|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

|

|

|

x

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2016

|

||

|

Or

|

||

|

o

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from to

|

||

|

Delaware

(State or Other Jurisdiction of Incorporation or

Organization)

|

|

38-2687639

(IRS Employer Identification No.)

|

|

Title of Each Class:

|

|

Name of Each Exchange on Which Registered:

|

|

Common stock, $0.01 par value

|

|

NASDAQ Stock Market LLC

|

|

Large Accelerated Filer

x

|

Accelerated Filer

o

|

Non-accelerated Filer

o

(Do not check if a smaller reporting company)

|

Smaller Reporting Company

o

|

|||

|

|

|

Page No.

|

|

|

||

|

|

||

|

|

||

|

|

||

|

•

|

On June 30, 2015, we completed the spin-off of our Cequent businesses, comprised of the former Cequent Americas and Cequent Asia Pacific Europe Africa ("Cequent APEA") reportable segments, creating a new independent publicly traded company, Horizon Global Corporation ("Horizon"), through the distribution of 100% of the Company's interest in Horizon to holders of the Company's common stock.

|

|

•

|

During the third quarter of 2014, we ceased operations of our NI Industries business. NI Industries manufactured cartridge cases for the defense industry and was party to a U.S. Government facility maintenance contract. We received approximately $6.7 million for the sale of certain intellectual property and related inventory and tooling.

|

|

•

|

In the health, beauty and home care market segments, the products include foamers, lotion pumps, fine mist sprayers and other packaging solutions for the cosmetic, personal care and household product markets in North America, Europe, Asia, Latin America, Middle East, Australia and Africa, and pharmaceutical and personal care dispensers sold in Europe and Asia.

|

|

•

|

In the food and beverage markets, the products include specialty plastic closures for bottles and jars, and dispensing pumps for North America, Europe, Asia and Australia.

|

|

•

|

Strong Product Innovation

. We believe that Packaging's research and development capability and new product focus is a competitive advantage. For nearly 100 years, Packaging's product development programs have provided innovative and proprietary product solutions, such as the Visegrip® steel flange and plug closure, and the all-plastic, environmentally safe, self-venting FlexSpout® flexible pouring spout. Recent examples of innovation within specialty dispensing include a range of products designed to meet the requirements of the high-growth e-commerce retail sector, a measured-dose dispenser which provides exact doses of highly-concentrated liquids in the health and beauty market, and customized product solutions for customers in the global automotive aftermarket sector. Packaging continues to expand the capabilities of its Global Innovation Center located near Delhi, India as well as its centers in the United Kingdom and United States. These teams are focused on driving innovation across Packaging's broad range of dispensing and closure solutions for its customers in the industrial, food and beverage, and health, beauty and home care markets. Packaging's emphasis on highly-engineered packaging solutions and research and development has yielded numerous issued and enforceable patents, with many other patent applications pending. We believe that Packaging's innovative product solutions have evolved our product applications to meet existing customers' needs, as well as attract new customers in a variety of consumer end markets such as beverage, cosmetic, food, medical, nutraceutical, personal care and pharmaceutical.

|

|

•

|

Customized Solutions that Enhance Customer Loyalty and Relationships

. A significant portion of Packaging's products are customized designs for end-users, that are developed and engineered to address specific customer technical, branding and marketing, and sustainability needs thereby enabling our customers to stand out from their competitors. Packaging provides extensive in-house design, development and technical staff to provide solutions to customer requirements for closures and dispensing applications. For example, the customization of specialty plastic caps and closures including branding, unique colors, collar sizes, lining and venting results in substantial customer loyalty. The substantial investment in flexible manufacturing cells allows Packaging to offer both short lead times for high volume products and extensive customization for low order volumes, which provides significant advantages to our consumer goods customer base. In addition, Packaging provides customized dispensing solutions including unique pump design, precision metering, unique colors and special collar sizes to fit the customer's bottles. Packaging has also been successful in promoting the sale of complementary products in an effort to create preferred supplier status.

|

|

•

|

Leading Market Positions and Global Presence

. We believe that Packaging is a leading designer and manufacturer of plastic closure caps, drum enclosures, and dispensing systems, such as pumps, foamers and specialty sprayers. Packaging maintains a global network of manufacturing and distribution sites, to serve its increasingly global customer base. Packaging's global customers often desire supply chain capability and a flexible manufacturing footprint close to their end markets providing shorter supply chains, reduced carbon footprint and better sustainability. To serve our customers in Asia, we have manufacturing capacity and offer highly engineered dispensing solutions through locations in China, India and Vietnam, and increased our Asian market coverage. Additionally, Packaging opened a new facility in San Miguel de Allende, Mexico, to replace an older facility in Mexico and provide additional manufacturing capacity to support growth. The majority of Packaging's manufacturing facilities around the world have technologically advanced injection molding machines required to manufacture engineered dispensing and closure solutions, as well as automated, high-speed flexible assembly equipment for multiple component products.

|

|

•

|

Innovate New Products and New Applications

. Packaging has focused its research and development capabilities on consumer applications requiring special packaging forms, stylized containers and dispensing systems requiring a high degree of functionality and engineering, as well as continuously evolving its industrial applications. Many new product innovations take years to develop. Packaging has a consistent pipeline of new products ready for launch. For example, 34 patents were filed in 2016 and 52 patents were issued. Other recent examples include a range of products for the high-growth e-commerce retail sector, as well as various foamers, pumps and sprayers.

|

|

•

|

Globalize Product Opportunities

. Packaging successfully globalizes its products by localizing its expertise in product customization to meet regional market requirements. Our global network of manufacturing and distribution sites ensures customers have a global product standard manufactured locally resulting in shorter lead-time to provide products and support where our customers require. Our sales teams are focused to serve customers in the industrial, food and beverage, and health, beauty and home care markets, successfully selling products across the Packaging group. We believe that, as compared with our competitors, Packaging is able to offer a wider variety of products to our global customers with enhanced service and tooling support. We have entered into supply agreements with many of these customers based on our broad product offering.

|

|

•

|

Increase Global Presence

. Over the past few years, Packaging has increased its international manufacturing and sales presence, with advanced manufacturing capabilities in China, India, Vietnam and Mexico. We have also increased our sales coverage in Europe, China and India. By maintaining a presence in international locations, Packaging is focused on developing new markets and new applications for our products which capitalize on our global design and manufacturing strength.

|

|

•

|

Monogram

Aerospace Fasteners.

We believe Monogram Aerospace Fasteners ("Monogram") is a leader in permanent blind bolts and temporary fasteners used in commercial, business and military aircraft construction and assembly. Certain Monogram products contain patent protection, with additional patents pending. We believe Monogram is a leader in the development of blind bolt fastener technology for the aerospace industry, specifically in high-strength, rotary-actuated blind bolts that allow sections of aircraft to be joined together when access is limited to only one side of the airframe, providing cost efficiencies over conventional two piece fastening devices.

|

|

•

|

Allfast Fastening Systems.

