REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| * | Each American Depositary Share representing ten shares of the registrant’s Common Stock. |

| ** | No par value. Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the U.S. Securities and Exchange Commission. |

| Accelerated filer ☐ | Non-accelerated filer ☐ | |||

| Emerging growth company | ||||

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

10.F |

DIVIDENDS AND PAYING AGENTS | 134 | ||||

10.G |

STATEMENT BY EXPERTS | 134 | ||||

10.H |

DOCUMENTS ON DISPLAY | 134 | ||||

10.I |

SUBSIDIARY INFORMATION | 135 | ||||

10.J |

ANNUAL REPORT TO SECURITY HOLDERS | 135 | ||||

ITEM 11. |

135 | |||||

ITEM 12. |

135 | |||||

12.A |

DEBT SECURITIES | 135 | ||||

12.B |

WARRANTS AND RIGHTS | 135 | ||||

12.C |

OTHER SECURITIES | 135 | ||||

12.D |

AMERICAN DEPOSITARY SHARES | 135 | ||||

ITEM 13. |

137 | |||||

ITEM 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 137 | ||||

ITEM 15. |

137 | |||||

ITEM 16. |

138 | |||||

ITEM 16A. |

138 | |||||

ITEM 16B. |

138 | |||||

ITEM 16C. |

139 | |||||

ITEM 16D. |

140 | |||||

ITEM 16E. |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 140 | ||||

ITEM 16F. |

141 | |||||

ITEM 16G. |

141 | |||||

ITEM 16H. |

144 | |||||

ITEM 16I. |

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | 144 | ||||

ITEM 17. |

145 | |||||

ITEM 18. |

145 | |||||

ITEM 19. |

146 | |||||

Yen in millions |

||||||||||||

Year Ended March 31, |

||||||||||||

2021 |

2022 |

2023 |

||||||||||

Automotive |

24,597,846 | 28,531,993 | 33,776,870 | |||||||||

Financial Services |

2,137,195 | 2,306,079 | 2,786,679 | |||||||||

All Other |

479,553 | 541,436 | 590,749 | |||||||||

Yen in millions |

||||||||||||

Year Ended March 31, |

||||||||||||

2021 |

2022 |

2023 |

||||||||||

Japan |

8,587,193 | 8,214,740 | 9,122,282 | |||||||||

North America |

9,325,950 | 10,897,946 | 13,509,027 | |||||||||

Europe |

2,968,289 | 3,692,214 | 4,097,537 | |||||||||

Asia |

4,555,897 | 5,778,115 | 7,076,922 | |||||||||

Other* |

1,777,266 | 2,796,493 | 3,348,530 | |||||||||

| * | “Other” consists of Central and South America, Oceania, Africa and the Middle East. |

| • | social, political and economic conditions; |

| • | introduction of new vehicles and technologies; |

| • | costs incurred by customers to purchase and operate automobiles; and |

| • | the availability of parts and components that Toyota needs to manufacture its products. |

|

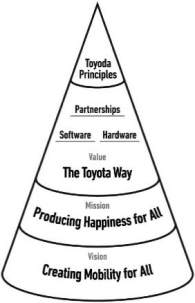

MISSION | Producing Happiness for All Using our technology, we work towards a future of convenience and happiness, available to all | ||||

| VISION | Creating Mobility for All Toyota strives to raise the quality and availability of mobility so that individuals, businesses, municipalities and communities can do more, while achieving a sustainable relationship with our planet | |||||

| VALUE | We unite our three strengths (Software, Hardware and Partnerships) to create new and unique value that comes from the Toyota Way | |||||

Thousands of Units |

||||||||||||||||||||||||

Year Ended March 31, |

||||||||||||||||||||||||

2021 |

2022 |

2023 |

||||||||||||||||||||||

Market |

Units |

% |

Units |

% |

Units |

% |

||||||||||||||||||

Japan |

2,125 | 27.8 | % | 1,924 | 23.4 | % | 2,069 | 23.5 | % | |||||||||||||||

North America |

2,313 | 30.3 | 2,394 | 29.1 | 2,407 | 27.3 | ||||||||||||||||||

Europe |

959 | 12.5 | 1,017 | 12.4 | 1,030 | 11.7 | ||||||||||||||||||

Asia |

1,222 | 16.0 | 1,543 | 18.7 | 1,751 | 19.8 | ||||||||||||||||||

Other* |

1,027 | 13.4 | 1,352 | 16.4 | 1,565 | 17.8 | ||||||||||||||||||

Total |

7,646 |

100.0 |

% |

8,230 |

100.0 |

% |

8,822 |

100.0 |

% | |||||||||||||||

| * | “Other” consists of Central and South America, Oceania, Africa and the Middle East, etc. |

Thousands of Units |

||||||||||||

Year Ended March 31, |

||||||||||||

2021 |

2022 |

2023 |

||||||||||

Japan |

||||||||||||

Total market sales (excluding mini-vehicles) |

2,901 |

2,664 |

2,696 |

|||||||||

Toyota sales (retail basis, excluding mini-vehicles) |

1,505 | 1,361 | 1,377 | |||||||||

Toyota market share |

51.9 | % | 51.1 | % | 51.1 | % | ||||||

Thousands of Units |

||||||||||||

Year Ended December 31, |

||||||||||||

2020 |

2021 |

2022 |

||||||||||

North America |

||||||||||||

Total market sales |

17,157 |

17,861 |

16,597 |

|||||||||

Toyota sales (retail basis) |

2,408 | 2,681 | 2,445 | |||||||||

Toyota market share |

14.0 | % | 15.0 | % | 14.7 | % | ||||||

Europe |

||||||||||||

Total market sales |

16,638 |

16,870 |

14,897 |

|||||||||

Toyota sales (retail basis) |

993 | 1,076 | 1,081 | |||||||||

Toyota market share |

6.0 | % | 6.4 | % | 7.3 | % | ||||||

Asia (excluding China) |

||||||||||||

Total market sales |

8,181 |

9,224 |

10,757 |

|||||||||

Toyota sales (retail basis) |

969 | 1,189 | 1,382 | |||||||||

Toyota market share |

11.8 | % | 12.9 | % | 12.8 | % | ||||||

Thousands of Units |

||||||||||||

Year Ended March 31, |

||||||||||||

2021 |

2022 |

2023 |

||||||||||

Japan |

3,948 | 3,738 | 3,789 | |||||||||

North America |

1,641 | 1,751 | 1,768 | |||||||||

Europe |

642 | 707 | 771 | |||||||||

Asia |

1,015 | 1,499 | 1,859 | |||||||||

Other* |

306 | 463 | 507 | |||||||||

Total |

7,553 | 8,158 | 8,694 | |||||||||

| * | “Other” consists of Central and South America and Africa. |

Dealers | ||||||

Channel |

Toyota Owned |

Independent |

Outlets | |||

Toyota brand |

1 company | 240 companies | 4,419 outlets | |||

Lexus brand |

22 outlets | 161 outlets | 183 outlets | |||

Country/Region |

Number of Countries |

Number of Distributors |

||||||

North America |

3 | 5 | ||||||

Europe |

53 | 29 | ||||||

China |

1 | 4 | ||||||

Asia (excluding China) |

19 | 13 | ||||||

Oceania |

17 | 15 | ||||||

Middle East |

16 | 14 | ||||||

Africa |

56 | 48 | ||||||

Central and South America |

39 | 40 | ||||||

| Developed countries | In parallel with the preparation of new models scheduled for launch in 2026, with a focus on the bZ series and with further refined performance, Toyota plans to greatly expand its product lineup. | |

| The United States | In 2025, Toyota plans to start the local production of a 3-row SUV equipped with batteries to be produced in North Carolina. | |

| China | In addition to the bZ4X and bZ3, Toyota plans to launch two models of locally developed BEVs in 2024 that will fit the local needs, and to continue increase the number of models in the following years. | |

| Asia and other emerging markets (Global South) | In order to respond to the growing demand for BEVs, Toyota plans to start local production of BEV pickup trucks by the end of 2023 and also launch a small BEV model. |

| • | Toyota Finance Corporation in Japan; |

| • | Toyota Credit Canada Inc. in Canada; |

| • | Toyota Finance Australia Ltd. in Australia; |

| • | Toyota Kreditbank GmbH in Germany; |

| • | Toyota Financial Services (UK) PLC in the United Kingdom; |

| • | Toyota Leasing (Thailand) Co., Ltd. in Thailand; and |

| • | Toyota Motor Finance (China) Co., Ltd. in China. |

Sustainability Meeting |

Sustainability Subcommittee | |||

Chairperson |

President |

Deputy Chief Officer, General Administration Human Resources Group (Senior management position responsible for sustainability) | ||

Members |

Members include three Outside Directors / Outside Audit Supervisory Board Members, the Chief Sustainability Officer and the Chief Human Resources Officer |

Officers and General / Managers from related divisions will participate in keeping with agenda topics such as the environment, financial affairs, and human resources | ||

