tnet-20210930

0000937098

December 31

2021

Q3

FALSE

1

0000937098

2021-01-01

2021-09-30

xbrli:shares

0000937098

2021-10-18

iso4217:USD

0000937098

tnet:ProfessionalServicesMember

2021-07-01

2021-09-30

0000937098

tnet:ProfessionalServicesMember

2020-07-01

2020-09-30

0000937098

tnet:ProfessionalServicesMember

2021-01-01

2021-09-30

0000937098

tnet:ProfessionalServicesMember

2020-01-01

2020-09-30

0000937098

tnet:InsuranceServicesMember

2021-07-01

2021-09-30

0000937098

tnet:InsuranceServicesMember

2020-07-01

2020-09-30

0000937098

tnet:InsuranceServicesMember

2021-01-01

2021-09-30

0000937098

tnet:InsuranceServicesMember

2020-01-01

2020-09-30

0000937098

2021-07-01

2021-09-30

0000937098

2020-07-01

2020-09-30

0000937098

2020-01-01

2020-09-30

iso4217:USD

xbrli:shares

0000937098

2021-09-30

0000937098

2020-12-31

0000937098

2021-06-30

0000937098

2020-06-30

0000937098

2019-12-31

0000937098

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2021-06-30

0000937098

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2020-06-30

0000937098

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2020-12-31

0000937098

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2019-12-31

0000937098

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2021-07-01

2021-09-30

0000937098

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2020-07-01

2020-09-30

0000937098

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2021-01-01

2021-09-30

0000937098

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2020-01-01

2020-09-30

0000937098

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2021-09-30

0000937098

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2020-09-30

0000937098

us-gaap:RetainedEarningsMember

2021-06-30

0000937098

us-gaap:RetainedEarningsMember

2020-06-30

0000937098

us-gaap:RetainedEarningsMember

2020-12-31

0000937098

us-gaap:RetainedEarningsMember

2019-12-31

0000937098

us-gaap:RetainedEarningsMember

2021-07-01

2021-09-30

0000937098

us-gaap:RetainedEarningsMember

2020-07-01

2020-09-30

0000937098

us-gaap:RetainedEarningsMember

2021-01-01

2021-09-30

0000937098

us-gaap:RetainedEarningsMember

2020-01-01

2020-09-30

0000937098

us-gaap:RetainedEarningsMember

2021-09-30

0000937098

us-gaap:RetainedEarningsMember

2020-09-30

0000937098

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-06-30

0000937098

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-06-30

0000937098

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-12-31

0000937098

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-12-31

0000937098

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-07-01

2020-09-30

0000937098

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-01-01

2020-09-30

0000937098

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-09-30

0000937098

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-09-30

0000937098

2020-09-30

tnet:segment

xbrli:pure

0000937098

us-gaap:NonUsMember

us-gaap:SalesRevenueNetMember

us-gaap:GeographicConcentrationRiskMember

2021-01-01

2021-09-30

0000937098

2020-04-01

2020-04-30

0000937098

2020-04-30

0000937098

us-gaap:HealthCareMember

2021-09-30

0000937098

us-gaap:HealthCareMember

2020-12-31

0000937098

us-gaap:CashAndCashEquivalentsMember

2021-09-30

0000937098

us-gaap:AvailableforsaleSecuritiesMember

2021-09-30

0000937098

us-gaap:CashAndCashEquivalentsMember

2020-12-31

0000937098

us-gaap:AvailableforsaleSecuritiesMember

2020-12-31

0000937098

tnet:PayrollFundsCollectedMember

us-gaap:CashAndCashEquivalentsMember

2021-09-30

0000937098

tnet:PayrollFundsCollectedMember

us-gaap:AvailableforsaleSecuritiesMember

2021-09-30

0000937098

tnet:PayrollFundsCollectedMember

2021-09-30

0000937098

tnet:PayrollFundsCollectedMember

us-gaap:CashAndCashEquivalentsMember

2020-12-31

0000937098

tnet:PayrollFundsCollectedMember

us-gaap:AvailableforsaleSecuritiesMember

2020-12-31

0000937098

tnet:PayrollFundsCollectedMember

2020-12-31

0000937098

tnet:HealthBenefitClaimsCollateralMember

us-gaap:CashAndCashEquivalentsMember

2021-09-30

0000937098

tnet:HealthBenefitClaimsCollateralMember

us-gaap:AvailableforsaleSecuritiesMember

2021-09-30

0000937098

tnet:HealthBenefitClaimsCollateralMember

2021-09-30

0000937098

tnet:HealthBenefitClaimsCollateralMember

us-gaap:CashAndCashEquivalentsMember

2020-12-31

0000937098

tnet:HealthBenefitClaimsCollateralMember

us-gaap:AvailableforsaleSecuritiesMember

2020-12-31

0000937098

tnet:HealthBenefitClaimsCollateralMember

2020-12-31

0000937098

us-gaap:CashAndCashEquivalentsMember

tnet:WorkersCompensationClaimsCollateralMember

2021-09-30

0000937098

us-gaap:AvailableforsaleSecuritiesMember

tnet:WorkersCompensationClaimsCollateralMember

2021-09-30

0000937098

tnet:WorkersCompensationClaimsCollateralMember

2021-09-30

0000937098

us-gaap:CashAndCashEquivalentsMember

tnet:WorkersCompensationClaimsCollateralMember

2020-12-31

0000937098

us-gaap:AvailableforsaleSecuritiesMember

tnet:WorkersCompensationClaimsCollateralMember

2020-12-31

0000937098

tnet:WorkersCompensationClaimsCollateralMember

2020-12-31

0000937098

us-gaap:CashAndCashEquivalentsMember

tnet:InsuranceCarriersSecurityDepositsMember

2021-09-30

0000937098

us-gaap:AvailableforsaleSecuritiesMember

tnet:InsuranceCarriersSecurityDepositsMember

2021-09-30

0000937098

tnet:InsuranceCarriersSecurityDepositsMember

2021-09-30

0000937098

us-gaap:CashAndCashEquivalentsMember

tnet:InsuranceCarriersSecurityDepositsMember

2020-12-31

0000937098

us-gaap:AvailableforsaleSecuritiesMember

tnet:InsuranceCarriersSecurityDepositsMember

2020-12-31

0000937098

tnet:InsuranceCarriersSecurityDepositsMember

2020-12-31

0000937098

us-gaap:AssetBackedSecuritiesMember

2021-09-30

0000937098

us-gaap:AssetBackedSecuritiesMember

2020-12-31

0000937098

us-gaap:CorporateDebtSecuritiesMember

2021-09-30

0000937098

us-gaap:CorporateDebtSecuritiesMember

2020-12-31

0000937098

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

2021-09-30

0000937098

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

2020-12-31

0000937098

us-gaap:USTreasurySecuritiesMember

2021-09-30

0000937098

us-gaap:USTreasurySecuritiesMember

2020-12-31

0000937098

us-gaap:CertificatesOfDepositMember

2021-09-30

0000937098

us-gaap:CertificatesOfDepositMember

2020-12-31

0000937098

us-gaap:OtherDebtSecuritiesMember

2021-09-30

0000937098