We believe Allfast Fastening Systems ("Allfast") is a leading brand of solid and blind rivets, blind bolts, temporary fasteners and installation tools for the aerospace industry with content on substantially all commercial, defense and business aviation platforms in production and in service. Certain Allfast products contain patent protection.

|

|

•

|

Mac Fasteners

. The Mac Fasteners brand consists of alloy and stainless steel aerospace fasteners, globally utilized by original equipment manufacturers ("OEMs"), aftermarket repair companies, and commercial and military aircraft producers.

|

|

•

|

Martinic Engineering

. The Martinic Engineering ("Martinic") brand consists of highly-engineered, precision machined, complex parts for commercial and military aerospace applications, including auxiliary power units, as well as electrical hydraulic and pneumatic systems.

|

|

•

|

Broad Product Portfolio of Established Brands

. We believe that Aerospace is a leading designer and manufacturer of fasteners and other complex, machined components for the aerospace industry. The combination of the Monogram, Allfast and Mac Fasteners brands enables Aerospace to offer a broad range of fastener products covering a broad scope of complexity and price ranges, as well as providing scale to customers who continue to rationalize their supply base and prefer to deal with fewer, broader-ranged suppliers. In several of the product categories, including rotary actuated blind bolts and blind and solid rivets, Aerospace has a meaningful market share with well-known and established brands.

|

|

•

|

Product Innovation

. We believe that Aerospace's engineering, research and development capability and new product focus is a competitive advantage. For many years, Aerospace’s product development programs have provided innovative and proprietary product solutions. We believe our customer-focused approach which will provide effective technical solutions for our customers, drive the development of new products and create new opportunities for growth.

|

|

•

|

Leading Manufacturing Capabilities and Processes

. We believe that Aerospace is a leading manufacturer of precision engineered components for the aerospace industry. As a result of regulations and customer requirements for Aerospace, products need to be manufactured within tight tolerances and specifications, often out of hard-to-work-with materials including titanium, inconel and specialty steels. Many of Aerospace's products, facilities and manufacturing processes are required to be qualified and/or certified. Key certifications in Aerospace include: AS9100:2009 Revision C; ISO9001:2008; TSO; and NADCAP for non-destructive testing, heat treatment, wet processes and materials testing. While proprietary products and patents are important, having proprietary manufacturing processes and capabilities makes Aerospace's products difficult to replicate. We believe Aerospace's manufacturing processes, capabilities and quality focus create a competitive strength for the business.

|

|

•

|

Increase Margins.

The Aerospace segment is focused on expanding margins through a variety of initiatives, including, but not limited to, improved manufacturing efficiencies and throughput and executing on profitable growth strategies. Increasing sales over the existing fixed cost structure, implementing price improvement strategies, and adding higher margin products to the product portfolio will all improve margins. In addition, Aerospace is focused on improving productivity, cycle times and on-time delivery, while reducing its variable costs to manufacture and overall fixed cost structure.

|

|

•

|

Develop New Products.

The Aerospace segment has a history of successfully creating and introducing new products and there are currently new product initiatives underway. We focus on expanding our current products into new applications on the aircraft, as well as securing qualified products onto new programs. Aerospace products contain patent protection, with additional patents pending, as well as proprietary manufacturing processes and "know-how." Monogram has developed new fastener products that offer a flush break upon installation, a new Composi-Lite™ derivative affording significant installed weight savings in concert with fuel efficient aircraft designs, and is developing and testing other fasteners designs which offer improved clamping characteristics on composite structures. Aerospace has also expanded its fastener offerings to include existing fastening product applications, including a suite of collar families used in traditional two-sided assembly. Our close working relationship between our sales and engineering teams and our customers' engineering teams is key to developing future products desired and required by our customers.

|

|

•

|

Leverage Strengths and Integrate Across the Aerospace Brands

. The combined product sets of Monogram, Allfast and Mac Fasteners uniquely position us to benefit from platform-wide supply opportunities. In addition, our aerospace platform should benefit from leveraging combined purchasing activities and indirect labor, joint commercial and product development efforts, and sharing of better practices between previously separate businesses. Aerospace customers will benefit from a combined product portfolio of proprietary products and product development efforts. The addition of Allfast, Martinic and Mac Fasteners products to the portfolio over the past several years enables this segment to reach additional customers, including tier one suppliers to airframe OEMs and aftermarket repair companies, respectively. Monogram and Allfast can also cross-sell products into each other's legacy set of customers.

|

|

•

|

Comprehensive Product Offering.

We offer a full suite of gasket and bolt products to the petroleum refining, petrochemical, oil field and industrial markets. Over the years, Energy has expanded its product offering to include custom-manufactured, specialty bolts of various sizes and made-to-order configurations and other CNC-machined components, isolation gasket kits, capabilities to produce high quality sheet jointing used in the manufacture of soft gaskets, and PTFE for its chemical customers. While many competitors manufacture and distribute either gaskets or bolts, supplying both provides us with an advantage to customers who prefer to deal with fewer suppliers.

|

|

•

|

Established and Extensive Distribution Channels.

Our business utilizes an established hub-and-spoke distribution system whereby our primary manufacturing facilities supply products to our own branches and a highly knowledgeable network of worldwide distributors and licensees, which are located in close proximity to our primary customers. Our primary manufacturing facility is in Houston, Texas with company-owned branches strategically located around the world to serve our global customer base. Enabled by its branch network and close proximity to its customers, Energy's

ability to provide quick turn-around and customized solutions for its customers provides a competitive advantage. This established network of branches, enhanced by third-party distributors, allows us to add new customers in various locations and to increase distribution to existing customers. Our experienced in-house sales support teams work with our global network of distributors and licensees to create a strong market presence in all aspects of the oil, gas and petrochemical refining industries.

|

|

•

|

Leading Market Positions and Strong Brand Name.

We believe we are one of the largest gasket and bolt suppliers to the global energy market. We believe that Lamons is known as a quality brand and offers premium service to the industry. We also believe that our facilities have the latest proprietary technology and equipment to be able to produce urgent requirement gaskets and bolts locally to meet our customers' demands.

|

|

•

|

Optimizing its Footprint to Drive Lower-Costs.

Over the past 18 months, we have continued to work through reducing our cost structure through ongoing manufacturing, overhead and administrative productivity initiatives, global sourcing and selectively shifting manufacturing capabilities to our lower cost locations. We have performed a comprehensive review of our physical footprint and have closed or consolidated locations to reduce our and realign fixed cost structure with recent demand levels. We have also moved a portion of our gasket and fastener operations from our Houston facility to a facility in Reynosa, Mexico, and we will continue to evaluate costs, lead-times and service levels to customers to determine where certain products should be manufactured. We have also reconfigured our Houston facility to increase efficiency and lower costs, allowing for incremental capacity. In addition to our core domestic manufacturing facility in Houston, we have sourcing capabilities in China. We believe expanding our new Matrix® product will further increase profitability, as we manufacture our own sheet product compared to reliance on comparable products from our competitors.

|

|

•

|

Improve Operational Efficiency at all Locations.

