f)

|

unanticipated litigation, claims or assessments. This includes: claims or problems related to intellectual property, product liability or warranty, environmental issues, and taxes;

|

|

(g)

|

changes in worldwide financial markets, including availability of financing and interest rates, which affect: the Company’s cost of funds and/or ability to raise capital; and customer demand and the ability of customers to obtain financing to purchase the Company’s products or equipment that contain the Company’s products;

|

|

(h)

|

the impact on the Company's pension obligations due to changes in interest rates, investment performance and other tactics designed to reduce risk;

|

|

(i)

|

retention of CDSOA distributions;

|

|

(j)

|

the Company's ability to realize the benefits of the Spinoff and avoid possible indemnification liabilities entered into with TimkenSteel in connection with the Spinoff;

|

|

(k)

|

the taxable nature of the Spinoff; and

|

|

(l)

|

those items identified under Item 1A. Risk Factors on pages

7

through

14

.

|

|

|

|||||||||

|

|

Year Ended December 31,

|

||||||||

|

2014

|

2013

|

2012

|

|||||||

|

(Dollars in millions, except per share data)

|

|||||||||

|

Net sales

|

$

|

3,076.2

|

|

$

|

3,035.4

|

|

$

|

3,359.5

|

|

|

Cost of products sold

|

2,178.2

|

|

2,167.0

|

|

2,331.5

|

|

|||

|

Gross Profit

|

898.0

|

|

868.4

|

|

1,028.0

|

|

|||

|

Selling, general and administrative expenses

|

542.5

|

|

546.6

|

|

554.5

|

|

|||

|

Impairment and restructuring charges

|

113.4

|

|

8.7

|

|

29.5

|

|

|||

|

Pension settlement charges

|

33.7

|

|

7.2

|

|

—

|

|

|||

|

Operating Income

|

208.4

|

|

305.9

|

|

444.0

|

|

|||

|

Interest expense

|

(28.7

|

)

|

(24.4

|

)

|

(31.1

|

)

|

|||

|

Interest income

|

4.4

|

|

1.9

|

|

2.9

|

|

|||

|

Gain on sale of real estate

|

22.6

|

|

5.4

|

|

—

|

|

|||

|

Continued Dumping and Subsidy Offset Act (expenses) receipts, net

|

(2.3

|

)

|

(2.8

|

)

|

108.0

|

|

|||

|

Other (expense) income, net

|

(0.4

|

)

|

4.1

|

|

(6.0

|

)

|