us-gaap:OtherDebtSecuritiesMember

2020-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2021-09-30

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2021-09-30

0000937098

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2021-09-30

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:AssetBackedSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:AssetBackedSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:AssetBackedSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:CorporateDebtSecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:CorporateDebtSecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:CorporateDebtSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2021-09-30

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2021-09-30

0000937098

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2021-09-30

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:OtherDebtSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:OtherDebtSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:OtherDebtSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:CertificatesOfDepositMember

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:CertificatesOfDepositMember

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:CertificatesOfDepositMember

us-gaap:FairValueMeasurementsRecurringMember

2021-09-30

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2020-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2020-12-31

0000937098

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2020-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:AssetBackedSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:AssetBackedSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

us-gaap:AssetBackedSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

us-gaap:CorporateDebtSecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

us-gaap:CorporateDebtSecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

us-gaap:CorporateDebtSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2020-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2020-12-31

0000937098

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:USTreasurySecuritiesMember

2020-12-31

0000937098

us-gaap:FairValueInputsLevel1Member

us-gaap:OtherDebtSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

us-gaap:FairValueInputsLevel2Member

us-gaap:OtherDebtSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

us-gaap:OtherDebtSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

tnet:A2029NotesPayableMember

2021-09-30

0000937098

us-gaap:InterestRateContractMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2020-12-31

0000937098

us-gaap:InterestRateContractMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2021-01-01

2021-09-30

0000937098

us-gaap:LoansPayableMember

tnet:A2018TermLoanAMember

2021-09-30

0000937098

us-gaap:LoansPayableMember

tnet:A2018TermLoanAMember

2020-12-31

0000937098

us-gaap:LoansPayableMember

tnet:A2029NotesPayableMember

2021-09-30

0000937098

us-gaap:LoansPayableMember

tnet:A2029NotesPayableMember

2020-12-31

0000937098

us-gaap:LoansPayableMember

tnet:A2018TermLoanAMember

2018-06-30

0000937098

us-gaap:RevolvingCreditFacilityMember

tnet:TwoThousandEighteenRevolverMember

2018-06-30

0000937098

us-gaap:SeniorNotesMember

tnet:A2029NotesPayableMember

2021-02-28

0000937098

us-gaap:SeniorNotesMember

tnet:A2029NotesPayableMember

tnet:FullRedemptionMember

us-gaap:DebtInstrumentRedemptionPeriodOneMember

2021-02-01

2021-02-28

0000937098

us-gaap:SeniorNotesMember

tnet:A2029NotesPayableMember

us-gaap:DebtInstrumentRedemptionPeriodOneMember

tnet:PartialRedemptionMember

2021-02-01

2021-02-28

0000937098

us-gaap:SeniorNotesMember

tnet:A2029NotesPayableMember

us-gaap:DebtInstrumentRedemptionPeriodTwoMember

2021-02-01

2021-02-28

0000937098

us-gaap:DebtInstrumentRedemptionPeriodThreeMember

us-gaap:SeniorNotesMember

tnet:A2029NotesPayableMember

2021-02-01

2021-02-28

0000937098

us-gaap:SeniorNotesMember

tnet:A2029NotesPayableMember

us-gaap:DebtInstrumentRedemptionPeriodFourMember

2021-02-01

2021-02-28

0000937098

tnet:A2021RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

us-gaap:RevolvingCreditFacilityMember

2021-02-28

0000937098

tnet:A2021RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

us-gaap:RevolvingCreditFacilityMember

2021-09-30

0000937098

srt:MinimumMember

tnet:A2021RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

us-gaap:RevolvingCreditFacilityMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2021-02-01

2021-02-28

0000937098

srt:MaximumMember

tnet:A2021RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

us-gaap:RevolvingCreditFacilityMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2021-02-01

2021-02-28

0000937098

us-gaap:BaseRateMember

srt:MinimumMember

tnet:A2021RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

us-gaap:RevolvingCreditFacilityMember

2021-02-01

2021-02-28

0000937098

us-gaap:BaseRateMember

srt:MaximumMember

tnet:A2021RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

us-gaap:RevolvingCreditFacilityMember

2021-02-01

2021-02-28

0000937098

tnet:A2021RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

us-gaap:FederalFundsEffectiveSwapRateMember

us-gaap:RevolvingCreditFacilityMember

2021-02-01

2021-02-28

0000937098

tnet:A2021RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

us-gaap:RevolvingCreditFacilityMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2021-02-01

2021-02-28

0000937098

tnet:A2021RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

us-gaap:RevolvingCreditFacilityMember

tnet:CreditRatingBelowInvestmentGradeMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2021-02-01

2021-02-28

0000937098

us-gaap:BaseRateMember

tnet:A2021RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

us-gaap:RevolvingCreditFacilityMember

tnet:CreditRatingBelowInvestmentGradeMember

2021-02-01

2021-02-28

tnet:retirementPlan

0000937098

2020-09-29

0000937098

tnet:TimeBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2021-01-01

2021-09-30

0000937098

srt:MinimumMember

tnet:TimeBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2021-01-01

2021-09-30

0000937098

srt:MaximumMember

tnet:TimeBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2021-01-01

2021-09-30

0000937098

tnet:PerformanceBasedRestrictedStockUnitsandRestrictedStockAwardsMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2021-01-01