We believe that there are additional opportunities to improve our operational efficiency through continued implementation of lean-based manufacturing initiatives. Through improved planning, inventory management, pricing and processes, Energy expects to improve its margins, while reducing product lead-times and increasing customer fill-rates.

|

|

•

|

Expand Engineered and Specialty Products Offering.

Over the past few years, we have launched several new highly-engineered and specialty products and have broadened our specialty bolt offering. Examples of new products include: WRI-LP gaskets, a hydrofluoric acid gasket solution; inhibitor gaskets designed to prevent corrosion in offshore platform flanges; IsoTek

TM

Gaskets, an engineered sealing solution for flanged pipe connections; hose products; and intelligent bolts which provide more reliable load indication. In

addition to providing revenue growth opportunities, specialty products tend to have higher margins than their standard counterparts.

|

|

•

|

Arrow Engine

. We believe that Arrow Engine

is a leading provider of natural gas powered engines and parts. Arrow Engine also provides gas compressors, gas production, meter runs, engine electronics and chemical pumps, all engineered for use in oil and natural gas production and other industrial and commercial markets. Arrow Engine distributes its products through a worldwide distribution network with a particularly strong presence in the United States and Canada. Arrow Engine owns the original equipment manufacturing rights to distribute engines and replacement parts for four main OEM engine lines and offers a wide variety of spare parts for an additional six engine lines, which are widely used in the energy industry and other industrial applications. Arrow Engine has developed a new line of products in the area of industrial engine spare parts for various industrial engines not manufactured by Arrow Engine, including selected engines manufactured and sold under the Caterpillar

®

, Waukesha

®

and Ajax

®

brands. Arrow Engine

has expanded its product line to include compressors and compressor packaging, gas production equipment, meter runs and other electronic products.

|

|

•

|

Norris Cylinder

. Norris Cylinder is a leading provider of a complete line of large, intermediate and small size, high-pressure and acetylene steel cylinders for the transportation, storage and dispensing of compressed gases. Norris Cylinder's large high-pressure seamless compressed gas cylinders are used principally for shipping, storing and dispensing oxygen, nitrogen, argon, helium and other gases for industrial and health care markets. In addition, Norris Cylinder offers a complete line of acetylene steel cylinders used to contain and dispense acetylene gas for the welding and cutting industries. Norris Cylinder markets cylinders primarily to major domestic and international industrial gas producers and distributors, welding equipment distributors and buying groups, as well as equipment manufacturers.

|

|

•

|

Strong Product Innovation.

The Engineered Components segment has a history of successfully creating and introducing new products and there are currently several significant product initiatives underway. Arrow Engine continues to introduce new products in the area of industrial engine spare parts for various industrial engines not manufactured by Arrow Engine, including selected engines manufactured and sold under the Caterpillar

®

, Waukesha

®

and Ajax

®

brands. Arrow Engine has also launched an offering of customizable compressors and gas production and meter run equipment, which are used by existing end customers in the oil and natural gas extraction markets, as well as development of a natural gas compressor used for compressed natural gas (CNG) filling stations. Norris Cylinder developed a process for manufacturing ISO cylinders from higher tensile strength steel which allows for a lighter weight cylinder at the same gas service pressure. Norris Cylinder was the first to gain United Nations certification by the US Department of Transportation for its ISO cylinders, and as such remains the first manufacturer approved to distribute ISO cylinders domestically. Norris Cylinder has also created new designs for seamless acetylene applications in marine and international markets

|

|

•

|

Entry into New Markets and Development of New Customers.

Engineered Components has opportunities to grow its businesses by offering its products to new customers, markets and geographies. Norris Cylinder is the only manufacturer of steel high-pressure and acetylene cylinders in North America. Norris Cylinder is selling its cylinders internationally into Europe, South Africa, and South and Central America, as well as pursuing new end markets such as cylinders for use as hydrogen fuel cells in storage (cell towers) and transport (fork trucks), in breathing air applications and in fire suppression. Arrow Engine continues to expand its product portfolio to serve new customers and new applications for oil and natural gas production in all areas of the industry, including shale drilling. Arrow Engine is also expanding international sales, particularly in Mexico, Indonesia and Venezuela.

|

|

•

|

Manage Capacity to Reflect Expected Demand Levels.

Norris Cylinder has deployed previously acquired assets in both its Huntsville, Alabama and Longview, Texas facilities to improve efficiency, mitigate risk and support its future expected growth, increasing its capacity for both large and small high pressure cylinders. Norris Cylinder is in process of installing equipment in an effort to produce higher volume cylinders more efficiently, while allowing higher technology products to be produced on the current forge asset. Norris Cylinder also flexes its costs in coordination with movements in demand. Arrow Engine has been unfavorably impacted by reductions in drilling activity driven by the decline in oil prices. In response, Arrow Engine has been focused on right-sizing its business to reflect the current demand levels by lowering costs and maximizing resources until the end market recovers. Where possible, Arrow Engine is variablizing the cost structure to respond quickly to end market changes and enhance flexibility, driving low cost sourcing efforts, and focusing on additional productivity and Lean initiatives.

|

|

•

|

our leverage may place us at a competitive disadvantage as compared with our less leveraged competitors and make us more vulnerable in the event of a downturn in general economic conditions or in any of our businesses;

|

|

•

|

our flexibility in planning for, or reacting to, changes in our businesses and the industries in which we operate may be limited;

|

|

•

|

a substantial portion of our cash flow from operations will be dedicated to the payment of interest and principal on our indebtedness, thereby reducing the funds available to us for operations, capital expenditures, acquisitions, future business opportunities or obligations to pay rent in respect of our operating leases; and

|

|

•

|

our operations are restricted by our debt instruments, which contain certain financial and operating covenants, and those restrictions may limit, among other things, our ability to borrow money in the future for working capital, capital expenditures, acquisitions, rent expense or other purposes.

|

|

•

|

pay dividends or redeem or repurchase capital stock;

|

|

•

|

incur additional indebtedness and grant liens;

|

|

•

|

make acquisitions and joint venture investments;

|

|

•

|

sell assets; and

|

|

•

|

make capital expenditures.

|

|

•

|

volatility of currency exchange between the U.S. dollar and currencies in international markets;

|

|

•

|

changes in local government regulations and policies including, but not limited to, foreign currency exchange controls or monetary policy, governmental embargoes, repatriation of earnings, expropriation of property, duty or tariff restrictions, investment limitations and tax policies;

|

|

•

|

political and economic instability and disruptions, including labor unrest, civil strife, acts of war, guerrilla activities, insurrection and terrorism;

|

|

•

|

legislation that regulates the use of chemicals;

|

|

•

|

disadvantages of competing against companies from countries that are not subject to U.S. laws and regulations, including the Foreign Corrupt Practices Act ("FCPA");

|

|

•

|

compliance with international trade laws and regulations, including export control and economic sanctions, such as anti-dumping duties;

|

|

•

|

difficulties in staffing and managing multi-national operations;

|

|

•

|

limitations on our ability to enforce legal rights and remedies;

|

|

•

|

tax inefficiencies in repatriating cash flow from non-U.S. subsidiaries that could affect our financial results and reduce our ability to service debt;

|

|

•

|

reduced protection of intellectual property rights; and

|

|

•

|

other risks arising out of foreign sovereignty over the areas where our operations are conducted.