Frequency |

Twice a year, in principle |

Four times a year, in principle | ||

Function |

• To help increase corporate value by reflecting opinions and external advice about key sustainability-related issues in management practices to achieve sustainable growth |

• To implement operations related to the promotion of sustainability • To consult with the Sustainability Meeting about key issues and submit reports to the Board of Directors |

| • | Creating a culture and capacity to continue taking on challenges without fear of failure |

| • | In order to bring together people with diverse characteristics and for each one of them to fully demonstrate their abilities, establishing a structure that stays close to the “individual” and that takes into account that each generation and life stage, and indeed each person has different values and sense of work. |

| • | Contribution to the automobile industry as a whole amid a period of transformation |

| • | Identifying carbon neutrality (“CN”) as an important issue in relation to climate change, we submitted to the Board of Directors, and the Board approved, the development of a transition plan towards achieving CN by 2050. |

| • | In addition, in order to meet the growing demand for BEVs, the Board of Directors approved Toyota investing in increasing its automotive battery production capacity by up to 40 GWh in Japan and the United States. |

Sustainability Meeting (Advisory function) |

Sustainability Subcommittee (Executory function) |

Environmental Product Design Assessment Committee |

Production Environment Committee | |||||

Frequency of reporting on climate related issues to the Board of Directors |

— |

When an important matter arises |

When an important matter arises |

When an important matter arises | ||||

Roles |

• Aims to improve the precision of initiatives with opinions and advice on key matters related to sustainability from a social perspective for sustainable growth |

• Executes operations related to promotion of sustainability • Reports important issues to the Sustainability Meeting and Board of Directors |

• Assesses product-related risks and opportunities, formulates / implements strategies and plans, conducts monitoring, etc. |

• Assesses plant / production-related risks and opportunities, determines countermeasures, conducts monitoring, etc. | ||||

Risks |

Opportunities |

Toyota’s measures |

Scenario Analysis* 2 | |||||||

Stated Policies Future Storyline |

1.5°C or less Future Storyline | |||||||||

(1) Tightening of regulations for fuel efficiency and ZEVs (acceleration of electrification) |

• Fines for failure in achieving fuel efficiency regulations • Decrease in total vehicle sales due to delays in complying with ZEV regulations • Impairment of internal combustion engine manufacturing facilities |

• Increase in sales of electrified vehicles • Increase in profits from external sales of electrification systems |

• Promotion of research and development to improve fuel and battery efficiency • Increase in investment in batteries and shift of resources • Start of external sales of electrification systems • Expansion of electrified vehicle lineup • Reduction of CO 2 emissions from vehicles currently in use |

Impacts will be an extension of current status | Impacts will increase | |||||

(3) Expansion of carbon pricing |

• Increase in production and purchasing costs due to the introduction of carbon taxes, etc. |

• Decrease in energy costs due to promoting the introduction of energy-saving technology • Improvement of energy security by diversifying energy supply sources |

• Comprehensive reduction of energy use and promotion of renewable energy and hydrogen use • Promotion of emission reductions in collaboration with suppliers |

Impacts will be an extension of current status | Impacts will increase | |||||

(7) Increase in frequency and severity of natural disasters |

• Production suspension due to damage to production sites and supply chain disruptions caused by natural disasters |

• Increase in demand for electrified vehicles due to increased need for supply of power from automobiles during emergency situations |

• Implementation of continuous adaptive improvements to our BCP in light of disaster experiences • Reinforcement of information gathering in collaboration with suppliers to avoid purchasing delays |

Impacts will increase | Impacts will be an extension of current status | |||||

Products and services |

Supply chains/value chains |

Investments in RD |

Adaptation activities and mitigation activities | |||||

Significant climate related risks |

• Regulatory risks for decarbonization in different countries (fuel efficiency regulations, GHG emission regulations, etc.) |

• Regulatory risks for decarbonization in different countries (fuel efficiency regulations, GHG emission regulations, etc.) |

• Regulatory risks for decarbonization in different countries • Market risks, such as changes in consumer needs |

• Regulatory risks, such as the introduction of carbon pricing and decarbonization • Market risks, such as increased cost reductions, including sudden price jumps low-carbon and renewable energy prices, etc. | ||||

Impact on strategies |

The following strategies were influenced: • Long-term strategy (2050 Target): Toyota Environmental Challenge 2050 announced in 2015 • Medium-term strategy (2030 Target): 2030 Milestone announced in 2018; confirmed by Toyota to be in line with SBTi *1 criteria in 2022• Short-term strategy (2025 Target): 7th Toyota Environmental Action Plan announced in 2020 * 1 Science Based Targets Initiative: Initiative established by CDP, United Nations Global Compact, World Resources Institute (WRI), and the World Wide Fund for Nature (WWF). | |||||||

History of impacts |

• The numerical target for CO 2 emissions reduction was set as the New Vehicle Zero CO2 Emissions Challenge.• Targets for Scope 3 Category 11 were set by Toyota consistent with SBTi criteria in 2022. • In 2021, Toyota announced its aim to sell 3.5 million BEVs in 2030. • In April 2023, Toyota announced a new average GHG emissions target for new vehicles and set a pace of selling 1.5 million BEV units by 2026 as our base volume. |

• The numerical target for CO 2 emissions reduction in the entire value chain was set as the Life Cycle Zero CO2 Emissions Challenge.• The medium-term strategy takes into account of the following: • Manufacturing and disposal of batteries for the manufacture of electrified vehicles • Collaboration with suppliers • Risks and opportunities related to recycling |

• The sales target for electrified vehicles was set as the New Vehicle Zero CO 2 Emissions Challenge.• An increase in research and development expenses is expected for the promotion of research and development activities for electrified vehicles. • In 2021, Toyota announced the aim to sell 3.5 million BEVs in 2030. • In April 2023, Toyota announced a new average GHG emissions target for new vehicles and set a pace of selling 1.5 million BEV units by 2026 as our base volume. |

• The target for CO 2 emissions reduction related to plant operations was set as the Plant Zero CO2 • In 2021, the decision to aim at carbon neutrality at plants by 2035 was announced. • Targets for Scope 1 and 2 were set by Toyota consistent with SBTi criteria in 2022. | ||||

| • | Toyota Environmental Challenge 2050: A long-term target toward 2050 |

| • | 2030 Milestone: A medium-term target (set by Toyota consistent with criteria of SBTi) |

| • | Seventh Toyota Environmental Action Plan: A short-term target toward 2025 |

Initiatives |

Correlation between coverage and Scope 1, 2 and 3 | |||||

Life Cycle Zero CO 2 Emissions Challenge |

Scope 1, 2 and 3 | |||||

New Vehicle Zero CO 2 Emissions Challenge |

Average GHG emissions from new vehicles (Scope 3, category 11)* 1 | |||||

Corporate activities |

Scope 1 and 2 + voluntary initiatives* 2 | |||||

Plant Zero CO 2 Emissions Challenge |

Scope 1 and 2 at production sites + voluntary actions* 2 | |||||

Emissions |

Target Year |

Base Year |

Reduction Rate |

Target Class | ||||||||||||

Scope 1, 2 |

|

2035 |

|

2019 | |

68 |

% |

1.5 degrees Celsius | ||||||||

Scope 3, category 11 (emission intensity) |

Passenger light duty vehicles and light commercial vehicles |

2030 | 33% or greate | r | Well Below 2 degrees Celsius | |||||||||||

Medium and heavy freight trucks |

11.6 | % | ||||||||||||||

Life Cycle Zero CO 2 Emissions Challenge |

New Vehicle Zero CO 2 Emissions Challenge |

Corporate Activities |

Plant Zero CO 2 Emissions Challenge |

Challenge of Minimizing and Optimizing Water Usage |

Challenge of Establishing a Recycling- based Society and Systems |

Challenge of Establishing a Future Society in Harmony with Nature | ||||||||

Contribution to SDGs |

|

|

|

|

|

|

| |||||||

Long-term |

||||||||||||||

Toyota Environmental Challenge 2050 | ||||||||||||||

| Achieve CN for GHG emissions throughout the life cycle* 1 by 2050 |

Achieve CN for average GHG emissions* 2 from new vehicles*3 by 2050 |

Achieve CN for GHG emissions from corporate activities* 4 by 2050 |

Achieve zero CO 2 emissions from production at plants*5 by 2050 |

Minimize water usage and implement water discharge management according to individual local conditions | Promote global deployment of End-of-life |

Connect the reach of nature conservation activities among communities, with the world, to the future | ||||||||

Medium-term |

Reduce global average GHG emissions* 2 by 50% or greater from new vehicles*3 by |

