|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Bermuda

(State or other jurisdiction of incorporation or organization)

|

|

98-1276572

(I.R.S. Employer Identification Number)

|

|

Canon's Court, 22 Victoria Street, Hamilton HM12, Bermuda

(Address of principal executive office)

|

||

|

(441) 294-8033

(Registrant's telephone number including area code)

|

||

|

Title of Each Class

|

Name of Exchange On Which Registered

|

|

|

Common shares, $0.01 par value per share

|

The New York Stock Exchange

|

|

|

Large Accelerated Filer

ý

|

|

|

Accelerated Filer

o

|

|

||

|

Non-accelerated filer

o

|

Smaller reporting company

o

|

|||||

|

Emerging growth company

o

|

||||||

|

DOCUMENTS INCORPORATED BY REFERENCE

|

|

|

Part of Form 10-K

|

Document Incorporated by Reference

|

|

Part III, Items 10, 11, 12, 13, and 14

|

Portion of the Registrant's proxy statement to be filed in connection with the Annual Meeting of Shareholders of the Registrant to be held on April 25, 2019.

|

|

|

|

Page No.

|

|

Item 9B

.

|

||

|

PART III

|

||

|

•

|

decreases in the demand for leased containers;

|

|

•

|

decreases in market leasing rates for containers;

|

|

•

|

difficulties in re-leasing containers after their initial fixed-term leases;

|

|

•

|

customers' decisions to buy rather than lease containers;

|

|

•

|

dependence on a limited number of customers for a substantial portion of our revenues;

|

|

•

|

customer defaults;

|

|

•

|

decreases in the selling prices of used containers;

|

|

•

|

extensive competition in the container leasing industry;

|

|

•

|

difficulties stemming from the international nature of Triton's businesses;

|

|

•

|

decreases in demand for international trade;

|

|

•

|

disruption to Triton's operations resulting from political and economic policies of the United States and other countries, particularly China, including but not limited to the impact of trade wars and tariffs;

|

|

•

|

disruption to Triton's operations from failure of or attacks on Triton's information technology systems;

|

|

•

|

disruption to Triton's operations as a result of natural disasters;

|

|

•

|

compliance with laws and regulations related to economic and trade sanctions, security, anti-terrorism, environmental protection and corruption;

|

|

•

|

ability to obtain sufficient capital to support growth;

|

|

•

|

restrictions imposed by the terms of Triton's debt agreements;

|

|

•

|

changes in the tax laws in Bermuda, the United States and other countries; and

|

|

•

|

other risks and uncertainties, including those listed under the caption "Risk Factors."

|

®.

®.

|

•

|

Dry Containers.

A dry container is a steel constructed box with a set of doors on one end. Dry containers come in lengths of 20, 40 or 45 feet. They are 8 feet wide, and either 8½

or 9½ feet tall. Dry containers are the least expensive and most widely used type of intermodal container and are used to carry general cargo such as manufactured component parts, consumer staples, electronics and apparel.

|

|

•

|

Refrigerated Containers.

Refrigerated containers include an integrated cooling machine and an insulated container. Refrigerated containers come in lengths of 20 or 40 feet. They are 8 feet wide, and are either 8½

or 9½ feet tall. These containers are typically used to carry perishable cargo such as fresh and frozen produce.

|

|

•

|

Special Containers.

Most of our special containers are open top and flat rack containers. Open top containers come in similar sizes as dry containers, but do not have a fixed roof. Flat rack containers come in varying sizes and are steel platforms with folding ends and no fixed sides. Open top and flat rack containers are generally used to move heavy or bulky cargos, such as marble slabs, steel coils or factory components, that cannot be easily loaded on a fork lift through the doors of a standard container.

|

|

•

|

Tank Containers.

Tank containers are stainless steel cylindrical tanks enclosed in rectangular steel frames with the same outside dimensions as 20 foot dry containers. These containers carry bulk liquids such as chemicals.

|

|

•

|

Chassis.

An intermodal chassis is a rectangular, wheeled steel frame, generally 23½, 40 or 45 feet in length, built specifically for the purpose of transporting intermodal containers over the road. Longer sized chassis, designed to solely accommodate rail containers, can be up to 53 feet in length. When mounted on a chassis, the container may be trucked either to its destination or to a railroad terminal for loading onto a rail car. Our chassis are primarily used in the United States.

|

|

•

|

Operating Flexibility.

The timing, location and daily volume of cargo movements for a shipping line are often unpredictable. Leasing containers and chassis helps our customers manage this uncertainty and minimizes the requirement for large inventory buffers by allowing them to pick-up leased equipment on short notice.

|

|

•

|

Fleet Size and Mix Flexibility.

The drop-off flexibility included in container and chassis operating leases allows our customers to more quickly adjust the size of their fleets and the mix of container types in their fleets as their trade volumes and patterns change due to seasonality, market changes or changes in company strategies.

|

|

•

|

Alternative Source of Financing.

Container and chassis leases provide an additional source of equipment financing to help our customers manage the high level of investment required to maintain pace with the growth of the asset intensive container shipping industry.

|

|

Lease Portfolio

|

December 31, 2018

|

||

|

Long-term leases

|

66.6

|

%

|

|

|

Finance leases

|

7.5

|

|

|

|

Service leases

|

11.3

|

|

|

|

Expired long-term leases (units on-hire)

|

14.6

|

|

|

|

Total

|

100.0

|

%

|

|

|

•

|

Equipment leasing—Our equipment leasing operations include the acquisition, leasing, re-leasing and ultimate sale of multiple types of intermodal transportation equipment, primarily intermodal containers.

|

|

•

|

Equipment trading—We purchase containers from shipping line customers, and other sellers of containers, and resell these containers to container retailers and users of containers for storage or one-way shipment.

|

|

•

|

the available supply and prices of new and used containers;

|

|

•

|

changes in economic conditions, the operating efficiency of customers and competitive pressures in the shipping industry;

|

|

•

|

the availability and terms of equipment financing for customers;

|

|

•

|

fluctuations in interest rates and foreign currency values;

|

|

•

|

import/export tariffs and restrictions, and customs procedures;

|

|

•

|

foreign exchange controls; and

|

|

•

|

other governmental regulations and political or economic factors that are inherently unpredictable and may be beyond our control.

|

|

•

|

making it more difficult for us to satisfy our obligations with respect to our debt facilities. Any failure to comply with such obligations, including a failure to make timely interest or principal payments, or a breach of financial or other restrictive covenants, could result in an event of default under the agreements governing such indebtedness, which could lead to, among other things, an acceleration of our indebtedness or foreclosure on the assets securing our indebtedness and which could have a material adverse effect on our business, financial condition, future prospects and solvency;

|

|

•

|

requiring us to dedicate a substantial portion of our cash flow from operations to make payments on our debt, thereby reducing funds available for operations, capital expenditures, future business opportunities and other purposes;

|

|

•

|

limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

|

|

•

|

limiting our ability to borrow additional funds, or to sell assets to raise funds, if needed, for working capital, capital expenditures, acquisitions or other purposes;

|

|

•

|

making it difficult for us to pay dividends on our common shares;

|

|

•

|

increasing our vulnerability to general adverse economic and industry conditions, including changes in interest rates; and

|

|

•

|

placing us at a competitive disadvantage compared to our competitors having less debt.

