|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

|

90-0907433

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Class A Common Stock, $0.00001 par value

|

|

New York Stock Exchange

|

|

Large accelerated filer

|

¨

|

Accelerated filer

|

ý

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

¨

|

|

Class

|

Outstanding

|

||

|

Class A Common Stock, $0.00001 par value

|

42,064,422

|

|

|

|

Class B Common Stock, $0.00001 par value

|

77,405,233

|

|

|

|

|

|

Page

Number

|

|

East

|

Atlanta, Charlotte, North Florida, Raleigh, Southwest Florida, and Tampa

|

|

|

Central

|

Austin, Dallas, and Houston (each of the Dallas and Houston markets include both a Taylor Morrison division and a Darling Homes division)

|

|

|

West

|

Bay Area, Chicago, Denver, Phoenix, Sacramento, and Southern California

|

|

|

Mortgage Operations

|

Taylor Morrison Home Funding (“TMHF”) and Inspired Title Services, LLC (“Inspired Title”)

|

|

|

•

|

pursuing core locations;

|

|

•

|

building distinctive communities;

|

|

•

|

maintaining a cost-efficient culture; and

|

|

•

|

appropriately balancing price with pace in the sale of our homes.

|

|

|

||||

|

•

|

On January 8, 2016, we completed the acquisition of Acadia Homes in Atlanta, Georgia, yielding approximately 1,100 lots for total consideration of $83.6 million.

|

|

•

|

On August 10, 2016, we announced our expansion of the Taylor Morrison brand to the Dallas market. Sales for this new division are expected to begin in 2017 with the opening of two communities offering homes in the $300,000 - $500,000 price range.

|

|

•

|

On February 6, 2017 we completed the sale of 11,500,000 shares of our Class A common stock in a registered public offering at a net purchase price per share of $18.2875 (the public offering price to the public of $19.00 per share less the underwriters’ discount). We used all of the net proceeds from the public offering to purchase partnership units in New TMM, our direct subsidiary, along with shares of our Class B common stock, held by our Principal Equityholders (as defined below). The aggregate number partnership units and corresponding shares of Class B common stock we purchased was equal to the number of shares of Class A common stock sold in the public offering. See — Our Structure and

Note 23 - Subsequent Events

in the Notes to the Consolidated Financial Statements included in Item 8 of this Annual Report for further detail.

|

|

•

|

Strategically opening new communities from existing land supply;

|

|

•

|

Combining land acquisition and development expertise with homebuilding operations;

|

|

•

|

Focusing product offerings on specific customer groups;

|

|

•

|

Building aspirational homes for our customers and delivering superior customer service;

|

|

•

|

Maintaining an efficient capital structure;

|

|

•

|

Selectively pursuing acquisitions; and

|

|

•

|

Employing and retaining a highly experienced management team with a strong operating track record.

|

|

(Dollars in thousands)

|

Homes

Closed

|

Average

Selling Price

of Closed

Homes

|

Net Homes

Sold

|

Average

Active Selling

Communities

|

Homes in

Backlog

|

$ Value of

Backlog

|

|||||||||||||

|

East

|

2,795

|

|

$

|

385

|

|

3,039

|

|

122

|

|

1,183

|

|

$

|

508,101

|

|

|||||

|

Central

|

2,050

|

|

476

|

|

1,837

|

|

109

|

|

817

|

|

419,359

|

|

|||||||

|

West

|

2,524

|

|

544

|

|

2,628

|

|

78

|

|

1,131

|

|

604,450

|

|

|||||||

|

Total

|

7,369

|

|

$

|

465

|

|

7,504

|

|

309

|

|

3,131

|

|

$

|

1,531,910

|

|

|||||

|

As of December 31, 2016

|

||||||||||||||||||||

|

|

Owned Lots

|

Controlled Lots

|

Owned and Controlled Lots

|

|||||||||||||||||

|

|

Raw

|

Partially

Developed

|

Finished

|

Long-

Term

Strategic

Assets

|

Total

|

Total

|

Total

|

|||||||||||||

|

East

|

3,262

|

|

5,707

|

|

4,076

|

|

293

|

|

13,338

|

|

5,071

|

|

18,409

|

|

||||||

|

Central

|

2,834

|

|

1,208

|

|

3,437

|

|

—

|

|

7,479

|

|

4,100

|

|

11,579

|

|

||||||

|

West

|

1,046

|

|

1,122

|

|

3,805

|

|

1,196

|

|

7,169

|

|

1,148

|

|

8,317

|

|

||||||

|

Total

|

7,142

|

|

8,037

|

|

11,318

|

|

1,489

|

|

27,986

|

|

10,319

|

|

38,305

|

|

||||||

|

As of December 31, 2015

|

||||||||||||||||||||

|

|

Owned Lots

|

Controlled Lots

|

Owned and Controlled Lots

|

|||||||||||||||||

|

|

Raw

|

Partially

Developed

|

Finished

|

Long-

Term

Strategic

Assets

|

Total

|

Total

|

Total

|

|||||||||||||

|

East

|

3,185

|

|

5,938

|

|

4,150

|

|

1,757

|

|

15,030

|

|

3,925

|

|

18,955

|

|

||||||

|

Central

|

3,465

|

|

974

|

|

3,526

|

|

—

|

|

7,965

|

|

5,433

|

|

13,398

|

|

||||||

|

West

|

1,650

|

|

1,992

|

|

4,618

|

|

1,348

|

|

9,608

|

|

1,411

|

|

11,019

|

|

||||||

|

Total

|

8,300

|

|

8,904

|

|

12,294

|

|

3,105

|

|

32,603

|

|

10,769

|

|

43,372

|

|

||||||

|

(Dollars in thousands)