Reduce GHG emissions in corporate activities by 68% by 2035 | Achieve CN for CO 2 emissions from production at plants*5 |

|||||||||||

Life Cycle Zero CO 2 Emissions Challenge |

New Vehicle Zero CO 2 Emissions Challenge |

Corporate Activities |

Plant Zero CO 2 Emissions Challenge |

Challenge of Minimizing and Optimizing Water Usage |

Challenge of Establishing a Recycling- based Society and Systems |

Challenge of Establishing a Future Society in Harmony with Nature | ||||||||

| 2035 (compared to 2019 levels) | (compared to 2019 levels) (target set by Toyota consistent with SBTi criteria) |

|||||||||||||

| 2030 Milestone | ||||||||||||||

| Reduce CO 2 emissions by 30% throughout the life cycle by 2030 (compared to 2019 levels) |

• Reduce average GHG emissions *2 from new vehicles by 2030- Passenger light duty vehicles and light commercial vehicles: 33% or greater reduction (compared to 2019 levels) - Medium and heavy freight trucks: 11.6% reduction (compared to 2019 levels) |

• Implement measures, on a priority basis, in the regions where the water environment is considered to have a large impact - Water quantity: Complete measures at the 4 Challenge-focused plants in North America, Asia, and South Africa - Water quality: Complete impact assessments and measures at all of the 22 plants where used water is discharged directly to river in North America, Asia, and Europe • Disclose information appropriately and communicate actively with local communities and suppliers |

• Complete establishment of battery collection to recycling systems globally • Complete setup of 30 model facilities for appropriate treatment and recycling of end-of-life |

• Realize “Plant in Harmony with Nature” — 12 in Japan and 7 in other regions — as well as implement activities promoting harmony with nature in all regions in collaboration with local communities and companies • Contribute to biodiversity conservation activities in collaboration with NGOs and others • Expand initiatives both in-house and outside to foster environmentally conscious persons responsible for the future | ||||||||||

Short-term |

7th Toyota Environmental Action Plan (2025 Target) | |||||||||||||

Basic research |

Phase to discover development theme Research on basic vehicle-related technology | |

Forward-looking and leading-edge technology development |

Phase requiring technological breakthroughs such as components and systems Development of leading-edge components and systems that are more advanced than those of competitors | |

Product development |

Phase mainly for development of new models Development of all-new models and existing-model upgrades |

| • | further improvements in hybrid technologies, including in functions and cost, and contributions to the environment through advancements; |

| • | improvement in internal combustion engine fuel economy technology as well as improvement in technology in connection with more stringent emission standards; |

| • | development of BEVs, FCEVs and other alternative fuel vehicles; |

| • | development of advanced safety technology designed to promote driving and vehicle safety; |

| • | development of automated driving technologies |

| • | connected car technologies; and |

| • | development of technology to bring about more comfortable travel (driving). |

Description of Activity |

Total Cost (Yen in billions) |

Location |

Primary Method of Financing | |||||

Japan |

||||||||

Investment primarily in technology and products by Toyota Motor Corporation |

1,105.6 |

Japan |

Internal funds, financing from issuance of bonds, etc. | |||||

Investment primarily in technology and products by Daihatsu Motor Co., Ltd. |

110.9 | Japan | Internal funds | |||||

Investment primarily in technology and products by Toyota Motor Kyushu, Inc. |

107.8 | Japan | Internal funds | |||||

Investment primarily in technology and products by Toyota Auto Body Co., Ltd. |

93.1 | Japan | Internal funds | |||||

Investment primarily in technology and products by Prime Planet Energy Solutions, Inc. |

92.5 | Japan | Internal funds | |||||

Investment primarily in technology and products by Primearth EV Energy Co., Ltd. |

61.4 | Japan | Internal funds | |||||

Outside of Japan |

||||||||

Investment primarily to promote localization by Toyota Motor Manufacturing Texas, Inc. |

173.6 | United States | Internal funds | |||||

Investment primarily to promote localization by Toyota Motor Manufacturing Canada, Inc. |

167.2 | Canada | Internal funds | |||||

Investment primarily to promote localization by Toyota Motor Manufacturing, Indiana, Inc. |

140.9 | United States | Internal funds | |||||

Investment primarily to promote localization by Toyota Battery Manufacturing, Inc. |

102.5 | United States | Internal funds | |||||

Investment primarily to promote localization by Toyota Motor Manufacturing, Kentucky, Inc. |

88.0 | United States | Internal funds | |||||

Investment primarily to promote localization by Toyota Motor Thailand Co., Ltd. |

68.7 | Thailand | Internal funds | |||||

Investment primarily to promote localization by Toyota Motor Europe NV/SA |

68.3 | Belgium | Internal funds | |||||

Investment primarily to promote localization by Toyota Motor Manufacturing, Northern Kentucky, Inc. |

66.1 | United States | Internal funds | |||||

Investment primarily in leased automobiles by Toyota Motor Credit Corporation |

5,095.0 |

United States |

Internal funds, financing from issuance of bonds, etc. | |||||

Description of Activity |

Total Cost (Yen in billions) |

Location |

Primary Method of Financing | |||||

Japan |

||||||||

Investment primarily in manufacturing facilities by Toyota Motor Corporation |

530.0 | Japan | Internal funds | |||||

Investment primarily in manufacturing facilities by Prime Planet Energy Solutions, Inc. |

76.5 | Japan | Internal funds | |||||

Outside of Japan |

||||||||

Investment primarily in manufacturing facilities by Toyota Battery Manufacturing, Inc. |

186.0 | United States | Internal funds | |||||

Investment primarily in manufacturing facilities by Toyota Motor Manufacturing de Guanajuato |

104.4 | Mexico | Internal funds | |||||

Investment primarily in manufacturing facilities by Toyota Motor Manufacturing, Indiana, Inc. |

91.7 | United States | Internal funds | |||||

Investment primarily in manufacturing facilities by Toyota Motor Manufacturing, Kentucky, Inc. |