|

|

Packaging

|

Energy

|

Aerospace

|

Engineered

Components

|

|||

|

United States:

Arkansas:

Atkins (1)

California:

Irwindale

(1)

Rohnert Park

(1)

Indiana:

Auburn Hamilton (1)

Ohio:

New Albany

(1)

International:

Germany:

Neunkirchen Mexico: Mexico City __ San Miguel de Allende (1) United Kingdom: Leicester

China:

Hangzhou (1)

Haining City

(1)

India:

Greater Noida

(1)

Baddi

Vietnam:

Thu Dau Mot

(1)

|

United States:

Texas:

Houston (1)

International:

Belgium:

Geel, Antwerp (1)

Canada:

Sarnia, Ontario (1)

India:

Bangalore (1)

Mexico:

Reynosa

(1)

Thailand:

Muang Rayong

(1)

United Kingdom:

Wolverhampton

(1)

|

United States:

California:

Commerce

(1)

Stanton

(1)

City of Industry

Kansas:

Ottawa

Arizona:

Tempe

(1)

Tolleson

|

United States:

Alabama:

Huntsville

Oklahoma: Tulsa

Texas:

Longview |

|||

|

(1)

|

Represents a leased facility. All such leases are operating leases.

|

|

|

Price range of

common stock

|

|||||||

|

|

High Price

|

Low Price

|

||||||

|

Year ended December 31, 2016

|

|

|

||||||

|

4th Quarter

|

$

|

24.10

|

|

$

|

17.26

|

|

||

|

3rd Quarter

|

$

|

20.12

|

|

$

|

17.00

|

|

||

|

2nd Quarter

|

$

|

18.74

|

|

$

|

15.63

|

|

||

|

1st Quarter

|

$

|

18.62

|

|

$

|

14.76

|

|

||

|

Year ended December 31, 2015

|

||||||||

|

4th Quarter

|

$

|

22.02

|

|

$

|

15.29

|

|

||

|

3rd Quarter

|

$

|

25.35

|

|

$

|

15.32

|

|

||

|

2nd Quarter

|

$

|

32.54

|

|

$

|

27.74

|

|

||

|

1st Quarter

|

$

|

31.85

|

|

$

|

26.59

|

|

||

______________

______________

|

(1)

|

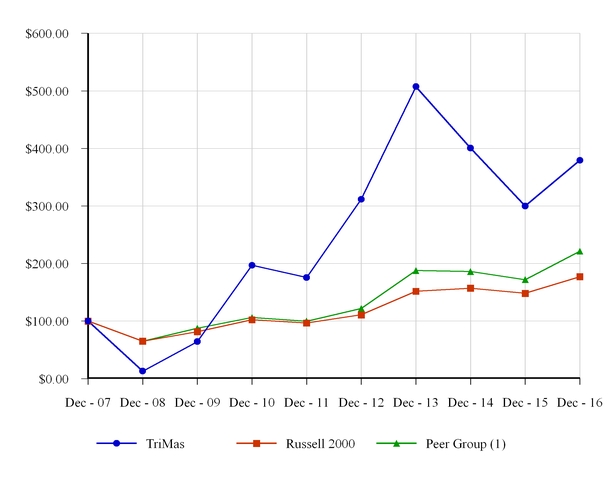

Includes Actuant Corporation, Carlisle Companies Inc., Crane Co., Dover Corporation, IDEX Corporation, Illinois Tool Works, Inc., SPX Corporation, Teleflex, Inc. and Kaydon Corp (included in peer group until being acquired in 2013).

|

|

|

Year ended December 31,

|

|||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||||

|

Statement of Operations Data:

|

|

|

|

|

|

|||||||||||||||

|

Net sales

|

$

|

794,020

|

|

$

|

863,980

|

|

$

|

887,300

|

|

$

|

799,700

|

|

$

|

738,550

|

|

|||||

|

Gross profit

|

210,480

|

|

236,110

|

|

237,010

|

|

226,040

|

|

211,750

|

|

||||||||||

|

Operating profit (loss)

(a)

|

(44,000

|

)

|

(4,250

|

)

|

86,650

|

|

97,210

|

|

88,400

|

|

||||||||||

|

Income (loss) from continuing operations

(a), (b)

|

(39,800

|

)

|

(28,660

|

)

|

46,890

|

|

59,240

|

|

13,750

|

|

||||||||||

|

Per Share Data:

|

|

|

|

|

|

|||||||||||||||

|

Basic:

|

|

|

|

|

|

|||||||||||||||

|

Continuing operations

(a)

|

$

|

(0.88

|

)

|

$

|

(0.64

|

)

|

$

|

1.03

|

|

$

|

1.34

|

|

$

|

0.30

|

|

|||||

|

Weighted average shares

|

45,407

|

|

45,124

|

|

44,882

|

|

40,926

|

|

37,521

|

|

||||||||||

|

Diluted:

|

|

|

|

|

|

|||||||||||||||

|

Continuing operations

(a)

|

$

|

(0.88

|

)

|

$

|

(0.64

|

)

|

$

|

1.02

|

|

$

|

1.32

|

|

$

|

0.30

|

|

|||||

|

Weighted average shares

|

45,407

|

|

45,124

|

|

45,269

|

|

41,396

|

|

37,949

|

|

||||||||||

|

|

Year ended December 31,

|

|||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||||

|

Balance Sheet Data:

|

|

|

|

|

|

|||||||||||||||

|

Total assets

(c), (d)

|

$

|

1,051,650

|

|

$

|

1,170,300

|

|

$

|

1,625,430

|

|

$

|

1,268,990

|

|

$

|

1,101,570

|

|

|||||

|

Total debt

(c), (d)

|

374,650

|

|

419,630

|

|

630,810

|

|

294,620

|

|

407,950

|

|

||||||||||

|

Goodwill and other intangibles

(a), (d)

|

529,000

|

|

652,790

|

|

757,500

|

|

445,840

|

|

401,370

|

|

||||||||||

|

(a)

|

During 2016, we recorded goodwill and indefinite-lived intangible asset impairment charges totaling approximately

$98.9 million

. During 2015, we recorded goodwill and indefinite-lived intangible asset impairment charges totaling approximately

$75.7 million

. See Note

7

, "

Goodwill and Other Intangibles Assets,

" included in Item 8, "

Financial Statements and Supplementary Data

," within this Form 10-K for further information.

|

|

(b)

|

During 2012, we incurred debt extinguishment costs of approximately $46.8 million related to the redemption of our former senior notes and the refinance of our previous credit agreement.

|

|

(c)

|

During 2015, we completed the spin-off of our Cequent businesses, thereby reducing the amount of our total assets and total debt as compared to prior periods. See Note

5

, "Discontinued Operations" included in Item 8, "Financial Statements and Supplementary Data," within this Form 10-K for further information.

|

|

(d)

|

During 2014, we acquired 100% of the equity interest in Allfast Fastening Systems, thereby increasing the amount of our total assets, total debt and goodwill and other intangibles. See Note