|

As of December 31, 2016

|

As of December 31, 2015

|

|||||||||||

|

Development Status

|

Owned Lots

|

Book Value of Land

and Development

|

Owned Lots

|

Book Value of Land

and Development

|

|||||||||

|

Raw land

|

7,142

|

|

$

|

403,902

|

|

8,300

|

|

$

|

378,081

|

|

|||

|

Partially developed

|

8,037

|

|

501,496

|

|

8,904

|

|

645,276

|

|

|||||

|

Finished lots

|

11,318

|

|

1,336,709

|

|

12,294

|

|

1,305,697

|

|

|||||

|

Long-term strategic assets

|

1,489

|

|

16,182

|

|

3,105

|

|

12,165

|

|

|||||

|

Total

|

27,986

|

|

$

|

2,258,289

|

|

32,603

|

|

$

|

2,341,219

|

|

|||

|

Allocation of Lots in Land Portfolio, by Year Acquired

|

As of December 31, 2016

|

As of December 31, 2015

|

|||

|

Acquired in 2016

|

17

|

%

|

—

|

%

|

|

|

Acquired in 2015

|

20

|

%

|

22

|

%

|

|

|

Acquired in 2014

|

11

|

%

|

13

|

%

|

|

|

Acquired in 2013 and earlier

|

52

|

%

|

65

|

%

|

|

|

Total

|

100

|

%

|

100

|

%

|

|

|

As of December 31, 2016

|

As of December 31, 2015

|

||||||||||||||||||||||

|

Homes in

Backlog

|

Models

|

Inventory

to be Sold

|

Total

|

Homes in

Backlog |

Models

|

Inventory

to be Sold |

Total

|

||||||||||||||||

|

East

|

1,183

|

|

135

|

|

|

413

|

|

1,731

|

|

875

|

|

157

|

|

430

|

|

1,462

|

|

||||||

|

Central

|

817

|

|

129

|

|

|

360

|

|

1,306

|

|

1,030

|

|

119

|

|

417

|

|

1,566

|

|

||||||

|

West

|

1,131

|

|

148

|

|

|

413

|

|

1,692

|

|

1,027

|

|

162

|

|

470

|

|

1,659

|

|

||||||

|

Total

|

3,131

|

|

412

|

|

1,186

|

|

4,729

|

|

2,932

|

|

438

|

|

1,317

|

|

4,687

|

|

|||||||

|

•

|

to utilize mortgage finance as a sales tool in the purchase process to ensure a consistent customer experience and assist in maintaining production efficiency; and

|

|

•

|

to control and analyze our backlog quality and to better manage projected closing and delivery dates for our customers.

|

|

•

|

the timing of the introduction and start of construction of new projects;

|

|

•

|

the timing of sales;

|

|

•

|

the timing of closings of homes, lots and parcels;

|

|

•

|

the timing of receipt of regulatory approvals for development and construction;

|

|

•

|

the condition of the real estate market and general economic conditions in the areas in which we operate;

|

|

•

|

mix of homes closed;

|

|

•

|

construction timetables;

|

|

•

|

the prevailing interest rates and the availability of financing, both for us and for the purchasers of our homes;

|

|

•

|

the cost and availability of materials and labor; and

|

|

•

|

weather conditions in the markets in which we build.

|

|

Three Months Ended,

|

Three Months Ended,

|

||||||||||||||||||||||

|

|

2016

|

2015

|

|||||||||||||||||||||

|

|

March 31

|

June 30

|

September 30

|

December 31

|

March 31

(1)

|

June 30

(1)

|

September 30

|

December 31

|

|||||||||||||||

|

Net homes sold

|

24.4

|

%

|

27.0

|

%

|

26.0

|

%

|

22.6

|

%

|

25.9

|

%

|

28.1

|

%

|

24.5

|

%

|

21.5

|

%

|

|||||||

|

Home closings revenue

|

18.4

|

%

|

24.2

|

%

|

23.7

|

%

|

33.7

|

%

|

17.1

|

%

|

23.6

|

%

|

27.0

|

%

|

32.3

|

%

|

|||||||

|

Net income from continuing operations

|

12.6

|

%

|

22.1

|

%

|

28.4

|

%

|

36.9

|

%

|

23.5

|

%

|

11.7

|

%

|

26.8

|

%

|

38.0

|

%

|

|||||||

|

As of December 31, 2016

|

As of February 6, 2017

|

||||||||||

|

Shares

Outstanding

|

Percentage

|

Shares

Outstanding |

Percentage

|

||||||||

|

Class A Common Stock

|

30,486,858

|

|

25.5

|

%

|

41,986,858

|

|

35.2

|

%

|

|||

|

Class B Common Stock

|

88,942,052

|

|

74.5

|

%

|

77,442,052

|

|

64.8

|

%

|

|||

|

Total

|

119,428,910

|

|

100.0

|

%

|

119,428,910

|

|

100.0

|

%

|

|||

|

•

|

short- and long-term interest rates;

|

|

•

|

the availability and cost of financing for homebuyers;

|

|

•

|

employment levels, job and personal income growth and household debt-to-income levels;

|

|

•

|

consumer confidence generally and the confidence of potential homebuyers in particular;

|

|

•

|

the ability of existing homeowners to sell their existing homes at prices that are acceptable to them;

|

|

•

|

the U.S. and global financial system and credit markets, including stock market and credit market volatility;

|

|

•

|

private and federal mortgage financing programs and federal and state regulation of lending practices;

|

|

•

|

federal and state income tax laws, including provisions for the deduction of mortgage interest payments;

|

|

•

|

housing demand from population growth, household formations and demographic changes (including immigration levels and trends or other costs of home ownership in urban and suburban migration);

|

|

•

|

demand from foreign buyers for our homes, which may fluctuate according to economic circumstances in foreign markets;

|

|

•

|

the supply of available new or existing homes and other housing alternatives, such as apartments and other residential rental property;

|

|

•

|

real estate taxes;

|

|

•

|

energy prices; and

|

|

•

|

the supply of developable land in our markets and in the United States generally.

|

|

•

|

work stoppages resulting from labor disputes;

|

|

•

|

shortages of and competition for qualified trades people, such as carpenters, roofers, electricians and plumbers;

|

|

•

|

changes in laws relating to union organizing activity;

|

|

•

|

changes in immigration laws and policies and trends with respect to labor force migration; and

|

|

•

|

increases in subcontractor and professional services costs.

|

|

•

|

timing of home deliveries and land sales;

|

|

•

|

the changing composition and mix of our asset portfolio; and

|

|

•

|

weather-related issues.

|

|

•

|

severe weather;

|

|

•

|

natural disasters;

|

|

•

|

climate change;

|

|

•

|

shortages in the availability or increased costs in obtaining land, equipment, labor or building supplies;

|

|

•

|

unemployment;

|

|

•

|

changes to the population growth rates and therefore the demand for homes in these regions; and

|

|

•

|

changes in the regulatory and fiscal environment.

|

|

•

|

difficulties in assimilating the operations and personnel of acquired companies or businesses;

|

|

•

|

diversion of our management’s attention from ongoing business concerns;

|

|

•

|

our potential inability to maximize our financial and strategic position through the successful incorporation or disposition of operations;

|

|

•

|

maintenance of uniform standards, controls, procedures and policies; and

|

|

•

|

impairment of existing relationships with employees, contractors, suppliers and customers as a result of the integration of new management personnel and cost-saving initiatives.