|

|

•

|

incur additional indebtedness;

|

|

•

|

pay dividends on or redeem or repurchase our shares;

|

|

•

|

issue additional share capital;

|

|

•

|

make loans and investments;

|

|

•

|

create liens;

|

|

•

|

sell certain assets or merge with or into other companies;

|

|

•

|

enter into certain transactions with our shareholders and affiliates;

|

|

•

|

cause our subsidiaries to make dividends, distributions and other payments to us; and

|

|

•

|

otherwise conduct necessary corporate activities.

|

|

•

|

regional or local economic downturns;

|

|

•

|

changes in governmental policy or regulation;

|

|

•

|

domestic and foreign customs and tariffs, import and export duties and quotas;

|

|

•

|

restrictions on the transfer of funds into or out of countries in which we operate;

|

|

•

|

compliance with U.S. Treasury and EU sanctions regulations restricting doing business with certain nations or specially designated nationals;

|

|

•

|

international incidents;

|

|

•

|

military conflicts;

|

|

•

|

government instability;

|

|

•

|

nationalization of foreign assets;

|

|

•

|

government protectionism;

|

|

•

|

compliance with export controls, including those of the U.S. Department of Commerce;

|

|

•

|

compliance with import procedures and controls, including those of the U.S. Department of Homeland Security;

|

|

•

|

potentially negative consequences from changes in tax laws;

|

|

•

|

requirements relating to withholding taxes on remittances and other payments by subsidiaries and customers;

|

|

•

|

labor or other disruptions at key ports;

|

|

•

|

difficulty in staffing and managing widespread operations;

|

|

•

|

difficulty in registering intellectual property or inadequate intellectual property protection in foreign jurisdictions; and

|

|

•

|

restrictions on our ability to own or operate subsidiaries, make investments or acquire new businesses in these jurisdictions.

|

|

•

|

75% or more of the our gross income in a taxable year is passive income; or

|

|

•

|

the average percentage of our assets (which includes cash) by value in a taxable year which produce or are held for the production of passive income is at least 50%.

|

|

•

|

broad market and industry factors including global and political instability, trade actions, and interest rate and currency changes;

|

|

•

|

variations in our financial results;

|

|

•

|

changes in financial estimates or investment recommendations by securities analysts following our business;

|

|

•

|

the public's response to our press releases, other public announcements and filings with the SEC;

|

|

•

|

changes in accounting standards, policies, guidance or interpretations or principles;

|

|

•

|

future sales of common shares by our directors, officers and significant shareholders;

|

|

•

|

announcements of technological innovations or enhanced or new products by us or our competitors;

|

|

•

|

the failure to achieve operating results consistent with securities analysts’ projections;

|

|

•

|

the operating and stock price performance of other companies that investors may deem comparable to us;

|

|

•

|

changes in our dividend policy and share repurchase programs;

|

|

•

|

fluctuations in the worldwide equity markets;

|

|

•

|

recruitment or departure of key personnel;

|

|

•

|

failure to timely address changing customer preferences; and

|

|

•

|

other events or factors, including those resulting from, the perceived or actual threat of impending natural disasters, coups, missile launches, terrorism or war, as well as the actual occurrence of such events or responses to such events.

|

|

Issuer Purchases of Common Shares

(1)

|

||||||||||

|

Period

|

Total number of shares purchased

|

Average price paid per share

|

Total number of shares purchased as part of publicly announced plan

|

Approximate dollar value of shares that may yet be purchased under the plan (in thousands)

|

||||||

|

October 1, 2018 through October 31, 2018

|

942,823

|

|

$

|

30.76

|

|

942,823

|

|

$

|

169,866

|

|

|

November 1, 2018 through November 30, 2018

|

270,642

|

|

$

|

34.00

|

|

270,642

|

|

$

|

160,658

|

|

|

December 1, 2018 through December 31, 2018

|

605,983

|

|

$

|

30.96

|

|

605,983

|

|

$

|

141,886

|

|

|

Total

|

1,819,448

|

|

|

|

1,819,448

|

|

$

|

141,886

|

|

|

|

(1)

|

On August 1, 2018, the Company's Board of Directors authorized the repurchase of up to

$200.0 million

of its common shares. The share repurchase authorization will terminate upon completing repurchases of

$200.0 million

of common shares unless earlier terminated by the Board.

|

|

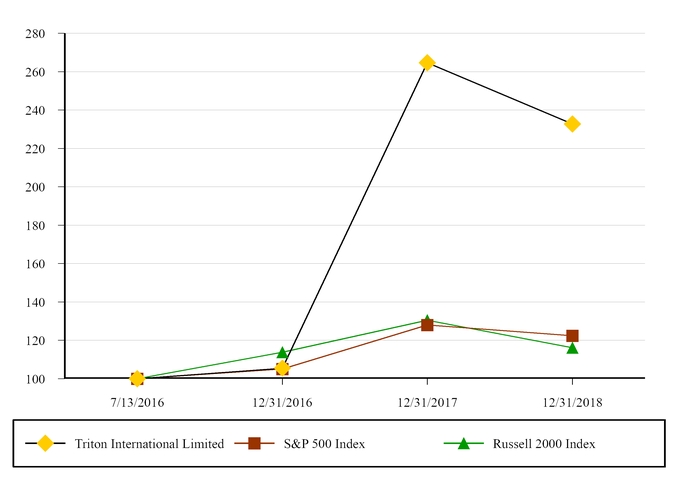

Base Period as of

|

INDEXED RETURNS FOR THE YEARS ENDED

|

||||||

|

Company / Index

|

July 13, 2016

|

December 31, 2016

|

December 31, 2017

|

December 31, 2018

|

|||

|

Triton International Limited

|

$100.00

|

$105.49

|

$264.66

|

$232.76

|

|||

|

S&P 500 Index

|

$100.00

|

$105.06

|

$127.99

|

$122.38

|

|||

|

Russell 2000 Index

|

$100.00

|

$113.77

|

$130.43

|

$116.07

|

|||

|

Year Ended December 31,

(In thousands, except per share data)

|

|||||||||||||||||||

|

Statements of Operations Data:

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||||||

|

Leasing revenues:

|

|||||||||||||||||||

|

Operating leases

|

$

|

1,328,756

|

|

$

|

1,141,165

|

|

$

|

813,357

|

|

$

|

699,810

|

|

$

|

699,188

|

|

||||

|

Finance leases

|

21,547

|

|

22,352

|

|

15,337

|

|

8,029

|

|

8,027

|

|

|||||||||

|

Total leasing revenues

|

1,350,303

|

|

1,163,517

|

|

828,694

|

|

|

707,839

|

|

|

707,215

|

|

|||||||

|

Equipment trading revenues

(1)

|

83,039

|

|

37,419

|

|

16,418

|

|

—

|

|

—

|

|

|||||||||

|

Equipment trading expenses

(1)

|

(64,118

|

)

|

(33,235

|

)

|

(15,800

|

)

|

—

|

|

—

|

|

|||||||||

|

Trading margin

|

18,921

|

|

4,184

|

|

618

|

|

|

—

|

|

|

—

|

|

|||||||

|

Net gain (loss) on sale of leasing equipment

|

35,377

|

|

35,812

|

|

(20,347

|

)

|

2,013

|

|

31,616

|

|

|||||||||

|

Net gain (loss) on sale of building

|

20,953

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Operating expenses:

|

|||||||||||||||||||

|

Depreciation and amortization

(2)

|

545,138

|

|

500,720

|

|

392,592

|

|

300,470

|

|

258,489

|

|

|||||||||

|

Direct operating expenses

|

48,326

|

|

62,891

|

|

84,256

|

|

54,440

|

|

58,014

|

|

|||||||||

|

Administrative expenses

|

80,033

|

|

87,609

|

|

65,618

|

|

53,435

|

|

55,659

|

|

|||||||||

|

Transaction and other costs

(3)

|

88

|

|

9,272

|

|

66,916

|

|

22,185

|

|

30,477

|

|

|||||||||

|

Provision (reversal) for doubtful accounts

|

(231

|

)

|

3,347

|

|

23,304

|

|

(2,156

|

)

|

1,324

|

|

|||||||||

|

Insurance recovery income

|

—

|

|

(6,764

|

)

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Total operating expenses

|

673,354

|

|

657,075

|

|

632,686

|

|

|

428,374

|

|

|

403,963

|

|

|||||||

|

Operating income

|

752,200

|

|

546,438

|

|

176,279

|

|

|

281,478

|

|

|

334,868

|

|

|||||||

|

Other expenses (income):

|

|||||||||||||||||||

|

Interest and debt expense

|

322,731

|

|

282,347

|

|

184,014

|

|

140,644

|

|

137,370

|

|

|||||||||

|

Realized (gain) loss on derivative instruments, net

|

(2,072

|

)

|

900

|

|

3,438

|

|

5,496

|

|

9,385

|

|

|||||||||

|

Unrealized (gain) loss on derivative instruments, net

(4)

|

430

|

|

(1,397

|

)

|

(4,405

|

)

|

2,240

|

|

3,798

|

|

|||||||||

|

Debt termination expense

|

6,090

|

|

6,973

|

|

141

|

|

1,170

|

|

7,468

|

|

|||||||||

|

Other (income) expense, net

|

(2,292

|

)

|

(2,637

|

)

|

(1,076

|

)

|

211

|

|

(689

|

)

|

|||||||||

|

Total other expenses

|

324,887

|

|

286,186

|

|

182,112

|

|

|

149,761

|

|

|

157,332

|

|

|||||||

|

Income (loss) before income taxes

|

427,313

|

|

260,252

|

|

(5,833

|

)

|

131,717

|

|

|

177,536

|

|

||||||||

|

Income tax expense (benefit)

|

70,641

|

|

(93,274

|

)

|

(48

|

)

|

4,048

|

|

6,232

|

|

|||||||||

|

Net income (loss)

|

$

|

356,672

|

|

$

|

353,526

|

|

$

|

(5,785

|

)

|

$

|

127,669

|

|

|

$

|

171,304

|

|

|||

|

Less: income attributable to non-controlling interest

|

7,117

|

|

8,928

|

|

7,732

|

|

16,580

|

|

21,837

|

|

|||||||||

|

Net income (loss) attributable to shareholders

|

$

|

349,555

|

|

$

|

344,598

|

|

|

$

|

(13,517

|

)

|

|

$

|

111,089

|

|

|

$

|

149,467

|

|

|

|

Earnings Per Share Data:

|

|||||||||||||||||||

|

Net income (loss) per common share—Basic

|

$

|

4.38

|

|

$

|

4.55

|

|

$

|

(0.24

|

)

|

|

$

|

2.75

|

|

|

$

|

3.73

|

|

||

|

Net income (loss) per common share—Diluted

|

$

|

4.35

|

|

$

|

4.52

|

|

|

$

|

(0.24

|

)

|

|

$

|

2.71

|

|

|

$

|

3.52

|

|

|

|

Weighted average common shares and non-voting common shares outstanding:

|

|||||||||||||||||||

|

Basic

|

79,782

|

|

75,679

|

|

56,032

|

|

40,429

|

|

40,021

|

|

|||||||||

|

Diluted

|

80,364

|

|

76,188

|

|

56,032

|

|

40,932

|

|

42,458

|

|

|||||||||

|

Cash dividends paid per common share

|

$

|

2.01

|

|

$

|

1.80

|

|

$

|

1.35

|

|

$

|

—

|

|

$

|

5.38

|

|

||||

|

(1)

|

Triton acquired the Equipment trading segment as part of the Merger on July 12, 2016 and had no such reporting segment prior to that date.

|

|

(2)

|

Depreciation expense was increased by $1.8 million per quarter beginning October 1, 2015 as the result of a decrease in residual value estimates and an increase in the useful life estimates for certain dry containers included in Triton’s depreciation policy.

|

|

(3)

|

Includes retention and stock compensation expense pursuant to the Merger and the plans established as part of TCIL's 2011 re-capitalization.

|

|

(4)

|

Unrealized (gains) losses on derivative instruments, net are primarily due to changes in interest rates, and reflect changes in the fair value of interest rate swaps not designated as cash flow hedges.

|

|

As of December 31,

(In thousands) |

|||||||||||||||||||

|

2018

|

2017

|

2016

|

2015

|

2014

|

|||||||||||||||

|

Balance Sheet Data (end of period):

|

|||||||||||||||||||

|

Cash and cash equivalents (including restricted cash)

|

$

|

159,539

|

|

$

|

226,171

|

|

$

|

163,492

|

|

$

|

79,264

|

|

$

|

97,059

|

|

||||

|

Accounts receivable, net

|

264,382

|

|

199,876

|

|

173,585

|

|

110,970

|

|

112,596

|

|

|||||||||

|

Revenue earning assets, net

|

9,467,969

|

|

8,703,570

|

|

7,817,192

|

|

4,428,699

|

|

4,613,372

|

|

|||||||||

|

Total assets

|

10,270,013

|

|

9,577,625

|

|

8,713,571

|

|

4,658,997

|

|

4,863,259

|

|

|||||||||

|

Debt, net of unamortized debt costs

|

7,529,432

|

|

6,911,725

|

|

6,353,449

|

|

3,166,903

|

|

3,364,510

|

|

|||||||||

|

Shareholders' equity

|

2,203,696

|

|

2,076,284

|

|

1,663,233

|

|

1,217,329

|

|

1,106,160

|

|

|||||||||

|

Non-controlling interests

|

121,513

|

|

133,542

|

|

143,504

|

|

160,504

|

|

190,851

|

|

|||||||||

|

Total equity (including non-controlling interests)

|

2,325,209

|

|

2,209,826

|

|

1,806,737

|

|

1,377,833

|

|

1,297,011

|

|

|||||||||

|

Other Financial Data:

|

|||||||||||||||||||

|

Capital expenditures

|

1,603,507

|

|

1,562,863

|

|

629,332

|

|

398,799

|

|

809,446

|

|

|||||||||

|

Proceeds from sale of equipment, net of selling costs

|

163,256

|

|

190,744

|

|

145,572

|

|

171,719

|

|

195,282

|

|

|||||||||

|

•

|

Equipment leasing - we own, lease and ultimately dispose of containers and chassis from our lease fleet.