2021-09-30

0000937098

tnet:TimeBasedRestrictedStockUnitsMember

2020-12-31

0000937098

tnet:TimeBasedRestrictedStockAwardsMember

2020-12-31

0000937098

tnet:TimeBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2020-12-31

0000937098

tnet:TimeBasedRestrictedStockUnitsMember

2021-01-01

2021-09-30

0000937098

tnet:TimeBasedRestrictedStockAwardsMember

2021-01-01

2021-09-30

0000937098

tnet:TimeBasedRestrictedStockUnitsMember

2021-09-30

0000937098

tnet:TimeBasedRestrictedStockAwardsMember

2021-09-30

0000937098

tnet:TimeBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2021-09-30

0000937098

tnet:PerformanceBasedRestrictedStockUnitsMember

2020-12-31

0000937098

tnet:PerformanceBasedRestrictedStockAwardsMember

2020-12-31

0000937098

tnet:PerformanceBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2020-12-31

0000937098

tnet:PerformanceBasedRestrictedStockUnitsMember

2021-01-01

2021-09-30

0000937098

tnet:PerformanceBasedRestrictedStockAwardsMember

2021-01-01

2021-09-30

0000937098

tnet:PerformanceBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2021-01-01

2021-09-30

0000937098

tnet:PerformanceBasedRestrictedStockUnitsMember

2021-09-30

0000937098

tnet:PerformanceBasedRestrictedStockAwardsMember

2021-09-30

0000937098

tnet:PerformanceBasedRestrictedStockUnitsandRestrictedStockAwardsMember

2021-09-30

0000937098

us-gaap:CostOfSalesMember

2021-07-01

2021-09-30

0000937098

us-gaap:CostOfSalesMember

2020-07-01

2020-09-30

0000937098

us-gaap:CostOfSalesMember

2021-01-01

2021-09-30

0000937098

us-gaap:CostOfSalesMember

2020-01-01

2020-09-30

0000937098

us-gaap:SellingAndMarketingExpenseMember

2021-07-01

2021-09-30

0000937098

us-gaap:SellingAndMarketingExpenseMember

2020-07-01

2020-09-30

0000937098

us-gaap:SellingAndMarketingExpenseMember

2021-01-01

2021-09-30

0000937098

us-gaap:SellingAndMarketingExpenseMember

2020-01-01

2020-09-30

0000937098

us-gaap:GeneralAndAdministrativeExpenseMember

2021-07-01

2021-09-30

0000937098

us-gaap:GeneralAndAdministrativeExpenseMember

2020-07-01

2020-09-30

0000937098

us-gaap:GeneralAndAdministrativeExpenseMember

2021-01-01

2021-09-30

0000937098

us-gaap:GeneralAndAdministrativeExpenseMember

2020-01-01

2020-09-30

0000937098

tnet:SystemsDevelopmentAndProgrammingCostsMember

2021-07-01

2021-09-30

0000937098

tnet:SystemsDevelopmentAndProgrammingCostsMember

2020-07-01

2020-09-30

0000937098

tnet:SystemsDevelopmentAndProgrammingCostsMember

2021-01-01

2021-09-30

0000937098

tnet:SystemsDevelopmentAndProgrammingCostsMember

2020-01-01

2020-09-30

0000937098

us-gaap:RestrictedStockMember

2021-07-01

2021-09-30

0000937098

us-gaap:RestrictedStockMember

2020-07-01

2020-09-30

0000937098

us-gaap:RestrictedStockMember

2021-01-01

2021-09-30

0000937098

us-gaap:RestrictedStockMember

2020-01-01

2020-09-30

0000937098

us-gaap:StockOptionMember

2021-07-01

2021-09-30

0000937098

us-gaap:StockOptionMember

2020-07-01

2020-09-30

0000937098

us-gaap:StockOptionMember

2021-01-01

2021-09-30

0000937098

us-gaap:StockOptionMember

2020-01-01

2020-09-30

0000937098

us-gaap:EmployeeStockMember

2021-07-01

2021-09-30

0000937098

us-gaap:EmployeeStockMember

2020-07-01

2020-09-30

0000937098

us-gaap:EmployeeStockMember

2021-01-01

2021-09-30

0000937098

us-gaap:EmployeeStockMember

2020-01-01

2020-09-30

0000937098

us-gaap:InternalRevenueServiceIRSMember

2021-01-01

2021-09-30

0000937098

us-gaap:InternalRevenueServiceIRSMember

2021-09-30

0000937098

2019-01-18

2019-01-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

10-Q

(Mark One)

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended

September 30, 2021

or

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from

to

Commission File Number:

001-36373

TRINET GROUP, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

95-3359658

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

One Park Place,

|

Suite 600

|

|

|

|

Dublin,

|

CA

|

|

94568

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (

510

)

352-5000

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock par value $0.000025 per share

|

TNET

|

New York Stock Exchange

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes

x

No

o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes

x

No

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

x

|

Accelerated filer

|

o

|

|

|

|

|

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

☐

|

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes

o

No

o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

☐

No

x

The number of shares of Registrant’s Common Stock outstanding as of October 18, 2021 was

65,749,724

.

TRINET GROUP, INC.

Form 10-Q - Quarterly Report

For the Quarterly Period Ended September 30, 2021

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

Form 10-Q

Cross Reference

|

Page

|

|

|

|

|

|

|

|

|

|

|

Part I, Item 1.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part I, Item 2.

|

|

|

|

Part I, Item 3.

|

|

|

|

Part I, Item 4.

|

|

|

|

Part II, Item 1.

|

|

|

Risk Factors

|

Part II, Item 1A.

|

|

|

|

Part II, Item 2.

|

|

|

|

Part II, Item 3.

|

|

|

|

Part II, Item 4.

|

|

|

|

Part II, Item 5.

|

|

|

|

Part II, Item 6.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Glossary of Acronyms and Abbreviations

Acronyms and abbreviations are used throughout this report, particularly in Part I, Item 1. Unaudited Condensed Consolidated Financial Statements and Part I, Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2021 Credit Program

|

A 2021 program potentially provide credits to certain 2021 customers, subject to certain predefined conditions and based on the existence of certain pandemic related excess health care cost savings.