|

|

•

|

making it more difficult for us to satisfy our obligations with respect to our debt or to our trade or other creditors;

|

|

•

|

increasing our vulnerability to adverse economic or industry conditions;

|

|

•

|

limiting our ability to obtain additional financing to fund capital expenditures and land acquisitions, particularly when the availability of financing in the capital markets is limited;

|

|

•

|

requiring us to pay higher interest rates upon refinancing or on our variable rate indebtedness if interest rates rise;

|

|

•

|

requiring a substantial portion of our cash flows from operations and the proceeds of any capital markets offerings or loan borrowings for the payment of interest on our debt and reducing our ability to use our cash flows to fund working capital, capital expenditures, land acquisitions and general corporate requirements;

|

|

•

|

limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; and

|

|

•

|

placing us at a competitive disadvantage to less leveraged competitors.

|

|

•

|

incur or guarantee additional indebtedness;

|

|

•

|

make certain investments;

|

|

•

|

repurchase equity or subordinated indebtedness;

|

|

•

|

pay dividends or make distributions on our capital stock;

|

|

•

|

sell assets, including capital stock of restricted subsidiaries;

|

|

•

|

agree to restrictions on distributions, transfers or dividends affecting our restricted subsidiaries;

|

|

•

|

consolidate, merge, sell or otherwise dispose of all or substantially all of our assets;

|

|

•

|

enter into transactions with our affiliates;

|

|

•

|

incur liens; and

|

|

•

|

designate any of our subsidiaries as unrestricted subsidiaries.

|

|

•

|

elect a majority of our directors and appoint our executive officers, set our management policies and exercise overall control over the Company and subsidiaries;

|

|

•

|

agree to sell or otherwise transfer a controlling stake in the Company; and

|

|

•

|

determine the outcome of substantially all actions requiring stockholder approval, including transactions with related parties, corporate reorganizations, acquisitions and dispositions of assets and dividends.

|

|

•

|

any change of control of TMHC;

|

|

•

|

acquisitions or dispositions by TMHC or any of its subsidiaries of assets valued at more than $50.0 million;

|

|

•

|

incurrence by TMHC or any of its subsidiaries of any indebtedness in an aggregate amount in excess of $50.0 million or the making of any loan in excess of $50.0 million;

|

|

•

|

issuance of any equity securities of TMHC, subject to limited exceptions (which include issuances pursuant to approved compensation plans);

|

|

•

|

hiring and termination of our Chief Executive Officer; and

|

|

•

|

certain changes to the size of our Board of Directors.

|

|

•

|

the division of our board of directors into three classes and the election of each class for three-year terms;

|

|

•

|

the sole ability of the board of directors to fill a vacancy created by the expansion of the board of directors;

|

|

•

|

advance notice requirements for stockholder proposals and director nominations;

|

|

•

|

after the Triggering Event, limitations on the ability of stockholders to call special meetings and to take action by written consent;

|

|

•

|

after the Triggering Event, in certain cases, the approval of holders of at least three-fourths of the shares entitled to vote generally on the making, alteration, amendment or repeal of our certificate of incorporation or bylaws will be required to adopt, amend or repeal our bylaws, or amend or repeal certain provisions of our certificate of incorporation;

|

|

•

|

after the Triggering Event, the required approval of holders of at least three-fourths of the shares entitled to vote at an election of the directors to remove directors, which removal may only be for cause; and

|

|

•

|

the ability of our board of directors to designate the terms of and issue new series of preferred stock without stockholder approval, which could be used, among other things, to institute a rights plan that would have the effect of

|

|

|

Year Ended December 31, 2016

|

||||||||||||||

|

|

1st Quarter

|

2nd Quarter

|

3rd Quarter

|

4th Quarter

|

|||||||||||

|

High

|

$

|

15.73

|

|

$

|

16.04

|

|

$

|

18.05

|

|

$

|

20.98

|

|

|||

|

Low

|

11.30

|

|

13.54

|

|

14.65

|

|

16.57

|

|

|||||||

|

|

Year Ended December 31, 2015

|

||||||||||||||

|

|

1st Quarter

|

2nd Quarter

|

3rd Quarter

|

4th Quarter

|

|||||||||||

|

High

|

$

|

21.01

|

|

$

|

21.33

|

|

$

|

21.30

|

|

$

|

20.19

|

|

|||

|

Low

|

16.06

|

|

18.26

|

|

18.60

|

|

15.43

|

|

|||||||

|

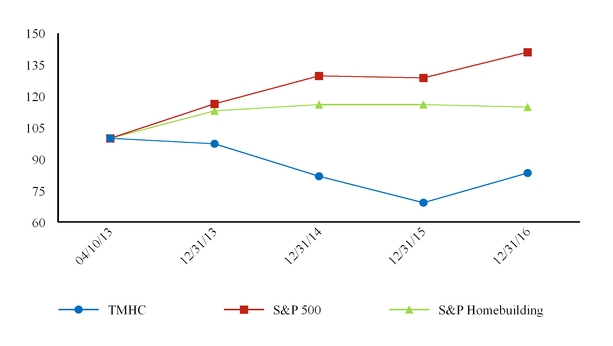

4/10/2013

|

12/31/2013

|

12/31/2014

|

12/31/2015

|

12/31/2016

|

|||||||||||||||

|

TMHC

|

$

|

100.00

|

|

$

|

97.44

|

|

$

|

81.99

|

|

$

|

69.44

|

|

$

|

83.59

|

|

||||

|

S&P 500

|

100.00

|

|

116.42

|

|

129.68

|

|

128.73

|

|

141.01

|

|

|||||||||

|

S&P Homebuilding Index

|

100.00

|

|

113.15

|

|

116.13

|

|

116.06

|

|

114.94

|

|

|||||||||

|

|

Year Ended December 31,

|

||||||||||||||||||

|

(Dollars in thousands, except per share amounts)