|

|

•

|

Equipment trading - we purchase containers from shipping line customers, and other sellers of containers, and resell these containers to container retailers and users of containers for storage or one-way shipment.

|

|

|

Equipment Fleet in Units

|

Equipment Fleet in TEU

|

|||||||||||||||

|

|

December 31, 2018

|

December 31, 2017

|

December 31, 2016

|

December 31, 2018

|

December 31, 2017

|

December 31, 2016

|

|||||||||||

|

Dry

|

3,340,946

|

|

3,077,144

|

|

2,737,982

|

|

5,476,406

|

|

5,000,043

|

|

4,424,905

|

|

|||||

|

Refrigerated

|

228,778

|

|

218,429

|

|

217,243

|

|

440,781

|

|

419,673

|

|

416,992

|

|

|||||

|

Special

|

93,900

|

|

89,066

|

|

92,957

|

|

169,614

|

|

159,172

|

|

164,977

|

|

|||||

|

Tank

|

12,509

|

|

12,124

|

|

11,961

|

|

12,509

|

|

12,124

|

|

11,961

|

|

|||||

|

Chassis

|

24,832

|

|

22,523

|

|

22,128

|

|

45,787

|

|

41,068

|

|

40,233

|

|

|||||

|

Equipment leasing fleet

|

3,700,965

|

|

3,419,286

|

|

3,082,271

|

|

6,145,097

|

|

5,632,080

|

|

5,059,068

|

|

|||||

|

Equipment trading fleet

|

13,138

|

|

10,510

|

|

15,927

|

|

21,361

|

|

16,907

|

|

26,276

|

|

|||||

|

Total

|

3,714,103

|

|

3,429,796

|

|

3,098,198

|

|

6,166,458

|

|

5,648,987

|

|

5,085,344

|

|

|||||

|

|

Equipment Fleet in CEU

(1)

|

|||||||

|

|

December 31, 2018

|

December 31, 2017

|

December 31, 2016

|

|||||

|

Operating Leases

|

7,009,605

|

|

6,678,282

|

|

6,126,320

|

|

||

|

Finance Leases

|

538,867

|

|

328,024

|

|

368,468

|

|

||

|

Equipment trading fleet

|

47,476

|

|

51,762

|

|

72,646

|

|

||

|

Total

|

7,595,948

|

|

7,058,068

|

|

6,567,434

|

|

||

|

(1)

|

In the equipment fleet tables above, we have included total fleet count information based on CEU. CEU is a ratio used to convert the actual number of containers in our fleet to a figure based on the relative purchase prices of our various equipment types to that of a 20-foot dry container. For example, the CEU ratio for a 40-foot high cube dry container is 1.68, and a 40-foot high cube refrigerated container is 10.0. The CEU ratios used in this calculation are from our debt agreements and may differ slightly from CEU ratios used by others in the industry.

|

|

Equipment Type

|

Percentage of

total fleet in units |

Percent of total fleet in CEU

|

|||

|

Dry

|

89.9

|

%

|

62.9

|

%

|

|

|

Refrigerated

|

6.2

|

|

29.6

|

|

|

|

Special

|

2.5

|

|

2.9

|

|

|

|

Tank

|

0.3

|

|

2.6

|

|

|

|

Chassis

|

0.7

|

|

1.4

|

|

|

|

Equipment leasing fleet

|

99.6

|

|

99.4

|

|

|

|

Equipment trading fleet

|

0.4

|

|

0.6

|

|

|

|

Total

|

100.0

|

%

|

100.0

|

%

|

|

|

•

|

Long-term leases typically have initial contractual terms ranging from three to eight years and provide us with stable cash flow and low transaction costs by requiring customers to maintain specific units on-hire for the duration of the lease.

|

|

•

|

Finance leases are typically structured as full payout leases and provide for a predictable recurring revenue stream with the lowest cost to the customer as customers are generally required to retain the equipment for the duration of its useful life.

|

|

•

|

Service leases command a premium per diem rate in exchange for providing customers with greater operational flexibility by allowing non-scheduled pick-up and drop-off of units during the lease term.

|

|

Lease Portfolio

|

December 31,

2018 |

|

December 31,

2017 |

|

December 31,

2016 |

|||

|

Long-term leases

|

66.6

|

%

|

72.2

|

%

|

69.7

|

%

|

||

|

Finance leases

|

7.5

|

|

4.9

|

|

6.3

|

|

||

|

Service leases

|

11.3

|

|

14.1

|

|

18.5

|

|

||

|

Expired long-term leases (units on-hire)

|

14.6

|

|

8.8

|

|

5.5

|

|

||

|

Total

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||

|

|

Quarter Ended

|

|||||||||

|

Average Utilization

|

Year Ended December 31,

|

December 31,

|

September 30,

|

June 30,

|

March 31,

|

|||||

|

2018

|

98.6%

|

98.2%

|

98.7%

|

98.8%

|

98.6%

|

|||||

|

2017

|

96.9%

|

98.3%

|

97.6%

|

96.5%

|

95.3%

|

|||||

|

2016

(2)

|

93.3%

|

93.6%

|

92.4%

|

93.3%

|

94.0%

|

|||||

|

Quarter Ended

|

||||||||

|

Ending Utilization

|

December 31,

|

September 30,

|

June 30,

|

March 31,

|

||||

|

2018

|

97.8%

|

98.6%

|

98.7%

|

98.7%

|

||||

|

2017

|

98.6%

|

98.0%

|

97.1%

|

95.8%

|

||||

|

2016

(2)

|

94.8%

|

92.6%

|

93.7%

|

93.5%

|

||||

|

(1)

|

Utilization is computed by dividing our total units on lease (in CEU) by the total units in our fleet (in CEU) excluding new units not yet leased and off-hire units designated for sale.

|

|

(2)

|

For the periods prior to the July 12, 2016 Merger, the utilization reflects the combined utilization of the TCIL and TAL equipment fleets.