4

, "Acquisitions" and Note

11

, "Long-term Debt" included in Item 8, "Financial Statements and Supplementary Data," within this Form 10-K for further information.

|

|

|

Year ended December 31,

|

||||||||||||||||||||

|

2016

|

As a Percentage of Net Sales

|

2015

|

As a Percentage of Net Sales

|

2014

|

As a Percentage of Net Sales

|

||||||||||||||||

|

Net Sales

|

|

|

|

|

|

|

|||||||||||||||

|

Packaging

|

$

|

341,340

|

|

43.0

|

%

|

$

|

334,270

|

|

38.7

|

%

|

$

|

337,710

|

|

38.1

|

%

|

||||||

|

Aerospace

|

174,920

|

|

22.0

|

%

|

176,480

|

|

20.4

|

%

|

121,510

|

|

13.7

|

%

|

|||||||||

|

Energy

|

158,990

|

|

20.0

|

%

|

193,390

|

|

22.4

|

%

|

206,720

|

|

23.3

|

%

|

|||||||||

|

Engineered Components

|

118,770

|

|

15.0

|

%

|

159,840

|

|

18.5

|

%

|

221,360

|

|

24.9

|

%

|

|||||||||

|

Total

|

$

|

794,020

|

|

100.0

|

%

|

$

|

863,980

|

|

100.0

|

%

|

$

|

887,300

|

|

100.0

|

%

|

||||||

|

Gross Profit

|

|

|

|

||||||||||||||||||

|

Packaging

|

$

|

120,980

|

|

35.4

|

%

|

$

|

120,610

|

|

36.1

|

%

|

$

|

118,210

|

|

35.0

|

%

|

||||||

|

Aerospace

|

35,390

|

|

20.2

|

%

|

58,580

|

|

33.2

|

%

|

34,710

|

|

28.6

|

%

|

|||||||||

|

Energy

|

29,690

|

|

18.7

|

%

|

23,720

|

|

12.3

|

%

|

35,660

|

|

17.3

|

%

|

|||||||||

|

Engineered Components

|

24,420

|

|

20.6

|

%

|

33,200

|

|

20.8

|

%

|

48,430

|

|

21.9

|

%

|

|||||||||

|

Total

|

$

|

210,480

|

|

26.5

|

%

|

$

|

236,110

|

|

27.3

|

%

|

$

|

237,010

|

|

26.7

|

%

|

||||||

|

Selling, General and Administrative

|

|||||||||||||||||||||

|

Packaging

|

$

|

42,770

|

|

12.5

|

%

|

$

|

41,990

|

|

12.6

|

%

|

$

|

38,490

|

|

11.4

|

%

|

||||||

|

Aerospace

|

27,170

|

|

15.5

|

%

|

29,700

|

|

16.8

|

%

|

16,860

|

|

13.9

|

%

|

|||||||||

|

Energy

|

42,420

|

|

26.7

|

%

|

46,790

|

|

24.2

|

%

|

40,600

|

|

19.6

|

%

|

|||||||||

|

Engineered Components

|

8,870

|

|

7.5

|

%

|

11,750

|

|

7.4

|

%

|

14,190

|

|

6.4

|

%

|

|||||||||

|

Corporate expenses

|

32,480

|

|

N/A

|

|

32,120

|

|

N/A

|

|

36,450

|

|

N/A

|

|

|||||||||

|

Total

|

$

|

153,710

|

|

19.4

|

%

|

$

|

162,350

|

|

18.8

|

%

|

$

|

146,590

|

|

16.5

|

%

|

||||||

|

Operating Profit (Loss)

|

|||||||||||||||||||||

|

Packaging

|

$

|

77,840

|

|

22.8

|

%

|

$

|

78,470

|

|

23.5

|

%

|

$

|

77,850

|

|

23.1

|

%

|

||||||

|

Aerospace

|

(90,810

|

)

|

(51.9

|

)%

|

28,320

|

|

16.0

|

%

|

17,830

|

|

14.7

|

%

|

|||||||||

|

Energy

|

(13,840

|

)

|

(8.7

|

)%

|

(97,160

|

)

|

(50.2

|

)%

|

(6,660

|

)

|

(3.2

|

)%

|

|||||||||

|

Engineered Components

|

15,300

|

|

12.9

|

%

|

18,240

|

|

11.4

|

%

|

34,080

|

|

15.4

|

%

|

|||||||||

|

Corporate

|

(32,490

|

)

|

N/A

|

|

(32,120

|

)

|

N/A

|

|

(36,450

|

)

|

N/A

|

|

|||||||||

|

Total

|

$

|

(44,000

|

)

|

(5.5

|

)%

|

$

|

(4,250

|

)

|

(0.5

|

)%

|

$

|

86,650

|

|

9.8

|

%

|

||||||

|

Capital Expenditures

|

|||||||||||||||||||||

|

Packaging

|

$

|

19,880

|

|

5.8

|

%

|

$

|

13,670

|

|

4.1

|

%

|

$

|

13,730

|

|

4.1

|

%

|

||||||

|

Aerospace

|

3,950

|

|

2.3

|

%

|

5,010

|

|

2.8

|

%

|

4,430

|

|

3.6

|

%

|

|||||||||

|

Energy

|

2,800

|

|

1.8

|

%

|

7,610

|

|

3.9

|

%

|

2,690

|

|

1.3

|

%

|

|||||||||

|

Engineered Components

|

4,670

|

|

3.9

|

%

|

2,320

|

|

1.5

|

%

|

1,690

|

|

0.8

|

%

|

|||||||||

|

Corporate

|

30

|

|

N/A

|

|

50

|

|

N/A

|

|

460

|

|

N/A

|

|

|||||||||

|

Total

|

$

|

31,330

|

|

3.9

|

%

|

$

|

28,660

|

|

3.3

|

%

|

$

|

23,000

|

|

2.6

|

%

|

||||||

|

Depreciation and Amortization

|

|||||||||||||||||||||

|

Packaging

|

$

|

22,120

|

|

6.5

|

%

|

$

|

20,920

|

|

6.3

|

%

|

$

|

20,410

|

|

6.0

|

%

|

||||||

|

Aerospace

|

14,090

|

|

8.1

|

%

|

13,290

|

|

7.5

|

%

|

7,630

|

|

6.3

|

%

|

|||||||||

|

Energy

|

4,280

|

|

2.7

|

%

|

4,790

|

|

2.5

|

%

|

4,600

|

|

2.2

|

%

|

|||||||||

|

Engineered Components

|

4,090

|

|

3.4

|

%

|

4,200

|

|

2.6

|

%

|

4,460

|

|

2.0

|

%

|

|||||||||

|

Corporate

|

280

|

|

N/A

|

|

340

|

|

N/A

|

|

340

|

|

N/A

|

|

|||||||||

|

Total

|

$

|

44,860

|

|

5.6

|

%

|

$

|

43,540

|

|

5.0

|

%

|

$

|

37,440

|

|

4.2

|

%

|

||||||

|

•

|

the impact of lower oil prices, primarily impacting sales and profit levels in our Engineered Components and Energy reportable segments;