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

Statements of Operations Data:

|

|||||||||||||||||||

|

Total revenues

|

$

|

3,550,029

|

|

$

|

2,976,820

|

|

$

|

2,708,432

|

|

$

|

1,916,081

|

|

$

|

1,041,182

|

|

||||

|

Gross margin

|

680,279

|

|

567,915

|

|

566,246

|

|

415,865

|

|

206,641

|

|

|||||||||

|

Income tax provision / (benefit)

|

107,643

|

|

90,001

|

|

76,395

|

|

(23,810

|

)

|

(284,298

|

)

|

|||||||||

|

Net income from continuing operations

|

206,563

|

|

170,986

|

|

225,599

|

|

28,355

|

|

355,955

|

|

|||||||||

|

Income from discontinued operations – net of tax

|

—

|

|

58,059

|

|

41,902

|

|

66,513

|

|

74,893

|

|

|||||||||

|

Net income before allocation to non-controlling interests

|

206,563

|

|

229,045

|

|

267,501

|

|

94,868

|

|

430,848

|

|

|||||||||

|

Net (income) / loss attributable to non-controlling interests – joint ventures

|

(1,294

|

)

|

(1,681

|

)

|

(1,648

|

)

|

131

|

|

(28

|

)

|

|||||||||

|

Net income before non-controlling interests – Principal Equityholders

|

205,269

|

|

227,364

|

|

265,853

|

|

94,999

|

|

430,820

|

|

|||||||||

|

Net (income) / loss from continuing operations attributable to non-controlling interests – Principal Equityholders

|

(152,653

|

)

|

(123,909

|

)

|

(163,790

|

)

|

1,442

|

|

(355,927

|

)

|

|||||||||

|

Net income from discontinued operations attributable to non-controlling interests – Principal Equityholders

(1)

|

—

|

|

(42,406

|

)

|

(30,594

|

)

|

(51,021

|

)

|

(74,893

|

)

|

|||||||||

|

Net income available to Taylor Morrison Home Corporation

|

$

|

52,616

|

|

$

|

61,049

|

|

$

|

71,469

|

|

$

|

45,420

|

|

$

|

—

|

|

||||

|

Earnings per common share:

|

|||||||||||||||||||

|

Basic

|

|||||||||||||||||||

|

Income from continuing operations

|

$

|

1.69

|

|

$

|

1.38

|

|

$

|

1.83

|

|

$

|

0.91

|

|

N/A

|

|

|||||

|

Discontinued operations – net of tax

(1)

|

—

|

|

0.47

|

|

0.34

|

|

0.47

|

|

N/A

|

|

|||||||||

|

Net income available to Taylor Morrison Home Corporation

|

$

|

1.69

|

|

$

|

1.85

|

|

$

|

2.17

|

|

$

|

1.38

|

|

N/A

|

|

|||||

|

Diluted

|

|||||||||||||||||||

|

Income from continuing operations

|

$

|

1.69

|

|

$

|

1.38

|

|

$

|

1.83

|

|

$

|

0.91

|

|

N/A

|

|

|||||

|

Discontinued operations – net of tax

(1)

|

—

|

|

0.47

|

|

0.34

|

|

0.47

|

|

N/A

|

|

|||||||||

|

Net income available to Taylor Morrison Home Corporation

|

$

|

1.69

|

|

$

|

1.85

|

|

$

|

2.17

|

|

$

|

1.38

|

|

N/A

|

|

|||||

|

Weighted average number of shares of common stock:

|

|||||||||||||||||||

|

Basic

|

31,084

|

|

33,063

|

|

32,937

|

|

32,840

|

|

N/A

|

|

|||||||||

|

Diluted

|

120,832

|

|

122,384

|

|

122,313

|

|

122,319

|

|

N/A

|

|

|||||||||

|

|

As of December 31,

|

||||||||||||||||||

|

(Dollars in thousands)

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

Balance Sheet Data:

|

|||||||||||||||||||

|

Cash and cash equivalents, excluding restricted cash

|

$

|

300,179

|

|

$

|

126,188

|

|

$

|

234,217

|

|

$

|

193,518

|

|

$

|

111,083

|

|

||||

|

Real estate inventory

|

3,017,219

|

|

3,126,787

|

|

2,518,321

|

|

2,012,580

|

|

1,366,902

|

|

|||||||||

|

Total assets

(1)

|

4,220,926

|

|

4,122,447

|

|

4,111,798

|

|

3,419,285

|

|

2,738,056

|

|

|||||||||

|

Total debt

(1)

|

1,586,533

|

|

1,668,425

|

|

1,715,791

|

|

1,238,457

|

|

969,499

|

|

|||||||||

|

Total stockholders’ equity

|

2,160,202

|

|

1,972,677

|

|

1,777,161

|

|

1,544,901

|

|

1,204,575

|

|

|||||||||

|

|

Year Ended December 31,

|

||||||||||||||||||

|

(Dollars in thousands)

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

Operating Data:

|

|||||||||||||||||||

|

Average active selling communities

|

309

|

|

259

|

|

206

|

|

158

|

|

108

|

|

|||||||||

|

Net sales orders (units)

|

7,504

|

|

6,681

|

|

5,728

|

|

5,018

|

|

3,738

|

|

|||||||||

|

Home closings (units)

|

7,369

|

|

6,311

|

|

5,642

|

|

4,716

|

|

2,933

|

|

|||||||||

|

Average sales price of homes delivered

|

$

|

465

|

|

$

|

458

|

|

$

|

464

|

|

$

|

394

|

|

$

|

336

|

|

||||

|

Backlog at the end of period (value)

|

$

|

1,531,910

|

|

$

|

1,392,973

|

|

$

|

1,099,767

|

|

$

|

987,754

|

|

$

|

716,033

|

|

||||

|

Backlog at the end of period (units)

|

3,131

|

|

2,932

|

|

2,252

|

|

2,166

|

|

1,864

|

|

|||||||||

|

East

|

Atlanta, Charlotte, North Florida, Raleigh, Southwest Florida, and Tampa

|

|

|

Central

|

Austin, Dallas, and Houston (each of the Dallas and Houston markets include both a Taylor Morrison division and a Darling Homes division)

|

|

|

West

|

Bay Area, Chicago, Denver, Phoenix, Sacramento, and Southern California

|

|

|

Mortgage Operations

|

Taylor Morrison Home Funding (“TMHF”) and Inspired Title Services, LLC (“Inspired Title”)

|

|

|

•

|

Net sales orders were

7,504

, a

12%

increase from the prior year

|

|

•

|

Home closings were

7,369

, a

17%

increase from the prior year

|

|

•

|

Total revenue was $

3.6 billion

, a

19%

increase from the prior year

|

|

•

|

GAAP home closings gross margin, inclusive of capitalized interest, was

18.2%

|

|

•

|

Net income from continuing operations for the year was

$207 million

with earnings per share of

$1.69

, an increase of

22%

from the prior year

|

|

Year Ended December 31,

|

|||||||||||

|

(Dollars in thousands)

|

2016

|

2015

|

2014

|

||||||||

|

Statements of Operations Data:

|

|||||||||||

|

Home closings revenue, net

|

$

|

3,425,521

|

|

$

|

2,889,968

|

|

$

|

2,619,558

|

|

||

|

Land closings revenue

|

64,553

|

|

43,770

|

|

53,381

|

|

|||||

|

Mortgage operations revenue

|

59,955

|

|

43,082

|

|

35,493

|

|

|||||

|

Total revenues

|

$

|

3,550,029

|

|

$

|

2,976,820

|

|

$

|

2,708,432

|

|

||

|

Cost of home closings

|

2,801,739

|

|

2,358,823

|

|

2,082,819

|

|

|||||

|

Cost of land closings

|

35,912

|

|

24,546

|

|

39,696

|

|

|||||

|

Mortgage operations expenses

|

32,099

|

|

25,536

|

|

19,671

|

|

|||||

|

Total cost of revenues

|

$

|

2,869,750

|

|

$

|

2,408,905

|

|

$

|

2,142,186

|

|

||

|

Gross margin

|

680,279

|

|

567,915

|

|

566,246

|

|

|||||

|

Sales, commissions and other marketing costs

|

239,556

|

|

198,676

|

|

168,897

|

|

|||||

|

General and administrative expenses

|

122,207

|

|

95,235

|

|

81,153

|

|

|||||

|

Equity in income of unconsolidated entities

|

(7,453

|

)

|

(1,759

|

)

|

(5,405

|

)

|

|||||

|

Interest (income)/expense, net

|

(184

|

)

|

(192

|

)

|

1,160

|

|

|||||

|

Other expense, net

|

11,947

|

|

11,634

|

|

18,447

|

|

|||||

|

Loss on extinguishment of debt

|

—

|

|

33,317

|

|

—

|

|

|||||

|

Gain on foreign currency forward

|

—

|

|

(29,983

|

)

|

—

|

|

|||||

|

Income from continuing operations before income taxes

|

$

|

314,206

|

|

$

|

260,987

|

|

$

|

301,994

|

|

||

|

Income tax provision

|

107,643

|

|

90,001

|

|

76,395

|

|

|||||

|

Net income from continuing operations

|

$

|

206,563

|

|

$

|

170,986

|

|

$

|

225,599

|

|

||

|

Net income from discontinued operations

|

—

|

|

58,059

|

|

41,902

|

|

|||||

|

Net income before allocation to non-controlling interests

|

$

|

206,563

|

|

$

|

229,045

|

|

$

|

267,501

|

|

||

|

Net income attributable to non-controlling interests – joint ventures

|

(1,294

|

)

|

(1,681

|

)

|

(1,648

|

)

|

|||||

|

Net income before non-controlling interests – Principal Equityholders

|

$

|

205,269

|

|

$

|

227,364

|

|

$

|

265,853

|

|

||

|

Net income from continuing operations attributable to non-controlling interests – Principal Equityholders

|

(152,653

|

)

|

(123,909

|

)

|

(163,790

|

)

|

|||||

|

Net income from discontinued operations attributable to non-controlling interests – Principal Equityholders

|

—

|

|

(42,406

|

)

|

(30,594

|

)

|

|||||

|

Net income available to Taylor Morrison Home Corporation

|

$

|

52,616

|

|

$

|

61,049

|

|

$

|

71,469

|

|

||

|

Home closings gross margin as a % of home closings revenue, net

|

18.2

|

%

|

18.4

|

%

|

20.5

|

%

|

|||||

|

Adjusted home closings gross margin as a % of home closings revenue, net

|

21.0

|

%

|

|

21.3

|

%

|

23.0

|

%

|

||||

|

Gross margin as a % of total revenues

|

19.2

|

%

|

19.1

|

%

|

20.9

|

%

|

|||||

|

Sales, commissions and other marketing costs as a % of home closings revenue, net

|

7.0

|

%

|

6.9

|

%

|

6.4

|

%

|

|||||

|

General and administrative expenses as a % of home closings revenue, net

|

3.6

|

%

|

3.3

|

%

|

3.1

|

%

|

|||||

|

Average sales price per home closed

|

$

|

465

|

|

$

|

458

|

|

$

|

464

|

|

||

|

|

Year Ended December 31,

|

|||||||

|

|

2016

|

2015

|

Change

|

|||||

|

East

|

122

|

|

91

|

|

34.1

|

%

|

||

|

Central

|

109

|

|

98

|

|

11.2

|

|

||

|

West

|

78

|

|

70

|

|

11.4

|

|

||

|

Total

|

309

|

|

259

|

|

19.3

|

%

|

||

|

|

Year Ended December 31,

(1)

|

|||||||||||||||||||||||||||||

|

(Dollars in thousands )

|

Net Homes Sold

|

Sales Value

|

Average Selling Price

|

|||||||||||||||||||||||||||

|

|

2016

|

2015

|

Change

|

2016

|

2015

|

Change

|

2016

|

2015

|

Change

|

|||||||||||||||||||||

|

East

|

3,039

|

|

2,124

|

|

43.1

|

%

|

$

|

1,175,440

|

|

$

|

794,356

|

|

48.0

|

%

|

$

|

387

|

|

$

|

374

|

|

3.5

|

%

|

||||||||

|

Central

|

1,837

|

|

2,018

|

|

(9.0

|

)

|

848,389

|

|

912,623

|

|

(7.0

|

)

|

462

|

|

452

|

|

2.2

|

|

||||||||||||

|

West

|

2,628

|

|

2,539

|

|

3.5

|

|

1,457,923

|

|

1,262,101

|

|

15.5

|

|

555

|

|

497

|

|

11.7

|

|

||||||||||||

|

Total

|

7,504

|

|

6,681

|

|

12.3

|

%

|

$

|

3,481,752

|

|

$

|

2,969,080

|

|

17.3

|

%

|

$

|

464

|

|

$

|

444

|

|

4.5

|

%

|

||||||||

|

|

Year Ended December 31,

|

||||

|

|

Cancellation Rate

(1)

|

||||

|

|

2016

|

2015

|

|||

|

East

|

12.0

|

%

|

12.4

|

%

|

|

|

Central

|

16.1

|

|

16.6

|

|

|

|

West

|

13.5

|

|

13.0

|

|

|

|

Total Company

|

13.6

|

%

|

13.9

|

%

|

|

|

|

As of December 31,

|

|||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

Sold Homes in Backlog

(1)

|

Sales Value

|

Average Selling Price

|

|||||||||||||||||||||||||||

|

|

2016

|

2015

|

Change

|

2016

|

2015

|

Change

|

2016

|

2015

|

Change

|

|||||||||||||||||||||

|

East

|

1,183

|

|

875

|

|

35.2

|

%

|

$

|

508,101

|

|

$

|

358,978

|

|

41.5

|

%

|

$

|

430

|

|

$

|

410

|

|

4.9

|

%

|

||||||||

|

Central

|

817

|

|

1,030

|

|

(20.7

|

)