|

|

|

Year Ended December 31, 2018

|

Year Ended December 31, 2017

|

Year Ended December 31, 2016

(1)

|

||||||||

|

Leasing revenues:

|

|||||||||||

|

Operating leases

|

$

|

1,328,756

|

|

$

|

1,141,165

|

|

$

|

813,357

|

|

||

|

Finance leases

|

21,547

|

|

22,352

|

|

15,337

|

|

|||||

|

Total leasing revenues

|

1,350,303

|

|

1,163,517

|

|

828,694

|

|

|||||

|

|

|

||||||||||

|

Equipment trading revenues

|

83,039

|

|

37,419

|

|

16,418

|

|

|||||

|

Equipment trading expenses

|

(64,118

|

)

|

(33,235

|

)

|

(15,800

|

)

|

|||||

|

Trading margin

|

18,921

|

|

4,184

|

|

618

|

|

|||||

|

|

|

||||||||||

|

Net gain (loss) on sale of leasing equipment

|

35,377

|

|

35,812

|

|

(20,347

|

)

|

|||||

|

Net gain (loss) on sale of building

|

20,953

|

|

—

|

|

—

|

|

|||||

|

|

|

||||||||||

|

Operating expenses:

|

|

|

|||||||||

|

Depreciation and amortization

|

545,138

|

|

500,720

|

|

392,592

|

|

|||||

|

Direct operating expenses

|

48,326

|

|

62,891

|

|

84,256

|

|

|||||

|

Administrative expenses

|

80,033

|

|

87,609

|

|

65,618

|

|

|||||

|

Transaction and other costs (income)

|

88

|

|

9,272

|

|

66,916

|

|

|||||

|

Provision (reversal) for doubtful accounts

|

(231

|

)

|

3,347

|

|

23,304

|

|

|||||

|

Insurance recovery income

|

—

|

|

(6,764

|

)

|

—

|

|

|||||

|

Total operating expenses

|

673,354

|

|

657,075

|

|

632,686

|

|

|||||

|

Operating income (loss)

|

752,200

|

|

546,438

|

|

176,279

|

|

|||||

|

Other expenses:

|

|

||||||||||

|

Interest and debt expense

|

322,731

|

|

282,347

|

|

184,014

|

|

|||||

|

Realized (gain) loss on derivative instruments, net

|

(2,072

|

)

|

900

|

|

3,438

|

|

|||||

|

Unrealized (gain) loss on derivative instruments, net

|

430

|

|

(1,397

|

)

|

(4,405

|

)

|

|||||

|

Debt termination expense

|

6,090

|

|

6,973

|

|

141

|

|

|||||

|

Other (income) expense, net

|

(2,292

|

)

|

(2,637

|

)

|

(1,076

|

)

|

|||||

|

Total other expenses

|

324,887

|

|

286,186

|

|

182,112

|

|

|||||

|

Income (loss) before income taxes

|

427,313

|

|

260,252

|

|

(5,833

|

)

|

|||||

|

Income tax expense (benefit)

|

70,641

|

|

(93,274

|

)

|

(48

|

)

|

|||||

|

Net income (loss)

|

$

|

356,672

|

|

$

|

353,526

|

|

$

|

(5,785

|

)

|

||

|

Less: income (loss) attributable to non-controlling interest

|

7,117

|

|

8,928

|

|

7,732

|

|

|||||

|

Net income (loss) attributable to shareholders

|

$

|

349,555

|

|

$

|

344,598

|

|

$

|

(13,517

|

)

|

||

|

(1)

|

The results for

December 31, 2016

are impacted by the Merger on a comparative basis. TCIL has been treated as the acquirer in the Merger for accounting purposes, and therefore, the results of our operations, included herein, for the periods prior to the Merger on

July 12, 2016

are for TCIL operations alone

|

|

|

Year Ended December 31, 2018

|

Year Ended December 31, 2017

|

Variance

|

||||||||

|

Leasing revenues:

|

|||||||||||

|

Operating leases

|

$

|

1,328,756

|

|

$

|

1,141,165

|

|

$

|

187,591

|

|

||

|

Finance leases

|

21,547

|

|

22,352

|

|

(805

|

)

|

|||||

|

Total leasing revenues

|

1,350,303

|

|

1,163,517

|

|

186,786

|

|

|||||

|

|

|

||||||||||

|

Equipment trading revenues

|

83,039

|

|

37,419

|

|

45,620

|

|

|||||

|

Equipment trading expenses

|

(64,118

|

)

|

(33,235

|

)

|

(30,883

|

)

|

|||||

|

Trading margin

|

18,921

|

|

4,184

|

|

14,737

|

|

|||||

|

|

|

||||||||||

|

Net gain (loss) on sale of leasing equipment

|

35,377

|

|

35,812

|

|

(435

|

)

|

|||||

|

Net gain (loss) on sale of building

|

20,953

|

|

—

|

|

20,953

|

|

|||||

|

|

|

||||||||||

|

Operating expenses:

|

|

|

|||||||||

|

Depreciation and amortization

|

545,138

|

|

500,720

|

|

44,418

|

|

|||||

|

Direct operating expenses

|

48,326

|

|

62,891

|

|

(14,565

|

)

|

|||||

|

Administrative expenses

|

80,033

|

|

87,609

|

|

(7,576

|

)

|

|||||

|

Transaction and other costs (income)

|

88

|

|

9,272

|

|

(9,184

|

)

|

|||||

|

Provision (reversal) for doubtful accounts

|

(231

|

)

|

3,347

|

|

(3,578

|

)

|

|||||

|

Insurance recovery income

|

—

|

|

(6,764

|

)

|

6,764

|

|

|||||

|

Total operating expenses

|

673,354

|

|

657,075

|

|

16,279

|

|

|||||

|

Operating income (loss)

|

752,200

|

|

546,438

|

|

205,762

|

|

|||||

|

Other expenses:

|

|

|

|||||||||

|

Interest and debt expense

|

322,731

|

|

282,347

|

|

40,384

|

|

|||||

|

Realized (gain) loss on derivative instruments, net

|

(2,072

|

)

|

900

|

|

(2,972

|

)

|

|||||

|

Unrealized (gain) loss on derivative instruments, net

|

430

|

|

(1,397

|

)

|

1,827

|

|

|||||

|

Debt termination expense

|

6,090

|

|

6,973

|

|

(883

|

)

|

|||||

|

Other (income) expense, net

|

(2,292

|

)

|

(2,637

|

)

|

345

|

|

|||||

|

Total other expenses

|

324,887

|

|

286,186

|

|

38,701

|

|

|||||

|

Income (loss) before income taxes

|

427,313

|

|

260,252

|

|

167,061

|

|

|||||

|

Income tax expense (benefit)

|

70,641

|

|

(93,274

|

)

|

163,915

|

|

|||||

|

Net income (loss)

|

$

|

356,672

|

|

$

|

353,526

|

|

$

|

3,146

|

|

||

|

Less: income (loss) attributable to non-controlling interest

|

7,117

|

|

8,928

|

|

(1,811

|

)

|

|||||

|

Net income (loss) attributable to shareholders

|

$

|

349,555

|

|

$

|

344,598

|

|

$

|

4,957

|

|

||

|

Leasing revenues

|

Year Ended December 31, 2018

|

Year Ended December 31, 2017

|

Variance

|

||||||||

|

Operating lease revenues:

|

|

||||||||||

|

Per diem revenues

|

$

|

1,278,354

|

|

$

|

1,100,507

|

|

$

|

177,847

|

|

||

|

Fee and ancillary revenues

|

50,402

|

|

40,658

|

|

9,744

|

|

|||||

|

Total operating lease revenues

|

1,328,756

|

|

1,141,165

|

|

187,591

|

|

|||||

|

Finance lease revenues

|

21,547

|

|

22,352

|

|

(805

|

)

|

|||||

|

Total leasing revenues

|

$

|

1,350,303

|

|

$

|

1,163,517

|

|

$

|

186,786

|

|

||

|

•

|

$133.4 million increase due to an increase of 671,636 CEU in the average number of containers on-hire under operating leases;

|

|

•

|

$24.0 million increase due to an increase in average CEU per diem rates;

|

|

•

|

$27.0 million increase due to reduced lease intangible amortization; partially offset by

|

|

•

|

$6.6 million decrease due to the reclassification of certain contracts from operating leases to finance leases in the fourth quarter of 2018 as a result of the renegotiation and extension of the contracts.

|

|

•

|

$11.3 million increase due to an increase in trading volume; and

|

|

•

|

$3.4 million increase due to an increase in per unit margin.

|

|

•

|

$66.6 million increase due to a net increase in the size of our depreciable fleet; partially offset by a

|

|

•

|

$13.6 million decrease due to an increase in the number of containers that are fully depreciated;

|

|

•

|

$5.8 million decrease due to an increase in other fully depreciated assets; and

|

|

•

|

$3.5 million decrease due to the reclassification of certain contracts from operating leases to finance leases in the fourth quarter of 2018 as a result of the renegotiation and extension of the contracts.

|

|

•

|

$15.4 million decrease due to a decrease in storage, handling, and repositioning costs due to a decrease in the number of our containers that were off-hire

|

|

•

|

$1.5 million decrease due to a decrease in inspection costs due to less new equipment purchases; partially offset by a

|

|

•

|

$2.2 million increase due to an increase in repair costs as a result of an increase in the volume of redeliveries in the fourth quarter of 2018.

|

|

•

|

$22.3 million increase due to an increase in the average debt balance of $531.0 million during 2018 compared to 2017; and

|

|

•

|

$18.1 million increase due to an increase in the average effective interest rate to 4.39% in 2018 compared to 4.14% in 2017. The increase in the effective interest rate was primarily due to an increase in short-term interest rates on our unhedged variable-rate debt facilities.

|

|

•

|

$24.7 million increase related to a U.S. entity to foreign entity intra-company asset sale; and

|

|

•

|

$139.4 million increase due to a one-time tax benefit recorded in 2017 that did not reoccur. The one-time benefit in 2017 reflected a decrease in our deferred tax liability resulting from the reduction of the U.S. corporate tax rate from 35% to 21% as part of the U.S. Tax Cuts and Jobs Act.

|

|

|

Year Ended December 31, 2017

|

Year Ended December 31, 2016

(1)

|

Variance

|

||||||||

|

Leasing revenues:

|

|||||||||||

|

Operating leases

|

$

|

1,141,165

|

|

$

|

813,357

|

|

$

|

327,808

|

|

||

|

Finance leases

|

22,352

|

|

15,337

|

|

7,015

|

|

|||||

|

Total leasing revenues

|

1,163,517

|

|

828,694

|

|

334,823

|

|

|||||

|

|

|

||||||||||

|

Equipment trading revenues

|

37,419

|

|

16,418

|

|

21,001

|

|

|||||

|

Equipment trading expenses

|

(33,235

|

)

|

(15,800

|

)

|

(17,435

|

)

|

|||||

|

Trading margin

|

4,184

|

|

618

|

|

3,566

|

|

|||||

|

|

|

||||||||||

|

Net gain (loss) on sale of leasing equipment

|

35,812

|

|

(20,347

|

)

|

56,159

|

|

|||||

|

|

|

||||||||||

|

Operating expenses:

|

|

|

|||||||||

|

Depreciation and amortization

|

500,720

|

|

392,592

|

|

108,128

|

|

|||||

|

Direct operating expenses

|

62,891

|

|

84,256

|

|

(21,365

|

)

|

|||||

|

Administrative expenses

|

87,609

|

|

65,618

|

|

21,991

|

|

|||||

|

Transaction and other costs (income)

|

9,272

|

|

66,916

|

|

(57,644

|

)

|

|||||

|

Provision (reversal) for doubtful accounts

|

3,347

|

|

23,304

|

|

(19,957

|

)

|

|||||

|

Insurance recovery income

|

(6,764

|

)

|

—

|

|

(6,764

|

)

|

|||||

|

Total operating expenses

|

657,075

|

|

632,686

|

|

24,389

|

|

|||||

|

Operating income (loss)

|

546,438

|

|

176,279

|

|

370,159

|

|

|||||

|

Other expenses:

|

|

||||||||||

|

Interest and debt expense

|

282,347

|

|

184,014

|

|

98,333

|

|

|||||

|

Realized loss (gain) on derivative instruments, net

|

900

|

|

3,438

|

|

(2,538

|

)

|

|||||

|

Unrealized (gain) loss on derivative instruments, net

|

(1,397

|

)

|

(4,405

|

)

|

3,008

|

|

|||||

|

Debt termination expense

|

6,973

|

|

141

|

|

6,832

|

|

|||||

|

Other (income) expense, net

|

(2,637

|

)

|

(1,076

|

)

|

(1,561

|

)

|

|||||

|

Total other expenses

|

286,186

|

|

182,112

|

|

104,074

|

|

|||||

|

Income (loss) before income taxes

|

260,252

|

|

(5,833

|

)

|

266,085

|

|

|||||

|

Income tax expense (benefit)

|

(93,274

|

)

|

(48

|

)

|

(93,226

|

)

|

|||||

|

Net income (loss)

|

$

|

353,526

|

|

$

|

(5,785

|

)

|

$

|

359,311

|

|

||

|

Less: income (loss) attributable to non-controlling interest

|

8,928

|

|

7,732

|

|

1,196

|

|

|||||

|

Net income (loss) attributable to shareholders

|

$

|

344,598

|

|

$

|

(13,517

|

)

|

$

|

358,115

|

|

||

|

(1)

|

Our operating performance and revenues were significantly impacted by the Merger on July 12, 2016 and the subsequent inclusion of TAL's results of operations and equipment fleet in our financial results and operating metrics. TCIL has been treated as the acquirer in the Merger for accounting purposes, and therefore, the results of operations for Triton, included herein, for the periods prior to the date of the Merger are for TCIL operations alone.