|

|

•

|

costs incurred and savings achieved from our FIP and other cost savings actions, spread across all of our reportable segments, with the largest amounts within our Energy reportable segment;

|

|

•

|

the impact of production and scheduling costs and inefficiencies, as well as the impact of lower distribution customer sales, all within our Aerospace reportable segment;

|

|

•

|

the impact of our November 2015 acquisition of the Tolleson, Arizona machined components facility from Parker-Hannifin Corporation within our Aerospace reportable segment;

|

|

•

|

the impact of a stronger U.S. dollar, primarily in our Packaging and Energy reportable segments;

|

|

•

|

the spin-off of the Cequent businesses in 2015, including costs incurred to affect and reclassifying to discontinued operations for all periods presented, and amending our credit agreement ("Credit Agreement"); and

|

|

•

|

an approximate $98.9 million goodwill and intangible asset impairment charge in 2016 in our Aerospace reportable segment and an approximate $74.1 million goodwill impairment charge in 2015 within our Energy and Engineered Components reportable segments.

|

|

|

Year ended December 31,

|

||||||

|

|

2016

|

2015

|

|||||

|

Corporate operating expenses

|

$

|

14.6

|

|

$

|

12.4

|

|

|

|

Employee costs and related benefits

|

17.9

|

|

19.7

|

|

|||

|

Corporate expenses

|

$

|

32.5

|

|

$

|

32.1

|

|

|

|

•

|

the spin-off of the Cequent businesses, including costs incurred to affect and reclassifying to discontinued operations for all periods presented, and amending our Credit Agreement;

|

|

•

|

the impact of lower oil prices, primarily in our Engineered Components and Energy reportable segments;

|

|

•

|

the impact of acquisitions (see below for the impact by reportable segment);

|

|

•

|

cash and non-cash costs incurred related to facility closures and consolidations, primarily within our Energy reportable segment;

|

|

•

|

an approximate

$74.1 million

goodwill impairment charge between our Energy and Engineered Components reportable segments;

|

|

•

|

the impact of the stronger U.S. dollar, primarily in our Packaging and Energy reportable segments; and

|

|

•

|

the impact of industrial slowing demand in the back half of 2015, primarily in our Packaging and Engineered Components reportable segments;

|

|

|

Year ended December 31,

|

|||||||

|

|

2015

|

2014

|

||||||

|

Corporate operating expenses

|

$

|

12.4

|

|

$

|

15.3

|

|

||

|

Employee costs and related benefits

|

19.7

|

|

21.2

|

|

||||

|

Corporate expenses

|

$

|

32.1

|

|

$

|

36.5

|

|

||

|

•

|

In

2016

, the Company generated

$82.9 million

in cash flows, based on the reported net loss from continuing operations of

$39.8 million

and after considering the effects of non-cash items related to impairment of goodwill and indefinite-lived intangible assets, losses on dispositions of businesses and other assets, depreciation, amortization, stock compensation and related changes in excess tax benefits, changes in deferred income taxes, debt financing and extinguishment costs and other, net. In

2015

, the Company generated

$92.8 million

based on the reported net loss from continuing operations of

$28.7 million

and after considering the effects of similar non-cash items.

|

|

•

|

Decreases in accounts receivable resulted in a source of cash of approximately

$8.0 million

and

$5.3 million

in

2016

and

2015

, respectively. The decreases in accounts receivable are primarily due to the decrease in year-over-year sales and the timing of such sales. In addition, a portion of the reduction in 2016 is as a result of improved cash collections, as we were able to lower days sales outstanding of receivables by three days during 2016.

|

|

•

|

We reduced our investment in inventory by approximately

$5.2 million

and

$3.3 million

in

2016

and

2015

, respectively, primarily as a result of needing to carry fewer items in stock given lower year-over-year sales levels. Our days sales in inventory remained relatively flat year-over-year given the reduced sales and inventory purchase levels.

|

|

•

|

Decreases in accounts payable and accrued liabilities resulted in a cash use of approximately

$18.1 million

and

$29.5 million

in

2016

and

2015

, respectively. The decrease in accounts payable and accrued liabilities is primarily a result of lower purchases of inventory and other supplies given the lower sales demand. Our days accounts payable on hand decreased by approximately nine days during 2016, primarily due to the timing of payments made to suppliers and mix of vendors and related terms.

|

|

Instrument

|

Amount

($ in millions) |

Maturity Date

|

Interest Rate

|

|||||

|

Credit Agreement

|

||||||||

|

Senior secured revolving credit facility

|

$

|

500.0

|

|

6/30/2020

|

LIBOR

(a)

plus 1.750%

(b)

|

|||

|

Senior secured term loan A facility

|

275.0

|

|

6/30/2020

|

LIBOR

(a)

plus 1.750%

(b)

|

||||

|

(a)

|

London Interbank Offered Rate ("LIBOR")

|

|

(b)

|

The interest rate spread is based upon the leverage ratio, as defined, as of the most recent determination date.

|

|

|

Year ended

December 31, 2016 |

|||

|

Net loss

|

$

|

(39,800

|

)

|

|

|

Bank stipulated adjustments:

|

||||

|

Interest expense, net (as defined)

|

13,720

|

|

||

|

Depreciation and amortization

|

44,860

|

|

||

|

Extraordinary non-cash charges

|

98,900

|

|

||

|

Non-cash compensation expense

(1)

|

6,940

|

|

||

|

Other non-cash expenses or losses

|

8,180

|

|

||

|

Non-recurring expenses or costs

(2)

|

11,400

|

|

||

|

Acquisition integration costs

(3)

|

1,460

|

|

||

|

Consolidated Bank EBITDA, as defined

|

$

|

145,660

|

|

|

|

|

December 31, 2016

|

||||

|

Total Consolidated Indebtedness, as defined

(4)

|

$

|

383,320

|

|

||

|

Consolidated Bank EBITDA, as defined

|

145,660

|

|

|||

|

Actual leverage ratio

|

2.63

|

|

x

|

||

|

Covenant requirement

|

3.50

|

|

x

|

||

|

|

December 31, 2016

|

|||

|

Interest expense, as defined

|

$

|

13,720

|

|

|

|

Interest income

|

(160

|

)

|

||

|

Non-cash amounts attributable to amortization of financing costs

|

(1,360

|

)

|

||

|

Total consolidated cash interest expense, as defined

|

$

|

12,200

|

|

|

|

|

December 31, 2016

|

|

|||

|

Consolidated Bank EBITDA, as defined

|

$

|

145,660

|

|

||

|

Total consolidated cash interest expense, as defined

|

12,200

|

|

|||

|

Actual interest expense coverage ratio

|

11.94

|

|

x

|

||

|

Covenant requirement

|

3.00

|

|

x

|

||

|

(1)

|

Non-cash compensation expenses resulting from the grant of restricted shares of common stock and common stock options.

|

|

(2)

|

Non-recurring costs and expenses related to cost savings projects, including restructuring and severance expenses, not to exceed $15 million in any fiscal year and $40.0 million in aggregate, subsequent to June 30, 2015.