|

419,359

|

|

519,251

|

|

(19.2

|

)

|

513

|

|

504

|

|

1.8

|

|

||||||||||||

|

West

|

1,131

|

|

1,027

|

|

10.1

|

|

604,450

|

|

514,744

|

|

17.4

|

|

534

|

|

501

|

|

6.6

|

|

||||||||||||

|

Total

|

3,131

|

|

2,932

|

|

6.8

|

%

|

$

|

1,531,910

|

|

$

|

1,392,973

|

|

10.0

|

%

|

$

|

489

|

|

$

|

475

|

|

2.9

|

%

|

||||||||

|

|

Year Ended December 31,

|

|||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

Homes Closed

|

Home Closings Revenue, Net

|

Average Selling Price

|

|||||||||||||||||||||||||||

|

|

2016

|

2015

|

Change

|

2016

|

2015

|

Change

|

2016

|

2015

|

Change

|

|||||||||||||||||||||

|

East

|

2,795

|

|

2,065

|

|

35.4

|

%

|

$

|

1,077,241

|

|

$

|

809,324

|

|

33.1

|

%

|

$

|

385

|

|

$

|

392

|

|

(1.8

|

)%

|

||||||||

|

Central

|

2,050

|

|

2,140

|

|

(4.2

|

)

|

974,841

|

|

990,925

|

|

(1.6

|

)

|

476

|

|

463

|

|

2.8

|

|

||||||||||||

|

West

|

2,524

|

|

2,106

|

|

19.8

|

|

1,373,439

|

|

1,089,719

|

|

26.0

|

|

544

|

|

517

|

|

5.2

|

|

||||||||||||

|

Total

|

7,369

|

|

6,311

|

|

16.8

|

%

|

$

|

3,425,521

|

|

$

|

2,889,968

|

|

18.5

|

%

|

$

|

465

|

|

$

|

458

|

|

1.5

|

%

|

||||||||

|

|

Year Ended December 31,

|

||||||||||

|

(Dollars in thousands)

|

2016

|

2015

|

Change

|

||||||||

|

East

|

$

|

21,042

|

|

$

|

9,375

|

|

$

|

11,667

|

|

||

|

Central

|

29,754

|

|

17,739

|

|

12,015

|

|

|||||

|

West

|

13,757

|

|

16,656

|

|

(2,899

|

)

|

|||||

|

Total

|

$

|

64,553

|

|

$

|

43,770

|

|

$

|

20,783

|

|

||

|

|

East

|

Central

|

West

|

Total

|

|||||||||||||||||||||||||||

|

|

For the Year Ended December 31,

|

||||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

2016

|

2015

|

2016

|

2015

|

2016

|

2015

|

2016

|

2015

|

|||||||||||||||||||||||

|

Home closings revenue

|

$

|

1,077,241

|

|

$

|

809,324

|

|

$

|

974,841

|

|

$

|

990,925

|

|

$

|

1,373,439

|

|

$

|

1,089,719

|

|

$

|

3,425,521

|

|

$

|

2,889,968

|

|

|||||||

|

Cost of home closings

|

848,988

|

|

631,956

|

|

793,384

|

|

806,695

|

|

1,159,367

|

|

920,172

|

|

2,801,739

|

|

2,358,823

|

|

|||||||||||||||

|

Home closings gross margin

|

228,253

|

|

177,368

|

|

181,457

|

|

184,230

|

|

214,072

|

|

169,547

|

|

623,782

|

|

531,145

|

|

|||||||||||||||

|

Inventory impairment

|

—

|

|

—

|

|

—

|

|

—

|

|

3,473

|

|

—

|

|

3,473

|

|

—

|

|

|||||||||||||||

|

Capitalized interest amortization

|

21,307

|

|

20,444

|

|

27,217

|

|

29,338

|

|

42,327

|

|

33,381

|

|

90,851

|

|

83,163

|

|

|||||||||||||||

|

Adjusted home closings gross margin

|

$

|

249,560

|

|

$

|

197,812

|

|

$

|

208,674

|

|

$

|

213,568

|

|

$

|

259,872

|

|

$

|

202,928

|

|

$

|

718,106

|

|

$

|

614,308

|

|

|||||||

|

Home closings gross margin %

|

21.2

|

%

|

21.9

|

%

|

18.6

|

%

|

18.6

|

%

|

15.6

|

%

|

15.6

|

%

|

18.2

|

%

|

18.4

|

%

|

|||||||||||||||

|

Adjusted home closings gross margin %

|

23.2

|

%

|

24.4

|

%

|

21.4

|

%

|

21.6

|

%

|

18.9

|

%

|

18.6

|

%

|

21.0

|

%

|

|

21.3

|

%

|

||||||||||||||

|

|

Year Ended

December 31,

|

||||||

|

(Dollars in thousands)

|

2016

|

2015

|

|||||

|

Mortgage operations revenue

|

$

|

59,955

|

|

$

|

43,082

|

|

|

|

Mortgage operations expense

|

32,099

|

|

25,536

|

|

|||

|

Mortgage operations gross margin

|

$

|

27,856

|

|

$

|

17,546

|

|

|

|

Mortgage operations margin %

|

46.5

|

%

|

40.7

|

%

|

|||

|

TMHF

Closed

Loans

|

Aggregate

Loan Volume

(in millions)

|

Capture

Rate

|

|||||||

|

December 31, 2016

|

4,435

|

|

$

|

1,492.5

|

|

80

|

%

|

||

|

December 31, 2015

|

3,675

|

|

$

|

1,219.0

|

|

79

|

%

|

||

|

|

Year Ended December 31,

|

|||||||

|

|

2015

|

2014

|

Change

|

|||||

|

East

|

91

|

|

65

|

|

40.0

|

%

|

||

|

Central

|

98

|

|

86

|

|

14.0

|

|

||

|

West

|

70

|

|

55

|

|

27.3

|

|

||

|

Total

|

259

|

|

206

|

|

25.7

|

%

|

||

|

|

Year Ended December 31,

(1)

|

|||||||||||||||||||||||||||||

|

(Dollars in thousands )

|

Net Homes Sold

|

Sales Value

|

Average Selling Price

|

|||||||||||||||||||||||||||

|

|

2015

|

2014

|

Change

|

2015

|

2014

|

Change

|

2015

|

2014

|

Change

|

|||||||||||||||||||||

|

East

|

2,124

|

|

1,521

|

|

39.6

|

%

|

$

|

794,356

|

|

$

|

564,338

|

|

40.8

|

%

|

$

|

374

|

|

$

|

371

|

|

0.8

|

%

|

||||||||

|

Central

|

2,018

|

|

2,222

|

|

(9.2

|

)

|

912,623

|

|

980,658

|

|

(6.9

|

)

|

452

|

|

441

|

|

2.5

|

|

||||||||||||

|

West

|

2,539

|

|

1,985

|

|

27.9

|

|

1,262,101

|

|

1,060,129

|

|

19.1

|

|

497

|

|

534

|

|

(6.9

|

)

|

||||||||||||

|

Total

|

6,681

|

|

5,728

|

|

16.6

|

%

|

$

|

2,969,080

|

|

$

|

2,605,125

|

|

14.0

|

%

|

$

|

444

|

|

$

|

455

|

|

(2.4

|

)%

|

||||||||

|

(1)

|

Net sales orders represent the number and dollar value of new sales contracts executed with customers, net of cancellations.