|

|

2018 Term Loan

|

Our $425 million term loan A that we entered into in June 2018

|

|

AFS

|

Available-for-sale

|

|

|

|

|

|

|

|

CARES Act

|

Coronavirus Aid Relief and Economic Security Act

|

|

|

|

|

CEO

|

Chief Executive Officer

|

|

CFO

|

Chief Financial Officer

|

|

COBRA

|

Consolidated Omnibus Budget Reconciliation Act

|

|

COPS

|

Cost of providing services

|

|

|

|

|

COVID-19

|

Novel coronavirus

|

|

|

|

|

|

|

|

D&A

|

Depreciation and amortization expenses

|

|

EBITDA

|

Earnings before interest expense, taxes, depreciation and amortization of intangible assets

|

|

|

|

|

EPS

|

Earnings Per Share

|

|

ERISA

|

Employee Retirement Income Security Act

|

|

ESAC

|

Employer Services Assurance Corporation

|

|

|

|

|

ETR

|

Effective tax rate

|

|

|

|

|

FFCRA

|

Families First Coronavirus Response Act

|

|

G&A

|

General and administrative

|

|

GAAP

|

Generally Accepted Accounting Principles in the United States

|

|

|

|

|

|

|

|

HR

|

Human Resources

|

|

|

|

|

|

|

|

|

|

|

IRS

|

Internal Revenue Service

|

|

ICR

|

Insurance cost ratio

|

|

ISR

|

Insurance service revenues

|

|

|

|

|

|

|

|

LIBOR

|

London Inter-bank Offered Rate

|

|

|

|

|

|

|

|

MD&A

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

|

|

|

|

|

|

|

|

|

|

OE

|

Operating expenses

|

|

|

|

|

PEO

|

Professional Employer Organization

|

|

PFC

|

Payroll funds collected

|

|

|

|

|

PPP

|

Paycheck Protection Program, a loan program administered by the U.S. Small Business Administration

|

|

PSR

|

Professional service revenues

|

|

Recovery Credit

|

2020 Program to provide clients with one-time reductions against fees for future services

|

|

Reg FD

|

Regulation Fair Disclosure

|

|

ROU

|

Right-of-use

|

|

RSA

|

Restricted Stock Award

|

|

RSU

|

Restricted Stock Unit

|

|

SBC

|

Stock Based Compensation

|

|

S&M

|

Sales and marketing

|

|

S&P

|

Standard & Poor's

|

|

SD&P

|

Systems development and programming

|

|

SEC

|

U.S. Securities and Exchange Commission

|

|

SMB

|

Small and medium-size business

|

|

|

|

|

|

|

|

U.S.

|

United States

|

|

|

|

|

WSE

|

Worksite employee

|

|

YTD

|

Year to date

|

|

|

|

|

|

|

|

|

|

|

|

FORWARD LOOKING STATEMENTS AND OTHER FINANCIAL INFORMATION

|

|

Cautionary Note Regarding Forward-Looking Statements

For purposes of this Quarterly Report on Form 10-Q (Form 10-Q), the terms “TriNet,” “the Company,” “we,” “us” and “our” refer to TriNet Group, Inc., and its subsidiaries. This Form 10-Q contains statements that are not historical in nature, are predictive in nature, or that depend upon or refer to future events or conditions or otherwise contain forward-looking statements within the meaning of Section 21 of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements are often identified by the use of words such as, but not limited to, "ability," “anticipate,” “believe,” “can,” “continue,” “could,” “design,” “estimate,” “expect,” “forecast,” “hope,” "impact," “intend,” “may,” “outlook,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “strategy,” “target,” "value," “will,” “would” and similar expressions or variations intended to identify forward-looking statements. Examples of forward-looking statements include, among others, TriNet’s expectations regarding: our ability to support the economic recovery of our clients and SMBs; our ability to respond appropriately to the impact of COVID-19 on our business and our clients' businesses; the impact on our prospects, clients and business of our Connect 360 service model, the impact of our TriNet Financial Services Preferred product, and our 2nd annual TriNet PeopleForce conference; the effect that our offering of $500 million of our 3.50% senior notes and of our replacement of our existing revolving facility with our new $500 million revolving facility will have on our business; the timing and strategies we employ with respect to corporate investments and capital expenditures; expectations regarding medical utilization rates by our WSEs; the impact of the COVID-19 pandemic on regulations and government programs; the impact of our 2020 Recovery Credit program and our 2021 Credit Program and their suitability for generating client loyalty and retention; our ability to modify or develop service offerings to assist clients affected by COVID-19; the impact of our vertical approach; our ability to leverage our scale and industry HR experience to deliver vertical service offerings; the impact of our plans to continue to grow our client base; planned improvements to our technology platform; our ability to drive operating efficiencies and improve the client experience; the impact of our client service initiatives; the volume and severity of insurance claims and the impact of COVID-19 on those claims; metrics that may be indicators of future financial performance; the relative value of our benefit offerings versus those SMBs can independently obtain; the principal competitive drivers in our market; our plans to retain clients and manage client attrition; our investment strategy and its impact on our ability to generate future interest income, net income, and Adjusted EBITDA; seasonal trends and their impact on our business, including due to COVID-19; fluctuations in the period-to-period timing of when we incur certain operating expenses; the estimates and assumptions we use to prepare our financial statements; and other expectations, outlooks and forecasts on our future business, operational and financial performance.