75.7 | United States | Internal funds | |||||

Name of Subsidiary |

Country of Incorporation |

Percentage Ownership Interest |

Percentage Voting Interest |

|||||||||

Toyota Financial Services Corporation |

Japan | 100.00 | 100.00 | |||||||||

Hino Motors, Ltd. |

Japan | 50.11 | 50.19 | |||||||||

Daihatsu Motor Co., Ltd. |

Japan | 100.00 | 100.00 | |||||||||

TOYOTA Mobility Tokyo Inc. |

Japan | 100.00 | 100.00 | |||||||||

Toyota Finance Corporation |

Japan | 100.00 | 100.00 | |||||||||

Toyota Mobility Parts Co., Ltd. |

Japan | 54.08 | 54.08 | |||||||||

Toyota Auto Body Co., Ltd. |

Japan | 100.00 | 100.00 | |||||||||

Toyota Motor Kyushu, Inc. |

Japan | 100.00 | 100.00 | |||||||||

Toyota Motor East Japan, Inc. |

Japan | 100.00 | 100.00 | |||||||||

Daihatsu Motor Kyushu Co., Ltd. |

Japan | 100.00 | 100.00 | |||||||||

Cataler Corporation |

Japan | 56.51 | 57.38 | |||||||||

Toyota Motor Engineering Manufacturing North America, Inc. |

United States | 100.00 | 100.00 | |||||||||

Toyota Motor Manufacturing, Kentucky, Inc. |

United States | 100.00 | 100.00 | |||||||||

Toyota Motor North America, Inc. |

United States | 100.00 | 100.00 | |||||||||

Toyota Motor Credit Corporation |

United States | 100.00 | 100.00 | |||||||||

Toyota Motor Manufacturing, Indiana, Inc. |

United States | 100.00 | 100.00 | |||||||||

Toyota Motor Manufacturing, Texas, Inc. |

United States | 100.00 | 100.00 | |||||||||

Toyota Motor Sales, U.S.A., Inc. |

United States | 100.00 | 100.00 | |||||||||

Toyota Financial Savings Bank |

United States | 100.00 | 100.00 | |||||||||

Toyota Motor Manufacturing Canada Inc. |

Canada | 100.00 | 100.00 | |||||||||

Toyota Credit Canada Inc. |

Canada | 100.00 | 100.00 | |||||||||

Toyota Canada Inc. |

Canada | 51.00 | 51.00 | |||||||||

Toyota Motor Manufacturing de Baja California, S. de R.L. de C.V. |

Mexico | 100.00 | 100.00 | |||||||||

Toyota Motor Manufacturing de Guanajuato, S.A.de C.V. |

Mexico | 100.00 | 100.00 | |||||||||

Toyota Motor Europe NV/SA |

Belgium | 100.00 | 100.00 | |||||||||

Toyota Motor Manufacturing France S.A.S. |

France | 100.00 | 100.00 | |||||||||

Toyota France S.A.S |

France | 100.00 | 100.00 | |||||||||

Toyota Motor Finance (Netherlands) B.V. |

Netherlands | 100.00 | 100.00 | |||||||||

Toyota Central Europe Sp. z o.o. |

Poland | 100.00 | 100.00 | |||||||||

Toyota Financial Services (UK) PLC |

United Kingdom | 100.00 | 100.00 | |||||||||

Toyota (GB) PLC |

United Kingdom | 100.00 | 100.00 | |||||||||

Toyota Motor Manufacturing Czech Republic, s.r.o. |

Czech Republic | 100.00 | 100.00 | |||||||||

Toyota Motor Manufacturing Turkey Inc. |

Turkey | 90.00 | 90.00 | |||||||||

Guangqi Toyota Engine Co., Ltd. |

China | 70.00 | 70.00 | |||||||||

Toyota Motor (China) Investment Co., Ltd. |

China | 100.00 | 100.00 | |||||||||

Toyota Motor Finance (China) Co., Ltd. |

China | 100.00 | 100.00 | |||||||||

Toyota Kirloskar Motor Private Ltd. |

India | 89.00 | 89.00 | |||||||||

P.T. Astra Daihatsu Motor |

Indonesia | 61.75 | 61.75 | |||||||||

PT. Toyota Motor Manufacturing Indonesia |

Indonesia | 95.00 | 95.00 | |||||||||

Toyota Motor Asia Pacific Pte Ltd. |

Singapore | 100.00 | 100.00 | |||||||||

Kuozui Motors, Ltd. |

Taiwan | 70.00 | 70.00 | |||||||||

Toyota Leasing (Thailand) Co., Ltd. |

Thailand | 87.44 | 87.44 | |||||||||

Toyota Motor Thailand Co., Ltd. |

Thailand | 86.43 | 86.43 | |||||||||

Toyota Daihatsu Engineering Manufacturing Co., Ltd. |

Thailand | 100.00 | 100.00 | |||||||||

Toyota Motor Corporation Australia Ltd. |

Australia | 100.00 | 100.00 | |||||||||

Toyota Finance Australia Ltd. |

Australia | 100.00 | 100.00 | |||||||||

Toyota Argentina S.A. |

Argentina | 100.00 | 100.00 | |||||||||

Toyota do Brasil Ltda. |

Brazil | 100.00 | 100.00 | |||||||||

Toyota South Africa Motors (Pty) Ltd. |

South Africa | 100.00 | 100.00 | |||||||||

Facility or Subsidiary Name |

Location |

Land Area (thousands of square meters) |

Number of Employees |

Principal Products or Functions | ||||||||

Japan (Toyota Motor Corporation) |

||||||||||||

Toyota Technical Center Shimoyama |

Toyota City, Aichi Pref. | 5,573 | 347 | Research and Development | ||||||||

Tahara Plant |

Tahara City, Aichi Pref. | 4,032 | 6,509 | Automobiles | ||||||||

Toyota Head Office and Technical Center |

Toyota City, Aichi Pref. | 2,767 | 22,891 | Research and Development | ||||||||

Higashi-Fuji Technical Center |

Susono City, Shizuoka Pref. | 2,722 | 2,572 | Research and Development | ||||||||

Motomachi Plant |

Toyota City, Aichi Pref. | 1,575 | 8,135 | Automobiles | ||||||||

Takaoka Plant |

Toyota City, Aichi Pref. | 1,318 | 4,189 | Automobiles | ||||||||

Tsutsumi Plant |

Toyota City, Aichi Pref. | 1,004 | 4,811 | Automobiles | ||||||||

Kamigo Plant |

Toyota City, Aichi Pref. | 895 | 3,172 | Automobile parts | ||||||||

Kinu-ura Plant |

Hekinan City, Aichi Pref. | 808 | 2,791 | Automobile parts | ||||||||

Honsha Plant |

Toyota City, Aichi Pref. | 623 | 1,838 | Automobile parts | ||||||||

Japan (Subsidiaries) |

||||||||||||

Daihatsu Motor Co., Ltd. |

Ikeda City, Osaka, etc. | 7,739 | 11,048 | Automobiles | ||||||||

Hino Motors, Ltd. |

Hino City, Tokyo, etc. | 6,324 | 12,244 | Automobiles | ||||||||

Toyota Auto Body Co., Ltd. |

Kariya City, Aichi Pref., etc. | 2,274 | 11,504 | Automobiles | ||||||||

Toyota Motor Kyushu, Inc. |

Miyawaka City, Fukuoka Pref. | 1,940 | 8,508 | Automobiles | ||||||||

TOYOTA Mobility Tokyo Inc. |

Minato-ku, Tokyo, etc. |

388 | 6,702 | Sales facilities | ||||||||

Outside Japan (Subsidiaries) |

||||||||||||

Toyota Motor Manufacturing, Texas, Inc. |

Texas, U.S.A. | 8,127 | 2,881 | Automobiles | ||||||||

Toyota Motor Manufacturing, Kentucky, Inc. |

Kentucky, U.S.A. | 5,161 | 7,715 | Automobiles | ||||||||

Toyota Motor Manufacturing Canada, Inc. |

Ontario, Canada | 4,752 | 7,904 | Automobiles | ||||||||

Toyota Motor Thailand Co., Ltd. |

Samutprakarn, Thailand | 4,414 | 8,189 | Automobiles | ||||||||

Toyota Motor Manufacturing, Indiana, Inc. |

Indiana, U.S.A. | 4,359 | 6,490 | Automobiles | ||||||||

Thousands of units |

||||||||||||

Year Ended March 31, |

||||||||||||

2021 |

2022 |

2023 |

||||||||||

Japan |

2,125 | 1,924 | 2,069 | |||||||||

North America |

2,313 | 2,394 | 2,407 | |||||||||

Europe |

959 | 1,017 | 1,030 | |||||||||

Asia |

1,222 | 1,543 | 1,751 | |||||||||

Other* |

1,027 | 1,352 | 1,565 | |||||||||

Overseas total |

5,521 | 6,306 | 6,753 | |||||||||

Total |

7,646 | 8,230 | 8,822 | |||||||||

| * | “Other” consists of Central and South America, Oceania, Africa and the Middle East, etc. |

| • | vehicle unit sales volumes, |

| • | the mix of vehicle models and options sold, |

| • | the level of parts and service sales, |

| • | the levels of price discounts and other sales incentives and marketing costs, |

| • | the cost of customer warranty claims and other customer satisfaction actions, |

| • | the cost of research and development and other fixed costs, |

| • | the prices of raw materials, |

| • | the ability to control costs, |

| • | the efficient use of production capacity, |

| • | the adverse effect on production due to such factors as the reliance on various suppliers for the provision of supplies, or the general scarcity of certain supplies, |

| • | climate change risk, including both physical risks as well as transition risks, |

| • | the adverse effect on market, sales and productions of natural calamities as well as the outbreak and spread of epidemics and interruptions of social infrastructure, and |

| • | changes in the value of the Japanese yen and other currencies in which Toyota conducts business. |

Yen in millions |

||||||||||||

Year ended March 31, |

||||||||||||

2021 |

2022 |

2023 |

||||||||||

Japan |

8,587,193 | 8,214,740 | 9,122,282 | |||||||||

North America |

9,325,950 | 10,897,946 | 13,509,027 | |||||||||

Europe |

2,968,289 | 3,692,214 | 4,097,537 | |||||||||

Asia |

4,555,897 | 5,778,115 | 7,076,922 | |||||||||

Other* |

1,777,266 | 2,796,493 | 3,348,530 | |||||||||

| * | “Other” consists of Central and South America, Oceania, Africa and the Middle East. |

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Japan |

15,991,436 | 17,583,196 | 1,591,760 | 10.0 | % | |||||||||||

North America |

11,166,479 | 13,843,901 | 2,677,421 | 24.0 | ||||||||||||

Europe |

3,867,847 | 4,273,735 | 405,888 | 10.5 | ||||||||||||

Asia |

6,530,566 | 8,044,906 | 1,514,340 | 23.2 | ||||||||||||

Other* |

2,928,183 | 3,472,193 | 544,011 | 18.6 | ||||||||||||

Intersegment elimination/unallocated amount |

(9,105,004 | ) | (10,063,633 | ) | (958,629 | ) | — | |||||||||

Total |

31,379,507 | 37,154,298 | 5,774,791 | 18.4 | ||||||||||||

Operating income (loss): |

||||||||||||||||

Japan |

1,423,445 | 1,901,463 | 478,018 | 33.6 | ||||||||||||

North America |

565,784 | (74,736 | ) | (640,520 | ) | — | ||||||||||

Europe |

162,973 | 57,460 | (105,513 | ) | (64.7 | ) | ||||||||||

Asia |

672,350 | 714,451 | 42,101 | 6.3 | ||||||||||||

Other* |

238,169 | 231,362 | (6,807 | ) | (2.9 | ) | ||||||||||

Intersegment elimination/unallocated amount |

(67,024 | ) | (104,974 | ) | (37,950 | ) | — | |||||||||

Total |

2,995,697 | 2,725,025 | (270,672 | ) | (9.0 | ) | ||||||||||

Operating margin |

9.5 | % | 7.3 | % | (2.2 | )% | ||||||||||

Income before income taxes |

3,990,532 | 3,668,733 | (321,799 | ) | (8.1 | ) | ||||||||||

Net margin from income before income taxes |

12.7 | % | 9.9 | % | (2.8 | )% | ||||||||||

Net income attributable to Toyota Motor Corporation |

2,850,110 | 2,451,318 | (398,792 | ) | (14.0 | ) | ||||||||||

Net margin attributable to Toyota Motor Corporation |

9.1 | % | 6.6 | % | (2.5 | )% | ||||||||||

| * | “Other” consists of Central and South America, Oceania, Africa and the Middle East. |