|

|

Leasing revenue

|

Year Ended December 31, 2017

|

Year Ended December 31, 2016

|

Variance

|

||||||||

|

Operating lease revenues:

|

|

||||||||||

|

Per diem revenues

|

$

|

1,100,507

|

|

$

|

762,011

|

|

$

|

338,496

|

|

||

|

Fee and ancillary revenues

|

40,658

|

|

51,346

|

|

(10,688

|

)

|

|||||

|

Total operating lease revenues

|

1,141,165

|

|

813,357

|

|

327,808

|

|

|||||

|

Finance leases

|

22,352

|

|

15,337

|

|

7,015

|

|

|||||

|

Total leasing revenues

|

$

|

1,163,517

|

|

$

|

828,694

|

|

$

|

334,823

|

|

||

|

•

|

$223.6 million increase due to the inclusion of TAL's per diem revenues for the full year in 2017 while TAL’s per diem revenues were included only after July 12

th

in 2016;

|

|

•

|

$128.3 million increase due to an increase of 1,131,167 CEU in the average number of containers on-hire under operating leases; partially offset by a

|

|

•

|

$14.9 million decrease due to a decrease in average CEU per diem rates.

|

|

•

|

$10.2 million increase due to the inclusion of TAL's fees and ancillary lease revenues for the full year in 2017 while TAL’s fee and ancillary lease revenues were included only after July 12

th

in 2016; and a

|

|

•

|

$20.9 million decrease in redelivery fees due to a decrease in the volume of customer redeliveries resulting from strong lease demand.

|

|

•

|

$3.9 million increase due to the inclusion of TAL's finance lease revenues for the full year in 2017 while TAL’s finance lease revenues were included only after July 12

th

in 2016;

|

|

•

|

$4.7 million increase due to the inclusion of a finance lease contract that commenced in September 2016 for the twelve months in 2017 as compared to four months in 2016; and

|

|

•

|

$1.6 million decrease due to the amortization of the existing portfolio.

|

|

•

|

$8.9 million increase due to the inclusion of TAL's gains on sale of leasing equipment for the full year in 2017 while TAL's gains on sale of leasing equipment were included only after July 12

th

in 2016; and a

|

|

•

|

$47.2 million increase due to an approximately 50% increase in our average used container selling prices.

|

|

•

|

$95.8 million increase due to the inclusion of TAL's depreciation and amortization for the full year in 2017 while TAL's depreciation and amortization was included only after July 12

th

in 2016;

|

|

•

|

$33.2 million increase due to a net increase in the size of our depreciable fleet; partially offset by a

|

|

•

|

$13.1 million decrease due to an impairment charge recorded as depreciation expense in 2016. There was no impairment charge recorded as depreciation expense in 2017; and

|

|

•

|

$7.0 million decrease due to equipment becoming fully depreciated.

|

|

•

|

$20.2 million increase due to the inclusion of TAL's direct operating expenses for the full year in 2017 while TAL’s direct operating expenses were included only after July 12

th

in 2016;

|

|

•

|

$22.2 million decrease due to a decrease in storage expenses resulting from decreases in the number of idle units; and

|

|

•

|

$16.5 million decrease due to a decrease in equipment repair and handling expenses resulting from decreases in the number of containers redelivered.

|

|

•

|

$23.5 million increase due to the inclusion of TAL administrative expenses for the full year in 2017 while TAL’s administrative expenses were included only after July 12

th

in 2016;

|

|

•

|

$3.0 million increase due to an increase in bonus expense as a result of improved financial performance;

|

|

•

|

$3.5 million increase due to a benefit in 2016 caused by a reclassification of accrued bonus expense from administrative expense to transaction and other costs that did not re-occur in 2017;

|

|

•

|

$3.5 million increase due to an increase in our professional fees and directors' share-based compensation expense; partially offset by a

|

|

•

|

$14.5 million decrease due to a decrease in employee compensation and benefit expense as a result of synergies gained from the Merger in addition to the $7.7 million in savings recognized in 2016. The $23.5 million increase in administrative expenses due to the inclusion of TAL administrative expenses in 2017, includes a benefit of $3.3 million related to employee compensation and benefit savings as a result of synergies gained from the Merger.

|

|

•

|

$65.2 million increase due to the inclusion of TAL's interest and debt expense for the full year in 2017 while TAL’s interest and debt expense was included only after July 12

th

in 2016;

|

|

•

|

$18.3 million increase due to a higher average debt balance during 2017 compared to 2016; and

|

|

•

|

$14.8 million increase due to an increase in the average effective interest rate to 4.33% in 2017 compared to 4.02% in 2016.

|

|

Amount

Outstanding

|

Maximum

Borrowing

Level

|

||||||

|

Institutional notes

|

$

|

2,198.2

|

|

$

|

2,198.2

|

|

|

|

Asset-backed securitization term notes

|

3,063.8

|

|

3,063.8

|

|

|||

|

Term loan facilities

|

1,543.4

|

|

1,543.4

|

|

|||

|

Asset-backed securitization warehouse

|

340.0

|

|

900.0

|

|

|||

|

Revolving credit facilities

|

375.0

|

|

1,235.0

|

|

|||

|

Capital lease obligations

|

75.5

|

|

75.5

|

|

|||

|

Total debt outstanding

|

$

|

7,595.9

|

|

$

|

9,015.9

|

|

|

|

Debt costs

|

(44.9

|

)

|

—

|

|

|||

|

Unamortized debt premiums & discounts

|

(5.3

|

)

|

—

|

|

|||

|

Unamortized fair value debt adjustment

|

(16.3

|

)

|

—

|

|

|||

|

Debt, net of unamortized debt costs

|

$

|

7,529.4

|

|

$

|

9,015.9

|

|

|

|

Financial Covenant

|

Entity

|

Covenant Threshold

|

Actual Value

|

|||

|

Fixed Charge Coverage Ratio

|

TCIL

|

Shall not be less than 1.25:1

|

2.58:1

|

|||

|

Minimum Consolidated Tangible Net Worth

|

TCIL

|

Shall not be less than $855 million

|

$1,705.4 million

|

|||

|

Funded Debt Ratio

|

TCIL

|

Shall not exceed 4.0:1

|

3.33:1

|

|||

|

EBIT to Cash Interest Expense

|

TAL

|

Shall not be less than 1.10:1

|

2.21:1

|

|||

|

Minimum Tangible Net Worth

|

TAL

|

Shall not be less than $300 million

|

$982.7 million

|

|||

|

Indebtedness to TNW

|

TAL

|

Shall not exceed 4.75:1

|

2.20:1

|

|||

|

|

Year Ended December 31, 2018

|

Year Ended December 31, 2017

|

Year Ended December 31, 2016

|

|||||||||

|

Net cash provided by (used in) operating activities

|

$

|

929,850

|

|

$

|

806,795

|

|

$

|

484,188

|

|

|||

|

Net cash provided by (used in) investing activities

|

$

|

(1,348,409

|

)

|

$

|

(1,311,391

|

)

|

$

|

(395,446

|

)

|

|||

|

Net cash provided by (used in) financing activities

|

$

|

351,927

|

|

—

|

|

$

|

567,275

|

|

$

|

(63,629

|

)