Important factors that could cause actual results, level of activity, performance or achievements to differ materially from those expressed or implied by these forward-looking statements are discussed above and throughout our Annual Report on Form 10-K for the year ended December 31, 2020 filed with the SEC on February 16, 2021 (our 2020 Form 10-K), including those appearing under the heading “Risk Factors” in Item 1A, and under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 of our 2020 Form 10-K, those appearing under the heading “Risk Factors” in Part II, Item 1A of this Form 10-Q and under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Form 10-Q and our Form 10-Q filings for the quarters ended March 31, 2021 June 30, 2021, and those appearing in our other periodic filings with the SEC, and including risk factors associated with: the economic, health and business disruption caused by the COVID-19 pandemic; the impact of the COVID-19 pandemic on our clients and prospects, insurance costs and operations; the impact of the COVID-19 pandemic on the laws and regulations that impact our industry and clients; our ability to mitigate the business risks we face as a co-employer; our ability to manage unexpected changes in workers’ compensation and health insurance claims and costs by worksite employees; the effects of volatility in the financial and economic environment on the businesses that make up our client base and the concentration of our clients in certain geographies and industries; the impact of failures or limitations in the business systems we rely upon; the impact of our 2020 Recovery Credit program and 2021 Credit Program; adverse changes in our insurance coverage or our relationships with key insurance carriers; our ability to improve our technology to satisfy regulatory requirements and meet the expectations of our clients and manage client attrition; our ability to effectively integrate businesses we have acquired or may acquire in the future; our ability to effectively manage and improve our operational processes; our ability to attract and retain qualified personnel; the effects of increased competition and our ability to compete effectively; the impact on our business of cyber-attacks and security breaches; our ability to secure our information technology infrastructure and our confidential, sensitive and personal information; our ability to comply with constantly evolving data privacy and security laws; our ability to manage changes in, uncertainty regarding, or adverse application of the complex laws and regulations that govern our business; changing laws and regulations governing health insurance and employee benefits; our ability to be recognized as an employer of worksite employees under federal and state regulations; changes in the laws and regulations that govern what it means to be an employer, employee or independent contractor; our ability to comply

|

|

|

|

|

|

|

|

FORWARD LOOKING STATEMENTS AND OTHER FINANCIAL INFORMATION

|

|

with the laws and regulations that govern PEOs and other similar industries; the outcome of existing and future legal and tax proceedings; fluctuation in our results of operation and stock price due to factors outside of our control, such as the volume and severity of our workers’ compensation and health insurance claims and the amount and timing of our insurance costs, operating expenses and capital expenditure requirements; our ability to comply with the restrictions of our credit facility and meet our debt obligations; and the impact of concentrated ownership in our stock. Any of these factors could cause our actual results to differ materially from our anticipated results.

Forward-looking statements are not guarantees of future performance, but are based on management’s expectations as of the date of this Form 10-Q and assumptions that are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from our current expectations and any past results, performance or achievements. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

The information provided in this Form 10-Q is based upon the facts and circumstances known as of the date of this Form 10-Q, and any forward-looking statements made by us in this Form 10-Q speak only as of the date of this Form 10-Q. We undertake no obligation to revise or update any of the information provided in this Form 10-Q, except as required by law.

The MD&A of this Form 10-Q includes references to our performance measures presented in conformity with GAAP and other non-GAAP financial measures that we use to manage our business, to make planning decisions, to allocate resources and to use as performance measures in our executive compensation plans. Refer to the Non-GAAP Financial Measures within our MD&A for definitions and reconciliations from GAAP measures.

Website Disclosures

We use our website (www.trinet.com) to announce material non-public information to the public and to comply with our disclosure obligations under Regulation Fair Disclosure (Reg FD). We also use our website to communicate with the public about our Company, our services, and other matters. Our SEC filings, press releases and recent public conference calls and webcasts can also be found on our website. The information we post on our website could be deemed to be material information under Reg FD. We encourage investors and others interested in our Company to review the information we post on our website. Information contained in or accessible through our website is not a part of this report.

|

|

|

|

|

|

|

|

MANAGEMENT'S DISCUSSION AND ANALYSIS

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Executive Summary

Overview

TriNet is a leading provider of HR expertise, payroll services, employee benefits and employment risk mitigation services for SMBs. We deliver a comprehensive suite of services that help our clients administer and manage various HR-related needs and functions, such as compensation and benefits, payroll processing, employee data, health insurance and workers' compensation programs, and other transactional HR needs using our technology platform and HR, benefits and compliance expertise. We empower SMBs to focus on what matters most - growing their business.

We leverage our scale and industry HR experience to deliver our service offerings for SMBs in specific industry verticals. We believe our vertical approach is a key differentiator for us and creates additional value for our clients driven by service offerings that are tailored to address industry-specific HR needs. We offer six industry-tailored vertical services: TriNet Financial Services, TriNet Life Sciences, TriNet Main Street, TriNet Nonprofit, TriNet Professional Services, and TriNet Technology.

Operational Highlights

Our consolidated results for the nine months ended September 30, 2021 reflect our continuing efforts to serve our existing clients throughout the COVID-19 pandemic and to support the economic recovery of SMBs. We will continue to monitor and evaluate developments relating to the COVID-19 pandemic and will work to respond appropriately to the impact of COVID-19 on our business and our clients' businesses.

During the nine months ended September 30, 2021 we:

•

continued to grow total revenues as we achieved the highest Total WSEs in our history,

•

established our 2021 Credit Program to benefit our eligible clients,

•

hosted the 2nd annual TriNet PeopleForce, our showcase customer and prospect conference focused on business transformation, agility and innovation for small and medium-size businesses,

•

introduced TriNet Financial Services Preferred, a new top-tier version of our HR solution that addresses the critical HR needs of businesses in the financial services industry,

•

launched 'Connect 360', an innovative service model intended to better meet client needs, and

•

completed a $500 million senior notes offering, repaid and terminated our outstanding term loan, and replaced our existing revolving credit facility with a new $500 million revolving credit facility.

|

|

|

|

|

|

|

|

MANAGEMENT'S DISCUSSION AND ANALYSIS

|

|

Performance Highlights

Our results for the third quarter ended September 30, 2021 when compared to the same period of 2020 are noted below:

Q3 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$1.1B

|

|

$105M

|

|

86%

|

|

|

Total revenues

|

|

Operating income

|

|

Insurance cost ratio

|

|

|

18

|

%

|

increase

|

|

133

|

%

|

increase

|

|

(3)

|

%

|

decrease

|

|

|

|

|

|

|

|

|

|

|

|

|

$77M

|

|

$1.16

|

|

$87M

|

|

|

Net income

|

|

Diluted EPS

|

|

Adjusted Net income *

|

|

|

133

|

%

|

increase

|

|

142

|

%

|

increase

|

|

123

|

%

|

increase

|

|

|

|

|

|

|

|

|

|

|

|

|

347,502

|

|

351,267

|

|

|

|

|

Average WSEs

|

|

Total WSEs

|

|

|

|

|

9

|

%

|

increase

|

|

10

|

%

|

increase

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Non-GAAP measure. See definitions below under the heading "

Non-GAAP Financial Measures

".

|

We continued to achieve quarter-over-quarter revenue growth, reflecting our higher Average WSEs, rate increases and the $48 million decrease in the Recovery Credit recognized in 2021 compared to 2020.