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Vehicles |

23,739,442 | 28,394,256 | 4,654,814 | 19.6 | % | |||||||||||

Parts and components for production |

1,504,215 | 1,710,422 | 206,208 | 13.7 | ||||||||||||

Parts and components for after service |

2,407,143 | 2,866,196 | 459,053 | 19.1 | ||||||||||||

Other |

881,193 | 805,995 | (75,198 | ) | (8.5 | ) | ||||||||||

Total Automotive |

28,531,993 | 33,776,870 | 5,244,877 | 18.4 | ||||||||||||

All Other |

541,436 | 590,749 | 49,314 | 9.1 | ||||||||||||

Total sales of products |

29,073,428 | 34,367,619 | 5,294,191 | 18.2 | ||||||||||||

Financial services |

2,306,079 | 2,786,679 | 480,600 | 20.8 | ||||||||||||

Total sales revenues |

31,379,507 | 37,154,298 | 5,774,791 | 18.4 | % | |||||||||||

Number of financing contracts in thousands |

||||||||||||||||

As of March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Japan |

2,745 | 2,767 | 22 | 0.8 | % | |||||||||||

North America |

5,549 | 5,500 | (49 | ) | (0.9 | ) | ||||||||||

Europe |

1,507 | 1,647 | 140 | 9.3 | ||||||||||||

Asia |

2,070 | 2,034 | (36 | ) | (1.7 | ) | ||||||||||

Other* |

895 | 938 | 43 | 4.8 | ||||||||||||

Total |

12,766 | 12,886 | 120 | 0.9 | % | |||||||||||

| * | “Other” consists of Central and South America, Oceania and Africa. |

Thousands of units |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales* |

3,640 | 3,703 | 62 | 1.7 | % | |||||||||||

* including number of exported vehicle unit sales |

||||||||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

15,706,514 | 17,271,451 | 1,564,938 | 10.0 | % | |||||||||||

Financial services |

284,922 | 311,744 | 26,822 | 9.4 | ||||||||||||

Total |

15,991,436 | 17,583,196 | 1,591,760 | 10.0 | % | |||||||||||

Thousands of units |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales |

2,394 | 2,407 | 13 | 0.5 | % | |||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

9,578,534 | 11,965,050 | 2,386,516 | 24.9 | % | |||||||||||

Financial services |

1,587,945 | 1,878,850 | 290,905 | 18.3 | ||||||||||||

Total |

11,166,479 | 13,843,901 | 2,677,421 | 24.0 | % | |||||||||||

Thousands of units |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales |

1,017 | 1,030 | 13 | 1.3 | % | |||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

3,671,205 | 4,003,043 | 331,838 | 9.0 | % | |||||||||||

Financial services |

196,642 | 270,693 | 74,050 | 37.7 | ||||||||||||

Total |

3,867,847 | 4,273,735 | 405,888 | 10.5 | % | |||||||||||

Thousands of units |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales |

1,543 | 1,751 | 208 | 13.5 | % | |||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

6,345,172 | 7,832,020 | 1,486,848 | 23.4 | % | |||||||||||

Financial services |

185,394 | 212,886 | 27,492 | 14.8 | ||||||||||||

Total |

6,530,566 | 8,044,906 | 1,514,340 | 23.2 | % | |||||||||||

Thousands of units |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales |

1,352 | 1,565 | 213 | 15.8 | % | |||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

2,756,840 | 3,225,962 | 469,122 | 17.0 | % | |||||||||||

Financial services |

171,343 | 246,232 | 74,889 | 43.7 | ||||||||||||

Total |

2,928,183 | 3,472,193 | 544,011 | 18.6 | % | |||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Operating costs and expenses |

||||||||||||||||

Cost of products sold |

24,250,784 | 29,128,561 | 4,877,778 | 20.1 | % | |||||||||||

Cost of financing services |

1,157,050 | 1,712,721 | 555,671 | 48.0 | ||||||||||||

Selling, general and administrative |

2,975,977 | 3,587,990 | 612,014 | 20.6 | ||||||||||||

Total |

28,383,811 | 34,429,273 | 6,045,462 | 21.3 | % | |||||||||||

Yen in millions |

||||

2023 v. 2022 Change |

||||

Changes in operating costs and expenses: |

||||

Effect of changes in vehicle unit sales and sales mix |

1,110,000 | |||

Effect of changes in exchange rates |

2,300,000 | |||

Effect of increase of cost of financial services |

320,000 | |||

Effect of cost reduction efforts |

1,290,000 | |||

Increase or decrease in expenses and expense reduction efforts |

525,000 | |||

Other |

500,462 | |||

Total |

6,045,462 | |||

Yen in millions |

||||

2023 v. 2022 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

680,000 | |||

Effect of cost reduction efforts |

(1,290,000 | ) | ||

Effect of changes in exchange rates |

1,280,000 | |||

Increase or decrease in expenses and expense reduction efforts |

(525,000 | ) | ||

Other |

(415,672 | ) | ||

Total |

(270,672 | ) | ||

Yen in millions |

||||

2023 v. 2022 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

365,000 | |||

Effect of cost reduction efforts |

(690,000 | ) | ||

Effect of changes in exchange rates |

1,210,000 | |||

Increase or decrease in expenses and expense reduction efforts |

(320,000 | ) | ||

Other |

(86,982 | ) | ||

Total |

478,018 | |||

Yen in millions |

||||

2023 v. 2022 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

90,000 | |||

Effect of cost reduction efforts |

(395,000 | ) | ||

Effect of changes in exchange rates |

(15,000 | ) | ||

Increase or decrease in expenses and expense reduction efforts |

(135,000 | ) | ||

Other |

(185,520 | ) | ||

Total |

(640,520 | ) | ||

Yen in millions |

||||

2023 v. 2022 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

130,000 | |||

Effect of cost reduction efforts |

(120,000 | ) | ||

Effect of changes in exchange rates |

(15,000 | ) | ||

Increase or decrease in expenses and expense reduction efforts |

(25,000 | ) | ||

Other |

(75,513 | ) | ||

Total |

(105,513 | ) | ||

Yen in millions |

||||

2023 v. 2022 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

75,000 | |||

Effect of cost reduction efforts |

(25,000 | ) | ||

Effect of changes in exchange rates |

90,000 | |||

Increase or decrease in expenses and expense reduction efforts |

(45,000 | ) | ||

Other |

(52,899 | ) | ||

Total |

42,101 | |||

Yen in millions |

||||

2023 v. 2022 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

60,000 | |||

Effect of cost reduction efforts |

(60,000 | ) | ||

Effect of changes in exchange rates |

10,000 | |||

Increase or decrease in expenses and expense reduction efforts |

0 | |||

Other |

(16,807 | ) | ||

Total |

(6,807 | ) | ||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Automotive: |

||||||||||||||||

Sales revenues |

28,605,738 | 33,820,000 | 5,214,263 | 18.2 | % | |||||||||||

Operating income |

2,284,290 | 2,180,637 | (103,653 | ) | (4.5 | ) | ||||||||||

Financial Services: |

||||||||||||||||

Sales revenues |

2,324,026 | 2,809,647 | 485,621 | 20.9 | ||||||||||||

Operating income |

657,001 | 437,516 | (219,485 | ) | (33.4 | ) | ||||||||||

All Other: |

||||||||||||||||

Sales revenues |

1,129,876 | 1,224,943 | 95,067 | 8.4 | ||||||||||||

Operating income |

42,302 | 103,451 | 61,150 | 144.6 | ||||||||||||

Intersegment elimination/unallocated amount: |

||||||||||||||||

Sales revenues |

(680,133 | ) | (700,293 | ) | (20,160 | ) | — | |||||||||

Operating income |

12,104 | 3,420 | (8,684 | ) | — | |||||||||||

Total |

||||||||||||||||

Sales revenues |

31,379,507 | 37,154,298 | 5,774,791 | 18.4 | ||||||||||||

Operating income |

2,995,697 | 2,725,025 | (270,672 | ) | (9.0 | ) | ||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2022 v. 2021 Change |