|

|

|

Year Ended December 31,

|

|||||

|

|

Cancellation Rate

(1)

|

|||||

|

|

2015

|

2014

|

||||

|

East

|

12.4

|

%

|

12.1

|

%

|

||

|

Central

|

16.6

|

|

12.2

|

|

||

|

West

|

13.0

|

|

15.1

|

|

||

|

Total Company

|

13.9

|

%

|

13.2

|

%

|

||

|

(1)

|

Cancellation rate represents the number of canceled sales orders divided by gross sales orders.

|

|

|

As of December 31,

|

|||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

Sold Homes in Backlog

(1)

|

Sales Value

|

Average Selling Price

|

|||||||||||||||||||||||||||

|

|

2015

|

2014

|

Change

|

2015

|

2014

|

Change

|

2015

|

2014

|

Change

|

|||||||||||||||||||||

|

East

|

875

|

|

557

|

|

57.1

|

%

|

$

|

358,978

|

|

$

|

259,622

|

|

38.3

|

%

|

$

|

410

|

|

$

|

466

|

|

(12.0

|

)%

|

||||||||

|

Central

|

1,030

|

|

1,152

|

|

(10.6

|

)

|

519,251

|

|

547,226

|

|

(5.1

|

)

|

504

|

|

475

|

|

6.1

|

|

||||||||||||

|

West

|

1,027

|

|

543

|

|

89.1

|

|

514,744

|

|

292,919

|

|

75.7

|

|

501

|

|

539

|

|

(7.1

|

)

|

||||||||||||

|

Total

|

2,932

|

|

2,252

|

|

30.2

|

%

|

$

|

1,392,973

|

|

$

|

1,099,767

|

|

26.7

|

%

|

$

|

475

|

|

$

|

488

|

|

(2.7

|

)%

|

||||||||

|

|

Year Ended December 31,

|

|||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

Homes Closed

|

Sales Value

|

Average Selling Price

|

|||||||||||||||||||||||||||

|

|

2015

|

2014

|

Change

|

2015

|

2014

|

Change

|

2015

|

2014

|

Change

|

|||||||||||||||||||||

|

East

|

2,065

|

|

1,479

|

|

39.6

|

%

|

$

|

809,324

|

|

$

|

546,045

|

|

48.2

|

%

|

$

|

392

|

|

$

|

369

|

|

6.2

|

%

|

||||||||

|

Central

|

2,140

|

|

2,099

|

|

2.0

|

|

990,925

|

|

958,096

|

|

3.4

|

|

463

|

|

456

|

|

1.5

|

|

||||||||||||

|

West

|

2,106

|

|

2,064

|

|

2.0

|

|

1,089,719

|

|

1,115,417

|

|

(2.3

|

)

|

517

|

|

540

|

|

(4.3

|

)

|

||||||||||||

|

Total

|

6,311

|

|

5,642

|

|

11.9

|

%

|

$

|

2,889,968

|

|

$

|

2,619,558

|

|

10.3

|

%

|

$

|

458

|

|

$

|

464

|

|

(1.3

|

)%

|

||||||||

|

|

Year Ended December 31,

|

||||||||||

|

(Dollars in thousands)

|

2015

|

2014

|

Change

|

||||||||

|

East

|

$

|

9,375

|

|

$

|

20,112

|

|

$

|

(10,737

|

)

|

||

|

Central

|

17,739

|

|

32,344

|

|

(14,605

|

)

|

|||||

|

West

|

16,656

|

|

925

|

|

15,731

|

|

|||||

|

Total

|

$

|

43,770

|

|

$

|

53,381

|

|

$

|

(9,611

|

)

|

||

|

|

East

|

Central

|

West

|

Total

|

|||||||||||||||||||||||||||

|

|

For the Year Ended December 31,

|

||||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

2015

|

2014

|

2015

|

2014

|

2015

|

2014

|

2015

|

2014

|

|||||||||||||||||||||||

|

Home closings revenue

|

$

|

809,324

|

|

$

|

546,045

|

|

$

|

990,925

|

|

$

|

958,096

|

|

$

|

1,089,719

|

|

$

|

1,115,417

|

|

$

|

2,889,968

|

|

$

|

2,619,558

|

|

|||||||

|

Cost of home closings

|

631,956

|

|

411,464

|

|

806,695

|

|

764,824

|

|

920,172

|

|

906,531

|

|

2,358,823

|

|

2,082,819

|

|

|||||||||||||||

|

Home closings gross margin

|

177,368

|

|

134,581

|

|

|

184,230

|

|

|

193,272

|

|

|

169,547

|

|

|

208,886

|

|

531,145

|

|

536,739

|

|

|||||||||||

|

Capitalized interest amortization

|

20,444

|

|

9,895

|

|

29,338

|

|

18,600

|

|

33,381

|

|

36,603

|

|

83,163

|

|

65,098

|

|

|||||||||||||||

|

Adjusted home closings gross margin

|

$

|

197,812

|

|

|

$

|

144,476

|

|

|

$

|

213,568

|

|

|

$

|

211,872

|

|

|

$

|

202,928

|

|

|

$

|

245,489

|

|

$

|

614,308

|

|

$

|

601,837

|

|

||

|

Home closings gross margin %

|

21.9

|

%

|

|

24.6

|

%

|

|

18.6

|

%

|

|

20.2

|

%

|

|

15.6

|

%

|

|

18.7

|

%

|

|

18.4

|

%

|

|

20.5

|

%

|

||||||||

|

Adjusted home closings gross margin %

|

24.4

|

%

|

|

26.5

|

%

|

|

21.6

|

%

|

|

22.1

|

%

|

|

18.6

|

%

|

|

22.0

|

%

|

|

21.3

|

%

|

|

23.0

|

%

|

||||||||

|

|

Year Ended

December 31,

|

||||||

|

(Dollars in thousands)