|

|

|

|

Contractual Obligations by Period

|

||||||||||||||||||||||||||

|

Contractual Obligations:

|

Total

|

2019

|

2020

|

2021

|

2022

|

2023

|

2024 and thereafter

|

||||||||||||||||||||

|

|

(dollars in millions)

|

||||||||||||||||||||||||||

|

Principal debt obligations

|

$

|

7,520.4

|

|

$

|

964.3

|

|

$

|

825.7

|

|

$

|

812.3

|

|

$

|

1,707.2

|

|

$

|

1,476.1

|

|

$

|

1,734.8

|

|

||||||

|

Interest on debt obligations

(1)

|

1,234.0

|

|

303.4

|

|

265.5

|

|

229.6

|

|

177.0

|

|

117.4

|

|

141.1

|

|

|||||||||||||

|

Capital lease obligations

(2)

|

86.2

|

|

11.2

|

|

10.8

|

|

10.8

|

|

10.8

|

|

18.7

|

|

23.9

|

|

|||||||||||||

|

Operating leases (mainly facilities)

|

11.9

|

|

3.2

|

|

2.9

|

|

2.4

|

|

2.0

|

|

1.4

|

|

—

|

|

|||||||||||||

|

Purchase obligations:

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Equipment purchases payable

|

22.4

|

|

22.4

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

Equipment purchase commitments

|

28.2

|

|

28.2

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

Severance benefit commitment

|

1.2

|

|

1.2

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

Total contractual obligations

|

$

|

8,904.3

|

|

$

|

1,333.9

|

|

$

|

1,104.9

|

|

$

|

1,055.1

|

|

$

|

1,897.0

|

|

$

|

1,613.6

|

|

$

|

1,899.8

|

|

||||||

|

(1)

|

Amounts include actual interest for fixed debt and estimated interest for floating rate debt based on

December 31, 2018

rates and the net effect of our interest rate swaps.

|

|

(2)

|

Amounts include interest.

|

|

As of December 31, 2018

|

As of December 31, 2017

|

||||||||||

|

Equipment Type

|

Depreciable Life

|

Residual Value

|

Depreciable Life

|

Residual Value

|

|||||||

|

Dry containers

|

|||||||||||

|

20-foot dry container

|

13 years

|

$

|

1,000

|

|

13 years

|

$

|

1,000

|

|

|||

|

40-foot dry container

|

13 years

|

$

|

1,200

|

|

13 years

|

$

|

1,200

|

|

|||

|

40-foot high cube dry container

|

13 years

|

$

|

1,400

|

|

13 years

|

$

|

1,400

|

|

|||

|

Refrigerated containers

|

|||||||||||

|

20-foot refrigerated container

|

12 years

|

$

|

2,350

|

|

12 years

|

$2,250 to $2,500

|

|||||

|

40-foot high cube refrigerated container

|

12 years

|

$

|

3,350

|

|

12 years

|

$3,250 to $3,500

|

|||||

|

Special containers

|

|||||||||||

|

40-foot flat rack container

|

16 years

|

$

|

1,700

|

|

12 to 14 years

|

$1,500 to $3,000

|

|||||

|

40-foot open top container

|

16 years

|

$

|

2,300

|

|

12 to 14 years

|

$2,300 to $2,500

|

|||||

|

Tank containers

|

20 years

|

$

|

3,000

|

|

20 years

|

$

|

3,000

|

|

|||

|

Chassis

|

20 years

|

$

|

1,200

|

|

20 years

|

$

|

1,200

|

|

|||

|

December 31, 2018

|

December 31, 2017

|

|||||||

|

Dry container units

|

$

|

6,666,560

|

|

$

|

5,941,097

|

|

||

|

Refrigerated container units

|

1,676,331

|

|

1,897,385

|

|

||||

|

Special container units

|

322,607

|

|

287,869

|

|

||||

|

Tank container units

|

107,284

|

|

105,821

|

|

||||

|

Chassis

|

150,669

|

|

132,312

|

|

||||

|

Total

|

$

|

8,923,451

|

|

$

|

8,364,484

|

|

||

|

Year Ended December 31, 2018

|

Year Ended December 31, 2017

|

Year Ended December 31, 2016

|

|||||||||

|

Impairment (loss) reversal on equipment held for sale

|

$

|

(3,933

|

)

|

$

|

3

|

|

$

|

(19,399

|

)

|

||

|

Gain (loss) on sale of equipment-net of selling costs

|

39,310

|

|

35,809

|

|

(948

|

)

|

|||||

|

Net gain (loss) on sale of leasing equipment

|

$

|

35,377

|

|

$

|

35,812

|

|

$

|

(20,347

|

)

|

||

|

Derivatives

|

Notional Amount

|

Weighted Average

Fixed Leg (Pay) Interest Rate

|

Cap Rate

|

Weighted Average

Remaining Term

|

||||

|

Interest Rate Swap

|

$1,565.6 million

|

2.24%

|

n/a

|

4.4 years

|

||||

|

Interest Rate Cap

|

$381.7 million

|

n/a

|

2.9%

|

0.1 years

|

||||

|

/s/ KPMG LLP

|

||

|

Page

|

|

|

Exhibit No.

|

Description

|

|

|

Amended and Restated By-Laws of Triton International Limited, dated July 12, 2016 (incorporated by reference to Exhibit 3.1 to the Company's Current Report on Form 8-K, filed July 14, 2016)

|

||

|

Memorandum of Association of Triton International Limited, dated September 29, 2015 (incorporated by reference to Exhibit 3.1 to the Company's Quarterly Report on Form 10-Q, filed June 23, 2016)

|

||

|

Form of Indemnification Agreement (incorporated by reference to Exhibit 3.1 to the Company's Current Report on Form 8-K, filed July 14, 2016)

|

||

|

TAL International Group, Inc. 2014 Equity Incentive Plan (incorporated by reference to Exhibit 3.1 to the Company's Current Report on Form 8-K, filed July 14, 2016)

|

||

|

Triton Container International Limited 2016 Equity Incentive Plan (incorporated by reference to Exhibit 3.1 to the Company's Current Report on Form 8-K, filed July 14, 2016)

|

||

|

Triton International Limited 2016 Equity Incentive Plan (incorporated by reference to Exhibit 3.1 to the Company's Current Report on Form 8-K, filed July 14, 2016)

|

||

|

Warburg Pincus Shareholders Agreement, as amended (incorporated by reference to Exhibit 3.1 to the Company's Current Report on Form 8-K, filed July 14, 2016)

|

||

|

Vestar Shareholders Agreement, as amended (incorporated by reference to Exhibit 3.1 to the Company's Current Report on Form 8-K, filed July 14, 2016)

|

||

|

Exhibit No.

|

Description

|

|

|

Ninth Restated and Amended Credit Agreement, dated as of April 15, 2016, by and among Triton Container International Limited, as Borrower, various lenders, and Bank of America, N.A., as Administrative Agent and an Issuer, and other parties thereto (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed on June 22, 2017)

|

||

|