|||||||||||||||

2021 |

2022 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Japan |

14,948,931 | 15,991,436 | 1,042,505 | 7.0 | % | |||||||||||

North America |

9,491,803 | 11,166,479 | 1,674,676 | 17.6 | ||||||||||||

Europe |

3,134,489 | 3,867,847 | 733,359 | 23.4 | ||||||||||||

Asia |

5,045,295 | 6,530,566 | 1,485,272 | 29.4 | ||||||||||||

Other* |

1,872,895 | 2,928,183 | 1,055,287 | 56.3 | ||||||||||||

Intersegment elimination/unallocated amount |

(7,278,820 | ) | (9,105,004 | ) | (1,826,185 | ) | — | |||||||||

Total |

27,214,594 | 31,379,507 | 4,164,914 | 15.3 | ||||||||||||

Operating income (loss): |

||||||||||||||||

Japan |

1,149,217 | 1,423,445 | 274,228 | 23.9 | ||||||||||||

North America |

401,361 | 565,784 | 164,423 | 41.0 | ||||||||||||

Europe |

107,971 | 162,973 | 55,002 | 50.9 | ||||||||||||

Asia |

435,940 | 672,350 | 236,410 | 54.2 | ||||||||||||

Other* |

59,847 | 238,169 | 178,322 | 298.0 | ||||||||||||

Intersegment elimination/unallocated amount |

43,413 | (67,024 | ) | (110,436 | ) | — | ||||||||||

Total |

2,197,748 | 2,995,697 | 797,948 | 36.3 | ||||||||||||

Operating margin |

8.1 | % | 9.5 | % | 1.4 | % | ||||||||||

Income before income taxes |

2,932,354 | 3,990,532 | 1,058,177 | 36.1 | ||||||||||||

Net margin from income before income taxes |

10.8 | % | 12.7 | % | 1.9 | % | ||||||||||

Net income attributable to Toyota Motor Corporation |

2,245,261 | 2,850,110 | 604,849 | 26.9 | ||||||||||||

Net margin attributable to Toyota Motor Corporation |

8.3 | % | 9.1 | % | 0.8 | % | ||||||||||

| * | “Other” consists of Central and South America, Oceania, Africa and the Middle East. |

Yen in millions |

||||||||||||||||

Year ended March 31, |

2022 v. 2021 Change |

|||||||||||||||

2021 |

2022 |

Amount |

Percentage |

|||||||||||||

Vehicles |

20,509,606 | 23,739,442 | 3,229,836 | 15.7 | % | |||||||||||

Parts and components for production |

1,287,053 | 1,504,215 | 217,162 | 16.9 | ||||||||||||

Parts and components for after service |

2,049,187 | 2,407,143 | 357,956 | 17.5 | ||||||||||||

Other |

752,000 | 881,193 | 129,193 | 17.2 | ||||||||||||

Total Automotive |

24,597,846 | 28,531,993 | 3,934,147 | 16.0 | ||||||||||||

All Other |

479,553 | 541,436 | 61,883 | 12.9 | ||||||||||||

Total sales of products |

25,077,398 | 29,073,428 | 3,996,030 | 15.9 | ||||||||||||

Financial services |

2,137,195 | 2,306,079 | 168,884 | 7.9 | ||||||||||||

Total sales revenues |

27,214,594 | 31,379,507 | 4,164,914 | 15.3 | % | |||||||||||

Number of financing contracts in thousands |

||||||||||||||||

As of March 31, |

2022 v. 2021 Change |

|||||||||||||||

2021 |

2022 |

Amount |

Percentage |

|||||||||||||

Japan |

2,660 | 2,745 | 85 | 3.2 | % | |||||||||||

North America |

5,553 | 5,549 | (4 | ) | (0.1 | ) | ||||||||||

Europe |

1,412 | 1,507 | 95 | 6.7 | ||||||||||||

Asia |

1,992 | 2,070 | 78 | 3.9 | ||||||||||||

Other* |

881 | 895 | 14 | 1.6 | ||||||||||||

Total |

12,498 | 12,766 | 268 | 2.1 | % | |||||||||||

| * | “Other” consists of Central and South America, Oceania and Africa. |

Thousands of units |

||||||||||||||||

Year ended March 31, |

2022 v. 2021 Change |

|||||||||||||||

2021 |

2022 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales* |

3,853 | 3,640 | (213 | ) | (5.5 | )% | ||||||||||

* including number of exported vehicle unit sales |

||||||||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2022 v. 2021 Change |

|||||||||||||||

2021 |

2022 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

14,674,496 | 15,706,514 | 1,032,018 | 7.0 | % | |||||||||||

Financial services |

274,435 | 284,922 | 10,487 | 3.8 | ||||||||||||

Total |

14,948,931 | 15,991,436 | 1,042,505 | 7.0 | % | |||||||||||

Thousands of units |

||||||||||||||||

Year ended March 31, |

2022 v. 2021 Change |

|||||||||||||||

2021 |

2022 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales |

2,313 | 2,394 | 81 | 3.5 | % | |||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2022 v. 2021 Change |

|||||||||||||||

2021 |

2022 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

7,995,051 | 9,578,534 | 1,583,483 | 19.8 | % | |||||||||||

Financial services |

1,496,752 | 1,587,945 | 91,193 | 6.1 | ||||||||||||

Total |

9,491,803 | 11,166,479 | 1,674,676 | 17.6 | % | |||||||||||

Thousands of units |

||||||||||||||||

Year ended March 31, |

2022 v. 2021 Change |

|||||||||||||||

2021 |

2022 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales |

959 | 1,017 | 58 | 6.0 | % | |||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2022 v. 2021 Change |

|||||||||||||||

2021 |

2022 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

2,976,259 | 3,671,205 | 694,946 | 23.3 | % | |||||||||||

Financial services |

158,229 | 196,642 | 38,413 | 24.3 | ||||||||||||

Total |

3,134,489 | 3,867,847 | 733,359 | 23.4 | % | |||||||||||

Thousands of units |

||||||||||||||||

Year ended March 31, |

2022 v. 2021 Change |

|||||||||||||||

2021 |

2022 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales |

1,222 | 1,543 | 321 | 26.3 | % | |||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2022 v. 2021 Change |

|||||||||||||||

2021 |

2022 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

4,874,746 | 6,345,172 | 1,470,426 | 30.2 | % | |||||||||||

Financial services |

170,549 | 185,394 | 14,845 | 8.7 | ||||||||||||

Total |

5,045,295 | 6,530,566 | 1,485,272 | 29.4 | % | |||||||||||

Thousands of units |

||||||||||||||||

Year ended March 31, |

2022 v. 2021 Change |

|||||||||||||||

2021 |

2022 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales |

1,027 | 1,352 | 326 | 31.7 | % | |||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2022 v. 2021Change |

|||||||||||||||

2021 |

2022 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

1,719,132 | 2,756,840 | 1,037,708 | 60.4 | % | |||||||||||

Financial services |

153,764 | 171,343 | 17,579 | 11.4 | ||||||||||||

Total |

1,872,895 | 2,928,183 | 1,055,287 | 56.3 | % | |||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2022 v. 2021 Change |

|||||||||||||||

2021 |

2022 |

Amount |

Percentage |

|||||||||||||

Operating costs and expenses |

||||||||||||||||

Cost of products sold |

21,199,890 | 24,250,784 | 3,050,894 | 14.4 | % | |||||||||||

Cost of financing services |

1,182,330 | 1,157,050 | (25,280 | ) | (2.1 | ) | ||||||||||

Selling, general and administrative |

2,634,625 | 2,975,977 | 341,351 | 13.0 | ||||||||||||

Total |

25,016,845 | 28,383,811 | 3,366,965 | 13.5 | % | |||||||||||

Yen in millions |

||||

2022 v. 2021 Change |

||||

Changes in operating costs and expenses: |

||||

Effect of changes in vehicle unit sales and sales mix |

1,330,000 | |||

Effect of changes in exchange rates |

780,000 | |||

Effect of decrease of cost of financial services |

(100,000 | ) | ||

Effect of cost reduction efforts |

360,000 | |||

Increase or decrease in expenses and expense reduction efforts |

220,000 | |||

Other |

776,965 | |||

Total |

3,366,965 | |||

Yen in millions |

||||

2022 v. 2021 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

860,000 | |||

Effect of cost reduction efforts |

(360,000 | ) | ||

Effect of changes in exchange rates |

610,000 | |||

Increase or decrease in expenses and expense reduction efforts |

(220,000 | ) | ||

Other |

(92,052 | ) | ||

Total |

797,948 | |||

Yen in millions |

||||

2022 v. 2021 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

260,000 | |||

Effect of cost reduction efforts |

(145,000 | ) | ||

Effect of changes in exchange rates |

370,000 | |||

Increase or decrease in expenses and expense reduction efforts |

(50,000 | ) | ||

Other |

(160,772 | ) | ||

Total |

274,228 | |||

Yen in millions |

||||

2022 v. 2021 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

380,000 | |||

Effect of cost reduction efforts |

(125,000 | ) | ||

Effect of changes in exchange rates |

50,000 | |||

Increase or decrease in expenses and expense reduction efforts |

(135,000 | ) | ||

Other |

(5,577 | ) | ||

Total |

164,423 | |||

Yen in millions |

||||

2022 v. 2021 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

105,000 | |||

Effect of cost reduction efforts |

(40,000 | ) | ||

Effect of changes in exchange rates |

0 | |||

Increase or decrease in expenses and expense reduction efforts |

(10,000 | ) | ||

Other |

2 | |||

Total |

55,002 | |||

Yen in millions |

||||

2022 v. 2021 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

130,000 | |||

Effect of cost reduction efforts |

(35,000 | ) | ||

Effect of changes in exchange rates |

170,000 | |||

Increase or decrease in expenses and expense reduction efforts |

(40,000 | ) | ||

Other |

11,410 | |||

Total |

236,410 | |||

Yen in millions |

||||

2022 v. 2021 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

95,000 | |||

Effect of cost reduction efforts |

(15,000 | ) | ||

Effect of changes in exchange rates |

20,000 | |||

Increase or decrease in expenses and expense reduction efforts |

15,000 | |||

Other |

63,322 | |||

Total |

178,322 | |||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2022 v. 2021 Change |