During the third quarter of 2021, our Average WSEs increased 9% and total WSEs increased 10% compared to the same period in 2020, primarily as a result of continued hiring in our installed base.

Increased medical services utilization in the third quarter of 2021, combined with increased volume due to WSE growth, resulting in higher insurance costs compared to the same period in 2020.

The growth in total revenues, partially offset by increases in insurance costs and operating expenses, resulted in increases in our net income and Adjusted Net Income of 133% and 123%, respectively.

Our results for the nine months ended September 30, 2021 when compared to the same period of 2020 are noted below:

YTD 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$3.3B

|

|

$364M

|

|

84%

|

|

|

Total revenues

|

|

Operating income

|

|

Insurance cost ratio

|

|

|

11

|

%

|

increase

|

|

8

|

%

|

increase

|

|

1

|

%

|

increase

|

|

|

|

|

|

|

|

|

|

|

|

|

$269M

|

|

$4.03

|

|

$302M

|

|

|

Net income

|

|

Diluted EPS

|

|

Adjusted Net income *

|

|

|

8

|

%

|

increase

|

|

10

|

%

|

increase

|

|

10

|

%

|

increase

|

|

|

|

|

|

|

|

|

|

|

|

|

333,839

|

|

|

|

|

|

|

|

|

Average WSEs

|

|

|

|

|

|

|

|

|

3

|

%

|

increase

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Non-GAAP measure. See definitions below under the heading "

Non-GAAP Financial Measures

".

|

|

|

|

|

|

|

|

|

MANAGEMENT'S DISCUSSION AND ANALYSIS

|

|

Results of Operations

The following table summarizes our results of operations for the third quarter and nine months ended September 30, 2021 when compared to the same periods of 2020. For details of the critical accounting judgments and estimates that could affect our Results of Operations, see the Critical Accounting Judgments and Estimates section within the MD&A in Item 7 of our 2020 Form 10-K.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30,

|

|

Nine Months Ended September 30,

|

|

(in millions, except operating metrics data)

|

2021

|

2020

|

% Change

|

|

2021

|

2020

|

% Change

|

|

Income Statement Data:

|

|

|

|

|

|

|

|

|

Professional service revenues

|

$

|

156

|

|

$

|

126

|

|

24

|

%

|

|

$

|

465

|

|

$

|

403

|

|

15

|

%

|

|

Insurance service revenues

|

992

|

|

849

|

|

17

|

|

|

2,843

|

|

2,568

|

|

11

|

|

|

Total revenues

|

1,148

|

|

975

|

|

18

|

|

|

3,308

|

|

2,971

|

|

11

|

|

|

Insurance costs

|

851

|

|

759

|

|

12

|

|

|

2,400

|

|

2,137

|

|

12

|

|

|

Operating expenses

|

192

|

|

171

|

|

12

|

|

|

544

|

|

496

|

|

10

|

|

|

Total costs and operating expenses

|

1,043

|

|

930

|

|

12

|

|

|

2,944

|

|

2,633

|

|

12

|

|

|

Operating income

|

105

|

|

45

|

|

133

|

|

|

364

|

|

338

|

|

8

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

Interest expense, bank fees and other

|

(5)

|

|

(8)

|

|

(38)

|

|

|

(15)

|

|

(16)

|

|

(6)

|

|

|

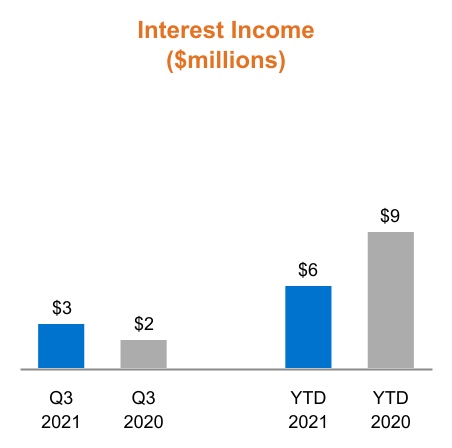

Interest income

|

3

|

|

2

|

|

50

|

|

|

6

|

|

9

|

|

(33)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before provision for income taxes

|

103

|

|

39

|

|

164

|

|

|

355

|

|

331

|

|

7

|

|

|

Income taxes

|

26

|

|

6

|

|

333

|

|

|

86

|

|

81

|

|

6

|

|

|

Net income

|

$

|

77

|

|

$

|

33

|

|

133

|

%

|

|

$

|

269

|

|

$

|

250

|

|

8

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flow Data:

|

|

|

|

|

|

|

|

|

Net cash used in operating activities

|

|

(16)

|

|

$

|

(40)

|

|

(60)

|

|

|

Net cash used in investing activities

|

|

(145)

|

|

(151)

|

|

(4)

|

|

|

Net cash provided by financing activities

|

|

20

|

|

77

|

|

(74)

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP measures

(1)

:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

|

$

|

132

|

|

69

|

|

91

|

|

|

$

|

449

|

|

$

|

413

|

|

9

|

|

|

Adjusted Net income

|

$

|

87

|

|

39

|

|

123

|

|

|

$

|

302

|

|

$

|

274

|

|

10

|

|

|

Corporate Operating Cash Flows

|

|

$

|

334

|

|

$

|

308

|

|

8

|

|

|

|

|

|

|

|

|

|

|

|

Operating Metrics:

|

|

|

|

|

|

|

|

|

Insurance Cost Ratio

|

86

|

%

|

89

|

%

|

(3)

|

%

|

|

84

|

%

|

83

|

%

|

1

|

%

|

|

Average WSEs

|

347,502

|

|

317,737

|

|

9

|

%

|

|

333,839

|

|

322,595

|

|

3

|

%

|

|

Total WSEs

|

351,267

|

|

320,604

|

|

10

|

|

|

351,267

|

|

320,604

|

|

10

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Refer to Non-GAAP measures definitions and reconciliations from GAAP measures under the heading "

Non-GAAP Financial Measures

".