|

|

(3)

|

Costs and expenses arising from the integration of any business acquired not to exceed $15 million in any fiscal year and $40 million in the aggregate.

|

|

(4)

|

Includes $4.0 million of acquisition related deferred purchase price as of December 31, 2016.

|

|

Payments Due by Periods

|

||||||||||||||||||||

|

Total

|

Less than

One Year

|

1 - 3 Years

|

3 - 5 Years

|

More than

5 Years

|

||||||||||||||||

|

Contractual cash obligations:

|

||||||||||||||||||||

|

Long-term debt and receivables facilities

|

$

|

379,370

|

|

$

|

13,810

|

|

$

|

36,190

|

|

$

|

329,370

|

|

$

|

—

|

|

|||||

|

Operating lease obligations

|

83,090

|

|

17,480

|

|

28,610

|

|

19,000

|

|

18,000

|

|

||||||||||

|

Benefit obligations

|

15,470

|

|

1,990

|

|

2,790

|

|

2,890

|

|

7,800

|

|

||||||||||

|

Interest obligations

(a)

|

28,750

|

|

8,710

|

|

16,280

|

|

3,760

|

|

—

|

|

||||||||||

|

Other

|

7,130

|

|

2,210

|

|

4,920

|

|

—

|

|

—

|

|

||||||||||

|

Total contractual obligations

|

$

|

513,810

|

|

$

|

44,200

|

|

$

|

88,790

|

|

$

|

355,020

|

|

$

|

25,800

|

|

|||||

|

(a)

|

Interest on our senior secured revolving credit facility and term loan A facility is based on LIBOR plus 175.0 basis points at

December 31, 2016

. Interest on our receivables facility is based on LIBOR plus 100.0 basis points at

December 31, 2016

. These rates were used to estimate our future interest obligations with respect to the long-term debt. These rates exclude the impact of our interest rate swap agreements. See Note

12

, "

Derivative Instruments

," included in Item 8, "

Financial Statements and Supplementary Data

," within this Form 10-K for additional information.

|

|

|

December 31,

|

|||||||

|

|

2016

|

2015

|

||||||

|

Assets

|

||||||||

|

Current assets:

|

|

|

||||||

|

Cash and cash equivalents

|

$

|

20,710

|

|

$

|

19,450

|

|

||

|

Receivables, net

|

111,570

|

|

121,990

|

|

||||

|

Inventories

|

160,460

|

|

167,370

|

|

||||

|

Prepaid expenses and other current assets

|

16,060

|

|

17,810

|

|

||||

|

Total current assets

|

308,800

|

|

326,620

|

|

||||

|

Property and equipment, net

|

179,160

|

|

181,130

|

|

||||

|

Goodwill

|

315,080

|

|

378,920

|

|

||||

|

Other intangibles, net

|

213,920

|

|

273,870

|

|

||||

|

Other assets

|

34,690

|

|

9,760

|

|

||||

|

Total assets

|

$

|

1,051,650

|

|

$

|

1,170,300

|

|

||

|

Liabilities and Shareholders' Equity

|

||||||||

|

Current liabilities:

|

|

|

||||||

|

Current maturities, long-term debt

|

$

|

13,810

|

|

$

|

13,850

|

|

||

|

Accounts payable

|

72,270

|

|

88,420

|

|

||||

|

Accrued liabilities

|

47,190

|

|

50,480

|

|

||||

|

Total current liabilities

|

133,270

|

|

152,750

|

|

||||

|

Long-term debt, net

|

360,840

|

|

405,780

|

|

||||

|

Deferred income taxes

|

5,910

|

|

11,260

|

|

||||

|

Other long-term liabilities

|

51,910

|

|

53,320

|

|

||||

|

Total liabilities

|

551,930

|

|

623,110

|

|

||||

|

Preferred stock $0.01 par: Authorized 100,000,000 shares;

Issued and outstanding: None |

—

|

|

—

|

|

||||

|

Common stock, $0.01 par: Authorized 400,000,000 shares;

Issued and outstanding: 45,520,598 shares at December 31, 2016 and 45,322,527 shares at December 31, 2015 |

460

|

|

450

|

|

||||

|

Paid-in capital

|

817,580

|

|

812,160

|

|

||||

|

Accumulated deficit

|

(293,920

|

)

|

(254,120

|

)

|

||||

|

Accumulated other comprehensive loss

|

(24,400

|

)

|

(11,300

|

)

|

||||

|

Total shareholders' equity

|

499,720

|

|

547,190

|

|

||||

|

Total liabilities and shareholders' equity

|

$

|

1,051,650

|

|

$

|

1,170,300

|

|

||

|

|

Year ended December 31,

|

|||||||||||

|

|

2016

|

2015

|

2014

|

|||||||||

|

Net sales

|

$

|

794,020

|

|

$

|

863,980

|

|

$

|

887,300

|

|

|||

|

Cost of sales

|

(583,540

|

)

|

(627,870

|

)

|

(650,290

|

)

|

||||||

|

Gross profit

|

210,480

|

|

236,110

|

|

237,010

|

|

||||||

|

Selling, general and administrative expenses

|

(153,710

|

)

|

(162,350

|

)

|

(146,590

|

)

|

||||||

|

Net loss on dispositions of property and equipment

|

(1,870

|

)

|

(2,330

|

)

|

(3,770

|

)

|

||||||

|

Impairment of goodwill and indefinite-lived intangible assets

|

(98,900

|

)

|

(75,680

|

)

|

—

|

|

||||||

|

Operating profit (loss)

|

(44,000

|

)

|

(4,250

|

)

|

86,650

|

|

||||||

|

Other expense, net:

|

||||||||||||

|

Interest expense

|

(13,720

|

)

|

(14,060

|

)

|

(9,590

|

)

|

||||||

|

Debt financing and extinguishment expenses

|

—

|

|

(1,970

|

)

|

(3,360

|

)

|

||||||

|

Other expense, net

|

(510

|

)

|

(1,840

|

)

|

(4,100

|

)

|

||||||

|

Other expense, net

|

(14,230

|

)

|

(17,870

|

)

|

(17,050

|

)

|

||||||

|

Income (loss) from continuing operations before income taxes

|

(58,230

|

)

|

(22,120

|

)

|

69,600

|

|

||||||

|

Income tax benefit (expense)

|

18,430

|

|

(6,540

|

)

|

(22,710

|

)

|

||||||

|

Income (loss) from continuing operations

|

(39,800

|

)

|

(28,660

|

)

|

46,890

|

|

||||||

|

Income (loss) from discontinued operations, net of income taxes

|

—

|

|

(4,740

|

)

|

22,390

|

|

||||||

|

Net income (loss)

|

(39,800

|

)

|

(33,400

|

)

|

69,280

|

|

||||||

|

Less: Net income attributable to noncontrolling interests

|

—

|

|

—

|

|

810

|

|

||||||

|

Net income (loss) attributable to TriMas Corporation

|

$

|

(39,800

|

)

|

$

|

(33,400

|

)