|

2015

|

2014

|

|||||

|

Mortgage operations revenue

|

$

|

43,082

|

|

$

|

35,493

|

|

|

|

Mortgage operations expense

|

25,536

|

|

19,671

|

|

|||

|

Mortgage operations gross margin

|

$

|

17,546

|

|

$

|

15,822

|

|

|

|

Mortgage operations margin %

|

40.7

|

%

|

44.6

|

%

|

|||

|

TMHF

Closed

Loans

|

Aggregate

Loan Volume

(in millions)

|

Capture

Rate

|

|||||||

|

December 31, 2015

|

3,675

|

|

$

|

1,219.0

|

|

79

|

%

|

||

|

December 31, 2014

|

3,312

|

|

$

|

1,097.7

|

|

74

|

%

|

||

|

•

|

Borrowings under our Revolving Credit Facility (as defined below);

|

|

•

|

Our various series of Senior Notes (as defined below);

|

|

•

|

Mortgage warehouse facilities;

|

|

•

|

Project-level financing (including non-recourse loans);

|

|

•

|

Performance, payment and completion surety bonds, and letters of credit; and

|

|

•

|

Cash generated from operations.

|

|

•

|

Cash generated from operations; and

|

|

•

|

Borrowings under our Revolving Credit Facility.

|

|

As of December 31,

|

||||||||

|

(Dollars in thousands)

|

2016

|

2015

|

||||||

|

Total Cash, including Restricted Cash

|

$

|

301,812

|

|

$

|

127,468

|

|

||

|

Total Revolving Credit Facility

|

500,000

|

|

500,000

|

|

||||

|

Letters of Credit Outstanding

|

(31,903

|

)

|

(32,906

|

)

|

||||

|

Revolving Credit Facility Borrowings Outstanding

|

—

|

|

(115,000

|

)

|

||||

|

Revolving Credit Facility Availability

|

468,097

|

|

352,094

|

|

||||

|

Total Liquidity

|

$

|

769,909

|

|

$

|

479,562

|

|

||

|

(Dollars in thousands)

|

Date Issued

|

Principal

Amount

|

Initial Offering

Price

|

Interest

Rate

|

Original Net Proceeds

|

Original Debt

Issuance

Cost

|

|||||||||||||

|

Senior Notes due 2021

|

April 16, 2013

|

550,000

|

|

100.0

|

%

|

5.250

|

%

|

541,700

|

|

8,300

|

|

||||||||

|

Senior Notes due 2023

|

April 16, 2015

|

350,000

|

|

100.0

|

%

|

5.875

|

%

|

345,500

|

|

4,500

|

|

||||||||

|

Senior Notes due 2024

|

March 5, 2014

|

350,000

|

|

100.0

|

%

|

5.625

|

%

|

345,300

|

|

4,700

|

|

||||||||

|

Total

|

$

|

1,250,000

|

|

$

|

1,232,500

|

|

$

|

17,500

|

|

||||||||||

|

(Dollars in thousands)

|

At December 31, 2016

|

||||||||||||

|

Facility

|

Amount

Drawn

|

Facility

Amount

|

Interest Rate

|

Expiration Date

|

Collateral

(1)

|

||||||||

|

Flagstar

|

$

|

37,093

|

|

$

|

55,000

|

|

LIBOR + 2.5%

|

30 days written notice

|

Mortgage Loans

|

||||

|

Comerica

|

57,875

|

|

85,000

|

|

LIBOR + 2.25%

|

November 16, 2017

|

Mortgage Loans

|

||||||

|

J.P. Morgan

|

103,596

|

|

125,000

|

|

LIBOR + 2.375% to 2.5%

|

September 26, 2017

|

Mortgage Loans and Pledged Cash

|

||||||

|

Total

|

$

|

198,564

|

|

$

|

265,000

|

|

|||||||

|

|

At December 31, 2015

|

||||||||||||

|

Facility

|

Amount

Drawn

|

Facility

Amount

|

Interest Rate

|

Expiration Date

|

Collateral

(1)

|

||||||||

|

Flagstar

|

$

|

63,210

|

|

$

|

75,000

|

|

LIBOR + 2.5%

|

30 days written notice

|

Mortgage Loans

|

||||

|

Comerica

|

18,009

|

|

50,000

|

|

LIBOR + 2.25%

|

November 16, 2016

|

Mortgage Loans

|

||||||

|

J.P. Morgan

|

102,225

|

|

120,000

|

|

LIBOR + 2.375%

|

September 29, 2016

|

Mortgage Loans and Pledged Cash

|

||||||

|

Total

|

$

|

183,444

|

|

$

|

245,000

|

|

|||||||

|

(1)

|

The mortgage warehouse borrowings outstanding as of

December 31, 2016

and 2015, are collateralized by

$233.2 million

and

$201.7 million

, respectively, of mortgage loans held for sale, which comprise the balance of mortgage receivables.

|

|

|

As of December 31,

|

||||||

|

(Dollars in thousands)

|

2016

|

2015

|

|||||

|

Letters of credit

(1)

|

$

|

31,903

|

|

$

|

32,906

|

|

|

|

Surety bonds

|

270,943

|

|

361,941

|

|

|||

|

Total outstanding letters of credit and surety bonds

|

$

|

302,846

|

|

$

|

394,847

|

|

|

|

(Dollars in thousands)

|

Payments Due by Period

|

||||||||||||||||||

|

|

Totals

|

Less than

1 year

|

1-3 years

|

3-5 years

|

More than

5 years

|

||||||||||||||

|

Operating lease obligations

|

$

|

27,231

|

|

$

|

7,434

|

|

$

|

11,577

|

|

$

|

6,002

|

|

$

|

2,218

|

|

||||

|

Unrecognized tax benefit obligations including interest and penalties

|

4,379

|

|

—

|

|

4,379

|

|

—

|

|

—

|

|

|||||||||

|

Land purchase contracts and lot options

|

542,609

|

|

225,193

|

|

218,355

|

|

27,779

|

|

71,282

|

|

|||||||||

|

Senior notes

(1)

|

1,250,000

|

|

—

|

|

—

|

|

550,000

|

|

700,000

|

|

|||||||||

|

Other debt outstanding

(1)

|

349,049

|

|

268,570

|

|

66,952

|

|

13,027

|

|

500

|

|

|||||||||

|

Estimated interest expense

(2)

|

528,043

|

|

77,833

|

|

141,181

|

|

138,820

|

|

170,209

|

|

|||||||||

|

Totals

|

$

|

2,701,311

|

|

$

|

579,030

|

|

$

|

442,444

|

|

$

|

735,628

|

|

$