The following table summarizes our balance sheet data as of September 30, 2021 compared to December 31, 2020.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions)

|

September 30,

2021

|

|

December 31,

2020

|

|

% Change

|

|

|

Balance Sheet Data:

|

|

|

|

|

|

|

|

Working capital

|

$

|

645

|

|

|

$

|

290

|

|

|

122

|

|

%

|

|

Total assets

|

3,069

|

|

|

3,043

|

|

|

1

|

|

|

|

Debt

|

495

|

|

|

370

|

|

|

34

|

|

|

|

Total stockholders’ equity

|

809

|

|

|

607

|

|

|

33

|

|

|

|

|

|

|

|

|

|

|

MANAGEMENT'S DISCUSSION AND ANALYSIS

|

|

Non-GAAP Financial Measures

In addition to financial measures presented in accordance with GAAP, we monitor other non-GAAP financial measures that we use to manage our business, to make planning decisions, to allocate resources and to use as performance measures in our executive compensation plan. These key financial measures provide an additional view of our operational performance over the long-term and provide information that we use to maintain and grow our business.

The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation from, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with GAAP.

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Measure

|

Definition

|

How We Use The Measure

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

|

• Net income, excluding the effects of:

- income tax provision,

- interest expense, bank fees and other,

- depreciation,

- amortization of intangible assets, and

- stock based compensation expense.

|

• Provides period-to-period comparisons on a consistent basis and an understanding as to how our management evaluates the effectiveness of our business strategies by excluding certain non-cash charges such as depreciation and amortization, and stock-based compensation recognized based on the estimated fair values. We believe these charges are either not directly resulting from our core operations or not indicative of our ongoing operations.

• Enhances comparisons to prior periods and, accordingly, facilitates the development of future projections and earnings growth prospects.

• Provides a measure, among others, used in the determination of incentive compensation for management.

• We also sometimes refer to Adjusted EBITDA margin, which is the ratio of Adjusted EBITDA to total revenues.

|

|

Adjusted Net Income

|

• Net income, excluding the effects of:

- effective income tax rate

(1)

,

- stock based compensation,

- amortization of other intangible assets, net,

- non-cash interest expense

(2)

, and

- the income tax effect (at our effective tax rate

(1)

of these pre-tax adjustments.

|

• Provides information to our stockholders and board of directors to understand how our management evaluates our business, to monitor and evaluate our operating results, and analyze profitability of our ongoing operations and trends on a consistent basis by excluding certain non-cash charges.

|

|

Corporate Operating Cash Flows

|

• Net cash provided by (used in) operating activities, excluding the effects of:

- Assets associated with WSEs (accounts receivable, unbilled revenue, prepaid expenses and other current assets) and

- Liabilities associated with WSEs (client deposits and other client liabilities, accrued wages, payroll tax liabilities and other payroll withholdings, accrued health benefit costs, accrued workers' compensation costs, insurance premiums and other payables, and other current liabilities).

|

• Provides information that our stockholders and management can use to evaluate our cash flows from operations independent of the current assets and liabilities associated with our WSEs.

• Enhances comparisons to prior periods and, accordingly, used as a liquidity measure to manage liquidity between corporate and WSE related activities, and to help determine and plan our cash flow and capital strategies.

|

|

|

|

|

(1) Non-GAAP effective tax rate is 25.5% for 2021 and 2020, which excludes the income tax impact from stock-based compensation, changes in uncertain tax positions and nonrecurring benefits or expenses from federal legislative changes.

(2) Non-cash interest expense represents amortization and write-off of our debt issuance costs and loss on derivative.

|

|

|

|

|

|

|

|

MANAGEMENT'S DISCUSSION AND ANALYSIS

|

|

Reconciliation of GAAP to Non-GAAP Measures

The table below presents a reconciliation of Net income to Adjusted EBITDA:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30,

|

|

Nine Months Ended

September 30,

|

|

(in millions)

|

2021

|

2020

|

|

2021

|

2020

|

|

Net income

|

$

|

77

|

|

$

|

33

|

|

|

$

|

269

|

|

$

|

250

|

|

|

Provision for income taxes

|

26

|

|

6

|

|

|

86

|

|

81

|

|

|

Stock based compensation

|

13

|

|

11

|

|

|

37

|

|

31

|

|

|

Interest expense, bank fees and other

|

5

|

|

8

|

|

|

15

|

|

16

|

|

|

Depreciation and amortization of intangible assets

¹

|

11

|

|

11

|

|

|

42

|

|

35

|

|

|

Adjusted EBITDA

|

$

|

132

|

|

$

|

69

|

|

|

$

|

449

|

|

$

|

413

|

|

|

Adjusted EBITDA Margin

|

11.5

|

%

|

7.1

|

%

|

|

13.6

|

%

|

13.9

|

%

|

(1)

Amount includes impairment of customer relationship intangibles and amortization of cloud computing arrangements included in operating expenses.

The table below presents a reconciliation of Net income to Adjusted Net Income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30,

|

|

Nine Months Ended

September 30,

|

|

(in millions)

|

2021

|

2020

|

|

2021

|

2020

|

|

Net income

|

$

|

77

|

|

$

|

33

|

|

|

$

|

269

|

|

$

|

250

|

|

|

Effective income tax rate adjustment

|

—

|

|

(4)

|

|

|

(4)

|

|

(3)

|

|

|

Stock based compensation

|

13

|

|

11

|

|

|

37

|

|

31

|

|

|

Amortization of other intangible assets, net

¹

|

1

|

|

1

|

|

|

11

|

|

4

|

|

|

Non-cash interest expense

|

—

|

|

1

|

|

|

3

|

|

1

|

|

|

Income tax impact of pre-tax adjustments

|

(4)

|

|

(3)

|

|

|

(14)

|

|

(9)

|

|

|

Adjusted Net Income

|

$

|

87

|

|

$

|

39

|

|

|

$

|

302

|

|

$

|

274

|

|

(1)

Amount includes impairment of customer relationship intangibles.