|

$

|

68,470

|

|

|||

|

Basic earnings (loss) per share attributable to TriMas Corporation:

|

||||||||||||

|

Continuing operations

|

$

|

(0.88

|

)

|

$

|

(0.64

|

)

|

$

|

1.03

|

|

|||

|

Discontinued operations

|

—

|

|

(0.10

|

)

|

0.50

|

|

||||||

|

Net income (loss) per share

|

$

|

(0.88

|

)

|

$

|

(0.74

|

)

|

$

|

1.53

|

|

|||

|

Weighted average common shares - basic

|

45,407,316

|

|

45,123,626

|

|

44,881,925

|

|

||||||

|

Diluted earnings (loss) per share attributable to TriMas Corporation:

|

||||||||||||

|

Continuing operations

|

$

|

(0.88

|

)

|

$

|

(0.64

|

)

|

$

|

1.02

|

|

|||

|

Discontinued operations

|

—

|

|

(0.10

|

)

|

0.49

|

|

||||||

|

Net income (loss) per share

|

$

|

(0.88

|

)

|

$

|

(0.74

|

)

|

$

|

1.51

|

|

|||

|

Weighted average common shares - diluted

|

45,407,316

|

|

45,123,626

|

|

45,269,409

|

|

||||||

|

Year ended December 31,

|

||||||||||||

|

2016

|

2015

|

2014

|

||||||||||

|

Net income (loss)

|

$

|

(39,800

|

)

|

$

|

(33,400

|

)

|

$

|

69,280

|

|

|||

|

Other comprehensive income (loss):

|

||||||||||||

|

Defined pension and postretirement pension plans (Note 15)

|

250

|

|

1,810

|

|

(3,340

|

)

|

||||||

|

Foreign currency translation

|

(12,620

|

)

|

(12,370

|

)

|

(13,820

|

)

|

||||||

|

Derivative instruments (Note 12)

|

(730

|

)

|

(2,650

|

)

|

(450

|

)

|

||||||

|

Total other comprehensive loss

|

(13,100

|

)

|

(13,210

|

)

|

(17,610

|

)

|

||||||

|

Total comprehensive income (loss)

|

(52,900

|

)

|

(46,610

|

)

|

51,670

|

|

||||||

|

Less: Net income attributable to noncontrolling interests

|

—

|

|

—

|

|

810

|

|

||||||

|

Total comprehensive income (loss) attributable to TriMas Corporation

|

$

|

(52,900

|

)

|

$

|

(46,610

|

)

|

$

|

50,860

|

|

|||

|

|

Year ended December 31,

|

||||||||||

|

|

2016

|

2015

|

2014

|

||||||||

|

Cash Flows from Operating Activities:

|

|

|

|

||||||||

|

Net income (loss)

|

$

|

(39,800

|

)

|

$

|

(33,400

|

)

|

$

|

69,280

|

|

||

|

Income (loss) from discontinued operations

|

—

|

|

(4,740

|

)

|

22,390

|

|

|||||

|

Income (loss) from continuing operations

|

(39,800

|

)

|

(28,660

|

)

|

46,890

|

|

|||||

|

Adjustments to reconcile net income (loss) to net cash provided by operating activities:

|

|||||||||||

|

Impairment of goodwill and indefinite-lived intangible assets

|

98,900

|

|

75,680

|

|

—

|

|

|||||

|

Loss on dispositions of property and equipment

|

1,870

|

|

2,330

|

|

3,770

|

|

|||||

|

Depreciation

|

24,390

|

|

22,570

|

|

21,380

|

|

|||||

|

Amortization of intangible assets

|

20,470

|

|

20,970

|

|

16,060

|

|

|||||

|

Amortization of debt issue costs

|

1,370

|

|

1,710

|

|

1,940

|

|

|||||

|

Deferred income taxes

|

(32,160

|

)

|

(8,750

|

)

|

(6,530

|

)

|

|||||

|

Non-cash compensation expense

|

6,940

|

|

6,340

|

|

7,110

|

|

|||||

|

Excess tax benefits from stock based compensation

|

(640

|

)

|

(590

|

)

|

(1,180

|

)

|

|||||

|

Debt financing and extinguishment expenses

|

—

|

|

1,970

|

|

3,360

|

|

|||||

|

(Increase) decrease in receivables

|

7,990

|

|

5,300

|

|

(9,790

|

)

|

|||||

|

(Increase) decrease in inventories

|

5,180

|

|

3,250

|

|

(6,010

|

)

|

|||||

|

Decrease in prepaid expenses and other assets

|

2,550

|

|

4,730

|

|

5,250

|

|

|||||

|

Increase (decrease) in accounts payable and accrued liabilities

|

(18,120

|

)

|

(29,530

|

)

|

11,830

|

|

|||||

|

Other, net

|

1,530

|

|

(750

|

)

|

(1,560

|

)

|

|||||

|

Net cash provided by operating activities of continuing operations

|

80,470

|

|

76,570

|

|

92,520

|

|

|||||

|

Net cash provided by (used for) operating activities of discontinued operations

|

—

|

|

(14,030

|

)

|

30,880

|

|

|||||

|

Net cash provided by operating activities

|

80,470

|

|

62,540

|

|

123,400

|

|

|||||

|

Cash Flows from Investing Activities:

|

|||||||||||

|

Capital expenditures

|

(31,330

|

)

|

(28,660

|

)

|

(23,000

|

)

|

|||||

|

Acquisition of businesses, net of cash acquired

|

—

|

|

(10,000

|

)

|

(382,880

|

)

|

|||||

|

Net proceeds from dispositions of property and equipment

|

220

|

|

1,700

|

|

200

|

|

|||||

|

Net cash used for investing activities of continuing operations

|

(31,110

|

)

|

(36,960

|

)

|

(405,680

|

)

|

|||||

|

Net cash used for investing activities of discontinued operations

|

—

|

|

(2,510

|

)

|

(4,410

|

)

|

|||||

|

Net cash used for investing activities

|

(31,110

|

)

|

(39,470

|

)

|

(410,090

|

)

|

|||||

|

Cash Flows from Financing Activities:

|

|

|

|

||||||||

|

Proceeds from borrowings on term loan facilities

|

—

|

|

275,000

|

|

275,000

|

|

|||||

|

Repayments of borrowings on term loan facilities

|

(13,850

|

)

|

(444,890

|

)

|

(8,910

|

)

|

|||||

|

Proceeds from borrowings on revolving credit and accounts receivable facilities

|

402,420

|

|

1,129,840

|

|

1,063,960

|

|

|||||

|

Repayments of borrowings on revolving credit and accounts receivable facilities

|

(433,350

|

)

|

(1,169,370

|

)

|

(989,090

|

)

|

|||||

|

Payments for deferred purchase price

|

(2,530

|

)

|

(6,440

|

)

|

—

|

|

|||||

|

Debt financing fees

|

—

|

|

(1,850

|

)

|

(3,840

|

)

|

|||||

|

Shares surrendered upon options and restricted stock vesting to cover taxes

|

(1,590

|

)

|

(2,770

|

)

|

(2,910

|

)