|||||||||||||||

2021 |

2022 |

Amount |

Percentage |

|||||||||||||

Automotive: |

||||||||||||||||

Sales revenues |

24,651,552 | 28,605,738 | 3,954,186 | 16.0 | % | |||||||||||

Operating income |

1,607,161 | 2,284,290 | 677,130 | 42.1 | ||||||||||||

Financial Services: |

||||||||||||||||

Sales revenues |

2,162,237 | 2,324,026 | 161,789 | 7.5 | ||||||||||||

Operating income |

495,593 | 657,001 | 161,408 | 32.6 | ||||||||||||

All Other: |

||||||||||||||||

Sales revenues |

1,052,365 | 1,129,876 | 77,512 | 7.4 | ||||||||||||

Operating income |

85,350 | 42,302 | (43,048 | ) | (50.4 | ) | ||||||||||

Intersegment elimination/unallocated amount: |

||||||||||||||||

Sales revenues |

(651,560 | ) | (680,133 | ) | (28,573 | ) | — | |||||||||

Operating income |

9,645 | 12,104 | 2,459 | — | ||||||||||||

SP |

Moody’s |

RI | ||||

Short-term borrowing |

A-1+ |

P-1 |

— | |||

Long-term debt |

A+ | A1 | AAA |

Yen in millions |

||||||||||||||||||||

Total |

Payments Due by Period |

|||||||||||||||||||

Less than 1 year |

1 to 3 years |

3 to 5 years |

5 years and after |

|||||||||||||||||

Contractual Obligations: |

||||||||||||||||||||

Short-term debt |

4,590,173 | 4,590,173 | — | — | — | |||||||||||||||

Long-term debt |

24,790,100 | 7,715,466 | 9,875,785 | 5,427,639 | 1,771,210 | |||||||||||||||

Commitments for the purchase of property, plant, other assets and services (note 30) |

522,336 | 251,521 | 208,243 | 28,942 | 33,630 | |||||||||||||||

Total |

29,902,609 | 12,557,160 | 10,084,028 | 5,456,581 | 1,804,840 | |||||||||||||||

Commercial Commitments (note 30): |

||||||||||||||||||||

Maximum potential exposure to guarantees given in the ordinary course of business |

3,600,631 | 955,483 | 1,614,133 | 926,168 | 104,847 | |||||||||||||||

Total |

3,600,631 | 955,483 | 1,614,133 | 926,168 | 104,847 | |||||||||||||||

| * | “Long-term debt” represents future principal payments. |

Facility |

Principal Activity | |

Japan |

||

Toyota Technical Center |

Product planning, style, design, prototype production and vehicle evaluation | |

Higashi-Fuji Technical Center |

Advanced development | |

Tokyo Design Research Laboratory |

Advanced styling designs | |

Woven by Toyota, Inc. |

Development of artificial intelligence technology with a focus on automated driving technology Development of Woven City and software platform technologies | |

Otemachi Office |

Development of key IT technologies, creation of new values by utilizing big data and collaboration with venture companies | |

Shibetsu Proving Ground |

Evaluation | |

Toyota Central RD Labs., Inc. |

Basic research | |

United States |

||

Toyota Motor Engineering and Manufacturing North America, Inc. |

Product planning, design and evaluation of vehicles manufactured in North America | |

Calty Design Research, Inc. |

Design | |

Toyota Research Institute of North America (TRI-NA) |

Advanced research relating to “energy and environment,” “safety” and “mobility infrastructure” | |

Toyota Research Institute, Inc. |

Research and development of artificial intelligence technology | |

Woven by Toyota, U.S., Inc. |

Development of automated driving technology and software | |

Europe |

||

Toyota Motor Europe NV/SA |

Planning and evaluation of vehicles manufactured in Europe | |

Toyota Europe Design Development S.A.R.L. |

Design | |

Toyota Motorsport GmbH |

Development of motor sports vehicles | |

Woven by Toyota, U.K., Ltd. |

Development of automated driving technology and software platform technology | |

Asia Pacific |

||

Toyota Daihatsu Engineering and Manufacturing Co., Ltd. |

Planning and evaluation of vehicles manufactured in Australia and Asia | |

China |

||

Toyota Motor Engineering and Manufacturing (China) Co., Ltd. |

Environmental technology design and evaluation in China | |

FAW Toyota Research Development Co., Ltd. |

Design, evaluation and certification of vehicles manufactured in China | |

GAC Toyota Motor Co., Ltd. RD Center |

Design, evaluation and certification of vehicles manufactured in China | |

BYD Toyota EV Technology Co., Ltd. |

Design and evaluation of BEVs | |

Toyota Motor Technical Research and Service (Shanghai) Co., Ltd. |

Research of new technology, construction and system of automobiles | |

United Fuel Cell System RD (Beijing) Co., Ltd. |

Development of FC system for commercial vehicles in China | |

Name (Date of Birth) |

Position |

Brief Career Summary and Important Concurrent Duties |

Number of Common Shares (in thousands) |

|||||

Akio Toyoda (May 3, 1956) |

Chairman of the Board of Directors |

1984 Joined TMC 2000 Member of the Board of Directors of TMC 2002 Managing Director of TMC 2003 Senior Managing Director of TMC 2005 Executive Vice President of TMC 2009 President of TMC 2023 Chairman of TMC (to present) (important concurrent duties) Chairman of TOYOTA FUDOSAN CO., LTD. Chairman of the Japan Automobile Manufacturers Association, Inc. Director of DENSO Corporation Representative Director of ROOKIE Racing, Inc. Chairman of TOYOTA GAZOO Racing World Rally Team |

24,691 | |||||

| Shigeru Hayakawa (September 15, 1953) | Vice Chairman of the Board of Directors |

1977 Joined Toyota Motor Sales Co., Ltd. 2007 Managing Officer of TMC 2007 Toyota Motor North America, Inc. President 2012 Senior Managing Officer of TMC 2015 Member of the Board of Directors and Senior Managing Officer of TMC 2017 Vice Chairman of TMC (to present) (important concurrent duties) Representative Director of Institute for International Economic Studies |

326 | |||||

Koji Sato (October 19, 1969) |

President, Member of the Board of Directors |

1992 Joined TMC 2017 Executive General Manager of TMC 2020 Operating Officer of TMC 2021 Operating Officer of TMC (current system) 2023 Operating Officer and President of TMC President of TMC (to present) (important concurrent duties) Chairman of TOYOTA GAZOO Racing Europe GmbH Chairman of Toyota Motor North America, Inc. |

55 | |||||

Name (Date of Birth) |

Position |

Brief Career Summary and Important Concurrent Duties |

Number of Common Shares (in thousands) |

|||||

Hiroki Nakajima (April 10, 1962) |

Member of the Board of Directors, Operating Officer, Vice President | 1987 Joined TMC 2014 Executive General Manager of TMC 2015 Managing Officer of TMC 2020 Operating Officer of TMC 2023 Operating Officer and Executive Vice President of TMC (current system) Member of the Board of Directors, Operating Officer, Vice President of TMC (to present) (important concurrent duties) President of Commercial Japan Partnership Technologies Corporation |

20 | |||||

Yoichi Miyazaki (October 19, 1963) |

Member of the Board of Directors, Operating Officer, Vice President |

1986 Joined TMC 2015 Managing Officer of TMC 2019 Operating Officer of TMC 2022 Operating Officer of TMC (current system) 2023 Operating Officer and Executive Vice President of TMC Member of the Board of Directors, Operating Officer, Vice President of TMC (to present) |

42 | |||||

Simon Humphries (March 30, 1967) |

Member of the Board of Directors, Operating Officer |

1988 Joined DCA Design in UK. 1994 Joined TMC 2016 President of Toyota Europe Design Development S.A.R.L. 2018 Executive General Manager of TMC 2023 Operating Officer of TMC Member of the Board of Directors, Operating Officer (to present) (important concurrent duties) Executive Vice President of Calty Design Research, Inc. |

10 | |||||

| Ikuro Sugawara (March 6, 1957) |

Outside Member of the Board of Directors |

1981 Joined Ministry of International Trade and Industry 2010 Director-General of the Industrial Science and Technology Policy and Environment Bureau, Ministry of Economy, Trade and Industry 2012 Director-General of the Manufacturing Industries Bureau, Ministry of Economy, Trade and Industry 2013 Director-General of the Economic and Industrial Policy Bureau, Ministry of Economy, Trade and Industry 2015 Vice-Minister of Ministry of Economy, Trade and Industry 2017 Retired from the Ministry of Economy, Trade and Industry |