The table below presents a reconciliation of net cash (used in) provided by operating activities to Corporate Operating Cash Flows:

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

September 30,

|

|

(in millions)

|

2021

|

2020

|

|

Net cash used in operating activities

|

$

|

(16)

|

|

$

|

(40)

|

|

|

Less: Change in WSE related other current assets

|

(50)

|

|

(103)

|

|

|

Less: Change in WSE related liabilities

|

(300)

|

|

(245)

|

|

|

Net cash used in operating activities - WSE

|

$

|

(350)

|

|

$

|

(348)

|

|

|

Net cash provided by operating activities - Corporate

|

$

|

334

|

|

$

|

308

|

|

|

|

|

|

|

|

|

|

MANAGEMENT'S DISCUSSION AND ANALYSIS

|

|

Operating Metrics

Worksite Employees (WSE)

Average WSE growth is a volume measure we use to monitor the performance of our business. Average WSEs increased 9% when comparing the third quarter of 2021 to the same period in 2020, primarily due to increased hiring in our installed base across all verticals in 2021, led by our Technology vertical. Our Recovery Credit program was designed to assist in the economic recovery of SMBs and to promote client loyalty and incentivize client retention. In the third quarter and nine months ended September 30, 2021, most of the hiring in our installed based was from clients that benefited from this program.

Total WSEs can be used to estimate our beginning WSEs for the next period and, as a result, can be used as an indicator of our potential future success in growing our business and retaining clients.

Anticipated revenues for future periods can diverge from the revenue expectation derived from Average WSEs or Total WSEs due to pricing differences across our HR solutions and services and the degree to which clients and WSEs elect to participate in our solutions during future periods. In addition to focusing on growing our Average WSE and Total WSE counts, we also focus on pricing strategies, benefit participation and service differentiation to expand our revenue opportunities. We report the impact of client and WSE participation differences as a change in mix.

In addition to focusing on retaining and growing our WSE base, we continue to review acquisition opportunities that would add appropriately to our scale. We continue to invest in efforts intended to enhance client experiences and manage attrition, through operational and process improvements.

Insurance Cost Ratio (ICR)

ICR is a performance measure calculated as the ratio of insurance costs to insurance service revenues. We believe that ICR promotes an understanding of our insurance cost trends and our ability to align our relative pricing to risk performance.

We purchase workers' compensation and health benefits coverage for our colleagues and WSEs. Under the insurance policies for this coverage, we bear claims costs up to a defined deductible amount. Our insurance costs, which comprise a significant portion of our overall costs, are significantly affected by our WSEs’ health and workers' compensation insurance claims experience. We set our insurance service fees for workers’ compensation and health benefits in advance for fixed benefit periods. As a result, increases in these insurance costs above our projections, reflected as a higher ICR, result in lower net income, and decreases in these insurance costs below our projections, reflected as a lower ICR, result in higher net income.

|

|

|

|

|

|

|

|

MANAGEMENT'S DISCUSSION AND ANALYSIS

|

|

Under our fully-insured workers' compensation insurance policies, we assume the risk for losses up to $1 million per claim occurrence (deductible layer). The ultimate cost of the workers’ compensation services provided cannot be known until all the claims are settled. Our ability to predict these costs is limited by unexpected increases in frequency or severity of claims, which can vary due to changes in the cost of treatments or claim settlements.

Under our risk-based health insurance policies, we assume the risk of variability in future health claims costs for our enrollees. This variability typically results from changing trends in the volume, severity and ultimate cost of medical and pharmaceutical claims, due to changes to the components of medical cost trend. These trends change, and other seasonal trends and variability may develop. As a result, it is difficult for us to predict our insurance costs with accuracy and a significant increase in these costs could have a material adverse effect on our business.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30,

|

|

Nine Months Ended September 30,

|

|

(in millions)

|

2021

|

2020

|

|

2021

|

2020

|

|

Insurance costs

|

$

|

851

|

|

$

|

759

|

|

|

$

|

2,400

|

|

$

|

2,137

|

|

|

Insurance service revenues

|

992

|

|

849

|

|

|

2,843

|

|

2,568

|

|

|

Insurance Cost Ratio

|

86

|

%

|

89

|

%

|

|

84

|

%

|

83

|

%

|

ICR decreased for the quarter due to the increase in insurance service revenues, resulting from higher Average WSEs, rate increases and the decrease in the Recovery Credit recognized, exceeding the increase in insurance costs.

ICR increased slightly for the nine months ended September 30, 2021 due to the increase in medical services utilization in 2021, combined with COVID-19 testing, treatment and vaccination costs, which together resulted in higher insurance costs. This was partially offset by the increase in insurance service revenues. While medical services utilization has increased in 2021, the ICR remains below pre-pandemic levels, as access to medical systems was constrained in certain regions due to the increase in hospitalizations arising from the COVID-19 Delta variant, reducing preventative and elective procedures.

Total Revenues

Our revenues consist of professional service revenues (PSR) and insurance service revenues (ISR). PSR represents fees charged to clients for processing payroll-related transactions on behalf of our clients, access to our HR expertise, employment and benefit law compliance services, and other HR-related services. ISR consists of insurance-related billings and administrative fees collected from clients and withheld from WSEs for workers' compensation insurance and health benefit insurance plans provided by third-party insurance carriers.

In April 2020, we created our Recovery Credit program to assist in the economic recovery of our existing SMB clients and enhance our ability to retain these clients. Eligible clients received one-time reductions against fees for future services, accounted for as a discount, to be received over the following 12 months.

As of June 30, 2021, we have fully recognized the $145 million maximum amount for the Recovery Credit and no further reduction to revenue will be recognized. The reduction in total revenue under the Recovery Credit program was estimated each period based on the timing of when eligible clients received the Recovery Credit and the ultimate amount of the total Recovery Credit. We did not recognize any reduction in total revenues in the third quarter of 2021 for the Recovery Credit, compared to a reduction of $48 million recognized in the third quarter of 2020.

|

|

|

|

|

|

|

|

MANAGEMENT'S DISCUSSION AND ANALYSIS

|

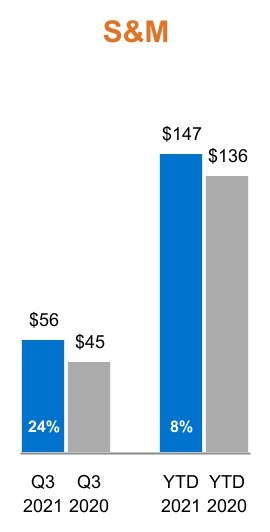

|