— | |||||

Name (Date of Birth) |

Position |

Brief Career Summary and Important Concurrent Duties |

Number of Common Shares (in thousands) |

|||||

2017 Special Advisor to the Cabinet 2018 Retired from Special Advisor to the Cabinet 2018 Outside Member of the Board of Directors of TMC (to present) (important concurrent duties) Independent Director of Hitachi, Ltd. Outside Director of FUJIFILM Holdings Corporation |

||||||||

| Sir Philip Craven (July 4, 1950) |

Outside Member of the Board of Directors |

1989 President of the International Wheelchair Basketball Federation 2001 President of the International Paralympic Committee 2002 Retired as President of the International Wheelchair Basketball Federation 2017 Retired as President of the International Paralympic Committee 2018 Outside Member of the Board of Directors of TMC (to present) |

— | |||||

Masahiko Oshima (September 13, 1960) |

Outside Member of the Board of Directors |

1984 Joined The Mitsui Bank Limited 2012 Executive Officer of Sumitomo Mitsui Banking Corporation (SMBC) 2014 Managing Executive Officer of SMBC 2017 Director and Managing Executive Officer of SMBC Director and Senior Managing Executive Officer of SMBC 2018 Senior Managing Corporate Executive Officer of Sumitomo Mitsui Financial Group, Inc. (SMFG) Senior Managing Executive Officer of SMBC 2019 Deputy President and Executive Officer of SMFG Director and Deputy President of SMBC 2023 Deputy Chairman of SMBC (to present) Outside Member of the Board of Directors of TMC (to present) (important concurrent duties) Deputy Chairman of Sumitomo Mitsui Banking Corporation |

— | |||||

Name (Date of Birth) |

Position |

Brief Career Summary and Important Concurrent Duties |

Number of Common Shares (in thousands) |

|||||

Emi Osono (August 8, 1965) |

Outside Member of the Board of Directors |

1988 Joined The Sumitomo Bank, Limited 1998 Visiting Professor of the Waseda Institute of Asia-Pacific Studies (WIAPS) 2000 Full-time lecturer at School of International Corporate Strategy, Hitotsubashi University Business School 2002 Assistant Professor at School of International Corporate Strategy, Hitotsubashi University Business School 2010 Professor at School of International Corporate Strategy, Hitotsubashi University Business School 2018 Professor at School of Business Administration, Hitotsubashi University Business School 2022 Dean and Professor at School of Business Administration and School of International Corporate Strategy, Hitotsubashi University Business School (to present) 2023 Outside Member of the Board of Directors of TMC (to present) (important concurrent duties) Professor at School of Business Administration, Hitotsubashi University Business School Outside Director of Tokio Marine Holdings, Inc. |

— | |||||

| Masahide Yasuda (April 1, 1949) |

Full-time Audit Supervisory Board Member |

1972 Joined TMC 2000 General Manager of Overseas Parts Division of TMC 2007 President of Toyota Motor Corporation Australia Ltd. 2014 Chairman of Toyota Motor Corporation Australia Ltd. 2017 Retired as Chairman of Toyota Motor Corporation Australia Ltd. 2018 Audit Supervisory Board Member of TMC (to present) |

62 | |||||

| Katsuyuki Ogura (January 25, 1963) | Full-time Audit Supervisory Board Member |

1985 Joined TMC 2015 General Manager of Affiliated Companies Finance Dept. of TMC 2018 General Manager of Audit Supervisory Board Office of TMC 2019 Audit Supervisory Board Member of TMC (to present) (important concurrent duties) Outside Audit Supervisory Board Member of Aichi Steel Corporation |

29 | |||||

Name (Date of Birth) |

Position |

Brief Career Summary and Important Concurrent Duties |

Number of Common Shares (in thousands) |

|||||

Takeshi Shirane (September 5, 1952) |

Full-time Audit Supervisory Board Member |

1977 Joined TMC 2001 General Manager of Production Management Div. of TMC 2004 General Manager of Global Procurement Planning Div. of TMC 2005 General Manager of 1st Procurement Div. of TMC Managing Officer of TMC 2009 Senior Managing Director of TMC 2011 Senior Managing Officer of TMC Advisor of Kanto Auto Works, Ltd. 2012 President of Kanto Auto Works, Ltd. President of Toyota Motor East Japan, Inc. 2019 Chairman of the Board of Toyota Motor East Japan, Inc. 2023 Senior Executive Advisor of Toyota Motor East Japan, Inc. (to present) Audit Supervisory Board Member of TMC (to present) |

150 | |||||

| George Olcott (May 7, 1955) |

Outside Audit Supervisory Board Member |

1986 Joined S.G.Warburg Co.,Ltd 1999 President of UBS Asset Management (Japan) 1999 President, Japan UBS Brinson 2000 Managing Director, Equity Capital Markets, UBS Warburg Tokyo 2001 Judge Business School, University of Cambridge 2005 FME Teaching Fellow, Judge Business School, University of Cambridge 2008 Senior Fellow, Judge Business School, University of Cambridge 2022 Outside Audit Supervisory Board Member of TMC (to present) (important concurrent duties) Outside Director of Kirin Holdings Company, Limited |

2 | |||||

Ryuji Sakai (August 7, 1957) |

Outside Audit Supervisory Board Member |

1985 Registered as attorney Nagashima Ohno 1990 Wilson, Sonsini, Goodrich Rosati (located in U.S.) 1995 Partner, Nagashima Ohno 2000 Partner, Nagashima Ohno Tsunematsu 2022 Audit Supervisory Board Member of TMC (to present) 2023 Senior Counsel of Nagashima Ohno Tsunematsu (to present) (important concurrent duties) Attorney |

— | |||||

Name (Date of Birth) |

Position |

Brief Career Summary and Important Concurrent Duties |

Number of Common Shares (in thousands) |

|||||

Catherine O’Connell (February 10, 1967) |

Outside Audit Supervisory Board Member |

1987 Japan Travel Bureau Inc. 1994 Senior Solicitor of Anderson Lloyd Barristers Solicitors (New Zealand) 2002 In House Counsel of Olympus Corporation 2004 Senior In House Counsel of Matsushita Electric Industrial Co., Ltd. Motor Company Senior In House Counsel of Matsushita Electronic Components Co., Ltd. 2008 Hogan Lovells Horitsu Jimusho Gaikokuho Kyodo Jigyo 2012 Head of Legal of Molex Japan LLC 2017 President of O’Connell Consultants 2018 CEO of Catherine O’Connell Law (to present) 2023 Outside Audit Supervisory Board Member of TMC (to present) (important concurrent duties) Registered foreign attorney External Audit Supervisory Board Member of Fujitsu Limited |

— | |||||

| 1. | Mr. Koji Sato, who is President and Member of the Board of Directors, concurrently serves as Operating Officer (President). |

| 2. | The terms of office of the members of the board of directors are from the conclusion of the Ordinary General Shareholders’ Meeting held on June 14, 2023 to the conclusion of the Ordinary General Shareholders’ Meeting for fiscal 2024. |

| 3. | The terms of office of Mr. Masahide Yasuda and Mr. George Olcott, who are both Audit Supervisory Board Members, are from the conclusion of the Ordinary General Shareholders’ Meeting held on June 15, 2022 to the conclusion of the Ordinary General Shareholders’ Meeting for fiscal 2026. |

| 4. | The terms of office of Mr. Katsuyuki Ogura, Mr. Takeshi Shirane, Mr. Ryuji Sakai and Ms. Catherine O’Connell, who are all Audit Supervisory Board Members, are from the conclusion of the Ordinary General Shareholders’ Meeting held on June 14, 2023 to the conclusion of the Ordinary General Shareholders’ Meeting for fiscal 2027. |

Name (Date of Birth) |

Position |

Brief Career Summary and Important Concurrent Duties |

Number of Common Shares | |||

Maoko Kikuchi (July 14, 1965) |

Substitute Audit Supervisory Board Member |

1992 Public Prosecutor at Public Prosecutor’s Office, Mistry of Justice 1997 Joined Paul Hastings, LLP (U.S.) 1999 Registered as attorney Joined Nagashima Ohno 2004 Chief of the General Secretariat of the Japan Fair Trade Commission 2006 General Manager of Legal and Regulatory Affairs Div. of Vodafone K.K. 2014 Executive Officer of Microsoft Japan Co., Ltd. 2016 Standing Outside Audit Supervisory Board Member of MITSUISOKO HOLDINGS Co., Ltd. 2020 President of Compass International Law Office (to present) (important concurrent duties) Attorney Outside Director of MITSUISOKO HOLDINGS Co., Ltd. Outside Director of Hitachi Construction Machinery Co., Ltd. |

— |

| • | It should be a system that encourages members of the board of directors to work to improve the medium- to long-term corporate value of Toyota. |